IPO Note | IT

February 6, 2016

Quick Heal Technologies

SUBSCRIBE

Issue Open: February 8, 2016

IPO Note

Issue Close: February 10, 2016

Quick Heal Technologies (QHTL) is a dominant player in the growing Retail IT Security

Issue Details

software market in India with a market share of 30% and an active license user base

of 7.13mn. ~87% of its customers are retail clients while the balance is made up of

Face Value: `10

enterprises and government institutions. The company has laid the foundation in terms

Present Eq. Paid up Capital: `62.2cr

of product development, creating infrastructure for distribution and built a brand to

further grow its overall business.

Fresh Issue**: 0.78cr Shares

Leadership position in growing Retail IT Security market: The Indian IT Security

Offer for sale: 0.63cr Shares

software market is estimated to be at `1,500-1,800cr in 2015, of which, the retail

Post Eq. Paid up Capital: `70cr

market accounts for ~`600-800cr. The retail market has grown from ~`400-600cr in

2013 and is expected to post a CAGR of 20-25% over 2015-17E on the back of

Market Lot: 45 Shares

growing number of internet users. QHTL is best placed to benefit from the growing

Fresh Issue (amount): `250cr

industry on the back of its brand visibility along with its wide distribution reach.

311-321

Price Band: `

Strong distribution network with good brand equity: Despite facing competition from

Post-issue implied mkt. cap `2,186cr*-

international as well as domestic players in India, QHTL has been able to successfully

2,248cr**

grow its business and establish a strong position across India on the back of its 19,000

Note:*at Lower price band and **Upper price band

retail channel partners. QHTL has also built support systems that include mobile,

enterprise and government channel partners. The company has historically spent ~10%

of its top-line on advertisement and is expected to allocate ~`111cr from the IPO

Book Building

proceeds (over three years) to further improve its visibility, which in turn, will aid growth.

QIBs

50%

Debt free with healthy Cash Flow generation for future R&D needs: QHTL has a debt-

Non-Institutional

15%

free balance sheet and cash balance of ~`107cr as of 1HFY2016. Over the past five

years, QHTL is generating strong operating cash flows which have grown from

Retail

35%

~`49cr in FY2012 to ~`77 in FY2015. We believe that the company generates

sufficient cash flows to cover for R&D and technology up-gradation related expenses.

Post Issue Shareholding Pattern(%)

Outlook Valuation: QHTL has shown significant growth over FY2012-15, posting a

revenue CAGR of 16.9% while its profitability has declined from `68cr in FY2012 to

Promoters Group

72.9

`54cr in FY2015 as the company was in an investment phase. Investments were

MF/Banks/Indian

incurred towards new product development for its Enterprise business and brand

FIs/FIIs/Public & Others

27.1

building.

On the valuation front, at the upper end of the price band, the pre-issue P/E works out

to 41.2x its 1HFY2016 annualized earnings which we consider decent taking into

account the company’s brand image. Further, the company is confident of it being

able to sustain its growth trajectory owing to its strong distribution network.

Additionally, there is a two-year lead-lag on product development for the Enterprise

business of which the company will reap benefits in future. Thus, we recommend a

Subscribe on the issue from a longer term perspective.

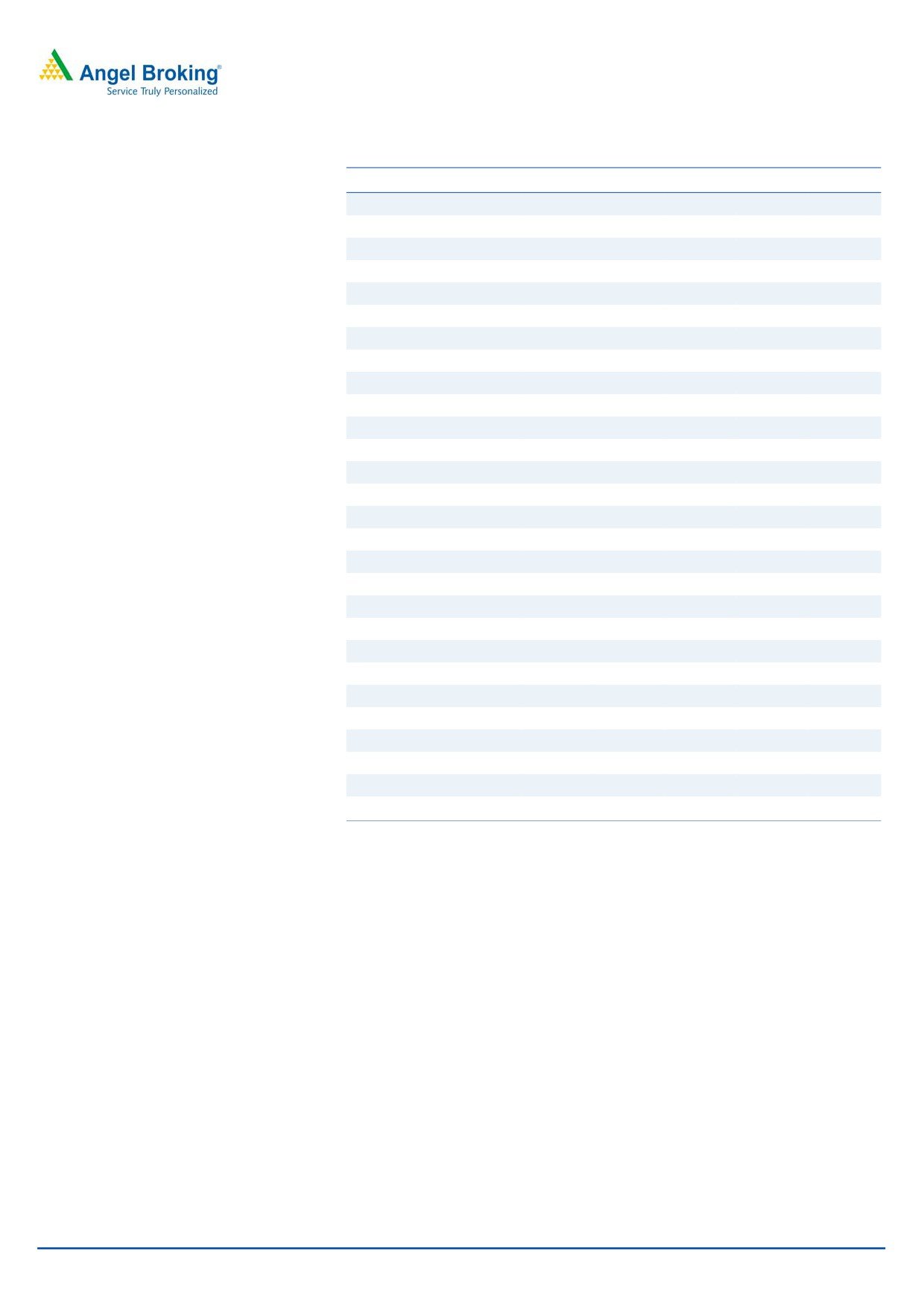

Key Financial

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

1HFY2016

Net Sales

179

205

243

286

148

% chg

-

14.5

18.5

17.8

-

Net Profit

68

77

58

54

24

% chg

-

12.8

(24.1)

(7.8)

-

Amarjeet S Maurya

OPM (%)

53.5

51.3

43.0

32.1

29.7

+91 22 4000 3600 Ext: 6831

EPS (`)

11.0

12.4

9.4

8.6

3.9

P/E (x)

29.3

26.0

34.2

37.1

-

P/BV (x)

9.5

7.0

6.0

6.0

-

RoE (%)

32.4

27.0

17.6

16.2

-

Milan Desai

RoCE (%)

44.5

35.3

28.2

21.6

-

EV/Sales (x)

10.6

9.0

7.6

6.5

-

+91 22 4000 3600 Ext: 6846

EV/EBITDA (x)

19.8

17.6

17.8

20.2

-

Source: Company, Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end of the price band

Please refer to important disclosures at the end of this report

1

Quick Heal Technologies | IPO Note

Company background

QHTL is one of the leading providers of security software products (antivirus) and

solutions in India with a market share of over 30% in the retail space. Its end

customers are home users, small offices and home offices, small and medium size

Business units (SMB), enterprises, educational institutions, as well as government

institutions. Its products are built for use across all platforms as well as devices

(laptops, mobile, etc). It meets diverse user requirements which are spread across

multiple price points. Its brand “Quick Heal” is well recognized (mainly for home

users) and it has recently launched “Seqrite” range of solution for its Enterprise

customers. As on December 31, 2015, the company had over 7.13mn active

licenses spread across more than 80 countries and has installed more than

24.5mn licenses of its products. Till now, ~97% of its revenue comes from India.

Retail sales account for ~87% of its overall sales, enterprises account for ~8%

while government enterprises account for the balance 5% of sales. As of December

31, 2015, it has a network of over 19,000 retail channel partners, 349 enterprise

channel partners, 319 government partners and 944 mobile channel partners.

Exhibit 1: Products Range

Home Users

Enterprises

Desktops, Laptops and Tablets

Smartphones/ Mobiles

SMB, Enterprises, Educational and Government

Quick Heal Total Security

Quick Heal Mobile Security for Android

Endpoint Security

Quick Heal Internet Security

Fonetastic Free

Gateway security

Quick Heal AntiVirus Pro

Fonetastic Pro

Server security

Quick Heal Total Security for Mac

Quick Heal Gadget Securance

Quick Heal Tablet Security for Android

Quick Heal Total Security for Android

Quick Heal PCTuner 3.0

Guardian NetSecure (basic antivirus solution)

Source: RHP, Angel Research

Exhibit 2: Revenue break up (1HFY2016)

Enterprises, 8%

Government, 5%

Retail, 87%

Source: Company, Angel Research

February 6, 2016

2

Quick Heal Technologies | IPO Note

Issue details

The company is raising `250cr through fresh issue of equity shares in the price

band of `311-321. In addition, the issue also consists of offer for sale of 62.7 lakh

shares of which 36.8 lakh shares will be offered by the promoter entities and 25.9

lakh shares by Sequoia Capital. The fresh issue will constitute 11.1% of the post-

issue paid-up equity share capital of the company assuming the issue is subscribed

at the upper end of the price band.

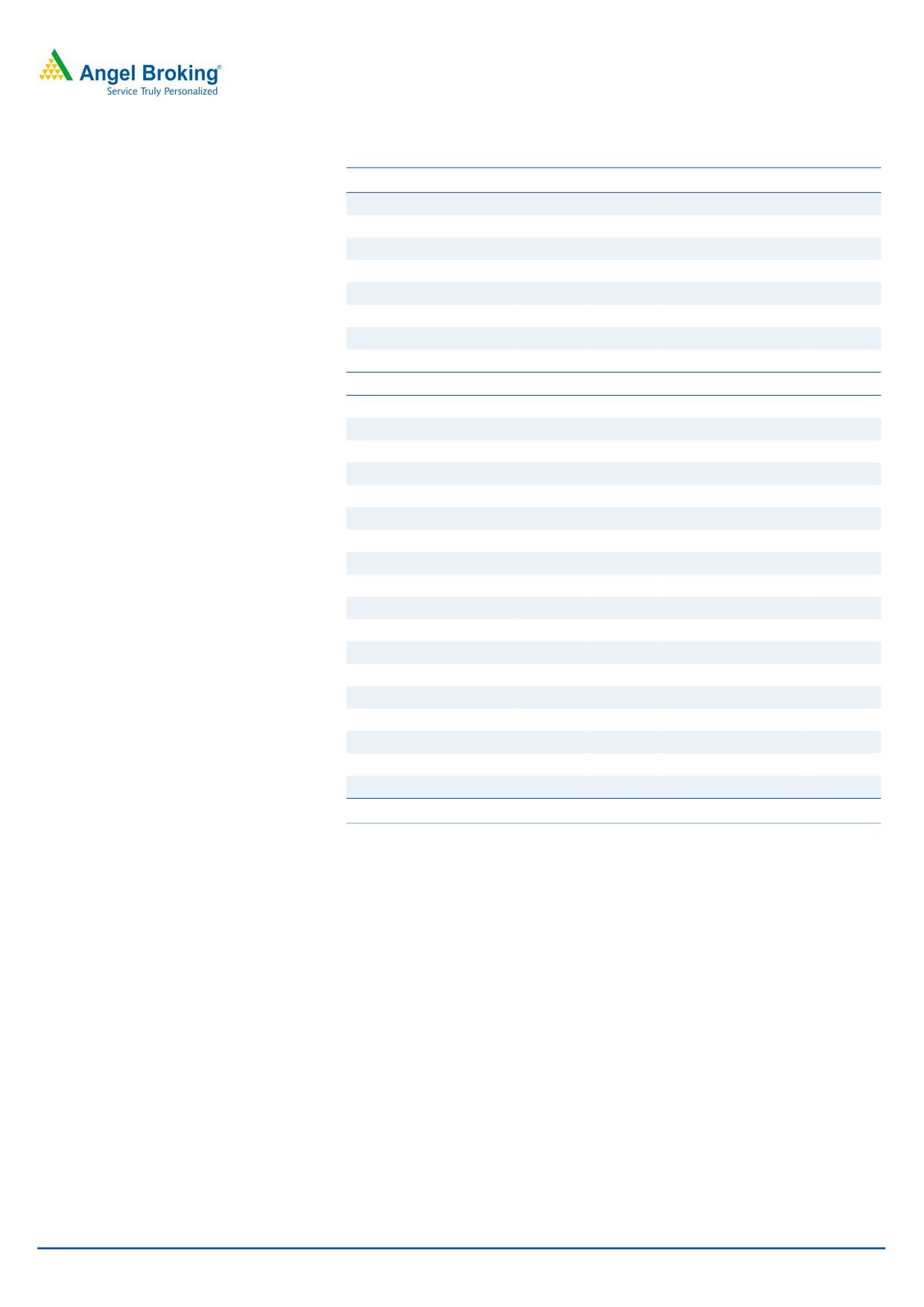

Exhibit 3: Shareholding pattern

Particulars

Pre-Issue

Post-Issue

No. of shares

(%)

No. of shares

(%)

Promoters

5,47,10,720

87.9

5,10,30,720

72.9

Others

75,31,147

12.1

1,89,99,309

27.1

Total

6,22,41,867

100.0

7,00,30,029

100.0

Source: Company, Angel Research

Objects of the offer

The company estimates to use up to `111cr of the IPO proceeds towards

advertising and sales promotion.

It would incur capital expenditure for R&D related expenses amounting to

`42cr.

The company intends on utilize upto `28cr for purchase, development and

renovation of office premises in Kolkata, Pune and New Delhi.

The balance will be utilized for general corporate purposes.

February 6, 2016

3

Quick Heal Technologies | IPO Note

Industry story in charts

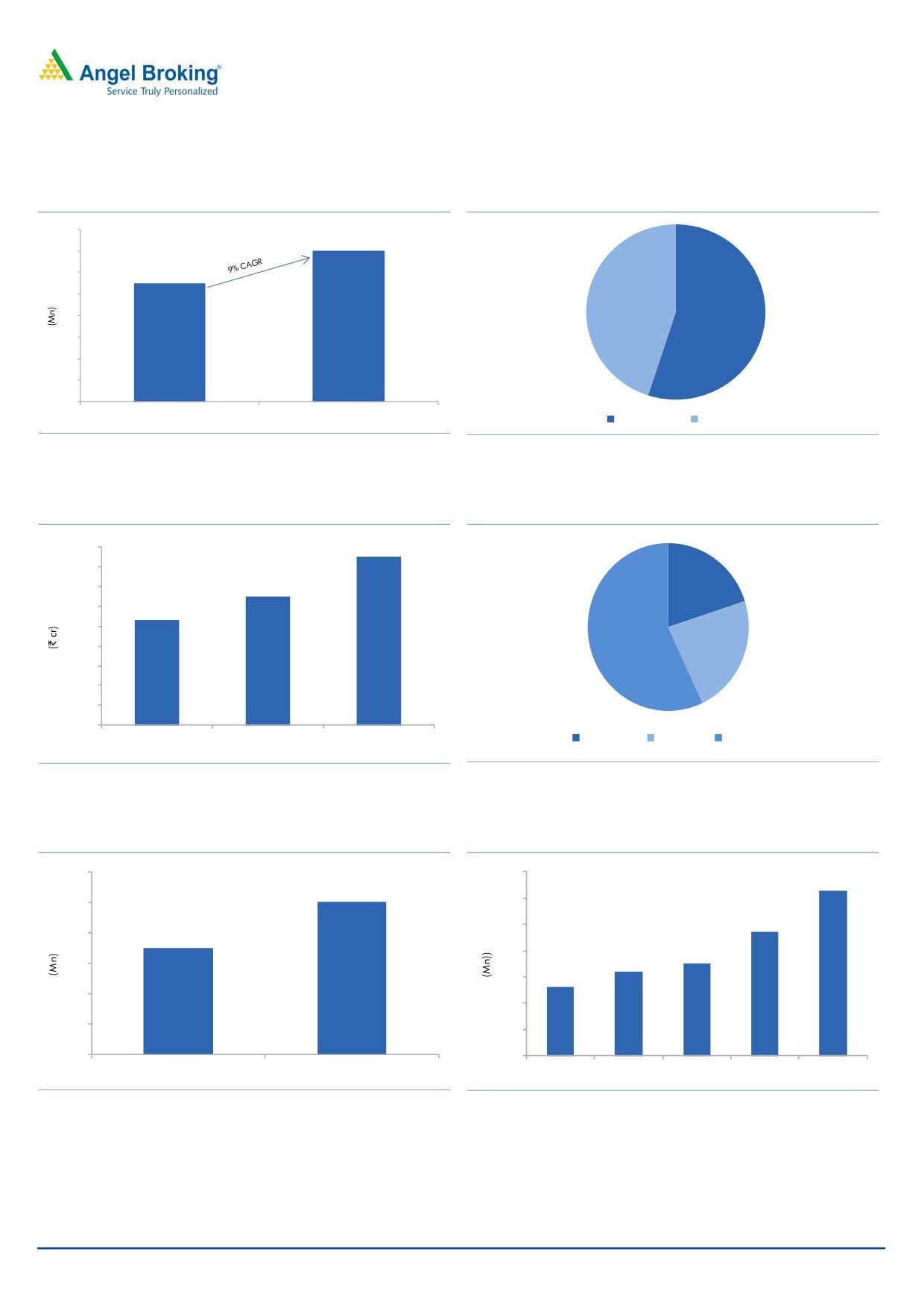

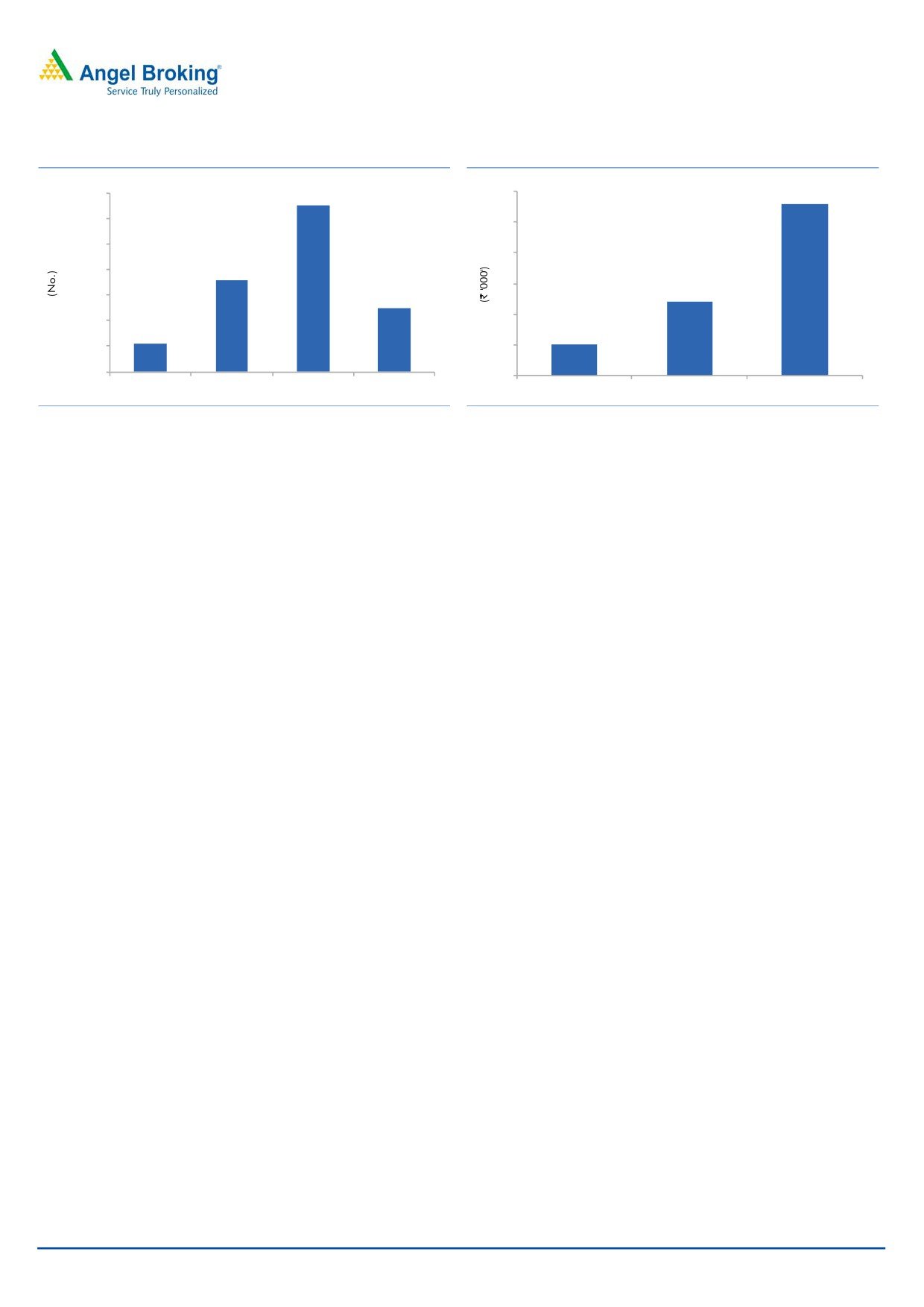

Exhibit 4: Growth in PCs installed

Exhibit 5: Segmental break-up

80

70

70

60

55

50

45%

40

55%

30

20

10

0

Current

2017E

Individual

Business

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 6: IT Security industry market size and its

Exhibit 7:

Split by segment

9,000

8,500

8,000

20%

7,000

6,500

6,000

5,300

5,000

4,000

57%

23%

3,000

2,000

1,000

-

2,013.0

2,015.0

2017E

Hadware

Software

Services

Source: RHP, Angel Research

Source: RHP, Angel Research

Exhibit 8: Expected growth in no. of internet users

Exhibit 9: No. of mobile internet users in India

350

600

314

500

500

300

236

250

400

350

200

175

159

300

150

130

200

100

100

50

0

0

Jun-15

2017E

2013

2014

2015

2016E

2017E

Source: Company, Angel Research

Source: Company, Angel Research

February 6, 2016

4

Quick Heal Technologies | IPO Note

Exhibit 10: Historical data of Cyber attacks in India

Exhibit 11: Avg. Cost suffered per attack in India

1,40,000

1,30,338

60

1,20,000

50

1,00,000

40

80,000

71,780

30

60,000

49,504

20

40,000

22,060

20,000

10

10-12

24-26

56-58

0

0

2012

2013

2014

2015 (5month)

2013

2014

2015E

Source: Company, Angel Research

Source: Company, Angel Research

February 6, 2016

5

Quick Heal Technologies | IPO Note

Investment rationale

Leadership position in a growing IT Security market

Currently, the IT Security software market in India is estimated to be at ~`1500-

1800cr which comprises of Retail, End Point Security (EPS), Unified Threat

Mangement (UTM) and Mobile Device Management (MDM). Going forward, the

overall industry is expected to grow to ~`2,000-2,500cr by 2017E. Of the overall

market, the retail segment forms the major portion and is currently estimated to be

at ~`600-800cr and is expected to post a CAGR of 20-25% over 2015-17E on the

back of growing number of internet users.

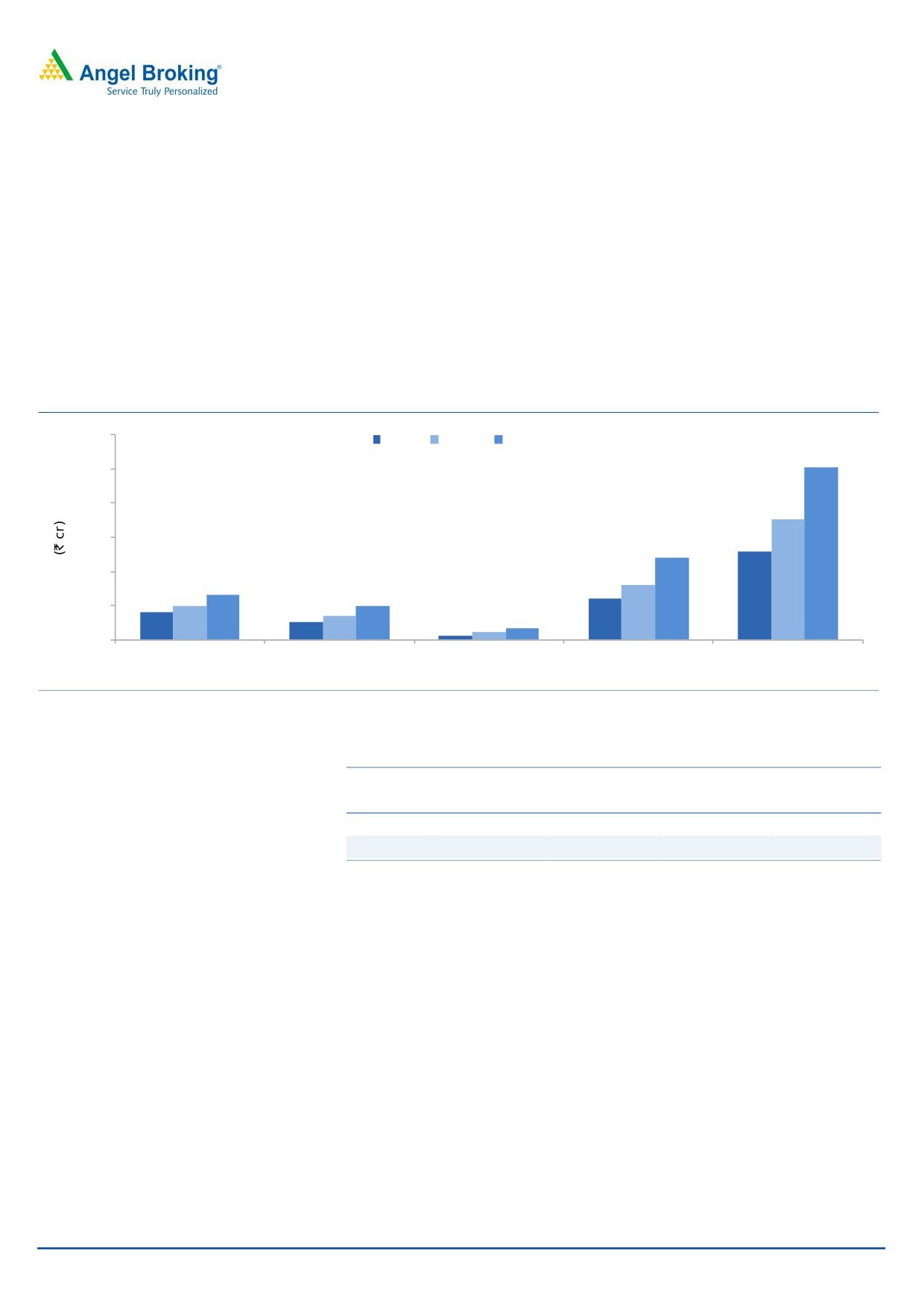

Exhibit 12: Product Segments - IT Security market

3,000

F2013

FY2015

FY2017E

2,520

2,500

2,000

1,760

1,300

1,500

1,200

800

1,000

650

600

500

500

400

500

350

250

170

110

50

0

End Point Security (EPS)

Unified Threat

Mobile Device

Retail

Total

Management (UTM)

Management (MDM)

Source: Company, Angel Research

Exhibit 13: IT Security Market (Product Segments) expected growth

CAGR

EPS

UTM

MDM

Retail

FY2013-15

10-15%

15-20%

45-50%

10-15%

FY2015-17E

10-15%

15-20%

25-30%

20-25%

Source: Company, Angel Research

Quick Heal had over 7.13mn active

Currently the company is one of the leading providers of security software solutions

licenses as on December

31,

2015

in India with a market share of ~30% in the retail segment. It has over 7.13mn

spread across India as well as outside

active licenses as of December 31, 2015 spread across India as well as outside

of India

India. Over the last four years the company has reported a ~26% CAGR in terms

of active users. Going forward, we expect the growth momentum to continue as

QHTL is best placed to benefit from the growing industry on the back of its brand

visibility and its wide distribution reach.

Further, other segments like EPS, UTM and MDM are also growing at a healthy

pace and we expect QHTL to benefit from its growing presence in the above

mentioned categories.

February 6, 2016

6

Quick Heal Technologies | IPO Note

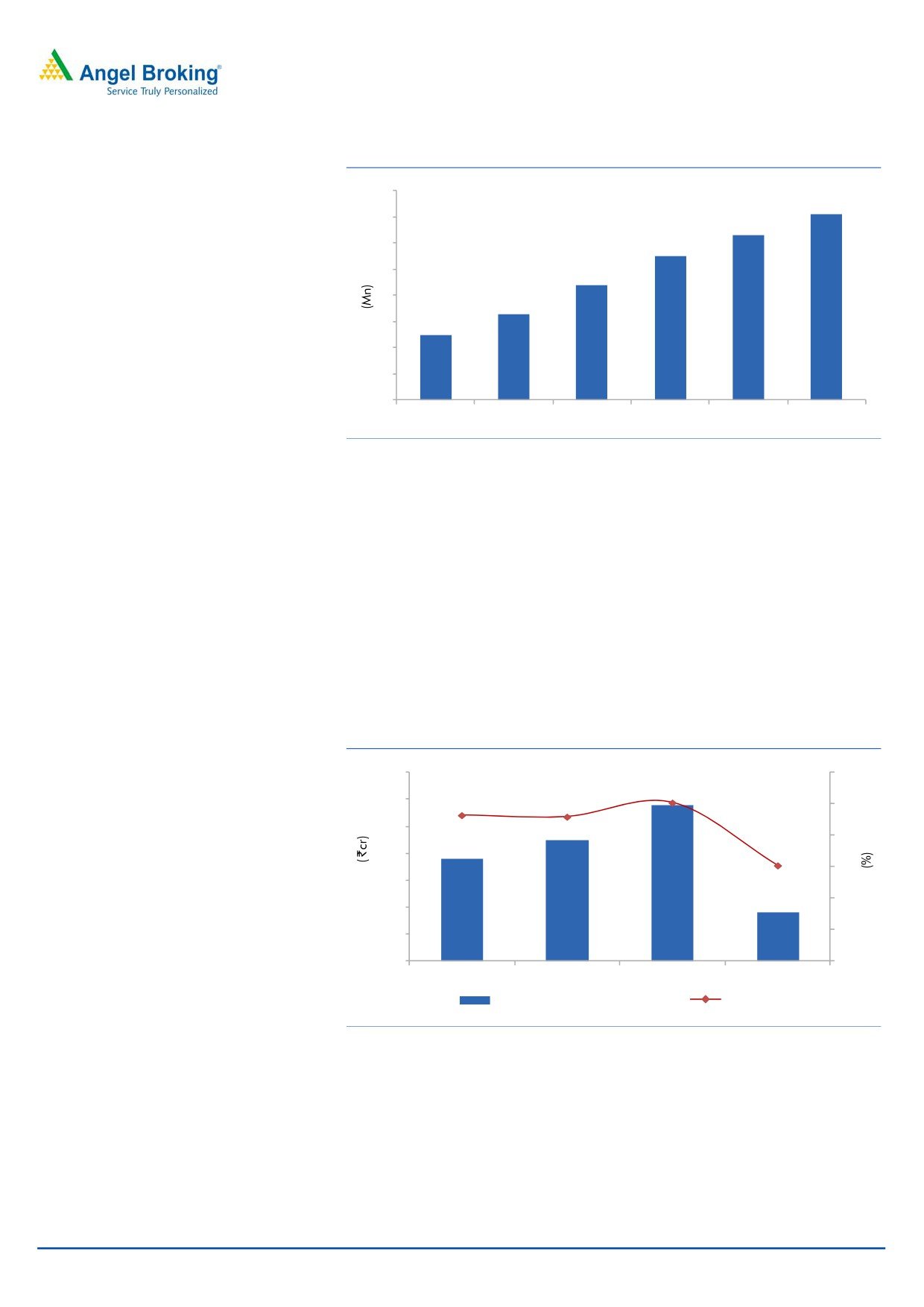

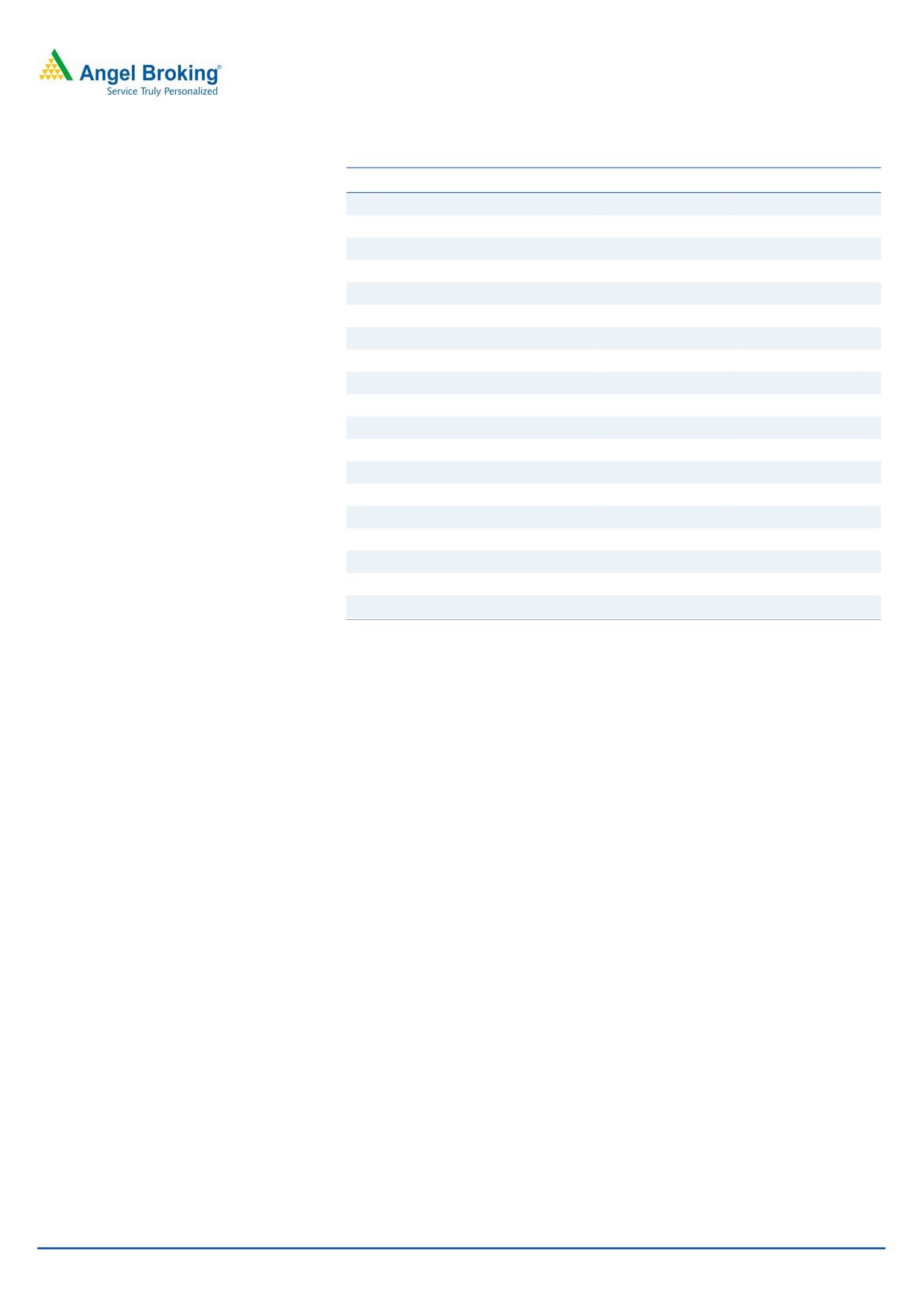

Exhibit 14: Active license user trend

8

7.1

7

6.3

6

5.5

5

4.4

4

3.3

3

2.5

2

1

0

FY2011

FY2012

FY2013

FY2014

FY2015

1HFY2016

Source: Company, Angel Research

Strong distribution network with good brand equity

Despite facing competition from international as well as domestic players in India,

QHTL has been able to successfully grow its business and establish a strong position

across India on the back of its 19,000 retail channel partners, 349 enterprise

channel partners, 319 government partners and 944 mobile channel partners,

who act as distributors and resellers of it solutions. Further, QHTL conducts sales

and marketing activities out of 64 offices and warehouses across 36 cities in India.

As of December 31, 2015, the company had a sales & marketing team comprised

of 400 employees who work closely with the company’s channel partners.

Exhibit 15: Historical ad spend by QHTL

35

12

10.1

30

9.3

9.2

10

25

8

6.1

20

6

15

4

10

2

5

19

22

29

9

0

0

FY2013

FY2014

FY2015

1HFY2016

Advertising and sales promotion

% to sales

Source: Company, Angel Research

QHTL continuously does major marketing exercises for expanding dealer and

retailer network. The company’s media presence spans newspapers, magazines,

news and entertainment TV channels, and FM radio channels in India. The

company has historically spent ~10% of its top-line on advertisement and is expected

to further spend ~`111cr from IPO proceeds (over three years) to further improve its

visibility which will aid growth.

February 6, 2016

7

Quick Heal Technologies | IPO Note

Significant R&D and technology capabilities

As of December

31,

2015, the

QHTL has strong R&D capability that enables it to be competitive in an industry

company had

1,396 employees,

where technology forms the core competency. It has steadily increased its R&D

including 547 employees who comprise

expense from 9.6% of sales in FY2013 to 19.6% of sales as of 1HFY2016 and

the R&D team.

would be utilizing `42cr of the IPO proceeds to further invest in R&D. As of

December 31, 2015, QHTL had 1,396 employees, of which 547 employees were

part of its R&D team.

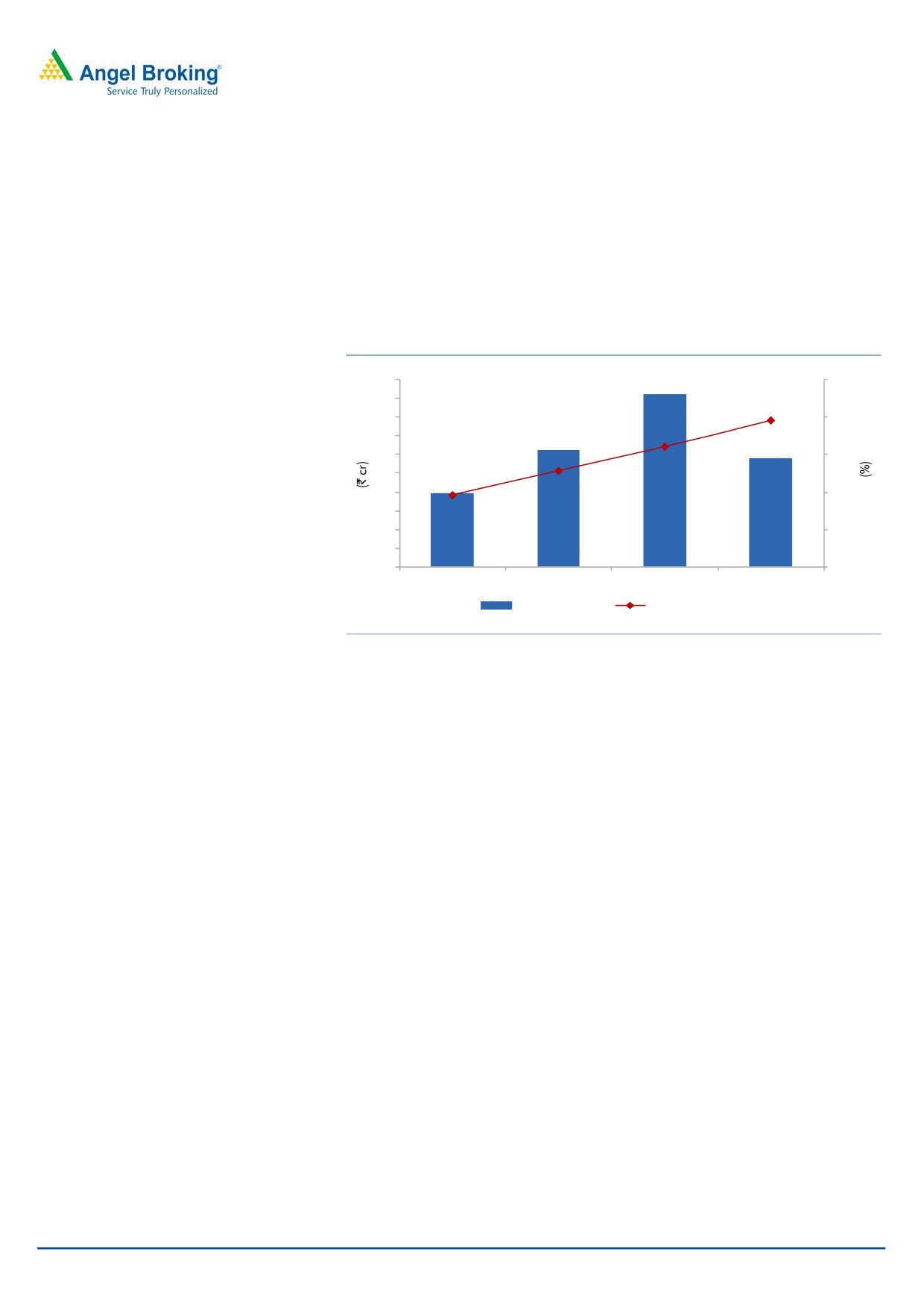

Exhibit 16: Historical R&D spend by QHTL

50

25

45

19.6

40

20

16.1

35

12.9

30

15

25

9.6

20

10

15

10

5

5

20

31

46

29

0

0

FY2013

FY2014

FY2015

1HFY2016

R & D expenses

% to sales

Source: Company, Angel Research

Debt free with healthy Cash Flow generation

QHTL has a debt free balance sheet and cash balance of ~`107cr as on

1HFY2016. Over the past 5 years, QHTL is generating strong operating cash flows

which have grown from ~`49cr in FY2012 to ~`77cr in FY2015. We believe that

the company generates sufficient cash flows to cover for technology upgradation

related expenses.

February 6, 2016

8

Quick Heal Technologies | IPO Note

Valuation

Outlook Valuation: QHTL has shown significant growth over FY2012-15, posting a

revenue CAGR of 16.9% while its profitability has declined from `68cr in FY2012

to `54cr in FY2015 as the company was in an investment phase. Investments were

incurred towards new product development for its Enterprise business and brand

building.

On the valuation front, at the upper end of the price band, the pre-issue P/E works

out to 41.2x its 1HFY2016 annualized earnings which we consider decent taking

into account the company’s brand image. Further, the company is confident of it

being able to sustain its growth trajectory owing to its strong distribution network.

Additionally, there is a two-year lead-lag on product development for the

Enterprise business of which the company will reap benefits in future. Thus, we

recommend a Subscribe on the issue from a longer term perspective.

Exhibit 17: Comparative Valuation

P/E P/BV

ROE EV/Sales EV/EBITDA

Pre issue valuation^

(x)

(x)

(%)

(x)

(x)

QHTL*

FY2016

41.2

5.1

12.7%

6.4

21.5

Symantec Corporation*

FY2016

23.8

2.1

8.9%

1.9

12.3

Source: RHP, Note: *based on 1HFY16 annualised numbers; ^based on price at upper band

Risks

Intense competition and lack of pricing power: QHTL faces stiff competition from

both international and Indian companies like Symantec, Trend, Micro, Kaspersky,

McAfee and others. This could levy pressure on the company’s operating margin

and lead to lower profitability.

Changes in technology: The IT security industry is subject to rapid changes in

technology. Any change in technology or better technology adoption by other

competitors could negatively affect the company’s revenue.

February 6, 2016

9

Quick Heal Technologies | IPO Note

Profit & Loss (consolidated)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

1HFY16

Total operating income

179

205

243

286

148

% chg

14.5

18.5

17.8

-

Total Expenditure

83

100

138

194

104

Raw Material

9

10

11

16

8

Employee Cost

21

29

43

64

42

Other Expenses

54

62

84

114

55

EBITDA

96

105

104

92

44

% chg

9.9

(0.7)

(12.0)

(% of Net Sales)

53.5

51.3

43.0

32.1

29.7

Depreciation& Amortisation

2

4

11

20

11

EBIT

94

101

94

72

33

% chg

7.7

(7.1)

(23.5)

(% of Net Sales)

52.3

49.1

38.5

25.0

22.0

Interest & other Charges

-

-

-

-

-

Other Income

6

10

10

8

4

(% of PBT)

5.7

8.8

9.5

10.3

11.1

Recurring PBT

99

110

103

80

37

% chg

11.3

(6.4)

(22.8)

Exceptional Exp/(inc)

-

-

17

-

-

PBT (reported)

99

110

86

80

37

Tax

31

34

28

26

13

(% of PBT)

31.3

30.4

32.1

32.6

34.1

PAT Reported

68

77

58

54

24

% chg

12.8

(24.1)

(7.8)

(% of Net Sales)

38.1

37.5

24.0

18.8

16.3

Basic EPS (`)

11.0

12.4

9.4

8.6

3.9

Fully Diluted EPS (`)

11.0

12.4

9.4

8.6

3.9

% chg

12.8

(24.1)

(7.8)

(55.0)

February 6, 2016

10

Quick Heal Technologies | IPO Note

Balance Sheet (consolidated)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

1HFY16

SOURCES OF FUNDS

Equity Share Capital

8

8

61

61

61

Reserves& Surplus

203

277

271

270

295

Shareholders’ Funds

210

285

332

331

356

Minority Interest

-

-

-

-

-

Total Loans

-

-

-

-

-

Long-term provisions

0.4

-

-

-

-

Deferred Tax Liability

0

1

-

-

-

Total Liabilities

211

285

332

331

356

APPLICATION OF FUNDS

Gross Block

19

38

82

111

150

Less: Acc. Depreciation

-

-

-

-

-

Net Block

19

38

82

111

150

Capital Work in Progress

24

29

55

74

49

Investments

100

139

131

130

96

Current Assets

78

97

92

91

87

Inventories

1

2

6

8

7

Sundry Debtors

66

77

69

65

58

Cash

8

10

10

13

11

Loans & Advances

4

7

6

6

8

Other Assets

0

0

0

0

4

Current liabilities

19

29

47

97

47

Net Current Assets

59

68

44

(6)

40

Long term loans and adv.

9

11

16

17

15

Other Non Current Assets

0

0

0

0

0

Deferred Tax Asset

-

-

4

5

5

Mis. Exp. not written off

-

-

-

-

-

Total Assets

211

285

332

331

356

February 6, 2016

11

Quick Heal Technologies | IPO Note

Cash flow statement (consolidated)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

1HFY16

Profit before tax

99

110

86

80

37

Depreciation

2

4

11

20

11

Change in Working Capital

(19)

(10)

(5)

13

(1)

Interest / Dividend (Net)

(5)

(7)

(8)

(7)

(3)

Direct taxes paid

(29)

(30)

(41)

(30)

(10)

Others

1

0

17

1

(0)

Cash Flow from Operations

49

68

61

77

34

(Inc.)/ Dec. in Fixed Assets

(9)

(33)

(77)

(66)

(25)

(Inc.)/ Dec. in Investments

(44)

(29)

18

13

37

Cash Flow from Investing

(53)

(63)

(59)

(53)

12

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

-

-

-

-

-

Dividend Paid (Incl. Tax)

-

(1)

(2)

(17)

(49)

Interest / Dividend (Net)

-

-

-

-

-

Cash Flow from Financing

-

(1)

(2)

(17)

(49)

Inc./(Dec.) in Cash

(4)

4

(1)

7

(2)

Opening Cash balances

6

3

6

5

13

Effect of Foreign exchange diff.

-

-

(0)

-

-

Closing Cash balances

3

6

5

13

10

February 6, 2016

12

Quick Heal Technologies | IPO Note

Key Ratios

Y/E March

FY2012

FY2013

FY2014

FY2015

Valuation Ratio (x)

P/E (on FDEPS)

29.3

26.0

34.2

37.1

P/CEPS

28.4

24.6

28.9

27.0

P/BV

9.5

7.0

6.0

6.0

Dividend yield (%)

0.1

0.1

0.5

2.3

EV/Sales

10.6

9.0

7.6

6.5

EV/EBITDA

19.8

17.6

17.8

20.2

EV / Total Assets

8.2

5.9

4.9

4.3

Per Share Data (`)

EPS (Basic)

11.0

12.4

9.4

8.6

EPS (fully diluted)

11.0

12.4

9.4

8.6

Cash EPS

11.3

13.1

11.1

11.9

DPS

0.2

0.3

1.5

7.4

Book Value

33.8

45.8

53.4

53.3

Returns (%)

ROCE

44.5

35.3

28.2

21.6

Angel ROIC (Pre-tax)

91.1

74.5

48.9

37.9

ROE

32.4

27.0

17.6

16.2

Turnover ratios (x)

Asset Turnover (Gross Block)

9.5

5.3

3.0

2.6

Inventory / Sales (days)

1

4

9

10

Receivables (days)

134

138

104

83

Payables (days)

29

37

44

48

WC cycle (ex-cash) (days)

106

105

70

45

Note: Valuation ratios based on pre-issue outstanding shares and at upper end of the price band

February 6, 2016

13

Quick Heal Technologies | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

February 6, 2016

14