2QFY2016 Result Update | Infrastructure

November 13, 2015

NCC

NEUTRAL

CMP

`77

Performance Highlights

Target Price

-

Quarterly Highlights - Standalone

Investment Period

-

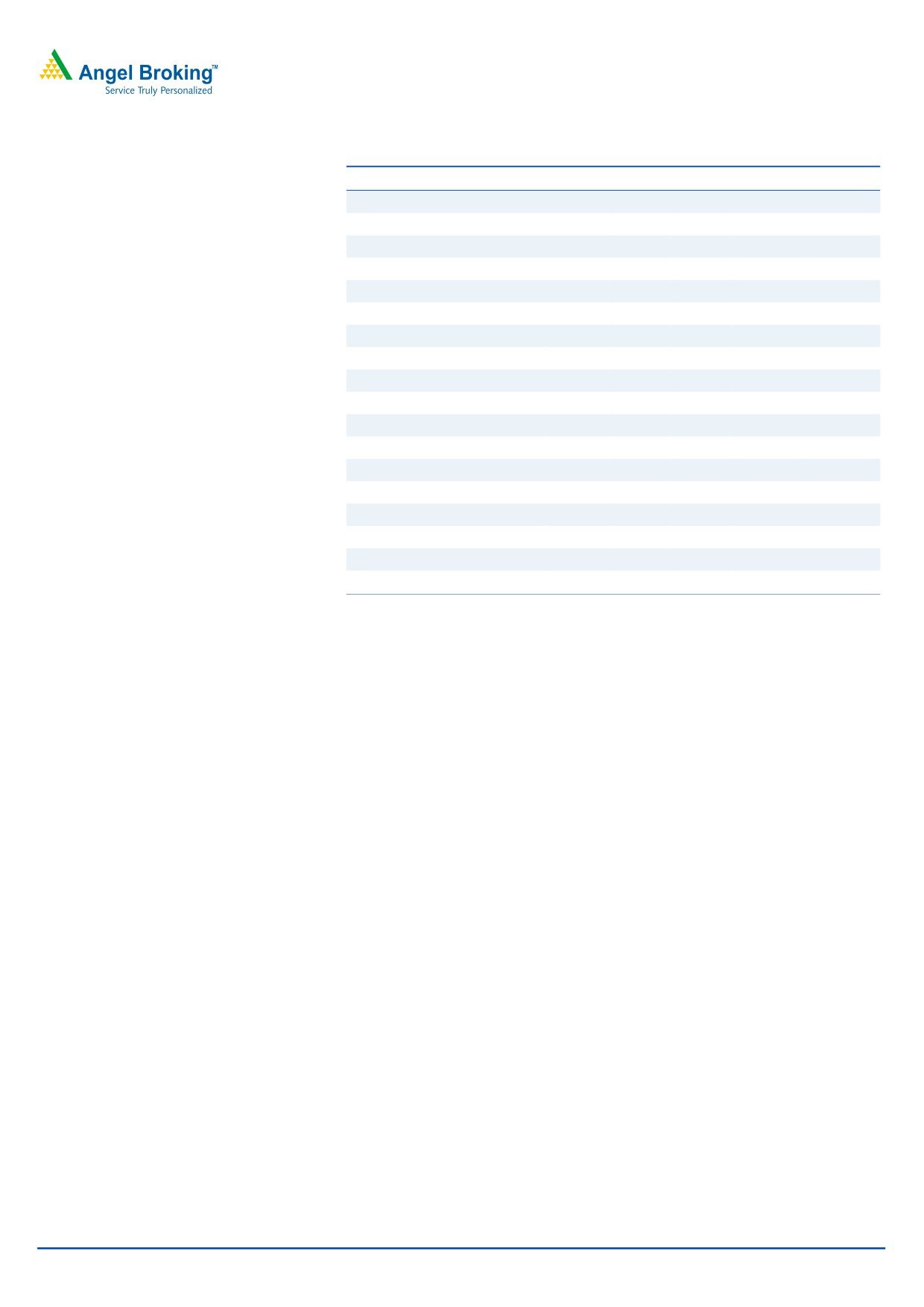

Y/E March (` cr)

2QFY16 2QFY15 1QFY16

% chg (yoy)

% chg (qoq)

Net sales

2,096

2,246

1,723

(6.6)

(21.7)

Stock Info

EBITDA

184

181

158

1.6

(16.4)

Net profit

55

22

41

148.4

(33.4)

Sector

Infrastructure

Source: Company, Angel Research;

Market Cap (` cr)

4,303

Net Debt (` cr)

1,813

For 2QFY2016, NCC reported a favorable standalone earnings performance,

Beta

1.7

reflecting better than expected execution, and lower yoy interest expenses owing to

decline in debt.

52 Week High / Low

118/53

Avg. Daily Volume

730,596

On the top-line front, NCC (standalone) reported a 6.6% yoy decline to `2,096cr.

Face Value (`)

2

On a sequential basis, the top-line grew 21.7%. Stronger execution seen across

BSE Sensex

25,867

Water, Environment & Railways (WER) and the Buildings and Roads (B&R)

Nifty

7,825

segment, and sale of a land parcel (worth `29.9cr), contributed to the better-than-

expected 2QFY2016 revenues.

Reuters Code

NGCN.BO

Bloomberg Code

NJCC@IN

NCC reported a 72bp yoy EBITDA margin improvement to 8.8%, owing to 21.3%

yoy decline in raw material expenses and real estate transaction. Expansion in

EBITDA margin on yoy basis coupled with lower yoy interest expenses led to PAT

Shareholding Pattern (%)

coming in at `55cr for the quarter as against `22cr in 2QFY2015.

Promoters

20.5

NCC’s outstanding order book as of 2QFY2016 stands at `17,487cr (exc.

MF / Banks / Indian Fls

14.5

international business, order book to LTM sales ratio stands at 1.8x), indicating a

FII / NRIs / OCBs

26.6

14.3% yoy decline.

Indian Public / Others

38.4

Outlook and valuation: NCC’s stock price has run-up by 36.9% in the last

12 months, mainly owing to the balance sheet de-leveraging exercise pursued by

Abs. (%)

3m 1yr

3yr

the company. NCC aims to repay debt by around `200-300cr through proceeds

Sensex

(6.0)

(7.6)

38.5

of stake sale. However stretched working capital cycle will likely inhibit the

NCC

6.3

36.9

208.6

company from cutting down its debt in FY2016E. We are of the view that the next

leg of re-rating in the stock would come from improvement in the EBITDA margin,

and further compression in working capital cycle. Since we estimate this to happen

3-year price chart

in FY2017E only, we assign a 14.0x P/E multiple to the standalone EPC business,

140

120

which in-turn has restricted the target price at `90/share. Given that all positives

100

are captured in the current market price, we assign a Neutral rating on the stock.

80

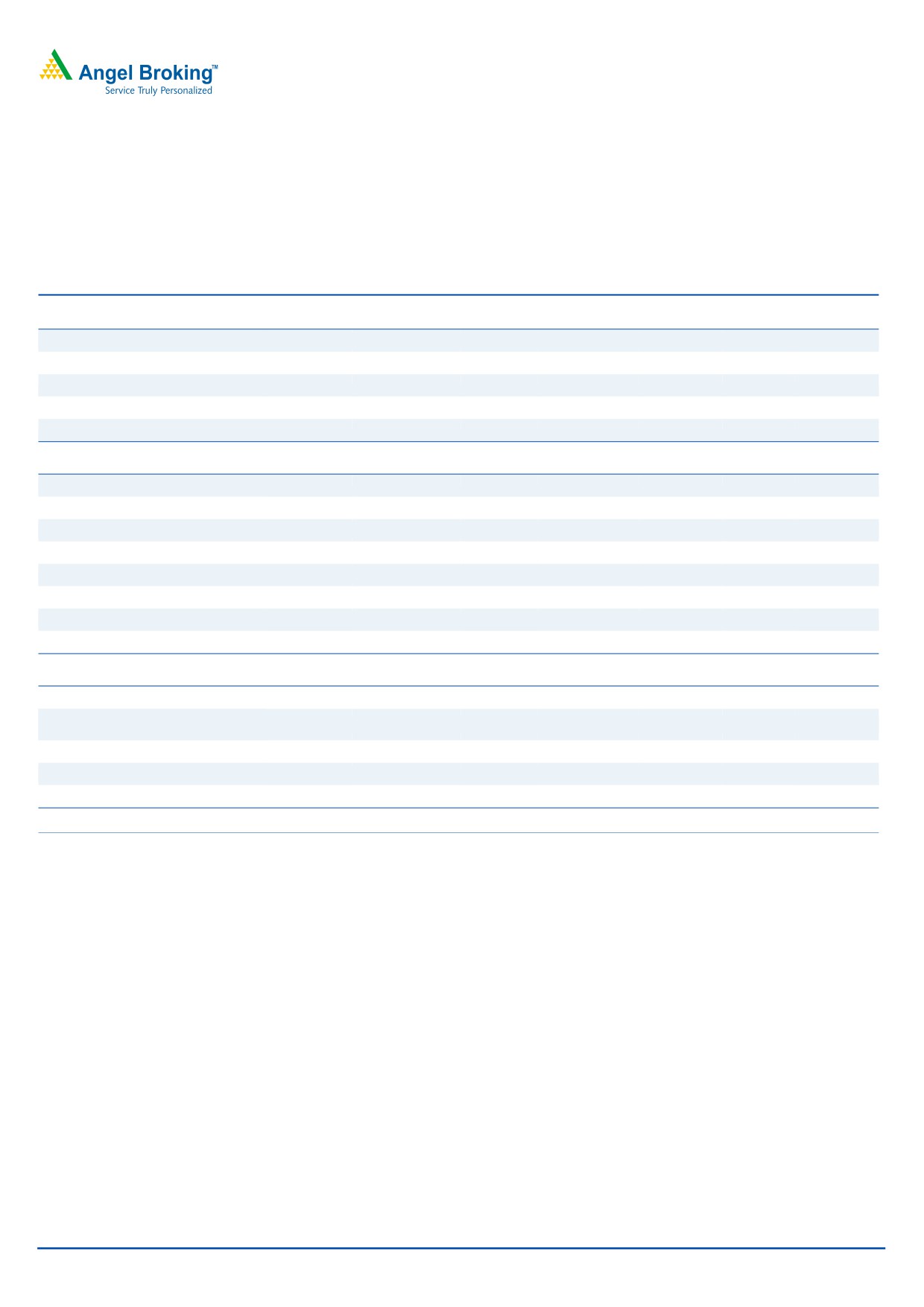

Key financials (Standalone)

60

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

40

Net Sales

5,725

6,117

8,297

7,892

8,842

20

0

% chg

9.0

6.9

35.6

(4.9)

12.0

Net Profit

63

41

112

165

297

% chg

74.2

(35.3)

175.9

47.5

79.9

EBITDA (%)

8.2

6.6

7.8

8.8

9.1

Source: Company, Angel Research

EPS (`)

2.4

1.6

2.0

3.0

5.3

P/E (x)

31.7

49.0

38.5

26.1

14.5

P/BV (x)

0.8

0.8

1.3

1.3

1.2

RoE (%)

2.6

1.6

3.9

5.0

8.5

RoCE (%)

8.4

6.7

10.8

11.0

12.7

EV/Sales (x)

0.7

0.7

0.7

0.8

0.7

EV/EBITDA (x)

8.4

10.4

9.4

8.9

7.2

OB/ LTM Sales (x)

3.3

3.4

2.3

2.4

2.1

Santosh Yellapu

Order Inflows

4,017

8,512

6,659

7,900

9,600

022-39357800 Ext: 6811

% chg

(56.6)

111.9

(21.8)

18.6

21.5

Source: Company, Angel Research; Note: CMP as of November 11, 2015

Please refer to important disclosures at the end of this report

1

NCC | 2QFY2016 Result Update

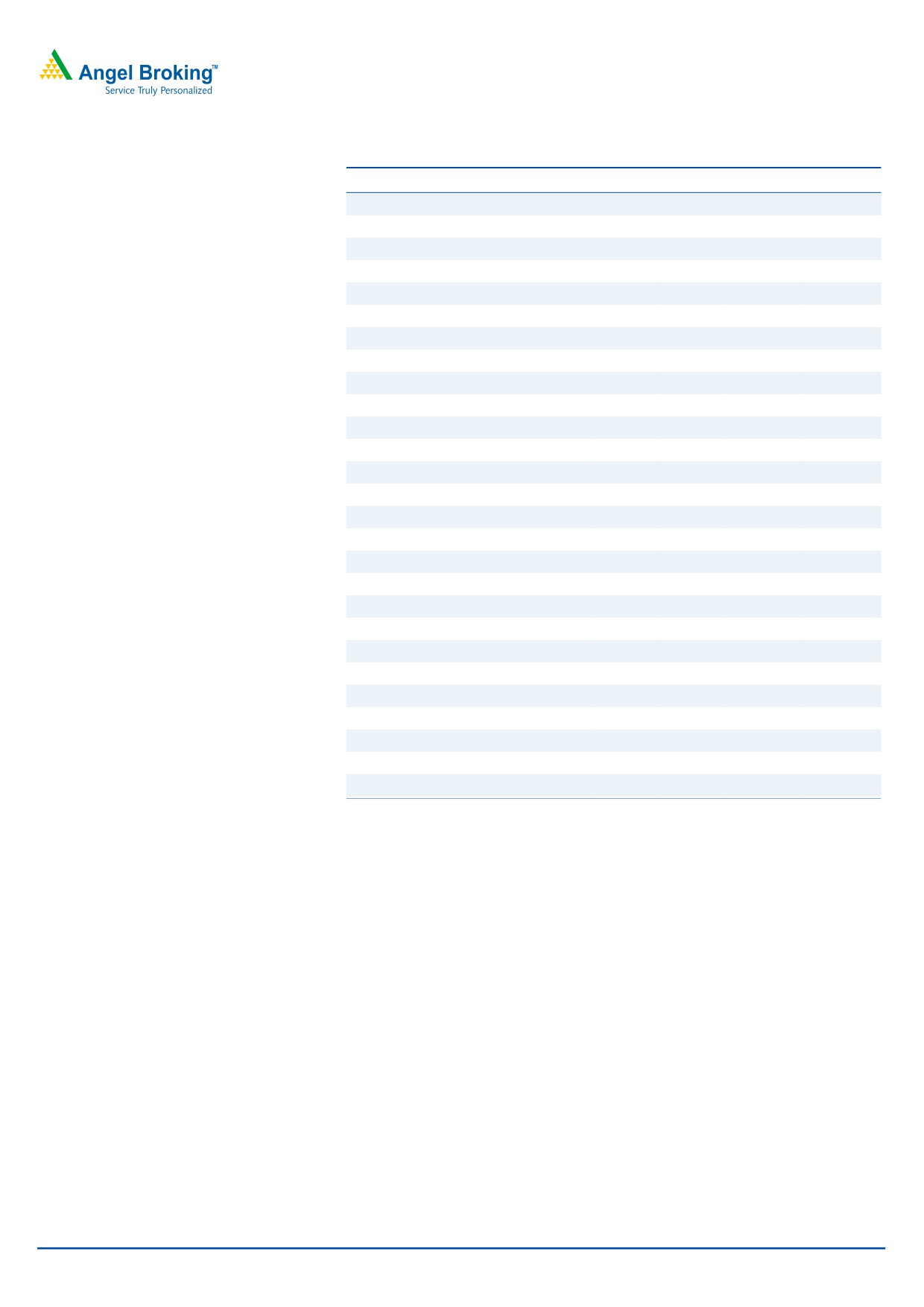

Exhibit 1: Quarterly performance (Standalone)

Particulars (` cr)

2QFY16

1QFY16

% chg (qoq) 2QFY15

% chg (yoy) 1HFY2016

1HFY2015

% chg

Net Sales

2,096

1,723

21.7

2,246

(6.6)

3,819

3,735

2.2

Total Expenditure

1,912

1,564

22.2

2,064

(7.4)

3,476

3,445

0.9

Cost of materials consumed

1,074

758

41.7

1,365

(21.3)

1,833

2,000

(8.4)

Construction & Sub-Contracting exp.

703

690

1.8

585

20.2

1,393

1,216

14.5

Employee benefits Expense

77

69

11.6

66

16.2

146

127

15.1

Other Expenses

58

46

25.0

48

20.4

104

102

2.7

EBITDA

184

158

16.4

181

1.6

343

290

18.0

EBIDTA %

8.8

9.2

8.1

9.0

7.8

Depreciation

28

27

3.2

28

(0.8)

55

57

(2.7)

EBIT

156

131

19.1

153

2.1

288

234

23.1

Interest and Financial Charges

131

126

3.7

158

(17.1)

257

296

(13.0)

Other Income

52

52

(0.9)

39

33.3

104

84

22.8

PBT before Exceptional Items

77

57

34.9

34

127.6

134

22

500.0

Exceptional Items

0

0

0

0

0

PBT

77

57

34.9

34

127.6

134

22

500.0

Tax

22

16

39.0

12

38

3

% of PBT

28.6

27.7

34.5

28.2

14.5

PAT

55

41

33.4

22

148.4

96

19

403.7

PAT %

2.6

2.4

1.0

2.5

0.5

Dil. EPS

0.99

0.74

33.8

0.86

15.1

1.73

0.74

133.8

Note: nmf- not meaningful; Source: Company, Angel Research

Revenues de-grew 6.6% yoy

For 2QFY2016, NCC reported a 6.6% yoy decline in its revenues to `2,096cr.

However, the reported revenues were ahead of our estimate of `1,979cr. Reported

revenues for the quarter include, (1) `312cr of in-house power project execution

(v/s `389cr in 1QFY2016 and `288cr in 2QFY2015), and (2) `29.9cr from sale of

a land parcel. On adjusting for real estate transaction, adj. revenues in 2QFY2016

de-grew 8.0% yoy.

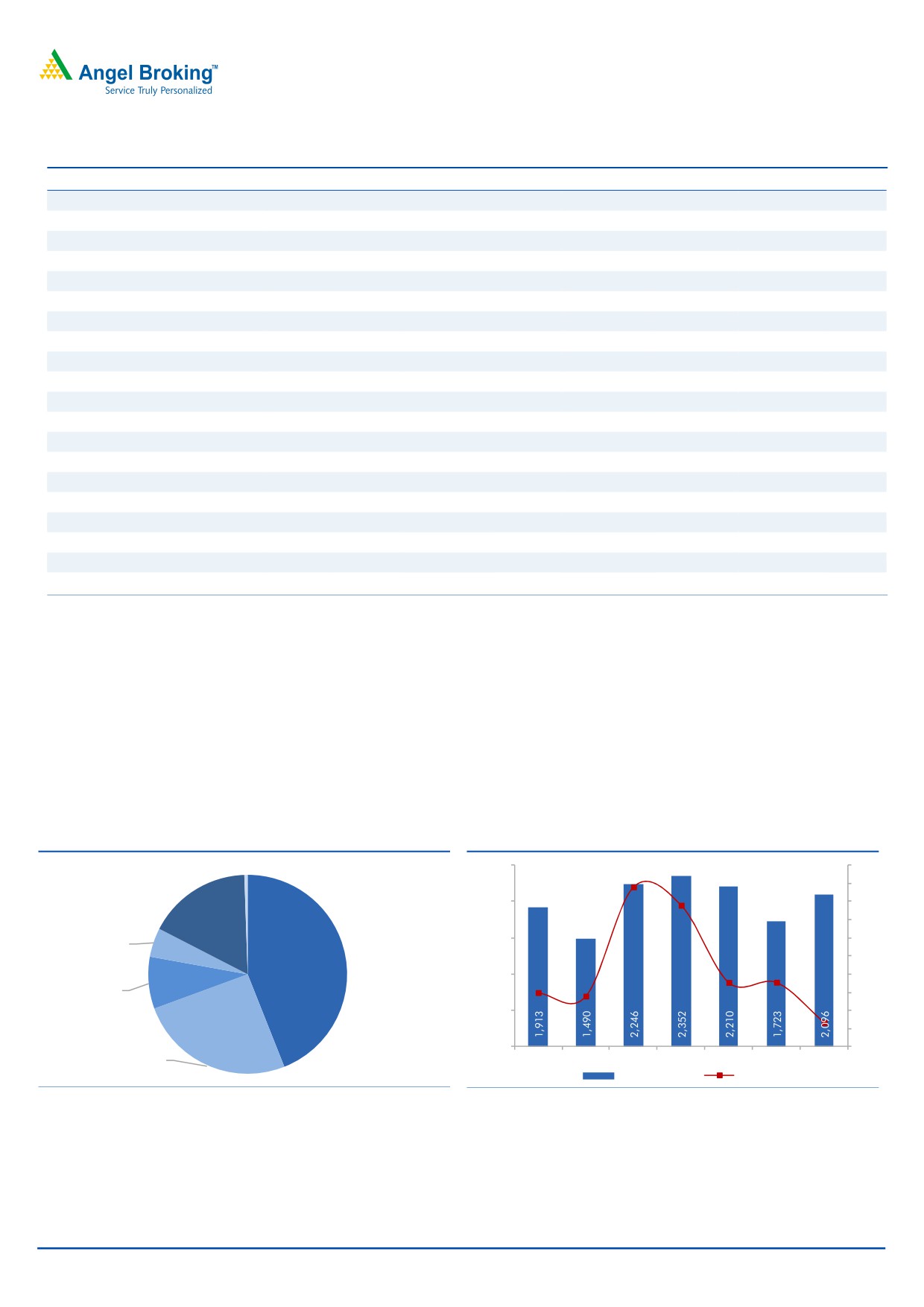

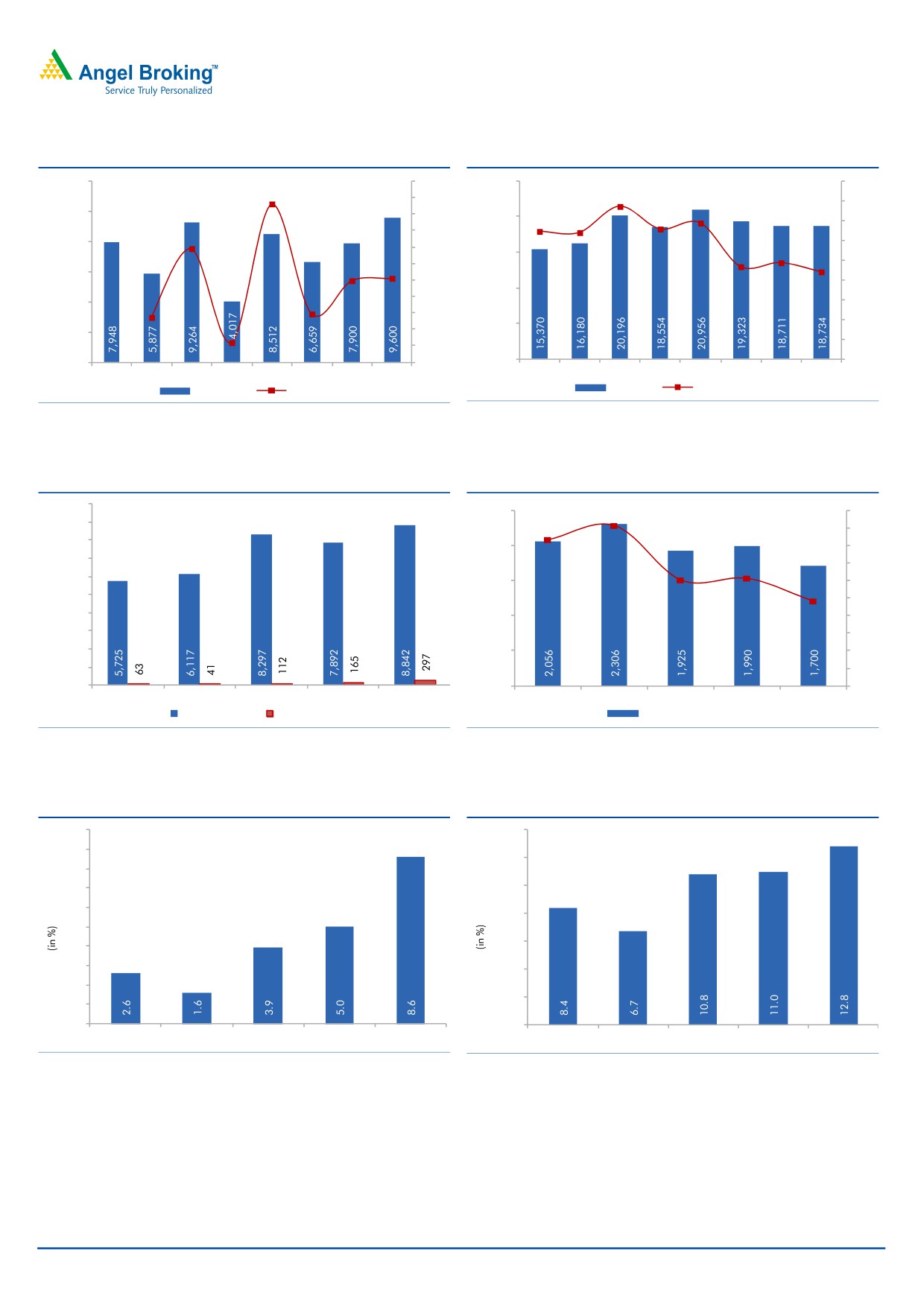

Exhibit 2: BR segment leads quarterly revenues...

Exhibit 3: Revenues de-grow 6.6% yoy...

Mining, 1%

2,500

80

70

68

2,000

60

58

Power, 23%

50

Irrigation,

5%

1,500

40

Building &

30

Roads, 44%

1,000

20

Electrical,,

10

16

16

10

7%

8

500

0

(7)

(10)

Water,

0

(20)

Environment &

4QFY14

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

Railways, 25%

Revenues (` cr)

y/y change (%)

Source: Company, Angel Research

Source: Company, Angel Research

In 2QFY2016, the Buildings and Roads (B&R) and Water, Environment, & Railways

(WER) segment, accounted for 44% and 25% of standalone revenues booked,

respectively.

November 13, 2015

2

NCC | 2QFY2016 Result Update

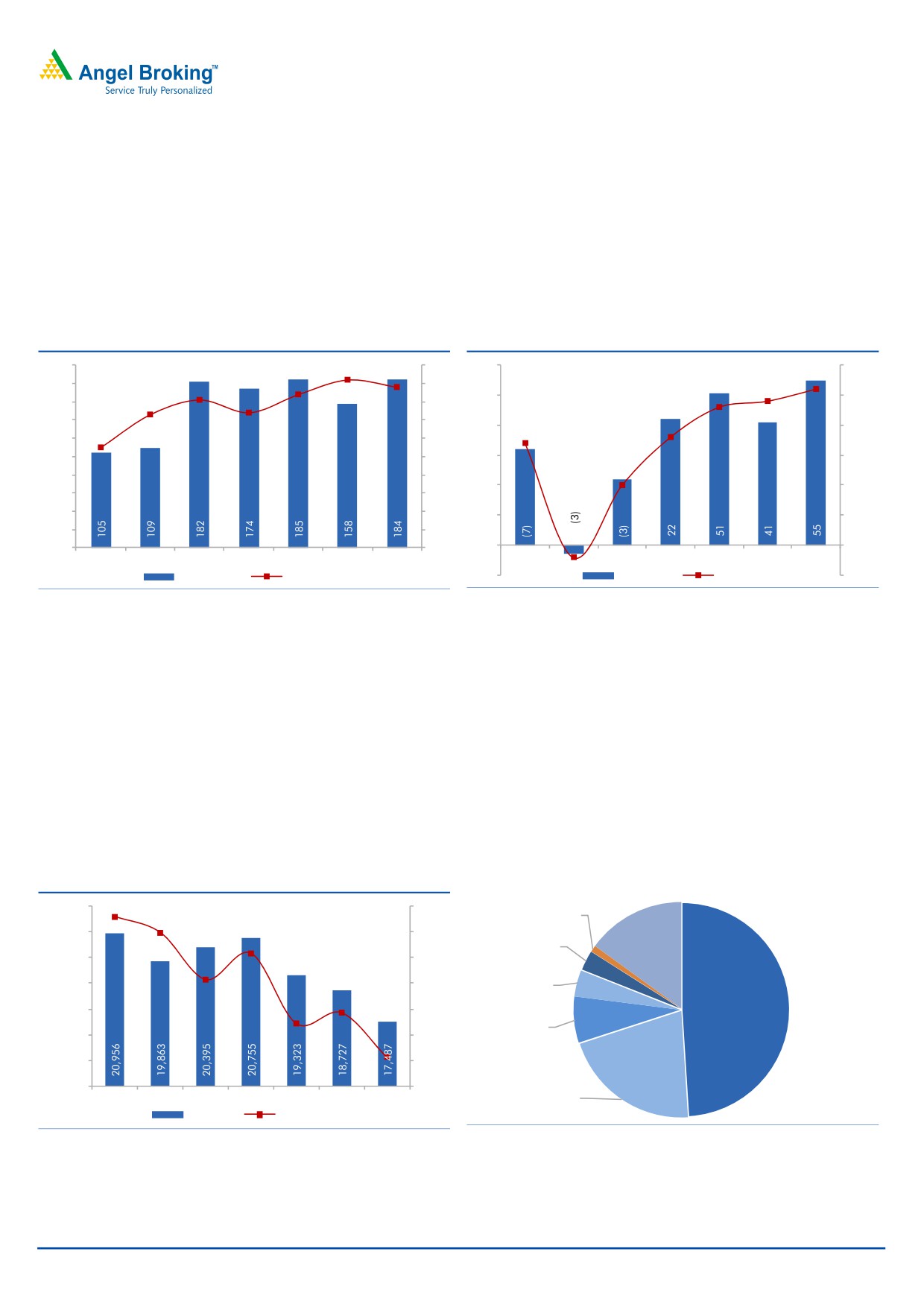

EBITDA margins expand on yoy basis

NCC reported an EBITDA of `184cr for the quarter, up 1.6% yoy. For the quarter

NCC reported EBITDA margin of 8.8%, against our expectation of 8.5% and year

ago levels of 8.1%. Surge in the yoy EBITDA margins is on account of (1) profit of

`29.9cr from a real estate transaction, and (2) 21.3% decrease in construction and

sub-contracting expenses. On adjusting for the real estate transaction (reported

under revenues), EBITDA margins would stand at 7.5%.

Exhibit 4: EBITDA margin at 8.8%

Exhibit 5: PAT margin aided by lower interest exp.

200

8.4

9.2

10

60

3.0

8.8

8.1

7.4

2.6

180

9

2.4

7.3

50

2.5

160

8

2.3

140

7

40

2.0

5.5

120

6

1.8

1.7

100

5

30

1.5

80

4

20

1.0

1.0

60

3

40

2

10

0.5

20

1

(0.2)

0

0

0

0.0

4QFY14

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

4QFY14

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

EBITDA (` cr)

EBITDA Margins (%)

(10)

PAT (` cr)

PAT Margins (%)

(0.5)

Source: Company, Angel Research

Source: Company, Angel Research

NCC reported a PAT of `55cr in 2QFY2016, ahead of our estimates of `44cr.

EBITDA margin expansion and decline in interest expenses led to a sharp PAT

margin expansion, from 1.0% in 2QFY2015 to 2.6% in 2QFY2016. On adjusting

for the real estate transaction, the adj. PAT margin would stand at 1.2%. Decline in

yoy interest expenses is attributable to decline in the average cost of borrowings

and decline in debt to `2,100.9cr (vs `2,675.2cr in 2QFY2015).

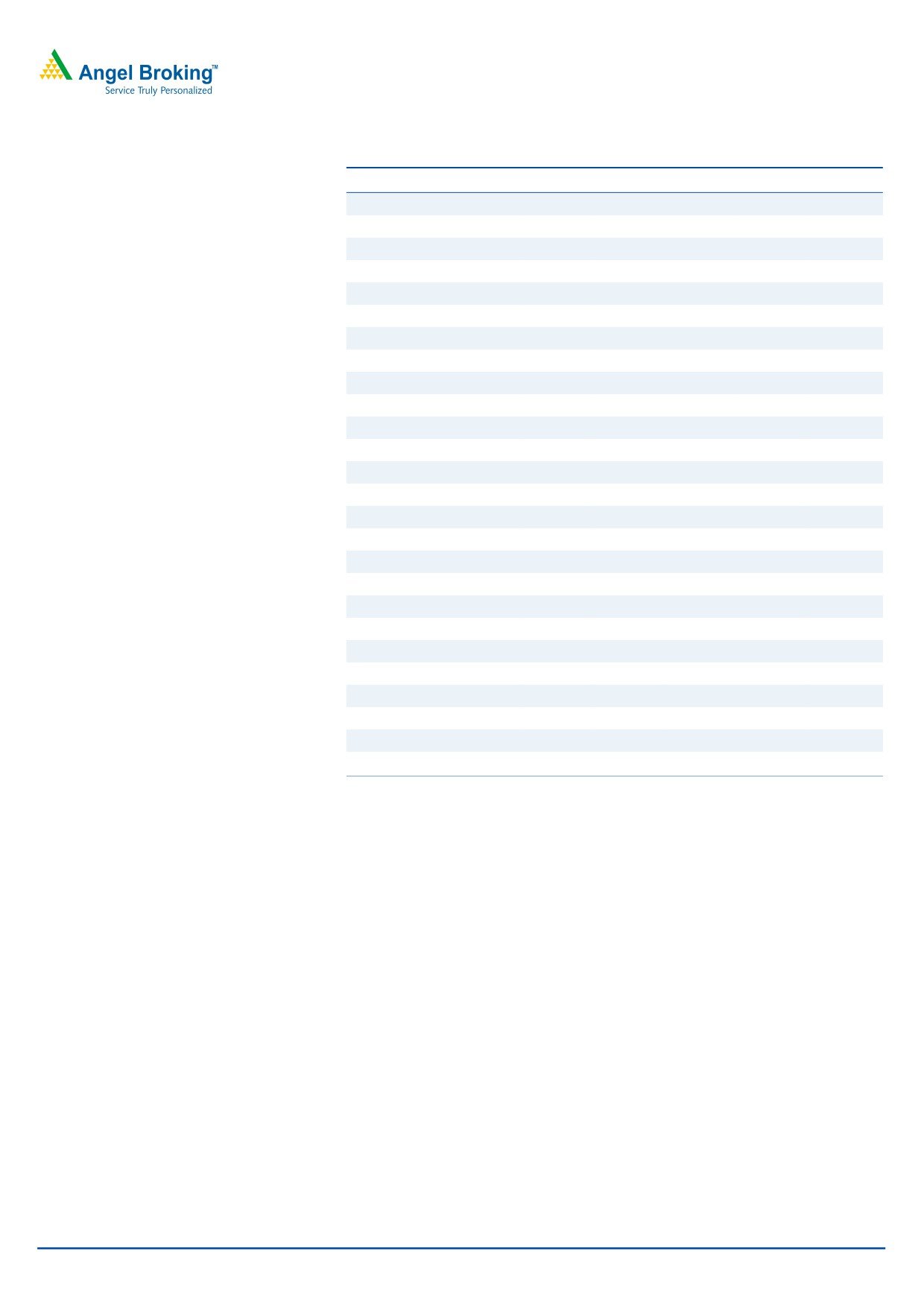

Order book analysis

NCC‘s order book (including international business) stands at `17,487cr as of

2QFY2016, indicating a 14.3% yoy decline.

Exhibit 6: Order book stands at `18,727cr

Exhibit 7: B&R contribute 49% of the current order book

22,000

15.0

Mining, 1%

12.9

21,000

9.8

10.0

Power, 3%

International,

20,000

5.8

5.0

15%

19,000

0.7

0.0

Irrigation,

4%

Building &

Roads, 49%

18,000

(5.0)

(5.7)

(14.3)

(7.8)

Electrical,,

17,000

(10.0)

7%

16,000

(15.0)

15,000

(20.0)

Water,

4QFY14 1QFY15 2QFY15 3QFY15 4QFY15 1QFY16 2QFY16

Environment &

Railways, 21%

OB (` cr)

y/y change (%)

Source: Company, Angel Research

Source: Company, Angel Research

NCC has secured orders worth

`1,015cr in 2QFY2016. On excluding the

international business, the current order book to Last Twelve Month (LTM) sales

November 13, 2015

3

NCC | 2QFY2016 Result Update

ratio stands at 1.8x. Out of the current order book, `536cr is from the company’s

in-house power project, which is expected to be completed in 2HFY2016.

International business update

NCC International LLC (Oman), NCC’s largest international subsidiary, reported a

15.2% yoy decline in revenue to `151cr, as Batinah Express project (Package-II,

worth `2,287.6cr) is yet to gain traction from operations.

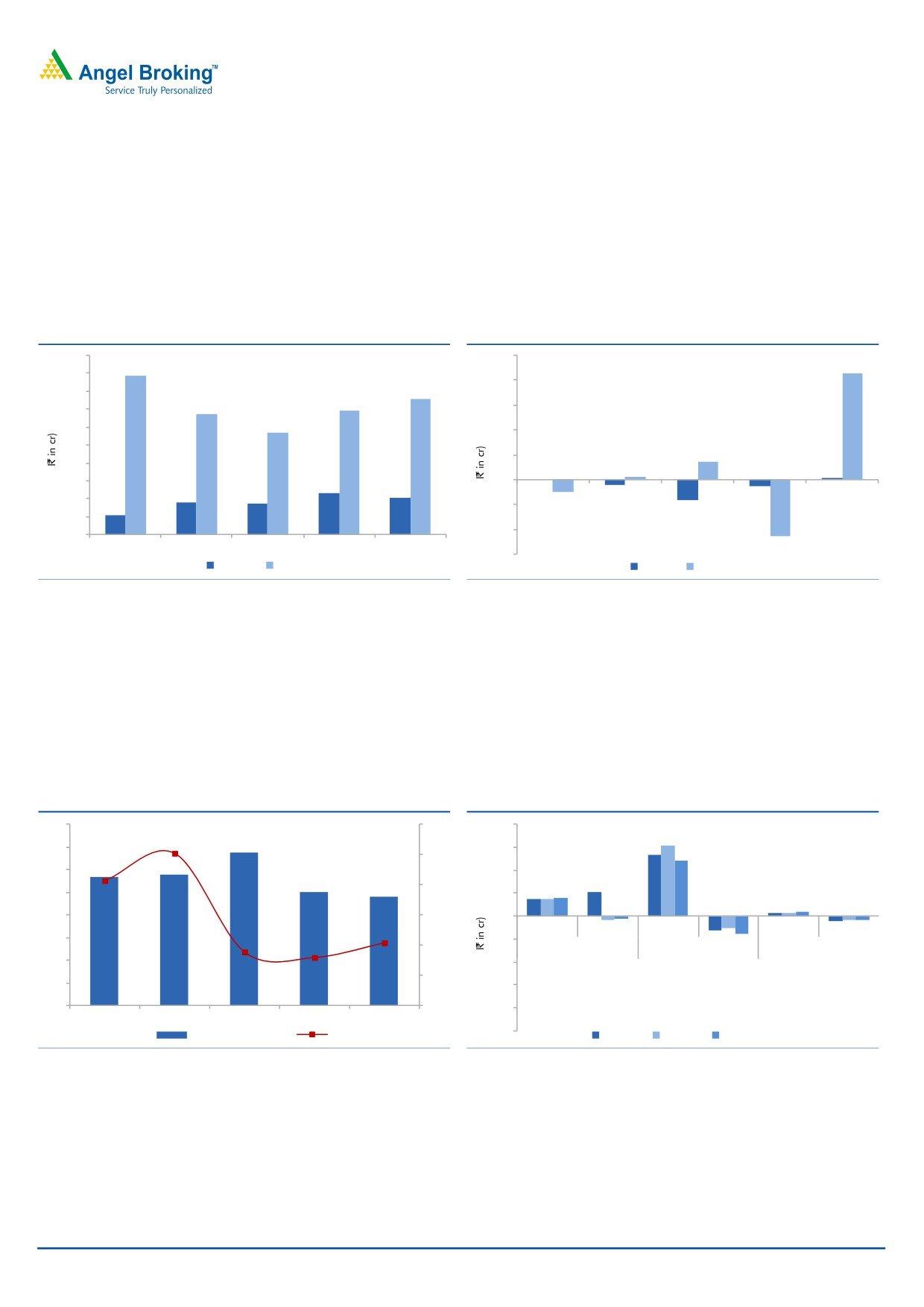

Exhibit 8: Muted Revenues in 2QFY2016

Exhibit 9: Oman subsidiaries reports profit

200

50

178

43

180

40

151

160

139

134

30

140

114

120

20

100

7

10

80

1

0

1

60

46

0

41

36

35

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

40

22

(10)

(5)

(2)

(8)

(3)

20

(20)

0

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

(23)

(30)

UAE

Oman

UAE

Oman

Source: Company, Angel Research

Source: Company, Angel Research

Notably, only the Omanese subsidiary reported a PAT of `43cr for 2QFY2016, on

account of higher revenue booking.

Real Estate business update

NCC Urban Infra, the company’s real estate subsidiary, reported a 15.8% yoy

decline in segment revenues to `48cr. Decline in yoy Real Estate segment revenues

led to PAT margin compression to 1.0% in 2QFY2016 (vs 2.1% in 2QFY2015).

Exhibit 10: Real Estate Business financials

Exhibit 11: BOT projects’ performance

80

3.0

40

31

26

70

30

24

2.5

2.5

60

20

10.3

2.1

2.0

7

8

8

50

10

1

1

2

40

1.5

0

Revenues

PAT

Revenues

PAT

Revenues

PAT

30

(10)

(2.1)

(1.9)

0.8

1.0

1.0

(1.5)

(6.0)

0.9

BETL

WUTL

PTTL

(1.9)

(1.4)

(7.6)

20

(20)

(5.0)

0.5

10

(30)

57

58

67

50

48

0

0.0

(40)

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

(50)

Revenues (` cr)

PAT %

4QFY15

1QFY16

2QFY16

Source: Company, Angel Research

Source: Company, Angel Research

BOT Projects Update

For the quarter, BETL (Bangalore Elevated Tollway Ltd) reported a revenue of

~`8cr (up 14.3% yoy) and and a PAT loss of `1.4cr (higher than year ago level

losses of `1.2cr), respectively.

November 13, 2015

4

NCC | 2QFY2016 Result Update

WUTL (Western UP Tollway Ltd) reported a 7.7% yoy decline in revenues to `24cr,

for the quarter. Losses at WUTL widened from `5cr to `7.6cr on a yoy basis.

Management Guidance & Our View

The company’s Management has maintained its order inflow guidance at `8,000cr

for FY2016, reflecting a 20% yoy growth. Considering `2,293cr of order inflows in

1HFY2016, and another

`2,058cr of order inflows in the current quarter

(3QFY2016) (takes the YTD total to `4,351cr), when coupled with uptick in the

awarding activity, indicates that NCC should attain its order inflow guidance for

FY2016E. Accordingly, we modeled

`7,900cr/`9,600cr of order inflows for

FY2016E/FY2017E, respectively.

The Management has given a revenue guidance of `7,800-`7,900cr for FY2016E.

Considering the bid pipeline, income from strategic sale of real estate and

execution cycle of current order book, we expect NCC to report a 3.2% revenue

CAGR during FY2016-17E, to `8,842cr.

NCC has guided for an EBITDA margin of 8.8-9% for FY2016E (reflecting 92-

117bp yoy improvement), and 9-9.25% for FY2017E. Considering 1HFY2016’s

performance and declining share of the low margin Power segment in the order

book, we model 127bp EBITDA margin expansion during FY2015-17E to 9.1%.

Other Key developments

NCC earlier announced sale of its stake in the 1,320MW Krishnapatnam Power

plant to Sembcorp. NCC’s Management has confirmed that it has received

`468.6cr of mobilization advances and another `317.8cr of retention money.

NCC is exploring to monetize its already operational BOT assets. The

Management highlighted that due diligence for Western UP Tollways is ongoing

and deal should get closed in the next few months. Further, the Management also

highlighted that it is exploring an alternative to monetize Bangalore Elevated

Tollways.

The Management highlighted that they have not made any fresh loans and

advances to their subsidiaries. Long-term loans and advances to subsidiaries as of

2QFY2016 stand at `135.9cr. On a qoq basis, loans and advances have

increased as interest from one of the subsidiaries has accrued but is not paid to the

parent. NCC Urban Infra, the real estate subsidiary, has repaid `71cr of debt to

the parent entity during YTDFY2016 and expects

~`29cr to be paid in

2HFY2016E.

Revision of Estimates

Considering income booked from Real Estate transactions (expected to contribute

in 3Q also), we are increasing our EBITDA and PAT estimates for FY2016E.

November 13, 2015

5

NCC | 2QFY2016 Result Update

Exhibit 12: Revised Earnings Estimates

FY2016E

FY2017E

Old

New

Chg. (%)

Old

New

Chg. (%)

Net Sales

7,892

7,892

0.0%

8,842

8,842

0.0%

EBITDA

651

695

6.8%

805

805

0.0%

EBITDA %

8.2

8.8

9.1

9.1

PAT

136

165

21.3%

297

297

0.0%

PAT %

1.7

2.1

3.4

3.4

Source: Company, Angel Research

November 13, 2015

6

NCC | 2QFY2016 Result Update

Outlook and Valuation

Considering the bid pipeline and emerging award activity environment, we are

optimistic that NCC should be able to report its targeted `8,000cr of order inflows

for FY2016E. Accordingly, we expect NCC to report `7,900cr/`9,600cr of order

inflows for FY2016E/ FY2017E, respectively.

Considering declining contribution of in-house power project, we have modeled a

4.9% yoy decline in revenues to `7,892cr in FY2016E. Higher contribution from

new projects should translate to 12% yoy revenue growth in FY2017E to `8,842cr.

On the whole, we expect NCC to report a

3.2% top-line CAGR during

FY2015-17E, respectively.

Considering (1) higher contribution from recently won projects (and declining

contribution from their low margin captive power project), and (2) better cost

management, we expect NCC to report a 127bp EBITDA margin expansion during

FY2015-17E to 9.1%.

Even though the Management expects NCC to repay `200-300cr of debt in

FY2016E, stretch in working capital (WC) cycle in our view should delay the debt

repayment cycle. We expect debt to decline by `290cr in FY2017E (reflecting

compression in the working capital cycle). This when coupled with lower interest

rates, should help the company report 15.5% negative CAGR in interest expenses

during FY2015-17E to `410cr. EBITDA margin expansion and decline in interest

expenses should lead to 201bp PAT margin expansion during FY2015-17E to

3.4%.

NCC’s stock price in the last 12 months has run up by 36.9%, mainly on account

of the company’s exercise of de-leveraging its balance sheet. Currently, NCC lags

behind its smaller peers on the execution front. On considering their declining

dependency on in-house power projects, we expect execution to gradually catch-up

from here on. With shift in execution mix towards higher margin orders, we expect

EBITDA margins to expand in FY2016-17E. Also, we see some leg-room for

improvement in WC as % of sales, going forward. On the whole, we expect the

next round of re-rating in the stock to come from (1) EBITDA margin expansion,

and (2) further compression in the working capital cycle.

We recommend Neutral with a price target of `90

We have valued NCC using the sum-of-the-parts method. NCC’s EPC business

(both, standalone entity and international subsidiaries) has been valued using

FY2017E P/E multiple, whereas BOT projects have been valued using “Free Cash

flow to Equity holders” method; the company’s real estate projects are valued

using Book Value.

Value of Core EPC business

We have valued NCC’s domestic EPC business (standalone entity) and Middle East

business (international subsidiaries) using P/E multiple of 14.0x and 10.0x,

respectively to arrive at an EPC business value of `81 per share.

November 13, 2015

7

NCC | 2QFY2016 Result Update

Value of BOT projects

BOT projects are valued at “Free Cash flow to Equity holders” method. Our value

for all 4 ongoing BOT projects comes to `6/share, which is 7% of the overall SOTP

value for the company.

Exhibit 13: Derivation of SOTP-based target price for NCC

FY17E PAT

Target

Target

Value/

% of

Particulars

Segment

Basis

(` cr)

Multiple

Value (` cr)

share (`)

SoTP

NCC's Domestic EPC business

Construction

297

14.0

4,155

75

83

P/E of 14x

NCC's International EPC business

Construction

32

10.0

323

6

6

P/E of 10x

Total

329

4,477

81

89

Disounted

Project

Adj. FCFE

Value/

% of

Particulars

Proj. Type

Basis

FCFE (` cr)

Stake

Value (` cr)

share (`)

SoTP

Road BOT projects

OB Infrastructure (OBIL)

Annuity

110

64%

71

1

1

Ke of 16%

Bangalore Elevated Tollway (BETL)

Toll

474

26%

123

2

2

Ke of 16%

Western UP Tollway (WUTL)

Toll

223

51%

114

2

2

Ke of 16%

Pondicherry-Tindivanam Tollway (PTTL)

Toll

107

40%

43

1

1

Ke of 16%

Total

915

350

6

7

Book Value

Target

Adj. Book

Value/

% of

Particulars

Proj. Type

Basis

(` cr)

Multiple

Value (` cr)

share (`)

SoTP

Other projects

Inv. in Real Estate proj.

Real Estate

355

0.5

178

3

4

P/BV of 0.5x

(inc. NCC Urban Infra)

Total

355

178

3

4

Grand Total

5,005

90

100

Source: Company, Angel Research

Value of Real Estate business

Real Estate business has been valued using the “Book Value” method. We have

valued the Real Estate business at 0.5x the FY2017E book value to arrive at

`4/share, which is 4% of the overall SOTP value for the company.

On combining the value of EPC business, BOT projects, and Real Estate business,

we arrive at a combined business value of `90/share. Given all the positives

captured in the stock price, we maintain our NEUTRAL rating on the stock.

Company background

NCC, having started off as a building/industrial construction company, has

emerged as an EPC contractor with a diversified portfolio. NCC’s presence across

all key Infrastructure verticals: 1) roads; 2) buildings; 3) irrigation; 4) electrical; 5)

water; 6) power; 7) oil and gas; and 8) metals, endows it with relatively de-risked

business model. NCC has also ventured in international geographies such as

Oman and UAE, which further indicates business diversification.

November 13, 2015

8

NCC | 2QFY2016 Result Update

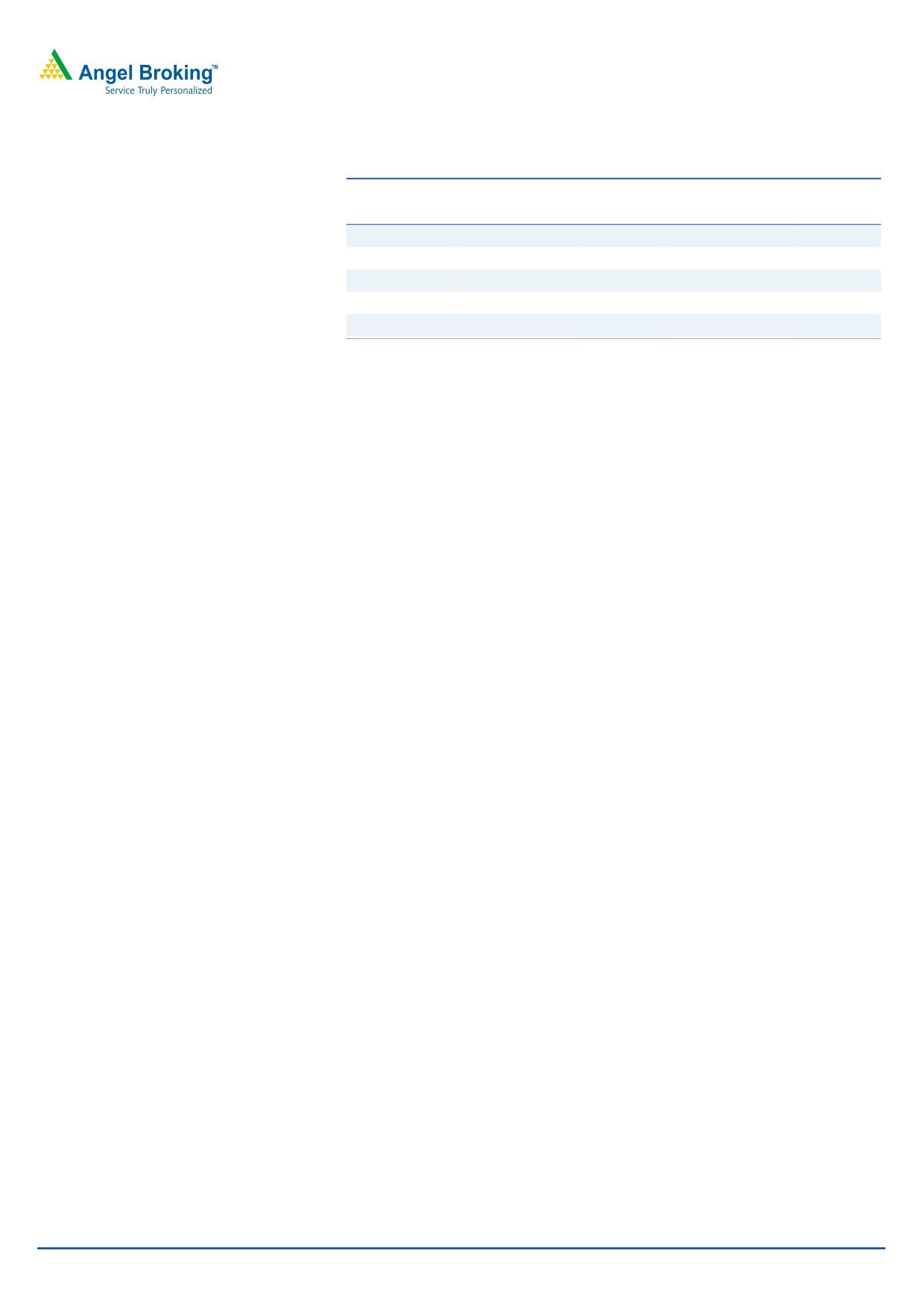

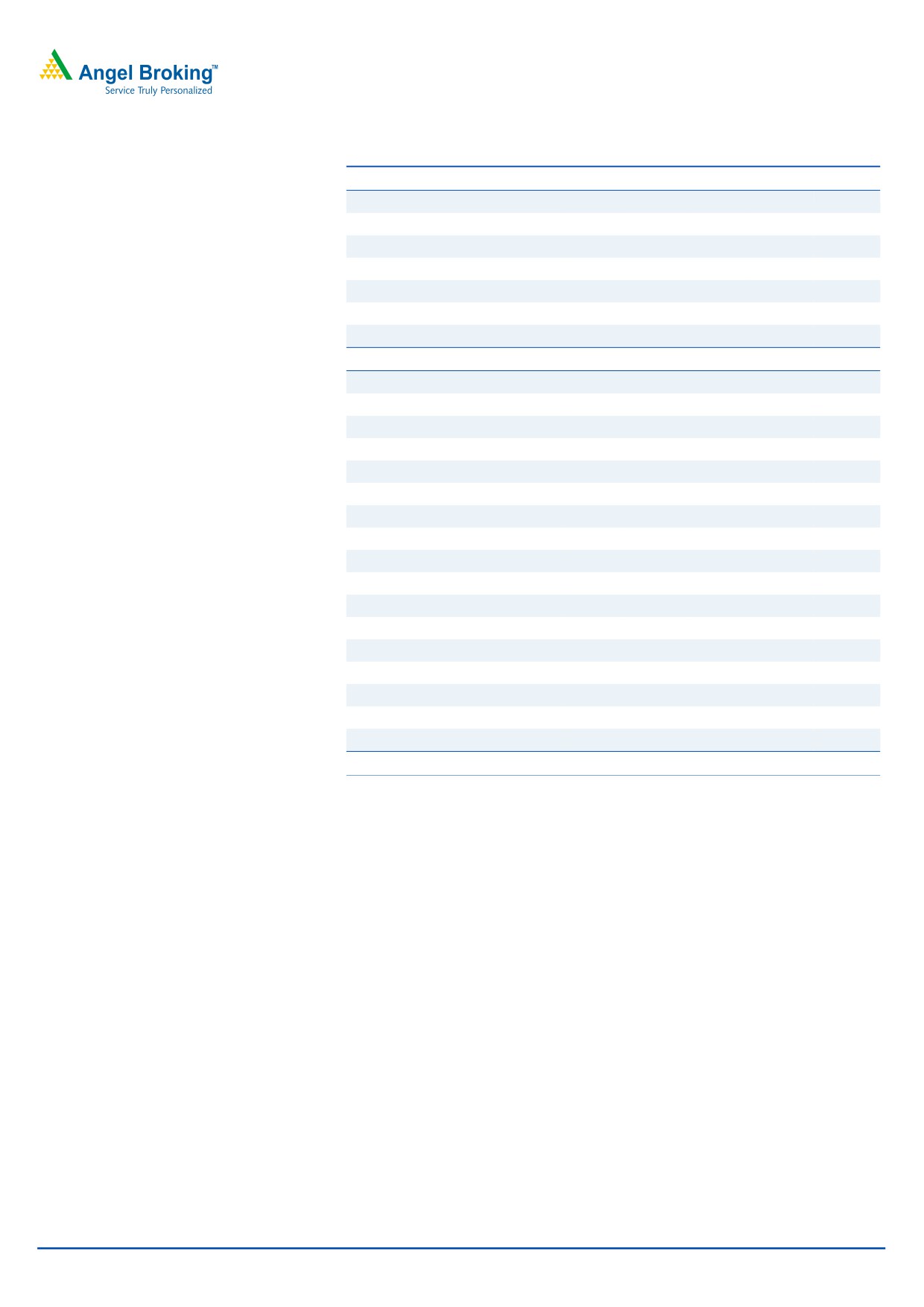

Exhibit 14: Order Inflows to report strong growth..

Exhibit 15: Order Book to see increased traction..

12,000

140

25,000

4.5x

3.9x

120

3.4x

4.0x

112

10,000

3.3x

2.3x

100

20,000

3.2x

3.2x

2.4x

2.2x

3.5x

80

8,000

3.0x

58

60

15,000

22

40

2.5x

6,000

19

20

2.0x

10,000

4,000

0

1.5x

(22)

(20)

(26)

1.0x

5,000

2,000

(40)

(57)

0.5x

(60)

0

(80)

0

0.0x

FY10

FY11

FY12

FY13

FY14

FY15

FY16E FY17E

FY10

FY11

FY12

FY13

FY14

FY15

FY16E FY17E

OI (` cr)

y/y change (%)

OB (` cr)

Execution Rate (x)

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 16: Profitability to see sharp improvement...

Exhibit 17: Std. D/E (to decline to 0.5x by FY2017E)

10,000

2,500

0.9x

1.0x

9,000

0.8x

0.9x

8,000

2,000

0.8x

7,000

0.7x

6,000

1,500

0.6x

0.6x

0.6x

5,000

0.5x

0.5x

4,000

1,000

0.4x

3,000

0.3x

2,000

500

0.2x

1,000

0.1x

0

0

0.0x

FY13

FY14

FY15

FY16E

FY17E

FY13

FY14

FY15

FY16E

FY17E

Revenues (` cr) PAT (` cr)

Standalone Debt (` cr)

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 18: RoEs set of expand to 8.6% by FY2017E

Exhibit 19: RoCE set of expand to 12.8% by FY2017E

10.0

14.0

9.0

12.0

8.0

7.0

10.0

6.0

8.0

5.0

6.0

4.0

3.0

4.0

2.0

2.0

1.0

0.0

0.0

FY13

FY14

FY15

FY16E

FY17E

FY13

FY14

FY15

FY16E

FY17E

Source: Company, Angel Research

Source: Company, Angel Research

November 13, 2015

9

NCC | 2QFY2016 Result Update

Profit & loss statement (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

Net Sales

5,725

6,117

8,297

7,892

8,842

% Chg

9.0

6.9

35.6

(4.9)

12.0

Total Expenditure

5,254

5,712

7,648

7,197

8,038

Cost of RM Consumed

2,080

2,609

4,453

3,891

4,377

Const. & Sub-contracting Exp.

2,743

2,665

2,693

2,809

3,104

Employee benefits Expense

243

240

265

292

327

Other Expenses

188

198

237

205

230

EBITDA

471

405

649

695

805

% Chg

18.0

(14.0)

60.4

7.0

15.8

EBIDTA %

8.2

6.6

7.8

8.8

9.1

Depreciation

92

90

112

119

127

EBIT

379

315

538

575

678

% Chg

19.9

(16.8)

70.5

7.0

17.7

Interest and Fin. Charges

407

466

574

499

410

Other Income

126

154

195

170

175

PBT

98

3

159

246

443

Exceptional Items

0

0

0

0

0

Prior Period Adjustments

0

0

0

0

0

Tax

35

(38)

47

81

146

% of PBT

35.9

nmf

29.7

33.0

33.0

PAT

63

41

112

165

297

% Chg

74.2

(35.3)

175.9

47.5

79.9

PAT %

1.1

0.7

1.3

2.1

3.4

Basic EPS

2.4

1.6

2.0

3.0

5.3

Diluted EPS

2.4

1.6

2.0

3.0

5.3

% Chg

74.2

(35.3)

27.4

47.5

79.9

November 13, 2015

10

NCC | 2QFY2016 Result Update

Balance sheet (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

SOURCES OF FUNDS

Equity Capital

51

51

111

111

111

Reserves Total

2,417

2,469

3,093

3,229

3,493

Shareholders Funds

2,468

2,520

3,204

3,340

3,604

Total Debt

2,056

2,306

1,925

1,990

1,700

Other Long-term Liabilities

54

63

53

63

66

Long-term Provision & Def. Tax Liab.

41

32

35

38

40

Total Liabilities

4,619

4,922

5,218

5,431

5,409

APPLICATION OF FUNDS

Gross Block

1,107

1,155

1,215

1,305

1,413

Accumulated Depreciation

389

463

575

694

822

Net Block

719

692

640

610

592

Capital WIP

6

10

1

6

7

Investments

1,254

1,164

1,157

1,157

1,157

Inventories

1,426

1,599

1,803

1,862

1,927

Sundry Debtors

1,143

1,444

1,363

1,424

1,522

Cash and Bank Balance

80

69

113

134

199

Short-term Loans & Advances

2,113

2,817

2,755

2,785

2,810

Other Current Assets

916

957

1,314

1,335

1,384

Trade Payables

1,399

1,539

1,766

1,731

1,915

Other Current Liabilities

2,070

2,654

2,415

2,410

2,528

Short-term Provisions

40

13

34

22

25

Net Current Assets

2,170

2,680

3,134

3,378

3,374

Long-term Loans & Advances

320

256

140

130

130

Other Assets

151

119

148

150

150

Total Assets

4,619

4,922

5,218

5,431

5,409

November 13, 2015

11

NCC | 2QFY2016 Result Update

Cash flow statement (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

Profit before tax

98

3

159

246

443

Depreciation

92

90

112

119

127

Other Adjustments

(111)

(114)

(203)

(41)

(24)

Change in Working Capital

(59)

(92)

(92)

(204)

73

Interest & Financial Charges

407

466

574

499

410

Direct taxes paid

(58)

17

(36)

(81)

(146)

Cash Flow from Operations

369

370

514

539

883

(Inc)/ Dec in Fixed Assets

(45)

(68)

(50)

(95)

(110)

(Inc)/ Dec in Invest. & Int. received

112

(105)

(29)

83

24

Cash Flow from Investing

67

(173)

(79)

(12)

(86)

Inc./ (Dec.) in Borrowings

(9)

250

(479)

65

(290)

Issue/ (Buy Back) of Equity

0

0

594

0

0

Dividend Paid (Incl. Tax)

(9)

(9)

(6)

(29)

(33)

Finance Cost

(405)

(457)

(518)

(499)

(410)

Cash Flow from Financing

(423)

(217)

(409)

(464)

(732)

Inc./(Dec.) in Cash

13

(20)

26

63

65

Opening Cash balances

52

65

45

71

134

Closing Cash balances

65

45

71

134

199

November 13, 2015

12

NCC | 2QFY2016 Result Update

Key ratios

Y/E March

FY13

FY14

FY15

FY16E

FY17E

Valuation Ratio (x)

P/E (on FDEPS)

31.7

49.0

38.5

26.1

14.5

P/CEPS

12.8

15.3

19.2

15.1

10.2

Dividend yield (%)

2.6

3.9

1.9

1.7

1.5

EV/Sales

0.7

0.7

0.7

0.8

0.7

EV/EBITDA

8.4

10.4

9.4

8.9

7.2

EV / Total Assets

0.9

0.9

1.2

1.1

1.1

Per Share Data (`)

EPS (Basic)

1.4

1.6

2.0

3.0

5.3

EPS (fully diluted)

1.4

1.6

2.0

3.0

5.3

Cash EPS

6.0

5.1

4.0

5.1

7.6

DPS

0.3

0.2

0.4

0.5

0.5

Book Value

96

98

58

60

65

Returns (%)

RoCE (Pre-tax)

8.4

6.7

10.8

11.0

12.7

Angel RoIC (Pre-tax)

8.5

6.6

10.7

11.1

13.3

RoE

2.6

1.6

3.9

5.0

8.5

Turnover ratios (x)

Asset Turnover (Gross Block) (x)

5.1

5.4

7.0

6.3

6.5

Inventory / Sales (days)

86

90

75

85

78

Receivables (days)

79

77

62

64

61

Payables (days)

243

246

201

212

196

NWC days

113

124

108

126

115

Leverage Ratios (x)

D/E ratio (x)

0.8

0.9

0.6

0.6

0.5

Debt/ EBITDA ratio (x)

4.4

5.7

3.0

2.9

2.1

Interest Coverage Ratio (x)

0.9

0.7

0.9

1.2

1.7

November 13, 2015

13

NCC | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

NCC

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 13, 2015

14