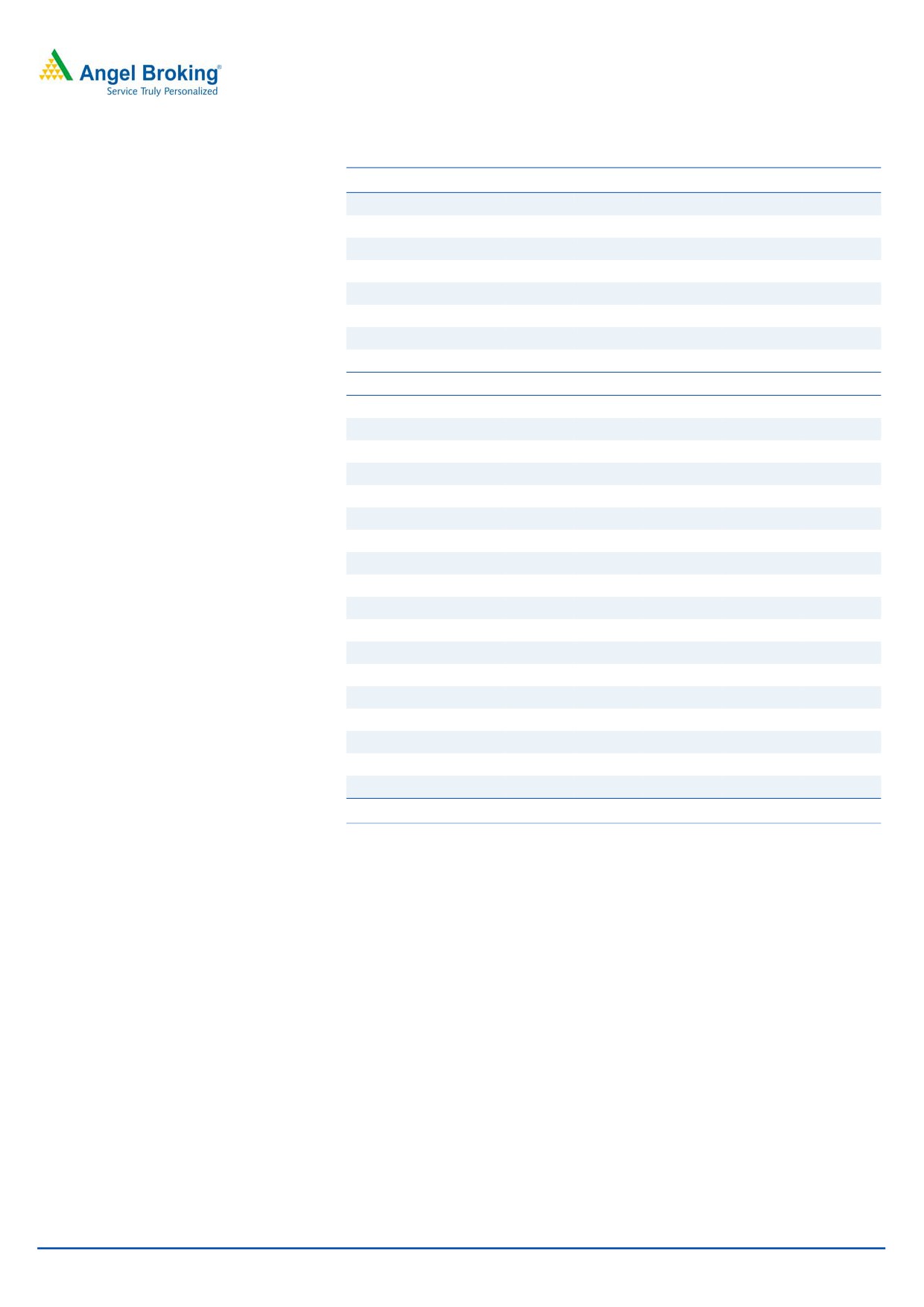

4QFY2016 Result Update | Plastic Products

May 17, 2016

Nilkamal

NEUTRAL

CMP

`1,312

Performance Update

Target Price

-

Y/E March (` cr)

4QFY2016 4QFY2015

% chg (yoy) 3QFY2016

% chg (qoq)

Investment Period

-

Net sales

503

490

2.6

428

17.4

EBITDA

66

48

37.5

46

41.9

Stock Info

EBITDA margin (%)

13.1

9.8

333bp

10.8

227bp

Adjusted PAT

33

22

50.6

20

61.7

Sector

Plastic Products

Source: Company, Angel Research

Market Cap (` cr)

1,958

Nilkamal (NILK) reported an excellent set of numbers for 4QFY2016. The

Net debt (` cr)

73

standalone top-line grew by 2.6% yoy to `503cr. On the operating front, the raw

Beta

1.5

material cost declined by 582bp yoy to 56.4% of sales while employee and other

52 Week High / Low

1,631 / 480

expenses increased by 104bp yoy and 146bp yoy to 6.8% and 23.6% of sales,

Avg. Daily Volume

38,003

respectively. Aided by lower material cost, the EBITDA margin expanded by

Face Value (`)

10

333bp yoy to 13.1%. The interest outgo declined by 30% yoy to `4cr while the

BSE Sensex

25,653

depreciation expense increased by 27.6% yoy to `16cr. Consequently, the net

Nifty

7,861

profit grew by 50.6% yoy to `33cr.

Reuters Code

NKML.BO

Recovery in overall economy to aid in maintaining top-line growth: The plastics

Bloomberg Code

NILK IN

division which accounts for a majority of the company’s revenue (86%) reported a

marginal volume growth of 3% in FY2016 after strong growth of 10% in FY2015.

Going forward, with gradual improvement in the macro environment, both the

Shareholding Pattern (%)

moulded furniture and material handling segments should perform well as they

Promoters

64.1

stand to be direct beneficiaries of an economic revival.

MF / Banks / Indian Fls

0.1

FII / NRIs / OCBs

7.9

Strong Balance sheet: NILK has been steadily reducing its debt and should be

Indian Public / Others

27.8

debt free by FY2017E, thereby resulting in interest cost savings. It has carried out

incremental capex of `38cr in FY2016 and we do not foresee any large

expenditure in the near future. The company’s return ratios have improved

Abs.(%)

3m

1yr

3yr

significantly in FY2016 on account of RM cost benefit along with better asset

Sensex

10.6

(6.1)

26.5

turnover. Going forward, although the return ratios are estimated to regress on account of

lower margins which would be due to an anticipated increase in RM cost, the company’s

NILK

24.5

152.7

699.0

return ratios are expected to continue to be stable on back of increase in turnover.

Outlook and Valuation: The company’s core plastics division has posted a CAGR

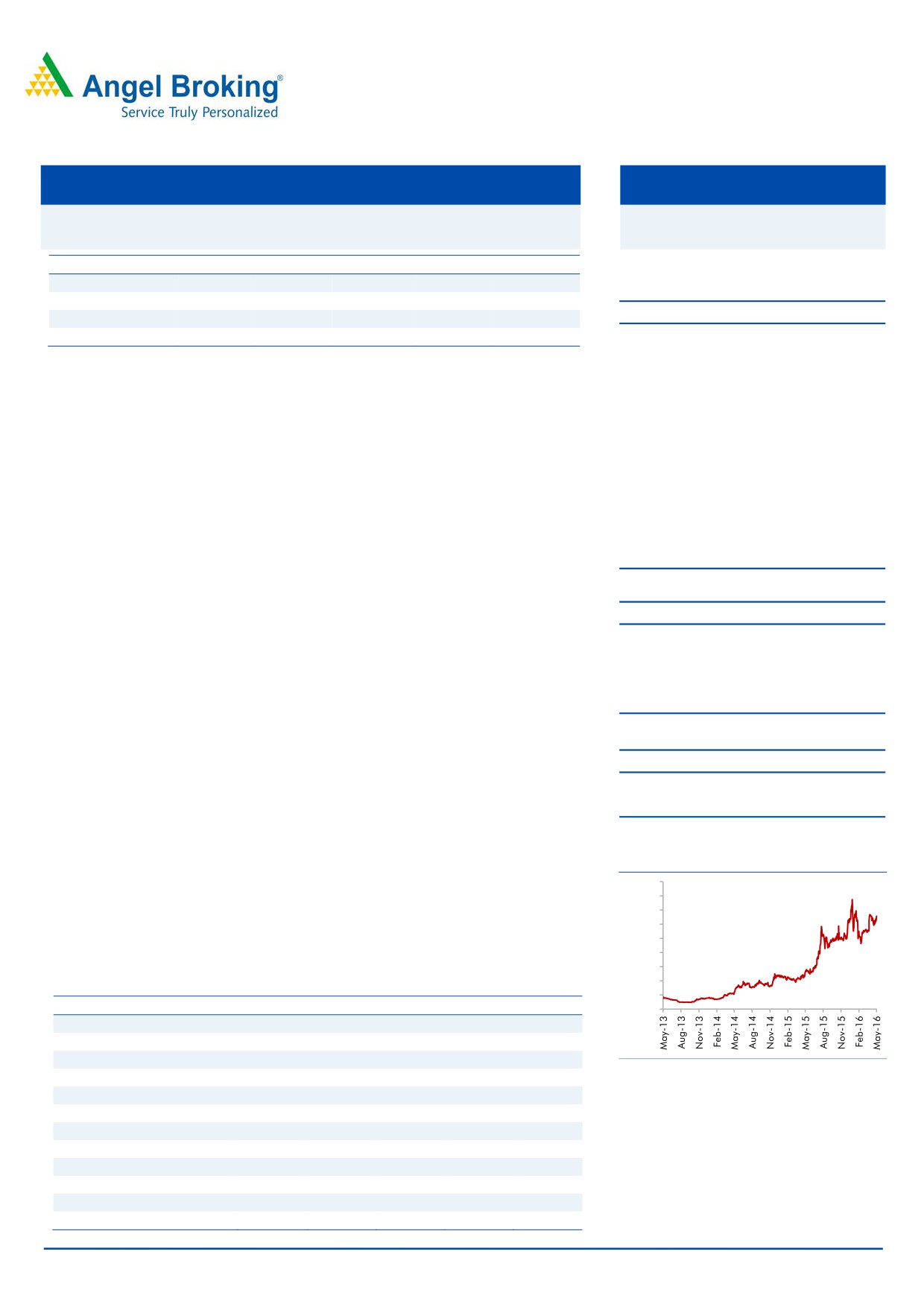

3 year daily price chart

of ~8.0% over FY2011-16 and is expected to maintain similar pace over

1,800

1,600

FY2016-18E, thereby resulting in an overall revenue CAGR of 7.6% over FY2016-18E to

1,400

`2,165. On account of increase in RM cost, the EBITDA margin is expected to soften to

1,200

10.4% and the net profit is expected to be at `120cr in FY2018E. At the current market

1,000

800

price, the stock is trading at FY2018E PE of 16.3x. We have a Neutral rating on the stock.

600

400

Financials (Standalone)

200

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E FY2018E

-

Net Sales

1,649

1,787

1,870

1,995

2,165

% chg

2.4

8.3

4.7

6.7

8.5

Adj. Net Profit

40

42

104

106

120

Source: Company, Angel Research

% chg

21.7

6.1

144.7

2.2

13.4

OPM (%)

8.8

7.8

11.5

10.7

10.4

EPS (Rs)

26.8

28.5

69.6

71.1

80.6

P/E (x)

48.9

46.1

18.8

18.4

16.3

P/BV (x)

4.2

4.0

3.3

2.9

2.5

RoE (%)

9.0

8.9

19.3

16.8

16.5

RoCE (%)

11.4

11.0

21.8

20.8

20.5

Milan Desai

EV/Sales (x)

1.4

1.2

1.1

1.0

0.9

022-4000 3600 Ext.: 6846

EV/EBITDA (x)

15.4

15.2

9.5

9.1

8.2

Source: Company, Angel Research; Note: CMP as of May 16, 2016

Please refer to important disclosures at the end of this report

1

Nilkamal | 4QFY2016 Result Update

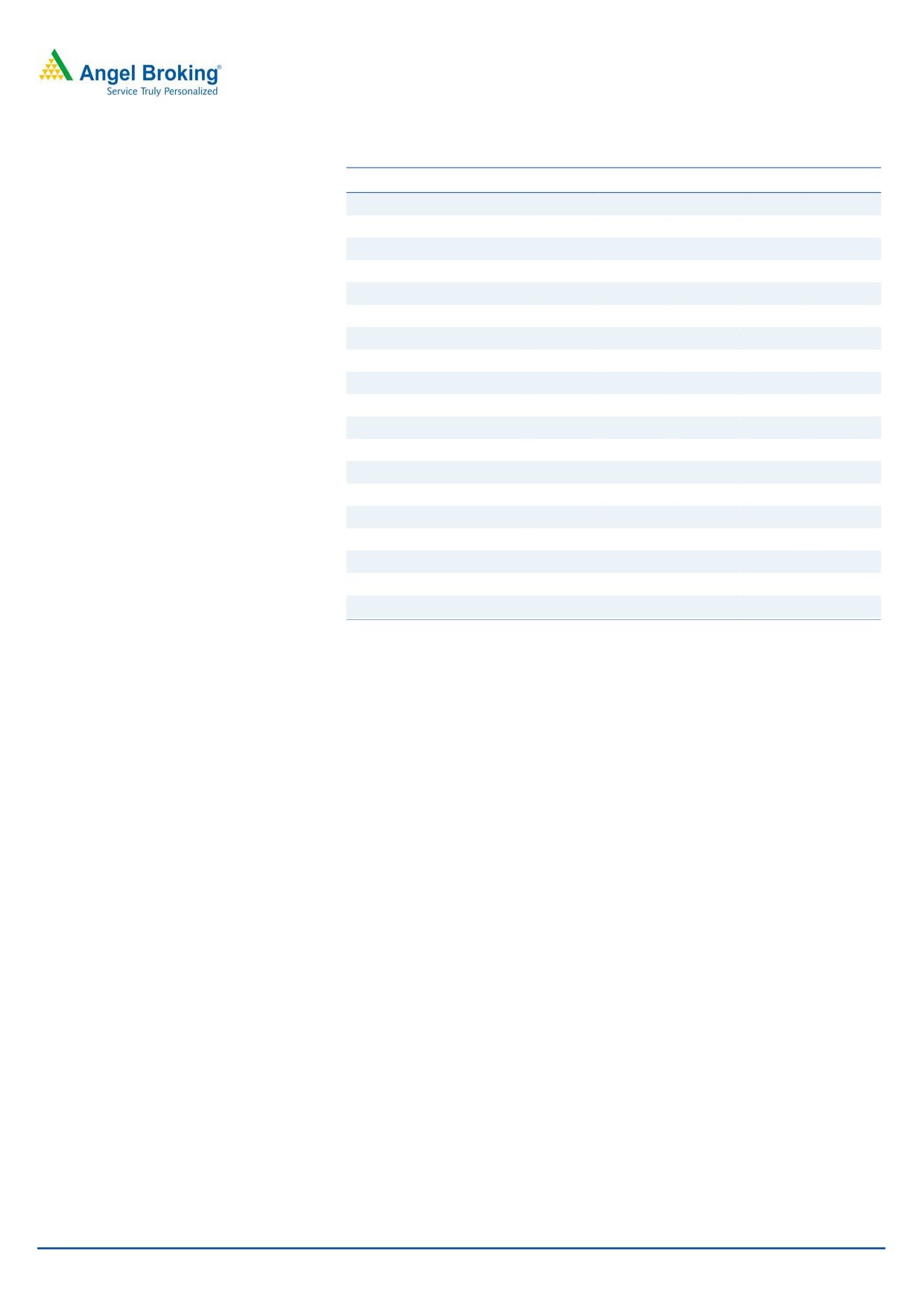

Exhibit 1: 4QFY2016 performance

Y/E March (` cr)

4QFY16

4QFY15

yoy chg (%)

3QFY16

qoq chg (%)

FY2016

FY2015

% chg

Net Sales

503

490

2.6

428

17.4

1,870

1,787

4.7

Net raw material

284

305

(7.0)

235

20.8

1071

1133

(5.5)

(% of Sales)

56.4

62.3

(582)bp

54.8

161bp

57.3

63.4

(616)bp

Staff Costs

34

28

20.9

37

(6.1)

135

113

19.4

(% of Sales)

6.8

5.8

104bp

8.6

(171)bp

7.2

6.3

89bp

Other Expenses

119

109

9.3

110

7.5

450

401

12.3

(% of Sales)

23.6

22.1

146bp

25.8

(216)bp

24.1

22.4

163bp

Total Expenditure

437

442

(1.2)

382

14.4

1,656

1,647

0.6

Operating Profit

66

48

37.5

46

41.9

215

140

53.2

OPM

13.1

9.8

333bp

10.8

227bp

11.5

7.8

363bp

Interest

4

6

(30.0)

4

9.6

18

32

(44.2)

Depreciation

16

12

27.6

12

27.1

53

54

(2.1)

Other Income

2.8

2.0

39.5

0.2

1484.1

9

6

47.1

PBT

49

32

54.9

30

60.4

153

61

12.6

(% of Sales)

9.7

6.4

7.1

8.2

3.4

Tax

16

10

10

49

18

174

(% of PBT)

33.1

31.2

33.6

32

30

Reported PAT

33

22

50.6

20

61.7

104

42

144.6

PATM

6.5

4.4

4.7

5.6

2.4

318bp

Source: Company, Angel Research

Exhibit 2: Actual vs. Angel estimates (4QFY2016)

Actual (` cr)

Estimate (` cr)

Var (%)

Total Income

503

503

(0.1)

EBIDTA

66

51

28.2

EBIDTA margin (%)

13.1

10.2

289bp

Adjusted PAT

33

23

41.6

Source: Company, Angel Research

Top-line meets our estimates, EBITDA and Net Profit beat

expectation

NILK reported an excellent set of numbers for 4QFY2016. The standalone top-line

grew by 2.6% yoy to `503cr which is the same as our estimate. Polyethylene

remained flat and we reckon towards the plastics division having posted a

marginal volume growth of ~2% during the quarter.

For FY2016, the company’s standalone top-line grew by 4.7% yoy to `1,870cr. As

per the Management, the plastics division registered a volume growth of 3% and

the division’s revenue grew by 4.3% yoy to `1,613cr.

May 17, 2016

2

Nilkamal | 4QFY2016 Result Update

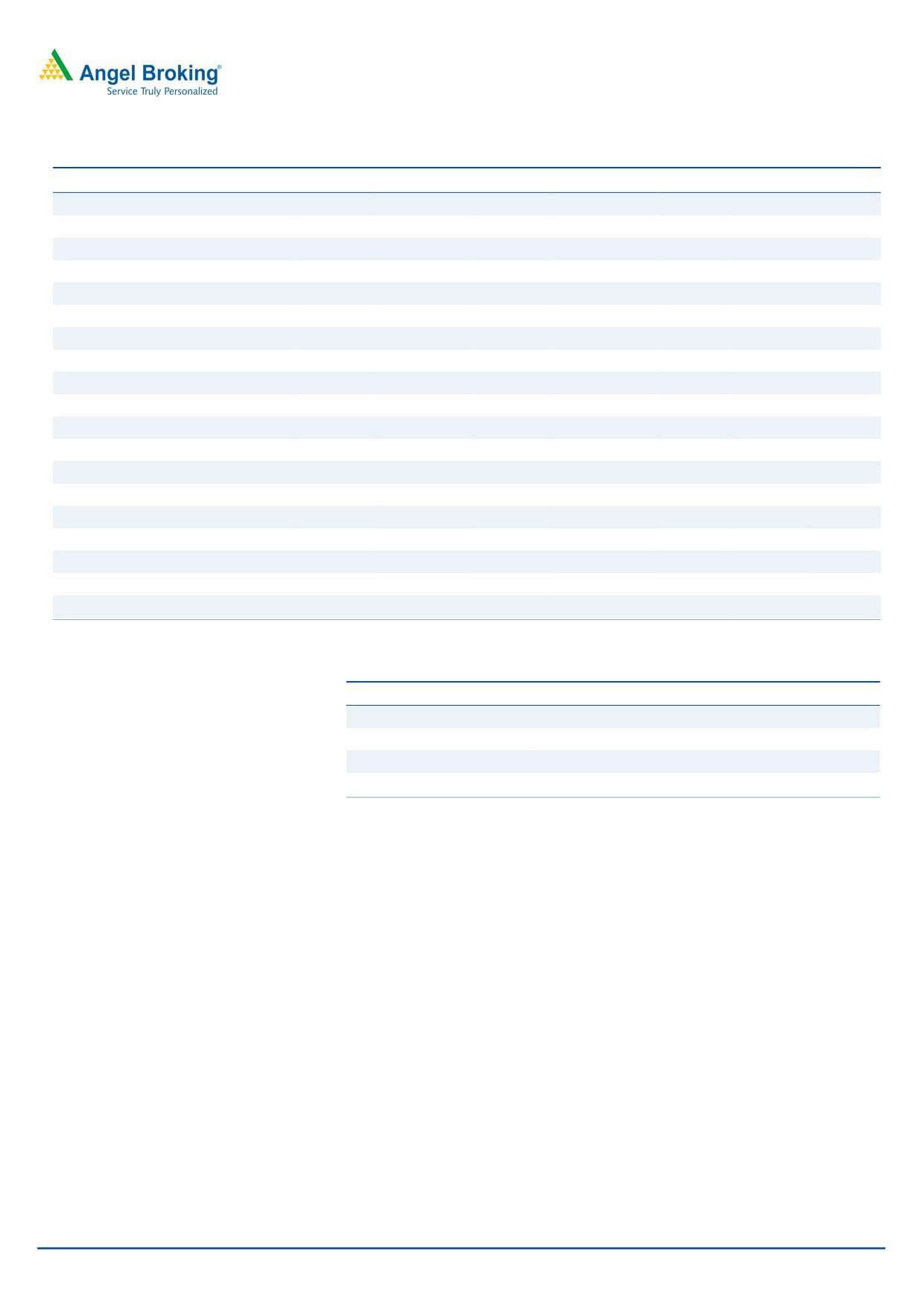

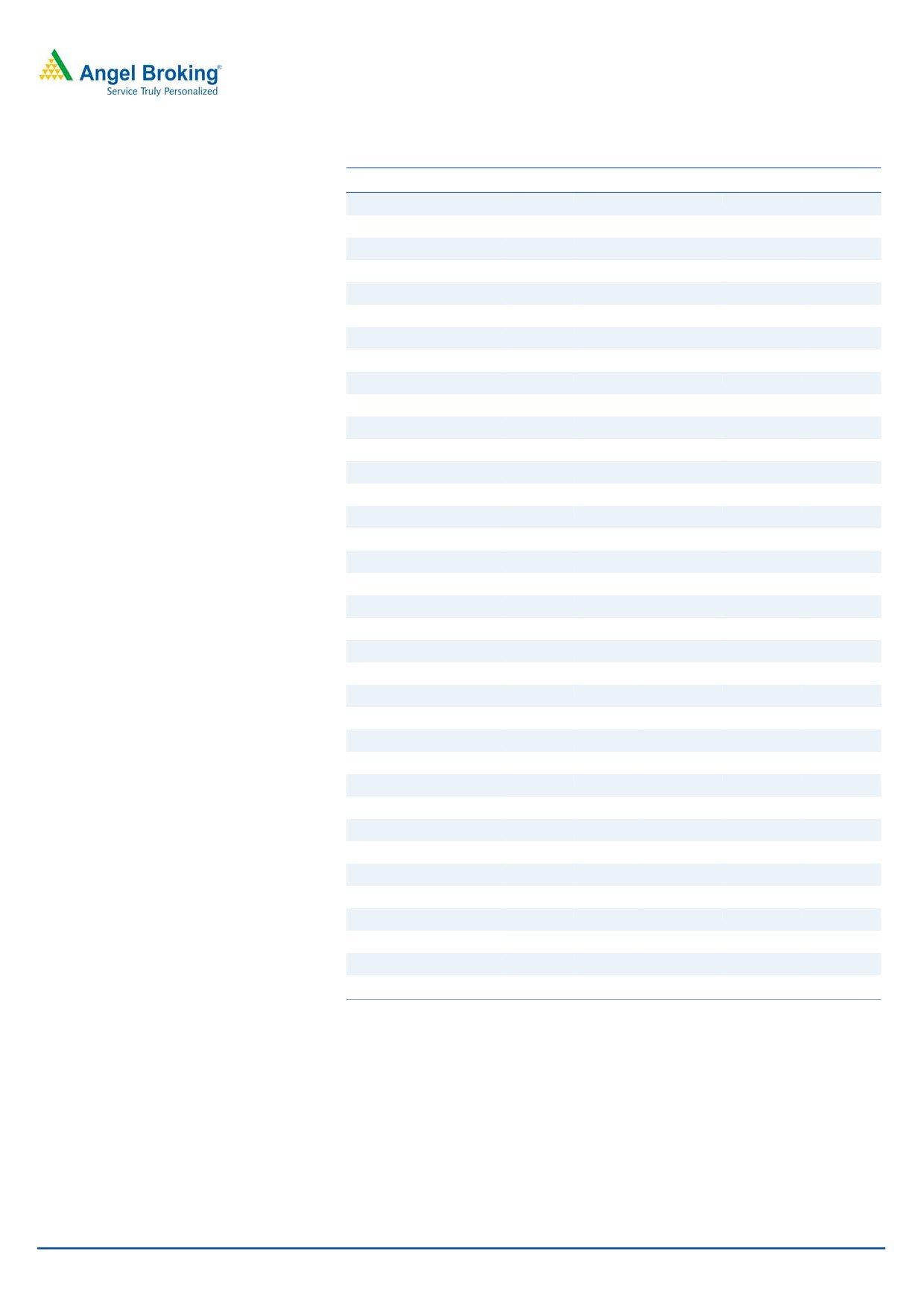

Exhibit 3: Revenue growth subtle yoy due to flattish volumes

600

12.0

11.2

500

10.0

9.6

8.3

400

8.0

7.0

6.5

300

6.0

5.1

200

4.2

4.0

2

.6

100

2.0

1.8

-

-

Revenue (LHS)

yoy growth (RHS)

Source: Company, Angel Research

The company benefitted from a sharp decline in raw material cost which came

down 582bp yoy to 56.4% yoy of sales during the quarter. However, employee

and other expenses increased by 104bp yoy and 146bp yoy to 6.8% and 23.6% of

sales, respectively.

Exhibit 4: Lower RM leads to Margin expansion...

Exhibit 5: ... and bottom-line growth

13.1

70

14.0

35

6.

5

7.0

11.3

10.8

60

10.4

12.0

30

6.0

9.8

5.5

5.3

9.2

50

10.0

25

5.0

7.4

4.4

4.7

6.8

6.7

40

8.0

20

4.0

30

6.0

15

3.1

3.0

2.0

20

4.0

10

2.0

1.3

1.5

10

2.0

5

1.0

-

-

-

-

EBITDA (LHS)

EBITDA Margin (RHS)

PAT (LHS)

PAT Margin (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

On the back of lower raw material cost, EBITDA grew by 37.5% yoy to `66cr and

the EBITDA margin expanded by 333bp yoy to 13.1% which is higher than our

estimate of 10.2%. We had estimated raw material cost to be on the higher side

which resulted in the deviation in margin vis-a-vis our estimates.

The company has reduced the debt quantum by `100cr over the past year, which

has resulted in lower interest outgo. Interest expense declined by 30.0% yoy to `4cr

but depreciation expense rose by 27.6% yoy to `16cr. Consequently, the net profit

grew by 50.6% yoy to `33cr, outperforming our estimate of `23cr.

May 17, 2016

3

Nilkamal | 4QFY2016 Result Update

Exhibit 6: Segment wise performance

Y/E March (` cr)

4QFY16

4QFY15

% chg (yoy) 3QFY16

% chg (qoq)

Total Revenue

A) Plastics

438

425

2.9

365

20.0

B) Lifestyle

60

60

0.9

60

0.9

C) Others

10

8

18.4

9

11.0

Total

508

493

3.0

433

17.2

Less: Inter-Segmental Rev.

5

3

5

Net Sales

503

490

2.6

428

17.4

Segmental Profit

A) Plastics

69

44

54.4

45

53.1

B) Lifestyle

(9)

(4)

114.7

(2)

419.1

C) Others

0.3

0

(13.3)

(1)

(134.8)

Segmental Margin (%)

A) Plastics

15.7

10.5

523bp

12.3

340bp

B) Lifestyle

(14.9)

(7.0)

(789)bp

(2.9)

(1200)bp

C) Others

2.7

3.7

(99)bp

(8.6)

1132bp

Source: Company, Angel Research

As for the segmental performance, the plastics division witnessed a 2.9% yoy

growth to `438cr in 4QFY2016 and the margins for the segment improved by

523bp yoy to 15.7%. For FY2016, the top-line for the division grew by 4.3% yoy to

`1,613cr while the segment margins expanded by 565bp yoy to 12.8%.

The lifestyle segment’s revenues grew by 0.9% yoy to `60cr while the segment

reported a bottom-line loss of `9cr. For FY2016, the segment reported a revenue

growth of 9.4% yoy to `238cr while the segment reported a bottom-line loss of

`12cr for FY2016 as against a loss of `11cr in the previous year.

Others, which includes the Mattress business, saw a revenue growth of 18.4% yoy

to `10cr while the segment reported a profit of `0.3cr for the quarter. For FY2016,

the top-line for the segment remained flat at `35cr while the segment reported a

loss of `1.4cr against a profit of `0.2cr in the last year.

May 17, 2016

4

Nilkamal | 4QFY2016 Result Update

Investment Arguments

Plastics division to benefit from revival in Economy

After a strong rebound in volumes in FY2015, the volumes for the plastics division

of the company have posted marginal growth rate of 3% for FY2016. The plastic

division accounts for ~86% of the company’s revenues and both the segments

within the division, viz moulded furniture (~36% of total revenue) and material

handling (~36% of total revenue) should benefit from improvement in the macro

conditions and disposable incomes.

The material handling segment is B2B in nature and is an important part of

industrial activity. NILK is a ’One Stop Shop’ for material handling solutions, with

the company being the largest manufacturer of plastic crates and other products

like pallets, metal storage racks, and material handling equipment for various

industries. As per an industry report, Supreme Industries, which is the second

largest material handling player, is very small compared to NILK in terms of size of

its material handling business with revenue of ~`240cr against ~`940cr for NILK.

Strong balance sheet

NILK has reduced its debt over the past year by ~`100cr and is expected to be net

debt free by FY2017E. The company generates strong operating cash flows which

should enable it to reduce its debt, take care of incremental capex and increase its

dividend payout. Interest expense has nearly halved as a result of its debt reduction

and it will further reduce and aid the bottom-line. The RoIC has improved

significantly from 11.6% in FY2015 to 23.0% in FY2016 and is estimated to

improve to 24.0% in FY2018E.

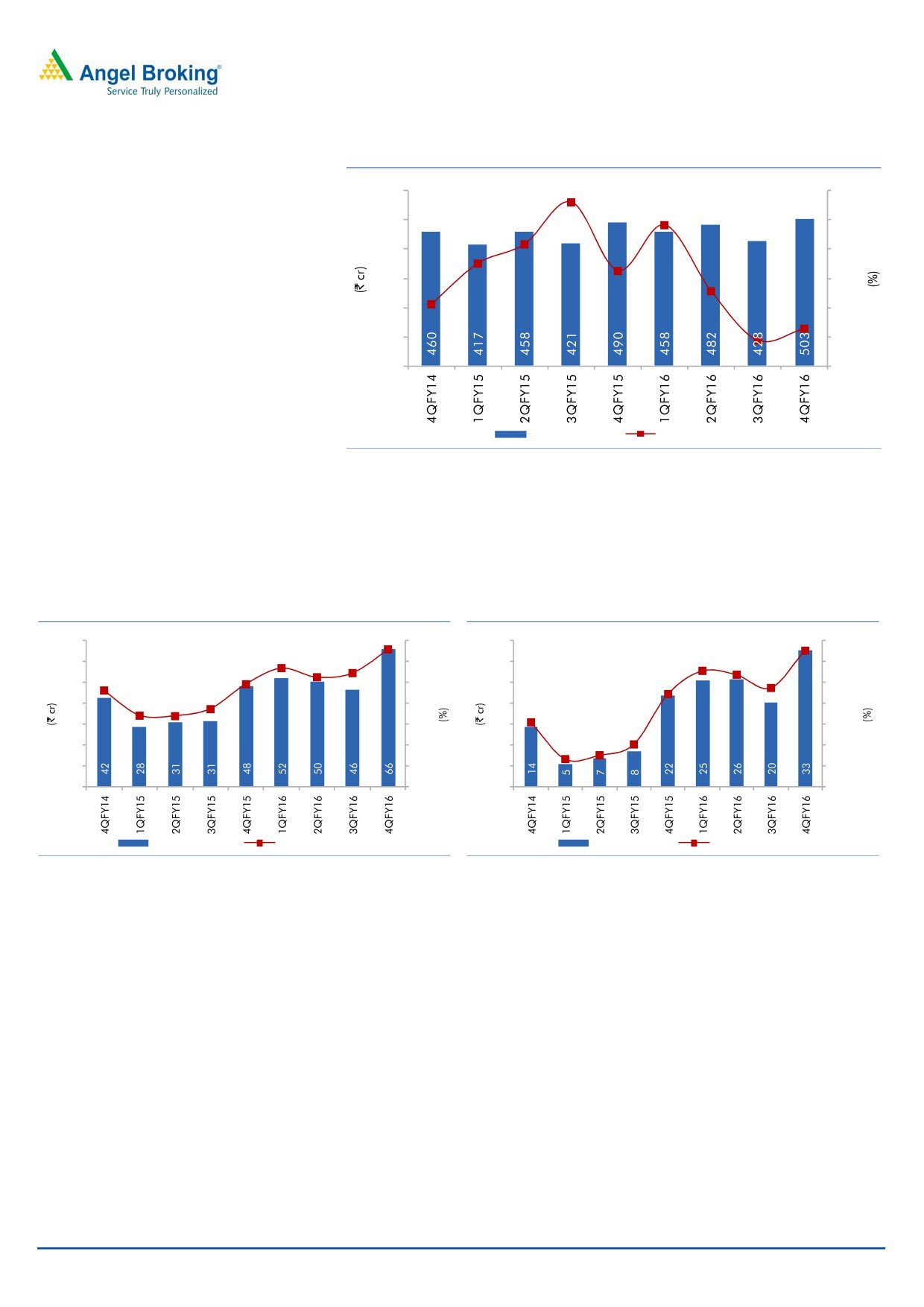

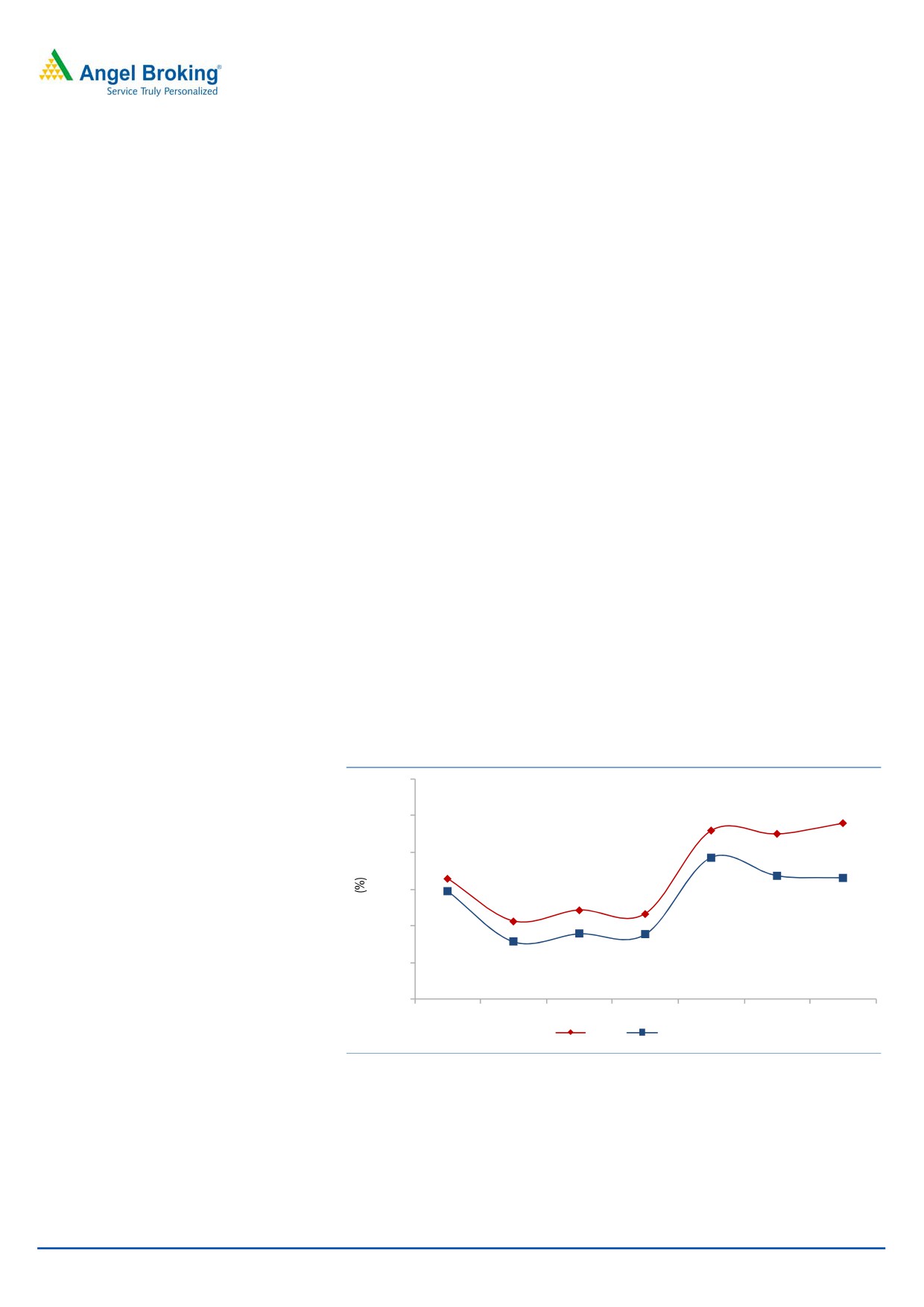

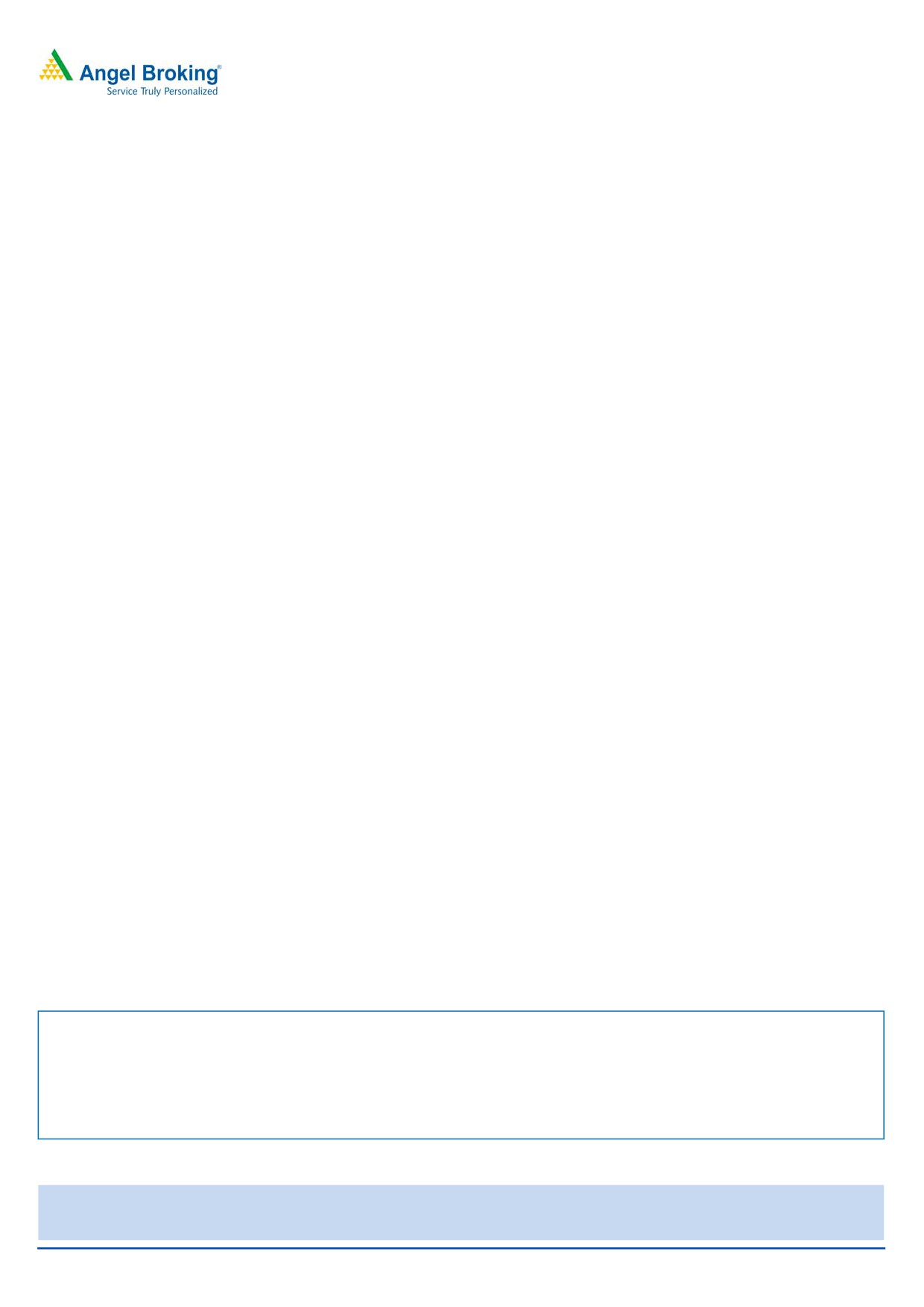

Exhibit 7: Improving Return Ratios

30.0

24.0

25.0

23.0

22.5

20.0

16.4

19.3

15.0

12.1

11.6

16.8

16.5

10.6

14.7

10.0

9.0

8.9

5.0

7.9

0.0

FY2012

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E

RoIC

ROE

Source: Company, Angel Research

May 17, 2016

5

Nilkamal | 4QFY2016 Result Update

Financials

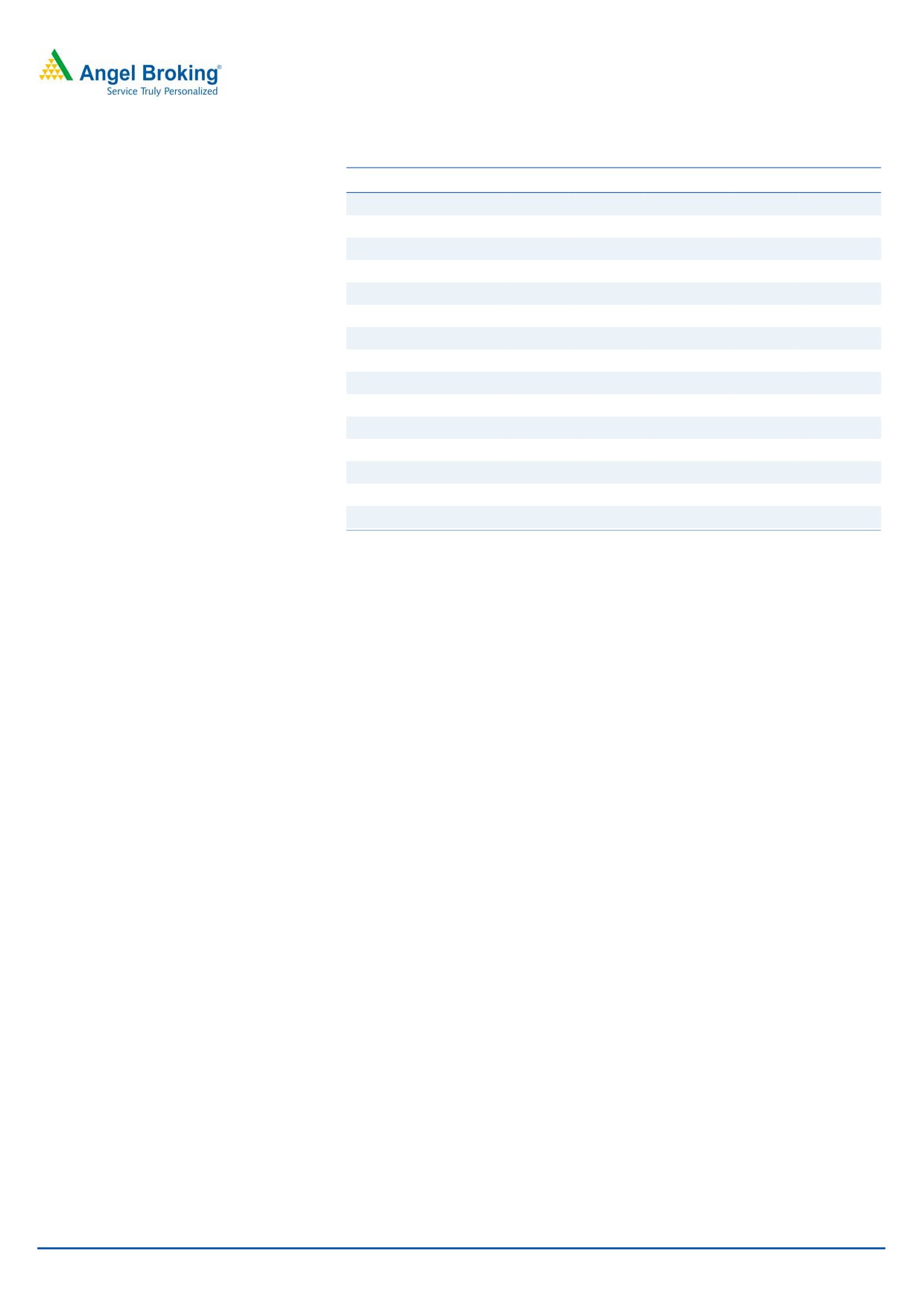

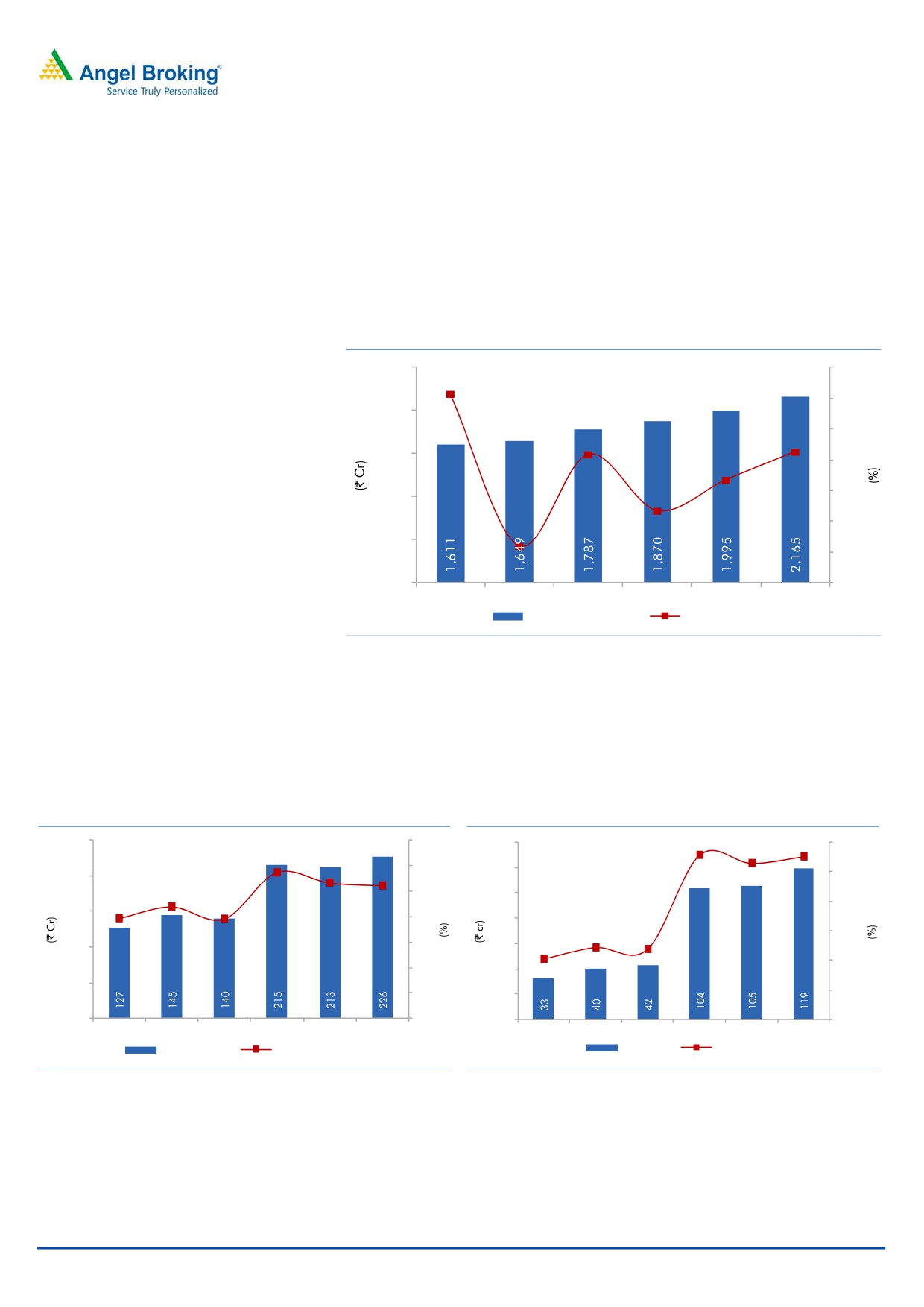

Revenue to post 7.6% CAGR over FY2016-18E

NILK’s plastic division has grown at ~8.0% over FY2011-2016. We are estimating

the division to post a revenue CAGR of 8.3% over FY2016-18E resulting in the

overall top-line registering a CAGR of 7.6% over FY2016-2018E to `2,165cr in

FY2018E.

Exhibit 8: Revenue to improve by 7.6% CAGR over FY2016-18E

14.0

2,500

12.3

12.0

2,000

10.0

8.5

8.3

1,500

6.7

8.0

6.0

1,000

4.7

4.0

500

2.4

2.0

-

0.0

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

Revenue (LHS)

Growth (RHS)

Source: Company, Angel Research

EBITDA margins have improved significantly in FY2016 largely owing to lower raw

material costs. Average polyethylene prices declined by 8.6% in FY2016 and the

prices are likely to increase from here on which should result in higher RM cost

going forward. The EBITDA margin is likely to contract from 11.5% in FY2016 to

10.4% in FY2018E.

Exhibit 9: EBITDA to contract on rebound in RM cost

Exhibit 10: PAT trajectory

250

14.0

140

5.6

6.0

5.3

11.5

5.5

12.0

120

10.7

10.

4

5.0

200

8.8

10.0

100

7.9

7.8

4.0

150

8.0

80

3.0

2.4

6.0

60

100

2.0

2.4

2.0

4.0

40

50

2.0

20

1.0

-

-

-

-

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

FY2013

FY2014

FY2015

FY2016E FY2017E FY2018E

EBITDA (LHS)

EBITDA Margin (RHS)

PAT (LHS)

PATM (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

May 17, 2016

6

Nilkamal | 4QFY2016 Result Update

Exhibit 11: Relative valuation (Standalone)

Company

Mcap

Sales

OPM

PAT

EPS

RoE

P/E

P/BV EV/EBITDA EV/Sales

(` cr)

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

Nilkamal

FY2018E

1,958

2,165

10.4

120

80.6

16.5

16.3

2.5

8.2

0.9

Supreme Industries (Standalone) FY2018E

10,987

5,339

14.2

375

29.5

24.0

29.2

6.6

14.7

2.1

Source: Company, Angel Research

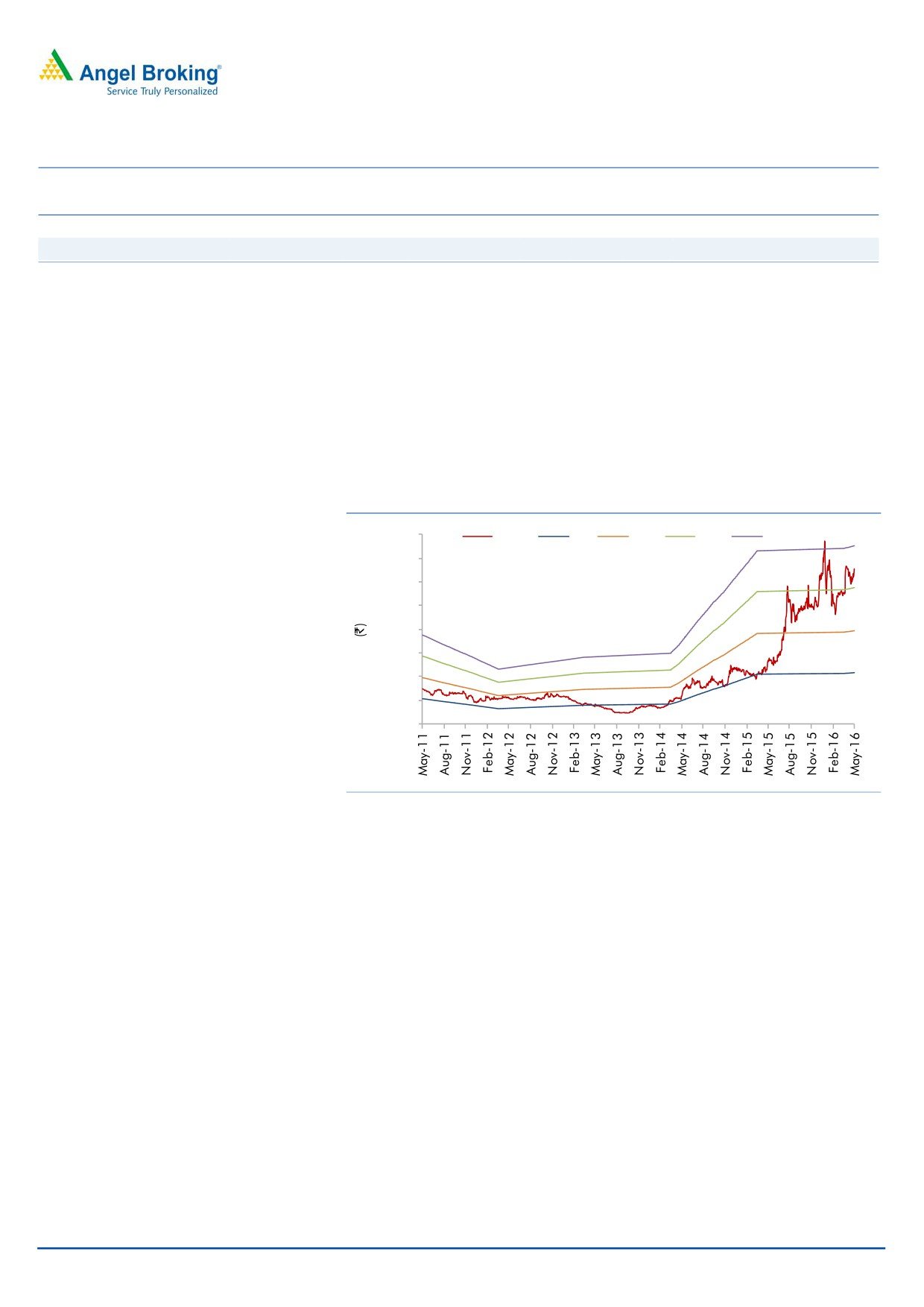

Outlook and Valuation

The plastics division has posted a CAGR ~8.0% over FY2011-16 and is expected

to maintain similar pace over FY2016-18E resulting in overall revenue CAGR of

7.6% over FY2016-18E to `2,165. On account of increase in RM cost, the EBITDA

margin is expected to be at 10.4% in FY2018E and the net profit is expected to be

at `120cr in FY2018E. At the current market price, the stock is trading at FY2018E

PE of 16.3x. We have a Neutral rating on the stock.

Exhibit 12: One-year forward PE chart

1,600

Price

6x

11x

16x

21x

1,400

1,200

1,000

800

600

400

200

-

Source: Company, Angel Research

Concerns

Volatile raw material prices: Raw materials account for 63% of net sales. High

volatility in crude and raw material prices could have a negative impact on the

company’s performance.

Economic slowdown: Economic slowdown will have a negative impact on the

performance of the company as both plastics and @home are dependent on the

economic scenario.

Competition from the unorganized segment: Availability of low priced furniture

from the unorganized segment poses a threat as it is able to undercut prices by

compromising on quality.

May 17, 2016

7

Nilkamal | 4QFY2016 Result Update

Exhibit 13: Crude and Polypropylene price fluctuation

130

8,500

120

7,500

110

6,500

100

90

5,500

9

3

80

4,500

70

3,500

60

3,0

41

2,500

50

40

1,500

Avg Polyethylene Prices (LHS)

Brent Prices INR (RHS)

Source: Company, Angel Research

Company background

Incorporated in 1985, Nilkamal Ltd (NILK) is a market leader in moulded plastic

products. The company has three divisions, viz plastics, lifestyle furniture, and

furnishings & accessories. The products of these divisions are sold through the

company’s retail chain “@home”. The company is also present in the mattress

business which although is relatively smaller in size. The company’s manufacturing

plants are located at Barjora in West Bengal, Hosur in Tamil Nadu, Jammu,

Kharadapada and Vasona in Dadra & Nagar Haveli, Noida in UP, Sinnor and

Nashik in Maharashtra and in Pudducherry.

NILK is a market leader in the material handling segment, backed by its ability to

directly reach a very diverse set of industrial customers through

400+

self-employed sales people operating from 39 regional sales offices across India.

The moulded furniture segment of the company enjoys a ~39% market share in its

category. NILK has 26 small format stores along with a strong network of 40+

depots and 1000+ channel partners on a pan India basis, thus enabling it to serve

the remotest rural markets. Its retail store chain

“@home”, operates

18 stores across 13 cities covering a retail space of over 3.15 lakh sq. ft.

May 17, 2016

8

Nilkamal | 4QFY2016 Result Update

Profit and loss statement (standalone)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

Total operating income

1,649

1,787

1,870

1,995

2,165

% chg

2.4

8.3

4.7

6.7

8.5

Net Raw Materials

1043

1133

1071

1164

1266

% chg

2.5

8.6

(5.5)

8.7

8.7

Power and Fuel

40

41

41

44

50

% chg

(15.8)

3.4

0.6

6.7

13.4

Personnel

105

113

135

142

154

% chg

3.7

7.2

19.4

5.1

8.5

Other

316

360

409

433

470

% chg

(0.4)

14.0

13.6

5.9

8.5

Total Expenditure

1504

1647

1656

1782

1939

EBITDA

145

140

215

213

226

% chg

14.3

(3.4)

53.3

(0.8)

6.3

(% of Net Sales)

8.8

7.8

11.5

10.7

10.4

Depreciation & Amortisation

49

54

53

55

57

EBIT

96

86

162

158

169

% chg

16.5

(10.2)

87.8

(2.4)

7.0

(% of Net Sales)

5.8

4.8

8.7

7.9

7.8

Interest & other Charges

41

32

18

9

5

Other Income

4

6

9

7

13

(% of Net Sales)

0.2

0.3

0.5

0.3

0.6

Recurring PBT

55

54

144

149

164

% chg

38.3

(0.6)

165.5

3.5

9.9

PBT (reported)

58

61

153

156

177

Tax

18

18

49

50

57

(% of PBT)

31.1

29.8

32.2

32.0

32.0

PAT (reported)

40

42

104

106

120

Extraordinary Expense/(Inc.)

-

-

-

-

-

ADJ. PAT

40

42

104

106

120

% chg

21.7

6.1

144.7

2.2

13.4

(% of Net Sales)

2.4

2.4

5.6

5.3

5.6

Basic EPS (`)

26.8

28.5

69.6

71.1

80.6

Fully Diluted EPS (`)

26.8

28.5

69.6

71.1

80.6

% chg

21.7

6.1

144.7

2.2

13.4

Dividend

7

8

12

15

18

Retained Earning

33

35

92

92

102

May 17, 2016

9

Nilkamal | 4QFY2016 Result Update

Balance sheet (Standalone)

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

FY2018E

SOURCES OF FUNDS

Equity Share Capital

15

15

15

15

15

Reserves& Surplus

448

478

570

662

764

Shareholders’ Funds

463

492

585

677

779

Total Loans

320

207

109

60

43

Other Long Term Liabilities

33

37

40

40

40

Long Term Provisions

7

7

5

5

5

Deferred Tax (Net)

24

16

9

9

9

Total Liabilities

847

759

749

791

876

APPLICATION OF FUNDS

Gross Block

717

716

745

775

807

Less: Acc. Depreciation

385

432

485

540

597

Less: Impairment

-

-

-

-

-

Net Block

333

284

260

236

210

Capital Work-in-Progress

2

1

1

1

1

Investments

26

26

26

26

26

Long Term Loans and adv.

56

52

51

51

51

Other Non-current asset

0

1

1

1

1

Current Assets

579

557

599

665

793

Cash

18

8

11

53

130

Loans & Advances

43

40

34

34

35

Inventory

301

277

296

317

344

Debtors

218

232

258

261

283

Other current assets

-

-

-

-

-

Current liabilities

149

161

189

188

205

Net Current Assets

430

395

410

477

588

Misc. Exp. not written off

-

-

-

-

-

Total Assets

847

759

749

791

876

May 17, 2016

10

Nilkamal | 4QFY2016 Result Update

Cash flow statement (Standalone)

Y/E March (`cr)

FY2014

FY2015

FY2016

FY2017E FY2018E

Profit before tax

58

61

153

156

177

Depreciation

49

54

53

55

57

Change in Working Capital

28

25

(12)

(25)

(33)

Direct taxes paid

(18)

(27)

(56)

(50)

(57)

Others

(4)

(6)

(9)

(7)

(13)

Cash Flow from Operations

113

106

129

129

131

(Inc.)/Dec. in Fixed Assets

(34)

2

(29)

(30)

(31)

(Inc.)/Dec. in Investments

(0)

0

(0)

0

0

(Incr)/Decr In LT loans & adv.

(5)

4

2

-

-

Others

4

6

10

7

13

Cash Flow from Investing

(36)

12

(17)

(23)

(18)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

(74)

(109)

(97)

(49)

(17)

Dividend Paid (Incl. Tax)

(7)

(8)

(12)

(15)

(18)

Others

(3)

(11)

-

-

-

Cash Flow from Financing

(84)

(128)

(109)

(64)

(35)

Inc./(Dec.) in Cash

(7)

(10)

3

42

77

Opening Cash balances

25

18

8

11

53

Closing Cash balances

18

8

11

53

130

May 17, 2016

11

Nilkamal | 4QFY2016 Result Update

Key Ratios (Standalone)

Y/E March

FY2014

FY2015

FY2016E

FY2017E

FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

48.9

46.1

18.8

18.4

16.3

P/CEPS

22.0

20.3

12.5

12.2

11.0

P/BV

4.2

4.0

3.3

2.9

2.5

Dividend yield (%)

0.4

0.4

0.6

0.7

0.9

EV/Net sales

1.4

1.2

1.1

1.0

0.9

EV/EBITDA

15.4

15.2

9.5

9.1

8.2

EV / Total Assets

2.7

2.9

2.7

2.5

2.1

Per Share Data (`)

EPS (Basic)

26.8

28.5

69.6

71.1

80.6

EPS (fully diluted)

26.8

28.5

69.6

71.1

80.6

Cash EPS

59.6

64.5

104.9

107.8

118.8

DPS

4.6

4.5

7.0

8.5

10.5

Book Value

310.1

330.0

392.0

453.4

521.9

DuPont Analysis

EBIT margin

5.8

4.8

8.7

7.9

7.8

Tax retention ratio

0.7

0.7

0.7

0.7

0.7

Asset turnover (x)

2.1

2.4

2.7

2.8

3.1

ROIC (Post-tax)

8.3

8.1

15.6

15.3

16.3

Cost of Debt (Post Tax)

8.0

8.5

7.7

7.1

7.0

Leverage (x)

0.6

0.4

0.1

(0.0)

(0.1)

Operating ROE

8.6

8.0

16.6

15.1

14.9

Returns (%)

ROCE (Pre-tax)

11.4

11.0

21.8

20.8

20.5

Angel ROIC (Pre-tax)

12.1

11.6

23.0

22.5

24.0

ROE

9.0

8.9

19.3

16.8

16.5

Turnover ratios (x)

Asset TO (Gross Block)

2.4

2.5

2.6

2.6

2.7

Inventory / Net sales (days)

67

59

56

56

56

Receivables (days)

50

46

48

48

48

Payables (days)

36

34

39

39

39

WC cycle (ex-cash) (days)

94

82

77

75

74

Solvency ratios (x)

Net debt to equity

0.6

0.4

0.1

(0.0)

(0.1)

Net debt to EBITDA

1.9

1.2

0.3

(0.1)

(0.5)

Int. Coverage (EBIT/ Int.)

2.3

2.7

9.1

17.8

32.3

May 17, 2016

12

Nilkamal | 4QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Nilkamal

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

May 17, 2016

13