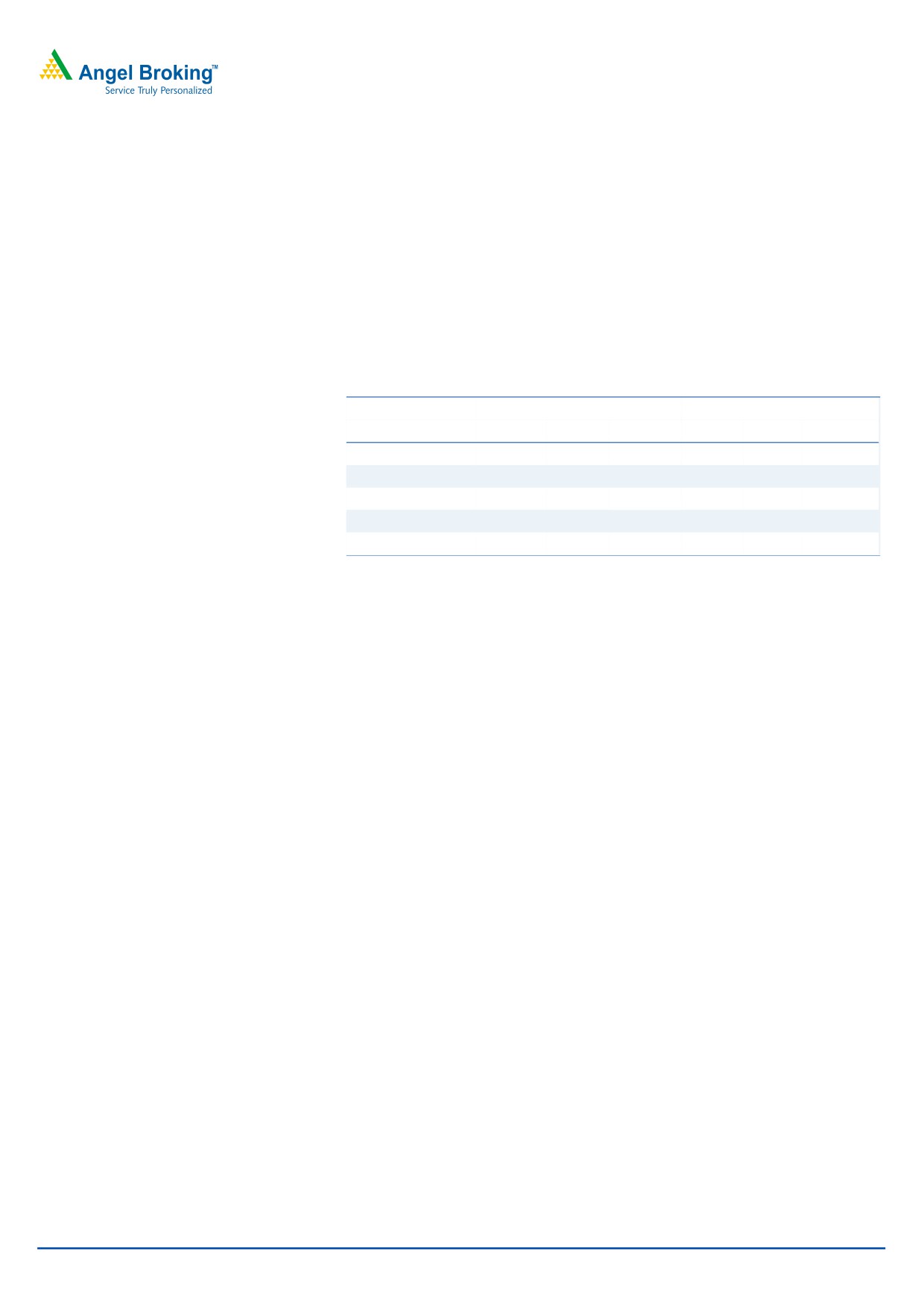

1QFY2017 Result Update | Infrastructure

August 31, 2016

PNC Infratech

BUY

CMP

`120

Performance Highlights

Target Price

`143

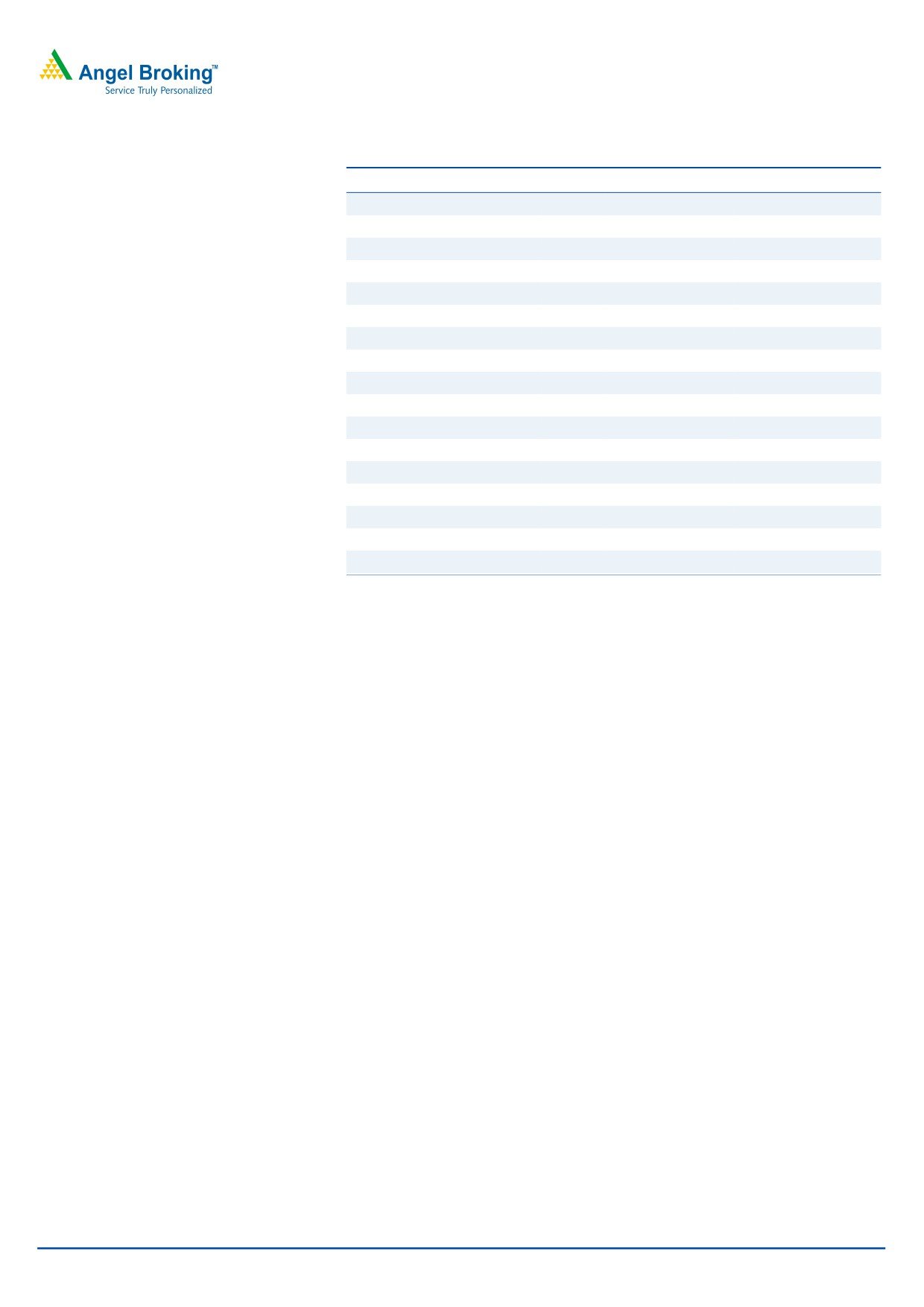

Quarterly highlights - Standalone

Investment Period

12 Months

Y/E March (` cr)

1QFY17

1QFY16

% chg (yoy)

Net sales

515

434

18.6

Stock Info

EBITDA

67

60

11.6

Sector

Infrastructure

Market Cap (` cr)

3,084

Reported PAT

64

26

145.6

Source: Company, Angel Research

Net debt (` cr)

(91)

Beta

0.6

For 1QFY2017, PNC Infratech (PNC) reported top-line growth of 18.6% while the

52 Week High / Low

135/82

bottom-line grew by substantial 145.6% yoy. The top-line growth was driven by

Avg. Daily Volume

75,832

strong execution across Agra-Firozabad and Varanasi-Gorakhpur road projects.

Face Value (`)

2

Despite strong execution, decline in raw material and other expenses led to 81bp

BSE Sensex

28,343

yoy decline in EBITDA margin to 13.0%. A 11.6% yoy EBITDA growth coupled

Nifty

8,744

with tax benefits and MAT credit led PAT grow by 145.6% yoy. PAT margins stood

Reuters Code

PNCI.BO

at 12.4%, rose significantly on a yoy basis.

Bloomberg Code

PNCL@IN

PNC’s unexecuted order book as of 1QFY2017 stands at `6,474cr (order book

to LTM sales ratio stands at 3.1x).

Shareholding Pattern (%)

All the BOT projects are now operational as of now. Management has indicated

Promoters

56.1

that it does not intend to add any new BOT projects in FY2017-18. As a result,

MF / Banks / Indian Fls

15.1

we are of the view that PNC’s consolidated D/E ratio would peak out from

FII / NRIs / OCBs

8.0

FY2017E onwards.

Indian Public / Others

20.8

Outlook and valuation: Considering the strong uptick in roads and highways EPC

award activity especially in north India, where PNC has more comfort, and given

its past track record and recent wins, we expect the standalone entity to report

Abs. (%)

3m 1yr 3yr

20.1% top-line CAGR over FY2015-2017E. With normal tax rate applicable from

Sensex

6.3

7.8

54.0

FY2018, the bottom-line growth would be of -3.3% CAGR during the same

PNC Infratech

6.4

21.4

NA

*NA as PNC listed on May 26, 2015

period. Accordingly, RoEs would decline from 23.3% in FY2016 to 13.9% in

FY2018E. We are also now comforted that the consolidated Balance Sheet would

peak from FY2017E onwards. Using the SoTP valuation methodology we arrive

3-Year Daily Price Chart

at a FY2018E based price target of `143. Given the 19% upside in stock form the

140

120

current levels, we recommend BUY rating on the stock.

100

Key financials (Standalone)

80

Y/E March (` cr)

FY14

FY15

FY16

FY17E

FY18E

60

Net Sales

1,145

1,561

2,014

2,350

2,904

40

% chg

(12.1)

36.3

29.0

16.7

23.6

20

Net Profit

67

100

243

232

227

0

% chg

(12.6)

50.2

141.9

(4.6)

(2.0)

EBITDA (%)

12.2

13.9

13.2

13.1

13.2

EPS (`)

3

4

9

9

8.8

Source: Company, Angel Research

P/E (x)

46.1

30.7

12.7

13.3

13.6

P/BV (x)

4.9

4.3

2.3

2.0

0.0

RoE (%)

11.2

14.9

23.3

15.9

13.9

RoCE (%)

15.0

20.2

19.4

17.9

17.3

Yellapu Santosh

EV/Sales (x)

0.5

0.5

0.3

0.4

0.3

022 - 3935 7800 Ext: 6811

EV/EBITDA (x)

4.5

3.6

2.0

2.9

2.3

Source: Company, Angel Research; Note: CMP as of August 30, 2016

Please refer to important disclosures at the end of this report

1

PNC Infratech | 1QFY2017 Result Update

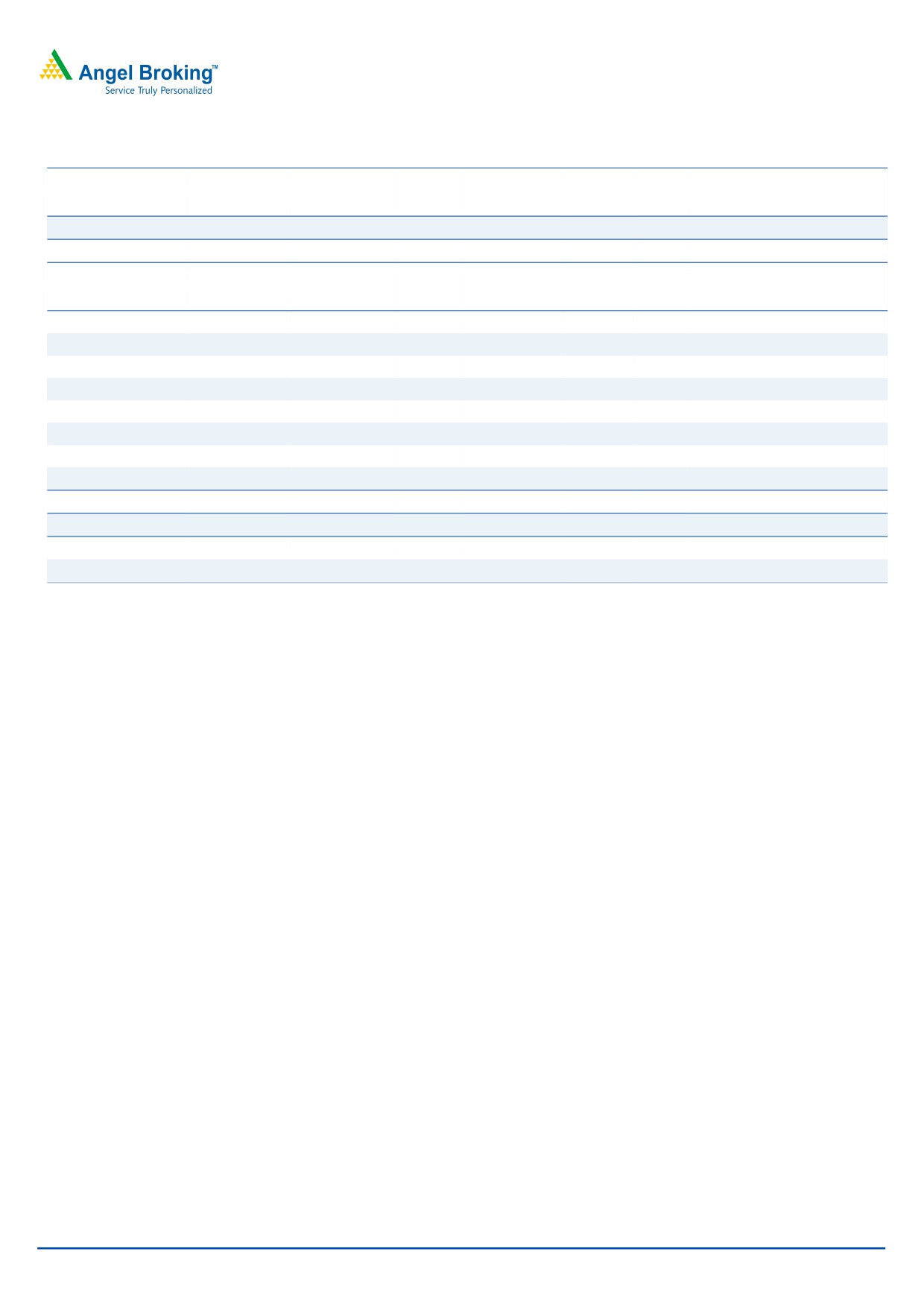

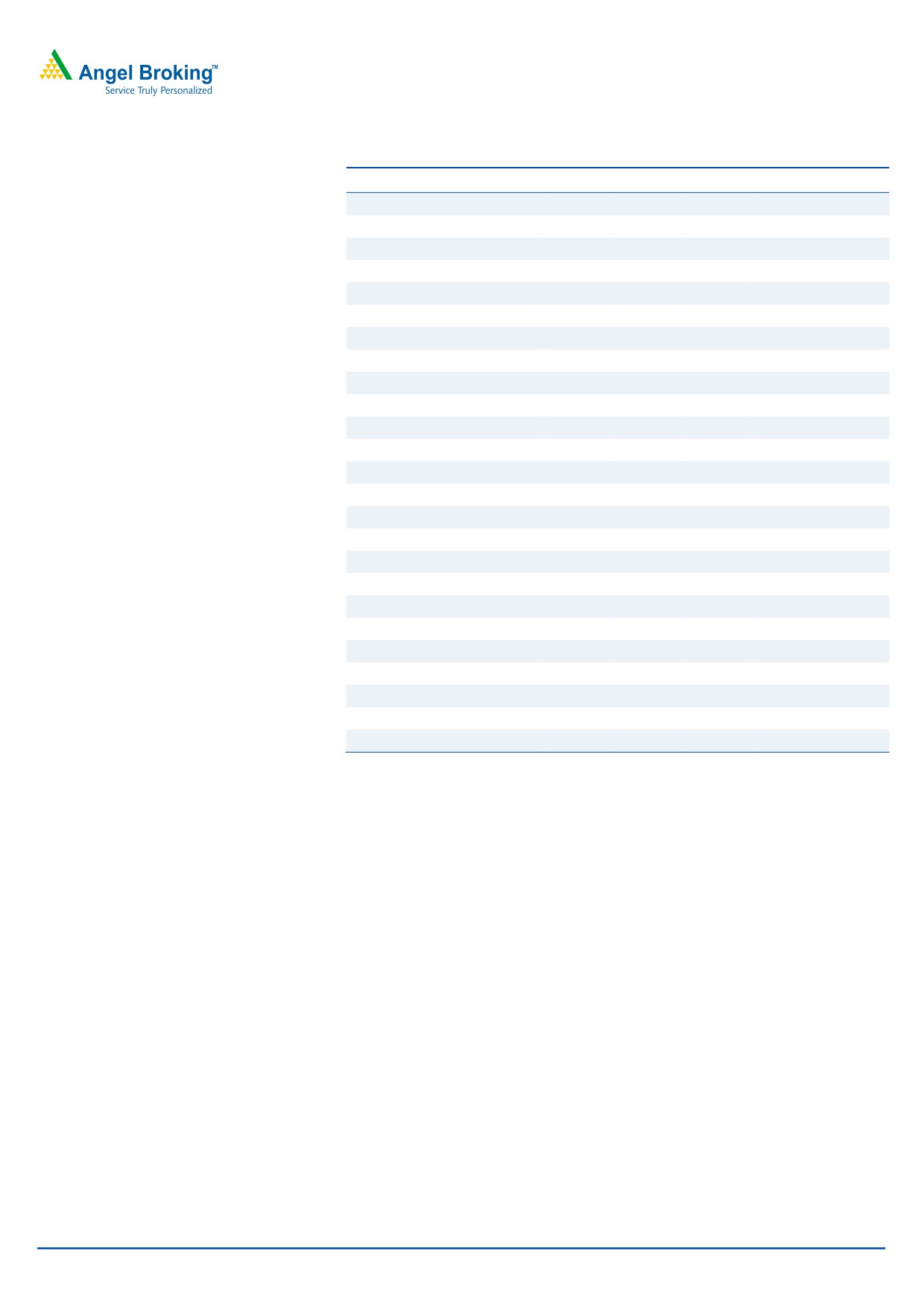

Exhibit 1: Quarterly Standalone Performance

Particulars (` cr)

1QFY17

1QFY16

% chg (yoy)

Net Sales

515

434

18.6

Total Expenditure

448

374

19.7

Cost of Materials consumed

378

302

25.1

Changes in Inv. Of FG & WIP

(2)

15

nmf

Employee Benefits Expense

24

19

26.9

Other Expenses

48

39

24.6

EBITDA

67

60

11.6

EBIDTA %

13.0

13.8

Depreciation

12

12

2.7

EBIT

55

48

13.7

Interest and Financial Charges

2

10

(79.2)

Other Income

17

2

831.6

PBT before Exceptional Items

70

40

76.5

Exceptional Items

0

0

PBT after Exceptional Items

70

40

76.5

Tax

6

14

(54.5)

% of PBT

8.9

34.5

PAT

64

26

145.6

PAT %

12.4

6.0

Other Comprehensive Income

0

0

(70.4)

Total Comprehensive Income

64

26

145.0

Dil. EPS (after extra-ord. Items)

2.49

1.16

114.7

Source: Company, Angel Research

Standalone Business Review

Strong execution seen during the quarter

Led by strong execution, PNC reported strong sales for 1QFY2017. Against our

15% yoy growth expectations, PNC reported 18.6% yoy top-line growth to `515cr.

Notably, Agra-Firozabad contributed `337cr (a/c’ed for 65% of the revenues) to

the 1QFY2017 standalone revenues. Varanasi-Gorakhpur project contributed

`65cr to the total revenues.

EBITDA margin declines to 13.0%

On the operating front, PNC reported an EBITDA of `67cr, reflecting 13.0%

EBITDA margin for the quarter. Reported EBITDA margins were lower than our

expectation, as they declined 81bp yoy to 13.0%. Despite strong execution, higher

raw material and other expenses led to yoy EBITDA margin compression.

PAT benefits from strong other income & low tax rate

PNC reported strong PAT at `64cr for the quarter. Reported PAT margin came in at

12.4%, ahead of 6.0% in the corresponding quarter a year ago and our

expectations. PAT on yoy basis benefitted from (1) sharp growth in other income

(to `17cr), and (2) lower effective tax rate at 8.9%. Of the total other income

booked for the quarter, PNC benefitted from ~`14cr of interest income from loans

given to the Ghaziabad-Aligarh JV. Lower tax rate is attributable to MAT credit and

section 80IA benefits.

August 31, 2016

2

PNC Infratech | 1QFY2017 Result Update

Order inflows continue to grow

In FY2016, PNC reported a 146% yoy increase in net order inflows to `3,972cr.

These include 6 highway projects and 1 airport runway project (has received letter

of award for all the 7 projects).

In FY2017, PNC is either L1 or has won 4 projects worth `1,373cr. Following are

the details of projects won:

(1) extension and resurfacing of runway at Air Force Station, Bakshi Ka Talab, near

Lucknow worth `139.6cr from Military Engineering Services, (2) upgradation of

Nanau-Dodon section in the district of Aligarh, Uttar Pradesh worth `119.9cr

by UP PWD, (3) 2/ 4 laning of Dausa-Lalsot-Kauthun section of NH-11 A

(Extension) in Rajasthan under NHDP IV, on HAM for `881cr of bid project cost,

and (4) 4-laning of Etah-Kasganj road project in UP worth `232.9cr.

PNC’s unexecuted order book (including L1 order wins) as of 1QFY2017 stands at

`6,474cr (order book to LTM sales ratio stands at 3.1x). Roads & Highways vertical

continues to dominate the order book mix.

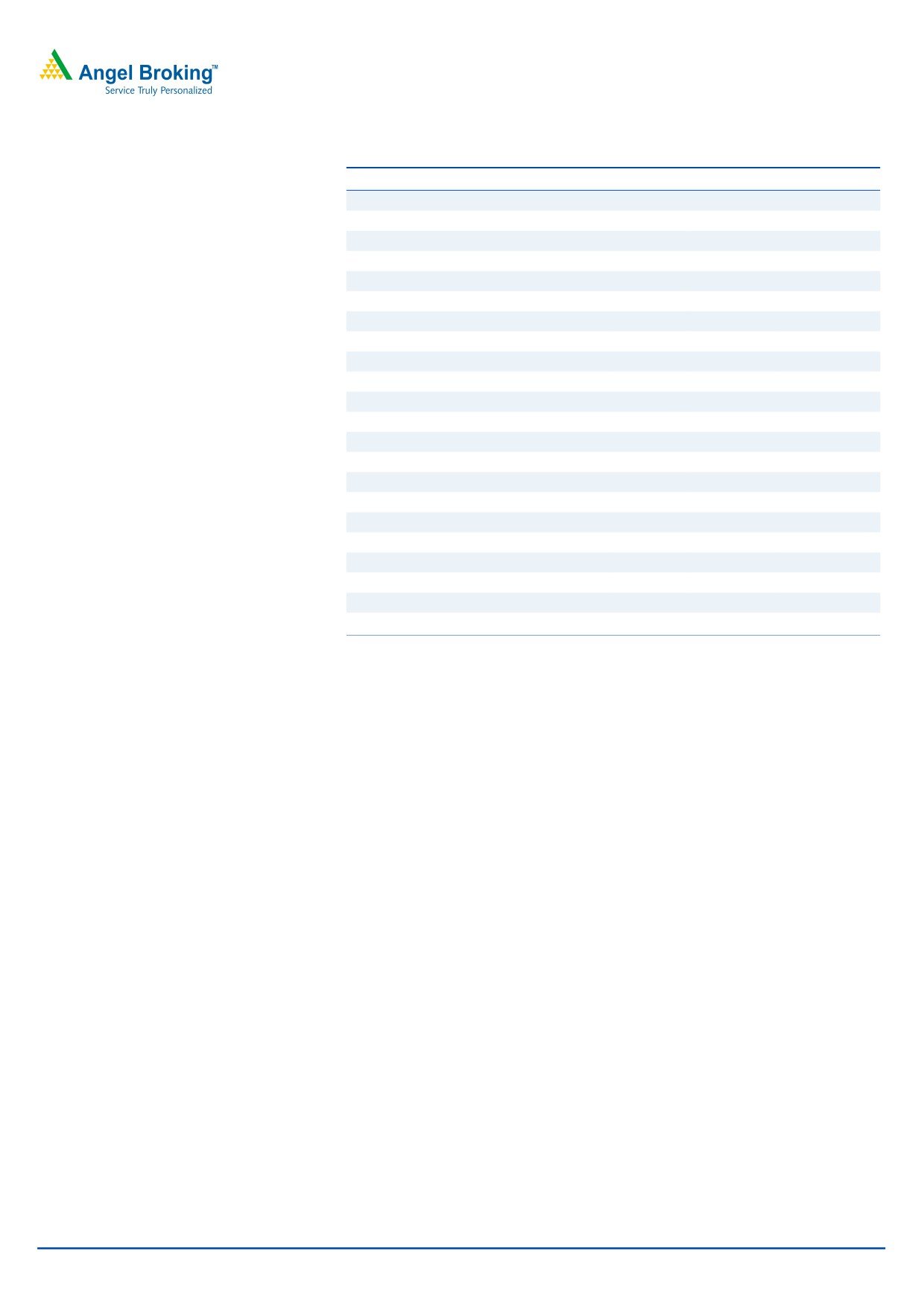

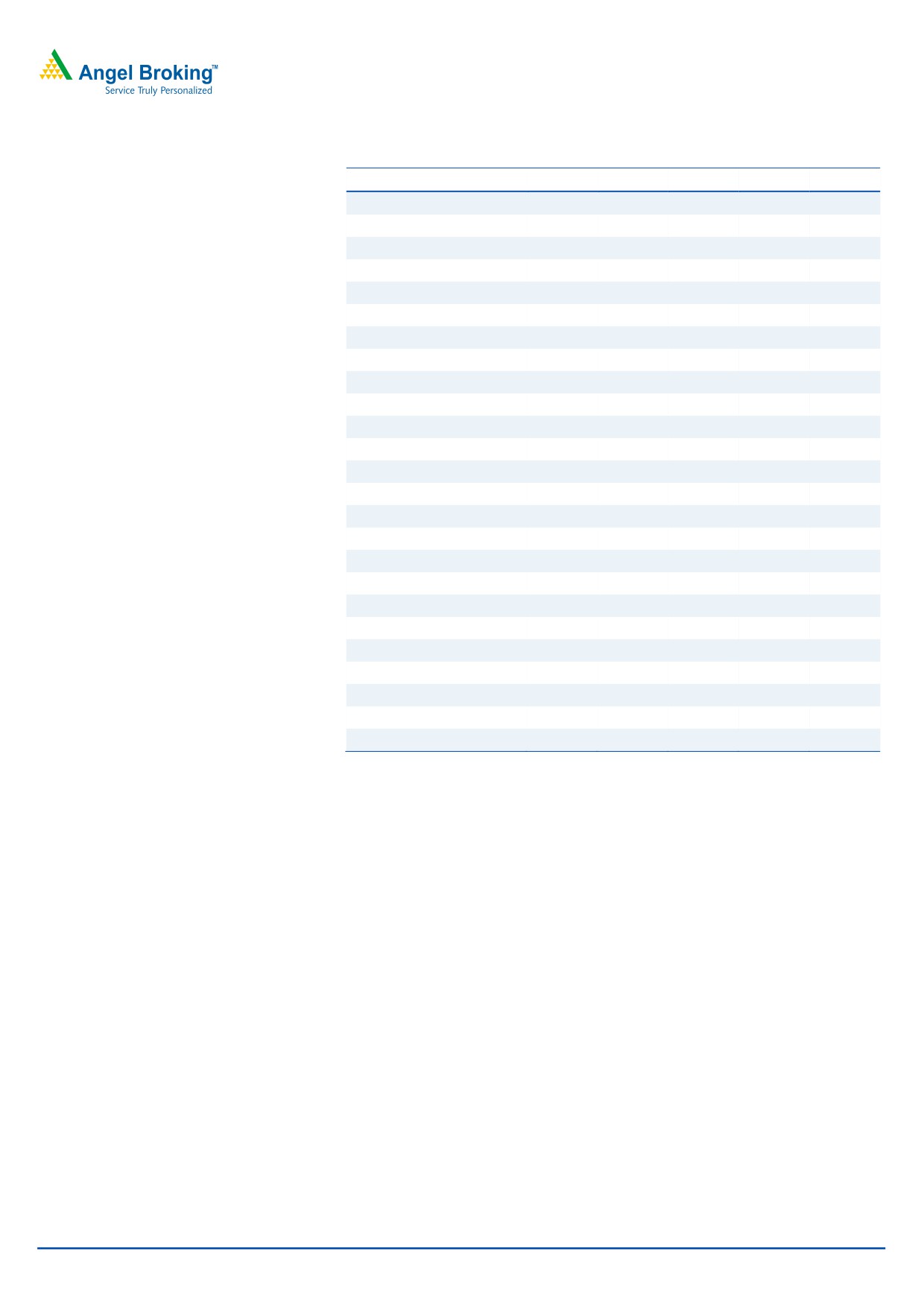

Exhibit 2: Top 5-projects as % of total Order Book

Exhibit 3: Details of Top-5 projects being executed

O/s Total Project

Project details

Value (` cr)

Nagina-Kashipur

1,156

28%

Varanasi-Gorakhpur

869

83%

Aligarh-Moradabad

645

Agra-Firozabad

523

Bhojpur-Buxar

477

Top 5-projects

3,670

Top 5 projects

Other Projects

Source: Company, Angel Research

Source: Company, Angel Research

August 31, 2016

3

PNC Infratech | 1QFY2017 Result Update

Update on BOT projects

PNC currently has 7 BOT/OMT assets which are at operational. Of these, 1 is a

BOT-Annuity project, 1 is an industrial estate maintenance project (BOT-Annuity +

Fee model), 1 is an OMT project, and the remaining 4 are BOT-Toll projects.

Notably, all 7 BOT projects are Uttar Pradesh (UP) or Central/North India based. 4

of these BOT projects have been won on Viability Gap Funding (VGF) basis,

amidst competition.

Currently all 7 BOT projects are operational (Rae Bareli-Jaunpur BOT project

commenced operations 98 days before the scheduled CoD of June-2016).

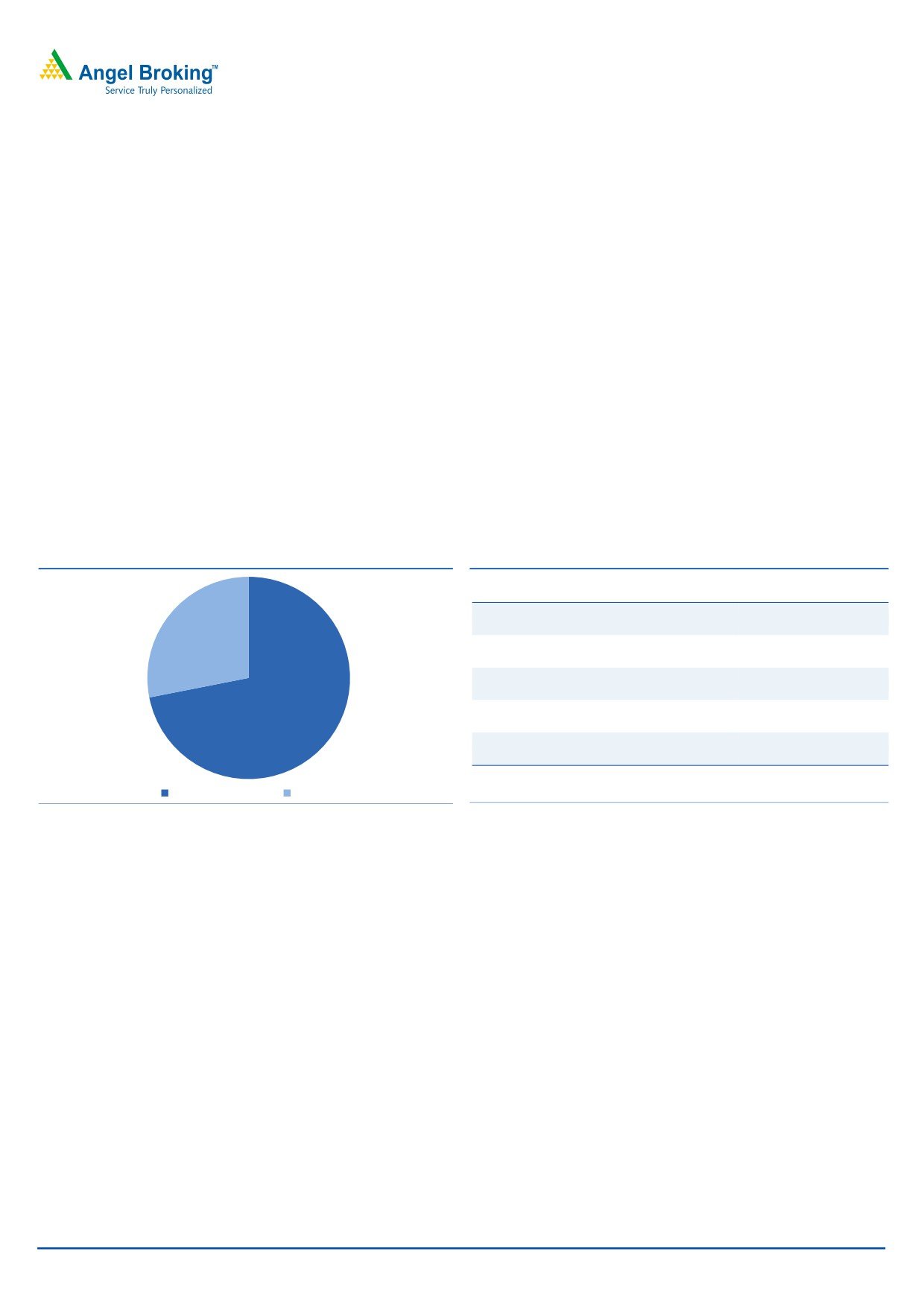

Exhibit 4: BOT Projects Status (at 1QFY2017-end)

PNC

Length

PNC Equity

BOT projects

Proj. Type

Status

TPC

Stake (%)

(kms)

Invested to-date

Ghaziabad-Aligarh

Toll

35%

Operational

125

2,000

68

Kanpur-Kabrai

Toll

100%

Operational

123

458

68

Gwalior-Bhind

Toll

100%

Operational

108

340

78

Bareilly-Almora

Toll

100%

Operational

54

604

75

Rae Bareli-Jaunpur

Annuity

100%

Operational

166

837

140

Narela Industrial Estate

Annuity + Fee

100%

Operational

NA

175

35

OMT projects

Kanpur-Ayodhya

Toll

100%

Operational

217

4,435

561

Source: Company, Angel Research

With all 7 BOT projects operational PNC does not have any equity commitments

pending towards the BOT projects.

Kanpur-Ayodhya OMT project during 1QFY2017 collected `69.8cr of gross toll

income, which in our estimate is over 10% yoy increase.

For Ghaziabad-Aligarh BOT project, PNC reported toll income of ~`41lakh/day.

Management expects tolling from this BOT to catch-up in next 3-6 months to

~`60lakh/day, (1) once entire road stretch gets operational (currently does partial

tolling); and (2) on implementation of over-loading charges.

Gwalior-Bhind reported

`15.5cr, Kanpur-Kabrai reported

`24.7cr, Kanpur-

Ayodhya reported `69.8cr and Bareilly Almora reported `9.6cr of toll income in

1QFY2017, respectively. All above-mentioned BOT projects benefitted from 2.5%

increase in tariff rate.

Risks & Concerns

Delay in order wins could pose as a risk to our estimates.

Roads & Highways account for substantial chunk of the order book. Slowdown

in orders from NHAI / State governments could affect company’s order inflow

adversely.

PNC's order book comes majorly from North India. Any slowdown in orders

from this region may impact our order inflow assumption for the company.

August 31, 2016

4

PNC Infratech | 1QFY2017 Result Update

Concall Takeaways:

PNC management highlighted that YTDFY2017 NHAI awarded 1,000kms of

road projects. Post the commencement of Hybrid Annuity (HAM) projects

awarding to-date ~30 projects covering ~1,600kms have been awarded.

Management highlighted that they are bidding for `15,000cr of EPC projects

and few HAM projects. Also, PNC has bid for ~`1,500cr of DFCC projects to

lay down railway track between Khurja-Pilkhani stretch in U.P.

Management expects to win `5,000cr of orders in FY2017E and end the year

with order book of `8,000cr.

On the back of recent win, management expects FY2017E revenue growth in

the range of 20-25%.

Despite completion of mobilization, Bihar based road stretches, Bhojpur-

Buxar, Koilwar-Bhojpur projects are expected to get their appointed date by

Oct-16. This project level delay is owing to land acquisition issue. Similarly,

management is hopeful of getting appointed dates for Aligarh-Moradabad by

Sep-16 and Varanasi-Gorakhpur, Nagina-Kashipur projects by Oct-16.

Management expects EBITDA margins to be in range of 13-14% for FY2017E.

For FY2017E, PNC is expected to report effective tax rate in range of ~5-7%

and 20-22% in FY2018E. This lower tax rate for FY2017/18E is attributable to

section 80IA benefits and MAT Credit entitlement.

Of the targeted `80cr capex for FY2017E, PNC has already incurred `8-10cr

capex in 1QFY2017. Management guided for `30-35cr capex in FY2018E.

On the back of uptick in the project execution from 2HFY2017E, management

expects stretch in the Working capital. As a result standalone debt is expected

to increase from `15cr in 1QFY2017 to `150-200cr by FY2017E-end. Consol.

debt at 1QFY2017 stands at `1,722cr (reflecting D/E of 1.3x).

August 31, 2016

5

PNC Infratech | 1QFY2017 Result Update

Outlook & Valuation

Considering strong execution trends exhibited by PNC, uptick in NHAI and MoRTH

awarding momentum, when coupled with recent NHAI announcements, we expect

further uptick in execution from here-on. On incorporating 1Q performance, we

expect PNC’s standalone business to report 20.1% top-line CAGR during FY2016-

18E to `2,904cr. We lower our EBITDA margin estimate to 13.1%/13.2% for

FY2017/18E, respectively. Given that the tax benefits availed during FY2016-18E,

would not be repeated beyond FY2018, we expect PAT to report negative 3.3%

CAGR during FY2016-18E to `227cr.

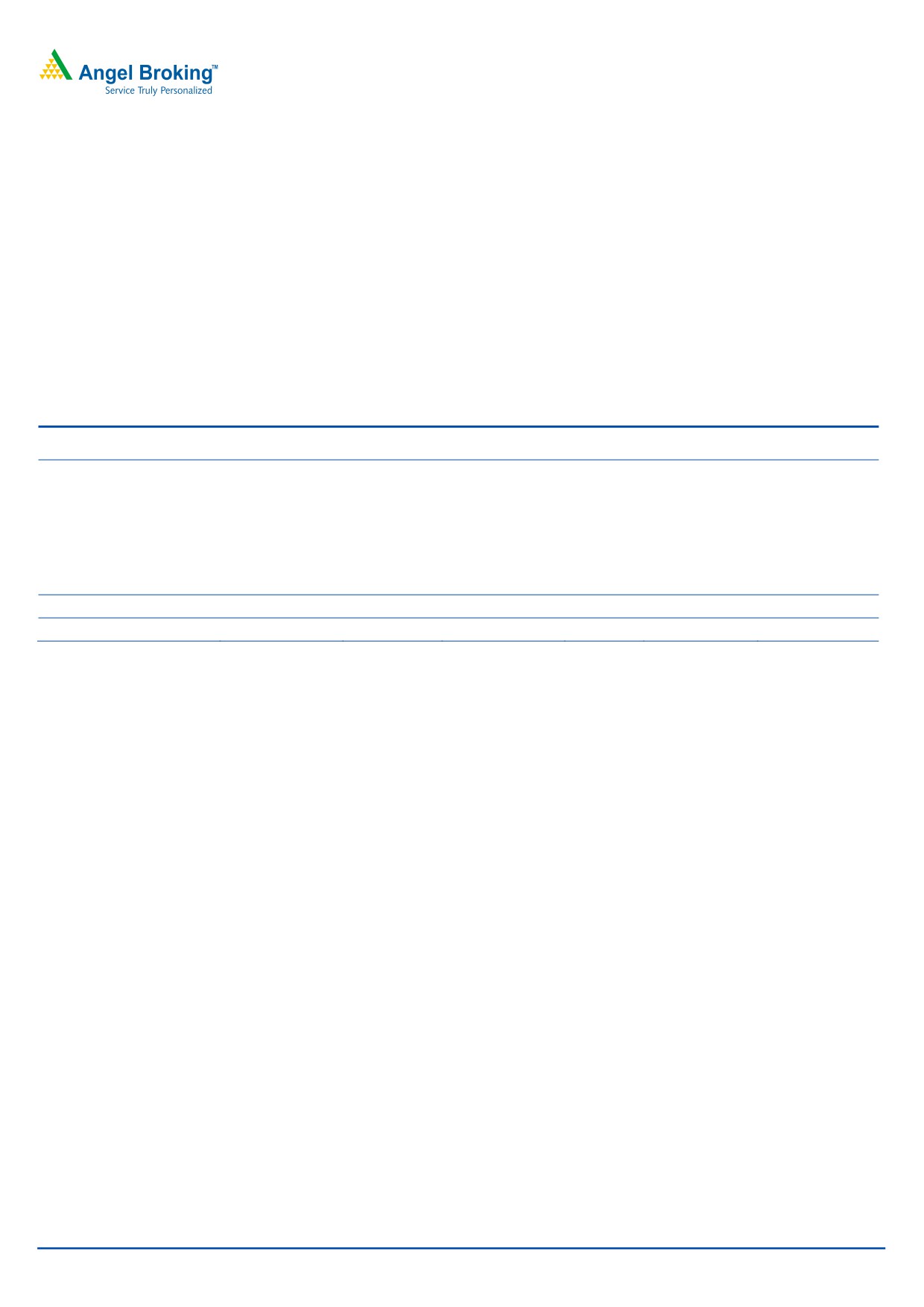

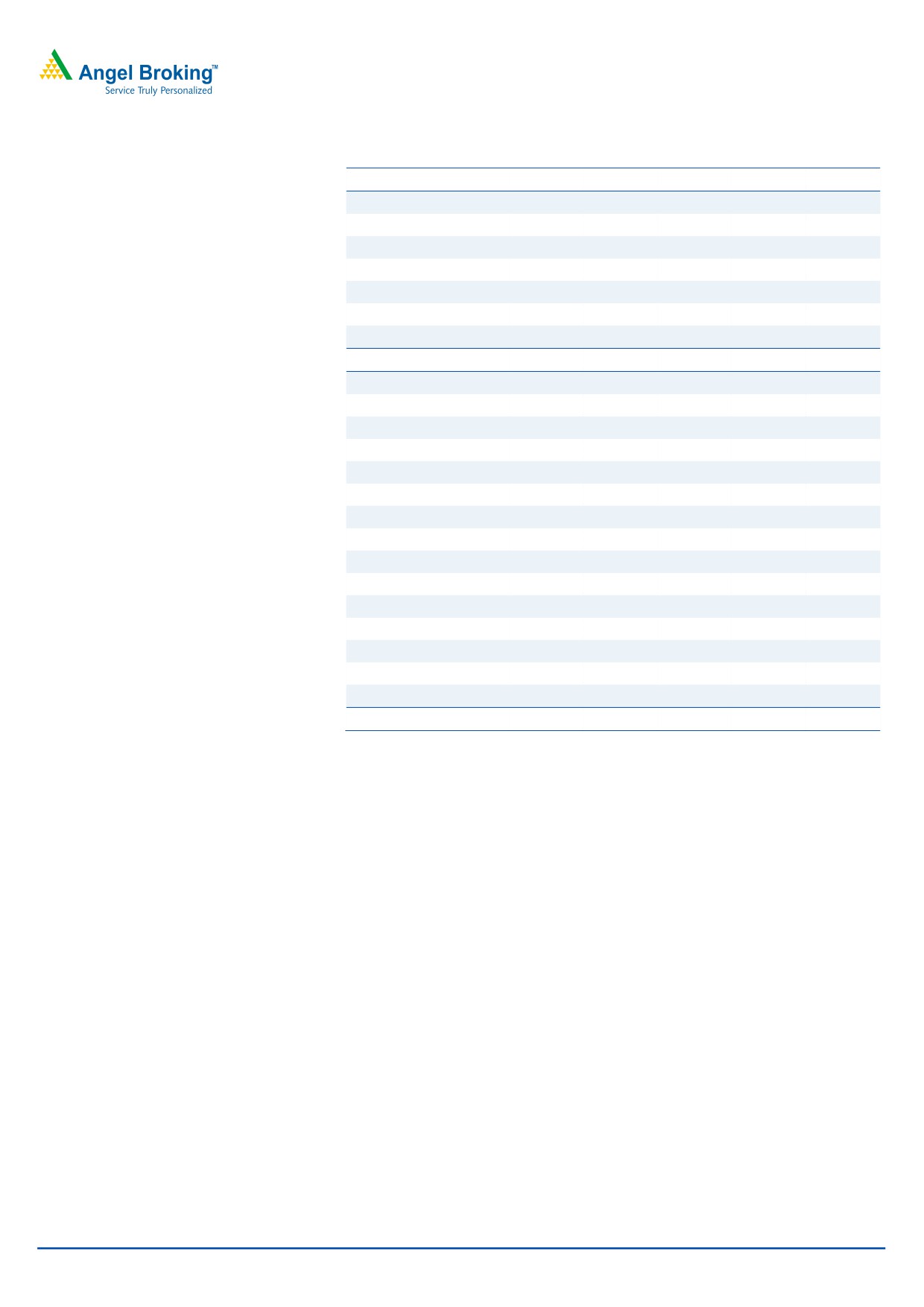

Exhibit 5: Earnings Revision

FY2017E

FY2018E

Y/E March (` cr)

Old

New Chan.(%)

Old

New Chan. (%)

Net Sales

2,350

2,350

0.0

2,904

2,904

0.0

EBITDA

315

308

(2.2)

396

382

(3.5)

EBITDA Margins (%)

13.4

13.1

13.6

13.2

PAT

245

232

(5.3)

218

227

4.1

PAT Margins (%)

6.4

9.9

7.5

7.8

Source: Angel Research

Value of Core EPC business

With applicability of normal tax rates from FY2018 onwards, we do not see a

scenario where the entire growth prospects of EPC segment (given expected uptick

in Roads and Highways award activity environment, current OB/LTM sales ratio of

3.1x), trickling down to the PAT level. We now expect PNC’s EPC business to report

20.1% top-line and -3.3% bottom-line CAGR during FY2016-18E, respectively. On

the same lines we expect RoEs of the standalone business to decline from 23.3% in

FY2016 to 13.9% in FY2018E. Accordingly, we value PNC’s core EPC business

(standalone entity) on P/E of 14.0x its FY2018E EPS of `8.8, resulting in a value of

`124/share.

August 31, 2016

6

PNC Infratech | 1QFY2017 Result Update

Exhibit 6: Sum-of-the-Parts based Valuation Table

Value/

FY18E Std.

Target

Target Value

% of

Particulars

Segment

share

Basis

PAT (` cr)

Multiple

(` cr)

SoTP

(`)

PNC's EPC business

Construction

227

14.0

3,175

124

87

P/E of 14x

Total

3,175

124

87

Adj. Equity

Value/

Equity Inv/ Disc.

Project

% of

Particulars

Proj. Type

Disc. FCFE

share

Basis

FCFE (` cr)

Stake

SoTP

(` cr)

(`)

Road BOT projects

Ghaziabad-Aligarh

Toll

194

35%

68

13

2

BV/share- 1.0x

Kanpur-Kabrai

Toll

68

100%

68

13

2

BV/share- 1.2x

Gwalior-Bhind

Toll

78

100%

78

15

2

BV/share- 1.0x

Bareilly-Almora

Toll

75

100%

75

15

2

BV/share- 1.0x

Rae Bareli-Jaunpur

Annuity

140

100%

140

27

4

BV/share- 1.0x

Narela Industrial Estate

Annuity+Fee

35

100%

35

7

1

BV/share- 1.1x

Kanpur Ayodhya

OMT

25

100%

25

5

1

FCFE, discount rate at 14%

Total

901

488

95

13

Grand Total

3,663

143

100

Upside

19%

CMP

120

Source: Company, Angel Research

Value of BOT projects

BOT projects have been valued using Book Value/Free Cash flow to Equity

holder’s method. Our value for all the 7 BOT projects comes to `19/share, which

is 13% of the overall SOTP value for the company.

On combining the value of EPC business BOT projects, we arrive at a combined

business value of `143/share, reflecting 19% upside in stock price from the current

levels. Given the upside, we maintain BUY rating on the stock.

August 31, 2016

7

PNC Infratech | 1QFY2017 Result Update

Investment arguments

Strong order inflows to lead to better execution: PNC, a north focused EPC

player, should gain from a sharp revival in NHAI and MoRTH award activity,

in-turn translating into strong order inflows over the next 12 months. We

expect PNC to report order inflows of

`5,000/4,500cr during

FY2017E/2018E, which should further lead to uptick in execution. Accordingly,

we expect PNC (on standalone basis) to report a strong 20.1% top-line CAGR

during FY2016-18E.

-3.3% PAT CAGR during FY2016-18E: Stronger execution, benefits of lower

raw material prices and absorption of fixed costs, should help PNC

(standalone entity) report 19.8% EBITDA CAGR during FY2016-18E. Entire

benefits of EBITDA growth would not trickle down to the PAT level, as the

normal tax rate would be applicable from FY2018 onwards. Accordingly, we

now expect PNC to report -3.3% PAT CAGR during the same period.

All BOT projects are operational: PNC has a portfolio of 7 BOT projects, with

all of them being operational. With commencement of all BOT projects in

FY2016E, we can expect gradual ease in the consolidated balance sheet stress

from FY2017E onwards.

Comfortable consol. D/E ratio: PNC entered the BOT space in FY2012 and

OMT space in FY2014. As a result, the consolidated debt of the company

increased from 0.2x in FY2011 to 1.2x in FY2016 (consol. debt at `1,603cr).

Management commented that they do not intend to build further the BOT

portfolio. With all pending BOT project getting operational, and PNC’s focus

to reduce additions to BOT projects portfolio, we expect consolidated D/E ratio

levels of the company to peak-out from FY2017E.

Company background

PNC Infratech Ltd (PNC), incorporated in 1999, is an Agra based infra player

mainly focused on Roads & Highways construction. PNC, in FY2012, diversified

into BOT-Toll & Annuity projects and in FY2014 into OMT projects. Currently, PNC

is executing 17 Engineering Procurement Construction (EPC) projects, 6 BOT

projects (including 2 Annuity projects) and 1 OMT project.

August 31, 2016

8

PNC Infratech | 1QFY2017 Result Update

Profit and Loss Statement (Standalone)

Y/E March (` cr)

FY14

FY15

FY16

FY17E

FY18E

Net Sales

1,145

1,561

2,014

2,350

2,904

% Chg

(12.1)

36.3

29.0

16.7

23.6

Total Expenditure

1,005

1,344

1,748

2,042

2,522

Cost of RM Consumed

372

1,196

1,434

1,741

2,147

Chg in Inventories of WIP

10

(60)

35

(23)

(15)

Employee benefits Expense

58

74

84

96

116

Other Expenses

566

135

196

228

273

EBITDA

140

217

266

308

382

% Chg

(10.0)

54.6

22.8

15.7

24.0

EBIDTA %

12.2

13.9

13.2

13.1

13.2

Depreciation

25

36

52

59

66

EBIT

115

180

213

248

316

% Chg

(13.3)

56.3

18.4

16.3

27.2

Interest Expenses

23

46

33

31

45

Other Income

11

14

20

40

20

PBT

102

148

200

257

291

Tax

36

47

(42)

26

64

% of PBT

34.8

32.1

(21.1)

10.0

22.0

PAT before Excep. Item

67

100

243

232

227

Exceptional item

0

0

0

0

0

PAT

67

100

243

232

227

% Chg

(12.6)

50.2

141.9

(4.6)

(2.0)

PAT %

5.8

6.4

12.1

9.9

7.8

Diluted EPS

2.6

3.9

9.5

9.0

8.8

% Chg

(86.4)

50.2

141.9

(4.6)

(2.0)

August 31, 2016

9

PNC Infratech | 1QFY2017 Result Update

Balance Sheet (Standalone)

Y/E March (` cr)

FY14

FY15

FY16

FY17E

FY18E

Sources of Funds

Equity Capital

40

40

51

51

51

Reserves Total

590

679

1,311

1,498

1,672

Networth

630

718

1,362

1,549

1,723

Total Debt

248

324

6

305

297

Other Long-term Liabilities

178

250

160

233

238

Deferred Tax Liability

3

0

(3)

(3)

(3)

Total Liabilities

1,058

1,293

1,525

2,084

2,255

Application of Funds

Gross Block

287

387

428

511

565

Accumulated Depreciation

134

171

223

283

348

Net Block

153

217

205

229

217

Capital WIP

2

1

9

1

1

Investments

351

424

464

849

949

Current Assets

Inventories

105

223

236

281

331

Sundry Debtors

344

367

376

555

645

Cash and Bank Balance

100

21

97

37

30

Loans, Adv. & Deposits

127

214

258

294

331

Other Current Asset

1

1

1

2

2

Current Liabilities

223

285

362

418

524

Net Current Assets

455

541

606

750

814

Other Assets

98

111

240

256

275

Total Assets

1,058

1,293

1,525

2,084

2,255

August 31, 2016

10

PNC Infratech | 1QFY2017 Result Update

Cash Flow Statement (Standalone)

Y/E March (` cr)

FY14

FY15

FY16

FY17E

FY18E

Profit before tax

103

148

200

257

291

Dep. & Other Non-cash Charges

28

28

82

51

57

Change in Working Capital

74

(105)

(209)

(147)

(84)

Interest & Financial Charges

23

46

33

31

45

Direct taxes paid

(33)

(50)

0

(26)

(64)

Cash Flow from Operations

195

67

107

167

245

(Inc)/ Dec in Fixed Assets

(54)

(100)

(49)

(75)

(54)

(Inc)/ Dec in Investments

(80)

(73)

(41)

(384)

(100)

Cash Flow from Investing

(133)

(172)

(90)

(459)

(154)

Issue/ (Buy Back) of Equity

0

0

435

0

0

Inc./ (Dec.) in Loans

21

76

(318)

299

(8)

Dividend Paid (Incl. Tax)

(3)

(7)

(37)

(45)

(53)

Net Interest Expenses

(17)

(42)

(21)

(23)

(37)

Cash Flow from Financing

0

27

59

232

(98)

Inc./(Dec.) in Cash

62

(79)

76

(61)

(7)

Opening Cash balances

38

100

21

97

37

Closing Cash balances

100

21

97

37

30

August 31, 2016

11

PNC Infratech | 1QFY2017 Result Update

Key Ratios (Standalone)

Y/E March

FY14

FY15

FY16

FY17E

FY18E

Valuation Ratio (x)

P/E (on FDEPS)

46.1

30.7

12.7

13.3

13.6

P/CEPS

33.6

22.5

10.4

10.6

10.5

Dividend yield (%)

4.0

2.0

0.4

0.3

0.3

EV/Sales

0.5

0.5

0.3

0.4

0.3

EV/EBITDA

4.5

3.6

2.0

2.9

2.3

EV / Total Assets

0.5

0.5

0.3

0.4

0.3

Per Share Data (`)

EPS (fully diluted)

16.8

25.2

47.3

45.1

44.2

Cash EPS

3.6

5.3

11.5

11.3

11.4

DPS

0.1

0.2

1.2

1.5

1.8

Book Value

25

28

53

60

67

Returns (%)

RoCE (Pre-tax)

15.0

20.2

19.4

17.9

17.3

Angel RoIC (Pre-tax)

16.5

21.6

20.5

18.7

17.6

RoE

11.2

14.9

23.3

15.9

13.9

Turnover ratios (x)

Asset Turnover (Gross Block) (x)

4.5

4.6

4.9

5.0

5.4

Inventory / Sales (days)

33

38

42

40

38

Receivables (days)

118

83

67

72

75

Payables (days)

80

69

68

70

68

WC (days)

72

52

41

43

46

Leverage Ratios (x)

D/E ratio (x)

0.4

0.5

0.0

0.2

0.2

Interest Coverage Ratio (x)

5.4

4.2

7.0

9.3

7.4

August 31, 2016

12

PNC Infratech | 1QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

PNC Infratech

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

August 31, 2016

13