IPO Note | Financials

Oct 31, 2017

The New India Assurance Company Ltd

NEUTRAL

sue Open: Nov 1, 2017

Is

Issue Close: Nov 3, 2017

The New India Assurance Company Ltd (NIA) is the leader in the non-life

insurance in India, controlling hefty 15% market share in terms of gross direct

Issue Details

premium

(`23,230cr). It issued

27.10 million policies across all product

segments. NIA is also market leader in Fire, marine, Motor & health insurance

Face Value: `5

with market share of 19.1%, 21.1%, 15.1% and 18.4%, respectively. As of June

Present Eq. Paid up Capital: `212cr

30, 2017, NIA distribution network in India included 68,389 individual agents

and bancassurance arrangements with 25 banks in India. The company has

Offer for Sale: **9.6cr Shares

developed a pan-India branch network. As on 1QFY2018, NIA had an

Fresh issue: `1,920cr

investment book worth `55,028cr on which company has been able to generate

yield of 8.1% for FY2017.

Post Eq. Paid up Capital: `212cr

Positives: a) Established brand and market leadership in Fire, Marine, Motor &

Issue size (amount): *`9,240cr -

Health insurance; b) Longstanding global footprint and successful international

**9,600cr

operations; c) Multi-channel distribution network; d) Capitalizing on lower

Price Band: `770-800

penetration of non-life insurance in India.

Lot Size: 18 shares and in multiple

thereafter

Investment concerns: a) Though NIA is market leader in terms of gross direct

premium but it reports loss in the insurance business (unprofitable underwriting).

Post-issue implied mkt. cap: *`63,448cr

- **`65,920cr

The combined ratio has consistently remained high for last 5 years at more than

115% and for FY2017 company reported combined ratio of 120%; b) it has been

Promoters holding Pre-Issue: 100%

reporting subdued ROE, average ROE for last 5 years is 9% and for FY2017 -

Promoters holding Post-Issue: 85%

7%; c) Declining interest rate would impact interest income on debt investment.

*Calculated on lower price band

Outlook & Valuation: At the upper price band of `800 the issue is offered at 5x

** Calculated on upper price band

FY2017 book value and 76x FY2017 EPS. Its listed peer ICICI Lombard is trading

Book Building

at 8x FY2017 book value and 48 times FY2017 EPS. ICICI Lombard reported

decent ROE of 17% and average ROE for last 5 years is 19%, while NIA reported

QIBs

50% of issue

subdued ROE of 7% for FY2017 and average ROE of 9%. NIA’s combined ratio is

Non-Institutional

15% of issue

consistently higher than

115%, which is impacting the profitability of the

Retail

35% of issue

company. Considering the subdued ROE, inconsistent PAT and higher combined

ratio, we recommend NEUTRAL rating on the issue.

Post Issue Shareholding Patter

Key Financials

Promoters

85%

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17

Premium Earned

9,599

10,994

13,354

15,215

17,675

Others

15%

% chg

15

21

14

16

Net Profit

914

805

1,377

930

840

% chg

(12)

71

(32)

(10)

EPS

11

10

17

12

10

Book Value

121

134

146

156

160

P/E (x)

70

80

46

69

76

P/BV (x)

7

6

5

5

5

ROE (%)

9

8

12

7

7

Combined Ratio

116

118

116

118

120

Jaikishan J Parmar

Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end o

+022 39357600, Extn: 6810

the price band

Please refer to important disclosures at the end of this report

1

The New India Assurance Company Limited | IPO Note

Company background

The New India Assurance Company Limited was incorporated on July 23, 1919.

Pursuant to the 1973 Scheme which came into force on January 1, 1974, the

company was nationalized by the Government of India.

NIA is the largest general insurance company in India in terms of net worth,

domestic gross direct premium, and number of branches as of and for the fiscal

year ended March 31, 2017 (Source: CRISIL Report). The Company has been in

operation for almost a century.

NIA’s insurance products can be broadly categorized into the following product

verticals i.e. fire insurance, marine insurance, motor insurance, crop insurance,

health insurance and other insurance products.

In FY2017, gross direct premium from fire, engineering, aviation, liability, marine,

motor and health insurance represented a market share of 19.1%, 21.9%, 29.6%,

18.2%, 21.0%, 15.1% and 18.4% respectively of total gross direct premium in

these segments in India. Moreover, NIA is the market leader in each such product

segment (Source: CRISIL Report).

As of 1QFY2018, NIA’s distribution network in India included 68,389 individual

agents and 16 corporate agents and bancassurance arrangements with 25 banks

in India. The company has developed a pan-India branch network. As of June 30,

2017, NIA had 2,452 offices in India across 29 States and 7 Union Territories. As

of June 30, 2017, it had international operations across 28 countries, through a

number of international branches, agency offices, subsidiaries and associated

companies.

Exhibit 1: NIA’s Market Share (in terms of overall Gross Premium) & Market Position

FY15

FY16

FY17

Market

Market

Market

Market

Market

Market

Segment

Share

Position

Share

Position

Share

Position

General Insurance

15.0%

1.0

15.7%

1.0

15.6%

1.0

Product Segment

Fire Insurance

19.1%

1.0

19.4%

1.0

20.4%

1.0

Marine Insurance

21.1%

1.0

20.7%

1.0

22.0%

1.0

Motor Insurance

15.1%

1.0

14.6%

1.0

14.4%

1.0

Health Insurance

18.4%

1.0

18.5%

1.0

18.2%

1.0

Source: RHP

Oct 31, 2017

2

The New India Assurance Company Limited | IPO Note

Issue details

Government owned NIA, the largest general insurance company in the country

and its IPO is a mix of Offer for Sale and fresh issue. The issue would constitute

fresh issue worth of `1,920cr and Offer for Sale worth of `7,680cr. The national

reinsurer will dilute 14.6% of its post-offer paid-up equity share capital. Of this, the

government will dilute 11.7% stake and the balance 2.9% by the Corporation

itself.

Note: A discount of `30 per equity share (3.7% on the upper price band) would be

offered to employees and retail individual bidders.

Exhibit 2: Pre and Post-IPO shareholding pattern

No of shares (Pre-issue)

% No of shares (Post-issue)

%

Promoter (GOI)

80,00,00,000

100

70,40,00,000

85.4

Public/Institution

12,00,00,000

14.6

80,00,00,000

100

82,40,00,000

100

Source: Source: RHP, Note: Calculated on upper price band

Objects of the offer

The company proposes to utilize the proceeds towards meeting future capital

requirements, which are expected to arise from the growth and expansion of

the business, improving solvency margin and consequently the solvency ratio.

To receive the benefits of listing of the Equity Shares on the Stock Exchanges,

enhancement of the Company’s brand name and creation of a public market

for Equity Shares in India.

Key Management Personnel

G. Srinivasan is Chairman cum Managing Director. He holds a bachelor’s degree

in commerce from the University of Madras. He is an associate of The Institute of

Cost Accountants of India and a fellow of the Federation of Insurance Institutes. He

has over 37 years of experience in the insurance industry. He is the chairman of

the General Insurance Council and chairman of General Insurance Public Sector

Association. He is also a member of the Insurance Advisory Committee of the

IRDAI and the chairman of Assocham’s National Council for Insurance. He has

been associated with NIA from 1979 till 2007. He was appointed as the

Chairman-cum-Managing Director on October 18, 2012.

Ms. S. N. Rajeswari, is the General Manager and Chief Financial Officer. She

holds a bachelor’s degree in commerce from the Madurai Kamaraj University and

a master’s degree in business administration from the Bharathiar University. She is

also an Associate of the Institute of Chartered Accountants of India and a Fellow of

the Insurance Institute of India. She has over 33 years of experience in the

insurance industry.

Oct 31, 2017

3

The New India Assurance Company Limited | IPO Note

Investment Rationale

Leadership position in General Insurance industry: NIA has retained its leadership

position in non-life insurance industry with market share of 15% of gross direct

premium. Despite significant competition, they have maintained their pole position

in the Indian General Insurance Market. They have increased their market share in

terms of Gross Direct Premium from 14.7% in Fiscal 2012 to 15% in Fiscal 2017.

In Fiscal 2017, they had issued 2.71cr policies across all their product segments,

the highest among all general insurers in India.

Exhibit 3: Share of players in different segments (2016 - 2017) (%)

Marine

Marine

Motor

Motor Own

Top 10 Multi Product Players

Fire

Health

Crop

Others

Cargo

Hull

Third Party

Damage

New India Assurance

19

18

16

34

17

13

5

17

United India Insurance

14

16

11

18

15

8

5

15

National Insurance

9

14

8

10

14

11

3

10

Oriental Insurance

10

11

10

21

9

6

5

10

ICICI Lombard

8

6

13

9

7

12

10

8

Bajaj Allianz

6

4

6

2

6

9

7

7

HDFC Ergo

5

4

4

4

2

4

10

3

IFFCO Tokio

3

2

6

1

5

6

6

4

TATA AIG

5

1

12

-

3

5

2

5

Reliance General

3

2

2

1

4

4

5

2

Cumulative market Share of top 10

81.5

78.1

88.1

99.7

81.8

78.0

58.7

80.1

multi-product insurers

Source: RHP

Multi-channel distribution network: As of 1QFY2018, the distribution network

included 68,389 individual agents and 16 corporate agents. NIA has over the

years developed strong relationships with their agents and brokers by leveraging

their established brand, financially strong operations and large product portfolio,

coupled with providing significant sales and management training, and continuing

infrastructure support.

The company has also established 7 large corporate and broker offices to support

their large corporate clients, and brokers. They distribute motor policies through

online portal at various dealer locations. They have developed a pan-India office

network, and as of 1QFY2018, they had 2,452 offices in India across 29 States

and 7 Union Territories.

Oct 31, 2017

4

The New India Assurance Company Limited | IPO Note

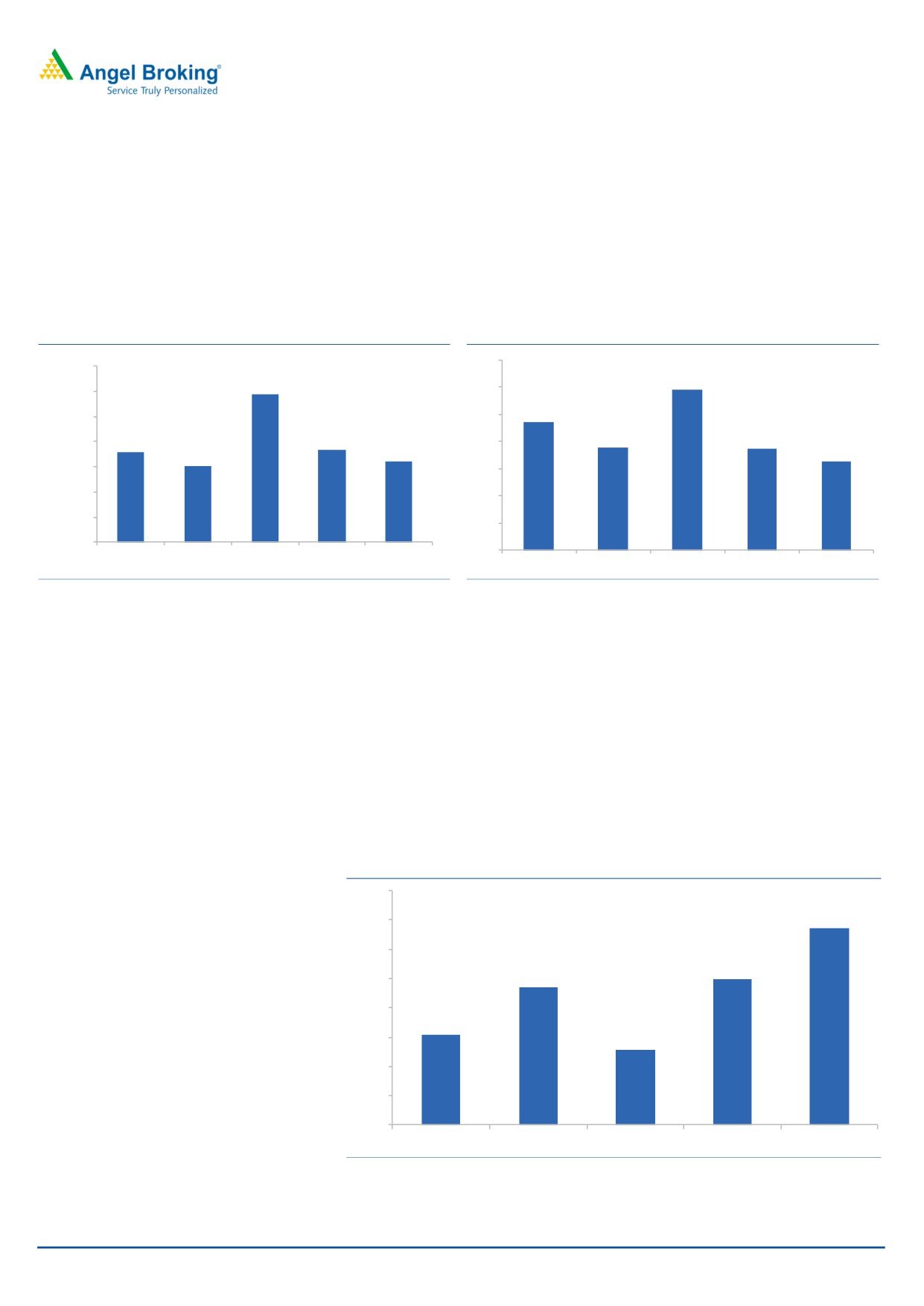

PAT inconsistent over a period of time: NIA has been able to grow its net premium

by steady CAGR of 16% over FY2013-17. But on profitability front it has been

reporting very inconsistent PAT, which has declined 2% CAGR over FY2013-17

(PAT for FY2013 - `914cr, FY2014 - `805cr, FY2015 - `1,377cr, FY2016 -

`930cr and FY2017 - `840cr). On the contrary, other listed general insurance

company ICICI Lombard has grown its net premium at CAGR of 15% over

FY2013-17. However, PAT grew at healthy CAGR of 22% over FY2013-17.

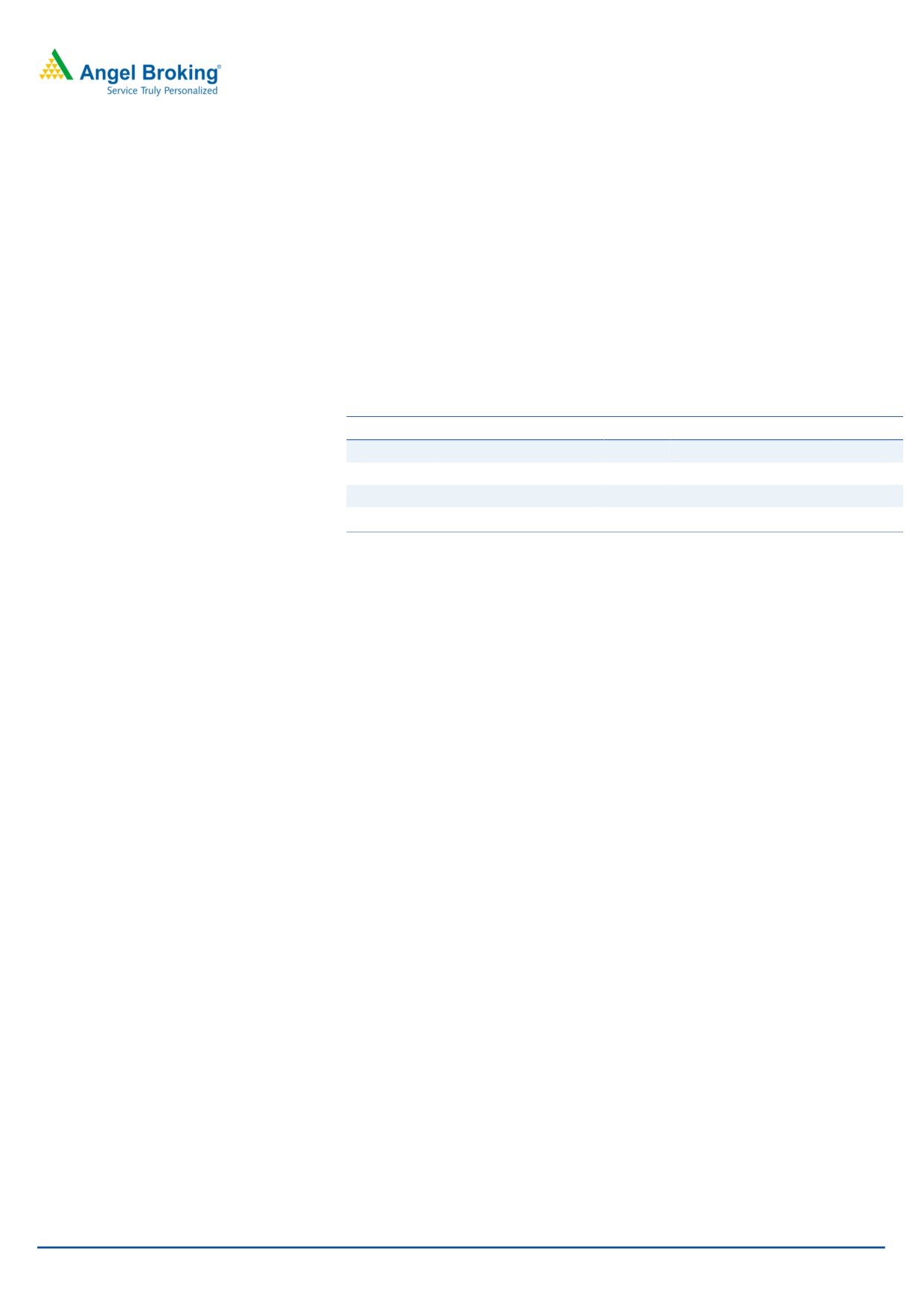

Exhibit 4: Inconsistent PAT (` in Cr)

Exhibit 5: ROE trend (%)

14

1,600

12

1,377

12

1,400

9

1,200

10

914

930

8

7

1,000

8

840

7

805

800

6

600

4

400

2

200

-

FY13

FY14

FY15

FY16

FY17

FY13

FY14

FY15

FY16

FY17

Source:

Source:

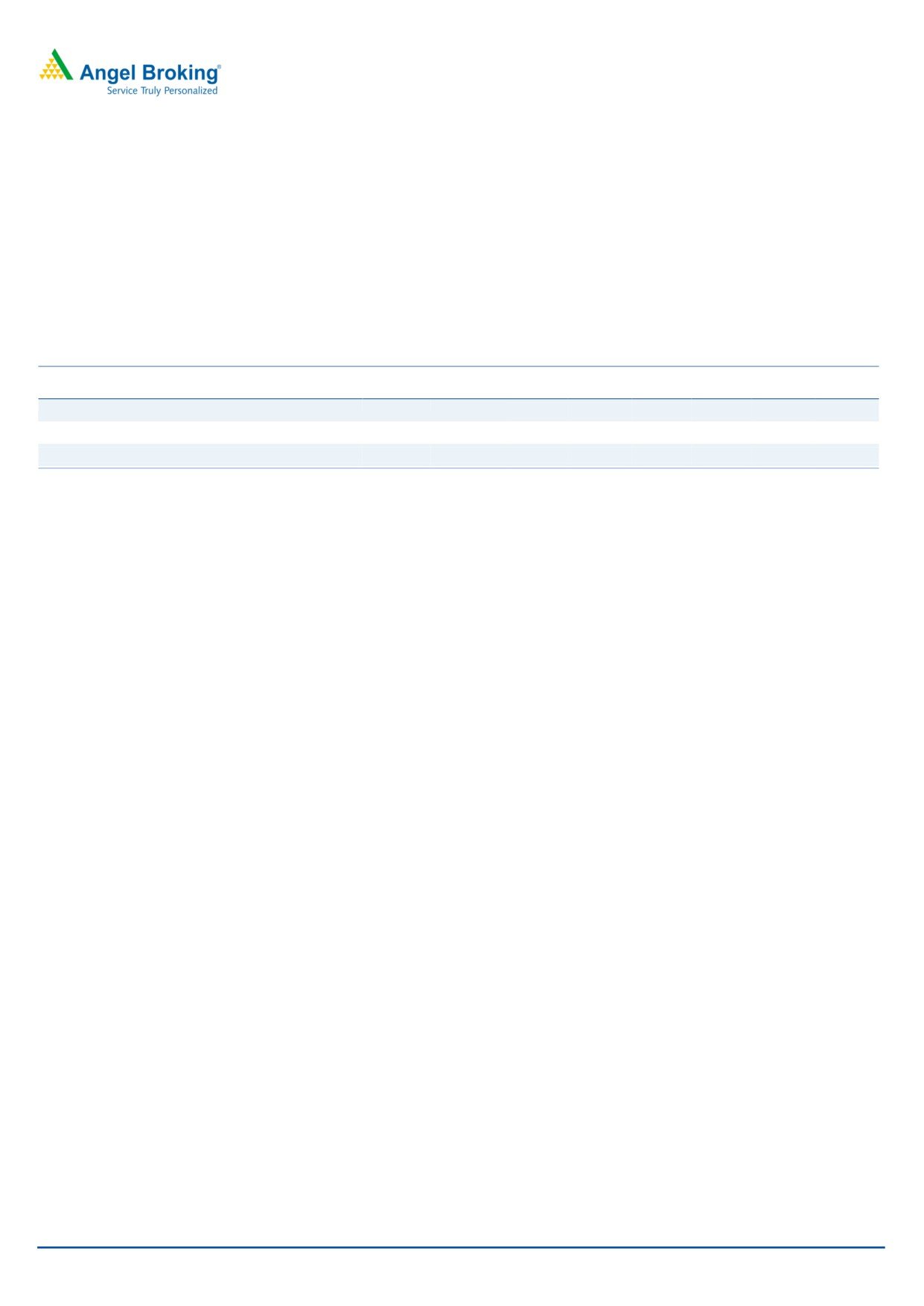

High combined ratio a negative for profitability & return ratio: Combined ratio is

the sum of loss ratio, expense ratio and commission ratio. The combined ratio is a

measure of the profitability of an insurance company’s underwriting business. A

ratio below 100% usually indicates that the insurance company generates a

margin in its insurance operations, while a ratio above 100% usually indicates that

insurance company is paying out more money in claims and operating expenses

than it is receiving from premiums. NIA’s combined ratio consistently remained

high for last 5 years at more than 115% and for FY2017 company reported

combined ratio of 120%. ICICI Lombard reported combined ratio of 104%.

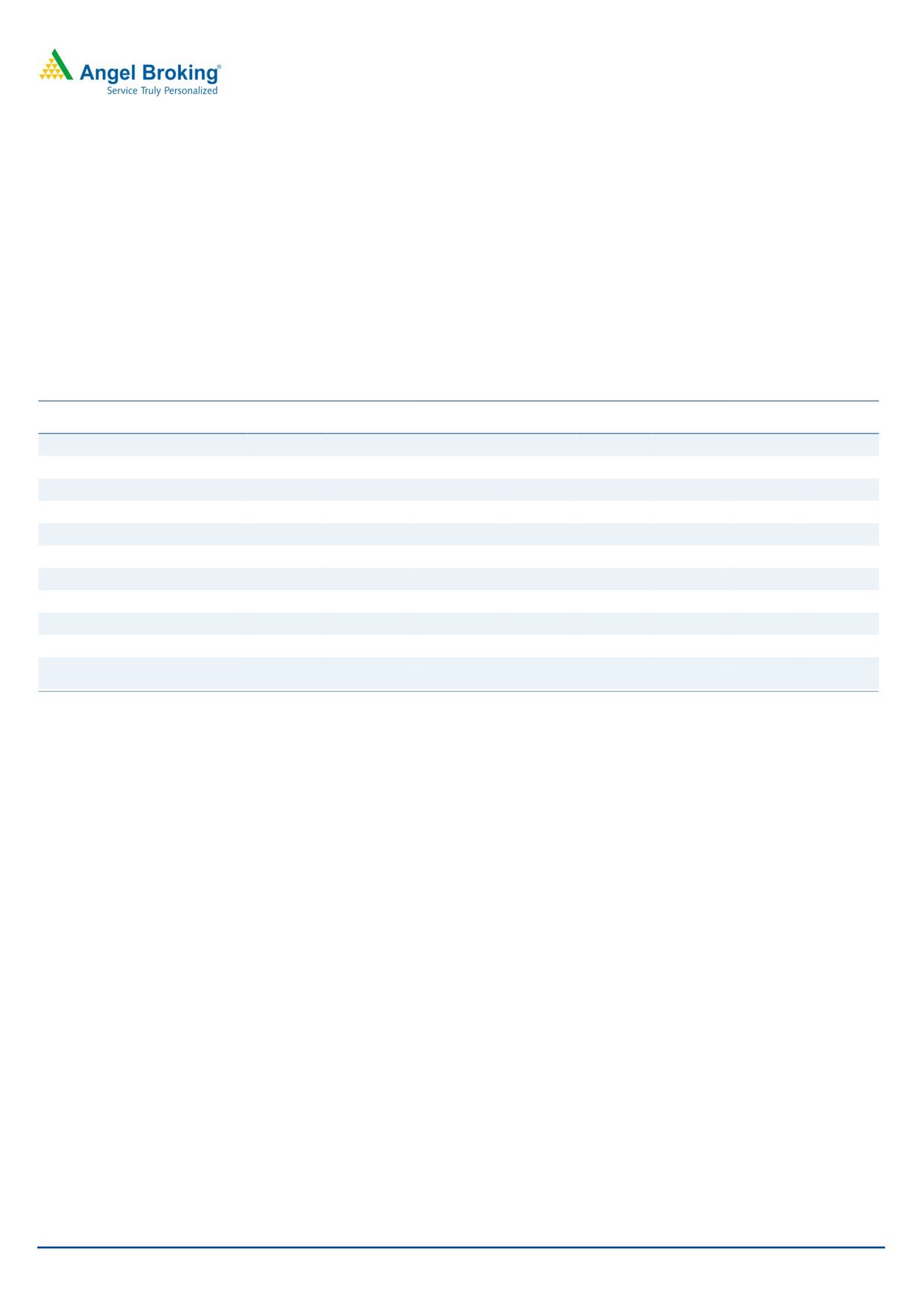

Exhibit 6: Combined Ratio (%)

121

120

120

119

118

118

118

117

116

116

116

115

114

113

FY13

FY14

FY15

FY16

FY17

Source: RHP

Oct 31, 2017

5

The New India Assurance Company Limited | IPO Note

Outlook & Valuation: At the upper price band of `800 the issue is offered at 5x

FY2017 book value and 76x FY2017 EPS. Its listed peer ICICI Lombard is trading

at 8x FY2017 book value and 48 times FY2017 EPS. ICICI Lombard reported

decent ROE of 17% and average ROE for last 5 years is 19%, while NIA reported

subdued ROE of 7% for FY2017 and average ROE of 9%. NIA’s combined ratio is

consistently higher than 115% for last 5 years, which is impacting the profitability

of the company. Considering the subdued ROE, inconsistent PAT and higher

combined ratio, we recommend NEUTRAL rating on the issue.

Exhibit 7: Relative Comparison

PAT

Net Premium

Combined

ROE

PE

PB

4 CAGR (%) 4 CAGR (%)

Ratio

FY16

FY17

FY16

FY17

FY17

FY17

New India Assurance Ltd

(3)

23

7

7

118

120

76

5

ICICI Lombard

22

15

16

17

107

104

48

8

Note- NIA Valuation ratios based on pre-issue outstanding shares and at upper end of the price band, ICICI Lombard valuation ratio as on 31/10/17

Key Risks

Improvement in underwriting profitability

Combined ratio is the sum of loss ratio, expense ratio and commission ratio. The

combined ratio is a measure of the profitability of an insurance company’s

underwriting business. Combined ratio of 100% is breakeven. Any material

improvement in combined ratio would positively impact profitability and return

ratio of the company.

Oct 31, 2017

6

The New India Assurance Company Limited | IPO Note

Income Statement

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17

Operating Profit/(Loss)

a. Fire Insurance

98

(169)

72

122

(167)

b. Marine Insurance

144

169

57

126

48

c. Miscellaneous Insurance

(274)

(387)

(78)

(781)

(783)

2. Income from Investments

-

-

-

-

-

Income From Insurance

(32)

(388)

50

(533)

(901)

a. Interest Dividend and Rent (Gross) - (SH)

690

837

920

981

960

b. Profit on Sale of Investment - (SH)

371

449

568

546

696

Less: Loss on Sale of Investment - (SH)

-

-

-

-

-

3. Other Income

20

27

26

47

86

Interest on Refund of Income Tax

-

-

149

30

133

Total Income from Investment

1,081

1,313

1,663

1,605

1,875

Total Income

1,049

925

1,713

1,072

973

% Chg

(12)

85

(37)

(9)

4. Provisions (Other Than Taxation)

-

-

-

-

-

a. Others - Amortisation Provision

3

3

3

4

3

b. For Doubtful Debts - Investments(SH)

(6)

1

1

(2)

(1)

c. For Doubtful Debts - Operations

-

-

-

24

9

d. For Dimunition In Value Of Investments (SH)

2

5

(1)

0

1

5. Other Expenses

-

-

-

-

-

a. Others - Interest On Income/Service Tax

(34)

(28)

3

1

1

b. (Profit)/Loss On Sale Of Assets

(1)

(0)

1

(1)

3

c. Penalty

0

0

-

0

0

Total Exp

(35)

(19)

8

26

16

% Chg

(47)

(145)

210

(37)

Profit Before Tax (A-B)

1,084

944

1,705

1,045

957

TAX as PBT

16

15

19

11

12

Provision For Taxation

170

139

328

115

117

Profit After Tax

914

805

1,377

930

840

% Chg

(12)

71

(32)

(10)

EPS

Source: RHP, SH - Share Holder

Oct 31, 2017

7

The New India Assurance Company Limited | IPO Note

Balance Sheet

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17

Sources of Funds

Share Capital

200

200

200

200

200

Reserves and Surplus

9,474

10,517 11,469 12,295 12,618

Net worth

9,674

10,717 11,669 12,495 12,818

- Growth (%)

11

9

7

3

Fair Value Change Account

Fair Value Change Account -Policyholders

10,054

10,969 14,273 11,962 15,299

Fair Value Change Account -Shareholders

5,811

6,870

8,566

7,132

8,402

Total Fair Value

15,865

17,839 22,839 19,093 23,702

Borrowings

-

-

-

-

-

Minority Interest

52

29

33

46

47

Total

25,590

28,585 34,541 31,634 36,567

Application of Funds

Investments

31,566

35,711 45,365 44,972 51,931

- Growth (%)

13

27

(1)

15

Loans

388

386

357

327

308

Fixed Assets

212

244

302

365

429

Deferred Tax Assets

136

165

166

217

220

Current Assets

14,274

17,839 16,770 18,090 17,161

a. Cash and Bank Balances

7,538

9,151

8,446

7,216

8,126

b Advances and Other Assets

6,736

8,687

8,325 10,874

9,036

c. Current Liabilities

15,053

18,462 20,004 23,949 23,835

d. Provisions

6,001

7,331

8,415

8,824

9,869

Net Current Assets

(6,780)

(7,955)(11,649)(14,683)(16,542)

6. Miscellaneous Expenditure

69

34

-

436

221

Total

25,590

28,585 34,541 31,634 36,567

- Growth (%)

12

21

(8)

16

Source: RHP

Oct 31, 2017

8

The New India Assurance Company Limited | IPO Note

Key Ratio

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17

Valuation Ratio (x)

P/E

70

80

46

69

76

P/BV

6.6

6.0

5.5

5.1

5.0

Profitability Ratio (%)

ROE

9

8

12

7

7

ROA

4

3

4

3

2

Yield on Investment

7.8

8.1

8.2

Per Share Data

EPS

11

10

17

12

10

BV

121

134

146

156

160

Operating Ratio

Solvency Ratio

2.7

2.8

2.5

2.5

2.2

Claim Ratio

85.3

86.1

84.3

87.0

92.2

Management Exp

22.2

21.9

22.1

22.2

20.4

Commission Ratio

8.6

9.7

9.2

8.8

7.1

Combined Ratio

116.1

117.7

115.6

118.0

119.7

Investment Leverage

4.6

4.3

4.8

Note- Valuation ratios based on pre-issue outstanding shares and at upper end of the price band

, investment yield on market value of investment.

Oct 31, 2017

9

The New India Assurance Company Limited | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Oct 31, 2017

10