IPO Note | Hospitals

December 16, 2015

Narayana Hrudayalaya

NEUTRAL

Issue Open: December 17, 2015

IPO Note

Issue Close: December 21, 2015

Narayana Hrudayalaya (NHL) is one of the leading private healthcare service

providers in India with a strong presence in Karnataka and the Eastern region

Face Value: `10

with while it is growing its presence is other parts of India as well. The company

Present Eq. Paid up Capital: `200cr

has a relatively light asset model with it owning just 1,613 out of its 5,442 operational

Offer Size: 2.5cr Shares

beds. It has a strong brand name and is known for its clinical excellence and being an

affordable healthcare service provider. It currently has 23 hospitals.

Post Eq. Paid up Capital: `200cr

Potential improvement in profitability: Generally, hospital businesses have a long

Issue size (amount)**: `600cr - `613cr

gestation period before they mature (in terms of occupancy rates) and it may

operate at a loss for a period of time before achieving profitability. Currently,

Price Band**: `245-250

NHL is in an investment phase where the company has increased its bed count at

Post-issue implied mcap**: `5,007cr-5,109cr

a higher rate in comparison to its peer Apollo Hospitals (Apollo). As a result, its

top-line has grown at a faster rate but its occupancy and profitability levels are

Promoters holding Pre-Issue: 64.0%

not as high as that of Apollo. Going forward, with NHL’s pace of expansion being

Promoters holding Post-Issue: 62.0%

slightly slower than in the past, we expect it to gradually increase its occupancy

Note:**at Lower and Upper price band respectively

rates and enhance its profitability.

Upcoming projects under light asset model to complement growing need for

healthcare delivery in India: Unlike its peers, which have higher number of owned

Book Building

hospitals, NHL has fewer owned hospitals while the rest are on either lease &

operate, revenue sharing, or managed basis. Going forward, the company plans

QIBs

At least 50%

to expand its bed-count following the asset light route, which would include PPP or

Non-Institutional

At least 15%

on operation and management basis, to grow its presence in other parts of the

country. Moreover, India lags behind other developing and developed countries

Retail

At least 35%

in terms of overall bed density, total expenditure on healthcare, and consumers

here incur a higher out-of-pocket expenditure on healthcare. We believe that the

company can gradually build its presence with efficient use of capital and by

Post Issue Shareholding Pattern (%

leveraging on its brand name to capitalize on the available opportunity in the

Promoters Group

62.0

under-penetrated healthcare delivery market in India.

MF/Banks/Indian

Outlook and Valuation: Currently, NHL’s operating margin is lower than its close

FIs/FIIs/Public & Others

38.0

peer Apollo Hospitals on account of lower realizations (focus on affordable

healthcare) and has lower occupancy rates. Since the hospital business has longer

gestation period, we expect the occupancy and overall profitability to improve

over a longer period of time. On the valuation front, at the upper end of the price

band, FY2016E annualized EV/Sales multiple works out to 3.4x for NHL which is

not at a significant discount to Apollo (which trades at 3.6x). Hence we have a

Neutral view on the IPO from a short term perspective. However, investors with a longer

term investment horizon can subscribe to the issue considering that the company’s

performance is expected to be more favorable in the longer run as the hospital business

entails a longer gestation period and takes time to perform at optimum levels.

Key Financial Consolidated

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

Net Sales

658

839

1,095

1,364

% chg

37.7

27.6

30.5

24.5

Net Profit

26

25

32

(11)

% chg

88.8

(3.7)

27.9

(134.3)

OPM (%)

12.5

9.7

11.0

9.5

Amarjeet Maurya

EPS (`)

1.3

1.2

1.6

(0.5)

P/E (x)

198.4

206.0

161.1

-

+91 22 4000 3600 Ext: 6831

P/BV (x)

9.9

9.3

8.8

6.7

RoE (%)

5.0

4.5

5.5

-

RoCE (%)

7.1

4.6

7.3

5.8

Milan Desai

EV/Sales (x)

7.9

6.3

4.8

3.9

+91 22 4000 3600 Ext: 6846

EV/EBITDA (x)

63.3

65.2

44.2

41.3

Source: Company, Angel Research, valuation ratios calculated at upper end of price band

Please refer to important disclosures at the end of this report

1

Narayana Hrudayalaya | IPO Note

Company Background

Founded in 2000 by Dr. Devi Prasad Shetty (Promoter), NHL is one of the leading

private healthcare service providers in India, operating a chain of multispecialty,

tertiary and primary healthcare facilities. Currently, NHL has a network of 23

hospitals (multispecialty and super specialty healthcare facilities which provide

tertiary care), 8 heart centers (super specialty units which are set up in a third party

hospital) and 24 primary care facilities (including clinics and information centers),

across a total of 31 cities, towns and villages in India. The network comprises of

5,442 operational beds while the capacity at the existing hospitals could be

augmented to 6,602 beds. Apart from this, NHL is also expected to commence

operations at 3 new facilities (Vaishno Devi, Mumbai and Lucknow) over the next

24 months, thereby increasing the number of beds by 864. It has a strong

presence in the southern state of Karnataka and Eastern India, as well as an

emerging presence in Western and Central India. Dr. Devi Prasad Shetty, is a

cardiac surgeon with over 30 years of medical experience.

Its centres provide advanced levels of care in over 30 specialties, including

cardiology and cardiac surgery, cancer care, neurology and neurosurgery,

orthopaedics, nephrology and urology, and gastroenterology.

As of FY2015, NHL generated 90.7% of its revenue from its 19 hospitals offering

multispecialty and super specialty services, 7.3% of its revenue from heart centers

and the balance from the management fee received from four managed hospitals,

ancillary businesses and other standalone clinics and primary care facilities.

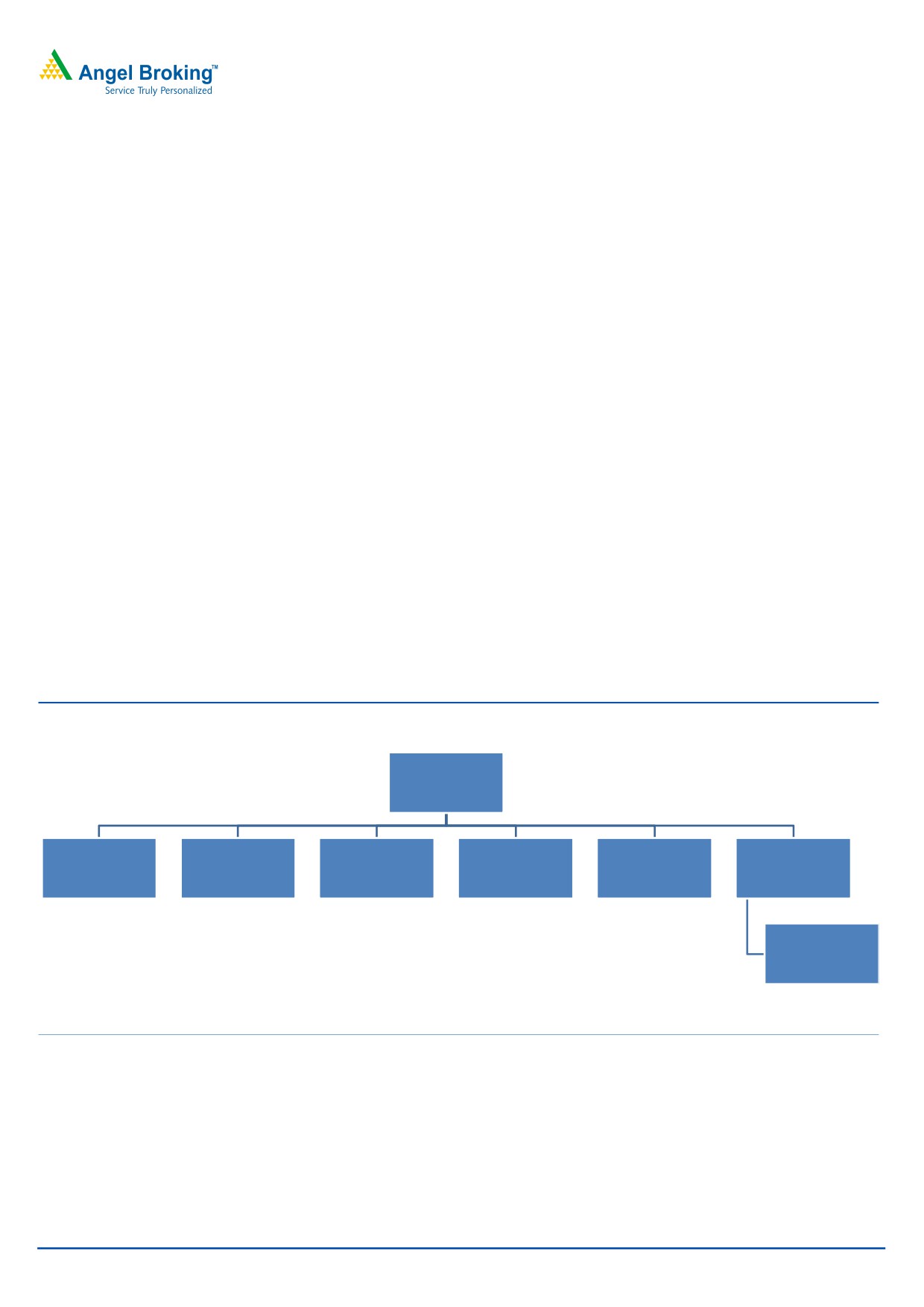

Exhibit 1: Corporate Structure

Narayana

Hrudayalaya

Narayana Hospitals

AHDL - 100% (Operates

MMRHL - 99% (Operates

- 100%

NVDSHPL - 100% (Intended

facility in Berthampore

West Bank facilities, one is

NSHSPL - 74% (Operates

Narayana Cayman Holding

(Holds land alloted in

to operate upcoming

granted on a lease basis by

freehold and the other on

facility in Mysore)

- 100% (Holding Company)

Jaipur, Ahmedabad and

hospital in Vaishno Devi)

the Murshidabad Zilla

long term lease granted by

Siliguri)

Parishad)

West Bengal Government)

HCCI - 28.6% (Operates

the facility in Grand

Cayman)

Source: RHP, Angel Research

December 16, 2015

2

Narayana Hrudayalaya | IPO Note

Issue details

The issue is an offer for sale by promoters and non-promoters of 2.45cr equity

shares aggregating to `613cr at the upper end of the price band. The issue

constitutes 12.0% of the paid-up equity share capital of the company. There is no

fresh capital being raised by the company.

Exhibit 2: Share holding pattern

Pre-Issue

Post-Issue

No. of Share (cr.)

(%)

No. of Share (cr.)

(%)

Promoters

13.1

64.0

Promoters

12.7

62.0

Dr. Devi Prasad Shetty

6.7

Dr. Devi Prasad Shetty

6.5

Shakuntala Shetty

6.4

Shakuntala Shetty

6.2

Investors

4.4

21.7

Investors

2.4

11.7

Ashoka Investment Holdings Limited

1.7

Ashoka Investment Holdings Limited

1.1

Ambadevi Mauritius Holding Limited

0.5

Ambadevi Mauritius Holding Limited

0.3

JPMorgan Mauritius

2.2

JPMorgan Mauritius

1.0

Others

2.9

14.3

Others

5.4

26.3

Total

20.4

100.0

Total

20.4

100.0

Source: Company, Angel Research

Objects of the Issue

The issue comprises of sale of shares by existing investors (10%) and promoters

(2%) and as a result, the company will not be receiving any proceeds of this offer.

However, the company will reap the benefits from being listed as it will enhance its

image. Besides, the issue will provide liquidity to the company’s existing

shareholders.

December 16, 2015

3

Narayana Hrudayalaya | IPO Note

Investment Arguments

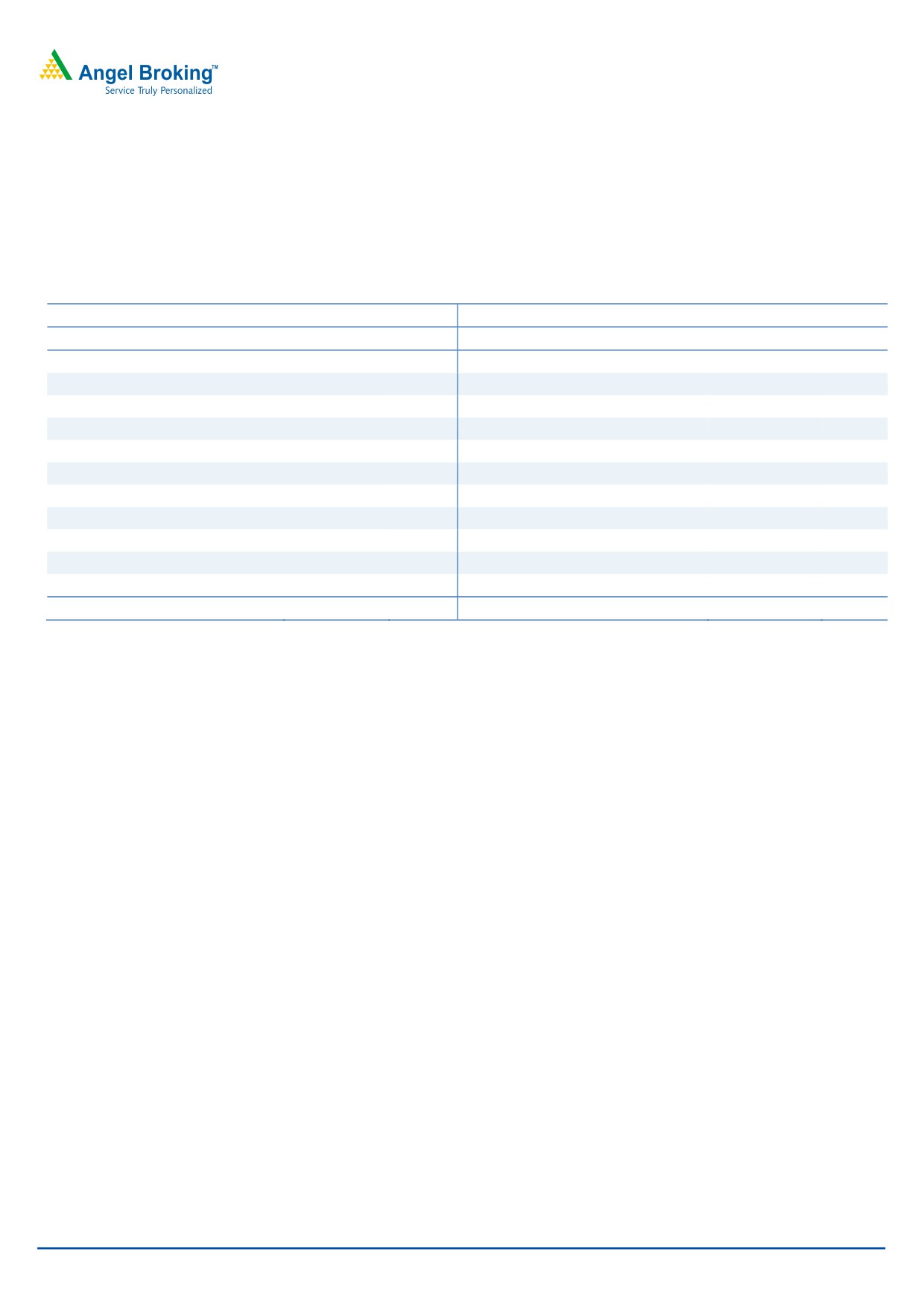

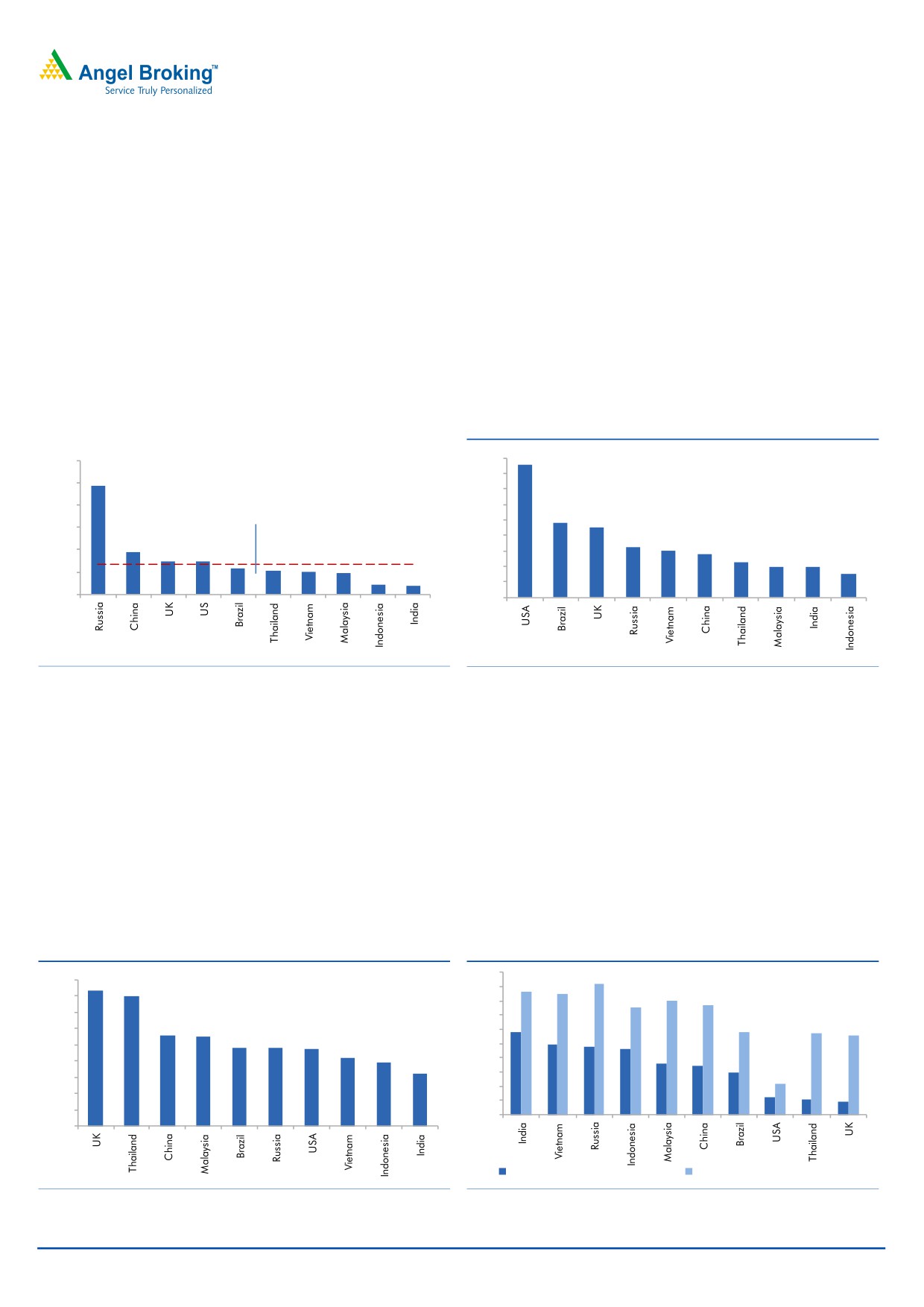

Potential of improvement in operating margin

Currently the company is in an investment phase and over the last few years it has

increased its bed count significantly. During FY2013-15, the company has

increased its bed count from 3,834 to 5,352 (a growth of ~40%) and on the other

hand, its peer Apollo has increased its bed capacity from 6,382 to

7207

representing a growth of 13%. This led to higher revenue growth but lower

occupancy and lower profitability for NHL. At the same time, Apollo has not added

beds aggressively which has resulted into higher occupancy rate and better margin

profile in comparison to NHL.

Exhibit 3: No. of bed additions during FY13-15

Exhibit 4: Occupancy rate during the same period

72.0

75

71.0

8,000

68.0

7,207

70

7,000

6,382

65

6,000

5,352

60

5,000

55

3,834

4,000

50

52.8

3,000

45

48.0

2,000

40

44.8

1,000

35

-

30

NHL

Apollo

FY2013

FY2014

FY2015

FY2013

FY2015

NHL

Apollo

Source: Company, Angel Research, Apollo PPT

Source: RHP, Angel Research

Exhibit 5: Higher bed addition resulted in stronger

Exhibit 6: Operational beds and margin profile for

top-line growth (CAGR) for NHL

NHL

35

50%

44%

30

30

40%

29%

25

30%

23.5%

19

20

17%

20%

10%

15

10%

4.8%

3.4%

10

0%

5

< 5 years old

3-5 years old

> 3 years old Acquired facilities

-10%

-

-20%

-14.4%

NHL

Apollo

FY11-15

Operational beds (%)

EBITDA margin (%)

Source: RHP, Angel Research

Source: RHP, Angel Research

Generally, hospital businesses have long gestation periods before they mature

(particularly with respect to occupancy rates) and they may operate at a loss for a

period of time before achieving profitability. As per the RHP, at end of FY2015,

NHL had 44% of its operational beds in the mature stage (at more than 5-year old

hospitals) having ~23.5% EBITDA margin and the balance at below 5-year old

hospitals were having lower profitability/loss at the EBITDA level.

Hence, going forward, the company will increase its capacity by 800-1,000 beds

over the next two years, following a relatively asset-light model, which is slower

December 16, 2015

4

Narayana Hrudayalaya | IPO Note

than the current pace. Thus, we believe that the company will gradually be able to

increase its occupancy rates with assist from its strong brand value.

Upcoming projects following the asset light model

Unlike its peers, NHL has fewer hospitals on an ownership basis. The company has

4 owned hospitals totaling to 1,613 beds which account for ~45% of revenues.

The remaining beds are on lease and operate, managed, or on a revenue sharing

model.

Exhibit 7: Various Operating Models

Model

Number of Operational Beds

Owned and Managed

1,613

Revenue Share

1,326

Lease and Operated

1,250

Managed

737

Clinics and Cayman Island

516

Total

5,442

Source: RHP, Angel Research

Currently, the company has a strong presence in Karnataka and the Eastern region

and it plans to grow its presence in other parts of the country. This bed addition

will be via the asset light route, which would include PPP or on operation and

management basis. As a result, the company will be incurring lower capex and

would thus enable it in delivering better return ratios.

Exhibit 8: Upcoming project for NHL

No of capacity

Location

Executed on the basis

Period

Types

beds to be added

Vaishno Devi

Public-private basis

Within the next 12 months

Multispeciality

241

Lucknow

Operation and Management basis

Within the next 24 months

Multispeciality

326

Mumbai

Operation and Management basis

Within the next 24 months

Multispeciality, Paediatric

297

Bhubaneshwar

Tertiary Care

Total

864

Source: RHP, Angel Research

December 16, 2015

5

Narayana Hrudayalaya | IPO Note

Pan India Presence

NHL is a well recognized brand with a reputation for clinical excellence and is

known for providing affordable healthcare services. It has a pan-India network

with a strong presence in Karnataka and Eastern India. Apart from this, the

company is also increasing its presence in the Western and the Central region. We

believe that the company can successfully leverage upon its brand name and

sound business model to scale up its presence in other parts of India.

Exhibit 9: Network with a strong presence in Karnataka and eastern India

Source: RHP, Angel Research

December 16, 2015

6

Narayana Hrudayalaya | IPO Note

Potential to increase bed capacities; lower out-of-pocket spend to

benefit hospital industry

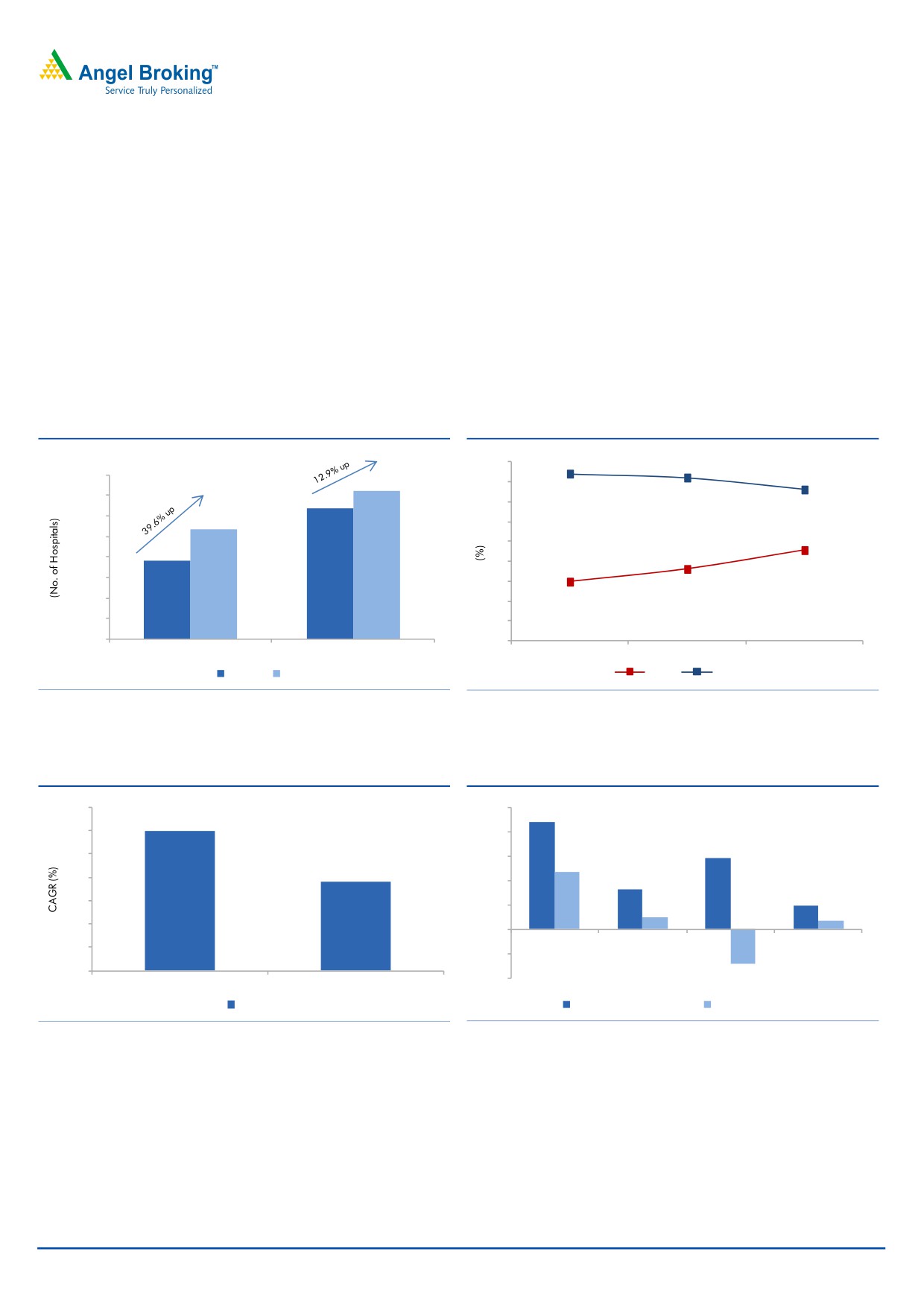

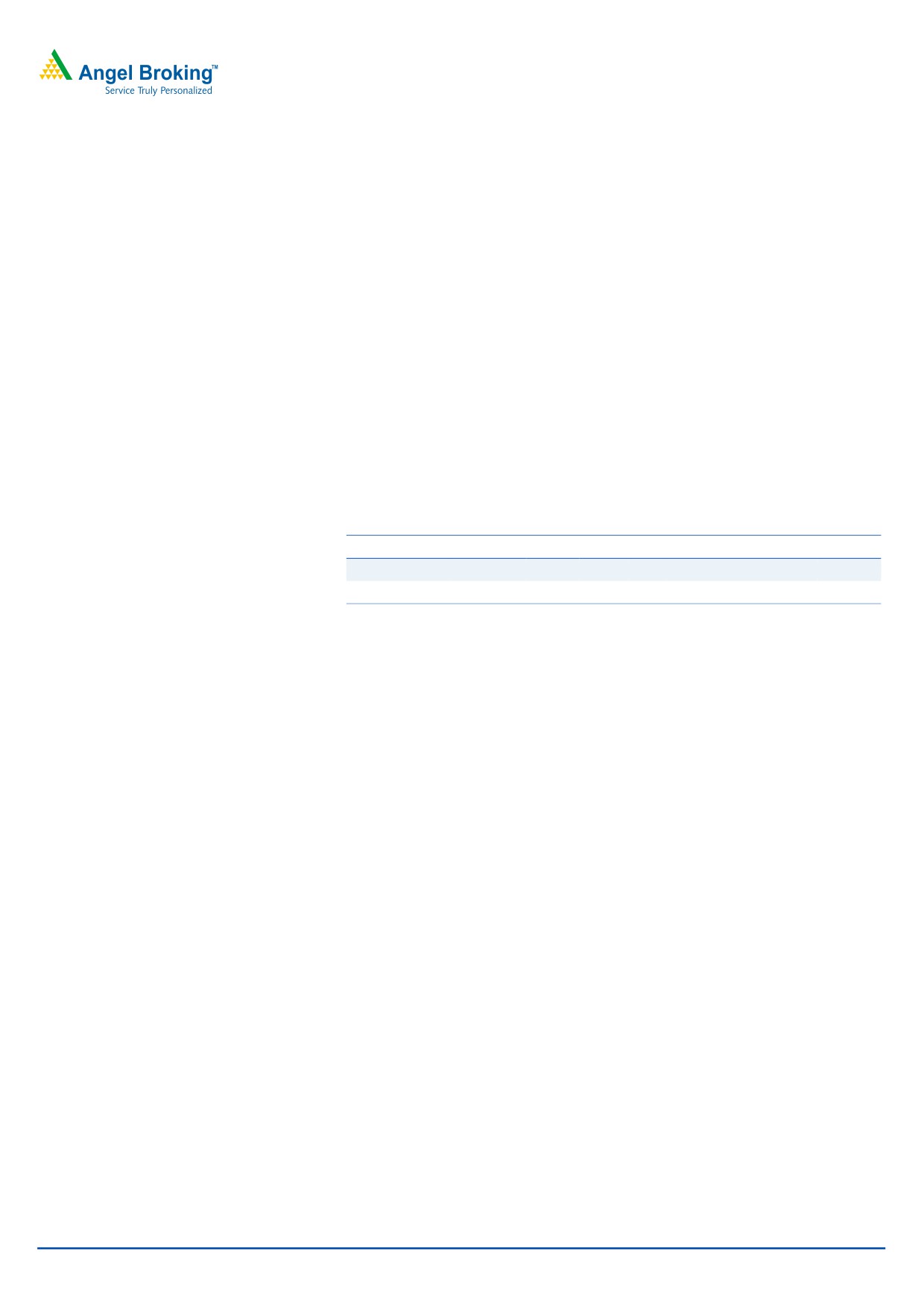

As per a report by Crisil, India has an overall bed density of ~7 per 10,000

population, which is significantly lower than that of other developing nations like

Brazil, Malaysia, Vietnam, and Indonesia and the global median of 27. One of the

reasons behind lower bed density in India could be lower total expenditure on

healthcare, which at 4.0% of GDP is one of the lowest among the developing and

developed nations. Of the total expenditure on healthcare in India, the

government’s contribution stands at ~32.2%, which too happens to be the lowest

among countries. Such lower spend has resulted in poor affordability of healthcare

services by a vast majority of India’s population.

Exhibit 10: Hospital bed density- India vs others (2012)

Exhibit 11: Total healthcare exp. as a % of GDP (2013)

120

18

17.1

97

16

100

14

80

12

Global median-27 Beds

9.7

10

9.1

60

38

8

6.5

6

5.6

40

29

29

6

4.6

23

21

20

19

4

4

4

3.1

20

9

7

2

0

0

Source: RHP, Angel Research

Source: RHP, Angel Research

As per the WHO, of the total healthcare expense in India, 58% is borne by

consumers directly (without insurance coverage or reimbursements). This

proportion is relatively higher at 86% in case of private healthcare services. Higher

out-of-pocket spend in terms of private healthcare services can be attributed to

lower penetration of health insurance. Growing affordability on account of higher

insurance penetration, growing overall population, improvement in income levels,

and growing working population coupled with changing lifestyles which are

leading to higher lifestyle related chronic diseases, are expected to be the key

drivers for the hospital industry in the country.

Exhibit 12: Government’s contribution on healthcare as

Exhibit 13: Proportion of out-of-pocket spending on

% of total healthcare spend

healthcare (2013)

100

92

90

83.5

86

85

80.1

90

80

80

75

77

80

70

70

58

58

57

56

60

55.8

54.8

60

49

48

48.2

48.1

46

47.1

50

50

41.9

39.0

36

34

40

40

30

32.2

30

22

30

20

12

11

20

9

10

10

0

0

OOP % of Total Healthcare Expend. OOP % of Pvt. Healthcare Expend.

Source: RHP, Angel Research

Source: RHP, Angel Research

December 16, 2015

7

Narayana Hrudayalaya | IPO Note

Outlook and Valuation

The company has registered a CAGR of 30% in revenues over FY2011-15 to

`1,364cr and its EBITDA has grown at a CAGR of 23.0% to `1,29cr over the same

period. For FY2015, the company has reported a net loss of ~`11cr on account of

loss posted in its subsidiary (HCCI Cayman island associate).

Currently, NHL’s operating margin is lower than its close peer Apollo Hospitals on

account of lower realizations (with focus on affordable healthcare) and has lower

occupancy rates. Since the hospital business has a longer gestation period, we

expect the occupancy and overall profitability to improve over a longer period of

time. On the valuation front, at the upper end of the price band, FY2016E

annualized EV/Sales multiple works out to 3.4x for NHL which is not at a

significant discount to Apollo (which trades at 3.6x). Hence we have a Neutral view

on the IPO from a short term perspective. However, investors with a longer term

investment horizon can subscribe to the issue considering that hospital businesses

take longer to perform at optimum levels.

Exhibit 14: Valuations

Sales OPM PAT EV/Operational Bed

EV/Sales

NHL

FY2016E*

1,567

11.1

25

1.0

3.4

Apollo Hospitals FY2016E*

5,945

13.8

378

2.4

3.6

Source: Company, Angel Research; Note: *Mcap based on post IPO O/s Shares at upper price

band and based on annualized numbers

Key risks/concerns

Lower capacity utilization can impact profitability: The company has laid out plans

to increase its presence in Eastern India while also growing its presence in Western

and Central Indian markets. The company expects to commence 3 hospitals in a

span of 2 years which will add 864 beds. Since hospitals take ~5 years to reach

the matured state, lower than expected utilization levels at newer hospitals can

impact profitability. Although the Vaishno Devi hospital will be EBITDA neutral, the

impact on profitability is not expected to be severe.

Retention and shortage of skilled doctors: Attrition of reputed doctors can have an

impact on the financials. Of the 2,563 doctors, 1,750 were engaged on a

consultancy basis. The company has not entered into employment contracts with

these doctors and there is no assurance that these doctors will continue to provide

their services. Failure to seek their services on a long term basis may impact the

revenue and profitability of the company.

December 16, 2015

8

Narayana Hrudayalaya | IPO Note

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

1HFY16

Total operating income

658

839

1,095

1,364

783

% chg

37.7

27.6

30.5

24.5

Total Expenditure

576

758

975

1,235

696

Purchase of Consumables

196

233

281

341

190

Personnel Expenses

113

157

198

277

160

Others Expenses

267

369

495

617

346

EBITDA

82

81

120

129

87

% chg

47.7

(1.2)

47.8

7.6

(32.5)

(% of Net Sales)

12.5

9.7

11.0

9.5

11.1

Depreciation& Amortisation

37

46

57

67

35

EBIT

45

35

63

63

52

% chg

91.2

(21.6)

77.7

(0.2)

(% of Net Sales)

6.8

4.2

5.7

4.6

6.6

Interest & other Charges

9

17

28

41

17

Other Income

3

15

22

8

5

(% of PBT)

7.5

44.8

39.5

26.4

13.0

Recurring PBT

39

34

57

29

40

% chg

85.6

(12.6)

67.7

(48.2)

36.5

Extraordinary Items

-

-

-

-

-

PBT (reported)

39

34

57

29

40

Tax

13

10

21

18

15

(% of PBT)

33.5

29.5

37.7

59.7

37.1

PAT (reported)

26

24

35

12

25

Minority Interest

0

1

2

2

0

Share in profit of Associates

-

0

(6)

(25)

(13)

PAT after MI (reported)

26

25

32

(11)

12

Extraordinary Items

-

-

-

-

-

ADJ. PAT

26

25

32

(11)

12

% chg

88.8

(3.7)

27.9

-

(% of Net Sales)

3.9

3.0

2.9

(0.8)

1.6

Basic EPS (`)

1.3

1.2

1.6

(0.5)

0.6

Fully Diluted EPS (`)

1.3

1.2

1.6

(0.5)

0.6

% chg

88.8

(3.7)

27.9

-

December 16, 2015

9

Narayana Hrudayalaya | IPO Note

Consolidated Balance Sheet

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

1HFY16

SOURCES OF FUNDS

Equity Share Capital

0

0

0

200

200

Reserves& Surplus

515

547

580

565

581

Shareholders Funds

515

547

580

765

781

Minority Interest

2

5

3

1

0

Total Loans

116

219

279

305

201

Deferred Tax Liability

18

19

25

29

26

Other LT Liabilities

1

2

2

5

2

Long-term provisions

5

6

6

11

10

Total Liabilities

657

797

896

1,115

1,021

APPLICATION OF FUNDS

Gross Block

616

791

962

1,156

1,213

Less: Acc. Depreciation

125

171

225

312

346

Net Block

491

620

737

843

867

Capital Work-in-Progress

87

44

20

20

15

Goodwill

-

-

1

59

59

Investments

-

7

51

52

70

Current Assets

129

176

239

261

298

Inventories

28

38

49

51

54

Sundry Debtors

67

91

134

143

157

Cash

19

25

28

30

44

Loans & Advances

10

13

14

26

31

Other Assets

4

7

13

11

13

Current liabilities

126

166

260

245

411

Net Current Assets

3

10

(21)

16

(113)

LT loans and advances

76

114

106

123

121

Other non-current assets

-

1

1

1

2

Deferred Tax Asset

-

-

-

-

-

Mis. Exp. not written off

-

-

-

-

-

Total Assets

657

797

896

1,115

1,021

December 16, 2015

10

Narayana Hrudayalaya | IPO Note

Consolidated Cash flow statement

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

1HFY16

Profit before tax

39

34

57

29

40

Depreciation

37

46

57

67

35

Change in Working Capital

(19)

(22)

7

(39)

47

Interest / Dividend (Net)

9

16

28

40

16

Direct taxes paid

(13)

(17)

(20)

(22)

(16)

Others

0

(12)

(19)

2

1

Cash Flow from Operations

53

45

110

77

125

(Inc.)/ Dec. in Fixed Assets

(121)

(140)

(124)

(221)

(65)

(Inc.)/ Dec. in Investments

(30)

(7)

(45)

(1)

(18)

Cash Flow from Investing

(91)

(147)

(168)

(222)

(83)

Issue of Equity

10

10

-

194

-

Inc./(Dec.) in loans

37

-

-

-

-

Dividend Paid (Incl. Tax)

-

-

-

-

-

Interest / Dividend (Net)

(12)

108

61

146

(28)

Cash Flow from Financing

35

108

61

146

(28)

Inc./(Dec.) in Cash

(3)

6

3

1

14

Opening Cash balances

22

19

25

28

30

Closing Cash balances

19

25

28

30

44

December 16, 2015

11

Narayana Hrudayalaya | IPO Note

Key Ratios

Y/E March

FY2012

FY2013

FY2014

FY2015

Valuation Ratio (x)

P/E (on FDEPS)

198.4

206.0

161.1

-

P/CEPS

81.2

73.2

55.1

65.1

P/BV

9.9

9.3

8.8

6.7

Dividend yield (%)

0.0

0.0

0.0

0.0

EV/Sales

7.9

6.3

4.8

3.9

EV/EBITDA

63.3

65.2

44.2

41.3

EV / Total Assets

6.6

5.5

4.6

3.9

Per Share Data (`)

EPS (Basic)

1.3

1.2

1.6

(0.5)

EPS (fully diluted)

1.3

1.2

1.6

(0.5)

Cash EPS

3.1

3.4

4.5

3.8

DPS

0.0

0.0

0.0

0.0

Book Value

25.2

26.8

28.4

37.4

Returns (%)

ROCE

7.1

4.6

7.3

5.8

Angel ROIC (Pre-tax)

7.3

4.8

8.0

6.3

ROE

5.0

4.5

5.5

(1.4)

Turnover ratios (x)

Asset Turnover (Gross Block)

1.1

1.2

1.2

1.3

Inventory / Sales (days)

16

17

16

14

Receivables (days)

37

40

45

38

Payables (days)

39

34

51

37

Working capital cycle (ex-cash) (days)

14

23

10

15

December 16, 2015

12

Narayana Hrudayalaya | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

December 16, 2015

13