2QFY2016 Result Update | Auto Ancillary

November 5, 2015

L G Balakrishnan & Bros

NEUTRAL

CMP

`456

Performance Highlights

Target Price

-

Quarterly Data (Standalone)

Investment Period

-

(` cr)

2QFY16

2QFY15

% yoy

2QFY16

% qoq

Revenue

282

267

5.6

247

14.1

Stock Info

EBITDA

36

36

(0.2)

24

47.7

Sector

Auto Ancillary

OPM (%)

12.8

13.5

(74)

9.8

291

Adj. PAT

17

17

4.6

9

92.5

Market Cap (` cr)

714

Source: Company, Angel Research

Net Debt (` cr)

133

LG Balakrishnan & Bros (LGBBL) reported a slightly better-than-expected standalone top-

Beta

0.5

line and bottom-line growth for 2QFY2016. The Transmission segment, which contributed

52 Week High / Low

764 / 401

~79% to the company’s total standalone revenue, reported a growth of 11% yoy, while the

Avg. Daily Volume

4,825

Others segment reported a decline on the sales front. On the bottom-line (standalone) front, the

Face Value (`)

10

company unperformed due to subdued sales growth and poor operating performance.

BSE Sensex

26,553

Top-line grew by ~6% yoy: The standalone top-line grew by ~6% yoy to ~`282cr, which is

Nifty

8,040

higher than our estimate of

~`267cr. The Transmission segment revenue was up

Reuters Code

LGB.BO

~11% yoy; the segment accounted for ~79% of the standalone revenue of the company.

Bloomberg Code

LGBB@IN

The Others segment reported a decline in sales.

Poor operating performance and lower other income mar profitability: The company

Shareholding Pattern (%)

reported an operating profit of ~`36cr, which is down 0.2% yoy. The operating margin

Promoters

47.3

contracted by by 74bp yoy to 12.8%, primarily on account of higher employee costs and

MF / Banks / Indian Fls

13.4

other expenditure. The reported standalone net profit declined by ~19% yoy to ~`17cr, but

is higher than our estimate of ~`16cr. However, on adjusting for the one-time exceptional

FII / NRIs / OCBs

0.0

gain incurred in 2QFY2015, the PAT during 2QFY2016 actually grew by 5% yoy.

Indian Public / Others

39.2

Outlook and valuation: LGBBL is a market leader in two-wheeler automotive chains with

~70% market share in the OEM segment. The company has been reporting lower growth

Abs. (%)

3m 1yr

3yr

in earnings since the last three quarters, which is mainly due to overall slowdown in the

Sensex

(5.4)

(4.7)

41.5

two-wheeler industry. The two-wheeler industry has been impacted mainly due to the rural

LGBL

(7.4)

10.7

261.6

slowdown. However, sales are expected to rebound in 2HFY2016 on expectations of a

normal monsoon which will boost crop output, thus leading to revival in rural demand. The

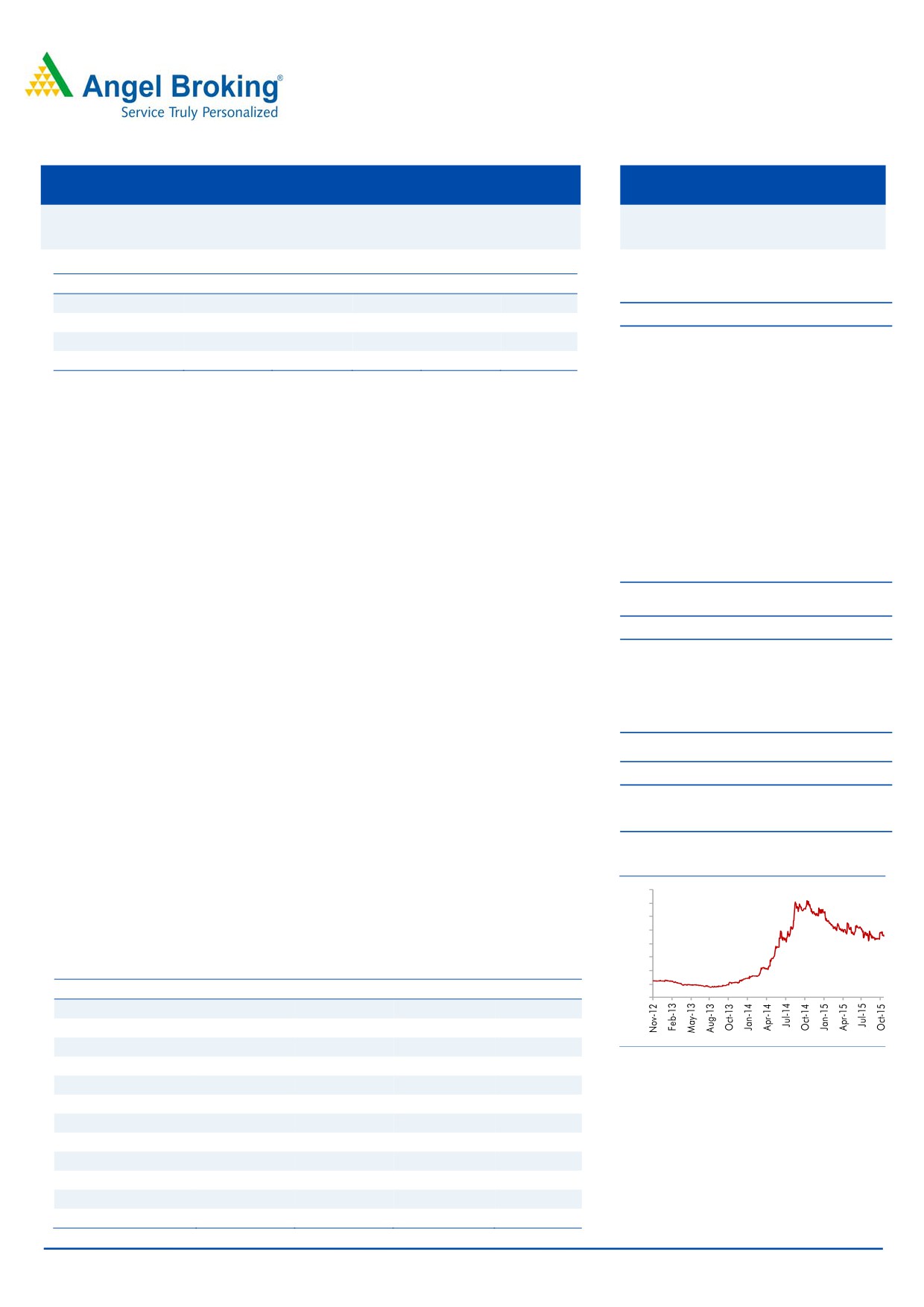

3-year price chart

company’s volume growth in the automotive chains segment is expected to improve over

800

FY2015-17E with its key clients like HMCL, HMSI, Yamaha, TVS Motor and others having

700

600

plans of capacity expansion and with they launching new models. We have a Neutral rating

500

on the stock.

400

300

Key financials (Consolidated)

200

100

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

0

Net Sales

1,109

1,173

1,196

1,277

% chg

15.9

5.8

2.0

6.7

Adj. Net Profit

63

71

55

64

Source: Company, Angel Research

% chg

92.0

5.1

(16.2)

16.3

EBITDA margin (%)

11.4

12.1

11.7

12.2

EPS (`)

40.0

45.4

35.3

41.0

P/E (x)

11.4

10.8

12.9

11.1

P/BV (x)

2.3

2.0

1.7

1.5

RoE (%)

20.3

19.3

13.3

13.6

RoCE (%)

20.3

19.4

16.3

16.7

Amarjeet S Maurya

EV/Sales (x)

0.8

0.7

0.7

0.7

022-39357800 Ext: 6831

EV/EBITDA (x)

6.7

6.0

6.0

5.4

Source: Company, Angel Research; Note: CMP as of November 4, 2015

Please refer to important disclosures at the end of this report

1

L G Balakrishnan & Bros | 2QFY2016 Result Update

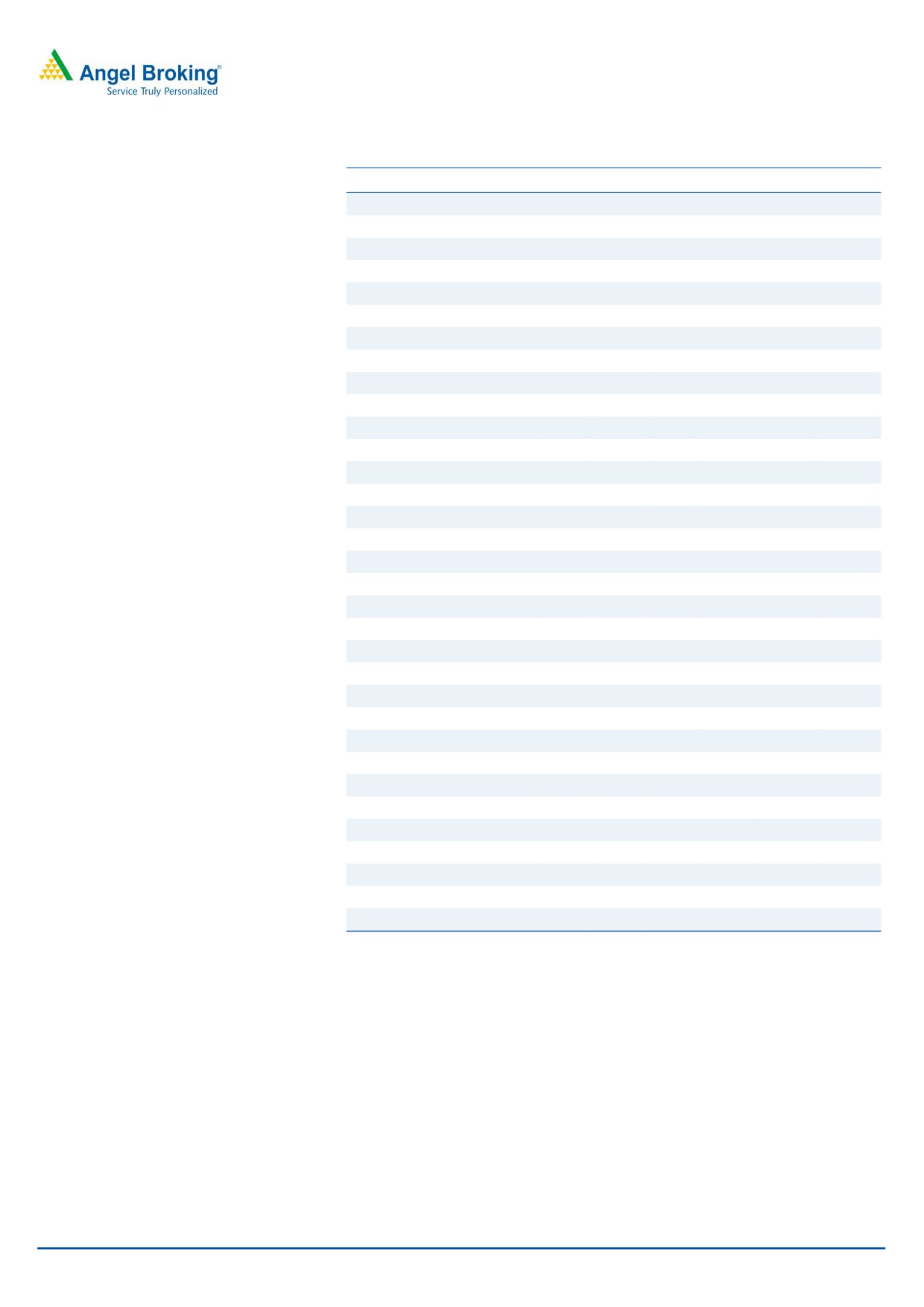

Exhibit 1: Quarterly performance (Standalone)

Y/E March (` cr)

2QFY16

2QFY15

% yoy

2QFY16

% qoq

FY2015

FY2014

% chg

Net Sales

282

267

5.6

247

14.1

1,048

988

6.1

Consumption of RM

126

122

3.1

110

14.8

486

483

0.6

(% of Sales)

44.8

45.9

44.5

46.4

48.9

Staff Costs

37

32

13.1

35

3.7

130

115

12.7

(% of Sales)

13.0

12.2

14.3

12.4

11.7

Operating Expense

83

76

9.2

77

7.2

303

278

9.3

(% of Sales)

29.4

28.4

31.3

28.9

28.1

Total Expenditure

246

231

6.5

223

10.4

919

876

5.0

Operating Profit

36

36

(0.2)

24

47.7

129

112

15.1

OPM (%)

12.8

13.5

9.8

12.3

11.3

Interest

4.5

4

11.1

4

6.0

16

17

Depreciation

10

10

4.3

9

10.7

37

31

19.0

Other Income

1

7

(85.2)

1

54.6

3

5

(40.0)

Exceptional items

7

PBT

22

29

(24.0)

11

95.3

85

69

23.7

(% of Sales)

7.8

10.8

4.5

8.1

6.9

Provision for Taxation

5

7

(37.7)

2

106.4

20

14

43.6

(% of PBT)

20.8

25.4

19.7

24.0

20.7

Minority Interest

0

0

Reported PAT

17

22

(19.4)

9.0

92.5

64

54

18.5

Adj. PAT

17

17

4.6

9.0

92.5

64

54

18.5

Source: Company, Angel Research

2

November 5, 2015

L G Balakrishnan & Bros | 2QFY2016 Result Update

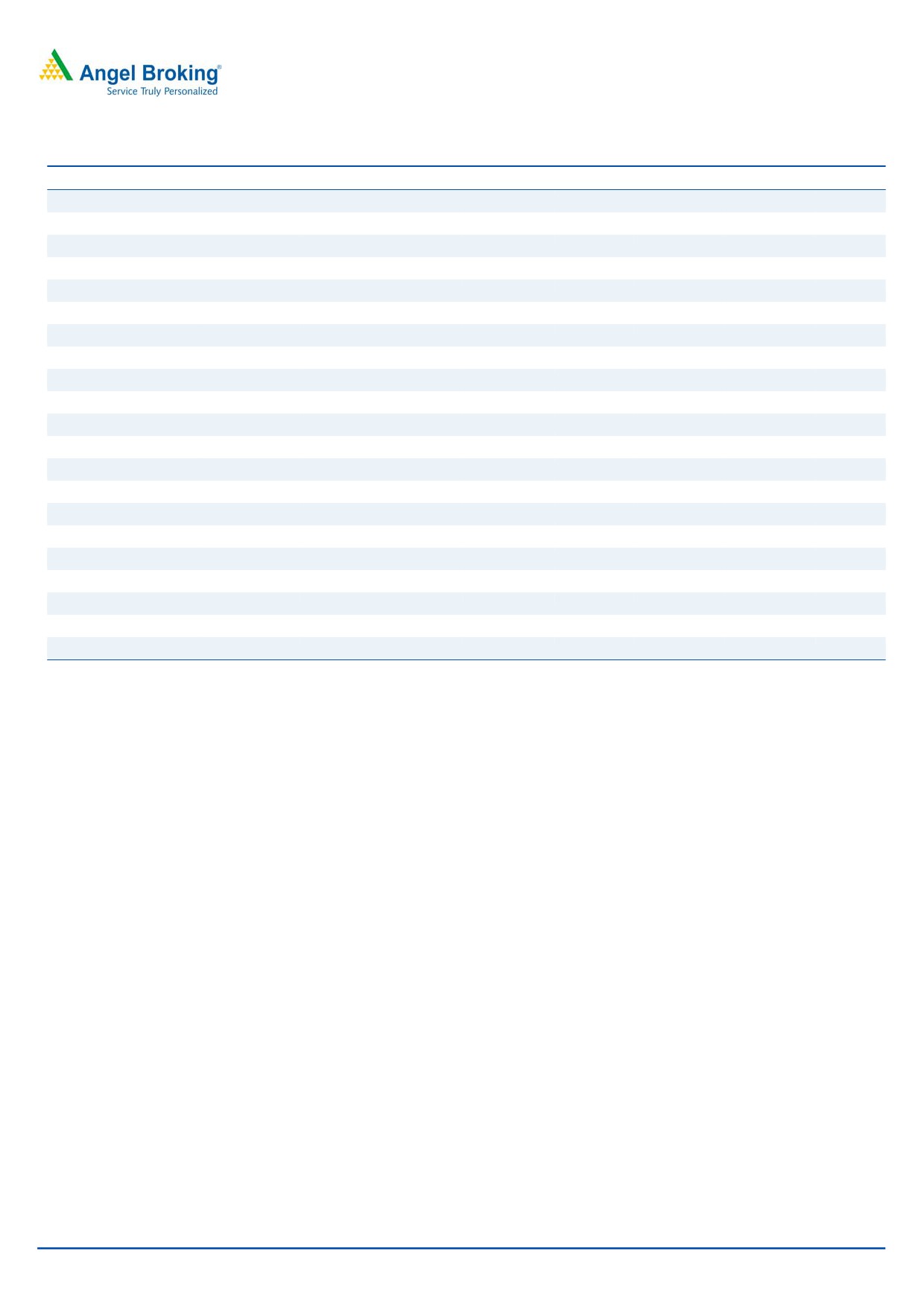

Top-line grows ~6% yoy

The standalone top-line grew by ~6% yoy to ~`282cr, which is higher than our

estimate of ~`267cr. The Transmission segment revenue was up ~11% yoy; the

segment accounted for ~79% of the standalone revenue of the company. The

Others segment reported a decline in sales.

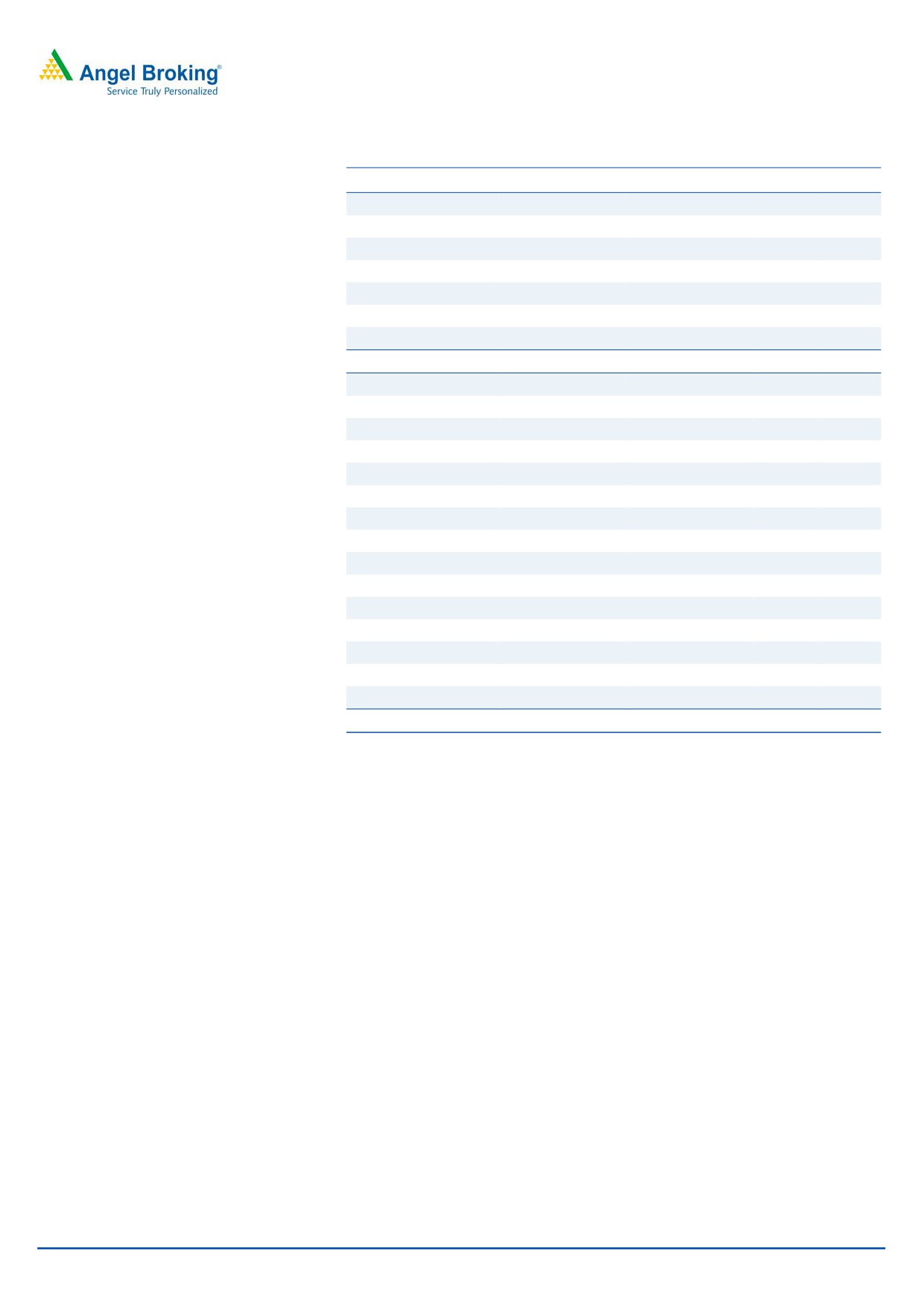

Exhibit 2: Top-line growth trend

300

20

250

15

200

10

150

5

100

0

50

(5)

0

(10)

Standalone net sales

QoQ growth (%)

Source: Company, Angel Research

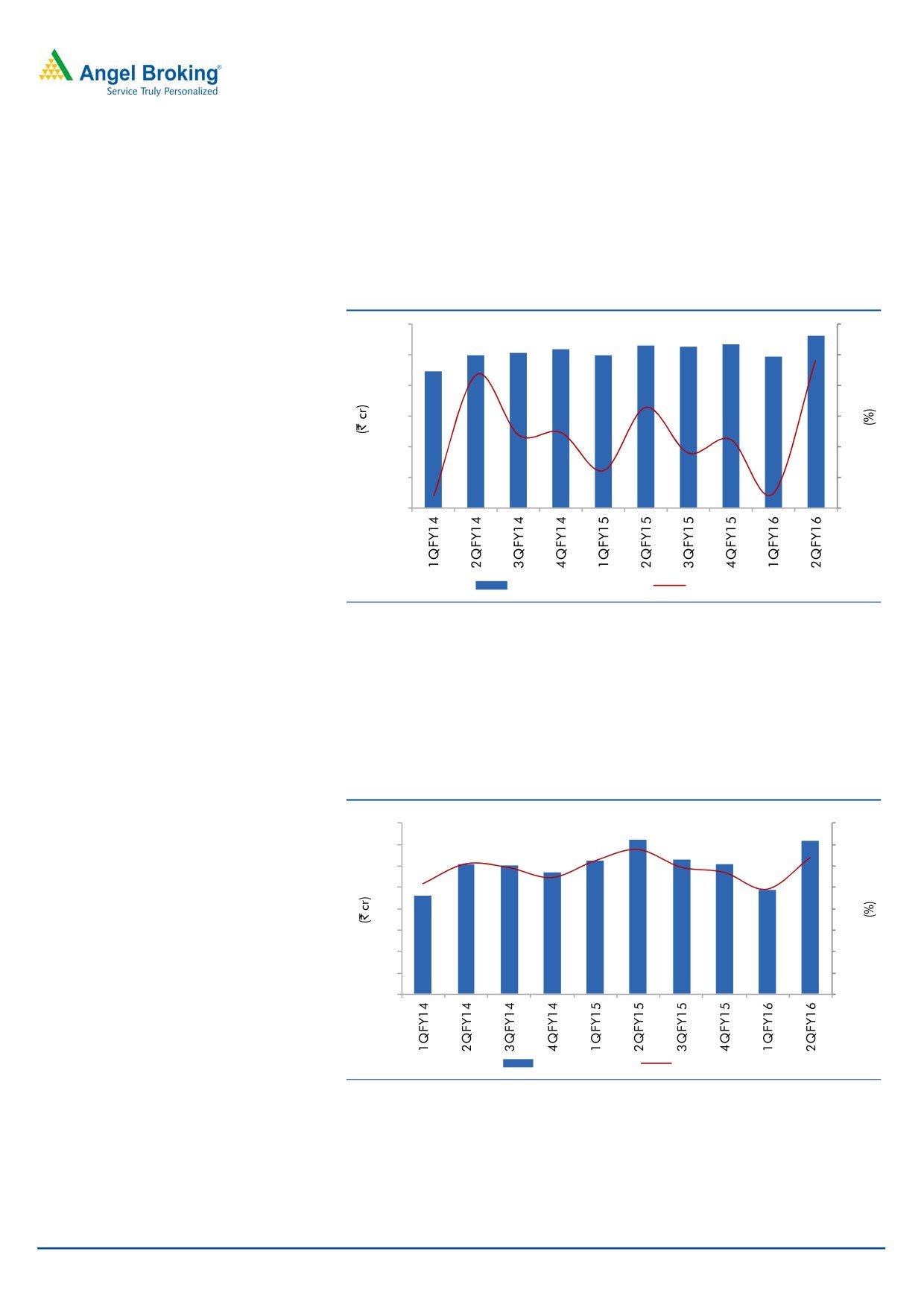

Operating margin contracts by 74bp yoy

The company reported an operating profit of ~`36cr, which is down 0.2% yoy. The

operating margin contracted by 74bp yoy to 12.8%, primarily on account of higher

employee costs and other expenditure.

Exhibit 3: Operating profit and margin trend

40

16

35

14

30

12

25

10

20

8

15

6

10

4

5

2

0

0

Operating profit

Margin (%)

Source: Company, Angel Research

3

November 5, 2015

L G Balakrishnan & Bros | 2QFY2016 Result Update

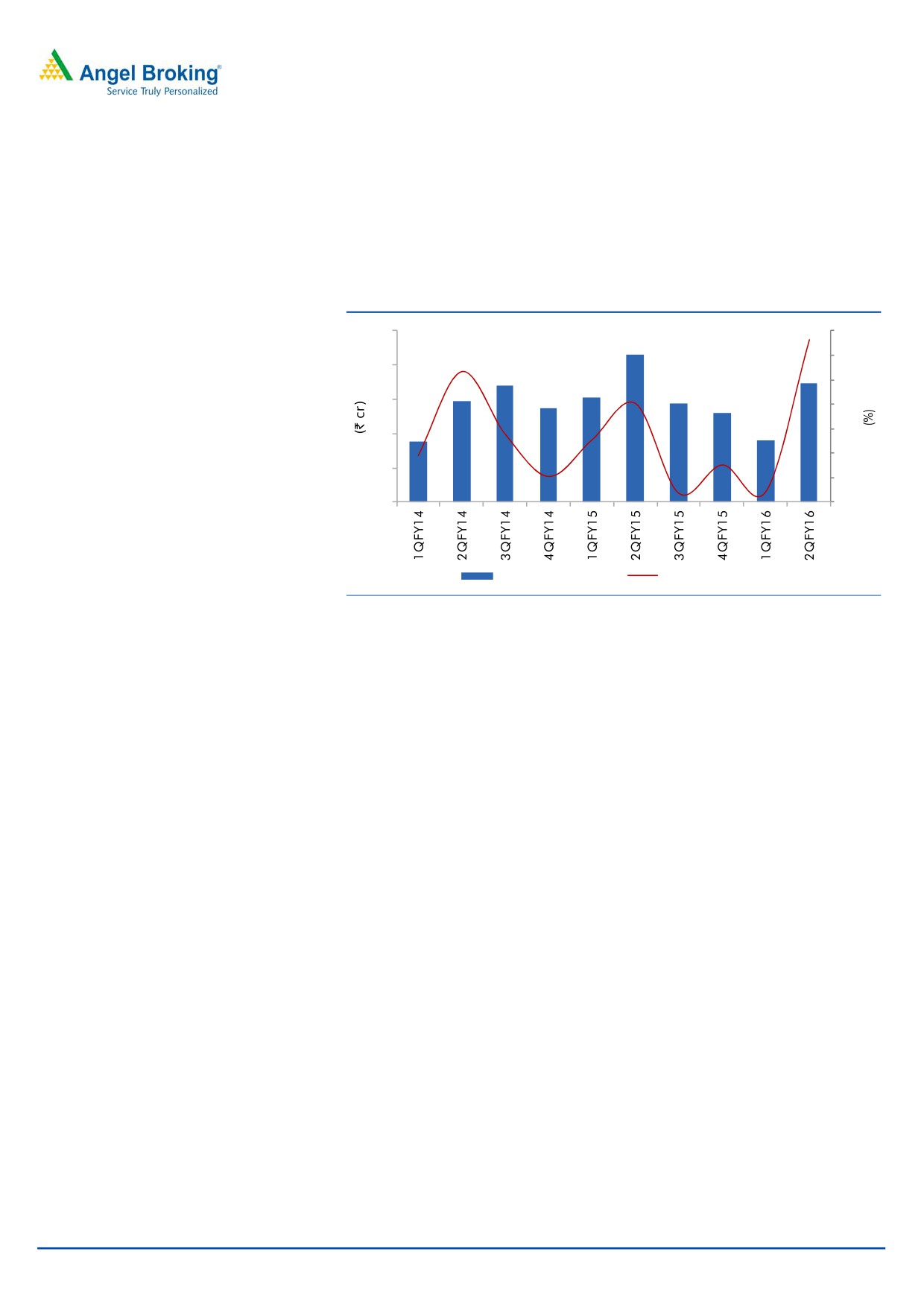

Subdued top-line growth, poor operating performance and

lower other income drag profitability

The reported standalone net profit declined by ~19% yoy to ~`17cr, but is higher than

our estimate of ~`16cr. However, on adjusting for the one-time exceptional gain

incurred in 2QFY2015, the PAT during 2QFY2016 actually grew by 5% yoy.

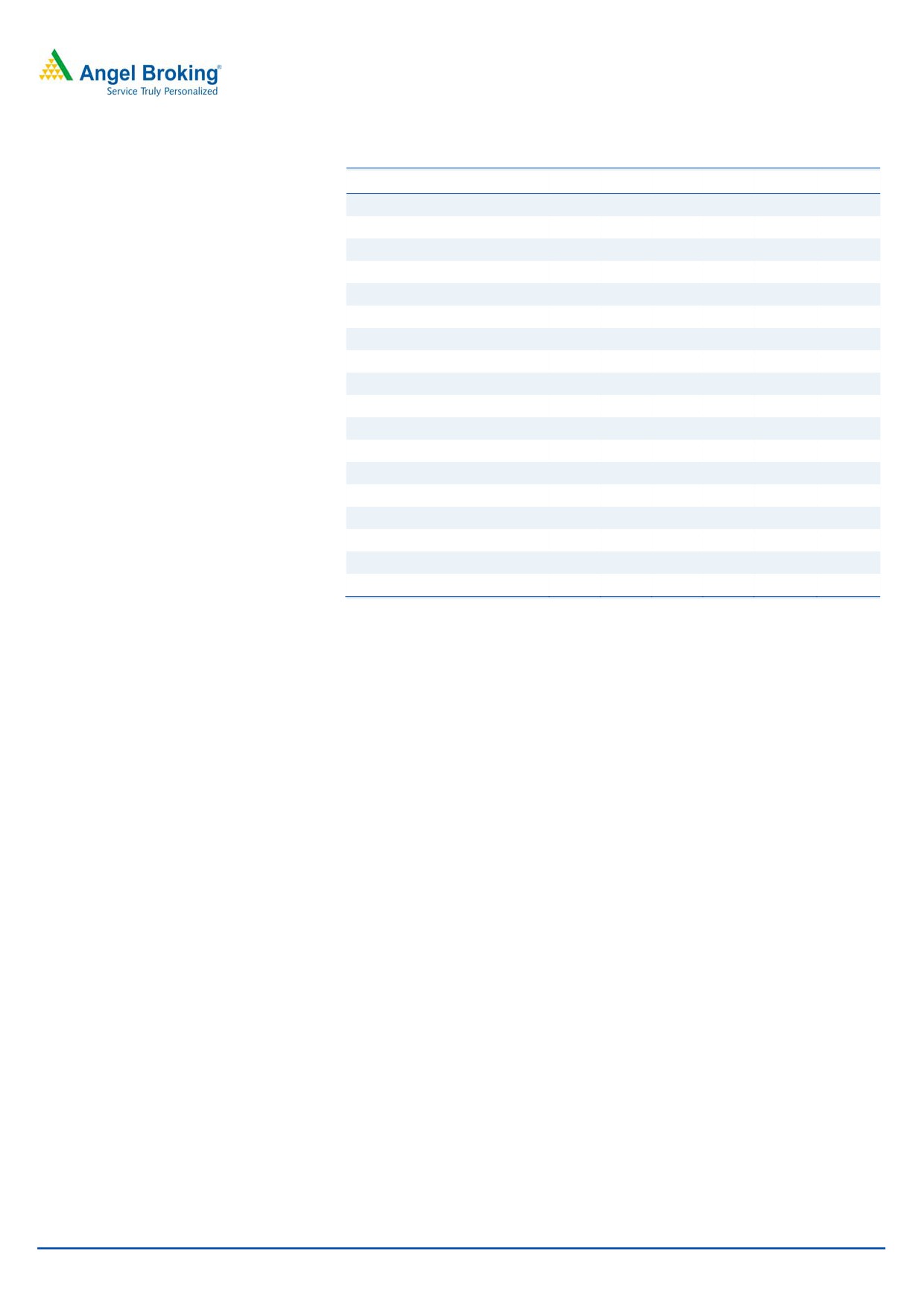

Exhibit 4: Net Profit trend

25

100

80

20

60

15

40

20

10

0

5

(20)

0

(40)

Standalon net profit

QoQ growth (%)

Source: Company, Angel Research

Investment rationale

Capacity expansion at key clients to drive growth for LGBBL

The company’s automotive chains segment caters to the OEM market for

two-wheelers. In the OEM segment, where the company has a 70% market share,

the company has tied up with leading two-wheeler players like Bajaj Auto, Hero

MotoCorp (HMCL), Honda Motorcycle and Scooter India (HMSI), TVS Motor,

Yamaha Motor etc., all of which have good growth prospects. These OEMs are

increasing their capacity and also entering newer geographies for export which

would drive growth of the industry. Hence, going forward, we believe that

expansion plans at various OEM clients would trigger volume growth for LGBBL.

4

November 5, 2015

L G Balakrishnan & Bros | 2QFY2016 Result Update

Outlook and valuation

LGBBL is a market leader in two-wheeler automotive chains with ~70% market

share in the OEM segment. The company has been reporting lower growth in

earnings since the last three quarters, which is mainly due to overall slowdown in

the two-wheeler industry. The two-wheeler industry has been impacted mainly due

to rural slowdown. However, sales are expected to rebound in 2HFY2016 on

expectations of a normal monsoon which will boost crop output, thus leading to

revival in rural demand. The company’s volume growth in the automotive chains

segment is expected to improve over FY2015-17E with its key clients like HMCL,

HMSI, Yamaha, TVS Motor and others having plans of capacity expansion and

with they launching new models. We have a Neutral rating on the stock.

Company Background

LG Balakrishnan & Bros Ltd is engaged in the manufacturing of chains, sprockets

and metal formed parts for automotive applications. It operates in three segments:

Transmission, Metal Forming and Others. The company's Transmission products

include chains, sprockets, tensioners, belts and brake shoe. The company's Metal

Forming products include fine blanking for precision sheet metal parts, machined

components and wire drawing products for internal use as well as for other chain

manufacturing plants, spring steel suppliers, and umbrella manufacturers. The

company's Others segment includes trading goods. It has manufacturing units

spread across Tamil Nadu, Maharashtra, Uttarakhand, Karnataka and Delhi.

5

November 5, 2015

L G Balakrishnan & Bros | 2QFY2016 Result Update

Profit and Loss Statement(Consolidated)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY17E

Total operating income

913

956

1,109

1,173

1,196

1,277

% chg

27.7

4.8

15.9

5.8

2.0

6.7

Total Expenditure

809

867

982

1,031

1,056

1,121

Cost of Materials

484

511

545

550

563

599

Personnel

88

100

134

150

156

169

Others

238

256

303

331

337

354

EBITDA

104

89

126

142

140

156

% chg

19.1

(13.8)

41.2

12.4

(1.3)

11.3

(% of Net Sales)

11.4

9.3

11.4

12.1

11.7

12.2

Depreciation& Amortisation

29

30

33

39

46

51

EBIT

75

59

93

102

94

105

% chg

22.3

(20.6)

57.0

9.6

(8.5)

12.3

(% of Net Sales)

8.2

6.2

8.4

8.7

7.8

8.2

Interest & other Charges

18

23

18

18

18

18

Other Income

2

4

5

3

4

5

(% of PBT)

2.9

9.5

5.7

3.1

5.0

5.4

Share in profit of Associates

-

-

-

-

-

-

Recurring PBT

59

40

80

87

80

92

% chg

22.5

(31.5)

98.4

9.1

(8.4)

15.7

Prior Period & Extra. Exp./(Inc.)

-

-

-

(7)

-

-

PBT (reported)

59

40

80

94

80

92

Tax

15

8

15

20

22

26

(% of PBT)

24.9

19.1

18.6

21.8

28.0

28.0

PAT (reported)

44

33

65

73

58

67

Add: Share of earnings of asso.

-

-

1

1

1

1

Less: Minority interest (MI)

-

(0)

3

3

3

3

PAT after MI (reported)

44

33

63

71

55

64

ADJ. PAT

44

33

63

66

55

64

% chg

(4.5)

(26.0)

92.0

5.1

(16.2)

16.3

(% of Net Sales)

4.8

3.4

5.7

5.6

4.6

5.0

Basic & Fully Diluted EPS (`)

28.2

20.8

40.0

45.4

35.3

41.0

Adjusted EPS (`)

28.2

20.8

40.0

42.1

35.3

41.0

% chg

(4.5)

(26.0)

92.0

5.1

(16.2)

16.3

6

November 5, 2015

L G Balakrishnan & Bros | 2QFY2016 Result Update

Balance sheet(Consolidated)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY17E

SOURCES OF FUNDS

Equity Share Capital

8

8

8

16

16

16

Reserves& Surplus

225

251

301

354

402

458

Shareholders Funds

233

258

309

370

418

473

Minority Interest

-

5

10

10

10

10

Total Loans

138

168

150

157

157

157

Deferred Tax Liability

18

18

17

17

17

17

Total Liabilities

388

450

486

554

602

657

APPLICATION OF FUNDS

Gross Block

367

428

486

556

636

716

Less: Acc. Depreciation

171

200

231

271

317

368

Net Block

197

228

255

285

319

348

Capital Work-in-Progress

3

3

9

12

14

14

Investments

14

19

18

18

18

18

Current Assets

341

372

408

433

456

505

Inventories

193

196

208

230

229

245

Sundry Debtors

109

124

146

147

151

161

Cash

6

10

7

7

14

19

Loans & Advances

33

41

47

47

60

77

Other Assets

0

1

0

1

2

4

Current liabilities

166

172

204

194

205

228

Net Current Assets

175

200

204

239

251

278

Mis. Exp. not written off

-

-

-

-

-

-

Total Assets

388

450

486

554

602

657

7

November 5, 2015

L G Balakrishnan & Bros | 2QFY2016 Result Update

Cash flow statement(Consolidated)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY17E

Profit before tax

59

40

80

87

80

92

Depreciation

29

30

33

39

46

51

Change in Working Capital

(49)

(12)

(15)

(34)

(6)

(21)

Interest / Dividend (Net)

17

23

18

18

18

18

Direct taxes paid

(17)

(8)

(17)

(20)

(22)

(26)

Others

(1)

(3)

(3)

7

-

-

Cash Flow from Operations

38

70

96

96

115

114

(Inc.)/ Dec. in Fixed Assets

(30)

(58)

(61)

(73)

(82)

(80)

(Inc.)/ Dec. in Investments

-

(5)

0

1

-

-

Cash Flow from Investing

(30)

(63)

(60)

(72)

(82)

(80)

Issue of Equity

-

6

-

8

-

-

Inc./(Dec.) in loans

20

-

-

7

-

-

Dividend Paid (Incl. Tax)

(9)

(15)

(6)

(13)

(9)

(11)

Interest / Dividend (Net)

(18)

7

(33)

(26)

(18)

(18)

Cash Flow from Financing

(8)

(2)

(39)

(23)

(27)

(29)

Inc./(Dec.) in Cash

1

5

(4)

1

6

5

Opening Cash balances

5

6

10

7

7

14

Closing Cash balances

6

10

7

7

14

19

8

November 5, 2015

L G Balakrishnan & Bros | 2QFY2016 Result Update

Key ratios

Y/E March

FY12

FY13

FY14

FY15

FY16E FY17E

Valuation Ratio (x)

P/E (on FDEPS)

16.2

21.9

11.4

10.8

12.9

11.1

P/CEPS

9.8

11.4

7.5

6.5

7.0

6.2

P/BV

3.1

2.8

2.3

2.0

1.7

1.5

Dividend yield (%)

1.1

1.2

0.8

1.3

1.3

1.5

EV/Sales

0.9

0.9

0.8

0.7

0.7

0.7

EV/EBITDA

8.1

9.6

6.7

6.0

6.0

5.4

EV / Total Assets

1.5

1.4

1.2

1.1

1.0

0.9

Per Share Data (`)

EPS (Basic)

28.2

20.8

40.0

45.4

35.3

41.0

EPS (fully diluted)

28.2

20.8

40.0

45.4

35.3

41.0

Cash EPS

46.5

39.9

60.9

70.5

64.8

73.3

DPS

5.0

5.5

3.8

6.0

6.0

7.0

Book Value

146.5

163.0

195.2

233.8

264.4

299.9

Returns (%)

RoCE

20.2

13.9

20.3

19.4

16.3

16.7

Angel RoIC (Pre-tax)

21.3

15.0

21.5

20.4

17.2

17.7

RoE

19.0

12.7

20.3

19.3

13.3

13.6

Turnover ratios (x)

Asset Turnover

2.5

2.2

2.3

2.1

1.9

1.8

Inventory / Sales (days)

77

75

68

72

70

70

Receivables (days)

44

47

48

46

46

46

Payables (days)

45

48

49

47

50

53

Net WC (days)

76

74

67

70

66

63

9

November 5, 2015

L G Balakrishnan & Bros | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

L G Balakrishnan & Bros

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

10

November 5, 2015