IPO Note | HR Services

June 27, 2016

Quess Corp

SUBSCRIBE

Issue Open: June 29, 2016

IPO Note - Attractive Quest on Valuations: Subscribe

Issue Close: July 1, 2016

Quess Corp Ltd (QCL), promoted by Thomas Cook (~63% holding post dilution),

Issue Details

provides comprehensive solutions including recruitment, temporary staffing,

technology staffing and IT product and solution, skill development, payroll,

Face Value: `10

compliance management, integrated facility management and industrial asset

Present Eq. Paid up Capital: `113.3cr

management services. The company derives 86% of its revenues from India while

the balance comes from its international business. Over the past three years, the

Fresh Issue**: 1.26cr Shares

company has made several acquisitions which has fueled its growth and has

Offer for sale:-NA

shown good track record of improving the performance of its acquisitions.

Post Eq. Paid up Capital: `126.0cr

Huge growth opportunities across business verticals: QCL has presence in

high-growth business verticals like temporary general staffing, payroll &

Market Lot: 45 Shares

compliance outsourcing, professional IT staffing, facilities management, etc.

under different brands. As per a report by Frost & Sullivan, the market for these

Issue (amount): `400cr

segments in India is expected to grow at a CAGR of 19-24% over 2014-19.

Price Band: `310-317

Further, the penetration level of temporary staffing is low in India (0.1%, which is

among the lowest in the world), and is likely to improve from hereon on account

Post-issue implied mkt. cap `3,913cr*-

3,993cr**

of increasing need for cost efficient structures. Thus, we expect QCL to benefit

Note:*at Lower price band and **Upper price band

from increasing demand for manpower across industries on the back of its strong

Management, healthy track record and presence in diversified business verticals

which would help it to enhance its market share and increase revenue.

Book Building

Focus on improving operating margins: Going forward, we expect the company’s

overall operating margin to improve on back of (a) change in revenue mix in

QIBs

75%

favor of higher margin businesses (currently the People and Services business

Non-Institutional

15%

contributes ~55% of the company’s overall top-line which is a low margin segment)

(b) two of its acquisitions Brainhunter and MFX showing improvement in performance with

Retail

10%

the latter having turned profitable recently, which should result in increase in margins

(c) improvement in ‘core to associate employees handled’ ratio from ~200 to 250.

Post Issue Shareholding Pattern(%)

Outlook & Valuation: Over the last four years, the company has reported strong

revenue CAGR of ~52% and PAT CAGR of ~94% which was largely fuelled by its

Promoters Group

89.5

strategic business acquisitions and by strong growth across business verticals. Going

MF/Banks/Indian

forward we expect the company to report healthy growth on back of increase in industry

FIs/FIIs/Public & Others

10.5

penetration. Further, the company’s profitability is also expected to increase due to its

focus on increasing the share of higher-margin businesses in the revenue mix.

On the valuation front, at the upper end of the price band, the pre-issue P/E

works out to 40.6x its FY2016 earnings which is lower compared to its peers

(Team Lease is trading at 63.1x FY2016 earnings) and also has a better margin

and ROE profile. Further, post the IPO, QCL is expected to improve its operating

margin significantly. Considering the above mentioned positives and the

company’s relatively lower valuation, we recommend a SUBSCRIBE on the issue.

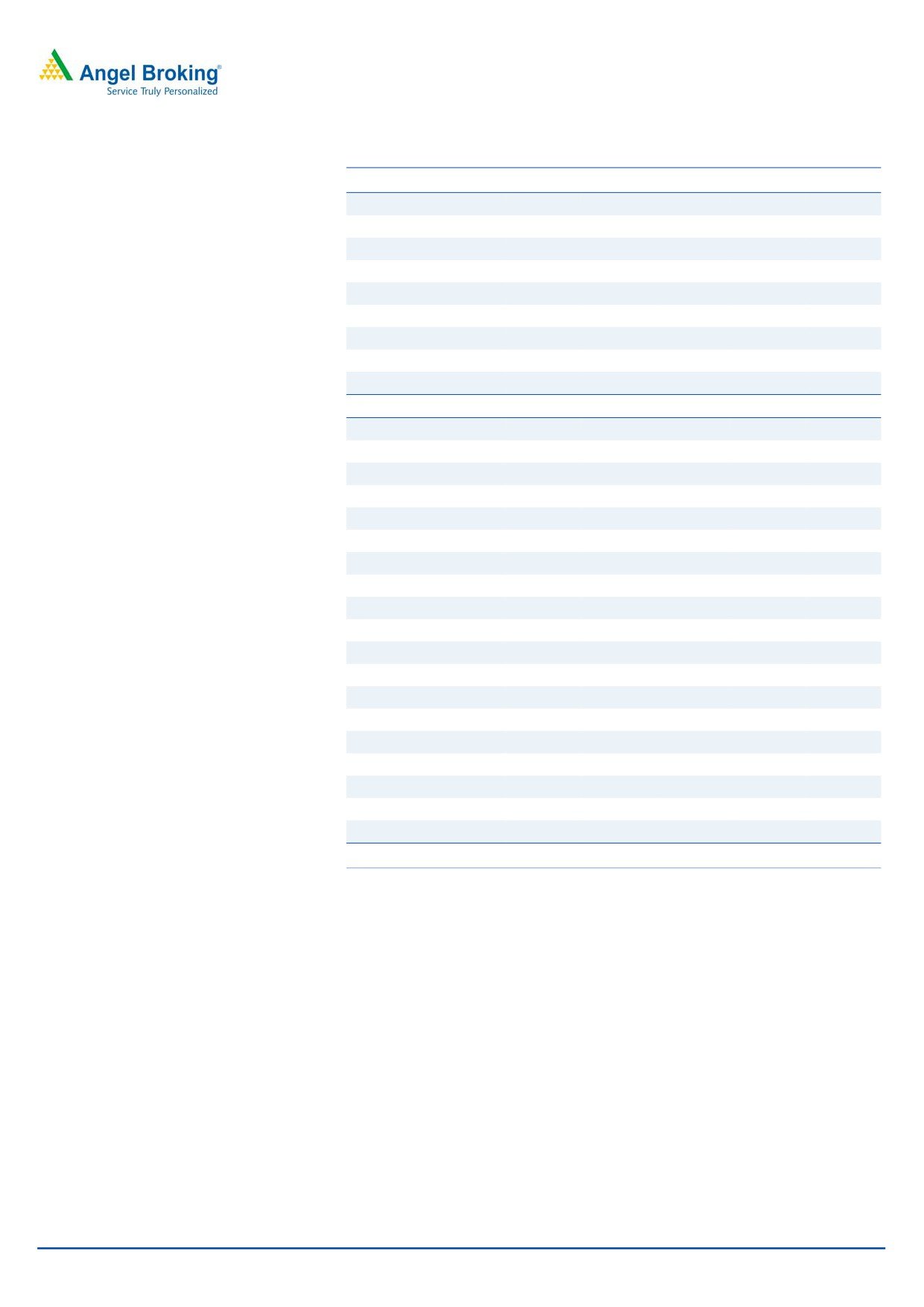

Key Financial

Y/E March (` cr)

FY2012

FY2013

9MFY14

15MFY15

FY2016

Net Sales

637

1,001

1,006

2,567

3,435

% chg

-

57.2

-

-

-

Net Profit

6

12

18

67

89

% chg

-

94.1

-

-

-

Amarjeet S Maurya

OPM (%)

4.2

4.3

4.0

5.1

4.8

EPS (`)

0.5

1.1

1.6

5.9

7.8

+91 22 4000 3600 Ext: 6831

P/E (x)

577.5

297.6

201.1

53.5

40.6

P/BV (x)

67.7

52.6

19.5

14.3

10.4

RoE (%)

11.7

17.7

9.7

26.7

25.6

RoCE (%)

21.4

24.8

14.3

25.5

20.6

Milan Desai

EV/Sales (x)

5.7

3.7

3.6

1.5

1.1

+91 22 4000 3600 Ext: 6846

EV/EBITDA (x)

134.3

84.9

91.0

28.6

23.5

Source: Company, Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end of the price band

Please refer to important disclosures at the end of this report

1

Quess Corp | IPO Note

Company background

QCL is among India’s leading integrated business service providers, focused on

emerging as the preferred partner for handling end-to-end business functions of its

clients. It has a pan-India presence with 47 offices across 26 cities, as well as

operations in North America, the Middle East and South East Asia. As of February

29, 2016, the company has employed more than 120,000 employees, including

over

3,400 Core Employees and over

117,000 Associate Employees, i.e.

employees placed with its clients. As of March 31, 2016, the company had more

than 1,300 clients, based on ongoing contracts. The company’s top 10 clients

accounted for 30.4% of its revenue in FY2016 and the largest client’s share was

7.4% in the same period.

The company’s operations can be classified into four key business services -

Global Technology Solutions (GTS), People and Services (P&S), Integrated Facility

Management (IFM) and Industrial Asset Management (IAM).

Exhibit 1: Operational snapshot

Quess Corp

Global Technology

Integrated Facility

Industrial Asset

People and Services (P&S)

Solutions (GTS)

Management (IFM)

Management (IAM)

General Staffing, Recruitment &

executive search, Recruitment

Soft services (cleaning, security,

Industrial operations &

IT staffing, and IT

process outsourcing, and

pest control, etc), Hard services

maintenance, Technology

Services

product solutions &

Payroll, compliance &

(electro mechanical, HVAC,

& consultation, and

services

background verification services,

refurbishment, etc), and Food &

Managed services

and Training and skill

hospitality services

development services

MFX, Brain Hunter,

Brands

Magna Infotech, and

IKYA, CoAchieve, and Excelus

Avon, and Aravon

Hofincons, and Maxeed

Mindwire

Robert Bosch, Large financial

L&T Special Steels and

Amazon, Bata, FMC,

Four Fortune 50 companies,

institutions in India, Fortune 500

Heavy Forgings, and

Hinduja Group, PNB

Key Clients

Large international banks and

real estate services companies,

India’s leading steel,

Housing Finance,

Indian IT consulting companies

and Private airport management

cement & energy

and VF Brands

companies

companies

TeamLease Services Limited,

Sodexo India, ISS

Power Mech Projects Ltd,

Manpower,

Adecco Personnel Pte. Ltd.,

Integrated Services Private Ltd,

Energo Construction Ltd,

Collabera, Artech,

Randstad Holding, Genius

Compass Group India Support

Competitors

and McNally Bharat

SourceOne, and

Consultants, Manpower Group,

Services Private Ltd, BVG India

Engineering Company Ltd

Datamatics

Global Innovsource Solutions,

Ltd, and Updater Services India

in India

etc.

Ltd

Associate Employees

8,077

82,170

20,012

-

Core Employees

723

405

343

-

Core/Associates

11

203

58

-

Source: Company, Angel Research

Over the years, the company has grown inorganically, with it having acquired 9

companies since 2008. It has also entered into an agreement to acquire Transfield

Services (Qatar) WLL (subject to receipt of relevant approvals).

June 27, 2016

2

Quess Corp | IPO Note

Exhibit 2: Key Acquisitions

Company

Date of Acquisition/ Consolidation

Shareholding Acquired

Total Shareholding

Avon

July 14, 2008

74.0%

74.0%

Magna Infotech

December 23, 2010

51.0%

51.0%

Avon

May 14, 2013

26.0%

100.0%

Magna Infotech

May 13, 2013

49.0%

100.0%

Hofincons

June 27, 2014

100.0%

100.0%

Brainhunter

October 23, 2014

100.0%

100.0%

MFX

November 3, 2014

49.0%

49.0%

Aravon Services

April 1, 2015

100.0%

100.0%

MFX

January 1, 2016

51.0%

100.0%

Randstad Lanka

April 26, 2016

100.0%

100.0%

Source: Company, Angel Research

Issue details

The company is raising `400cr through fresh issue of equity shares in the price

band of `310-317. The fresh issue will constitute 10% of the post-issue paid-up

equity share capital of the company assuming the issue is subscribed at the upper

end of the price band.

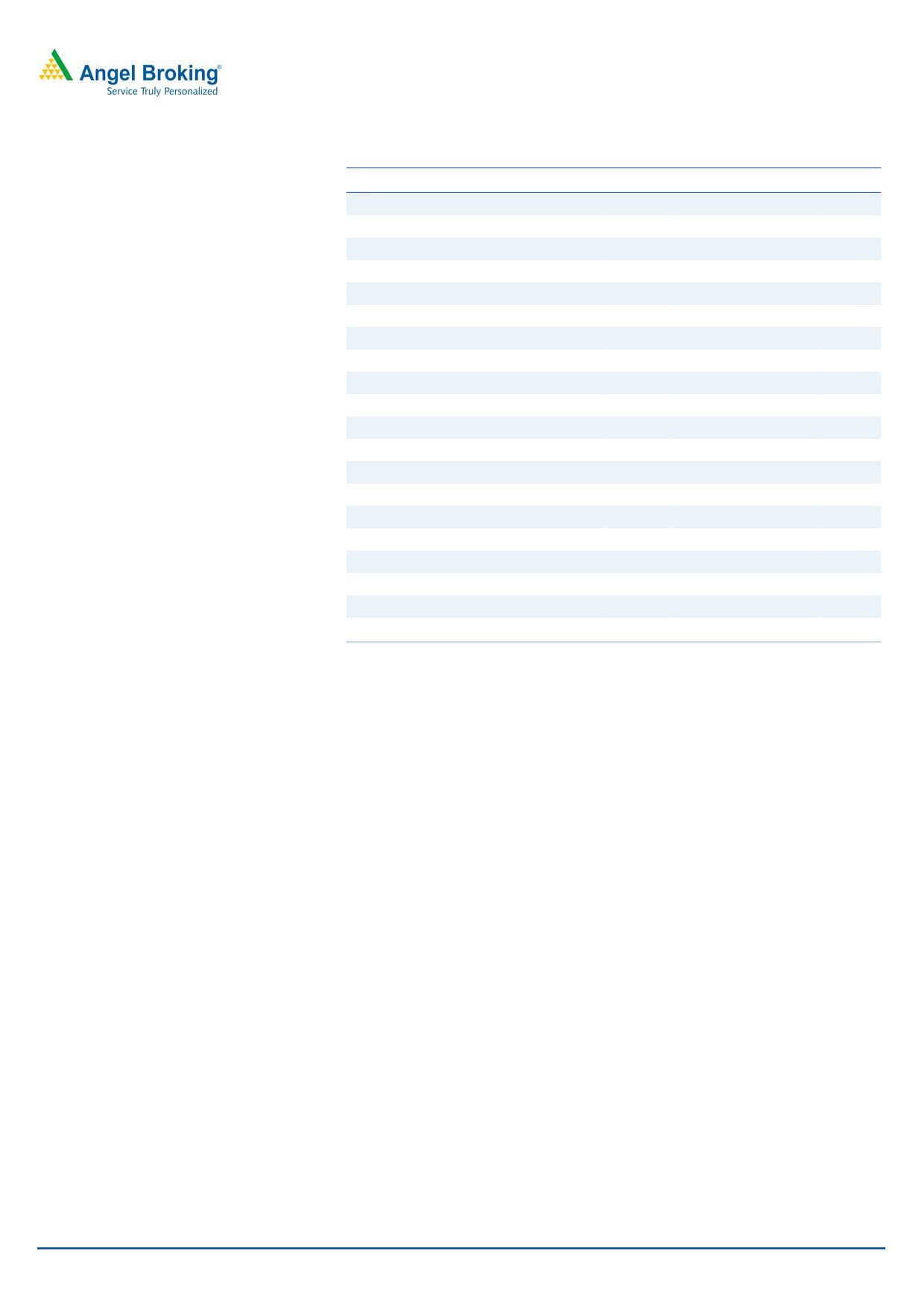

Exhibit 3: Shareholding pattern

Particulars

Pre-Issue

Post-Issue

No. of shares

(%)

No. of shares

(%)

Promoter group

11,27,75,280

99.5

11,27,75,280

89.5

Others

5,59,776

0.5

1,31,78,073

10.5

Total

11,33,35,056

100.0

12,59,53,353

100.0

Source: Company, Angel Research

Objects of the offer

`50cr will be utilized for repayment of debt availed by the company.

~`72cr will be used for funding capital expenditure requirements of the

company and its subsidiary, MFX US.

~`158cr will be used for funding incremental working capital requirement of

the company.

`80cr will be utilized for acquisitions and other strategic initiatives.

The balance will be used for general corporate purposes.

June 27, 2016

3

Quess Corp | IPO Note

Investment rationale

Huge growth opportunities across business verticals

QCL is present in high growth business verticals like temporary general staffing,

payroll and compliance outsourcing, professional IT staffing, and facilities

management etc. through its different brands.

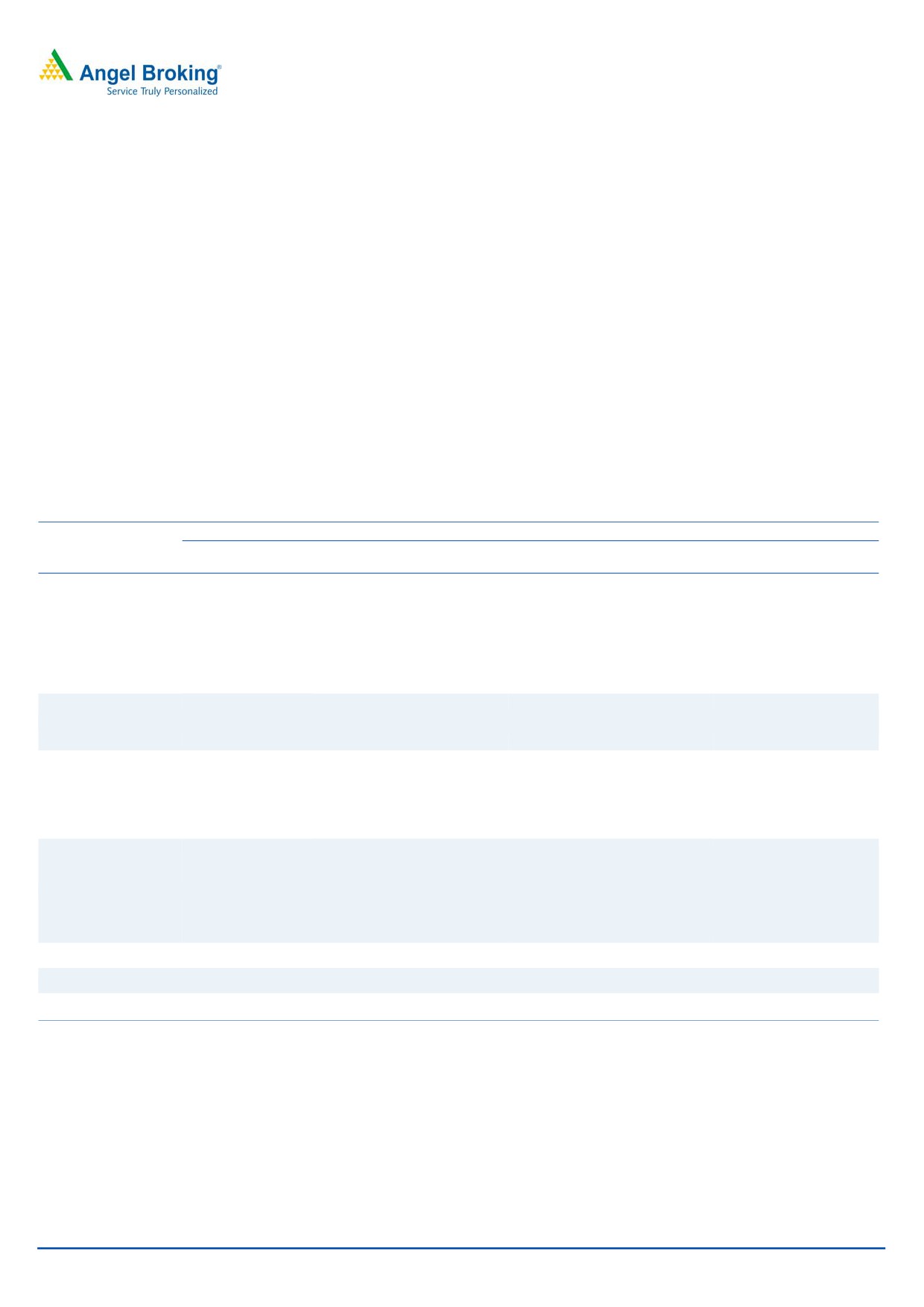

Exhibit 4: Revenue break-up business verticals wise (in FY2016)

IAM, 6%

IFM, 11%

GTS, 27%

P&S, 57%

Source: Company, Angel Research

The market for these verticals in India is expected to grow at a CAGR of 19-24%

over 2014-19 according to a report by Frost & Sullivan (published in January

2016). Further, penetration levels of these business services is low in India (0.1%

for temporary staffing; among the lowest in the world), whereas the same is

expected to rise as there is a growing need for flexible and efficient cost structures.

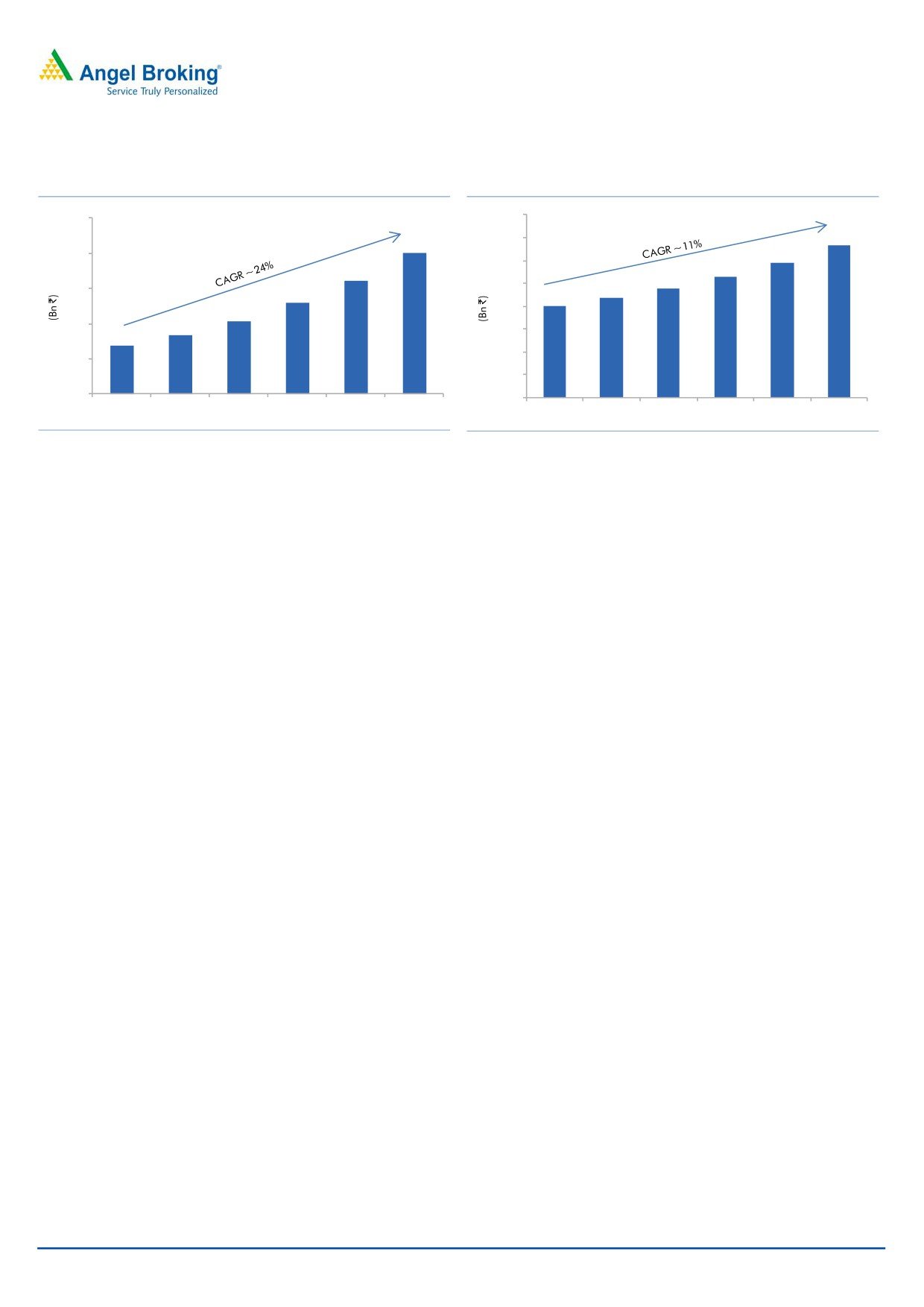

Exhibit 5: Temporary General Staffing Market-Revenue

Exhibit 6: Professional IT Staffing Market-Revenue

Forecasts, India, 2014-19

Forecasts, India, 2014-2019

1,000

917

400

900

333.8

350

769

800

300

271.7

700

645

600

542

250

222

457

182.4

500

200

385

150.7

400

125

150

300

100

200

50

100

0

0

2014

2015

2016

2017

2018

2019

2014

2015

2016

2017

2018

2019

Source: Company, Angel Research

Source: Company, Angel Research

June 27, 2016

4

Quess Corp | IPO Note

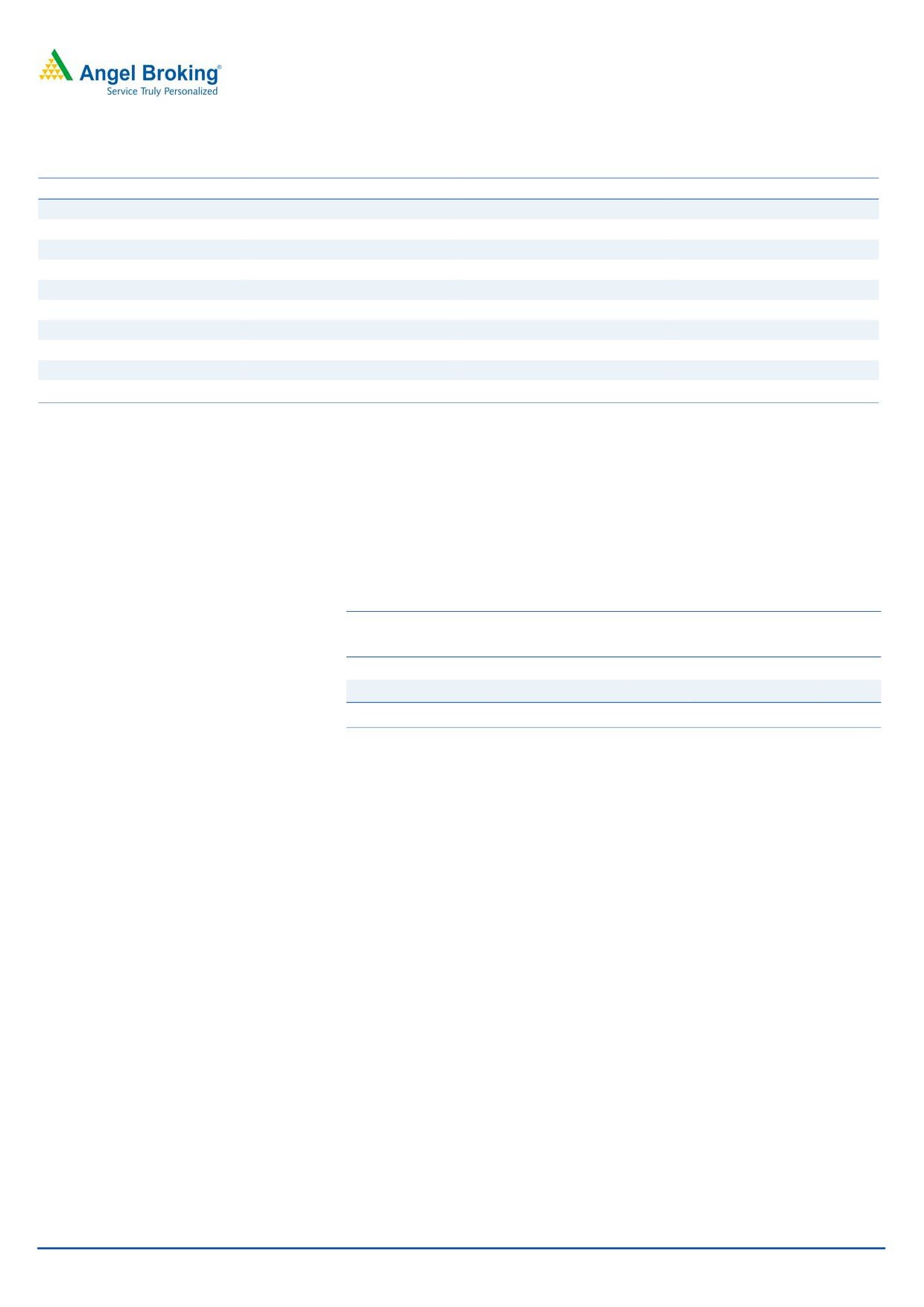

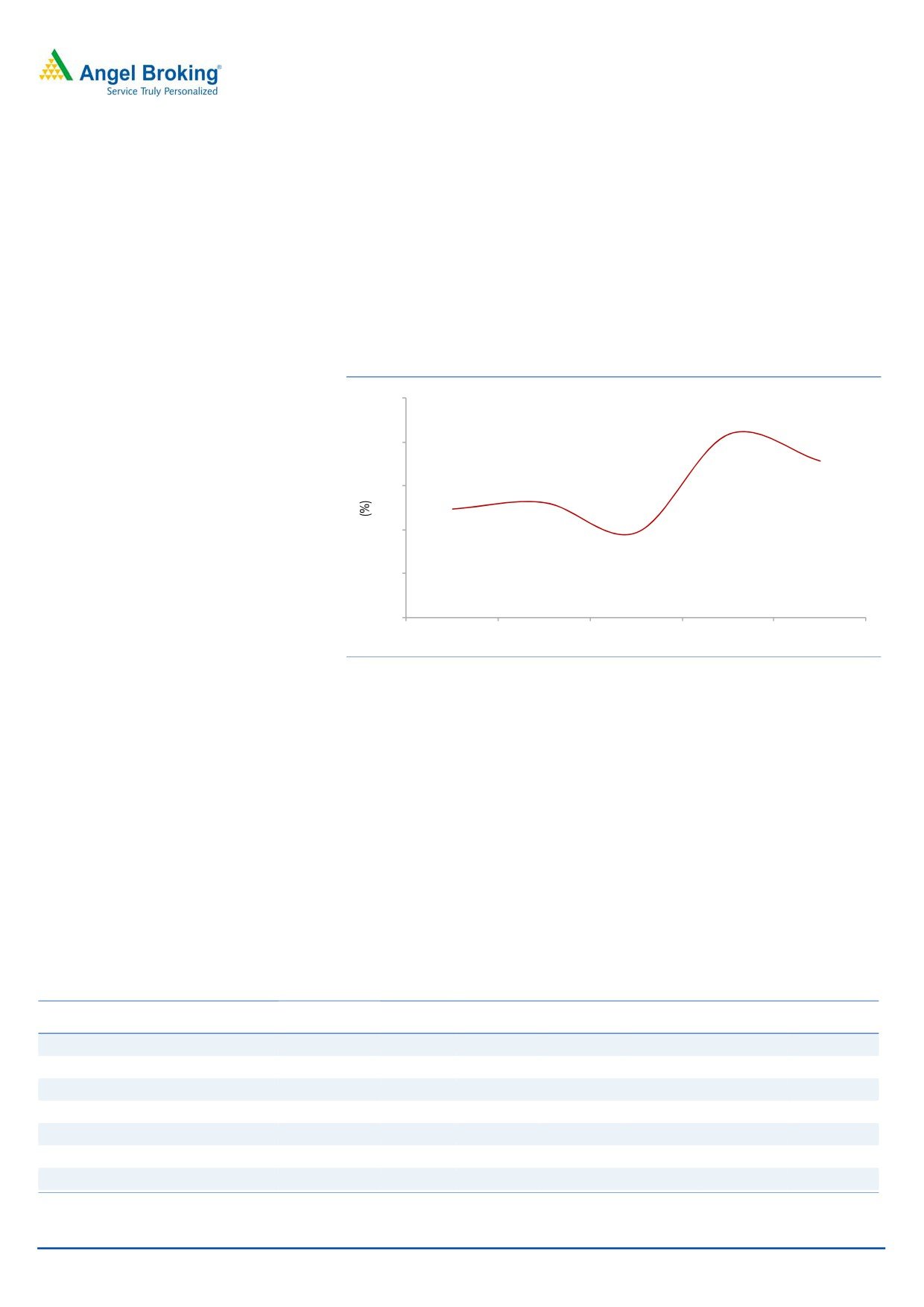

Exhibit 7: Integrated Facilities Management Market-

Exhibit 8: Forecast of the Industrial Asset Management

Revenue Forecast, India, 2014-19

Market, India, 2014-19

250

80.0

66.8

200

70.0

200

59.1

60.0

52.9

160

47.7

50.0

43.5

150

129

40.0

104

40.0

100

84

30.0

68

20.0

50

10.0

0

0.0

2014

2015

2016

2017

2018

2019

2014

2015

2016

2017

2018

2019

Source: Company, Angel Research

Source: Company, Angel Research

We expect QCL to benefit from increasing demand for manpower across industries

on the back of its strong Management, healthy track record and presence in

diversified business verticals which would help it to enhance its market share and

increase revenue.

June 27, 2016

5

Quess Corp | IPO Note

Focus on high-margin business

Going forward, we expect the company’s overall operating margin to improve on

back of (a) change in revenue mix in favor of higher margin businesses (currently

the People and Services business contributes ~55% of the company’s overall top-

line which is a low margin segment) (b) two of its acquisitions Brainhunter and MFX

showing improvement in performance with the latter having turned profitable

recently, which should result in increase in margins (c) improvement in ‘core to

associate employees handled’ ratio from ~200 to 250.

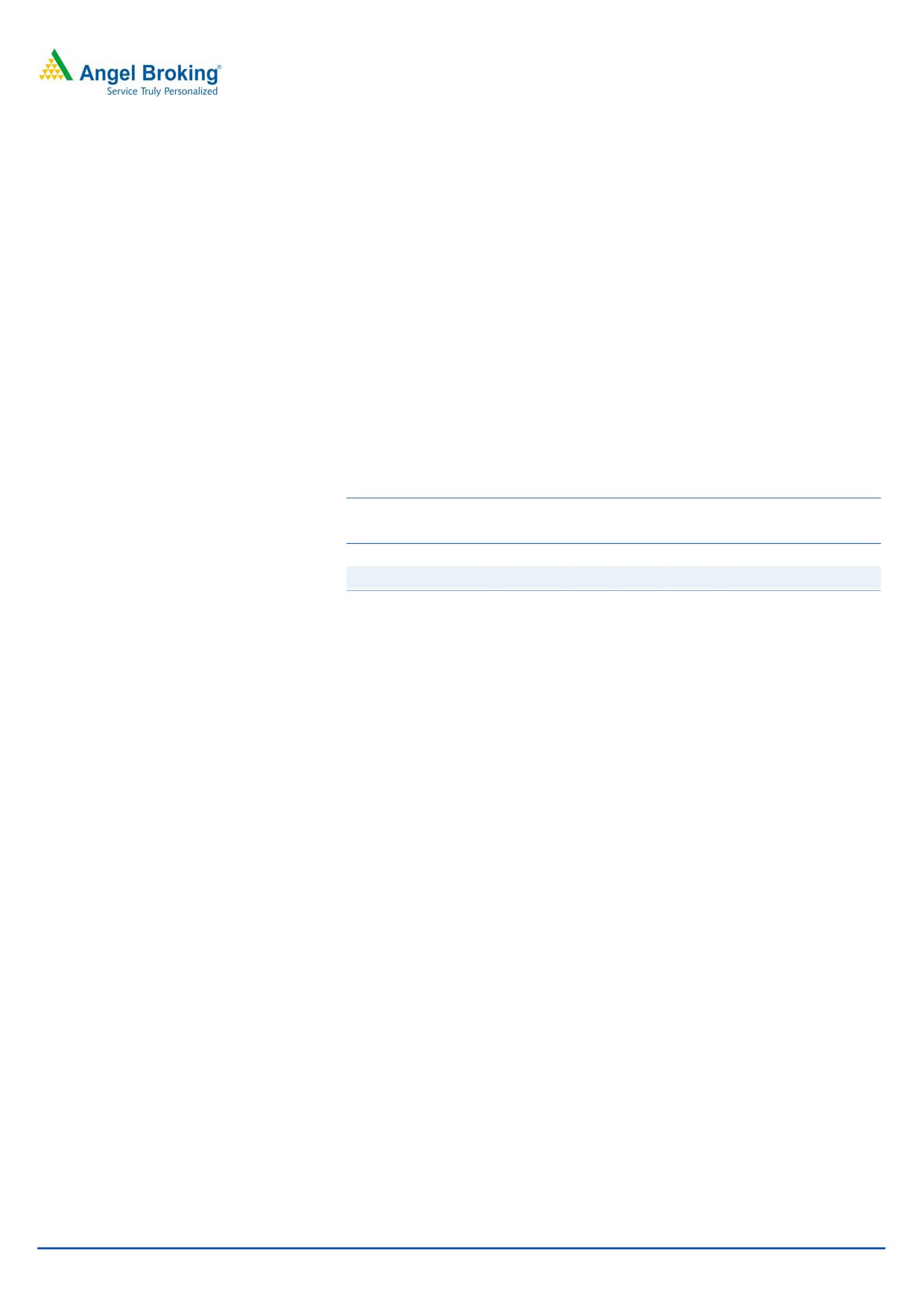

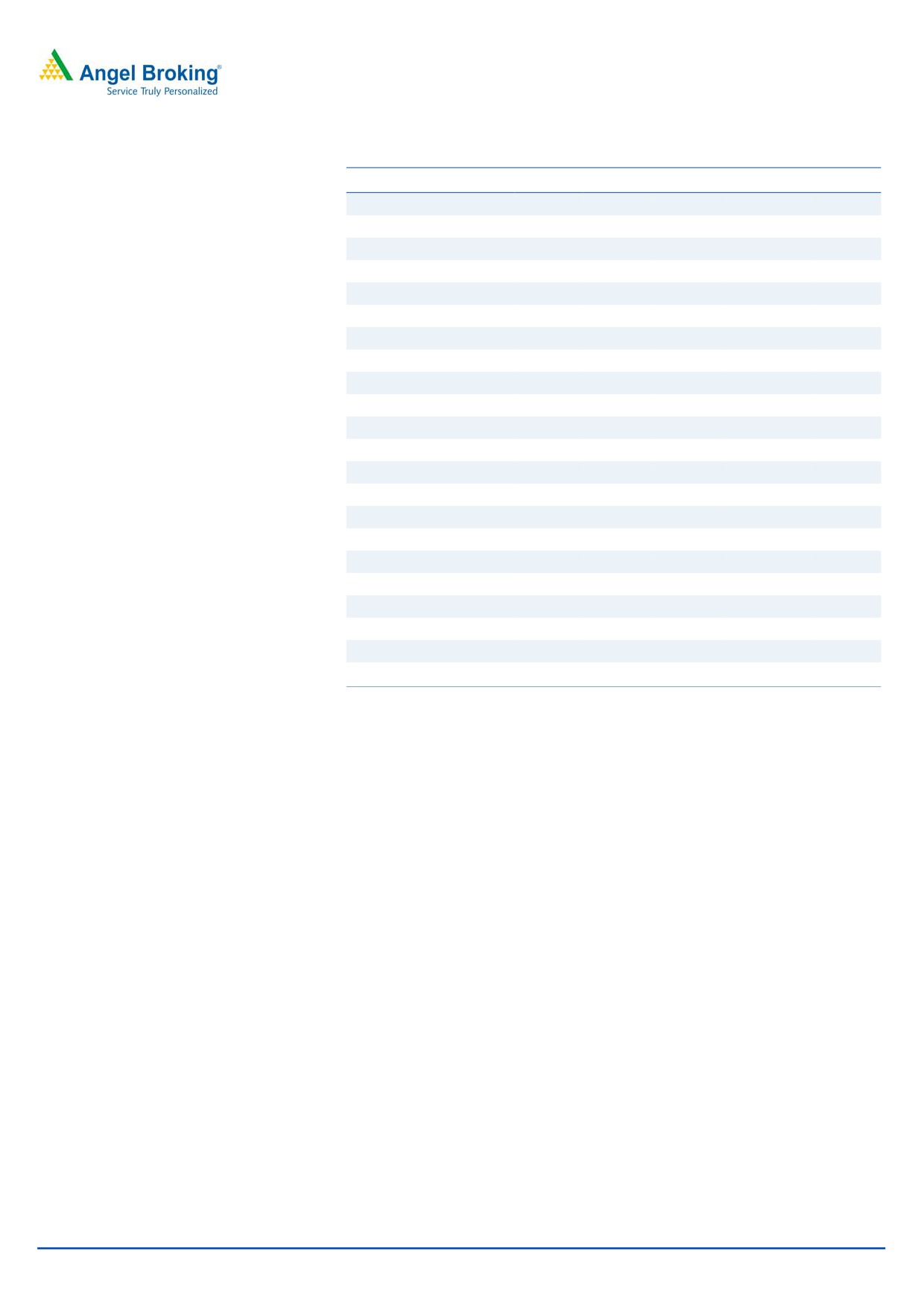

Exhibit 9: Operating margin trend

5.5

5.1

5.0

4.8

4.5

4.3

4.2

4.0

4.0

3.5

3.0

FY2012

FY2013

9MFY14

15MFY15

FY2016

Source: Company, Angel Research

Successful track record in strategic acquisitions which has

boosted the company’s overall financials

Over the years, QCL has acquired 9 companies. The company has established a

track record of successful inorganic growth through strategic acquisitions to

supplement the business verticals, diversify revenue streams, and integrate such

acquired businesses to further strengthen the service portfolio.

The company has historically introduced operating efficiencies, revenue growth

and increased profitability in acquired businesses, resulting in increased operating

margins. In the past, the company has significantly grown the business and

improved the financial performances of Magna and Avon following their

acquisitions.

Exhibit 10: Financial performance of Magna and Avon following their acquisition

Year of

Avon

FY2011

FY2012

FY2013

9MFY14

15MFY15

1HFY2016

acquisition

Revenue (` cr)

11.7

46.3

71.7

114.2

127.2

302.1

152.2

EBITDA

0.2

2.2

5.2

8.0

8.1

20.7

9.8

(%)

1.9%

4.7%

7.2%

7.0%

6.4%

6.9%

6.5%

Magna Infotech

Revenue

182.0

181.96

205.3

269.3

262.8

544.8

233.7

EBITDA

10.0

10.0

13.6

18.4

21.6

63.7

26.6

(%)

5.5%

5.5%

6.6%

6.9%

8.2%

11.7%

11.4%

Source: Company, Angel Research

June 27, 2016

6

Quess Corp | IPO Note

Outlook and Valuation

Over the last four years, the company has reported strong revenue CAGR of

~52% and PAT CAGR of ~94% which was largely fuelled by its strategic business

acquisitions and by strong growth across business verticals. Going forward we

expect the company to report healthy growth on back of increase in industry

penetration. Further, the company’s profitability is also expected to increase due to

its focus on increasing the share of higher-margin businesses in the revenue mix.

On the valuation front, at the upper end of the price band, the pre-issue P/E works

out to 40.6x its FY2016 earnings which is lower compared to its peers (Team Lease

is trading at 63.1x FY2016 earnings) and also has a better margin and ROE

profile. Further, post the IPO, QCL is expected to improve its operating margin

significantly. Considering the above mentioned positives and the company’s

relatively lower valuation, we recommend a SUBSCRIBE on the issue.

Exhibit 11: Comparative Valuation

P/E

P/BV

ROE EV/Sales

EV/EBITDA

Pre issue valuation^

(x)

(x)

(%)

(x)

(x)

QCL

FY2016

40.6

10.4

25.6

1.0

23.5

TeamLease

FY2016

63.1

5.0

8.0

0.5

51.4

Source: RHP, Bloomberg; Note: ^based on price at upper band

Risks

Intense competition and lack of pricing power: The staffing industry is highly

fragmented with intense competition and lacks a clear cut leader accounting for

dominant share in the employment services market. Almost 70-80% of the

industry is unorganized consisting of small players. Although QCL is the third

largest player in the industry, its lead over its followers is narrow. QCL faces stiff

competition from these companies as well as other small players, thus leading to

lack of pricing power.

Slowdown in economy: Slowdown in economy can restrict QCL’s growth as it

provides temporary staffing solution to various sectors like manufacturing, logistic,

telecom, hospitality, IT/ITes etc. which are dependent on economic growth.

June 27, 2016

7

Quess Corp | IPO Note

Profit & Loss (consolidated)

Y/E March (` cr)

FY2012

FY2013

9MFY14

15MFY15

FY2016

Total operating income

637

1,001

1,006

2,567

3,435

% chg

-

57.2

-

-

-

Total Expenditure

610

958

966

2,437

3,271

Cost of Services

5

15

22

72

63

Personnel Expenses

574

907

910

2,268

3,036

Others Expenses

31

36

34

96

172

EBITDA

27

43

40

130

164

% chg

-

59.9

-

-

-

(% of Net Sales)

4.2

4.3

4.0

5.1

4.8

Depreciation& Amort.

4

4

4

10

16

EBIT

23

39

36

120

148

% chg

-

66.3

-

-

-

(% of Net Sales)

3.7

3.9

3.5

4.7

4.3

Interest & other Charges

13

18

9

22

31

Other Income

2

3

2

6

7

(% of PBT)

18.6

13.2

7.4

5.5

5.9

Recurring PBT

13

24

29

104

125

% chg

-

85.6

-

-

-

Extraordinary Expense/(Inc.)

-

-

-

-

-

PBT (reported)

13

24

29

104

125

Tax

5

7

10

37

36

(% of PBT)

36.5

29.6

33.7

35.5

29.0

PAT before MI

8

17

19

67

89

Minority Interest (after tax)

2

5

1

-

-

PAT after MI(reported)

6

12

18

67

89

Exceptional Items

-

-

-

-

-

ADJ. PAT

6

12

18

67

89

% chg

-

94.1

-

-

-

(% of Net Sales)

1.0

1.2

1.8

2.6

2.6

Basic EPS (`)

0.5

1.1

1.6

5.9

7.8

Fully Diluted EPS (`)

0.5

1.1

1.6

5.9

7.8

% chg

-

94.1

-

-

-

June 27, 2016

8

Quess Corp | IPO Note

Balance Sheet (consolidated)

Y/E March (` cr)

FY2012

FY2013

9MFY14

15MFY15

FY2016

SOURCES OF FUNDS

Equity Share Capital

30

30

96

26

113

Reserves& Surplus

23

38

88

226

232

Shareholders Funds

53

68

185

252

346

Minority Interest

11

16

-

-

-

Total Loans

56

88

64

220

374

Other long term liabilities

-

0

2

1

-

Long-term provisions

1

1

1

9

46

Deferred Tax Liability

-

-

-

-

-

Total Liabilities

121

174

252

482

767

APPLICATION OF FUNDS

Gross Block

19

24

32

60

147

Less: Acc. Depreciation

12

16

20

41

97

Net Block

7

8

12

19

51

Capital Work in Progress

-

-

0

-

2

Goodwill

25

25

73

110

205

Investments

-

-

-

-

4

Current Assets

189

261

245

531

867

Inventories

0

0

0

0

2

Sundry Debtors

118

158

124

275

428

Cash

29

23

29

82

109

Loans & Advances

14

26

9

44

40

Other Assets

29

54

82

131

288

Current liabilities

133

157

146

238

471

Net Current Assets

56

104

99

294

396

Long term loans and adv.

25

29

63

55

84

Other Non Current Assets

0

1

0

0

2

Deferred Tax Asset

8

7

5

4

23

Mis. Exp. not written off

-

-

-

-

-

Total Assets

121

174

252

482

767

June 27, 2016

9

Quess Corp | IPO Note

Cash flow statement (consolidated)

Y/E March (` cr)

FY2012

FY2013

9MFY14

15MFY15

FY2016

Profit before tax

13

24

29

104

125

Depreciation

4

4

4

10

16

Change in Working Capital

(16)

(45)

(5)

(94)

(164)

Interest / Dividend (Net)

11

16

9

21

30

Direct taxes paid

(9)

(20)

(25)

(41)

(53)

Others

2

4

4

3

2

Cash Flow from Operations

5

(16)

15

2

(44)

(Inc.)/ Dec. in Fixed Assets

(5)

(4)

(9)

(14)

(23)

(Inc.)/ Dec. in Investments

1

0

(57)

(55)

0

Cash Flow from Investing

(4)

(4)

(66)

(69)

(23)

Issue of Equity

-

-

97

-

3

Inc./(Dec.) in loans

19

32

(24)

101

114

Dividend Paid (Incl. Tax)

-

-

-

-

-

Interest / Dividend (Net)

(13)

(17)

(9)

(22)

(30)

Cash Flow from Financing

7

15

64

80

86

Inc./(Dec.) in Cash

7

(5)

13

13

19

Opening Cash balances

10

18

12

25

74

Acquired on acquisition

-

-

-

37

13

Forex translation

-

-

(0)

(1)

(0)

Closing Cash balances

18

12

25

74

107

June 27, 2016

10

Quess Corp | IPO Note

Key Ratios

Y/E March

FY2012

FY2013

9MFY14

15MFY15

FY2016

Valuation Ratio (x)

P/E (on FDEPS)

577.5

297.6

201.1

53.5

40.6

P/CEPS

362.6

218.2

162.6

46.4

34.4

P/BV

67.7

52.6

19.5

14.3

10.4

EV/Sales

5.7

3.7

3.6

1.5

1.1

EV/EBITDA

134.3

84.9

91.0

28.6

23.5

EV / Total Assets

14.2

11.1

9.1

5.2

3.1

Per Share Data (`)

EPS (Basic)

0.5

1.1

1.6

5.9

7.8

EPS (fully diluted)

0.5

1.1

1.6

5.9

7.8

Cash EPS

0.9

1.5

1.9

6.8

9.2

Book Value

4.7

6.0

16.3

22.2

30.5

Returns (%)

ROCE

21.4

24.8

14.3

25.5

20.6

Angel ROIC (Pre-tax)

42.5

35.9

24.4

43.0

37.0

ROE

11.7

17.7

9.7

26.7

25.6

Turnover ratios (x)

Asset Turnover (Gross Block)

33.4

41.1

31.6

42.5

23.3

Inventory / Sales (days)

0

0

0

0

0

Receivables (days)

67

58

34

49

45

Payables (days)

2

2

1

7

7

WC cycle (ex-cash) (days)

65

56

33

42

39

Note: Valuation ratios based on pre-issue outstanding shares and at upper end of the price band

June 27, 2016

11

Quess Corp | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

June 27, 2016

12