3QFY2016 Result Update | Automobile

January 30, 2016

Maruti Suzuki

NEUTRAL

CMP

`4,097

Performance Highlights

Target Price

-

Y/E March (` cr)

3QFY16 3QFY15

% chg (yoy)

2QFY16

% chg (qoq)

Investment Period

-

Net Sales

15,082

12,603

19.7

13,934

8.2

Stock Info

EBITDA

2,170

1,619

34.0

2,269

(4.4)

Sector

Automobile

EBITDA Margin (%)

14.4

12.9

150 bp

16.3

(190 bp)

Market Cap (` cr)

123,776

Net Profit

1,019

802

27.1

1,226

(16.8)

Net Debt (` cr)

(12,652)

Source: Company, Angel Research

Beta

0.8

Operating results meet estimates, lower other income drags profitability: Maruti

52 Week High / Low

4,789/3,362

Suzuki India Ltd (MSIL) 3QFY2016 operating results adjusted for one off items

Avg. Daily Volume

57,323

were in line with our estimates. MSIL revenues, expectedly grew 20% yoy to

Face Value (`)

5

`15,082 cr driven majorly by a robust 16% volume growth. New product

BSE Sensex

24,871

launches coupled with robust festive demand enabled MSIL to clock strong

Nifty

7,564

volumes. Realisation/vehicle grew 4% led by a better product mix. MSIL incurred

Reuters Code

MRTI.BO

one off expenditures to the tune of `175 cr during the quarter (`150 cr on

Bloomberg Code

MSIL@IN

account of inventory decretion and `25 cr due to higher employee expenses due

to higher bonus declared retrospectively for 21 months). Adjusted for the one off

items, operating margins came in at 15.5% which is line with our estimates.

Shareholding Pattern (%)

However, MSIL reported lower other income of `32 cr (as against `102 cr

Promoters

56.2

reported in corresponding quarter last year) which led to the Adjusted Net Profit

MF / Banks / Indian Fls

15.9

coming in at `1,142 cr as against our estimate of `1,270 cr.

FII / NRIs / OCBs

25.2

Indian Public / Others

2.7

Outlook and valuation: The passenger vehicle (PV) industry is well poised to post

double-digit growth over the next two years, given the improved consumer

sentiments, better economic outlook, and softer fuel prices. Given the new

Abs. (%)

3m 1yr

3yr

launches, MSIL is likely to retain its market share despite increased competitive

Sensex

(7.3)

(16.2)

24.4

intensity. However, MSIL margins are likely to tread down in FY2017 from the

Maruti Suzuki

(7.8)

11.1

157.3

record 1HFY2016 levels given the increased sales promotion expenses due to

new launches and the recent appreciation of JPY vis a vis INR which would

increase the raw material and the royalty expenses. At CMP, MSIL is trading at P/E

3-year price chart

5,000

of 25.6x and 19.4x its FY2016 and FY2017 earnings respectively, leaving no

scope of meaningful upside from current levels. Hence, we maintain our Neutral

4,000

rating on the stock.

3,000

2,000

Key financials (post SPIL merger)

1,000

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

Net Sales

43,701

49,971

58,365

69,070

0

% chg

1.4

14.3

16.8

18.3

Net Profit

2,783

3,711

4,838

6,374

% chg

21.0

33.4

30.4

31.8

Source: Company, Angel Research

EBITDA (%)

11.6

13.4

15.5

15.5

EPS (`)

92.1

122.9

160.1

211.0

P/E (x)

44.5

33.3

25.6

19.4

P/BV (x)

5.9

5.2

4.6

3.4

RoE (%)

13.3

15.7

17.9

20.2

RoCE (%)

16.2

20.5

24.4

26.3

Bharat Gianani

EV/Sales (x)

2.7

2.4

1.9

1.6

022-3935 7800 Ext: 6817

EV/EBITDA (x)

22.8

18.0

12.5

10.2

Source: Company, Angel Research; Note: CMP as of January 29, 2016

Please refer to important disclosures at the end of this report

1

Maruti Suzuki | 3QFY2016 Result Update

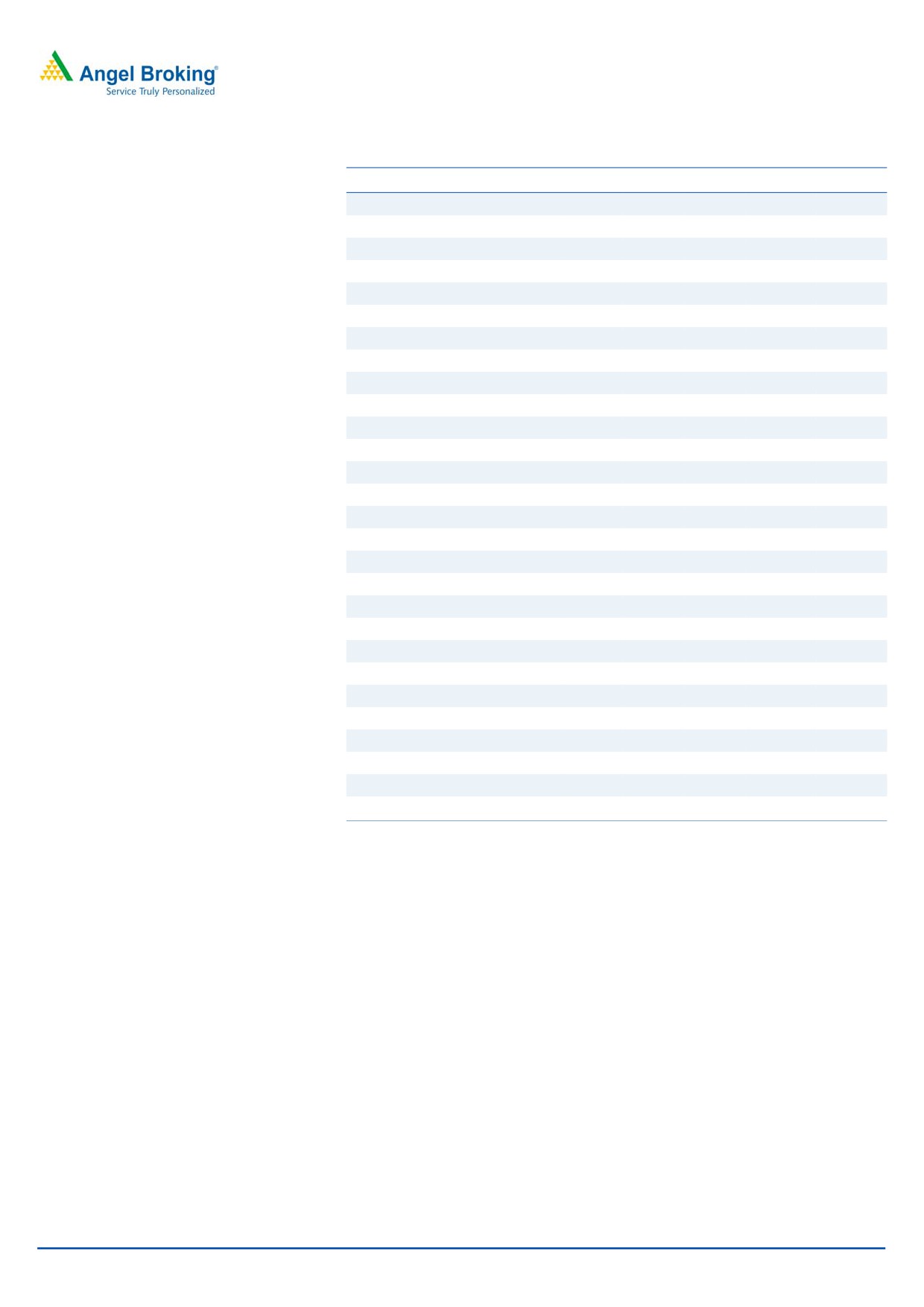

Exhibit 1: Quarterly financial performance

Y/E March (` cr)

3QFY16

3QFY15

% chg (yoy)

2QFY16

% chg (qoq)

9MFY16

9MFY15

% chg (yoy)

Net Sales

15,082

12,603

19.7

13,934

8.2

42,441

36,346

16.8

Raw-material cost

10,328

8,826

17.0

9,312

10.9

28,685

25,785

11.2

(% of Sales)

68.5

70.0

66.8

67.6

70.9

Staff cost

505

375

34.5

418

20.7

1,386

1,098

26.2

(% of Sales)

3.3

3.0

3.0

3.3

3.0

Other Expenses

2,080

1,782

16.7

1,934

7.5

5,741

4,924

16.6

(% of Sales)

13.8

14.1

13.9

13.5

13.5

Total Expenditure

12,912

10,983

17.6

11,664

10.7

35,812

31,808

12.6

Operating Profit

2,170

1,619

34.0

2,269

(4.4)

6,629

4,538

46.1

OPM (%)

14.4

12.9

16.3

15.6

12.5

Interest

24

30

(18.7)

18

37.2

61

103

(40.8)

Depreciation

722

628

15.0

669

7.9

2,063

1,810

14.0

Other Income

32

102

(69.1)

137

(77.0)

341

522

(34.8)

PBT (excl. Extr. Items)

1,455

1,064

36.8

1,719

(15.4)

4,845

3,147

54.0

Extr. Income/(Expense)

-

-

-

-

-

-

-

-

PBT (incl. Extr. Items)

1,455

1,064

36.8

1,719

(15.4)

4,845

3,147

54.0

(% of Sales)

9.6

8.4

12.3

11.4

8.7

Provision for Taxation

436

262

66.6

494

(11.7)

1,407

720

95.5

(% of PBT)

29.9

24.6

28.7

29.0

22.9

Reported PAT

1,019

802

27.1

1,226

(16.8)

3,438

2,427

41.6

Adj PAT

1,019

802

27.1

1,226

(16.8)

3,438

2,427

41.6

Adj. PATM

6.8

6.4

8.8

8.1

6.7

Equity capital (cr)

151.0

151.0

151.0

151.0

151.0

Reported EPS (`)

33.7

26.6

27.1

40.6

(16.8)

113.8

80.3

41.6

Source: Company, Angel Research

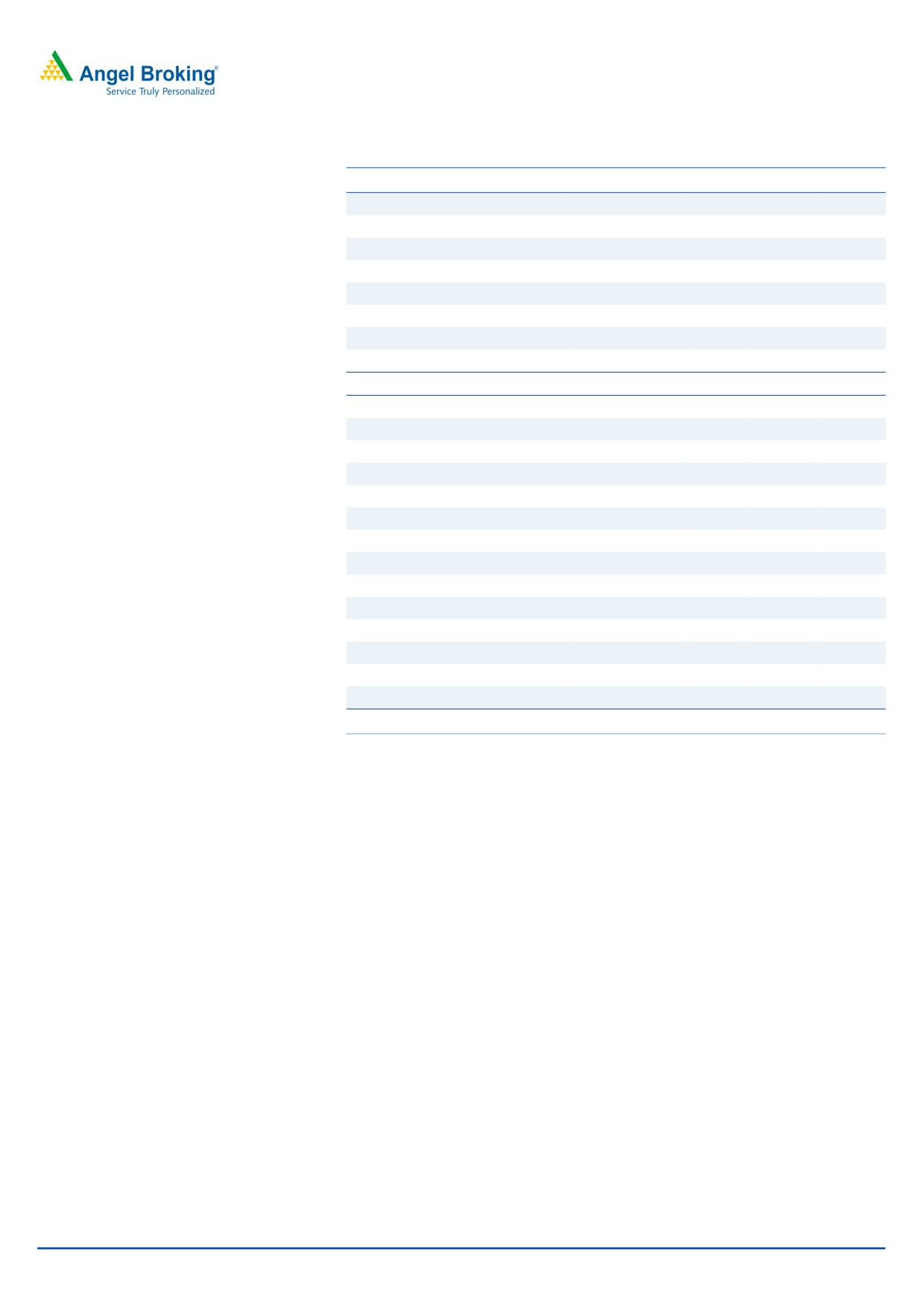

Exhibit 2: 3QFY2016 - Actual vs Angel estimates

Y/E March (` cr)

Actual

Estimates

Variation (%)

Net Sales

15,082

15,115

(0.2)

EBITDA

2,170

2,335

(7.1)

EBITDA margin (%)

14.4

15.4

(100 bp)

Net Profit

1,019

1,270

(19.8)

Source: Company, Angel Research

January 30, 2016

2

Maruti Suzuki | 3QFY2016 Result Update

Exhibit 3: Quarterly volume performance

Volume (units)

3QFY16 3QFY15

% chg (yoy) 2QFY16

% chg (qoq) 9MFY16 9MFY15

% chg (yoy)

A: Mini: Alto, WagonR

110,810

108,124

2.5

110,987

(0.2)

326,598

309,845

5.4

A: Compact: Swift, Ritz, Celerio, Dzire, Baleno

153,423

121,027

26.8

144,439

6.2

435,695

380,726

14.4

A: Mid-Size: Ciaz

14,240

15,308

(7.0)

10,546

35.0

38,160

17,485

118.2

Total Passenger cars

278,473

244,459

13.9

265,972

4.7

800,453

708,056

13.0

B: Utility Vehicles: Gypsy, Ertiga

27,291

17,316

57.6

21,083

29.4

63,924

49,685

28.7

C: Vans: Omni, Eeco

37,231

33,427

11.4

36,214

2.8

107,581

95,791

12.3

Total Domestic

342,995

295,202

16.2

323,269

6.1

971,958

853,532

13.9

Total Exports

31,187

28,709

8.6

30,066

3.7

96,888

92,171

5.1

Total Volume

374,182

323,911

15.5

353,335

5.9

1,068,846

945,703

13.0

Source: Company, Angel Research

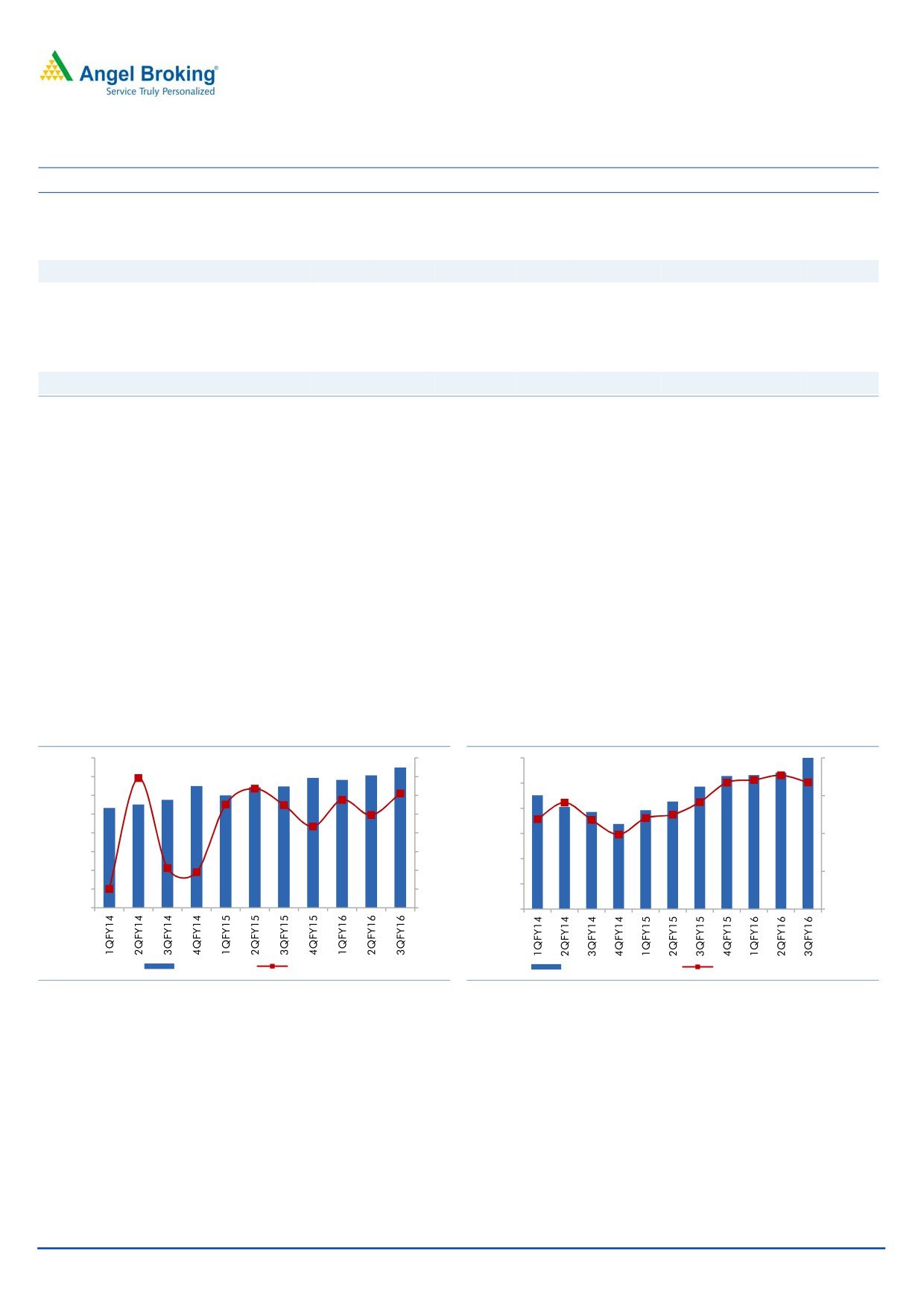

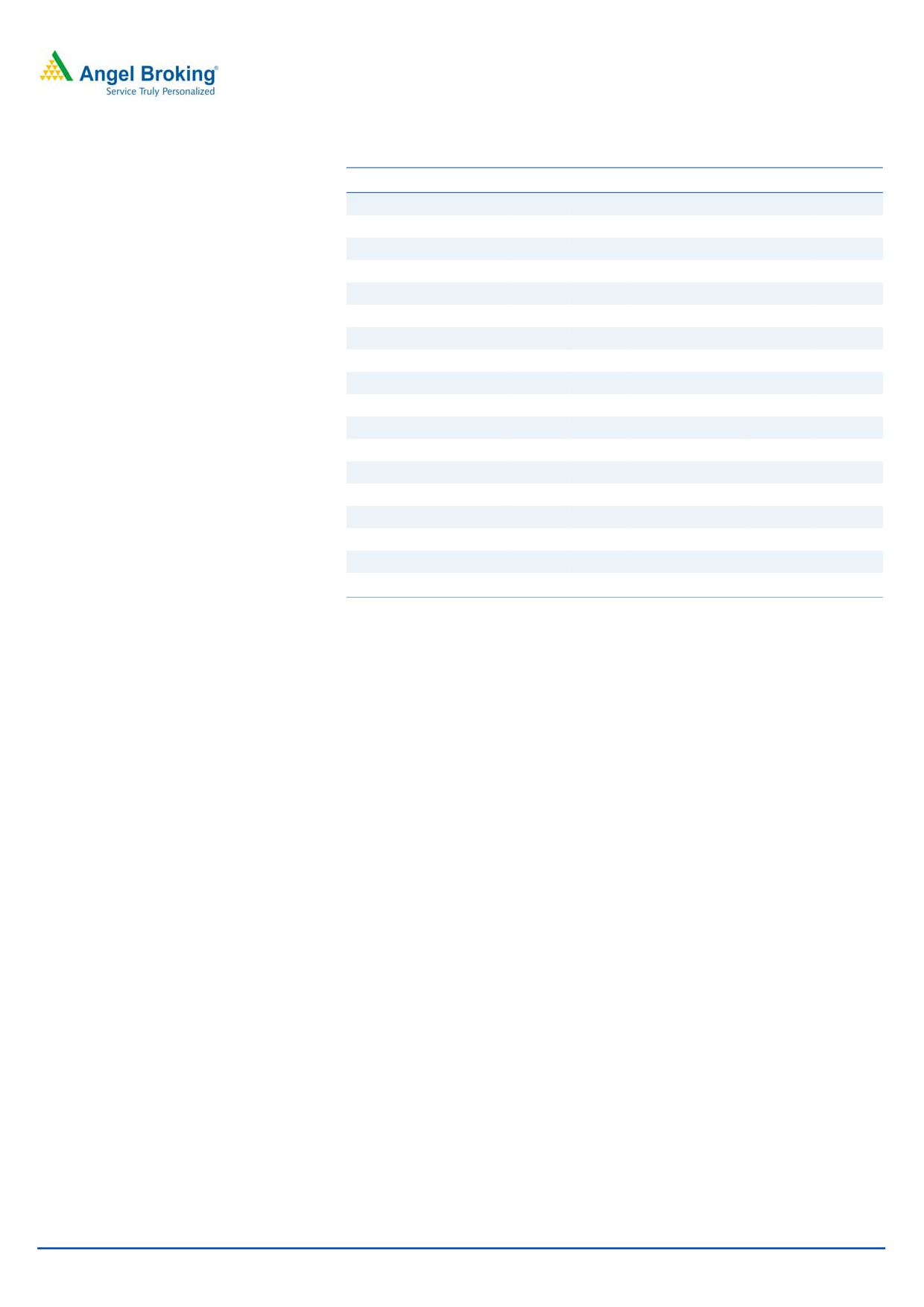

MSIL maintained its outperformance during the quarter, reporting a robust

double-digit volume growth. Improved consumer sentiments, strong festive

demand coupled with declining fuel prices boosted sales.

Realisation/vehicle grew 4% yoy owing to a better product mix with higher

volumes of Baleno, Ertiga and Celerio. Further, the Contribution/vehicle

improved sharply by 9% due to soft commodity prices and a better product

mix.

MSIL continued to outperform the domestic passenger vehicle industry,

registering a growth of 14% yoy in 9MFY2016 as compared to industry growth

of 9%. Consequently, MSIL’s market share improved from 45% in 9MFY2015

to 47% in 9MFY2016.

Exhibit 4: Volumes maintain double-digit growth

Exhibit 5: Realisation & contribution per vehicle

400,000

25

390,000

140,000

350,000

20

380,000

300,000

15

120,000

370,000

250,000

10

200,000

5

360,000

100,000

150,000

0

350,000

100,000

(5)

80,000

340,000

50,000

(10)

0

(15)

330,000

60,000

Volumes (units)

growth yoy (%)

Realisation/vehicle (LHS)

Contribution/vehicle (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

January 30, 2016

3

Maruti Suzuki | 3QFY2016 Result Update

Exhibit 6: Domestic PV market share trend

Exhibit 7: Festive season leads to increased discounts

55

25,000

70

20,000

50

50

47.7

46.8

46.6

45.9

15,000

30

45.2

44.9

44.2

44.0

45

42.8

10,000

10

40.4

40.7

40

5,000

(10)

0

(30)

35

Discounting/vehicle

Growth (%)

Source: SIAM, Angel Research

Source: Company, Angel Research

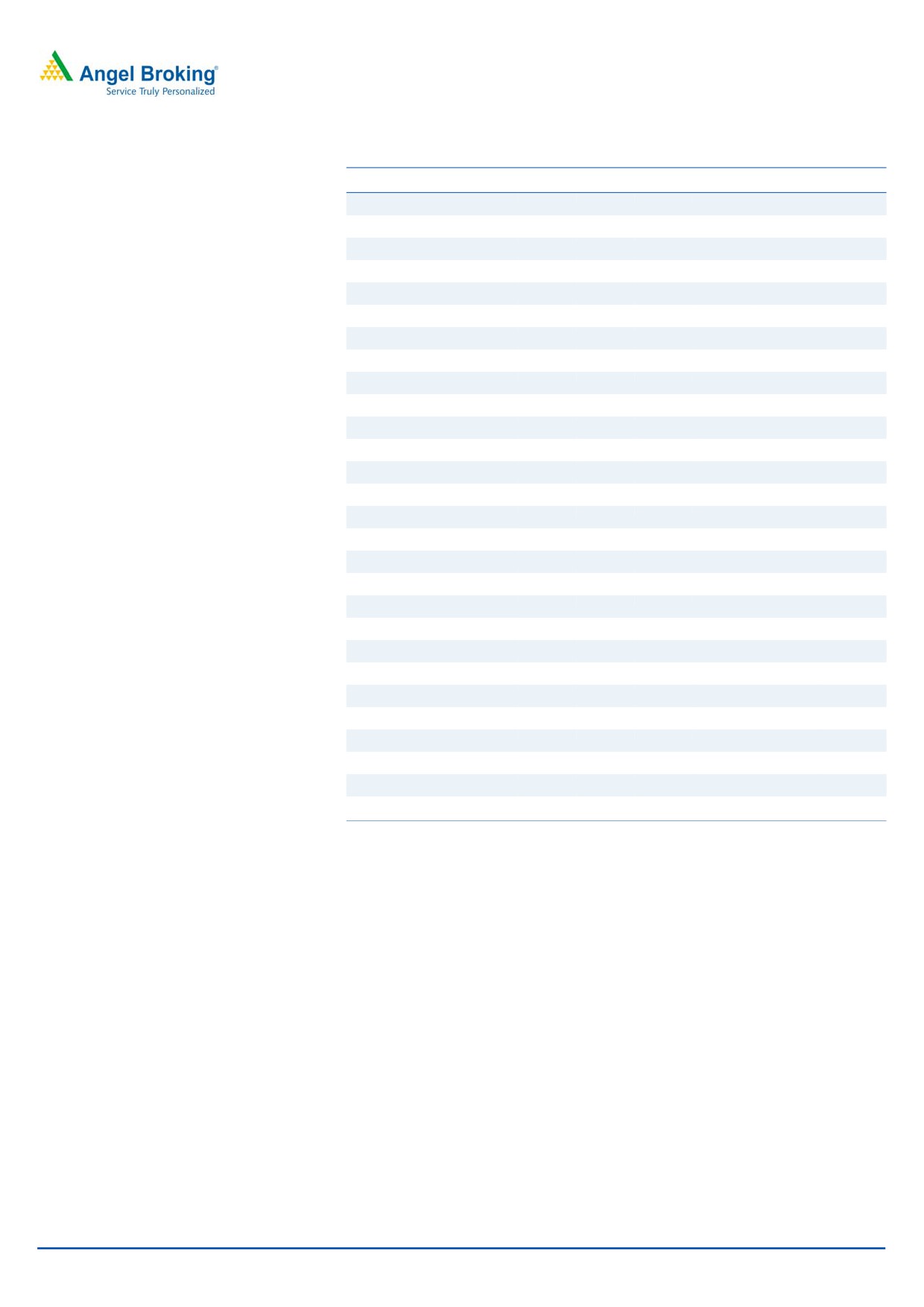

Exhibit 8: Quarterly revenue and realization performance

1QFY2015

2QFY2015

3QFY2015

4QFY2015 1QFY2016 2QFY2016 3QFY2016

Domestic revenue (` cr)

9,831

10,595

11,039

12,070

11,694

12,447

13,523

Change yoy (%)

8.2

21.9

13.9

12.8

19.0

17.5

22.5

Domestic realization (`)

363,228

368,294

373,952

380,539

382,550

385,029

394,254

Change yoy (%)

(1.9)

2.3

3.5

6.2

5.3

4.5

5.4

Export revenue (` cr)

1,243

1,401

1,224

1,203

1,384

1,128

1,245

Change yoy (%)

37.0

(7.8)

31.8

7.2

11.3

(19.5)

1.7

Export realization (`)

424,943

409,517

426,347

407,217

388,382

375,175

399,205

Change yoy (%)

(1.2)

(8.3)

(8.4)

(4.6)

(8.6)

(8.4)

(6.4)

Source: Company, Angel Research

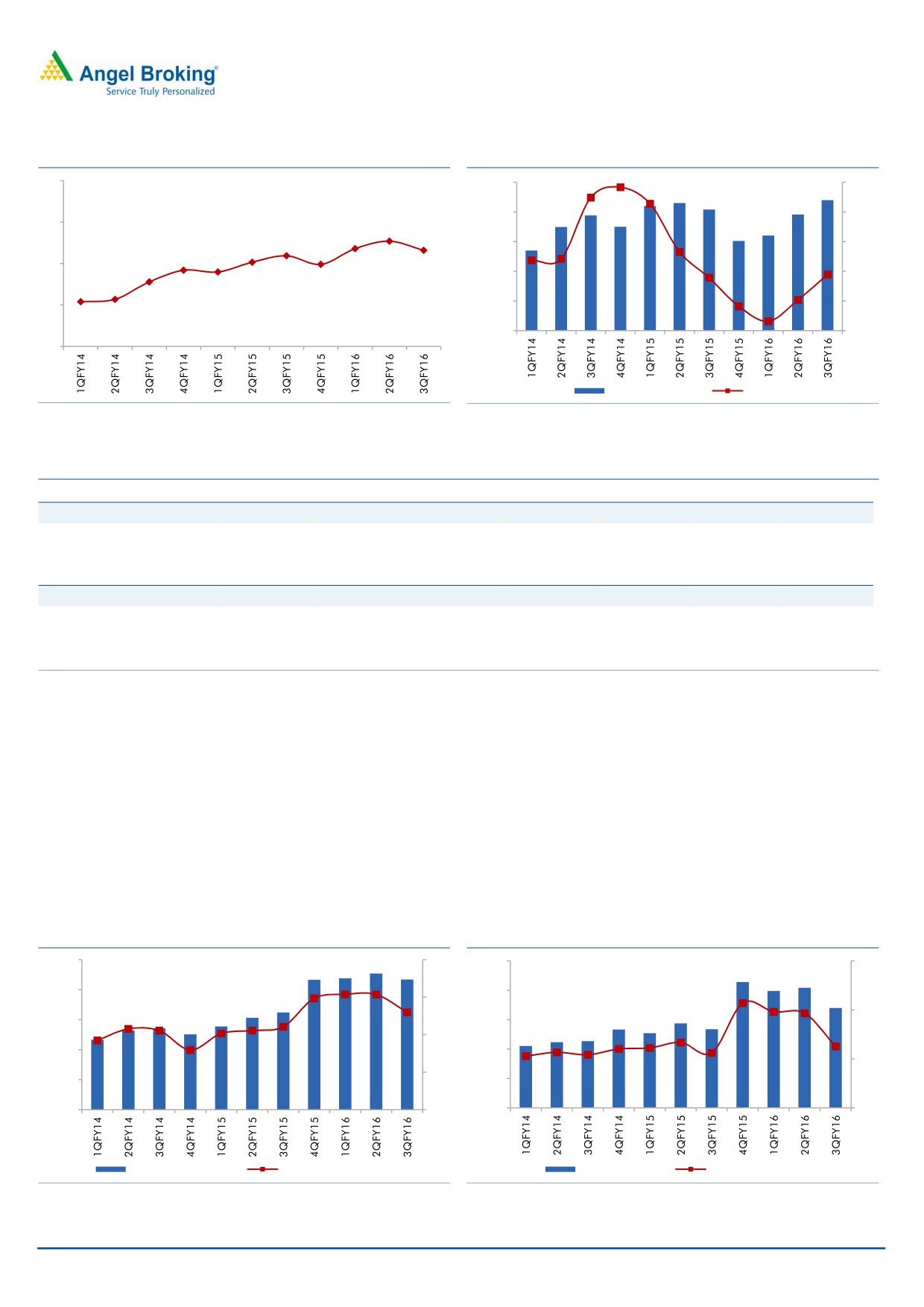

MSIL margins dipped sequentially by 190 bp yoy to 14.4%. The margins were

impacted by a one off items to the tune of `175 crores (`150 cr on account of

inventory decretion and `25 cr due to higher employee expenses due to

higher bonus declared retrospectively for 21 months). Adjusted for the one off

items, the operating margins stood at 15.5%.

Dip in the operating performance impacted profitability. Also, lower other

income at `32 cr as against `102 cr in the corresponding period last year. The

net profit at `1,019 cr came in lower than our estimate of `1,270 cr.

Exhibit 9: EBITDA margin dips sequentially

Exhibit 10: PAT impacted by margin decline

2,500

20

1,500

12

1,200

2,000

16

9

1,500

900

12

1,000

600

6

8

500

300

0

4

0

3

EBIDTA (`cr; LHS)

EBIDTA Margin (%; RHS)

PAT (`cr; LHS)

PAT Margin (%; RHS)

Source: Company, Angel Research

Source: Company, Angel Research

January 30, 2016

4

Maruti Suzuki | 3QFY2016 Result Update

Conference call - Key highlights

The PV industry is witnessing shift towards the petrol segment given the

narrowing gap between petrol and diesel fuel prices and recent ban on sales

of diesel vehicles with engine capacity above 2,000 cc in the NCR region. The

share of the petrol vehicles has gone up from 54% in 9M FY15 to 56% in

9MFY16. MSIL diesel vehicles form 32% of the overall MSIL portfolio

MSIL continues to gain market share on back of new launches. The recently

launched Baleno and refreshes of Ertiga enabled MSIL to outpace industry

growth. During 9M FY2016, MSIL market share improved to 47% from 45%

levels in 9MFY2015

MSIL discounting per vehicle in 3QFY2016 increased to about

`22,000/vehicle from `19,500/vehicle level in 2QFY2016. Festive season

coupled with higher discounting on diesel vehicles led to increase in the

discounts. MSIL expects the discounting to remain high in the near term

MSIL indicated the currency exposure (Yen to INR) is likely to stay in the 21-

22% of the sales bracket in the near term. Further localization of raw materials

is likely to take time.

MSIL is operating at more than 90% of the capacity utilization currently.

However the management indicated that debottlenecking of the plant can lead

to 8-10% capacity increases before the Gujarat plant comes onstream in

FY2018.

MSIL has witnessed strong acceptance of the AMT technology. AMT is now

available in Alto as well as the Wagon R models. MSIL has increased the AMT

capacity from 4,000/month in FY2015 to about 10,000/month currently and

can further scale up capacity depending on the demand.

MSIL believes that a large chunk of the commodity benefits have already been

accrued. MSIL expects stable commodity prices going ahead and no further

benefits are expected from commodity softness.

MSIL is aggressively expanding the premium distribution network “Nexa”. MSIL

has so far set up 100 Nexa showrooms and aims to reach 200 showrooms by

end of FY2017.

MSIL has guided for overall capex of `3,000 cr for FY2016.

January 30, 2016

5

Maruti Suzuki | 3QFY2016 Result Update

Investment arguments

Per capita car penetration near inflexion point: In FY2012, passenger vehicle

penetration in India was estimated at around 16 vehicles/1,000 people

compared to around 70 vehicles/1,000 people in China. Moreover, India’s

PPP-based per capita is estimated to approach US$7,000 over the next four to

five years, which is expected to be the inflexion point for the country’s car

demand. Further, MSIL has a sizeable competitive advantage over new foreign

entrants due to its widespread distribution network (nearly 3,000 and 1,200

service and sales outlets, respectively), which is not easy to replicate.

Product launches in new segments to help outpace the PV industry: MSIL is

targeting to launch products in new segments in order to outgrow the

passenger vehicle industry. MSIL would introduce products in the compact

utility vehicle space which currently accounts for about 10% of the industry

volumes. Also, MSIL would introduce crossovers (vehicles combining features

of a car and a SUV) which would further enable it to gain market share.

Merger with SPIL to be a positive in the long run: MSIL has merged its

associate company, Suzuki Powertrain India (SPIL) with itself. SPIL

manufactures and supplies diesel engines and transmission components for

vehicles. SPIL currently supplies ~90% of its production to MSIL. We believe

the merger of SPIL with MSIL is a positive for MSIL given that MSIL itself is

setting up a new diesel engine facility (capacity of 300,000 units by FY2015)

in Gurgaon. Further, with increased product introductions in the diesel

segment (LCV and compact utility vehicle), the integration of SPIL will result in

better control over diesel engine sourcing, flexibility in production planning,

and managing fluctuations in market demand. Additionally, single

management control of diesel engine operations will result in better sourcing,

localization, and cost-reduction.

January 30, 2016

6

Maruti Suzuki | 3QFY2016 Result Update

Outlook and valuation

The passenger vehicle (PV) industry is well poised to post double-digit growth over

the next two years, given the improved consumer sentiments, better economic

outlook, and softer fuel prices. Given the new launches, MSIL is likely to retain its

market share despite increased competitive intensity. However, MSIL margins are

likely to tread down in FY2017 from the record 1HFY2016 levels given the

increased sales promotion expenses due to new launches and the recent

appreciation of JPY vis a vis INR which would increase the raw material and the

royalty expenses. At CMP, MSIL is trading at P/E of 25.6x and 19.4x its FY2016

and FY2017 earnings respectively, leaving no scope of meaningful upside from

current levels. Hence, we maintain our Neutral rating on the stock.

Exhibit 11: Volume assumptions

Y/E March

FY2011

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Mini: M800, Alto, WagonR

573,238

491,389

429,569

436,032

425,742

456,743

484,330

Compact: Swift, Ritz, Celerio, Dzire

369,754

345,886

424,873

450,393

514,638

586,687

657,090

Compact Utility Vehicle

36,000

Mid-Size: Ciaz

23,317

17,997

6,707

4,029

33,151

48,000

54,000

Executive: Kizashi

138

458

188

1

-

-

-

Total passenger cars

966,447

855,730

861,337

890,455

973,531

1,091,430

1,231,420

UV - Gypsy, Vitara, Ertiga, S-Cross

5,666

6,525

79,192

61,119

68,198

88,657

97,523

Vans - Omni, Versa, Eeco

160,626

144,061

110,517

102,115

128,973

141,870

156,057

Total passenger vehicles - domestic

1,132,739

1,006,316

1,051,046

1,053,689

1,170,702

1,321,958

1,485,000

Total passenger vehicles - exports

138,266

127,379

120,388

101,352

121,713

129,888

146,000

Light Commercial Vehicle

21,000

Total sales (domestic + exports)

1,271,005

1,133,695

1,171,434

1,155,041

1,292,415

1,451,846

1,652,000

% chg

24.8

(10.8)

3.3

(1.4)

11.9

12.3

13.8

Source: Company, Angel Research

Company background

Maruti Suzuki (MSIL), a subsidiary of Suzuki Motor Corporation (SMC), Japan

(which holds a 56% stake in MSIL), is the largest passenger car company in India,

accounting for ~50% of the domestic passenger car market. MSIL derives ~60%

of its overall sales from the small car segment and has a dominant position in the

segment with a market share of ~50%, led by popular models like Alto, Wagon R,

Celerio and Swift. The company operates from two facilities in India (Gurgaon and

Manesar) with an installed capacity of 1.5mn units. Also, MSIL has steadily

increased its presence internationally and exports now account for ~10% of its

overall sales volume.

January 30, 2016

7

Maruti Suzuki | 3QFY2016 Result Update

Profit and loss statement (post SPIL merger)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Total operating income

35,587

43,588

43,701

49,971

58,365

69,070

% chg

(2.8)

22.5

1.4

14.3

16.8

18.3

Total expenditure

33,074

39,358

38,611

43,268

49,324

58,365

Net raw material costs

28,108

32,559

31,314

35,008

39,407

46,324

Employee expenses

844

1,070

1,368

1,607

1,892

2,194

Other expenditure

4,122

5,730

5,928

6,654

8,024

9,847

EBITDA

2,513

4,230

5,090

6,703

9,041

10,706

% chg

(30.9)

68.3

44.8

31.5

34.9

18.4

(% of total op. income)

7.1

9.7

11.6

13.4

15.5

15.5

Depreciation & amort.

1,138

1,861

2,084

2,470

2,813

3,130

EBIT

1,375

2,368

3,834

5,074

6,869

8,599

% chg

(47.6)

72.3

27.7

32.3

35.4

25.2

(% of total op. income)

3.9

5.4

8.8

10.2

11.8

12.4

Interest and other charges

55

190

176

206

106

100

Other income

827

812

829

842

641

1023

Recurring PBT

2,146

2,991

3,659

4,868

6,763

8,499

% chg

(31.0)

39.4

27.7

33.1

38.9

25.7

Extraord. income/ (exp.)

-

-

-

PBT

2,146

2,991

3,659

4,868

6,763

8,499

Tax

511

599

876

1,157

1,925

2,125

(% of PBT)

23.8

20.0

23.9

23.8

28.5

25.0

PAT (reported)

1,635

2,392

2,783

3,711

4,838

6,374

ADJ. PAT

1,635

2,392

2,783

3,711

4,838

6,374

% chg

(28.6)

46.3

21.0

33.4

30.4

31.8

(% of total op. income)

4.6

5.5

6.4

7.4

8.3

9.2

Basic EPS (`)

54.1

79.2

92.1

122.9

160.1

211.0

Adj. EPS (`)

54.1

79.2

92.1

122.9

160.1

211.0

% chg

(28.6)

46.3

15.8

33.4

30.4

31.8

January 30, 2016

8

Maruti Suzuki | 3QFY2016 Result Update

Balance sheet statement (post SPIL merger)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E

SOURCES OF FUNDS

Equity share capital

145

151

151

151

151

151

Reserves & surplus

15,043

18,428

20,827

23,553

26,940

31,401

Shareholders’ Funds

15,187

18,579

20,978

23,704

27,091

31,552

Total loans

1,078

1,389

1,685

180

200

200

Deferred tax liability

302

409

587

481

587

587

Other long term liabilities

97

104

239

105

105

105

Long term provisions

169

226

198

293

198

198

Total Liabilities

16,834

20,706

23,686

24,763

28,181

32,642

APPLICATION OF FUNDS

Gross block

14,735

19,801

22,702

26,462

29,962

33,712

Less: Acc. depreciation

7,214

10,002

11,911

14,202

17,016

20,146

Net Block

7,521

9,799

10,790

12,259

12,946

13,566

Capital work-in-progress

942

1,942

2,621

1,883

2,500

2,500

Investments

6,147

7,078

10,118

12,814

9,849

10,849

Long term loans and adv.

1,341

1,279

1,638

1,349

1,992

2,353

Other noncurrent assets

26

895

9

44

44

44

Current assets

6,325

5,695

5,359

5,202

8,801

12,491

Cash

2,436

775

630

18

3,238

5,982

Loans & advances

778

1,115

1,251

1,173

1,590

1,870

Other

3,111

3,805

3,478

4,010

3,973

4,639

Current liabilities

5,468

5,982

6,849

8,788

7,951

9,160

Net current assets

857

(287)

(1,491)

(3,586)

850

3,331

Total Assets

16,834

20,706

23,686

24,763

28,181

32,642

Note: Cash and bank balance includes term deposits with banks

January 30, 2016

9

Maruti Suzuki | 3QFY2016 Result Update

Cash flow statement (post SPIL merger)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E

Profit before tax

2,146

2,991

3,659

4,868

6,763

8,499

Depreciation

1,138

1,861

1,910

2,291

2,813

3,130

Change in working capital

227

512

2,112

1,440

(1,216)

263

Direct taxes paid

(251)

(533)

(876)

(1,157)

(1,925)

(2,125)

Others

(700)

(447)

(242)

154

(631)

(361)

Cash Flow from Operations

2,560

4,384

6,563

7,596

5,803

9,406

(Inc.)/Dec. in fixed assets

(2,963)

(3,810)

(3,580)

(3,021)

(4,117)

(3,750)

(Inc.)/Dec. in investments

(782)

(916)

(3,040)

(2,687)

2,966

(1,000)

Others

649

1,152

-

-

-

-

Cash Flow from Investing

(3,096)

(3,574)

(6,620)

(5,708)

(1,152)

(4,750)

Issue of equity

-

-

-

-

-

-

Inc./(Dec.) in loans

911

(514)

296

(1,505)

20

-

Dividend paid (Incl. Tax)

(217)

(217)

(696)

(884)

(1,451)

(1,912)

Others

(78)

(235)

312

(101)

-

-

Cash Flow from Financing

617

(966)

(88)

(2,388)

(1,432)

(1,912)

Inc./(Dec.) in cash

81

(156)

(145)

(501)

3,220

2,744

Opening Cash balances

96

281

775

630

18

3,238

Closing Cash balances

176

125

630

18

3,238

5,982

Note: Closing Cash balances excludes term deposits with banks and unclaimed dividend accounts

January 30, 2016

10

Maruti Suzuki | 3QFY2016 Result Update

Key ratios

Y/E March

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

75.7

51.5

44.5

33.3

25.6

19.4

P/CEPS

44.6

32.1

25.4

20.0

16.2

11.5

P/BV

8.1

6.4

5.9

5.2

4.6

3.4

Dividend yield (%)

0.2

0.2

0.3

0.6

1.2

1.5

EV/Sales

3.3

2.8

2.7

2.4

1.9

1.6

EV/EBITDA

44.0

33.9

22.8

18.0

12.5

10.2

EV / Total Assets

7.0

5.8

4.9

4.9

4.0

3.3

Per Share Data (`)

EPS (Basic)

54.1

79.6

92.1

122.9

160.1

211.0

EPS (fully diluted)

54.1

79.6

92.1

122.9

160.1

211.0

Cash EPS

91.8

127.5

161.1

204.6

253.3

314.6

DPS

7.5

8.4

12.0

25.0

48.0

63.3

Book Value

502.8

643.1

694.5

784.7

896.8

1,044.5

Returns (%)

ROCE (Pre-tax)

8.8

14.7

16.2

20.5

24.4

26.3

Angel ROIC (Pre-tax)

18.3

15.2

16.6

20.5

27.5

32.3

ROE

11.3

12.4

13.3

15.7

17.9

20.2

Turnover ratios (x)

Asset Turnover (Gross Block)

2.7

2.2

1.9

1.9

1.9

2.0

Inventory / Sales (days)

16

16

14

19

13

12

Receivables (days)

9

12

12

8

11

11

Payables (days)

37

45

52

54

45

43

WC cycle (ex-cash) (days)

(12)

(18)

(26)

(27)

(21)

(20)

Solvency ratios (x)

Net debt to equity

(0.5)

(0.3)

(0.4)

(0.5)

(0.5)

(0.5)

Net debt to EBITDA

(3.0)

(1.8)

(1.8)

(1.9)

(1.4)

(1.6)

Interest Coverage (EBIT / Int.)

24.9

22.0

21.8

24.6

64.7

86.0

January 30, 2016

11

Maruti Suzuki | 3QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Maruti Suzuki

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

January 30, 2016

12