IPO note | Oil & Gas

June 20, 2016

Mahanagar Gas Limited

SUBSCRIBE

ssue Open: June 21, 2016

I

Business to gain further traction, Valuations Attractive

Issue Close: June 23, 2016

Company background: Mahanagar Gas Ltd (MGL) is the third largest city gas

Issue Details

distribution (CGD) company in India with a history of 20+ years of natural gas

distribution in Mumbai and adjoining areas. MGL is promoted by GAIL and

Face Value: `10

British Gas. As of FY2016-end, MGL served 0.47mn vehicles through its 4,646km

Present Eq. Paid up Capital: `98.8cr

of pipeline and 188 compressed natural gas (CNG) filling stations. It supplies

piped natural gas (PNG) to 0.86mn domestic households, 2,800 commercial

Fresh Issue: 0.0cr Shares

consumers and 60 industrial consumers.

Offer for Sale: 2.46cr Shares

MGL is the sole CGD operator for Mumbai, Thane, Navi Mumbai, and Raigad

Post Eq. Paid up Capital: `98.8cr

districts. Mumbai and adjoining areas are currently under penetrated (CNG is served to

Issue size (amount): `938.4-1,039.6cr

0.47mn of targeted 2.15mn motor vehicles; PNG is served to ~0.9mn of targeted

Price Band: `380-421

2.71mn households). MGL enjoys a monopolistic position in its markets owing to

(1) entry barriers for new players in the form of regulatory restrictions,

Lot Size: 35 shares and in multiple there-of

(2) parentage support which assures a majority of its gas requirement from GAIL,

Post-issue implied mkt. cap:

`3,753.6cr- 4,158.5cr

and (3) huge pipeline infrastructure which continues to grow. We expect MGL to

Promoters holding Pre-Issue: 100.0%

report 7-8% volume growth over the next few quarters.

Promoters holding Post-Issue: 75.0%

86% of MGL’s volumes are accounted by its CNG and domestic PNG business,

which have a stable outlook. Considering the government’s long-term plans to

phase out LPG subsidy amongst affluent classes, CNG/domestic PNG penetration

in Mumbai at ~22/28% levels, coupled with assured 86% of gas supplies on

Book Building

cheaper rates on APM and PMT prices (currently APM price is at $3.06/mmbtu),

QIBs

50% of issue

there exists scope for economies of scale to come into play.

Non-Institutional

15% of issue

Valuation: On considering (1) almost similar growth potential as that of the

Retail

35% of issue

industry peer Indraprastha Gas (IGL), (2) 22%+ RoE levels as reported in the last

6 years, (3) debt free status, (4) yearly cash flow generating potential of `200cr+,

(5) strong dividend payout ratio (Management has guided for 35% dividend pay-

out; translates to ~4% dividend yield), the issue at 12.9x PE FY2016 (vs peers

Post Issue Shareholding Pattern

trading at over 18.0x) is attractively priced. We recommend SUBSCIRBE to

Promoters Group

75.0

Mahanagar Gas IPO.

DIIs/FIIs/Public & Others

25.0

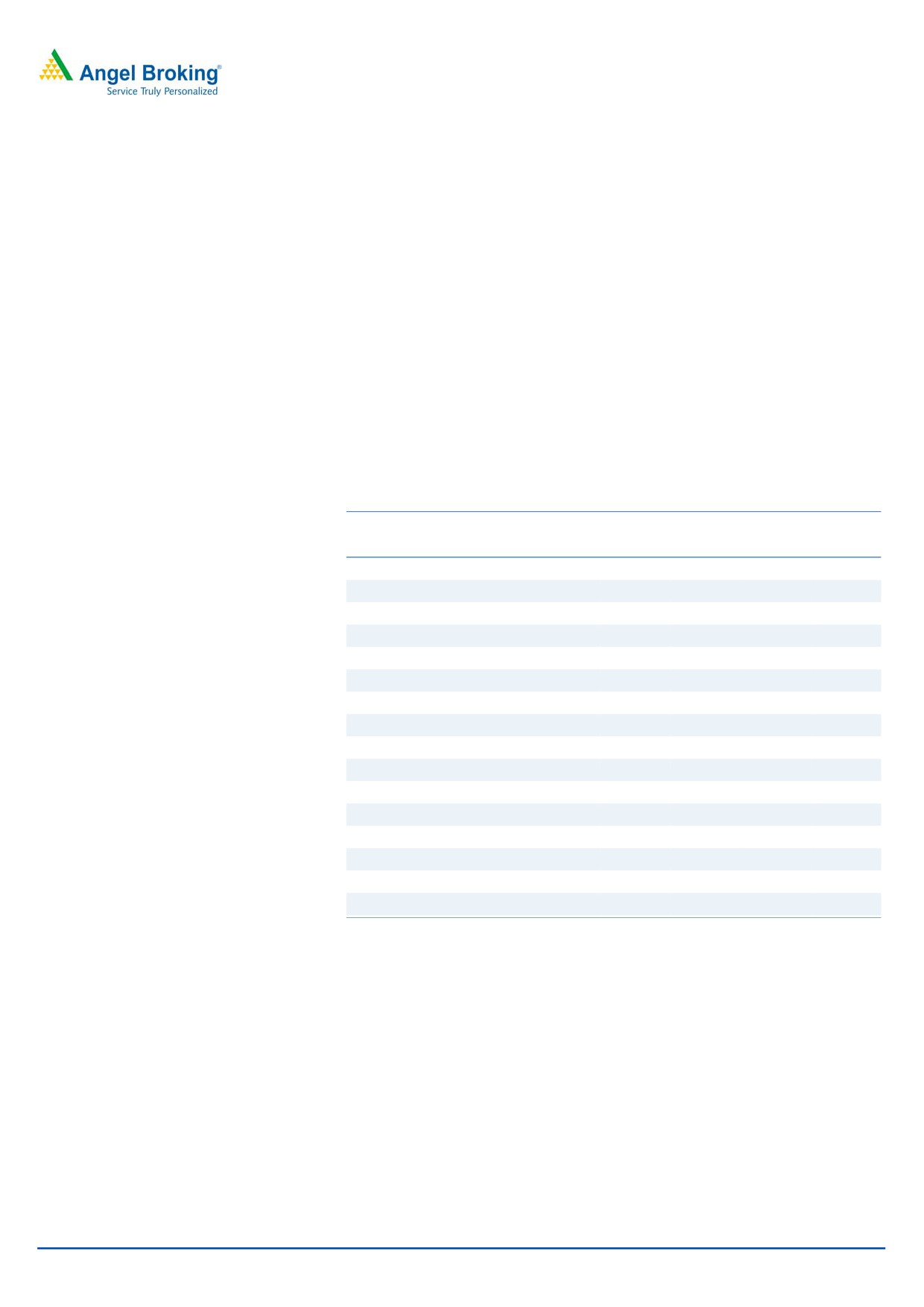

Key Financials

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16

Net Sales

1,309

1,514

1,885

2,095

2,079

% chg

15.7

24.5

11.1

(0.8)

Net Profit

319

277

314

318

322

% chg

(13.3)

13.4

1.4

1.3

EBITDA (%)

38.0

29.3

25.9

23.4

24.7

EPS (`)

32

28

32

32

33

P/E (x)

13.0

15.0

13.2

13.0

12.9

P/BV (x)

3.4

3.2

2.9

2.7

2.5

RoE (%)

29.9

23.4

25.3

23.5

22.0

RoCE (%)

40.7

31.5

31.4

29.1

28.1

Yellapu Santosh

EV/Sales (x)

2.8

2.4

2.0

1.7

1.7

022 - 3935 7800 Ext: 6811

EV/EBITDA (x)

7.5

8.3

7.5

7.4

7.0

Source: Company, Note: Valuation multiples on upper end (i.e. ` 421) of price band

Please refer to important disclosures at the end of this report

1

Mahanagar Gas | IPO note

Issue Details

MGL is offering 2.46cr equity shares of `10 each via book building route in the

price band of `380-421/share, entirely comprising offer for sale by current

promoters GAIL and BYBG Asia Pacific Holdings Pte.

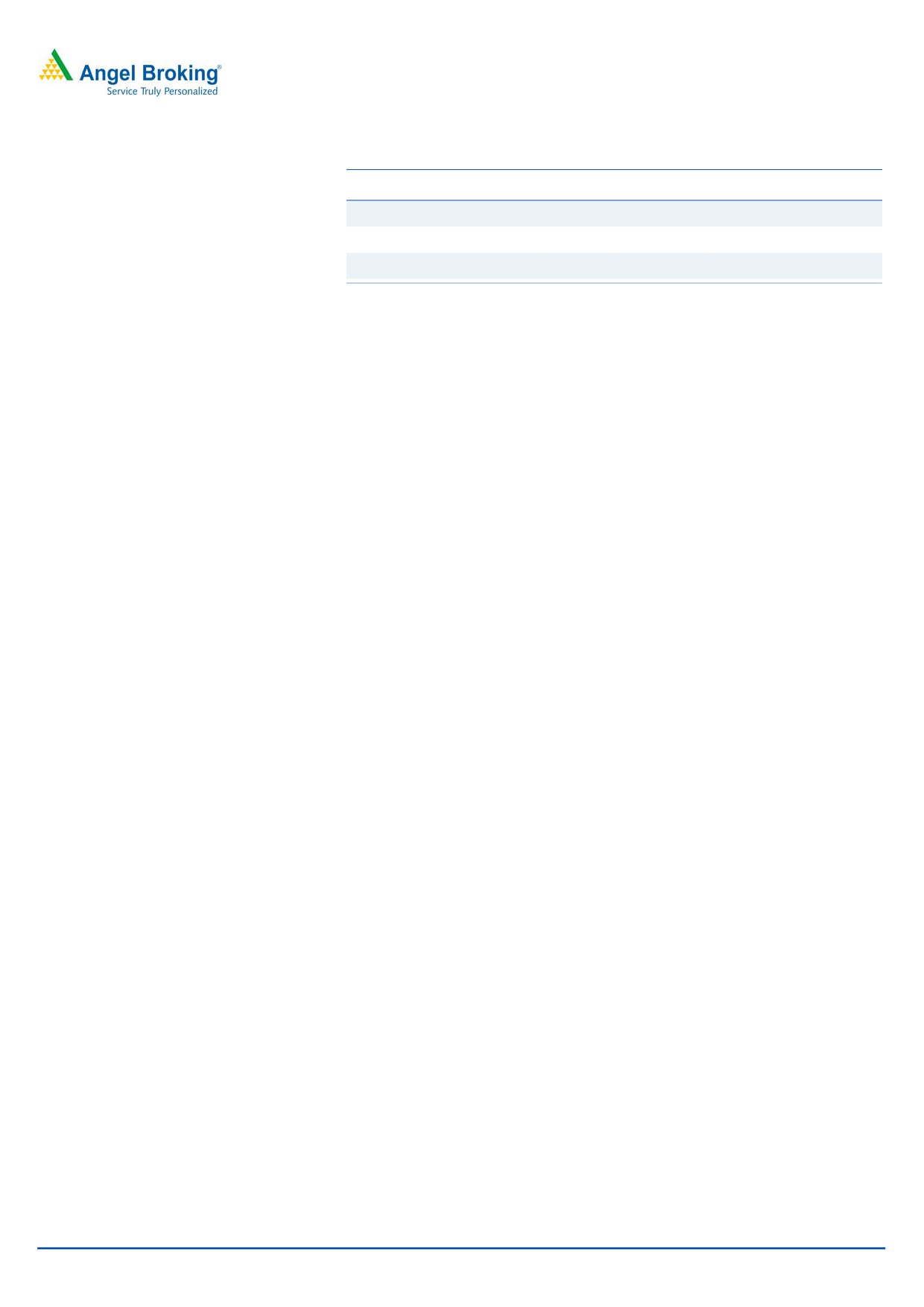

Exhibit 1: Shareholding Pattern

Pre-Issue

Post-Issue

Particulars

No. of Shares

(%)

No. of Shares

(%)

Promoter Group

98,777,778

100.0

74,083,278

75.0

Retail & HNI Investors

0

0.0

12,347,250

12.5

Institutional Investors

0

0.0

12,347,250

12.5

Source: Company, Angel Research

Objects of the Offer

Objects of the Offer are to achieve benefits of listing equity shares on stock

exchanges and to carry out the offer for sale. Listing of equity shares will

enhance MGL’s brand name and provide liquidity to existing shareholders.

The listing will also provide a public market for the equity shares in India.

June 20, 2016

2

Mahanagar Gas | IPO note

Company details

MGL is India’s third largest CGD company with 20 years of natural gas distribution

experience in Mumbai and its adjoining areas. The company was incorporated on

May 8, 1995 as a joint venture between GAIL and British Gas, with each holding

49.75% stake, with the balance 0.5% being held by the Maharashtra government.

Post conversion of compulsory convertible shares on Jun 7, 2016, Maharashtra

government’s stake increased to 10%. Post IPO, both the promoters holding would

decrease to 32.5% stake each in the company.

MGL operates as CGD operator for 3 areas, namely, (1) Mumbai (includes south

Mumbai, Central Mumbai & Mumbai suburbs), (2) Thane district (includes areas

like Kalyan, Ambarnath and Badlapur), Bhiwandi & Navi Mumbai, and (3) Raigad

district (includes Karjat and Poladpur). The first license for Mumbai area was

awarded in 1995, with marketing/networking exclusivity till Jan-2012/

2020.

Thereafter, MGL won second license for Thane District, Bhiwandi & Navi Mumbai

areas in 2005, with marketing/networking exclusivity till Jan-2012/ 2030. Third

license was won by MGL in 2015 for Raigad district, with marketing/networking

exclusivity till 2020/2040. Notably, regulations provide for extension of networking

exclusivity for another 10 years.

As of FY2016-end, MGL with its supply network of 4,646km of pipeline (includes

~4,231km of polyethylene pipeline and 415km of steel pipeline) and 188 CNG

filling stations (13 owned by MGL; remaining are either owned by OMCs [oil

marketing companies] and private parties or are situated at state transportations

bus depots) served 0.47mn vehicles. It supplies piped natural gas (PNG) to

0.86mn domestic households, 2,800 commercial consumers and 60 industrial

consumers.

June 20, 2016

3

Mahanagar Gas | IPO note

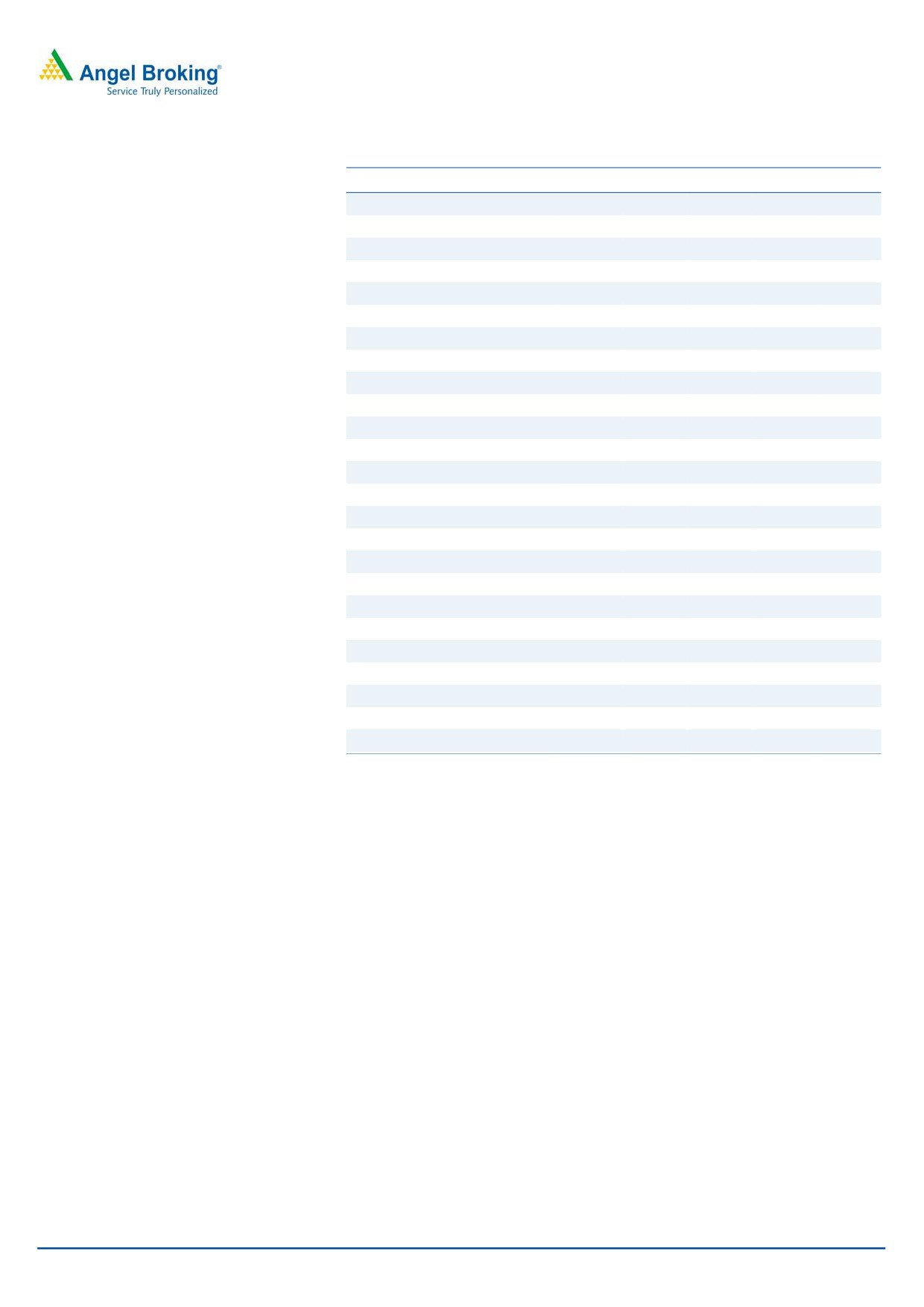

Industry peers

In the Indian CGD space, MGL comes next to IGL and Gujarat Gas Ltd (GGL).

The following table highlights the business model of industry peers:

Exhibit 2: Peer Group Comparison

MGL

IGL

Gujarat Gas

Gujarat (19 districts),

Companies

Mumbai, Thane

Delhi

Dadra Nagar & Haveli

& Raigad

NCR

& Thane (Rural)

CNG stations

188

340

248

CNG stations- JVs with OMC

136

156

150

CNG stations- Owned

13

129

70

CNG stations- Owned (as % of total)

7

38

28

CNG Vehicles served (mn)

0.47

0.87

0.50

CNG Vehicles targeted (mn)

2.15

3.15

2.75

CNG vehicle penetration (%)

22

28

18

CNG volumes (mmscmd)

1.8

3.1

0.9

PNG- Domestic cm (mn)

0.87

0.64

1.46

PNG- Domestic cm target (mn)

3.08

2.00

12.20

PNG- Domestic cm penetration (%)

28

32

12

PNG- Ind./Commercial cm

2,866/ 60

2,580

11,500/ 2,700

PNG volumes (mmscmd)

0.6

0.9

4.7

Sales Mix (%):

CNG

74

77

16

PNG-Domestic

12

6

9

PNG-Commercial

6

11

75

PNG-Industrial

8

Trading

0

6

0

Source: Company RHP, Annual Reports & Presentations, Media Articles, Angel Research

In comparison to peers, and on considering pace of growth of Mumbai city and

adjoining areas, we see huge long-term opportunity emerging for MGL across

both, CNG & PNG businesses.

June 20, 2016

4

Mahanagar Gas | IPO note

Investment Rationale

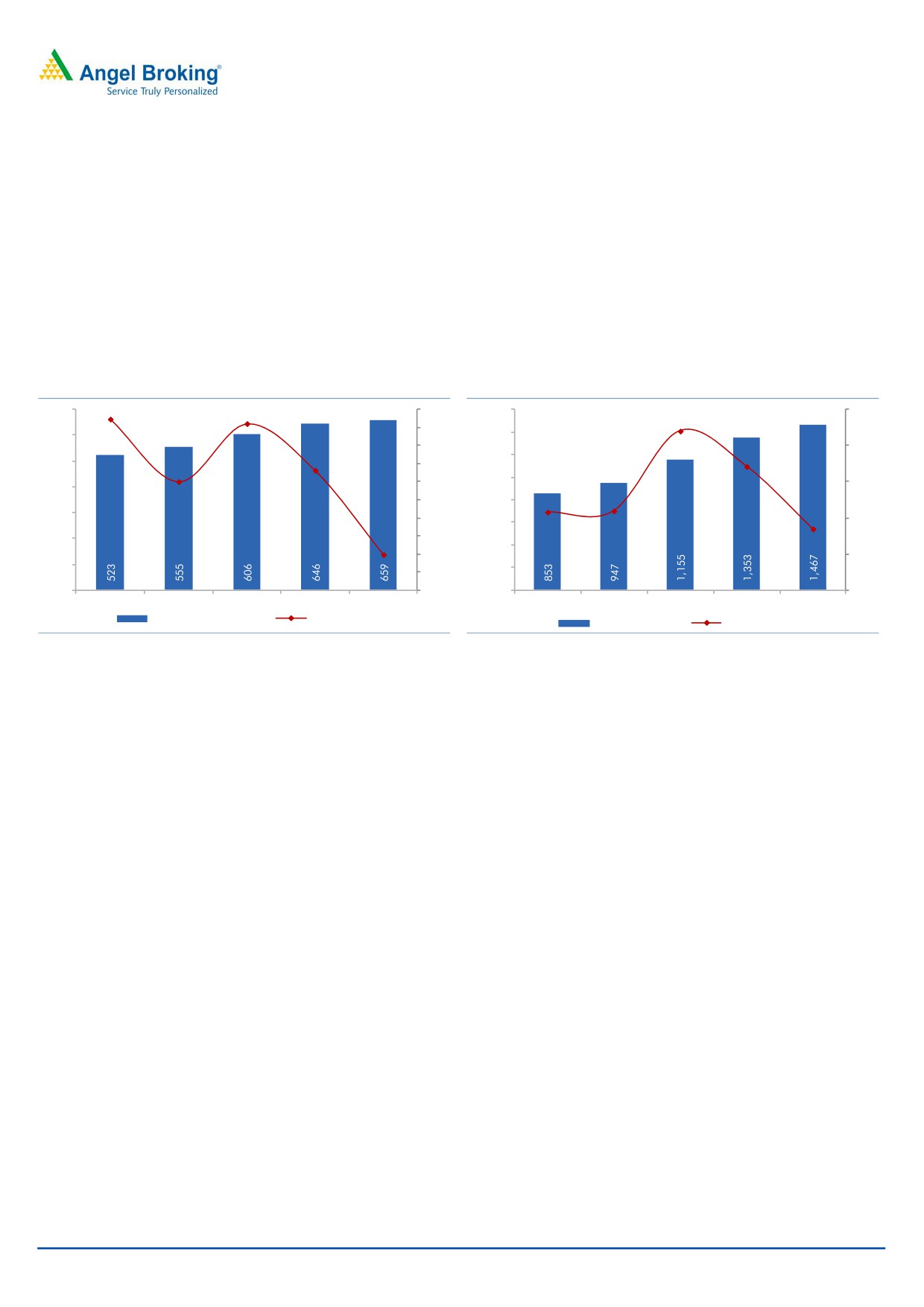

Decent volume growth in non-supportive regulatory environment

MGL reported 6.7% volume CAGR during FY2011-16, with PNG (26% of FY2016

volumes) reporting 7.0% volume CAGR and CNG (74% of FY2016 volumes)

reporting 6.6% volume CAGR, during the same period. Again if we look at PNG

sub-segments, then volume growth was mainly driven by the domestic segment

which reported 9.2% volume CAGR during FY2011-16.

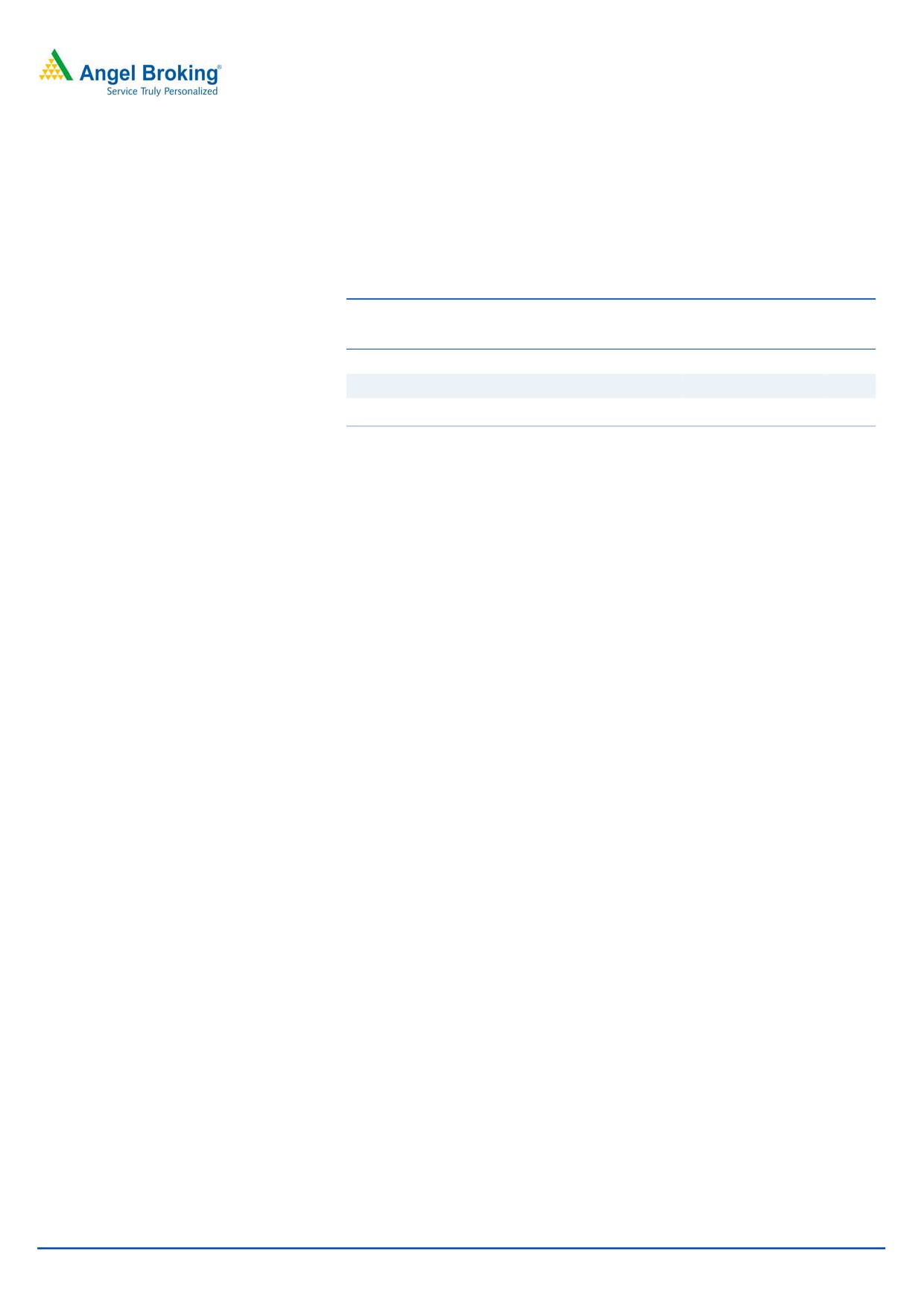

Exhibit 3: IGL vs. MGL Total Sale volume trends

Exhibit 4: : IGL vs. MGL CNG sale volume trends

4.50

3.50

4.00

3.00

3.50

2.50

3.00

2.50

2.00

2.00

1.50

1.50

1.00

1.00

0.50

0.50

0.00

0.00

FY2011

FY2012

FY2013

FY2014

FY2015

FY2016

FY2011

FY2012

FY2013

FY2014

FY2015

FY2016

IGL volume (mmscmd)

MGL volume (mmscmd)

IGL CNG volume (mmscmd)

MGL CNG volume (mmscmd)

Source: Company, Angel Research

Source: Company, Angel Research

IGL reported

6.5% CNG volume CAGR during FY2011-16 supported by

regulations (compulsory conversion of public transport and new taxis to CNG)

while MGL reported similar volume CAGR of 6.6% during the same period without

any regulatory support. We sense MGL’s matching performance despite absence

of regulatory support is owing to cost benefits that CNG offers in comparison to

other liquid fuels (like petrol, diesel). Also, MGL at regular intervals has been able

to take price hikes to maintain its gross margins. We expect MGL to continue

reporting such growth on the back of following, (1) more number of private

vehicles switching to CNG, (2) more public transport buses switching to CNG, and

(3) volumes kicking-in from newly added Raigad district.

Favourable Sales mix

Unlike its peer GGL, which gets

75% of its sales from PNG-Industrial &

Commercial, MGL enjoys favourable business model, where it gets 86% of its sales

from retail driven CNG & PNG-Domestic business (combined). Industrial &

Commercial PNG users are more price sensitive than retail CNG and PNG users.

Industrial & Commercial PNG users tend to switch to alternative fuels (like LPG) in

an adverse pricing scenario, given that their plants are built to run on duel fuels.

Also, from a margin profile perspective, business models with high dependency on

Industrial volumes could lead to lower margins (as seen from GGL’s margins).

CNG - huge scope for penetration

MGL claims that it supplied CNG to ~0.47mn vehicles in FY2016 of the total

~6.7mn motor vehicles in Mumbai, Thane and Navi Mumbai region (vehicle count

as of Jul-2015, Source: Mumbai Transport Commissioner’s office) through 188

CNG stations. MGL has indicated target market to be at ~2.15mn motor vehicles

June 20, 2016

5

Mahanagar Gas | IPO note

and has planned to add 83 CNG stations in next 5 years. We see possibility of

such planned expansion materializing given the scope to penetrate in the light of

IGL’s 28% penetration levels in Delhi. Further, our view gets strengthened from the

point that CNG operated vehicles have grown at 13.75% CAGR during FY2010-

16 in Mumbai and adjoining areas, outpacing the overall vehicle growth (Source:

Mumbai Transport Commissioner’s office).

Also outcome of a High Court case, which intends to direct conversion of all public

transport buses in Mumbai and adjoining areas, is pending. Any favorable ruling

could contribute to significant uptick in CNG volumes from state public transport.

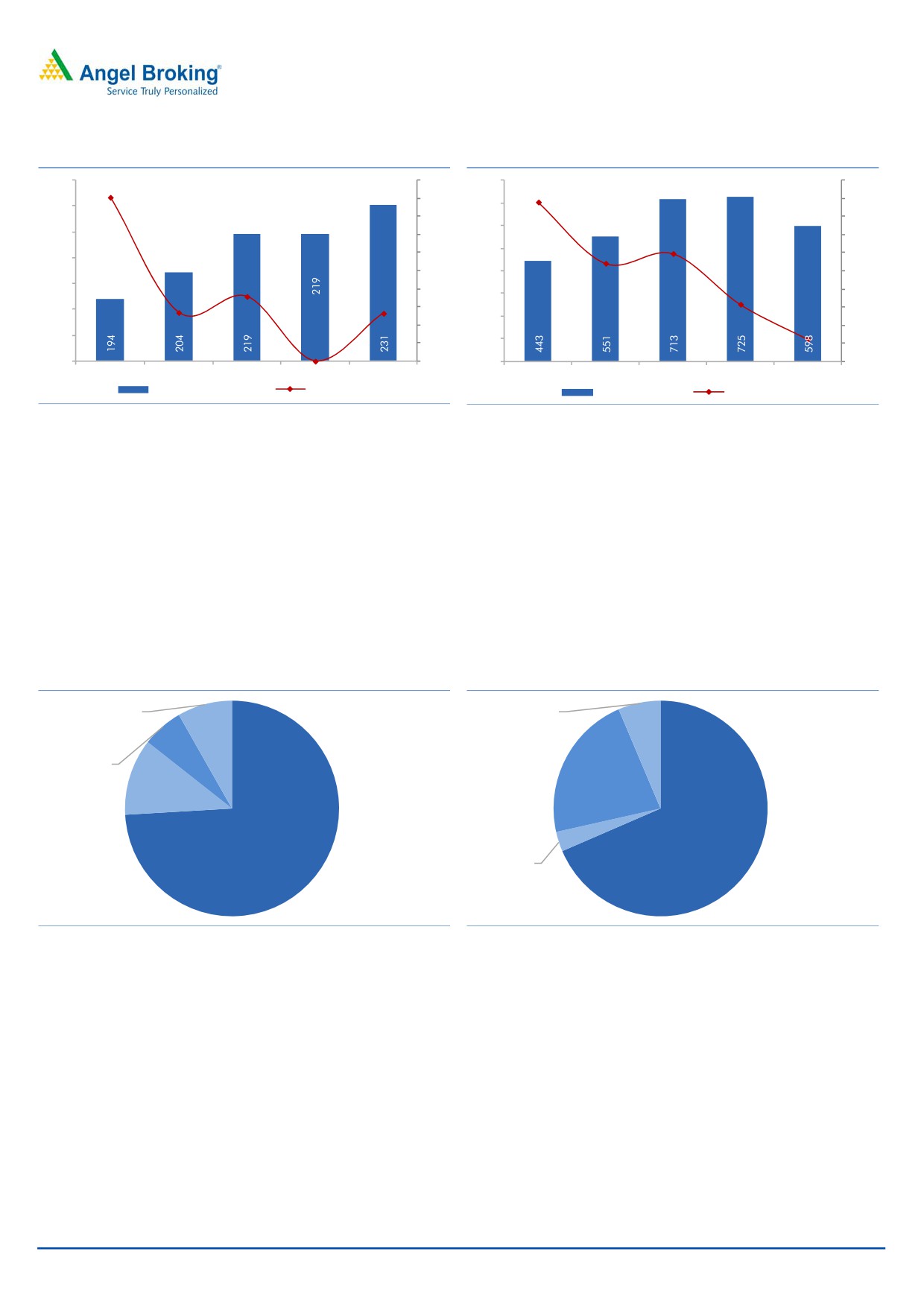

Exhibit 5: CNG Volume trend

Exhibit 6: CNG yearly sale trend

700

9.5%

9.2%

10%

1,600

25%

22.0%

9%

1,400

17.1%

600

8%

20%

6.6%

1,200

500

6.0%

7%

11.0%

1,000

10.8%

6%

15%

400

5%

800

8.5%

300

4%

10%

600

200

2.0%

3%

400

2%

5%

100

200

1%

0

0%

0

0%

FY2012

FY2013

FY2014

FY2015

FY2016

FY2012

FY2013

FY2014

FY2015

FY2016

CNG sale vol. (mmscm)

yoy growth (%)

CNG sales (` cr)

yoy growth (%)

Source: Company, Angel Research

Source: Company, Angel Research

PNG growth seen in tougher environment…

As of FY2016-end, MGL reported 0.87mn domestic PNG users against the target

households of 3.08mn, indicating 28.2% penetration. IGL at FY2016-end had

0.64mn domestic PNG users, against its own internal potential estimate of 2mn,

indicating 32.0% penetration. Domestic PNG users currently contribute 12% of the

total sale volumes at 2.43mmscmd. MGL Management sees potential opportunity

of ~1.0mmscmd of volumes from domestic PNG users. What impresses us about

this business is that it assures revenue sustainability and can possibly lead to higher

margins in the long-run.

Currently 2,866 of 9,000-10,000 targeted Commercial customers are connected.

With expensive long-term contracts signed and alternative fuel (like PNG) getting

cheaper, PNG sales to Industrial and Commercial customers started moderating in

FY2014-15. Despite ~30% correction in spot LNG prices at ~5/MMBtu in the last

1-year, we do not expect major uptick in business from Commercial/Industrials

side, given that there are smaller number of industries which have access to low

price alternative fuels. It’s only incremental volumes from Raigad region that could

make noticeable contribution to PNG Commercial/Industrials side of the business.

June 20, 2016

6

Mahanagar Gas | IPO note

Exhibit 7: PNG Volume trend

Exhibit 8: PNG yearly sale trend

240

18.1%

20%

800

58.0%

70%

18%

60%

230

700

16%

50%

600

24.2%

220

14%

40%

29.5%

500

12%

30%

210

10%

400

1.6%

20%

200

7.1%

8%

10%

300

5.4%

5.3%

190

6%

(17.5%_

0%

200

4%

-10%

180

100

0.0%

2%

-20%

170

0%

0

-30%

FY2012

FY2013

FY2014

FY2015

FY2016

FY2012

FY2013

FY2014

FY2015

FY2016

PNG sale vol. (mmscm)

yoy growth (%)

PNG sales (` cr)

yoy growth (%)

Source: Company, Angel Research

Source: Company, Angel Research

Margin expansion lags growth

Favorable Gas sourcing strategy in place

Post implementation of revised Ministry of Petroleum and Natural Gas (MoPNG)

guidelines in Aug-2014, GAIL is directed to supply natural gas 10% over and

above 100% requirement of each CGD entity (taking into account last 6 months

consumption by the CGD) towards supply to priority sector. Given that MGL serves

85.6% of its gas volumes under the priority sector, we are assured that availability

of the cheaper domestic gas would continue going forward.

Exhibit 9: MGL FY2016 Sale Volume mix

Exhibit 10: MGL FY2016 Gas vol. Sourcing mix

PNG-

Mid/Short term

Industrial,

LNG , 6.0%

8.2%

PNG-

Commercial,

6.2%

PNG-

Domestic,

PMT, 20.9%

11.5%

CNG, 74.1%

APM, 64.7%

Non APM,

2.8%

Source: Company, Angel Research

Source: Company, Angel Research

MGL currently sources 85.5% of its total purchase from the domestic sources

(administered price mechanism [APM] and Panna-Mukta and Tapti fields [PMT]) at

cheaper rates. Currently, MGL has tied-up with GAIL at an Administered Price of

$3.06/mmBtu. Pricing for supplies from PMT is at $5.73/mmBtu & $5.57/mmBtu,

respectively. The rest of the gas is procured from spot and term LNG contracts with

various suppliers.

APM prices are formula based (reflects international markets’ pricing) and any

changes are reflected with 6 months’ lag effect. The PNG-Industrial & Commercial

demand is met through LNG, where MGL has term-deals with BPCL, BG, and

Hazira LNG, and purchases spot cargoes from GAIL, GSPC and HPCL. MGL does

not get into any long-term pricing model.

June 20, 2016

7

Mahanagar Gas | IPO note

On the whole, any correction in international prices in the next 2-3 quarters could

benefit MGL in terms of low cost of gas.

Despite muted growth seen in gross margin/scm, EBITDA/scm lagged, mainly

owing to higher other expenses. Other expenses/scm reported 7.7% CAGR during

FY2011-16, reflecting sharp increase in power & fuel, rent, repairs to plant and

machinery and miscellaneous expenses.

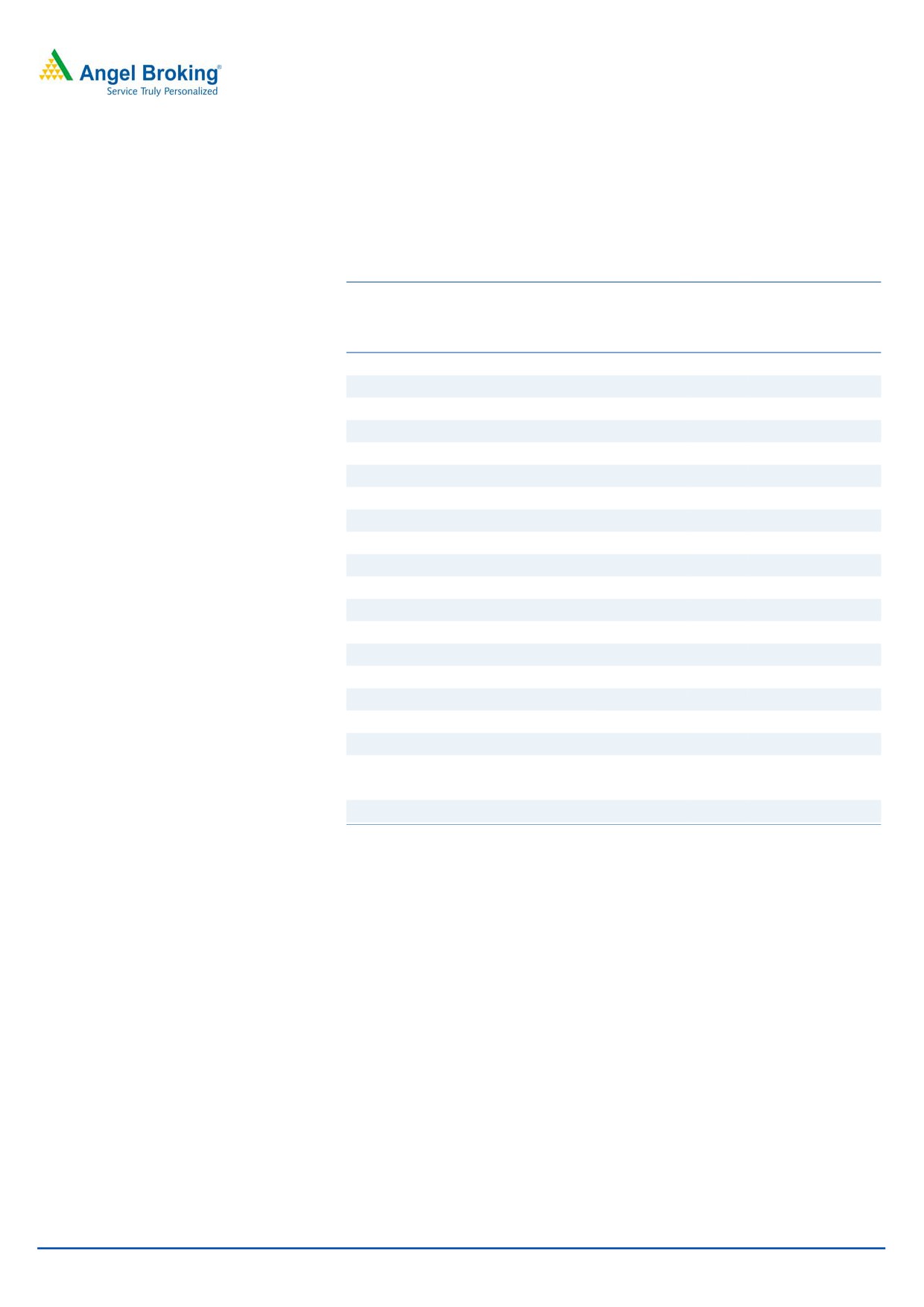

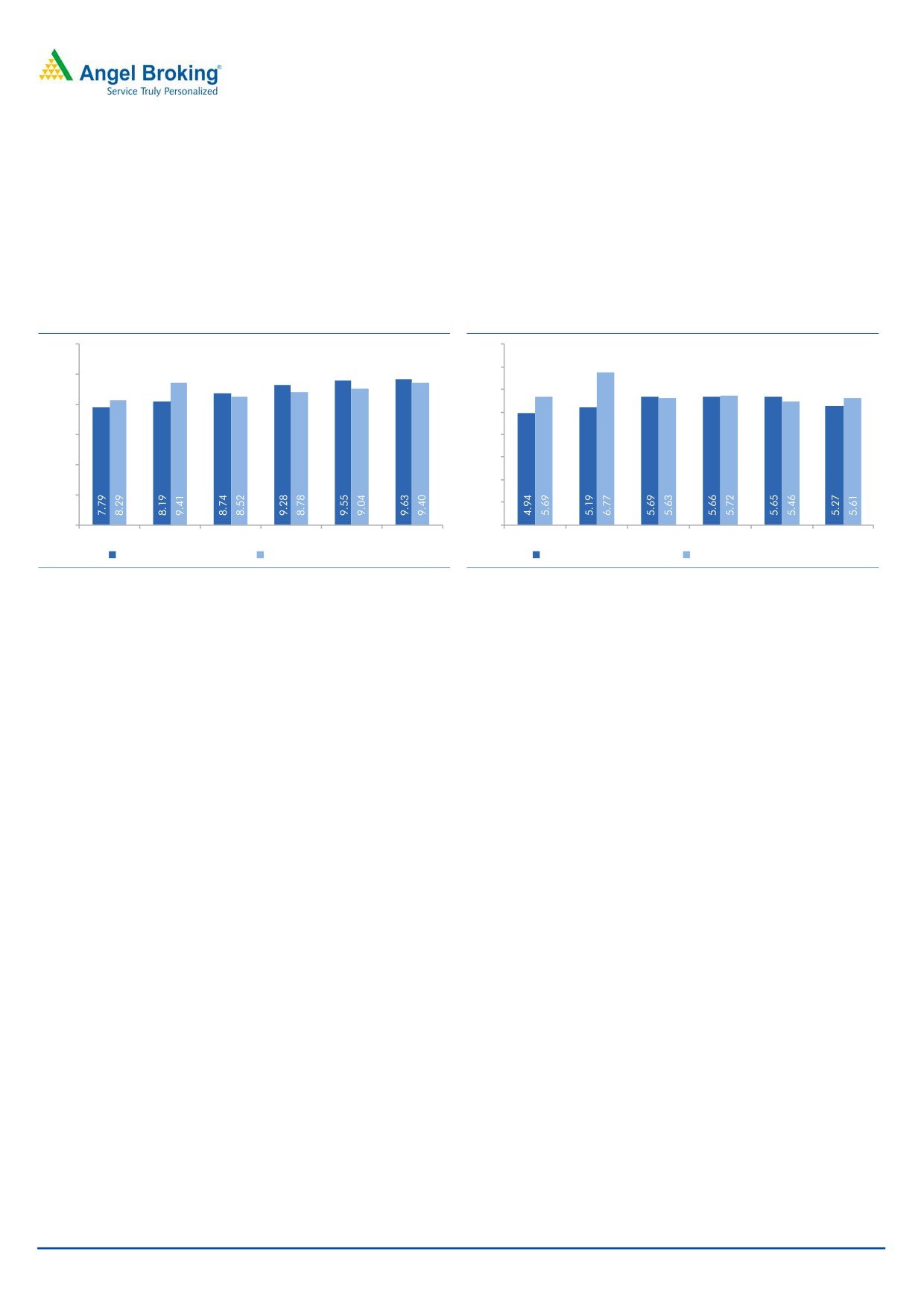

Exhibit 11: IGL vs MGL Gross margin/scm trends

Exhibit 12: IGL vs MGL EBITDA margin/scm trends

12.0

8.0

7.0

10.0

6.0

8.0

5.0

6.0

4.0

3.0

4.0

2.0

2.0

1.0

0.0

0.0

FY2011

FY2012

FY2013

FY2014

FY2015

FY2016

FY2011

FY2012

FY2013

FY2014

FY2015

FY2016

IGL Gross Margin/scm

MGL Gross Margin/scm

IGL EBITDA Margin/scm

MGL EBITDA Margin/scm

Source: Company, Angel Research

Source: Company, Angel Research

Notably, MGL reported -0.3% EBITDA/scm CAGR during FY2011-16, vs +1.3%

CAGR for IGL during the same period. Barring 2 of the last 6 years, MGL reported

higher EBITDA/scm than that of IGL.

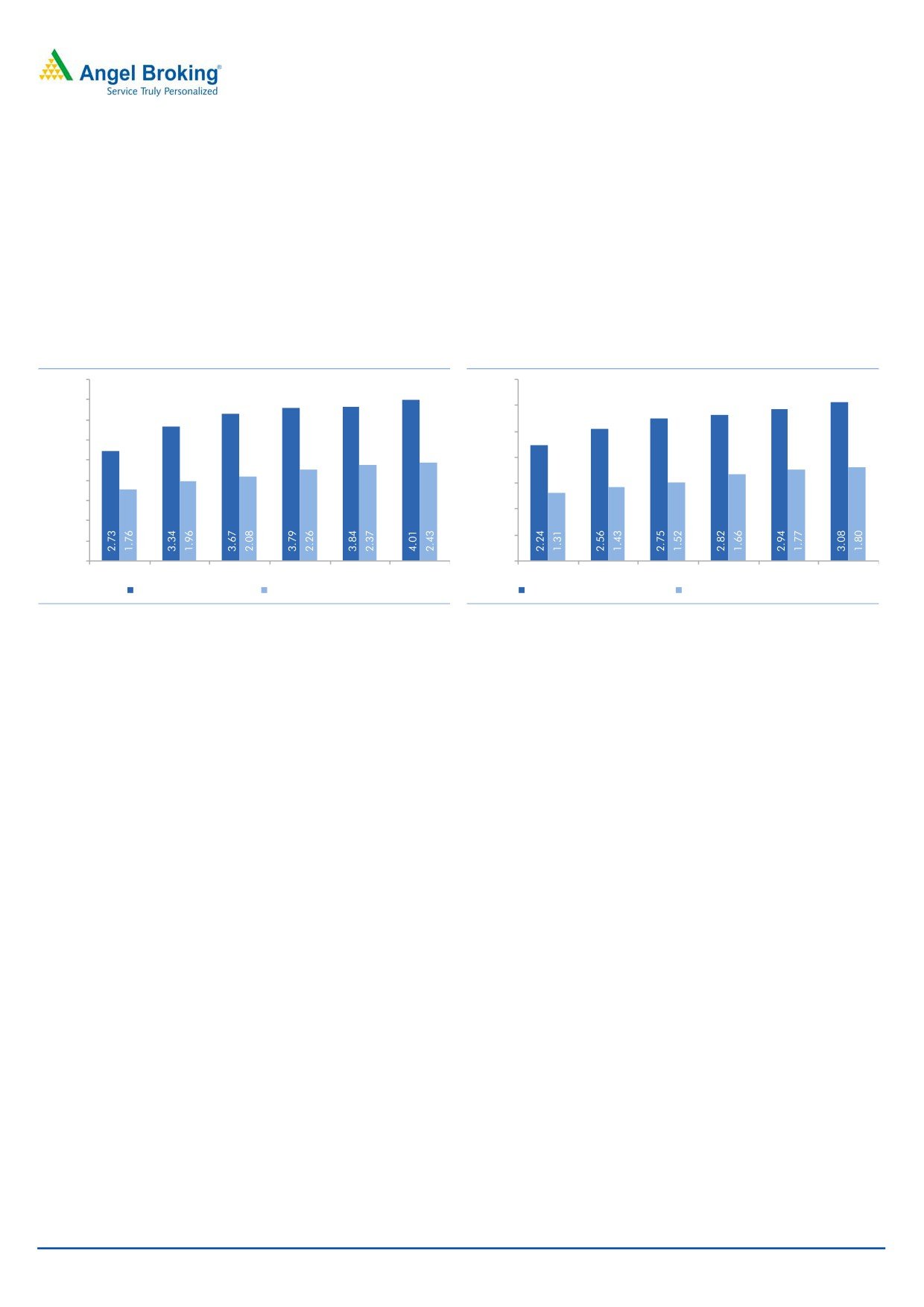

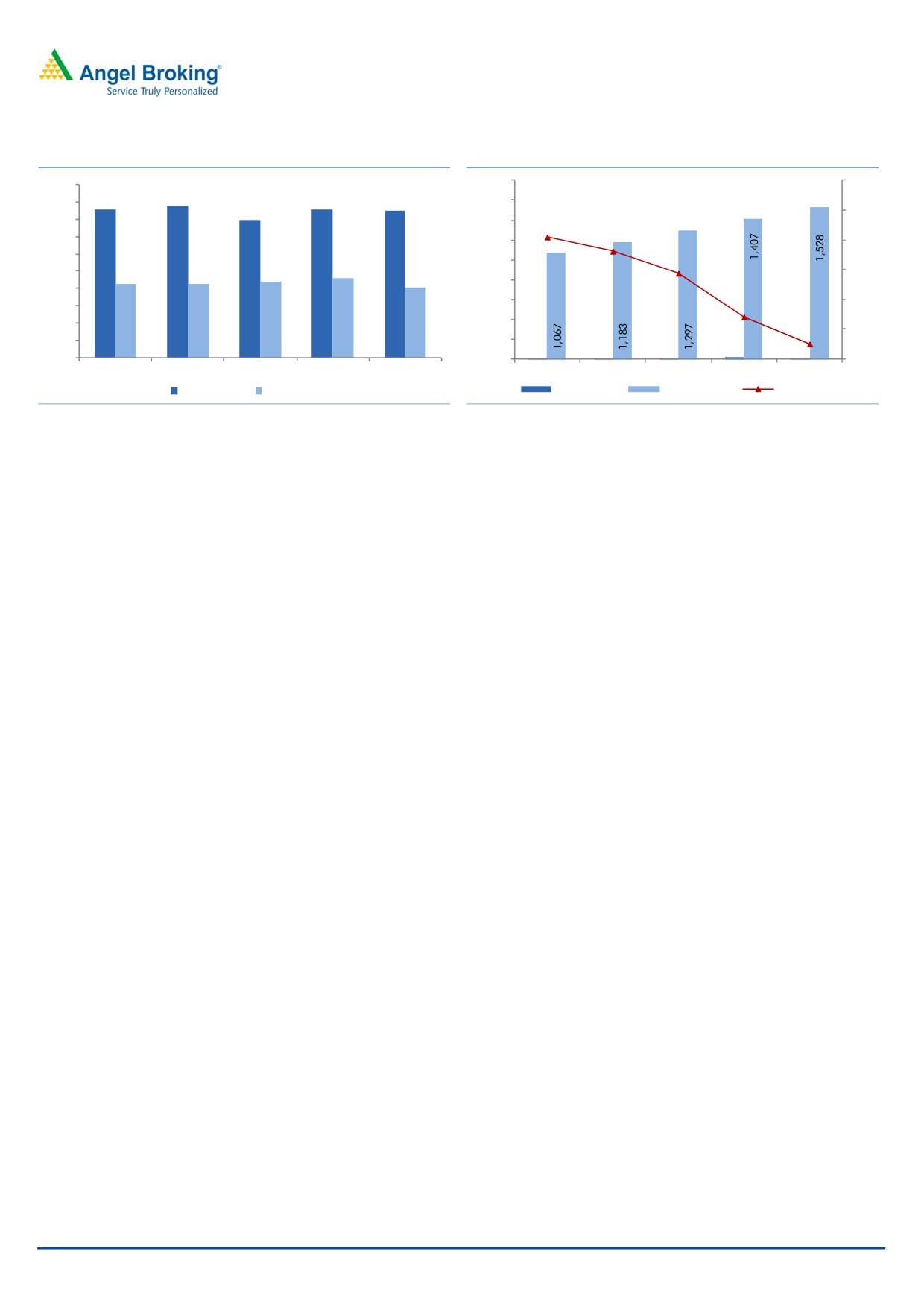

Maintained Balance sheet discipline

MGL historically has exhibited that it financed its growth by properly managing its

capital resources. For last 6 years, MGL generated ~`400cr of cash flows from

operations. Given the stable business, we expect this trend of cash flow generation

to continue going forward also. MGL has been spending `200cr towards capex,

which is expected to increase to `250cr. Accordingly, MGL is generating yearly free

cash flows of over `200cr.

Further, MGL in the last 6 years has reported decline in its Return on Equity (RoE)

on account of decline in their EBITDA/scm. Despite compression in EBITDA/scm,

MGL has been able to maintain its RoE in the north of 22% levels.

Another impressive point about MGL has been that it has reported 49% dividend

payout in 5 of the last 6 years. Such huge dividend payout translates to FY2016

dividend yield of 4.2% (at the upper end of the issue price band).

Despite (1) financing its growth from cash flow from operations, and (2) high

dividend pay-outs, MGL continues to be a debt free company (currently sitting on

net cash of `168cr). This efficient capital management has helped the company

follow a disciplined approach in maintaining its balance sheet.

June 20, 2016

8

Mahanagar Gas | IPO note

Exhibit 13: OCF and FCF trends

Exhibit 14: Maintained strong Balance Sheet

0.0x

1,800

500

439

428

427

425

450

1,600

398

0.0x

400

1,400

0.0x

350

0.0x

1,200

0.0x

300

1,000

-0.1x

250

214

214

221

229

-0.1x

204

800

200

600

-0.1x

-0.1x

150

100

400

-0.1x

-0.1x

50

200

10

10

8

16

4

0

0

-0.1x

FY2012

FY2013

FY2014

FY2015

FY2016

FY2012

FY2013

FY2014

FY2015

FY2016

OCF (` in cr) FCF (` in cr)

Debt (` in cr)

Equity (` in cr)

Net D/E (x)

Source: Company, Angel Research

Source: Company, Angel Research

Raigad to contribute growth in long-term; Maintain focus on new

areas

MGL won the Raigad district CGD contract from PNGRB 2015 and operations

here are expected to start by FY2017-end. Management highlighted that Raigad

offers huge long-term growth opportunities at the backdrop of Smart City policy,

upcoming International airport and Trans Harbour Link. Accordingly, MGL has

already identified 6-7 industrial clusters which can be accessible to gas grid and

be quickly tapped through concentrated network. Accordingly, to tap the emerging

opportunities, Management indicated that they plan to invest `50cr p.a. for the

next 5 years in the Raigad district.

Also, to reduce its geographical risk, MGL’s Management has indicated that the

company is participating in PNGRB bids and is open to secure new CGS contracts.

Strong parentage support, well-run professional management team, learning from

20 years of experience of operating the Mumbai and adjoining areas, puts MGL in

competitive advantage, allowing it to expand and grow business in the long-run.

Risks & Concerns

1. Any government/regulatory ruling which could affect gas sourcing and pricing

to customers could affect the financials and return ratios.

2. Termination of contract post completion of marketing exclusivity with OMCs

from Mar 31, 2018 could affect the financials of the company.

3. Given that it takes at least 4-5 months to get 25 clearances for pursuing

PNG-domestic expansion, any delays could affect volumes and in-turn affect

the company’s financials.

4. Any adverse movement in the INR-USD could affect the margins, given that

gas pricing is in USD.

June 20, 2016

9

Mahanagar Gas | IPO note

Outlook and Valuation

On comparing IGL’s and GGL’s business models, we sense IGL is the closest peer

to MGL, given that GGL is majorly dependant on industrial and commercial

segments, which leads to volatility in volumes and its lower margins profile. IGL on

the other hand has homogeneity on the business-mix front, margin profile and

return ratios.

IGL on the back of regulatory support has reported 8.0% volume CAGR during

FY2011-16, whereas MGL, without regulatory support and on the back of

favourable cost dynamics, has been able to report 6.7% volume CAGR during

FY2011-16.

MGL reported superior financial metrics for FY2016. It reported EBITDA/scm and

PAT/scm of `5.77/`3.62, respectively. IGL for same period reported EBITDA/scm

and PAT/scm of `5.27/`2.87, respectively.

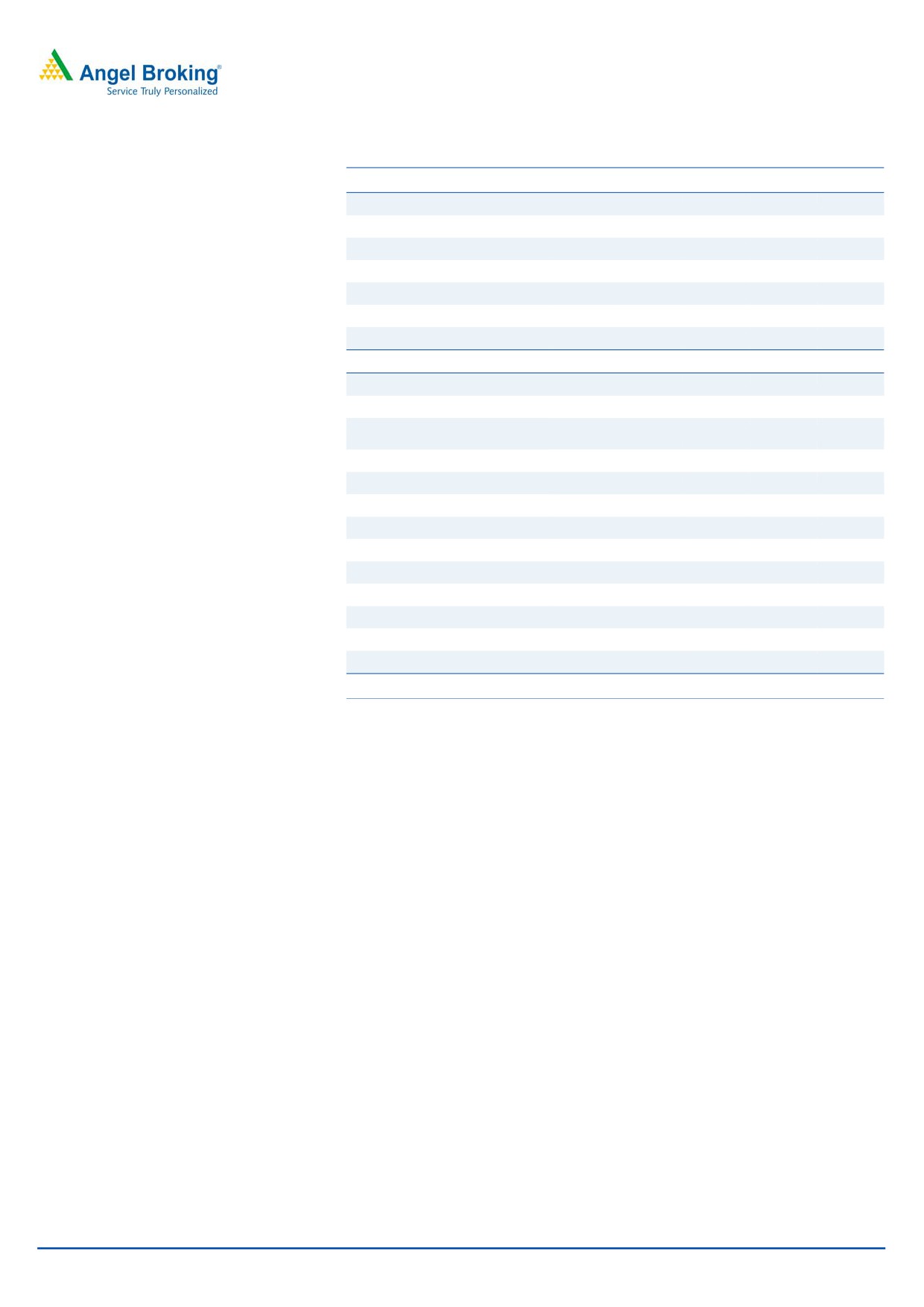

Exhibit 15:IGL vs MGL Operational & Financial Metrics Comparison

IGL

MGL

FY2015

FY2016

FY2015

FY2016

Operational Metrics:

Sales Volume (mmscmd)

3.84

4.01

2.39

2.43

CNG to total sales (%)

77

77

74

74

Domestic PNG to total sales (%)

5

6

11

12

Commercial & Industrial to total sales (%)

18

17

15

14

CNG Stations (no’s)

326

340

180

188

CNG Vehicle (no’s)

817,117

868,573

421,258

470,478

Domestic Consumers (no’s)

560,752

636,318

801,321

862,299

Industrial/ Commercial consumers (no’s)

2,292

2,580

2,664

2,926

Financials:

Gross Margin (%)

36.4

38.3

37.6

40.5

Gross Margin/scm

9.55

9.63

9.04

9.40

EBITDA Margin (%)

21.5

20.9

23.4

24.7

EBIDTA/scm

5.66

5.27

5.61

5.78

PAT/scm

3.12

2.84

3.68

3.62

ROE (%)

22.7

18.5

23.5

22.0

Source: Company RHP, Annual Reports & Presentations, Media Articles, Angel Research

Further, on the growth side, IGL has reported 9.9% PAT CAGR during FY2011-16,

outpacing MGL’s -0.4% PAT CAGR during the same period. Despite outpacing the

PAT growth, IGL reported FY2015/16 RoEs of 22.7%/18.5%, which is lower than

MGL’s 23.5%/22.0%, respectively.

MGL trades at 12.9/11.6x our FY2016 EPS at the upper and lower end of the issue

price band. MGL reported a 6.7% volume CAGR during FY2011-16 and the same

is likely to grow to 7-8% levels, going forward, considering penetration potential,

possible regulatory support and increased traction from the Raigad markets.

June 20, 2016

10

Mahanagar Gas | IPO note

Exhibit 16: Peer Group Comparison

IGL

MGL

Gujarat Gas (GGL)

P/E

18.6x

12.9x

45.7x

P/BV

3.5x

2.5x

3.4x

EV/EBITDA

10.6x

7.0x

12.1x

Source: Bloomberg, Company, Angel Research, CMP as of Jun 17, 2016

Valuation: On considering (1) almost similar growth potential as that of the

industry peer Indraprastha Gas (IGL), (2) 22%+ RoE levels as reported in the last 6

years, (3) debt free status, (4) yearly cash flow generating potential of `200cr+, (5)

strong dividend payout ratio (Management has guided for 35% dividend pay-out;

translates to ~4% dividend yield), the issue at 12.9x PE FY2016 (vs peers trading

at over 18.0x) is attractively priced. We recommend SUBSCIRBE to Mahanagar

Gas IPO.

June 20, 2016

11

Mahanagar Gas | IPO note

Profit & Loss Statement

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16

Net Sales

1,309

1,514

1,885

2,095

2,079

% Chg

15.7

24.5

11.1

(0.8)

Total Expenditure

811

1,070

1,397

1,605

1,566

Cost of Natural Gas & Traded items

622

851

1,144

1,296

1,230

Changes in inventory

(0)

(0)

(0)

(0)

0

Employee benefits Expense

32

36

42

51

54

Other Expenses

157

184

211

258

283

EBITDA

498

444

488

490

513

% Chg

(10.7)

9.9

0.3

4.7

EBIDTA %

38.0

29.3

25.9

23.4

24.7

Depreciation

64

71

81

80

84

EBIT

434

373

408

410

429

% Chg

(14.0)

9.2

0.6

4.7

Interest & Financial Charges

0

1

0

1

3

Other Income

32

49

51

58

56

EBT & exceptional items

465

421

458

466

482

Exceptional Items

0

0

0

0

0

EBT

465

421

458

466

482

Tax Expenses

146

144

145

148

160

% of PBT

31.4

34.2

31.5

31.8

33.2

PAT

319

277

314

318

322

% Chg

(13.3)

13.4

1.4

1.3

PAT %

24.4

18.3

16.6

15.2

15.5

Diluted EPS

32.4

28.1

31.8

32.3

32.7

% Chg

(13.3)

13.4

1.4

1.3

June 20, 2016

12

Mahanagar Gas | IPO note

Balance Sheet

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16

Sources of Funds

Equity Capital

89

89

89

89

89

Reserves & Surplus

978

1,093

1,208

1,318

1,439

Networth

1,067

1,183

1,297

1,407

1,528

Total Debt

10

10

8

16

4

Deferred Tax Liabilities (net)

65

80

89

103

118

Other Long-term Liabilities & Prov.

1

0

5

8

6

Total Liabilities

1,143

1,272

1,398

1,534

1,656

Application of Funds

Net Block

764

926

991

1,064

1,160

Capital WIP & Intan.

322

315

345

380

429

Assets under Develop.

Investments

236

302

342

371

388

Current Assets

Inventories

14

14

16

17

18

Sundry Debtors

82

90

109

96

89

Cash and Bank Balance

51

66

89

145

172

Loans & Advances

58

47

52

60

71

Other Current Asset

19

23

29

32

30

Current Liabilities

403

511

576

632

700

Net Current Assets

(178)

(270)

(281)

(281)

(320)

Other Assets

0

0

0

0

0

Total Assets

1,143

1,272

1,398

1,534

1,656

June 20, 2016

13

Mahanagar Gas | IPO note

Cash Flow Statement

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16

Profit before tax

454

442

442

449

469

Depreciation & Other Non-cash Charges

54

49

54

49

57

Change in Working Capital

35

93

30

66

47

Interest & Financial Charges

0

1

0

1

3

Direct taxes paid

(115)

(146)

(129)

(139)

(150)

Cash Flow from Operations

428

439

398

427

425

(Inc)/ Dec in Fixed Assets

(213)

(225)

(177)

(197)

(221)

(Inc)/ Dec in Investments & Oth. Adj.

(112)

(60)

(23)

(63)

(8)

Cash Flow from Investing

(326)

(285)

(200)

(261)

(229)

Issue/ (Buy Back) of Equity

0

0

0

0

0

Inc./ (Dec.) in Borrowings

(0)

(1)

(2)

8

(2)

Dividend Paid (Incl. Tax)

(90)

(156)

(183)

(183)

(188)

Interest Expenses & Oth. Adj.

(0)

(1)

(0)

(1)

(1)

Cash Flow from Financing

(91)

(157)

(185)

(176)

(191)

Inc./(Dec.) in Cash & forex translation

11

(3)

13

(10)

5

Opening Cash balances

5

17

13

26

16

Closing Cash balances

17

13

26

16

21

June 20, 2016

14

Mahanagar Gas | IPO note

Ratio Analysis

Y/E March

FY12

FY13

FY14

FY15

FY16

Valuation Ratio (x)

Adj. P/E (on FDEPS)

13.0

15.0

13.2

13.0

12.9

Adj. P/CEPS

9.8

10.8

9.5

9.4

9.3

Dividend yield (%)

2.1

3.6

4.2

4.2

4.2

EV/Sales

2.8

2.4

2.0

1.7

1.7

EV/EBITDA

7.5

8.3

7.5

7.4

7.0

EV / Total Assets

3.3

2.9

2.6

2.4

2.2

Per Share Data (`)

Adj. EPS (fully diluted)

32.4

28.1

31.8

32.3

32.7

Cash EPS

42.9

38.9

44.2

44.6

45.5

DPS

8.7

15.0

17.5

17.5

17.5

Book Value

119

132

145

158

171

Returns (%)

RoCE (Pre-tax)

40.7

31.5

31.4

29.1

28.1

Angel RoIC (Pre-tax)

52.8

38.9

38.7

35.4

34.7

RoE

29.9

23.4

25.3

23.5

22.0

Turnover ratios (x)

Total Asset Turnover (x)

1.1

1.2

1.3

1.4

1.3

Inventory / Sales (days)

4

3

3

3

3

Receivables (days)

23

22

21

17

16

Payables (days)

112

123

111

110

123

WC (days)

(85)

(98)

(87)

(90)

(104)

Leverage Ratios (x)

D/E ratio (x)

0.0

0.0

0.0

0.0

0.0

*Note: Valuation details on higher end of the price band (i.e. at `421/share)

June 20, 2016

15

Mahanagar Gas | IPO note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

June 20, 2016

16