3QFY2017 Result Update | Automobile

January 27, 2017

Maruti Suzuki

ACCUMULATE

CMP

`5,797

Performance Highlights

Target Price

`6,560

Y/E March (` cr)

3QFY17 3QFY16

% chg (yoy)

2QFY17

% chg (qoq)

Investment Period

12 Months

Net Sales

16,865

15,013

12.3

17,843

(5.5)

EBITDA

2,489

2,145

16.0

3,037

(18.1)

Stock Info

EBITDA Margin (%)

14.8

14.3

46 bp

17.0

(226) bp

Sector

Automobile

Adj. PAT

1,745

1,183

47.5

2,398

(27.3)

Market Cap (` cr)

175,110

Source: Company, Angel Research

Net Debt (` cr)

(17,593)

Beta

0.8

Strong operating performance aided by decent UV volumes: Maruti Suzuki (MSIL)

52 Week High / Low

5,972/3,202

reported a good set of numbers for 3QFY2017 with yoy 12.3% revenue growth

Avg. Daily Volume

76,907

and yoy 47.5% growth in its PAT. EBITDA came at `2,489cr, a yoy growth of

Face Value (`)

5

16.0%. EBITDA margins were at 14.8% v/s. 14.3% in 3QFY2016 and 17.0% in

2QFY2017. On sequential basis, revenue witnessed a 5.5% decline due to

BSE Sensex

27,708

demonetization. On the volume front, company reported yoy 5.8% and 1.6%

Nifty

8,603

decline in mini and compact segment vehicles respectively. The UV segment,

Reuters Code

MRTI.BO

however, reported yoy 25.5% growth due to the performance of recently launched

Bloomberg Code

MSIL@IN

models. Net realizations remained at `429,272 per unit showing a yoy growth of

8.65%. RM cost per unit at `301,453 increased by 9.59% yoy due to the rise in

Shareholding Pattern (%)

input costs. Management has indicated that showroom footfalls have come back

Promoters

56.2

to normalcy indicating that 4QFY2017 numbers are likely to be better than

MF / Banks / Indian Fls

12.2

3QFY2017.

FII / NRIs / OCBs

24.7

Indian Public / Others

6.9

Outlook and valuation: MSIL has continued to report double digit numbers due to

the strong performance of its utility vehicles. Company expects to launch one

model each year, which is likely to sustain its growth momentum in the near term.

Abs. (%)

3m 1yr

3yr

MSIL has indicated that showroom footfalls have come back to normalcy, which

Sensex

(0.5)

13.2

31.1

were impacted immediately after the demonetisation announcement. We believe

Maruti Suzuki

(1.3)

41.9

227.0

that 4QFY2017 revenue growth is likely to be better than 3QFY2017. With the

Gujarat plant nearing commissioning, the company will see de-bottlenecking of

capacity constraints. With the strong performance, MSIL is likely to gain further

3-year price chart

market share. At CMP, MSIL is trading at P/E of 22.8x and 18.6x its FY2017E and

6,000

FY2018E earnings respectively. We value MSIL on 21x of its FY2018E EPS of `312

5,000

with a target price of `6,560 with Accumulate rating on the stock.

4,000

3,000

Key financials (post SPIL merger)

2,000

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

1,000

Net Sales

48,606

56,350

66,847

82,165

0

% chg

14.0

15.9

18.6

22.9

Net Profit

3,711

4,571

7,664

9,433

% chg

33.4

23.2

67.7

23.1

Source: Company, Angel Research

OPM (%)

13.8

15.9

16.3

16.6

EPS (Rs)

122.9

151.4

253.8

312.4

P/E (x)

47.2

38.3

22.8

18.6

P/BV (x)

7.4

6.5

5.2

4.2

RoE (%)

15.7

16.9

23.0

22.9

RoCE (%)

17.5

22.6

24.0

25.3

Shrikant Akolkar

EV/Sales (x)

3.3

2.7

2.2

1.7

022-3935 7800 Ext: 6846

EV/EBITDA (x)

24.3

17.5

14.0

10.7

Source: Company, Angel Research; Note: CMP as of January 25, 2016

Please refer to important disclosures at the end of this report

1

Maruti Suzuki | 3QFY2017 Result Update

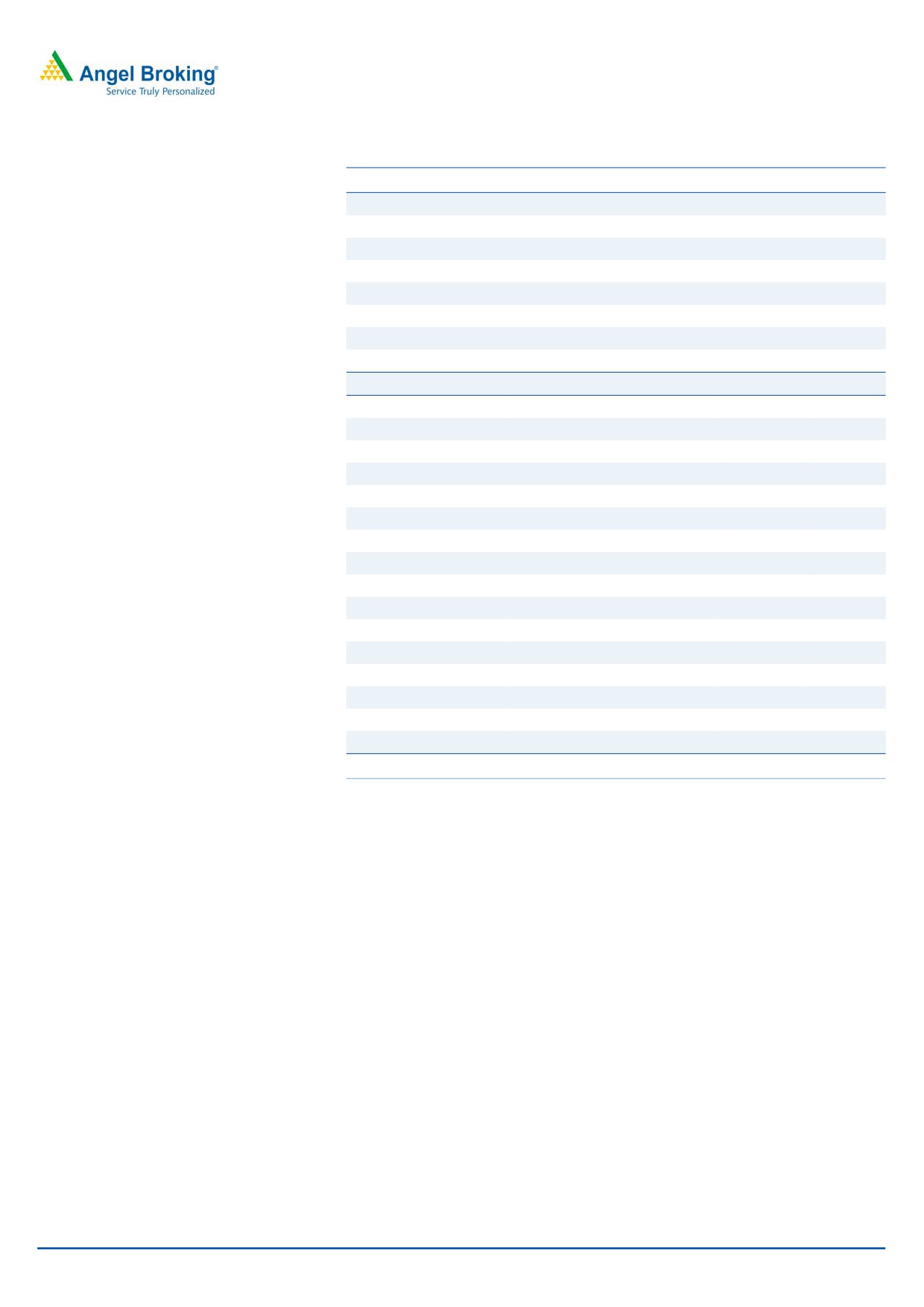

Exhibit 1: Quarterly financial performance

Y/E March (` cr)

3QFY17

3QFY16

% chg (yoy)

2QFY17

% chg (qoq)

9MFY17

9MFY16

% chg (yoy)

Net Sales

16,865

15,013

12.3

17,843

(5.5)

49,628

42,141

17.8

Raw-material cost

11,674

10,293

13.4

12,074

(3.3)

33,873

28,579

18.5

(% of Sales)

69.2

68.6

67.7

68.3

67.8

Staff cost

617

502

22.9

519

18.8

1,715

1,381

24.2

(% of Sales)

3.7

3.3

2.9

3.5

3.3

Other Expenses

2,085

2,073

0.6

2,212

(5.7)

6,298

5,724

10.0

(% of Sales)

12.4

13.8

12.4

12.7

13.6

Total Expenditure

14,376

12,868

11.7

14,805

(2.9)

41,886

35,683

17.4

Operating Profit

2,489

2,145

16.0

3,037

(18.1)

7,742

6,458

19.9

OPM (%)

14.8

14.3

17.0

15.6

15.3

Interest

29

24

18.9

20

47.2

68

61

10.8

Depreciation

635

722

(12.1)

630

0.8

1,904

2,063

-7.7

Other Income

592

243

144.1

813

(27.2)

1,888

923

104.6

PBT (excl. Extr. Items)

2,417

1,641

47.3

3,200

(24.5)

7,658

5,256

45.7

Extr. Income/(Expense)

PBT (incl. Extr. Items)

2,417

1,641

47.3

3,200

(24.5)

7,658

5,256

45.7

(% of Sales)

14.3

10.9

17.9

15.4

12.5

Provision for Taxation

673

458

46.8

802

(16.2)

2,031

1,468

38.3

(% of PBT)

27.8

27.9

25.1

26.5

27.9

Reported PAT

1,745

1,183

47.5

2,398

(27.3)

5,628

3,788

48.6

Adj PAT

1,745

1,183

47.5

2,398

(27.3)

5,628

3,788

48.6

Adj. PATM

10.3

7.9

13.4

11.3

9.0

Equity capital (cr)

151

151

151

151

151

Reported EPS (`)

57.75

39.16

47.5

79.38

(27.3)

186.30

125.40

48.6

Source: Company, Angel Research

January 27, 2017

2

Maruti Suzuki | 3QFY2017 Result Update

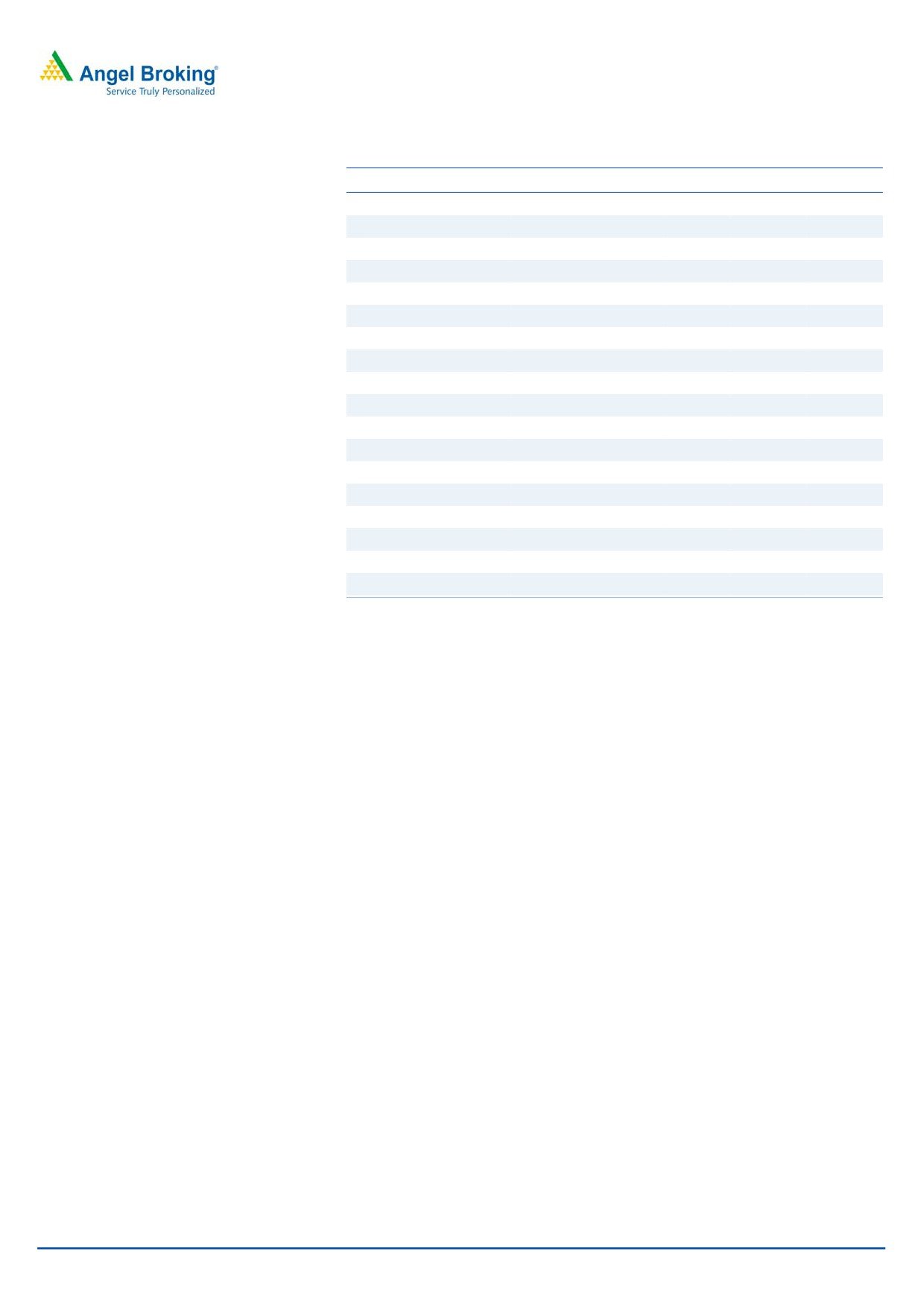

Exhibit 2: Quarterly volume performance

Volume (units)

Q3FY17

Q3FY16

% chg (yoy) Q2FY17

% chg (qoq)

9MFY17

9MFY16

% chg (yoy)

A: Mini: Alto, WagonR

104,342

110,810

(5.8)

114,936

(9.2)

312,001

326,598

(4.5)

A: Compact: Swift, Celerio, Dzire, Baleno

150,899

153,423

(1.6)

156,284

(3.4)

447,204

435,695

2.6

A: Mid-Size: Ciaz

15,504

14,240

8.9

17,920

(13.5)

47,114

38,160

23.5

Total Passenger cars

270,745

278,473

(2.8)

289,140

(6.4)

8,06,319

8,00,453

0.7

B: Utility Vehicles: Gypsy, Ertiga

34,252

27,291

25.5

52,611

(34.9)

126,211

79,055

59.6

C: Vans: Omni, Eeco

51,295

37,231

37.8

41,197

24.5

129,050

92,450

39.6

D: LCV

211

0

83

294

0

n.a

Total Domestic (includes LCV)

356,503

342,995

3.9

383,031

(6.9)

10,61,874

971,958

9.3

Total Exports

30,748

31,187

(1.4)

35,440

(13.2)

92,291

96,888

(4.7)

Total Volume

387,251

374,182

3.5

418,471

(7.5)

11,54,165

10,68,846

8.0

Source: Company, Angel Research

MSIL saw reduced footfalls immediately after the demonetisation

announcement, however, footfalls have been restored, indicating that the

impact of note ban is likely to vanish earlier than expected.

Total volumes during the quarter were at 387,251 showing a yoy growth of

3.5%. Domestic volumes grew by 3.94% while export volumes contracted by

1.4%.

Company reported 5.84% decline in its mini vehicle segment; the compact

class vehicle sales growth was flat. Mid size, vans and UV segment vehicles

showed growth of 8.9%, 37.8% and 25.5% respectively, indicating that the

performance was better than entry level cars.

During the quarter, company sold 211 LCVs compared to 83 LCVs in

3QFY2017.

Company continues to outperform the industry growth. During the quarter

industry growth was 1.8% while company growth was at 3.9%.

Realisation per vehicle grew 8.65% yoy owing to a better product mix with

higher volumes of utility vehicles. The contribution/vehicle also improved by

~9.6% due to better product mix.

We estimate domestic and export realizations to be `4.27 lakh and `4.50 lakh

showing yoy growth 8.31% and 12.54% respectively.

During the quarter company paid royalty at 5.5% of net sales v/s. 6.1% of net

sales in 2QFY2017.

Company is targeting millennial group (age group 18-28) as potential

customers for newly launched hatchback Ignis.

January 27, 2017

3

Maruti Suzuki | 3QFY2017 Result Update

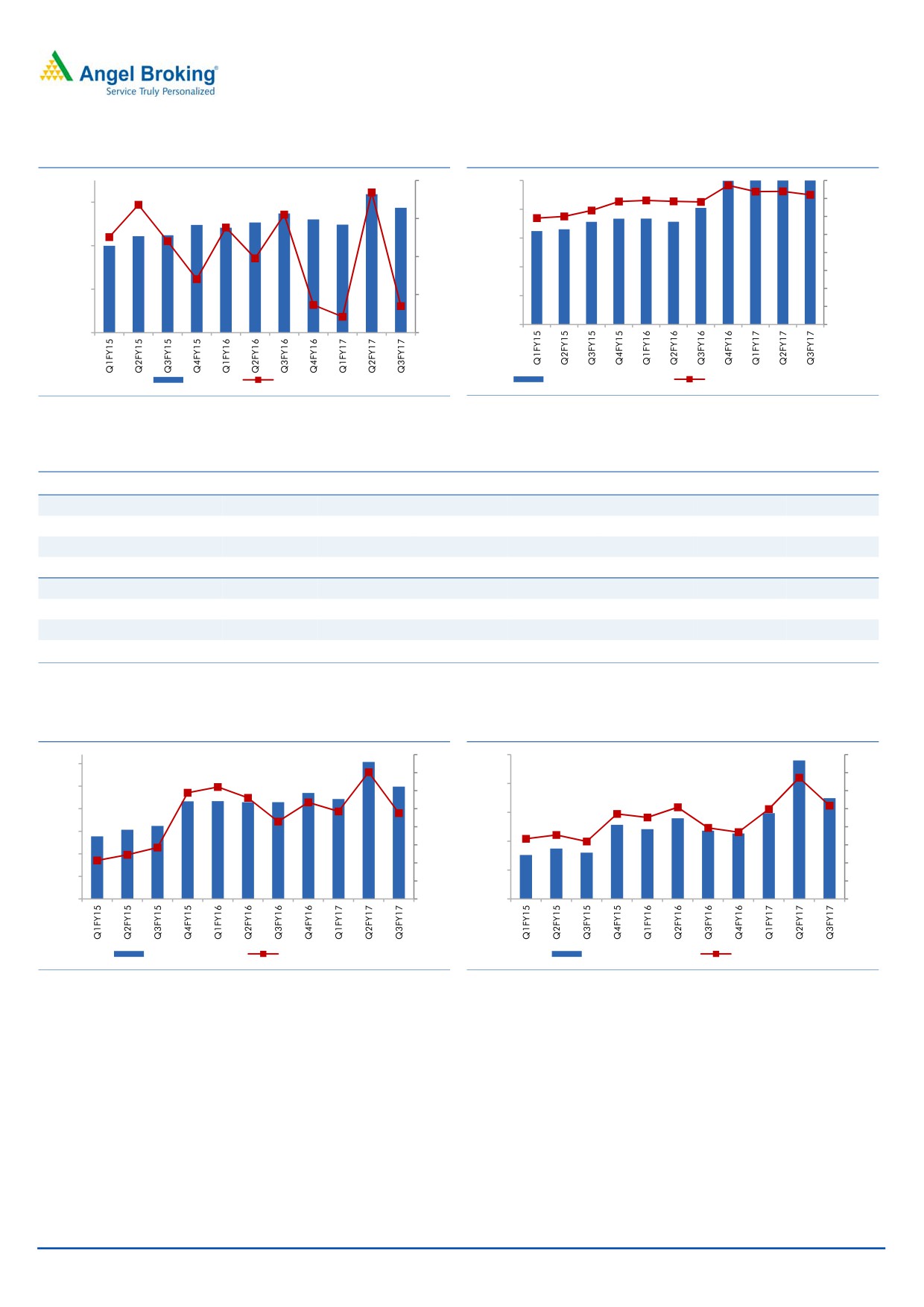

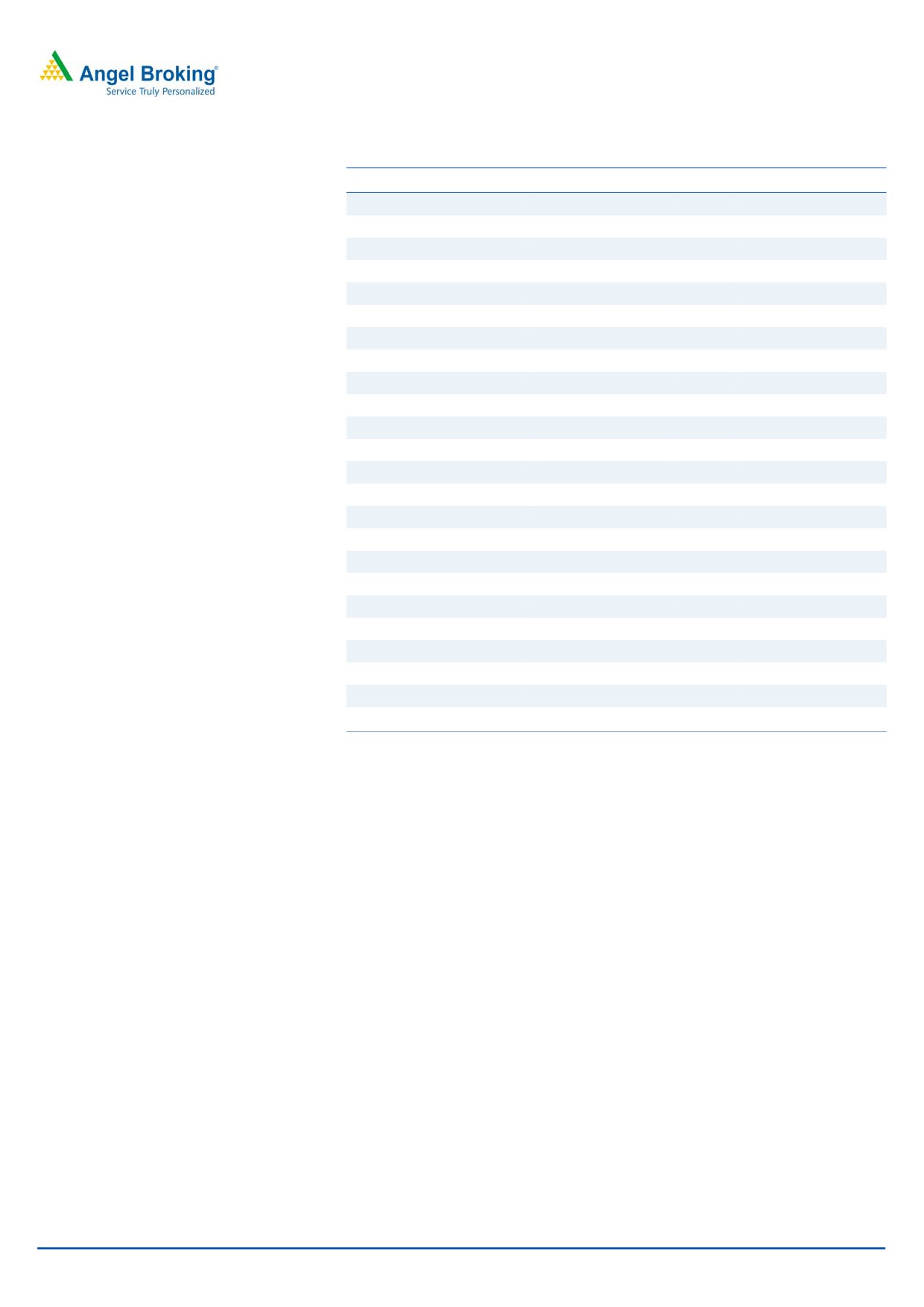

Exhibit 3: Growth slows due to demonetisation

Exhibit 4: Realisation & contribution per vehicle

20.0

425,000

150,000

400,000

130,000

400,000

15.0

110,000

375,000

90,000

300,000

70,000

10.0

350,000

50,000

200,000

30,000

5.0

325,000

10,000

300,000

-10,000

100,000

0.0

Volumes

yoy growth (%)

Net realization (`)

Contribution / Vehicle (`)

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 5: Quarterly revenue and realization performance

Q1FY16

Q2FY16

Q3FY16

Q4FY16

Q1FY17

Q2FY17

*Q3FY17

Domestic revenue (` cr)

11,698

12,360

13,523

13,548

13,334

16,030

15,242

Change yoy (%)

19.00

16.66

22.50

12.25

13.98

29.69

12.58

Domestic realization (`)

382,680

382,344

394,254

406,352

413,663

418,494

427,547

Change yoy (%)

5.36

3.82

5.43

7.12

8.10

9.45

8.31

Export revenue (` cr)

1,380

1,130

1,245

1,382

1,352

1,565

1,381

Change yoy (%)

11.0

(19.3)

1.7

14.9

(2.0)

38.5

11.0

Export realization (`)

387,260

375,840

399,077

511,681

517,948

441,591

449,272

Change yoy (%)

(8.87)

(8.22)

(6.40)

25.65

33.75

17.49

12.54

Source: Company, Angel Research, * Estimates

Exhibit 6: EBITDA growth at 16%, margins at 14.8%

Exhibit 7: PAT grows despite demonetisation impact

18.0

2,500

16.0

3,000

17.0

14.0

2,500

2,000

16.0

12.0

2,000

15.0

1,500

10.0

14.0

8.0

1,500

13.0

1,000

6.0

1,000

12.0

4.0

500

500

11.0

2.0

0

10.0

0

0.0

EBITDA (`cr)

EBITDA margins (%)

Net profit (`cr)

Net margin (%)

Source: Company, Angel Research

Source: Company, Angel Research

January 27, 2017

4

Maruti Suzuki | 3QFY2017 Result Update

Conference call - Key highlights

Company has indicated that share of diesel vehicles has declined to 40% and

company has 30% market share in the diesel vehicles.

While exports showed flat growth, company expects to reach the target of

124,000 exports by end of the year.

The discount during the quarter was at `19,048 v/s. 21,997 in 3QFY2016

and `16,100 in 2QFY2017.

Company has said that demand scenario remains strong but has ruled out

price increase of its products.

It has also said that recovery in the rural market is on the lines of recovery of

urban markets, implying that rural demand has picked up very strong and that

entry level volumes are likely to show good numbers in 4QFY2017.

The commissioning of the Gujarat plant is around the corner, and it will ease

capacity constraints.

Government employees segment constitute ~20% of MSIL’s sales v/s. 14-15%

in the last quarter. In the last quarter, company had indicated that it had

dedicated a team to cater to this segment and we believe that

20%

contribution from govt. employees is an effect of this.

It also indicated that inquiries are growing form the first time buyers, however,

the sentiment of small business owners remained impacted.

Waiting period for Baleno is 24 weeks while that for Ignis is 8-10 weeks.

Company has indicated that Suzuki will take care of the Gujarat plant capex.

MSIL has guided FY2017E full year capex of `3,500cr.

Company expects higher maintenance capex due to its aging plants (Gurgaon

and Manesar).

January 27, 2017

5

Maruti Suzuki | 3QFY2017 Result Update

Investment arguments

MSIL seeing faster recovery after demonetisation: The automobile demand in

India has seen the impact of demonetization in 3QFY2017 however Maruti

with its strong performance has continued to grow in double digits. We

believe, MSIL is seeing faster recovery than its peers. Further, the low interest

rate is expected to boost the consumer sentiment, which will benefit MSIL due

to its high market share. Overall, we expect resilient demand in 4QFY2017,

which will result in growth in volumes for the Automobile companies.

MSIL expected to gain market share: MSIL is the largest passenger car

manufacturer in the country and enjoys a leadership position. MSIL’s major

product portfolio is towards the petrol cars, where it enjoys highest market

shares among its peers. The lower petrol prices have benefitted the company

and continued weakness in crude prices is expected to benefit the company by

keeping petrol prices at lower levels. In 2QFY2017, MSIL’s share of petrol

vehicles in total passenger vehicle industry stood at 59.2% compared to 53.7%

in 2QFY2016. Strong dealership network and improved product mix is

expected to benefit the company in gaining further market share. We also

expect the passenger vehicle penetration to go up in the country, which will

help MSIL, as it already covers most parts of the country through its robust

dealership network.

Gujarat plant to ease capacity constraints: MSIL is currently seeing capacity

constraints, which have led to company overstretching its existing capacity. In

2QFY2017, MSIL’s capacity utilization was more than 100% and indicates that

it may not be able to cater the strong demand without capacity expansion.

Gujarat capacity is expected to address these constraints by adding additional

capacity of 250,000 vehicles per annum from 4QFY2017 onwards.

Ignis to help MSIL reporting double digit growth: MSIL’s new launch, Ignis - a

hatchback, is likely to take the company’s growth story forward. The last few

launches have been received well by the market and we expect the same to

continue. Ignis is targeted for tech savvy millennial consumers (18-25 age

groups). Company has started booking and has already received ~10,000+

booking and the waiting period is 8-10 weeks.

January 27, 2017

6

Maruti Suzuki | 3QFY2017 Result Update

Outlook and valuation

MSIL has continued to report double digit numbers due to the strong performance

of its utility vehicles. Company expects to launch one model each year, which is

likely to sustain its growth momentum in the near term. MSIL has indicated that

showroom footfalls have come back to normalcy, which were impacted

immediately after the demonetisation announcement.

We believe that 4QFY2017 revenue growth is likely to be better than 3QFY2017.

With the Gujarat plant nearing commissioning, the company will see de-

bottlenecking of capacity constraints. With the strong performance, MSIL is likely to

gain further market share. At CMP, MSIL is trading at P/E of 22.8x and 18.6x its

FY2017E and FY2018E earnings respectively. We value MSIL on 21x of its

FY2018E EPS of `312 with a target price of `6,560 with Accumulate rating on the

stock.

Exhibit 8: Key assumptions

Y/E March

FY2013

FY2014

FY2015

FY2016E

FY2017E

FY2018E

Domestic unit sales

1,050,859

1,053,688

1,170,702

1,305,351

1,424,099

1,575,324

YoY growth (%)

4.4

0.3

11.1

11.5

9.1

10.6

Exports unit sales

120,388

101,352

121,713

123,897

124,000

145,721

YoY growth (%)

(5.5)

(15.8)

20.1

1.8

0.1

17.5

Total volumes

1,171,247

1,155,040

1,292,415

1,429,248

1,548,099

1,721,045

YoY growth (%)

3.3

(1.4)

11.9

10.6

8.3

11.2

Per unit domestic realization

405,502

404,719

415,183

431,688

425,888

466,969

Per unit exports realization

378,784

408,645

380,641

386,797

499,737

590,330

Per unit realisation (blended)

363,822

369,206

376,083

394,266

431,803

477,414

YoY growth (%)

18.8

1.5

1.9

4.8

9.5

10.6

Per unit RM

277,611

271,112

270,873

271,331

297,209

326,934

YoY growth (%)

12.1

(2.3)

(0.1)

0.2

9.5

10.0

Source: Company, Angel Research

Company background

Maruti Suzuki (MSIL), a subsidiary of Suzuki Motor Corporation (SMC), Japan

(which holds a 56% stake in MSIL), is the largest passenger car company in India,

accounting for ~47% of the domestic passenger car market. MSIL operates from

two facilities in India (Gurgaon and Manesar) with an installed capacity of 1.5mn

units. Company is also in process of commissioning production at Gujarat plant,

which will help the company to ease its capacity constraints. Company in the last

two years has moved in premium products with launch of Baleno, Vitara, S-Cross

and Ciaz. Also, MSIL has steadily increased its presence internationally, and

exports now account for ~9% of its overall sales volume and same is expected to

increase going ahead.

January 27, 2017

7

Maruti Suzuki | 3QFY2017 Result Update

Profit and loss statement (post SPIL merger)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

Total operating income

43,792

49,971

57,746

67,822

83,288

% chg

2.8

14.1

15.6

17.4

22.8

Total Expenditure

38,605

43,258

48,768

56,958

69,635

Cost of Materials

31,315

35,008

38,780

46,011

56,267

Personnel

1,368

1,607

1,989

2,406

3,098

Others Expenses

5,922

6,643

7,999

8,541

10,271

EBITDA

5,187

6,713

8,979

10,865

13,653

% chg

22.6

29.4

33.7

21.0

25.7

(% of Net Sales)

11.8

13.4

15.5

16.0

16.4

Depreciation& Amort.

2,084

2,470

2,824

2,804

3,155

EBIT

3,103

4,243

6,155

8,060

10,498

% chg

122.7

36.7

45.1

31.0

30.2

(% of Net Sales)

7.1

8.5

10.7

11.9

12.6

Interest & other Charges

176

206

82

91

103

Other Income

732

832

462

2,479

2,707

(% of PBT)

20.0

17.1

7.1

23.7

20.7

Recurring PBT

3,659

4,868

6,535

10,448

13,102

% chg

81.5

33.1

34.2

59.9

25.4

Prior Period & Extra. Exp./(Inc.)

-

-

-

-

-

PBT (reported)

3,659

4,868

6,535

10,448

13,102

Tax

876

1,157

1,964

2,784

3,669

(% of PBT)

23.9

23.8

30.0

26.6

28.0

PAT (reported)

2,783

3,711

4,571

7,664

9,433

Add: Share of earnings of asso.

-

-

-

-

-

Less: Minority interest (MI)

-

-

-

-

-

PAT after MI (reported)

2,783

3,711

4,571

7,664

9,433

ADJ. PAT

2,783

3,711

4,571

7,664

9,433

% chg

16.3

33.4

23.2

67.7

23.1

(% of Net Sales)

6.4

7.4

7.9

11.3

11.3

Basic EPS (`)

92.1

122.9

151.4

253.8

312.4

Fully Diluted EPS (`)

92.1

122.9

151.4

253.8

312.4

% chg

16.3

33.4

23.2

67.7

23.1

January 27, 2017

8

Maruti Suzuki | 3QFY2017 Result Update

Balance sheet statement (post SPIL merger)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

SOURCES OF FUNDS

Equity Share Capital

151

151

151

151

151

Reserves& Surplus

20,827

23,553

26,856

33,218

41,047

Shareholders’ Funds

20,978

23,704

27,007

33,369

41,198

Minority Interest

-

-

-

-

-

Total Loans

1,824

516

231

231

231

Deferred Tax Liability

691

587

625

625

625

Other Liabilities

437

398

424

424

424

Total Liabilities

23,930

25,205

28,288

34,649

42,479

APPLICATION OF FUNDS

Gross Block

22,702

26,462

29,409

32,909

37,209

Less: Acc. Depreciation

11,911

14,202

16,641

19,446

22,601

Net Block

10,790

12,259

12,768

13,463

14,608

Capital Work-in-Progress

2,621

1,883

1,007

1,007

1,007

Investments

10,118

12,814

17,786

22,060

27,936

Current Assets

7,070

6,593

7,635

9,881

13,223

Inventories

1,706

2,686

3,132

3,663

4,502

Sundry Debtors

1,414

1,070

1,299

1,648

2,026

Cash

630

18

39

1,093

1,683

Loans & Advances

1,629

1,426

1,807

1,939

2,876

Other Assets

1,692

1,393

1,359

1,537

2,136

Current liabilities

6,775

8,451

11,059

11,913

14,447

Net Current Assets

295

(1,857)

(3,424)

(2,032)

(1,224)

Deferred Tax Asset

105

106

151

151

151

Mis. Exp. not written off

-

-

-

-

-

Total Assets

23,930

25,205

28,288

34,649

42,479

Note: Cash and bank balance includes term deposits with banks

January 27, 2017

9

Maruti Suzuki | 3QFY2017 Result Update

Cash flow statement (post SPIL merger)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E FY2018E

Profit before tax

3,659

4,868

6,535

10,448

13,102

Depreciation

2,084

2,470

2,824

2,804

3,155

Change in Working Capital

756

746

1,466

(337)

(219)

Interest / Dividend (Net)

(106)

43

(80)

91

103

Direct taxes paid

(832)

(1,041)

(1,910)

(2,784)

(3,669)

Others

(658)

(766)

(401)

-

-

Cash Flow from Operations

4,904

6,321

8,433

10,222

12,473

(Inc.)/ Dec. in Fixed Assets

(3,498)

(3,157)

(2,594)

(3,500)

(4,300)

(Inc.)/ Dec. in Investments

(1,395)

(1,253)

(4,582)

(4,274)

(5,876)

Cash Flow from Investing

(4,893)

(4,410)

(7,176)

(7,774)

(10,176)

Issue of Equity

-

-

1

-

-

Inc./(Dec.) in loans

378

(1,328)

(235)

0

0

Dividend Paid (Incl. Tax)

(242)

(363)

(755)

(1,303)

(1,604)

Interest / Dividend (Net)

(293)

(831)

(246)

(91)

(103)

Cash Flow from Financing

(156)

(2,522)

(1,236)

(1,394)

(1,707)

Inc./(Dec.) in Cash

(145)

(611)

21

1,054

590

Opening Cash balances

775

630

18

39

1,093

Closing Cash balances

630

18

39

1,093

1,683

Note: Closing Cash balances excludes term deposits with banks and unclaimed dividend accounts

January 27, 2017

10

Maruti Suzuki | 3QFY2017 Result Update

Key ratios

Y/E March

FY2014

FY2015

FY2016

FY2017E FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

62.9

47.2

38.3

22.8

18.6

P/CEPS

36.0

28.3

23.7

16.7

13.9

P/BV

8.3

7.4

6.5

5.2

4.2

Dividend yield (%)

0.1

0.2

0.4

0.7

0.9

EV/Sales

3.8

3.3

2.7

2.2

1.7

EV/EBITDA

32.0

24.3

17.5

14.0

10.7

EV / Total Assets

5.4

4.8

4.0

3.3

2.6

Per Share Data (`)

EPS (Basic)

92.1

122.9

151.4

253.8

312.4

EPS (fully diluted)

92.1

122.9

151.4

253.8

312.4

Cash EPS

161.1

204.7

244.9

346.6

416.8

DPS

8.0

12.0

25.0

43.1

53.1

Book Value

694.5

784.7

894.3

1,104.9

1,364.2

Returns (%)

ROCE

13.6

17.5

22.6

24.0

25.3

Angel ROIC (Pre-tax)

25.7

37.3

65.4

77.2

88.9

ROE

13.3

15.7

16.9

23.0

22.9

Turnover ratios (x)

Asset Turnover (Gross Block)

1.9

1.9

2.0

2.1

2.2

Inventory / Sales (days)

15

20

20

20

20

Receivables (days)

12

8

8

9

9

Payables (days)

46

45

49

44

44

WC cycle (ex-cash) (days)

(20)

(17)

(21)

(15)

(15)

January 27, 2017

11

Maruti Suzuki | 3QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Maruti Suzuki

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

January 27, 2017

12