4QFY2018 Result Update | Cable

May 7, 2018

Matrimony.com Ltd

BUY

CMP

`850

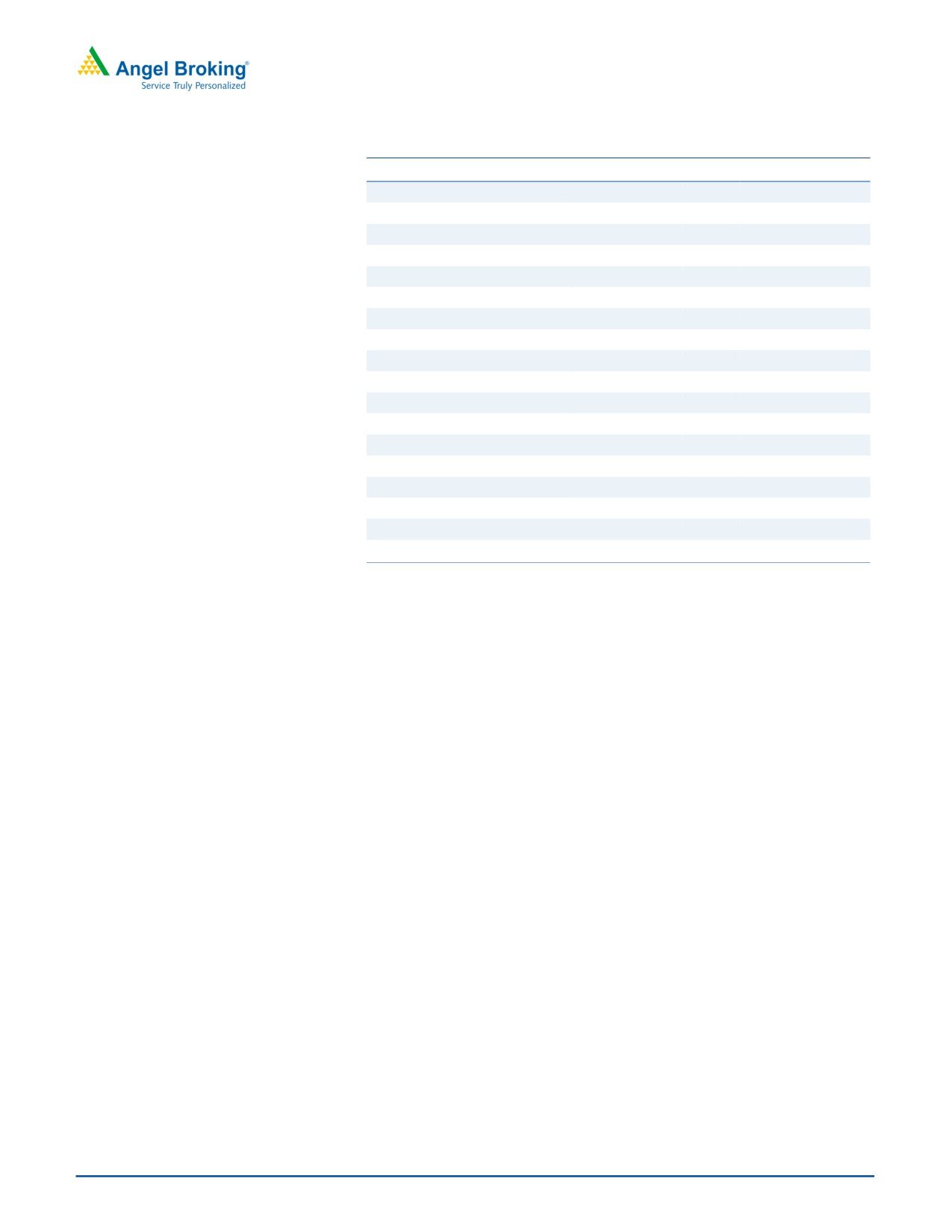

Performance Update

Target Price

`1,016

Y/E March (` cr)

4QFY18

4QFY17

% yoy

3QFY18

% qoq

Investment Period

12 month

Net sales

84

75

12

84

1

Sector

Internet Services

EBITDA

20

11

78

17

15

Market Cap (Rs cr)

1,910

EBITDA margin (%)

23.6

14.8

878bp

20.8

280bp

Net Debt

(167)

Adjusted PAT

17

13

26

13

29

Beta

0.3

Source: Company, Angel Research

52 Week High / Low

1025/703

Avg. Daily Volume

36,577

For 4QFY2018, Matrimony.com Ltd (MCL) posted results in-line with our

Face Value (Rs)

10

expectations on both top-line as well as bottom-line fronts. Consolidated revenues

BSE Sensex

35,025

grew by ~12% yoy and operating margins were also higher yoy. On the bottom-

Nifty

10,653

Reuters Code

NA

line front, MCL reported growth of ~26% yoy to `17cr on the back of strong top-

Bloomberg Code

MATRIM.IN

line growth and operating performance.

Top-line driven by healthy volume growth: The company’s top-line grew by ~12%

Shareholding Pattern (%)

yoy to `84cr on the back of healthy growth in volumes and price hike. In the

Promoters

50.6

Matchmaking Services segment the company reported ~14% growth yoy and in

MF / Banks / Indian Fls

24.1

FII / NRIs / OCBs

22.4

Marriage Services segment the company reported ~20% de-growth yoy.

Indian Public / Others

2.9

Healthy revenues and strong operating performance aided overall profitability: On

the operating front, the company’s margin improved by 878bps yoy on the back of

Abs. (%)

3m 1yr

3yr

strong growth in Matchmaking Services, which is a higher margin business. The

Sensex

0.5

15.9

27.0

company reported ~26% yoy rise in its net profit to `17cr on the back of healthy

MCL

(3.9)

NA

NA

revenue growth and operating margin improvement.

Outlook and Valuation: We expect MCL to report net revenue CAGR of ~15% to

~`450cr over FY2018-20E mainly due to strong growth in online matchmaking

and marriage related services coupled by its strong brand recall and large user

database. On the bottom-line front, we expect CAGR of ~15% to `83cr over the

Historical share price chart

same period on the back of margin improvement. We maintain our BUY rating on

1,000

950

the stock with target price of `1,016.

900

850

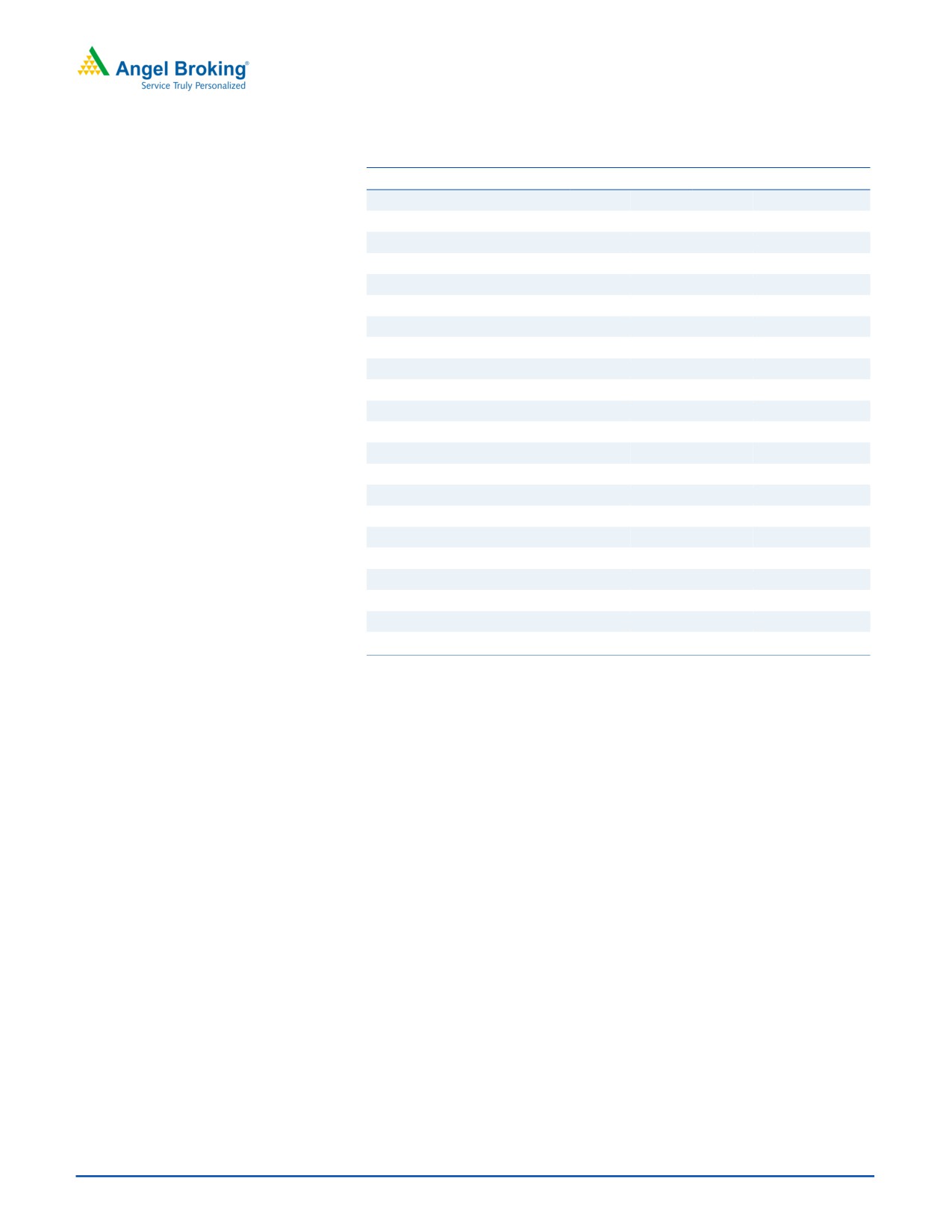

Key Financials

800

Y/E March (` cr)

FY2017

FY2018E

FY2019E FY2020E

750

Net sales

293

335

388

450

700

% chg

14.9

14.6

15.5

16.0

650

Adj. Net profit

48

63

70

83

600

% chg

-

30.8

11.2

18.0

EBITDA margin (%)

18.7

23.1

24.6

25.3

EPS (`)

21.3

27.9

31.0

36.6

Source: Company, Angel Research

P/E (x)

39.9

30.5

27.4

23.3

Amarjeet S Maurya

P/BV (x)

-

11.9

8.3

6.1

022-40003600 Ext: 6831

RoE (%)

-

38.9

30.2

26.3

RoCE (%)

330.8

40.4

35.0

30.8

EV/Sales (x)

6.5

5.2

4.5

3.7

EV/EBITDA (x)

34.9

22.6

18.3

14.8

Source: Company, Angel Research Note: CMP as of May 04, 2018

Please refer to important disclosures at the end of this report

1

Matrimony.com Ltd | 4QFY2018 Result Update

Exhibit 1: 4QFY2018 Performance

Y/E March (` cr)

4QFY18

4QFY17

% yoy

3QFY18

% qoq

FY2018

FY2017

% chg

Net Sales

84

75

11.9

84

0.8

335

293

14.6

Staff Costs

34

29

17.3

34

(0.2)

133

116

14.2

(% of Sales)

40.2

38.4

40.6

39.6

39.8

Selling & Adm Expenses

15

14

3.9

15

(1.0)

56

52

7.3

(% of Sales)

17.2

18.6

17.5

16.7

17.8

Other Expenses

16

21

(25.0)

18

(9.3)

69

70

(1.1)

(% of Sales)

18.9

28.3

21.1

20.6

23.8

Total Expenditure

64

64

0.3

66

(2.8)

258

238

8.2

Operating Profit

20

11

78.1

17

14.6

78

54

42.4

OPM

23.6

14.8

20.8

23.1

18.6

Interest

0.0

1.1

(98.1)

0.1

(81.8)

1.5

6

(72.6)

Depreciation

2.2

2.4

(7.8)

2.5

(11.5)

9.6

10

(7.8)

Other Income

2

1

15

19.3

4

PBT (excl. Ext Items)

20

9

126.3

30

(32.4)

86

43

99.5

Ext (Income)/Expense

PBT (incl. Ext Items)

20

9

126.3

30

(32.4)

86

43

99.5

(% of Sales)

23.6

11.7

35.3

25.6

14.7

Provision for Taxation

3

-

7

12

0

(% of PBT)

15.7

-

22.1

13.9

0.0

Reported PAT

17

9

90.8

23

(26.9)

74

43

71.9

PATM

19.9

11.7

27.5

22.0

14.7

Minority Interest After NP

(4.5)

10.0

10.9

(4.2)

Extra-ordinary Items

Adj. PAT

17

13

26.3

13

29.3

63

47

33.4

Source: Company, Angel Research

May 7, 2018

2

Matrimony.com Ltd | 4QFY2018 Result Update

Key investment arguments

Huge untapped market opportunity: Unmarried population in CY2016 was 107mn,

out of which active seekers were 63mn. However, active users of the online

matrimony segment were only 6mn in CY2016, according to KPMG report.

Currently, MCL has 3.08mn active profiles on Matrimony.com. Hence, there is a

huge untapped market opportunity for the company.

Leading provider of online matchmaking services in India: According to the

comScore Report for June

2017, Matrimony.com is the leader for online

matchmaking services in India in terms of the average number of website pages

viewed by unique visitors, time spent and total pages viewed mainly due to the

company’s large database of profiles.

Strong consumer brand recall: Matrimony.com has high degree of brand recall and

trust in India, as evidenced by the average number of website pages viewed by

unique visitors in June 2017 (comScore Report). BharatMatrimony.com has been

ranked as India’s most trusted online matrimony brand by The Brand Trust Report

India Study 2014. MCL spends 17-18% (% of sales) on ad spends every year.

Foray into marriage services: MCL’s key strategy for driving monetization is to

increase the length of relationship with customers and increase the amount of

revenue earned from customers by offering additional wedding related services such

as photography & videography, wedding apparel, venue, stage decorations, make-

up, catering and honeymoon packages from various vendors to meet customers’

wedding needs.

Outlook & Valuation: We expect MCL to report net revenue CAGR of ~15% to

~`450cr over FY2018-20E mainly due to strong growth in online matchmaking and

marriage related services coupled by its strong brand recall and large user

database. On the bottom-line front, we expect CAGR of ~15% to `83cr over the

same period on the back of margin improvement (due to strong operating leverage

& reduction in losses of marriage service business). We maintain our BUY rating on

the stock with target price of `1,016.

May 7, 2018

3

Matrimony.com Ltd | 4QFY2018 Result Update

Downside risks to our estimates

Any increase in competition from online and offline companies could impact

MCL’s earnings.

If MCL is unable to keep pace with changing technology, evolving industry

standards and does not develop new products for business, its profitability could

be impacted.

The company is dependent on telecommunications and information technology

systems, networks and infrastructure to operate its business. Any interruption or

breakdown in such systems, networks or infrastructure or its technical systems

could impair MCL’s products and services.

Company Background

Incorporated in 2001, Matrimony.com is engaged in providing online matchmaking

and marriage services. They offer their services through Internet and mobile

platforms in India and internationally. MCL is one of the first companies to provide

online matchmaking services in India, having database comprising of 3.08 million

active profiles (being profiles that have been published or logged in at least once

during the prior 180 day period). They offer a range of targeted and customized

products and services that are tailored to meet the specific requirements of customers

based on their religious or caste preferences or other criteria such as marital status

and age bracket. Currently, they have 140 retail centers distributed across India

where customers can walk in and register on their websites. Its flagship brand,

BharatMatrimony, has 15 language based domains under its umbrella. They also

have other portals like EliteMatrimony, CommunityMatrimony, MatrimonyDirectory,

MatrimonyPhotography,

MatrimonyBazaar,

MatrimonyDirectory

and

MatrimonyMandaps.

May 7, 2018

4

Matrimony.com Ltd | 4QFY2018 Result Update

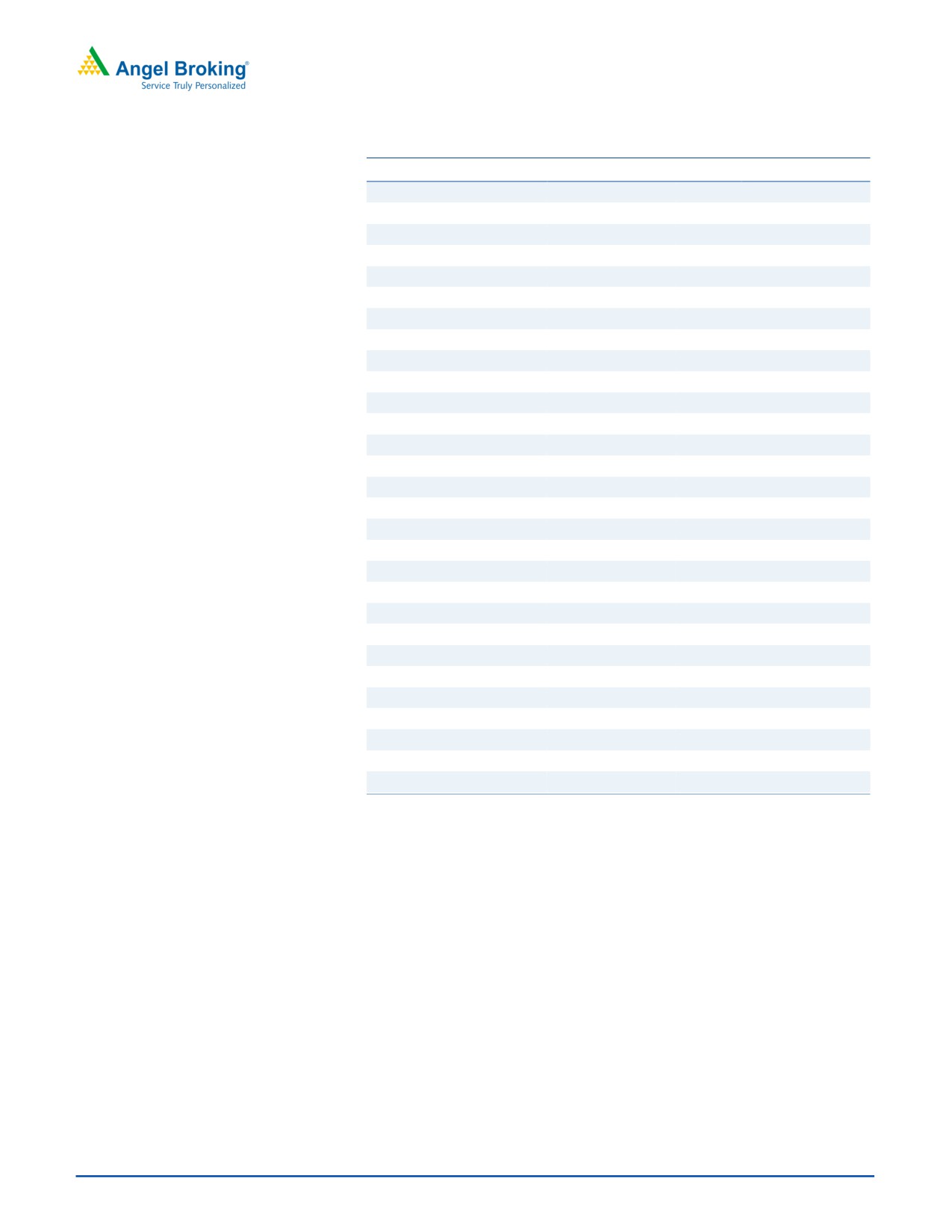

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2016

FY2017

FY2018

FY2019E

FY2020E

Total operating income

255

293

335

388

450

% chg

5.6

14.9

14.6

15.5

16.0

Total Expenditure

322

238

258

292

336

Employee

125

117

133

147

171

Selling & Administrative Expenses

54

52

56

59

65

Others Expenses

143

69

69

86

100

EBITDA

(67)

55

78

95

114

% chg

41.8

22.9

19.3

(% of Net Sales)

(26.4)

18.7

23.1

24.6

25.3

Depreciation& Amortisation

10

10

10

12

15

EBIT

(77)

44

68

83

99

% chg

53.4

22.8

18.3

(% of Net Sales)

(30.2)

15.1

20.3

21.5

22.0

Interest & other Charges

3

4

2

1

1

Other Income

5

4

19

5

5

(% of PBT)

(6.4)

8.9

22.5

5.7

4.8

Share in profit of Associates

-

-

-

-

-

Recurring PBT

(75)

44

86

87

103

% chg

95.8

2.0

18.0

Tax

-

0

12

17

21

(% of PBT)

-

0.0

13.9

20.0

20.0

PAT (reported)

(75)

44

74

70

83

Minority Interest (after tax)

0

-

-

-

-

Extraordinary Items

(74)

(4)

11

-

-

ADJ. PAT

(1)

48

63

70

83

% chg

30.8

11.2

18.0

(% of Net Sales)

(0.5)

16.4

18.8

18.1

18.4

Basic & Fully Diluted EPS (`)

(0.6)

21.3

27.9

31.0

36.6

% chg

30.8

11.2

18.0

May 7, 2018

5

Matrimony.com Ltd | 4QFY2018 Result Update

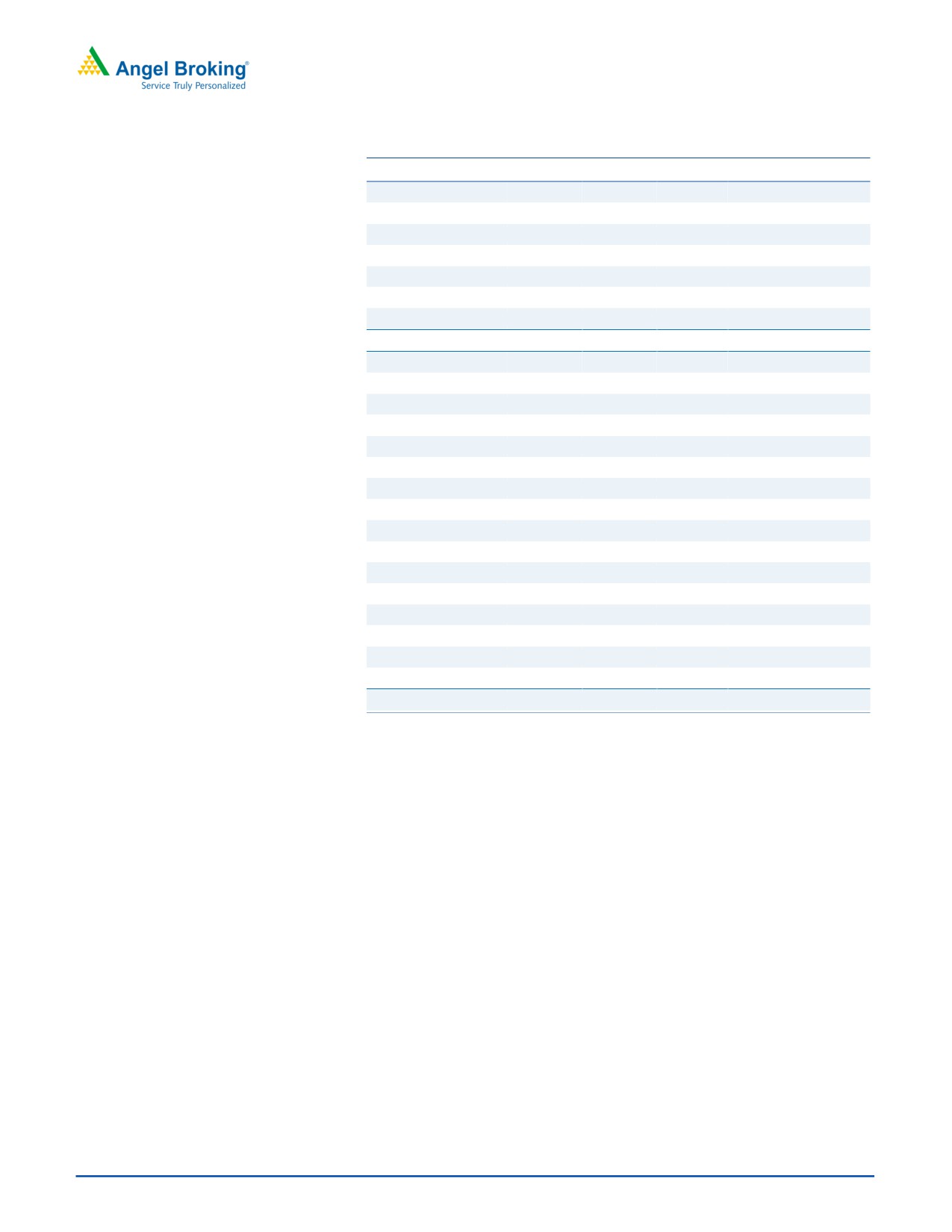

Consolidated Balance Sheet

Y/E March (` cr)

FY2016

FY2017

FY2018

FY2019E FY2019E

SOURCES OF FUNDS

Equity Share Capital

9

11

11

11

11

Reserves& Surplus

(85)

(42)

151

221

303

Shareholders Funds

(76)

(31)

162

232

314

Minority Interest

0

-

-

-

-

Total Loans

49

45

6

6

6

Deferred Tax Liability

23

2

2

2

2

Total Liabilities

(5)

16

170

240

323

APPLICATION OF FUNDS

Gross Block

63

24

77

120

130

Less: Acc. Depreciation

34

-

10

21

36

Net Block

28

24

68

99

94

Capital Work-in-Progress

-

-

-

-

-

Investments

-

-

74

74

74

Current Assets

95

95

165

212

315

Inventories

-

-

-

-

-

Sundry Debtors

2

2

17

21

31

Cash

58

58

98

113

167

Loans & Advances

24

16

17

27

45

Other Assets

11

19

34

50

72

Current liabilities

128

104

136

144

159

Net Current Assets

(33)

(9)

29

68

156

Deferred Tax Asset

-

-

-

-

-

Mis. Exp. not written off

-

-

-

-

-

Total Assets

(5)

16

170

240

323

May 7, 2018

6

Matrimony.com Ltd | 4QFY2018 Result Update

Consolidated Cashflow Statement

Y/E March (Rs cr)

FY2016

FY2017

FY2018

FY2019E FY2019E

Profit before tax

(1)

48

86

87

103

Depreciation

10

10

10

12

15

Change in Working Capital

13

(9)

3

(24)

(33)

Interest / Dividend (Net)

(1)

1

0

0

0

Direct taxes paid

(1)

(2)

(12)

(17)

(21)

Others

(27)

(34)

0

0

0

Cash Flow from Operations

(8)

14

86

57

64

(Inc.)/ Dec. in Fixed Assets

(10)

(10)

(53)

(43)

(10)

(Inc.)/ Dec. in Investments

11

11

(74)

0

0

Cash Flow from Investing

1

1

(127)

(43)

(10)

Issue of Equity

0

1

130

0

0

Inc./(Dec.) in loans

21

0

(38)

0

0

Dividend Paid (Incl. Tax)

0

0

0

0

0

Interest / Dividend (Net)

(3)

(9)

17

0

0

Cash Flow from Financing

18

(8)

109

0

0

Inc./(Dec.) in Cash

12

7

68

14

54

Opening Cash balances

11

23

30

98

113

Closing Cash balances

23

30

98

113

167

May 7, 2018

7

Matrimony.com Ltd | 4QFY2018 Result Update

Key Ratios

Y/E March

FY2016

FY2017

FY2018

FY2019E FY2019E

Valuation Ratio (x)

P/E (on FDEPS)

-

39.9

30.5

27.4

23.3

P/CEPS

-

35.5

23.0

23.5

19.7

P/BV

-

(61.7)

11.9

8.3

6.1

EV/Sales

7.5

6.5

5.2

4.5

3.7

EV/EBITDA

-

34.9

22.6

18.3

14.8

EV / Total Assets

-)

122.3

10.3

7.2

5.2

Per Share Data (Rs)

EPS (Basic)

(0.6)

21.3

27.9

31.0

36.6

EPS (fully diluted)

(0.6)

21.3

27.9

31.0

36.6

Cash EPS

(28.9)

24.0

36.9

36.2

43.2

Book Value

(33.7)

(13.8)

71.6

102.6

139.1

Returns (%)

ROCE

280.8

330.8

40.4

35.0

30.8

Angel ROIC (Pre-tax)

89.7

(99.4)

(1,758.7)

161.3

123.5

ROE

1.7

(154.7)

38.9

30.2

26.3

Turnover ratios (x)

Asset Turnover (Gross Block)

4.1

12.1

4.3

3.2

3.5

Inventory / Sales (days)

-

-

-

-

-

Receivables (days)

3

3

18

20

25

Payables (days)

58

22

20

18

16

Working capital cycle (ex-cash) (days)

(55)

(19)

(2)

2

9

Source: Company, Angel Research

May 7, 2018

8

Matrimony.com Ltd | 4QFY2018 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make

investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this

document are those of the analyst, and the company may or may not subscribe to all the views expressed within.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources

believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for

general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any

loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt.

Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any

representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking

Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance,

or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or

other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in

the past.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Century Plyboards India

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

Reduce (-5% to -15%)

Sell (< -15%)

May 7, 2018

9