IPO note | Infrastructure

May 8, 2015

PNC Infratech Limited

SUBSCRIBE

sue Open: May 08, 2015

Is

Subscribe at lower price band with longer horizon

Issue Close: May 12, 2015

Company background: PNC Infratech Ltd (PNC), incorporated in 1999, is an

Agra based infra player mainly focused on Roads & Highways construction. PNC,

Issue Details

in FY2012, diversified into BOT-Toll & Annuity projects and in FY2014 into OMT

Face Value: `10

projects. Currently, PNC is executing 23 Engineering Procurement Construction

(EPC) projects (1 through JV route), 7 BOT projects (including 2 Annuity projects)

Present Eq. Paid up Capital: `39.8cr

and 1 OMT project. 3 of the 7 BOT projects are already operational. Another

4 are likely to be operational in the next 12 months. With no more BOT projects

Fresh Issue: 1.15cr Shares

in the pipeline, PNC’s dependency on BOT projects for EPC works has

Offer for Sale: 0.14cr Shares

substantially declined from what it was two years ago. Currently, 12% of the EPC

order book comes from in-house BOT projects and this should further decline in

Post Eq. Paid up Capital: `51.3cr

the next 1-2 quarters.

Issue size (amount): `458-488cr

Positives: (1) Order book to FY2015 sales (for the standalone entity) is at 2.2x

which gives good revenue visibility, (2) `50,000cr of NHAI and Uttar Pradesh (UP)

Price Band: `355-378

PWD Roads & Highways bid-pipeline, gives visibility on the order book growth

Lot Size: 35 shares

front, (3) commencement of 4 BOT projects in the next 12 months to ease

Balance Sheet stress. Announcements on new order wins, better execution, and

Post-issue implied mkt. cap:

`1,821.4cr- 1,939.4cr

commencement of BOT projects could lead to re-rating.

Promoters holding Pre-Issue: 72.3%

Risks & Concerns: (1) Prolonged delay in the UP road sector award activity, (2)

lower-than-expected traffic numbers across the 3 upcoming BOT projects (the

Promoters holding Post-Issue: 56.1%

fourth is a Annuity project), (3) higher dependency on sub-contracting works could

Note:*at Lower-end of the price band

impact their FY2016-17E EBITDA margins.

Valuation: PNC is poised to deliver healthy growth on the top-line as well as the

bottom-line front with improvement in order book, particularly on account of

Book Building

revival in the NHAI and UP PWD award activity. On the valuation front, the

company is available at a 12% discount to its listed Road focused EPC peers on

QIBs

50% of issue

Adj. P/E basis at the lower end of the issue price. The issue poses a good

Non-Institutional

15% of issue

opportunity for investors with a 12 month investment horizon as the stock has

potential to get re-rated on account of panning out of possible triggers, which

Retail

35% of issue

include 1) commencement of Tolling/ Annuity across 4 BOT projects, 2) news flow

pertaining to better execution and stable EBITDA margins (at ~13%) and (3)

gradual build-up in the company’s track-record as a listed entity. Accordingly, we

Post Issue Shareholding Pattern

advise investors with a 12 months investment horizon to SUBSCRIBE to this issue

at the lower end of the price band.

Promoters Group

56.1

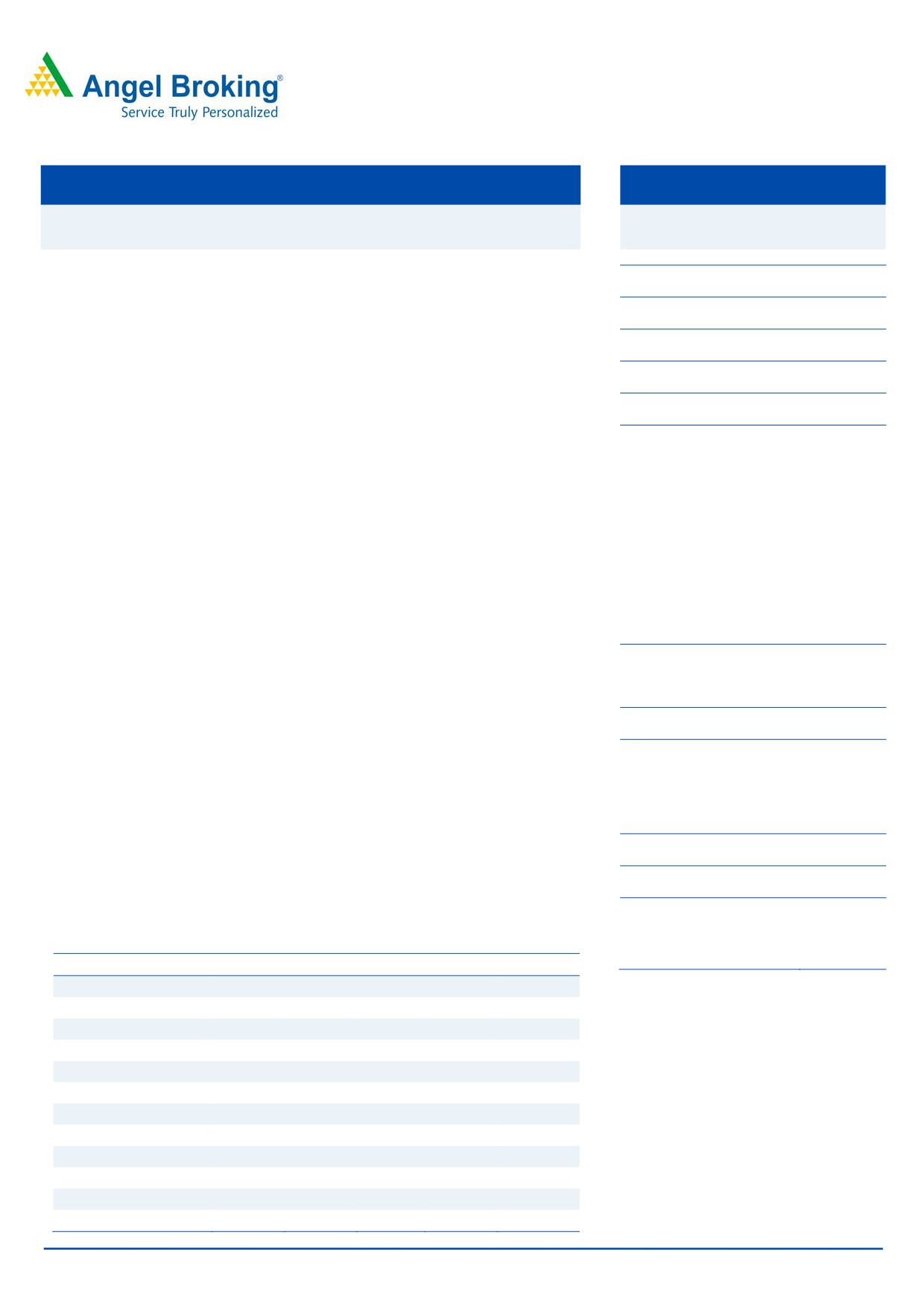

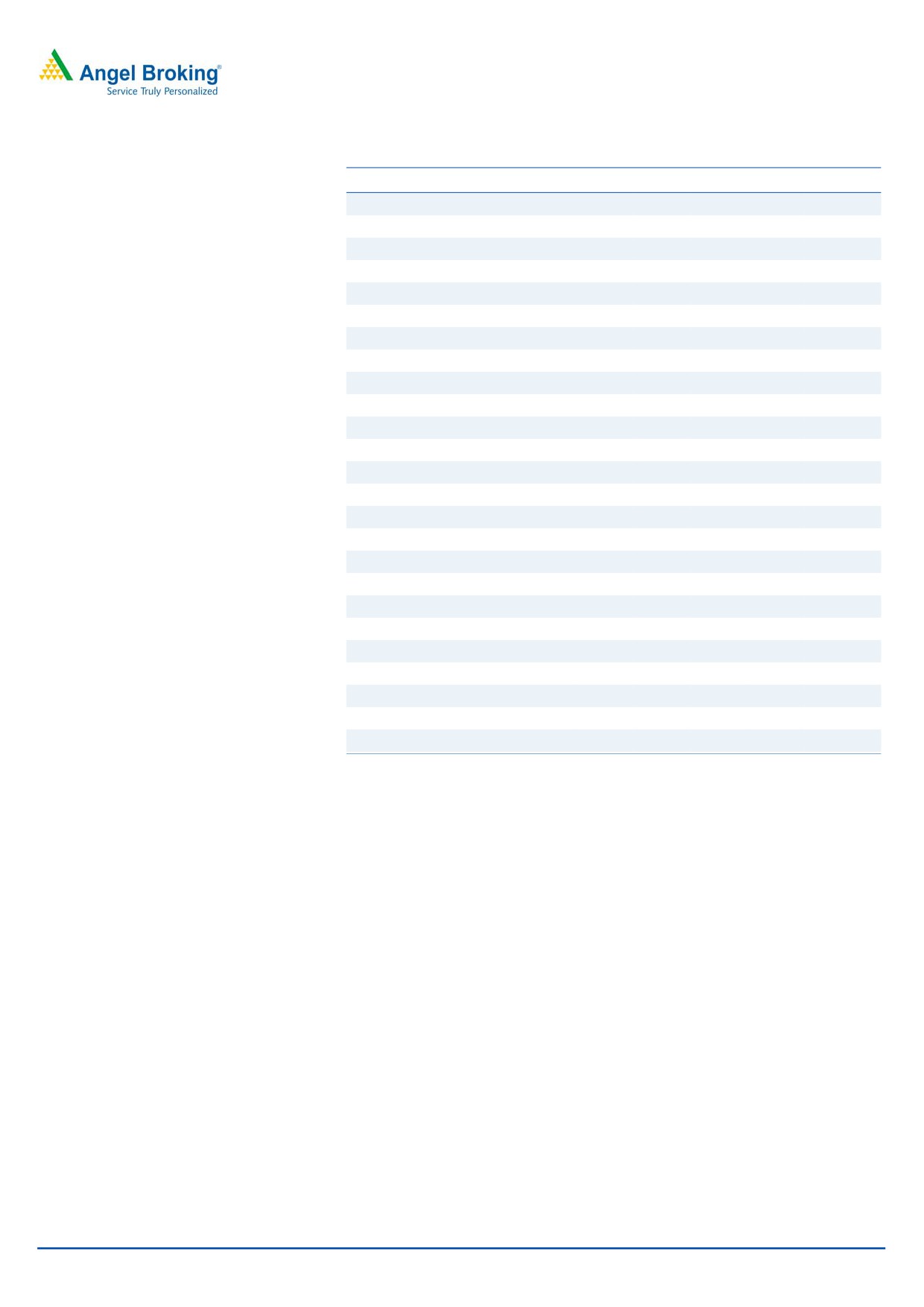

Key Financials (Standalone)

DIIs/FIIs/Public & Others

43.9

Y/E March (` cr)

FY11

FY12

FY13

FY14

9mFY15

Net Sales

1,139

1,274

1,303

1,145

1,097

% chg

11.8

2.3

(12.1)

Net Profit

71

79

76

67

67

% chg

10.7

(3.3)

(12.6)

EBITDA (%)

11.3

12.1

11.9

12.2

14.2

EPS (`)

18

20

19

17

17

P/E (x)

21.1

19.0

19.7

22.5

P/BV (x)

3.6

3.0

2.7

2.4

RoE (%)

23.5

17.4

14.4

11.2

RoCE (%)

29.3

22.6

17.7

15.0

Yellapu Santosh

EV/Sales (x)

1.4

1.4

1.3

1.4

022 - 3935 7800 Ext: 6828

EV/EBITDA (x)

12.0

11.2

10.9

11.8

Source: Company, Angel Research; Note: Valuation ratio’s arrived using higher end of the Issue price

Please refer to important disclosures at the end of this report

1

PNC Infratech | IPO note

Issue Details

PNC Infratech is offering 1.29cr equity shares of `10 each via book building route

in a price band of `355-378, consisting of fresh equity issue of 1.15cr shares and

offer for sale by PE firm of 0.14cr equity shares. Further, 50,000 shares have been

reserved for employees of the company.

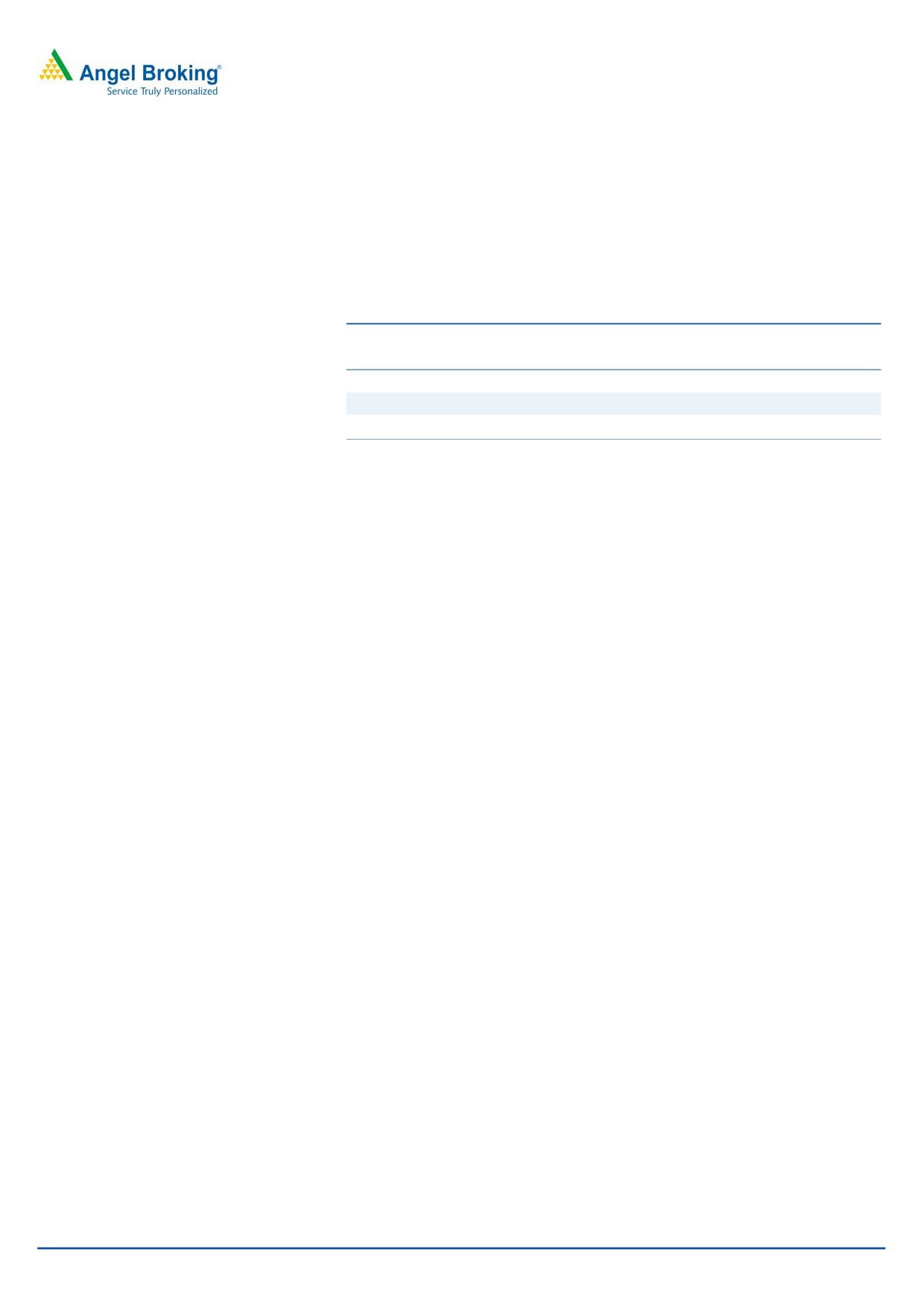

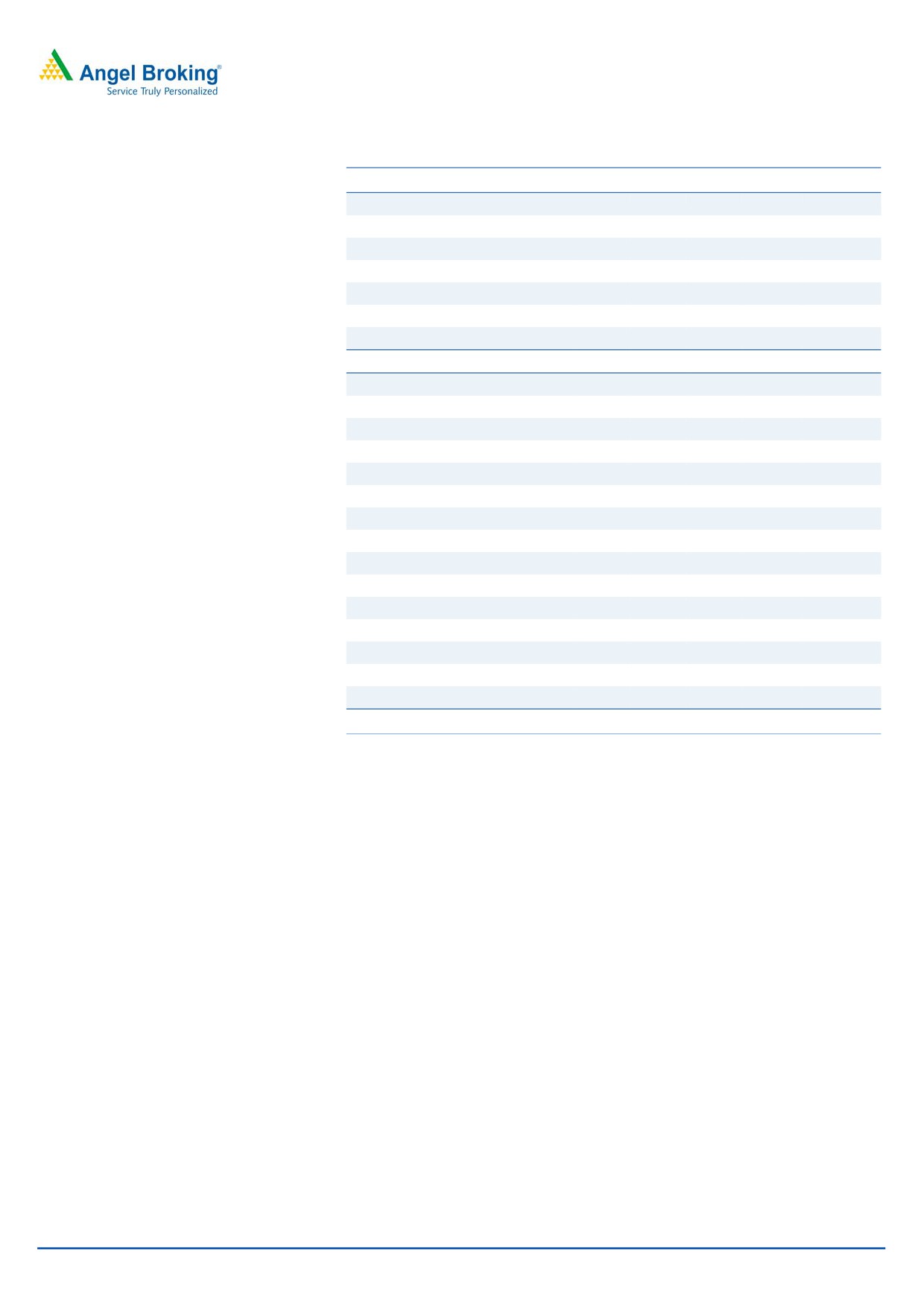

Exhibit 1: Shareholding Pattern

Pre-Issue

Post-Issue

Particulars

No. of Shares

(%)

No. of Shares

(%)

Promoter Group

2,87,69,121

72.3

2,87,69,121

56.1

Retail & HNI Investors

53,50,173

13.4

1,11,25,173

21.7

Institutional Investors

56,88,539

14.3

1,14,13,539

22.2

Source: Company, Angel Research

Objects of the Offer

Utilize the IPO proceeds for funding Working Capital requirements of `150cr.

Equity investment of `65cr towards Raebareli-Jaunpur BOT project, a 100%

subsidiary of PNC Infratech.

Invest in Machinery / Equipment to the tune of `103cr.

Prepay/ Repay debt to the tune of `35.21cr.

General Corporate Purposes.

May 8, 2015

2

PNC Infratech | IPO note

Company Details

PNC Infratech (PNC), incorporated in 1999, is an Agra based infrastructure player

mainly focused on Roads, Highways and Bridge construction. The company in

recent

years has diversified

into

Build,

Operate and Transfer

(BOT)-Toll & Annuity projects as well as Operate Maintain Transfer (OMT) projects.

In 2011, Nylim Jacob Ballas India (FVCI) III LLC, acquired a stake in PNC and

currently holds 14.29% of the pre-offer capital of the company.

In the backdrop of lull in EPC award activity (as seen during FY2012-14), PNC

pursued the strategy of building its EPC Order Book by adding BOT projects to its

asset portfolio. The company entered the BOT space in FY2012, when it reported

its first order win of Jaora-Nayagaon Project through JV route. Since then PNC has

won 5 BOT Road projects to build its EPC Order book. 3 of the 7 BOT projects are

already operational. Another 4 BOT projects are likely to be operational in next 12

months. With no more BOT projects in the pipeline, PNC’s dependency on BOT

projects for EPC works would substantially decline from what it was 2 years ago.

Currently, 12% of the EPC OB comes from in-house BOT projects and this would

further decline in next 1-2 quarters.

To-date PNC has executed 42 major infra projects across more than 13 states.

Currently, PNC is executing

23 projects (including

1 JV) on Engineering

Procurement Construction (EPC) basis.

Exhibit 2: Vertical-wise Projects Split

Total No. of Ongoing Projects

23

No. of projects (on JV basis)

1

Roads & Highways

19

Power Transmission & Distribution

1

Airport Runways

2

Water Supply Infrastructure

1

Source: Company, Angel Research

The gross and net EPC order book (inc. escalation) of PNC at FY2015-end is at

`7,849.7cr and `3,474.8cr, respectively. A major chunk of the current order book

is from the Roads, Highways & Bridges vertical. At FY2015-end, the order book of

PNC stands at 2.2x FY2015 standalone revenues.

PNC is also currently developing / operating 7 BOT projects and 1 OMT project.

May 8, 2015

3

PNC Infratech | IPO note

Exhibit 3: BOT & OMT Project Key details

Project

PNC

Length

TPC

Equity

BOT projects

Status

Type

Stake (%)

(kms)

(` cr)

Inv.

Ghaziabad-Aligarh

Toll

35%

Under Const.

125

2,000

68

Kanpur-Kabrai

Toll

100%

Under Const.

123

458

81

Gwalior-Bhind

Toll

100%

Operational

108

340

78

Bareilly-Almora

Toll

100%

Under Const.

54

604

75

Jaora-Nayagaon

Toll

9%

Operational

128

907

24

Rae Bareilly-Jaunpur

Annuity

100%

Under Const.

166

837

140

Narela Industrial

Annuity

100%

Operational

NA

175

39

Estate

+Fee

OMT project

Kanpur-Ayodhya

Toll

100%

Operational

217

0

0

Source: Company, Angel Research

May 8, 2015

4

PNC Infratech | IPO note

Key Investment Rationale

Order book to FY2015 sales at 2.2x…gives revenue visibility

PNC currently is working on 23 EPC projects across Roads, Highways & Bridges

vertical, Power Transmission vertical and Airport Runways vertical. At FY2015-end,

PNC reported gross and net EPC order book (including escalation) of `7,849.7cr

and `3,474.8cr, respectively. Current the order book, at 2.3x FY2015 standalone

revenues, gives better near-to-medium term revenue visibility.

Notably, Roads, Highways & Bridges vertical contributes majorly to the current

order book.

Exhibit 4: Order Book details

Sl.

Gross EPC

Project details

Kms

State

No.

val. (` cr)

1 Develop Agra-Firozabad stretch

51

U.P.

1,636

2 Upgrade Sonauli-Gorakhpur stretch on NH-29E

80

U.P.

441

3 Construct 4-laning of Agra Bypass stretch

NA

U.P.

385

Construct 4-lane of Dholpur-Morena stretch (inc.

4

10 Rajasthan-M.P.

294

Chambal Bridge) on NH-3

5 Upgrade Barabanki-Jarwal stretch on NH-28C

43

U.P.

273

6 EPC works from in-house Ghaziabad-Aligarh BOT

387

U.P.

1,725

7 EPC works from in-house Raebareli-Jaunpur BOT

166

U.P.

728

8 EPC works from in-house Bareilly-Almora BOT

NA

U.P.

540

9 EPC works from in-house Kanpur-Kabrai BOT

NA

U.P.

429

10 EPC works from in-house Gwalior-Bhind BOT

NA

M.P.-U.P.

316

Gross EPC business - Order Book Value

7,850

Net EPC business - Order Book Value

3,475

Source: Company, Angel Research

Order Inflow to pick-up...gives revenue growth visibility…

If we look at the standalone entity’s (which captures EPC business) financials, PNC

during FY2011-14 reported muted growth (vs some of its peers which reported a

sharp decline in their profitability). During the same period, PNC reported a 0.2%

top-line and

-2.2% bottom-line CAGR, respectively. This could be majorly

attributed to slowdown in NHAI roads & highways award activity environment.

Even though PNC has executed major projects across over 13 states to-date since

its inception, the Management claims that the company is more comfortable and

focused on UP based road projects. NHAI road award activity for UP has been

lackluster to-date. However, both, NHAI and UP PWD have guided for strong bid-

pipeline in UP for FY2016.

If we look at NHAI’s award activity pipeline, then ~2,127 kms/`29,083cr worth of

road projects are expected to be awarded from UP alone in FY2016-17E. Further,

UP State Government made `20,871cr of budgetary allocation in FY2015-16E

towards roads, highways and bridges. Of this allocation,

`1,635cr of

Agra-Firozabad stretch (of the proposed Green Expressway connecting Agra-

Lucknow) has already been awarded under competitive bidding format to PNC.

May 8, 2015

5

PNC Infratech | IPO note

Exhibit 5: NHAI Bid Pipeline

Gross

Sl.

Proj.

Project Details

Kms

State

TPC val.

No.

Type

(` cr)

BOT/

1

6-laning of Agra-Etawah stretch

125

U.P.

1,787

DBFOT

BOT/

2 Lucknow-Sultanpur

126

U.P.

1,276

DBFOT

Chutmalpur-Saharapur-Yamunagarh-Haryana/

BOT/

3

105

U.P.

139

UP Border

DBFOT

4 IndoNepal Border-Ghaghra Bridge

122

EPC

U.P.

1,220

5 Barabanki-Bahraich-Nanpara-Rupaideeha

152

EPC

U.P.

1,520

6 Gorakhpur-Ferenda-Nautawa-Sonouli

99

EPC

U.P.

990

7 Aligarh-Moradabad

146

EPC

U.P.

503

U.P./

8 Eastern Periphal Expressway (6-lane) Pack.-1

46

EPC

771

Haryana

U.P./

9 Eastern Periphal Expressway (6- lane) Pack.-2

45

EPC

786

Haryana

U.P./

10 Eastern Periphal Expressway (6-lane) Pack.-3

44

EPC

789

Haryana

U.P./

11 Eastern Periphal Expressway (6-lane) Pack.-4

22

EPC

789

Haryana

U.P./

12 Eastern Periphal Expressway (6-lane) Pack.-5

21

EPC

665

Haryana

U.P./

13 Eastern Periphal Expressway (6-lane) Pack.-6

22

EPC

769

Haryana

14 4-laning of Ghaghra Bridge-Varanasi

178

EPC

U.P.

2,295

15 4-laning of Varanasi-Gorakhpur (Pack. 2)

76

EPC

U.P.

857

16 4-laning of Varanasi-Gorakhpur (Pack. 3)

60

EPC

U.P.

852

17 4-laning of Varanasi-Gorakhpur (Pack. 4)

60

EPC

U.P.

1,038

U.P./Haryana Border-Yamunagar-Saha-

18

45

EPC

U.P.

587

Barwala-Panchkula (Pack.-1)

U.P./Haryana Border-Yamunagar-Saha-

19

45

EPC

U.P.

567

Barwala-Panchkula (Pack.-2)

20 4-laning of Sultanpur-Varanasi (Pack.-1)

74

EPC

U.P.

1,028

21 4-laning of Sultanpur-Varanasi (Pack.-2)

70

EPC

U.P.

815

BOT

22 4-laning of Haridwar-Dehradun

39

U.P.

488

(Annuity)

23 4-laning of Handia-Varanasi

72

BOT (Toll)

U.P.

2,362

BOT/

24 4-laning of Meerut-Bulandshahr

61

U.P.

641

DBFOT

BOT/

25 Delhi-Meerut Expressway (Hapur Bypass)

50

U.P.

2,887

DBFOT

26 4-laning of Kashipur-Sitarganj

77

BOT (Toll)

U.P.

1,001

27 6-laning of Chakeri-Allahabad

145

BOT (Toll)

U.P.

1,662

Totals

2,127

29,083

Source: Company, Angel Research

With improved outlook in the UP roads and highways space (as over `50,000cr of

projects are to be awarded in FY2016E), we expect PNC to stand a better chance

to report new project wins during FY2016-17E. The Management maintained that

it has historically experienced 20% bid success rate. On considering the same,

PNC stands a good chance of reporting order book growth, which again translates

to improved outlook towards revenue and profitability growth from here-on.

May 8, 2015

6

PNC Infratech | IPO note

4 BOT projects to start paying-off in FY2016-17E

PNC currently has 8 BOT/OMT Assets which are at different stages of execution.

Of this 1 is BOT-Annuity project, 1 is an Industrial Estate maintenance project

(BOT-Annuity+Fee model), 1 is an OMT project and the remaining 5 are BOT-Toll

projects. Notably, all the 8 BOT projects are either UP based or are Central/North

India focused. Again, if we look into the details, then the most interesting

perspective that emerged is that 5 of the BOT projects have been won on Viability

Gap Funding (VGF) basis amidst intense competition. The VGF component in the

TPC comforts us to a certain extent. The equity IRRs are slated to be in the range of

16-18%, as has been highlighted by the Management.

Only 4 of these 8 BOT/OMT projects are currently operational (including 1 OMT

project). Barring Rae Bareilly-Jaunpur BOT project, all the required equity towards

the other 7 BOT/OMT projects has been infused. Part proceeds (`65cr) of the IPO

money would be deployed towards the equity of this project. Also all the required

land for these 4 ongoing BOT projects is in place, thereby allaying fears of any

delays in completion of the EPC works and in getting the Commercial Operations

Date (CoD).

The management highlighted that the Ghaziabad-Aligarh, Kanpur-Kabrai and

Bareilly-Almora BOT projects would commence tolling in FY2016E. Whereas, the

company’s only BOT Annuity project in the portfolio, Rae Bareilly-Jaunpur BOT

project, is expected to commence operations in FY2017E.

With commencement of these 4 BOT projects, revenues from these subsidiaries

should see sharp growth in FY2016-17E. In-line with surge in revenues, we expect

debt repayment cycle of these SPVs to commence, thereby easing consol. Balance

sheet stress.

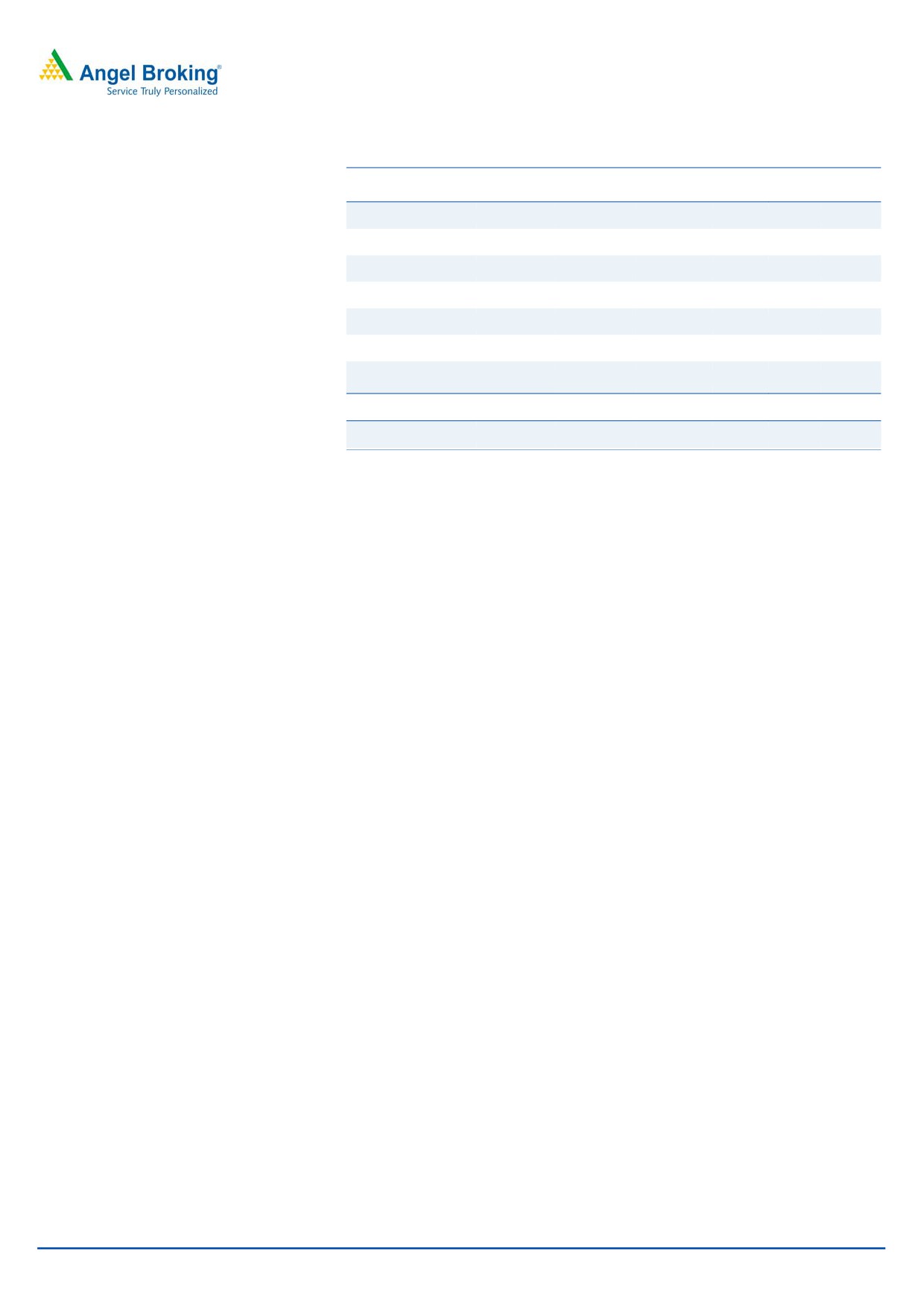

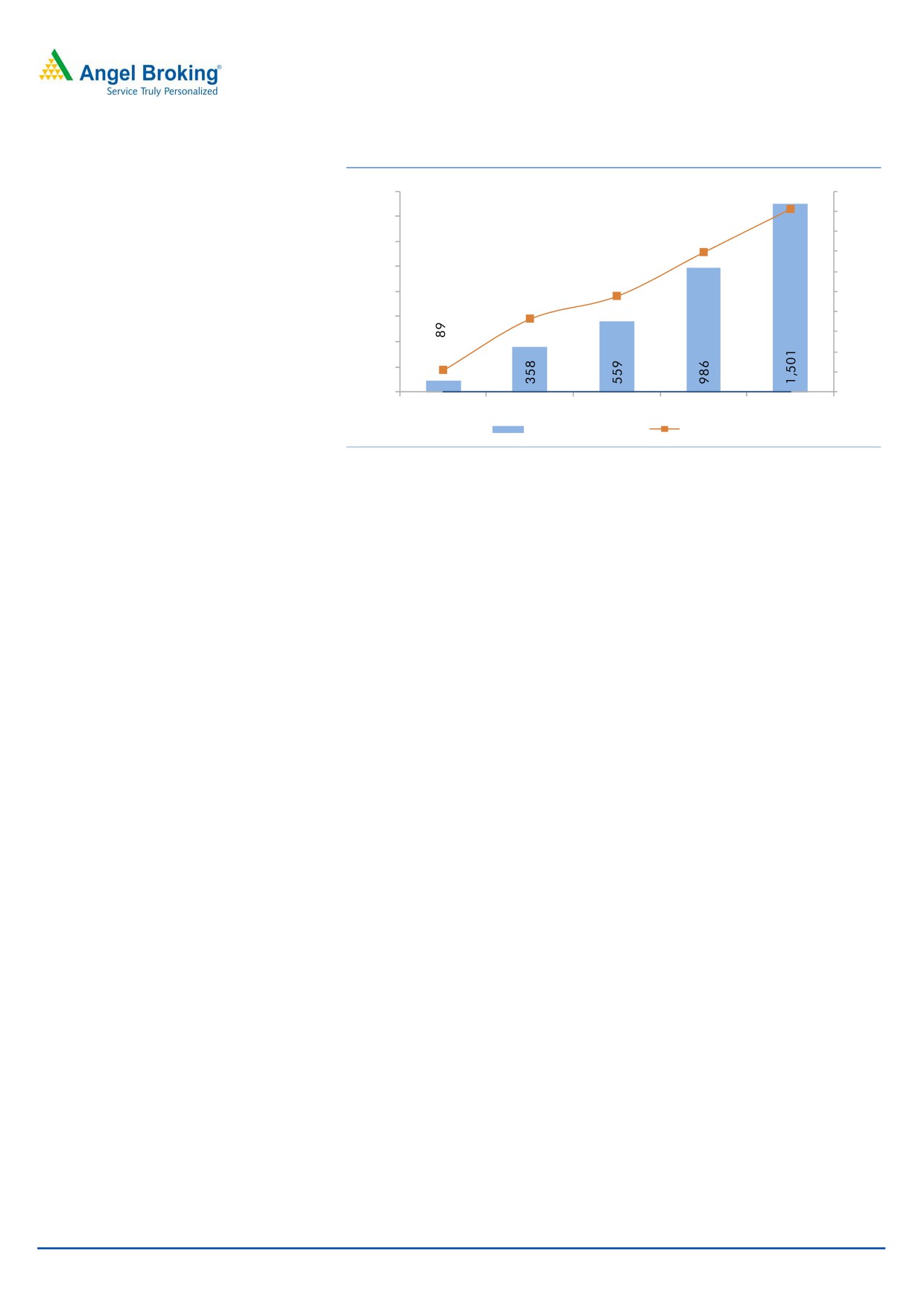

Balance Sheet stress to ease…

PNC entered the BOT space in FY2012 and the OMT space in FY2014. As a

result, the consolidated debt of the company increased from 0.2x in FY2011 to

1.8x as of 9MFY2015-end. The consolidated debt of the company stands at

`1,501cr as of Dec-2015 end.

The Management commented that they do not intend to build BOT portfolio unless

(1) the BOT project gives an estimated 16-18% equity IRR, (2) the project’s ticket

size is within `500cr as the Management intends equity funding for new BOTs to

be done through internal accruals, and (3) the project is based within UP.

With the pending 4 (of the total 7) BOT projects likely to get operational in the next

12 months, and PNC’s focus to reduce additions to the BOT projects portfolio, we

expect the consolidated D/E ratio levels of the company to peak-out in the next few

quarters.

May 8, 2015

7

PNC Infratech | IPO note

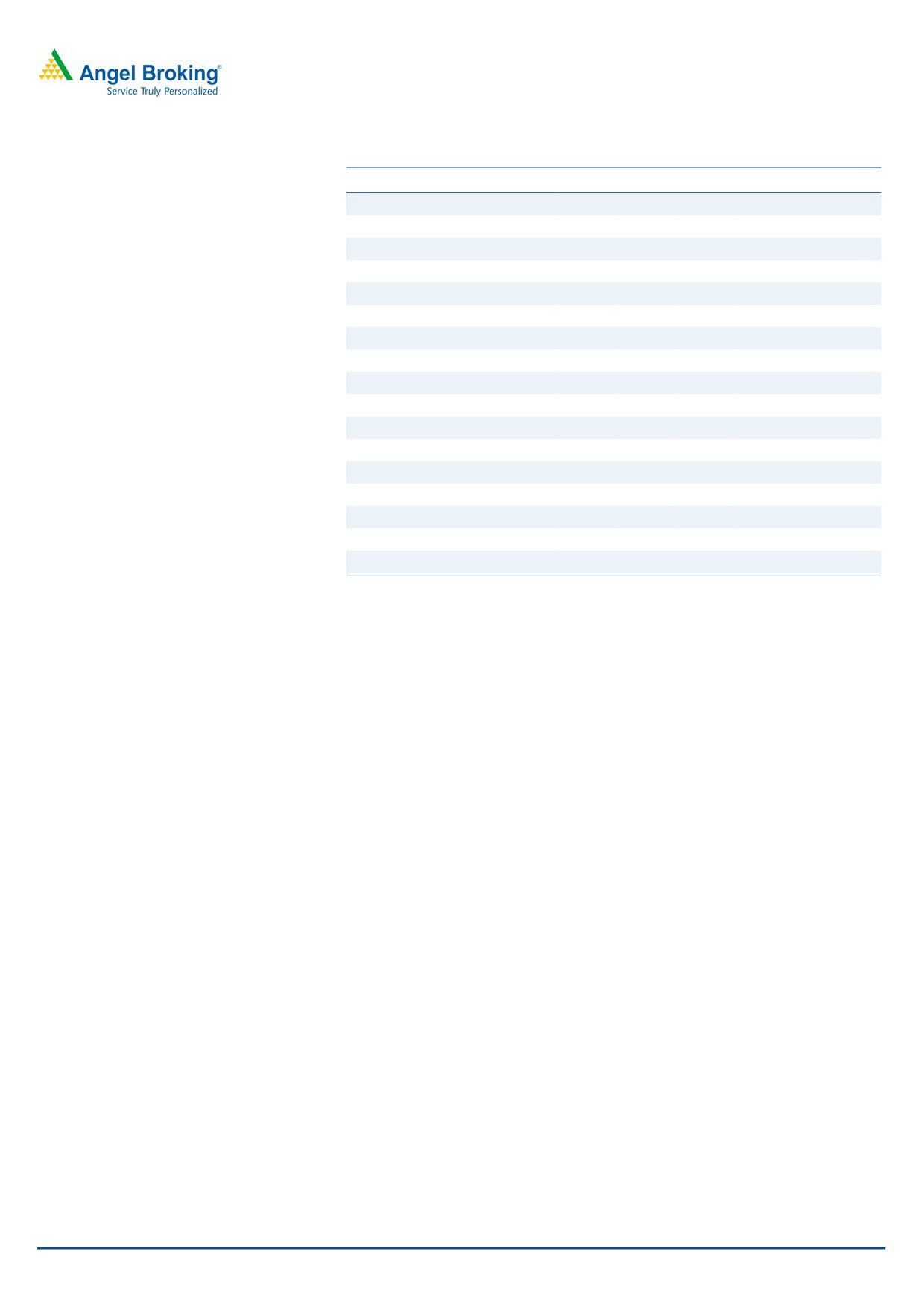

Exhibit 6: Balance Sheet stress to ease

1,600

1.8x

2.0x

1.8x

1,400

1.6x

1.4x

1,200

1.4x

1,000

1.2x

1.0x

800

1.0x

0.7x

0.8x

600

0.6x

400

0.2x

0.4x

200

0.2x

0

0.0x

FY11

FY12

FY13

FY14

9mFY15

Consol. Debt

Consol. D/E

Source: Company, Angel Research

May 8, 2015

8

PNC Infratech | IPO note

Outlook and Valuation

During FY2011-14, PNC Infratech (standalone entity) reported a 0.2% top-line

and -2.2% bottom-line CAGR, respectively. In order to maintain its financials

during the same period, PNC built its EPC order book by building its BOT projects

portfolio. With ~`50,000cr worth of NHAI & UP PWD projects likely to be awarded

in FY2016-17E, the Management has indicated that it is now focusing less on

adding any more BOT projects to the portfolio. Also, EPC works flowing in from

the in-house BOT projects currently constitute ~12% of the net order book, which

is lesser than what it was 2 years ago. In the next 1-2 quarters, we expect this

contribution to further decline.

With a revival in order inflows, we are optimistic that PNC would be able to

emerge as one of the key beneficiaries in the Roads and Highways space. We

expect the order book of PNC to report a healthy growth during FY2015-17E, from

the current net order book levels of `3,474cr. This when coupled with PNC’s

increased emphasis of doing in-house EPC works vs its earlier practice of doing

more of sub-contracting, should help it maintain EBITDA margins at 13% levels,

going forward. We expect the standalone entity’s profitability growth to pick-up

from current levels considering (1) stronger order book execution, (2) EBITDA

margins being held at ~13% levels, and (3) benefits accruing from lower interest

expenses (considering that part of the IPO proceeds would be deployed towards

debt repayment and interest rates are in a down-cycle).

Considering PNC’s current lower dependency on in-house BOT projects, higher

dependency on Roads & Highways vertical and their Balance Sheet size, we are

considering 2 of the Road focused EPC players, MBL Infra and KNR Construction

for peer group comparison purpose.

In order to value the EPC business (captures standalone business) on FY2015E

numbers, we have adjusted the value of BOT projects from their current market

price.

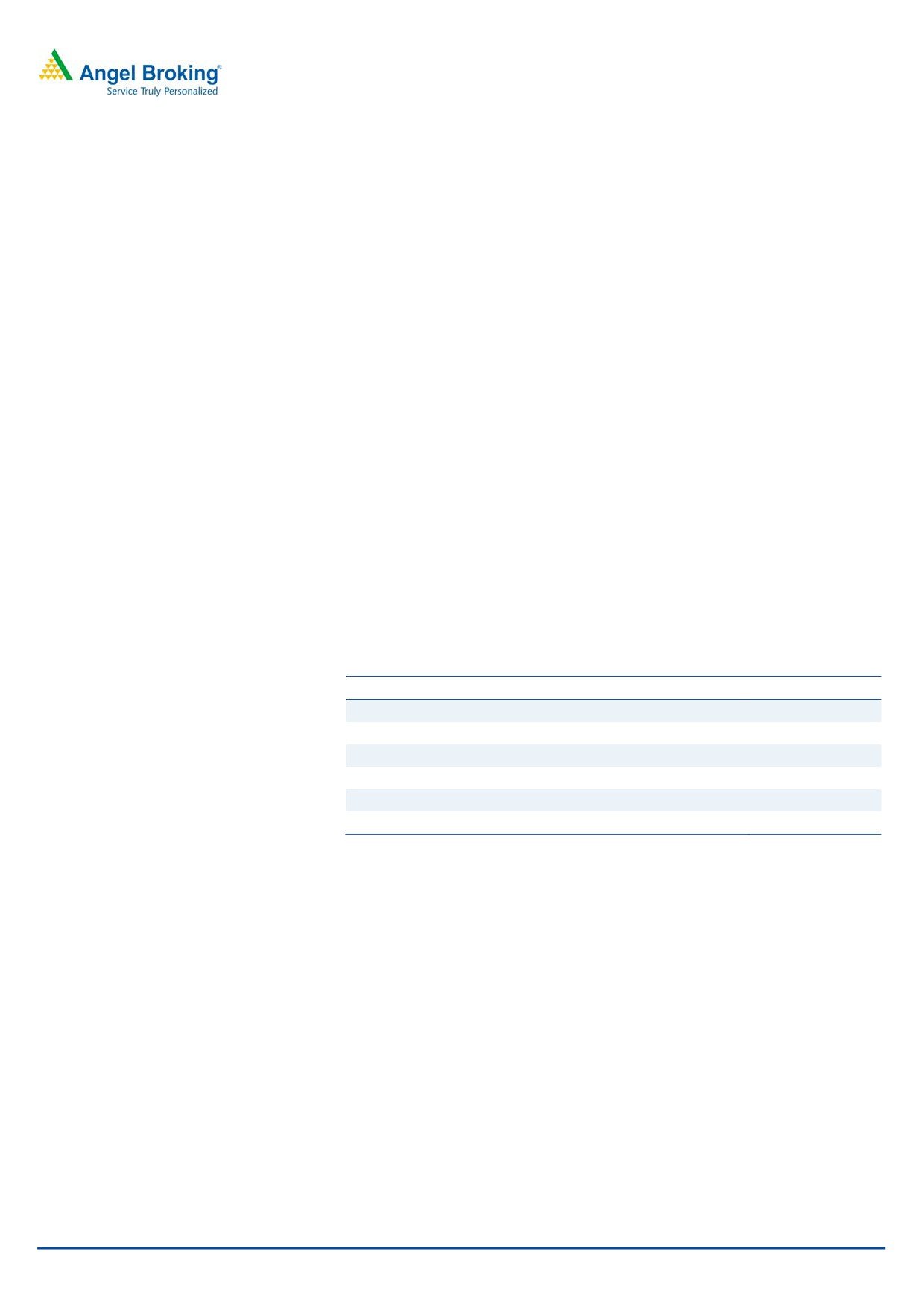

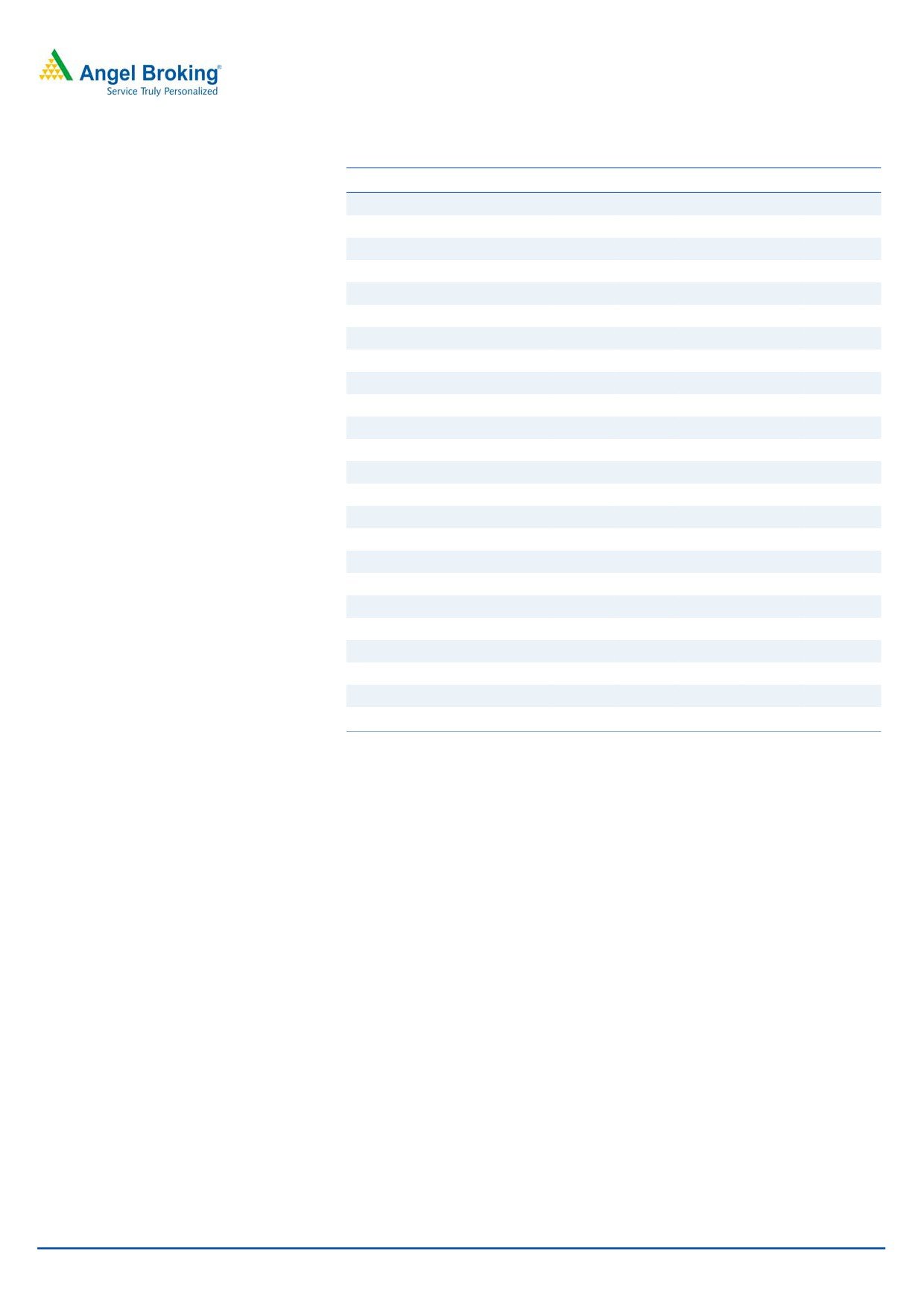

Exhibit 7: Adj. P/E Multiple on FY2015E EPS

CMP Adj. CMP

Adj. P/E

Adj. P/E Adj. P/E

(`)

(BOT proj.)

FY15E

FY16E FY17E

PNC Infratech (higher price band)

378

273

14.0x

PNC Infratech (lower price band)

355

250

12.8x

MBL Infra

558

478

11.7x

9.9x

8.4x

KNR Construction

448

388

17.4x

14.1x

11.1x

Average

14.5x

12.0x

9.7x

Source: Company, Angel Research; Note: Valued PNC has been valued using post IPO shares o/s

The above table clearly highlights that the PNC Infratech issue is relatively more

attractive (assuming FY2015E post IPO outstanding shares) at the lower end of the

issue price band. Alternatively PNC’s issue, at the lower end of the price band, is at

a considerable discount to its peers’ average Adj. P/E multiple of 14.5x.

Notably, the lower P/E multiple enjoyed by MBL Infra is on account of,

(1)

comparatively higher D/E ratio (of 1.1x), (2) lower order book/FY2015 sales (at

1.4x), and (3) lower earnings growth estimate.

May 8, 2015

9

PNC Infratech | IPO note

At FY2015E EPS, PNC (at lower-end of listing price) would be trading at 12.8x. In

our view, the current valuations are not reflecting benefits of award activity revival

and uptick in PNC’s profitability.

Given the prospects of a healthy growth in the order book which in turn would

translate into uptick in earnings momentum, the stock would pose to be a good

investment opportunity in terms of valuations turning attractive.

At the backdrop of the following catalysts panning out: (1) standalone entity’s

growth potential (with NHAI and UP PWD award activity revival) from here-on, (2)

Management’s focus to maintain standalone entity’s EBITDA margins at ~13%, (3)

commencement of 4 BOT projects in next 12 months, and (4) gradual build-up in

track-record as a listed entity, there exists potential for the stock to get re-rated (led

by both, possible growth in earnings and expansion in valuation multiple).

Accordingly we advise investors to SUBSCRIBE to this issue at the lower end of the

issue price from a 12 month investment horizon.

May 8, 2015

10

PNC Infratech | IPO note

Profit & Loss Statement (Standalone)

Y/E March (` cr)

FY11

FY12

FY13

FY14

9mFY15

Net Sales

1,139

1,274

1,303

1,145

1,097

% Chg

11.8

2.3

(12.1)

Total Expenditure

1,010

1,120

1,148

1,005

941

Cost of Raw Materials Consumed

183

353

367

372

442

Change in Inventories of WIP

(73)

52

2

10

(25)

Employee benefits Expense

32

42

47

58

50

Other Expenses

869

673

732

566

474

EBITDA

129

154

156

140

156

% Chg

19.4

1.0

(10.0)

EBIDTA %

11.3

12.1

11.9

12.2

14.2

Depreciation

19

19

23

25

26

EBIT

110

135

133

115

130

% Chg

22.8

(1.7)

(13.3)

Interest and Financial Charges

9

24

23

23

35

Other Income

4

6

4

11

5

PBT

105

118

114

102

100

Tax

34

39

37

36

33

% of PBT

32.2

32.8

32.7

34.8

33.2

PAT before Exceptional item

71

79

76

67

67

Exceptional item

0

0

0

0

0

PAT

71

79

76

67

67

% Chg

10.7

(3.3)

(12.6)

PAT %

6.3

6.2

5.9

5.8

6.1

Diluted EPS (on pre-IPO basis)

18

20

19

17

17

% Chg

10.7

(3.3)

(12.6)

May 8, 2015

11

PNC Infratech | IPO note

Balance Sheet (Standalone)

Y/E March (` cr)

FY11

FY12

FY13

FY14

9mFY15

Sources of Funds

Equity Capital

40

40

40

40

40

Reserves Total

375

454

527

590

655

Networth

415

493

566

630

695

Total Debt

89

256

234

248

364

Other Long-term Liabilities

18

115

99

178

214

Deferred Tax Liability

2

2

0

3

1

Total Liabilities

524

867

900

1,058

1,274

Application of Funds

Gross Block

180

203

225

287

327

Accumulated Depreciation

79

92

111

134

161

Net Block

101

111

114

153

166

Cap. WIP & Intan. Assets under Dev.

0

6

12

2

1

Investments

51

167

271

351

367

Current Assets

Inventories

148

148

105

105

170

Sundry Debtors

190

416

398

344

427

Cash and Bank Balance

41

38

38

100

21

Loans & Advances

18

64

75

127

147

Other Current Asset

1

2

2

1

1

Current Liabilities

74

167

218

223

226

Net Current Assets

323

501

401

455

539

Other Assets

48

82

102

98

202

Total Assets

524

867

900

1,058

1,274

May 8, 2015

12

PNC Infratech | IPO note

Cash Flow Statement (Standalone)

Y/E March (` cr)

FY11

FY12

FY13

FY14

9mFY15

Profit before tax

105

117

114

103

100

Dep. & Other Non-cash Charg.

20

14

22

28

23

Change in Working Capital

(200)

(118)

59

74

(234)

Interest & Financial Charges

9

24

23

23

35

Direct taxes paid

(34)

(39)

(39)

(33)

(35)

Cash Flow from Operations

(100)

(2)

179

195

(111)

(Inc)/ Dec in Fixed Assets

(31)

(34)

(33)

(54)

(40)

(Inc)/ Dec in Investments

(28)

(116)

(104)

(80)

(16)

Cash Flow from Investing

(60)

(150)

(137)

(133)

(55)

Issue/ (Buy Back) of Equity

150

0

0

0

0

Inc./ (Dec.) in Loans

9

167

(17)

21

119

Dividend Paid (Incl. Tax)

0

0

(3)

(3)

0

Net Interest Expenses

(8)

(18)

(21)

(17)

(32)

Cash Flow from Financing

152

149

(42)

0

87

Inc./(Dec.) in Cash

(8)

(3)

0

62

(79)

Opening Cash balances

49

41

38

38

100

Closing Cash balances

41

38

38

100

21

May 8, 2015

13

PNC Infratech | IPO note

Ratio Analysis (Standalone)

Y/E March

FY11

FY12

FY13

FY14

9mFY15

Valuation Ratio (x)

P/E (on FDEPS)

21.1

19.0

19.7

22.5

P/CEPS

16.7

15.4

15.2

16.4

Dividend yield (%)

0.0

0.0

12.7

12.7

EV/Sales

1.4

1.4

1.3

1.4

EV/EBITDA

12.0

11.2

10.9

11.8

EV / Total Assets

2.6

1.7

1.5

1.3

Per Share Data (`)

EPS (fully diluted)

17.9

19.9

19.2

16.8

16.8

Cash EPS

22.7

24.6

24.9

23.0

23.2

DPS

0.0

0.0

0.8

0.8

0.0

Book Value

104

124

142

158

175

Returns (%)

RoCE (Pre-tax)

29.3

22.6

17.7

15.0

Angel RoIC (Pre-tax)

33.1

24.2

18.8

16.5

RoE

23.5

17.4

14.4

11.2

Turnover ratios (x)

Asset Turnover (Gross Block) (x)

6.9

6.6

6.1

4.5

Inventory / Sales (days)

31

42

35

33

Receivables (days)

52

87

114

118

Payables (days)

27

39

61

80

Leverage Ratios (x)

D/E ratio (x)

0.2

0.5

0.4

0.4

0.5

Interest Coverage Ratio (x)

13.1

5.9

5.8

5.4

Note: Valuation ratio’s arrived using higher end of the Issue price

May 8, 2015

14

PNC Infratech | IPO note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel has received in-principal approval

from SEBI for registering as a Research Entity in terms of SEBI (Research Analyst) Regulations, 2014. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its associates

including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by

Analyst. Angel or its associates/analyst has not received any compensation / managed or co-managed public offering of securities of

the company covered by Analyst during the past twelve months. Angel/analyst has not served as an officer, director or employee of

company covered by Analyst and has not been engaged in market making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

May 8, 2015

15