Quick take

LT Foods

BUY

CMP

`74

A Royal Daawat for investors

Target Price

`96

LT Foods Limited (LTFL) is a branded speciality foods company engaged in milling,

Investment Period

12 Months

processing and marketing of branded and non-branded basmati rice and

Sector

Food Processing

manufacturing of rice food products in the domestic and overseas markets. Its

Market Cap (` cr)

1,983

geographical segments include India, North America and Rest of the World. The

Net Debt (` cr)

1,565

major brands of the company are Daawat, Gold Seal Indus Valley, Rozana and

Beta

1.0

52 Week High / Low

85/ 21

817 Elephant.

Avg. Daily Volume

1,09,568

Market leadership with strong brand visibility: LTFL’s flagship brand Daawat

Face Value (`)

1

enjoys 22% market share in the branded rice market of India. The company has

BSE Sensex

33,731

strong market share in North America selling Basmati rice under the brand name

Nifty

10,452

‘Royal’. Historically, the company has been focusing on strong brand visibility, and

Reuters Code

LTOL.BO

in order to enhance brand visibility it spends on ad spends.

Bloomberg Code

LTFO.IN

Wide distribution network: Currently LTFL has an access to 1,40,000 traditional

retail outlets and reaches to 93% of towns with over 2 lakh population and 3,000

Shareholding Pattern (%)

wholesalers. Further, the company sells its products to premium hotels &

Promoters

67.2

restaurants (~50% share) and has an access to 6,000 foodservice outlets i.e.

MF / Banks / Indian Fls

1.3

‘DawatChefs Secretz”. Moreover, it has an access to 2,500 modern trade stores

FII / NRIs / OCBs

2.5

including 121 hypermarkets, 298 supermarkets and 1,462 mini markets. It is the

Indian Public / Others

29.1

1st Rice Company to place Brown Basmati Rice in Medical Chains.

Diversified product portfolio catering to varied customers: LTFL has a well-

Abs. (%)

3m

1yr

3yr

diversified product basket, which caters to consumers of all income groups. The

Sensex

4.5%

23%

21%

company is present in segments like Basmati rice, Speciality rice (non-Basmati)

LTFL

6.1%

184%

497.0%

and Other food products. It is also consistently working on adding new products to

its portfolio. LTFL has done JV with Japanese Snack Food major Kameda, which

would launch rice based snacks in India. LTFL has recently introduced ‘Daawat

Rozana GoldPlus’ brand.

Strong global footprint: LT Foods is now an emerging global Foods Company with

a focus on basmati and other speciality rice, organic foods and convenience rice

based products. LT Foods has a global footprint, selling their flagship basmati rice

brands i.e. Royal and Daawat into 65 countries. The company has established on

ground presence in the US, Europe and Middle East in order to unlock the full

potential of these territories.

Outlook and Valuation: Going forward, we expect the company to report healthy

top-line CAGR of 13.5% over the next two years on the back of strong distribution

network & brand, continuous expansion, wide product basket and addition of new

products in portfolio. On the bottom-line front, we expect ~20% CAGR on the

back of robust improvement in operating performance. We expect margin

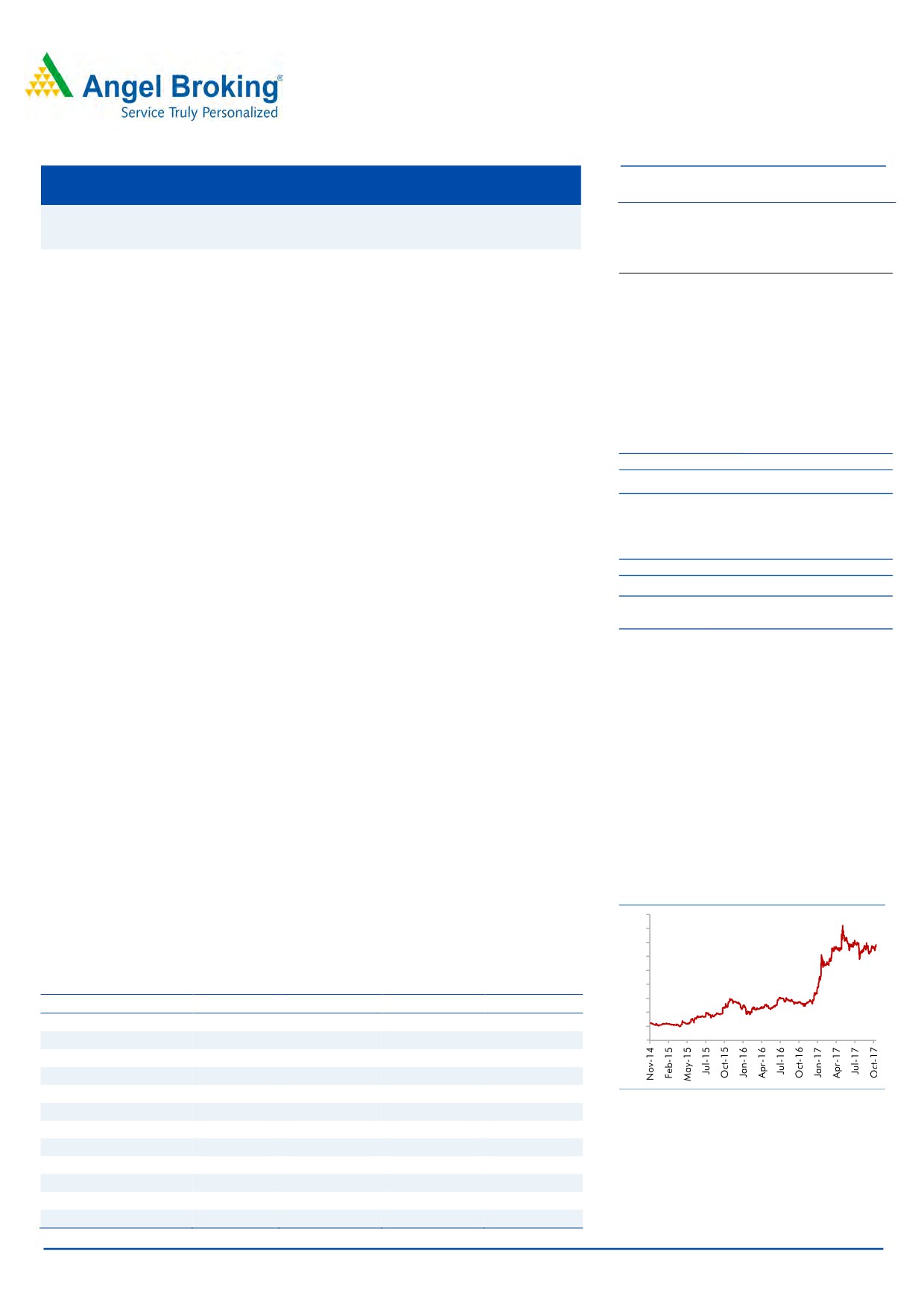

3 year daily price chart

expansion on the back of better manufacturing efficiency, increase in scale and

90

change in product mix. We initiate coverage on the stock with a Buy

80

recommendation and Target Price of `96 (15x FY2019E EPS), indicating an upside

70

of ~29% from the current levels.

60

50

Key financials

40

30

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

20

Net sales

2,973

3,287

3,747

4,234

10

% chg

7.0

10.5

14.0

13.0

-

Net profit

99

117

139

170

% chg

36.3

18.9

18.2

22.6

EBITDA margin (%)

10.5

11.1

11.5

11.5

Source: Company, Angel Research

EPS (`)

3.7

4.4

5.2

6.4

P/E (x)

20.1

16.9

14.3

11.7

P/BV (x)

3.7

3.0

2.5

2.1

Amarjeet S Maurya

RoE (%)

18.4

17.9

17.5

17.6

022-39357800 Ext: 6831

RoCE (%)

12.2

13.8

15.4

16.3

EV/Sales (x)

1.2

1.1

0.9

0.8

EV/EBITDA (x)

11.3

9.7

8.2

7.3

Source: Company, Angel Research, Note: CMP as of Nov 06, 2017

Please refer to important disclosures at the end of this report

1

Quick take

LT Foods

Investment Arguments

Market leadership with strong brand visibility

LTFL has a wide range of brands across price range catering to various customer

segments. The company’s flagship brand Daawat enjoys 22% market share in the

branded rice market of India. LTFL has been continuously focusing on strong

brand visibility. Hence, historically, the company has been spending on ad spends

in order to increase brand visibility. The company also has strong market share in

North America selling Basmati rice under the brand name ‘Royal’.

Exhibit 1: All India Rural &Urban Markets (%)

Exhibit 2: All India Modern Trade (%)

18.9

25

20

22.1

21.5

17.4

20

15

15

10

10

6.2

5

3.4

3.3

5

2.5

0

0

LT Foods

Peer 1

Peer 2

Peer 3

LT Foods

Peer 1

Peer 2

Peer 3

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 3: LTFL strong brand presence across the segment

Source: Company, Angel Research

November 07, 2017

2

Quick take

LT Foods

Wide distribution network

Currently LTFL has an access to 1,40,000 traditional retail outlets and reaches to

93% of towns with over 2 lakh population and 3,000 wholesalers. Further, the

company sells its products to premium hotels & restaurants (~50% share) and has

an access to 6,000 foodservice outlets i.e. ‘DawatChefs Secretz”. Moreover, it has

an access to 2,500 modern trade stores including 121 hypermarkets,

298

supermarkets and 1,462 mini markets. It is the 1st Rice Company to place Brown

Basmati Rice in Medical Chains.

Diversified product portfolio catering to varied customers

The company has a well-diversified product basket catering to consumers of all

income groups. The company’s strong flagship brand is Daawat. In the basmati

rice segment, the company has products like White Basmati, Brown Basmati, Sela

Basmati, Organic Basmati, Traditional Basmati, and Super Basmati. The speciality

rice (non-Basmati) includes Jasmine Thai, Brown Jasmine Thai, Arborio, Sona

Masoori, Sona Masoori Organic, Kerala Mata rice, Ponni rice and Gujarat no. 17

rice. Furthermore, the company has wide range of Other food products like Curry

paste, Cooking sauces, Wheat flour, Couscous, Tea, Ecolife organic, range Rice

mixes and Grape seed oil.

LT Foods is also consistently working on adding new products to its portfolio. LTFL

has done JV with Japanese Snack Food major Kameda, which would launch rice

based snacks in India. LTFL had recently introduced “Daawat Rozana GoldPlus”

brand.

Exhibit 4: Broad Portfolio of Products

Source: Company, Angel Research

November 07, 2017

3

Quick take

LT Foods

Strong global footprint

LT Foods is now an emerging global Foods Company with a focus on basmati and

other speciality rices, organic foods and convenience rice based products.

The company has a global footprint and sells its flagship basmati rice brands i.e.

Royal and Daawat, into 65 countries. Further, LT Foods has a dedicated network

for expanding its global reach. The company has established on ground presence

in the US, Europe and Middle East in order to unlock the full potential of these

territories. In addition, the company’s other product brands such as ecoLife and

Devaaya are also being strongly appreciated globally.

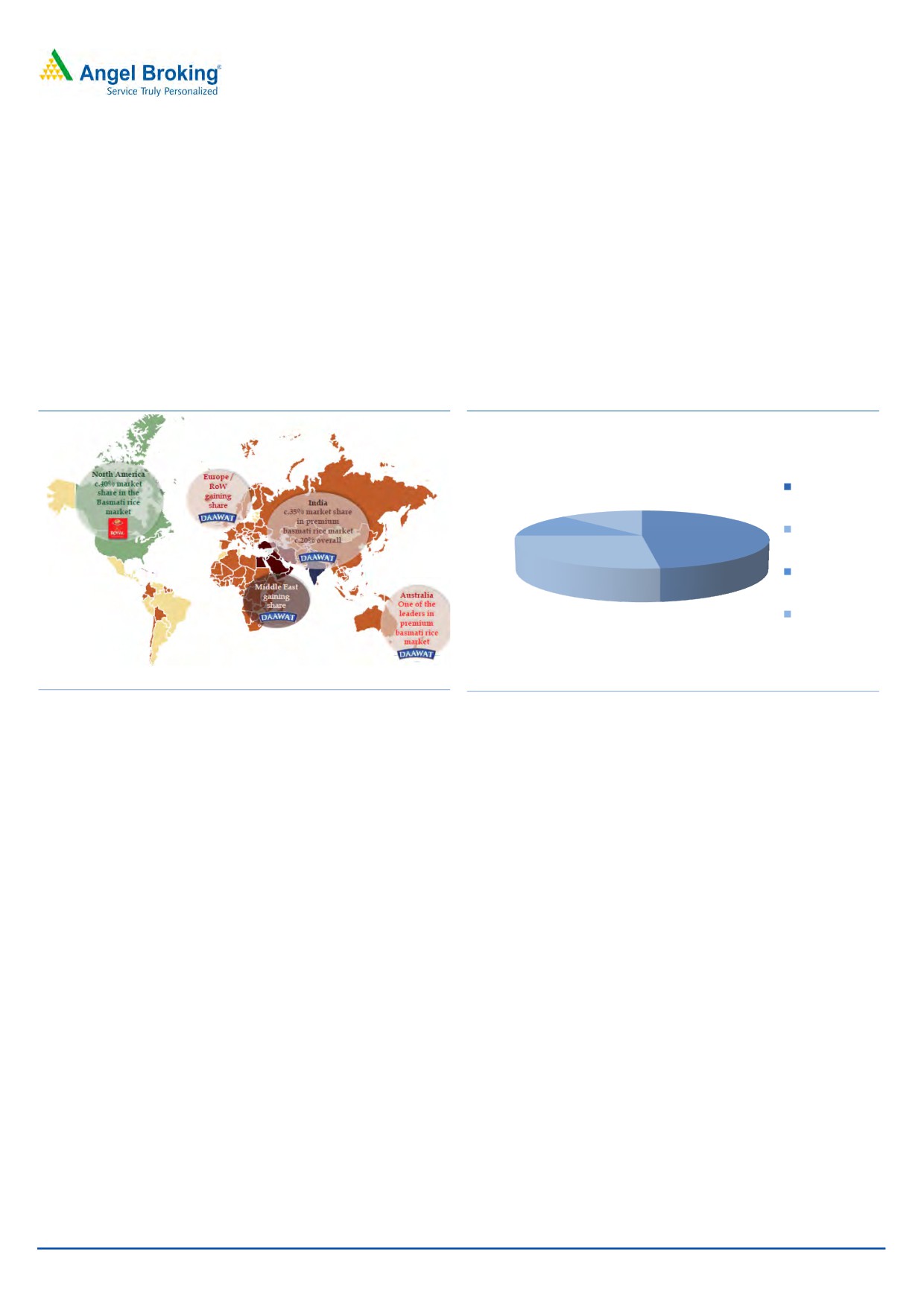

Exhibit 5: Global presence in over 65 countries

Exhibit 6: Revenue by geography in FY2017

India

12%

13%

North America

48%

MiddleEast

27%

RoW

Source: Company, Angel Research

Source: Company, Angel Research

November 07, 2017

4

Quick take

LT Foods

Outlook and Valuation

Going forward, we expect the company to report healthy top-line CAGR of 13.5%

over the next two years on the back of strong distribution network & brand,

continuous expansion, wide product basket and addition of new products in

portfolio. On the bottom-line front, we expect ~20% CAGR on the back of robust

improvement in operating performance. We expect margin expansion on the back

of better manufacturing efficiency, increase in scale and change in product mix.

We initiate coverage on the stock with a Buy recommendation and Target Price of

`96 (15x FY2019E EPS), indicating an upside of ~29% from the current levels.

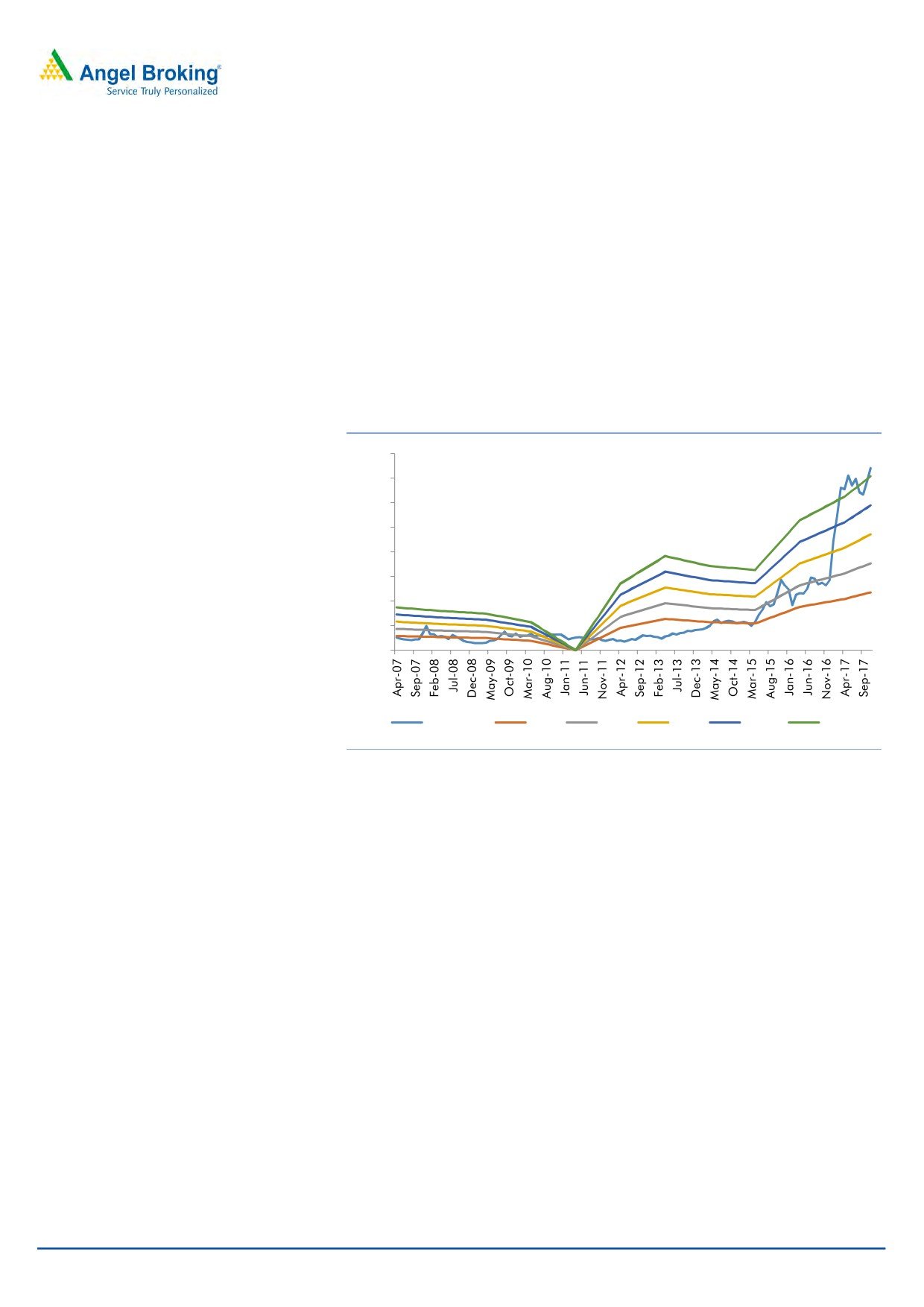

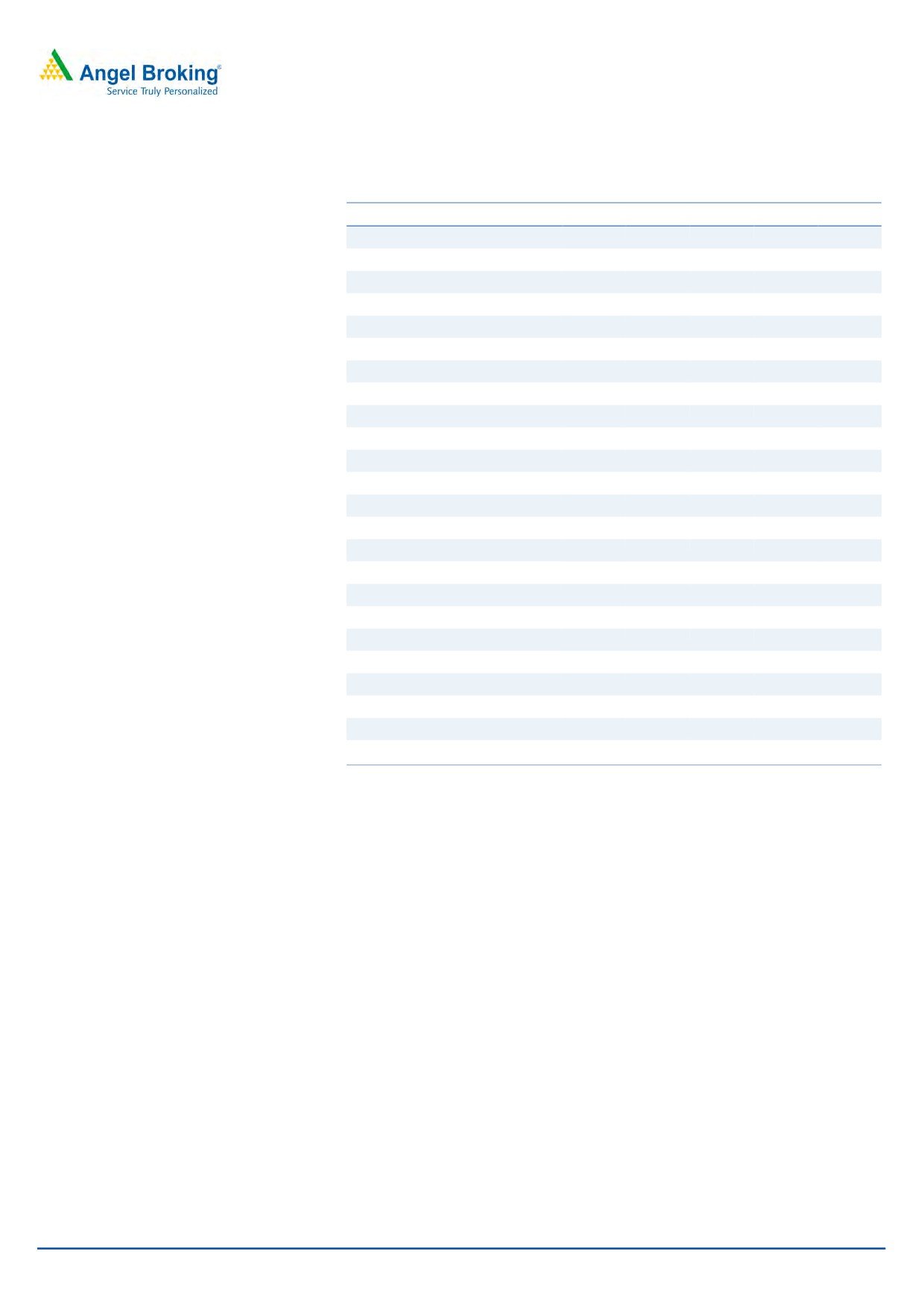

Exhibit 7: One year forward PE chart

80

70

60

50

40

30

20

10

0

Share Price

4.0 X

6.0 X

8.0 X

10.0 X

12.0 X

Source: Company, Angel Research

Key risks to our estimates

1) Increase in competition from unorganized players would impact overall growth

prospects of the company.

2) Basmati rice is an extremely volatile commodity. Hence, any unfavorable

change in Basmati rice prices could impact the company’s profitability.

3) Company derives ~52% revenue from overseas market; any unfavorable

change in currency could have an adverse impact on the company’s profitability.

November 07, 2017

5

Quick take

LT Foods

Company Background

LT Foods Limited (LTFL) is a branded speciality foods company. The company is

engaged in milling, processing and marketing of branded and non-branded

basmati rice and manufacturing of rice food products in the domestic and

overseas markets. Its geographical segments include India, North America and

Rest of the World. Its operations include contract farming, procurement, storage,

processing, packaging and distribution. Its rice product portfolio comprises of

brown rice, white rice, steamed rice, parboiled rice, organic rice, quick cooking

rice, value added rice and flavoured rice in the ready to cook segment. The

company's brands include (a) Royal, ecoLife, an organic food brand that includes

rice, pulses, oil seeds, cereal grains, spices, nuts & fruits and vegetables; (b)

Devaaya, which offers branded basmati rice, with staples, such as Atta, Suji,

Besan, Dalia, Poha and Maida; and (c) Heritage, a basmati rice brand. The other

brands of the company include Daawat, Gold Seal Indus Valley, Rozana and 817

Elephant.

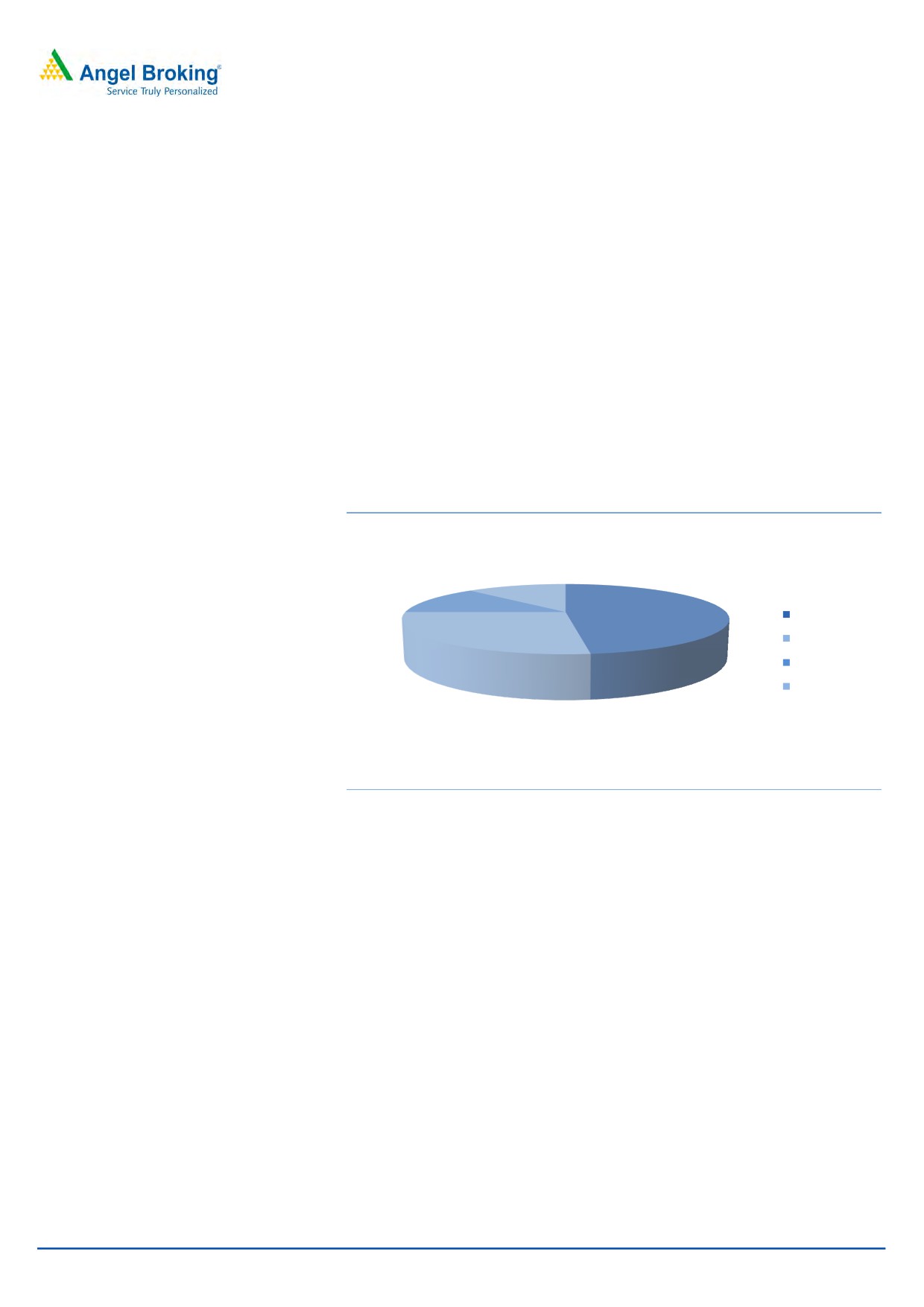

Exhibit 8: Revenue break-up for LTFL (FY2017)

12%

13%

48%

India

North America

MiddleEast

RoW

27%

Source: Company, Angel Research

November 07, 2017

6

Quick take

LT Foods

Consolidated Profit & Loss Statement

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018E

FY2019E

Total operating income

2,779

2,973

3,287

3,747

4,234

% chg

11.5

7.0

10.5

14.0

13.0

Total Expenditure

2,471

2,661

2,920

3,316

3,747

Raw Material

2,076

2,105

2,405

2,743

3,099

Personnel

74

90

117

139

157

Others Expenses

321

466

398

435

491

EBITDA

308

313

366

431

487

% chg

9.6

1.6

17.2

17.6

13.0

(% of Net Sales)

11.1

10.5

11.1

11.5

11.5

Depreciation& Amortisation

47

52

54

57

60

EBIT

261

261

312

374

427

% chg

7.3

(0.0)

19.5

19.8

14.1

(% of Net Sales)

9.4

8.8

9.5

10.0

10.1

Interest & other Charges

151

148

155

157

159

Other Income

1

6

36

10

10

(% of PBT)

1.1

5.2

18.4

4.4

3.6

Share in profit of Associates

-

-

-

-

-

Recurring PBT

111

120

193

227

278

% chg

(15.1)

7.5

61.5

17.4

22.5

Tax

35

47

64

75

92

(% of PBT)

31.3

39.4

33.3

33.0

33.0

PAT (reported)

76

72

129

152

186

Minority Interest (after tax)

4

(0)

10

12

15

Profit/Loss of Associate Company

-

(1)

(1)

(1)

(1)

Extraordinary Items

-

(27)

-

-

-

ADJ. PAT

72

99

117

139

170

% chg

(7.5)

36.3

18.9

18.2

22.6

(% of Net Sales)

2.6

3.3

3.6

3.7

4.0

Basic EPS (`)

2.7

3.7

4.4

5.2

6.4

Fully Diluted EPS (`)

2.7

3.7

4.4

5.2

6.4

% chg

(7.5)

36.3

18.9

18.2

22.6

November 07, 2017

7

Quick take

LT Foods

Consolidated Balance Sheet

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018E FY2019E

SOURCES OF FUNDS

Equity Share Capital

26

27

27

27

27

Reserves& Surplus

436

510

630

768

938

Shareholders Funds

463

537

656

795

965

Minority Interest

34

34

45

45

45

Total Loans

1,692

1,597

1,612

1,632

1,652

Deferred Tax Liability

5

1

5

5

5

Total Liabilities

2,194

2,169

2,318

2,477

2,667

APPLICATION OF FUNDS

Gross Block

638

676

736

736

766

Less: Acc. Depreciation

268

315

365

422

482

Net Block

370

361

371

313

283

Capital Work-in-Progress

15

24

40

40

40

Investments

7

6

5

5

5

Current Assets

2,052

2,065

2,299

2,566

2,846

Inventories

1,362

1,300

1,448

1,653

1,856

Sundry Debtors

318

376

463

513

580

Cash

21

32

41

62

72

Loans & Advances

319

189

179

169

169

Other Assets

31

168

167

169

169

Current liabilities

256

296

410

460

521

Net Current Assets

1,796

1,769

1,889

2,105

2,325

Deferred Tax Asset

6

8

13

13

13

Mis. Exp. not written off

-

-

-

-

-

Total Assets

2,194

2,169

2,318

2,477

2,667

November 07, 2017

8

Quick take

LT Foods

Consolidated Cashflow Statement

Y/E March (` cr)

FY2015

FY2016

FY2017

FY2018E FY2019E

Profit before tax

111

163

195

227

278

Depreciation

47

52

54

57

60

Change in Working Capital

(245)

(69)

(125)

(195)

(211)

Interest / Dividend (Net)

145

140

143

157

159

Direct taxes paid

(50)

(34)

(44)

(75)

(92)

Others

1

45

(7)

0

0

Cash Flow from Operations

9

297

217

171

194

(Inc.)/ Dec. in Fixed Assets

(55)

(53)

(85)

(30)

(30)

(Inc.)/ Dec. in Investments

(3)

(1)

(4)

0

0

Cash Flow from Investing

(58)

(54)

(89)

(30)

(30)

Issue of Equity

1

5

2

0

0

Inc./(Dec.) in loans

184

(93)

23

20

20

Dividend Paid (Incl. Tax)

(6)

(5)

(4)

0

0

Interest / Dividend (Net)

(147)

(142)

(145)

(129)

(175)

Cash Flow from Financing

32

(235)

(124)

(109)

(155)

Inc./(Dec.) in Cash

(17)

8

4

32

9

Opening Cash balances

35

18

26

30

62

Closing Cash balances

18

26

30

62

72

November 07, 2017

9

Quick take

LT Foods

Key Ratios

Y/E March

FY2015

FY2016

FY2017

FY2018E

FY2019E

Valuation Ratio (x)

P/E (on FDEPS)

27.4

20.1

16.9

14.3

11.7

P/CEPS

16.1

16.0

10.8

9.5

8.1

P/BV

4.3

3.7

3.0

2.5

2.1

Dividend yield (%)

0.3

0.0

0.0

0.0

0.0

EV/Sales

1.3

1.2

1.1

0.9

0.8

EV/EBITDA

11.8

11.3

9.7

8.2

7.3

EV / Total Assets

1.7

1.6

1.5

1.4

1.3

Per Share Data (`)

EPS (Basic)

2.7

3.7

4.4

5.2

6.4

EPS (fully diluted)

2.7

3.7

4.4

5.2

6.4

Cash EPS

4.6

4.6

6.9

7.8

9.2

DPS

0.2

0.0

0.0

0.0

0.0

Book Value

17.3

20.1

24.6

29.8

36.2

Returns (%)

ROCE

12.1

12.2

13.8

15.4

16.3

Angel ROIC (Pre-tax)

12.3

12.5

14.0

15.9

16.8

ROE

15.7

18.4

17.9

17.5

17.6

Turnover ratios (x)

Asset Turnover (Gross Block)

4.4

4.4

4.5

5.1

5.5

Inventory / Sales (days)

179

160

161

161

160

Receivables (days)

42

46

51

50

50

Payables (days)

13

18

24

24

24

Working capital cycle (ex-cash) (days)

208

188

188

187

186

Source: Company, Angel Research

November 07, 2017

10

Quick take

LT Foods

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

LT Foods

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)