2QFY2016 Result Update | Power

November 5, 2015

Power Grid Corporation of India

BUY

CMP

`132

Performance Highlights

Target Price

`165

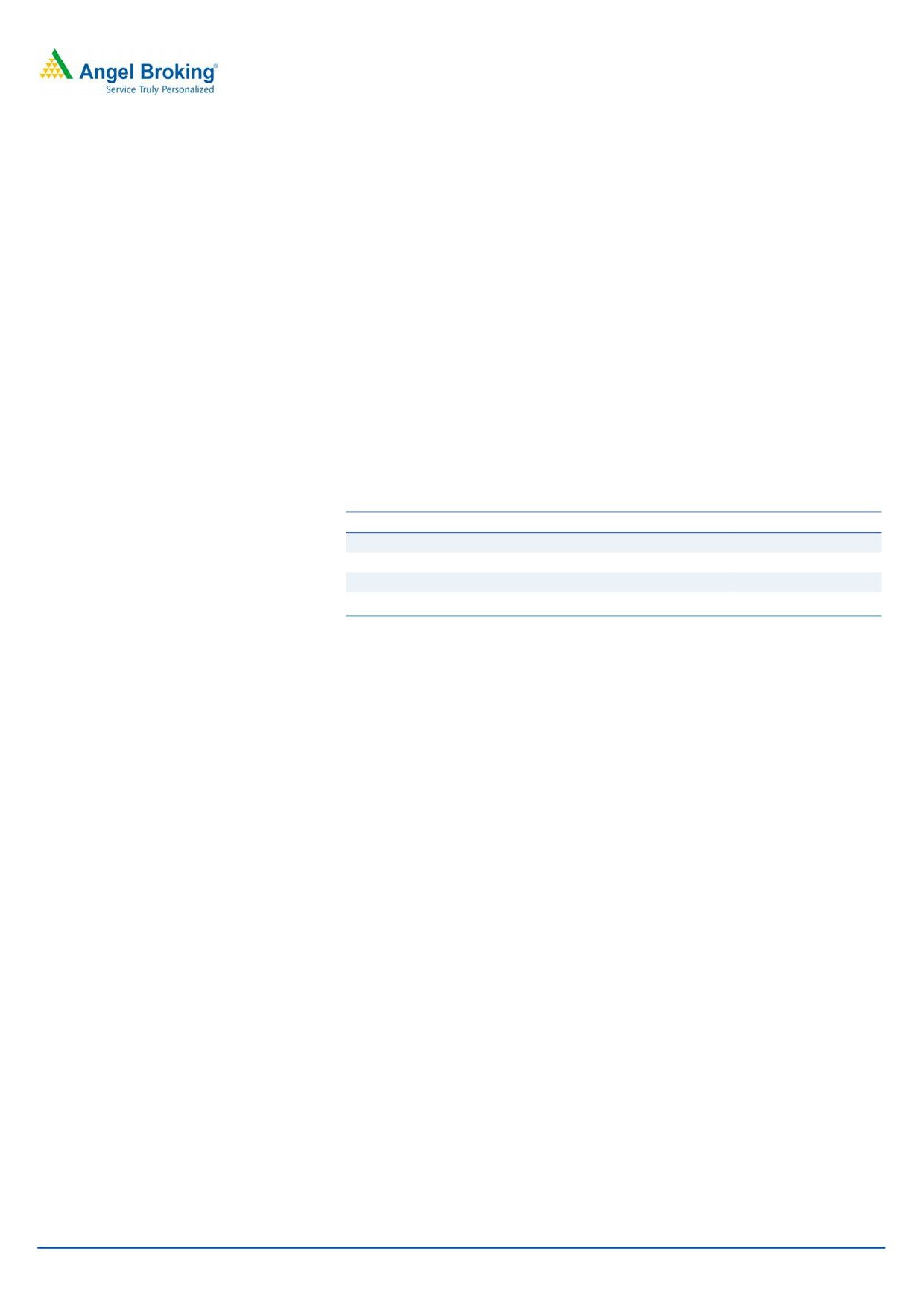

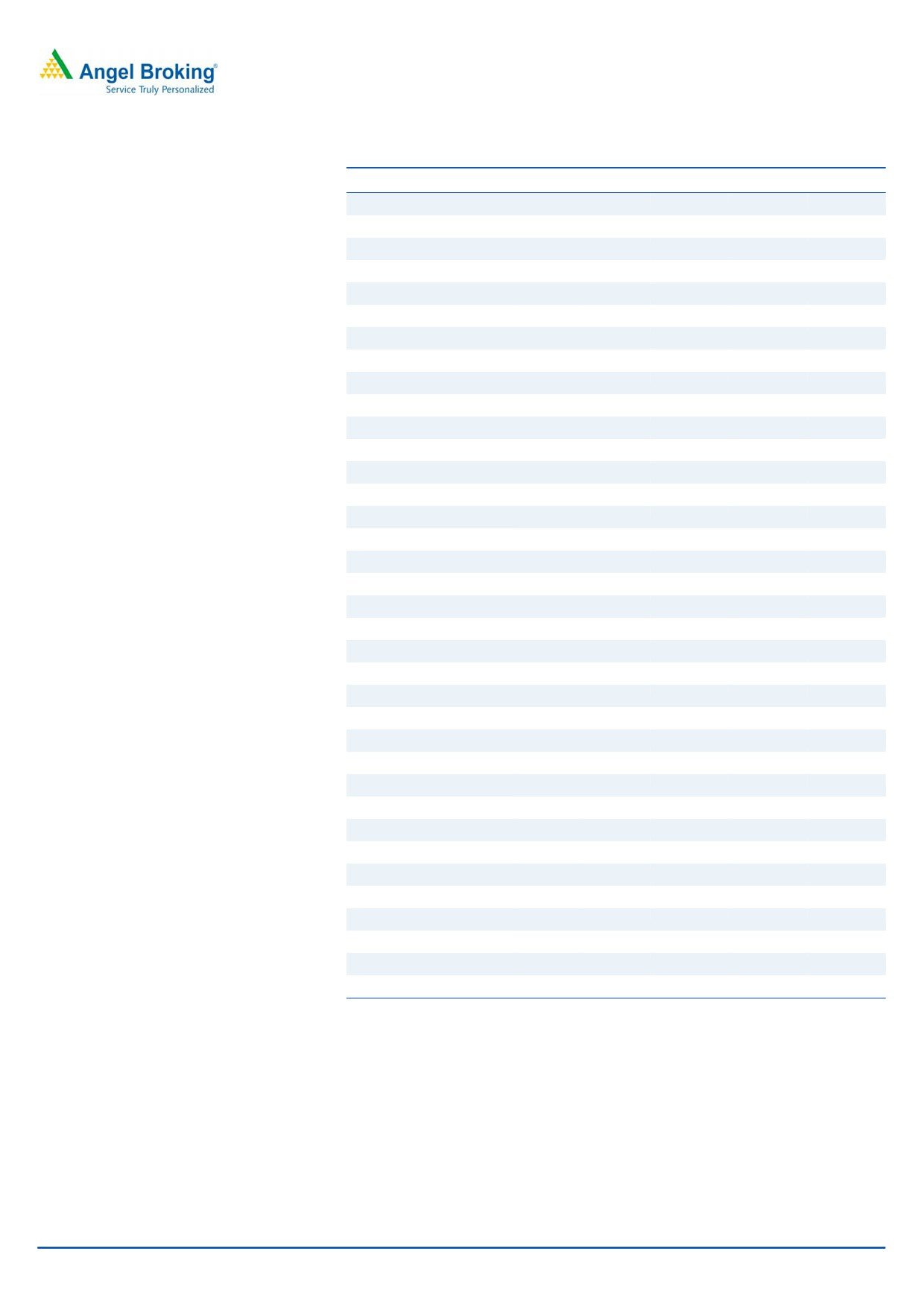

Standalone (` cr)

2QFY16

2QFY15

yoy (%)

1QFY16

qoq%

Investment Period

12 months

Total Revenue

4,918

4,179

17.7

4,718

4.2

EBITDA

4,318

3,590

20.3

4,137

4.4

Stock Info

Margin (%)

87.8

85.9

188bp

87.7

10bp

Sector

Power

Reported PAT

1,448

1,201

20.5

1,367

6.0

Source: Company, Angel Research

Market Cap (` cr)

68,639

Net Debt (` cr)

95,520

For 2QFY2016, Power Grid Corporation of India (PWGR) reported a 16.8% yoy

Beta

0.6

increase in transmission revenues to `4,708cr, which is 3.5% below our estimate

52 Week High / Low

159 / 121

of `4,878cr, on account of lower than expected capitalisation. For the quarter,

Avg. Daily Volume

24,34,052

capitalisation stood at

`5,053cr, well below our estimate of

`6,246cr.

Face Value (`)

10

Capitalisation was expected to remain strong on account of spill-over in the

BSE Sensex

26,553

commissioning of certain projects from 1QFY2016 to 2QFY2016 and the

commissioning of the Biswanath Chariyali - Agra transmission line in 2QFY2016.

Nifty

8,040

The company incurred a capex of `5,088cr during the quarter, which is higher

Reuters Code

PGRD.BO

than our estimate of `4,850cr. We reduce our FY2016 capitalisation estimate to

Bloomberg Code

PWGR IN

`21,991cr, as against `22,257cr earlier.

Lower operating expenses as a percentage of revenues and higher consultancy

Shareholding Pattern (%)

income helped the company in improving its EBITDA margin by 188bp yoy to

Promoters

57.9

87.8%. In terms of operating performance, the impact of lower than expected

MF / Banks / Indian Fls

8.7

revenue was partially offset by operating efficiencies, with transmission and

FII / NRIs / OCBs

26.1

employee expenses coming in lower than expected. The EBITDA came in at

Indian Public / Others

7.4

`4,318cr, as against our estimate of `4,368cr.

Outlook and valuation

Abs. (%)

3m 1yr

3yr

We have reduced our estimates marginally to factor in the lower-than-expected

Sensex

(5.4)

(4.7)

41.6

capitalisation in 2QFY2016. We expect PWGR to report a revenue and EBITDA

PWGR

(6.8)

(9.4)

11.3

CAGR of ~16% (vs 17% earlier) and the net profit to grow at a CAGR of 17%

(vs 18% earlier) over FY2015-17E. At the current market price of `132, the stock

3-year price chart

trades at a P/BV of 1.6x and 1.4x its FY2016E and FY2017E BV of `82 and `92,

170

respectively. We reduce our target price to `165 on the stock, based on ~1.8x

160

150

FY2017E BV, implying a 26% upside from the current levels. We reiterate our Buy

140

rating on the stock.

130

120

110

Key financials (Standalone)

100

Y/E March (` cr)

FY2014

FY2015

FY2016E FY2017E

90

80

Net sales

15,230

17,177

20,278

23,159

70

% chg

19.4

12.8

18.1

14.2

Net profit

4,497

4,979

6,124

6,846

% chg

7.3

11.1

21.8

11.8

Source: Company, Angel Research

EBITDA margin (%)

85.1

86.2

87.6

86.4

EPS (`)

9.4

9.5

11.7

13.1

P/E (x)

14.0

13.8

11.2

10.0

P/BV (x)

2.0

1.8

1.6

1.4

RoE (%)

14.9

13.8

15.1

15.1

RoCE (%)

8.3

7.6

8.2

8.0

Rahul Dholam

EV/Sales (x)

9.7

9.5

8.5

7.8

Tel: 022- 3935 7800 Ext: 6847

EV/EBITDA (x)

11.4

11.0

9.7

9.0

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Power Grid Corporation of India | 2QFY2016 Result Update

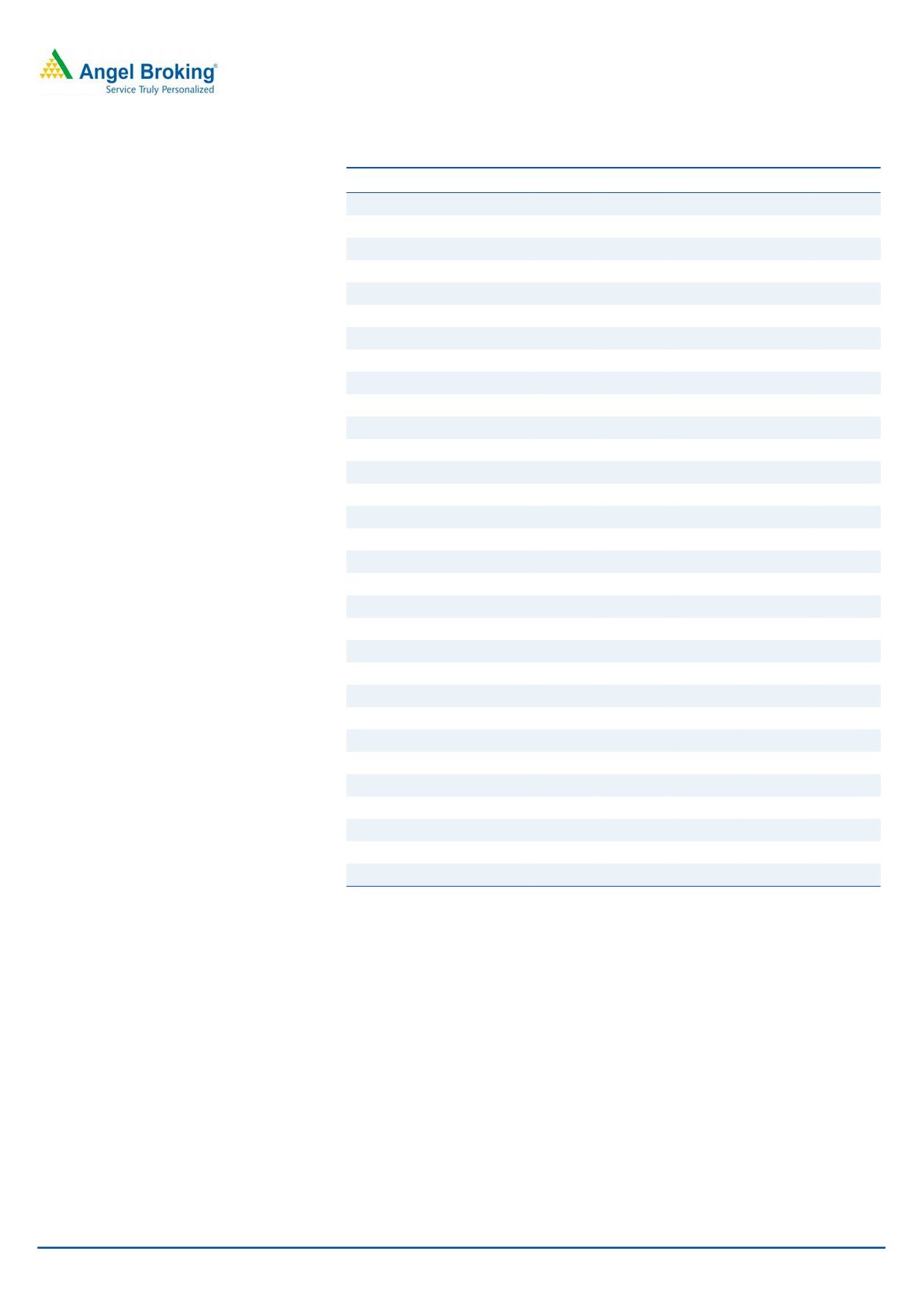

Exhibit 1: 2QFY2016 performance (Standalone)

(` cr)

2QFY16

2QFY15

yoy%

1QFY16

qoq%

FY2015

FY2014

yoy%

Transmission Revenue

4,708

4,030

16.8

4,540

3.7

16,451

14,046

17.1

Other Operating Income

210

149

41.0

177

18.2

726

1,184

(38.6)

Total Revenue

4,918

4,179

17.7

4,718

4.2

17,177

15,230

12.8

Transmission Expenses

361

331

9.1

350

3.2

1,355

1,328

2.1

% of net sales

7.3

7.9

7.4

7.9

8.7

Employee Cost

239

257

(7.1)

230

3.7

1,024

942

8.7

% of net sales

4.9

6.2

4.9

6.0

6.2

Total expenditure

600

588

2.0

580

3.4

2,379

2,269

4.8

% of net sales

12.2

14.1

12.3

13.8

14.9

EBITDA

4,318

3,590

20.3

4,137

4.4

14,798

12,961

14.2

Margin (%)

87.8

85.9

188bp

87.7

10bp

86.2

85.1

270bp

Interest

1,149

989

16.2

1,109

3.6

3,979

3,168

25.6

Depreciation

1,448

1,212

19.5

1,370

5.7

5,085

3,996

27.3

Other income

109

131

(16.7)

70

54.6

603

491

22.7

Exceptional items

(1)

10

(0)

47

25

Profit before tax

1,830

1,510

21.2

1,729

5.8

6,289

6,264

0.4

% of net sales

37.2

36.1

36.7

36.6

41.1

Tax

382

309

23.9

363

5.4

1,310

1,766

(25.8)

% of PBT

20.9

20.4

21.0

20.8

28.2

Net Profit

1,448

1,201

20.5

1,367

6.0

4,979

4,497

10.7

Source: Company, Angel Research

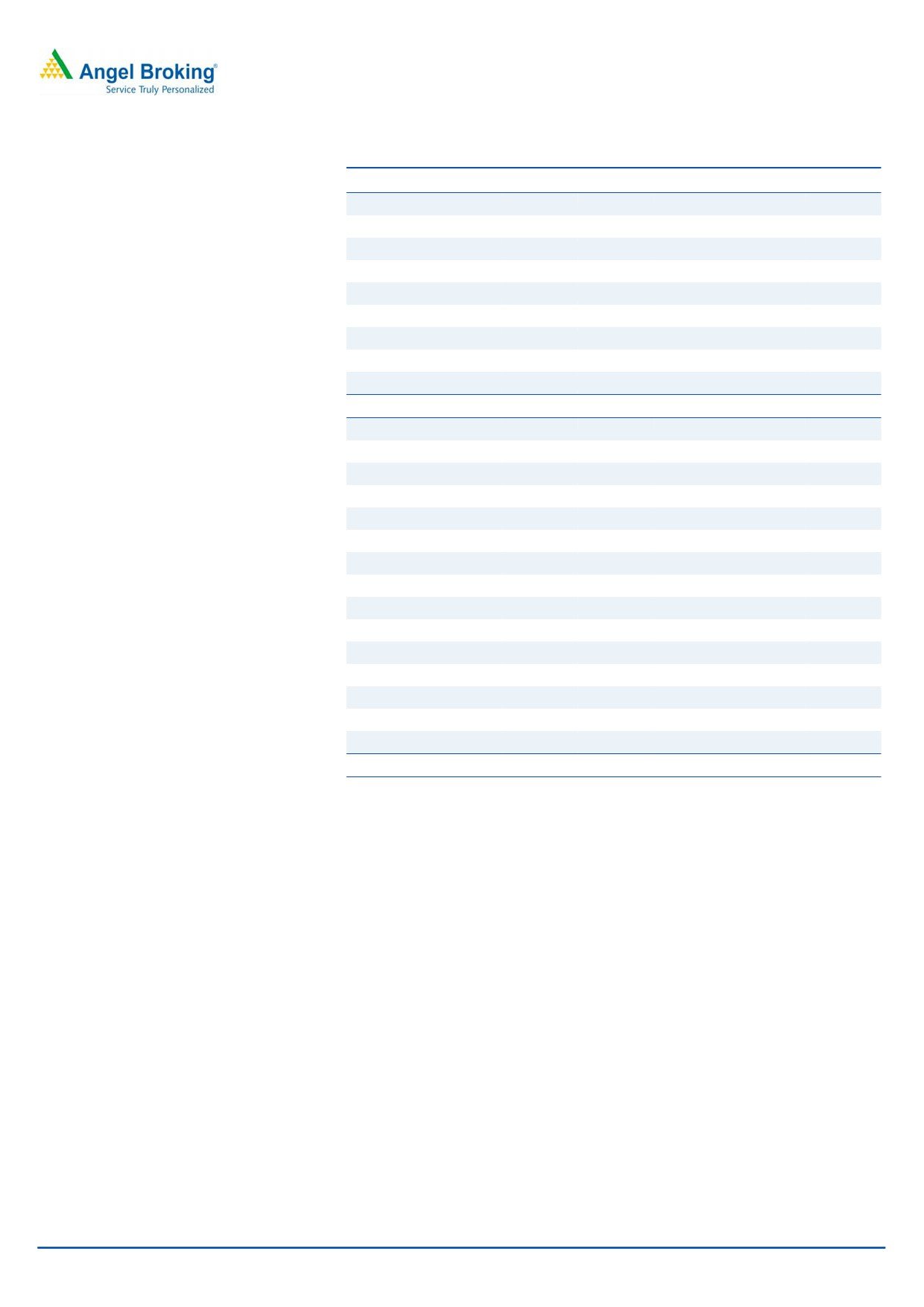

Exhibit 2: Standalone - 2QFY2016 Actual vs. Angel estimates

(` cr)

Actual

Estimates

Variation (%)

Revenue

4,918

5,062

(2.8)

EBITDA

4,318

4,368

(1.1)

EBITDA margin (%)

87.8

86.3

151bp

Net Profit

1,448

1,441

0.5

Source: Company, Angel Research

Result highlights

Revenue growth in line with expectation

PWGR reported a 16.8% yoy increase in transmission revenues to `4,708cr

(3.5% below our estimate of `4,878cr), on account of lower than expected

capitalisation. Consultancy revenues came in 12% ahead of our estimate at `99cr,

while telecom revenues too surprised positively, increasing by 55% yoy to `97cr (as

against our estimate of `64cr). The increase in consultancy and telecom income

partially offset the lower than expected transmission revenue, resulting in total

operating income of `4,918cr, 2.8% lower than our estimate of `5,062cr.

November 5, 2015

2

Power Grid Corporation of India | 2QFY2016 Result Update

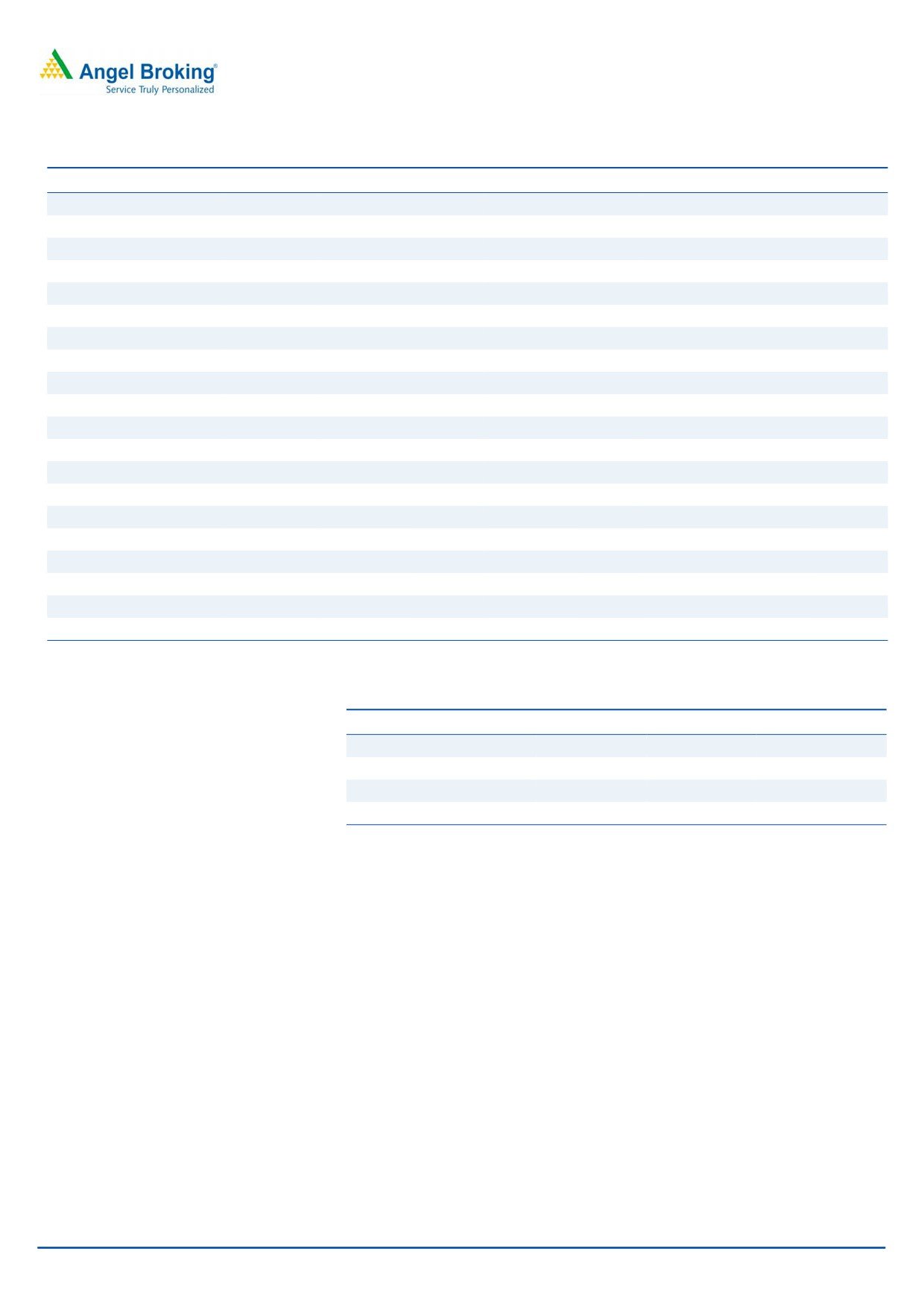

Exhibit 3: Capitalisation below estimate due to delays

Exhibit 4: Strong revenue growth of ~18% yoy

8.0

1.6

6,000

30

7.2

6.9

7.0

6.4

6.4

1.4

5,000

25

5.8

5.8

6.0

5.6

5.1

1.2

5.0

5.1

4,000

20

4.9

4.9

4.7

4.9

4.5

5.0

1.0

3,000

15

4.0

0.8

3.0

2,000

10

3.0

0.6

2.0

0.4

1,000

5

1.0

0.2

-

0

-

-

3Q14

4Q14

1Q15

2Q15

3Q15

4Q15

1Q16

2Q16

Capex

Capitalisation

Capitalisation/Capex (x)

Revenue (` Cr)

yoy change (%)

Source: Company, Angel Research

Source: Company, Angel Research

2QFY2016 capitalisation stood at `5,053cr, well below our estimate of `6,246cr.

We had expected capitalisation to remain strong on account of spill-over in the

commissioning of certain projects from 1QFY2016 to 2QFY2016 and with the

commissioning of the Biswanath Chariyali - Agra transmission line during the

quarter. Capex incurred during the quarter, at `5,088cr, was however higher than

our estimate of `4,850cr. We reduce our FY2016 capitalisation estimate to

`21,991cr, as against `22,257cr earlier.

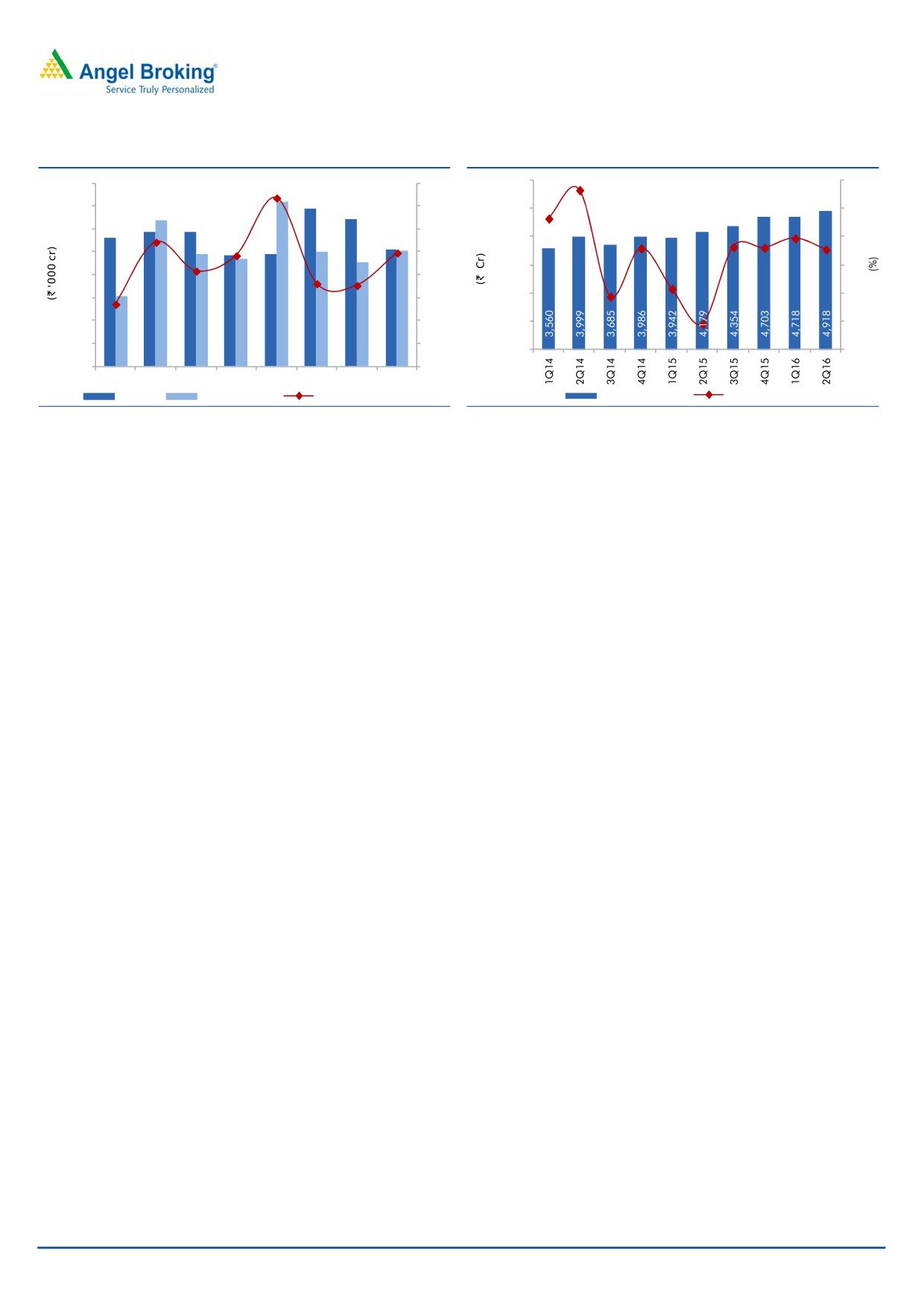

EBITDA and net profit marginally ahead of our estimates

Lower operating expenses as a percentage of revenues and higher consultancy

income helped the company in improving its EBITDA margin by 188bp yoy to

87.8%. In terms of operating performance, the impact of lower than expected

revenue was partially offset by operating efficiencies, with transmission and

employee expenses coming in lower than expected. The EBITDA came in at

`4,318cr, as against our estimate of `4,368cr.

Depreciation increased ~20% yoy to `1,448cr (still, 3.1% lower than our estimate

of `1,495cr) led by lower than expected capitalisation. Interest costs, at `1,149cr,

were marginally above our expectation of `1,128cr. Other income, at `109cr, was

higher than our estimate of `76cr. Tax expenses were in-line with our estimate at

`1,830cr, leading to a 20.5% yoy increase in net profit to `1,448cr (in line with

our estimate of `1,441cr).

November 5, 2015

3

Power Grid Corporation of India | 2QFY2016 Result Update

Exhibit 5: EBITDA margin increases ~188bp yoy

Exhibit 6: Net profit jumps ~21% yoy

5,000

89

1,600

32

4,500

88

1,400

31

4,000

1,200

3,500

87

30

3,000

1,000

86

2,500

800

29

85

2,000

600

28

1,500

84

400

1,000

83

27

500

200

-

82

-

26

EBITDA (` Cr)

Margin (%)

PAT (` Cr)

Margin (%)

Source: Company, Angel Research

Source: Company, Angel Research

November 5, 2015

4

Power Grid Corporation of India | 2QFY2016 Result Update

Investment arguments

Huge investments lined up for augmenting power generation and

transmission capacities

Power generation capacity in the country is expected to increase to ~318GW by

the end of the XII plan and a further addition of ~110GW has been planned

during the XIII plan. The transmission sector is also expected to see huge

investments of ~`1,80,000cr and ~`2,00,000cr during the XII and XIII plans,

respectively. A majority of these investments are expected to be towards inter-

regional transmission. PWGR has planned a capital outlay of `1,10,000cr during

the XII plan. Further, we expect

~60-65% of XIII plan investments in the

transmission sector toward inter-state transmissions, implying a capex outlay of

~`1,20,000cr - `1,30,000cr by PWGR.

Regulated ROE model assures steady earnings growth

PWGR receives a fixed return on equity (ROE) of 15.5%, with an additional 0.5%

for timely completion of projects, as per norms laid out by the Central Electricity

Regulatory Commission (CERC). The fixed ROE model implies that earnings growth

is directly linked to the growth in assets capitalised. PWGR’s current outlay over the

next two years (CWIP + capex) is upward of `1 lakh cr, providing strong earnings

visibility.

November 5, 2015

5

Power Grid Corporation of India | 2QFY2016 Result Update

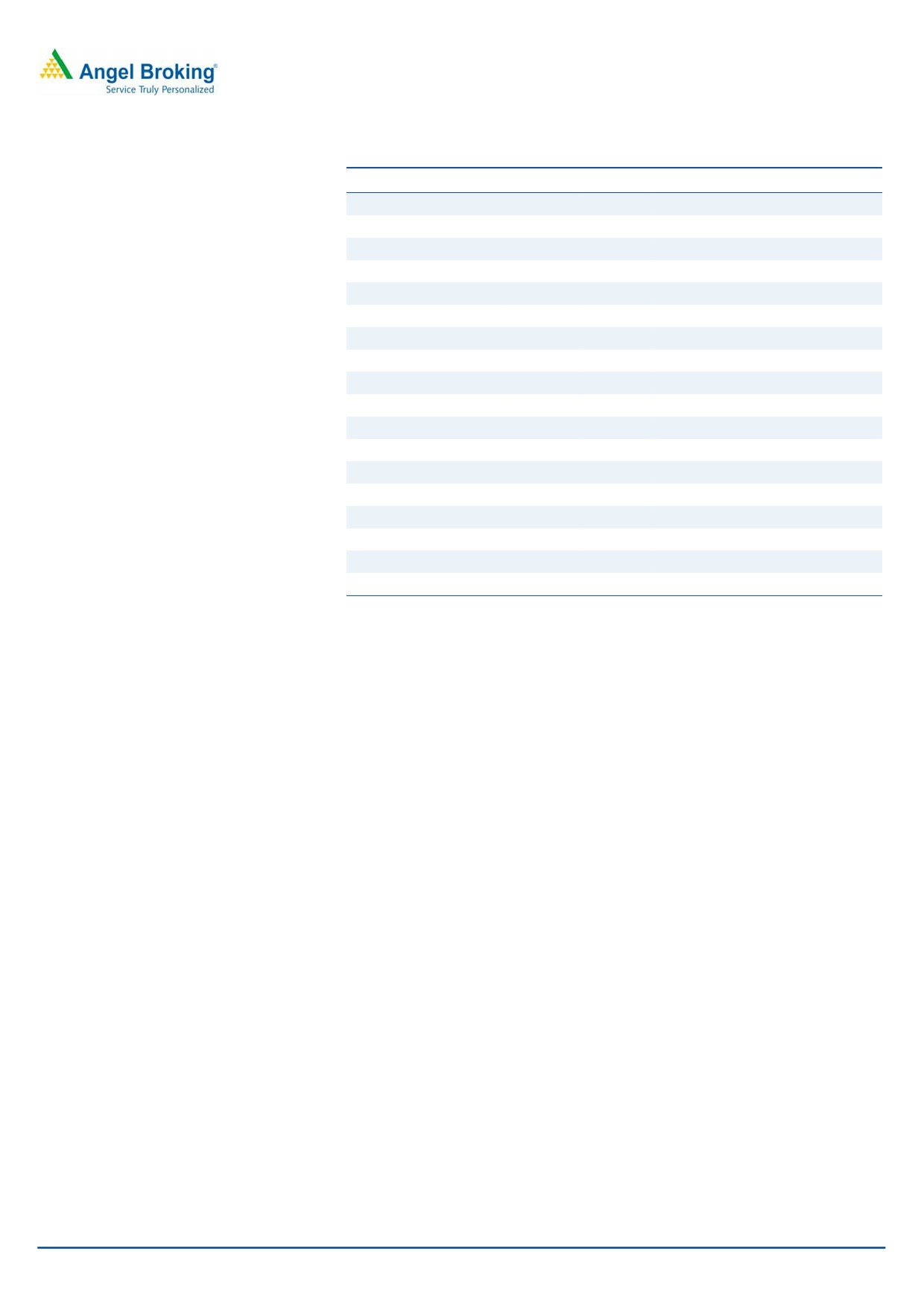

Outlook and valuation

We like PWGR for its high quality earnings as well as for the growth offered by its

regulated equity model. The company has had a good execution track record in

the past and we expect the same to continue. Strong entry barriers for new entrants

on account of huge investments that are required in the transmission sector, place

the company is a strong position. We have reduced our estimates marginally to

factor in the lower-than-expected capitalisation in 2QFY2016. We expect PWGR to

report a revenue and EBITDA CAGR of ~16% (vs 17% earlier) and the net profit to

grow at a CAGR of 17% (vs 18% earlier) over FY2015-17E.

At the current market price of `132, the stock trades at a P/BV of 1.6x and 1.4x its

FY2016E and FY2017E BV of `82 and `92, respectively. We reduce our target

price to `165 on the stock, based on ~1.8x FY2017E BV, implying a 26% upside

from the current levels. We reiterate our Buy rating on the stock.

Exhibit 7: Valuation (FY2017E)

Price / BV

(` cr)

Equity

48,102

Multiple (x)

1.8

Equity Value

86,583

Target price (`)

165

Source: Company, Angel Research

Company background

Power Grid Corporation of India Ltd is the Central Transmission Utility (CTU) of the

country and a 'Navratna' company operating under the Ministry of Power. The

company is engaged in the power transmission business with the responsibility for

planning, implementation, operation and maintenance of inter-state transmission

system and operation of National & Regional Power Grids. As of August 10, 2015,

the company owns and operates a transmission network of about 1,18,261ckm of

transmission lines and 197 EHVAC & HVDC substations with transformation

capacity of about 2,39,424MVA. The company continues to wheel ~50% of total

power generated in the country through its transmission network with a consistently

high availability of over 99.9%.

November 5, 2015

6

Power Grid Corporation of India | 2QFY2016 Result Update

Profit & Loss Statement (Standalone)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Transmission Charges

11,754

14,046

16,451

19,372

22,176

Telecom+Consultancy Revenue

547

903

655

842

888

Net Sales

12,300

14,949

17,106

20,214

23,064

Other operating income

457

281

71

64

96

Total operating income

12,758

15,230

17,177

20,278

23,159

% chg

25.5

19.4

12.8

18.1

14.2

Transmission Expenses

368

456

553

652

746

Employee Expenses

886

942

1,024

986

1,380

Other Mfg costs

558

849

755

871

972

Provisions

3

22

47

(2)

63

EBITDA

10,943

12,961

14,798

17,771

19,999

% chg

28.6

18.4

14.2

20.1

12.5

(% of Net Sales)

85.8

85.1

86.2

87.6

86.4

Depreciation& Amortisation

3,352

3,996

5,085

5,924

7,096

EBIT

7,591

8,965

9,713

11,847

12,903

% chg

27.8

18.1

8.3

22.0

8.9

(% of Net Sales)

59.5

58.9

56.5

58.4

55.7

Interest & other Charges

2,535

3,168

3,979

4,518

5,001

Other Income

571

491

603

392

746

(% of PBT)

10.1

7.8

9.5

5.1

8.6

Share in profit of Associates

-

-

-

-

-

Recurring PBT

5,627

6,289

6,337

7,722

8,647

% chg

21.9

11.8

0.8

21.9

12.0

Extraordinary Inc/(Expense)

18

(25)

(47)

-

-

PBT (reported)

5,645

6,264

6,289

7,722

8,647

Tax

1,410

1,766

1,310

1,598

1,801

(% of PBT)

25.0

28.2

20.8

20.7

20.8

PAT (reported)

4,235

4,497

4,979

6,124

6,846

ADJ. PAT

4,216

4,523

5,026

6,124

6,846

% chg

28.7

7.3

11.1

21.8

11.8

(% of Net Sales)

33.0

29.7

29.3

30.2

29.6

November 5, 2015

7

Power Grid Corporation of India | 2QFY2016 Result Update

Balance Sheet (Standalone)

Y/E March (` cr)

FY2013

FY2014

FY2015E

FY2016E

FY2017E

SOURCES OF FUNDS

Equity Share Capital

4,630

5,232

5,232

5,232

5,232

Reserves & Surplus

21,610

29,228

32,935

37,626

42,870

Shareholders Funds

26,239

34,460

38,167

42,858

48,102

Share Warrants

-

-

-

-

-

Total Loans

68,188

83,170

95,817

1,07,378

1,17,574

Deferred Tax Liability

1,959

2,443

2,472

2,501

2,531

Other Long term liabilities

4,708

5,855

6,610

7,743

8,293

Long term provisions

443

524

591

698

797

Total Liabilities

1,01,537

1,26,452

1,43,657

1,61,178

1,77,296

APPLICATION OF FUNDS

Gross Block

80,600

96,504

1,18,264

1,40,255

1,59,423

Less: Acc. Depreciation

19,199

23,350

28,577

34,501

41,597

Net Block

61,401

73,154

89,686

1,05,754

1,17,826

Capital Work-in-Progress

19,115

31,851

39,882

39,523

42,481

Construction Stores

21,038

21,479

16,409

17,213

17,637

Investments

964

814

741

741

741

Non-current Loans & Adv.

2,351

3,190

3,652

4,502

5,142

Current Assets

6,265

9,100

7,930

10,677

13,213

Cash

1,662

4,418

2,063

3,897

5,494

Loans & Advances

429

472

566

669

764

Other

4,175

4,211

5,301

6,111

6,956

Current liabilities

9,597

13,138

14,644

17,231

19,744

Net Current Assets

(3,331)

(4,037)

(6,714)

(6,555)

(6,530)

Mis. Exp. not written off

-

-

-

-

-

Total Assets

1,01,537

1,26,452

1,43,657

1,61,178

1,77,296

November 5, 2015

8

Power Grid Corporation of India | 2QFY2016 Result Update

Cash flow statement (Standalone)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E

Profit before tax

5,645

6,264

6,289

7,722

8,647

Depreciation

3,380

4,011

5,228

5,924

7,096

Change in Working Capital

1,241

3,333

660

2,193

2,057

Others

2,091

2,809

4,494

5,268

5,195

Direct taxes paid

(1,072)

(1,157)

(1,310)

(1,598)

(1,801)

Cash Flow from Operations

11,284

15,259

15,361

19,509

21,194

(Inc.)/ Dec. in Fixed Assets

(22,389)

(26,735)

(24,721)

(22,436)

(22,550)

(Inc.)/ Dec. in Investments

137.0

148.8

72.3

-

-

Others

303

209

(462)

(850)

(640)

Cash Flow from Investing

(21,948)

(26,378)

(25,111)

(23,286)

(23,190)

Issue of Equity

0

5,297

0

0

0

Inc./(Dec.) in loans

13,795

12,720

12,599

11,561

10,196

Dividend Paid (Incl. Tax)

(1,569)

(1,391)

(1,224)

(1,433)

(1,602)

Others

(2,236)

(2,752)

(3,979)

(4,518)

(5,001)

Cash Flow from Financing

9,990

13,874

7,395

5,611

3,593

Inc./(Dec.) in Cash

(675)

2,756

(2,355)

1,834

1,597

Opening Cash balances

2,337

1,662

4,418

2,063

3,897

Closing Cash balances

1,662

4,418

2,063

3,897

5,494

November 5, 2015

9

Power Grid Corporation of India | 2QFY2016 Result Update

Key ratios

Y/E March

FY2013

FY2014

FY2015E

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

14.4

14.0

13.8

11.2

10.0

P/CEPS

8.0

7.4

6.8

5.7

4.9

P/BV

2.3

2.0

1.8

1.6

1.4

Dividend yield (%)

2.1

2.0

1.5

1.8

2.0

EV/Sales

10.0

9.7

9.5

8.5

7.8

EV/EBITDA

11.6

11.4

11.0

9.7

9.0

EV/Total Assets

1.3

1.2

1.1

1.1

1.0

Per Share Data (`)

Adjusted EPS (Basic)

9.1

9.4

9.6

11.7

13.1

Adjusted EPS (fully diluted)

9.1

9.4

9.6

11.7

13.1

Cash EPS

16.3

17.7

19.3

23.0

26.6

DPS

2.8

2.6

2.0

2.3

2.6

Book Value

56.7

65.9

73.0

81.9

91.9

Dupont Analysis

EBIT margin

59.5

58.9

56.5

58.4

55.7

Tax retention ratio (%)

75.0

71.8

79.2

79.3

79.2

Asset turnover (x)

0.1

0.1

0.1

0.1

0.1

ROIC (Post-tax)

6.7

6.1

6.2

6.6

6.6

Cost of Debt (Post Tax)

3.1

3.0

3.5

3.5

3.5

Leverage (x)

2.4

2.4

2.4

2.4

2.4

Operating RoE

15.1

13.6

12.4

14.2

13.8

Returns (%)

RoCE (Pre-tax)

8.7

8.3

7.6

8.2

8.0

Angel RoIC (Pre-tax)

15.6

15.4

13.9

14.0

13.3

RoE

17.0

14.9

13.8

15.1

15.1

Turnover ratios (x)

Asset Turnover (Gross Block)

0.2

0.2

0.2

0.2

0.2

Inventory (days)

14

15

15

15

15

Receivables (days)

42

36

39

40

39

Payables (days)

44

45

55

58

54

WC cycle (ex-cash) (days)

(116)

(161)

(183)

(173)

(177)

Solvency ratios (x)

Net debt to equity

2.5

2.3

2.5

2.4

2.3

Net debt to EBITDA

6.1

6.1

6.3

5.8

5.6

Interest Coverage

3.0

2.8

2.4

2.6

2.6

November 5, 2015

10

Power Grid Corporation of India | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Power Grid Corporation of India

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 5, 2015

11