2QFY2016 Result Update | Infrastructure

November 17, 2015

MBL Infrastructures

BUY

CMP

`206

Performance Highlights

Target Price

`285

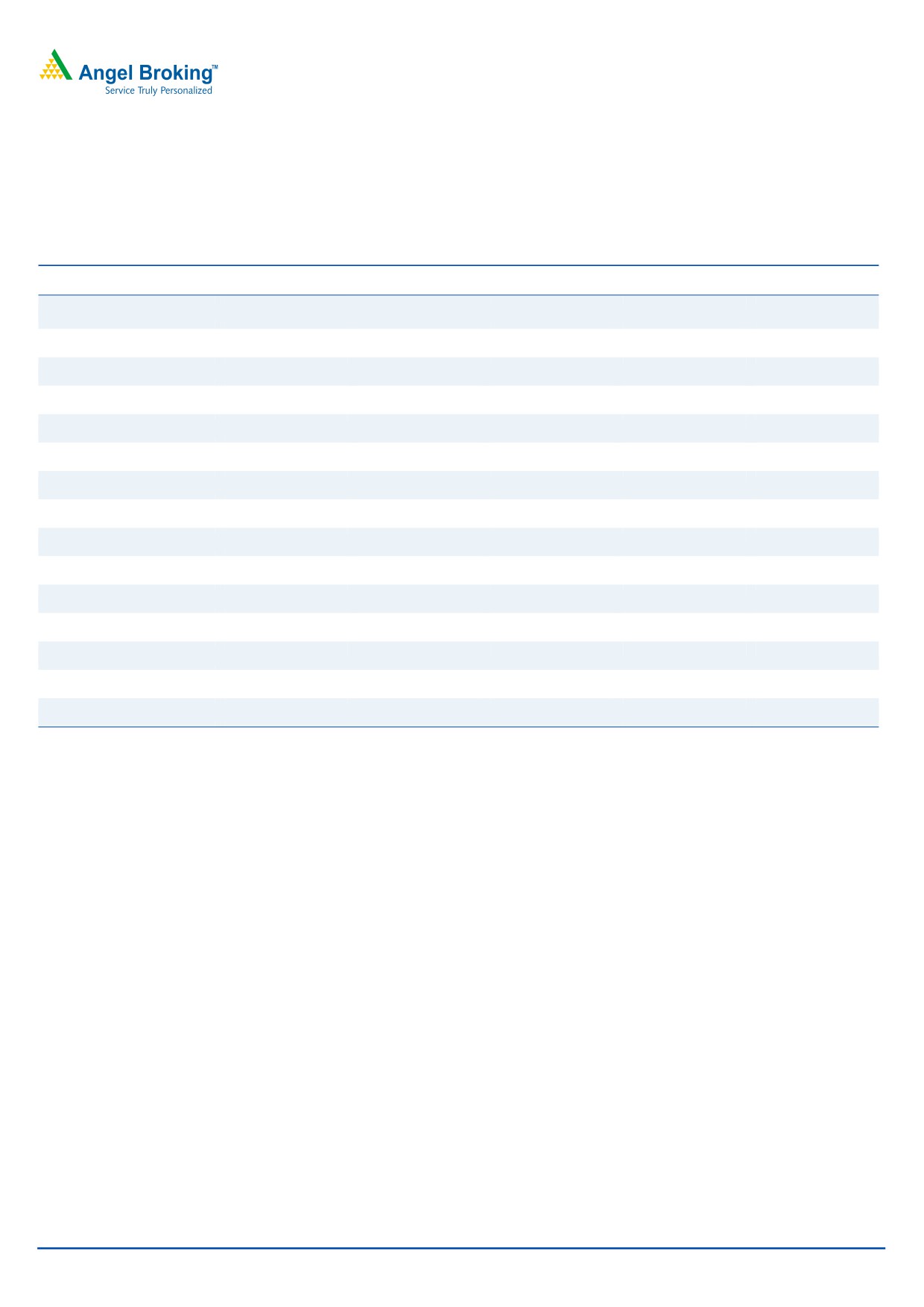

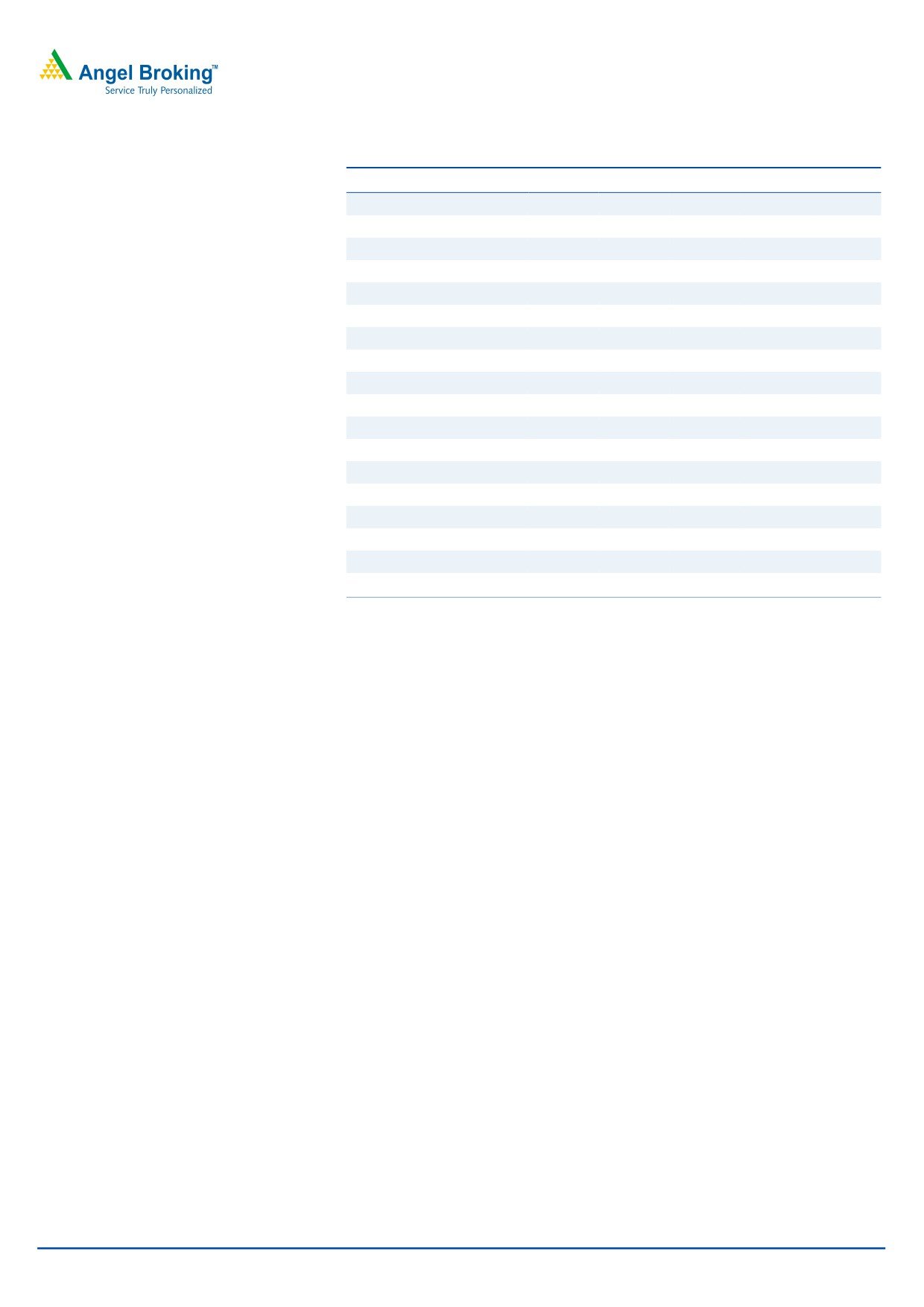

Quarterly highlights - Standalone

Investment Period

12 Months

Y/E March (` cr)

2QFY16 1QFY16 2QFY15

% chg (yoy)

% chg (qoq)

Net sales

406

610

348

16.8

(33.4)

Stock Info

EBITDA

47

65

53

(10.0)

(26.9)

Sector

Infrastructure

Reported PAT

18

29

21

(17.6)

(39.8)

Market Cap (` cr)

856

Source: Company, Angel Research

Net debt (` cr)

987

For 2QFY2016, MBL Infrastructures (MBL) reported a 16.8% yoy top-line growth

Beta

1.0

to `406cr. The company reported a yoy decline in EBITDA margin to 11.7% for

52 Week High / Low

329/170

the quarter. During 2QFY2015, MBL had received `5cr as escalation amount

Avg. Daily Volume

7,511

from the Guwahati project. On adjusting for the same, the EBITDA margin

Face Value (`)

10

declined 202bp yoy. Fall in yoy EBITDA margin reflects (1) 85.8% increase in

BSE Sensex

25,760

other expenses (to `29cr) and 82.8% increase in labor and sub-contracting costs

Nifty

7,807

(to `28cr). The 41.5% yoy increase in employee expenses is mainly on account of

Reuters Code

MBLI.BO

induction of new employees into the company in earlier quarters. Despite strong

Bloomberg Code

MBL@IN

execution, EBITDA decline on a yoy basis percolated to the PAT level; PAT

declined by 17.6% yoy to `18cr. The Reported PAT margin of the company

declined from 6.2% a year ago to 4.4% in 2QFY2016.

Shareholding Pattern (%)

MBL’s unexecuted order book as of 2QFY2016 stands at ~`2,150cr (order book

Promoters

46.7

to LTM revenues is at 1.0x).

MF / Banks / Indian Fls

28.0

With 3 BOT projects expected to commence tolling in FY2016-2017E and

FII / NRIs / OCBs

11.8

Management clarifying that it does not intend to add any new BOT projects to the

Indian Public / Others

13.5

company’s portfolio till FY2017, we are confident that MBL’s D/E ratio would

peak out in FY2017E at 2.3x.

Abs. (%)

3m 1yr 3yr

Outlook and valuation: We continue to maintain our positive view on MBL

Sensex

(7.6)

(8.6)

40.5

considering its historical execution experience, huge emerging market opportunity

MBL

(21.1)

9.9

144.1

in the Roads & Highways vertical and 3 BOTs expected to commence operations

in the next 12-15 months. Likelihood of 3 BOT projects commencing operations

in FY2017E comforts us to estimate that the consolidated Balance Sheet should

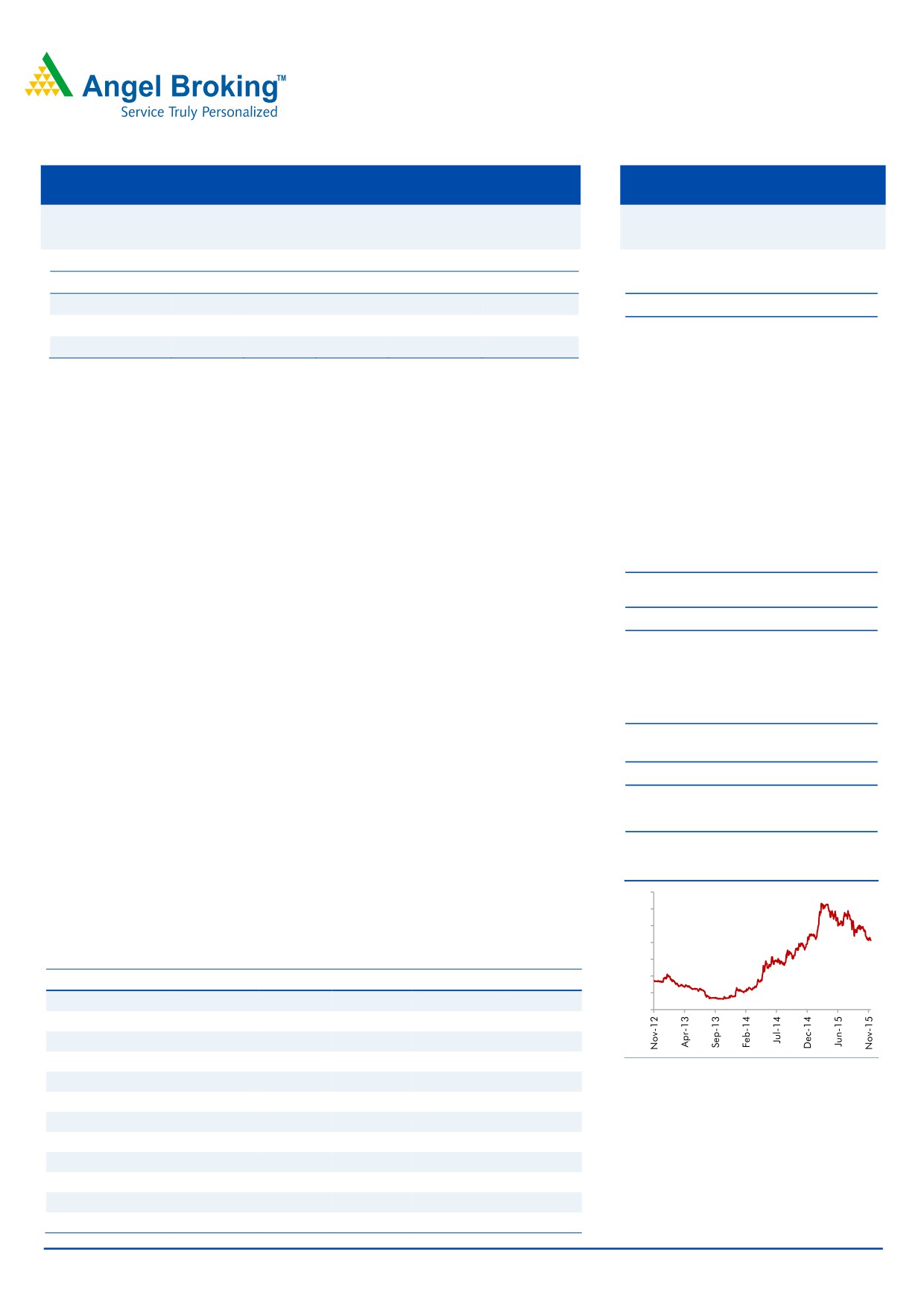

3-Year Daily Price Chart

peak in FY2017E, which is comparatively better than some of its peers. Using

350

300

SoTP based valuation methodology we arrive at FY2017E based price target of

250

`285. Given the upside potential, we maintain our Buy on the stock.

200

Key financials (Consolidated)

150

100

Y/E March (` cr)

FY13

FY14

FY15P

FY16E

FY17E

50

Net Sales

1,355

1,766

1,962

2,313

2,797

0

% chg

30.3

11.1

17.9

21.0

Net Profit

57

77

82

80

84

% chg

35.9

6.0

(2.1)

5.0

Source: Company, Angel Research

EBITDA (%)

10.6

10.7

12.1

12.2

14.6

EPS (`)

32

44

39

19

20

P/E (x)

6.4

4.7

5.2

10.7

10.2

P/BV (x)

0.9

0.8

0.7

1.1

1.0

RoE (%)

15.2

17.8

14.5

11.3

10.6

RoCE (%)

14.6

15.6

14.9

12.1

13.9

Yellapu Santosh

EV/Sales (x)

0.7

0.6

0.7

1.1

1.0

022 - 3935 7800 Ext: 6811

EV/EBITDA (x)

6.5

5.7

6.0

8.8

6.5

Source: Company, Angel Research; CMP as of November 16, 2015

Please refer to important disclosures at the end of this report

1

MBL Infrastructures | 2QFY2016 Result Update

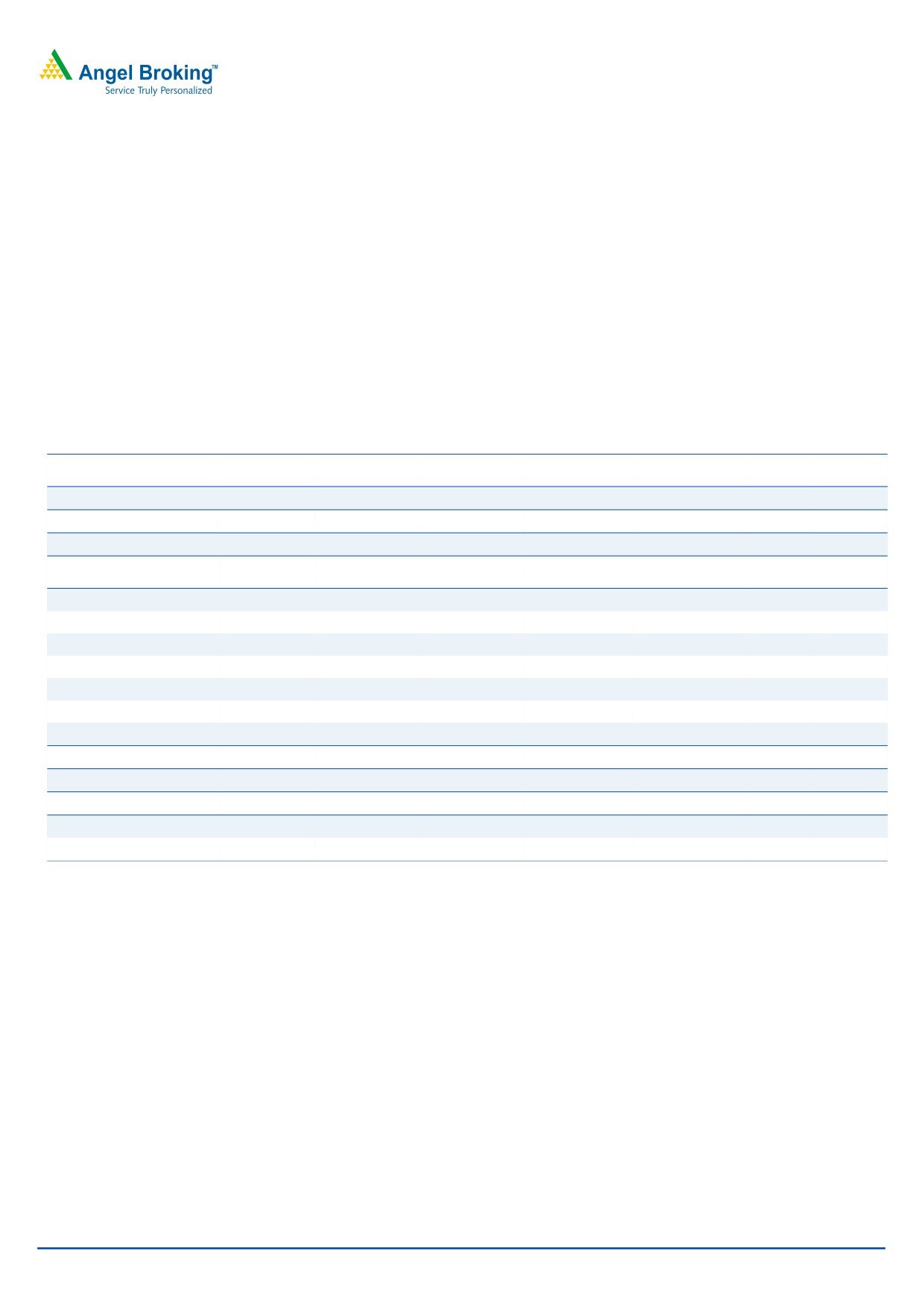

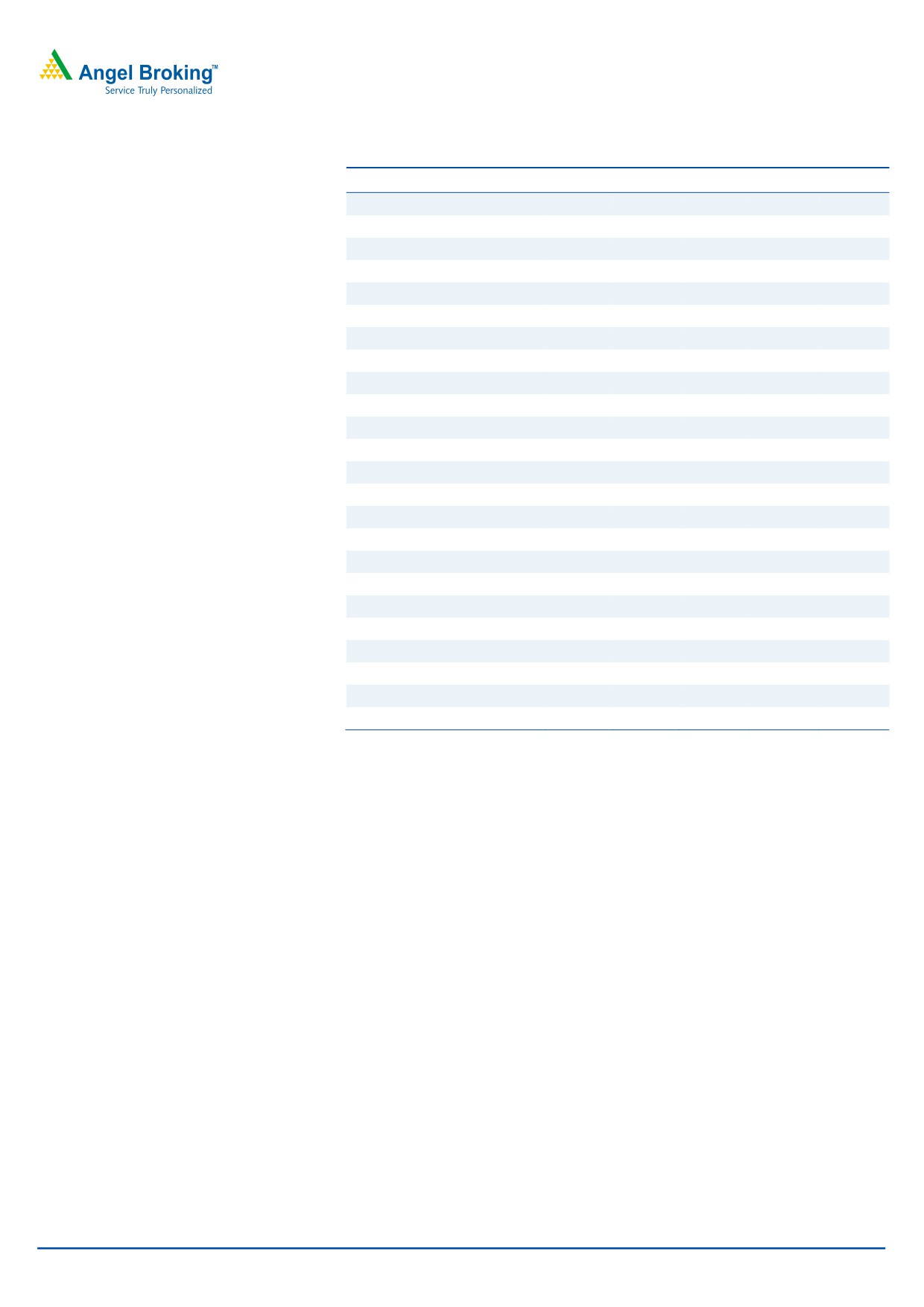

Exhibit 1: Quarterly Performance (Standalone)

Particulars (` cr)

2QFY16

1QFY16

% chg (qoq)

2QFY15

% chg (yoy)

1HFY16

1HFY15

% chg

Net Sales

406

610

(33.4)

348

16.8

1,016

857

18.5

Total Expenditure

359

545

(34.2)

295

21.5

904

751

20.3

Cost of materials consumed

290

467

(37.9)

256

13.3

757

676

11.9

Direct Labour, Sub-Contracts, etc.

28

34

(17.9)

15

82.8

62

25

147.8

Employee benefits Expense

12

11

6.1

9

41.5

23

17

41.7

Other Expenses

29

33

(12.8)

16

85.8

62

34

83.9

EBITDA

47

65

(26.9)

53

(10.0)

112

106

5.8

EBIDTA %

11.7

10.6

15.1

11.0

12.4

Depreciation

4

4

2.2

4

12.8

8

8

11.0

EBIT

43

61

(28.9)

49

(11.7)

104

98

5.5

Interest and Financial Charges

24

24

(1.9)

23

3.8

48

42

15.7

Other Income

2

1

388.2

0

632.4

3

1

368.8

PBT before Exceptional Items

22

37

(41.1)

26

(17.1)

58

57

2.0

Exceptional Items

0

0

0

0

0

PBT after Exceptional Items

22

37

(41.1)

26

(17.1)

58

57

2.0

Tax

4

7

(46.1)

5

(14.7)

11

12

(10.2)

% of PBT

18.1

19.8

17.6

19.1

21.8

PAT after Minority Int.

18

29

(39.8)

21

(17.6)

47

45

5.4

Adj. PAT %

4.4

4.8

6.2

4.6

5.2

Dil. EPS

8.53

14.18

(39.8)

12.21

(30.1)

22.71

25.49

(10.9)

Source: Company, Angel Research

Standalone Business Review

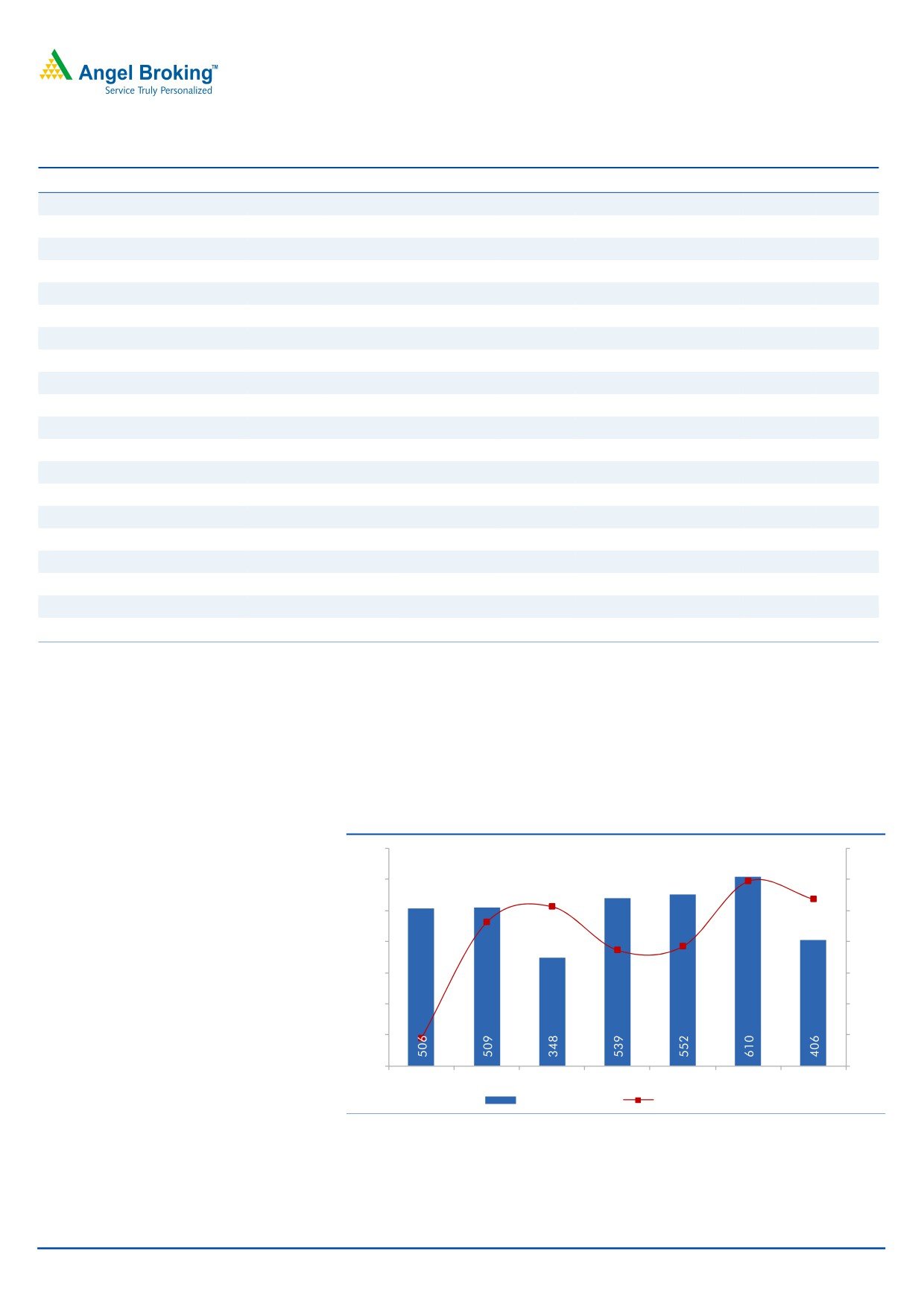

16.8% yoy revenue growth

MBL reported 16.8% yoy top-line growth to `406cr. On a sequential basis, the top-

line de-grew by 33.4%.

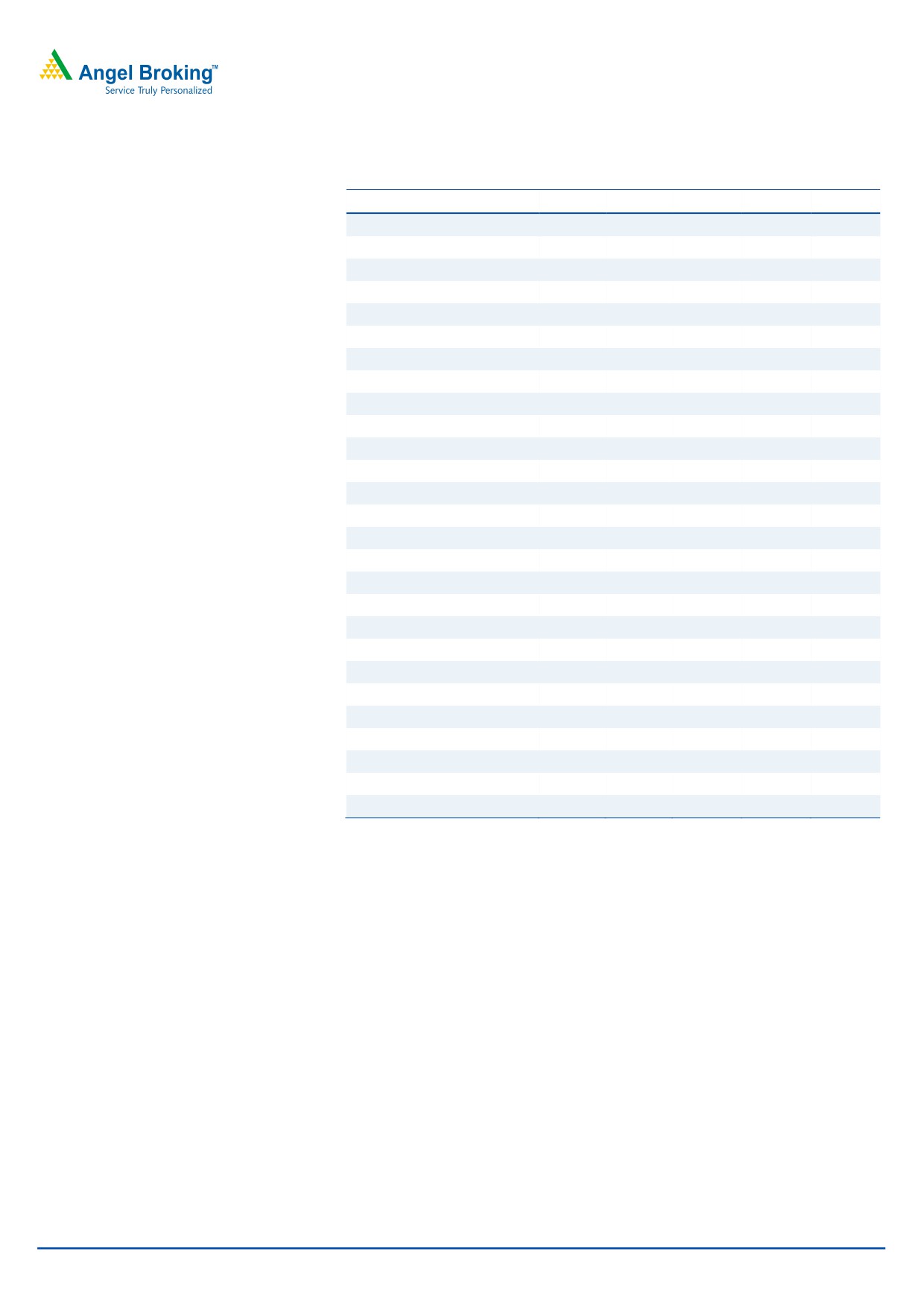

Exhibit 2: Quarterly Revenues

700

25

19.7

600

20

15.6

16.8

500

15

13.1

400

8.6

10

9.2

300

5

200

0

100

(5.6)

(5)

0

(10)

4QFY14

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

Revenues (` cr)

y/y change (%)

Source: Company, Angel Research

November 17, 2015

2

MBL Infrastructures | 2QFY2016 Result Update

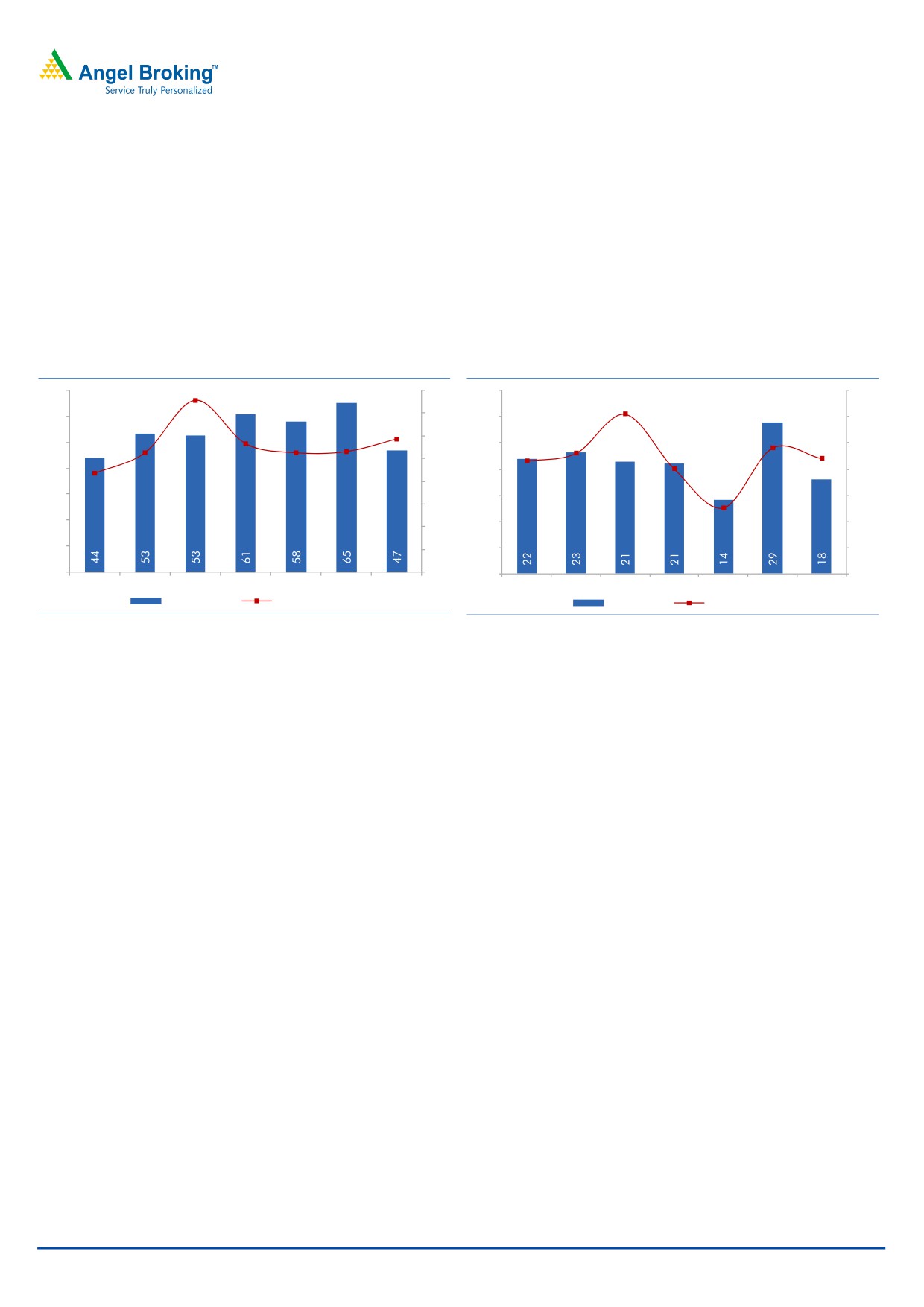

EBITDA margin at 11.7%

On the EBITDA margin front, MBL reported a yoy decline in margin to 11.7% for

2QFY2016. During 2QFY2015, MBL received `5cr as escalation amount from the

Guwahati project. On adjusting for the same, the EBITDA margin declined by

202bps on a yoy basis. Fall in yoy EBITDA margin reflects (1) 85.8% increase in

other expenses (to `29cr) and 82.8% increase in labor and sub-contracting costs

(to `28cr). The 41.5% yoy increase in employee expenses is mainly on account of

induction of new employees into the company in earlier quarters.

Exhibit 3: EBITDA margin at 11.7% for the quarter

Exhibit 4: PAT Margin at 4.4% for the quarter

70

16

35

7.0

15.1

6.1

60

14

30

6.0

11.7

12

4.6

4.8

50

11.3

25

4.3

4.4

5.0

10.5

4.0

10.6

10

10.5

40

20

4.0

8.7

8

30

15

2.5

3.0

6

20

10

2.0

4

10

2

5

1.0

0

0

0

0.0

4QFY14

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

4QFY14 1QFY15 2QFY15 3QFY15 4QFY15 1QFY16 2QFY16

EBITDA (` cr)

EBITDA Margins (%)

PAT (` cr)

PAT Margins (%)

Source: Company, Angel Research

Source: Company, Angel Research

PAT margins declines yoy to 4.4%

Despite strong execution, EBITDA decline on a yoy basis percolated to the PAT

level. MBL reported a 17.6% yoy decline in its PAT to `18cr. Reported PAT margins

of the company declined from 6.2% a year ago to 4.4% in 2QFY2016.

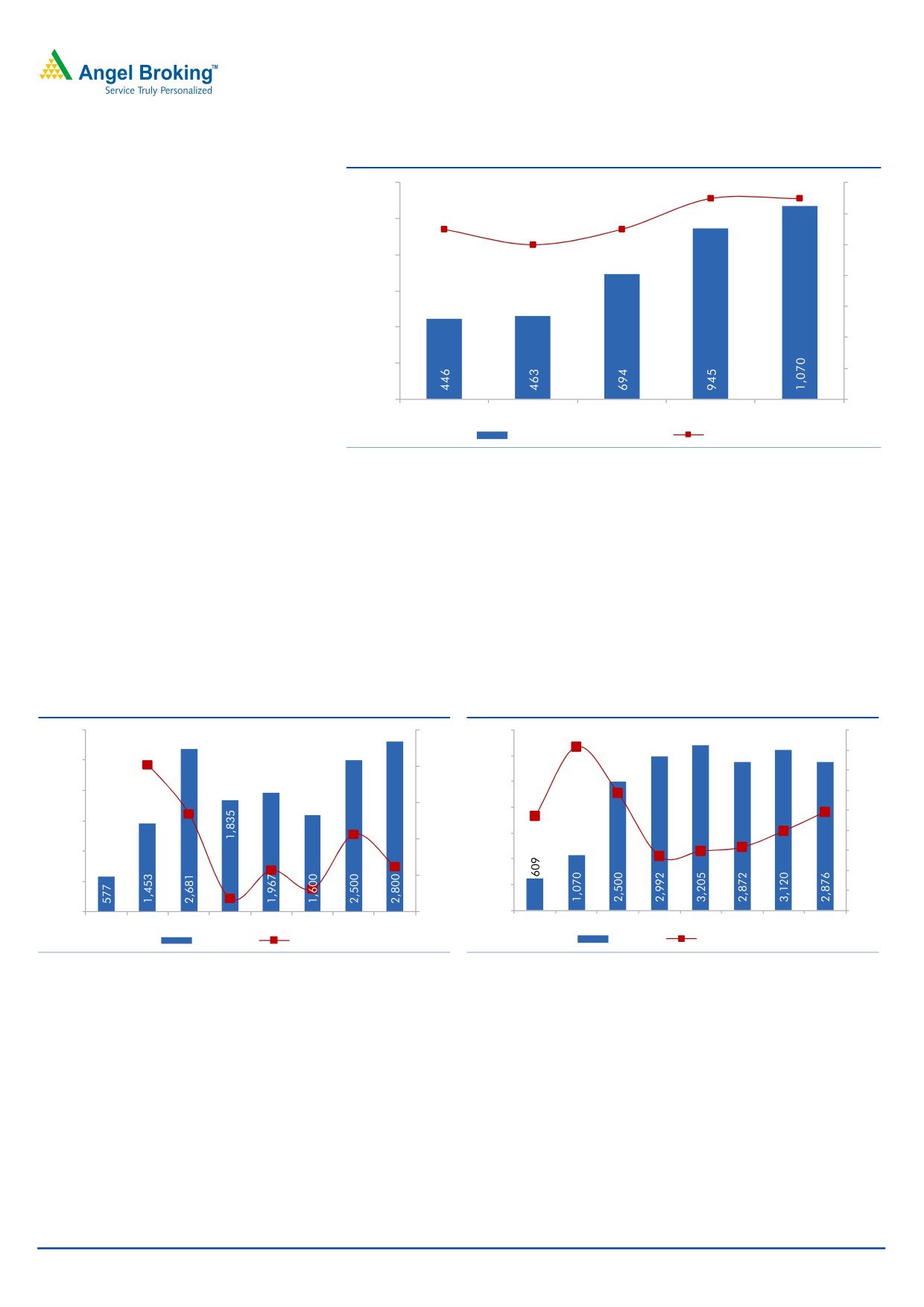

Comfortable D/E ratio

In 4QFY2015, post correction of Steel & Stone Aggregate prices, MBL spent on

building inventories. With ramp-up in execution, we expect some release of

inventory, which should further lead to ease in the working capital cycle of the

company. Accordingly, interest expenses on a qoq basis have seen some

moderation with a 1.9% decline to `24cr. The Standalone entity’s D/E ratio as of

1HFY2016-end stood at 1.2x, which is a comfortable level.

November 17, 2015

3

MBL Infrastructures | 2QFY2016 Result Update

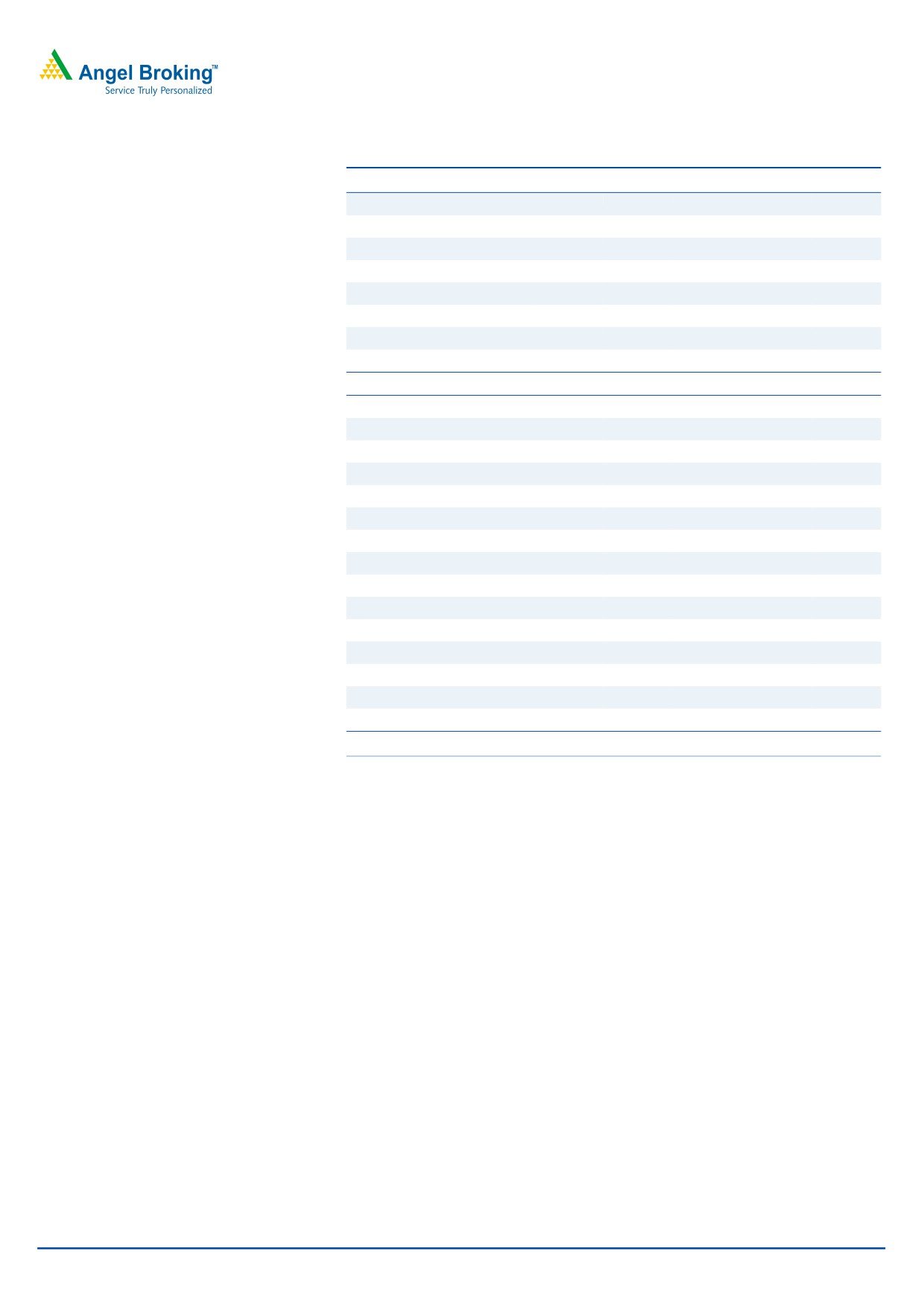

Exhibit 5: Standalone D/E

1,200

1.3x

1.3x

1.4x

1.1x

1.1x

1.2x

1,000

1.0x

1.0x

800

0.8x

600

0.6x

400

0.4x

200

0.2x

0

0.0x

FY13

FY14

FY15

FY16E

FY17E

Standalone Debt (` cr)

D/E ratio (x)

Source: Company, Angel Research

Order Inflow yet to gain momentum

In FY2015 MBL reported order inflows to the tune of ~`1,600cr.

In 1QFY2016 MBL won ~`200cr of smaller orders. In 2QFY2016, MBL benefitted

from ~`337cr of escalation in the value of the order book. At the backdrop of the

company claiming strong bid pipeline and the Management maintaining its order

inflow guidance of ~`3,500cr for FY2016, we are hopeful that MBL should report

new order wins during 3Q-4QFY2016E.

Exhibit 6: Order Inflows

Exhibit 7: Order Book

3,000

200

3,500

1.8x

1.6x

1.6x

3,000

2,500

152

150

1.4x

2,500

2,000

1.2x

1.2x

100

2,000

1.0x

1.0x

84

1,500

0.8x

0.8x

56

1,500

0.9x

50

0.6x

1,000

0.6x

0.6x

1,000

0.5x

7

12

0.4x

0

500

500

(19)

0.2x

(32)

0

(50)

0

0.0x

FY10

FY11

FY12

FY13

FY14

FY15

FY16E FY17E

FY10

FY11

FY12

FY13

FY14

FY15

FY16E FY17E

OI (` cr)

y/y change (%)

OB (` cr)

Execution Rate (x)

Source: Company, Angel Research

Source: Company, Angel Research

MBL’s unexecuted order book as of 2QFY2016 stands at ~`2,150cr (OB to LTM

sales ratio of 1.0x).

November 17, 2015

4

MBL Infrastructures | 2QFY2016 Result Update

Update on BOT projects

In addition to the already operational Seoni-Balaghat-Rajegaon Road BOT project,

Waraseoni-Lalbarra BOT project commenced operations during the quarter.

Exhibit 8: BOT Projects Status (at 2QFY2016-end)

Name of SPV

AAPIL

MPTRCL

MPRNCL

MHDCL

SBTRCPL

Seoni-Balaghat-

Project

Waraseoni-Lalbarra

Garra-Waraseoni

Seoni-Katangi

Suratgarh-Bikaner

Rajegaon

BOT Type

Toll

Toll + Annuity

Toll + Annuity

Toll

Toll

Length (kms)

114

18

47

76

172

Total Project Cost

108

57

137

212

620

EPC component

82

40

108

154

496

EPC works o/s

0

0

76

11

288

Equity

12

15

40

82

170

Debt

50

42

97

130

450

Debt Pending/ (o/s)

(28)

(49)

(97)

49

237

Equity pending

0

0

0

0

50

Source: Company, Angel Research

The Management highlighted that the Seoni-Katangi and Garra-Waraseoni BOT

projects could get provisional Date of Completion (CoD) in FY2016 and full CoD

in FY2017E. Similarly, Suratgarh-Bikaner BOT project is expected to report CoD in

FY2017E.

Even though substantial portion of the total EPC works at Seoni-Katangi BOT

project is completed, MBL’s Management expects CoD for this project to come

around June-2016E. Such delay is on account of change in the scope of project for

a 5km stretch near Katangi Township, where Madhya Pradesh Road Dev.

Corporation (MPRDC) would reimburse ~`35cr to MBL.

With the entire equity infusion having been done across Seoni-Katangi and Garra-

Waraseoni BOT projects, MBL is left with `50cr of equity infusion (of the total

`278cr of equity investments for all the 4 BOT projects, excluding Seoni-Balaghat-

Rajegaon BOT projects) in the next 12 months, towards the Bikaner-Suratgarh

project. MBL is expected to fund the required equity for the BOT through internal

accruals.

November 17, 2015

5

MBL Infrastructures | 2QFY2016 Result Update

Valuation

We recommend Buy with target price of `285

We have valued MBL using Sum-Of-The-Parts method. MBL’s EPC business (under

standalone entity) has been valued using FY2017E P/E multiple, whereas BOT

projects are valued using the “Free Cash flow to Equity holders” method.

Value of Core EPC business

On considering growth prospects (for the EPC business), we have valued MBL’s

core EPC business on P/E multiple of 9.0x for its FY2017E EPS of `26, resulting in

a value of `232 per share.

Exhibit 9: Sum-of-the-Parts based Valuation Table

FY17E Std. PAT

Target

Target Value

Value/ share

% of

Particulars

Segment

Basis

(` cr)

Multiple

(` cr)

(`)

SoTP

MBL's EPC business

Construction

106

9.0

962

232

82

P/E

Total

962

232

82

Discounted FCFE

Project

Adj. FCFE Value

Value/ share

% of

Particulars

Proj. Type

Basis

(` cr)

Stake

(` cr)

(`)

SoTP

Road BOT projects

Seoni-Balaghat-Rajegaon

Toll

31

100%

31

7

3

Ke of 17%

Waraseoni-Lalbarra

Toll + Annuity

22

100%

22

5

2

Ke of 17%

Garra-Waraseoni

Toll + Annuity

17

100%

17

4

1

Ke of 17%

Seoni-Katangi

Toll

74

100%

74

18

6

Ke of 17%

Suratgarh-Bikaner

Toll

114

65%

74

18

6

Ke of 17%

Total

258

218

53

18

Grand Total

1,180

285

100

Upside

38%

CMP

206

Source: Company, Angel Research

Value of BOT projects

BOT projects have been valued using “Free Cash flow to Equity holders” method.

Our value for all the 5 BOT projects comes to `53/share, which is 18% of the

overall SOTP value of the company.

On combining the value of EPC business BOT projects, we arrive at a combined

business value of `285/share, reflecting 38% upside in the stock price from the

current levels. Given the upside, we maintain our BUY rating on the stock.

November 17, 2015

6

MBL Infrastructures | 2QFY2016 Result Update

Investment arguments

Strong order inflows to lead to better execution: On the back of revival in

NHAI and MoRTH award activity, MBL a specialist EPC player, is expected to

report strong order inflow growth during 3Q-4QFY2016. We expect MBL to

report order inflows of

`2,500cr/`2,800cr during FY2016/FY2017E,

respectively, which gives increased comfort towards strong uptick in execution.

Accordingly, we expect MBL (on a standalone basis) to report a strong 17%

top-line CAGR during FY2015-17.

15% PAT CAGR during FY2015-17: Stronger execution, which should result in

better absorption of fixed costs, should help the standalone entity report 15%

EBITDA CAGR during FY2015-17. We expect the effect of strong operating

performance to flow-down to the PAT level too. We expect MBL (standalone

entity) to report 15% CAGR during the same period.

BOT projects nearing completion: MBL has a portfolio of 5 BOT Road projects,

of which 4 are won on “Toll+Grant” or “Toll+Annuity” model. This, when

coupled with the fact that 4 of these projects are in the mineral belt region and

are inter-connected with no alternate roads, indicates that these projects could

generate impressive equity IRRs. With recent commencement of 1 BOT project

and another 3 BOT projects in FY2017, we can expect a possible easing in the

balance sheet stress.

Comfortable Balance Sheet: MBL is one of the few Road developers with lower

consolidated D/E ratio of 1.6x (as of FY2015-end). With 2 BOT projects

already operating and 3 of them expected to commence tolling in FY2016-

2017E, when coupled with Management’s clarification that it does not intend

to add any new BOT projects to the company’s portfolio till FY2017, we are

confident that MBL’s D/E ratio would peak out in FY2017.

Risks & Concerns

Delays in order wins could pose as a risk to our estimates.

Roads & Highways account for over 70% of the order book. Any slowdown in

orders from NHAI or State governments could affect its order inflow adversely.

MBL's order book comes majorly from the East and the North regions. Any

slowdown in orders from these two areas may impact our order inflow

assumption of the company.

Any further delays in the commencement of BOT projects, than our estimated

time-line.

Company background

MBL Infrastructures Ltd is engaged in the construction and maintenance of roads

and highways, industrial infrastructure projects and other civil engineering projects

for various government bodies and other clients. They have executed and

undertaken a number of projects in states such as West Bengal, Madhya Pradesh,

Uttarakhand, Orissa, Rajasthan, Assam, Uttar Pradesh, Bihar, Delhi, Andhra

Pradesh, Chattisgarh, Jharkhand, Haryana and Karnataka. MBL’s clients include

NHAI, MPRDC, MMRDA, CPWD and State PWDs.

November 17, 2015

7

MBL Infrastructures | 2QFY2016 Result Update

Profit and Loss Statement (Consolidated)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

Net Sales

1,355

1,766

1,962

2,313

2,797

% Chg

30.3

11.1

17.9

21.0

Total Expenditure

1,212

1,578

1,725

2,031

2,389

Cost of Materials Consumed

954

1,376

1,517

1,777

2,089

Direct Labour, Sub-Contracts

180

118

84

138

161

Employee benefits Expense

23

27

37

36

41

Other Expenses

55

57

87

79

98

EBITDA

143

188

237

282

408

% Chg

31.2

25.9

19.0

44.8

EBIDTA %

10.6

10.7

12.1

12.2

14.6

Depreciation

11

14

20

33

57

EBIT

132

174

217

249

351

% Chg

31.6

24.5

14.8

41.1

Interest and Financial Charges

58

75

101

140

246

Other Income

2

4

3

3

3

PBT

76

103

119

111

108

Tax

20

26

37

31

39

% of PBT

25.7

25.2

31.3

28.1

35.6

PAT before Exceptional item

57

77

82

80

70

Exceptional item

0

0

0

0

0

PAT before Minority Interest

57

77

82

80

70

Minority Interest

0

0

0

0

(14)

PAT after Minority Interest

57

77

82

80

84

% Chg

35.9

6.0

(2.1)

5.0

PAT %

4.2

4.4

4.2

3.5

3.0

Diluted EPS

32

44

39

19

20

% Chg

36.0

(10.5)

(51.1)

5.0

November 17, 2015

8

MBL Infrastructures | 2QFY2016 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

Sources of Funds

Equity Capital

18

18

21

41

41

Reserves Total

380

451

635

715

779

Networth

398

469

656

756

820

Total Debt

644

772

1,063

1,680

1,848

Other Long-term Liabilities

44

40

80

73

73

Minority Interest

0

32

0

0

(14)

Deferred Tax Liability

30

34

41

35

35

Total Liabilities

1,116

1,347

1,839

2,544

2,762

Application of Funds

Gross Block

248

287

351

921

1,663

Accumulated Depreciation

59

73

91

120

181

Net Block

189

214

260

801

1,482

Capital WIP

209

376

497

620

0

Investments

20

20

24

24

24

Current Assets

Inventories

`491

559

811

807

919

Sundry Debtors

253

318

395

450

544

Cash and Bank Balance

77

68

76

49

39

Loans, Advances & Deposits

72

98

88

101

104

Other Current Asset

6

8

7

6

7

Current Liabilities

208

330

379

375

417

Net Current Assets

692

721

998

1,038

1,195

Other Assets

6

16

61

61

61

Total Assets

1,116

1,347

1,839

2,544

2,762

November 17, 2015

9

MBL Infrastructures | 2QFY2016 Result Update

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

Profit before tax

76

103

119

111

108

Depreciation

11

14

20

33

57

Change in Working Capital

(35)

(56)

(261)

(217)

(488)

Interest & Financial Charges

58

75

101

140

246

Direct taxes paid

(48)

(14)

(37)

(31)

(39)

Cash Flow from Operations

62

122

(58)

37

(115)

(Inc)/ Dec in Fixed Assets

(172)

(206)

(186)

(552)

197

(Inc)/ Dec in Investments

(20)

0

(4)

0

0

Cash Flow from Investing

(191)

(206)

(190)

(552)

197

Issue/ (Buy Back) of Equity

0

0

117

21

0

Inc./ (Dec.) in Loans

202

128

290

617

176

Dividend Paid (Incl. Tax)

(3)

(6)

(7)

(8)

(9)

Interest Expenses

(58)

(75)

(101)

(140)

(246)

Minority Interest

0

32

(32)

0

(14)

Cash Flow from Financing

142

78

267

490

(92)

Inc./(Dec.) in Cash

13

(6)

18

(26)

(11)

Opening Cash balances

50

63

57

75

49

Closing Cash balances

63

57

75

49

39

November 17, 2015

10

MBL Infrastructures | 2QFY2016 Result Update

Key Ratios (Consolidated)

Y/E March

FY13

FY14

FY15

FY16E

FY17E

Valuation Ratio (x)

P/E (on FDEPS)

6.4

4.7

5.2

10.7

10.2

P/CEPS

5.3

4.0

4.2

7.6

6.1

Dividend yield (%)

1.5

1.5

1.5

0.8

0.9

EV/Sales

0.7

0.6

0.7

1.1

1.0

EV/EBITDA

6.5

5.7

6.0

8.8

6.5

EV / Total Assets

0.8

0.8

0.8

1.0

1.0

Per Share Data (`)

EPS (fully diluted)

32.3

44.0

39.4

19.3

20.2

Cash EPS

38.7

52.0

49.1

27.3

34.0

DPS

3.0

3.0

3.1

1.6

1.9

Book Value

227.1

267.6

316.5

182.5

197.9

Returns (%)

RoCE (Pre-tax)

14.6

15.6

14.9

12.1

13.9

Angel RoIC (Pre-tax)

12.9

14.4

12.8

10.3

13.3

RoE

15.2

17.8

14.5

11.3

10.6

Turnover ratios (x)

Asset Turnover (Gross Block) (X)

0.6

0.7

0.7

0.5

0.4

Inventory / Sales (days)

127

108

127

128

113

Receivables (days)

57

59

66

67

65

Payables (days)

18

25

37

32

19

Leverage Ratios (x)

D/E ratio (x)

1.6

1.6

1.6

2.2

2.3

Interest Coverage Ratio (x)

2.3

2.4

2.2

1.8

1.4

November 17, 2015

11

MBL Infrastructures | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

MBL Infrastructures

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

November 17, 2015

12