IPO Note | Auto Ancillary

January 27, 2016

Precision Camshafts

NEUTRAL

Issue Open: January 27, 2016

IPO Note - Valuations expensive; Neutral

Issue Close: January 29, 2016

Investment Rationale:

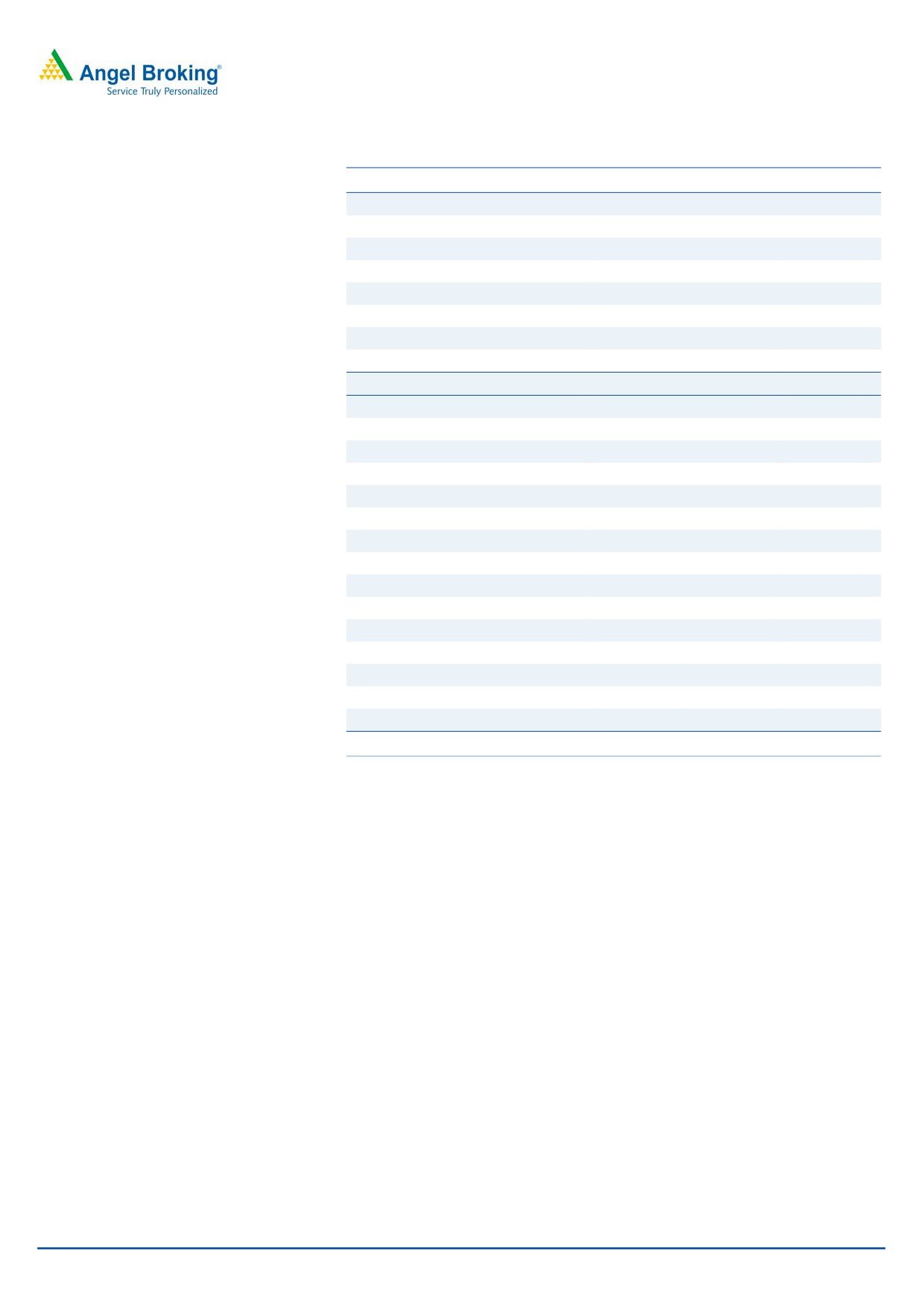

Issue Details

Amongst largest camshaft player with long term client relationship

Face Value: `10

PCL is one of the world’s leading manufacturers and suppliers of passenger

vehicle camshafts producing about 150 different varities. Over the last five years,

Present Eq. Paid up Capital: `81.8cr

PCL has almost doubled its market share and currently commands about 8-9% of

Fresh Issue**: 1.29cr Shares

the global passenger vehicle camshaft market. PCL has developed long term

Offer for sale: 0.92cr Shares

relationship of over 10 years with global OEM’s and, is the preferred supplier with

General Motors, Ford Motors, Hyundai, Maruti Suzuki and Tata Motors.

Post Eq. Paid up Capital: `94.7cr

Increased outsourcing of machining by OEM’s coupled with new plant to trigger

Market Lot: 80 Shares

growth: There is a growing trend of outsourcing camshaft machining amongst the

Fresh Issue (amount): `240cr

global OEM’s. As per the industry estimates, currently ~35% of camshafts are

Price Band: `182-186

machined in house by the OEM’s. Given the high capex involved in setting up the

machining facilities (machining typically has asset turnover of 1x), OEM’s are

Post-issue implied mkt. cap `1,724cr*-

1,762cr**

increasingly outsourcing the machining operations. Further, the proposed new

Note:*at Lower price band and **Upper price band

ductile iron camshaft machining plant would broaden the product profile for PCL.

Investment concern:

Currency risks and client concentration: PCL derives about 80% of revenues from

Book Building

exports with Euro and GBP constituting major revenue currencies thus exposing it

QIBs

60%

to risk of adverse currency movement. Further, General Motors and Ford form about

Non-Institutional

15%

35% of the revenues each leading to client concentration.

Retail

35%

Outlook and Valuation: PCL return ratios are likely to be impacted over the next

two years on account of raising of capital and low capacity utilisation of the plant

initially. Further PCL is exposed to currency risks and higher client concentration.

Post Issue Shareholding Pattern(%)

On the price to earnings per share (EPS; post-IPO) front, the company is valued at

Promoters Group

63.5

25.8x 1HFY2016 annualized numbers, while a larger and more diversified player

MF/Banks/Indian

in a similar business, Bharat Forge is trading at a similar multiple of 25.1x

FIs/FIIs/Public & Others

36.5

FY2016 estimated numbers despite better ROE. Also, another player in forgings

business like Ramkrishna Forgings with a better ROE is trading at steep discount

to PCL. Further, PCL is trading at a higher EV/Sales multiple of 3.6x as compared

to 2.7x and 2.2x of Bharat Forge and Ramkrishna Forgings respectively despite

competitors having diverse product profile and far bigger size as compared to

PCL. Hence we recommend Neutral on the issue given the expensive valuations.

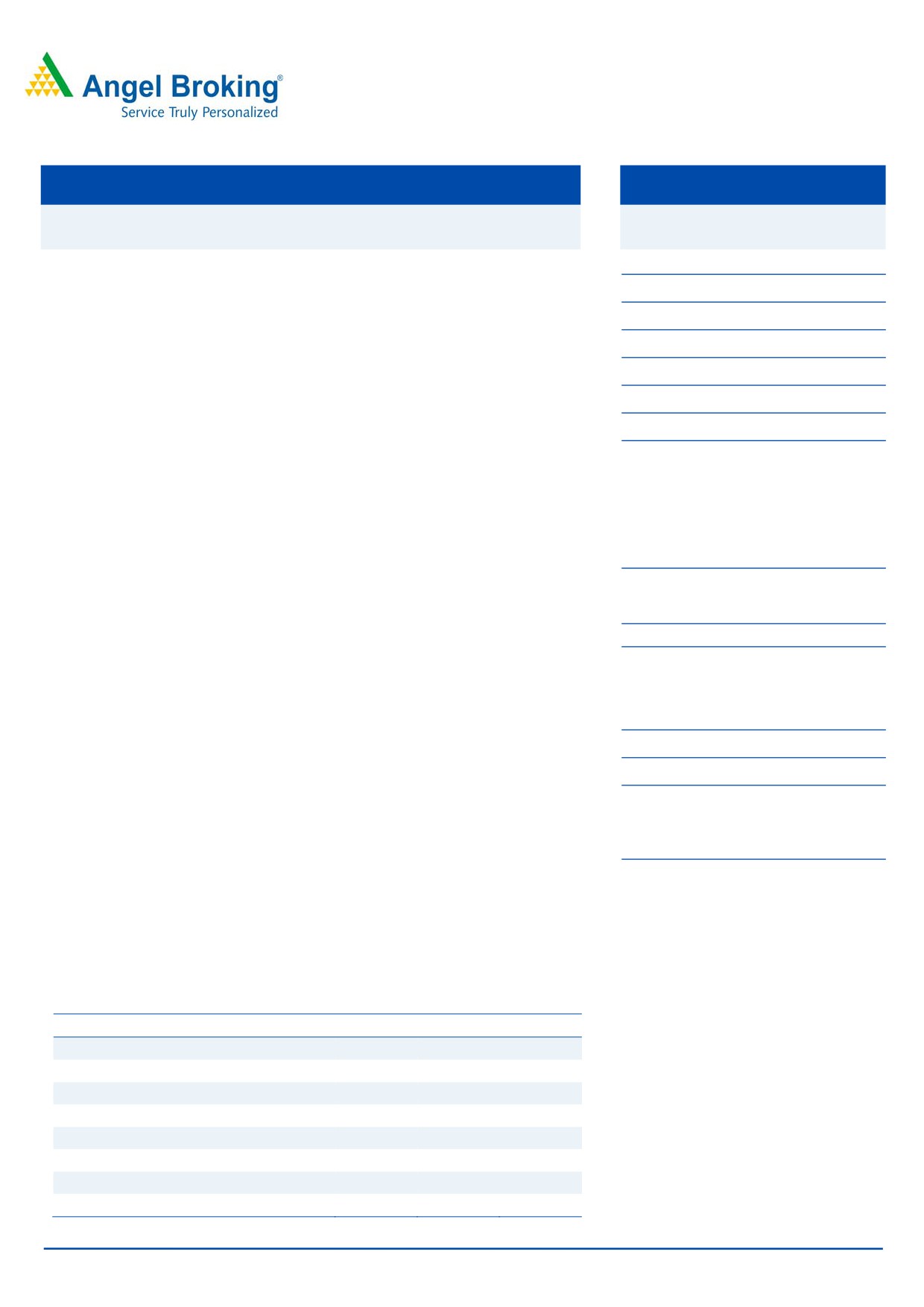

Key Financials

Y/E March (` cr)

FY2014

FY2015

1HFY16

Net Sales

467

532

253

Net Profit

13

62

34

OPM (%)

13.4

26.5

28.6

EPS (`)

1.6

7.6

4.2

P/E (x)*

116.0

24.4

-

P/BV (x)*

8.7

6.5

-

Bharat Gianani

EV/Sales (x)*

4.1

3.5

-

+91 22 3935 7800 Ext: 6817

EV/EBITDA (x)*

30.7

13.2

-

Source: Company, Angel Research; Note: *The above numbers are considering subscription at the

upper end of the price band

Please refer to important disclosures at the end of this report

1

Precision Camshafts | IPO Note

Company background

Precision Camshafts Ltd (PCL) was incorporated in 1992 and is based in Solapur,

Maharashtra. PCL, promoted by Mr Yatin Shah is one of the world’s leading

manufacturer and supplier of passenger vehicle camshafts commanding a global

market share of about

8-9%. Camshaft is a critical engine component as

camshaft’s design impacts the engine’s power, efficiency, mileage and emission.

PCL supplies over 150 varieties of camshafts for passenger vehicles, tractors, light

commercial vehicles and locomotive engine applications from its manufacturing

facilities in Solapur, Maharashtra. PCL currently has two state-of-the-art

manufacturing facilities - an EOU unit and a domestic unit - both situated at

Solapur, Maharashtra. PCL’s manufacturing capacity is 13.38 million camshaft

castings per annum and 2.22 million machined camshafts per annum. PCL key

customers include global car makers viz General Motors, Ford Motors, Hyundai,

Maruti Suzuki, Tata Motors and Mahindra and Mahindra. PCL derives majority of

the revenues (80%) from exports whilst the rest is derived from the domestic

market.

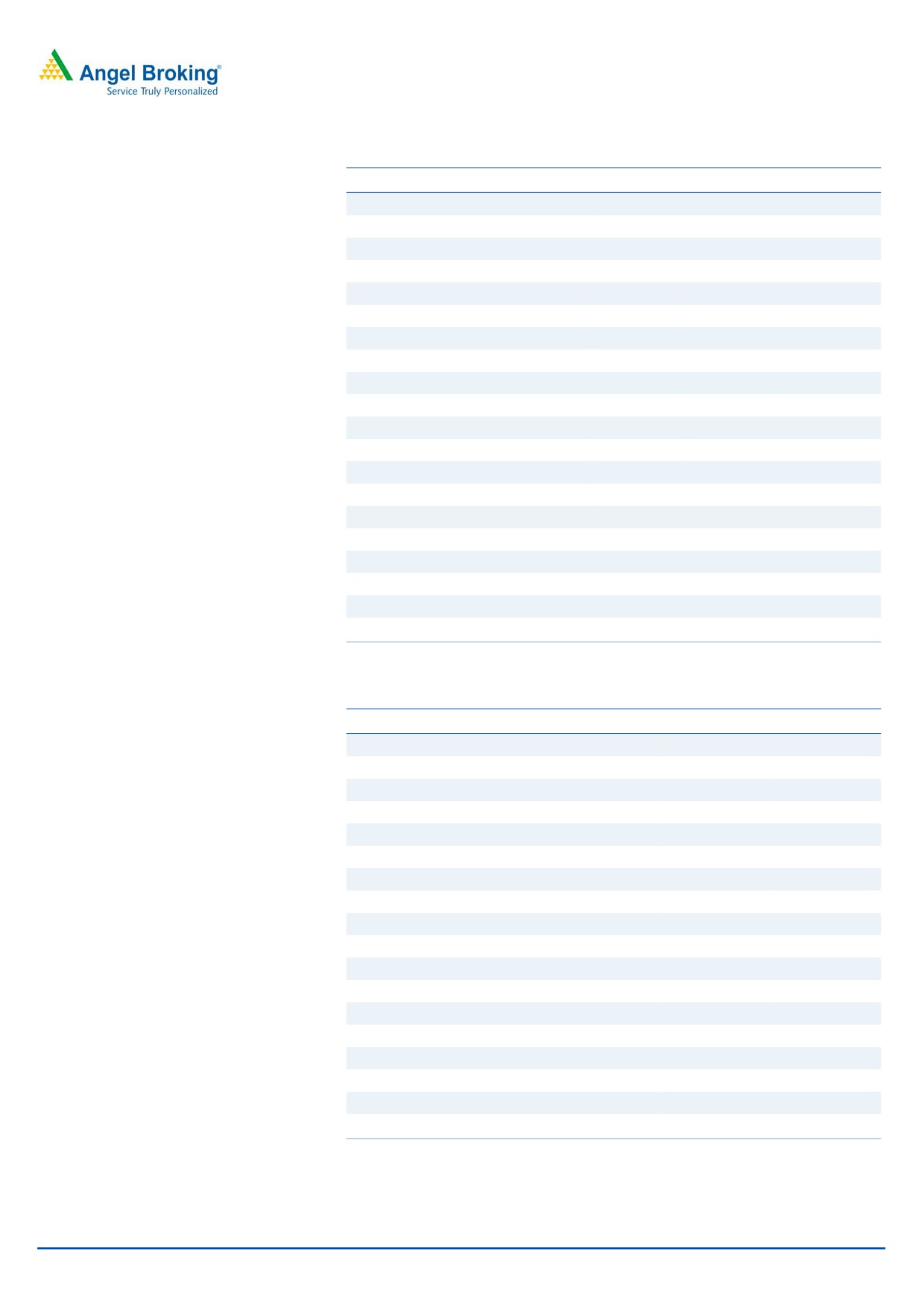

Exhibit 1: Manufacturing unit details (EOU unit Solapur)

FY15

Foundry/shops

Capacity

Capacity utilisation

Camshaft castings

Four foundries

12 mn

80.47%

Machined camshafts

Two machine shops

1.86 mn

54.67%

Source: Company, Angel Research

Exhibit 2: Manufacturing unit details (Domestic unit Solapur)

FY15

Foundry/shops

Capacity

Capacity utilisation

Camshaft castings

One foundry

1.38 mn

33.32%

Machined camshafts

One machine shop

0.36 mn

57.56%

Source: Company, Angel Research

Issue details

The company is raising `240 cr through fresh issue of equity shares in the price

band of `182-186. In addition, the issue also consists of offer for sale of 91.5 lakh

shares of which 61.5 lakh shares will be offered by the promoter entities and 30

lakh shares by other investors. The fresh issue will constitute 13.62% of the post-

issue paid-up equity share capital of company assuming the issue is done at the

upper price band.

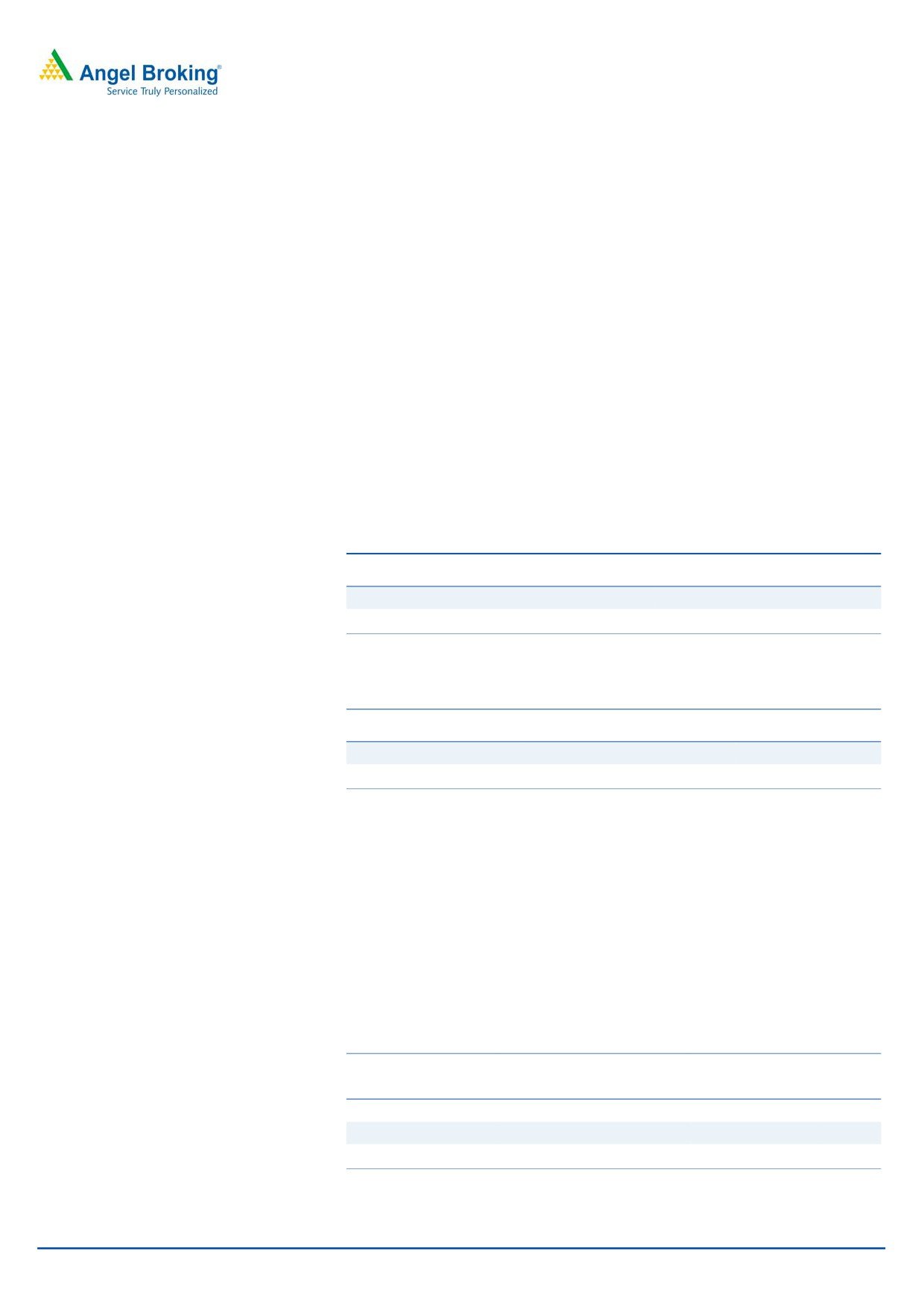

Exhibit 3: Shareholding pattern

Particulars

Pre-Issue

Post-Issue

No. of shares

(%)

No. of shares

(%)

Promoter group

66,706,400

81.5

60,206,400

63.5

Others

15,135,200

18.5

34,538,426

36.5

Total

81,841,600

100.0

94,744,826

100.0

Source: Company, Angel Research

January 27, 2016

2

Precision Camshafts | IPO Note

Objects of the offer

Investing `200 cr for establishment of a machine shop for ductile iron

camshafts at the Solapur EOU

General corporate purposes

Key investment rationale

Amongst largest camshaft player having long term relationship

with global clients

PCL is one of the world’s leading manufacturers and suppliers of camshafts in the

passenger vehicle segment producing about 150 different varities of camshafts.

Over the last five years, PCL has almost doubled its market share and currently

commands about 8-9% of the global passenger vehicle camshaft market. PCL has

developed long term relationships of over 10 years with global OEM’s and, is the

preferred supplier with marquee global automakers such as General Motors, Ford

Motors, Hyundai, Maruti Suzuki and Tata Motors.

Increased outsourcing of machining by OEM’s provides growth

opportunity

There is a growing trend of outsourcing manufacturing of camshafts amongst the

global OEM’s. Automakers like General Motors, Ford Motors, Hyundai and FIAT

have outsourced majority of their camshaft production. As per the industry

estimates, currently ~35% of camshafts are machined in house by the OEM’s.

Given the high capex involved in setting up the machining facilities (machining

typically has asset turnover of 1x), OEM’S are increasingly outsourcing the

machining operations. PCL is likely to benefit from increasing outsourcing practices

by the automakers.

Broadening product profile provides new growth avenue

PCL currently manufactures cast iron camshafts which currently constitute about

40% of the overall camshaft market. PCL is utilizing most of the IPO proceeds to

set up a machining facility for ductile iron camshafts. As per industry estimates,

about 20% of the overall camshaft market is ductile iron. As per PCL, the ductile

iron capacity it is setting up already has confirmed orders from the OEM’s. Thus,

the proposed facility would enable PCL to significantly address its addressable

market and provide additional growth avenue going ahead.

January 27, 2016

3

Precision Camshafts | IPO Note

Key investment concerns

Growth to be back ended with the new machined plant being

operational only in FY18

The majority of the IPO proceeds (about `200) is being utilized by PCL in setting

up a ductile camshaft machining plant at Solapur EOU. PCL has already received

approval from the existing OEM’s for this upcoming facility. The plant is being set

up at an investment of `230 cr and is expected to be the key revenue driver for

PCL. At full utilization levels, the plant is expected to generate revenues of about

`225 cr (based on Asset Turnover of about 1x of the machining unit).

However, as per the management the plant is likely to commence production only

in early FY2018. Also, the management indicated that the ramp up at the new

plant would only be gradual and the full utilization levels would be reached only in

FY2020. We expect the utilisation levels to remain subdued in FY2018 and expect

the growth to be back ended

Currency risks and client concentration

PCL derives about 80% of the revenues from export markets which exposes it to

currency risks. Most of PCL revenues are denominated in Euro and GBP.

Favourable currency movements (weakening of INR against the Euro and GBP)

have been one of the key factors enabling PCL to pose strong double digit growth

historically. However, recent appreciation of INR against Euro and GBP has

impacted the topline of PCL. (PCL 1HFY16 annualised revenues show a

5%

decline). Any adverse movement in the currency is likely to have significant impact

on PCL revenues.

Further PCL has relatively higher client concentration with the two large global

OEM’s (General Motors and Ford) accounting for 35% of the revenues each. Any

disruptions/market share loss in any of the OEM’s have the potential to

significantly impact PCL operations.

Expensive valuation

During FY2015, PCL reported a top-line of ~`532cr and a bottom-line of ~`62cr.

For 1HFY2016, the company has reported a top-line of `253cr and a net profit of

`34cr.

On the price to earnings per share (EPS; post-IPO) front, the company is valued at

25.8x 1HFY2016 annualized numbers, while a larger and more diversified player

in a similiar business, Bharat Forge is trading at a similar multiple of 25.1x

FY2016 estimated numbers despite better ROE. Also, another player in forgings

business like Ramkrishna Forgings with a better ROE is trading at steep discount to

PCL. Further, PCL is trading at a higher EV/Sales multiple of 3.6x as compared to

2.7x and 2.2x of Bharat Forge and Ramkrishna Forgings respectively despite

competitors having diverse product profile and far bigger size as compared to

PCL. Hence we recommend Neutral on the issue given the expensive valuations.

January 27, 2016

4

Precision Camshafts | IPO Note

Exhibit 4: Comparative Valuation

Post issue valuation^

PCL*

RFL*

BFL#

P/E (x)

25.8

16.6

25.1

P/BV (x)

3.4

2.4

4.9

EV/Sales (x)

3.6

2.2

2.7

EV/EBIDTA (x)

12.7

10.5

13.4

ROE (%)

13.0

14.4

21.1

ROIC (%)

20.2

13.4

20.0

Source: Company, Angel Research; Not: *based on 1HFY16 annualised nos; # based on FY16

estimated numbers; ^based on price at upper band

Risks to upside

Favourable currency movement (depreciation of INR against Euro and GBP) has

boosted PCL’s export realization historically (exports form 80% of overall revenues)

and has been the key contributor to growth. However, over the last one year INR

has been on the appreciation trend viz a viz the above currencies thereby

impacting the revenues. Any reversal in the exchange rates (INR depreciation

against the Euro and the GBP) is likely to boost PCL realization and would be a key

upside risk to our estimates.

January 27, 2016

5

Precision Camshafts | IPO Note

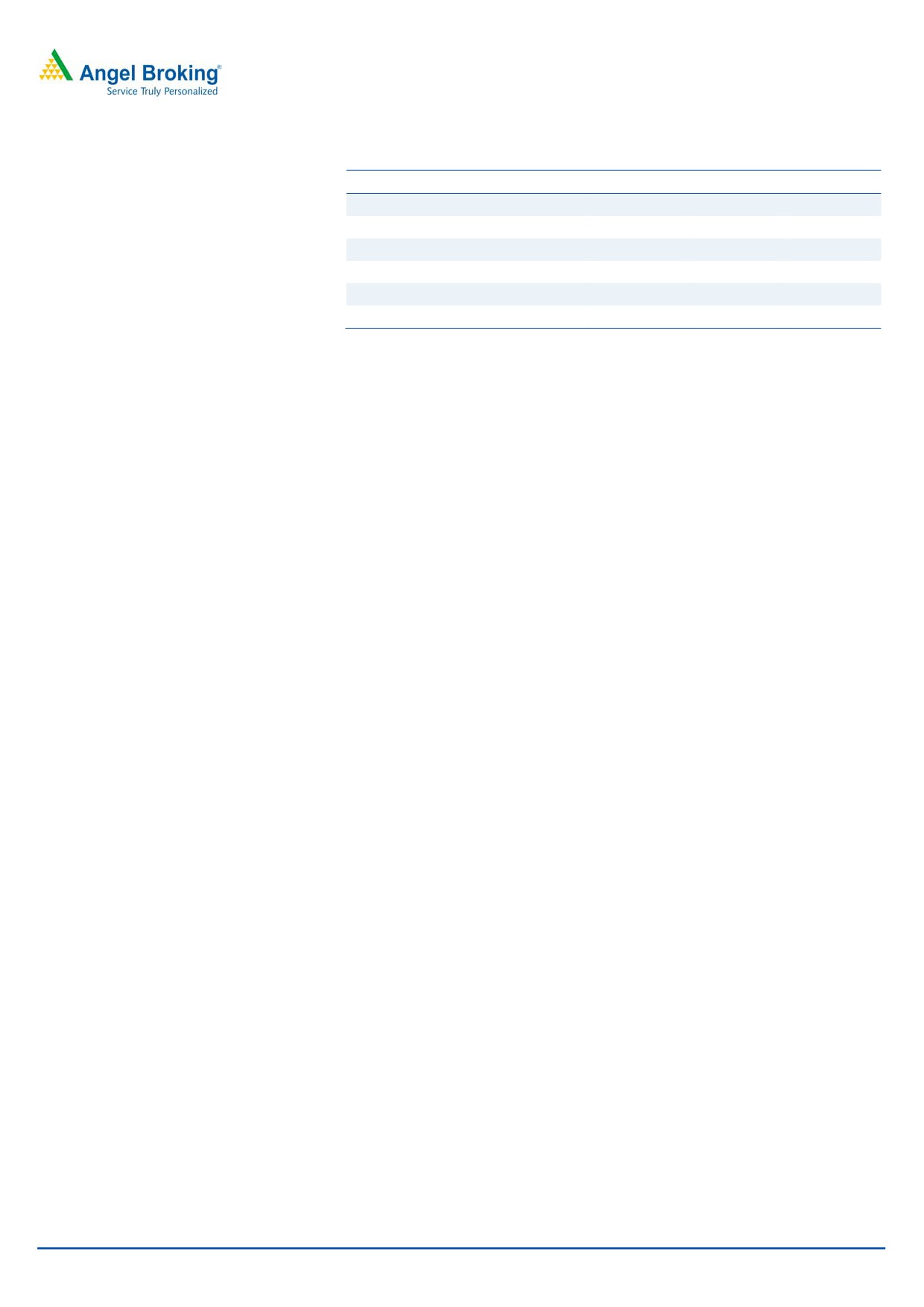

Profit & Loss (consolidated)

Y/E March (` cr)

FY2014

FY2015

1HFY2016

Total operating income

467

532

253

Total Expenditure

405

392

181

Cost of Materials

153

168

73

Personnel Expenses

114

69

29

Others Expenses

138

155

78

EBITDA

62

141

72

(% of Net Sales)

13.4

26.5

28.6

Depreciation& Amortisation

28

41

22

EBIT

47

110

61

(% of Net Sales)

10.1

20.6

24.1

Interest & other Charges

13

11

6

Other Income

13

10

10

(% of PBT)

1.3

0.2

2.6

Recurring PBT

35

99

55

Prior Period & Extraordinary Expense/(Inc.)

-

-

-

PBT (reported)

35

99

55

Tax

21

36

21

(% of PBT)

62.0

36.8

38.5

PAT (reported) before MI

13

62

34

Minority interest

-

-

-

PAT after MI (reported)

13

62

34

(% of Net Sales)

2.8

11.7

13.5

Basic EPS (`)

1.6

7.6

4.2

January 27, 2016

6

Precision Camshafts | IPO Note

Balance Sheet

Y/E March (` cr)

FY2014

FY2015

1HFY2016

SOURCES OF FUNDS

Equity Share Capital

4

82

82

Reserves& Surplus

170

152

187

Shareholders Funds

174

234

269

Minority Interest

-

-

-

Total Loans

185

186

180

Deferred Tax Liability

15

11

10

Other long term liability

-

1

2

Total Liabilities

374

432

461

APPLICATION OF FUNDS

Fixed Assets

229

231

243

Capital Work-in-Progress

5

16

9

Investments

62

62

62

Other non current assets

3

3

3

Long term loans & adv

6

12

10

Current Assets

207

271

276

Inventories

44

44

49

Sundry Debtors

112

105

99

Cash

34

95

102

Loans & Advances

14

20

18

Other Assets

3

7

7

Current liabilities

138

163

142

Net Current Assets

69

108

134

Deferred Tax Asset

0

0

1

Total Assets

374

432

461

January 27, 2016

7

Precision Camshafts | IPO Note

Cash flow statement

Y/E March (` cr)

FY2014

FY2015

1HFY2016

Profit before tax

35

99

55

Depreciation

28

41

22

Change in Working Capital

(25)

14

(15)

Interest / Dividend (Net)

9

4

0

Others

43

(7)

1

Taxes paid

(11)

(32)

(25)

Cash Flow from Operations

78

120

38

(Inc.)/ Dec. in Fixed Assets

(47)

(66)

(18)

(Inc.)/ Dec. in Investments

(54)

(37)

(46)

Others

2

6

6

Cash Flow from Investing

(100)

(98)

(57)

Issue of Equity

1

Inc./(Dec.) in loans

48

12

(13)

Dividend Paid (Incl. Tax)

(0)

(0)

Interest / Dividend (Net)

(10)

(10)

(4)

Cash Flow from Financing

39

2

(17)

Inc./(Dec.) in Cash

17

24

(36)

Opening Cash balances

13

30

54

Exchange rate difference on foreign cash

(1)

0

1

Closing Cash balances

30

54

18

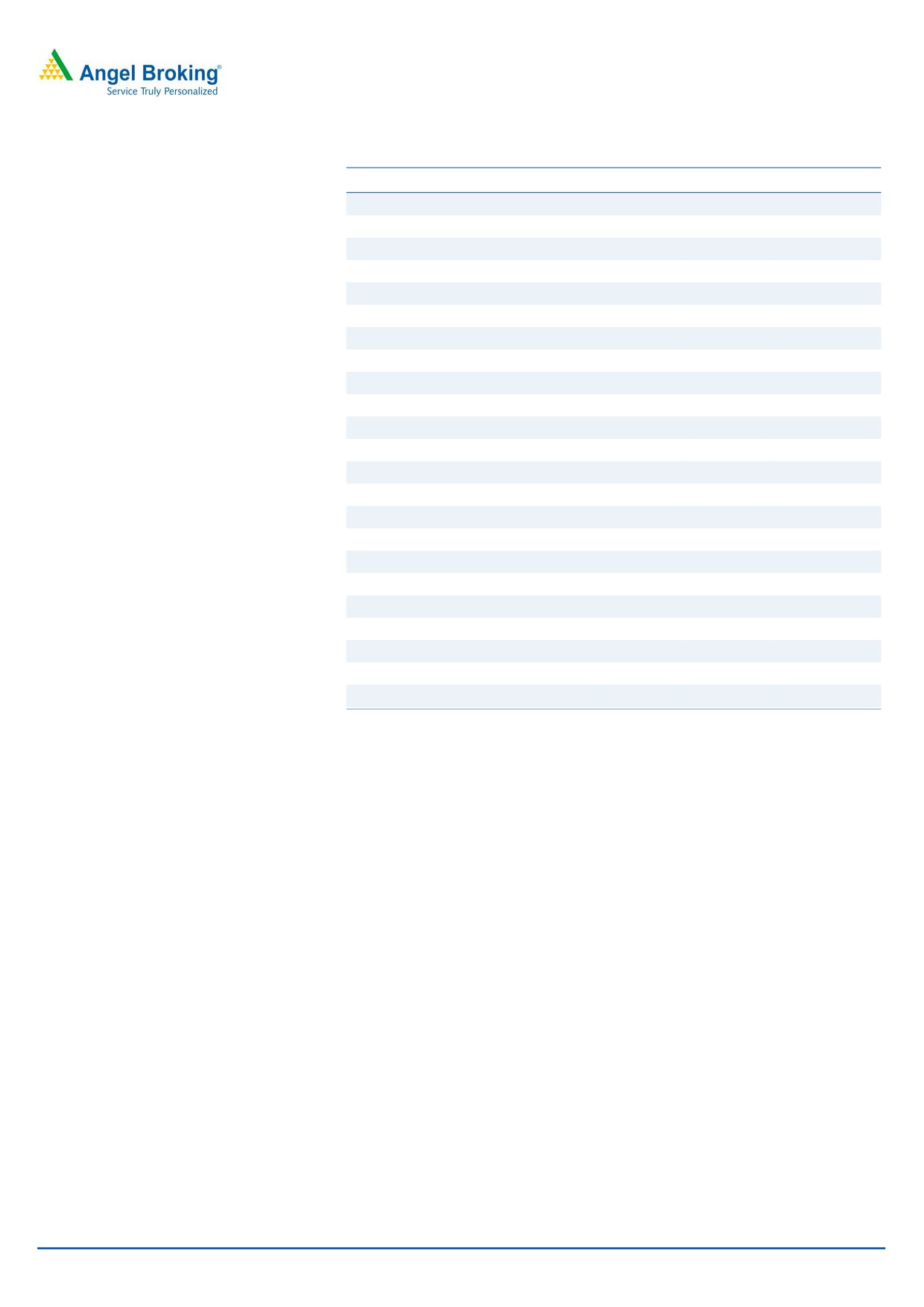

Key Ratios

Y/E March

FY2014

FY2015

Valuation Ratio (x)

P/E (on FDEPS)

116.0

24.4

P/CEPS

37.2

14.7

P/BV

8.7

6.5

EV/Sales

4.1

3.5

EV/EBITDA

30.7

13.2

EV / Total Assets

5.1

4.3

Per Share Data (`)

EPS (Basic)

1.6

7.6

EPS (fully diluted)

1.6

7.6

Cash EPS

5.0

12.7

Book Value

21.3

28.6

Turnover ratios (x)

Asset Turnover

1.2

1.2

Inventory / Sales (days)

34.0

30.4

Receivables (days)

87.6

71.9

Payables (days)

100.9

100.5

Working capital cycle (days)

27.3

9.0

January 27, 2016

8

Precision Camshafts | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

January 27, 2016

9