IPO Note | Metal

Mar 19, 2018

MISHRA DHATU NIGAM Ltd.

NEUTRAL

sue Open: Mar 21, 2018

Is

Issue Close: Mar 23, 2018

Incorporated in 1973, with an aim of achieving self-reliance in research and

development, and supply of critical alloys and products of national security, Mishra

Issue Details

Dhatu Nigam Ltd. (MIDHANI) is one of the leading manufacturers of special steels,

super alloys and the only manufacturer of titanium alloys in India. These are high

Face Value: `10

value products which cater to niche end user segments such as defence, space and

Present Eq. Paid up Capital: `187.3cr

power.

Positives: (a) Modern and integrated metallurgical plant for manufacturing a wide

Fresh issue: Nil

spectrum of critical alloys in variety of forms for defence, space and thermal power

Post Eq. Paid up Capital: `187.3cr

(b) Strong long-term customer relationships (c) In-house R&D team aimed at latest

development and improvement of product quality and processes innovation (d)

Issue size (amount): `438cr

Experienced Promoters supported by professionally qualified, experienced and

entrepreneurial management team.

Price Band: `87-90

Investment concerns: (a) MIDHANI reported low top-line and bottom-line CAGR of

Lot Size: 150 shares and in multiple

11% & 10% respectively over FY15-17 (b) Company has an order book of `517cr

thereafter

which works out to 0.64x compared to FY2017 revenue, reflecting low revenue

Post-issue implied mkt. cap: *`1630cr -

visibility (c) During 1HFY18, the company has reported very low operating margin

**`1686cr

and profitability.

Promoters holding Pre-Issue: 100.0%

Outlook & Valuation: In terms of valuations, the pre-issue P/E works out to 30.9x

Promoters holding Post-Issue: 74.0%

1HFY2018 annualized earnings (at the upper end of the issue price band), which is

*Calculated on lower price band

high considering MIDHANI’s historical two year CAGR top-line & bottom-line

growth. Further, MIDHANI has an undersized order book which lacks revenue

** Calculated on upper price band

visibility, coupled with lower return ratios. Considering the above factors, we

Book Building

recommend NEUTRAL rating on the issue.

QIBs

50% of issue

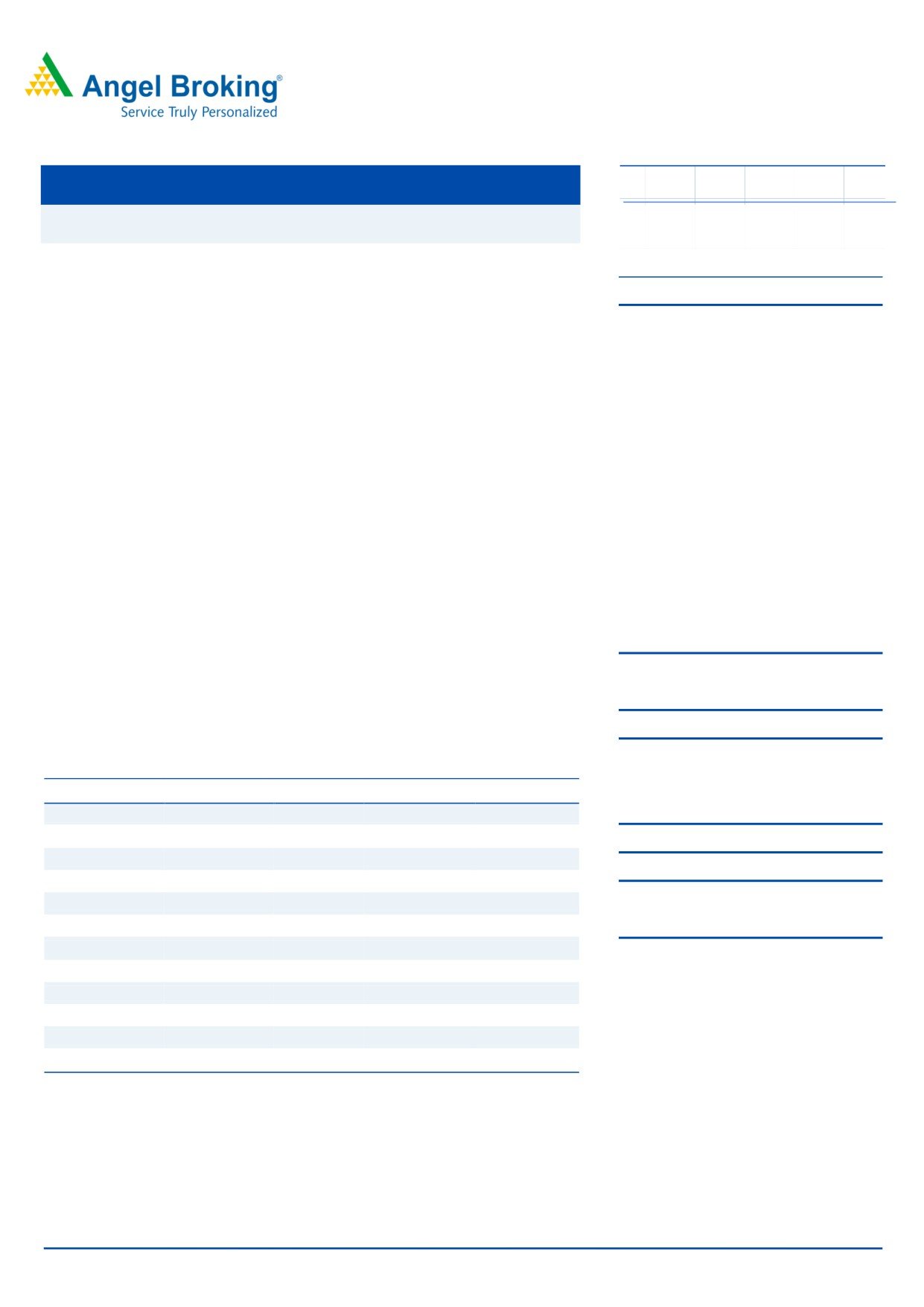

Key Financials

Non-Institutional

15% of issue

Y/E March (` cr)

FY2015

FY2016

FY2017

1HFY18

Net Sales

656

761

810

208

Retail

35% of issue

% chg

-

16.1

6.3

-

Net Profit

104

119

126

27

Post Issue Shareholding Patter

% chg

-

15.2

5.8

-

Promoters

74.0%

OPM (%)

20.6

19.8

22.9

21.7

EPS (`)

5.5

6.4

6.7

1.5

Others

26.0%

P/E (x)

16.3

14.1

13.3

-

P/BV (x)

3.1

2.7

2.4

-

RoE (%)

19.2

19.3

17.9

-

RoCE (%)

21.0

21.8

23.3

-

EV/Sales (x)

2.5

2.0

1.8

-

EV/EBITDA (x)

12.2

9.9

8.0

-

Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end

of the price band

Amarjeet S Maurya

+022 39357600, Extn: 6831

Please refer to important disclosures at the end of this report

1

MIDHANI | IPO Note

Company background

Incorporated in 1973, with an aim of achieving self-reliance in research and

development, and supply of critical alloys and products of national security,

MIDHANI is one of the leading manufacturers of special steels, super alloys and

the only manufacturer of titanium alloys in India. These are high value products

which cater to niche end user segments such as defence, space and power.

It has emerged as a ‘National Centre for Excellence’ in advanced metallurgical

production of special metals and super alloys in India. MIDHANI has the

technological ability to manufacture a wide range of advanced metals and alloys

under one roof. With the growth of MIDHANI business and operations, it has

achieved the status of a Mini Ratna, Category-I company in 2009.

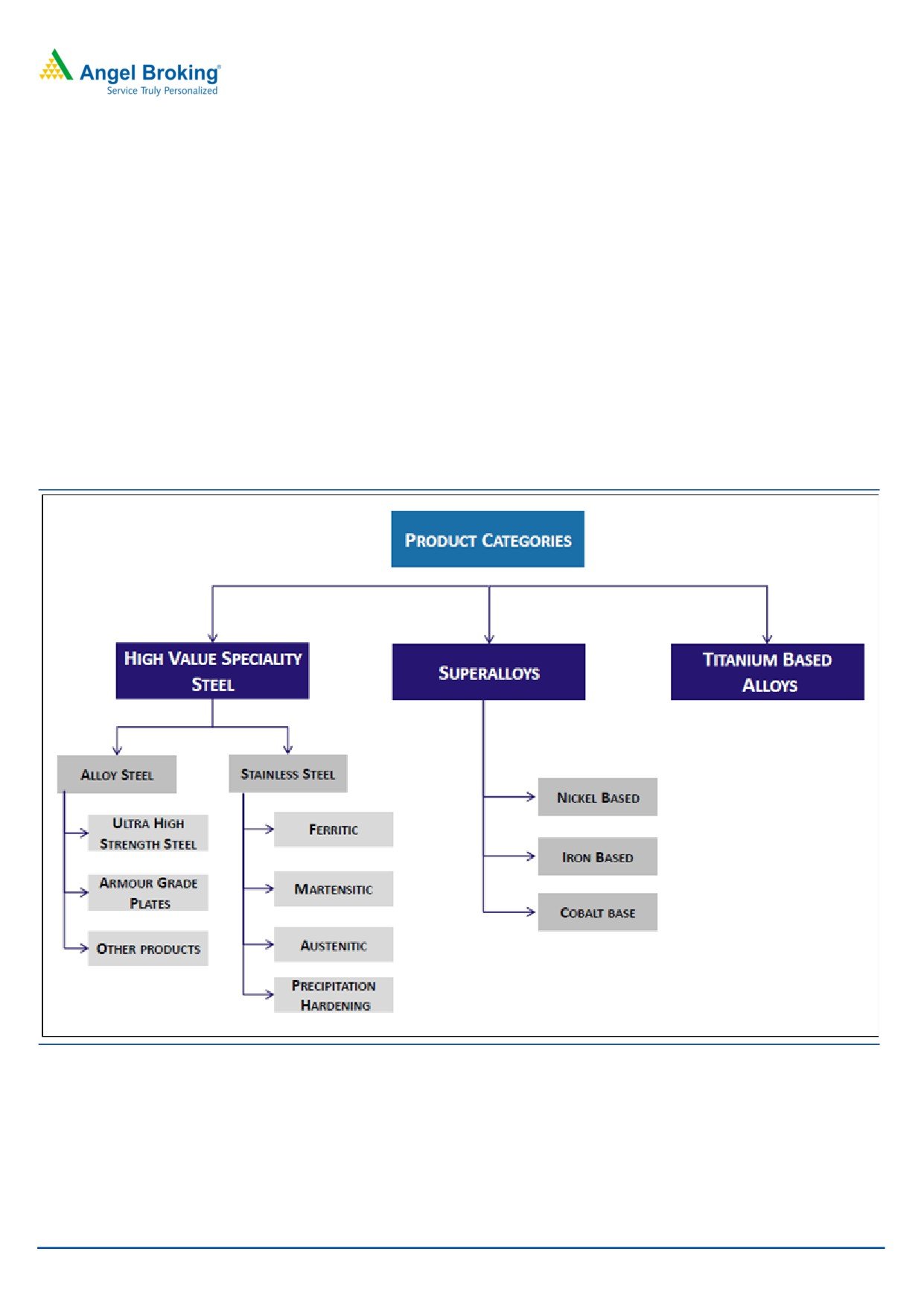

Exhibit 1: Product Portfolio

Source: Company, Angel Research

Mar 19, 2018

2

MIDHANI | IPO Note

Issue details

MIDHANI is raising ~`438cr through offer for sale of equity shares in the price

band of `87-`90. The company will dilute 26.0% (at upper price band) of its post-

offer paid-up equity share capital.

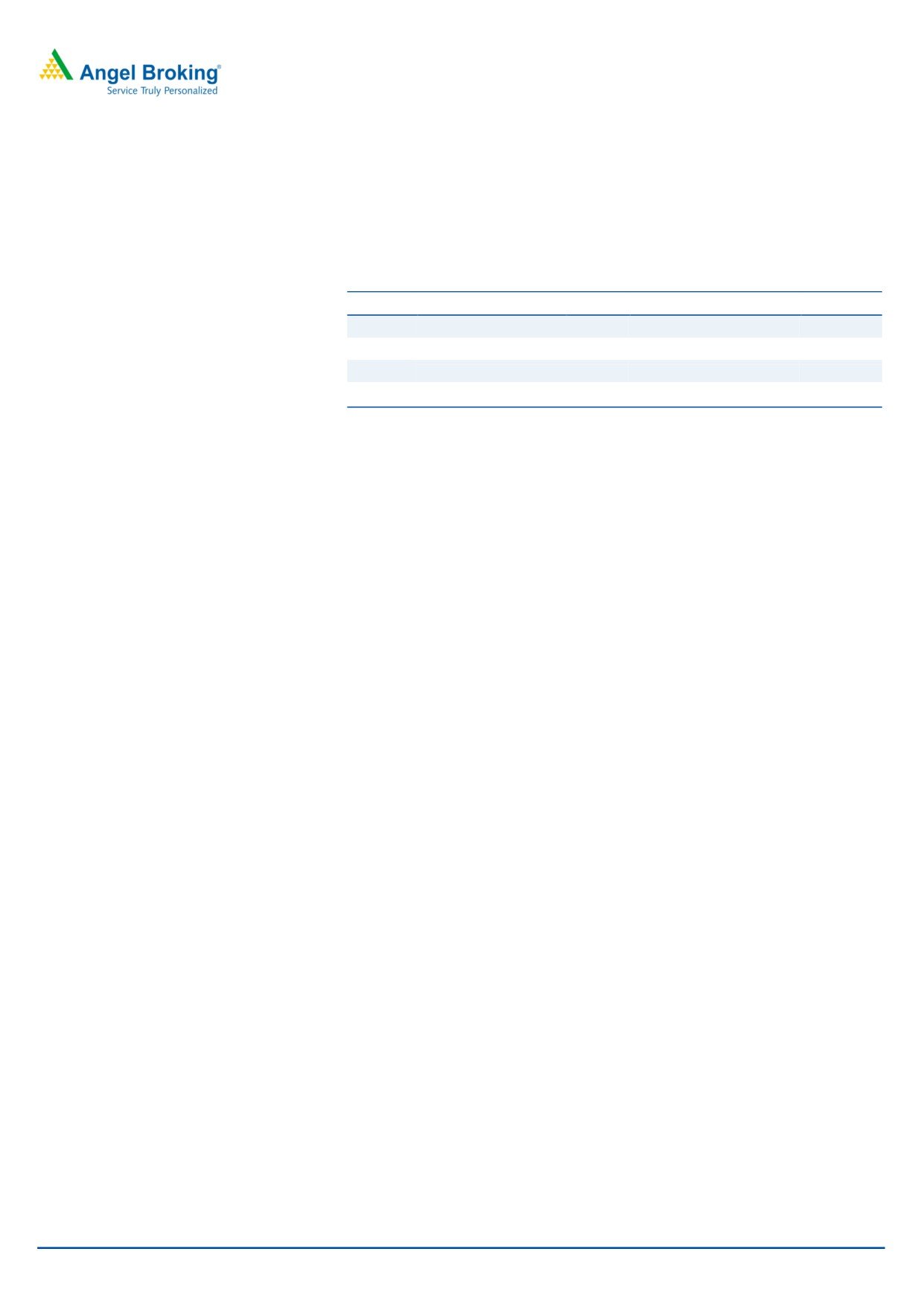

Exhibit 2: Pre and Post IPO shareholding pattern

N o of share s (Pre-issue)

% No of shares (Post-issue)

%

Promoters

18,73,40,000

100.0%

13,86,31,600

74.0%

Others

-

-

4,87,08,400

26.0%

18,73,40,000

100.0%

18,73,40,000

100.0%

Source: Source: RHP, Note: Calculated on upper price band

Note: A discount of `3 per equity share is offered to Retail Investors & Employees.

Objectives of the Offer

Company’s objectives of the offer are:

To achieve the benefits of listing the Equity Shares on the Stock Exchanges

Raising funds for general corporate purposes

Outlook & Valuation

In terms of valuations, the pre-issue P/E works out to 30.9x 1HFY2018

annualized earnings (at the upper end of the issue price band), which is high

considering MIDHANI’s historical two year CAGR top-line & bottom-line

growth. Further, MIDHANI has an undersized order book which lacks revenue

visibility, coupled with lower return ratios. Considering the above factors, we

recommend NEUTRAL rating on the issue.

Key Risks

Strong order inflow and improvement in execution cycle of current order

book could improve the company’s profitability. It will pose an upside risk

to our view.

Increase in competition from other players can impact the business of

MIDHANI.

Mar 19, 2018

3

MIDHANI | IPO Note

Income Statement

Y/E March (`cr)

FY2015

FY2016

FY2017

1HFY18

Total operating income

656

761

810

208

% chg

-

16.1

6.3

-

Total Expenditure

521

610

624

163

Raw Material

228

328

308

18

Personnel

99

91

109

49

Others Expenses

194

192

207

95

EBITDA

135

151

185

45

% chg

-

12.0

22.6

-

(% of Net Sales)

20.6

19.8

22.9

21.7

Depreciation& Amortisation

10

14

18

9

EBIT

125

137

168

36

% chg

-

9.5

22.3

-

(% of Net Sales)

19.1

18.0

20.7

17.2

Interest & other Charges

7

4

5

2

Other Income

23

29

23

13

(% of PBT)

16.1

17.9

12.5

26.8

Share in profit of Associ ates

-

-

-

-

Recurring PBT

141

162

186

47

% chg

-

15.0

15.1

-

Tax

37

42

60

20

(% of PBT)

26.4

26.2

32.2

41.9

PAT (reported)

104

119

126

27

% chg

-

15.2

5.8

-

(% of Net Sales)

15.8

15.7

15.6

13.1

Basic EPS (`)

5.5

6.4

6.7

1.5

Fully Diluted EPS (`)

5.5

6.4

6.7

1.5

% chg

-

15.2

5.8

-

Source: Company, Angel Research

Mar 19, 2018

4

MIDHANI | IPO Note

Exhibit 3: Balance Sheet

Y/E March (` cr)

FY2015

FY2016

FY2017

1HFY18

SOURCES OF FUNDS

Equity Share Capital

187

187

187

187

Reserves& Surplus

353

432

517

546

Shareholders’ Funds

540

620

704

733

Total Loans

55

9

14

66

Deferred Tax Liability

13

23

20

24

Total Liabilities

608

651

739

823

APPLICATION OF FUNDS

Net Block

298

327

357

363

Capital Work-in-Progress

9

7

6

54

Investments

2

2

2

2

Current Assets

854

785

736

810

Inventories

423

289

206

251

Sundry De btors

220

209

289

222

Cash

89

196

208

261

Loans & Advances

0

0

0

0

Other Assets

121

92

34

77

Current liabilities

555

470

362

407

Net Current Assets

298

316

374

404

Deferred Tax Asset

-

-

-

-

Total Assets

608

651

739

823

Source: Company, Angel Research

Mar 19, 2018

5

MIDHANI | IPO Note

Exhibit 4: Cash Flow Statement

Y/E March (`cr)

FY2015

FY2016

FY2017

1HFY18

Profit before tax

143

163

188

50

Depreciation

10

14

18

9

Change in Working Capital

(64)

84

(13)

22

Interest / Dividend (Net)

7

4

5

2

Direct taxes paid

(38)

(38)

(61)

(26)

Others

(11)

(11)

(17)

(9)

C ash Flow from Operati ons

47

216

119

47

(Inc.)/ Dec. in Fixed Assets

(20)

(19)

(64)

(45)

(Inc.)/ Dec. in Investments

11

(87)

(0)

(85)

C ash Flow from Inve sting

(9)

(107)

(65)

(130)

Issue of Equity

Inc./(Dec.) in loans

9

(46)

5

52

Dividend Pai d (Incl. Tax)

(45)

(40)

(43)

0

Interest / Dividend (Net)

(7)

(4)

(5)

(2)

C ash Flow from Financing

(43)

(90)

(43)

50

Inc./(Dec.) in Cash

(5)

19

12

(32)

Ope ning Cash bal ances

9

3

22

34

Closing Cash balances

3

22

34

2

Source: Company, Angel Research

Mar 19, 2018

6

MIDHANI | IPO Note

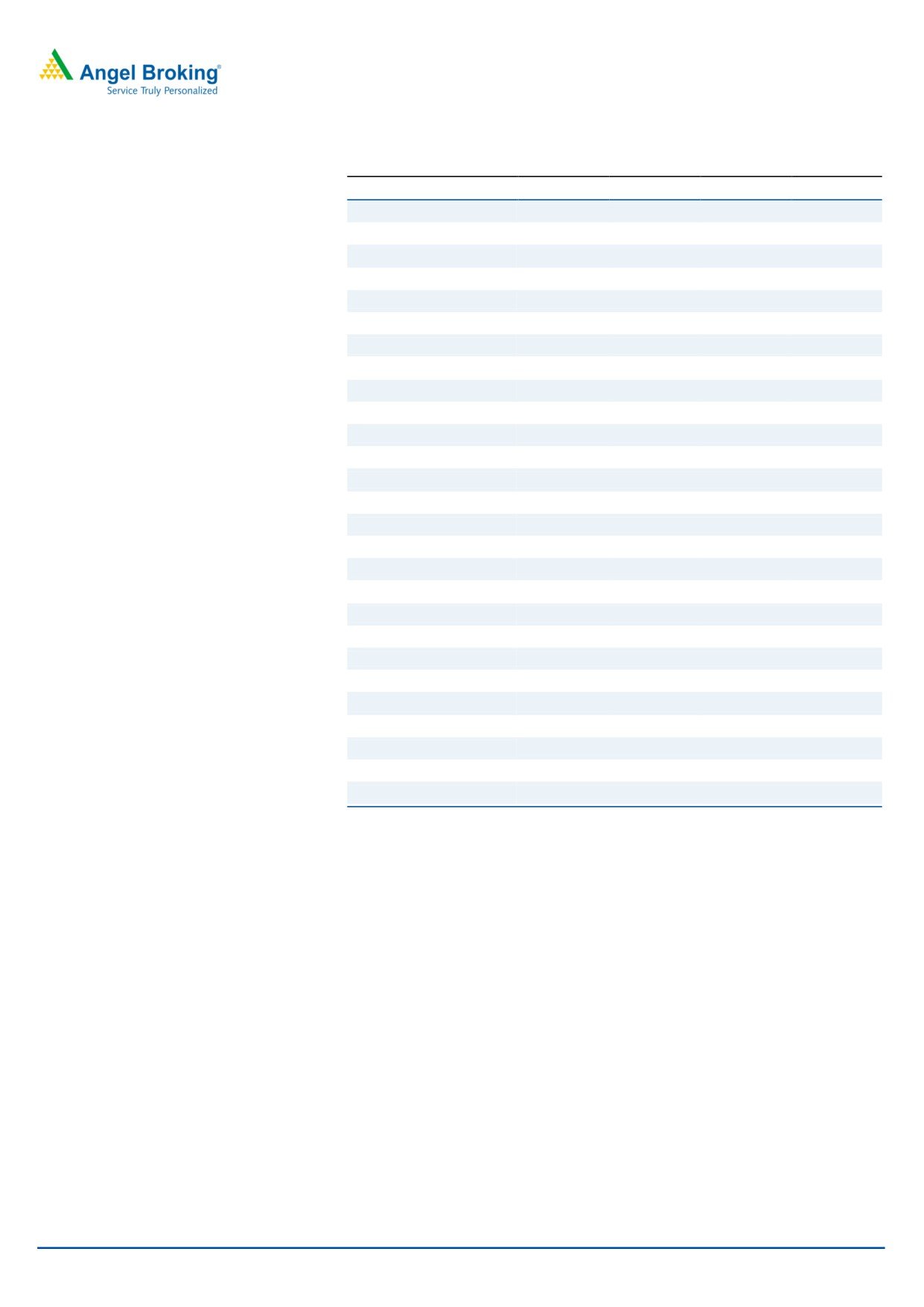

Exhibit 5: Key Ratios

Y/E March

FY2015

FY2016

FY2017

Valuati on Ratio (x)

P/E (on FDEPS)

16.3

14.1

13.3

P/CEPS

14.9

12.6

11.7

P/BV

3.1

2.7

2.4

Dividend yield (%)

0.0

0.0

0.0

EV/Sales

2.5

2.0

1.8

EV/EBITDA

12.2

9.9

8.0

EV / Total Assets

2.7

2.3

2.0

Per Share Data (`)

EPS (Basic)

5.5

6.4

6.7

EPS (fully diluted)

5.5

6.4

6.7

Cash EPS

6.1

7.1

7.7

Book Value

28.8

33.1

37.6

Returns (%)

ROCE

21.0

21.8

23.3

Angel ROIC (Pre-tax)

24.9

31.8

33.0

ROE

19.2

19.3

17.9

Turnover rati os (x)

Inventory / Sales (days)

235

138

93

Receivables (days)

123

100

130

Payable s (days)

53

25

30

Working capital cycle (ex-cash) (days)

305

213

193

Source: Company, Angel Research

Mar 19, 2018

7

MIDHANI | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager and investment advisor with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking

Private Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regul ations, 2014 vide

registration number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory

authority for accessing /dealing in securities Market. Angel or its associates/analyst has not received any compen sation / managed or

co-managed public offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any in vestment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document sho uld

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities o f the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to de termine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other rel iable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduc ed,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise fr om

or in connection with the use of this information.

Mar 19, 2018

8