IPO Note | Online

Sep 8, 2017

Matrimony.com

SUBSCRIBE

Issue Open: Sep 11, 2017

Issue Close: Sep 13, 2017

Incorporated in 2001, Matrimony.com (MCL) today is the leader in match making

services. The company provides online matchmaking and marriage services

Issue Details

through Internet and mobile platforms in India and internationally. Currently, the

company has a huge database comprising of 3.08 million active profiles. Its

Face Value: `5

flagship brand, BharatMatrimony, has 15 language based domains under its

umbrella.

Present Eq. Paid up Capital: `10.6cr

A trusted brand with strong consumer base and 140 retail centers: Strong brand

Offer for Sale: **0.38cr Shares

recall and trust are the factors which determine the growth of Matrimony services

in India. According to comScore Report, the average number of website pages

Fresh issue: `130cr

viewed by unique visitors in June 2017, render Matrimony.com to be the leader in

matrimony services. Further, the company has 140 retail centers distributed

Post Eq. Paid up Capital: `11.3cr

across India where potential or existing customers can walk in and seek the

assistance of retail executives to register on websites and/or make payment for

Issue size (amount): *`500cr -**501 cr

the matchmaking product or service of their choice.

Leader in online matchmaking service space in India: According to the comScore

Report for June 2017, Matrimony.com is the leader in online matchmaking

Price Band: `983-985

services in India in terms of the average number of website pages viewed by

Lot Size: 15 shares and in multiple

unique visitors, time spent and total pages viewed vis-à-vis peers, mainly on the

thereafter

back of the large database of profiles.

Huge untapped market opportunity: According to a KPMG report, unmarried

Post-issue implied mkt. cap: *`2220cr -

**`2224cr

population in CY2016 was 107mn, in which active seekers were 63mn, out of

which only 6mn were active users of online matrimony. Currently, MCL has

Promoters holding Pre-Issue: 56.0%

3.08mn active profiles, leaving a scope for a huge untapped market opportunity

for company.

Promoters holding Post-Issue: 50.6%

Continuous expansion into marriage services: The company’s key strategy for

*Calculated on lower price band

driving monetization is to strengthen the length of relationship with customers and

increase the amount of revenue earned by offering additional marriage services

** Calculated on upper price band

to online matchmaking user base like availing wedding-related services i.e.

photography & videography, wedding apparel & make-up, venue, stage

Book Building

decoration, catering and honeymoon packages from various vendors to meet

QIBs

75% of issue

customers’ wedding needs.

Outlook & Valuation:

Non-Institutional

15% of issue

Going forward, we expect the company to perform better on top-line and bottom-

line front considering strong brand value, leadership position, robust technology

Retail

10% of issue

and expansion into marriage services segment. Further, it has strong user data

base, which provides competitive edge to the company. At the upper end of the

price band, the pre issue P/E multiples works out be 35.7x of 1QFY2018

Post Issue Shareholding Patter

Annualized EPS, which is lower compared to peers (Info edge is trading at 46.4x

its 1QFY2018 Annualized EPS). Hence, we recommend ‘SUBSCRIBE’ on the issue

Promoters

50.6%

for a mid-to-long term period.

Others

49.4%

Key Financial

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017

Net Sales

205

241

255

293

% chg

9%

18%

6%

15%

Net Profit

(18)

(20)

(75)

44

EBITDA (%)

1.0%

-0.3%

2.6%

20.2%

EPS (Rs)

(8.6)

(9.4)

(35.3)

20.6

P/E (x)

254

-

-

47.8

Amarjeet S Maurya

EV/Sales (x)

10.1

8.6

8.2

7.1

+022 39357600, Extn: 6831

Source: RHP, Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end of the price band

Please refer to important disclosures at the end of this report

1

Matrimony.com Limited | IPO Note

Company background

Incorporated in

2001, Matrimony.com is engaged in providing online

matchmaking and marriage services. They offer their services through Internet and

mobile platforms in India and internationally.

It is one of the first companies to provide online matchmaking services in India,

having a database comprising of 3.08 million active profiles (being profiles that

have been published or logged in at least once during the prior 180 day period).

They offer a range of targeted and customized products and services that are

tailored to meet the specific requirements of customers based on their religious or

caste preferences or other criteria such as marital status and age bracket.

As of June 30, 2017, they had 140 retail centers distributed across India, where

customers can walk in and register on their websites. The flagship brand,

BharatMatrimony, has 15 language based domains under its umbrella. They also

have other portals like EliteMatrimony, CommunityMatrimony, MatrimonyDirectory,

MatrimonyPhotography,

MatrimonyBazaar,

MatrimonyDirectory

and

MatrimonyMandaps.

Issue Details

The issue comprises of Fresh Issue up to `130cr and OFS up to 3,767,254 equity

shares. The issue comprises Offer For Sale of up to 1,461,006 equity shares by

Bessemer India Capital Holdings II Ltd, Offer For Sale of up to 155,760 equity

shares by Mayfield XII, Mauritius, Offer for Sale of up to 1,683,207 equity shares

by CMDB II, Offer for Sale of up to 384,447 equity shares by Murugavel

Janakiraman (Promoter Selling Shares) and Offer for Sale of up to 82,834 equity

shares by Indrani Janakiraman (a member of the Promoter group).

Note: A discount of up to `98 per equity share may be offered to employees and

retail individual bidders.

Exhibit 1: Pre and Post-IPO shareholding pattern (cr)

No of shares (Pre-issue)

% No of shares (Post-issue)

%

Promoter

1.2

56.0%

1.1

50.6%

Public

0.9

44.0%

1.1

49.4%

2.1

100.0%

2.3

100.0%

Source: RHP, Angel Research; Note: Calculated on upper price band

Objects of the offer

Advertising and business promotion activities -` 20cr

Purchase of land for construction of office premises in Chennai - `43cr

Repayment of overdraft facilities - `43cr

Balance for general corporate purpose

Sep 8, 2017

2

Matrimony.com Limited | IPO Note

Investment rationale

A trusted brand with strong consumer base and 140 retail centers: Strong

brand recall and trust are the factors which determine the growth of

Matrimony services in India. According to comScore Report, the average

number of website pages viewed by unique visitors in June 2017, render

Matrimony.com to be the leader in matrimony services. Further, the company

has 140 retail centers distributed across India where potential or existing

customers can walk in and seek the assistance of retail executives to register

on websites and/or make payment for the matchmaking product or service of

their choice.

Further, shift to the organized sector i.e. increasing mobility leading to shift

from local media to matrimonial portals would also assist the company’s

growth. Increased freedom of choice over life decisions by young generation

today, is the key growth catalyst for the company.

Leader in online matchmaking service space in India: According to the

comScore Report for June 2017, Matrimony.com is the leader in online

matchmaking services in India in terms of the average number of website

pages viewed by unique visitors (Matrimony.com

9,91,000, Shaadi.com

4,20,000, Jeevansathi.com

3,48,000), time spend (Matrimony.com

149minutes mn, Shaadi.com 26minutes mn, Jeevansathi.com 33minutes mn)

and total pages viewed (Matrimony.com

459mn, Shaadi.com

46mn,

Jeevansathi.com 48mn) mainly due to the company’s large database of

profiles.

Considering that internet penetration is expected to grow from 462 mn internet

users as of July 1, 2016 to 730 mn users by the end of FY2020, we believe

that online matchmaking services would also witness a boom, which will be a

positive for the company. Mobile internet users are expected to grow from

358mn in 2016 to 670mn by FY2020, and with the ease and comfort of

mobile internet matchmaking facilities, this space would register newer uses,

and hence, the company would increase its database of profiles.

Huge untapped market opportunity: According to a KPMG report, unmarried

population in CY2016 was 107mn, in which active seekers were 63mn, out of

which only 6mn were active users of online matrimony. Currently, MCL has

3.08mn active profiles, leaving a scope for a huge untapped market

opportunity for company.

Continuous expansion into marriage services

The company’s key strategy for driving monetization is to strengthen the length

of relationship with customers and increase the amount of revenue earned by

offering additional marriage services to online matchmaking user base like

availing wedding-related services i.e. photography & videography, wedding

apparel & make-up, venue, stage decoration, catering and honeymoon

packages from various vendors to meet customers’ wedding needs.

Sep 8, 2017

3

Matrimony.com Limited | IPO Note

Outlook & Valuation

Going forward, we expect the company to perform better on top-line and

bottom-line front considering strong brand value, leadership position, robust

technology and expansion into marriage services segment. Further, it has

strong user data base, which provides competitive edge to the company. At

the upper end of the price band, the pre issue P/E multiples works out be

35.7x of 1QFY2018 Annualized EPS, which is lower compared to peers (Info

edge is trading at

46.4x its 1QFY2018 Annualized EPS). Hence, we

recommend ‘SUBSCRIBE’ on the issue for a mid-to-long term period.

Key risks

Increased competition from online and offline companies could impact

the earnings of the company.

The company could face adverse effect if they are unable to keep pace

with changing technology and evolving industry standards, or fail to

develop newer products for business.

The company is highly dependent on telecommunications and information

technology systems, networks and infrastructure to operate its business,

however, any interruption or breakdown in such systems, networks,

infrastructure or technical systems could hinder the company’s products

and services and also the efficiency.

Sep 8, 2017

4

Matrimony.com Limited | IPO Note

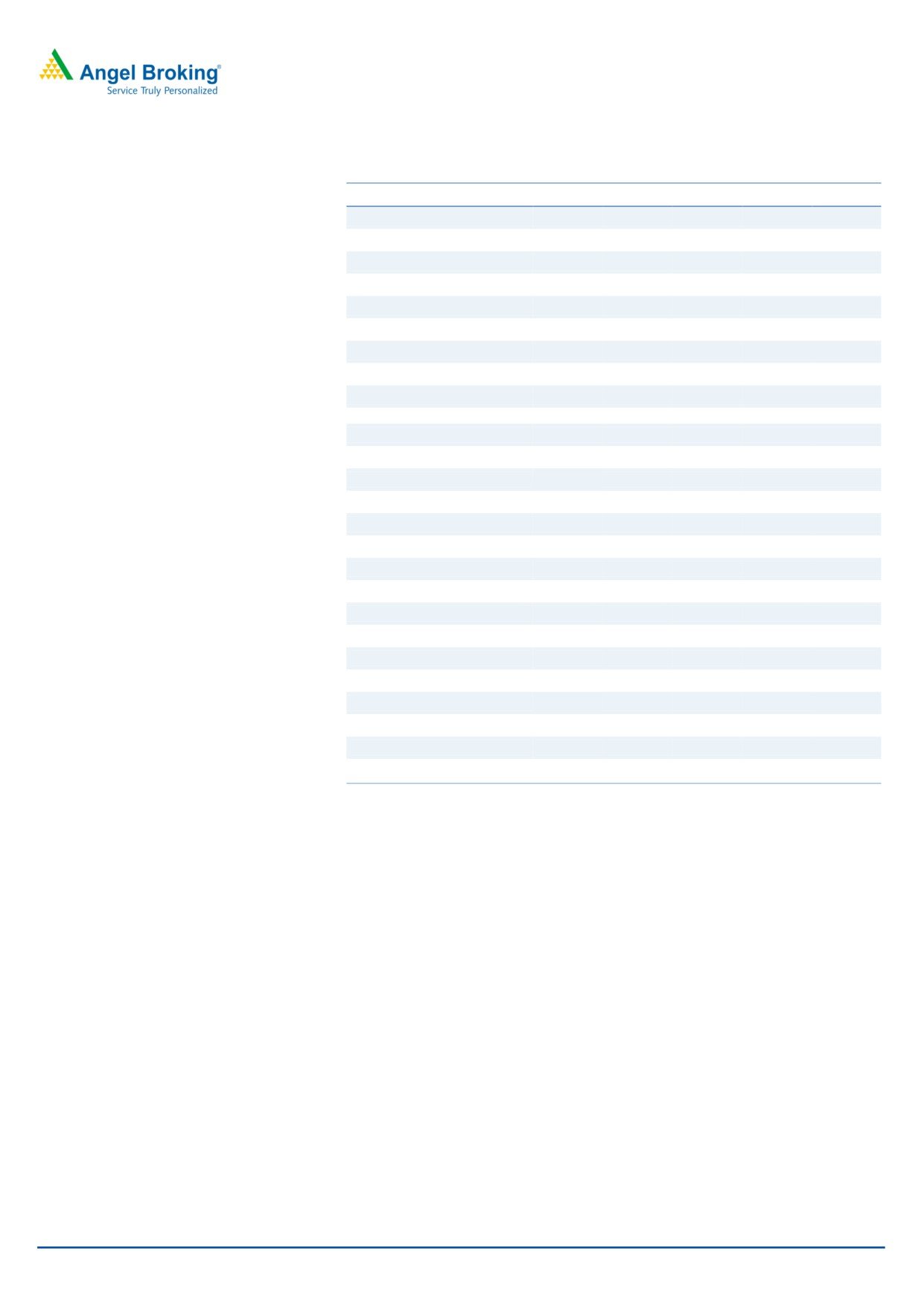

Exhibit 2: Consolidated Income Statement

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017

Total operating income

189

205

241

255

293

% chg

-

8.9

17.5

5.6

14.9

Total Expenditure

175

203

242

248

234

Purchase of traded goods

2

10

19

-

-

Employee

75

88

106

125

117

Adv expenses

46

48

53

54

52

Others Expenses

51

57

64

69

65

EBITDA

14

2

(1)

7

59

% chg

-

(85.7)

-

-

7.9

(% of Net Sales)

7.3

1.0

(0.3)

2.6

20.2

Depreciation& Amortisation

6

6

8

10

10

EBIT

7

(4)

(9)

(3)

49

% chg

-

-

-

-

(% of Net Sales)

3.9

(1.8)

(3.7)

(1.2)

16.6

Interest & other Charges

1

1

2

3

4

Other Income

4

5

5

5

4

Extraordinary Items

2

19

14

74

4

Share in profit of Associates

0

0

0

0

0

Recurring PBT

8

(18)

(20)

(75)

44

% chg

-

-

-

-

Tax

0.0

0.0

0.0

0.0

0.0

PAT (reported)

8

(18)

(20)

(75)

44

% chg

-

-

-

(% of Net Sales)

4.4

(8.9)

(8.3)

(29.5)

15.0

Basic & Fully Diluted EPS (Rs)

3.9

(8.6)

(9.4)

(35.3)

20.6

% chg

-

-

-

Sep 8, 2017

5

Matrimony.com Limited | IPO Note

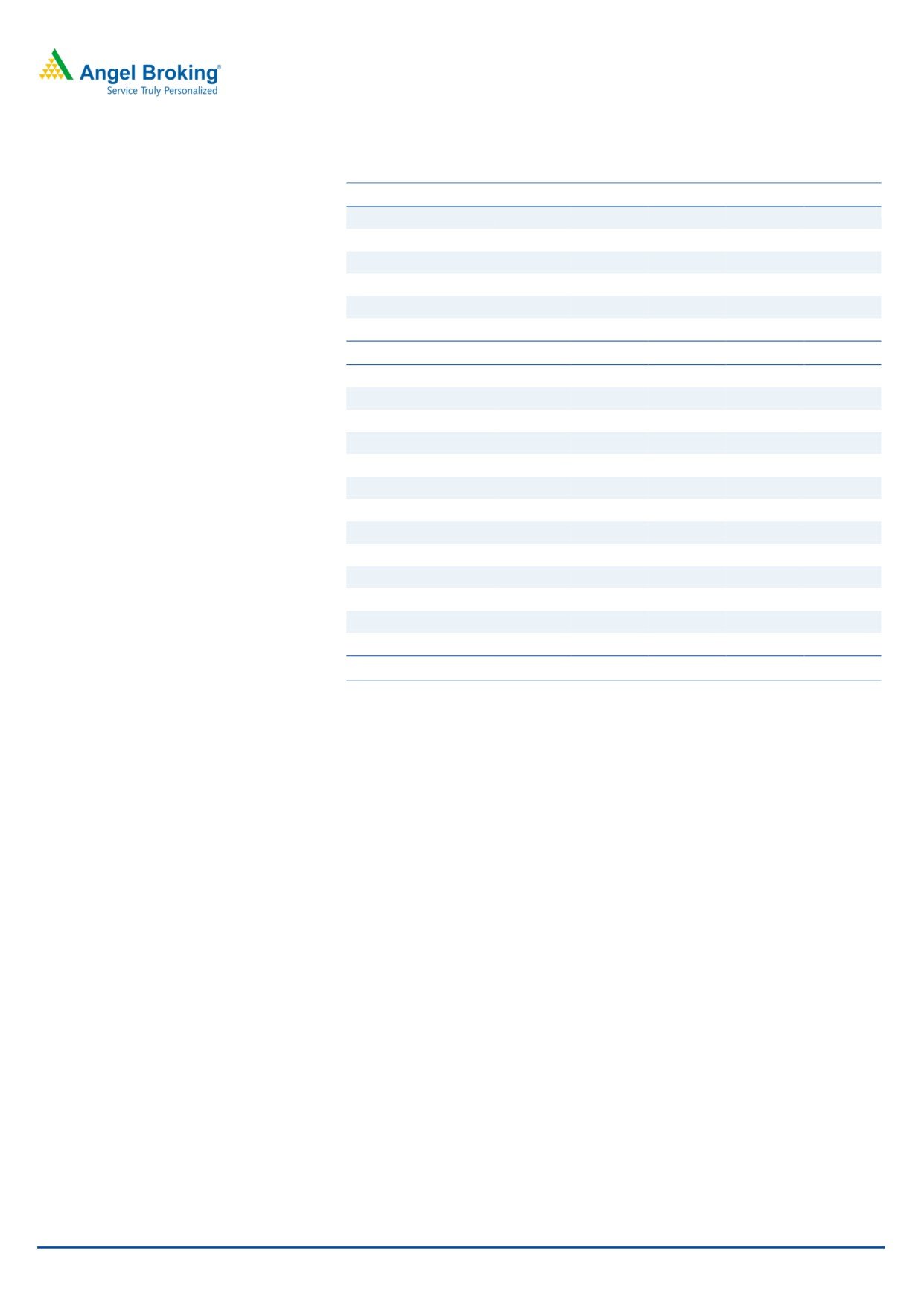

Exhibit 3: Consolidated Balance Sheet

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017

SOURCES OF FUNDS

Equity Share Capital

6

6

9

9

11

Reserves& Surplus

1

(8)

(10)

(85)

(42)

Shareholders Funds

7

(2)

(1)

(76)

(31)

Total Loans

26

15

28

49

45

Minority Interest

0

0

0

0

-

Total Liabilities

33

13

27

(27)

13

APPLICATION OF FUNDS

Net Block

18

19

24

28

24

Capital Work-in-Progress

0

4

0

-

-

Investments

0

0

-

-

-

Current Assets

72

59

79

95

95

Inventories

0

0

-

-

-

Sundry Debtors

1

2

1

2

2

Cash

32

37

53

58

58

Loans & Advances

25

6

13

24

16

Other Assets

14

15

12

11

19

Current liabilities

58

70

76

151

106

Net Current Assets

15

(11)

3

(56)

(11)

Mis. Exp. not written off

Total Assets

33

13

27

(27)

13

Sep 8, 2017

6

Matrimony.com Limited | IPO Note

Exhibit 4: Consolidated Cash Flow Statement

Y/E March (`cr)

FY2013

FY2014

FY2015

FY2016

FY2017

Profit before tax

12

10

11

(1)

48

Depreciation

6

6

8

10

10

Change in Working Capital

(4)

8

2

13

(9)

Interest / Dividend (Net)

(3)

(2)

(2)

(1)

1

Direct taxes paid

1

(1)

(0)

(1)

(2)

Others

1

(0)

3

1

1

Cash Flow from Operations

10

5

8

-8

14

(Inc.)/ Dec. in Fixed Assets

(10)

(12)

(10)

(10)

(10)

(Inc.)/ Dec. in Investments

4

(2)

3

11

11

Cash Flow from Investing

(6)

(14)

(8)

1

1

Issue of Equity

0

0

4

0

1

Inc./(Dec.) in loans

(6)

10

11

18

(9)

Others

0

(0)

(0)

(0)

0

Cash Flow from Financing

(6)

10

15

18

-8

Inc./(Dec.) in Cash

(1)

0

16

12

7

Opening Cash balances

3

2

37

11

23

Closing Cash balances

2

2

53

23

30

Exhibit 5: Key Ratios

Y/E March

FY2013

FY2014

FY2015

FY2016

FY2017

Valuation Ratio (x)

P/E (on FDEPS)

254.4

-

-

-

47.8

P/CEPS

142.7

-

-

-

38.7

P/BV

141.3

-

-

-

-

EV/Sales

11.1

10.1

8.6

8.2

7.1

EV/EBITDA

151.1

1,045.7

-

314.8

35.2

EV / Total Assets

63.9

161.3

77.0

-

155.3

Per Share Data (Rs)

EPS (Basic)

3.9

-

-

-

20.6

EPS (fully diluted)

3.9

-

-

-

20.6

Cash EPS

6.9

-

-

-

25.5

Book Value

7.0

-

-

-

-

Returns (%)

ROCE

22.6

-

-

11.4

363.3

Angel ROIC (Pre-tax)

1,204.8

14.8

33.4

3.7

-

ROE

117.7

837.6

2,147.7

98.7

-

Turnover ratios (x)

Inventory / Sales (days)

0

1

-

-

-

Receivables (days)

3

3

2

3

3

Payables (days)

38

41

34

50

20

Working capital cycle (ex-cash) (days)

(35)

(37)

(33)

(48)

(18)

Sep 8, 2017

7

Matrimony.com Limited | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Sep 8, 2017

8