Update|NBFC

May 02, 2018

L&T Finance Holdings

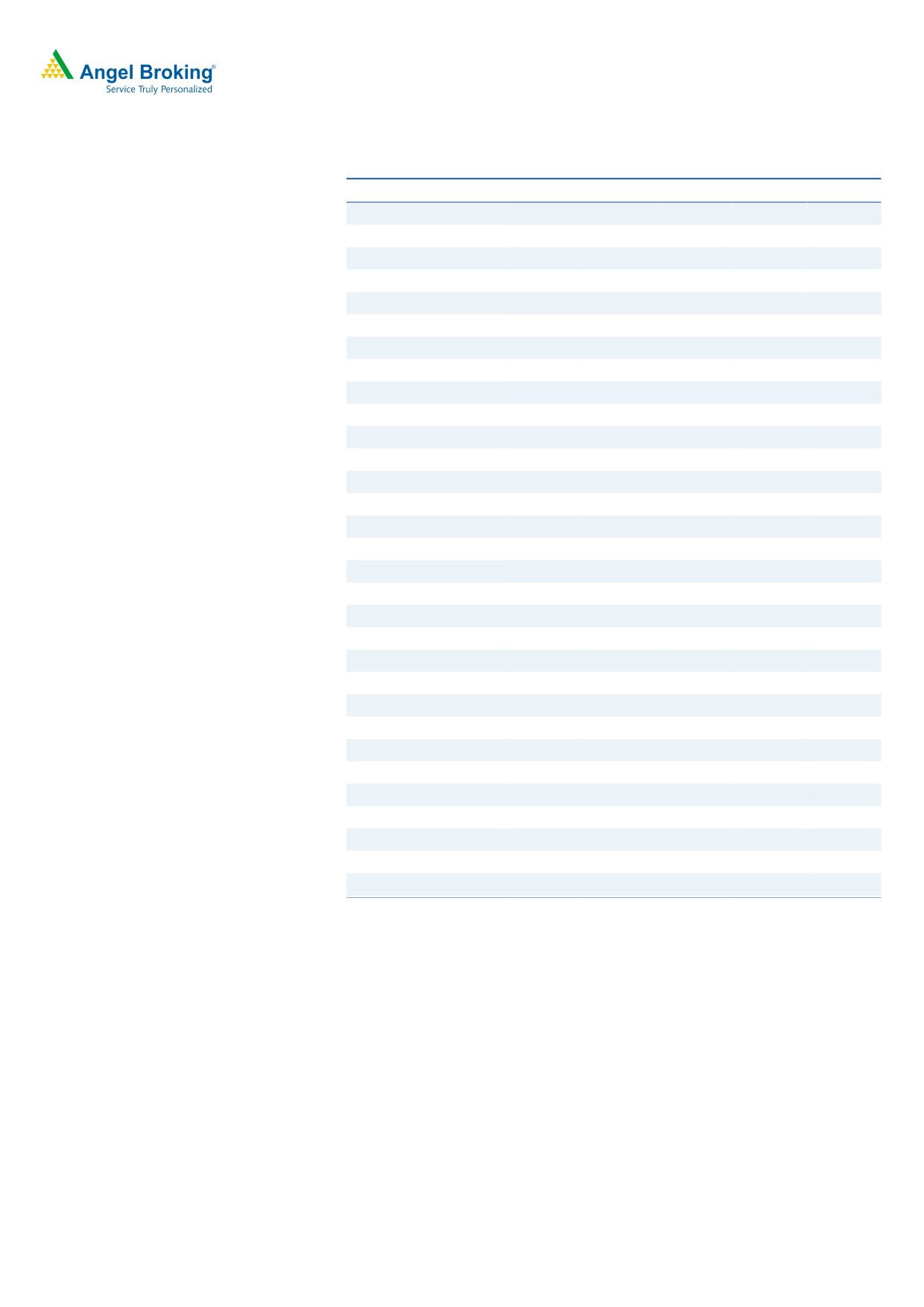

BUY

CMP

`174

Focus on improving ROE

Target Price

`210

L&T Finance Holdings Ltd (LTFH), promoted by L&T Ltd (64.2%) is a leading NBFC

Investment Period

12 Months

with a diversified lending portfolio. Over the last two year the management has

Sector

NBFC

restructured its business model and is focusing on selective segments where it has

Market Cap (` cr)

34,654

competitive advantage, simultaneously downsizing some products which were

Beta

1.8

making losses.

52 Week High / Low

213.6/119.1

Avg. Daily Volume

41,45,730

New management strategies delivering results: LTFH had a vast portfolio of

Face Value (`)

10

financial products, which was a mix of productive as well as non-productive

BSE Sensex

35,176

segments. The company underwent a restructure at the beginning of FY17, when

Nifty

10,718

the new management focused on five products - retail, housing and whole sale

Reuters Code

LTFH.BO

loans, investment and wealth management services. Since then, LTFH set a target

Bloomberg Code

LTFH.IN

of ROE 18% to be achieved by 2020. As of 3QFY18, the company’s ROE stands at

15.9% which was 9.8% at the beginning of new management in FY17. The focus

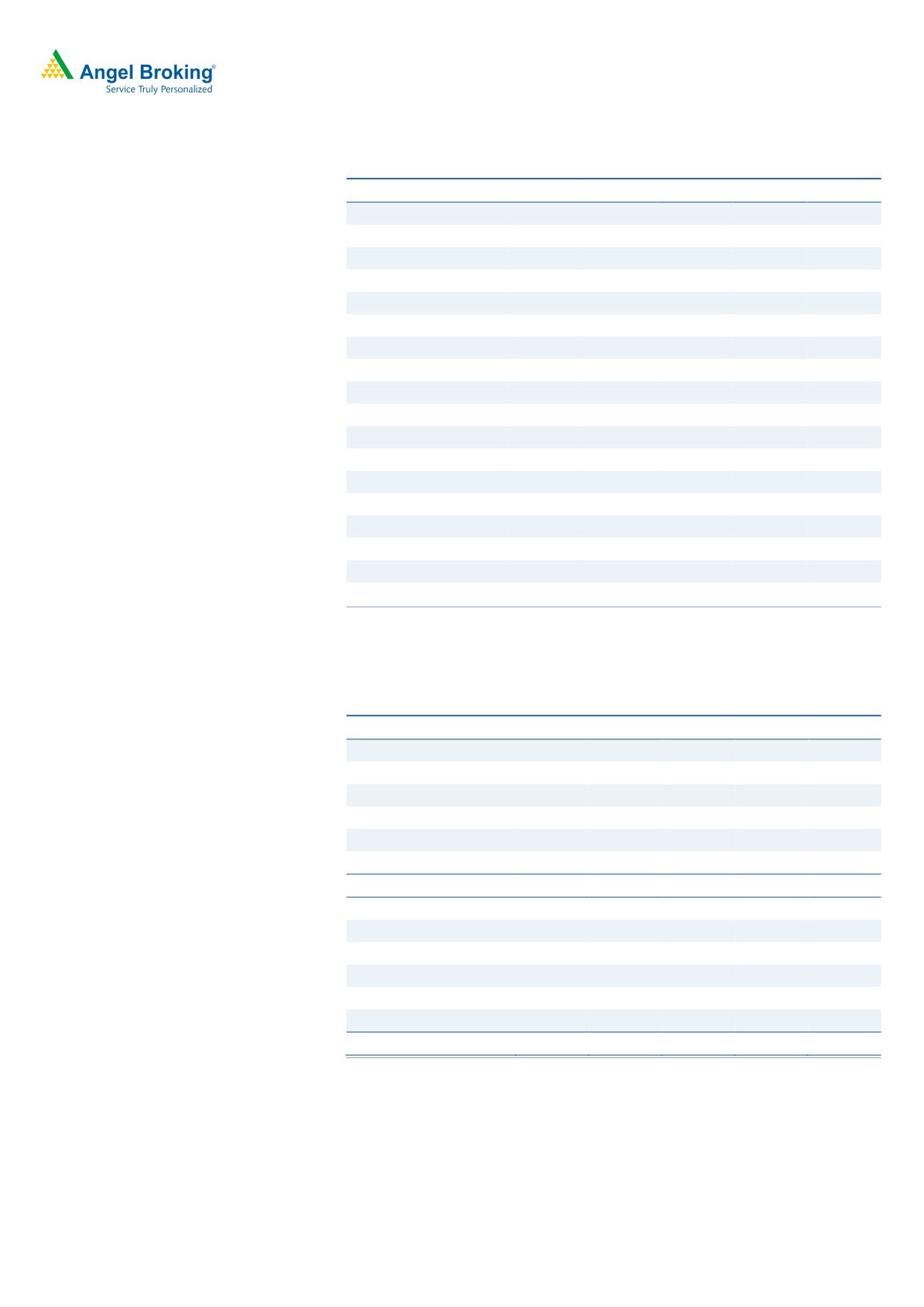

Shareholding Pattern (%)

products are delivering continuous growth.

Promoters

64.2

Constant improvement in asset quality: LTFH’s loans & advances is increasing

MF / Banks / Indian Fls

8.3

steadily and reported a 26% rise at the end of 9MFY18. Major portion of the

FII / NRIs / OCBs

16.6

advances comprise of wholesale loan, followed by housing loans and retail loans.

In the midst of rising loan disbursements also, there is great focus at maintaining

Indian Public / Others

10.9

asset quality. The gross NPA as of 9MFY18 decreased to 5.5% from 9% in the

previous year. Similarly, net NPA also slumped to 2.9% from 7.3% in the year-ago,

primarily on account of an expansion in provision coverage from 20.4% in 49.1%.

Abs. (%)

3m 1yr

3yr

Sensex

(3.1)

17.6

30.2

Capital infusion to leverage growth: LTFH recently raised capital of `3,000cr,

which will keep the company’s required CAR intact. Additional capital infusion will

LTFH

(1.8)

29.0

173.7

help in developing its lending business in the coming years which is already

growing at a level of ~20%. The company raised `3,000cr in equity capital, of

which `2,000Cr came from the parent and `1000cr from institutional investors.

Outlook & Valuation: We expect going forward advance to grow at healthy CAGR

3-year price chart

250

of 24% over FY17-FY20E, primarily owing to focused lending segment (rural,

200

housing and wholesale) and better managed credit cost would further help to

150

improve return ratio. At CMP LTFH is trading at 2.5x of FY20 AdjBV. We

100

recommend a Buy rating on the stock, with a target price of `210.

50

0

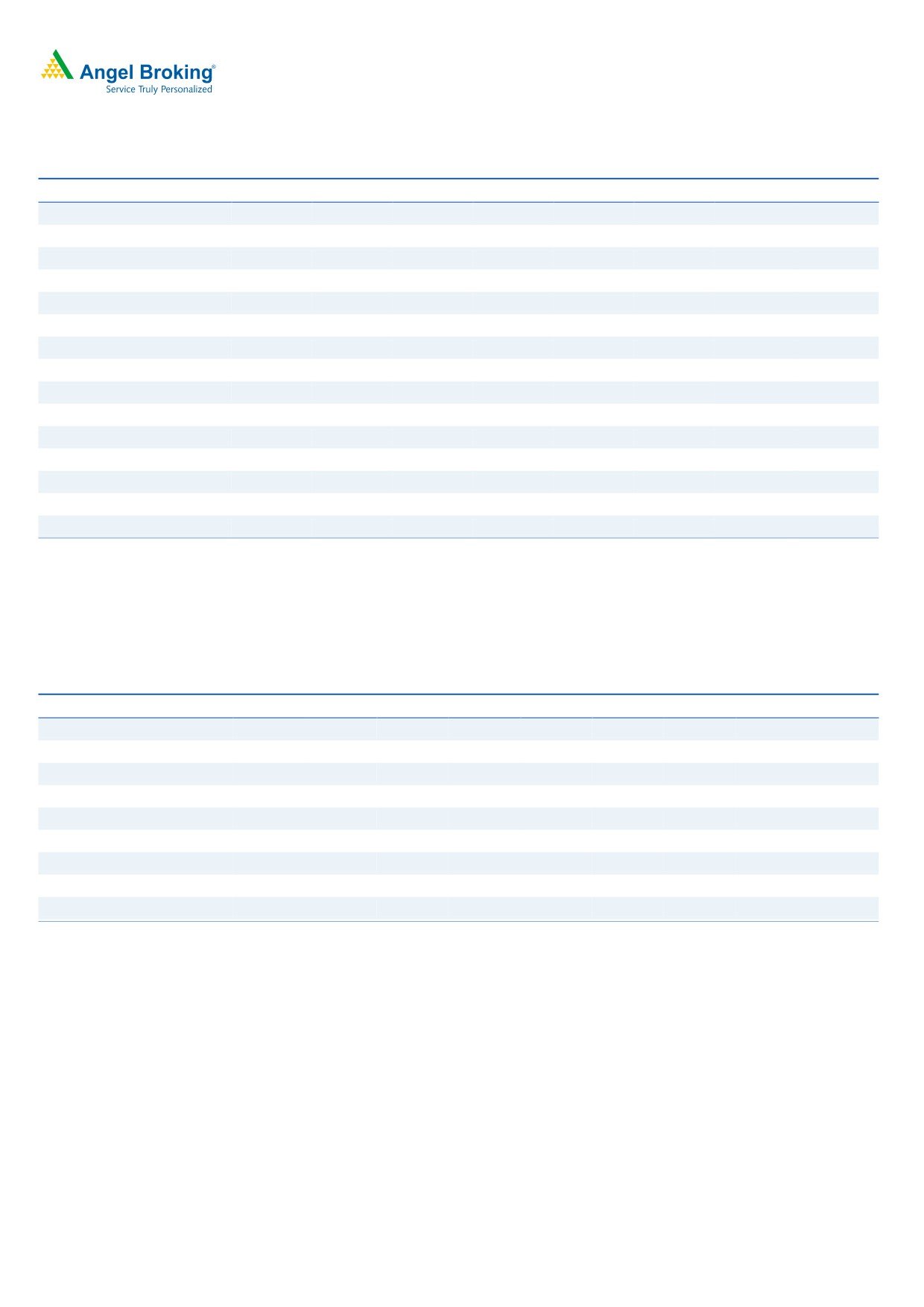

Key financials (Consolidated)

Y/E March (` cr)

FY16

FY17

FY18E

FY19E

FY20E

NII

2,693

3,034

3,686

4,674

5,846

Source: Company, Angel Research

% chg

15

13

21

27

25

Net profit

854

1,043

1,345

1,931

2,479

% chg

17

22

29

44

28

NIM (%)

5.3

5.1

5.2

5.2

5.3

EPS (`)

4

5

6

9

11

P/E (x)

44

36

28

19

15

P/ABV (x)

5.0

4.6

4.3

2.9

2.5

Jaikishan Parmar

RoA (%)

1

2

2

2

2

022 - 39357600 Ext: 6810

RoE (%)

11

12

14

16

16

Source: Company, Angel Research; Note: CMP as of may 2, 2018

Please refer to important disclosures at the end of this report

1