Please refer to important disclosures at the end of this report

1

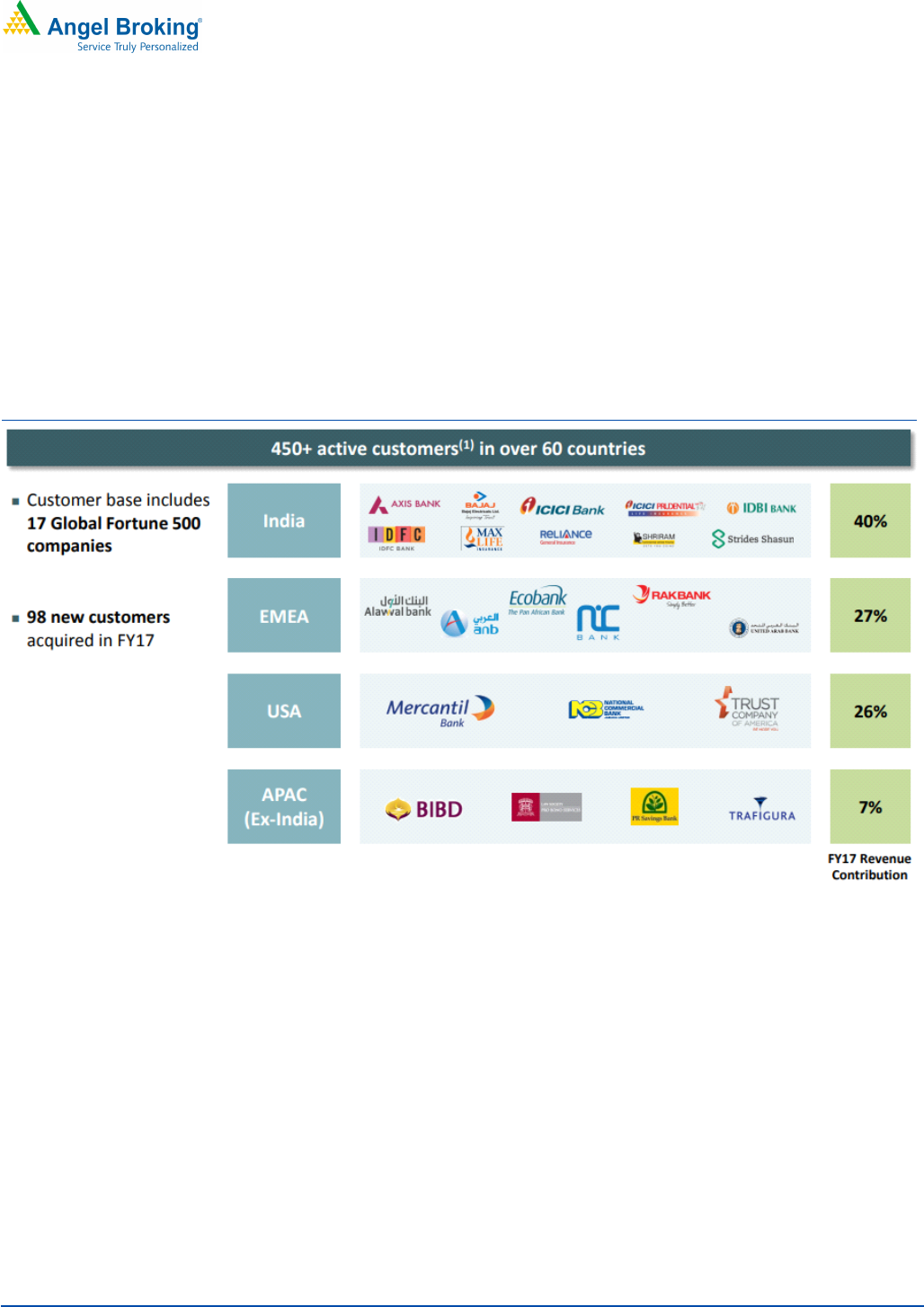

Incorporated in 1992, Newgen Software Technologies Limited (NSTL) is a

New

Delhi based IT company and

a global provider of Business Process Management

(BPM), Enterprise Content Management (ECM), Customer Communication

Management (CCM), Document Management System (DMS), Workflow and

Process Automation. NSTL has 450+ active customers, with clients spread over

60

countries. The company sells its products to banks, insurance firms, BPOs and

healthcare organizations. It has offices in the US, Canada, the United Kingdom,

Singapore, and Dubai.

Positives: (a) Diversified business across several verticals including

Banking,

Government/PSUs, BPO/IT, Insurance and Healthcare (b)

Diversified revenue

streams from multiple geographies with low customer concentration (c)

Recurring

and non-recurring repeat revenues from long standing customer relationships

(d)

Focused on driving innovation through in-house R&D.

Investment concerns: (a) NSTL was able to report only single digit bottom-

line

CAGR of ~8% despite a top-line CAGR ~20% over FY13-17, due to lack of

stability in operating margins (b) During 1HFY18, the company

has reported very

low margin and profitability (c) working capital days are very high

Outlook & Valuation: In terms of valuations, the pre-

issue P/E works out to 274x its

1HFY2018 annualized earnings (at the upper end of the issue price band), which is

higher compared to its peers like Intellect Design Arena (trading at PE 143x -

1HFY2018 annualized earnings).

Further last four years historical financial records

and 1HFY18 doesn’t provides confidence.

Hence, we recommend Neutral rating

on the issue.

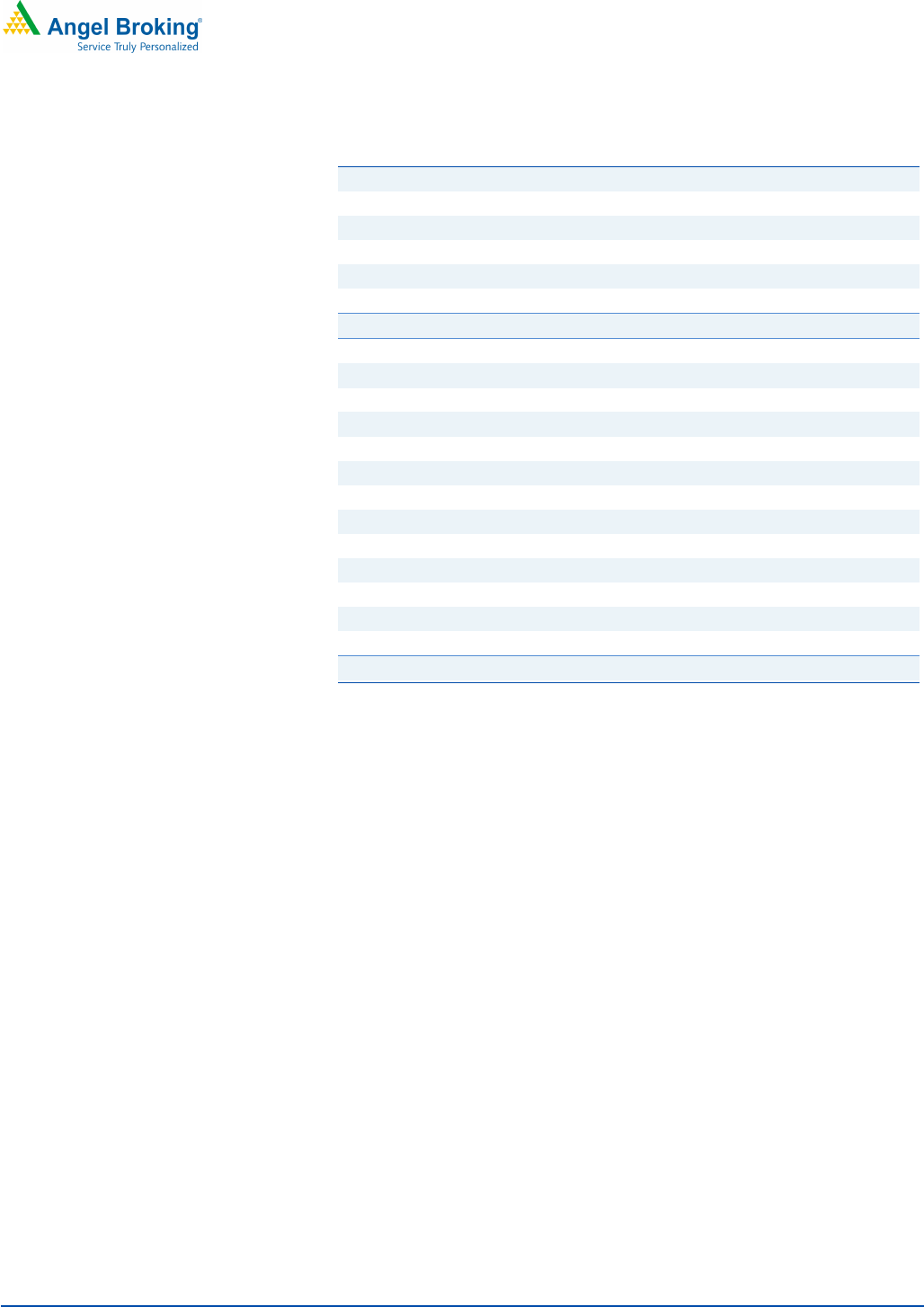

Key Financials

Y/E March (` cr) FY2015 FY2016 FY2017 1HFY18

Net Sales 308 347 427 207

% chg 24.2 12.4 23.2 -

Net Profit 46 28 52 6

% chg 12.9 (40.0) 88.2 -

OPM (%) 18.7 11.3 16.4 4.6

EPS (Rs) 7.1 4.3 8.0 0.9

P/E (x) 34.5 57.6 30.6 -

P/BV (x) 7.6 7.0 5.8 -

RoE (%) 21.9 12.1 19.1 -

RoCE (%) 20.9 12.1 19.9 -

EV/Sales (x) 5.1 4.6 3.7 -

EV/EBITDA (x) 27.1 40.5 22.4 -

Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end

of the price band

Neutral

Issue Open: Jan 16, 2018

Issue Close: Jan 18, 2018

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters

66.3%

Others

33.7%

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: `69.2cr

Issue size (amount): **`425

cr (Inculde offer

for sale -

`

330)

Price Band: `240-245

Lot Size: 61 shares and in multiple

thereafter

Post-issue implied mkt. cap: *`1,662cr -

**`1,696cr

Promoters holding Pre-Issue: 70.3

%

Promoters holding Post-Issue: 66.3

%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Fresh issue: `95cr

Issue Details

Face Value:

`10

Present Eq. Paid up Capital: `65.4cr

Amarjeet S Maurya

+022 39357600, Extn: 6831

amarjeet.maurya@angelbroking.com

Newgen Software Technologies Ltd

IPO Note |

IT

Jan 12, 2018

Newgen Software Technologies Limited | IPO Note

Jan 12, 2018

2

Company background

Newgen Software Technologies Limited is an IT company, incorporated in 1992

with head quarter in New Delhi. Newgen Software is a global provider of Business

Process Management (BPM), Enterprise Content Management (ECM), Customer

Communication Management (CCM), Document Management System (DMS),

Workflow and Process Automation. Some of the biggest clients of the company are

TCS, HP and HCL.

The firm currently sells its products across 60 countries. The company’s clients are

spread across banks, insurance firms, BPOs and healthcare organizations. It has

offices in the US, Canada, the United Kingdom, Singapore, and Dubai.

Exhibit 1: Diversified Global Customer Base

Source: Company, Angel Research

Newgen Software Technologies Limited | IPO Note

Jan 12, 2018

3

Issue details

NSTL’s IPO is a mix of Offer for sale and fresh issue. The issue would constitute

fresh issue worth of `95cr and Offer for sale worth of `330cr (at upper band). The

company will dilute 5.6% of its post-offer paid-up equity share capital.

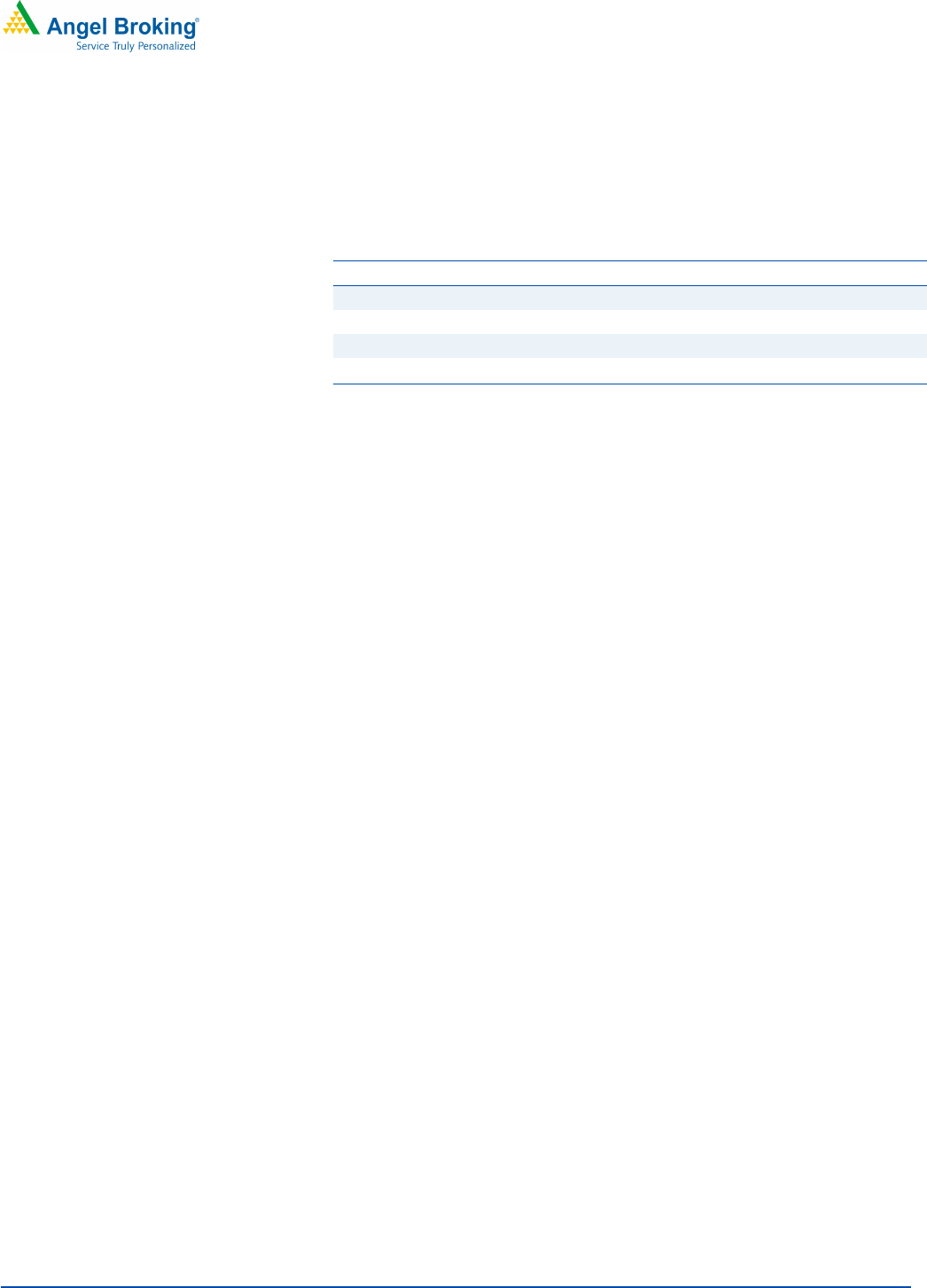

Exhibit 2: Pre and Post-IPO shareholding pattern

No of shares (Pre-

issue)

%

No of shares (Post-

issue)

%

Promoters

45,928,938 70.3%

45,928,938 66.3

%

Others

19,429,212

29.7%

23,306,763 33.7%

65,358,15

0

100.0% 69,235,701 100.0%

Source: Source: RHP, Note: Calculated on upper price band

Objectives of the offer:

The objectives of the IPO for the Company are:

to purchase and furnish office premises near Noida-Greater Noida

Expressway, Uttar Pradesh; and

general corporate purposes

Outlook and Valuation:

In terms of valuations, the pre-issue P/E works out to 274x its 1HFY2018

annualized earnings (at the upper end of the issue price band), which is higher

compared to its peers like Intellect Design Arena (trading at PE 143x -1HFY2018

annualized earnings). Further last four years historical financial records and

1HFY18 doesn’t provides confidence. Hence, we recommend Neutral rating on the

issue.

Key Risk

The company may be subject to intellectual property infringement claims

by other companies which could materially increase costs & harm

company’s ability to generate future revenue & profits.

Increase in competition from other player can impact the business of

company.

Newgen Software Technologies Limited | IPO Note

Jan 12, 2018

4

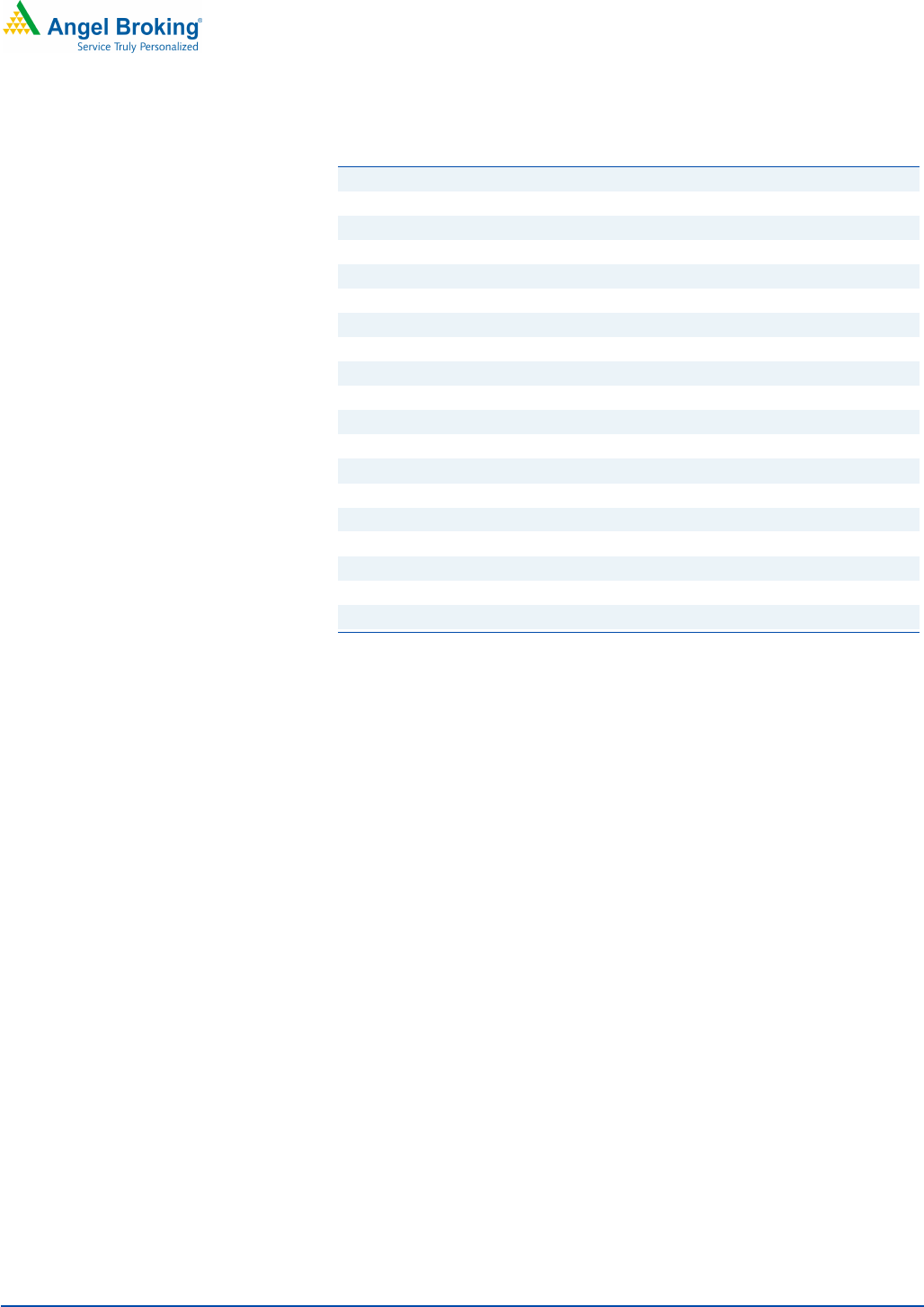

Consolidated Income Statement

Y/E March (` cr) FY2014

FY2015 FY2016 FY2017

1HFY18

Total operating income 248

308 347

427

207

% chg 23.5

24.2 12.4 23.2

-

Total Expenditure 200

251 308

357

198

Raw Material 3

0 -

-

-

Personnel 116

143 183

210

118

Others Expenses 82

107 -124

147

80

EBITDA 48

58 39 70

10

% chg 6.2

20.3 (32.1) 78.3

-

(% of Net Sales) 19.3

18.7 11.3 16.4 4.6

Depreciation& Amortization

4

4 4 5 3

EBIT 44

53 35 65 7

% chg 7.3

20.1 (34.7) 86.8

-

(% of Net Sales) 17.9

17.3 10.1 15.3 3.3

Interest & other Charges 1

2 4 4 2

Other Income 7

8 3 7 3

(% of PBT) 13.5

13.1 8.4 9.9 35.3

Share in profit of Associates

-

- -

-

-

Recurring PBT 50

59 34 68 8

% chg 11.7

18.8 (42.0) 97.3

-

Tax 9

13 6 15 2

(% of PBT) 17.4

21.5 18.7 22.5 23.7

PAT (reported) 41

46 28 52 6

% chg 11.2

12.9 (40.0) 88.2

-

(% of Net Sales) 16.5

15.0 8.0 12.3 2.8

Basic EPS (`) 6.3

7.1 4.3 8.0 0.9

Fully Diluted EPS (`) 6.3

7.1 4.3 8.0 0.9

% chg 11.2

12.9 (40.0) 88.2

-

Source: RHP, Angel Research

Newgen Software Technologies Limited | IPO Note

Jan 12, 2018

5

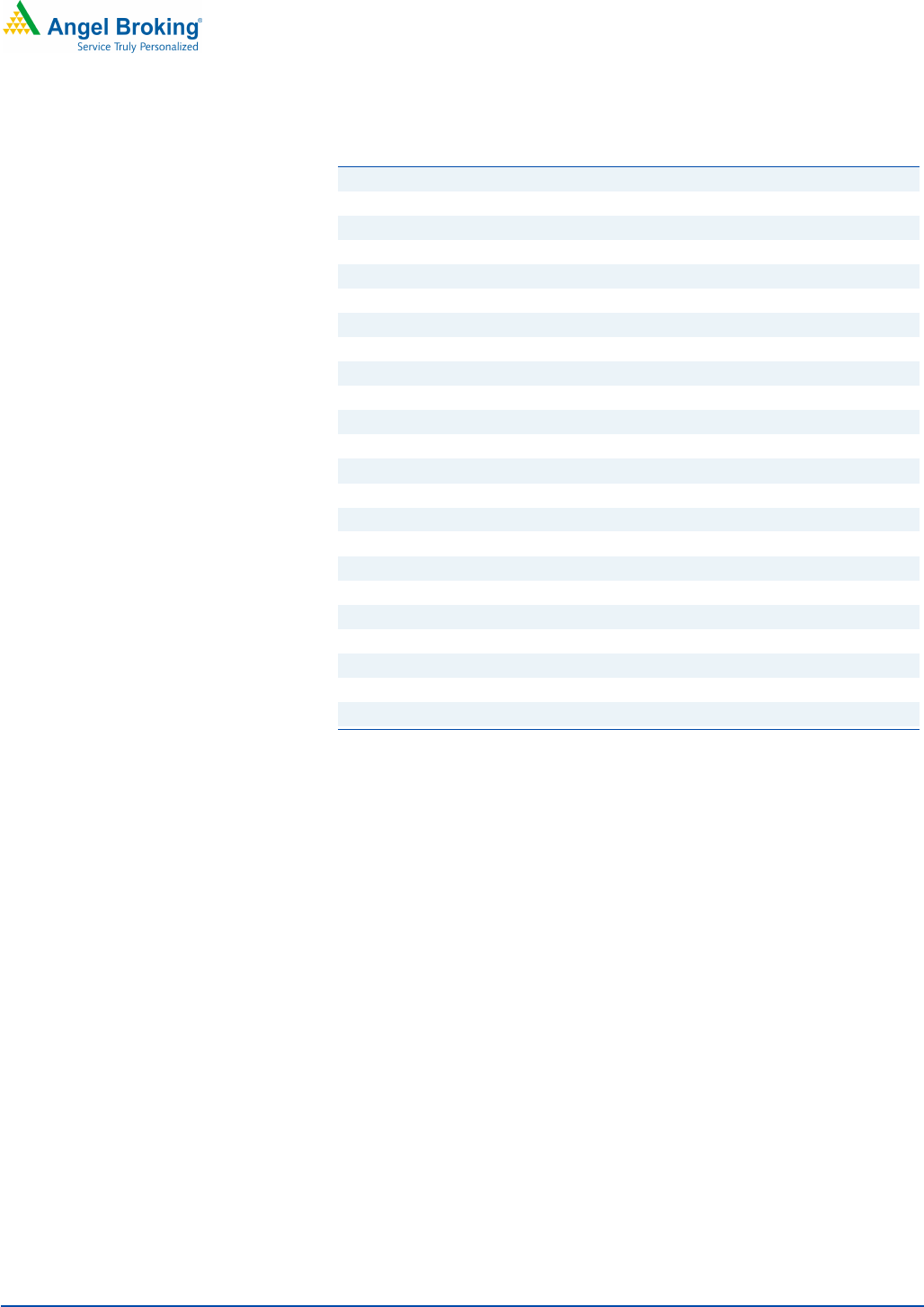

Consolidated Balance Sheet

Y/E March (` cr) FY2014

FY2015

FY2016

FY2017

1HFY18

SOURCES OF FUNDS

Equity Share Capital 10

63

63

63

64

Reserves& Surplus 163

148

166

211

208

Shareholders Funds 174

211

229

275

271

Total Loans 39

45

59

52

66

Deferred Tax Liability -

0

0

0

0

Total Liabilities 213

256

288

327

338

APPLICATION OF FUNDS

Net Block 19

23

57

55

54

Capital Work-in-Progress

3

5

6

11

17

Investments 55

60

45

48

49

Current Assets 184

231

273

322

327

Inventories -

-

-

-

-

Sundry Debtors 131

176

206

239

204

Cash 24

19

24

35

44

Loans & Advances 12

14

18

21

32

Other Assets 17

22

26

27

48

Current liabilities 52

68

101

120

123

Net Current Assets 132

162

172

203

205

Deferred Tax Asset 4

6

9

10

12

Total Assets 213

256

288

327

338

Source: RHP, Angel Research

Newgen Software Technologies Limited | IPO Note

Jan 12, 2018

6

Consolidated Cash Flow Statement

Y/E March (` cr) FY2014

FY2015 FY2016

FY2017

1HFY18

Profit before tax

50

59

34

68

8

Depreciation

4

4

4

5

3

Change in Working Capital (32)

(43)

(20)

(37)

10

Interest / Dividend (Net)

0

(0)

0

0

0

Direct taxes paid (8)

(13)

(17)

(17)

(11)

Others

4

2

9

14

4

Cash Flow from Operations

17

9

11

33

14

(Inc.)/ Dec. in Fixed Assets (6)

(10)

(22)

(10)

(8)

(Inc.)/ Dec. in Investments (53)

1

16

3

1

Cash Flow from Investing (59)

(9)

(6)

(6)

(7)

Issue of Equity (1)

0

0

0

0

Inc./(Dec.) in loans

62

6

14

(3)

15

Dividend Paid (Incl. Tax) (6)

(9)

(12)

(8)

(12)

Interest / Dividend (Net) (1)

(2)

(3)

(4)

(2)

Cash Flow from Financing

53

(6)

(1)

(15)

1

Inc./(Dec.) in Cash

11

(5)

5

11

8

Effect of exch diff on cash

0

(0)

0

(0)

1

Opening Cash balances

13

24

19

24

35

Closing Cash balances

24

19

24

35

44

Source: Company, Angel Research

Newgen Software Technologies Limited | IPO Note

Jan 12, 2018

7

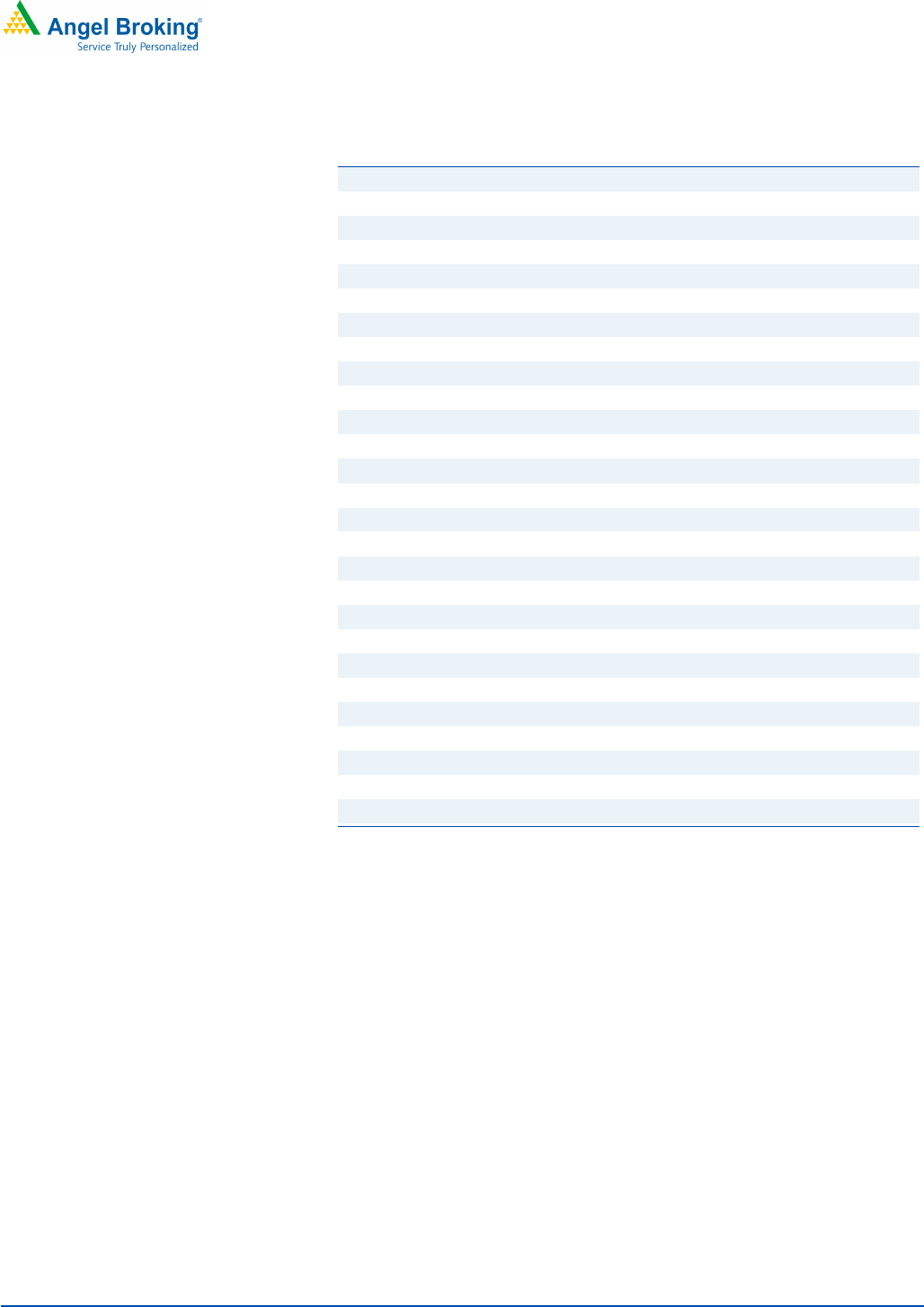

Exhibit 3: Key Ratios

Y/E March FY2014 FY2015 FY2016 FY2017

Valuation Ratio (x)

P/E (on FDEPS) 39.0 34.5 57.6 30.6

P/CEPS 35.9 31.6 49.8 28.0

P/BV 9.2 7.6 7.0 5.8

Dividend yield (%) 0.0 0.0 0.0 0.0

EV/Sales 6.3 5.1 4.6 3.7

EV/EBITDA 32.5 27.1 40.5 22.4

EV / Total Assets 7.3 6.1 5.5 4.8

Per Share Data (Rs)

EPS (Basic) 6.3 7.1 4.3 8.0

EPS (fully diluted) 6.3 7.1 4.3 8.0

Cash EPS 6.8 7.8 4.9 8.8

DPS 0.0 0.0 0.0 0.0

Book Value 26.6 32.3 35.1 42.0

Returns (%)

ROCE 20.9 20.9 12.1 19.9

Angel ROIC (Pre-tax) 33.3 30.1 15.9 26.7

ROE 23.7 21.9 12.1 19.1

Turnover ratios (x)

Inventory / Sales (days) - - - -

Receivables (days) 192 208 216 205

Payables (days) 11 17 16 15

Working capital cycle (ex-

cash) (days)

182 191 201 189

Source: Company, Angel Research

Newgen Software Technologies Limited | IPO Note

Jan 12, 2018

8

Research Team Tel: 022

-

39357800

E

-

mail: research@angelbroking.

com Website:

www.angelbroking.com

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.