3QFY2016 Result Update | Infrastructure

February 2, 2015

Larsen & Toubro

BUY

CMP

`1,122

Performance Highlights

Target Price

`1,310

Quarterly highlights - Standalone

Investment Period

12 Months

Y/E March (` cr)

3QFY16 2QFY16 3QFY15

% chg (yoy)

% chg (qoq)

Net sales

14,774

13,324

14,995

(1.5)

11.6

EBITDA

1,002

1,012

1,569

(36.2)

(1.0)

Stock Info

Adj. PAT

791

643

1,060

(25.3)

23.1

Sector

Infrastructure

Source: Company, Angel Research

Market Cap (` cr)

104,496

Standalone numbers disappoint: For 3QFY2016, Larsen & Toubro (L&T) reported

Net debt (` cr)

11,421

1.5% yoy decrease in its top-line to `14,774cr, reflecting revenue de-growth

Beta

1.2

across Infrastructure and Others segments. The EBITDA margin for the quarter is

down 368bp yoy to 6.8%, on account of surge in SAO and employee expenses. The

52 Week High / Low

1,893/1,070

PAT came in at `791cr, down 25.3% yoy, reflecting poor operational performance.

Avg. Daily Volume

2,542,243

Order inflows for the consolidated entity in 9MFY2016 declined 13.2% yoy to

Face Value (`)

2

`93,524cr. The order backlog stands at `2,56,458cr, thereby giving revenue

BSE Sensex

26,656

visibility for over the next 10 quarters.

Nifty

8,066

Hydro-carbon reports minimal losses: Despite completion of legacy projects in

Reuters Code

LART.BO

the international business, strong execution of ongoing projects helped the

Bloomberg Code

LT@IN

Hydro-carbon segment report revenues of `2,184cr in 3QFY2016. For the

quarter, this segment reported a turnaround in its EBIT to `39cr vs a loss of

Shareholding Pattern (%)

`137cr in 3QFY2015. On the whole, this segment ended 9MFY2016 with an

EBIT level profit of `77cr.

Promoters

-

MF / Banks / Indian Fls

39.3

Key Positives: Surprise on the order inflow numbers for the quarter, turnaround in

the Hydro-carbon segment; net WC cycle at 24% of sales.

FII / NRIs / OCBs

16.7

Key Negatives: Lowering of order inflow guidance for FY2016, revenue de-

Indian Public / Others

44.0

growth in 3QFY2016.

Outlook and valuation: L&T’s diversified presence and an anticipated recovery in

Abs. (%)

3m

1yr

3yr

the capex cycle coupled with the company’s strong balance sheet comfort us that

Sensex

(6.9)

(14.9)

25.5

it is well positioned to benefit from a revival in the award activity environment.

LT

(20.5)

(34.0)

9.7

With order backlog expected to grow, execution should pick-up gradually. We

have valued the company using the sum-of-the-parts (SoTP) methodology, to

capture the value of all its businesses and investments. Ascribing separate values

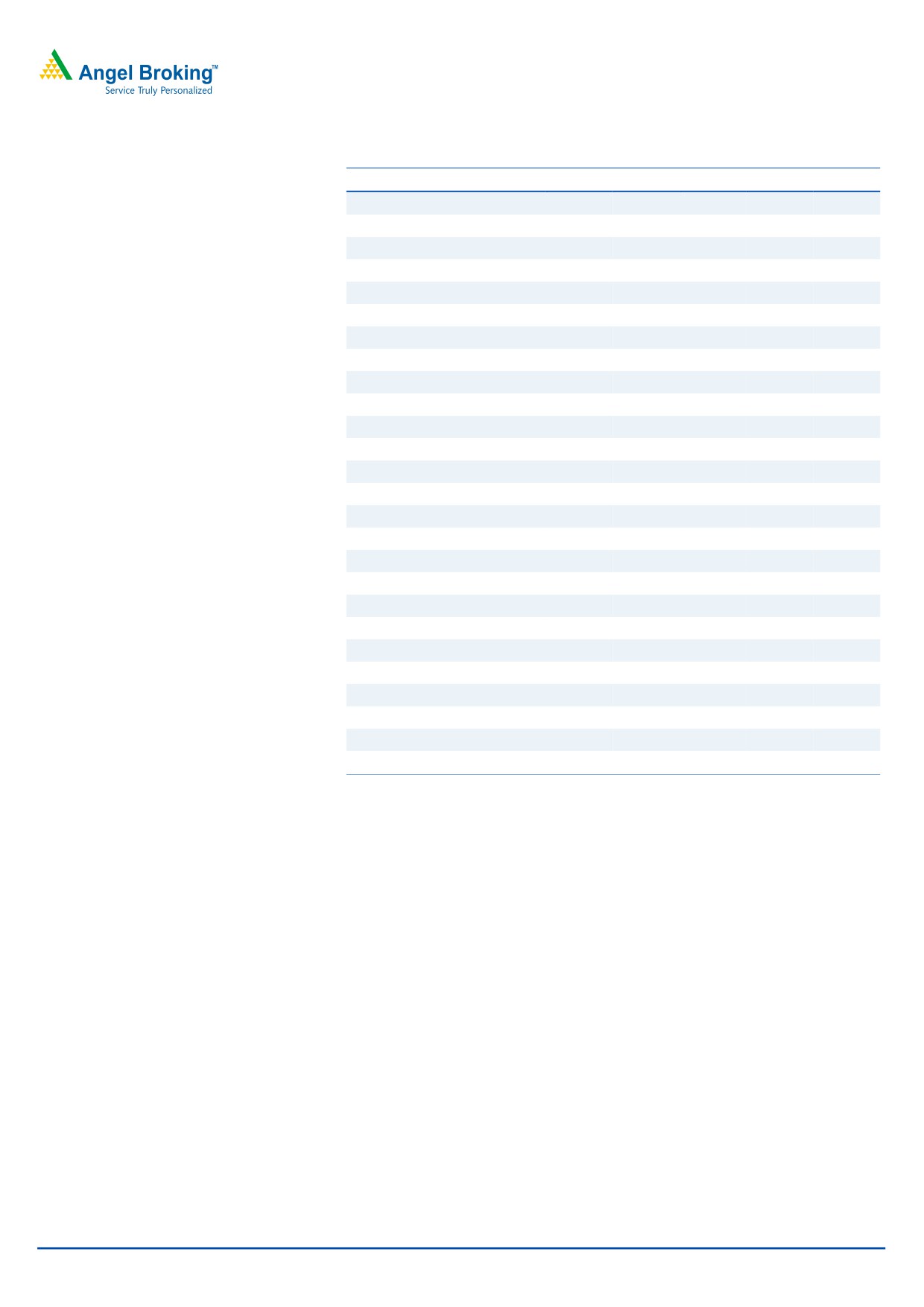

3-year price chart

to its parent business (on a P/E basis) and investments in subsidiaries (using P/E,

2,000

P/BV and M-cap basis), we arrive at FY2017E based target price of `1,310. We

1,500

are of the view that L&T is a good proxy play for investors wanting to ride on the

revival of the Indian infrastructure growth story. Given the 16.7% upside potential

1,000

in the stock from the current levels, we maintain our BUY rating on the stock.

500

Key financials (Standalone)

0

Y/E March (` cr)

FY13

FY14

FY15E

FY16E

FY17E

Net Sales

51,611

56,599

57,017

58,870

65,708

% chg

9.7

0.7

3.2

11.6

Net Profit

4,385

5,493

5,056

3,981

4,975

Source: Company, Angel Research

% chg

25.3

(8.0)

(21.3)

25.0

EBITDA (%)

10.6

11.8

11.4

8.3

10.3

EPS (`)

53

59

54

42

53

P/E (x)

21.2

19.0

20.7

26.5

21.2

P/BV (x)

2.4

2.3

2.1

1.9

1.7

RoE (%)

14.2

15.6

13.3

8.8

11.2

RoCE (%)

17.5

18.7

16.3

11.6

13.9

Yellapu Santosh

EV/Sales (x)

2.0

2.0

2.0

2.0

1.8

022 - 3935 7800 Ext: 6811

EV/EBITDA (x)

18.5

17.0

17.8

24.1

17.5

Source: Company, Angel Research; Note: CMP as of February 1, 2016

Please refer to important disclosures at the end of this report

1

Larsen & Toubro | 3QFY2016 Result Update

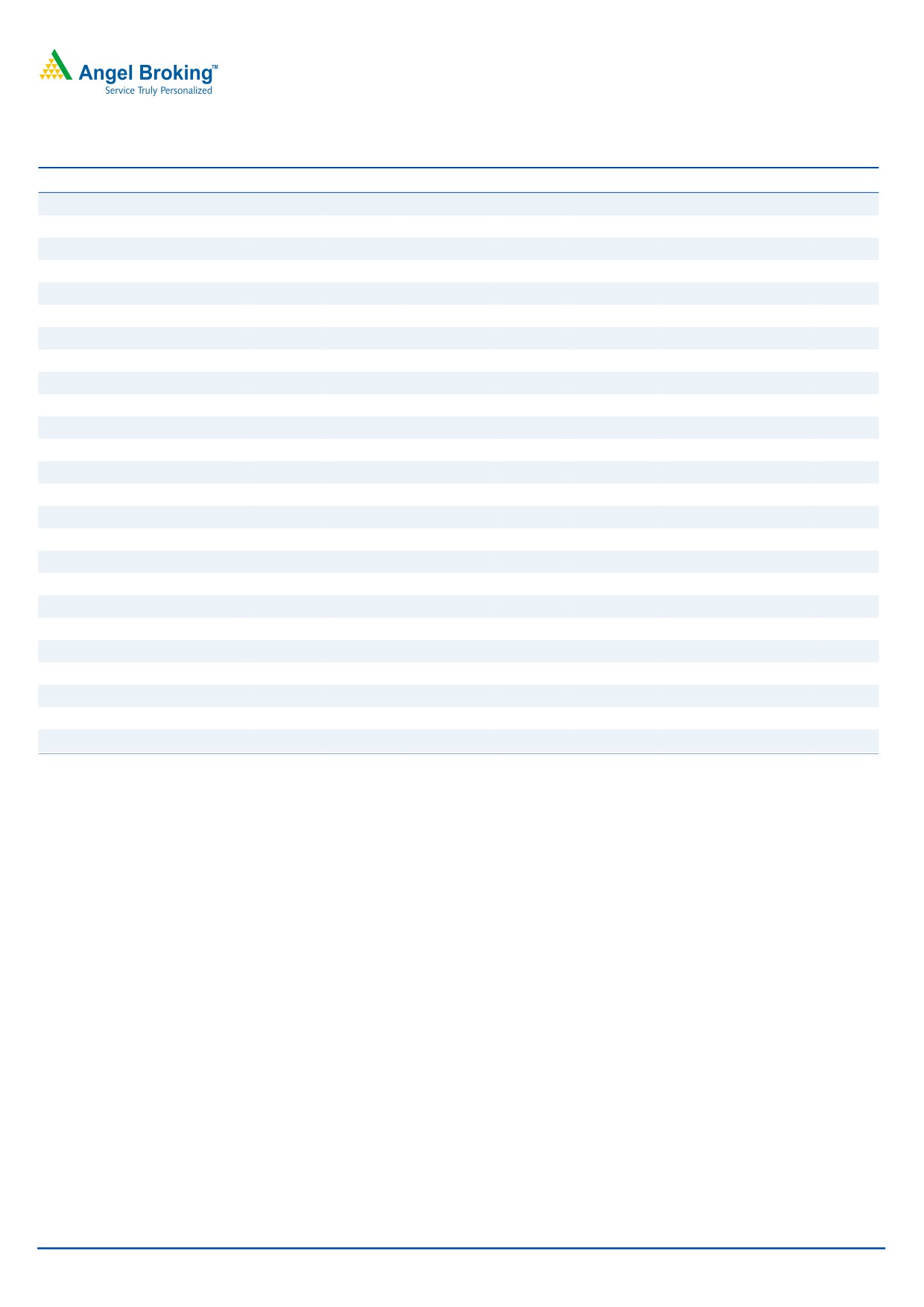

Exhibit 1: Quarterly Performance (Standalone)

Particulars (` cr)

3QFY16

2QFY16

% chg (qoq)

3QFY15

% chg (yoy)

9mFY16

9mFY15

% chg

Net Sales

14,774

13,234

11.6

14,995

(1.5)

38,718

38,049

1.8

Total Expenditure

13,772

12,222

12.7

13,426

2.6

35,730

34,052

4.9

Operating Expenses

11,819

10,372

14.0

11,921

(0.9)

30,405

29,581

2.8

Employee benefits Expense

1,200

1,254

(4.4)

959

25.1

3,443

3,141

9.6

Sales, Admin & Other Expenses

753

596

26.4

546

38.0

1,882

1,330

41.6

EBITDA

1,002

1,012

(1.0)

1,569

(36.2)

2,988

3,998

(25.2)

EBIDTA %

6.8

7.6

10.5

7.7

10.5

Depreciation

244

254

(3.6)

264

(7.4)

744

762

(2.4)

EBIT

757

759

(0.2)

1,306

(42.0)

2,244

3,236

(30.6)

Interest and Financial Charges

381

383

(0.6)

500

(23.8)

1,052

1,085

(3.1)

Other Income

617

487

26.6

622

(0.8)

1,658

1,713

(3.2)

PBT before Exceptional Items

993

863

15.1

1,427

(30.4)

2,851

3,864

(26.2)

Exceptional Items

(92)

(546)

0

(638)

(171)

PBT after Exceptional Items

1,085

1,409

(23.0)

1,427

(24.0)

3,488

4,035

(13.6)

Tax

202

220

(8.2)

367

(44.9)

716

1,040

(31.1)

% of PBT

18.6

15.6

25.7

20.5

25.8

PAT

883

1,188

(25.7)

1,060

(16.7)

2,772

2,996

(7.5)

Adj. PAT (for excep. Items)

791

643

23.1

1,060

(25.3)

2,135

2,824

(24.4)

Adj. PAT %

5.4

4.9

7.1

5.5

7.4

Dil. EPS

9.44

12.71

(25.7)

11.34

(16.8)

29.63

32.06

(7.6)

Source: Company, Angel Research

Standalone business

Revenues de-grew 1.5% yoy

For the quarter, L&T reported a 1.5% yoy decline in its top-line to `14,774cr. The

reported revenues were below our expectation of `15,895cr. Revenue de-growth

on a yoy basis reflects (1) 8.7% decrease in Infrastructure segment, 2.6% decrease

in Metallurgical & Material Handling segment and 23.3% decrease in Others

segment. Revenue de-growth across Infrastructure segment was owing to

slowdown in payments cycle and delayed clearances. Sharp revenue de-growth in

Others segment reflects slowdown in the Realty business, and delayed receipt of

new orders. Whereas, on the other hand, Power segment reported strong yoy

revenue growth reflecting strong execution of large ticket projects won in the

previous year.

February 2, 2015

2

Larsen & Toubro | 3QFY2016 Result Update

Exhibit 2: Segment-wise Gross Revenue Split (Standalone)

Particulars (` cr)

3QFY16

2QFY16

% chg (qoq)

3QFY15

% chg (yoy)

9mFY16

9mFY15

% chg

Infrastructure

9,785

9,241

5.9

10,720

(8.7)

26,226

26,374

(0.6)

Power

2,107

1,352

55.9

1,075

96.1

4,551

3,034

50.0

Metallurgical & Material Handling

678

646

4.9

696

(2.6)

1,852

2,378

(22.1)

Heavy Engineering

826

568

45.5

749

10.3

1,989

2,361

(15.8)

Electrical & Automation

1,085

1,038

4.6

1,060

2.4

2,992

2,814

6.3

Others

791

833

(5.0)

1,030

(23.3)

2,376

2,086

13.9

Less: Inter-segment Revenues

327

289

13.2

205

59.9

803

633

26.7

Gross Segmental Revenues

14,944

13,388

11.6

15,125

(1.2)

39,183

38,412

2.0

Source: Company, Angel Research

Exhibit 3: Segment-wise Unadj. EBIT & EBIT Margins (Standalone)

Particulars (` cr)

3QFY16

2QFY16

% chg (qoq)

3QFY15

% chg (yoy)

9mFY16

9mFY15

% chg

Infrastructure

833

703

18.6

937

(11.1)

2,280

2,485

(8.3)

EBIT Margin (%)

8.5

7.6

8.7

8.7

9.4

Power

79

82

(3.5)

66

20.6

182

150

21.7

EBIT Margin (%)

3.8

6.1

6.1

4.0

4.9

Metallurgical & Material Handling

(24)

7

nmf

36

nmf

(39.6)

178

nmf

EBIT Margin (%)

(3.6)

1.1

5.2

(2.1)

7.5

Heavy Engineering

(17)

(88)

nmf

64

nmf

(64.7)

225

nmf

EBIT Margin (%)

(2.1)

(15.5)

8.6

(3.3)

9.6

Electrical & Automation

122

103

17.6

126

(3.7)

322

308

4.7

EBIT Margin (%)

11.2

10.0

11.9

10.8

10.9

Others

136

162

(16.0)

352

(61.4)

453

554

(18.2)

EBIT Margin (%)

17.2

19.4

34.2

19.0

26.5

Segmental EBIT (unadj.)

1,129

969

16.4

1,582

(28.7)

3,132

3,900

(19.7)

Source: Company, Angel Research; Note- nmf- Not Meaningful

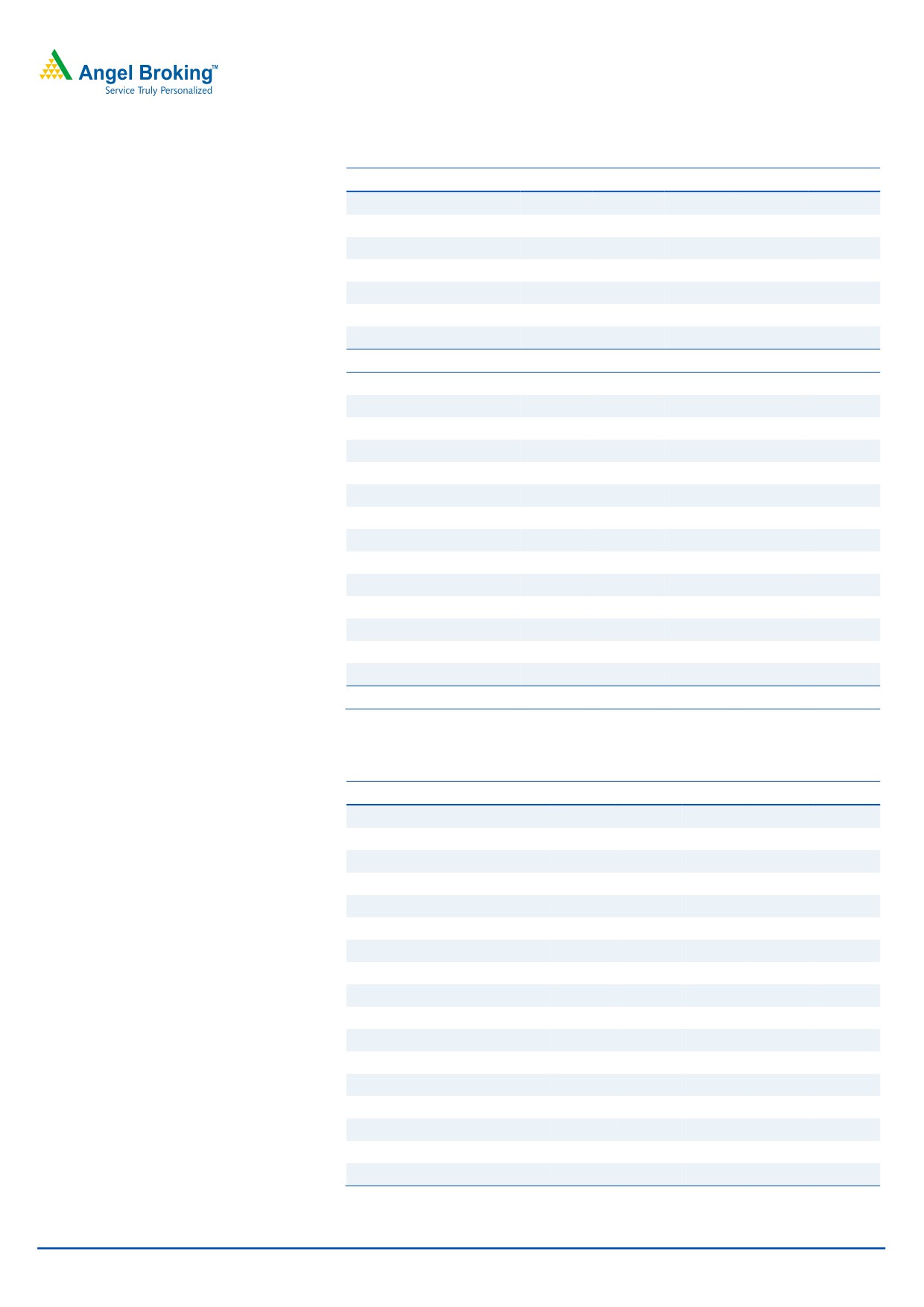

Reports sub-7% EBITDA margin since 2QFY2007

L&T reported lower than expected EBITDA of `1,002cr in 3QFY2016. L&T, for the

first time since 2QFY2007 (6.4% margins), reported EBITDA margins below 7.0%

levels, ie at 6.8%. Further, 3QFY2016 is the third successive quarter where L&T

reported yoy decline in its EBITDA margins (down 368bps). Top-line de-growth

coupled with (a) 25.1% yoy increase in employee expenses (to `1,200cr), and (b)

38.0% yoy increase in Sales, Administrative and other (SAO) expenses (to `753cr)

led to the yoy decline in EBITDA margins.

At the segment level, EBIT margin pressure on yoy basis was seen across

Infrastructure (down 23bp to 8.5%), Electrical & Automation segment (down 72bp

to 11.2%); and Others segment (down 1,701bp to 17.2%). Margin compression

across Electrical & Automation segment is on account of change in project/

product sales mix and new product introductions.

Sharp decline in Other segment’s margin is owing to lower contribution from the

high margin Realty business. In 3QFY2016 there were no benefits of accumulated

margin recognition as in 3QFY2015.

February 2, 2015

3

Larsen & Toubro | 3QFY2016 Result Update

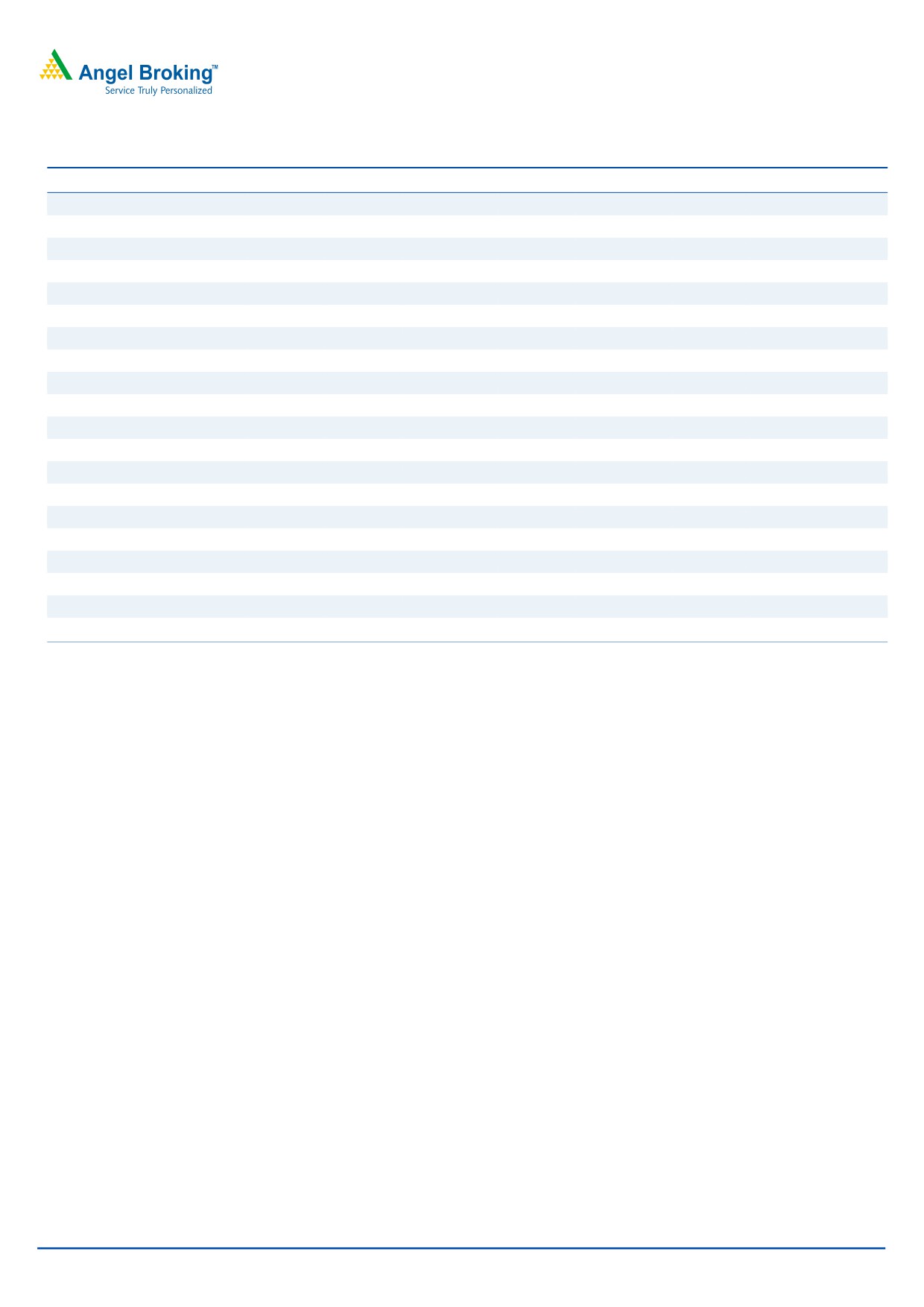

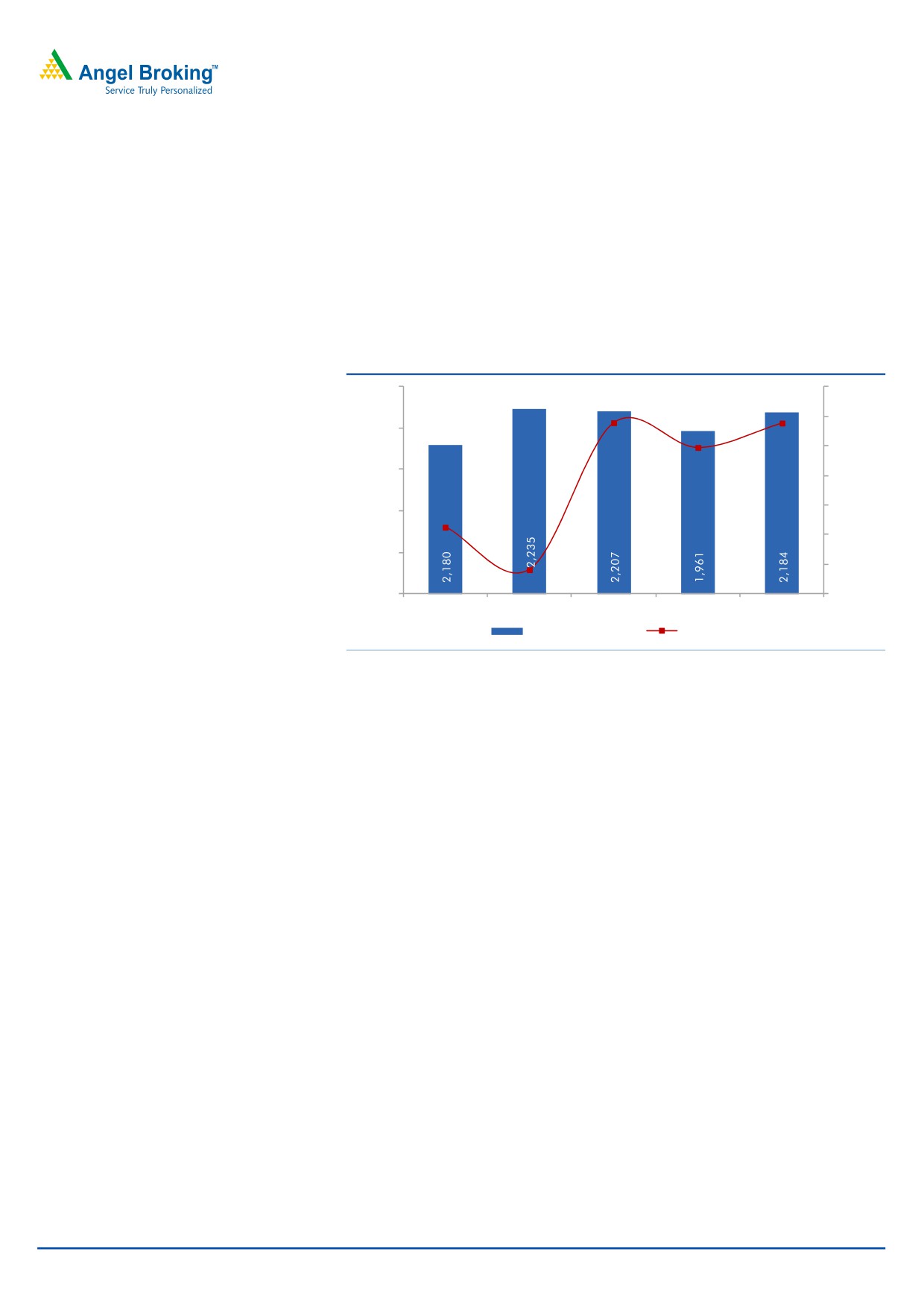

Exhibit 4: EBITDA margin declines to 6.8%

Exhibit 5: Adj. PAT margin decline yoy to 5.4%

3,000

13.1

14.0

2,000

12.0

1,800

9.9

2,500

10.5

10.5

12.0

10.0

1,600

8.2

9.1

10.0

1,400

2,000

7.1

8.0

7.6

6.5

6.8

8.0

1,200

5.4

1,500

1,000

4.9

6.0

6.0

800

1,000

4.0

4.0

600

400

500

2.0

2.0

200

0

0.0

0

0.0

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

EBITDA (`cr, LHS)

EBITDAM (%, RHS)

PAT (` cr, LHS)

PATM (%, RHS)

Source: Company, Angel Research

Source: Company, Angel Research

Adj. PAT numbers report yoy decline

L&T reported PAT of `883cr for the quarter, again below our estimate. On

adjusting for gains on divestment of part stake in 3 subsidiaries and stake in an

associate company (at `92cr), the Adjusted PAT of the company stood at `791cr.

The Adj. PAT margin of the company declined from 7.1% a year ago to 5.4% in

3QFY2016. Decline in yoy Adj. PAT is on account of decline in EBITDA and 23.8%

decrease in depreciation expenses to `381cr.

Consolidated business

Revenue grew 8.3% yoy

L&T reported an 8.3% yoy and 10.4% qoq growth in its consolidated business’ top-

line to `25,829cr. Revenue growth on yoy basis reflects (1) weak execution across

Infrastructure segment (2.5% revenue growth to `12,112cr), (2) strong execution

across Power segment (100.8% increase in revenue to `2,296cr),

(3)

22.7%

increase in Hydro-carbon segment (to `2,184cr), and 16.6% increase in IT &

Technology Services segment (to `2,320cr).

Weak project execution in domestic markets was offset by strong execution across

International business within the Infrastructure segment. Despite legacy projects still

nearing completion, stronger execution across Hydro-carbon segment led the

segment report strong 22.7% yoy revenue increase. IT & Technology Services

benefitted from strong revenue contribution from wide range of sectors (barring

Energy sector). Commissioning of new roads and increase in traffic across GSRDC

roads led to 12.4% yoy increase in Developmental project revenues to `1,288cr.

February 2, 2015

4

Larsen & Toubro | 3QFY2016 Result Update

Exhibit 6: Quarterly Performance (Consolidated)

Particulars (` cr)

3QFY16

2QFY16

% chg (qoq)

3QFY15

% chg (yoy)

9mFY16

9mFY15

% chg

Net Sales

25,829

23,393

10.4

23,848

8.3

69,475

63,982

8.6

Total Expenditure

23,179

20,802

11.4

20,962

10.6

61,943

56,255

10.1

Man. Cons. & Opex Exp. (MCO)

19,049

16,996

12.1

17,763

7.2

50,499

46,458

8.7

Employee benefits Expense

2,411

2,433

(0.9)

1,929

25.0

6,937

5,949

16.6

Sales, Admin & Other Expenses

1,719

1,372

25.3

1,271

35.3

4,508

3,849

17.1

EBITDA

2,650

2,592

2.3

2,886

(8.2)

7,531

7,727

(2.5)

EBIDTA %

10.3

11.1

12.1

10.8

12.1

Depreciation

620

694

(10.6)

679

(8.7)

1,936

2,035

(4.9)

EBIT

2,030

1,898

7.0

2,207

(8.0)

5,596

5,692

(1.7)

Interest and Financial Charges

745

828

(10.0)

918

(18.9)

2,279

2,379

(4.2)

Other Income

452

219

106.2

237

90.8

929

728

27.5

PBT before Exceptional Items

1,737

1,289

34.8

1,525

13.9

4,245

4,041

5.0

Exceptional Items

0

(310)

0

(310)

(249)

PBT after Exceptional Items

1,737

1,599

8.7

1,525

13.9

4,555

4,291

6.2

Tax

556

494

12.6

569

(2.4)

1,595

1,487

7.2

% of PBT

32.0

30.9

37.3

35.0

34.7

PAT before Minority Int.

1,182

1,105

6.9

956

23.6

2,960

2,803

5.6

Extra-Ordinary Items

0

0

0

0

0

Share in profit of Associates (net)

(2)

(1)

2

(1)

4

Adj. of Minority Interests

(145)

(109)

(91)

(322)

(112)

PAT after Minority Interest

1,035

996

3.9

867

19.4

2,637

2,695

(2.2)

Adj. PAT (for excep. Items)

1,035

686

50.8

867

19.4

2,327

2,446

(4.8)

Adj. PAT %

4.0

2.9

3.6

3.3

3.8

Dil. EPS

11.07

10.65

3.9

9.27

19.4

28.20

28.84

(2.2)

Source: Company, Angel Research

EBITDA margin declines yoy to 10.3%

L&T reported an 184bps yoy decline in EBITDA margin in 3QFY2016 to 10.3%.

The decline is owing to (1) 25.0% increase in employee expenses to `2,411cr and

(2) 35.3% increase in SAO expenses to `1,719cr. Surge in employee expenses is

on account of manpower augmentation, normal revisions and higher staff mix

from international operations. Increase in yoy SAO expenses is mainly attributable

to higher provisions.

Further, if we look at the segment-wise details, then yoy EBIT margins were

impacted due to margin compression seen across Power (545bps), Electrical

Automation (193bps), Infrastructure (23bps), and Others segments (224bps).

Notably, the Hydro-Carbon business reported 1.8% EBIT margin during the

quarter, against loss margin in the previous quarter and the year ago quarter.

Adj. PAT margins continue to decline

L&T reported a PAT of `1,035cr for 3QFY2016. PAT margins of the company were

at 4.0%, higher than the previous year’s 3.6%. Despite yoy EBITDA de-growth,

90.8% increase in other income to `452cr and lower tax rates (at 32.0% in

February 2, 2015

5

Larsen & Toubro | 3QFY2016 Result Update

3QFY2016 vs 37.3% in 3QFY2015) led to a 19.4% yoy increase in PAT. Increase

in other income on a yoy basis is owing to treasury gains. PAT numbers also

benefitted from 18.9% yoy decrease in interest expenses (to `745cr), which reflects

impact of loan refinancing and debt retrials.

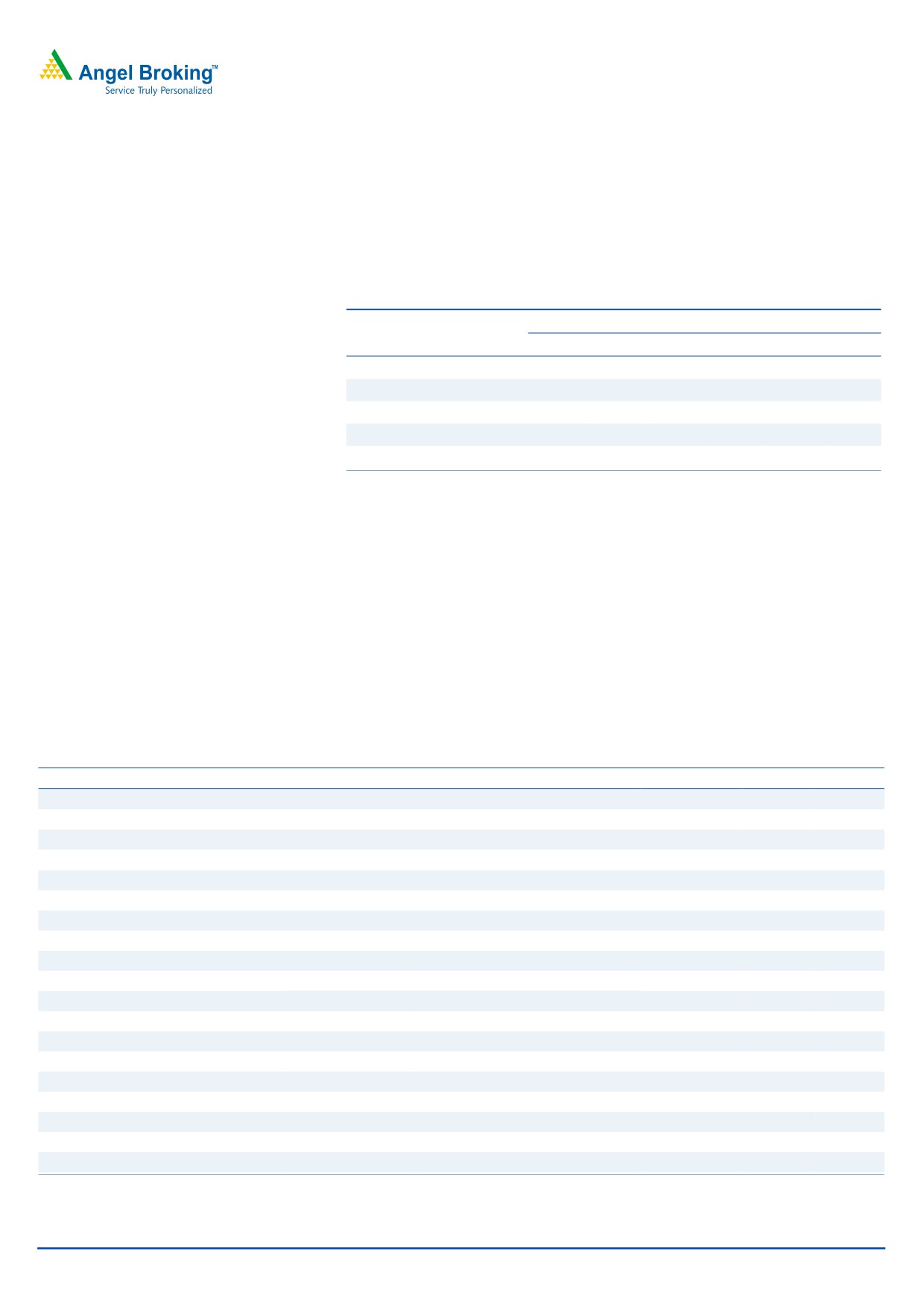

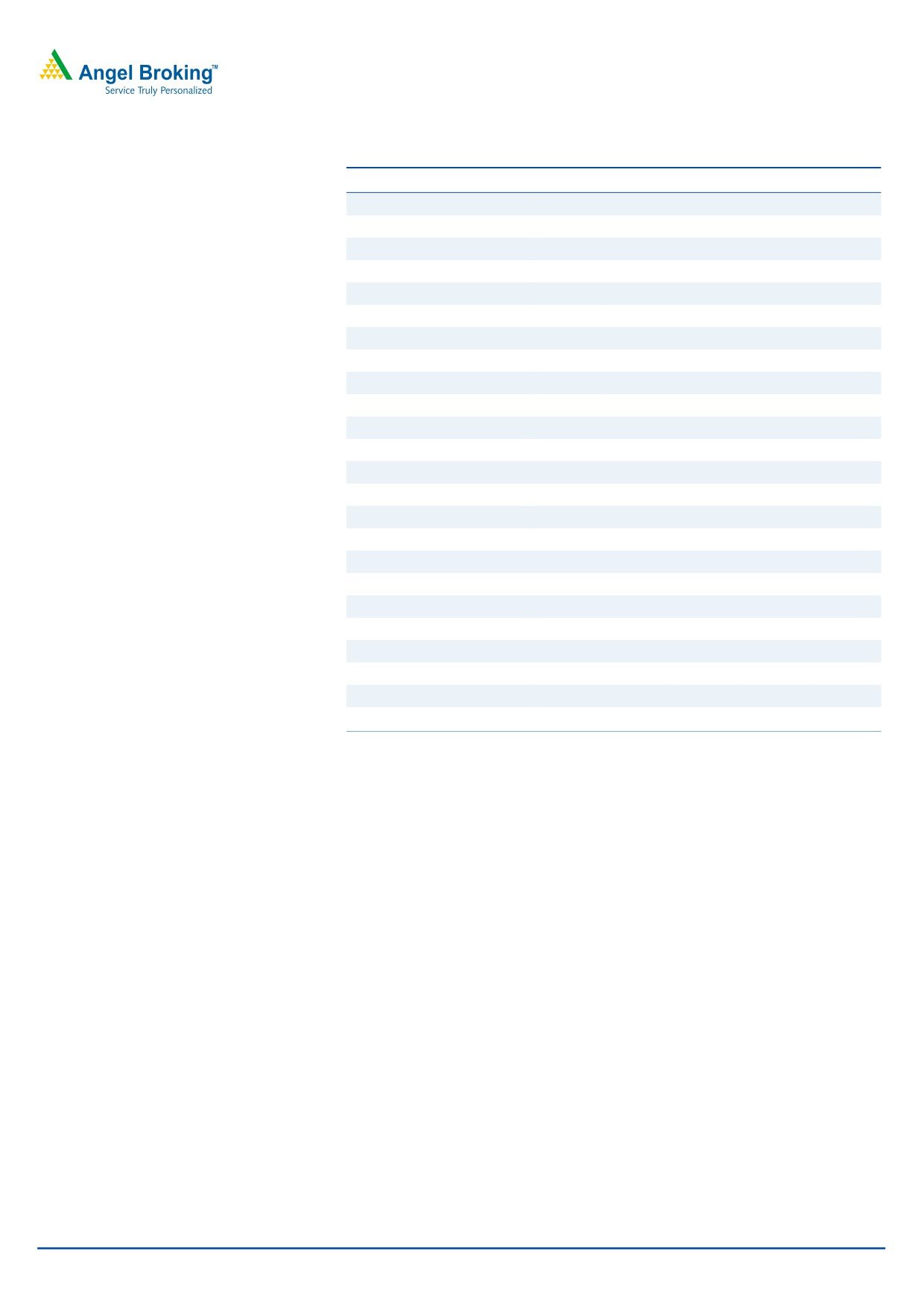

Hydro-carbon business turns around

At the backdrop of stronger execution, Hydro-carbon business reported revenues

of `2,184cr.

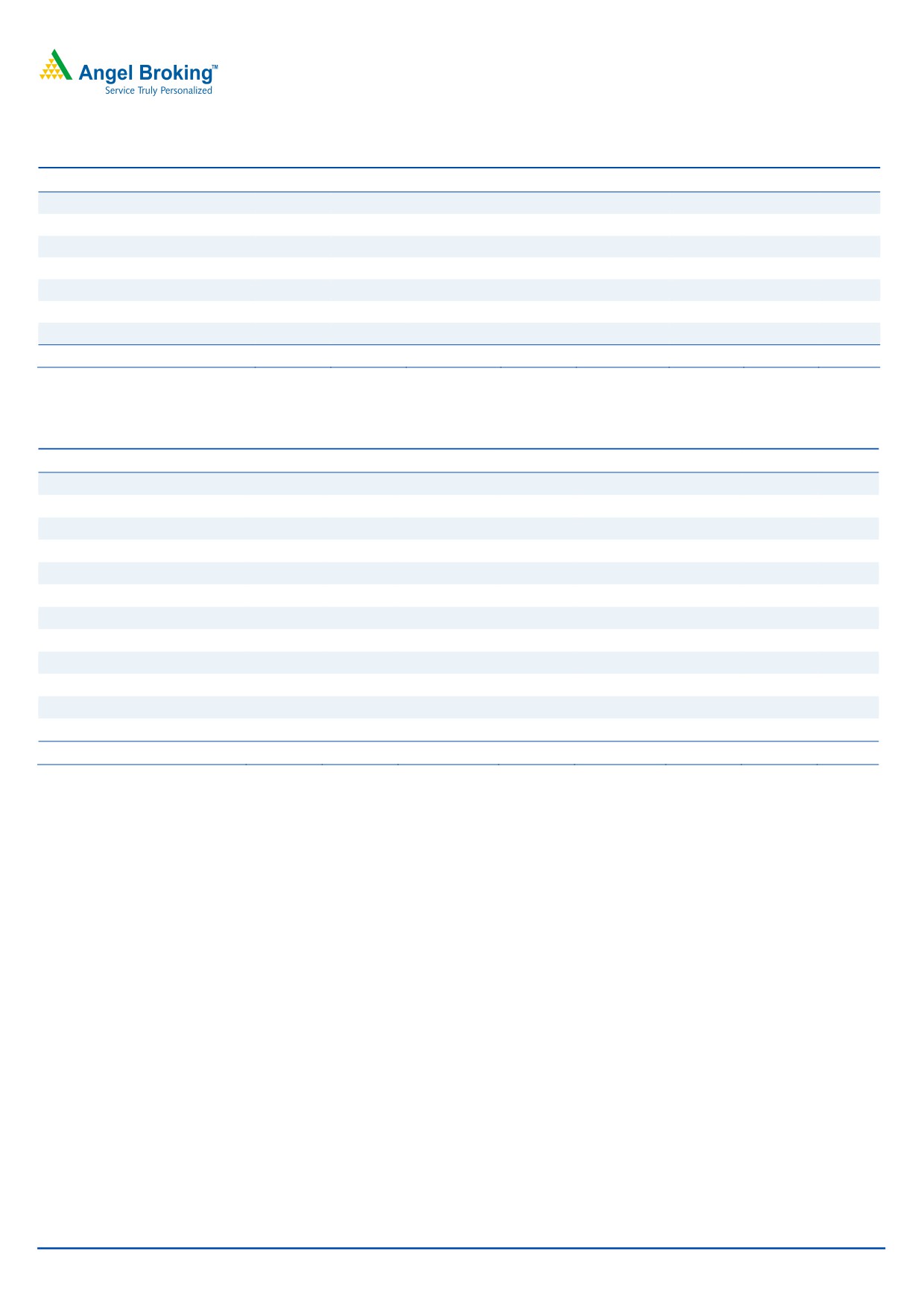

Exhibit 7: Hydro-carbon - Quarterly Revenues & EBIT

2,500

40

39

100

50

2,000

(2)

0

1,500

(137)

(209)

(50)

(100)

1,000

(150)

500

(200)

0

(250)

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Revenue (` cr, LHS)

EBIT (` cr, RHS)

Source: Company, Angel Research

Hydro-carbon business reported strong `39cr EBIT in 3QFY2016 (vs `137cr EBIT

level loss in the corresponding period a year ago). EBIT level turn around reflects

loss minimisation of international projects in the current year and legacy projects

nearing completion.

IT & Technology Services business report strong growth

L&T’s IT & Technology Services business reported an impressive 16.6% yoy

increase in revenue for the quarter to `2,320cr. Top-line growth was driven across

all the end-markets across sectors, except the Energy segment. On the profitability

front, operational efficiencies led to EBIT margin expanding by 233bp yoy to

19.8%.

February 2, 2015

6

Larsen & Toubro | 3QFY2016 Result Update

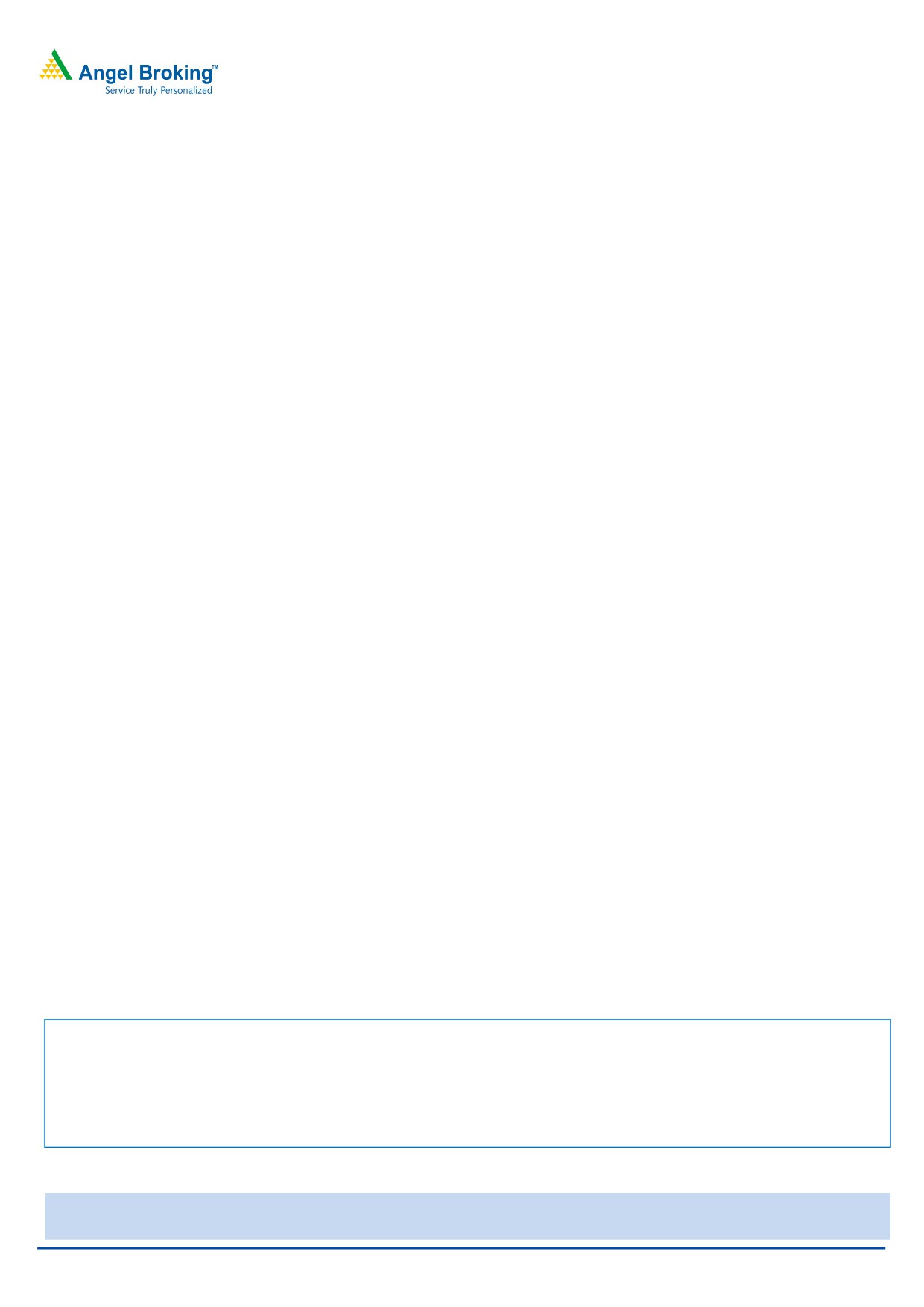

Order inflow growth disappoints

The consolidated order inflow for the quarter increased 11.3% yoy to `38,528cr

(on excluding the Services business, order inflow reported 9.9% yoy increase). A

majority of 3QFY2016 order inflows were from Transportation Infra, PT&D and

Water business.

On the whole, order inflows for 9MFY2016 declined 13.2% yoy to `93,524cr.

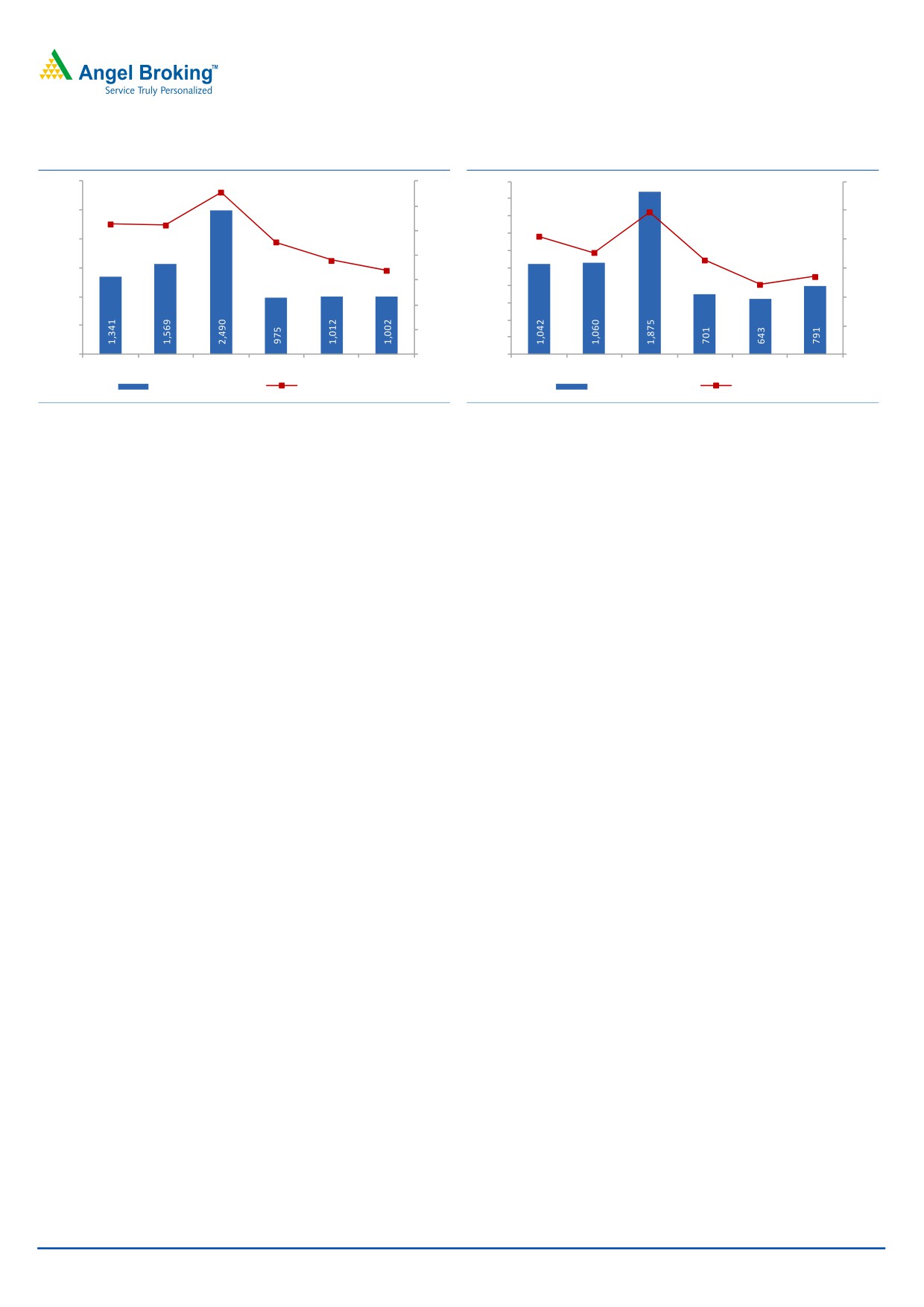

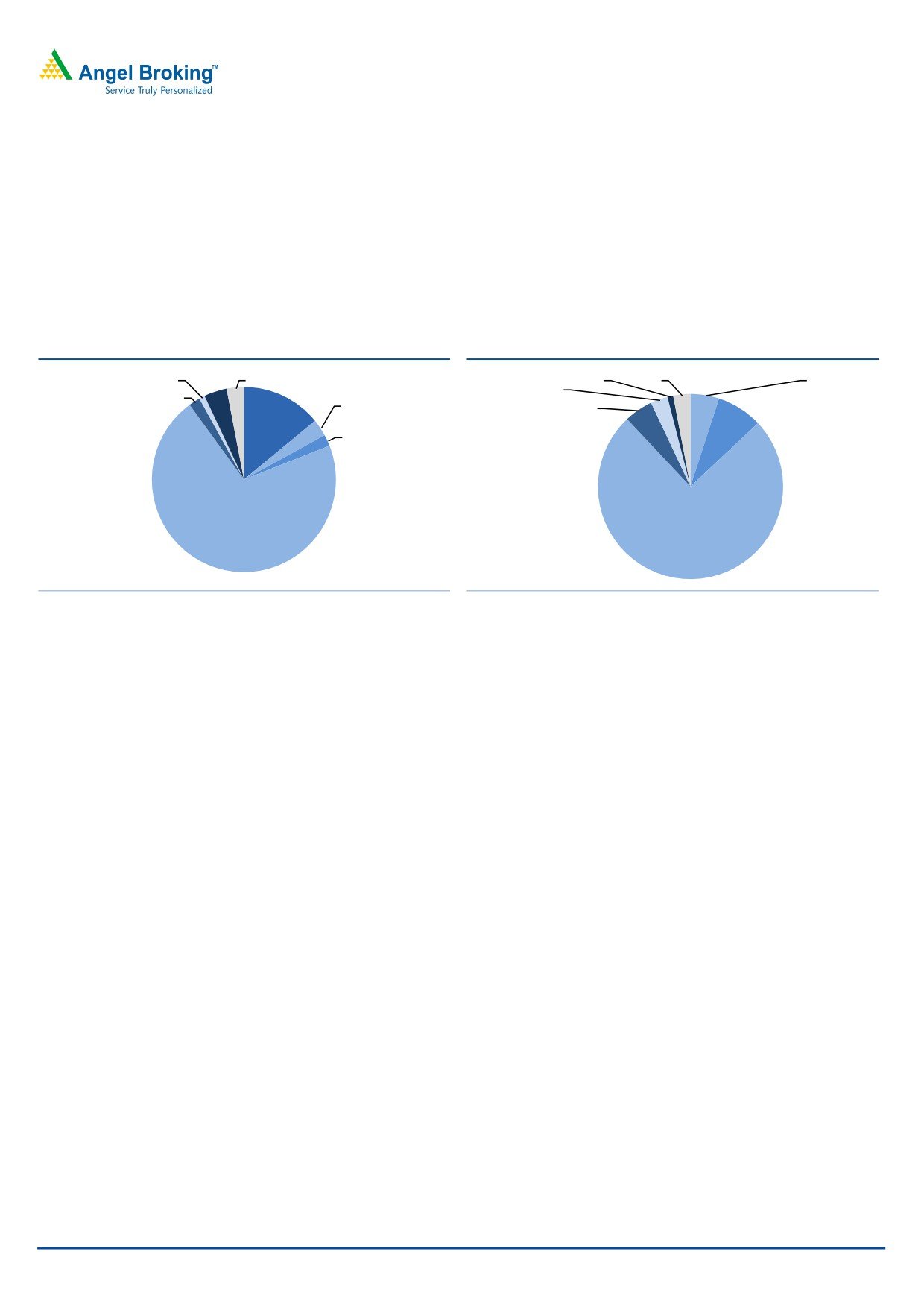

Exhibit 8: 3QFY16 Order Inflows mix (consol.)

Exhibit 9: 3QFY16 Order Book mix (consol.)

HE, 1%

EA, 4%

Others, 3%

EA, 1% Others, 3%

Hydrocarbon,

HE, 3%

Services, 0%

Hydrocarbon,

5%

MMH, 2%

3%

MMH, 5%

Power, 8%

Services,

14%

Power, 2%

Infrastructure,

Infrastructure,

71%

75%

Source: Company, Angel Research

Source: Company, Angel Research

L&T’s order book currently stands at `2,56,458cr, indicating a 13.6% yoy growth.

As of 3QFY2016, L&T’s order book is majorly dominated by Infra (75%), followed

by Power (8%) and Hydro-carbon (5%) segments. MMH (5%), HE (3%) and Others

(3%) which constitute the remaining order book. International order book

constitutes 27% of the total order book. The current order book gives revenue

visibility for over the next 10 quarters.

One of the positives of the 3QFY2016 results were 11.4% yoy increase in

3QFY2016 order inflows.

In the back-drop of lower 9MFY2016 order inflows and reduced bid pipeline of

`2,00,000cr (from the earlier `5,00,000cr at the beginning of year), company

Management lowered its order inflow growth guidance from earlier 5-7% to flattish

levels for FY2016. L&T in order to attain its flattish order inflow growth guidance

for FY2016 has to report `61,900cr order wins in 4QFY2016. This translates to an

asking rate of 30% order inflow growth in 4QFY2016, which in our view is very

challenging.

Despite management’s optimistic order inflow guidance, we revise downward our

order inflow (to `150,500cr and `162,600cr) and order book (to `2,88,800cr and

`3,47,000cr) assumptions for FY2016E and FY2017E, respectively.

February 2, 2015

7

Larsen & Toubro | 3QFY2016 Result Update

Revision of Estimates

Considering the yoy de-growth across 9MFY2016 order inflow numbers and lower

than expected revenue booking, we revise down our top-line and PAT number

estimates. We now expect L&T (standalone entity) to report PAT of `3,981cr and

`4,975cr for FY2016E and FY2017E, respectively.

Exhibit 10: Revised estimates

FY2016E

FY2017E

Particulars (` cr)

Old

New

% chg.

Old

New

% chg.

Net Sales

64,148

58,870

(8.2)

73,241

65,708

(10.3)

EBITDA

7,377

4,857

(34.2)

8,569

6,735

(21.4)

EBITDA Margins (%)

11.5

8.3

11.7

10.2

Rep. PAT

5,776

3,981

(31.1)

6,155

4,975

(19.2)

Rep. PAT Margins (%)

9.0

6.8

8.4

7.6

Source: Company, Angel Research

Valuation

We recommend BUY with a target price of `1,310

We believe L&T has a tough chance to beat its revised order inflow guidance and

also attain its revenue growth guidance for FY2016. Further, on considering

9MFY2016 results for Hydro-carbon vertical, we expect improved performance to

continue in 4QFY2016. On the whole, L&T with its diverse business profile (E&C,

Power, Alternate Energy, Roads & Highways, Defense, Metros, Urban Infra) is well

positioned to benefit from revival in domestic infra capex cycle.

Exhibit 11: Derivation of SOTP-based target price for L&T (FY2017E)

Business Segment

Methodology

Remarks

` cr

`/share

% to TP

L&T- Parent

P/E

15.0x FY2017E Earnings

74,632

790

60.3

Infrastructure Subsidiaries

IDPL

P/BV

1.3x FY2017E BV

11,133

118

9.0

Key Subsidiaries - Services

L&T InfoTech

P/E

15.0x FY2017E Earnings

16,574

175

13.4

L&T Finance

M-cap Basis

20% holding company discount

7,667

81

6.2

Realty Space

L&T Realty (inc. Seawoods Realty)

P/BV

1.0x FY2017E BV

3,180

34

2.6

Hydro-Carbons Business

Hydro-Carbons

P/BV

1.5x FY2017E BV

1,965

21

1.6

Key Subsidiaries - Manufacturing

L&T Power-equipment JVs

P/BV

1.0x FY2017E BV

698

7

0.6

Other Associate Companies

P/BV

1.0x FY2017E BV

5,420

58

4.4

International Business

International Subsidiaries

P/BV

1.5x FY2017E BV

2,322

25

1.9

Grand Total

108,360

1,310

100

Upside

16.7%

CMP

1,122

Source: Company, Angel Research

February 2, 2015

8

Larsen & Toubro | 3QFY2016 Result Update

We have valued the company using sum-of-the-parts (SOTP) methodology to

capture the value of all its businesses and investments. Ascribing separate values to

its parent business on a P/E basis and investments in subsidiaries (using P/E, P/BV

and M-cap basis), we arrive at a FY2017E target price of `1,310. At the current

market price of `1,122, the standalone entity is trading at an implied P/E multiple

of 11.4x (FY2017), which is attractive. We are of the view that L&T is a proxy play

for investors wanting to play on the revival in the Indian infrastructure growth story.

Given the 16.7% upside potential in the stock from the current levels, we maintain

our BUY rating on the stock.

Investment arguments

Indian capex recovery is a matter of time: Recent burst of policy measures

would ease environment for capex. This along with rate cuts makes us believe

that strong recovery is on the cards. Considering that the award activity revival

should further gain momentum, we sense that a full-fledged recovery will be

seen only in FY2017, but we can expect early signs of improvement in L&T's

execution and margin expansion from 1QFY2017 onwards.

Slowdown in order inflow from the Middle East markets coupled with revival in

domestic capex cycle should lead to shift in the order inflow mix more towards

the domestic markets, going forward. On the back of shift in order book

towards domestic markets, we expect uptick in execution. Accordingly, we have

modeled a 7.4% top-line CAGR over FY2015-2017E.

Given that L&T is currently sitting on an order book which gives revenue

visibility for over 10 quarters, this shift in order inflow mix should help the

company in faster margin recovery. We expect EBITDA margins to expand

from 8.3% in FY2016E to 10.3% in FY2017E.

Best stock to play the Indian infrastructure theme: We are of the view that L&T

is very well positioned to benefit from gradual recovery in the domestic capex

cycle, given its diverse range of sectoral exposure, strong balance sheet and

better cash flow generating potential in comparison to its peers, which are

struggling with higher leverage, and strained cash flows.

Company background

L&T, the largest Indian infrastructure conglomerate, is present across almost all the

infrastructure segments and is at the forefront of the Indian infra growth story.

Over the years, the company has diversified across various segments to encash the

untapped infra opportunity, not only in India but in other geographies as well, and

has an excellent track record of achieving the same. Currently, L&T manufactures

and services its business in over 30 countries worldwide.

February 2, 2015

9

Larsen & Toubro | 3QFY2016 Result Update

Profit & loss statement (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

Net Sales

51,611

56,599

57,017

58,870

65,708

% Chg

9.7

0.7

3.2

11.6

Total Expenditure

46,138

49,932

50,530

54,013

58,973

Raw Mat. & Contracting Exp.

40,205

43,346

44,397

45,889

51,679

Employee benefits Expense

3,861

4,662

4,151

5,181

4,797

Sales, Admin. & Other Expenses

2,072

1,923

1,982

2,944

2,497

EBITDA

5,473

6,667

6,488

4,857

6,735

% Chg

22

(3)

(25)

39

EBIDTA %

10.6

11.8

11.4

8.3

10.3

Depreciation

728

792

1,008

1,013

1,102

EBIT

4,745

5,875

5,480

3,844

5,633

% Chg

23.8

(6.7)

(29.8)

46.5

Interest and Financial Charges

955

1,076

1,419

1,466

1,618

Other Income

1,887

1,881

2,283

2,328

2,547

PBT

5,678

6,679

6,344

4,706

6,561

Exceptional Item

(176)

(589)

(357)

(546)

(120)

PBT after Exceptional Item

5,854

7,268

6,701

5,252

6,681

Tax Expenses

1,541

1,775

1,645

1,271

1,706

% of PBT

27.1

26.6

25.9

27.0

26.0

PAT before Extra-Ordinary Items

4,313

5,493

5,056

3,981

4,975

Extra-Ordinary Item

(72)

0

0

0

0

PAT

4,385

5,493

5,056

3,981

4,975

% Chg

25.3

(8.0)

(21.3)

25.0

PAT %

8.5

9.7

8.9

6.8

7.6

EPS (after Extra-ord. Items)

53

59

54

42

53

% Chg

11.6

(8.3)

(21.6)

25.0

February 2, 2015

10

Larsen & Toubro | 3QFY2016 Result Update

Balance Sheet (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

Sources of Funds

Equity Capital

123

185

186

186

186

Reserves Total

29,020

33,476

36,899

40,847

45,111

Networth

29,143

33,662

37,085

41,032

45,297

Total Debt

8,834

11,459

12,937

15,000

16,500

Other Long-term Liabilities

788

393

470

557

569

Deferred Tax Liability

242

410

363

363

363

Total Liabilities

39,007

45,924

50,854

56,952

62,729

Application of Funds

Gross Block

11,855

11,397

12,604

14,554

16,534

Accumulated Depreciation

3,550

3,836

4,844

5,856

6,959

Net Block

8,305

7,561

7,760

8,697

9,575

Capital WIP

597

676

222

250

250

Investments

16,103

19,215

23,053

26,103

28,413

Current Assets

47,419

50,853

55,869

58,436

62,051

Inventories

2,064

1,983

2,208

2,359

2,575

Sundry Debtors

22,613

21,539

23,051

23,876

24,475

Cash and Bank Balance

1,456

1,783

1,516

2,269

2,735

Loans, Advances & Deposits

9,413

10,067

10,533

12,088

13,279

Other Current Asset

11,873

15,481

18,562

17,845

18,987

Current Liabilities

33,417

32,381

36,050

36,534

37,560

Net Current Assets

14,002

18,472

19,820

21,902

24,491

Total Assets

39,007

45,924

50,854

56,952

62,729

Cash Flow Statement (Standalone)

Y/E March (` cr)

FY13

FY14

FY15P

FY16E

FY17E

Profit before tax

5,678

6,679

6,344

4,706

6,561

Depreciation

728

792

1,008

1,013

1,102

Change in Working Capital

(3,703)

(5,029)

(1,579)

(2,229)

(3,030)

Net Interest & Financial Charges

422

581

909

946

1,083

Direct taxes paid

(1,653)

(1,977)

(1,645)

(1,271)

(1,706)

Cash Flow from Operations

1,472

1,047

5,037

3,165

4,011

(Inc)/ Dec in Fixed Assets

(1,000)

(962)

(1,655)

(1,922)

(1,980)

(Inc)/ Dec in Investments

1,657

(252)

(2,345)

397

149

Cash Flow from Investing

657

(1,214)

(3,999)

(1,524)

(1,831)

Issue/ (Buy Back) of Equity

163

144

0

0

0

Inc./ (Dec.) in Loans

(1,515)

2,612

1,478

2,063

1,500

Dividend Paid (Incl. Tax)

(1,115)

(1,227)

(1,375)

(1,485)

(1,595)

Interest Expenses

(850)

(1,025)

(1,419)

(1,466)

(1,618)

Cash Flow from Financing

(3,316)

504

(1,316)

(888)

(1,713)

Inc/(Dec) in cash (inc. Dis. Opr)

(410)

337

(278)

753

467

Opening Cash balances

1,906

1,496

1,794

1,516

2,269

Closing Cash balances

1,496

1,794

1,516

2,269

2,735

February 2, 2015

11

Larsen & Toubro | 3QFY2016 Result Update

Key Ratios (Standalone)

Y/E March

FY13

FY14

FY15

FY16E

FY17E

Valuation Ratio (x)

P/E (on FDEPS)

21.2

19.0

20.7

26.5

21.2

P/CEPS

18.7

16.6

17.4

21.1

17.3

Dividend yield (%)

0.0

0.0

0.0

0.0

0.0

EV/Sales

2.0

2.0

2.0

2.0

1.8

EV/EBITDA

18.5

17.0

17.8

24.1

17.5

EV / Total Assets

2.6

2.5

2.3

2.1

1.9

Per Share Data (`)

EPS (fully diluted)

52.9

59.0

54.1

42.4

53.0

Cash EPS

59.9

67.5

64.6

53.2

64.7

DPS

12.0

12.3

13.3

14.4

15.4

Book Value

464

493

542

607

668

Returns (%)

RoCE (Pre-tax)

17.5

18.7

16.3

11.6

13.9

Angel RoIC (Pre-tax)

17.5

17.2

15.5

11.0

13.2

RoE

14.2

15.6

13.3

8.8

11.2

Turnover ratios (x)

Asset Turnover (Gross Block) (X)

4.4

4.9

4.8

4.3

4.2

Inventory / Sales (days)

15

13

13

14

14

Receivables (days)

160

142

143

145

134

Payables (days)

134

122

127

125

113

Leverage Ratios (x)

D/E ratio (x)

0.3

0.3

0.3

0.4

0.4

Interest Coverage Ratio (x)

6.9

7.2

5.5

4.2

5.1

February 2, 2015

12

Larsen & Toubro | 3QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

L&T

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

February 2, 2015

13