Initiating Coverage| Bank

August 31, 2016

RBL Bank

ACCUMULATE

CMP

`300

Strong Management at the helm of affairs

Target Price

`325

Strong management team & focused approach to drive growth: The new

Investment Period

12 Months

Management led by MD & CEO Mr Vishwavir Ahuja which took charge in 2010

has been instrumental in the outstanding growth of the bank over the years,

Stock Info

wherein the bank transformed itself from being a traditional bank to a new age

bank. RBL has been largely focusing on funding working capital to large and mid-

Sector

Banking

sized corporates. It has recently ventured into retail lending by buying out the

Market Cap (` cr)

11,063

credit card business of Royal Bank of Scotland (RBS) and has been expanding its

Beta

retail business by introducing other new retail-centric products.

52 Week High / Low

305 / 274

Avg. Daily Volume

NA

Expect 33% CAGR in loan book over FY2016-18: Over FY2012-16, RBL has

Face Value (`)

10

expanded its loan book at a CAGR of 50%. With increasing size of its balance

BSE Sensex

28,400

sheet, we believe it will still be able to grow at a CAGR of ~33% over FY2016-18.

Nifty

8,750

Large and mid-sized corporates form

39% and

21% of the loan book,

Reuters Code

RATB.NS

respectively; while retail and the high yielding MFI segment account for 17% and

Bloomberg Code

RBK.IN

15% of the book. We expect strong growth from all the segments going ahead.

Growth without a compromise in asset quality is likely to be the business mantra:

While the new Management has been aggressive in growth, it has also put in

Shareholding Pattern (%)

place an efficient risk management system which has led to GNPAs being

Foreign Bodies

39

contained below 1% in the last four years. For FY2016, GNPAs at 0.98% and

Domestic Bodies

24

NNPAs at 0.59% are very much comparable to that of new age private sector

banks. Avoiding loans to long gestation projects has helped the bank in

Individuals

34

maintaining superior asset quality and we believe the same is sustainable

Others

3

provided it continues to maintain a conservative approach towards the segment.

Note: Listed on August 31, 2016; Share holding

pettern as per offer documents

Reduction in cost/income (C/I) & improvement in CASA should be ROE accretive:

A 2x rise in branches and 3x rise in employee count over the past few years have

kept the cost structure high for the bank. Front loading of investments resulted in

C/I going upto 70% in FY14, which is down to 58% in FY16, we see further scope

for cost rationalization. Also, the bank’s CASA base at ~18.5% is still low and we

see that improving to 22% by FY18 end. While we have not factored in major

improvement in NIM, there is scope for that in the years to come. ROE is expected

to see a 200bp improvement over FY2018, backed by lower cost structure and

increasing fee income.

Outlook & Valuations: Currently the stock is valued at 2.3x its FY2018E BV of

`130; this we feel is quite attractive given the growth prospects of the bank.

Changing business mix & stable credit cost are expected to lead to a predictable

earnings growth. While the ROE improvement could be gradual, we believe

absolute growth in earnings could accelerate going ahead. RBL in our view has all

the ingredients to become a multi-year growth story with a stable asset quality.

Keeping this in mind we feel the stock should be valued at 2.5x its FY2018E BV.

We recommend ACCUMULATE on the stock with a target price of `325.

Key Financials (Standalone)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

NII

342

556

819

1,125

1,455

% chg

32.6

62.9

47.2

37.3

29.4

Net profit

93

207

296

460

592

% chg

0

124

43

55

29

NIM (%)

2.2

2.5

2.5

2.6

2.6

EPS (`)

3.4

7.1

9.1

12.7

16.4

P/E (x)

32.9

23.6

18.3

P/ABV (x)

3.3

2.6

2.3

Siddharth Purohit

RoA (%)

0.6

0.9

0.9

1.0

1.0

022 - 3935 7800 Ext: 6872

RoE (%)

5.3

10.1

11.4

12.8

13.3

Source: Company, Angel Research; Note: CMP as of August 31, 2016

Please refer to important disclosures at the end of this report

1

RBL Bank | Initiating Coverage

Investment rationale

Strong management team & Focused approach to drive growth: RBL has been

growing largely on its concerted focus of funding working capital needs of large

and mid-sized corporates. Over the past five years, while a large portion of growth

has been accounted by the corporate loan segment, the bank intends to gradually

reduce its dependence on the segment. Although, corporate would still form a

large part of the loan book, there lies enough scope for the bank to expand into

other products. Over FY12-16, RBL has expanded its loan book at a CAGR of

50%; despite a higher base, we believe it will still be able to grow at ~33% CAGR

over FY2016-18. Large and mid-sized corporates form ~39% & 21% of the loan

book, respectively; while retail, a new area of business for the bank accounting for

17% of the book, too is expected to report strong growth.

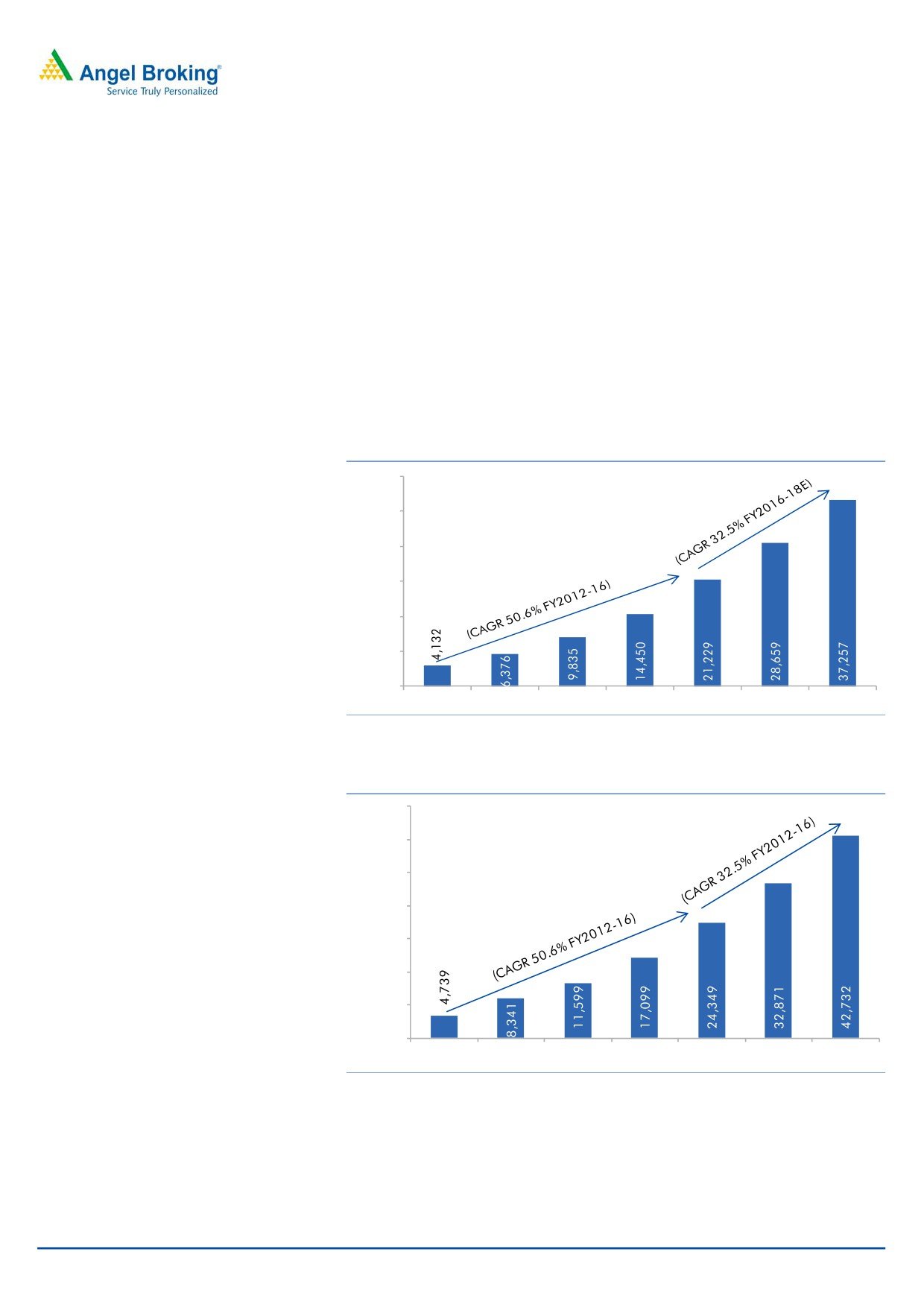

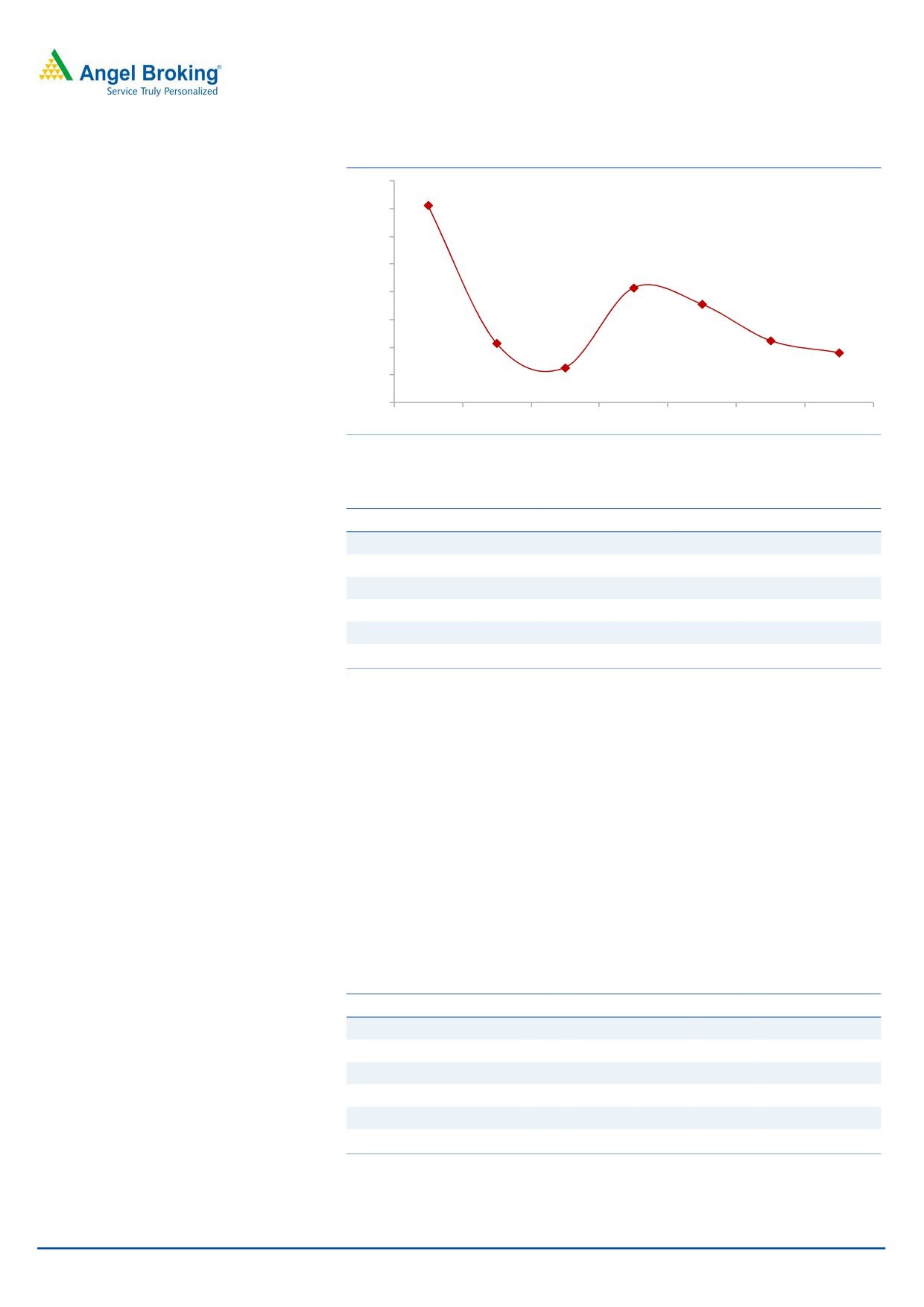

Exhibit 1: Advances Growth

42,000

35,000

28,000

21,000

14,000

7 ,000

0

FY12

FY13

FY14

FY15

FY16

FY17E

FY18E

Source: Company, Angel Research

Exhibit 2: Deposit Growth

49,000

42,000

35,000

28,000

21,000

14,000

7,000

-

FY12

FY13

FY14

FY15

FY16

FY17E

FY18E

Source: Company, Angel Research

August 31, 2016

2

RBL Bank | Initiating Coverage

RBL bought over the credit card business of RBS and has been expanding its retail

focus with the introduction of other new retail products. The microfinance segment

accounts for 15% of the bank’s book (~`3133cr), half of which is in the form of

direct loans to micro borrowers, while the balance is through lending to micro

finance companies. Despite it being traditionally perceived to be a risky segment,

the bank has been accruing a very high yield on micro finance disbursals so far,

thereby reflecting the Management’s ability in maintaining asset quality firm; going

forward as well we don’t expect material stress to arise from this segment. The

bank works through business correspondent for the MFI segment and hence has a

strong control over the asset quality.

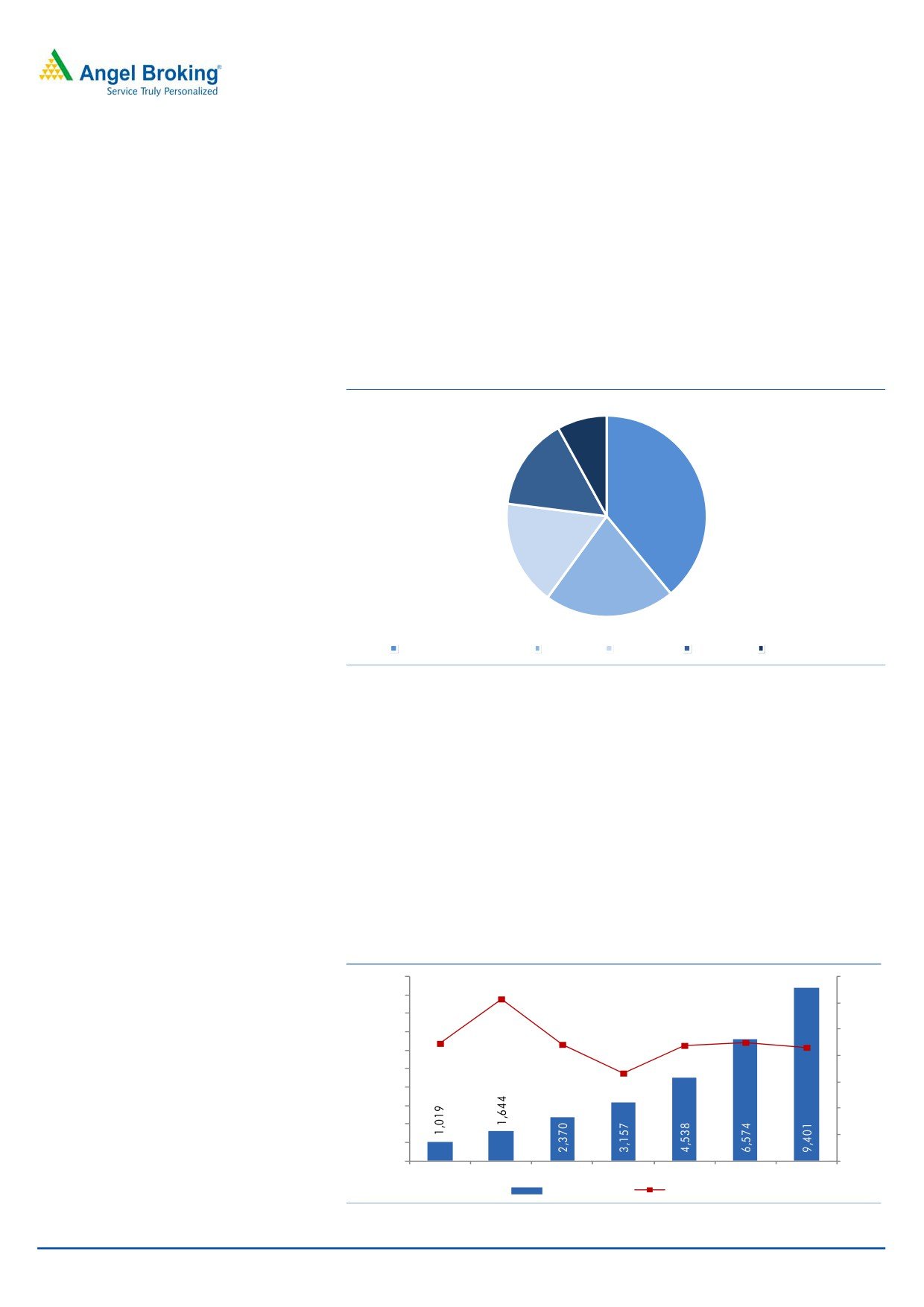

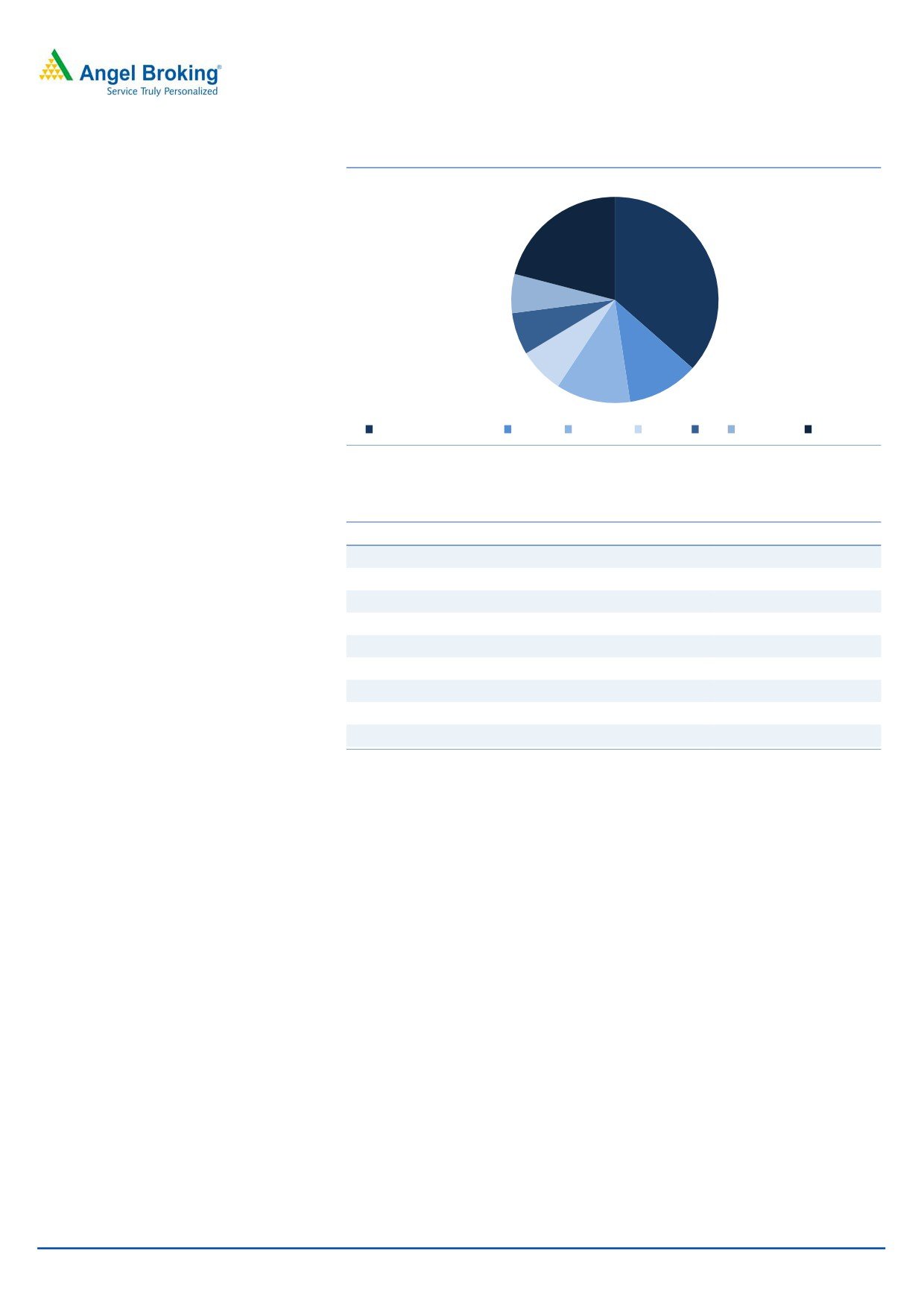

Exhibit 3: Loan Book composition

8%

15%

39%

17%

21%

Large Corporates

SME

Retail

MFIs

Agribusiness

Source: Company, Angel Research

CASA ratio still low but there lies scope for improvement: RBL has a low CASA

base of ~18.5%, but in absolute terms it has been growing at a CAGR of ~45% in

the past few years. It has been observed with many private sector banks that CASA

tends to improve with maturity of business. Going forward, expansion in RBL’s

branch network should enable it to garner low cost deposits, while adoption of

technology and attractive rate loan offerings should also play a role in increasing

the CASA base. We expect RBL to be able to scale up its CASA, albeit at a slower

pace than other private sector banks. Thus, we have factored in

150bp

improvement in CASA ratio for FY2017 and FY2018 each and estimate the CASA

base to reach ~22% by FY2018 end.

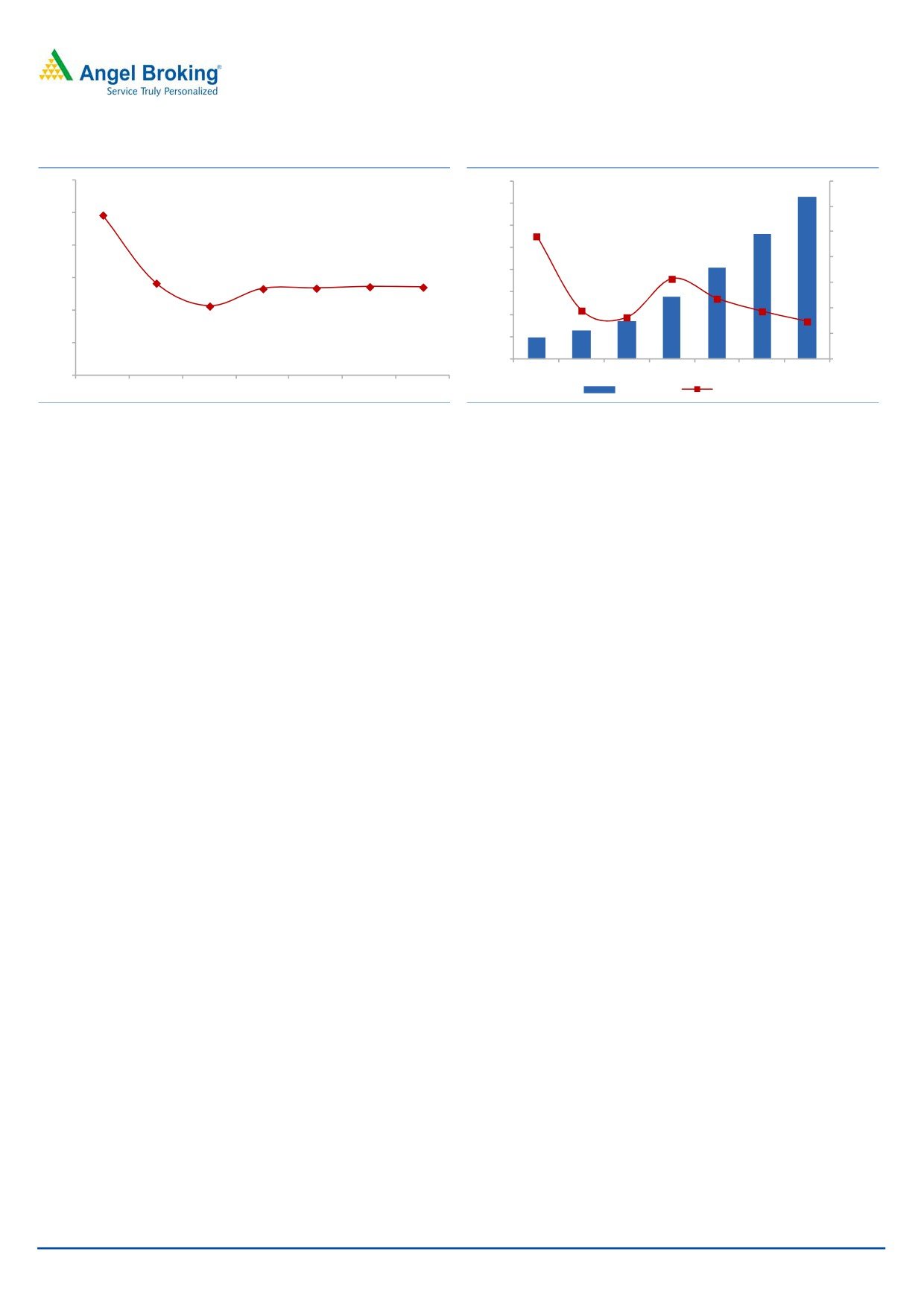

Exhibit 4: CASA growth to remain strong

10,000

70.0

61.3

9 ,000

60.0

8 ,000

7 ,000

44.5

44.1

43.7

44.9

50.0

6 ,000

43.0

40.0

33.2

5 ,000

30.0

4 ,000

3 ,000

20.0

2 ,000

10.0

1 ,000

-

0 .0

FY12

FY13

FY14

FY15

FY16

FY17E

FY18E

CASA (` cr)

Growth YoY (%)

Source: Company, Angel Research

August 31, 2016

3

RBL Bank | Initiating Coverage

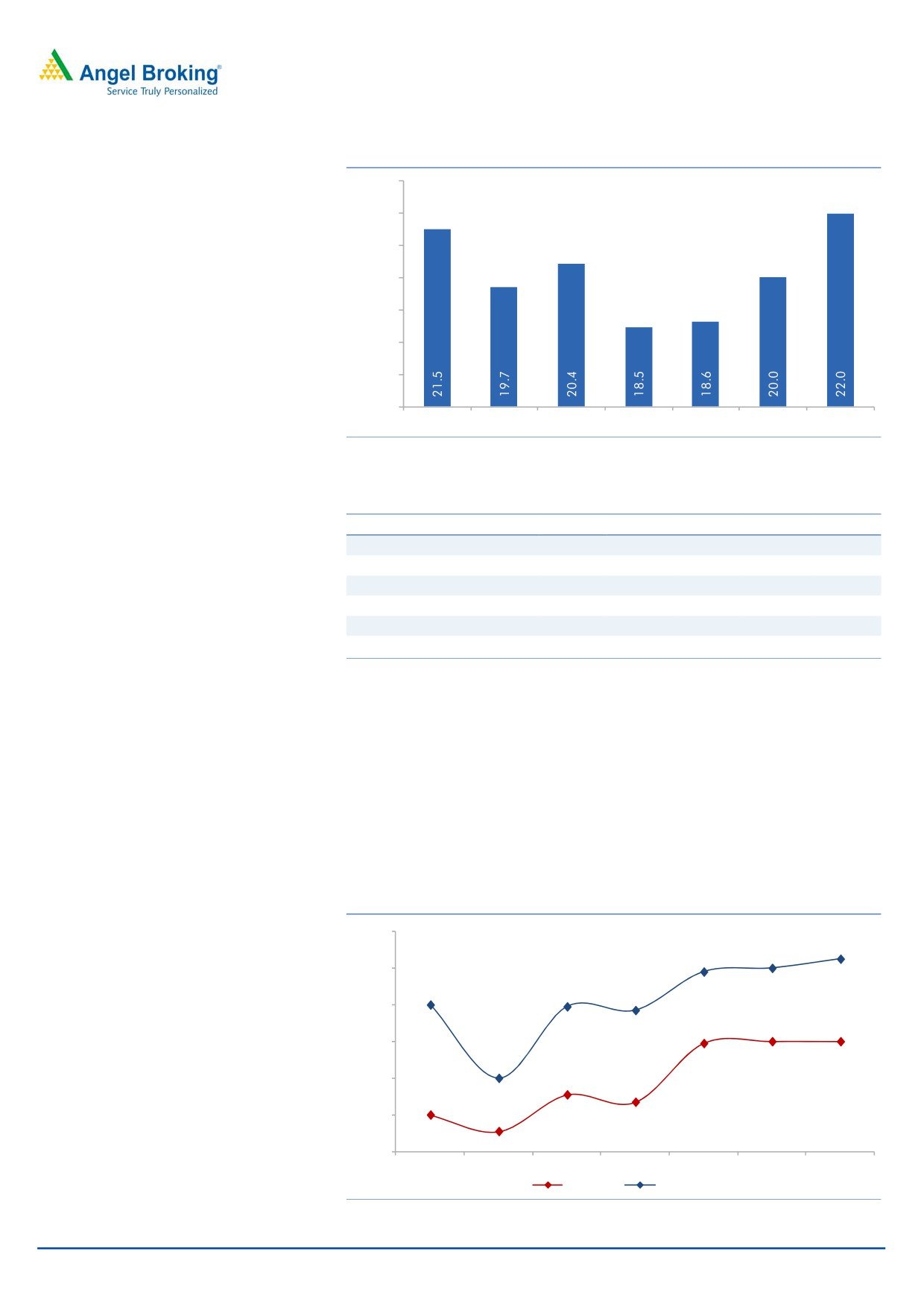

Exhibit 5: CASA ratio trend

23.0

22.0

21.0

20.0

19.0

18.0

17.0

16.0

FY12

FY13

FY14

FY15

FY16

FY17E

FY18E

Source: Company, Angel Research

Exhibit 6: RBL’s CASA vis-a-vis peers

FY12

FY13

FY14

FY15

FY16

RBL Bank

22.0

20.0

20.0

18.0

19.0

Karur Vysya Bank

19.0

19.0

21.0

22.0

23.3

Federal Bank

27.4

27.2

31.2

30.5

32.5

IndusInd Bank

27.3

29.3

32.5

34.1

35.2

Yes Bank

15.0

18.9

22.0

23.1

28.1

Kotak Mahindra Bank

32.0

29.0

32.0

36.0

38.0

Source: Company, Angel Research;

Strong asset quality despite aggressive growth: Though the new Management has

been aggressive in expanding the loan book, it has been able to adopt an efficient

risk management practice and hence NPAs has been consistently contained below

1% in the last four years. For FY2016 the GNPAs and NNPAs stood at 0.98% and

0.59%, respectively. The bank has a persistent focus of expanding its loan book

and we don’t expect any material deterioration in its asset quality going forward as

well. We expect RBL will be able to maintain slippages ratio of ~1% and credit cost

of 60 bps going ahead.

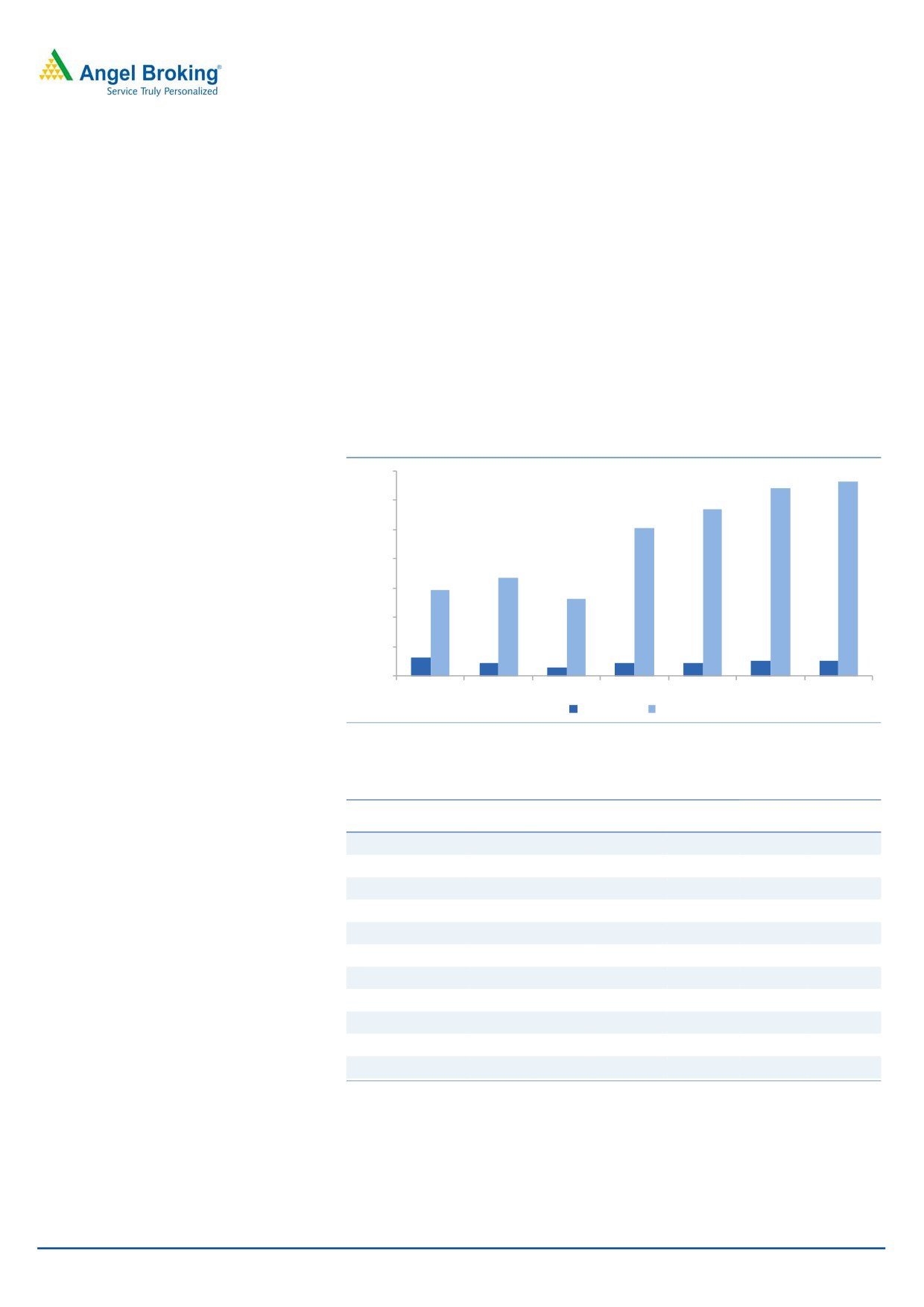

Exhibit 7: GNPAs and NNPAs trend

1.20

1.05

1.00

0.98

1.00

0.80

0.79

0.77

0.80

0.59

0.60

0.60

0.60

0.40

0.40

0.31

0.27

0.20

0.20

0.11

-

FY12

FY13

FY14

FY15

FY16

FY17E

FY18E

NPA (%)

GNPA (%)

Source: Company, Angel Research

August 31, 2016

4

RBL Bank | Initiating Coverage

Exhibit 8: Comparative Asset Quality

FY16

GNPAs % NNPAs % PCR % Slippages %

Credit Cost %

RBL

0.98

0.59

55.9

1.38

0.54

KVB

1.30

0.55

82.5

3.14

0.83

Federal Bank

2.84

1.65

72.0

3.6

1.21

IndusInd

0.90

0.40

58.6

1.09

0.76

Yes bank

0.76

0.29

62.0

0.93

0.55

Kotak bank

2.40

1.10

63.7

2.42

0.77

Source: Company, Angel Research

Enough scope to bring down cost/income ratio: RBL’s new Management has

brought in fresh talent from other private sector banks and also invested heavily in

technology, along with expansion in the branch network. The bank’s branches

have doubled from 100 to 201 in the past five years, while the number of

employees has also increased by 3x over the same period. This resulted in the

C/I going up to 70% as in FY2014 from 55% in FY2012; for FY2016 it stood at

58%. With the bank now positioned to avail to economies of scale post the

aggressive expansion, we believe there is enough scope for improvement in the

cost structure, which in turn should add to the bottom-line.

Exhibit 9: Cost/Income Ratio (%)

75.0

70.3

70.0

65.0

62.5

59.2

60.0

58.3

54.8

53.48

53.70

55.0

50.0

FY12

FY13

FY14

FY15

FY16

FY17E

FY18E

Source: Company, Angel Research

August 31, 2016

5

RBL Bank | Initiating Coverage

Exhibit 10: Cost/Asset Ratio (%)

3.1

2.9

2.9

2.7

2.5

2.3

2.2

2.3

2.1

1.9

1.9

1.9

1.9

1.8

1.7

1.5

FY12

FY13

FY14

FY15

FY16

FY17E

FY18E

Source: Company, Angel Research

Exhibit 11: Comparable Cost/Income to peer banks

Cost to Income %

FY11

FY12

FY13

FY14

FY15

FY16

RBL Bank

83.1

54.8

59.2

70.3

62.5

58.3

Karur Vysya Bank

41.8

42.7

47.3

54.7

53.9

50.3

Federal Bank

36.9

39.4

44.7

47.6

50.0

56.7

IndusInd Bank

48.2

49.4

48.8

45.7

46.8

47.0

Yes Bank

36.3

37.7

38.4

39.4

41.3

40.9

Kotak Mahindra Bank

54.0

52.6

50.6

49.7

52.1

57.5

Source: Company, Angel Research

See scope for NIM improvement going ahead: RBL has reported a

strong 44.7% CAGR in NII over FY2012-16. The yield on advances for the bank at

10.95% is on the higher side compared to other small and mid-sized private

banks, partly due to its aggressive expansion in the retail and microfinance

segment. However, RBL’s cost of deposits is relatively high which could be

attributed to the low CASA base and hence the bank’s NIM has been lower than its

peers. Nevertheless, what gives comfort is the intention and ability of the bank to

gradually bring down the overall funding cost, which we feel should start adding to

the NIM over the next few quarters. While improvement in CASA will be an added

advantage, the banks intention to reduce dependence on bulk deposits also will

help in lowering of cost funds there by adding to NIM.

Exhibit 12: Comparative NIM

Bank

FY11

FY12

FY13

FY14

FY15

FY16

RBL Bank

3.7

3.7

2.6

2.3

2.5

2.5

Karur Vysya Bank

3.4

3.1

3.0

2.6

2.9

3.4

Federal Bank

4.0

3.6

3.1

3.6

3.3

3.3

IndusInd Bank

3.5

3.3

3.4

3.7

3.7

3.9

Yes Bank

2.9

2.8

2.9

2.9

3.2

3.4

Kotak Mahindra Bank

5.2

4.7

4.6

4.9

4.9

4.3

Source: Company, Angel Research

August 31, 2016

6

RBL Bank | Initiating Coverage

Exhibit 13: NIM likely to remain healthy

Exhibit 14: NII growth trend

4.2

1,600

140.0

1455

3.7

1,400

120.0

3.7

1125

1,200

100.0

96.3

3.2

1,000

819

80.0

2.6

62.9

2.5

2.5

2.6

2.6

800

2.7

60.0

2.3

600

556

37.9

47.2

2.2

342

40.0

400

32.6

37.3

258

187

29.4

200

20.0

1.7

0

-

1.2

FY12

FY13

FY14

FY15

FY16

FY17E FY18E

FY12

FY13

FY14

FY15

FY16

FY17E

FY18E

NII (` cr)

Growth (%)

Source: Company, Angel Research

Source: Company, Angel Research

Fee Income has been one of the key ROA driver for other private banks, RBL can

follow suit: Over the last 5 -8 years, the new generation private sector banks have

seen an improvement in their ROA and ROE profiles, partly on robust growth in

fee income. While RBL has been a late entrant, it too could follow suit to boost up

its return ratios. Fee income as a % of total income for RBL much lower than its

peers, due to the fact that it is still highly dependent on the corporate segment for

growth. However, increasing share of business from retail could push of the fee

income, which can be ROA accretive.

August 31, 2016

7

RBL Bank | Initiating Coverage

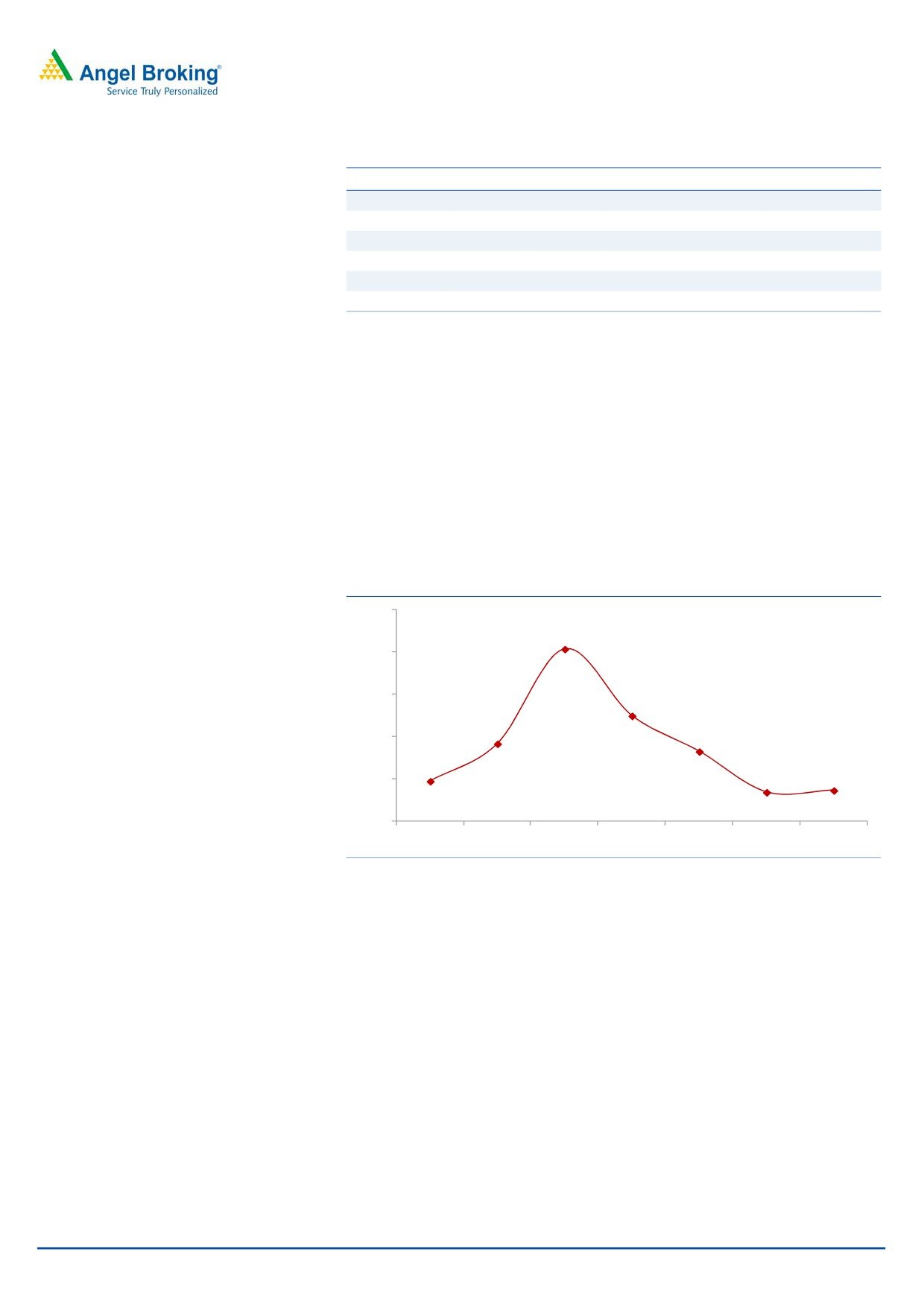

ROE & ROA still at lower end of the curve; there lies scope for improvement: Post

the new Management having taken charge, there has been an aggressive growth

in the bank’s balance sheet as well as earnings. However, large scale investments

in branches and manpower have resulted in subdued ROA and ROE. ROA has

remained below 1% for the last four years while ROE has also lagged business and

earnings growth due to front loading of investments. We believe, adoption of cost

rationalization measures will enable the bank to improve its ROA and ROE by

300bp each over the next two years. However, the ROE of the bank could still lag

behind other new generation private sector banks, as the bank will have to

continue with the legacy branches. Nevertheless, launch of new high yielding retail

loans and simultaneous cost reduction could take RBL’s ROE somewhere near to its

peers over the next four to five years.

Exhibit 15: ROA & ROE Trend

14.0

13.3

12.8

12.0

11.4

10.1

10.0

8.0

6.7

5.9

6.0

5.3

4.0

2.0

1.3

0.9

0.9

0.9

1.0

1.0

0.6

-

FY12

FY13

FY14

FY15

FY16

FY17E

FY18E

ROA (%)

ROE (%)

Source: Company, Angel Research

Exhibit 16: Comparative DuPont

Yes

Kotak

Year End FY15

RBL

KVB

Federal

IndusInd

Bank

Mahindra

Net Interest Income

2.5

3.3

2.9

3.6

3.0

4.6

Non Interest Income

1.5

1.3

0.9

2.6

1.8

1.8

Total Revenues

4.0

4.7

3.8

6.3

4.8

6.4

Operating Cost

2.3

2.3

2.1

2.9

2.0

3.7

PPP

1.7

2.3

1.6

3.3

2.9

2.7

Total Provisions

0.4

0.6

0.8

0.5

0.4

0.6

PBT

1.3

1.7

0.8

2.8

2.5

2.1

Tax

0.4

0.6

0.3

0.9

0.8

0.7

ROA

0.9

1.1

0.5

1.8

1.7

1.4

Leverage

12.7

13.1

10.8

8.8

11.8

7.8

RoE (%)

11.4

13.9

5.9

16.1

19.9

11.0

Source: Company, Angel Research

August 31, 2016

8

RBL Bank | Initiating Coverage

Bank well capitalized post IPO to feed growth: With the bank

aggressively growing its balance sheet in the past few years, the capital adequacy

has come down from 17.1% in FY2013 to 12.9% in FY2016. We believe, the

recent fund raising through the IPO should take care of the bank’s higher capital

requirements to maintain a similar growth rate as in the past few years on a now

higher base. We believe the bank will not need capital for next 18-24 months and

might get into capital raising post that.

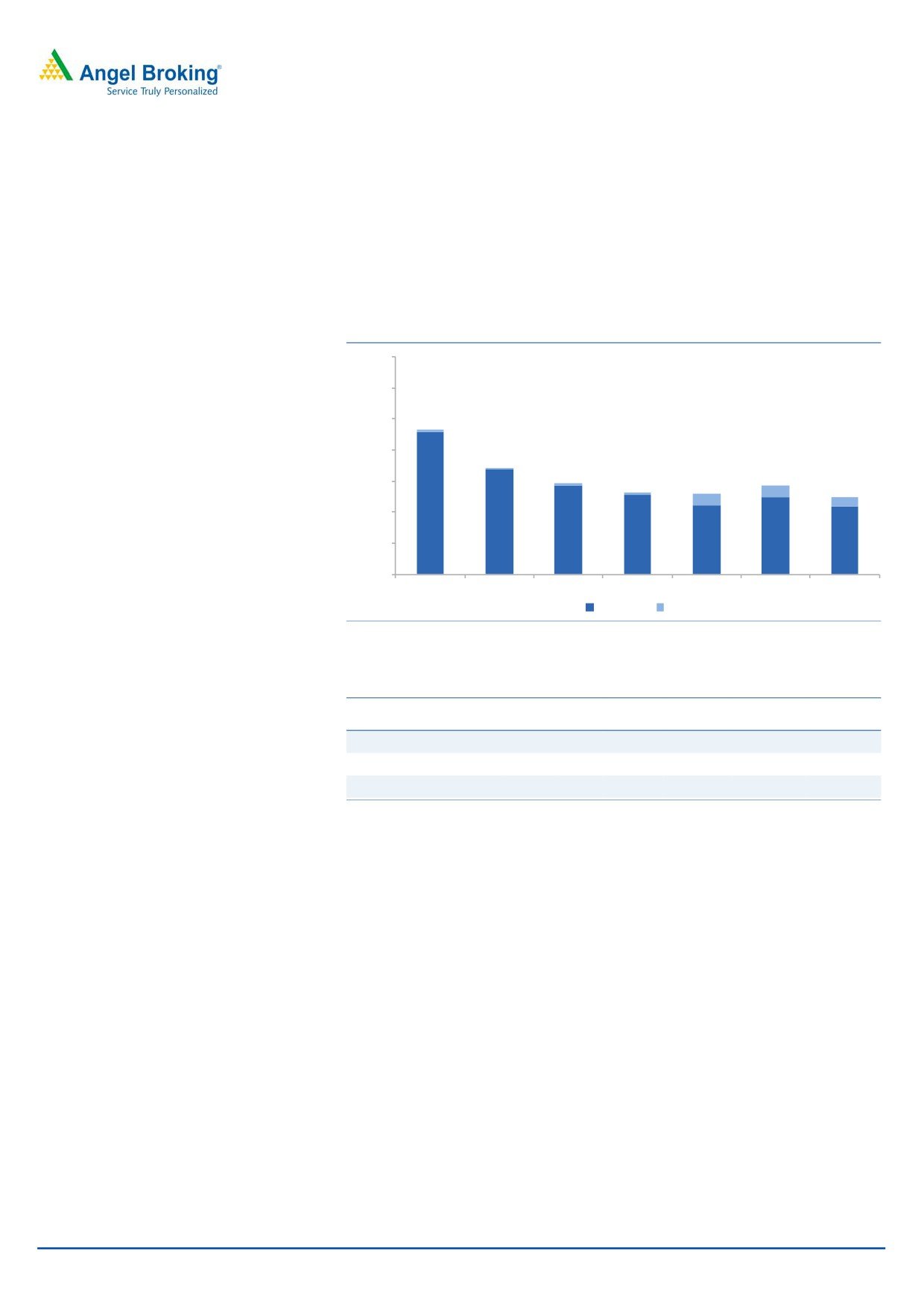

Exhibit 17: Capital Adequacy Ratio

35.0

30.0

23.2

25.0

0.4

17.1

20.0

14.6

14.2

12.4

0.3

13.1

12.9

15.0

0.3

0.4

1.7

22.8

1.8

1.6

10.0

16.8

14.3

12.7

12.5

5.0

11.1

10.9

-

FY12

FY13

FY14

FY15

FY16

FY17E

FY18E

TIER1

TIER2

Source: Company, Angel Research

Exhibit 18: Exhibit 22: Comparative CAR

Kotak

(As on 31st March,2016)

RBL KVB Federal IndusInd Yes Bank

Mahindra

CAR %

12.9

12.2

13.9

15.5

16.5

16.3

Tier I

11.1

11.3

13.4

14.9

10.7

15.3

Tier II

1.8

0.9

0.5

0.6

5.8

1.0

Source: Company, Angel Research

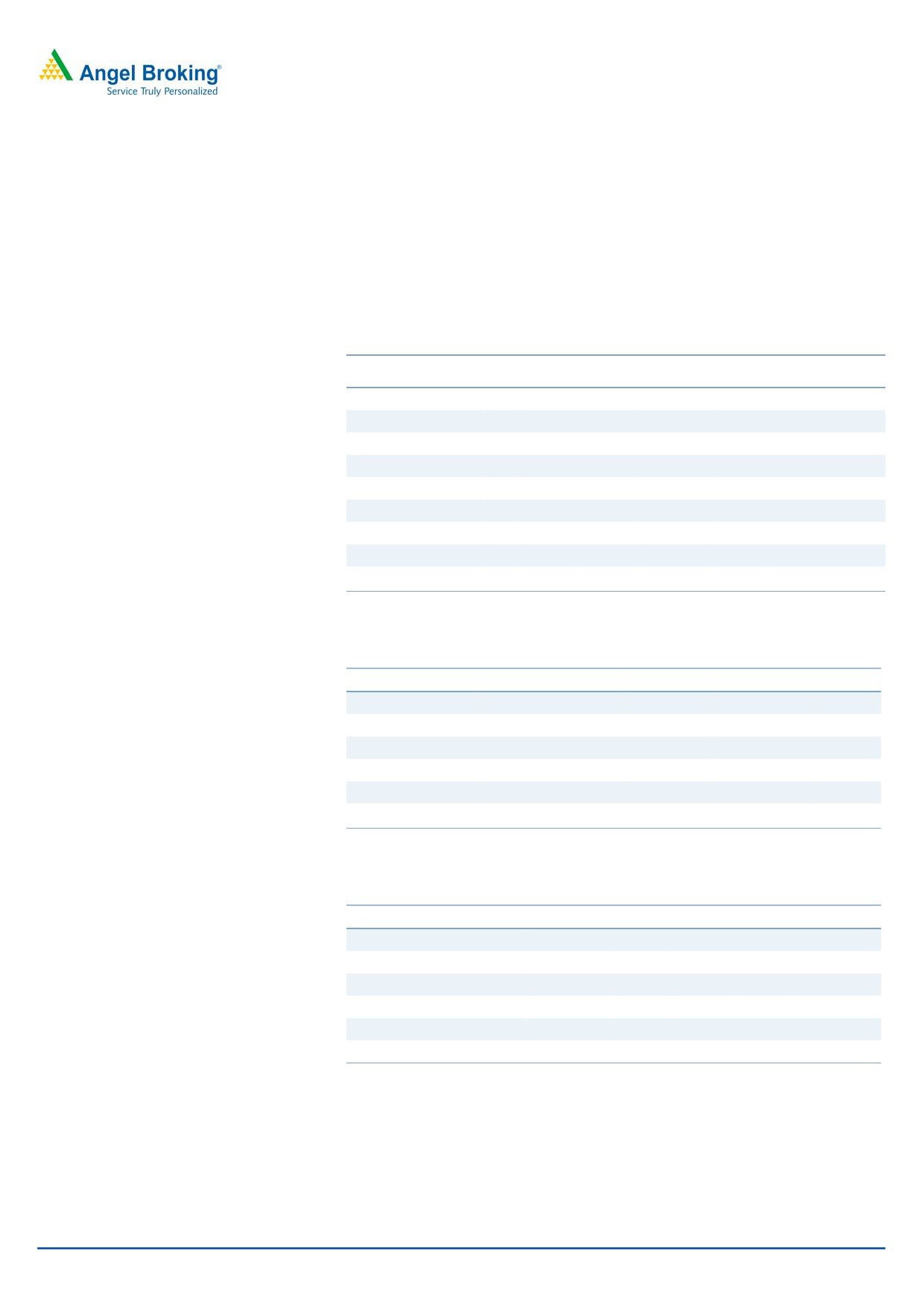

Aggressive branch expansion in last five years; large part of the branches still in

Maharashtra alone: During the last five years, the new Management has nearly

doubled the bank’s branch network from 100 to 197. But even now, nearly half of

the bank’s total branches are still located in Maharashtra alone. The bank is

gradually increasing its footprint in other states, but in our opinion, it would be

prudent to continue to focus expansion in Maharashtra and neighboring states like

Karnataka and Gujarat.

August 31, 2016

9

RBL Bank | Initiating Coverage

Exhibit 19: Geographical Mix of Branches (%)

21%

37%

6%

7%

7%

11%

12%

Maharastra (ex-Mumbai)

Mumbai Karnataka

Gujarat

MP Tamil Nadu

Rest of India

Source: Company, Angel Research

Exhibit 20: Branches State Wise

Location

Number Of Branches

Maharastra (ex-Mumbai)

72

Mumbai

22

Karnataka

23

Gujarat

14

MP

13

Tamil Nadu

12

New Delhi

8

Goa

8

Rest of India

25

Source: Company, Angel Research

August 31, 2016

10

RBL Bank | Initiating Coverage

Outlook and valuation

Currently the stock is valued at 2.3x its FY2018E BV of `130; this we feel is quite

attractive given the growth prospects of the bank. Changing business mix & stable

credit cost are expected to lead to a predictable earnings growth. While the ROE

improvement could be gradual, we believe absolute growth in earnings could

accelerate going ahead. RBL in our view has all the ingredients to become a multi-

year growth story with a stable asset quality. Keeping this in mind we feel the stock

should be valued at 2.5x its FY2018E BV. We recommend ACCUMULATE on the

stock with a target price of `325.

Key risks & concerns

The stupendous growth of the bank has been achieved by the new Management

team led by Mr Vishwavir Ahuja. The ability of the bank’s future growth also

largely lies on the strategy laid out by the new Management. Any exit of the key

Management personnel can hamper future growth of the bank. However, the key

Management have been incentivized via ESOPs and hence we feel the risk of

losing them is low at least in the near term.

Company Background

RBL Bank Ltd, the erstwhile Ratnakar Bank Ltd, has a long history in India with

operations since 1943 when the bank was incorporated as a small regional bank

in Maharashtra with two branches in Kolhapur and Sangli. The bank has been in

existence for the last 73 years and it has transformed itself from a traditional bank

into a new age bank in the last six years. While the bank still has its presence

largely in the western part of India and ~50% of the branches are in Maharashtra

(including Mumbai), gradually it has started venturing to other geographies. As of

31st March, 2016 the bank had a network of 197 branches and 362 ATMs and

had a customer base of 1.9mn.

Key Management Personnel

Mr Vishwavir Ahuja-Managing Director & CEO- Mr Ahuja is a well recognized

personality in the banking field in India and he along with other management

team has been one of the prime driving force behind the aggressive growth of RBL.

Previously he was the MD & Country Executive Officer of Bank of America

Mr Rajeev Ahuja -Head- Strategy, Retail, Transaction Banking and Financial

Inclusion- Ahuja was previously associated with Citibank India, Bank of America,

India and Bankers Trust Company.

Mr Naresh Karia is the Chief Financial Officer. Previously he was the Country

Controller of Citibank.N.A, India

August 31, 2016

11

RBL Bank | Initiating Coverage

Comparative table

Within the listed space, we believe RBL Bank can be compared to the old

generation south based Pvt Banks. However, looking at the aggressive growth it

has embarked upon it can also be compared to the new generation small and

midsized pvt sector banks. We believe it will be able to attract valuations in

between the old generation and new generation small Pvt Banks. Further rerating

will be a function of ROE improvement going ahead.

Exhibit 21: Comparative Analysis:

RBL

Federal

IndusInd

Yes

Kotak

Parameters (` Cr)

KVB

Bank

Bank

Bank

Bank

Mahindra Bank

5 Yr NII CAGR %

54

18

7

27

30

25

NII March 2011

95

767

1747

1,376

1,247

2,245

NII March 2016

819

1,781

2,504

4,517

4,567

6,900

5 Yr PAT CAGR %

90

6

(4)

32

28

21

PAT March 2011

12

416

587

577

727

818

PAT March 2016

296

568

476

2,286

2,539

2,090

Source: Company, Angel Research

Exhibit 22: Comparative -Balance sheet

(` Cr)

Loan

Deposits

C/ D Ratio Retail Loans%

CASA%

RBL

21,229

24,349

87.2

17.0

19.0

KVB

39,471

50,079

78.8

15.0

23.3

Federal Bank

58,090

79,172

73.4

29.8

32.5

IndusInd

88,419

93,000

95.1

41.0

35.2

Yes bank

98,210

111,720

87.9

10.8

28.1

Kotak bank

118,665

138,643

85.6

44.3

38.0

Source: Company, Angel Research

Exhibit 23: Comparative - Valuations

P/BV

ROE% ROA% NIM%

Div Yield%

RBL Bank

3.3

11.4

0.9

2.5

0.4

Karur Vysya Bank

1.3

12.4

1.0

3.4

2.9

Federal Bank

1.4

6.0

0.6

3.1

3.4

IndusInd Bank

4.1

16.8

1.9

3.9

0.3

Yes Bank

4.2

19.9

1.7

3.4

0.7

Kotak Mahindra Bank

6.4

8.7

1.2

4.3

0.1

Source: Company, Angel Research; Net Worth Adj for NPAs, and all data has been taken for FY16

end for comparative purpose.

August 31, 2016

12

RBL Bank | Initiating Coverage

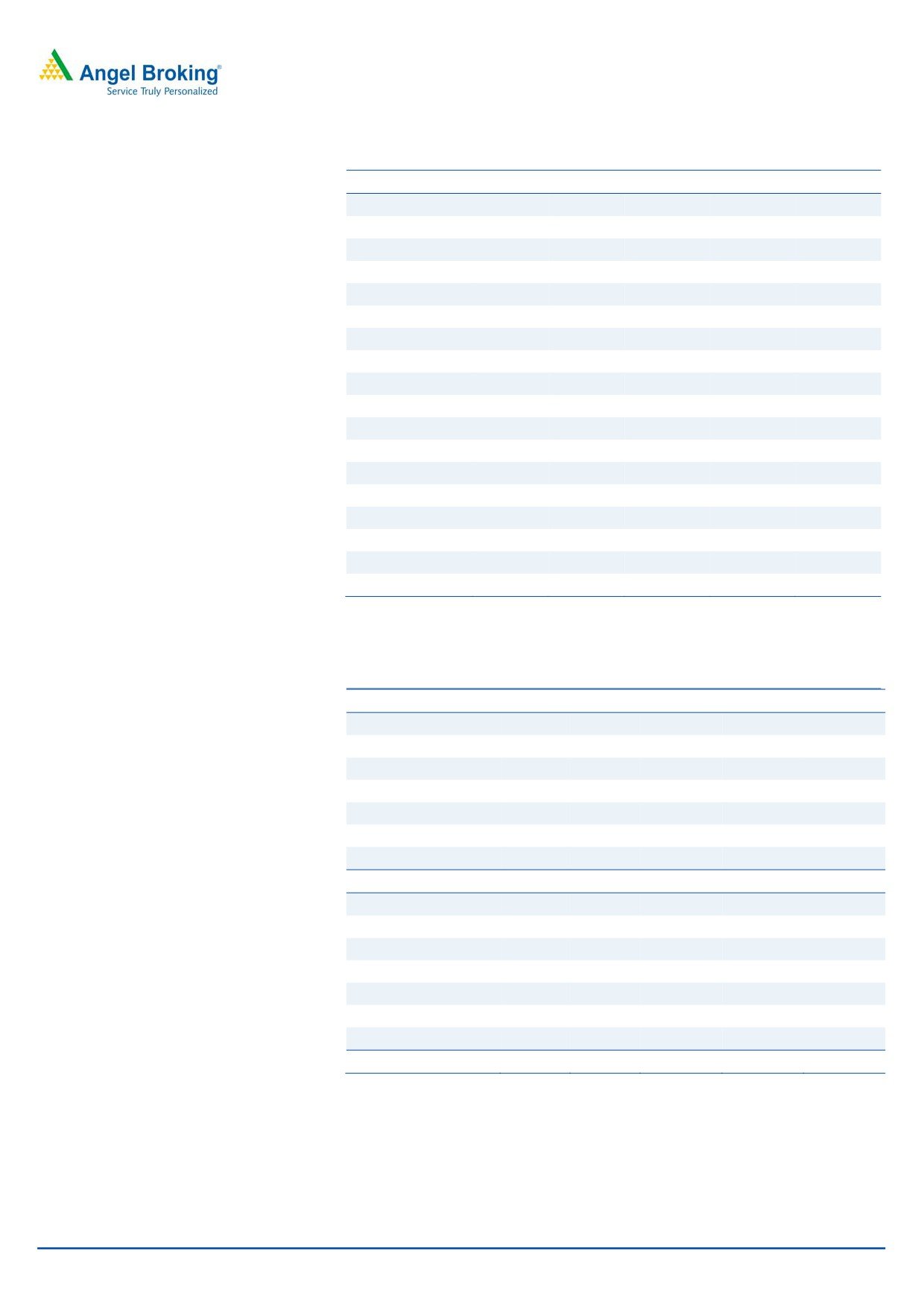

Income statement (standalone)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

NII

342

556

819

1125

1455

- YoY Growth (%)

32.6

62.9

47.2

37.3

29.4

Other Income

261

403

491

659

854

- YoY Growth (%)

106.4

54.6

21.6

34.3

29.7

Operating Income

603

960

1310

1783

2309

- YoY Growth (%)

56.9

59.3

36.5

36.1

29.5

Operating Expenses

424

600

763

954

1240

- YoY Growth (%)

86.5

41.5

27.3

24.9

30.0

Pre - Provision Profit

179

360

546

829

1069

- YoY Growth (%)

14.0

101.5

51.7

51.8

28.9

Prov. & Cont.

46

60

114

172

224

- YoY Growth (%)

104.2

30.3

90.1

50.3

30.0

Profit Before Tax

133

300

432

658

845

- YoY Growth (%)

(1.2)

126.3

44.0

52.2

28.6

Prov. for Taxation

40

93

136

197

254

- as a % of PBT

(4.2)

132.8

46.1

45.6

28.6

PAT

93

207

296

460

592

- YoY Growth (%)

0

124

43

55

29

Balance sheet (standalone)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

Share Capital

272

293

325

362

362

Reserve & Surplus

1,613

1,937

2,665

3,851

4,354

NetWorth

1,885

2,230

2,989

4,213

4,716

Deposits

11,599

17,099

24,349

32,871

42,732

- YoY Growth (%)

39.1

47.4

42.4

35.0

30.0

Borrowings

3,896

6,963

10,536

12,491

16,238

Other Liab & prov

689

812

1,287

1,644

2,137

Total Liabilities

18,198

27,105

39,161

51,218

65,823

Cash and Bal With RBI

981

1,456

1,340

1,808

2,350

Bal.with Banks

212

715

1,110

1,479

1,923

Investments

6,518

9,792

14,436

17,750

22,648

Advances

9,835

14,450

21,229

28,659

37,257

- Growth (%)

54.2

46.9

46.9

35.0

30.0

Fixed Assets

134

164

177

230

299

Other Assets

518

528

869

1291

1345

Total Assets

18,198

27,105

39,161

51,218

65,823

August 31, 2016

13

RBL Bank | Initiating Coverage

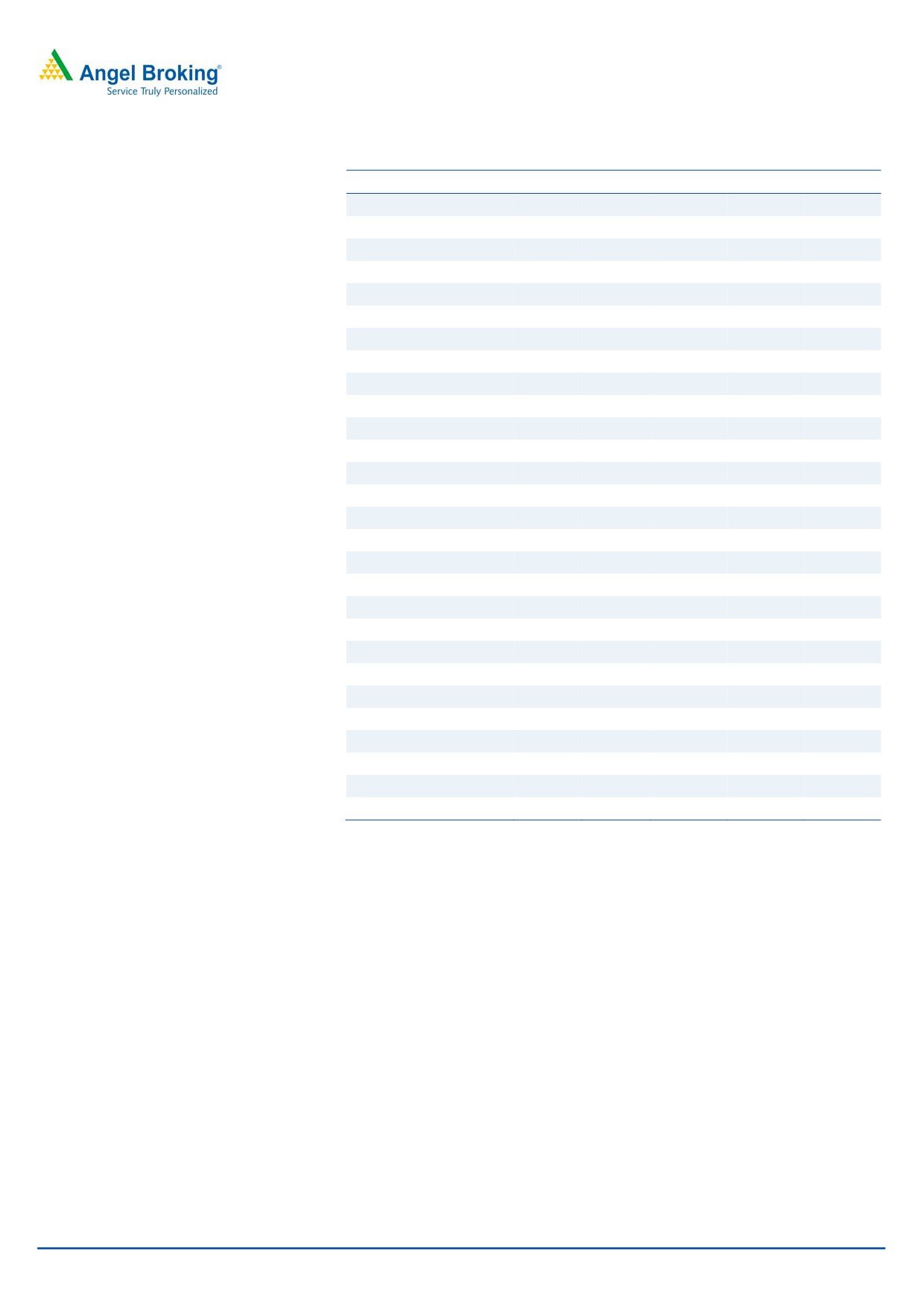

Ratio analysis (standalone)

Y/E March

FY2014

FY2015

FY2016

FY2017E

FY2018E

Profitability ratios (%)

NIMs

2.3

2.5

2.5

2.6

2.6

RoA

0.6

0.9

0.9

1.0

1.0

RoE

5.3

10.1

11.4

12.8

13.3

Asset Quality (%)

Gross NPAs

0.8

0.8

1.0

1.0

1.0

Net NPAs

0.3

0.3

0.6

0.6

0.6

Per Share Data (`)

EPS

3.4

7.1

9.1

12.7

16.4

BV

69.3

76.0

92.1

116.5

130.4

Adj BV

68.2

74.7

88.2

111.6

123.6

Valuation Ratios

PER (x)

32.9

23.6

18.3

P/BVPS (x)

3.3

2.6

2.3

P/ABVPS (x)

3.4

2.7

2.4

Dividend Yield (%)

0.4

1.4

2.4

DuPont Analysis

Net Interest Income

2.2

2.5

2.5

2.5

2.5

Non Interest Income

1.7

1.8

1.5

1.5

1.5

Total Revenues

3.9

4.2

4.0

3.9

3.9

Operating Cost

2.7

2.6

2.3

2.1

2.1

PPP

1.1

1.6

1.6

1.8

1.8

Total Provisions

0.3

0.3

0.3

0.4

0.4

PBT

0.9

1.3

1.3

1.5

1.4

Tax

0.3

0.4

0.4

0.4

0.4

ROA

0.6

0.9

0.9

1.0

1.0

Leverage

8.9

11.0

12.7

12.5

13.1

RoE (%)

5.3

10.1

11.4

12.8

13.3

August 31, 2016

14

RBL Bank | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

RBL Bank

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

August 31, 2016

15