Please refer to important disclosures at the end of this report

1

Mazagon Dock Shipbuilders Ltd (MDSL)

is India's leading defence public sector

unde

rtaking shipyard under the Ministry of Defence (MoD). Mazagon Dock is

primarily engaged in constructing and repairing warships and submarines for

MoD and other types of vessels i.e. cargo ships, multipurpose support vessels,

barges and border outposts, tug

s, dredgers, water tankers, etc. for commercial

clients.

Strong order book provides revenue visibility: Currently, MDSL has

strong order

book of around `54,074cr that provides revenue visibility for long-term.

Order

book comprises of four P-15 B destroyers, four P-17A

stealth frigates, repair

and refit of a ship, four Scorpene class submarine

s and one medium refit and

life certification of a submarine.

Government’s focus on indigenization to boost Indian defence: MDSL’s

focus

on indigenization under ‘Make in India’, ‘Atmanirbhar Bharat’, etc.

will be a

key positive for growth. Recently, the government has taken steps

to ban 101

defence items, which clearly indicates government’s focus on indigenization

to

promote and create big opportunities in Indian defence sector. Going ahead, it

would be beneficial for companies like MDSL.

Plans to diversify revenue: MDSL intends to foray into segments like exporting

its products, focus on ship repair facility and also enhancing i

nfrastructure &

manufacturing capacity th

at would help the company to diversify its revenue in

future.

Outlook & Valuation: In terms of valuations, the pre-

issue P/E works out to 6.1x

FY20 earnings (at the upper end of the issue price band), which is lower vs.

peers like Garden Reach Shipbuilders and Cochin Shipyard

(trading at 12.2x

and 6.6x of its FY20 earnings, respectively). Further, MDSL

has healthy ROE of

~16% coupled with

highest dividend yield (7.4%) and higher cash on balance

sheet among its peers. Hence, considering the above positive f

actors, we

recommend SUBSCRIBE to the issue with a long-term horizon.

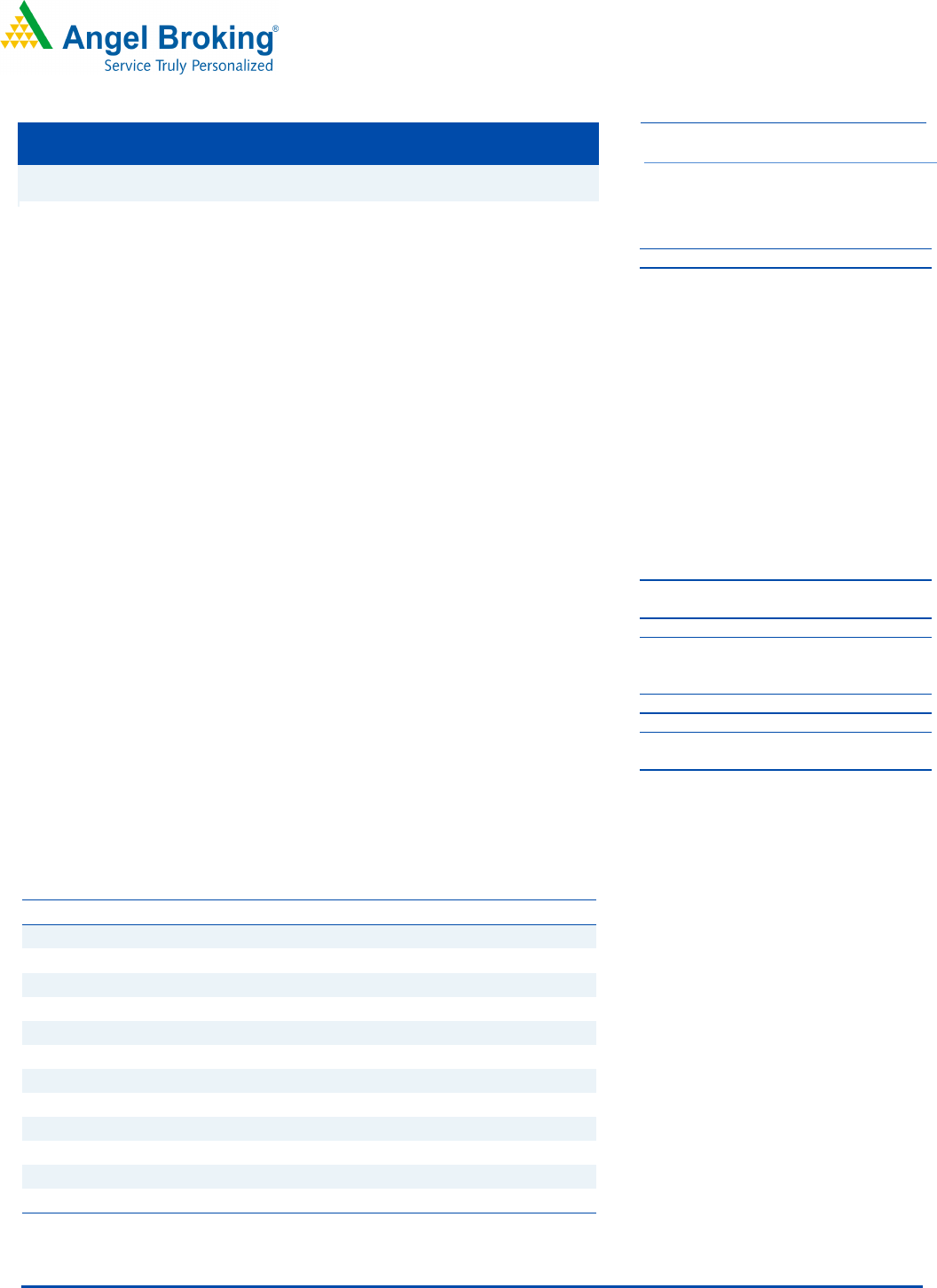

Key Financials

Y/E March (Rs cr)

FY2017

FY2018

FY2019 FY2020

Net Sales

3,519

4,470

4,614

4,978

% chg

27.0

3.2

7.9

Net Profit

598

496

532

477

% chg

(17.1)

7.3

(10.4)

OPM (%)

3.6

3.5

5.7

5.4

EPS (Rs)

29.7

24.6

26.4

23.7

P/E (x)

4.9

5.9

5.5

6.1

P/BV (x)

1.0

1.0

0.9

1.0

RoE (%)

20.0

17.5

16.6

15.5

RoCE (%)

2.7

3.4

5.8

6.2

EV/Sales (x)

(1.6)

(1.0)

(1.0) (0.6)

EV/EBITDA (x)

(45.0)

(29.3)

(18.5) (11.9)

Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end

of the price band

SUBSCRIBE

Issue Open: Sep 29, 2020

Issue Close: Oct 01, 2020

Offer for Sale: 3cr Share

QIBs 50% of issue

Non-Institutional 15% of issue

Retail 35% of issue

Promoters 85.0%

Others 15.0%

Issue Details

Face Value: Rs.10

Present Eq. Paid up Capital: Rs202cr

Post Issue Shareholding Pattern

Post Eq. Paid up Capital: Rs202cr

Issue size (amount): **Rs444cr

Price Band: Rs135-145

Lot Size: 103 shares and in multiple thereafter

Post-issue implied mkt. cap: * Rs2,723cr - **Rs2,925cr

Promoters holding Pre-Issue: 100%

Promoters holding Post-Issue: 85%

*Calculated on lower price band

** Calculated on upper price band

Book Building

Amarjeet S Maurya

+022 39357600, Extn: 6831

amarjeet.maurya@angelbroking.com

Mazagon Dock Shipbuilders Ltd.

IPO Note | Defenc

e

Sep 27

, 2020

Mazagon Dock Shipbuilders Limited |

IPO Note

September 27, 2020

2

Company background

Incorporated in 1934, Mazagon Dock Shipbuilders Ltd. is India's leading

defence public sector undertaking shipyard under the Ministry of Defence

(MoD). Mazagon Dock is primarily engaged in constructing and repairing

warships and submarines for MoD and other types of vessels i.e. cargo ships,

multipurpose support vessels, barges & border outposts, tugs, dredgers, water

tankers, etc. for commercial clients. It is the only shipyard to build destroyers

and conventional submarines to be used by the Indian Navy.

The business has two key operating divisions i.e. Shipbuilding division that

undertakes building and repairing of naval ships, and Submarine and heavy

engineering division, which includes building, repairing, and refitting of diesel

electric submarines. Till 2020, the company has built 795 vessels, including 25

warships, 4 missile boats, 3 submarines, 6 Leander class frigates, 3 Godavari

class frigates, 3 Shivalik class frigates, 3 corvettes, and 6 destroyers.

Mazagon Dock Shipyard is strategically located on the west coast of India, the

sea route that connects Europe, Pacific Rim, and West Asia.

Mazagon Dock Shipbuilders Limited |

IPO Note

September 27, 2020

3

Issue details

MDSL’s Promoter (Government of India) is selling ~3cr equity share (face value of

₹10) through Offer for Sale in the price band of `135-145, which is ~15% total

paid-up equity share capital.

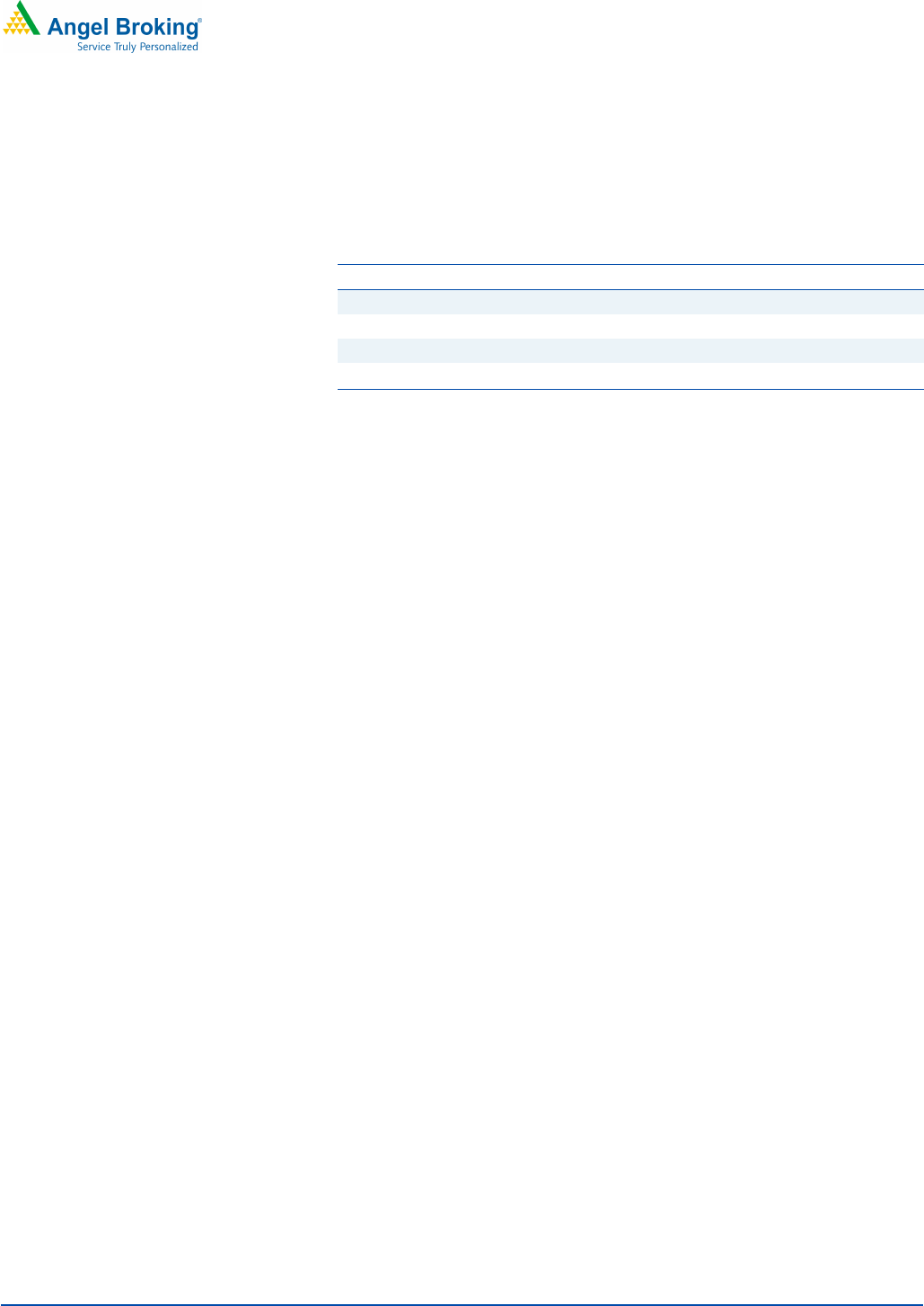

Exhibit 1: Pre and post IPO shareholding pattern

No of shares (Pre-

issue)

%

No of shares (Post-

issue)

%

Promoters

201,690,000

100%

171,090,983

85%

Others

NA

0%

30,599,017

15%

201,690,000

100%

201,690,000

100%

Source: Source: RHP

Objectives of the Offer

The net proceeds from the IPO will be used towards following objectives:

To carry out the disinvestment plan

To achieve the benefits of share listing on the stock exchanges

Outlook & Valuation

In terms of valuations, the pre-issue P/E works out to 6.1x FY20 earnings (at

the upper end of the issue price band), which is lower compared to peers like

Garden Reach Shipbuilders and Cochin Shipyard (trading at 12.2x and 6.6x

of its FY20 earnings, respectively). Further, MDSL has healthy ROE of ~16%

coupled with highest dividend yield (7.4%) and higher cash on balance sheet

among its peers. Hence, considering the above positive factors, we

recommend SUBSCRIBE on the issue with a long-term horizon.

Key Risks

Slowdown in order inflow and execution would impact the company’s

profitability.

Mazagon Dock Shipbuilders Limited |

IPO Note

September 27, 2020

4

Income Statement

Y/E March (` cr)

FY2017

FY2018

FY2019

FY2020

Net Sales

3519

4470

4614

4978

% chg

27.0

3.2

7.9

Total Expenditure

3,393

4,316

4,353

4,710

Raw Material

2175

2785

3

165

2865

Personnel

729

886

689

793

Others Expenses

490

645

499

1051

EBITDA

126

155

261

268

% chg

23.0

68.6

2.7

(% of Net Sales)

3.6

3.5

5.7

5.4

Depreciation& Amortisation

42

52

64

69

EBIT

84

102

196

199

% chg

21.6

92.2

1.4

(% of Net Sales)

2.4

2.3

4.3

4.0

Interest & other Charges

9

9

9

9

Other Income

756

557

591

558

Recurring PBT

831

650

778

748

% chg (21.7)

19.6

(3.9)

Extraordinary Items

-

-

-

12

PBT

831

650

778

735

Tax

288

257

308

352

(% of PBT)

34.6

39.5

39.5

47.0

PAT (reported)

543

394

470

384

Profit/Loss of Associate Company

55

103

62

93

ADJ. PAT

598

496

532

477

% chg (17.1)

7.3

(10.4)

(% of Net Sales)

17.0

11.1

11.5

9.6

Basic EPS (`)

29.7

24.6

26.4

23.7

Fully Diluted EPS (`)

29.7

24.6

26.4

23.7

% chg (17.1)

7.3

(10.4)

Source: Company, Angel Research

Mazagon Dock Shipbuilders Limited |

IPO Note

September 27, 2020

5

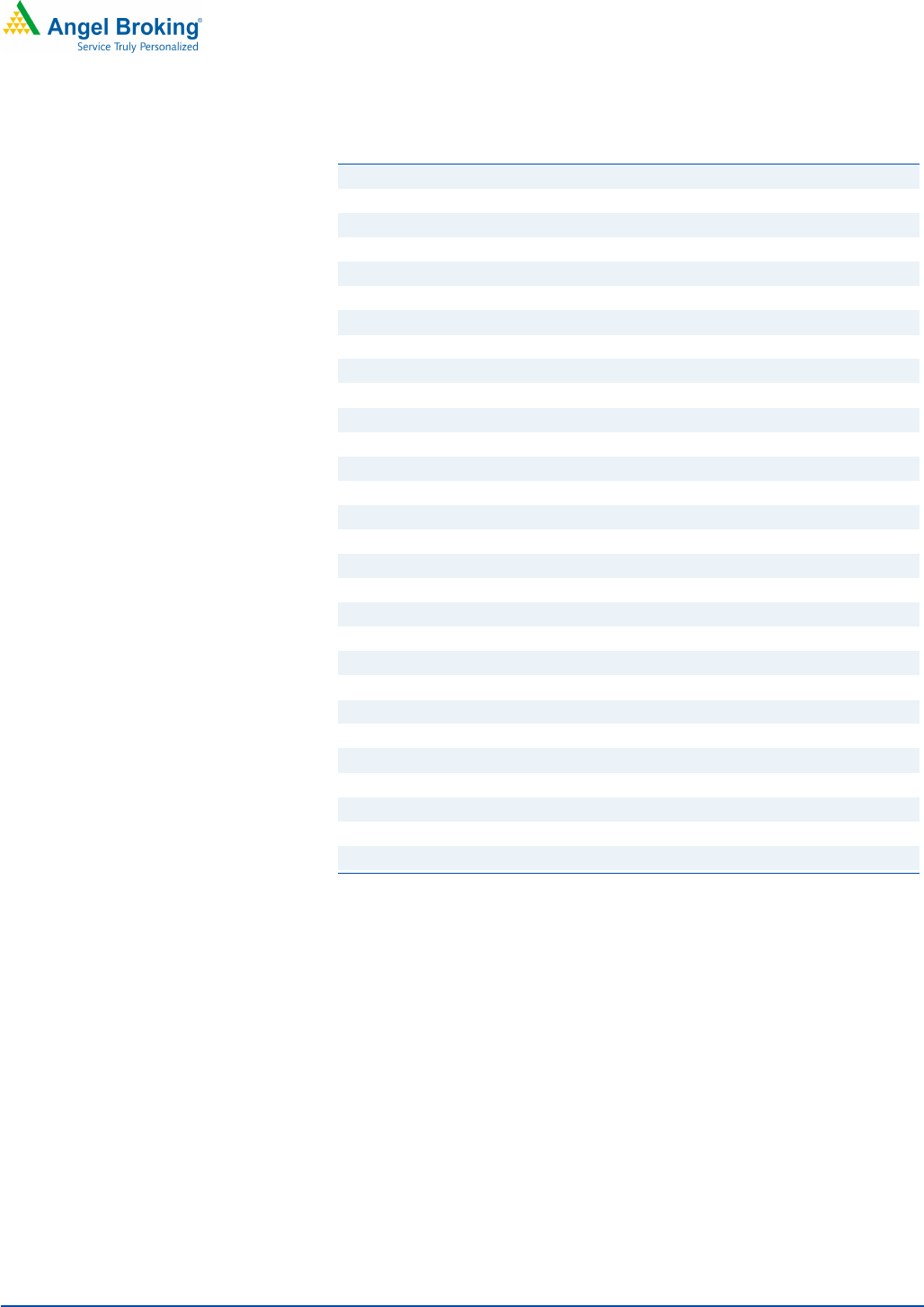

Exhibit 2: Balance Sheet

Y/E March (` cr) FY2017 FY2018 FY2019

FY2020

SOURCES OF FUNDS

Equity Share Capital 249

224

224

202

Reserves& Surplus 2,741

2,610

2,993

2,867

Shareholders Funds 2,990

2,834

3,217

3,069

Total Loans 167

160

158

169

Deferred Tax Liability -

-

-

-

Total Liabilities 3,157

2,994

3,375

3,239

APPLICATION OF FUNDS

Net Block 565

705

810

848

Capital Work-in-Progress 98

85

89

80

Investments 384

429

431

484

Current Assets 17,656

17,392

18,743

18,916

Inventories 4,029

3,786

3,790

4,623

Sundry Debtors 828

1,129

1,489

1,474

Cash 8,363

7,190

7,470

5,798

Loans & Advances 10

10

11

9

Other Assets 4,427

5,277

5,983

7,012

Current liabilities 16,234

16,377

17,473

17,727

Net Current Assets 1,422

1,015

1,270

1,188

Deferred Tax Asset 688

759

775

638

Total Assets 3,157

2,994

3,375

3,239

Source: Company, Angel Research

Mazagon Dock Shipbuilders Limited |

IPO Note

September 27, 2020

6

Exhibit 3: Cash Flow Statement

Y/E March (` cr)

FY2017

FY2018

FY2019 FY2020

Profit before tax

8,306

6,504

7,781

7,354

Depreciation

417

525

6

43

711

Change in Working Capital

(8,985)

5,795

819

(1,661)

Interest / Dividend (Net)

93

91

91

93

Direct taxes paid

(3,461)

(3,070)

(3,159)

(2,082)

Others

(6,396)

(4,937)

(5,523)

(5,370)

Cash Flow from Operations

(10,027)

4,908

652

(956)

(Inc.)/ Dec. in Fixed Assets

(2,183)

(1,929)

(1,718)

(1,095)

(Inc.)/ Dec. in Investments

7,113

5,409

5,884

5,632

Cash Flow from Investing

4,930

3,479

4,166

4,537

Issue of Equity

0

0

0

0

Inc./(Dec.) in loans

0

0

0

0

Dividend Paid (Incl. Tax)

(2,398)

(2,954)

(1,206)

(2,618)

Interest / Dividend (Net)

(54)

(3,126)

(52)

(3,428)

Cash Flow from Financing

(2,452)

(6,080)

(1,257)

(6,046)

Inc./(Dec.) in Cash

(7,549)

2,307

3,561

(2,464)

Opening Cash balances

8,978

1,429

3,736

7,297

Closing Cash balances

1,429

3,736

7,297

4,833

Source: Company, Angel Research

Mazagon Dock Shipbuilders Limited |

IPO Note

September 27, 2020

7

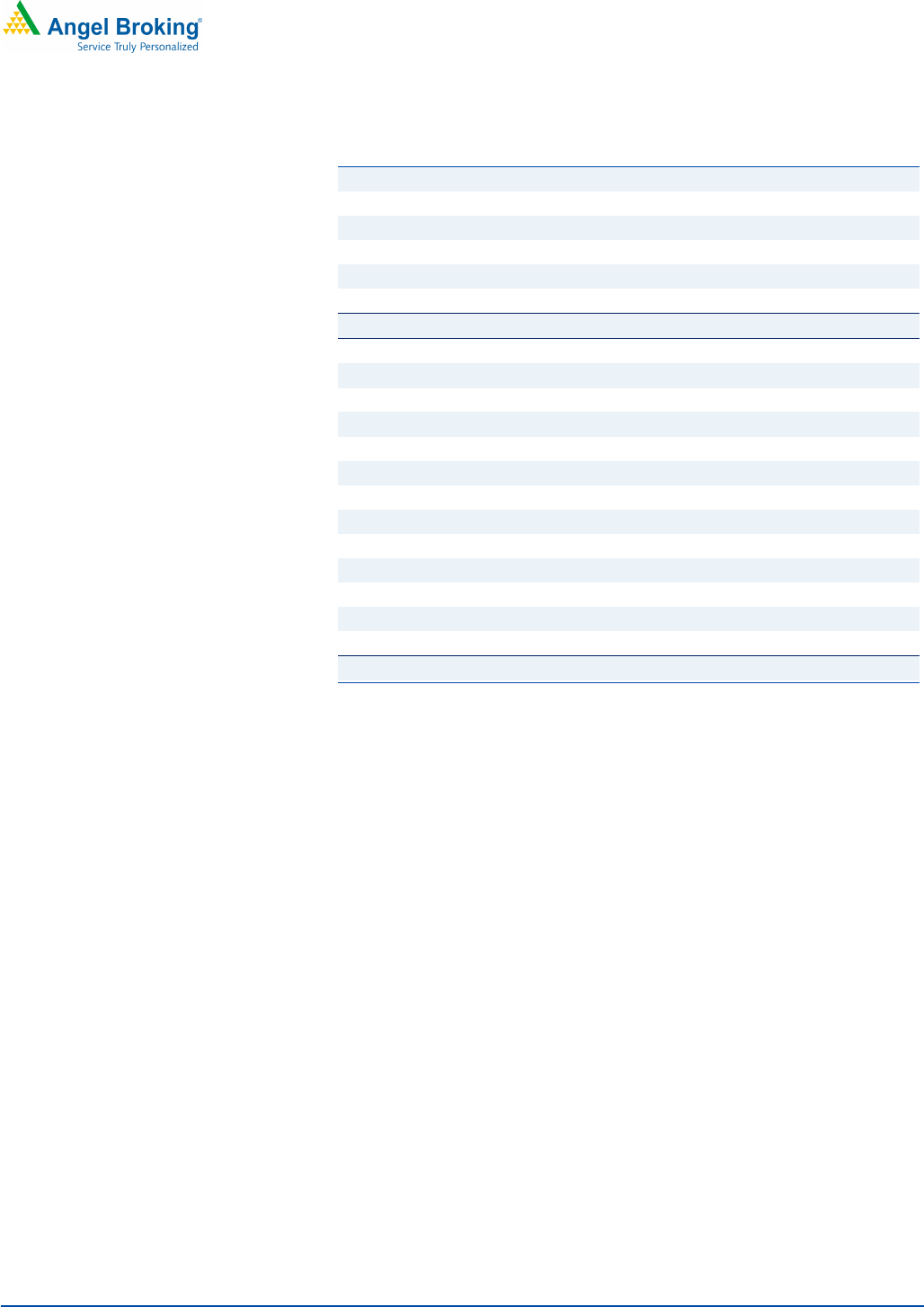

Exhibit 4: Key Ratios

Y/E March FY2017 FY2018

FY2019

FY2020

Valuation Ratio (x)

P/E (on FDEPS)

4.9

5.9

5.5

6.1

P/CEPS

5.0

6.6

5.5

6.5

P/BV

1.0

1.0

0.9

1.0

Dividend yield (%)

6.8

8.4

3.4

7.4

EV/Sales

(1.6) (1.0)

(1.0)

(0.6)

EV/EBITDA

(45.0)

(29.3)

(18.5)

(11.9)

EV / Total Assets

(1.8) (1.5)

(1.4)

(1.0)

Per Share Data (`)

EPS (Basic)

29.7

24.6

26.4

23.7

EPS (fully diluted)

29.7

24.6

26.4

23.7

Cash EPS

29.0

22.1

26.5

22.4

DPS

9.9

12.2

5.0

10.8

Book Value

148.3

140.5

159.5

152.2

Returns (%)

ROCE

2.7

3.4

5.8

6.2

Angel ROIC (Pre-tax)

(1.5) (2.2)

(4.3)

(6.5)

ROE

20.0

17.5

16.6

15.5

Turnover ratios (x)

Inventory / Sales (days)

418

309

300

339

Receivables (days)

86

92

118

108

Payables (days)

98

197

232

351

Working capital cycle (ex-

cash) (days)

406

205

186

96

Source: Company, Angel Research

Mazagon Dock Shipbuilders Limited |

IPO Note

September 27, 2020

8

Research Team Tel: 022

-

39357800 E

-

m

ail: research@angelbroking.

com Website:

www.angelbroking.com

DISCLAIMER

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National

Commodity & Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and

Investment Adviser with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered

entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164.

Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities

Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public offering of securities of

the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.