4QFY2016 Result Update | Others

May 13, 2016

MM Forgings

BUY

CMP

`460

Performance highlights

Target Price

`536

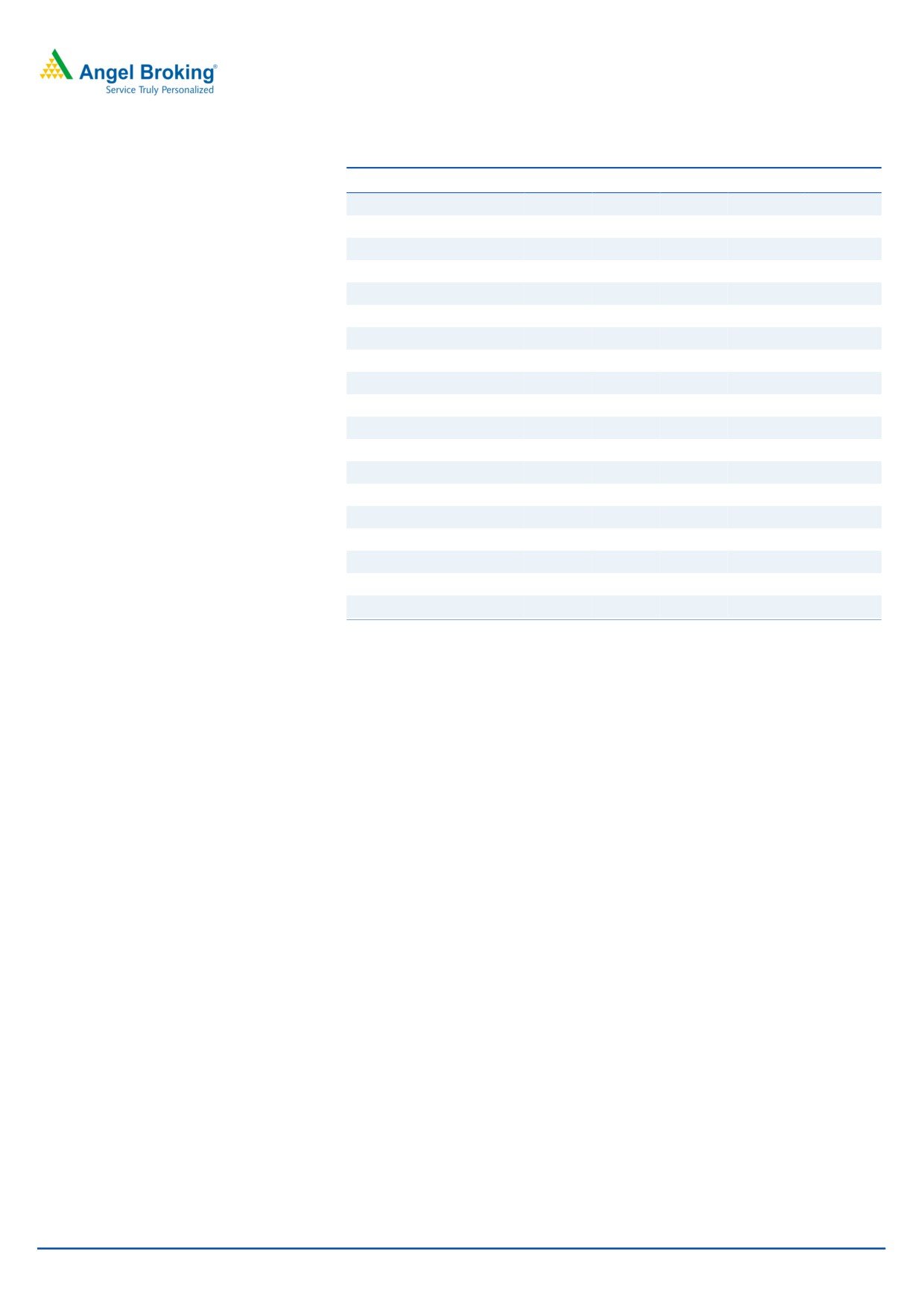

Y/E March (` cr)

4QFY16 4QFY15

% chg. (yoy) 3QFY16

% chg. (qoq)

Investment Period

12 months

Net sales

124

127

(1.7)

126

(1.1)

EBITDA

26

27

(4.5)

28

(7.6)

Stock Info

EBITDA Margin (%)

20.5

21.1

(60)

22.0

(145)

Adjusted PAT

11

11

(1.3)

13

(16.3)

Sector

Others

Source: Company, Angel Research

Market Cap (` cr)

550

MM Forgings (MMFL)’ numbers for 4QFY2016 have come in marginally below our

Net debt (` cr)

92

estimates. Its top-line for the quarter de-grew by 1.7% yoy to `124cr, which is below

Beta

0.7

our estimate of `129cr. The EBITDA declined by 4.5% yoy to `26cr while the EBITDA

margin declined marginally by 60bp yoy to 20.5% (against our estimate of 21.0%).

52 Week High / Low

717/ 336

Further, the interest and depreciation expenses for the quarter stood more or less

Avg. Daily Volume

2,256

flat in absolute terms on a yoy basis and other income increased by 90.4% yoy to `1.9cr.

Face Value (`)

10

Consequently, the net profit declined by 1.3% yoy to `11cr vis-à-vis our expectation of `12cr.

BSE Sensex

25,790

On-going capacity expansion to help cater to domestic as well as international

Nifty

7,900

markets: The company derives ~70% of its revenues from North America and Europe

Reuters Code

MMFO.BO

while the balance is contributed by the domestic markets. Automotives make up for

~78% of its revenue with higher concentration of commercial vehicles (CV) in the mix.

Bloomberg Code

MMFG IN

The company has been continuously increasing its capacity over the last two years and

is expected to touch the 65,000MT mark by the end of FY2017 from the current level of

53,000MT. Although the US CV industry is expected to post flat growth in sales for

Shareholding Pattern (%)

CY2016 after having reported a sharp increase in CY2015, the demand from the

Promoters

56.4

domestic CV industry is expected to continue to be strong. This, along with a stable

MF / Banks / Indian Fls

13.7

growth rate of ~7% estimated for the European CV industry in CY2016, should enable

FII / NRIs / OCBs

3.4

the company to utilize its expanding capacity. At the moment, the company’s top-five

Indian Public / Others

26.5

clients account for ~70% of its revenue. We expect the company to be aggressive in

terms of client acquisitions which should also compliment its growing capacity.

Outlook and valuation: Considering flattish CV growth in the US (although stable

Abs.(%)

3m

1yr

3yr

growth in domestic and European CV sales), we have lowered our revenue expectation

Sensex

12.2

(5.2)

30.8

for FY2017 and expect improvement only in FY2018. We expect MMFL to register a

MMFL

17.3

(33.5)

502.4

revenue CAGR of 10% over FY2016-18E to `608cr. The company’s EBITDA margin is

expected to witness contraction in FY2017 on account of pricing pressure and higher

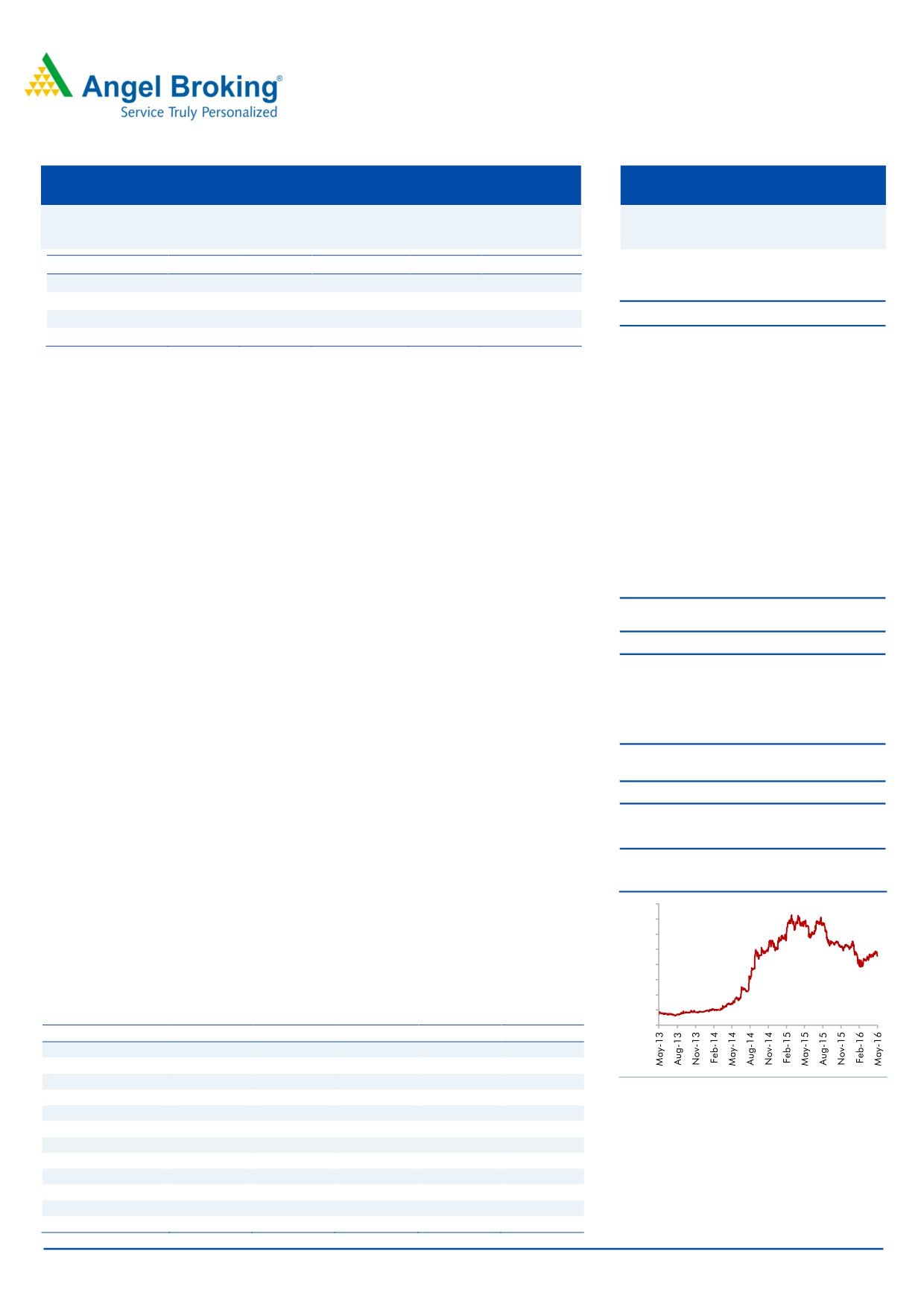

3 year price chart

contribution from the relatively lower-margin domestic market, but improve thereon to

800

700

20.7% in FY2018. The net profit as a result is expected to remain flat in FY2017 and

600

improve to `59cr in FY2018. At the current market price, the company is trading at a

500

P/E of 9.4x its FY2018E earnings. We have a Buy rating on the stock with a target price

400

300

of `536 based on a target P/E of 11.0x its FY2018E earnings.

200

100

Key financials

-

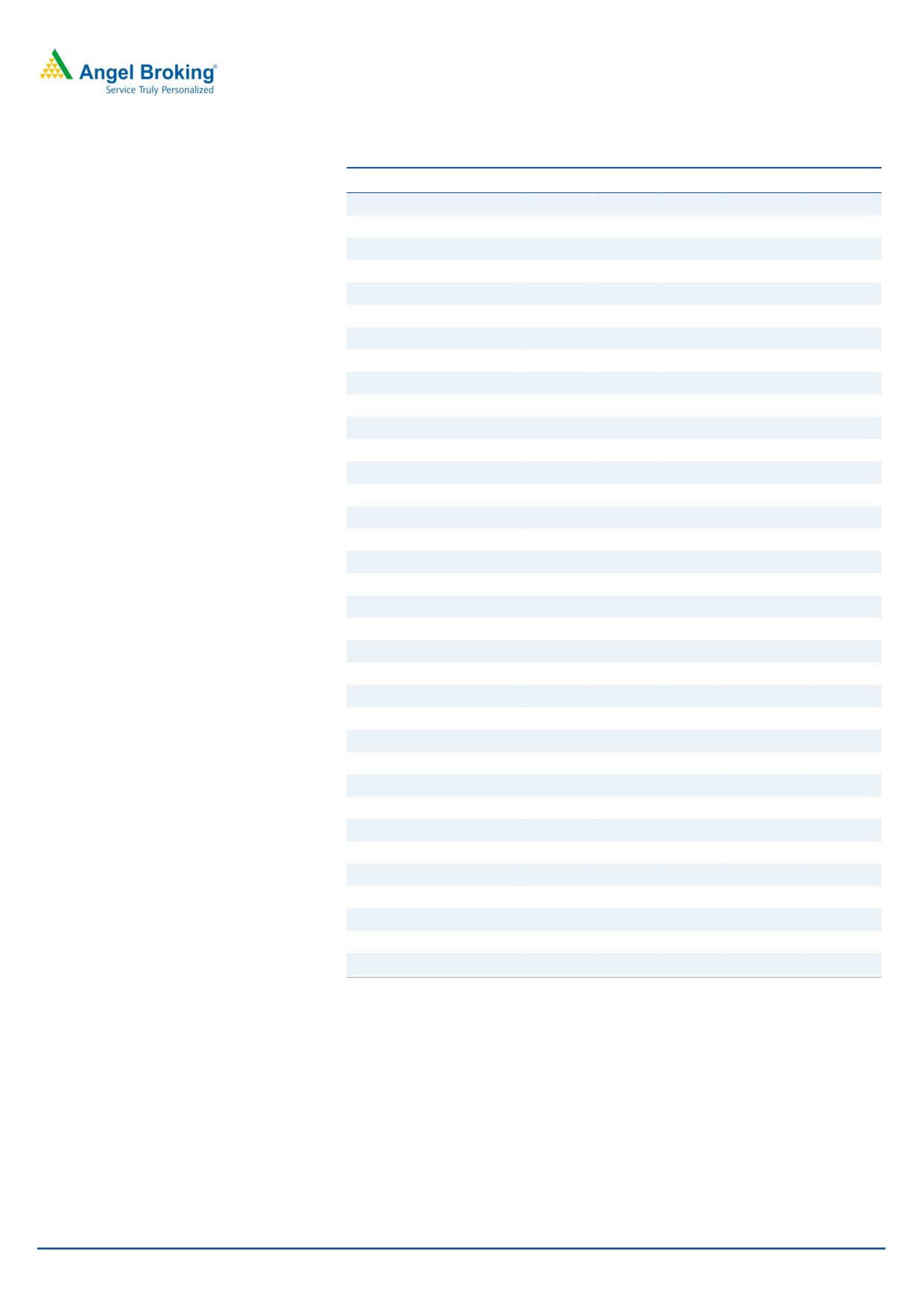

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

Net Sales

411

503

502

546

608

% chg

13.9

22.1

(0.1)

8.8

11.3

Adj. Net Profit

28

51

50

50

59

Source: Company, Angel Research

% chg

14.8

80.0

(0.9)

(0.6)

18.1

OPM (%)

19.2

22.0

21.5

20.4

20.7

EPS (`)

23.3

41.9

41.5

41.3

48.7

P/E (x)

19.6

10.9

11.0

11.1

9.4

P/BV (x)

2.8

2.3

2.0

1.7

1.5

RoE (%)

15.3

23.3

19.4

16.6

17.0

RoCE (%)

12.9

19.4

15.7

14.0

15.7

Milan Desai

EV/Sales (x)

1.6

1.3

1.3

1.1

0.9

022-40003600 Ext: 6846

EV/EBITDA (x)

8.6

5.9

5.9

5.6

4.5

Source: Company, Angel Research; CMP as on May 12, 2016

Please refer to important disclosures at the end of this report

1

M M Forgings | 4QFY2016 Result Update

Exhibit 1: 2QFY2016 performance

Y/E March (` cr)

4QFY16

4QFY15

% chg. (yoy)

3QFY16

% chg. (qoq)

FY2016

FY2015

% chg

Net Sales

124

127

(1.7)

126

(1.1)

502

503

(0.1)

Net raw material

55

47

16.0

57

(3.0)

209

207

1.1

(% of Sales)

44.2

37.4

674bp

45.0

(86)bp

41.7

41.2

Employee Cost

13

14

(6.3)

13

0.6

55

48

14.2

(% of Sales)

10.8

11.3

(54)bp

10.6

18bp

11.0

9.6

Power, Oil & Fuel

11

13

(18.8)

10

6.4

47

49

(3.4)

(% of Sales)

8.5

10.3

(180)bp

7.9

60bp

9.4

9.8

Other Expenses

20

25

(20.5)

18

9.2

83

87

(5.6)

(% of Sales)

16.0

19.8

(380)bp

14.5

152bp

16.4

17.4

Total Expenditure

99

100

(0.9)

98

0.7

394

392

0.6

Operating Profit

26

27

(4.5)

28

(7.6)

108

111

(2)

OPM (%)

20.5

21.1

(60)bp

22.0

(145)bp

21.5

22.0

(54)bp

Interest

2

2

(5.6)

2

24.0

8

9

(9.0)

Depreciation

8.8

8.4

5.2

9

(2.1)

36

35

1.2

Other Income

1.9

1.0

90.4

1

68.3

5

2

125.1

PBT

17

17

(3.6)

18

(8.5)

69

69

0.9

(% of Sales)

13.3

13.6

14.4

13.8

13.7

Tax

6

6

(7.7)

5

11.8

19

18

6.0

(% of PBT)

34.0

35.5

27.8

27.7

26.4

Reported PAT

11

11

(1.3)

13

(16.3)

50

51

(0.9)

Extraordinary Expense/(Inc.)

0.0

0

-

0

0

Adjusted PAT

11

11

(1.3)

13

(16.3)

50

51

(0.9)

PATM

8.8

8.8

10.4

10.0

10.1

Source: Company, Angel Research

Exhibit 2: Actual vs. Angel estimates (4QFY2016)

Actual (` cr)

Estimate (` cr)

Var (%)

Total Income

124

129

(3.3)

EBIDTA

26

27

(5.5)

EBIDTA margin (%)

20.5

21.0

(49)

Adjusted PAT

11

12

(10.7)

Source: Company, Angel Research

Numbers marginally below our expectation

The company’s numbers for 4QFY2016 have come in marginally below our

estimates. The top-line for the quarter de-grew by 1.7% yoy to `124cr. The same is

below our estimate of `129cr as we reckon towards the company having witnessed

a marginal decline in volume, ie in the range of ~2% in FY2016. The raw material

cost increased by 674bp yoy to 44.2% of sales which could be attributed to the

current rebound in metal prices. However, employee, power, and other expenses

declined by 54bp yoy, 180bp yoy and 380bp yoy to 10.8%, 8.5% and 16.0% of

sales, respectively. EBITDA declined by 4.5% yoy to `26cr while EBITDA margin

declined marginally by 60bp yoy to 20.5% (against our estimate of 21.0%).

Further, interest and depreciation expenses for the quarter stood more or less flat in

absolute terms on a yoy basis and other income increased by 90.4% yoy to `1.9cr.

May 13, 2016

2

M M Forgings | 4QFY2016 Result Update

Consequently, the net profit declined by

1.3% yoy to

`11cr vis-à-vis our

expectation of `12cr.

Investment arguments

Ongoing capacity expansion to help cater to improvement in

global demand over the long run

The company has been continuously increasing its capacity over the last two years

and its current capacity stands at 53,000MT, up from 46,000MT in FY2015 and

40,000MT in FY2014. The company intends to scale up its capacity to ~65,000MT

by the end of FY2017. The company caters mainly to global markets with focus on

the CV industry. It derives ~30% of its revenues from the US, ~30% from Europe,

~30% from the domestic market, and the balance from other North American

markets. In line with the Management’s earlier guidance, the US as well as Europe

have witnessed good growth rates for CV sales in CY2015. US CV sales as per

OICA grew by 12.8% yoy and European CV sales grew by 7.7% yoy in CY2015.

We expect growth in the US CV industry to be flat in CY2016 while we expect the

European CV industry to maintain its growth rate of ~7% for the year on the back

of higher growth in countries like Spain and other Eastern European markets. We

expect the company to face some margin pressure on account of pricing

constraints and have accordingly revised our estimates downwards. Also we

believe that it’s unlikely that the company would be fully able to utilize its extended

capacity in the near term.

However, we expect global growth to inch upwards from hereon, thereby enabling

the company to utilize its extended capacity more efficiently from a medium to

longer term perspective.

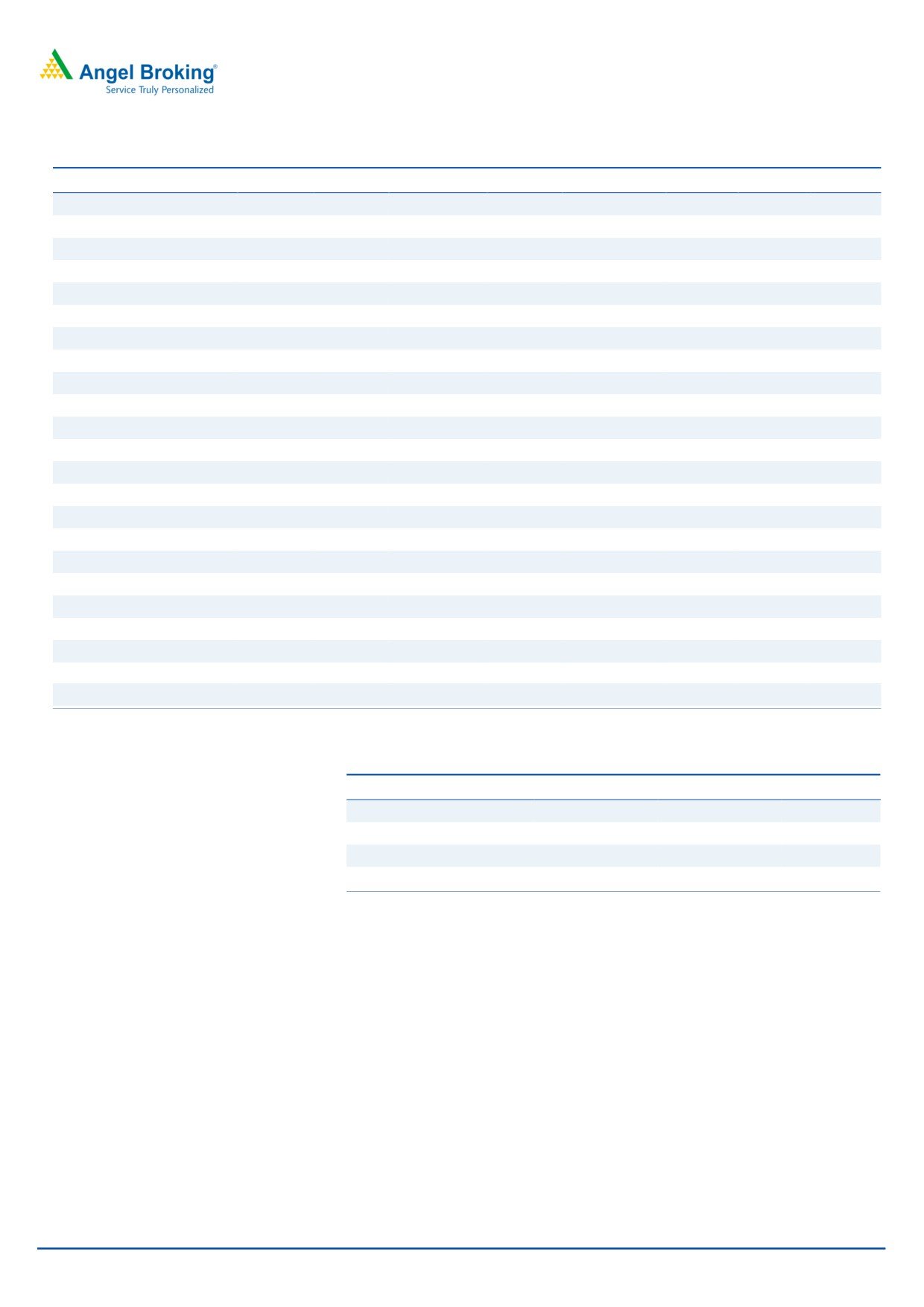

Exhibit 3: US & Europe CV Sales Growth

Exhibit 4: Geographical Revenue Mix

25.0

18.0

13.3

12.8

Europe, 30%

15.0

8.5

10.0

N. America

5.7

(non US), 10%

5.0

13.4

11.4

7.7

(5.0)

1.3

(3.9)

(2.9)

(15.0)

(22.7)

(25.0)

(33.2)

(35.0)

India, 30%

USA, 30%

AMERICA

EUROPE

Source: OICA, Angel Research

Source: Company, Angel Research

Favorable outlook for domestic CV industry

The Indian CV industry reported 11.5% growth in FY2016 after de-growth of 2.8%

in FY2015. The growth was mainly led by 29.9% yoy growth in MHCV sales during

the year while LCV sales remained flat. MHCV sales have been stellar over the past

two years while the sharp de-growth in LCVs witnessed in FY2014 and FY2015 got

arrested with the segment managing to post flat volumes in FY2016. Going

forward, MHCVs are expected to post good volume growth; SIAM estimates

May 13, 2016

3

M M Forgings | 4QFY2016 Result Update

suggest a 12-15% growth for FY2017 for the segment. Additionally, the growth is

expected to be steady on account of pre-buying ahead of the implementation of

Bharat Stage (BS) IV emission norms from April 2017. As for LCVs, volumes are

expected to grow in excess of 8% on account of better availability of load from the

consumer goods segment.

This positive outlook for the overall domestic CV industry along with stable growth

rates for passenger vehicles will enable the company to register good volumes

even in the eventuality of export volumes possibly facing contraction.

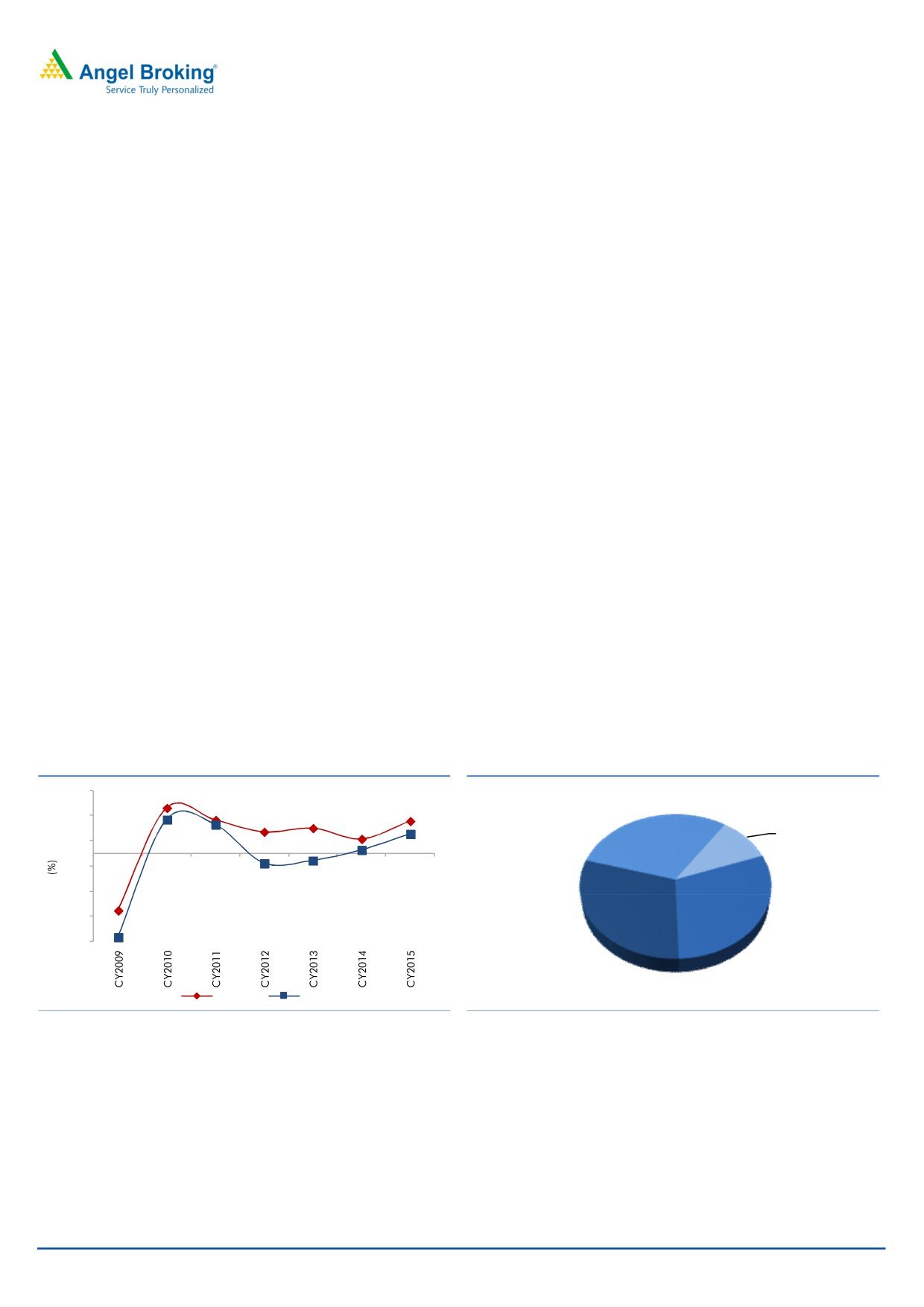

Exhibit 5: Domestic CV and Passenger Sales

50.0

Passanger Car

MHCV

LCV

40.0

29.9

30.0

20.0

8.0

10.0

-

(10.0)

0.3

(20.0)

(30.0)

(40.0)

Source: SIAM, Angel Research

Financials

Revenue to grow at 10.0% over FY2016-18E

After posting robust revenue CAGR of 25% over FY2010-15, the company

witnessed a marginal decline of 0.1% yoy in FY2016 revenues which we believe is

on account of slight drop in volumes. Going forward, we expect some deceleration

in growth in the global CV industry; however, we expect the same to be offset by

strong growth in the domestic CV industry, which should thus enable an

improvement in the company’s volumes in FY2017. Additionally, a rebound in

commodity prices should also result in higher realizations. We expect the top-line

to post a CAGR of 10% over FY2016-18E.

May 13, 2016

4

M M Forgings | 4QFY2016 Result Update

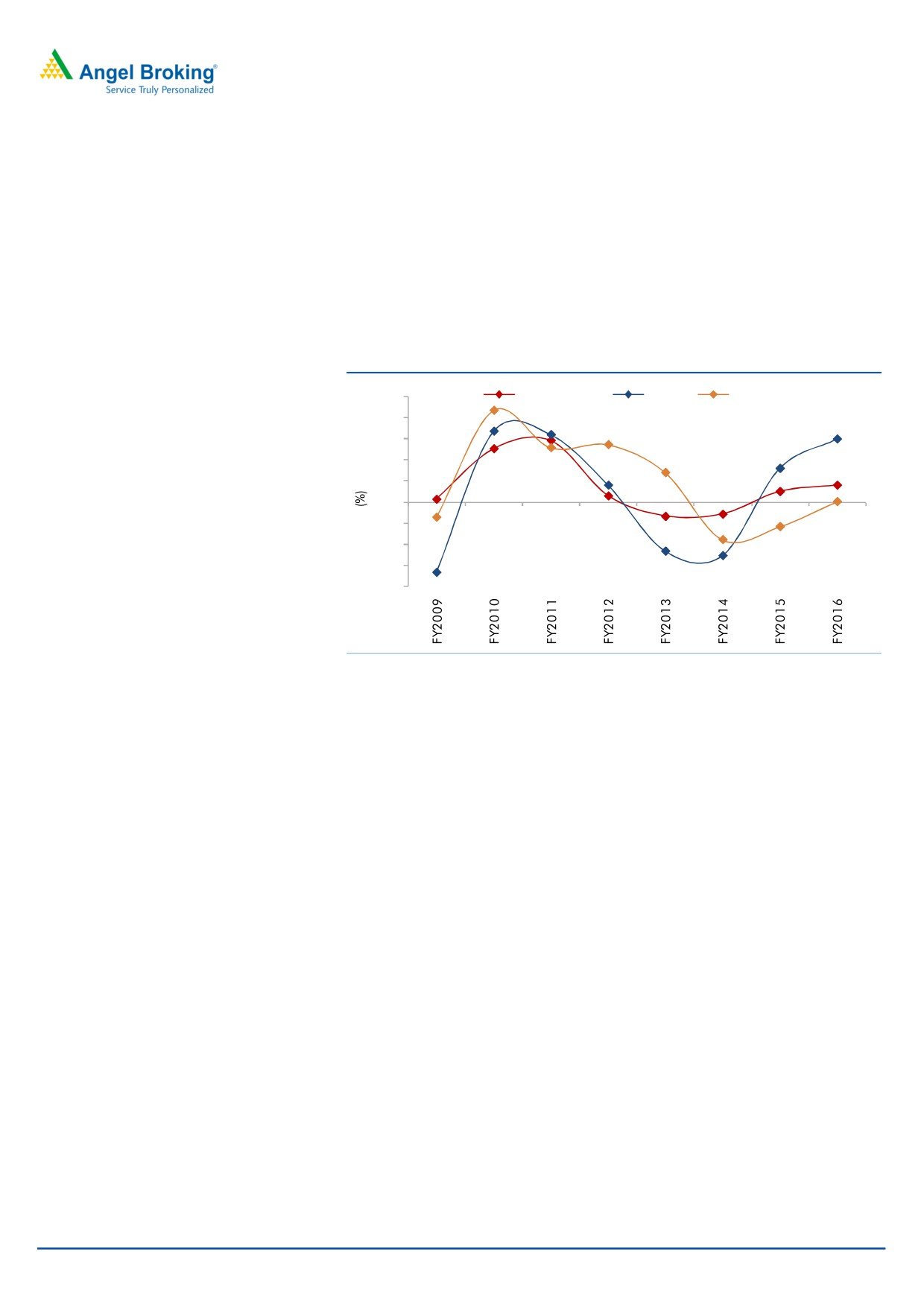

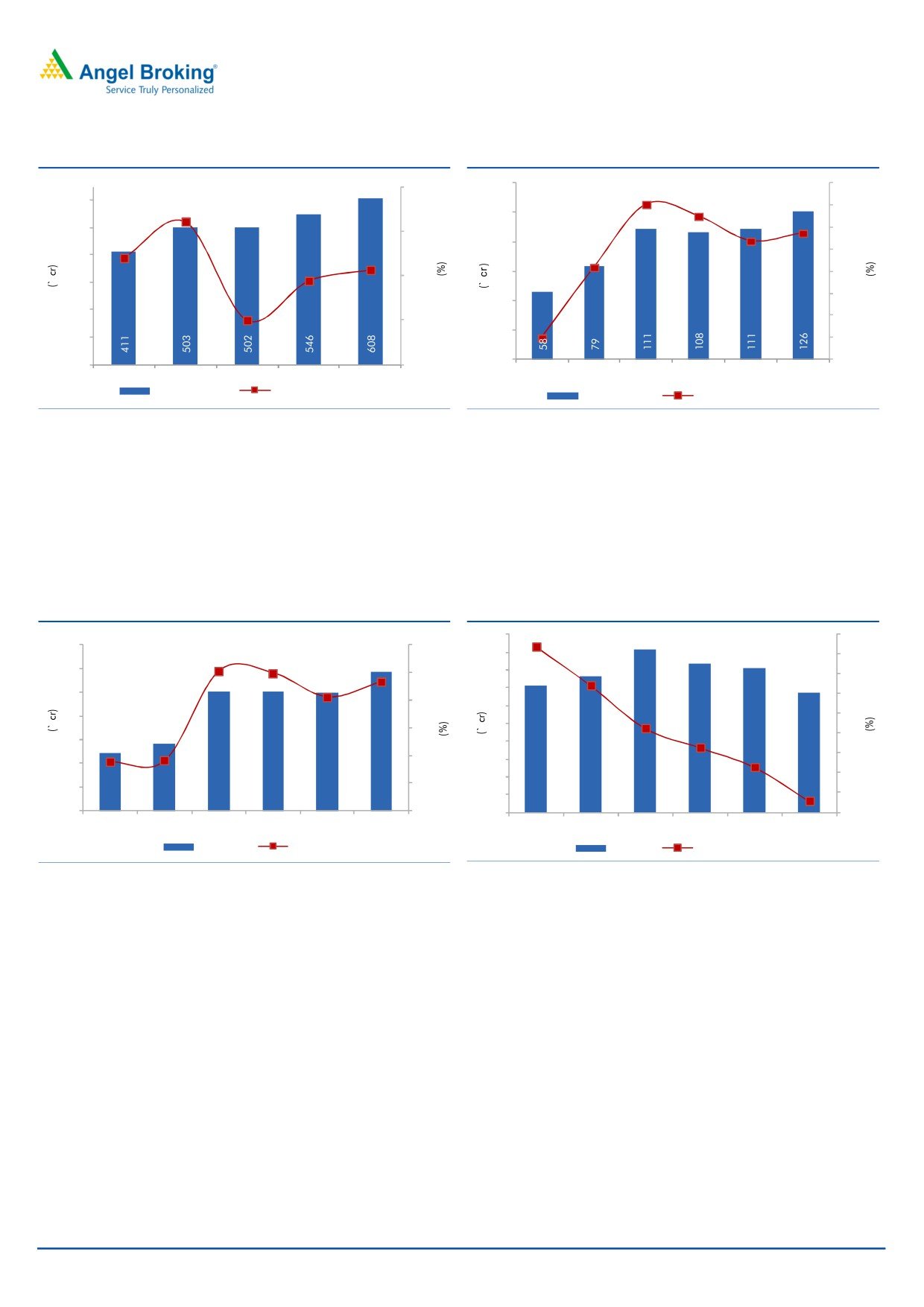

Exhibit 6: Revenue CAGR of 10% over FY2016-18E

Exhibit 7: EBITDA margin to witness contraction

30.0

150

22.0

23.0

600

21.5

22.0

125

20.4

500

22.1

21.0

20.0

20.7

100

19.2

20.0

13.9

400

11.

3

8.8

75

19.0

10.0

300

18.0

50

200

17.0

-

25

100

(0.1)

16.0

16.0

-

15.0

-

(10.0)

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E

FY2014

FY2015

FY2016

FY2017E

FY2018E

Revenue (LHS)

Revenue growth (RHS)

EBITDA (LHS)

EBITDA Margin (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

With the demand from US expected to remain flat, we expect pricing pressure to

impact margins to a certain extent. Margins will also be impacted on account of

higher contribution from the relatively lower margin yielding domestic market

given that the demand outlook for the Indian CV industry looks favorable. We

expect EBITDA margin to witness 112bp yoy contraction in FY2017 to 20.4% and

improve to 20.7% in FY2018.

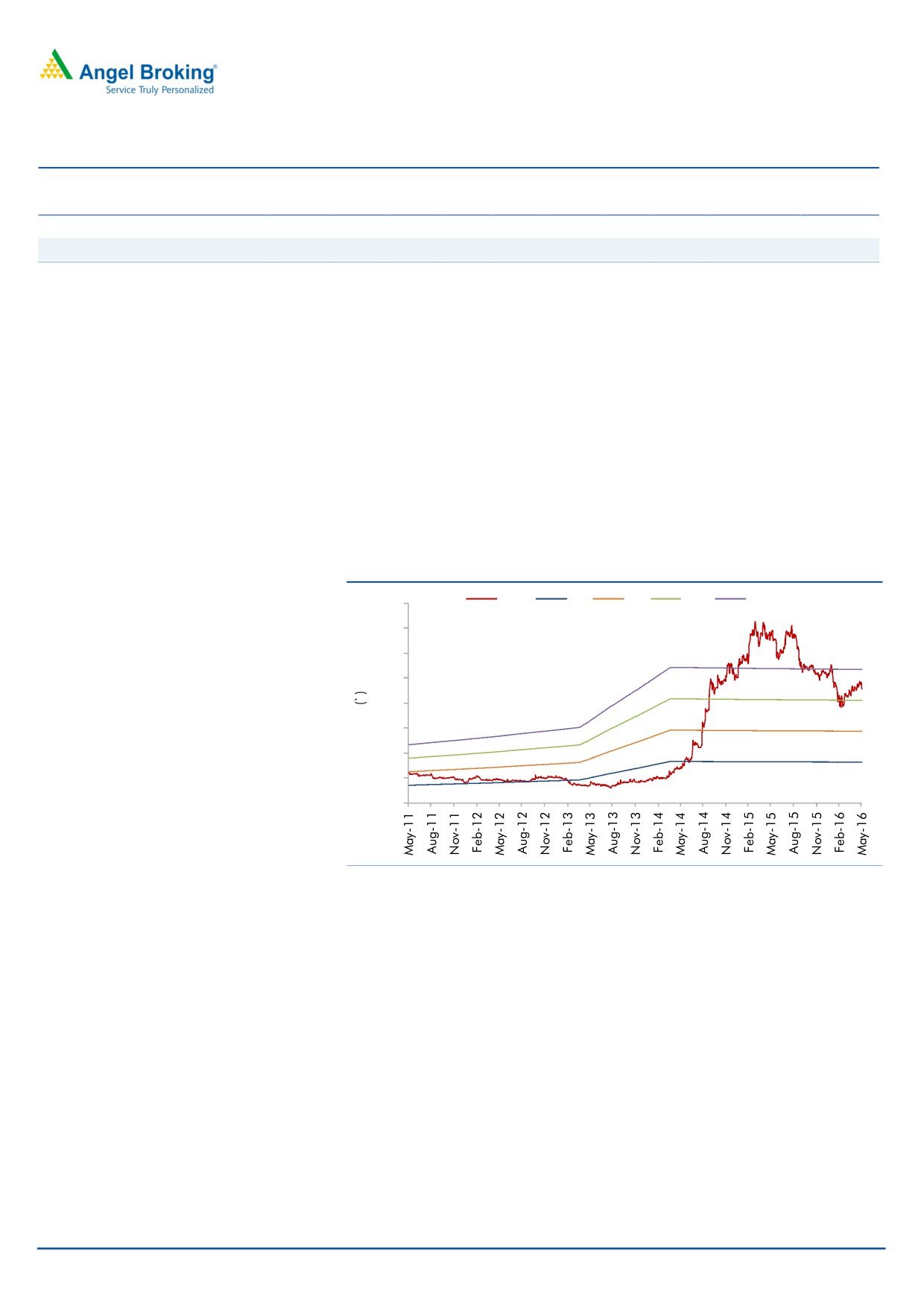

Exhibit 8: PATM to improve

Exhibit 9: Net debt to equity to decrease

10

0.8

0.9

70

10.0

11.0

10.1

9

0.8

9.7

60

10.0

8

0.6

0.7

9.1

7

50

0.6

9.0

6

40

0.5

6.8

5

8.0

0.4

0.4

30

6.8

4

0.3

7.0

0.3

3

20

0.2

2

0.2

6.0

10

1

0.1

24

28

51

50

50

59

7

8

9

8

8

7

0.1

-

5.0

-

-

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E

FY2013

FY2014

FY2015

FY2016

FY2017E FY2018E

PAT (LHS)

PATM (RHS)

Interest

Net debt to equity

Source: Company, Angel Research

Source: Company, Angel Research

On account of lower margins and higher depreciation, the bottom-line is expected

to remain flat in FY2017 and improve in FY2018 to `59cr. The company

generates healthy cash flows that should enable it to cover its capex and gradually

reduce its debt over FY2016-18. We expect the net debt to equity to come down

from 0.3x level in FY2016 to 0.1x in FY2018.

May 13, 2016

5

M M Forgings | 4QFY2016 Result Update

Exhibit 10: Relative valuation (Trailing twelve months)

Mcap Sales OPM

PAT

EPS

RoIC

P/E

P/BV

EV/EBITDA

EV/

Company

(` cr)

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

Sales (x)

M M Forgings

550

502

21.5

50

41.0

20.7

11.1

2.0

5.7

1.2

Ramkrishna Forgings

1,058

913

19.9

78

28.5

10.7

13.5

2.3

10.2

2.0

Source: Company, Angel Research;

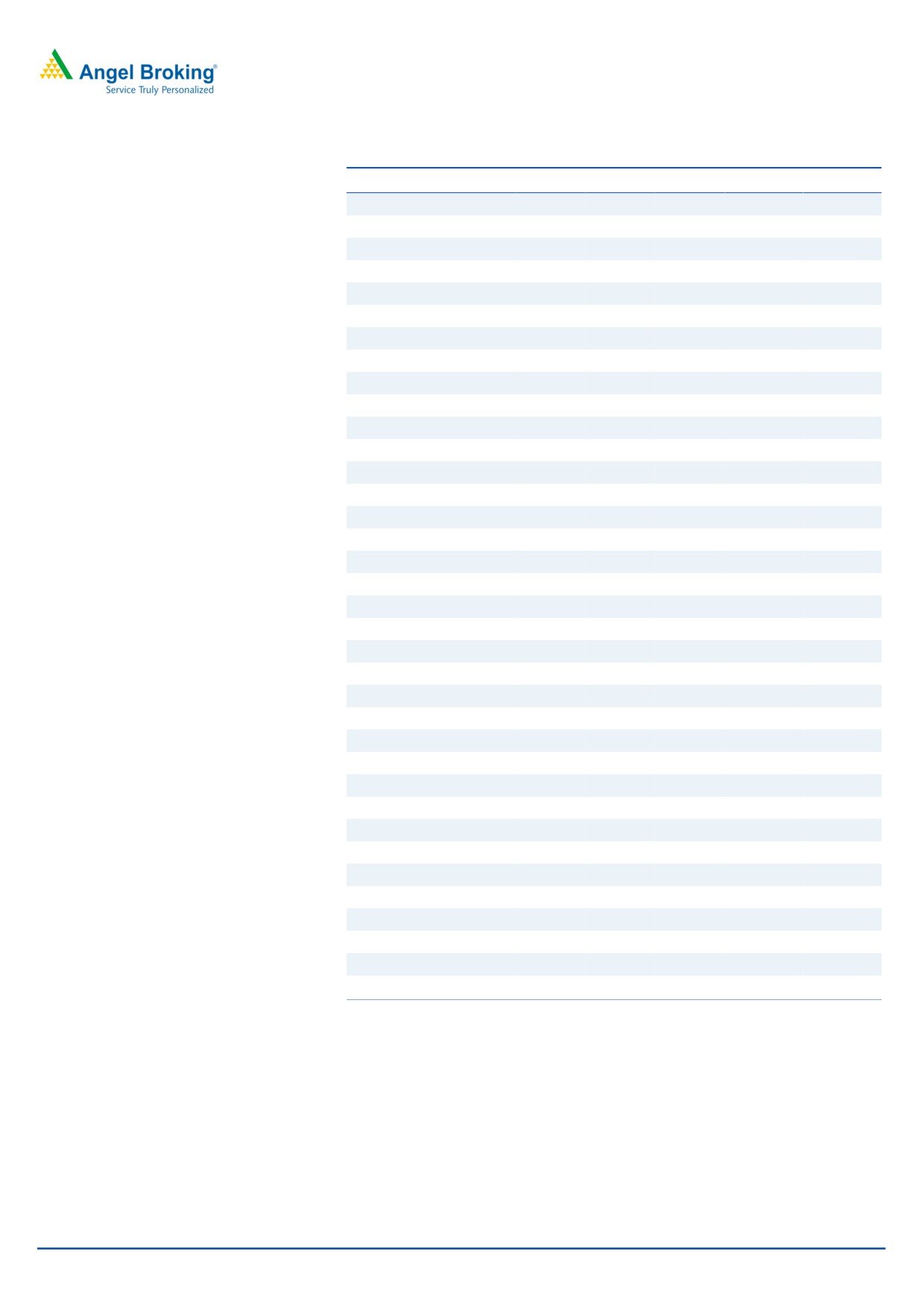

Outlook and valuation: Considering flattish CV growth in the US (although stable

growth in domestic and European CV sales), we have lowered our revenue

expectation for FY2017 and expect improvement only in FY2018. We expect MMFL

to register a revenue CAGR of 10% over FY2016-18E to `608cr. The company’s

EBITDA margin is expected to witness contraction in FY2017 on account of pricing

pressure and higher contribution from the relatively lower-margin domestic

market, but improve thereon to 20.7% in FY2018. The net profit as a result is

expected to remain flat in FY2017 and improve to `59cr in FY2018. At the current

market price, the company is trading at a P/E of 9.4x its FY2018E earnings. We

have a Buy rating on the stock with a target price of `536 based on a target P/E of

11.0x its FY2018E earnings.

Exhibit 11: One-year forward P/E band

Price

4x

7x

10x

13x

800

700

600

500

400

300

200

100

-

Source: Company, Angel Research

Concerns

De-growth in US and European CV industry: Any sharp decline in US CV industry

volumes in CY2016 contrary to our estimation of flat volume performance can

have a negative impact on the company’s performance.

Adverse movement in currency: Rupee depreciation is an added advantage for the

company. In case of any appreciation, the revenue of the company will be

adversely affected.

Fluctuations in steel price: Any substantial fluctuation in the price of steel can lead

to margin compression for the company.

May 13, 2016

6

M M Forgings | 4QFY2016 Result Update

Company background

MM Forgings (MMFL) was incorporated in 1946 as Madras Motors Ltd. and was

renamed MM Forgings Ltd. in the year 1993.. It manufactures steel forgings in

raw, semi-machined and fully machined stages in various grades of carbon, alloy,

micro-alloy and stainless steels in the weight range of 0.20Kg to 60Kg. The

company caters to the forging requirements of almost all sections of the industry -

automotive, valve and oil-filed, engineering and off highway.

The company’s manufacturing plants are located at Singampunari-Pasumpon

Muthuramalingam District, Viralimalai-Pudukkottai District and Karainaithangal

Village- Kanchipuram District, all in Tamil Nadu. The company has its Wind Farm

at Panakudi Village- Tirunelveli District and at Meenakshipuram, Theni District and

the power generated is utilised for captive use.

May 13, 2016

7

M M Forgings | 4QFY2016 Result Update

Profit and loss statement

Y/E Mar. (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

Net Sales

411

503

502

546

608

Other operating income

-

-

-

-

-

Total operating income

411

503

502

546

608

% chg

13.9

22.1

(0.1)

8.8

11.3

Net Raw Materials

176

207

209

234

260

% chg

14.4

17.3

1.1

11.9

11.2

Power and Fuel

44

49

47

51

57

% chg

(5.0)

12.1

(3.4)

7.7

11.3

Personnel

39

48

55

60

66

% chg

25.1

24.9

14.2

9.0

10.0

Other

74

87

83

90

99

% chg

2.0

18.8

(5.6)

9.0

10.0

Total Expenditure

332

392

394

435

482

EBITDA

79

111

108

111

126

% chg

36.6

40.3

(2.5)

3.1

13.2

(% of Net Sales)

19.2

22.0

21.5

20.4

20.7

Depreciation

36

35

36

41

45

EBIT

43

75

72

70

81

% chg

17.1

75.7

(4.2)

(2.5)

14.6

(% of Net Sales)

10.4

15.0

14.4

12.9

13.3

Interest & other Charges

8

9

8

8

7

Other Income

3

2

5

6

7

(% of Net Sales)

0.8

0.5

1.1

1.1

1.1

Recurring PBT

35

66

64

62

74

% chg

19.5

87.9

(3.6)

(2.5)

18.7

PBT (reported)

38

69

69

68

81

Tax

9

18

19

18

22

(% of PBT)

23.7

26.4

27.7

27.0

27.0

PAT (reported)

29

51

50

50

59

Extraordinary Expense/(Inc.)

1

0

0

0

0

ADJ. PAT

28

51

50

50

59

% chg

14.8

80.0

(0.9)

(0.6)

18.1

(% of Net Sales)

6.8

10.1

10.0

9.1

9.7

Basic EPS (`)

23.3

41.9

41.5

41.3

48.7

Fully Diluted EPS (`)

23.3

41.9

41.5

41.3

48.7

% chg

14.8

80.0

(0.9)

(0.6)

18.1

May 13, 2016

8

M M Forgings | 4QFY2016 Result Update

Balance sheet

Y/E Mar. (` cr)

FY2014

FY2015

FY2016E

FY2017E

FY2018E

SOURCES OF FUNDS

Equity Share Capital

12

12

12

12

12

Reserves& Surplus

184

226

268

309

359

Shareholders’ Funds

196

238

280

321

371

Total Loans

151

190

213

191

144

Other Long Term Liabilities

1

1

0

0

0

Long Term Provisions

0

0

0

0

0

Deferred Tax (Net)

11

12

14

14

14

Total liabilities

359

441

506

526

529

APPLICATION OF FUNDS

Gross Block

438

499

551

651

683

Less: Acc. Depreciation

238

273

309

350

396

Net Block

200

225

242

301

287

Capital Work-in-Progress

7

11

50

5

6

Goodwill

-

-

-

-

-

Investments

0

0

0

0

0

Long Term Loans and adv.

16

15

6

6

7

Other Non-current asset

4

4

3

4

4

Current Assets

151

218

237

246

265

Cash

25

89

121

118

122

Loans & Advances

20

21

28

30

33

Inventory

76

79

73

76

84

Debtors

29

29

15

22

25

Other current assets

0

0

0

0

0

Current liabilities

19

32

31

36

40

Net Current Assets

132

186

205

211

225

Misc. Exp. not written off

-

-

-

-

-

Total Assets

359

441

506

526

529

May 13, 2016

9

M M Forgings | 4QFY2016 Result Update

Cash flow statement

Y/E Mar. (` cr)

FY2014 FY2015 FY2016 FY2017E FY2018E

Profit before tax

38

69

69

68

81

Depreciation

36

35

36

41

45

Change in Working Capital

4

10

12

(8)

(10)

Direct taxes paid

(9)

(17)

(18)

(18)

(22)

Others

(34)

9

(5)

(6)

(7)

Cash Flow from Operations

35

106

94

77

87

(Inc.)/Dec. in Fixed Assets

(43)

(65)

(91)

(55)

(33)

(Inc.)/Dec. in Investments

-

-

(0)

-

-

(Incr)/Decr In LT loans & adv.

(3)

2

10

(1)

(1)

Others

6

0

5

6

7

Cash Flow from Investing

(40)

(63)

(76)

(50)

(27)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

6

39

22

(21)

(48)

Dividend Paid (Incl. Tax)

(6)

(8)

(8)

(8)

(8)

Others

6

(10)

-

-

-

Cash Flow from Financing

6

21

14

(30)

(56)

Inc./(Dec.) in Cash

1

64

32

(3)

4

Opening Cash balances

24

25

89

121

118

Closing Cash balances

25

89

121

118

122

May 13, 2016

10

M M Forgings | 4QFY2016 Result Update

Key ratios

Y/E Mar.

FY2014

FY2015

FY2016

FY2017E

FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

19.6

10.9

11.0

11.1

9.4

P/CEPS

8.6

6.4

6.4

6.1

5.3

P/BV

2.8

2.3

2.0

1.7

1.5

EV/Net sales

1.6

1.3

1.3

1.1

0.9

EV/EBITDA

8.6

5.9

5.9

5.6

4.5

EV / Total Assets

1.9

1.5

1.3

1.2

1.1

Per Share Data (`)

EPS (Basic)

23.3

41.9

41.5

41.3

48.7

EPS (fully diluted)

23.3

41.9

41.5

41.3

48.7

Cash EPS

53.1

71.2

71.2

75.2

86.4

DPS

4.0

6.0

6.0

6.0

6.0

Book Value

162.2

197.1

231.6

265.9

307.7

DuPont Analysis

EBIT margin

10.4

15.0

14.4

12.9

13.3

Tax retention ratio

0.8

0.7

0.7

0.7

0.7

Asset turnover (x)

1.3

1.6

1.5

1.5

1.6

ROIC (Post-tax)

10.4

17.2

16.1

14.5

15.2

Cost of Debt (Post Tax)

3.9

3.9

3.0

2.9

2.9

Leverage (x)

0.6

0.4

0.3

0.2

0.1

Operating ROE

14.6

22.9

20.3

17.1

15.9

Returns (%)

ROCE (Pre-tax)

12.9

19.4

15.7

14.0

15.7

Angel ROIC (Pre-tax)

13.7

23.4

22.2

19.8

20.8

ROE

15.3

23.3

19.4

16.6

17.0

Turnover ratios (x)

Asset TO (Gross Block)

1.0

1.1

1.0

0.9

0.9

Inventory / Net sales (days)

65

56

55

50

48

Receivables (days)

28

21

16

15

15

Payables (days)

29

24

29

30

30

WC cycle (ex-cash) (days)

96

74

66

59

59

Solvency ratios (x)

Net debt to equity

0.6

0.4

0.3

0.2

0.1

Net debt to EBITDA

1.6

0.9

0.8

0.7

0.2

Int. Coverage (EBIT/ Int.)

5.6

8.2

8.7

8.7

12.0

May 13, 2016

11

M M Forgings | 4QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

M M Forgings

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

May 13, 2016

12