1QFY2018 Result Update | Automobile

July 28, 2017

Maruti Suzuki

ACCUMULATE

CMP

`7,622

Performance Highlights

Target Price

`8,501

Y/E March (` cr)

1QFY18 1QFY17

% chg (yoy)

4QFY17

% chg (qoq)

Investment Period

12 Months

Net Sales

17,546

14,945

17.4

18,333

-4.3

Stock Info

EBITDA

2,331

2,215

5.3

2,560

-8.9

Sector

Automobile

EBITDA Margin (%)

13.3

14.8

-153 bp

14.0

-67 bp

Market Cap (` cr)

230,244

Adj. PAT

1,556

1,491

4.4

1,711

-9.0

Net Debt (` cr)

(1,543)

Source: Company, Angel Research

Beta

1.2

Result impacted due to material cost, compensation: MSIL’s 1QFY18 earnings

52 Week High / Low

7,679/4,570

and margins were below the cons. estimates. Net sales were at `17,546cr while

Avg. Daily Volume

55,788

PAT was at `2,331cr. Net sales, EBITDA and PAT grew by 17.4% / 5.3% 4.4% on

Face Value (`)

5

yoy basis and were 0.3%/-6.8%/-7.9% against the consensus estimates. While

BSE Sensex

32,310

PAT has grown by 4.4% to `1,556 in the quarter, there is `85cr component on

Nifty

10,014

one-off write backs. Adjusted for the one off item PAT could have been higher.

Reuters Code

MRTI.BO

EBITDA margins decline by 153bps: EBITDA was at `2,331cr, up 5.3% yoy

Bloomberg Code

MSIL@IN

however margins came in at 13.3% vs. 14.8% in 1QFY17 which. Staff cost

grew by 12.6% yoy due to the salary revision while other expenses were up

Shareholding Pattern (%)

13.9% yoy. The margin decline mainly occurred as this quarter soaked in the

Promoters

56.2

GST related one time compensation costs (~50bps), higher material costs and

higher promotional expenses (~30bps). If adjusted for these items, actual

MF / Banks / Indian Fls

11.8

margins would be higher than reported margins by ~80bps.

FII / NRIs / OCBs

25.0

Indian Public / Others

7.0

Outlook and valuation: MSIL continues to report double digit numbers due to the

strong performance of utility vehicles. Company expects to launch one model

Abs. (%)

3m 1yr

3yr

each year which is likely to sustain its growth momentum in the near term. The

Sensex

7.9

15.5

23.7

order book for the new vehicles remains strong and company has indicated of

Maruti Suzuki

20.3

70.1

204.4

increasing its NEXA outlets to 300 from current 266. We believe that 1QFY18

results are one-off in nature and will not recur. We expect 22%/ 21% CAGR in

revenue and PAT over next two years. At CMP, MSIL is trading at P/E of 21.5x of

3-year price chart

its FY2019E earnings. We value MSIL on 24x of its FY2019E EPS of `354 with a

8000

target price of `8,501 with Accumulate rating on the stock.

7000

6000

Key financials

5000

4000

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

3000

Net Sales

57,746

68,009

82,443

100,951

2000

% chg

15.9

18.7

21.2

22.7

1000

0

Net Profit

4,571

7,344

8,629

10,698

% chg

23.2

60.6

17.5

24.0

OPM (%)

15.9

15.4

15.3

15.2

Source: Company, Angel Research

EPS (Rs)

151.4

243.2

285.7

354.2

P/E (x)

50.4

31.3

26.7

21.5

P/BV (x)

8.5

7.2

5.9

4.8

RoE (%)

16.9

22.9

22.0

22.2

RoCE (%)

22.6

23.8

24.1

24.2

EV/Sales (x)

3.7

3.1

2.5

1.9

Shrikant Akolkar

EV/EBITDA (x)

23.7

20.2

16.4

12.8

022-3935 7800 Ext: 6846

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

Maruti Suzuki | 1QFY2018 Result Update

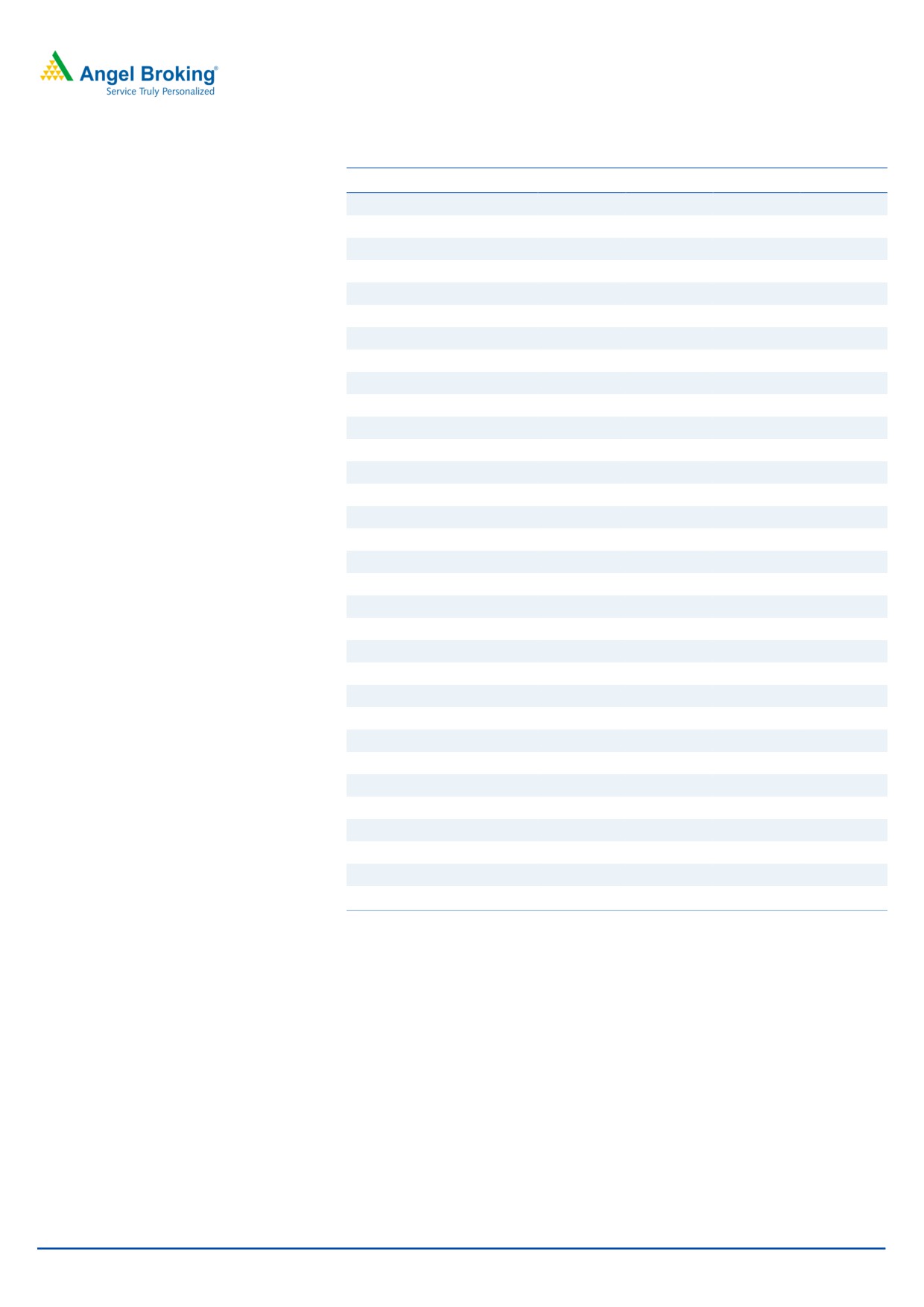

Exhibit 1: Quarterly financial performance

Y/E March (` cr)

1QFY18

1QFY17

% chg (yoy)

4QFY17

% chg (qoq)

Net Sales

17,546

14,945

17.4

18,333

-4.3

Raw-material cost

12,288

10,154

21.0

12,767

-3.7

(% of Sales)

70.0

67.9

69.6

Staff cost

652

579

12.6

616

5.9

(% of Sales)

3.7

3.9

3.4

Other Expenses

2,274

1,997

13.9

2,391

-4.9

(% of Sales)

13.0

13.4

13.0

Total Expenditure

15,215

12,730

19.5

15,774

-3.5

Operating Profit

2,331

2,215

5.3

2,560

-8.9

OPM (%)

13.3

14.8

14.0

Interest

31

18

72.9

23

38.5

Depreciation

684

638

7.2

701

-2.4

Other Income

683

488

39.9

449

52.0

PBT (excl. Extr. Items)

2,299

2,047

12.3

2,285

0.6

Extr. Income/(Expense)

0

0

0

PBT (incl. Extr. Items)

2,299

2,047

12.3

2,285

0.6

(% of Sales)

13.1

13.7

12.5

Provision for Taxation

742

556

33.5

575

29.2

(% of PBT)

32.3

27.2

25.1

Reported PAT

1,556

1,491

4.4

1,711

-9.0

Adj PAT

1,556

1,491

4.4

1,711

-9.0

Adj. PATM

8.9

10.0

9.3

Equity capital (cr)

151

151

151

Reported EPS (`)

51.5

49.4

4.4

56.6

-9.0

Source: Company, Angel Research

July 28, 2017

2

Maruti Suzuki | 1QFY2018 Result Update

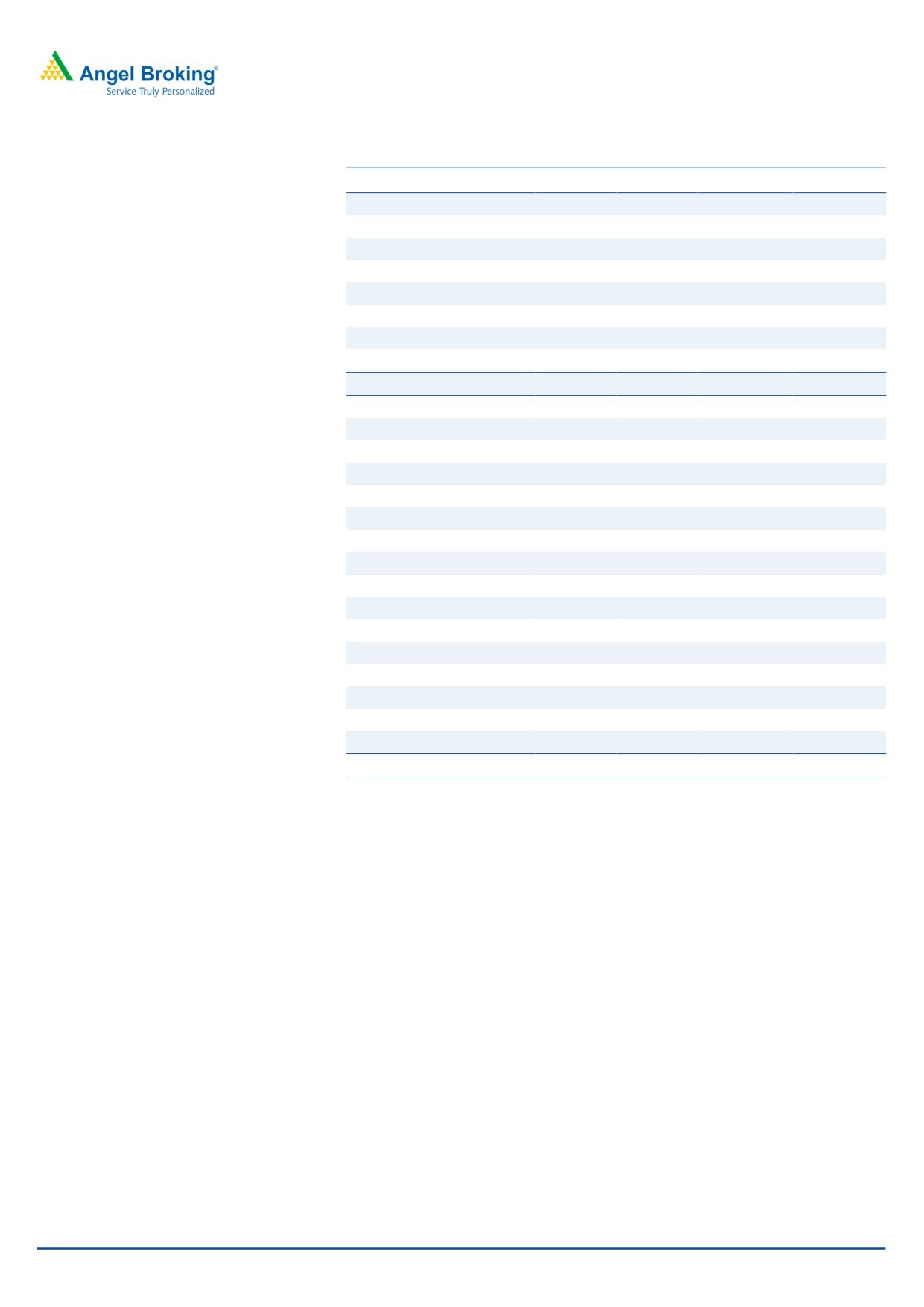

Exhibit 2: Quarterly volume performance

Volume (units)

Q1FY18

Q1FY17

% chg (yoy)

Q4FY17

% chg (qoq)

A: Mini: Alto, WagonR

103,510

92,723

11.6

101,980

1.5

A: Compact: Swift, Ritz, Celerio, Dzire, Baleno

155,314

140,021

10.9

170,259

-8.8

A: Mid-Size: Ciaz

15,698

13,690

14.7

17,334

-9.4

Total Passenger cars

274,522

246,434

11.4

289,573

-5.2

B: Utility Vehicles: Gypsy, Ertiga

57,125

39,348

45.2

52,487

8.8

C: Vans: Omni, Eeco

35,739

36,558

-2.2

40,002

-10.7

D: LCV

1,045

0

606

Total Domestic (includes LCV)

368,431

322,340

14.3

382,668

-3.7

Total Exports

26,140

26,103

0.1

31,771

-17.7

Total Volume

394,571

348,443

13.2

414,439

-4.8

Source: Company, Angel Research

Net realizations during the quarter were at `434,203 vs. `421,475 in

1QFY17 and `434,448 in 4QFY17. Realization growth was 3% on yoy basis.

As a result of increase in the commodity prices, material costs per vehicle

inched up 6.9% yoy which led to decline in the margins.

Domestic volumes grew by 14.3% yoy while exports growth was flat. Total

volumes during the quarter were at 394,571 showing a yoy growth of 13.2%.

Mini/compact/midsize vehicles grew by 11.6%/17.5%/14.7% yoy.

UVs grew by 45.2% yoy, indicating a sustained momentum of growth in this

range.

During the quarter, company sold 1,045 LCVs compared to 606 LCVs in

4QFY17. LCVs sales were started in 2QFY17.

Company continues to outperform the industry growth. During the quarter

industry growth was 4.8% while company growth was at 14.3%.

During the quarter company paid royalty of `886cr, or 5.2% of net sales vs.

6.1% of net sales in Q2FY17.

Company is targeting millennial group (age group 18-28) as potential

customers for newly launched hatchback Ignis

July 28, 2017

3

Maruti Suzuki | 1QFY2018 Result Update

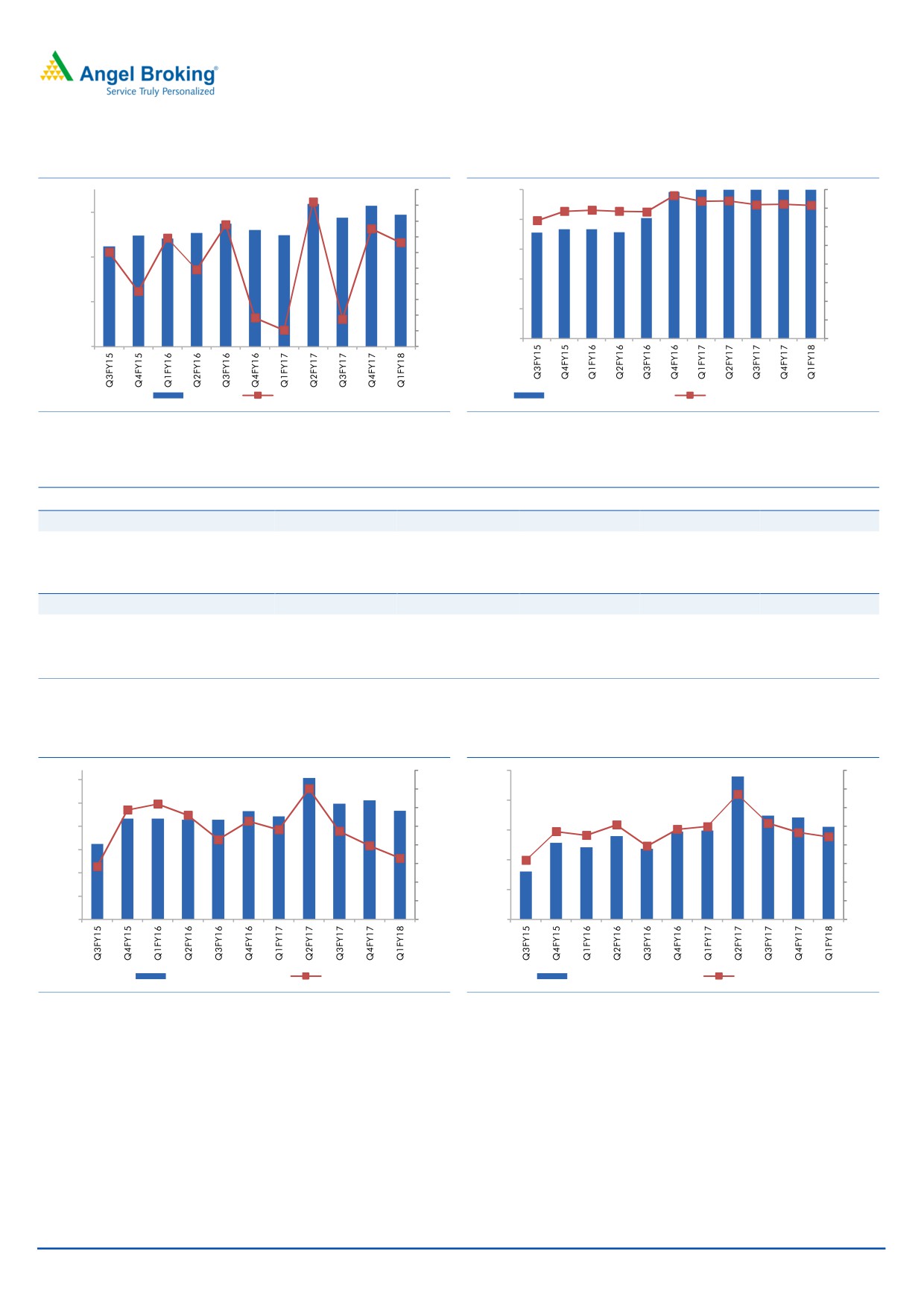

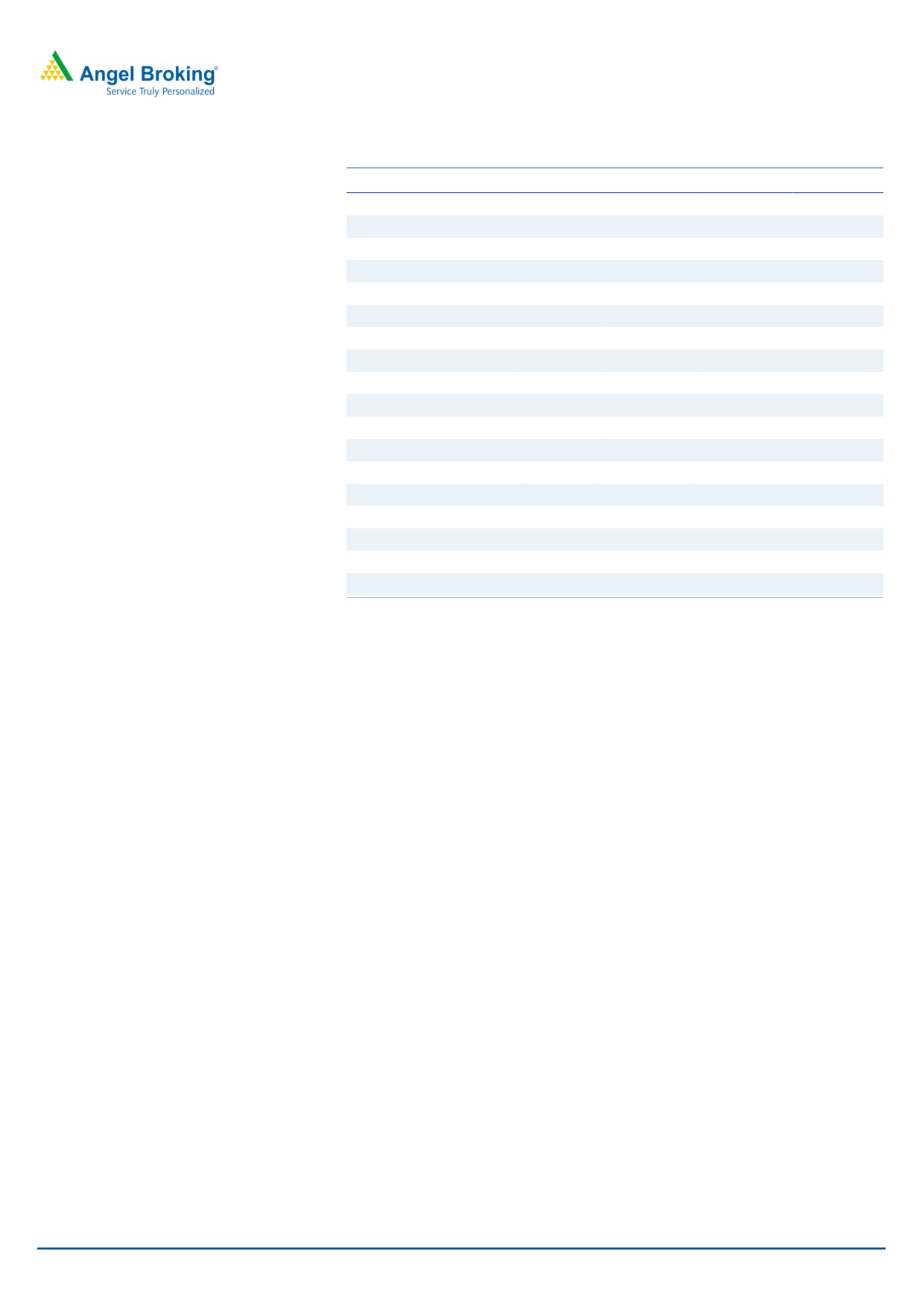

Exhibit 3: Growth slows due to demonetisation

Exhibit 4: Realisation & contribution per vehicle

20.0

425,000

150,000

18.0

130,000

400,000

16.0

400,000

110,000

14.0

375,000

90,000

12.0

300,000

10.0

70,000

350,000

8.0

50,000

200,000

6.0

30,000

325,000

4.0

10,000

2.0

300,000

-10,000

100,000

0.0

Volumes

yoy growth (%)

Net realization (`)

Contribution / Vehicle (`)

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 5: Quarterly revenue and realization performance

Q1FY17

Q2FY17

Q3FY17

Q4FY17

*Q1FY18

Domestic revenue (` cr)

13,334

16,030

15,041

16,505

15,632

Change yoy (%)

13.98

29.69

11.09

21.52

17.24

Domestic realization (`)

413,663

418,494

421,893

431,319

424,297

Change yoy (%)

8.10

9.45

6.88

5.87

2.57

Export revenue (` cr)

1,352

1,565

1,583

1,500

1,500

Change yoy (%)

-2.0

38.5

27.1

8.5

10.9

Export realization (`)

517,948

441,591

514,830

472,129

573,833

Change yoy (%)

33.75

17.49

28.96

-7.73

10.79

Source: Company, Angel Research, * Estimates

Exhibit 6: EBITDA growth at 16%, margins at 14.8%

Exhibit 7: PAT grows despite demonetisation impact

18.0

2,500

16.0

3,000

17.0

14.0

2,500

2,000

16.0

12.0

2,000

15.0

1,500

10.0

14.0

8.0

1,500

13.0

1,000

6.0

1,000

12.0

4.0

500

500

11.0

2.0

0

10.0

0

0.0

Series1

Series2

Net profit (`cr)

Net margin (%)

Source: Company, Angel Research

Source: Company, Angel Research

July 28, 2017

4

Maruti Suzuki | 1QFY2018 Result Update

Conference call - Key highlights

While the industry grew by 4.8% during the quarter, company grew by 14.3%

implying gain in the market share.

Nexa contributes ~20% of MSIL’s business.

Total discounts during the quarter were at `16,600 vs. 15,194 in 4QFY17 and

`16,800 in 1QFY17.

Company has indicated that demand scenario remains strong and company

will bring more efficiency through cost reduction programs.

During the quarter, company has felt the impact of higher raw material prices,

however expects the steady state of the commodity prices going ahead.

The higher promotional expenses (30bps) and compensation due to the GST

(50bps) contributed in decline in the margins.

The royalty of the new models is still in discussion with Suzuki and company

has not given any clarity at this time.

Company has indicated that the retail sales in June were higher and in the first

ten days of July, there was slowdown in retail sales and demand has see pick

up now.

Company expects ~1.5mn vehicles from the existing two plants and 150,000

vehicles from the Gujarat plant in FY18. It also expects to add second line at

Gujarat plant in 2019.

Company has indicated of ~125,000 export volumes in FY18.

MSIL has guided FY18E full year capex of `4,500cr of which `900cr has been

spend by 1QFY18.

While all vendors have not moved to Gujarat, company expects the same to

change in next three years will all vendors moving to the Gujarat for all the

models that MSIL will assemble at the this plant.

Company has said that Baleno/Dzire /Brezza have 16/16/20 weeks of waiting

period.

July 28, 2017

5

Maruti Suzuki | 1QFY2018 Result Update

Investment arguments

MSIL outperforming the industry: MSIL is the largest passenger car

manufacturer in the country and enjoys a leadership position. MSIL has been

outperforming the industry PV growth. While the industry in volume terms grew

by 3.4% from FY13-FY17, MSIL’s domestic sales grew by 8.3%. Owing to this,

its market share has also grown from ~39% in FY13 to ~50% in early FY18.

With the well timed model launches, entry in premium vehicles, and

nationwide reach, MSIL has achieved this superior growth record. This theme

is likely to continue in our opinion with MSIL maintaining more than 50%

market share.

MSIL expected to gain market share: MSIL’s major product portfolio is more

towards the petrol cars where it enjoys highest market shares among its peers.

The lower petrol prices as well as have benefitted the company and continued

weakness in crude prices is expected to benefit the company by keeping petrol

prices at lower levels. Strong dealership network and improved product mix is

expected to benefit the company in gaining further market share. We also

expect the passenger vehicle penetration to go up in the country which will

help MSIL as it already covers most part of the country through its robust

dealership network.

Easing capacity constraints: MSIL has started production at its Gujarat facility

which currently has a capacity of 150k vehicles per annum. The plant

produced ~24,000 units in the quarter and company expects to increase this

numbers going ahead. It also has plans to add another line at this plant which

will be operational in 2019.

Expansion of Nexa: MSIL launched NEXA a few years ago in order to sales the

premium cars like S-Cross, Baleno, Ciaz, etc. The Nexa dealership has since

grown to 266 outlets and company expects to increase Nexa dealerships to

300. The new cars launched by the company are offered through the Nexa

and the ramp of the same is expected to be positive on its business.

July 28, 2017

6

Maruti Suzuki | 1QFY2018 Result Update

Outlook and valuation

MSIL continues to report double digit numbers due to the strong performance of its

utility vehicles. Company expects to launch one model each year which is likely to

sustain its growth momentum in the near term. The order book for the new

vehicles remains strong and company has indicated of increasing its NEXA outlets

to 300 from current 266. We believe that 1QFY18 results are one off in nature due

to the one-off events. We expect 22%/ 21% CAGR in revenue and PAT over next

two years. At CMP, MSIL is trading at P/E of 21.5x of its FY2019E earnings. We

value MSIL on 24x of its FY2019E EPS of `354 with a target price of `8,501 with

Accumulate rating on the stock.

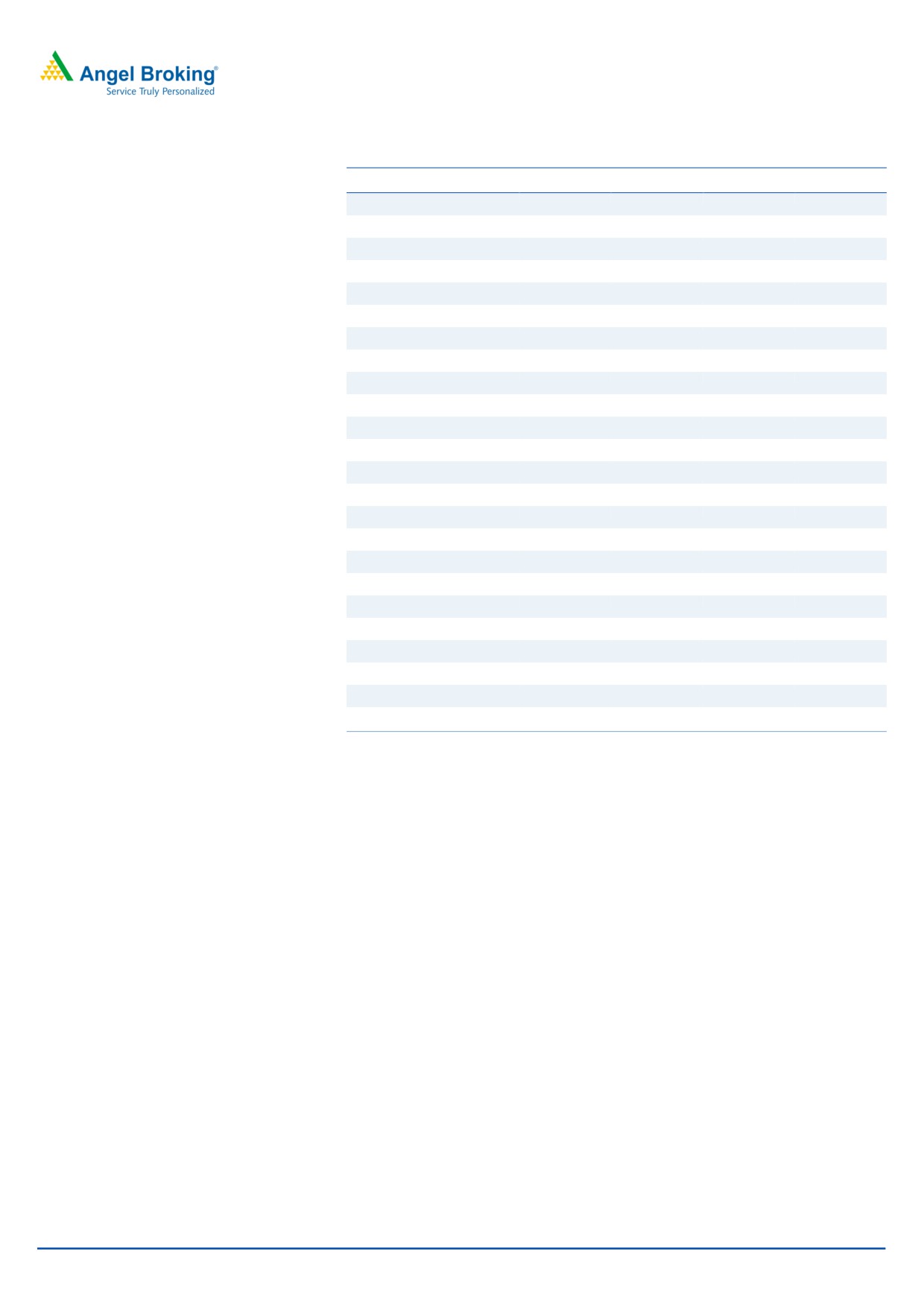

Exhibit 8: Key assumptions

Y/E March

FY2013

FY2014

FY2015

FY2016

FY2017

FY2018E

FY2019E

Domestic unit sales

1,050,859

1,053,688

1,170,702

1,305,351

1,444,542

1,681,872

1,972,281

YoY growth (%)

4.4

0.3

11.1

11.5

10.7

16.4

17.3

Exports unit sales

120,388

101,352

121,713

123,897

124,062

128,994

135,439

YoY growth (%)

-5.5

-15.8

20.1

1.8

0.1

4.0

5.0

Total volumes

1,171,247

1,155,040

1,292,415

1,429,248

1,568,604

1,810,866

2,107,720

YoY growth (%)

3.3

-1.4

11.9

10.6

9.8

15.4

16.4

Per unit domestic realization

405,502

404,719

415,183

431,688

421,652

440,606

462,749

Per unit exports realization

378,784

408,645

380,641

386,797

483,629

540,016

604,818

Per unit realisation (blended)

363,822

369,206

376,083

394,266

426,554

447,688

471,878

YoY growth (%)

18.8

1.5

1.9

4.8

8.2

5.0

5.4

Per unit RM

277,611

271,112

270,873

271,331

297,742

315,081

332,384

YoY growth (%)

12.1

-2.3

-0.1

0.2

9.7

5.8

5.5

Source: Company, Angel Research

Company background

Maruti Suzuki (MSIL), a subsidiary of Suzuki Motor Corporation (SMC), Japan

(which holds a 56% stake in MSIL), is the largest passenger car company in India,

accounting for ~50% of the domestic passenger car market. MSIL operates from

two facilities in India (Gurgaon and Manesar) with an installed capacity of 1.5mn

units. Company has commissioned production at Gujarat plant which will help

company ease its capacity constraints. Company in the last two years has moved in

premium products with launch of Baleno, Vitara, S-Cross and Ciaz. Also, MSIL has

steadily increased its presence internationally and exports now account for ~9% of

its overall sales and same is expected to increase going ahead.

July 28, 2017

7

Maruti Suzuki | 1QFY2018 Result Update

Profit and loss statement

Y/E March (` cr)

FY2016

FY2017E

FY2018E

FY2019E

Total operating income

57,746

68,009

82,443

100,951

% chg

15.6

17.8

21.2

22.4

Total Expenditure

48,768

57,709

70,073

85,812

Cost of Materials

38,780

46,704

57,057

70,057

Personnel

1,989

2,331

2,813

3,443

Others Expenses

7,999

8,674

10,202

12,312

EBITDA

8,979

10,300

12,370

15,138

% chg

33.7

14.7

20.1

22.4

(% of Net Sales)

15.5

15.1

15.0

15.0

Depreciation& Amort.

2,824

2,603

2,864

3,424

EBIT

6,155

7,697

9,506

11,714

% chg

45.1

25.1

23.5

23.2

(% of Net Sales)

10.7

11.3

11.5

11.6

Interest & other Charges

82

89

117

120

Other Income

462

2,342

2,733

3,264

(% of PBT)

7.1

23.5

22.5

22.0

Recurring PBT

6,535

9,949

12,122

14,858

% chg

34.2

52.2

21.8

22.6

Prior Period & Extra. Exp./(Inc.)

-

-

-

-

PBT (reported)

6,535

9,949

12,122

14,858

Tax

1,964

2,605

3,493

4,160

(% of PBT)

30.0

26.2

28.8

28.0

PAT (reported)

4,571

7,344

8,629

10,698

Add: Share of earnings of asso.

-

-

-

-

Less: Minority interest (MI)

-

-

0

0

PAT after MI (reported)

4,571

7,344

8,629

10,698

ADJ. PAT

4,571

7,344

8,629

10,698

% chg

23.2

60.6

17.5

24.0

(% of Net Sales)

7.9

10.8

10.5

10.6

Basic EPS (`)

151.4

243.2

285.7

354.2

Fully Diluted EPS (`)

151.4

243.2

285.7

354.2

% chg

23.2

60.6

17.5

24.0

July 28, 2017

8

Maruti Suzuki | 1QFY2018 Result Update

Balance sheet statement

Y/E March (` cr)

FY2016

FY2017E

FY2018E

FY2019E

SOURCES OF FUNDS

Equity Share Capital

151

151

151

151

Reserves& Surplus

26,856

31,934

39,096

47,975

Shareholders’ Funds

27,007

32,085

39,247

48,126

Minority Interest

-

-

-

-

Total Loans

231

231

231

231

Deferred Tax Liability

625

625

625

625

Other Liabilities

424

424

424

424

Total Liabilities

28,288

33,366

40,528

49,407

APPLICATION OF FUNDS

Gross Block

29,409

32,609

37,109

41,609

Less: Acc. Depreciation

16,641

19,244

22,109

25,533

Net Block

12,768

13,365

15,000

16,076

Capital Work-in-Progress

1,007

1,007

1,007

1,007

Investments

17,786

22,080

26,753

32,821

Current Assets

7,635

8,758

11,915

16,835

Inventories

3,132

3,666

4,442

5,450

Sundry Debtors

1,299

1,467

1,777

2,180

Cash

39

146

994

3,735

Loans & Advances

1,807

1,940

2,837

3,183

Other Assets

1,359

1,539

1,865

2,288

Current liabilities

11,059

11,995

14,299

17,484

Net Current Assets

(3,424)

(3,237)

(2,384)

(649)

Deferred Tax Asset

151

151

151

151

Mis. Exp. not written off

-

-

-

-

Total Assets

28,288

33,366

40,528

49,407

Note: Cash and bank balance includes term deposits with banks

July 28, 2017

9

Maruti Suzuki | 1QFY2018 Result Update

Cash flow statement

Y/E March (` cr)

FY2016

FY2017E

FY2018E

FY2019E

Profit before tax

6,535

9,949

12,122

14,858

Depreciation

2,824

2,603

2,864

3,424

Change in Working Capital

1,466

(80)

(6)

1,007

Interest / Dividend (Net)

(80)

89

117

120

Direct taxes paid

(1,910)

(2,605)

(3,493)

(4,160)

Others

(401)

-

-

-

Cash Flow from Operations

8,433

9,957

11,605

15,249

(Inc.)/ Dec. in Fixed Assets

(2,594)

(3,200)

(4,500)

(4,500)

(Inc.)/ Dec. in Investments

(4,582)

(4,294)

(4,673)

(6,068)

Cash Flow from Investing

(7,176)

(7,494)

(9,173)

(10,568)

Issue of Equity

1

-

-

-

Inc./(Dec.) in loans

(235)

0

0

0

Dividend Paid (Incl. Tax)

(755)

(2,266)

(1,467)

(1,819)

Interest / Dividend (Net)

(246)

(89)

(117)

(120)

Cash Flow from Financing

(1,236)

(2,355)

(1,584)

(1,939)

Inc./(Dec.) in Cash

21

107

847

2,742

Opening Cash balances

18

39

146

994

Closing Cash balances

39

146

994

3,735

Note: Closing Cash balances excludes term deposits with banks and unclaimed dividend accounts

July 28, 2017

10

Maruti Suzuki | 1QFY2018 Result Update

Key ratios

Y/E March

FY2016

FY2017E

FY2018E

FY2019E

Valuation Ratio (x)

P/E (on FDEPS)

50.4

31.3

26.7

21.5

P/CEPS

31.1

23.1

20.0

16.3

P/BV

8.5

7.2

5.9

4.8

Dividend yield (%)

0.5

1.0

0.6

0.8

EV/Sales

3.7

3.1

2.5

1.9

EV/EBITDA

23.7

20.2

16.4

12.8

EV / Total Assets

5.4

4.6

3.7

2.9

Per Share Data (`)

EPS (Basic)

151.4

243.2

285.7

354.2

EPS (fully diluted)

151.4

243.2

285.7

354.2

Cash EPS

244.9

329.4

380.6

467.6

DPS

35.0

75.0

48.6

60.2

Book Value

894.3

1,062.4

1,299.6

1,593.6

Returns (%)

ROCE

22.6

23.8

24.1

24.2

Angel ROIC (Pre-tax)

65.4

76.3

81.0

99.3

ROE

16.9

22.9

22.0

22.2

Turnover ratios (x)

Asset Turnover (Gross Block)

2.0

2.1

2.2

2.4

Inventory / Sales (days)

20

20

20

20

Receivables (days)

8

8

8

8

Payables (days)

49

44

44

44

WC cycle (ex-cash) (days)

(21)

(16)

(16)

(16)

July 28, 2017

11

Maruti Suzuki | 1QFY2018 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Maruti Suzuki

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

July 28, 2017

12