3QFY2017 Result Update | HFC

January 17, 2017

LIC Housing Finance

BUY

CMP

`532

Performance Highlights

Target Price

`630

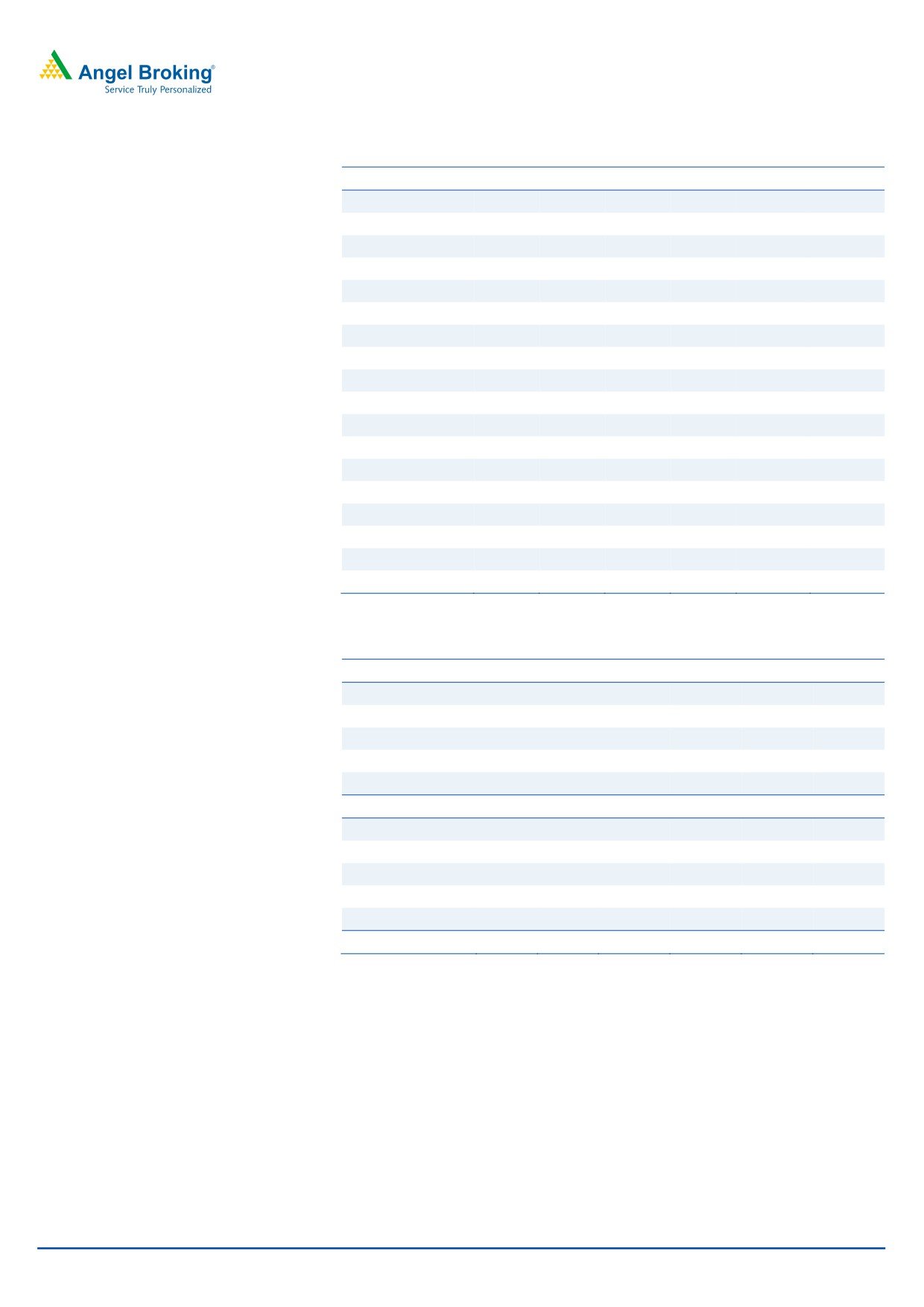

Particulars (` cr)

3QFY17 2QFY17

% chg (qoq) 3QFY16

% chg (yoy)

Investment Period

12 months

NII

915

866

5.7

747

22.6

Pre-prov. profit

811

791

2.5

680

19.2

Stock Info

PAT

499

495

0.9

419

19.2

Sector

Housing Finance

Source: Company, Angel Research

Market Cap (` cr)

27,266

LICHF came out with a positive set of results for 3QFY2017 with the PAT growing

Beta

1.5

by 19.2% yoy. While we were expecting moderation in business growth, due to

52 Week High / Low

624/389

demonetization, better result was possible backed by growth in non-retail segment.

Avg. Daily Volume

213,118

Sluggish growth in retail; non-retail portfolio gained momentum: LICHF’s total

Face Value (`)

2

loan book grew by 15.3% yoy, during 3QFY2017. While LAP grew by 87.7% yoy

BSE Sensex

27,236

(up 99% in 2QFY2017); developer loans picked up further momentum, up 45.2%

yoy v/s 22.4% in 2QFY2017. However, the core retail loans continued to be

Nifty

8,398

sluggish like the previous quarter and grew by only 9.2% yoy. The share of LAP+

Reuters Code

LICH.BO

developer loans in the books continued to increase and stood at 13.7% v/s 12.5%

Bloomberg Code

LICHF@IN

qoq. LICHF’s noncore portfolio has been growing fast, however as percentage to total

portfolio, it still remains lower than other HFCs and is not a cause of concern.

Favorable cost of funds helped NIM improvement, marginal pressure expected

Shareholding Pattern (%)

going ahead: During the quarter, the incremental yield on assets increased to

Promoters

40.3

10.69% up 11 bps qoq, partly backed by high yielding LAP portfolio, while the

MF / Banks / Indian Fls

21.1

incremental costs stood at 8.19% down 21 bps qoq. As a result, on a qoq basis,

FII / NRIs / OCBs

24.7

incremental spread improved by 32 bps to 2.50% and NIM improved by 7 bps to

Indian Public / Others

13.9

2.75%. With sharp rate cuts by banks there will be competition in the industry and

LICHF also will have to face the same, however, we feel volume growth should

pick up in the medium term, compensating the same in the quarters to come.

Abs.(%)

3m 1yr 3yr

Asset quality remained resilient: While there was initially fear of deterioration in

Sensex

(0.7)

11.8

29.8

asset quality, post demonetization, the collection levels were not as bad as it was

perceived, which is visible from stable GNPAs of 0.56% and NNPAs 0.27%.

LICHF

(7.7)

15.7

156.0

Contrary to expectations, the asset quality has seen fairly large stability in the last

few quarters and we don’t expect sharp deterioration in the medium term.

3-Year Daily Price Chart

Outlook and valuation: The core retail portfolio continues to be sluggish growing

700

by less than 10%, however, other segments like LAP & Developer loans have been

600

driving the growth for LICHF. With lower interest rates and interest subvention

500

schemes by the Government, we expect growth for housing to rebound in the

400

coming quarters, which should help the company in posting loan book CAGR of

300

19% over FY2016-18E, translating into earnings CAGR of 18.0% over the same

200

period. The stock currently trades at 2.2x its FY2018E ABV. We maintain our BUY

100

rating on the stock with a Target Price of `630.

0

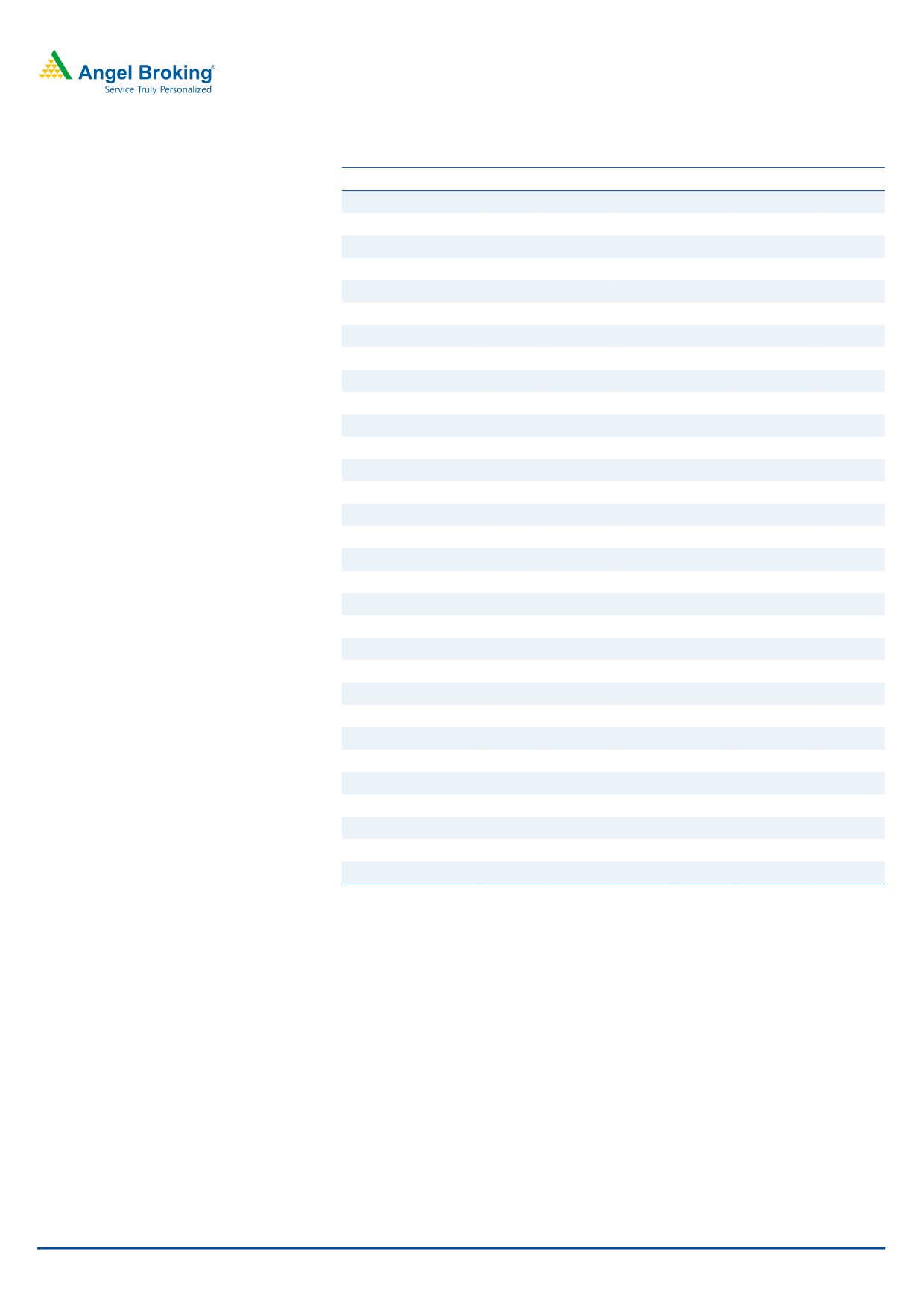

Key financials (standalone)

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

NII

2,349

2,944

3,542

4,116

Source: Company, Angel Research

% chg

16.4

25.3

20.3

16.2

Net profit

1,386

1,661

1,968

2,323

% chg

5.2

19.8

18.5

18.0

NIM (%)

2.3

2.6

2.6

2.5

EPS (`)

27.5

32.9

39.0

46.0

P/E (x)

19.4

16.2

13.7

11.6

P/ABV (x)

3.5

3.0

2.6

2.2

Siddharth Purohit

RoA (%)

1.4

1.4

1.4

1.4

022 - 3935 7800 Ext: 6872

RoE (%)

18.1

19.6

19.9

20.1

Source: Company, Angel Research; Note: CMP as of January 17, 2016

Please refer to important disclosures at the end of this report

1

LIC Housing Finance | 3QFY2017 Result Update

Exhibit 1: 3QFY2017 performance (standalone)

Particulars (` cr)

3QFY17

2QFY17

% chg (qoq) 3QFY16

% chg (yoy) FY2016

FY2015

% chg

Interest earned

3,513

3,428

2.5

3,102

13.2

12,396

10,669

16

Interest expenses

2,597

2,563

1.3

2,355

10.3

9,307

8,310

12.0

Net interest income

915

866

5.7

747

22.6

3,089

2,359

31.0

Non-interest income

36

62

(41.3)

55

(34.1)

89

129

(30.9)

Operating income

952

927

2.6

802

18.7

3,179

2,488

27.7

Operating expenses

141

136

3.2

121

15.9

469

379

23.6

Pre-prov. profit

811

791

2.5

680

19.2

2,710

2,109

28.5

Provisions & cont.

45

30

49.4

34

31.5

146

7

1,920.0

PBT

766

761

0.7

646

18.5

2,564

2,102

22.0

Prov. for taxes

266

266

0.2

227

17.3

903

716

26.1

PAT

499

495

0.9

419

19.2

1,661

1,386

19.8

EPS (`)

9.9

9.8

0.9

8.3

32.9

27.5

19.8

Cost-to-income ratio (%)

14.8

14.7

15.1

14.7

15.2

Effective tax rate (%)

34.8

35.0

35.2

35.2

34.1

Net NPA (%)

0.27

0.28

0.32

0.2

0.2

Source: Company, Angel Research

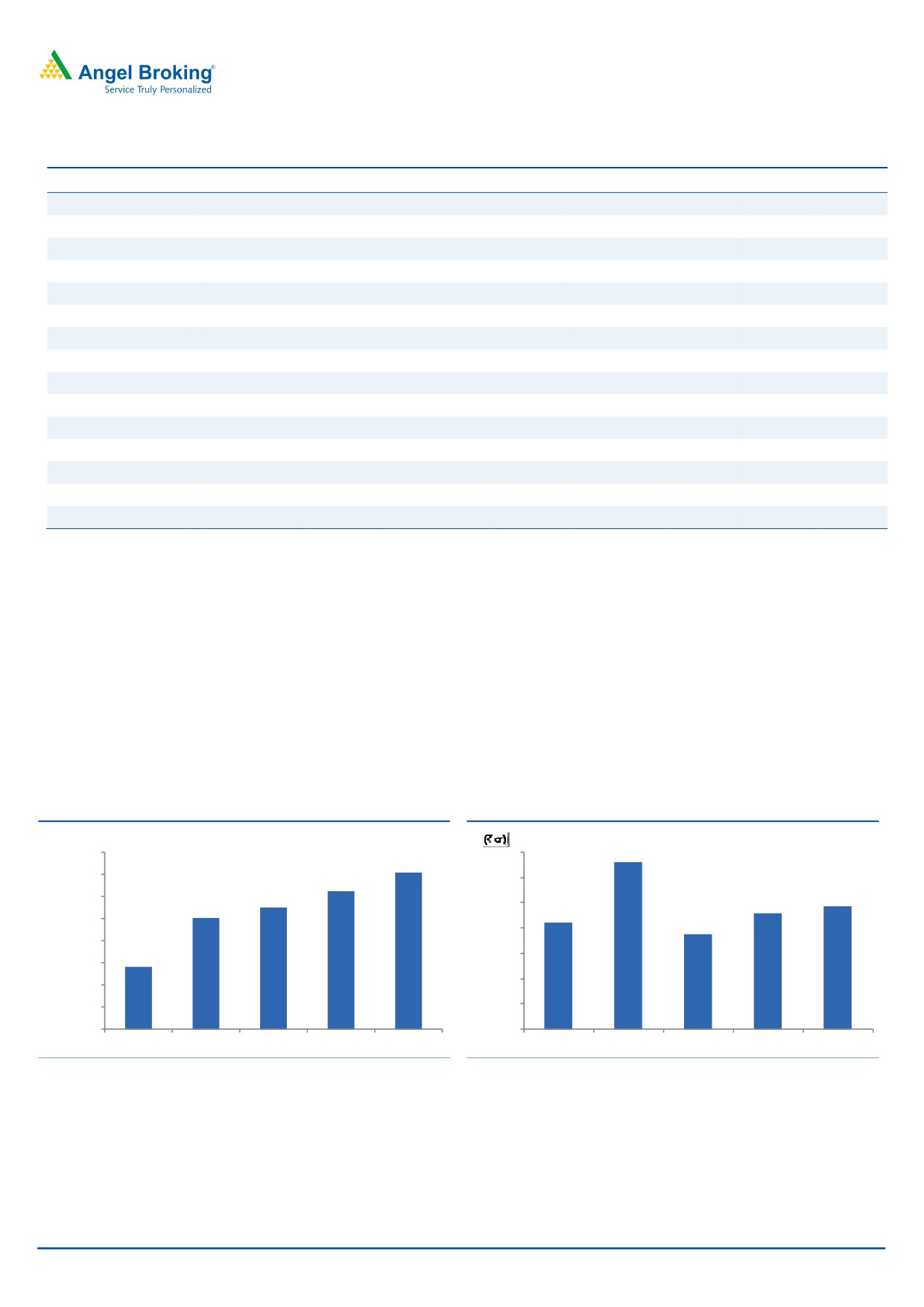

Sluggish growth in retail; non-retail portfolio gained momentum: LIC’s total loan

book grew by 15.3% yoy, during 3QFY2017. While LAP grew by 87.7% yoy (up

99% yoy in 2QFY2017; developer loans picked up further momentum up by

45.2% yoy v/s 22.4% yoy reported in 2QFY2017. However, the core retail loans

continued to be sluggish like the previous quarter and grew by only 9.2% yoy. The

share of LAP+ developer loans in the books continued to increase and stood at

13.7% v/s 12.5% qoq. LICHF’s noncore portfolio has been growing fast, however

as percentage to total portfolio, it still remains lower than other HFCs and is not a

cause of concern. The management has reiterated now onwards the focus will be

on core retail portfolio and it may not aggressively expand its LAP book.

Exhibit 2: Decent Growth in Advances

Exhibit 3: Disbursements remained healthy

(` cr)

1,40,000

14,000

13,216

1,35,366

1,35,000

1,31,096

12,000

1,30,000

1,27,437

9,684

1,25,173

10,000

9,123

8,390

1,25,000

7,542

8,000

1,20,000

1,14,069

6,000

1,15,000

4,000

1,10,000

1,05,000

2,000

1,00,000

-

Q2FY16

Q4FY16

Q1FY17

Q2FY17

Q3FY17

Q2FY16

Q4FY16

Q1FY17

Q2FY17

Q3FY17

Source: Company, Angel Research

Source: Company, Angel Research

January 17, 2017

2

LIC Housing Finance | 3QFY2017 Result Update

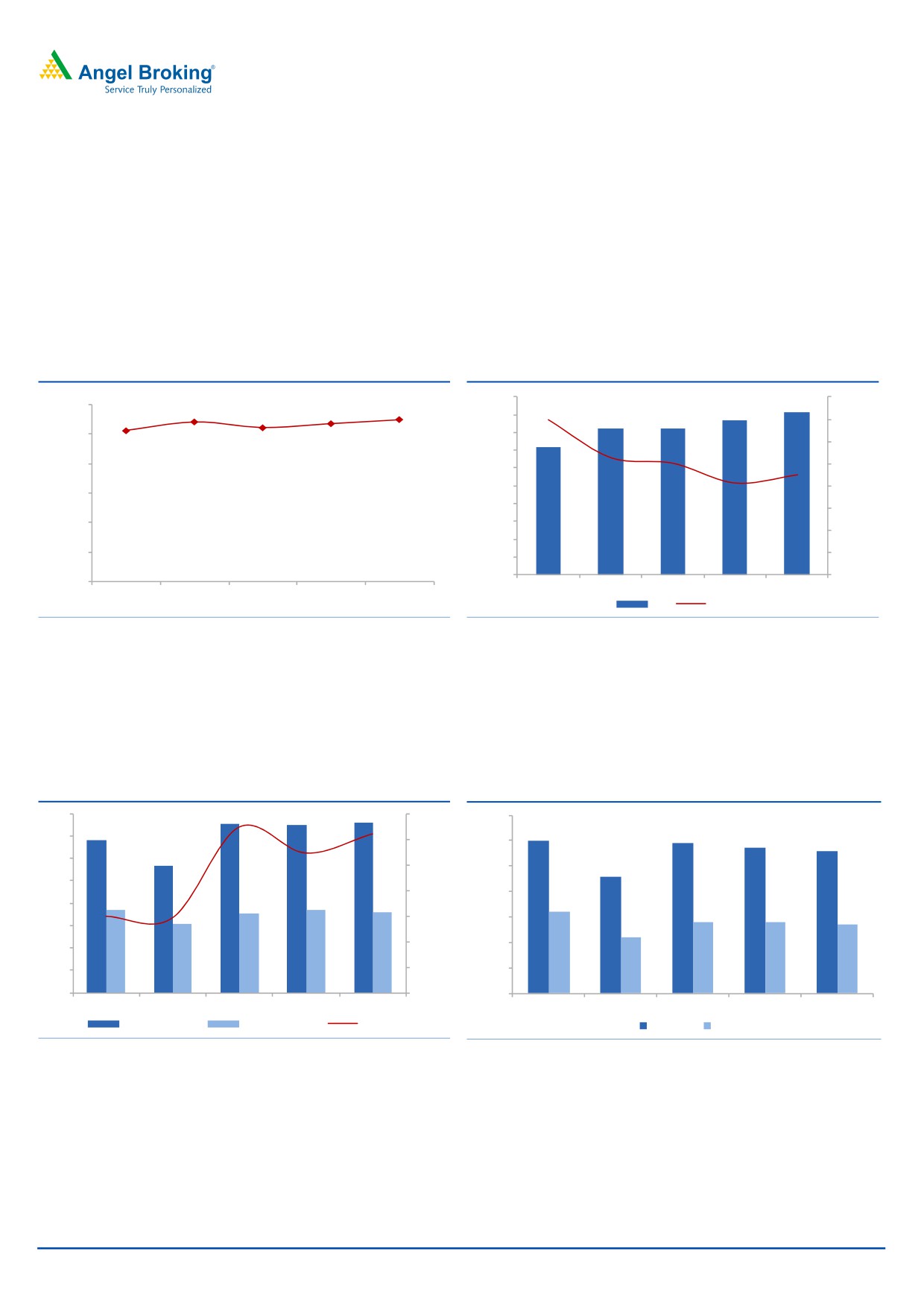

Favorable cost of funds helped NIM improvement, marginal pressure expected

going ahead: During the quarter, the incremental yield on assets increased to

10.69% up 11 bps sequentially partly backed by high yielding LAP portfolio, while

the incremental costs stood at 8.19% down 21 bps sequentially. As a result, on a

qoq basis, incremental spread improved by 32 bps to 2.50% and NIM improved

by 7 bps to 2.75%. With sharp rate cuts by banks there will be competition in the

industry and LICHF also will have to face the same, however we feel volume

growth should pick up in the medium term, compensating the same in the quarters

to come.

Exhibit 4: Low cost funds added to NIM

Exhibit 5: NII growth trend

1,000

915

40.0%

3.00%

2.71%

2.68%

2.75%

2.61%

866

2.56%

900

821

825

35.0%

2.50%

800

717

30.0%

700

2.00%

25.0%

600

500

20.0%

1.50%

400

15.0%

1.00%

300

10.0%

200

0.50%

5.0%

100

-

0.0%

0.00%

Q2FY16

Q4FY16

Q1FY17

Q2FY17

Q3FY17

Q2FY16

Q4FY16

Q1FY17

Q2FY17

Q3FY17

NII

% YoY

Source: Company, Angel Research

Source: Company, Angel Research

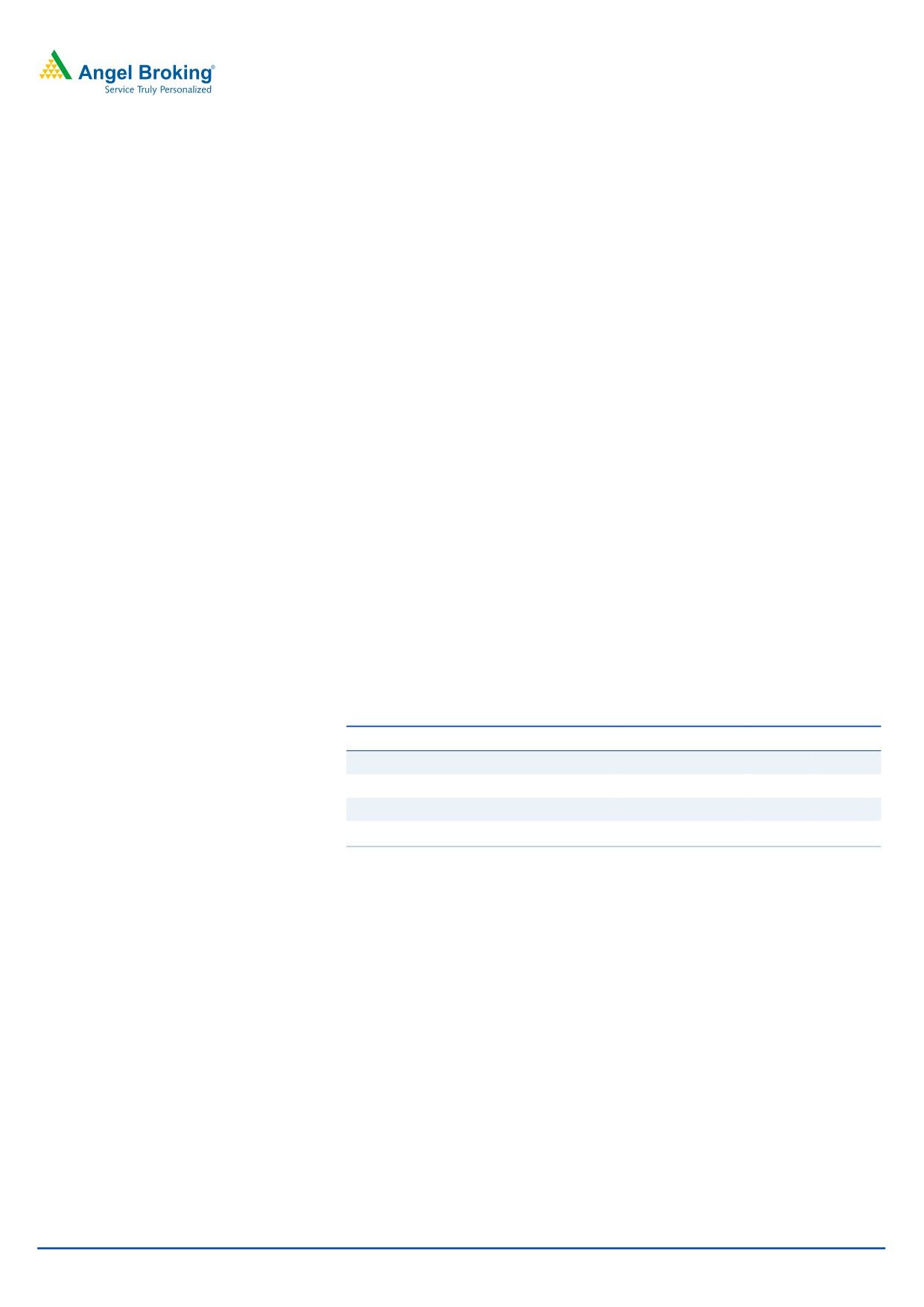

Asset quality remained resilient: While there was initially fear of deterioration in

asset quality, post demonetization, the collection levels were not as bad as it was

perceived, which is visible from stable GNPAs of 0.56% and NNPAs 0.27%.

Contrary to expectations, the asset quality has seen fairly large stability in the last

few quarters and we don’t expect sharp deterioration in the medium term.

Exhibit 6: Stable Asset quality

Exhibit 7: Gross and Net NPAs remained stable

800

757

750

759

54.0%

0.70%

683

0.60%

0.59%

700

0.57%

52.0%

0.60%

0.56%

567

600

50.0%

0.50%

0.46%

500

48.0%

0.40%

369

356

368

361

0.32%

400

307

0.28%

0.28%

0.27%

46.0%

0.30%

300

0.22%

44.0%

0.20%

200

100

42.0%

0.10%

0

40.0%

0.00%

Q2FY16

Q4FY16

Q1FY17

Q2FY17

Q3FY17

Q2FY16

Q4FY16

Q1FY17

Q2FY17

Q3FY17

GNPAs (` Cr)

NNPAs (` Cr)

PCR %

GNPAs % NNPAs%

Source: Company, Angel Research

Source: Company, Angel Research

January 17, 2017

3

LIC Housing Finance | 3QFY2017 Result Update

Outlook and valuation

Outlook and valuation: The core retail portfolio continues to be sluggish growing

by less than 10%, however, other segments like LAP & Developer loans have been

driving the growth for LICHF. With lower interest rates and interest subvention

schemes by the Government we expect growth for housing to rebound in the

coming quarters, which should help the company in posting loan book CAGR of

19% over FY2016-18E, translating into an earnings CAGR of 18.0% over the same

period. The stock currently trades at 2.2x its FY2018E ABV. We maintain our BUY

rating on the stock with a Target Price of `630.

Company Background

LIC Housing Finance (LICHF) is one of the largest specialized mortgage lenders in

India, with a loan book size of ~ `1,35,00cr, of which ~97% is derived from the

retail segment. The company has a network of ~245 marketing offices spread

across the country and is promoted by the state-owned life insurance behemoth,

Life Insurance Corporation of India (LIC), which holds a 40.3% stake in the

company.

The company has a low-risk business model as ~82% of the loans are disbursed

to salaried customers. Loans to individuals account for 87.5% of the outstanding

loan book and the segment is the key focus area of the company. LAP accounts for

10.4% and loans to developers account for 3.3% of the total outstanding loan

book. The company’s incremental average ticket size of the loans stood at ~`20

lakh while the average cumulative ticket size stood at ~`12lakh.

Exhibit 8: Key Operating Indicators

Key Operating Indicators

FY13

FY14

FY15

FY16

Floating Loan Portfolio

49.0

42.0

37.0

47.0

LTV

59.7

54.5

50.9

46.6

Pre Payment Ratio

7.8

9.3

8.4

11.9

Income to Installment Ratio

33.9

34.7

33.9

33.3

Source: Company, Angel Research

January 17, 2017

4

LIC Housing Finance | 3QFY2017 Result Update

Income statement (standalone)

Y/E March (` cr)

FY2013 FY2014 FY2015

FY2016

FY2017E

FY2018E

NII

1,605

2,019

2,349

2,944

3,542

4,116

- YoY Growth (%)

8.4

25.8

16.4

25.3

20.3

16.2

Other Income

128

142

139

235

170

178

- YoY Growth (%)

(10.6)

10.5

(1.9)

68.8

(27.6)

4.7

Operating Income

1,733

2,160

2,488

3,179

3,712

4,293

- YoY Growth (%)

6.7

24.6

15.2

27.7

16.8

15.7

Operating Expenses

282

313

379

469

505

588

- YoY Growth (%)

18.9

11.1

21.1

23.6

7.8

16.3

Pre - Provision Profit

1,451

1,847

2,109

2,710

3,207

3,706

- YoY Growth (%)

4.6

27.3

14.2

28.5

18.3

15.6

Prov. & Cont.

79

21

7

146

223

183

- YoY Growth (%)

(49.5)

(72.8)

(66.2)

1,920.0

52.1

(17.8)

Profit Before Tax

1,372

1,826

2,102

2,564

2,984

3,522

- YoY Growth (%)

11.5

33.0

15.1

22.0

16.4

18.0

Prov. for Taxation

347

508

716

903

1,016

1,199

- as a % of PBT

25.3

27.8

34.1

35.2

34.1

34.1

PAT

1,026

1,317

1,386

1,661

1,968

2,323

- YoY Growth (%)

12.2

28.4

5.2

19.8

18.5

18.0

Balance sheet (standalone)

Y/E March (` cr)

FY2013 FY2014 FY2015 FY2016

FY2017E

FY2018E

Share Capital

101

101

101

101

101

101

Reserve & Surplus

6,380

7,432

7,717

9,016

10,555

12,371

Loan Funds

68,764

81,486

96,532

1,11,509

1,30,465

1,53,917

- Growth (%)

22.6

18.5

18.5

15.5

17.0

18.0

Other Liab. & Prov.

4,407

4,414

5,622

6,409

7,509

8,995

Total Liabilities

79,653

93,432

1,09,972

1,27,035

1,48,631

1,75,384

Investments

185

199

237

274

320

378

Advances

77,813

91,341

1,08,361

1,25,173

1,46,452

1,72,814

- Growth (%)

23.4

17.4

18.6

15.5

17.0

18.0

Fixed Assets

62

76

80

92

108

127

Other Assets

1,593

1,817

1,295

1,496

1,750

2,065

Total Assets

79,653

93,432

1,09,972

1,27,035

1,48,631

1,75,384

January 17, 2017

5

LIC Housing Finance | 3QFY2017 Result Update

Ratio analysis (standalone)

Y/E March

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

Profitability ratios (%)

NIMs

2.3

2.4

2.3

2.6

2.6

2.5

Cost to Income Ratio

16.3

14.5

15.2

14.7

13.6

13.7

RoA

1.4

1.5

1.4

1.4

1.4

1.4

RoE

16.9

18.8

18.1

19.6

19.9

20.1

Asset Quality (%)

Gross NPAs

0.61

0.67

0.46

0.45

0.54

0.50

Net NPAs

0.35

0.39

0.22

0.22

0.24

0.23

Provision Coverage

41.4

41.9

52.6

52.4

55.0

54.0

Per Share Data (`)

EPS

20.3

26.1

27.5

32.9

39.0

46.0

ABVPS (75% cover.)

125.2

145.2

152.6

178.0

207.9

243.4

DPS

3.8

4.5

5.0

6.0

7.1

8.4

Valuation Ratios

PER (x)

26.8

20.4

19.4

16.2

13.7

11.6

P/ABVPS (x)

4.3

3.7

3.5

3.0

2.6

2.2

Dividend Yield

0.8

0.9

1.0

1.2

1.4

1.7

DuPont Analysis

NII

2.2

2.3

2.3

2.5

2.6

2.5

(-) Prov. Exp.

0.1

0.0

0.0

0.1

0.2

0.1

Adj. NII

2.1

2.3

2.3

2.4

2.4

2.4

Treasury

(0.0)

0.0

0.0

0.0

0.0

0.0

Int. Sens. Inc.

2.1

2.3

2.3

2.4

2.4

2.4

Other Inc.

0.2

0.2

0.1

0.2

0.1

0.1

Op. Inc.

2.3

2.5

2.4

2.6

2.5

2.5

Opex

0.4

0.4

0.4

0.4

0.4

0.4

PBT

1.9

2.1

2.1

2.2

2.2

2.2

Taxes

0.5

0.6

0.7

0.8

0.7

0.7

RoA

1.4

1.5

1.4

1.4

1.4

1.4

Leverage

11.9

12.4

13.2

14.0

13.9

14.0

RoE

16.9

18.8

18.1

19.6

19.9

20.1

January 17, 2017

6

LIC Housing Finance | 3QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

LIC Housing Finance

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

January 17, 2017

7