Initiating Coverage | Media

July 20, 2017

Music Broadcast Limited

BUY

CMP

`368

Rhythm of profitable investment

Target Price

`434

Music Broadcast Limited (MBL) owns and operates FM radio stations under the

Investment Period

12 Months

brand names Radio City and Radio Mantra. MBL has 39 radio stations and

operates in 37 Indian cities. The company has a strong listenership base in cities

Stock Info

like Mumbai, Delhi and Bengaluru.

Long term barriers a positive for Industry: Radio Industry is protected by licenses

Sector

Media

for 15 years, thereby restricting the entry of new players. This would support the

Market Cap (` cr)

2,107

existing companies to strengthen their position and maintain a healthy growth

Beta

0.3

rate. The new radio stations are being added in the semi-urban areas which is

positive for the industry as this will increase the listener base. As radio

52 Week High / Low

420/329

broadcasting enjoys pricing advantage over other ways of broadcasting such as

Avg. Daily Volume

71,162

TV, print, etc. we believe that the industry is expected to see faster revenue growth

going ahead, benefitting all the players. KPMG-FICCI expects the Radio Industry

Face Value (`)

10

to grow at a CAGR of 16.9% over FY2015-20.

BSE Sensex

31,904

Higher listenership, wider reach to fetch premium advertisement rates: As on

Nifty

9,873

March 31, 2017, Radio City reached out to over 52.2mn listeners in 23 cities

(ENIL- 42.1mn). It grabbed the Number 1 position in Mumbai, Bengaluru and

Reuters Code

MUSI.NS

Delhi in terms of number of listeners. Leadership position in top markets, wider

Bloomberg Code

RADIOCIT@IN

reach (62% of population) and better quality of content has enabled MBL to

charge ~30% higher advertising rates than its peers and 12-15% higher charges

than its closest peer. Owing to this, Radio City enjoys healthy 33.6% operating

Shareholding Pattern (%)

margin, much better than ENIL’s ~22% margin in FY2017.

Leading the industry owing to better financials: MBL outperformed its closest peer

Promoters

71.4

with 18.4% CAGR in revenue over FY2013-17 (ENIL reported 13.2% CAGR in

MF / Banks / Indian Fls

7.5

revenue). On the profitability front too, MBL, with 32.3% CAGR in PAT over

FII / NRIs / OCBs

4.1

FY2013-17, has performed much better than ENIL (-5.2% CAGR in PAT).

Moreover, Radio City posted a six year CAGR of 12.1% v/s. 9.1% of industry

Indian Public / Others

17.0

owing to higher advertising volumes.

Capex for next 15 years done, paving the way for healthy free cash flow: Capex

for 39 licenses have been done for the next 15 years, hence no heavy incremental

Abs.(%)

3m 1yr 3yr

Capex requirement would emerge. Moreover, the maintenance Capex would be

Sensex

8.9

15.0

24.6

as low as `5-10cr. This would leave sufficient cash flow to distribute as dividend.

Outlook & Valuation: We expect MBL to report Revenue/EBITDA/PAT CAGR of

Music Broadcast Ltd

9.3

-

-

17%/19.2%/47.6% respectively over FY2017-19E driven by launches of new

stations, increase in advertising rates and improvement in utilization of radio

stations. MBL is trading at relatively lower valuations compared to its peer ENIL on

Price chart

FY19E, (MBL is trading at P/E-26.3, P/B-3.1, EV/EBITDA-14.2 as compared to

ENIL P/E-34.3,P/B-4.3,EV/EBITDA-18.6). Considering sustainable growth

380

opportunities over the next 5-7 years, most of the capex already through and

370

strong parentage, we initiate coverage on MBL with a BUY recommendation and

360

350

a Target Price of `434 (31x of FY19E EPS `14/-.)

340

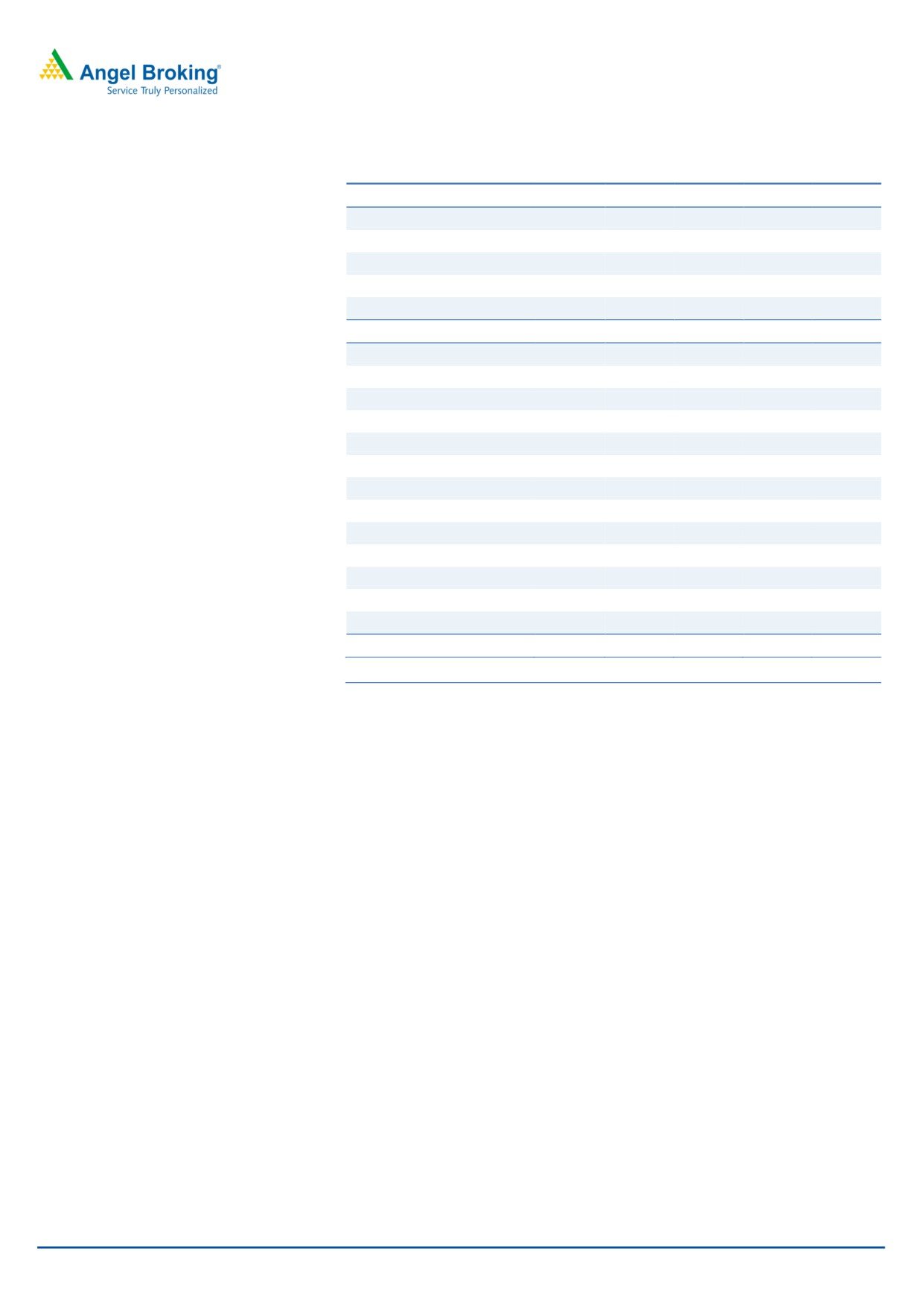

Key financials

330

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018E

FY2019E

320

Net Sales

201

225

271

317

372

% chg

30

12

20

17

18

Net Profit

47

27

36

56

80

% chg

93

(42)

30

57

43

Source: Company, Angel Research

EBITDA (%)

31

35

34

34

35

EPS (Rs)

8

5

6

10

14

P/E (x)

45

77

59

38

26

P/BV (x)

36

10

4

3

3

RoE (%)

82

13

6

9

12

Jaikishan J Parmar

RoCE (%)

14

16

10

13

14

022 39357600, Extn: 6810

EV/EBITDA

37

29

20

18

14

Source: Company, Angel Research, Note: CMP as of July 20, 2017

Please refer to important disclosures at the end of this report

1

Music Broadcast ltd | Initiating Coverage

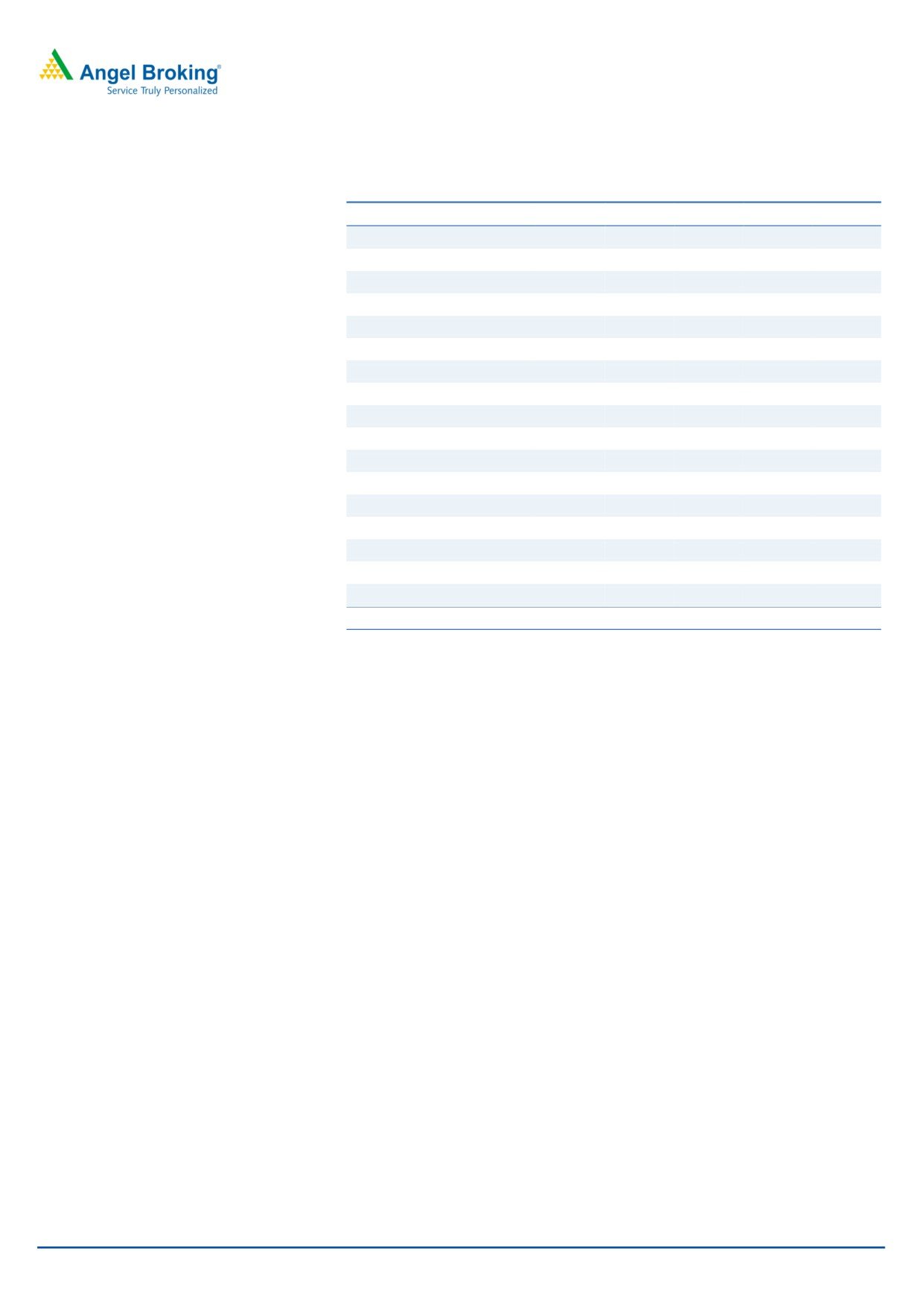

Story in Charts

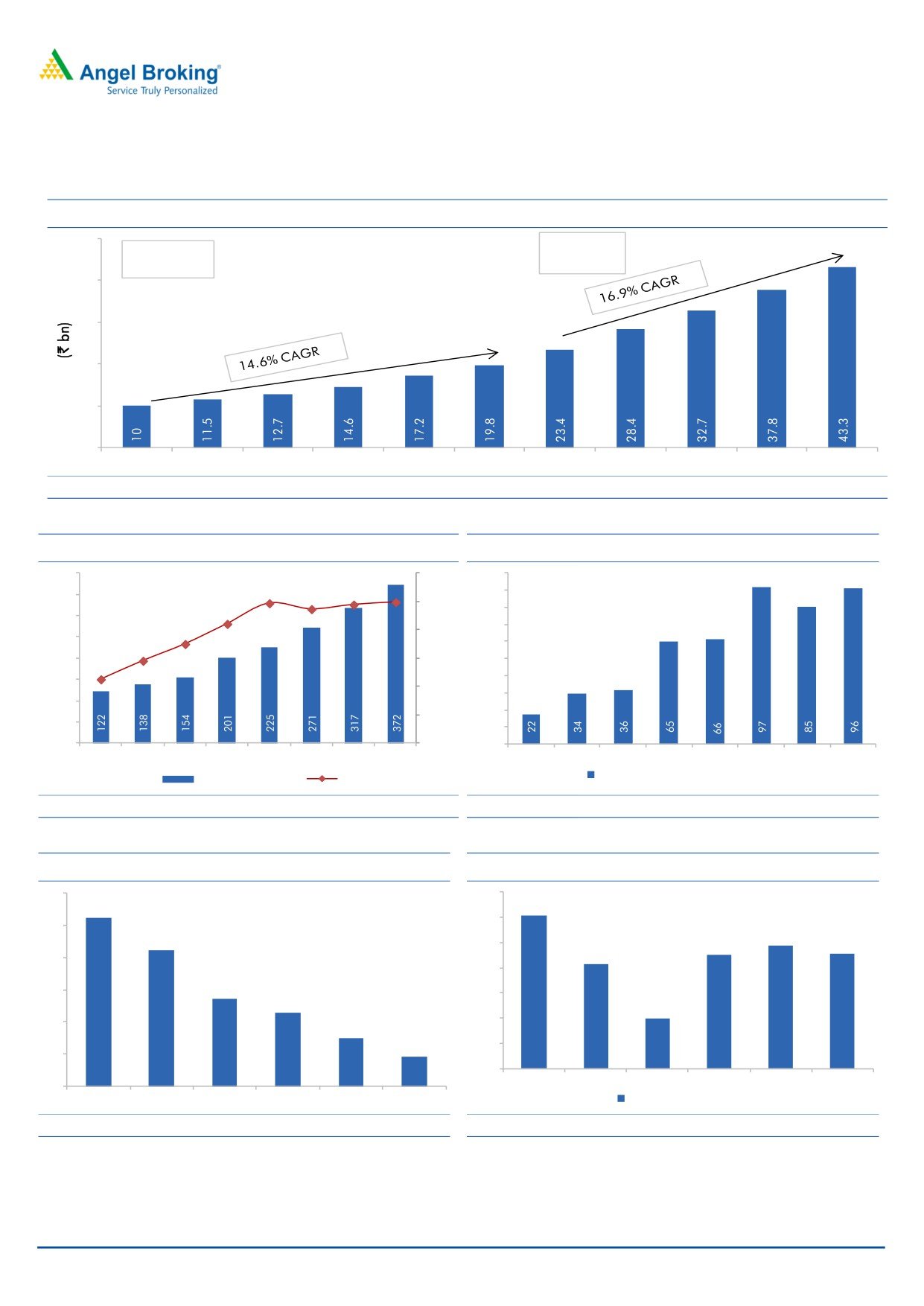

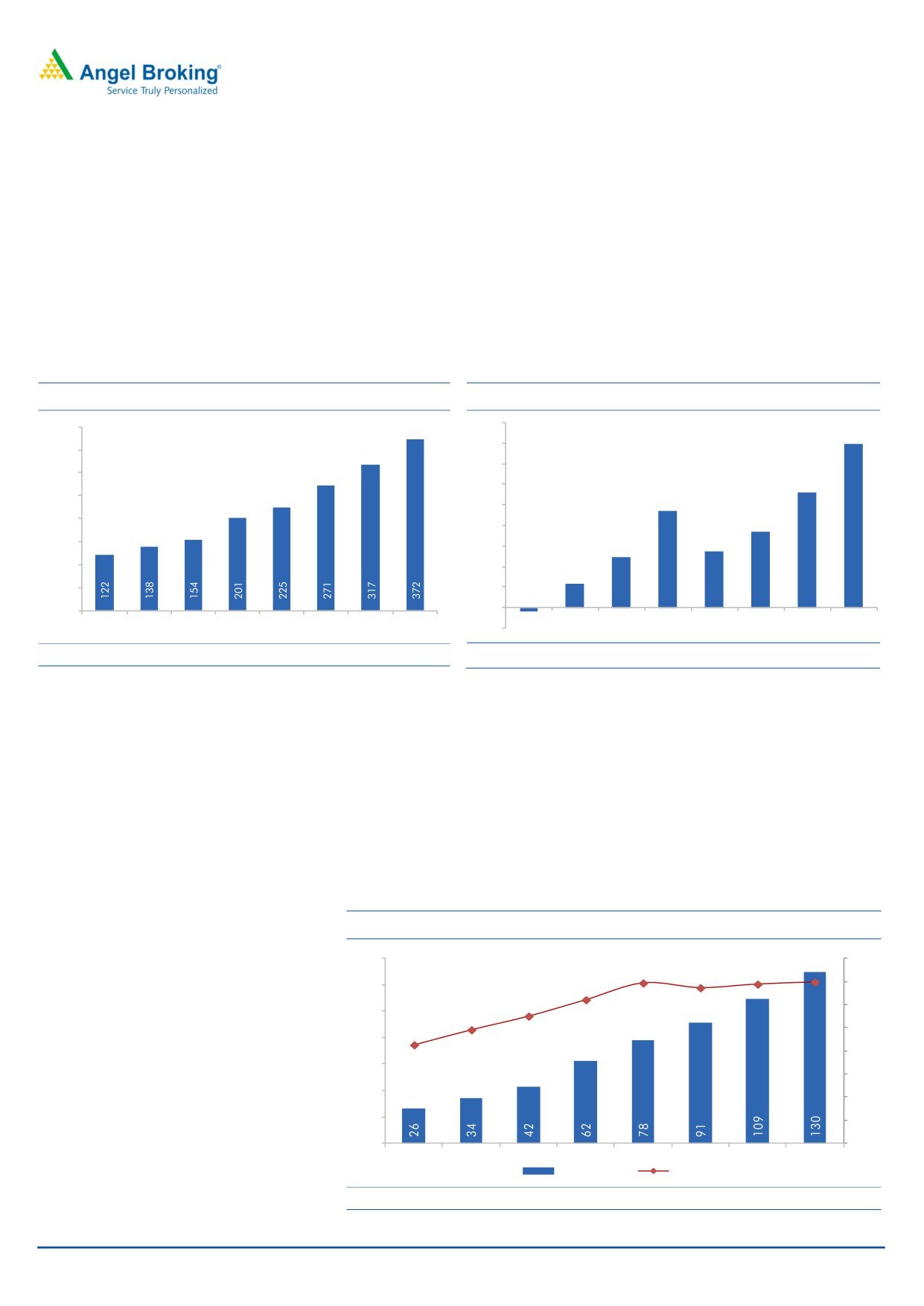

Exhibit 1: Radio Industry’s Historical & Projected trend

50

Phase III

Phase II

302 towns

86 towns

40

30

20

10

0

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

Source: Company, Angel Research, KPMG-FICCI Report

Exhibit 2: Revenue & EBITDA Margin Trend

Exhibit 3: Healthy Cash Flow From Operations

400

40%

105

34.9%

34.7%

34.4%

95

350

33.6%

35%

31.0%

85

300

27.5%

75

30%

250

24.5%

65

200

25%

55

21.3%

150

45

20%

35

100

25

15%

50

15

-

10%

5

FY12

FY13

FY14

FY15

FY16

FY17

FY18E FY19E

FY12

FY13

FY14

FY15

FY16

FY17

FY18E FY19E

Cash Flow fromOperation(` in cr)

Revenue (` in cr)

EBITDA (%)

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 4: Leadership Across Market

Exhibit 5: Advertising Volume

60

14%

52.5

12.10%

12%

50

In mn

9.70%

42.1

10%

9.00%

9.10%

8.30%

40

8%

30

27.2

6%

22.7

4.00%

4%

20

15.1

9.1

2%

10

0%

Radio City Radio Mirchi BIG FM

Red FM

Fever

Radio One

0

Radio City Radio Mirchi

BIG FM

Red FM

Fever

Radio One

6 year CAGR (FY11-17)

Source: Company, Angel Research, AZ Research , March 2017 (23 Markets

Source: Company, Angel Research

July 20, 2017

2

Music Broadcast ltd | Initiating Coverage

Investment Argument

Long term barriers a positive for Industry

Increase in

- listener base (smaller

The allotment of radio stations in Phase III and migration from Phase II to Phase III

towns), inventory post Phase III auctions

has been licensed for the period of the 15 years, thereby, restricting the entry of

and wallet share to drive Radio

new players over the next 15 years.

Industry’s growth

Entry barriers would support the existing radio companies to strengthen their

position and help them to grow at healthy rate given - (1) new launches of radio

stations, which would increase the listener base as well as the inventory;

(2)

Considering the new launches of radio stations (increase in listener base),

especially in smaller cities, we believe that MBL’s growth would be fuelled. The

combination of increased local penetration and affordable pricing v/s. other

sources of media & entertainment coupled with an increase in the wallet share

Radio Industry is estimated

would augur well for the industry;

(3) Radio’s contribution to the total

to grow at a CAGR 16.9%

advertisement industry increased to 4.2% in CY2015 from 3.5% in CY2005, which

over FY2015-20 - KPMG-FICCI Report

is far lesser than the developed countries (7-10%) and it is expected to increase at

a faster rate.

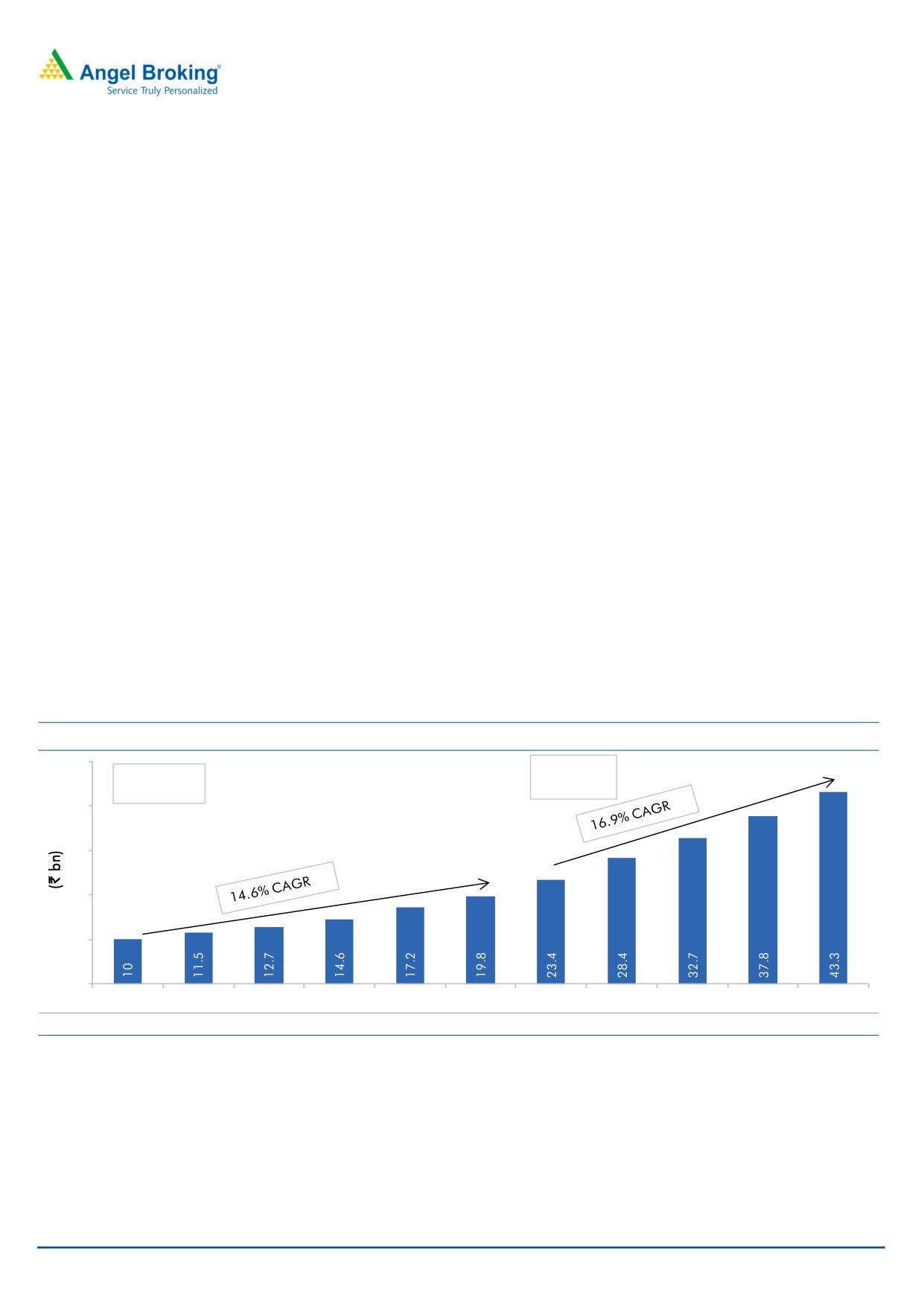

According to the KPMG-FICCI Report, the radio industry has grown at a steady

CAGR of 14.5% between the calendar year 2011 and 2015 and recorded an

estimated growth rate of 15.1% in calendar year 2015 to reach revenues of

`19.8billion. Going forward, the Radio Industry is expected to grow at a CAGR of

16.9% between the calendar year 2015 and 2020.

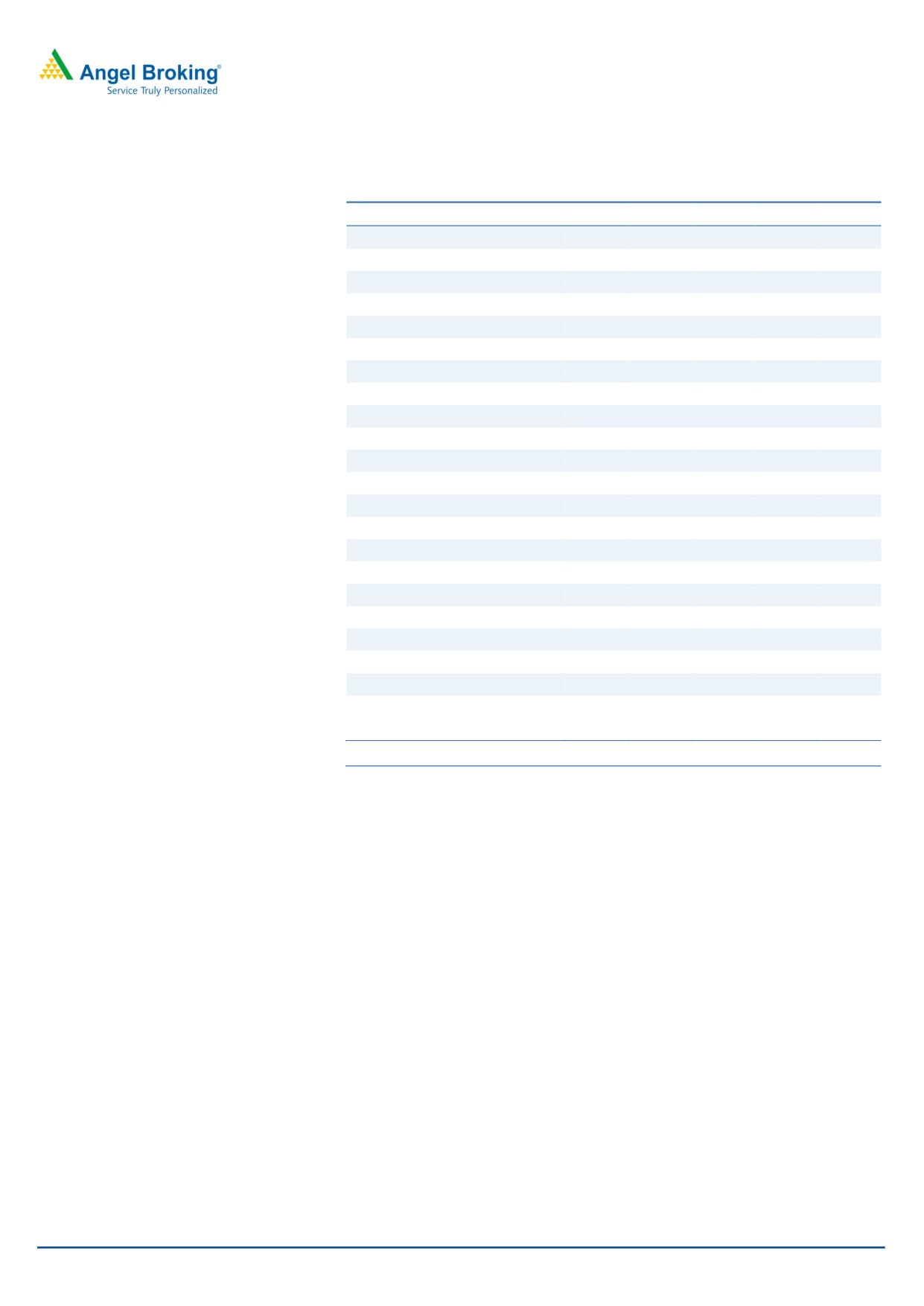

Exhibit 6: Radio Industry’s Historical & Projected Trend

50

Phase III

Phase II

302 towns

86 towns

40

30

20

10

0

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

Source: Company, Angel Research, KPMG-FICCI Report

July 20, 2017

3

Music Broadcast ltd | Initiating Coverage

Higher listenerships, wider reach to fetch premium

advertisement rates

Leadership position in large markets

As on March 31, 2017, Radio City reached out to over 52.2mn listeners in 23

cities (ENIL- 42.1mn). It grabbed the Number 1 position in Mumbai, Bengaluru

and Delhi in terms of number of listeners. Leadership position in top markets,

wider reach (62% of population) and better quality of content has enabled MBL to

charge ~30% higher advertising rates than its peers and 12-15% higher charges

than its closest peer. Owing to this, Radio City enjoys healthy 33.6% operating

margin, much better than ENIL’s ~22% margin in FY2017.

MBL is the first and the oldest private FM radio player in India with over 15 years

of expertise in the Radio Industry. It has pan India presence spanning across

Southern, Northern, Western and Eastern geographies of India. The company is

also present in 12 of the 15 most populated cities in India and has been able to

reach out to over 42.5 million listeners and covers 62% of India’s population with

access to FM radio in 302 towns (post Phase III). Additionally, it also benefits from

the group (JAGARAN), as MBL can bring incremental advertisers on board quickly.

Exhibit 7: Listenership Across Market (In Mn)

Exhibit 8: Listenership in Mumbai (In Mn)

60

9

8.4

52.5

8

50

42.1

7

6.4

5.9

40

6

5.5

5

30

27.2

22.7

4

20

15.1

3

2

9.1

2

10

1

0

0

Radio City Radio Mirchi

BIG FM

Red FM

Fever

Radio One

Radio City

BIG FM

Radio Mirchi

Fever

Radio One

Source: Company, Angel Research, AZ Research, March 2017 (23 Markets)

Source: Company, Angel Research, AZ Research,March 2017 (23 Markets)

Exhibit 9: Listenership in Delhi (In Mn)

Exhibit 10: Listenership in Bengaluru (In Mn)

10

5

4.7

9.2

9

4.5

8.2

4

3.7

8

7.2

3.5

3.2

7

5.8

5.5

3

2.7

6

2.3

2.5

5

4

2

1.5

3

2

1

0.5

1

0

0

Radio City

Radio Mirchi

Red FM

BIG FM

Fever

Radio City

BIG FM

Radio Mirchi

Fever

Radio One

Source: Company,Angel Research, AZ Research, March 2017(23 Markets)

Source: Company, Angel Research,AZ Research, March 2017 (23 Markets)

July 20, 2017

4

Music Broadcast ltd | Initiating Coverage

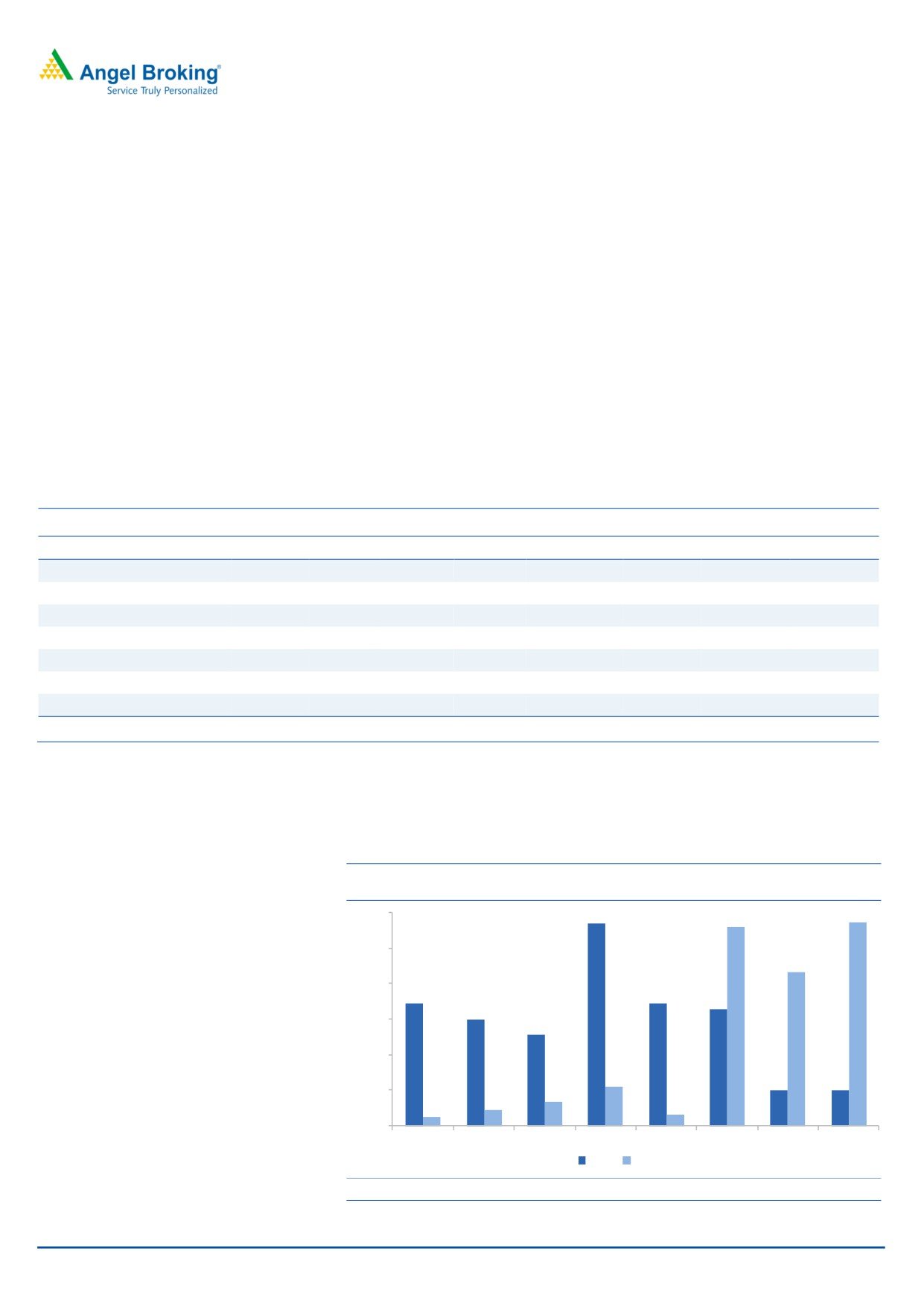

Capex for next 15 years done, paving the way for healthy free

cash flow

Net cash position & miniscule capex

Radio business requires minuscule maintenance CAPEX once the stations are

requirement would lead to higher

operational. MBL has done CAPEX of ~`340cr for buying 11 new stations and for

dividend distribution to equity holders

migrating from Phase II to Phase III. This CAPEX has been done for the next 15

years to run the radio business of 39 stations. We believe that here on the

maintenance capital requirement would be around `5-10cr. This would leave

sufficient cash flow with the company for distribution to equity share holders.

Since 2012, MBL has been consistently reporting increased positive cash flow from

operations. CFO/EBITDA ratio has always remained higher than 75%, which

displays the company’s ability of generating consistent cash flow. As major capex

is through, we believe that MBL would generate `90cr of free cash flow in FY19,

which is 4.4% of current market cap. We estimate FCF generation of `152cr over

the next 2 years (FY2018E & FY2019E)

Exhibit 11: Healthy Cash Flow trend

FY12

FY13

FY14

FY15

FY16

FY17

FY18E

FY19E

CFO

22.4

34.3

36.4

65.0

66.3

96.8

82.1

95.7

Capex

-14.6

-2.5

-3.8

-2.7

-339.8

-35.2

-20.0

-5.0

FCF

7.8

31.8

32.6

62.3

-273.5

61.5

62.1

90.7

EBITDA

26.0

33.9

42.4

62.3

78.1

91.3

109.0

129.7

PAT

-2.2

11.6

24.3

47.1

27.3

35.6

56.0

79.8

CFO/EBITDA

81%

101%

86%

104%

85%

106%

75%

74%

FCF/EBITDA

137%

109%

95%

109%

-520%

145%

94%

78%

Source: Company, Angel Research

MBL recently concluded IPO of `400cr, primarily to pay debt, leaving a net cash

position of `120cr by the end of FY2017. Considering healthy cash position and

stable free cash flow, MBL might scout for local/smaller radio firms in places like

Kolkata, Madhya Pradesh and Chhattisgarh after the three-year lock-in period

under Phase III of radio privatization expires on March 31, 2018.

Exhibit 12: MBL To Have ~`235cr Of Net Cash On Books By FY2019E

300

285

280

285

250

216

200

173

173

163

149

150

128

100

54

50

50

50

34

22

12

16

-

FY12

FY13

FY14

FY15

FY16

FY17

FY18E FY19E

Debt Cash

Source: Company, Angel Research

July 20, 2017

5

Music Broadcast ltd | Initiating Coverage

Financial Highlights

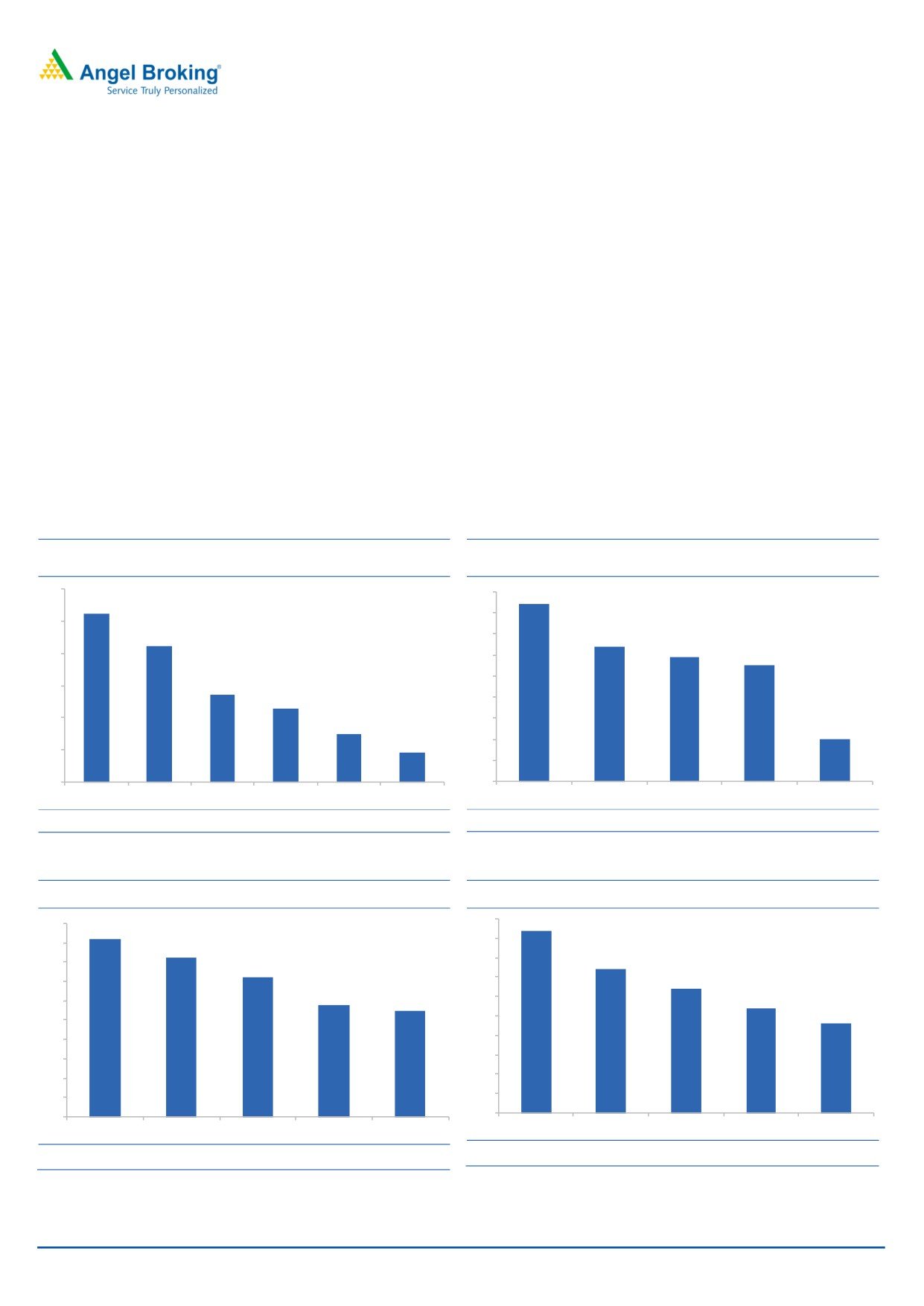

MBL has reported a healthy Revenue/EBITDA/PAT CAGR of 18.4%/28.1%/32.3%

respectively over FY2013-17. Advertising volume growth of 12.5% and price

growth of 5-6% has contributed to the increase in revenues. It has managed to

improve its EBITDA by ~909bps from 24.5% in FY2013 to 34.7% in FY2017, led

by efficiently managed stations and ability to charge premium rates compared to

peers in metro cities. PAT grew at a CAGR of 32.3% over FY2013-17, however,

margins declined amid rising in finance costs, as MBL had taken debt to fund news

stations.

Exhibit 13: Revenue Trend (` in cr)

Exhibit 14: PAT Trend (` in cr)

90

400

80

80

350

70

300

56

60

250

47

50

200

37

40

150

28

30

24

100

20

12

50

10

-2

-

-

FY12

FY13

FY14

FY15

FY16

FY17

FY18E FY19E

FY12

FY13

FY14

FY15

FY16

FY17

FY18E FY19E

-10

Source: Company, Angel Research

Source: Company, Angel Research

Historically, major costs for running a radio station are Staff Costs, Marketing,

Music Royalties, License fees, and other administration costs. These cost structures

continue to remain the same. Out of the above costs discussed, 75% of the cost

would not increase as a proportion to the increase in sales percentage. Hence, we

have seen EBITDA margin improvement trend in MBL. Moreover, we believe that

MBL would report a rise in margins over the next 3 to 4 years, as operating

leverage kicks in with stable costs and new stations allotted in Phase III have gone

live in 2HFY2017, which would add to the revenue, but cost for setting up a new

station has, however been done.

Exhibit 15: EBITDA Trend

140

40%

34.7%

34.4%

34.9%

33.6%

120

31.0%

35%

27.5%

30%

100

24.5%

21.3%

25%

80

20%

60

15%

40

10%

20

5%

0

0%

FY12

FY13

FY14

FY15

FY16

FY17

FY18E FY19E

EBITDA (`)

EBITDA (%)

Source: Company, Angel Research

July 20, 2017

6

Music Broadcast ltd | Initiating Coverage

Outlook & Valuation: We expect MBL to report Revenue/EBITDA/PAT CAGR of

17%/19.2%/47.6% respectively over FY2017-19E driven by launches of new

JPL Group Relationships, Experienced

stations, increase in advertising rates and improvement in utilization of radio

Team, Knowledge of Local Markets

stations. MBL is trading at relatively lower valuations compared to its peer ENIL on

& Credibility with Advertisers to support

FY19E, (MBL is trading at - P/E-26.2, P/B-3.1, EV/EBITDA-14.1 as compared to

growth

ENIL P/E-34.3, P/B-4.3, EV/EBITDA-18.6). Considering sustainable growth

opportunities over the next 5-7 years, most of the capex already through and

strong parentage, we initiate coverage on MBL with a BUY recommendation and a

Target Price of `434 (31x of FY19E EPS `14/-.)

Exhibit 16: Comparative Valuation vis-à-vis ENIL

P/E

P/B

EV/EBITDA

ROE (%)

FY17

FY18E

FY19E

FY17

FY18E

FY19E

FY17

FY18E

FY19E

FY17

FY18E

FY19E

ENIL

80.0

52.3

34.3

5.1

4.8

4.3

34.9

24.5

18.6

6.8

9.4

13.0

MBL

58.7

37.3

26.2

3.8

3.5

3.1

20.1

17.4

14.1

6.5

9.3

12.0

Source: Company, Angel Research, Bloomberg consensus of ENIL and CMP as on July 20, 2017

Key Risk

Slowdown in Indian economy would impact overall ad spends

A slowdown in the economy could affect the spending from the clients, which in

turn would affect the company’s overall earnings.

Increase in content price

Inability to effectively source music content from third party music production

entities/associations can increase the input costs for the company, and hence, may

result in the dip in margins.

Reduction in listenership numbers

Rising acceptance of data and continuous reduction in the cost of data could lead

to shift of listenership to digital platform/mobile applications (Hungama, Saavn,

Gaana) and options to download could risk the listenership in Metros and key

towns initially.

July 20, 2017

7

Music Broadcast ltd | Initiating Coverage

Company Background

Music Broadcast Limited (MBL) owns and operates FM radio stations under the

brand names Radio City and Radio Mantra. The company has 39 radio stations

and operates its radio stations in 37 Indian cities. Radio City is present in 12 out of

the top 15 cities in India by population. Radio City has been ranked Number One

in Mumbai, Bengaluru and Delhi in terms of number of listeners and has a total

number of 49.60mn listeners across all 23 cities (according to AZ Research). Music

Broadcast Limited operates as a subsidiary of Jagran Prakashan Limited. It also

operates 40 Web radio stations that offer Internet radio with live RJ hosted shows

through Planet Radio City in 8 languages. In addition, Music Broadcast Limited

operates 'Planet Radio City' mobile app that plays various stations such as 'Radio

City Freedom', 'Radio City Electronica', 'Radio City Metal', and 'Radio City Smaran'

in various languages on mobile and other smart devices.

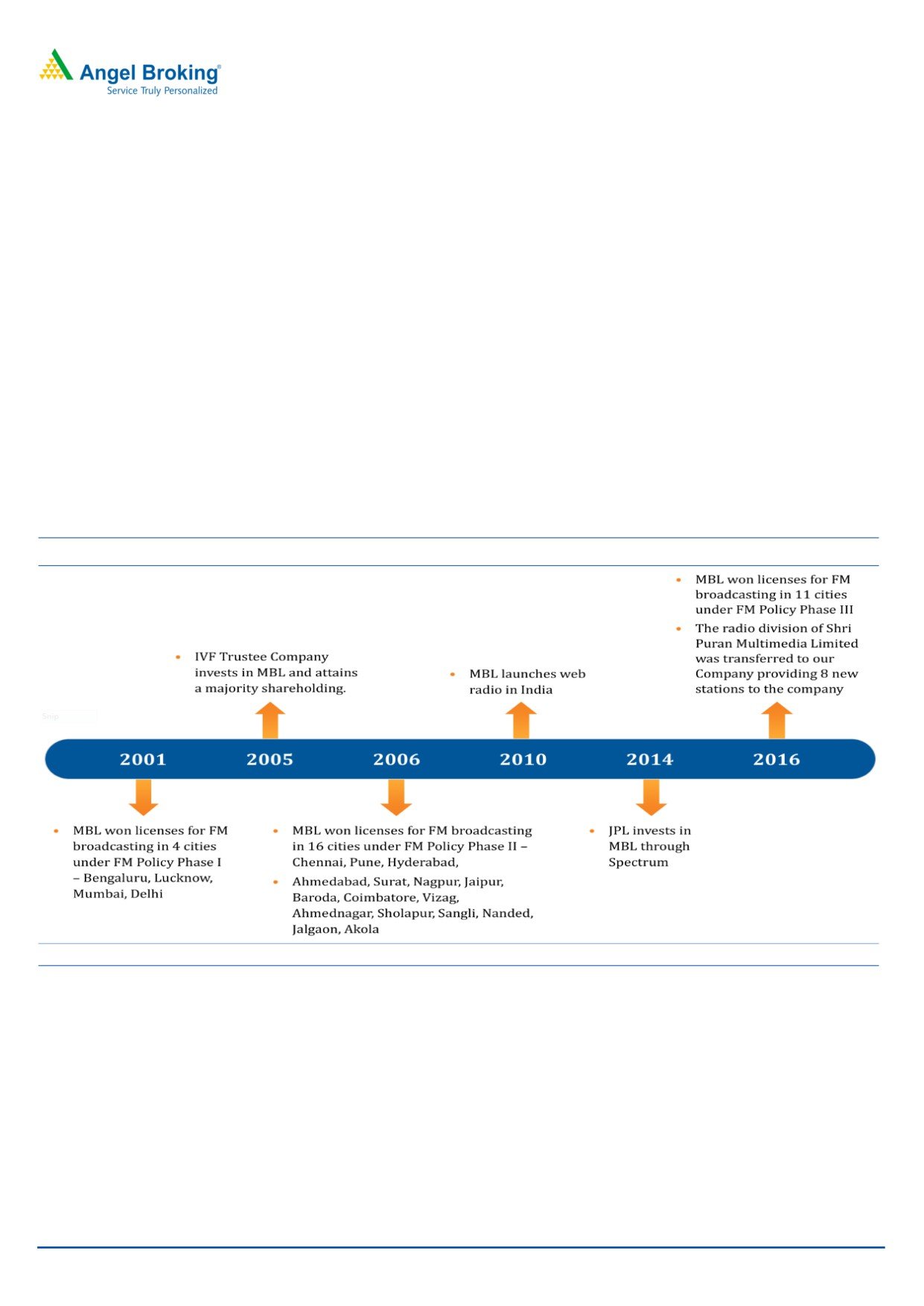

Exhibit 17: 15 years of Radio City - Growing along with the FM industry’s liberalization curve

Source: Company, Angel Research

July 20, 2017

8

Music Broadcast ltd | Initiating Coverage

Key management Personnel

APURVA PUROHIT, Director - BSc from Madras University and PGDMA from IIM

Bengaluru, she is the president of the Jagran group and handles the group’s

portfolio across several verticals including print, radio, digital and outdoor and

also accountable for any new businesses, in which the group may venture into in

the media space.

ABRAHAM THOMAS, CEO - Holds Bachelor’s degree in Pharmacy from the

University of Bombay and a Master’s diploma in Business Administration from the

Institute of Management, Development and Research, Pune. He is also on the

board of directors of One Network and Media Agnos. He has prior experience of

working at Garware Paints, Astro Broadcasting Corporation (BVI), Digital Radio

(Delhi) Broadcasting, MTV Networks India, SET India and Indian Express

Newspapers Bombay. He joined MBL on November 23, 2015.

PRASHANT DOMADIA, CFO - Holds Bachelor’s degree in Commerce from

University of Mumbai and is an associate member of Institute of Chartered

Accountants of India. He has prior experience of working with Viacom 18 Media,

Ratan S Mama & Co, Indian Hotel Company Limited and A. F. Ferguson & Co. He

joined MBL on March 13, 2008 and was appointed as CFO on November 23,

2015.

July 20, 2017

9

Music Broadcast ltd | Initiating Coverage

Income Statement

Y/E March (` cr)

FY2015

FY2016

FY2017P

FY2018E

FY2019E

Total operating income

201

225

271

317

372

% chg

30

12

20

17

18

Total Expenditure

139

147

180

208

242

License fees

9

17

19

22

26

Personnel

43

51

65

74

87

Others Expenses

86

79

96

111

129

EBITDA

62

78

91

109

130

% chg

47

25

17

19

19

(% of Net Sales)

31

35

34

34

35

Depreciation& Amortization

16

17

20

25

26

EBIT

47

61

72

84

104

% chg

73

32

17

17

24

(% of Net Sales)

23

27

26

26

28

Interest & other Charges

6

21

19

13

5

Other Income

7

15

4

13

20

(% of PBT)

14

27

8

16

17

Extraordinary Items

14

0

1

-

-

Share in profit of Associates

Recurring PBT

47

56

57

84

119

% chg

93

18

3

47

43

Tax

0

14

20

28

39

PAT (reported)

47

27

36

56

80

% chg

93

(42)

30

57

43

(% of Net Sales)

23

12

13

18

21

Basic & Fully Diluted EPS (Rs)

8

5

6

10

14

% chg

93

(42)

30

57

43

July 20, 2017

10

Music Broadcast ltd | Initiating Coverage

Balance Sheet Statement

Y/E March (` cr)

FY2015

FY2016

FY2017P FY2018E FY2019E

SOURCES OF FUNDS

Equity Share Capital

39

42

57

57

57

Reserves& Surplus

19

168

491

547

611

Shareholders’ Funds

58

210

548

604

668

Total Loans

288

236

168

55

55

Total Liabilities

345

446

717

659

723

APPLICATION OF FUNDS

Net Block

19

230

312

307

286

Capital Work-in-Progress

0

66

0

0

0

Investments

0

15

27

27

27

Current Assets

347

113

385

338

429

Inventories

0

0

0

0

0

Sundry Debtors

34

22

33

38

45

Cash

54

16

280

216

285

Loans & Advances

215

0

0

0

0

Other Assets

0

21

23

27

31

Current liabilities

52

44

45

50

57

Net Current Assets

294

69

340

288

373

Other Non Current Asset

32

66

38

38

38

Total Assets

345

446

717

659

723

July 20, 2017

11

Music Broadcast ltd | Initiating Coverage

Cash Flow Statement

Y/E March (` cr)

FY2015

FY2016

FY2017P FY2018E FY2019E

Profit before tax

47

56

57

84

119

Depreciation

16

17

20

25

26

Change in Working Capital

(5)

11

21

(12)

(15)

Interest / Dividend (Net)

6

19

19

13

5

Direct taxes paid

1

(11)

(20)

(28)

(39)

Others

1

(26)

-

-

-

Cash Flow from Operations

65

66

97

82

96

(Inc.)/ Dec. in Fixed Assets

(3)

(286)

(35)

(20)

(5)

(Inc.)/ Dec. in Investments

(198)

217

(12)

-

-

Cash Flow from Investing

(201)

(69)

(47)

(20)

(5)

Issue of Equity

-

-

303

-

-

Inc./(Dec.) in loans

200

83

(123)

-

-

Others

(40)

(111)

38

(127)

(21)

Cash Flow from Financing

160

(28)

218

(127)

(21)

Inc./(Dec.) in Cash

24

(31)

268

(64)

70

Opening Cash balances

19

43

13

280

216

Closing Cash balances

43

13

280

216

285

July 20, 2017

12

Music Broadcast ltd | Initiating Coverage

Key ratios

Y/E March

FY2015

FY2016

FY2017

FY2018E FY2019E

Valuation Ratio (x)

P/E (on FDEPS)

44.6

77.0

59.1

37.5

26.3

P/CEPS

33.5

47.7

38.0

25.9

19.9

P/BV

36.5

10.0

3.8

3.5

3.1

Dividend yield (%)

0.0

0.0

0.0

0.0

0.8

EV/Sales

11.6

9.9

6.8

6.0

4.9

EV/EBITDA

37.4

28.7

20.2

17.5

14.2

EV / Total Assets

6.7

5.0

2.6

2.9

2.5

Per Share Data (`)

EPS (Basic)

8.2

4.8

6.2

9.8

14.0

EPS (fully diluted)

8.2

4.8

6.2

9.8

14.0

Cash EPS

11.0

7.7

9.7

14.2

18.5

DPS

0.0

0.0

0.0

0.0

2.8

Book Value

10.1

36.8

96.1

105.9

117.1

Returns (%)

ROCE

13.6

16.0

10.0

12.8

14.5

Angel ROIC (Pre-tax)

16.0

17.5

17.5

20.1

25.3

ROE

81.7

13.0

6.5

9.3

12.0

Turnover ratios (x)

Inventory / Sales (days)

-

-

-

-

-

Receivables (days)

140

123

110

110

110

Payables (days)

62

36

44

44

44

Working capital cycle (ex-cash) (days)

79

87

66

66

66

July 20, 2017

13

Music Broadcast ltd | Initiating Coverage

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Music Broadcast Ltd

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

July 20, 2017

14