2QFY2016 Result Update | Capital Goods

November 16, 2015

Power Mech Projects

NEUTRAL

CMP

`606

Performance Highlights

Target Price

-

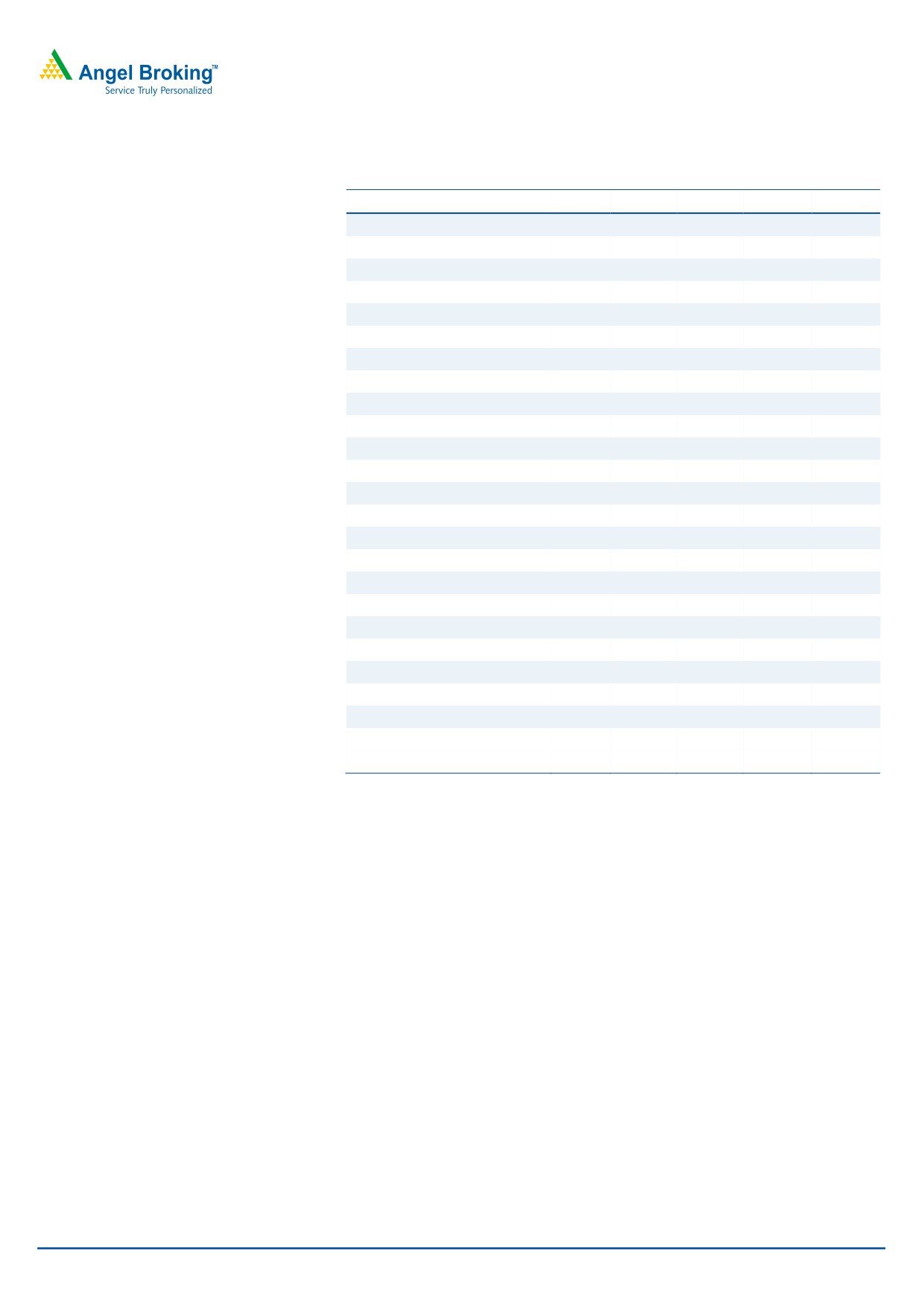

Quarterly highlights - Standalone

Investment Period

-

Y/E March (` cr)

2QFY16 1QFY15 2QFY15

% chg (yoy)

% chg (qoq)

Stock Info

Net sales

317

301

316

0.3

5.2

Sector

Capital Goods

EBITDA

43

40

38

13.0

7.4

Market Cap (` cr)

891

Reported PAT

18

16

15

23.3

12.7

Net debt (` cr)

160

Source: Company, Angel Research

Beta

Power Mech Projects (Power Mech) reported flat yoy sales for 2QFY2016. The

52 Week High / Low

663/565

Avg. Daily Volume

43,448

company reported a top-line of `317cr, which is up 0.3% yoy from the year ago

Face Value (`)

10

levels. The EBITDA, at `43cr in 2QFY2016, grew 13.0% yoy. Despite flat sales,

BSE Sensex

25,611

the EBITDA margin of the company expanded on a yoy basis to 13.5% for

Nifty

7,762

2QFY2016. In-line with EBITDA growth, Power Mech reported a PAT of `18cr for

Reuters Code

POMP.NS

the quarter, reflecting 23.3% yoy growth. A 3.2% yoy decline in depreciation

Bloomberg Code

POWM@IN

expenses (to `9cr) and decline in effective tax rate (from 35.4% a year ago to

33.9% in the quarter) helped the company report a 107bp yoy PAT margin

Shareholding Pattern (%)

expansion.

Promoters

64.8

MF / Banks / Indian Fls

17.6

Power Mech’s order book as of 2QFY2016-end stood at `3,700cr, reflecting

FII / NRIs / OCBs

1.0

order book to LTM ratio of 2.2x.

Indian Public / Others

16.6

Valuation: On considering Power Mech’s 2QFY2016 order book of `3,700cr

(which gives strong earnings growth visibility), negligible debt on the books, and

Abs. (%)

3m 1yr 3yr

higher return ratios (RoE of Power Mech is higher than that of its peers), we

Sensex

(8.8)

(8.7)

38.6

PowerMech

3.4

NA NA

assign a 9.0x 1-year forward P/E multiple to our FY2017E, EPS estimate of

*NA- Not Applicable as PowerMech got listed on Aug 26, 2015

`72/share to arrive at a price target of `649/share. Given the limited upside, we

maintain our Neutral rating on the stock.

3-Year Daily Price Chart

660

Key financials (Standalone)

640

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

620

600

Net Sales

933

1,187

1,356

1,539

1,801

580

560

% chg

42.4

27.3

14.2

13.6

17.0

540

Net Profit

50

68

71

87

106

520

% chg

(0.4)

36.3

3.5

22.7

22.1

EBITDA (%)

13.0

13.0

12.2

12.8

12.7

Source: Company, Angel Research

EPS (`)

46.6

62.4

56.2

59.0

72.1

P/E (x)

13.0

9.7

10.8

10.3

8.4

P/BV (x)

3.2

2.4

2.2

1.5

1.3

RoE (%)

28.0

28.7

22.5

18.6

16.8

RoCE (%)

32.8

35.1

26.5

24.7

24.0

EV/Sales (x)

0.8

0.6

0.7

0.6

0.5

Yellapu Santosh

022 - 3935 7800 Ext: 6811

EV/EBITDA (x)

5.9

4.9

5.6

4.5

3.9

Source: Company, Angel Research; CMP as of November 13, 2015

Please refer to important disclosures at the end of this report

1

PowerMech | 2QFY2016 Result Update

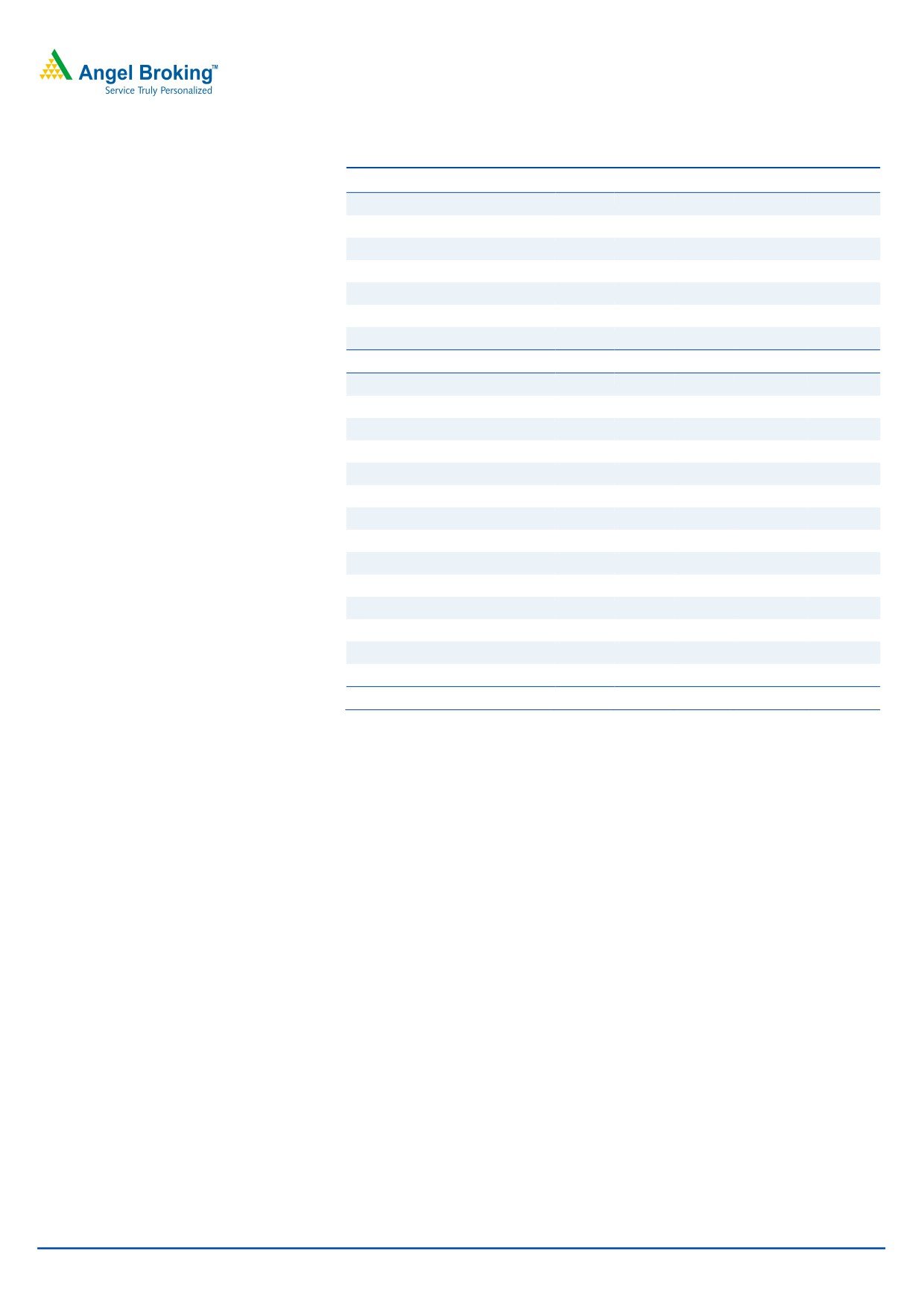

Exhibit 1: Quarterly Performance (Standalone)

Particulars (` cr)

2QFY16

1QFY16

% chg (qoq) 2QFY15

% chg (yoy) 1HFY16 1HFY15

% chg (yoy)

Net Sales

317

301

5.2

316

0.3

618

663

(6.7)

Total Expenditure

274

262

4.9

278

(1.5)

536

579

(7.5)

Cost of materials consumed

21

21

(3.4)

16

28.6

42.1

33.7

24.9

Contract Execution Exp.

221

206

7.3

229

(3.4)

426.8

478.4

(10.8)

Employee benefits Expense

26

28

(6.3)

29

(9.2)

54.6

59.2

(7.7)

Other Expenses

6

6

3.8

4

43.6

12.3

7.8

57.0

EBITDA

43

40

7.4

38

13.0

82.6

83.5

(1.0)

EBIDTA %

13.5

13.2

12.0

13.4

12.6

Depreciation

9

9

(2.0)

9

(3.2)

18.1

18.0

1.0

EBIT

34

31

10.2

29

18.2

64.5

65.5

(1.6)

Interest and Financial Charges

8

8

1.6

7

6.1

15.6

13.5

15.5

Other Income

1

2

(6.5)

2

(5.6)

3.0

4.1

(26.3)

PBT before Exceptional Items

27

24

11.8

23

20.6

51.9

56.1

(7.5)

Exceptional Items

0

0

0

0.0

0.0

PBT after Exceptional Items

27

24

11.8

23

20.6

51.9

56.1

Tax

9.3

8

10.1

8

15.5

17.7

18.5

% of PBT

33.9

34.5

35.4

34.2

33.1

PAT

18

16

12.7

15

23.3

34.1

37.5

(9.1)

Adj. PAT %

5.7

5.3

4.6

5.5

5.7

Dil. EPS

13.02

12.75

2.1

12.04

8.1

24.57

30.62

(19.8)

Source: Company, Angel Research

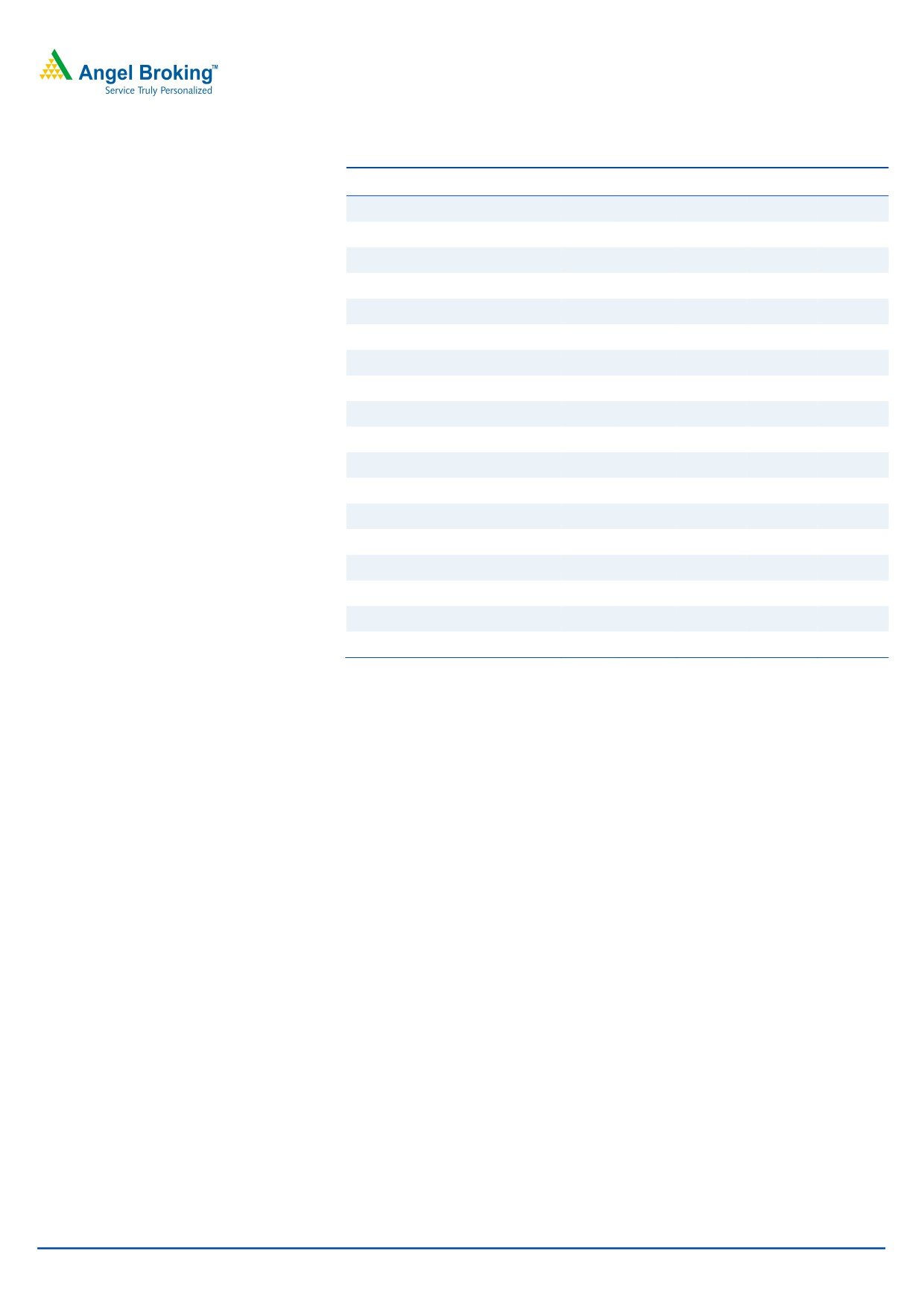

Revenues grow 0.3% yoy

Power Mech reported flat yoy sales for the quarter. The company reported a top-

line of `317cr, which is up 0.3% yoy from the year ago levels. Lower revenue

booking from recently won projects, led to flattish yoy top-line growth.

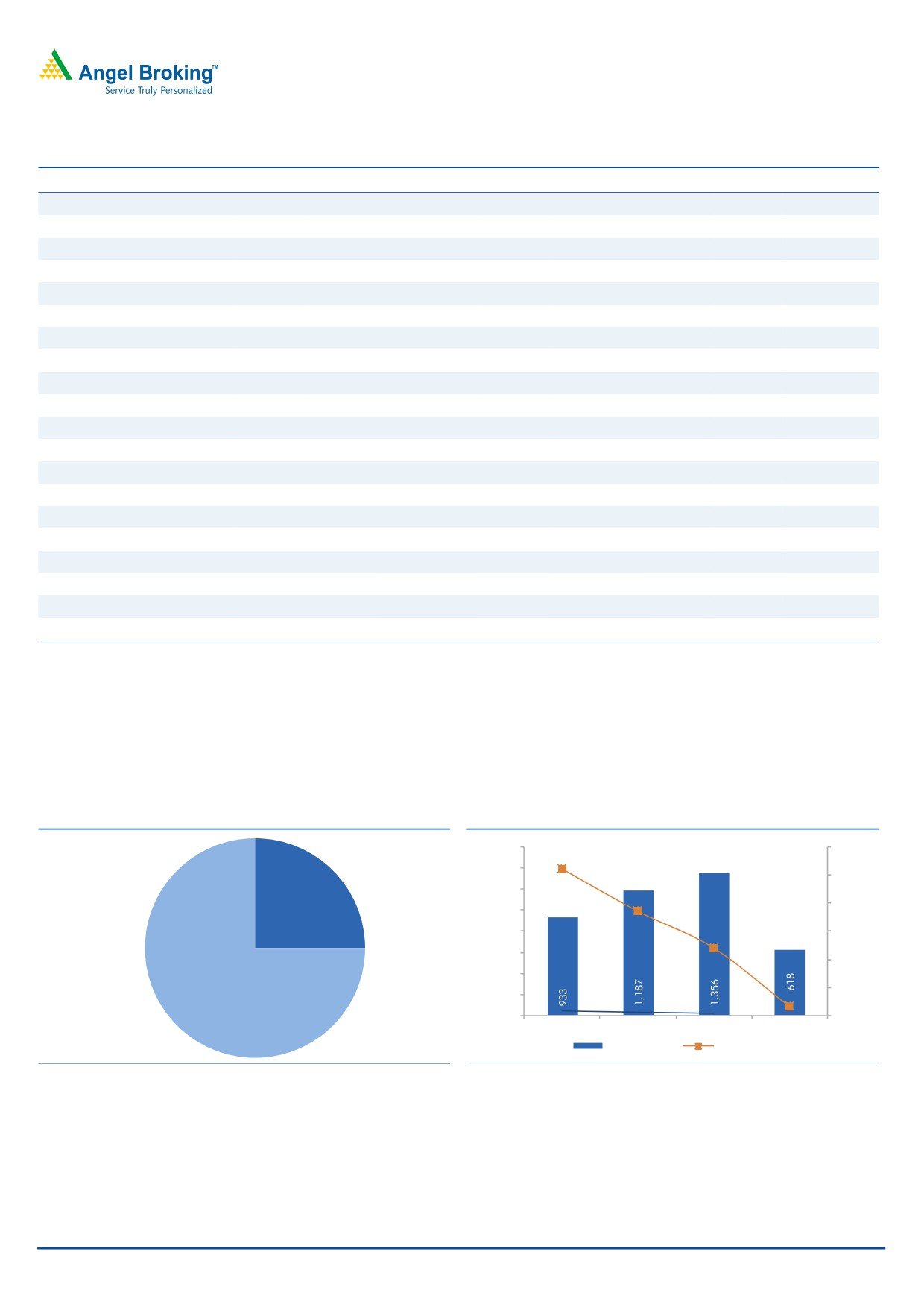

Exhibit 2: Segment-wise 2QFY2016 Revenue split

Exhibit 3: Revenue trend

1,600

50.0

1,400

42.4

40.0

1,200

O&M, 25%

30.0

1,000

27.3

800

20.0

14.2

600

10.0

400

Erectiom &

0.0

Civil

200

Works, 75%

-6.7

0

-10.0

FY13

FY14

FY15

1HFY16

Revenues

yoy growth (%)

Source: Company, Angel Research

Source: Company, Angel Research

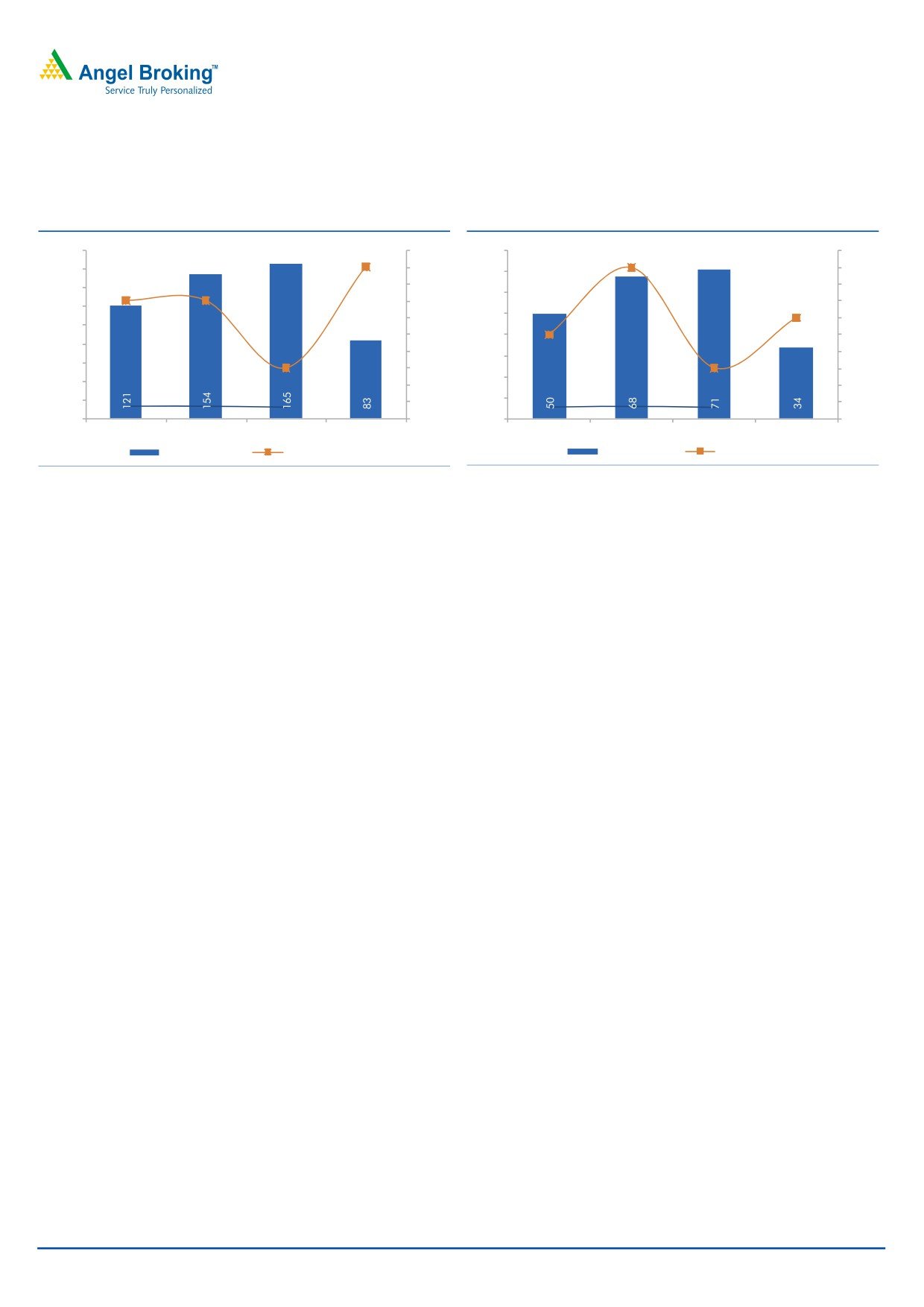

Reports yoy EBITDA margin expansion

Power Mech reported an EBITDA of `43cr in 2QFY2016, reflecting 13.0% yoy

growth. Despite flat sales, the EBITDA margin expanded on a yoy basis to 13.5%

for 2QFY2016. Margin expansion is owing to higher revenue contribution from the

November 16, 2015

2

PowerMech | 2QFY2016 Result Update

O&M segment. Our view strengthened from the point that Contract execution

expenses as % of sales declined from 72.4% a year ago to 69.7% in 2QFY2016.

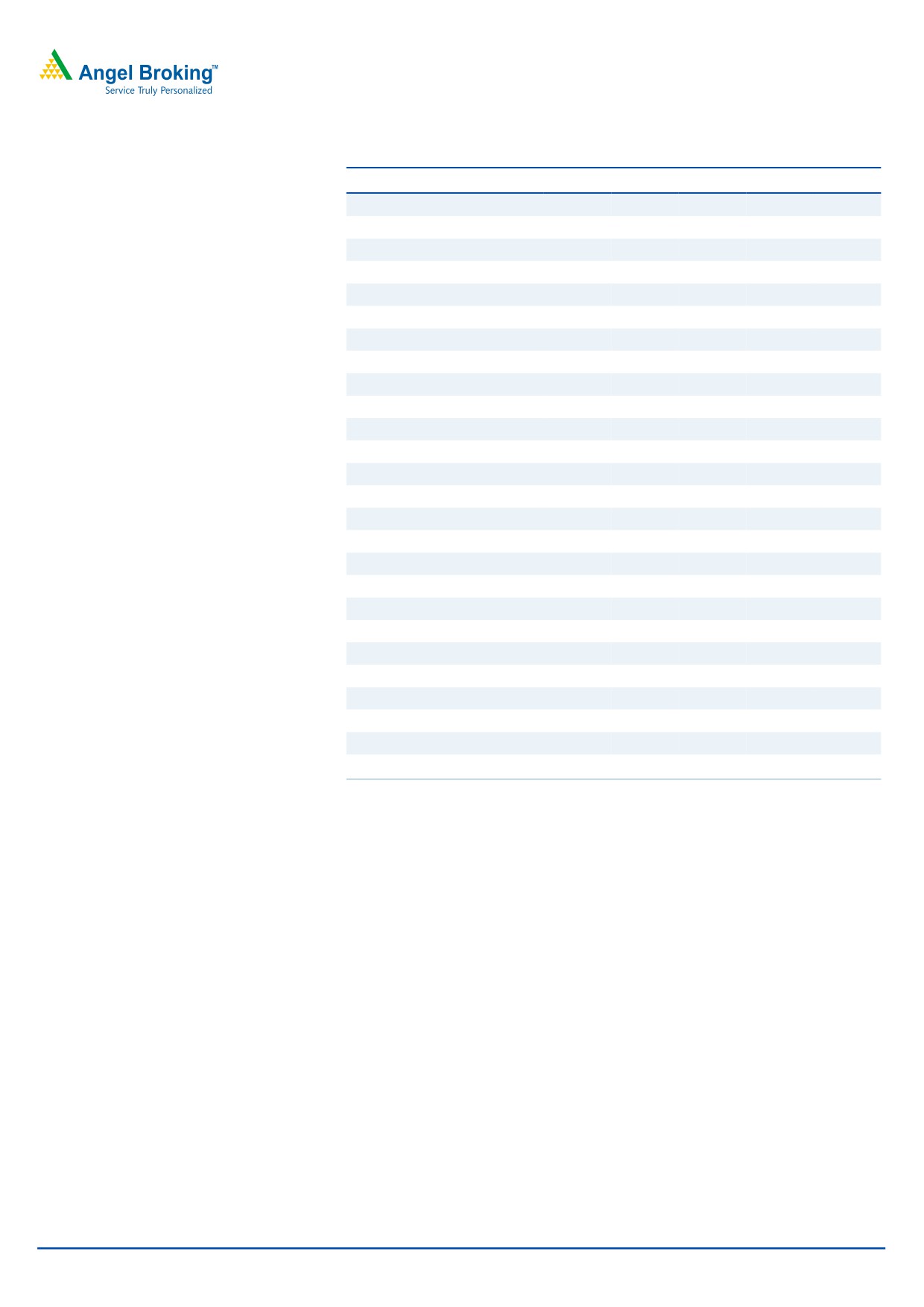

Exhibit 4: EBITDA margins expand

Exhibit 5: PAT Margins at 5.5%

180

13.4

13.6

80

5.8

5.9

160

13.4

5.8

70

140

13.0

13.0

13.2

5.7

60

13.0

5.5

5.6

120

50

12.8

5.4

5.5

100

12.6

40

5.4

80

12.2

12.4

5.2

5.3

30

60

12.2

5.2

20

40

12.0

5.1

20

11.8

10

5.0

0

11.6

0

4.9

FY13

FY14

FY15

1HFY16

FY13

FY14

FY15

1HFY16

EBITDA (` in cr)

EBITDA Margin (%)

PAT (` in cr)

PAT Margin (%)

Source: Company, Angel Research

Source: Company, Angel Research

PAT margins improve yoy

In-line with EBITDA growth, Power Mech reported a PAT of `18cr for the quarter,

reflecting 23.3% yoy growth. A 3.2% yoy decline in depreciation expenses (to `9cr)

and decline in effective tax rate (from 35.4% year ago to 33.9% in 2QFY2016)

helped the company report a 107bp yoy PAT margin expansion.

Reports `1,150cr of Order Inflows for 2QFY2016

Power Mech in 1HFY2016 reported `1,150cr of order inflows, led by both,

Erection and O&M segments. Some of the key projects won during 1HFY2016

include- Vedanta’s Jharsuguda project worth `422cr, Kottagudem project worth

`165cr; JP Group’s `166cr O&M order for Bara project, and `90cr order from

Neyveli.

Post these order wins, the company’s order book at 2QFY2016 adds up to

`3,700cr, reflecting order book to LTM ratio of 2.2x. Again a major 45% of the

order book is from the Erection segment, 35% from the O&M space and the

remaining 20% from the Civil segment.

The Management highlighted that they are participating in bid pipeline of over

`2,200cr (O&M projects-`800cr, Erection projects- `1,400cr), where outcome is

pending in the next few months. The Management has maintained optimism that it

would report ~`2,000cr of order wins in FY2016E.

November 16, 2015

3

PowerMech | 2QFY2016 Result Update

Investment arguments

Order book/LTM sales at 2.3x… depicting good revenue visibility

Power Mech, as of 2QFY2016-end, is sitting on an order book (exc. suspended

projects) of `3,700cr, which is 2.2x its last twelve month (LTM) revenues, thereby

giving good near-to-medium term revenue visibility.

Order inflow to benefit from uptick in award activity

Power Mech reported a 19.0% top-line and 17.1% bottom-line CAGR (during

FY2011-15) in a challenging macro environment. This was in an environment,

when the entire power generation sector had been facing structural problems such

as fuel unavailability, deteriorating financial health of SEBs, and difficulty in getting

requisite clearances, amongst other issues. The new government’s steps such as,

targeting to double Coal India (CIL)’s production by 2020 (some signs of ramp-up

in operations are already being seen), fastening the clearances process for large

ticket projects, and opening the mining sector to private players, reflect the

government’s focus towards reviving the ailing power generation sector.

We expect over 20GW of power projects (with different packages of BoP/BTG/EPC

works) to come-up for awarding in FY2016-17E and companies like Power Mech

should emerge as key beneficiaries on account of the same.

Power Mech claims it has limited competition when it comes to comprehensive

packages coming up for awarding; whereas, it faces competition from over half a

dozen players for smaller ticket projects. Based on their past track record and

market positioning, we expect Power Mech to report order wins of

`2,000cr/`2,500cr in FY2016E/FY2017E.

Strong profitability growth to be seen during FY2015-17E

At the backdrop of order inflow growth and average execution cycle of 25-36

months (for O&M contracts, the execution cycle stretches to 36 months), we expect

Power Mech to report strong 15.3% top-line and 22.4% bottom-line CAGR during

FY2015-17E.

Power Mech reported ~20% of its FY2015 revenues from the high margin O&M

business. Increased exposure to the O&M segment, which happens to be a high

EBITDA margin business, should act as a cushion to the company’s overall EBITDA

margins. Accordingly, we model 12.8%/12.7% EBITDA margins for FY2016/

2017E, respectively.

With the IPO proceeds likely to be deployed for retiring working capital debt, we

expect savings on interest expenses, which should result in 22.4% PAT CAGR

during FY2015-17E to `106cr.

Restricted WC cycle leads to unlevered Balance Sheet…

Power Mech is one of the few companies that has been able to hold on to its WC

cycle despite deteriorating health of its clients. This could be owing to the following

reasons: (1) tendering by equipment manufacturers is made only after land

acquisition is done and all clearances are in place (2) scope of works for ETC

companies is usually 13-20% of the BTG/BOP packages, (3) company has a policy

of billing clients once in a month instead of milestone based payments cycle

November 16, 2015

4

PowerMech | 2QFY2016 Result Update

followed by EPC players. These reasons have led to a superior WC cycle for Power

Mech in comparison to its peers.

Power Mech enjoys a better WC/sales ratio in comparison to its peers. In FY2015,

Power Mech reported a WC/sales ratio of 21.1% vs a comparable 34.7% average

of two of its closest industry peers - Sunil Hitech and TechnoElectric Engineering.

Owing to shorter WC cycle, Power Mech has been able to maintain its debt/equity

ratio at comfortable levels of 0.6x (as of FY2015-end). With `105cr of IPO

proceeds to be used towards retirement of debt, we expect the D/E ratio to further

decline, going forward.

Better RoEs …

Diversification of Power Mech across sub-verticals within the power sector helped

the company build its order book in an atmosphere where peers were experiencing

decline in order inflows. Driven by continuously increasing order book, Power

Mech reported a strong 19.0% top-line and 17.1% bottom-line CAGR during

FY2011-15. On the back of strong earnings growth, Power Mech reported an

above-industry RoE of 22.5-28% during FY2013-15, respectively. Considering our

earnings growth estimates and diluted equity, we expect RoEs in FY2016/FY2017E

to decline to 18.6%/16.8%, respectively, which is still impressive.

November 16, 2015

5

PowerMech | 2QFY2016 Result Update

Outlook & Valuation

During FY2011-15, Power Mech (standalone entity) reported a 19.0% and 17.1%

top-line and bottom-line CAGR, respectively. The company’s diversification

strategy has helped it grow its order book in a awarding down cycle. Recent

initiatives by the government strengthen our view that over 20GW of awarding by

state run entities (SEBs/NTPC) would be made to power generation equipment

manufacturers in FY2016-17E, which in-turn enhances the bid pipeline for ETC

companies like Power Mech.

With order inflow revival in the power generation space, we are optimistic that

Power Mech would emerge as one of the key beneficiaries, going forward. We

expect the order book of Power Mech to report a healthy 16.6% CAGR during

FY2015-2017E to `4,377cr by FY2017E. This, when coupled with Power Mech’s

focus to add more of high margin O&M works to its order book, should act as a

cushion against any further fall in the EBITDA margin. Accordingly, we model

12.8%/ 12.7% EBITDA margin for FY2016E/FY2017E. We expect EBITDA to report

a 17.5% CAGR during FY2015-17E.

In addition to EBITDA growth, we expect benefits flowing-in from a lower interest

expense (considering that `105cr of IPO proceeds would be used for debt

repayment). On the whole, we expect the standalone entity to report a 22.4%

bottom-line CAGR during FY2015-17E to `109cr.

On considering Power Mech’s 2QFY2016 order book of `3,700cr (which gives

strong earnings growth visibility), negligible debt on the books, and higher return

ratios (RoE of Power Mech is higher than its peers), we assign a 9.0x 1-year

forward P/E multiple to our FY2017E EPS of `72/share to arrive at a price target of

`649/share. Given the limited upside, we maintain our Neutral rating on the stock.

November 16, 2015

6

PowerMech | 2QFY2016 Result Update

Risks & Concerns

Prolonged delay in the award activity could act as risk to our estimates.

Higher than expected loss of market share in the ETC-BTG/BOP awarding

cycle could again act as a threat to our estimates and view.

56.4% of FY2015 order book came from top 5 clients (declined from 64.7% in

FY2014). Any change in outlook of these companies could act as a big risk to

our view and estimates.

Company background

Power Mech, incorporated in 1999, was founded by Mr Kishore Babu. Over the

years, Power Mech has emerged as a leading integrated power infrastructure

services player at a pan-India level. The company is in the business of providing

Erection, Testing and Commissioning (ETC) of Boilers, Turbines and Generators

(BTG) and Balance of Plant (BOP) works. Also, in recent years Power Mech has

built capabilities in Civil Works and power plants’ Operation and Maintenance

(O&M) services.

Erection Works: Since commencing its operations in 2003, Power Mech has

worked on more than 100 erection works projects. To-date, it has been involved in

100+ Erection works contracts. Power Mech provides ETC works for both-BTG and

BOP space of the power plants, including Ultra-Mega Power Plants (UMPPs) and

Super-critical power plants with unit capacities in150-800MW. It also provides

erection work services to gas plants, HRSG, WHRB, CFBC boilers, steam turbine

generators, steam generators including auxiliaries, ESPs, hydro turbines and BOP

packages, including structural steel works, ash handling, coal handling, fuel oil

systems and high-pressure piping works.

Operation and Maintenance (O&M) services: The O&M segment includes annual

maintenance contracts (AMCs), repairs, renovation and modernization, residual

life assessment, scheduled shutdowns, retro-fits, as well as overhauling,

maintenance and upgradation services for power plants. Power Mech has provided

O&M services for various projects in the Middle East, North Africa, South Asia and

South American markets. To-date PowerMech has been engaged in more than

400 O&M contracts.

Power Mech is a leading AMC services provider for power plants in India and this

business is expected to grow as a lot of new capacity additions have come from

IPPs in recent years. Currently, Power Mech is engaged in 23 O&M contracts with

unit capacity of 32,835MW.

Civil Works: As a diversification move, Power Mech entered the Civil Works

business in 2011. Scope of Civil Works segment includes civil and structural works

contracts ancillary to the ETC-BTG projects. In this segment, Power Mech

undertakes a range of civil and structural works (such as area grading, leveling,

excavation, piling, mass concreting foundations for buildings, turbine/generator

decks and super-structures, fabrication and erection of structures, main plant bay

etc).

November 16, 2015

7

PowerMech | 2QFY2016 Result Update

Profit and Loss Statement (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

Net Sales

933

1,187

1,356

1,539

1,801

% Chg

42.4

27.3

14.2

13.6

17.0

Total Expenditure

812

1,033

1,190

1,342

1,573

Cost of Raw Materials Consumed

64

74

76

85

100

Contract Execution Expenses

672

838

977

1,094

1,286

Employee benefits Expense

67

107

118

137

159

Other Expenses

9

13

20

25

29

EBITDA

121

154

165

197

228

% Chg

6.7

27.6

7.0

19.5

15.4

EBIDTA %

13.0

13.0

12.2

12.8

12.7

Depreciation

33

33

37

39

44

EBIT

88

122

129

158

184

% Chg

16.8

39.0

5.7

23.0

16.4

Interest and Financial Charges

17

26

29

32

26

Other Income

5

12

6

6

6

PBT

75

107

105

132

164

Exceptional Items

0

0

0

0

0

Tax

25

39

35

46

58

% of PBT

33.5

36.1

32.8

34.5

35.5

PAT

50

68

71

87

106

% Chg

(0.4)

36.3

3.5

22.7

22.1

PAT %

5.4

5.8

5.2

5.6

5.9

Basic EPS

46.6

62.4

56.2

59.0

72.1

Diluted EPS

46.6

62.4

56.2

59.0

72.1

% Chg

(0.4)

34.0

(10.0)

5.0

22.2

November 16, 2015

8

PowerMech | 2QFY2016 Result Update

Balance Sheet (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

Sources of Funds

Equity Capital

11

11

13

15

15

Reserves Total

192

263

341

563

667

Networth

203

273

354

577

682

Total Debt

122

175

227

178

155

Other Long-term Liabilities

83

94

64

74

78

Long-term Provision

0

0

0

0

0

Total Liabilities

408

542

645

829

914

Application of Funds

Gross Block

262

298

339

370

411

Accumulated Depreciation

92

124

160

200

243

Net Block

169

173

178

171

168

Capital WIP

7

7

9

8

8

Investments

0

5

7

10

13

Other Current Assets

109

161

241

278

340

Inventories

19

24

31

43

60

Sundry Debtors

174

148

194

231

280

Cash and Bank Balance

57

69

67

173

155

Loans & Advances

130

193

260

299

360

Current Liabilities

356

412

506

556

650

Net Current Assets

133

183

286

468

545

Other Assets

98

173

165

173

180

Total Assets

408

542

645

829

914

November 16, 2015

9

PowerMech | 2QFY2016 Result Update

Cash Flow Statement

Y/E March (` cr)

FY13

FY14

FY15P

FY16E

FY17E

Profit before tax

75

107

105

132

164

Depreciation

33

33

37

39

44

Other Adjustments

(5)

(7)

(6)

(11)

(11)

Change in Working Capital

(74)

(99)

(118)

(75)

(98)

Interest & Financial Charges

17

26

29

32

26

Direct taxes paid

(26)

(33)

(37)

(42)

(54)

Cash Flow from Operations

22

26

10

76

72

(Inc)/ Dec in Fixed Assets

(36)

(36)

(44)

(30)

(42)

(Inc)/ Dec in Invest. & Int. received

(3)

(9)

6

59

2

Cash Flow from Investing

(39)

(45)

(38

29

(40)

Inc./ (Dec.) in Borrowings

41

44

59

(50)

(23)

Issue/ (Buy Back) of Equity

0

0

0

138

(0)

Dividend Paid (Incl. Tax)

(1)

(1)

(2)

(2)

(2)

Finance Cost

(15)

(23)

(29)

(31)

(25)

Cash Flow from Financing

25

20

28

56

(50)

Inc./(Dec.) in Cash

8

1

0

161

(18)

Opening Cash balances

2

9

11

11

173

Closing Cash balances

9

11

11

173

155

November 16, 2015

10

PowerMech | 2QFY2016 Result Update

Ratio Analysis (x)

Y/E March

FY13

FY14

FY15

FY16E

FY17E

Valuation Ratio (x)

P/E (on FDEPS)

13.0

9.7

10.8

10.3

8.4

P/CEPS

7.8

6.6

7.1

7.1

5.9

Dividend yield (%)

6.1

4.0

6.0

6.1

6.1

EV/Sales

0.8

0.6

0.7

0.6

0.5

EV/EBITDA

5.9

4.9

5.6

4.5

3.9

EV / Total Assets

1.7

1.4

1.4

1.1

1.0

Per Share Data (`)

EPS (Basic)

46.6

62.4

56.2

59.0

72.1

EPS (fully diluted)

46.6

62.4

56.2

59.0

72.1

Cash EPS

77.7

92.4

85.3

85.8

101.9

DPS

1.0

1.5

1.0

1.0

1.0

Book Value

189.0

250.0

281.3

392.4

463.6

Returns (%)

RoCE (Pre-tax)

32.8

35.1

26.5

24.7

24.0

Angel RoIC (Pre-tax)

35.4

36.0

26.5

28.5

28.1

RoE

28.0

28.7

22.5

18.6

16.8

Turnover ratios (x)

Asset Turnover (Gross Block) (x)

3.5

4.2

4.3

4.3

4.6

Inventory / Sales (days)

6

7

7

9

10

Receivables (days)

63

50

46

50

52

Payables (days)

48

59

63

59

53

NWC days

21

(2)

(9)

0

10

Leverage Ratios (x)

D/E ratio (x)

0.6

0.6

0.6

0.3

0.2

Interest Coverage Ratio (x)

5.5

5.1

4.6

5.2

7.4

Note: nmf- Not Meaningful

November 16, 2015

11

PowerMech | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Power Mech Projects

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

November 16, 2015

12