Initiating coverage | Real Estate

August 22, 2016

Mahindra Lifespace Developers

BUY

CMP

`432

New launches and strong sales velocity to drive growth…

Target Price

`522

Mahindra Lifespace Developers (MLF) is the Real Estate company of Mahindra

Investment Period

12 Months

group. The company benefits from the strong pedigree, brand name, trust and

reputation of the Mahindra group. We also believe that over last few years, the

company has shaped and executed its business strategy very well, positioning it for strong

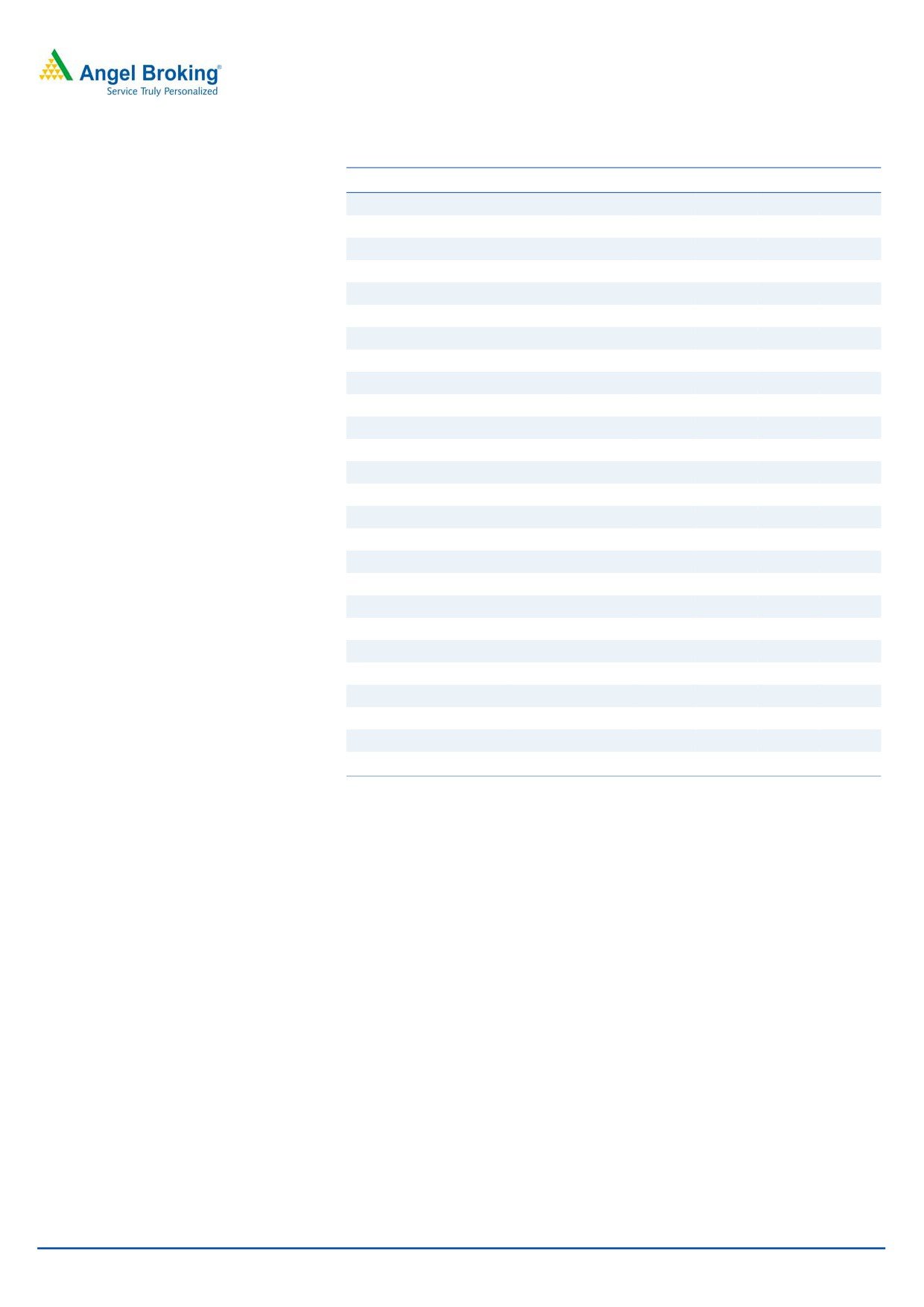

Stock Info

revenue and earnings growth, as well as market share gains over the coming years.

Sector

Real Estate

Speedy execution & even speedier sales: The company has diversified its portfolio

Market Cap (` cr)

1,773

well by taking-up multiple small to mid-sized residential projects across multiple

Net debt (` cr)

1,325

cities (currently 11 projects are under implementation in cities like, Chennai, Delhi

Beta

0.4

NCR, Nagpur, Pune, Hyderabad, Bangalore, Mumbai). The company’s project-

52 Week High / Low

559/415

wise data shows that it has maintained a consistent and relatively fast completion

of the projects (4-4.5 years in Mumbai, other-wise 3-3.5 years across other cities),

Avg. Daily Volume

16,422

compared to other listed/ unlisted developers. More positively, the sales cycle has

Face Value (`)

10

in 83% of the projects been even faster than execution cycle, contrary to industry

BSE Sensex

27,986

trends. Even in a market like Delhi NCR, the company’s Luminare P-I project has

Nifty

8,629

sold 73% since 6 quarters of launch, ahead of completed 41%. This strategy of fast

execution and sales in our view is the optimal strategy, as it helps the company in revenue

Reuters Code

MALD.BO

recognition, inventory cycle (better than Oberoi, DLF), cash flows and profitability. Even

Bloomberg Code

MLIFE IN

more importantly, it helps in consolidation of the company’s brand image and create

virtuous cycle of continuous fast growth and translate to market share gains.

Strong revenue growth visibility in short-to-long run: MLF as of 1QFY2017 is

Shareholding Pattern (%)

pursuing sale of ~4.0mn sq. ft. of total ~20.3mn sq. ft. of its saleable area.

Promoters

50.8

Having sold ~56% of the ongoing projects, we expect MLF to launch 1.48mn

MF / Banks / Indian Fls

1.2

sq.ft. of saleable area (includes, Banerghatta project- 0.23 mn sq.ft., Vivante

FII / NRIs / OCBs

25.6

project- 0.23 mn sq.ft., Palghar project- 0.36 mn sq.ft.) in a rational way during

3QFY2017-2QFY2018E, across 4 cities. Maturity from existing projects, new

Indian Public / Others

22.4

launches give better revenue visibility for the medium-term. We expect MLF to

report an impressive 25.5% consol. adj. sales CAGR during FY2016-18E to

`1,300cr. In line with the top-line growth, given the unlevered balance sheet, we

Abs. (%)

3m

1yr

3yr

expect consol. profits to grow to `147cr in FY2018E. Further, MLF is sitting on a

Sensex

3.6

8.7

51.1

land bank of 11.4mn sq.ft across 3 cities (majorly from Chennai), which allays

Mahindra Lifespace

(5.4)

0.2

(1.5)

any concern over the long-term revenue growth visibility. Further, in our view,

over longer-term organized, professional run and well funded players which enjoy

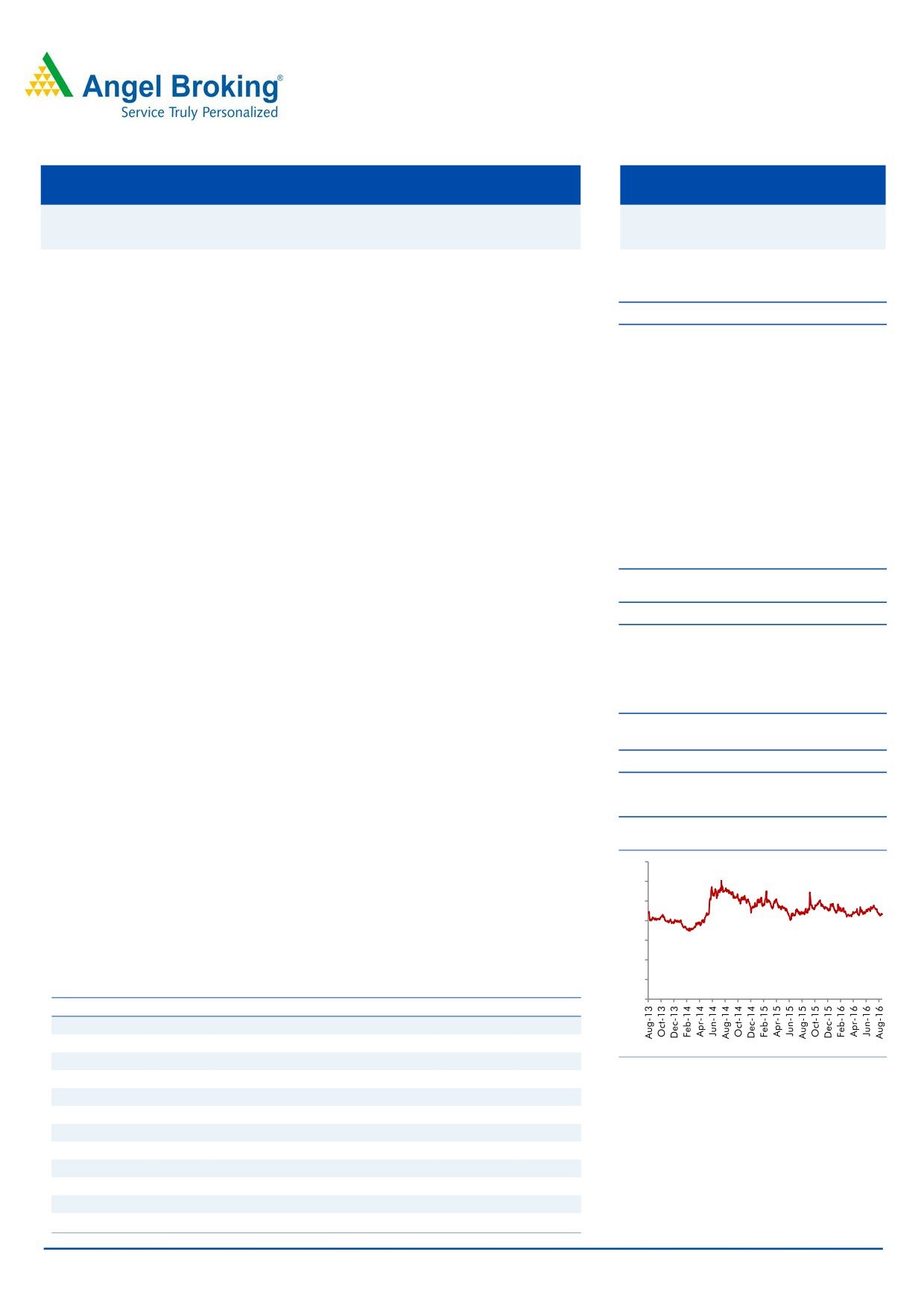

3-Year Daily price chart

strong trust due to reliable and fast execution strategy, will gain market share. This

would be further amplified once the real estate bill is implemented, as players with

700

already good business practices like MLF would stand to gain the most.

600

500

Attractive valuations: Given the ongoing improvement in company’s

400

fundamentals, strong earnings growth visibility and the long-term growth outlook,

we believe at current valuations of 1.0x FY2018E P/BV, MLF stock looks attractive.

300

We initiate coverage on MLF with a BUY recommendation and target price of `522.

200

100

Key Financials

0

Y/E Mar (` cr)

FY13

FY14

FY15

FY16

FY17E

FY18E

Net Sales

738

705

1,086

826

1,152

1,300

% chg

5.3

(4.5)

54.0

(23.9)

39.5

12.8

Net Profit

141

101

266

93

123

147

Source: Company, Angel Research

% chg

18.7

(28.8)

164.5

(65.0)

31.8

19.9

EBITDA (%)

32.8

24.1

39.1

20.1

22.7

24.6

EPS (`)

35

25

65

23

29.9

35.8

P/E (x)

12.5

17.5

6.7

19.0

14.4

12.1

P/BV (x)

1.4

1.4

1.2

1.1

1.1

1.0

RoE (%)

10.9

7.9

19.5

6.1

7.6

8.6

RoCE (%)

11.4

6.5

15.3

5.1

8.1

10.0

Yellapu Santosh

EV/Sales (x)

3.5

4.4

2.7

3.7

2.2

1.9

022 - 3935 7800 Ext: 6811

EV/EBITDA (x)

10.7

18.2

6.9

18.6

9.9

7.7

Source: Company, Angel Research; CMP as of August 22, 2016

Please refer to important disclosures at the end of this report

1

Initiating coverage | Mahindra Lifespace Developers

Investment Rationale

Focus on sales and project execution velocity

MLF unlike its peers does not pursue the strategy of building land banks. Most

developers execute a project in 8-10 years; they block their capital for long periods

and look to benefit from an appreciation in property prices. Instead, MLF looks to

buy a land parcel, get fast approvals and execute the entire project in 3-5 years.

MLF is able to drive sales velocity by (1) leveraging on the strong brand value of

the parent, (2) implementing attractive pricing strategies (most of the times, pricing

is at par with competitors in nearby areas), and (3) purchasing relatively smaller

land parcels of ~0.5/1.0mn sq.ft. and launching them in a phased manner.

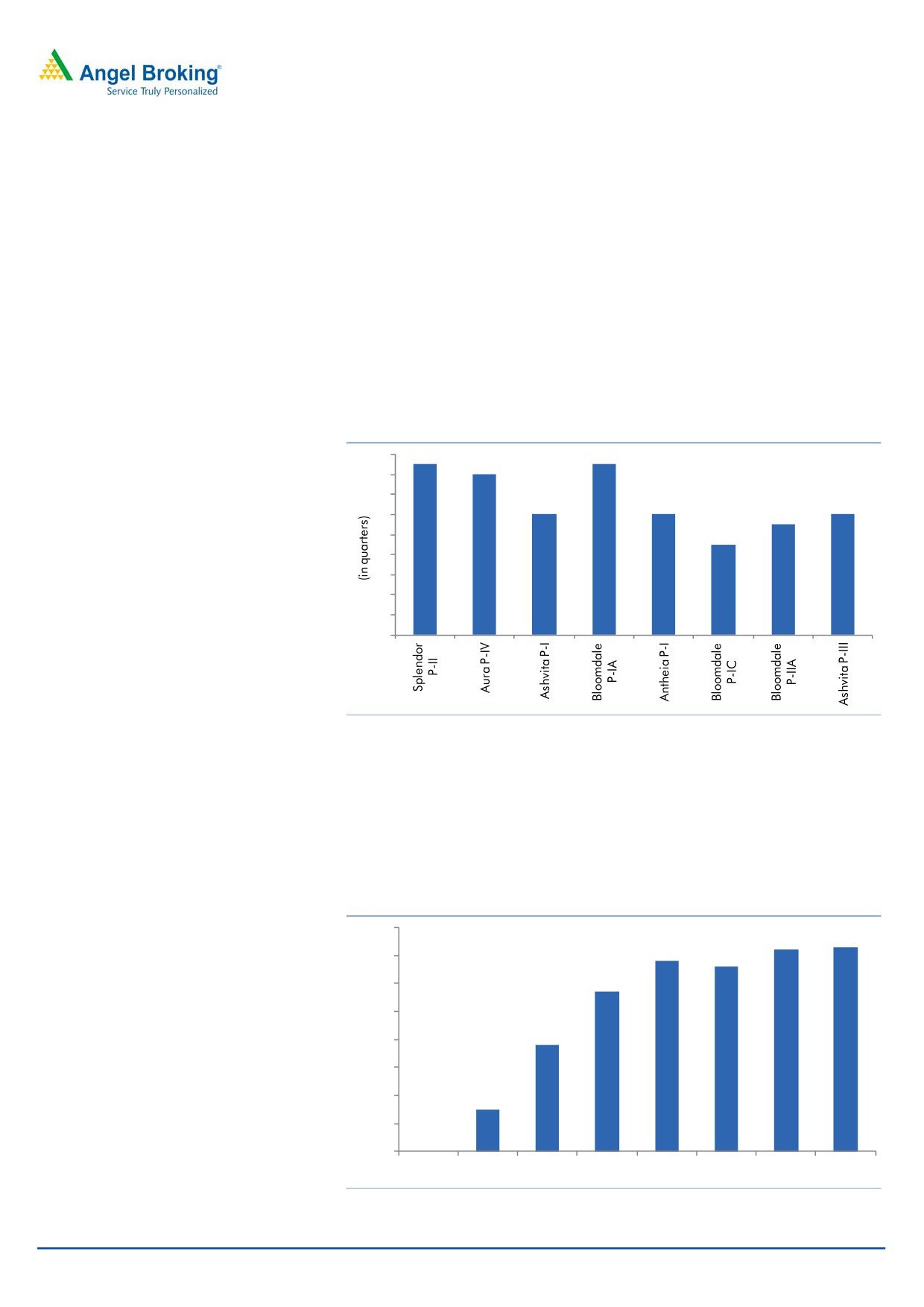

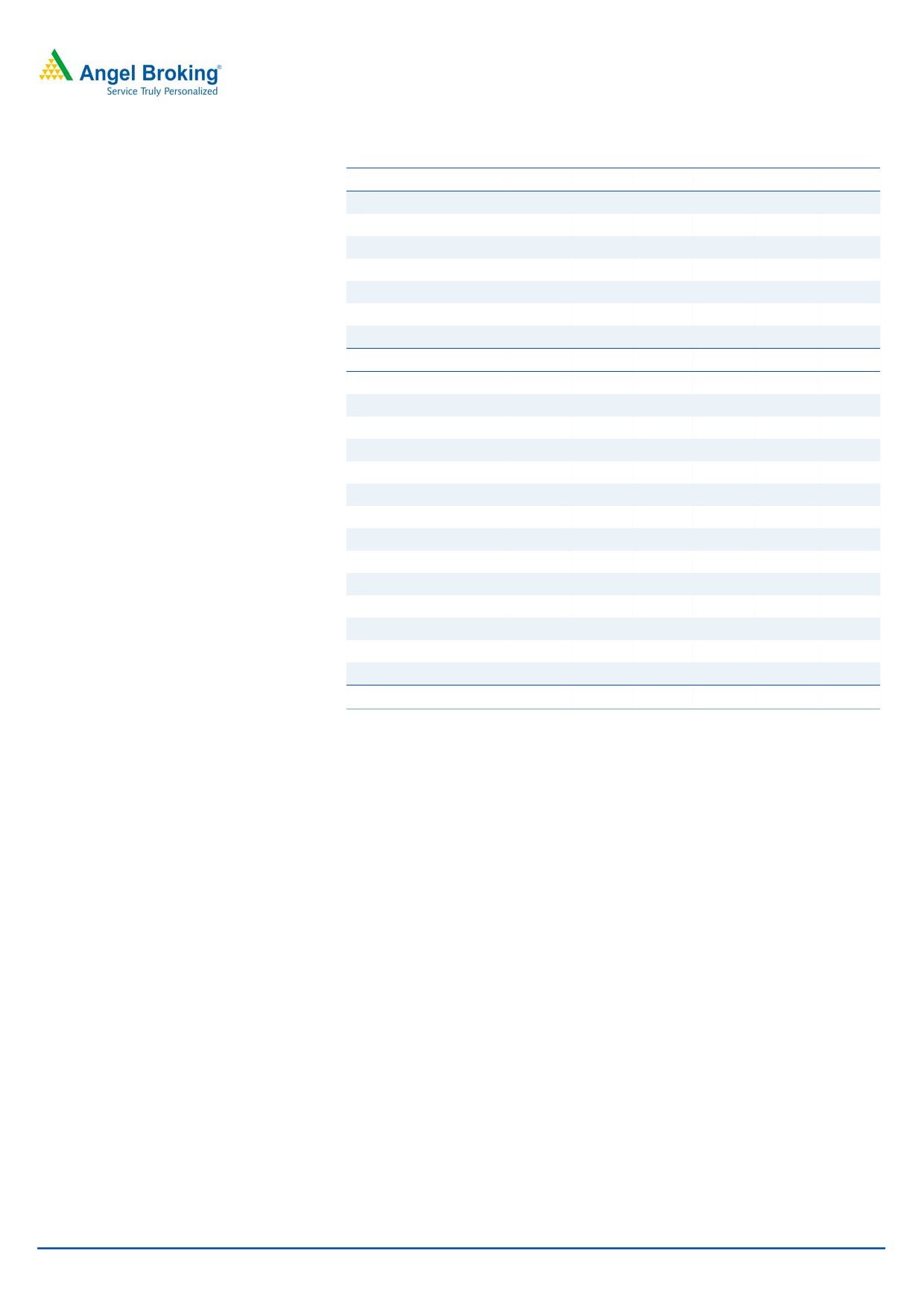

Exhibit 1: Faster sales churn

18

17

17

16

16

14

12

12

12

11

12

10

9

8

6

4

2

0

Source: Company, Angel Research; Note: Exc. time period from land parcel acquisition to getting

approvals, which in our view could stretch the project by another 1-2 years.

The table above clearly highlights that MLF has been able to deliver projects in 3-5

years. What impresses us is that 2 phases of the completed projects were from

inventory overhang markets like Delhi NCR/Mumbai, which got completed in

~16/17 quarters time, respectively. Luminare P-I, their ongoing project in Delhi

has already reported 73% of sales in the 7 quarters since launch.

Exhibit 2: Luminare P-I (% sold)

80%

72%

73%

68%

70%

66%

57%

60%

50%

38%

40%

30%

20%

15%

10%

0%

0%

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

4QFY16

1QFY17

Source: Company, Angel Research

August 22, 2016

2

Initiating coverage | Mahindra Lifespace Developers

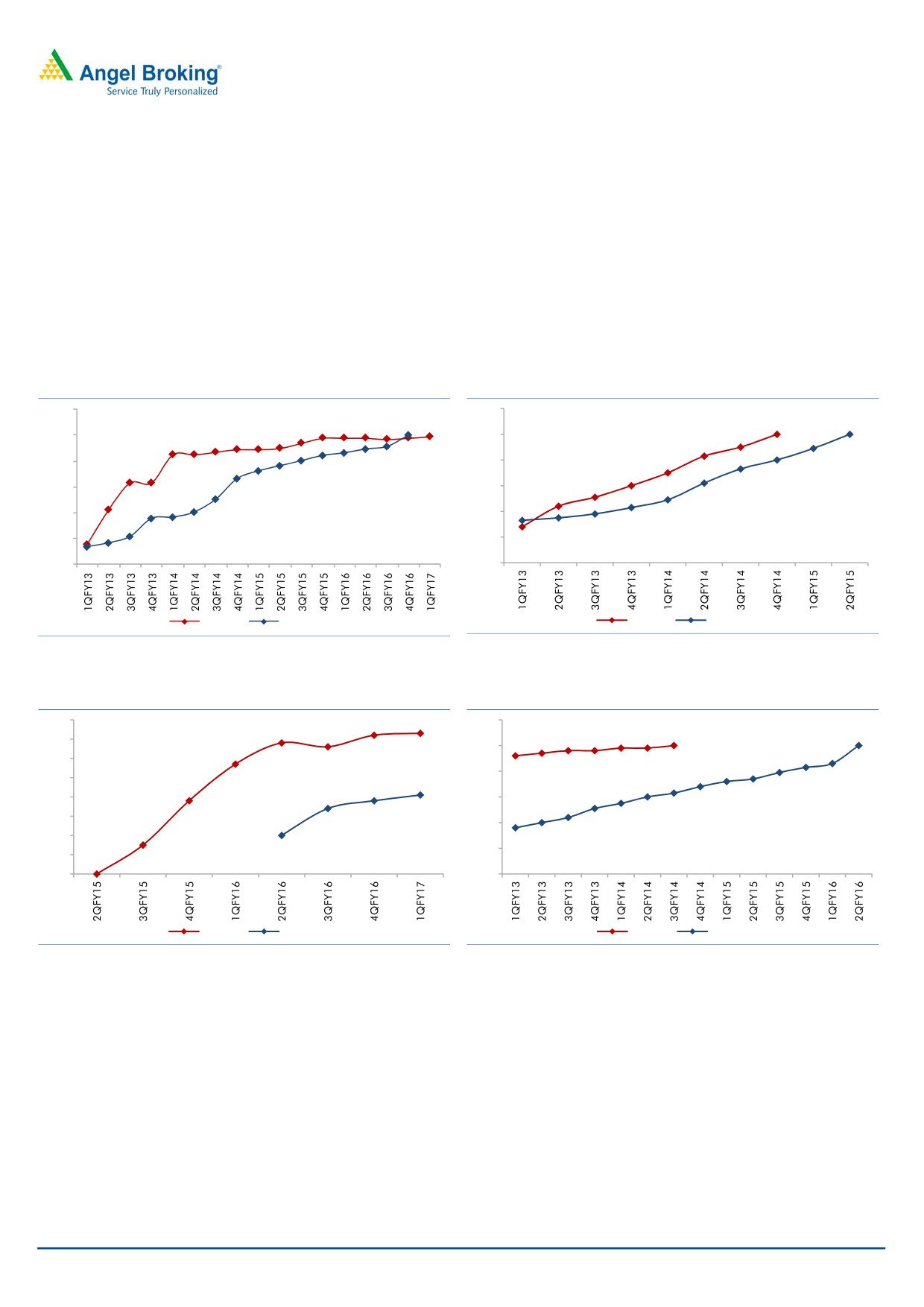

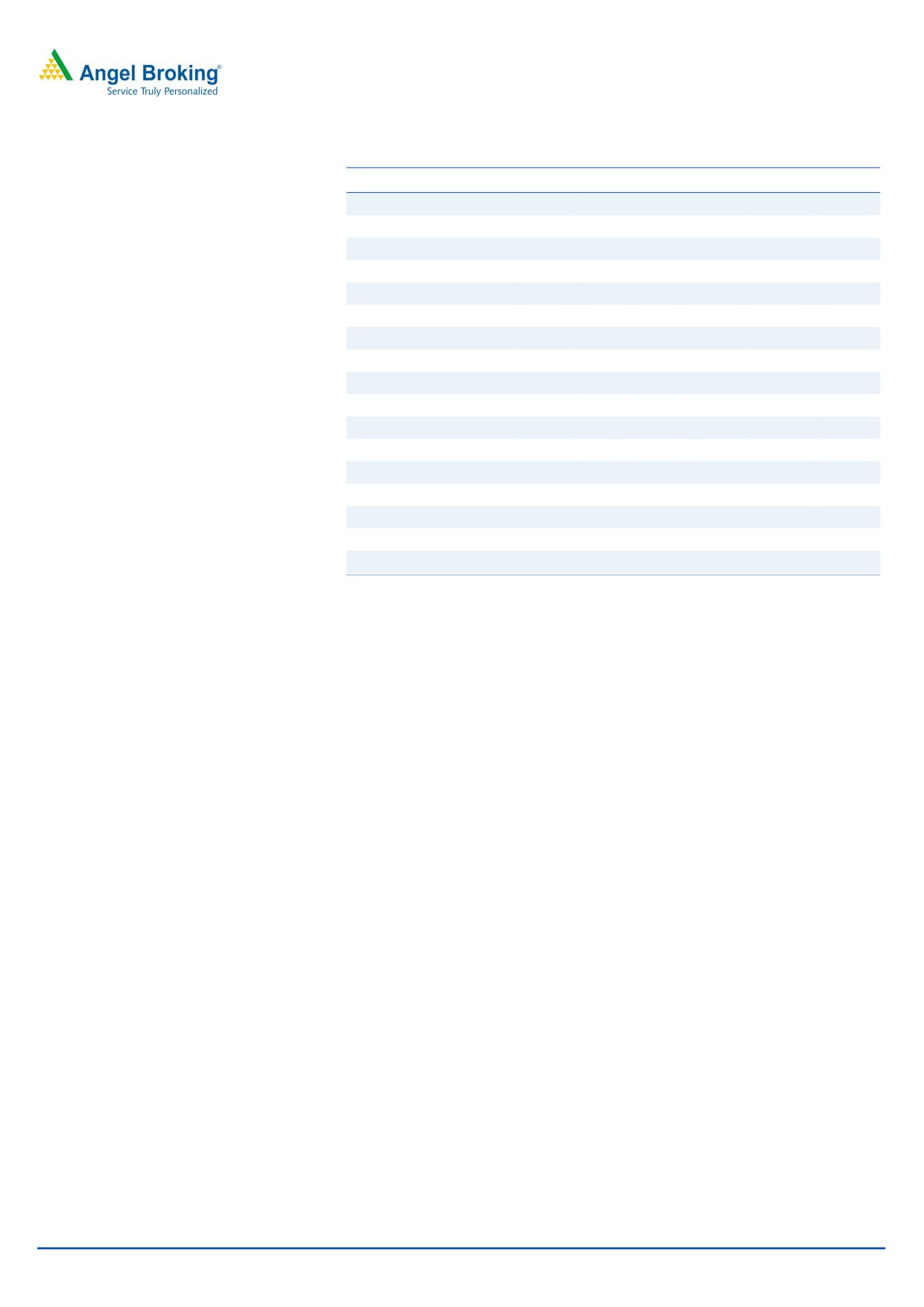

In line with the sales booking cycle, MLF unlike some of its peers, also focuses on

prompt execution of its projects. The company usually executes the project with a

lag of just 4-5 quarters of sales booking, which allows it in following an optimal

cash flow cycle.

MLF follows prudent strategy of depending on advances/collections from its

home-buyers to fund its projects, rather than depending on stop-gap financing

arrangements, a strategy followed by most of the peers. Many developers follow a

land bank strategy, thus putting stress on their cash flow cycles, which is not the

case with MLF. The following charts depict the same.

Exhibit 3: Bloomdale P-IB

Exhibit 4: Aqualily Villas P-III

120

120

98

98

98

97

98

99

100

94

90

87

89

89

90

100

100

85

85

83

100

70

100

80

80

63

63

89

91

60

89

84

86

80

51

80

76

60

73

60

72

44

42

66

62

40

40

28

50

49

15

43

40

33

35

38

20

35

36

20

21

13

16

0

0

% sold

% completed

% sold

% completed

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 5: Luminare P-I

Exhibit 6: Aura P-IV

80

72

73

120

68

100

66

96

96

98

98

70

92

94

57

100

60

100

80

50

86

38

83

79

40

60

72

74

68

41

63

30

38

60

40

55

15

34

51

20

36

40

44

20

10

20

0

0

0

% sold

% completed

% sold

% completed

Source: Company, Angel Research

Source: Company, Angel Research

Revenue recognition from a project happens when 25% of construction costs, 25%

of sales and 10% of collections from customers is achieved. The above tables

highlight that as MLF books 35%+ of its project sales, 25%+ of construction costs

in first 3-5 quarters of launch. Thus, this enables the company to recognise

revenues from a project in 3-5 quarters of launch, which is not the case with most

of the other developers.

Focus on launching smaller projects in phases across cities

Another differentiating factor for MLF is that it focuses on launching smaller

projects in phases across cities. MLF takes up projects of up to 0.5mn sq.ft. in

Mumbai and up to 1 mn sq.ft. in non-Mumbai areas. Despite the smaller project

August 22, 2016

3

Initiating coverage | Mahindra Lifespace Developers

size, MLF launches the project in a phased manner. This strategy when coupled

with focus on driving the sales velocity helps it attain revenue recognition threshold

levels in 3-5 quarters of launch across most of its projects.

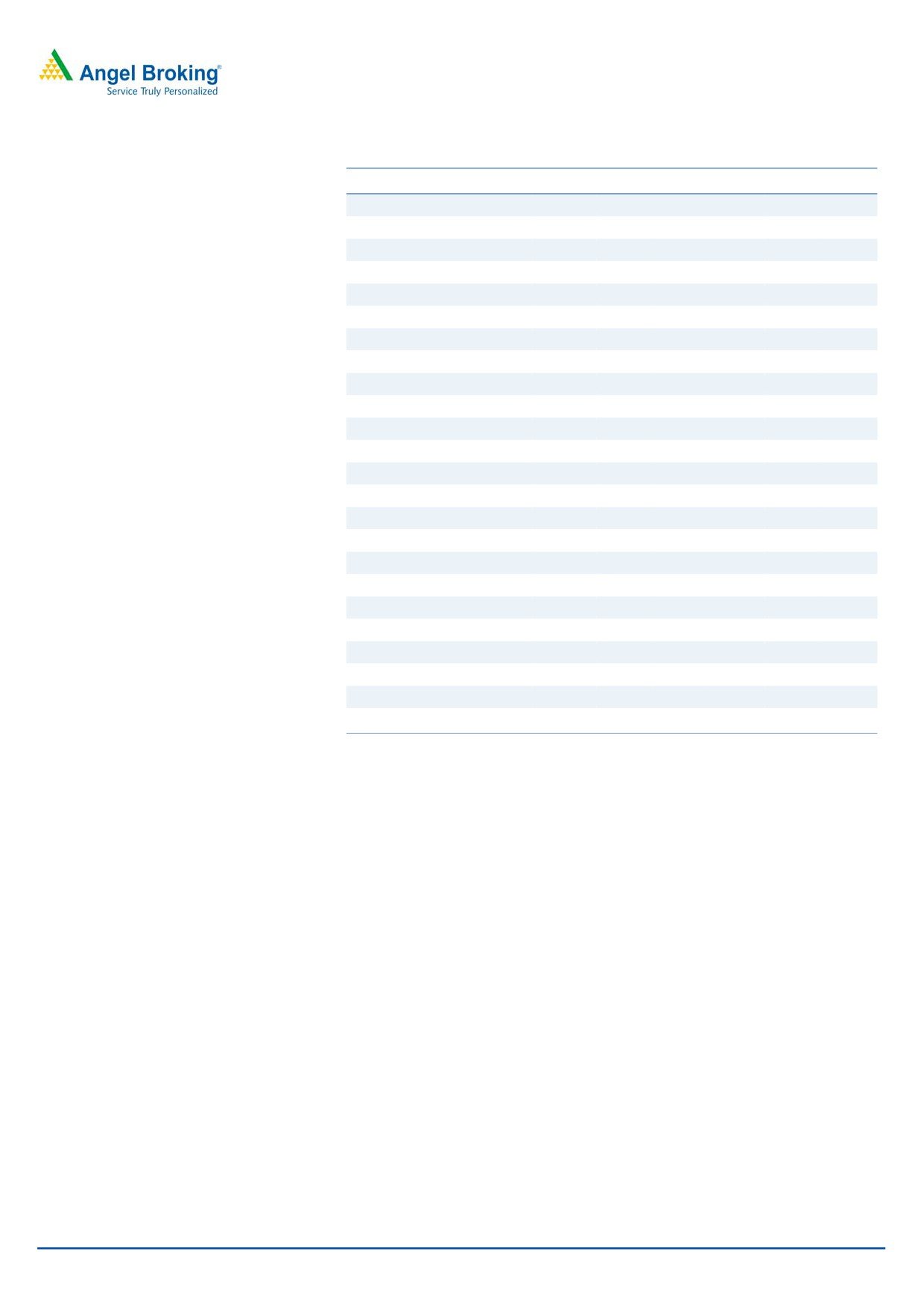

Strong project launch pipeline visibility

MLF as of 1QFY2017 is sitting on land parcels with total saleable area of

~20.3mn sq.ft. Of this, MLF is pursuing projects covering ~4.0mn sq.ft. of

saleable area (Delhi NCR-20%, Pune-20% and Mumbai-17%). As of 1QFY2017,

MLF has sold ~56% of the total ~4.0mn sq.ft. saleable area, which leaves no

option for the company but to launch new projects sooner.

We expect MLF to launch ~1.48mn sq. ft. of saleable area during 3QFY2017-

2QFY2018E. A major 0.98mn sq. ft. of the launches planned are in the Mumbai

and surrounding markets.

Exhibit 7: Pipeline of projects to be launched

Exhibit 8: Sale volumes trends

0.6

1.6

1.4

0.5

1.2

0.4

1.0

0.3

0.8

0.6

0.2

0.4

0.1

0.2

0.0

0.0

Source: Company, Angel Research

Source: Company, Angel Research

Historically, MLF has seen yearly sales of ~1-1.2mn sq.ft. At the backdrop

of

~1.48mn sq.ft. of saleable area planned to be launched during

3QFY2017-2QFY2018E, when coupled with company’s focus on sales velocity,

comforts us that the yearly sales volume would gradually catch-up from here on.

We expect sale volumes to increase from 0.9mn sq.ft. in FY2014 to 1.4mn sq.ft. in

FY2018E.

Standalone business to drive profits during FY2015-18E

During 1QFY2015 MLF completed sale of its 5-acre land parcel at Byculla,

Mumbai, for which it fetched `325cr. On adjusting for the same, MLF reported

FY2015 consol. sales of `761cr. In absence of any such one-time transactions, in

FY2016 M-Life reported consol. sales of `826cr, reflecting 8.6% yoy growth. As

highlighted above, we expect sale volumes to increase from 0.9mn sq.ft. in

FY2014 to 1.4mn sq.ft. in FY2018E. Uptick in sale volumes coupled with expected

increase in blended sale realizations (led by higher contribution kicking-in from

Mumbai, Bangalore and Delhi based projects) would lead to strong top-line

growth at standalone level. Led by strong growth across the standalone business,

we expect adj. consol. sales to report 25.5% CAGR during FY2016-18E to

`1,300cr.

August 22, 2016

4

Initiating coverage | Mahindra Lifespace Developers

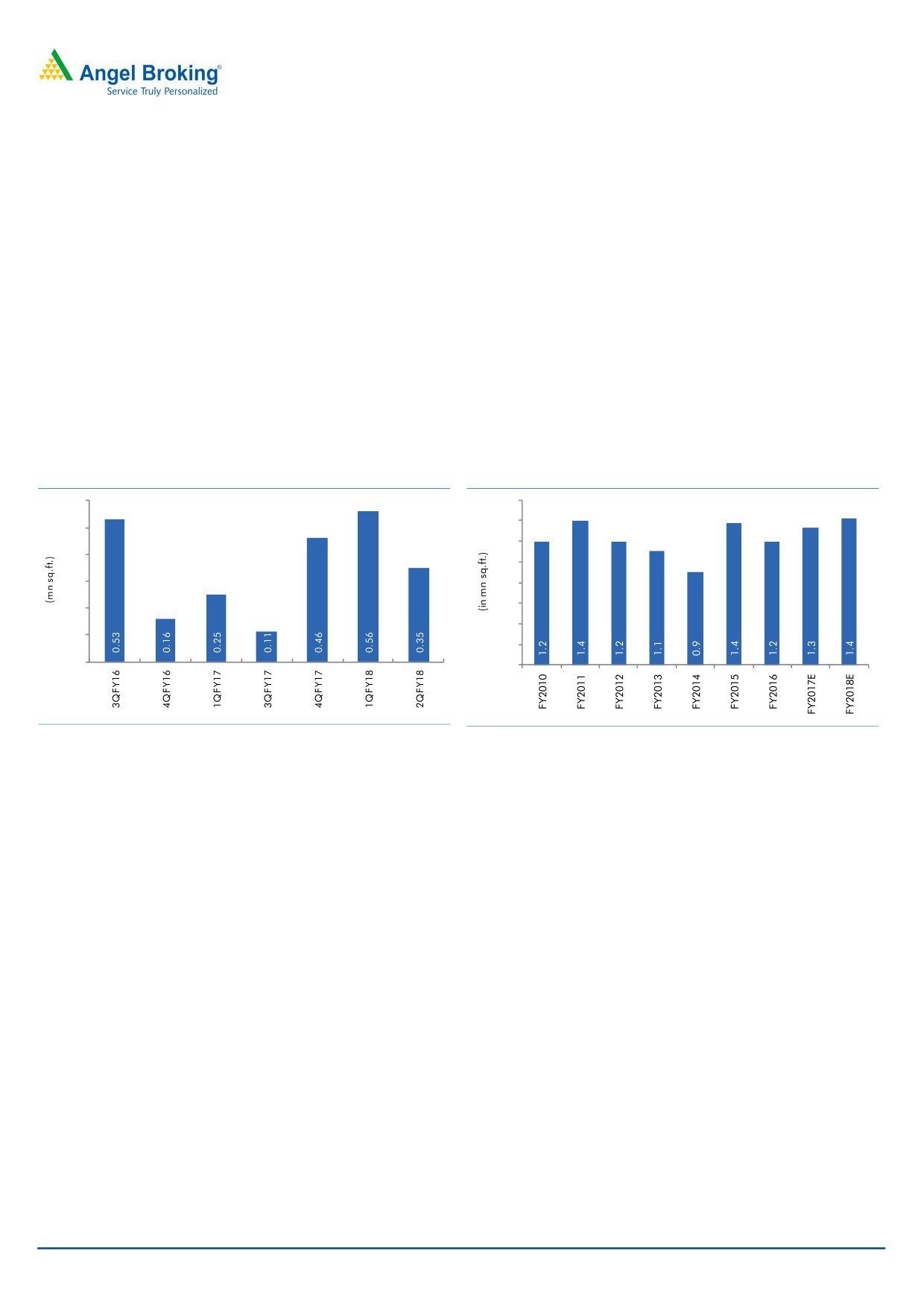

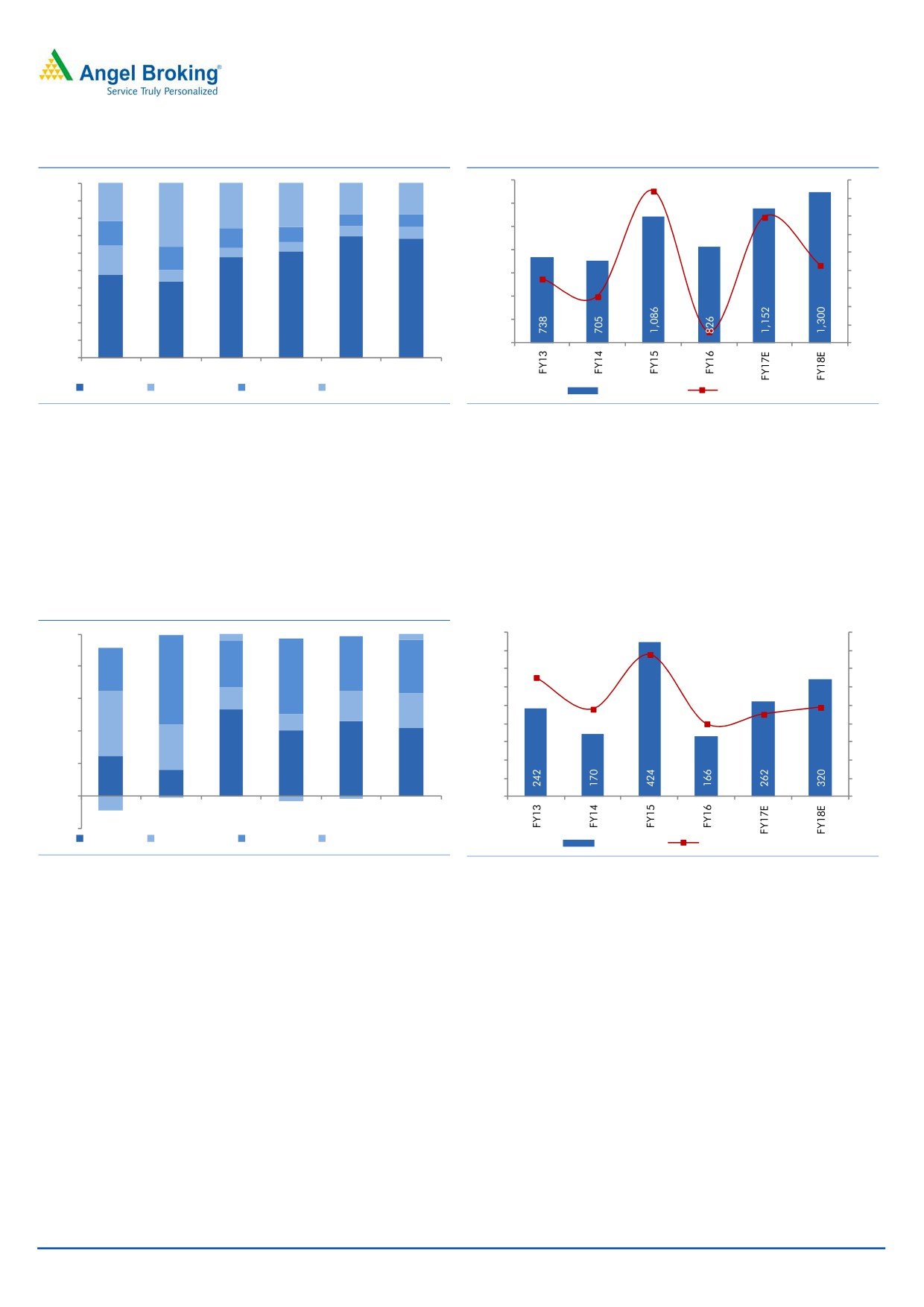

Exhibit 9: Std. revenues contribution to increase

Exhibit 10: Consolidated revenues set to grow

100%

1,400

54.0

39.5

60

90%

18%

18%

50

22%

26%

25%

1,200

80%

37%

40

7%

7%

12.8

1,000

14%

9%

6%

7%

30

70%

11%

5%

800

(4.5)

60%

6%

5.3

(23.9)

20

17%

13%

50%

600

10

7%

40%

0

69%

68%

400

30%

57%

61%

(10)

48%

44%

200

20%

(20)

10%

0

(30)

0%

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E

Standalone

MWC, Chennai MWC, Jaipur MRDL, MITL & Others

Revenues (` cr)

yoy growth (%)

Source: Company, Angel Research

Source: Company, Angel Research

With shift further getting skewed towards residential business mix (standalone

financials) when coupled with increased contribution from Tier-1 cities (Mumbai,

Delhi and Bangalore), there exists scope for EBITDA margin expansion. We expect

adj. EBITDA to report an impressive 38.7% CAGR during FY2016-18E to `320cr.

In-line with EBITDA growth, we expect overall profitability to report strong growth

to `147cr in FY2018E.

Exhibit 11: Std. business to drive consol. EBITDA

Exhibit 12: Consolidated EBITDA% to be at ~25% levels

100%

450

45

4%

3%

39.1

400

40

28%

34%

32.8

80%

32%

33%

350

24.6

35

56%

49%

300

30

24.1

60%

14%

22.7

20%

250

20.1

25

22%

48%

11%

200

20

40%

150

15

28%

53%

48%

100

10

20%

43%

42%

30%

50

5

17%

0%

-1%

-3%

-2%

0

0

-10%

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E

-20%

Standalone

MWC, Chennai MWC, Jaipur MRDL, MITL & Others

EBITDA (` cr)

EBITDA Margin (%)

Source: Company, Angel Research

Source: Company, Angel Research

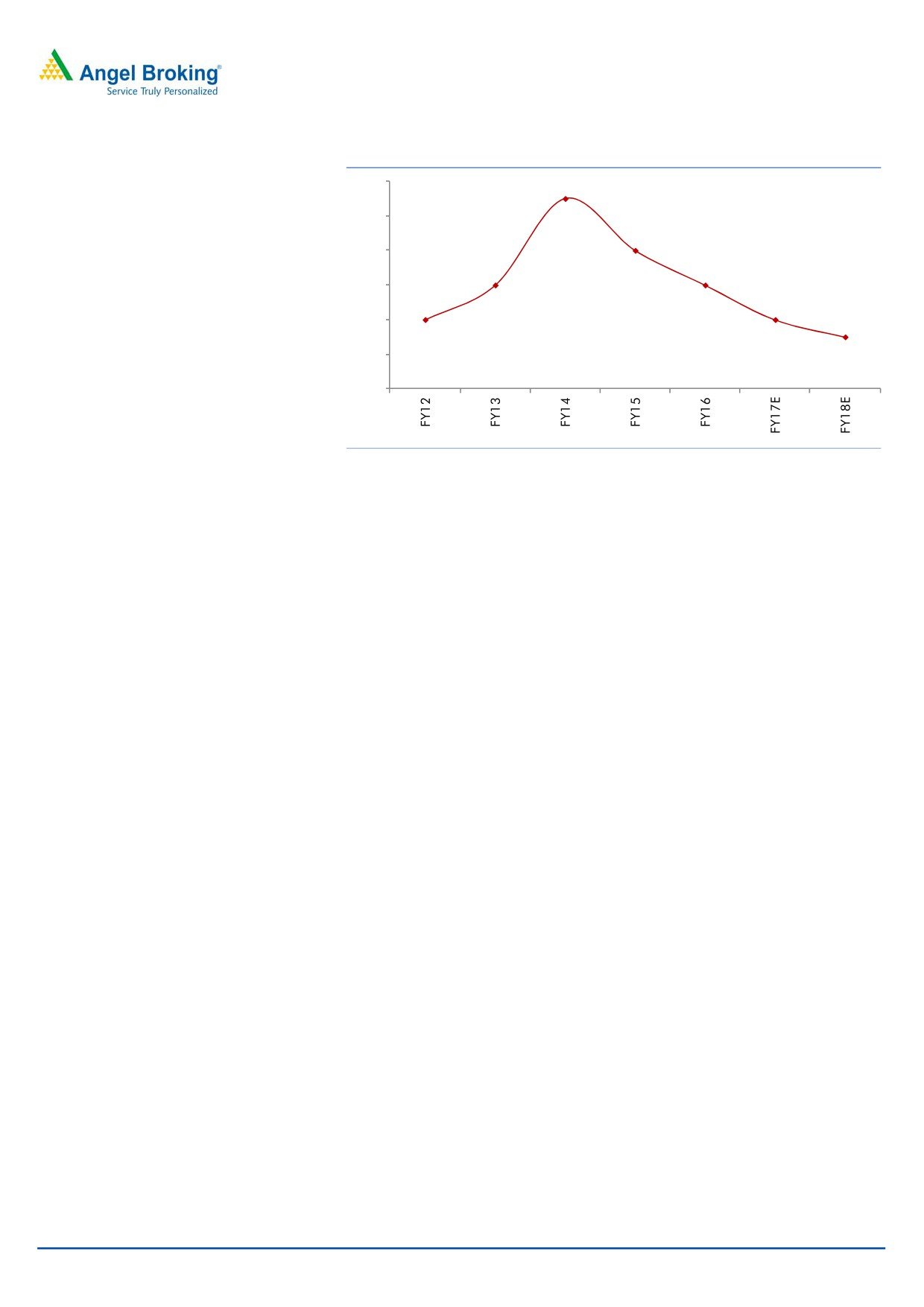

Better Net debt to equity ratio…

MLF reported comfortable consol. net debt to equity ratio of 0.8x as of 4QFY2016.

We expect it to come down to 0.4x by FY2018E, as we believe cash flows

generated from residential and SEZ sales would compensate for the capex. At the

standalone level, MLF has a strong balance sheet and is currently sitting on net

debt of `476cr, reflecting net D/E ratio of 0.3x. We believe focus on collections

from home buyers, and lower dependency on external borrowings has led MLF in

maintaining unlevered balance sheet. We expect the company’s unlevered balance

sheet and unique business strategies help it to continue reporting growth, going

forward.

August 22, 2016

5

Initiating coverage | Mahindra Lifespace Developers

Exhibit 13: Net D/E ratio at comfortable levels

1.2x

1.1x

1.0x

0.8x

0.8x

0.6x

0.6x

0.6x

0.4x

0.4x

0.4x

0.3x

0.2x

0.0x

Source: Company, Angel Research

Management’s impressive track record

MLF is a subsidiary of the Mahindra Group, which has a well diversified presence

across automobile, defense, financial services, and IT services sectors. Considering

the group’s track record of emerging as one of the top player within the sector it

enters, we are of the view that MLF would continue to focus on growing its

business. Also, their parent’s brand name, unique business strategies have helped

them deliver projects in a timely manner, which has created the trust factor with its

home buyers.

The new Real Estate bill augurs well for MLF’s growth

Central Government having passed the new Real Estate regulatory bill in both the

houses, now it is the turn of respective state governments to implement this bill.

Tamil Nadu has emerged as the first state to implement this bill in their state, with

states like Andhra Pradesh following the implementation of the bill. This bill is being

perceived negative by some of the industry participants. Some of the key features

include- (1) adherence to declared plans, (2) deposit 50% of the amounts realized

from home-buyers towards project level escrow account,

(3) mandatory

registration and public disclosure of real estate projects, (4) functions of real estate

agents, as well as regulatory authority.

MLF is a professionally run organization, with defined processes in place. This

when coupled with the company’s business strategy, where sales cycle is ahead of

the execution cycle, leads us to anticipate that it would face minimal impact on the

day-to-day business operations.

Further, many of the smaller developers in our view are not professionally run and

do not follow ideal industry practices. As a result, they are exposed to higher

business risks in the case of the bill getting passed. This unearths huge potential

for MLF to scale up its business at the cost of unorganized small developers, which

would eventually lose business. The reason for we forming a view that MLF should

be a key beneficiary is owing to its financially strong position, professionally well

run management, and ideal industry practices being put in to place.

August 22, 2016

6

Initiating coverage | Mahindra Lifespace Developers

On the whole, we see the passage of this bill to be positive for MLF in the long run

given that it is well placed to see minimal changes to the conduct of its business

and huge business opportunities emerging.

SEZ business a long-term story

MLF is developing two integrated business cities “Mahindra World City (MWC)”, ie

one each in Chennai (~1,600 acres) and Jaipur (~3,000 acres) with total area of

~4,600 acres on lines of work-live-plug-n-play infrastructure. These cities are

meticulously planned and have been divided into zones for business and lifestyle.

These comprise of Special Economic Zone (SEZ) and Domestic Tariff Area (DTA).

The lifestyle zone, located in close proximity to the Business Zone, offers residential

units, school, medical centers, retail malls, business hotels, and recreation and

leisure facilities amidst wide open green spaces.

Mahindra World City Chennai has been in existence for the last 13 years, with

3 broad sectors functioning- IT Services, Apparel & Fashion Accessories, and Auto

Ancillaries (which is a domestic tariff area, DTA). The entire business zone has

64 customers (51 operational) and provides employment to ~38,000 people. 804

acres of the total 848 acres of industrial area and 257 acres of the total 289 acres

of residential and social area have been leased, indicating that the project has

attained maturity.

MLF expects to leverage on its MWC success and is in the process of launching

~300 acres of integrated development project in North Chennai, home to large

industries in the engineering and automobile sector. It expects to invest `375cr

towards the development of this property. In 1QFY2016, MLF announced a tie-up

with Sumitomo Corp in 60/40 ratio to execute this project.

With 95% of the industrial area and 89% of residential areas being leased at MWC

Chennai, we expect the revenues to be stagnant for FY2017-18E. With likely

commencement of operations at North Chennai development project, we expect

FY2018E revenues to see 30% yoy revenue growth to `30cr. On the same lines, we

expect EBITDA also to be flat in FY2017E, and see strong yoy growth in FY2018E

to `70cr.

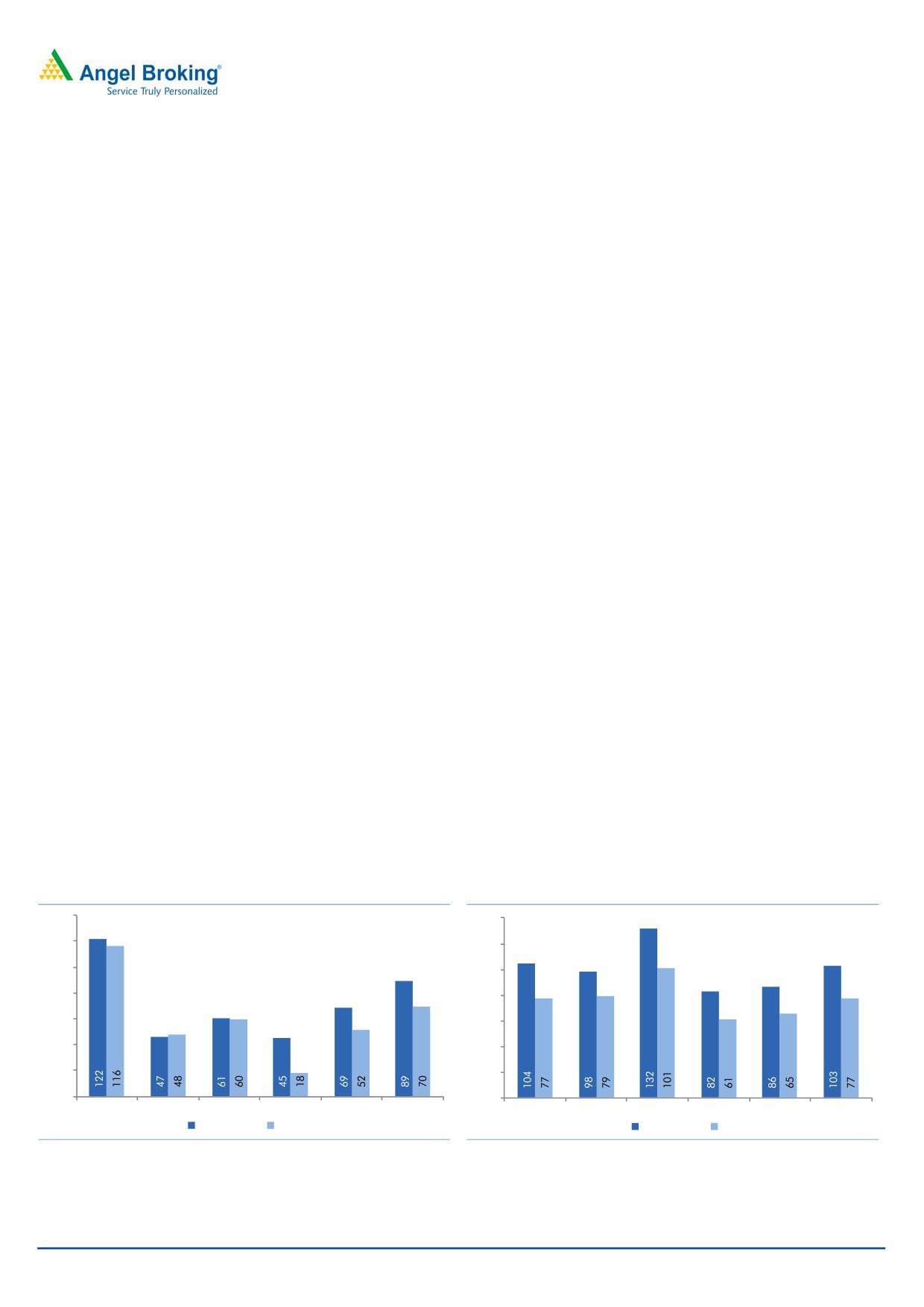

Exhibit 14: MWC Chennai business performance

Exhibit 15: MWC Jaipur business performance

140

140

120

120

100

100

80

80

60

60

40

40

20

20

0

0

FY2013

FY2014

FY2015

FY2016

FY2017

FY2018

FY2013

FY2014

FY2015

FY2016

FY2017

FY2018

Revenues

EBITDA

Revenues

EBITDA

Source: Company, Angel Research

Source: Company, Angel Research

August 22, 2016

7

Initiating coverage | Mahindra Lifespace Developers

Trying to replicate its MWC Chennai’s success, MLF entered the Jaipur SEZ market

through its 74% subsidiary MWC, Jaipur. Of the total ~2,061 acres of saleable

area, the SEZ accounts for 1,026 acres, DTA accounts for 349 acres and the

remaining 686 acres are residential. ~366 acres of SEZ area (36% of SEZ area)

and 316 acres of DTA area (91% of DTA area) has been leased. Given the better

than expected absorption of DTA, MWC Jaipur applied for conversion of

residential land to DTA and it recently got all approvals for the 500 acres land

parcel. As a result, now DTA area stands at 793 acres and the residential areas

stands at 186 acres. The residential area is yet to be launched. We expect that on

attaining more maturity from DTA space, the company would announce launch of

its residential project.

Even though the Jaipur SEZ has a long-way to turn successful, we expect the

following favorable reasons to contribute to its growth, (1) proximity to Delhi NCR’s

industrial cluster and ports on the west coast, (2) as per our estimate, over a third

of the Delhi-Mumbai freight corridor would pass through Rajasthan, (3) incentives/

tax benefits for SEZ/DTA. Even though the current capex cycle is slow, we expect all

the above factors to gradually contribute to MWC Jaipur’s growth from here on.

We expect MWC Jaipur to report 16.1% top-line and 13.0% EBITDA CAGR during

FY2016-18E, to `97.3cr and `104.6cr, respectively.

August 22, 2016

8

Initiating coverage | Mahindra Lifespace Developers

Valuation

At the current market price of `432, the stock is trading at 1.0x FY2018E P/BV.

Considering the quality of Management and better leverage position, we believe

the current valuations are attractive. We are initiating coverage on MLF with a BUY

recommendation and target price of `522, using the NAV methodology, as it

captures the true and long-term value of the SEZ and real estate business. To

arrive at NAV value, (1) we have considered discounting rate of 15% for SEZ and

real estate business, (2) valued commercial property at 9% cap rate.

In terms of vertical wise break-up, the residential segment contributes 75% to our

target price valuation, followed by SEZ contributing 20% to our target valuation.

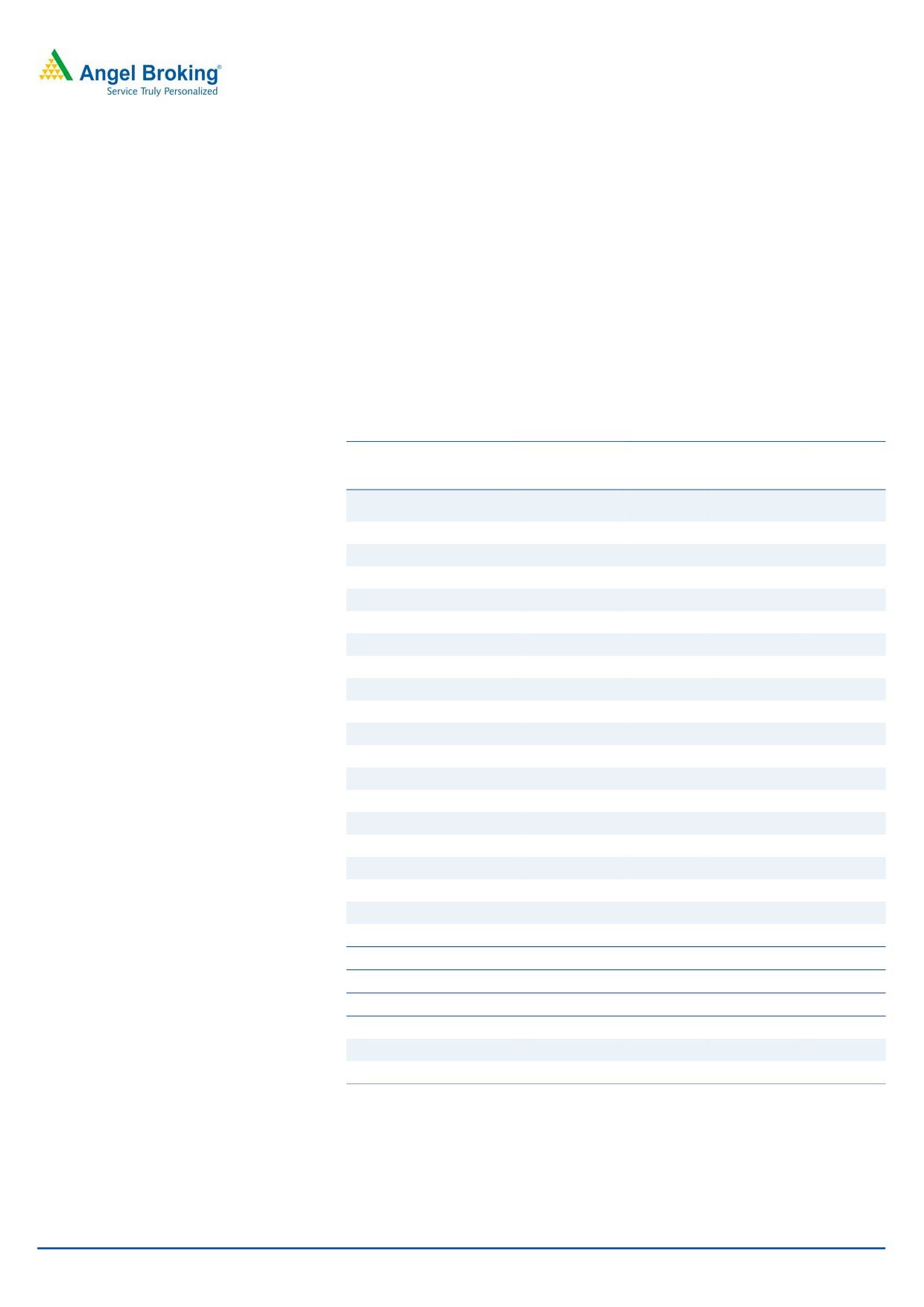

Exhibit 16: NAV based valuation

FY2017E

MLD

Stake

Value/

Project Details

FCFE Value

Stake (%)

Value (` cr)

share (`)

(` cr)

MWC, Chennai &

72

89

64

16

N-Chennai SEZ

MITL

39

97

38

9

MRDL

73

100

73

18

Avadi

51

100

51

12

MWC Jaipur SEZ

492

74

364

89

MWC Jaipur (Residential)

90

74

67

16

Andheri

289

100

289

70

Sakinaka

260

100

260

63

Kandivalli

74

100

74

18

Boisar

30

100

30

7

Alibaug

74

100

74

18

Thane

114

100

114

28

Palghar

121

100

121

29

Bengaluru

179

50

90

22

Aura- Delhi NCR

29

100

29

7

Luminare- Delhi NCR

537

50

269

66

Pune

334

100

334

81

Hyderabad

71

100

71

17

Nagpur

90

70

63

15

Land Parcel (paid) & Others

420

100

420

102

Gross Totals

3,439

2,895

703

Net Debt (Std.)

(89)

NAV /share

614

Discount to NAV- @15%

522

CMP

432

Upside (%)

20.8

Source: Company, Angel Research

August 22, 2016

9

Initiating coverage | Mahindra Lifespace Developers

Risk & Concerns

Delays in getting project as well as land approvals across cities could delay the

projects. These delays could act as a major risk to our execution estimates.

Removal of MAT exemption or Rajasthan government exemptions, may impact SEZ

demand outlook, which in-turn could affect our revenue growth assumptions.

August 22, 2016

10

Initiating coverage | Mahindra Lifespace Developers

Profit & Loss Statement

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17E

FY18E

Net Sales

738

705

1,086

826

1,152

1,300

% Chg

5.3

(4.5)

54.0

(23.9)

39.5

12.8

Total Expenditure

496

535

662

660

890

980

Operating Expenses

398

426

501

502

718

791

Employee benefits Expense

35

40

55

67

74

83

Admin. & Other Expenses

63

69

106

91

98

106

EBITDA

242

170

424

166

262

320

% Chg

26.4

(29.6)

149.2

(60.8)

57.4

22.3

EBIDTA %

32.8

24.1

39.1

20.1

22.7

24.6

Depreciation

9

10

13

19

21

22

EBIT

233

160

411

147

241

298

% Chg

28.1

(31.3)

156.5

(64.2)

63.9

23.5

Interest and Fin. Charges

31

50

51

51

47

42

Other Income

34

51

61

51

39

42

PBT

236

161

421

147

233

298

Exceptional Item

0

0

0

0

0

0

PBT after Exceptional Item

236

161

421

147

233

298

Tax Expenses

80

51

138

50

76

97

% of PBT

33.9

31.6

32.7

34.1

32.8

32.5

PAT before Minority Interest

156

110

283

97

156

201

Minority Interest

(15)

(9)

(17)

(4)

(34)

(54)

Rep. PAT

141

101

266

93

123

147

% Chg

18.7

(28.8)

164.5

(65.0)

31.8

19.9

PAT %

19.1

14.3

24.5

11.3

10.6

11.3

Diluted EPS

35

25

65

23

29.9

35.8

% Chg

18.7

(28.8)

163.4

(65.0)

31.8

19.9

August 22, 2016

11

Initiating coverage | Mahindra Lifespace Developers

Balance Sheet

Y/E March (` cr)

FY13

FY14

FY15

FY16 FY17E FY18E

Sources of Funds

Equity Capital

41

41

41

41

41

41

Reserves & Surplus

1,252

1,221

1,434

1,522

1,619

1,724

Networth

1,293

1,262

1,475

1,563

1,660

1,765

Total Debt

966

1,401

1,238

1,505

1,260

1,288

Minority Interest

86

84

97

170

204

258

Deferred Tax Liability

37

43

56

40

40

40

Total Liabilities

2,382

2,790

2,866

3,279

3,165

3,352

Application of Funds

Gross Block

256

276

317

337

432

475

Accumulated Depreciation

47

56

66

85

106

128

Net Block & C-WIP

216

236

259

255

330

350

Goodwill

95

102

102

102

102

102

Investments

133

301

222

382

382

382

Current Assets

2,414

2,787

3,026

3,635

3,207

3,465

Inventories

1,631

1,776

1,970

2,423

1,946

2,077

Sundry Debtors

90

109

59

74

161

178

Cash and Bank Balance

144

67

77

181

440

609

Loans & Advances

433

693

694

632

319

318

Other Current Asset

115

142

225

326

341

283

Current Liabilities

476

637

743

1,096

856

947

Net Current Assets

1,937

2,150

2,283

2,540

2,351

2,518

Total Assets

2,382

2,790

2,866

3,279

3,165

3,352

August 22, 2016

12

Initiating coverage | Mahindra Lifespace Developers

Cash Flow Statement

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17E

FY18E

Profit after tax

141

101

266

93

123

147

Depreciation

9

10

13

19

21

22

Change in Working Capital

(407)

(360)

(54)

(263)

525

98

Net Interest & Fin. Charges

(3)

(1)

(10)

(0)

8

0

Direct taxes & Other Adj.

16

(4)

11

(67)

(76)

(97)

Cash Flow from Operations

(244)

(255)

226

(217)

600

171

(Inc)/ Dec in Fixed Assets

(22)

(30)

(49)

(16)

(95)

(42)

(Inc)/ Dec in Investments

191

(165)

92

51

39

42

Cash Flow from Investing

169

(195)

42

36

(56)

(0)

Dividend & oth. Adj.

(3)

(132)

(53)

(5)

(26)

(42)

Inc./ (Dec.) in Loans

284

575

(158)

341

(211)

82

Goodwill on consolidation

(66)

(7)

0

0

0

0

Interest Expenses

(31)

(50)

(51)

(51)

(48)

(42)

Cash Flow from Financing

184

386

(263)

285

(285)

(3)

Inc./(Dec.) in Cash

109

(64)

6

104

259

168

Opening Cash balances

150

122

58

77

181

440

Closing Cash balances

259

58

64

181

440

608

August 22, 2016

13

Initiating coverage | Mahindra Lifespace Developers

Key Ratios

Y/E March

FY13

FY14

FY15

FY16

FY17E FY18E

Valuation Ratio (x)

P/E (on FDEPS)

12.5

17.5

6.7

19.0

14.4

12.1

P/CEPS

11.8

15.9

6.3

15.8

12.4

10.5

Dividend yield (%)

1.4

1.4

2.6

1.2

1.1

1.2

EV/Sales

3.5

4.4

2.7

3.7

2.2

1.9

EV/EBITDA

10.7

18.2

6.9

18.6

9.9

7.7

EV / Total Assets

1.1

1.1

1.0

0.9

0.8

0.7

Per Share Data (`)

EPS (fully diluted)

35

25

65

23

30

36

Cash EPS

37

27

68

27

35

41

DPS

6

6

16

4

5

9

Book Value

317

309

360

381

405

430

Returns (%)

RoCE (Pre-tax)

11.4

6.5

15.3

5.1

8.1

10.0

Angel RoIC (Pre-tax)

9.4

4.2

12.8

3.3

8.1

10.1

RoE

10.9

7.9

19.5

6.1

7.6

8.6

Turnover ratios (x)

Asset Turnover (Gross Block) (X)

2.9

2.6

3.4

2.5

2.7

2.7

Inventory / Sales (days)

806

919

662

1,071

617

583

Receivables (days)

45

56

20

33

51

50

Payables (days)

236

330

250

484

271

266

Leverage Ratios (x)

D/E ratio (x)

0.7

1.1

0.8

1.0

0.8

0.7

Interest Coverage Ratio (x)

7.5

3.2

8.0

2.9

5.1

7.1

August 22, 2016

14

Initiating coverage | Mahindra Lifespace Developers

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Mahindra Lifespace Developers

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

August 22, 2016

15