2QFY2016 Result Update | Auto Ancillary

November 18, 2015

Motherson Sumi Systems

ACCUMULATE

CMP

`281

Performance Highlights

Target Price

`313

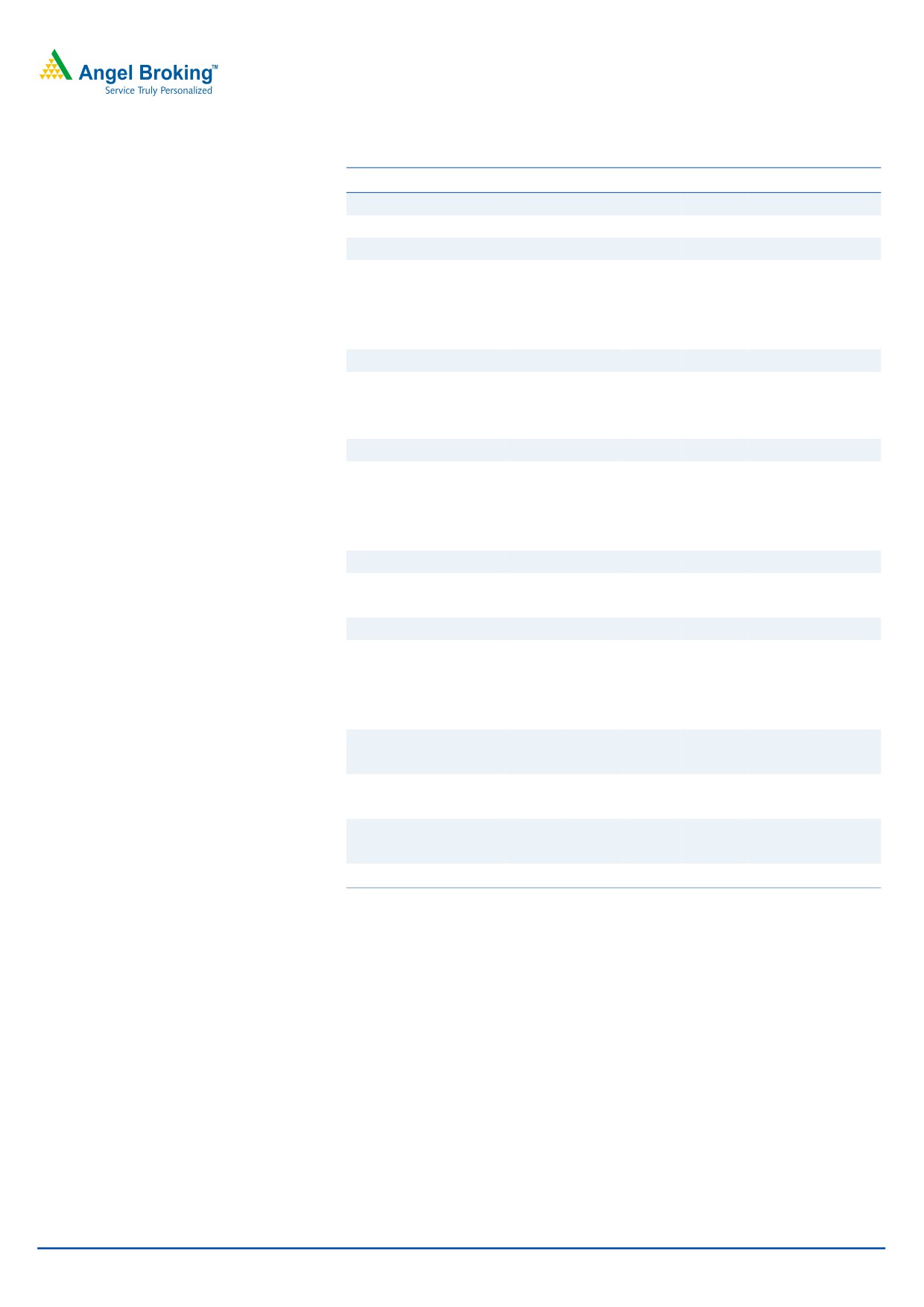

Y/E March - Consol. (` cr) 2QFY16 2QFY15

% chg (yoy) 1QFY16

% chg (qoq)

Investment Period

12 Months

Net Sales

9,198

8,017

14.7

9,385

(2.0)

EBITDA

957

729

31.3

838

14.2

EBITDA Margin (%)

10.4

9.1

130 bp

8.9

150 bp

Stock Info

Adjusted PAT

289

229

26.5

290

(0.3)

Sector

Auto Ancillary

Source: Company, Angel Research

Market Cap (` cr)

37,202

For 2QFY2016, Motherson Sumi Systems Ltd (MSS)’s results have come in ahead

Net Debt (` cr)

2,954

of estimates. The top-line grew strongly by 15% yoy led by robust growth in SMP

Beta

1.1

and pick up in the standalone business. Given the healthy revenue growth and

52 Week High / Low

396/217

soft commodity prices, the adj net profit grew at a faster pace of 27% yoy.

Avg. Daily Volume

268,937

Top-line growth remains strong: MSS maintained its double digit top-line growth

Face Value (`)

1

momentum, reporting sales of `9,198cr for 2QFY2016, implying a growth of

BSE Sensex

25,483

15%. The growth was led by SMP, whose revenues grew 18% yoy to `4,399cr,

Nifty

7,732

despite the depreciation in the Euro. Pick-up in order execution boosted growth.

(In Euro terms SMP grew 31% yoy). Standalone revenues grew 10% yoy to

Reuters Code

MOSS.BO

`1,393cr led by recovery in the passenger vehicle industry. However, SMR’s

Bloomberg Code

MSS@IN

revenue growth moderated to

3% (at

`2,424cr) impacted by the Euro

depreciation. But in Euro terms, SMR’s growth continued to remain strong

growing by 14%.

Shareholding Pattern (%)

Operating leverage along with soft commodity prices boost profitability: Given the

Promoters

65.6

robust double digit top-line growth and soft commodity prices, MSS’ operating

MF / Banks / Indian Fls

9.1

margins expanded 130bp yoy to reach 10.4%. Given the strong operating

FII / NRIs / OCBs

17.8

performance, MSS’ net profit grew strongly by 27% yoy to `289.3cr.

Indian Public / Others

7.5

Outlook and valuation: MSS continues to report improvement in its operating

performance, driven by its strategy of increasing the content per car, improvement

in utilization levels at the new plants and profitability improvement measures at

Abs. (%)

3m 1yr 3yr

SMP. However, the emission scandal at MSS largest customer, Volkswagen

Sensex

(8.4)

(9.5)

39.2

(Volkswagen currently accounts for ~40% of the topline) could have a near term

MSS

(17.6)

(4.3)

287.6

impact on the revenues as the brand takes a knock leading to loss of volumes.

The issue is likely to remain a key overhang on the stock, unless further clarity

emerges on the same. Nevertheless, we expect the company to sustain its strong

3-year price chart

performance in the long term through increased internal sourcing by subsidiaries

500

and improvement in utilization levels at the plants led by execution of new orders

400

(new order book currently stands at Euro 12.5 billion which gives a strong

outlook). We expect MSS to register a strong revenue and net profit CAGR of

300

~14% and ~27% respectively over FY2015-17E. Thus, we assign Accumulate

200

rating on the stock with a target price of `313 (based on 25x FY2017 earnings).

100

Key financials (Consolidated)

0

Y/E March (` cr)

FY2014

FY2015 FY2016E

FY2017E

Net Sales

30,428

34,585

39,343

45,100

% chg

20.2

13.7

13.8

14.6

Source: Company, Angel Research

Net Profit

765

1,027

1,333

1,654

% chg

72.1

34.3

29.7

24.1

EBITDA (%)

7.9

8.0

8.8

9.1

EPS (`)

8.7

11.6

10.1

12.5

P/E (x)

33.8

30.0

29.1

22.5

P/BV (x)

8.7

7.8

8.8

6.9

RoE (%)

29.2

32.7

35.5

34.6

RoCE (%)

20.5

20.5

23.5

24.8

Bharat Gianani

EV/Sales (x)

0.9

0.8

1.0

0.9

022-3935 7800 Ext: 6817

EV/EBITDA (x)

12.0

10.4

12.1

9.8

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Motherson Sumi Systems | 2QFY2016 Result Update

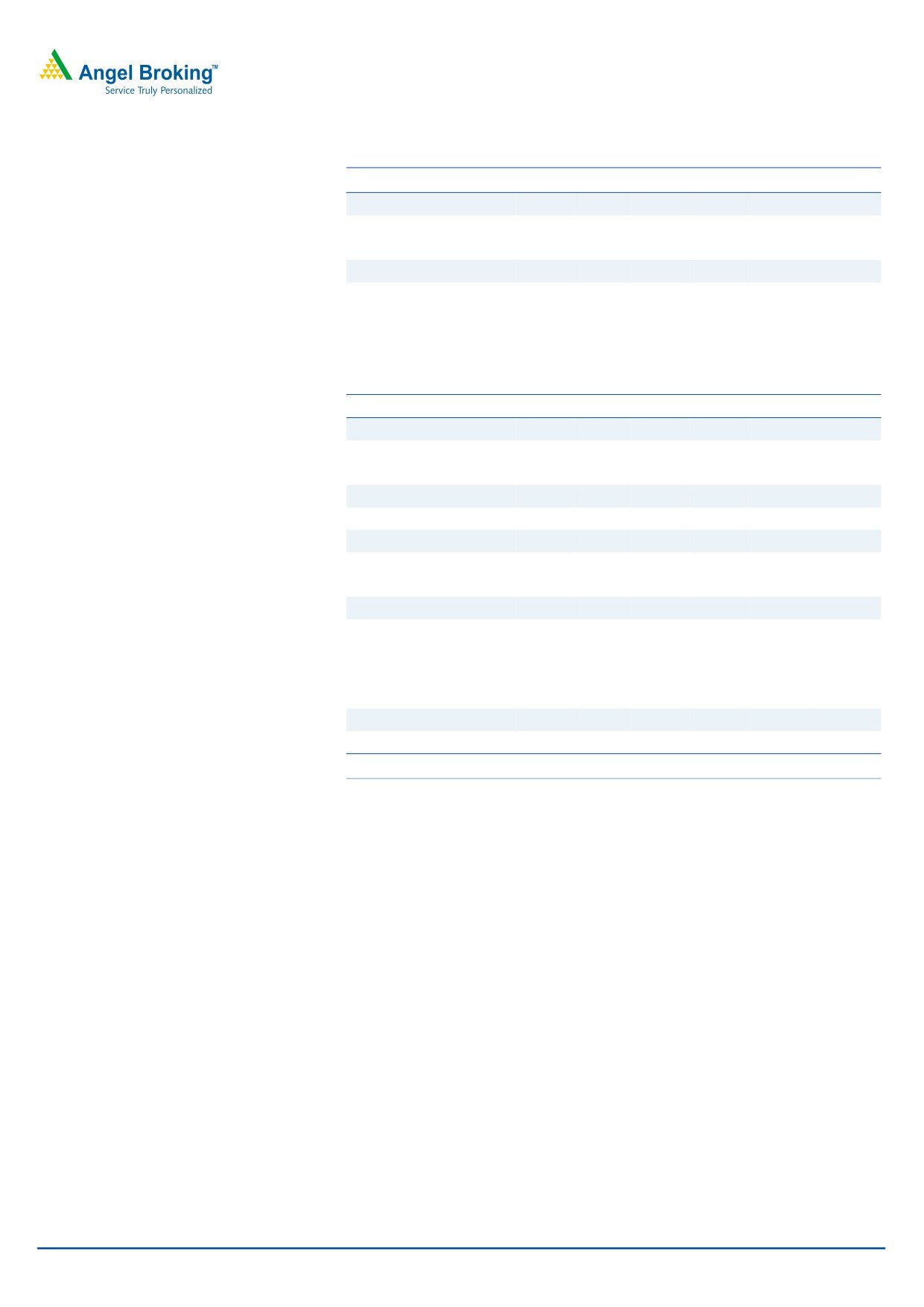

Exhibit 1: Quarterly financial performance (Consolidated)

Y/E March (` cr)

2QFY16

2QFY15

% chg (yoy)

1QFY16

% chg (qoq)

1HFY16

1HFY15

% chg (yoy)

Net Sales

9,198

8,017

14.7

9,385

(2.0)

18,582

16,408

13.3

Consumption of RM

5,478

4,846

13.0

5,759

(4.9)

11,236

10,082

11.5

(% of Sales)

59.6

60.5

61.4

60.5

61.4

Staff Costs

1,751

1,502

16.5

1,783

(1.8)

3,533

3,030

16.6

(% of Sales)

19.0

18.7

19.0

19.0

18.5

Other Expenses

1,012

940

7.7

1,005

0.7

2,017

1,840

9.6

(% of Sales)

11.0

11.7

10.7

10.9

11.2

Total Expenditure

8,240

7,288

13.1

8,546

(3.6)

16,787

14,951

12.3

Operating Profit

957

729

31.3

838

14.2

1,795

1,457

23.2

OPM (%)

10.4

9.1

8.9

9.7

8.9

Interest

65

96

(32.0)

68

(4.9)

133

158

(15.5)

Depreciation

270

237

13.9

235

15.0

505

456

10.6

Other Income

5

5

8.8

25

(78.5)

30

10

206.6

Foreign exchange difference

61

20

205.4

5

1061.1

66

67

(0.6)

PBT (excl. Extr. Items)

567

381

48.6

555

2.1

1,121

786

42.7

Extr. Income/(Expense)

2

124

25

27

124

PBT (incl. Extr. Items)

564

257

119.5

530

6.4

1,094

662

65.4

(% of Sales)

6.1

3.2

5.7

5.9

4.0

Provision for Taxation

182

109

67.4

164

10.9

345

261

32.4

(% of PBT)

32.2

42.2

30.9

31.6

39.4

PAT before minority interest (MI)

382

148

157.6

367

4.4

749

401

86.8

Minority interest

96

44

116.6

101

(5.1)

196

133

47.7

Share of profit/(loss) of associates

0

0

0

0

0

Reported net profit

287

104

174.7

266

8.0

553

268

106.1

Adjusted net profit

289

229

26.5

290

(0.3)

580

392

47.7

PATM (%)

3.1

2.9

3.1

3.1

2.4

Equity capital (cr)

132

88

88

132

88

Adjusted EPS (`)

2.2

2.6

3.3

4.4

4.4

Source: Company, Angel Research

Robust top-line growth continues despite currency impact: MSS maintained strong

double digit top-line growth, with the consolidated revenues growing strongly by

14.7% yoy to `9,198cr in 2QFY2016. The growth at key overseas subsidiaries viz

SMP and SMR was strong led by new client additions. They grew by 31% and 14%

in Euro terms, respectively. In INR terms the growth of SMP and SMR moderated to

18% and 3%, respectively, due to Euro devaluation. The standalone business

reported a healthy 10% growth led by recovery in passenger vehicle demand and

increasing content per vehicle. At the consolidated level, while India revenues grew

by 11% yoy, overseas revenues grew by 15% yoy, during the quarter.

November 18, 2015

2

Motherson Sumi Systems | 2QFY2016 Result Update

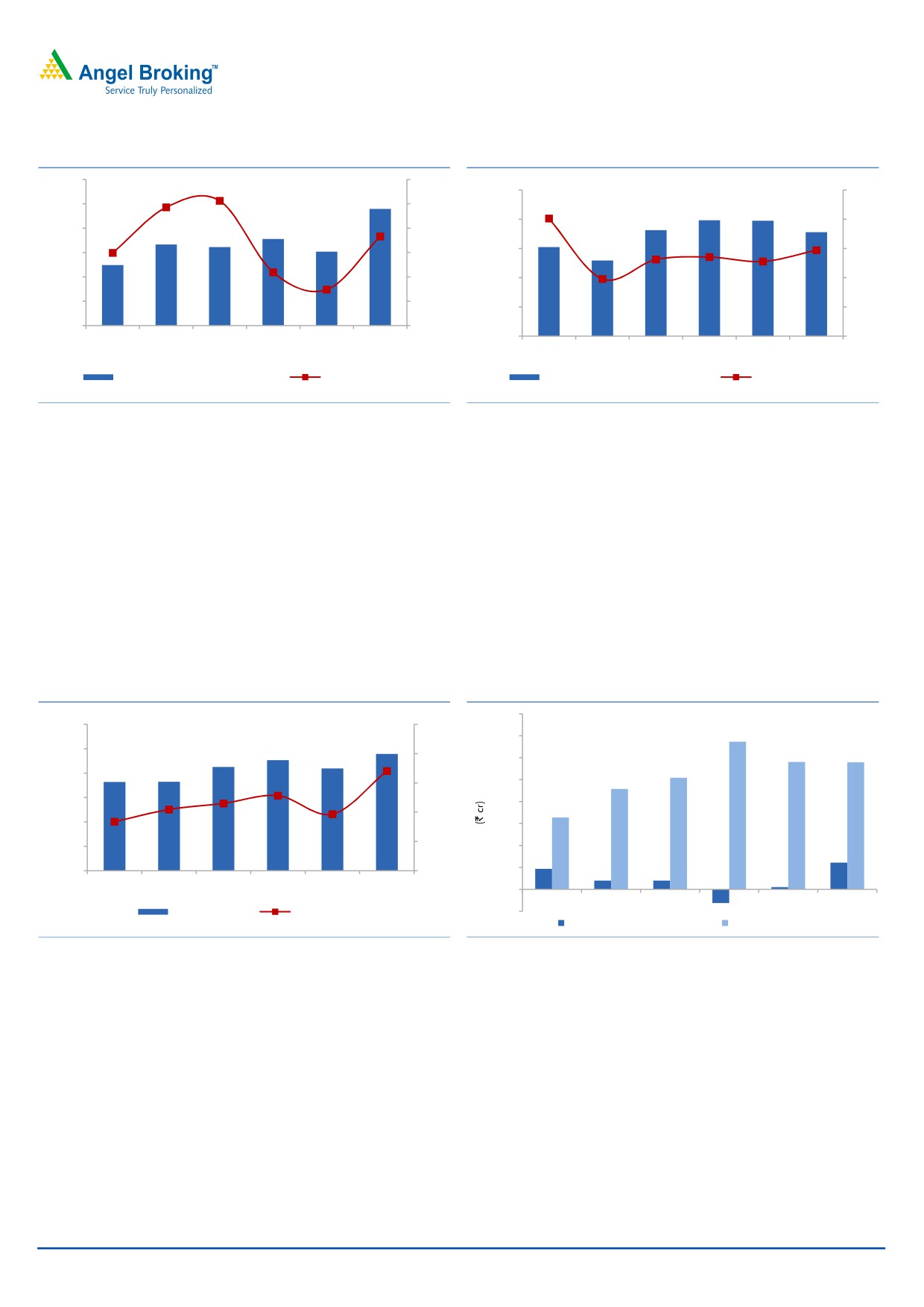

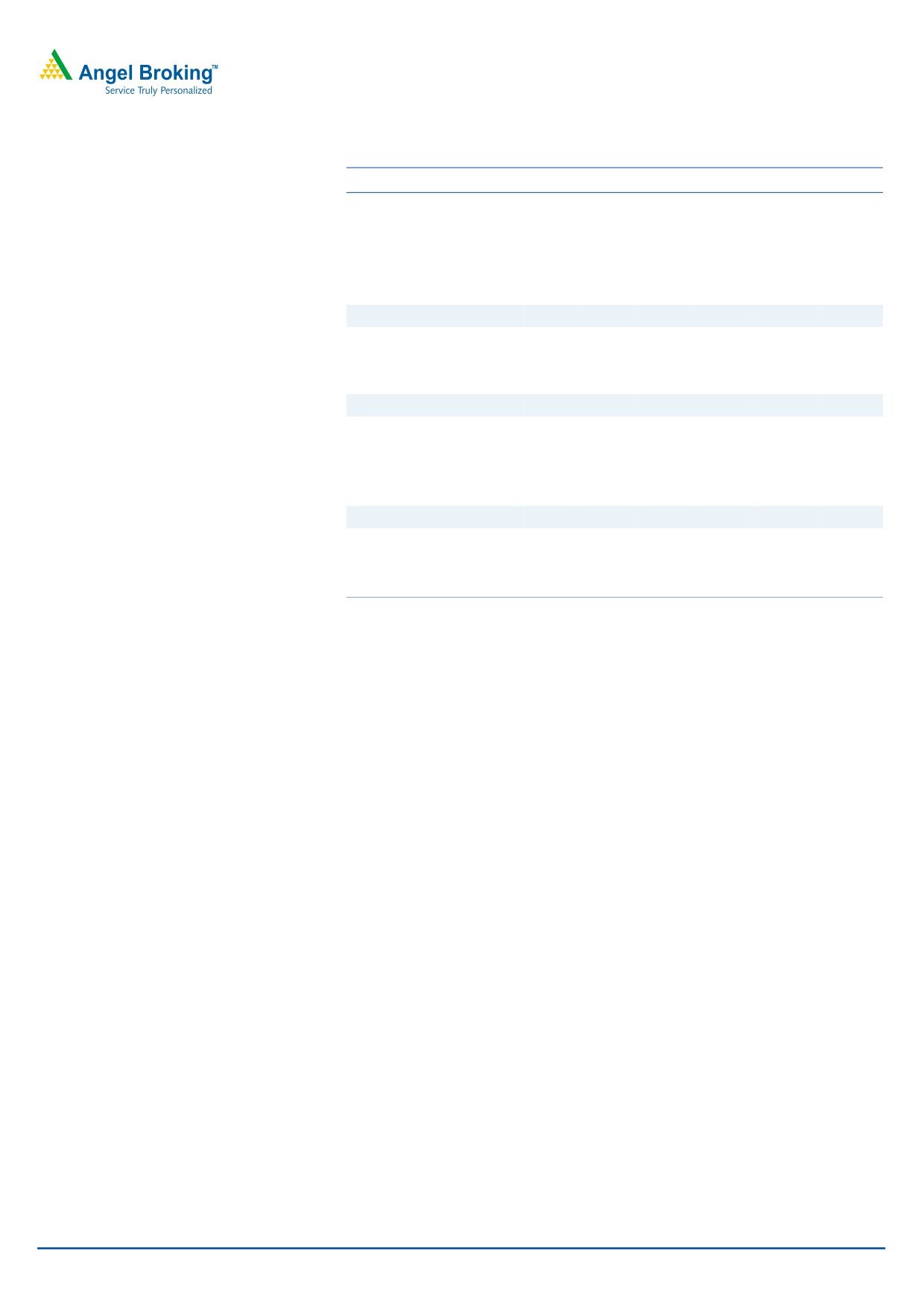

Exhibit 2: India revenues continue to recover

Exhibit 3: Overseas revenue growth remains strong

1,600

18

9,000

25

1,500

15

8,000

20

1,400

12

1,300

9

7,000

15

1,200

6

6,000

10

1,100

3

5,000

5

1,000

0

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

4,000

0

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

Within India revenues (` cr)

Growth yoy (%)

Outside India revenues (` cr)

Growth yoy (%)

Source: Company, Angel Research

Source: Company, Angel Research

Operating performance continues to improve: At the operating level, MSS reported

the highest operating margin of 10.4% in the last four years. The margins

improved 130bp yoy to reach the double-digit mark. Benign commodity prices

coupled with operating leverage led to margin improvement. Margins improved

across verticals. SMP’s margins at 6.7% improved 40bp yoy while SMR’s margins

at 9.6% improved 60bp on a yoy basis. Standalone business’ margins improved

160bp yoy to 19.6%.

During the quarter MSS registered a foreign exchange loss of `61cr. Adjusted for

the same, the bottom-line grew strongly by 26.5% yoy to `289cr.

Exhibit 4: EBITDA margin at four-year high level

Exhibit 5: Operating performance boosts Net profit

400

1,200

12

350

1,000

11

300

800

10

250

600

200

9

400

150

200

8

100

50

0

7

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

0

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

EBIDTA (` cr)

Margin (%)

(50)

Foreign exchange loss/(gain)

Adj Net Profit

Source: Company, Angel Research

Source: Company, Angel Research

November 18, 2015

3

Motherson Sumi Systems | 2QFY2016 Result Update

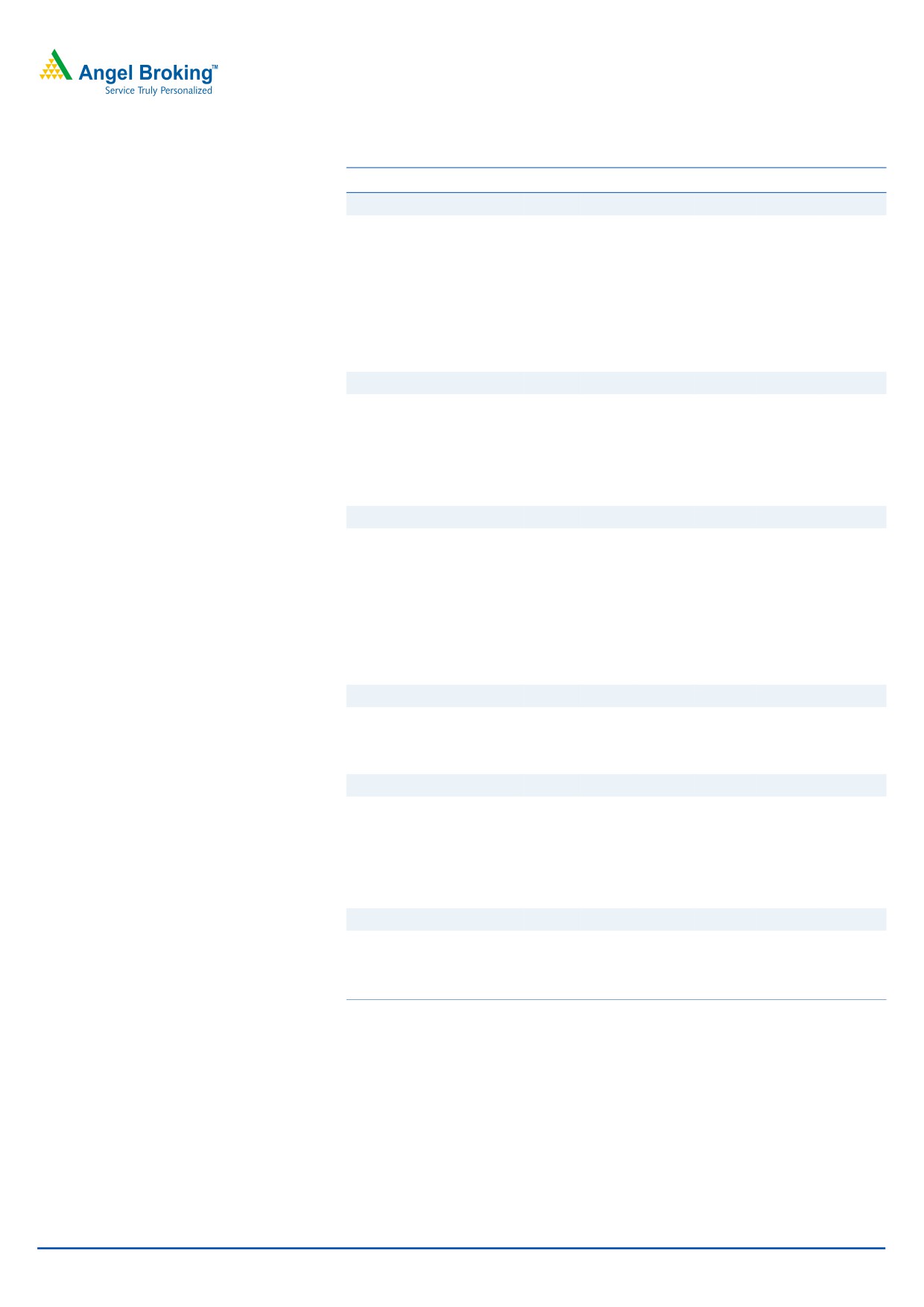

Exhibit 6: Standalone performance

Y/E March (` cr)

2QFY16 2QFY15

% chg (yoy) 1QFY16

% chg (qoq) 1HFY16 1HFY15

% chg (yoy)

Revenues

1,393

1,271

9.6

1,237

12.6

2,630

2,496

5.4

EBITDA

273

229

19.2

214

27.8

486

437

11.4

EBITDA margin (%)

19.6

18.0

17.3

18.5

17.5

Adj Net Profit

197

145

36.3

159

24.2

356

255

39.5

Source: Company, Angel Research

Exhibit 7: SMR performance

Y/E March (` cr)

2QFY16 2QFY15

% chg (yoy) 1QFY16

% chg (qoq) 1HFY16 1HFY15

% chg (yoy)

Revenues (Euro Mn)

335

293

14.3

365

(8.2)

700

588

19.0

Revenues

2,424

2,348

3.2

2,565

(5.5)

4,989

4,766

4.7

PBIDT

232

214

230

462

433

PBIDT margin (%)

9.6

9.1

5.0

9.0

6.7

9.3

9.1

1.9

Source: Company, Angel Research

Exhibit 8: SMP performance

Y/E March (` cr)

2QFY16 2QFY15

% chg (yoy) 1QFY16

% chg (qoq) 1HFY16 1HFY15

% chg (yoy)

Revenues (Euro Mn)

608

464

31.0

666

(8.7)

1274

995

28.0

Revenues

4,399

3,719

18.3

4,678

(6.0)

9,077

8,076

12.4

PBIDT

295

224

290

585

486

PBIDT margin (%)

6.7

6.0

11.3

6.2

8.2

6.4

6.0

7.1

Source: Company, Angel Research

November 18, 2015

4

Motherson Sumi Systems | 2QFY2016 Result Update

Investment arguments

Focus on increasing content per car to sustain leadership position: MSS' wide

product portfolio, global manufacturing presence, good relationships with

original equipment manufacturers (OEMs) and ability to provide end-to-end

solutions have enabled it to increase the content per car that it supplies to its

customers. Further, SMP’s acquisition has enhanced MSS' product offerings

significantly and strengthened its position as a key tier-I supplier globally.

Further, MSS is setting up manufacturing facilities in the US and China to cater

to its customer base which would results in robust growth going ahead.

Pick-up in order execution at SMR and SMP coupled with new orders to boost

performance: SMR and SMP have witnessed continuous improvement in

operating performance since being taken over by MSS and have bagged new

orders to be supplied over the life of the new models, which would be

launched in the near future. SMR and SMP currently have a huge order book

of Euro 12.5bn as of September 2015, which would help the company to

achieve its long term target of USD 18bn revenues by FY2020. MSS is

gradually progressing towards achieving its target of double-digit EBITDA

margins at the SMR front.

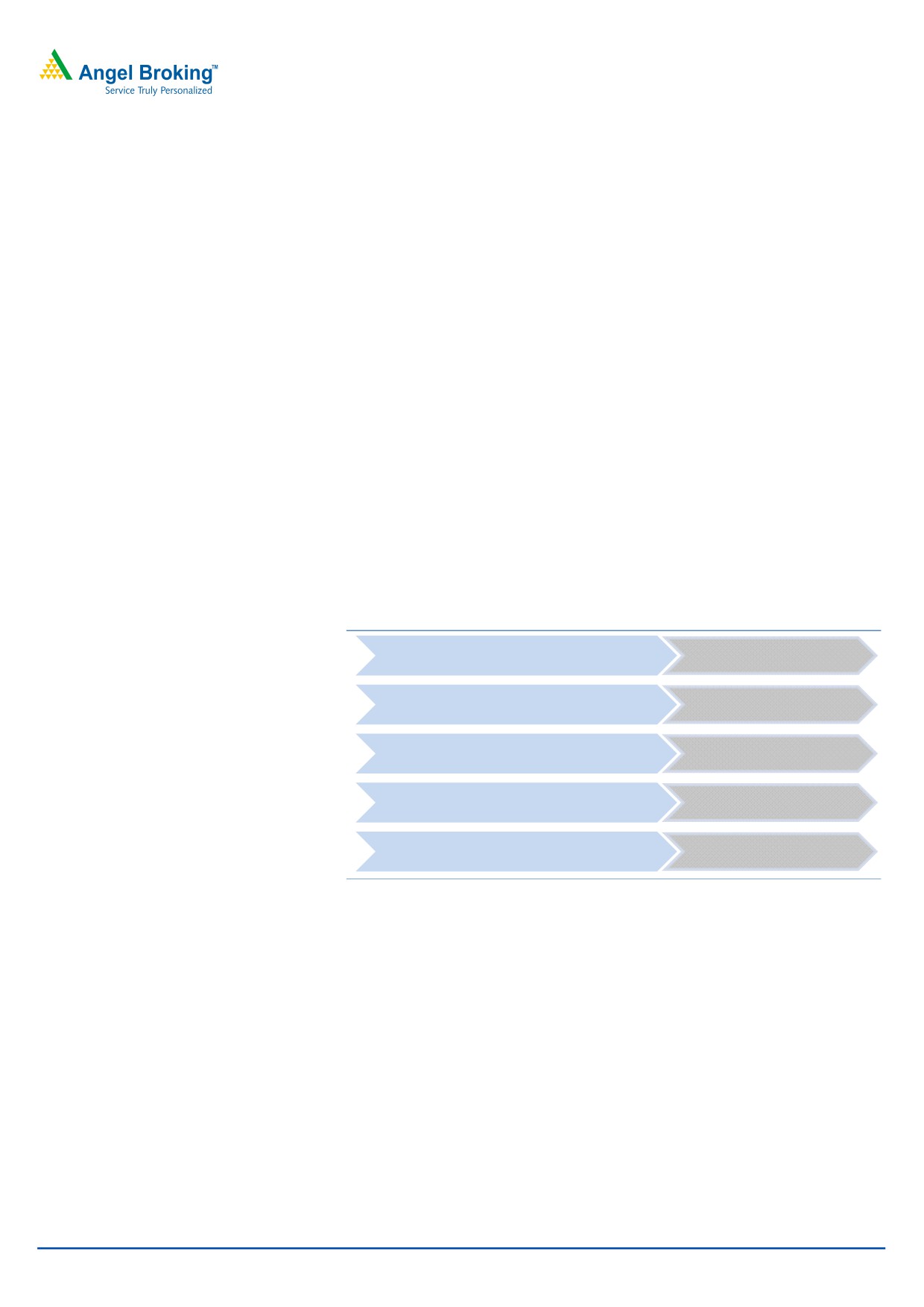

Exhibit 9: Five-year milestone set in FY2005

To cross US $1bn in revenue by FY2010

Achieve US $1.5bn topline

Achieved over 65% of

To achieve 60% of sales from outside India

sales from outside India

Largest customer constituted

Not more than 20% from one customer

15% of total turnover

RoCE 37% standalone &

To strive to maintain business RoCE of 40%

22% consolidated basis

To achieve dividend payout of 40% on

Achieved payout ratio of

consolidated profit

23% for FY2010

Source: Company, Angel Research

November 18, 2015

5

Motherson Sumi Systems | 2QFY2016 Result Update

Exhibit 10: Five-year milestone set in FY2010

To cross US $5bn in revenue by

Clocked US $5.5bn topline

FY2015

To attain RoCE of 40% on consolidated

Acheived RoCE of 41% for standalone.

basis

Consol RoCE stood at 26%

To acheive 70% of sales from outside

85% of sales is contributed by exports

India

Has presence in 25 countries thru

Global presence in 26-27 countries

JV/subsidiaries

To achieve dividend payout of 40% on

Achieved payout ratio of 30% for

consolidated profit

FY2015

Source: Company, Angel Research

Five year milestones set in 2015

MSS has set a target to attain turnover of USD 18 bn by FY20: This would be

achieved through increased sourcing for existing customers (specifically

targeting US and China markets), gaining new customers and through

acquisitions (inorganic route). MSS has planned a massive growth aim (the

revenue target points to a robust CAGR of 28% for the next five years).

To attain RoCE of 40% on consolidated basis: MSS aims to attain 40% RoCE

level by FY20. Improving subsidiary performance through enhanced capacity

utilization and cost control measures would enable MSS to achieve the return

targets.

3Cx15: In order to achieve more balanced and diversified growth, MSS has

proposed 3Cx15 which implies that no single customer, country or component

should constitute more than 15% of the turnover.

To achieve dividend payout ratio of 40%: In order to reward the shareholders,

MSS aims to reach a dividend payout ratio of 40% by FY20.

November 18, 2015

6

Motherson Sumi Systems | 2QFY2016 Result Update

Outlook and valuation

MSS continues to report improvement in its operating performance, driven by its

strategy of increasing the content per car, improvement in utilization levels at the

new plants and profitability improvement measures at SMP. However, the emission

scandal at MSS largest customer, Volkswagen (Volkswagen currently accounts for

~40% of the topline) could have a near term impact on the revenues as the brand

takes a knock leading to loss of volumes. The issue is likely to remain a key

overhang on the stock, unless further clarity emerges on the same. Nevertheless,

we expect the company to sustain its strong performance in the long term through

increased internal sourcing by subsidiaries and improvement in utilization levels at

the plants led by execution of new orders (new order book currently stands at Euro

12.5 billion which gives a strong outlook). We expect MSS to register a strong

revenue and net profit CAGR of ~14% and ~27% respectively over FY2015-17E.

Thus, we assign Accumulate rating on the stock with a target price of `313 (based

on 25x FY2017 earnings).

Company background

Motherson Sumi Systems (MSS), a JV between Samvardhana Motherson Group

(SMG, 36.9% stake) and Sumitomo Wiring Systems, Japan (25.3% stake), is the

world’s largest supplier of rear view mirrors and India’s biggest supplier of wiring

harness. MSS is considered to be a JV specialist (12 JVs) and has a successful

history of acquisitions, which have helped it expand its product portfolio, gain

access to technology and evolve into a leading global OEM supplier. MSS’ most

notable acquisitions include Visiocorp (now referred to as Samvardhana

Motherson Reflectec [SMR]) in FY2009, which is a global leader in automotive rear

view mirrors; and Peguform in FY2012, which is a leading supplier of door and

instrument panels and cockpit assemblies. The company is present across

25 countries and has over 145 manufacturing facilities worldwide.

November 18, 2015

7

Motherson Sumi Systems | 2QFY2016 Result Update

Profit and loss statement (Consolidated)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Total operating income

14,777

25,312

30,428

34,585

39,343

45,100

% chg

76.5

71.3

20.2

13.7

13.8

14.6

Total expenditure

13,884

23,836

28,031

31,829

35,881

40,996

Net raw material costs

9,544

16,484

19,361

21,632

24,590

28,187

Other mfg costs

0

0

0

0

0

0

Employee expenses

2,317

4,283

5,106

6,365

7,082

8,073

Other

2,024

3,069

3,563

3,833

4,210

4,735

EBITDA

893

1,477

2,397

2,756

3,462

4,104

% chg

0.4

65.5

62.3

15.0

25.6

18.5

(% of total op. income)

6.0

5.8

7.9

8.0

8.8

9.1

Depreciation & amort.

380

715

817

921

1,035

1,186

EBIT

513

762

1,580

1,835

2,428

2,918

% chg

(20.1)

48.6

107.3

16.2

32.3

20.2

(% of total op. income)

3.5

3.0

5.2

5.3

6.2

6.5

Interest and other charges

165

250

294

318

305

305

Other income

145

322

311

464

525

593

Recurring PBT

493

834

1,596

1,982

2,647

3,206

% chg

(17.6)

69.4

91.3

24.2

33.6

21.1

Extraordinary items

(81)

0

0

(165)

(27)

0

PBT (reported)

412

834

1,596

1,817

2,620

3,206

Tax

215

384

499

526

811

982

(% of PBT)

52.3

46.0

31.3

28.9

30.6

30.6

PAT before MI

196

451

1,097

1,292

1,810

2,224

Minority interest

(63)

6

332

429

504

570

Reported PAT

260

444

765

862

1,306

1,654

ADJ. PAT

341

444

765

1,027

1,333

1,654

% chg

(2.6)

30.5

72.1

34.3

29.7

24.1

(% of total op. income)

2.3

1.8

2.5

3.0

3.4

3.7

Basic EPS (`)

3.0

5.0

8.7

9.8

9.9

12.5

Adj. EPS (`)

3.9

5.0

8.7

11.6

10.1

12.5

% chg

(2.6)

29.2

72.1

34.3

(13.5)

24.1

November 18, 2015

8

Motherson Sumi Systems | 2QFY2016 Result Update

Balance sheet statement (Consolidated)

Y/E March (` cr)

FY2012 FY2013 FY2014

FY2015

FY2016E

FY2017E

SOURCES OF FUNDS

Equity share capital

39

59

88

88

132

132

Reserves & surplus

1,833

2,230

2,871

3,236

4,058

5,256

Shareholders’ Funds

1,871

2,289

2,959

3,324

4,190

5,389

Minority interest

503

403

790

1,014

1,518

2,088

Total loans

4,129

4,071

3,995

4,910

4,710

4,710

Deferred tax liability

60

56

50

(45)

(45)

(45)

Other long term liabilities

164

239

208

309

309

309

Long term provisions

110

168

204

218

218

218

Total Liabilities

6,838

7,225

8,206

9,730

10,901

12,669

APPLICATION OF FUNDS

Gross block

9,432

10,743

12,634

12,644

14,572

16,704

Less: Acc. depreciation

4,740

5,466

6,715

6,515

7,550

8,736

Net Block

4,692

5,277

5,919

6,129

7,022

7,968

Capital work-in-progress

446

386

647

956

874

835

Investments

94

72

75

65

65

65

Long term loans and adv.

156

151

357

569

750

1,000

Other noncurrent assets

140

135

191

243

300

350

Current assets

6,439

6,719

8,056

9,419

10,057

11,385

Cash

456

594

906

1,892

1,681

1,783

Loans & advances

721

581

616

744

866

992

Other

5,262

5,544

6,533

6,783

7,511

8,610

Current liabilities

5,128

5,514

7,038

7,650

8,168

8,935

Net current assets

1,311

1,205

1,017

1,769

1,890

2,451

Misc. exp. not written off

0

0

0

0

0

0

Total Assets

6,838

7,225

8,206

9,730

10,901

12,669

November 18, 2015

9

Motherson Sumi Systems | 2QFY2016 Result Update

Cash flow statement (Consolidated)

Y/E March (` cr)

FY2012 FY2013 FY2014 FY2015 FY2016E FY2017E

Profit before tax

412

834

1,596

1,817

2,620

3,206

Depreciation

2,685

725

1,249

(200)

1,035

1,186

Change in working capital

(412)

245

499

234

(332)

(458)

Others

82

132

(56)

(32)

(58)

(50)

Direct taxes paid

(215)

(384)

(499)

(526)

(811)

(982)

Cash Flow from Operations

2,551

1,553

2,789

1,294

2,455

2,902

(Inc.)/Dec. in fixed assets

(5,667)

(1,250)

(2,152)

(319)

(1,846)

(2,093)

(Inc.)/Dec. in investments

(47)

22

(3)

10

0

0

(Inc.)/Dec. in loans and adv

(63)

5

(206)

(213)

(181)

(250)

Cash Flow from Investing

(5,777)

(1,223)

(2,362)

(522)

(2,027)

(2,343)

Issue of equity

0

20

29

0

44

0

Inc./(Dec.) in loans

2,987

(58)

(77)

916

(200)

0

Dividend paid (Incl. Tax)

(107)

(143)

(269)

(322)

(483)

(483)

Others

448

(10)

200

(380)

0

0

Cash Flow from Financing

3,328

(191)

(116)

214

(639)

(483)

Inc./(Dec.) in cash

103

139

312

986

(211)

76

Opening Cash balances

353

456

594

906

1,892

1,681

Closing Cash balances

456

594

906

1,892

1,681

1,756

November 18, 2015

10

Motherson Sumi Systems | 2QFY2016 Result Update

Key ratios

Y/E March

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

98.5

58.1

33.8

30.0

29.7

22.5

P/CEPS

40.0

22.3

16.3

14.5

16.6

22.5

P/BV

13.7

11.3

8.7

7.8

8.9

6.9

Dividend yield (%)

0.5

0.7

0.9

1.0

1.0

1.1

EV/Sales

1.7

1.1

0.9

0.8

1.0

0.9

EV/EBITDA

29.5

19.8

12.0

10.4

12.1

9.8

EV / Total Assets

4.3

4.0

3.5

3.0

3.8

3.2

Per Share Data (`)

EPS (Basic)

3.0

5.0

8.7

9.8

9.9

12.5

EPS (fully diluted)

3.9

5.0

8.7

11.6

10.1

12.5

Cash EPS

7.3

13.1

17.9

20.2

17.7

21.5

DPS

1.0

1.3

2.5

3.0

3.0

3.0

Book Value

21.3

25.8

33.6

37.7

31.7

40.5

Dupont Analysis

EBIT margin

3.5

3.0

5.2

5.3

6.2

6.5

Tax retention ratio

0.5

0.5

0.7

0.7

0.7

0.7

Asset turnover (x)

3.2

3.9

4.4

4.6

4.6

4.5

ROIC (Post-tax)

5.4

6.3

15.6

17.2

19.7

20.1

Cost of Debt (Post Tax)

3.0

3.3

5.0

5.1

4.4

4.5

Leverage (x)

1.2

1.7

1.2

0.9

0.8

0.6

Operating ROE

8.3

11.5

28.5

28.8

31.7

29.7

Returns (%)

ROCE (Pre-tax)

10.3

10.8

20.5

20.5

23.5

24.8

Angel ROIC (Pre-tax)

8.0

11.5

21.6

23.4

26.3

26.8

ROE

19.6

21.4

29.2

32.7

35.5

34.6

Turnover ratios (x)

Asset Turnover (Gross Block)

2.2

2.5

2.6

2.7

2.9

2.9

Inventory / Sales (days)

41

35

35

37

37

37

Receivables (days)

49

43

37

33

33

33

Payables (days)

80

72

70

72

77

75

WC cycle (ex-cash) (days)

16

11

4

(0)

0

4

Solvency ratios (x)

Net debt to equity

1.9

1.5

1.0

0.9

0.7

0.5

Net debt to EBITDA

4.0

2.3

1.3

1.1

0.9

0.7

Interest Coverage (EBIT / Int.)

3.1

3.1

5.4

5.8

8.0

9.6

November 18, 2015

11

Motherson Sumi Systems | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Motherson Sumi Systems

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 18, 2015

12