2QFY2016 Result Update | Capital Goods

November 17, 2015

Kirloskar Oil Engines

NEUTRAL

CMP

`262

Performance Highlights

Target Price

-

Y/E March (` cr)

2QFY16 2QFY15

% chg. (yoy)

1QFY15

% chg. (qoq)

Investment Period

-

Net Sales

590

628

(6.0)

582

1.5

EBITDA

48

64

(24.3)

53

(8.1)

Stock Info

EBITDA margin (%)

8.2

10.2

(198)

9.0

(86)

Sector

Capital Goods

PAT

36

35

1.1

36

(0.5)

Market Cap (` cr)

3,796

Source: Company, Angel Research (Standalone)

Net debt (` cr)

(876)

For 2QFY2016, Kirloskar Oil Engines (KOEL) reported a disappointing set of

Beta

0.6

numbers. Its top-line for the quarter declined by 6.0% yoy to `590cr. The raw

52 Week High / Low

261/ 141

material cost declined by 286bp yoy to 62.3% of sales while employee expense

Avg. Daily Volume

26,711

increased by 79bp yoy to 8.5% of sales, and other expenses increased by

Face Value (`)

2

405bp yoy to 21.0% of sales. This resulted in the EBITDA margin contracting by

BSE Sensex

25,760

198bp yoy to 8.2%. Other income increased by 61.1% yoy to `20cr and

Nifty

7,807

consequently, the net profit remained flat at `36cr.

Reuters Code

KIRO.BO

Bloomberg Code

KOEL IN

Outlook to remain subdued in the near term: In the near term, we expect the

company to witness some pressure on account of overall slowdown in the Genset

industry. In addition, the absence of large engines orders has been impacting the

Shareholding Pattern (%)

top-line and profitability. KOEL has expanded its capacity in the past and is

Promoters

72.7

positioned to successfully cater to improvement in demand once the operating

MF / Banks / Indian Fls

6.6

environment changes in the longer run. KOEL also has taken measures to

FII / NRIs / OCBs

10.4

increase its focus on exports which should aid growth.

Indian Public / Others

10.3

Cash rich position: KOEL is a debt free company with cash and cash equivalents

of approximately `835cr. With ample capacity in place, there is no major capex

expected in the near future. Consequently depreciation expense is also expected to remain

Abs.(%)

3m 1yr

3yr

low which will add to the bottom-line. We expect KOEL’s cash and cash equivalents to be

Sensex

(7.6)

(8.6)

40.7

at ~`982cr in FY2017E which is approximately 26% of the current market cap.

KOEL

(0.8)

1.7

39.4

Outlook and Valuation: We expect KOEL’s revenue to recover post FY2016, ie to

`2,826cr in FY2017E. With recovery in the top-line, we expect the EBITDA margin

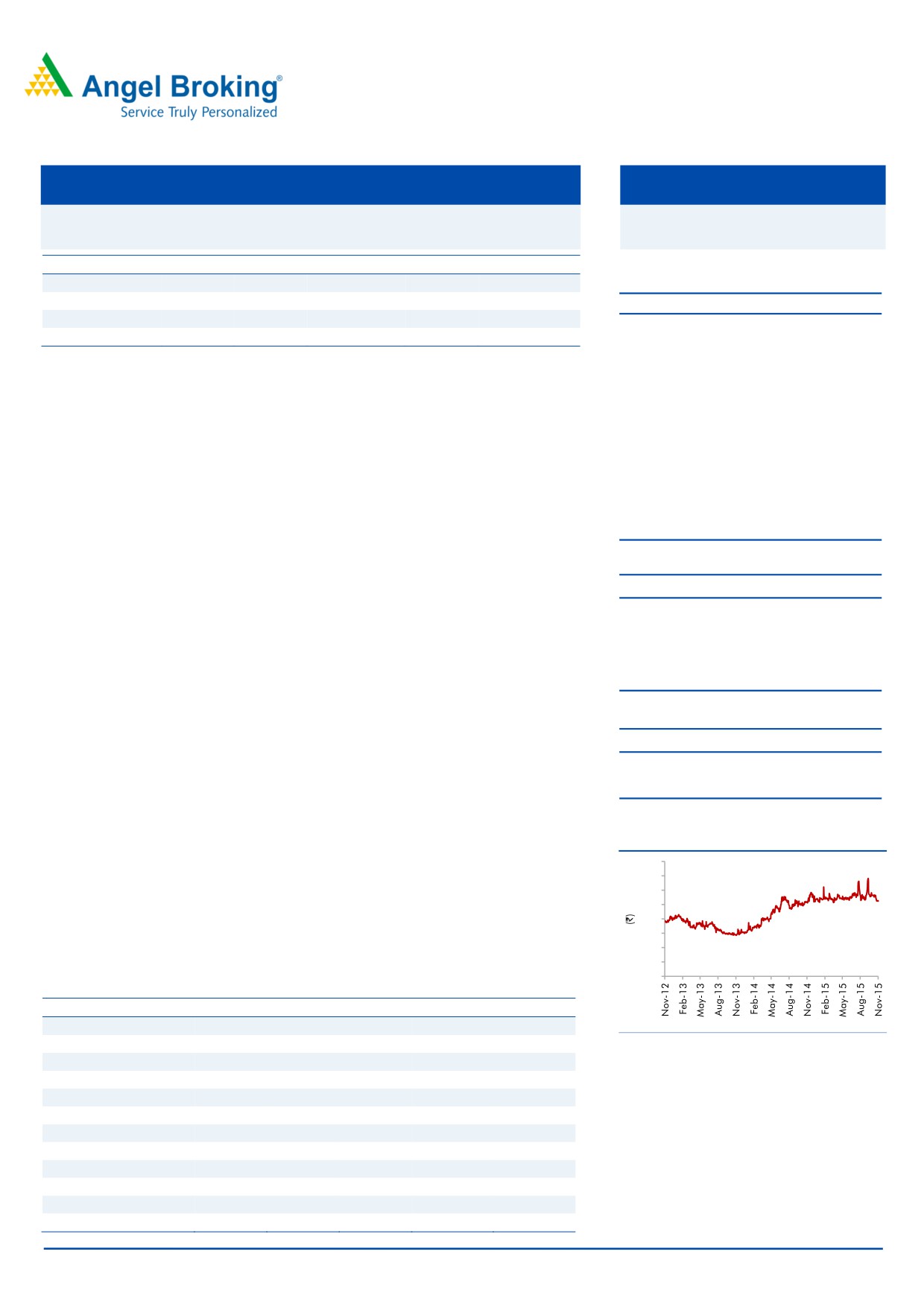

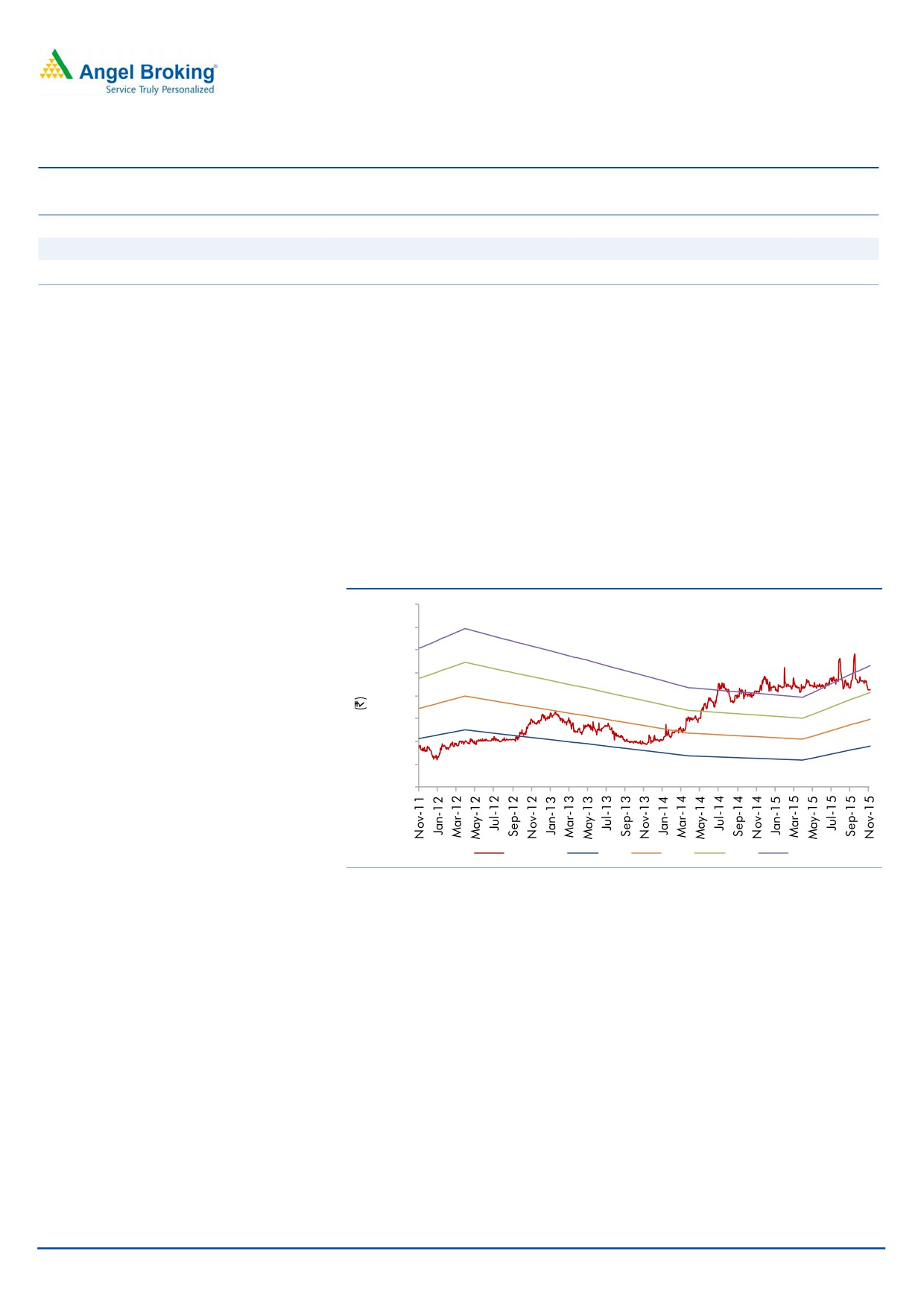

3 Year price chart

to recover to 10.4% in FY2017E. Consequently the profit is expected to grow to

400

`193cr in FY2017E. We have scaled down our numbers for FY2016E and have

350

300

accounted for improvement in the top-line for FY2017E. At the current market price,

250

the stock trades at 19.7x its FY2017E earnings (vs its 3-year median of 21.7x). At

200

150

the current juncture, we have a Neutral rating on the stock as the infrastructure

100

scenario in the country is expected to remain dampened in the near term.

50

0

Key financials

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Net Sales

2,357

2,319

2,507

2,471

2,826

% chg

1.3

(1.6)

8.1

(1.4)

14.3

Source: Company, Angel Research

Adj. Net Profit

212

178

143

132

193

% chg

35.2

(15.9)

(19.8)

(7.8)

46.1

OPM (%)

13.8

13.1

9.9

8.8

10.4

EPS (`)

14.7

12.3

9.9

9.1

13.3

P/E (x)

17.9

21.2

26.5

28.7

19.7

P/BV (x)

3.3

3.0

2.8

2.7

2.5

RoE (%)

19.4

14.7

11.0

9.7

13.4

RoCE (%)

19.4

16.4

10.9

8.0

12.4

Milan Desai

EV/Sales (x)

1.4

1.4

1.2

1.2

1.0

022 4000 3600 Ext: 6846

EV/EBITDA (x)

10.3

10.3

11.6

13.4

9.5

Source: Company, Angel Research, Note: CMP as of November 13, 2015

Please refer to important disclosures at the end of this report

1

Kirloskar Oil Engines | 2QFY2016 Result Update

Exhibit 1: 2QFY2016 performance highlights

Y/E March (` cr)

2QFY16

2QFY15

% chg. (yoy)

1QFY15

% chg. (qoq)

1HFY2016

1HFY2015

% chg

Net Sales

590

628

(6.0)

582

1.5

1,171

1,267

(7.5)

Net raw material

368

409

(10.2)

373

(1.5)

741

825

(10.2)

(% of Sales)

62.3

65.2

(286)

64.2

(186)

63.2

65.1

(2.9)

Employee Cost

50

48

3.6

48

5.5

98

94

3.8

(% of Sales)

8.5

7.7

79

8.2

32

8.3

7.4

12.2

Other Expenses

124

106

16.4

108

14.5

232

208

11.3

(% of Sales)

21.0

16.9

405

18.6

239

19.8

16.5

20.4

Total Expenditure

542

564

(4.0)

529

2.4

1,071

1,128

(5.1)

Operating Profit

48

64

(24.3)

53

(8.1)

101

139

(27.6)

OPM (%)

8.2

10.2

(198)

9.0

(86)

8.6

11.0

(238)

Interest

0

0

(86.7)

0

(33.3)

0

0

(79.2)

Depreciation

27

26

3.9

26

2.4

53

50

5.4

Other Income

20

12

61.1

19

2.2

39

26

49.4

PBT

41

50

(17.9)

46

(9.8)

87

115

(24.5)

(% of Sales)

7.0

8.0

7.8

7.4

9.1

Tax

5

15

(63.5)

10

(44.4)

15

32

(53.1)

(% of PBT)

13.1

29.4

21.2

17.4

28.0

Reported PAT

36

35

1.1

36

(0.5)

72

83

(13.3)

Extraordinary Expense/(Inc.)

-

-

-

-

-

Adjusted PAT

36

35

1.1

36

(0.5)

72

83

(13.3)

PATM

6.1

5.6

6.2

6.1

6.5

Source: Company, Angel Research

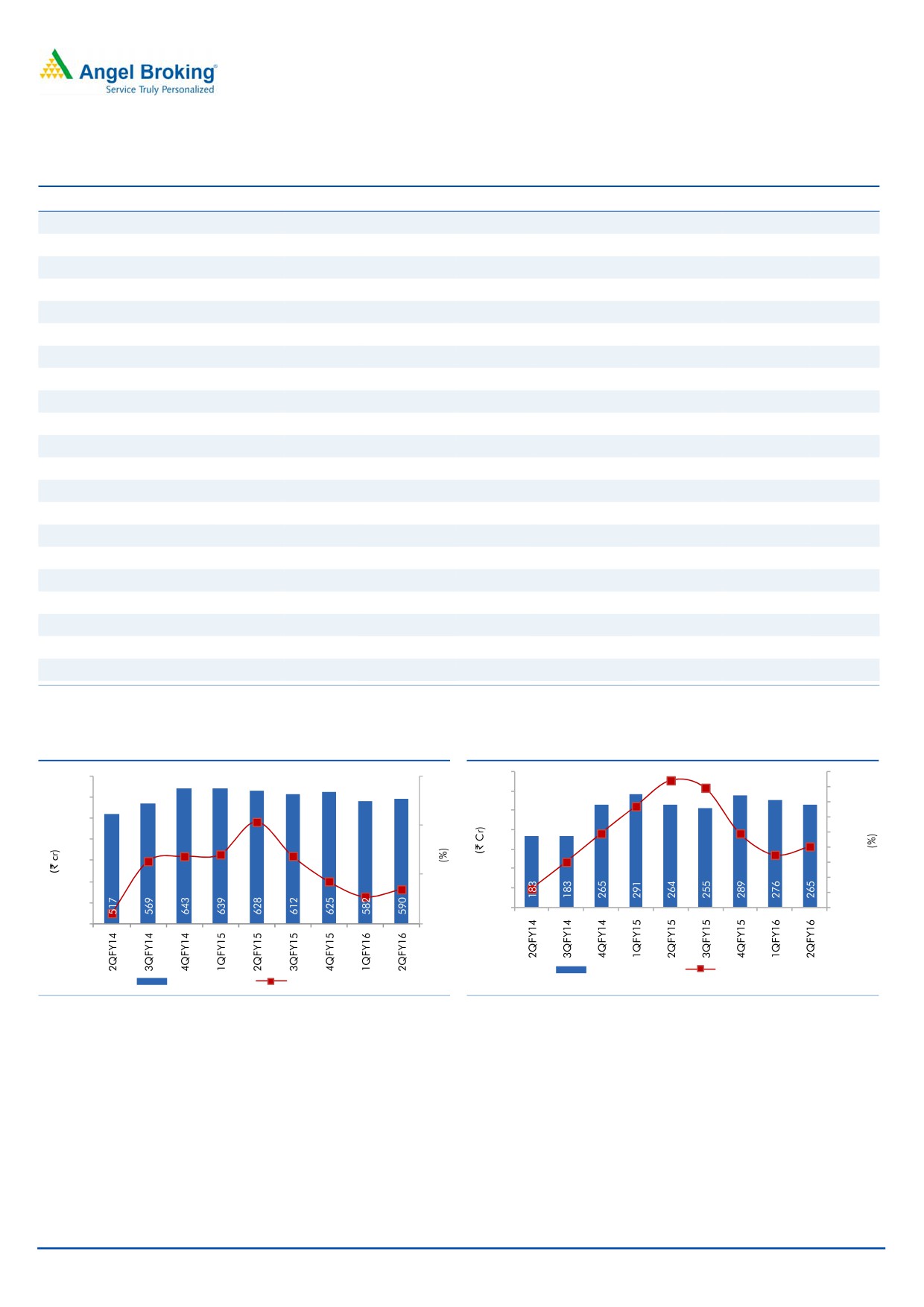

Exhibit 2: Top-line remains subdued

Exhibit 3: PowerGen Segment growth

350

50.0

700

40

44.3

39.3

40.0

300

600

27.1

30.0

250

500

21.4

20.0

20

200

9.1

9.1

10.0

400

0

.4

7.4

7.5

150

-

300

5.4

8.2

(10.0)

100

(9.9)

(5.2)

(2.8)

0

(9.0)

(20.0)

200

(6

.0)

50

(30.0)

(27.7)

100

(15.7)

0

(40.0)

0

(20)

PowerGen (LHS)

yoy growth (RHS)

Revenue (LHS)

yoy growth (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

Top-line growth remains subdued

For 2QFY2016, the top-line declined by 6.0% yoy to `590cr. The decline was on

account of a muted performance across all segments and due to absence of large

engine orders in FY2016 (last portion of the order completed in FY2015). As per

the Management, the domestic power gen segment saw a decline of 4% in

1HFY2016E. Exports performed well, growing by 27% on a yoy basis.

November 17, 2015

2

Kirloskar Oil Engines | 2QFY2016 Result Update

Exhibit 4: Segmental Performance

(` Cr)

2QFY16

2QFY15

% chg. (yoy)

1HFY16

1HFY15

% chg. (yoy)

PowerGen

265

264

0.5

541

555

(2.4)

Agricultural

107

113

(5.8)

206

205

0.4

Industrial

99

94

5.0

190

193

(1.6)

Customer Support

83

85

(2.4)

172

177

(2.7)

Large Engines

31

67

(54.3)

52

122

(57.4)

Total

584

623

1,162

1,252

Source: Company, Angel Research

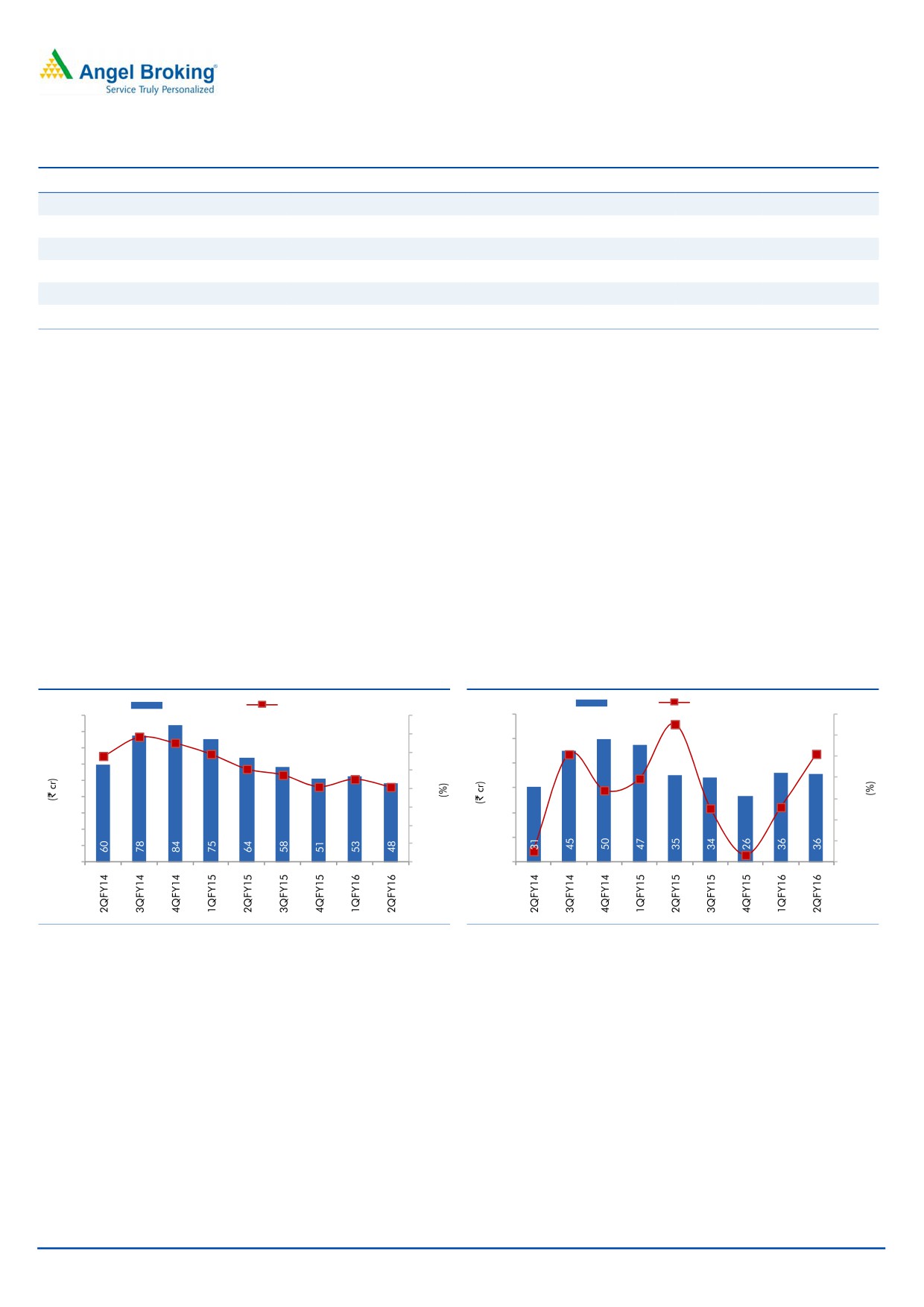

EBITDA Margin contracts on account of higher other expenses

The raw material cost declined by 286bp yoy to 62.3% of sales while employee

expense increased by 79bp yoy to 8.5% of sales, and other expenses increased by

405bp yoy to 21.0% of sales. This resulted in the EBITDA margin contracting by

198bp yoy to 8.2%. As per the Management, the other expense was higher as

there was a one-off expense related to payment of consultancy fees and shifting of

manufacturing from Pune plant to Kagal plant. The fixed portion of the fees (~`7-

`8cr) was paid up front. Additionally, the CSR expense which was incurred in the

last quarter of the previous year has been spread out evenly in the current year. As

on 1HFY2016, the expense was `3cr against `10-`20 lakhs in the same period

last year. Aided by higher other income which grew by 61.1% yoy to `20cr, the net

profit grew marginally by 1.1% yoy to `36cr.

Exhibit 5: EBITDA margin

Exhibit 6: Net profit trend

EBITDA (LHS)

EBITDA Margin (RHS)

PAT (LHS)

yoy growth (RHS)

90

16

60

20

13.7

13.0

15.2

80

14

11.6

11.8

50

10

70

10.2

12

0.9

1.1

9.5

0

60

9.0

40

8.2

8.2

10

(10.6)

(16.1)

50

(10)

8

30

40

(20)

6

(24.7)

(24.1)

30

20

(30)

20

4

10

2

(40)

10

(44.9)

(46.7)

0

0

0

(50)

Source: Company, Angel Research

Source: Company, Angel Research

November 17, 2015

3

Kirloskar Oil Engines | 2QFY2016 Result Update

Conference Call Highlights

Economic revival has been sluggish and has had a direct impact on the

PowerGen and Industrial segment. The Agri business was impacted on

account of shift in demand towards electrical pump sets as electrification has

improved. Spare sales were lower on account of low usage of DG set and

lesser industrial activities.

The competitive scenario is intense in the sub-125kVA segment and everybody

is scampering for a share of the pie. The domestic PowerGen segment industry

saw a decline of 4% in volume terms. Few players in MHP and HHP have

taken price cuts of ~4-5%. KOEL has refrained from cutting its prices.

Market share increase in PowerGen by ~4-5% for a competitor is on account

of pick up in 4G activity (Reliance Jio). Ex of telecom, KOEL maintained its

market share. The Management expects telecom to be in a lull over the next

few months but it should pick up when the Airtel order comes up. The

company has not participated in a big way in 4G but is hopeful that some of

the test orders translate in to larger orders.

Exports’ contribution has increased from

8% in 1HFY2015 to

10% in

1HFY2016. The company expects to maintain its previous growth rates.

Tiller volumes are expected to pick up in the next year on account of subsidy

application and link up with four major banks for retail financing. Subsidy

approval from various state governments will be an important factor in the

near term. The company has sold 600 power tillers in 1HFY2016. With timely

subsidies, the Management is expecting sales of ~500 tillers per month for

FY2017E.

Investment arguments

Near term performance subdued; to improve over the longer run

The generator set industry in general is facing headwinds on account of delay in

pickup in economic recovery. In the past, the industrial and infrastructure segment

witnessed persistent headwinds such as inflationary pressures, slow order inflows,

high interest rates and policy paralysis, which has resulted in slower execution and

dip in demand for gensets. The PowerGen segment accounts for ~45% of total

revenues and is impacted by the above mentioned reasons. Although the recovery

has been slower than expected, the expected improvement in the economic

scenario would impact KOEL positively as it has the necessary capacity in place to

cater to an improving scenario.

Debt free and cash rich company

KOEL is a debt free company with cash and cash equivalents of approximately

`835cr. With ample capacity in place, there is no major capex expected in the

near future. Consequently depreciation expense is also expected to remain low

which will add to the bottom-line. We expect KOEL’s cash and cash equivalents to

be at ~`982cr in FY2017E which is approximately 26% of the current market cap.

November 17, 2015

4

Kirloskar Oil Engines | 2QFY2016 Result Update

This is on the back of measures taken by the company to significantly reduce its

debtor days from 45 in FY2013 to 17 in FY2015.

Increasing focus on exports - a long term growth driver

In order to balance out any slowdown in the domestic economy, the company is

focusing on the export market. The company’s major export markets are Middle

East and Africa along with USA, Europe and South Asia/South East Asia. Middle

East accounts for 47% of total exports and Africa accounts for 37%. The company

is upping its focus on exports and plans to enter new markets while also increasing

its market share in existing markets. The company expects Middle East and Africa

to be larger contributors to the international business of the company and is taking

steps to increase its presence in USA where it has less of a presence.

Financials

Slow recovery in top-line

On account of overall slowdown in the PowerGen and Industrial segment along

with absence of large engine orders, we expect the top-line to regress in FY2016E

and recover in FY2017E to `2,826cr. The margins are expected to remain under

pressure for the current year on account of lower sales and on account of some

one-time expenses in the current year (Shifting to Kagal plant and Consultancy

fees). We expect the EBITDA margin to improve on account of operating leverage

and also due to higher-margin large engine orders coming in FY2017E.

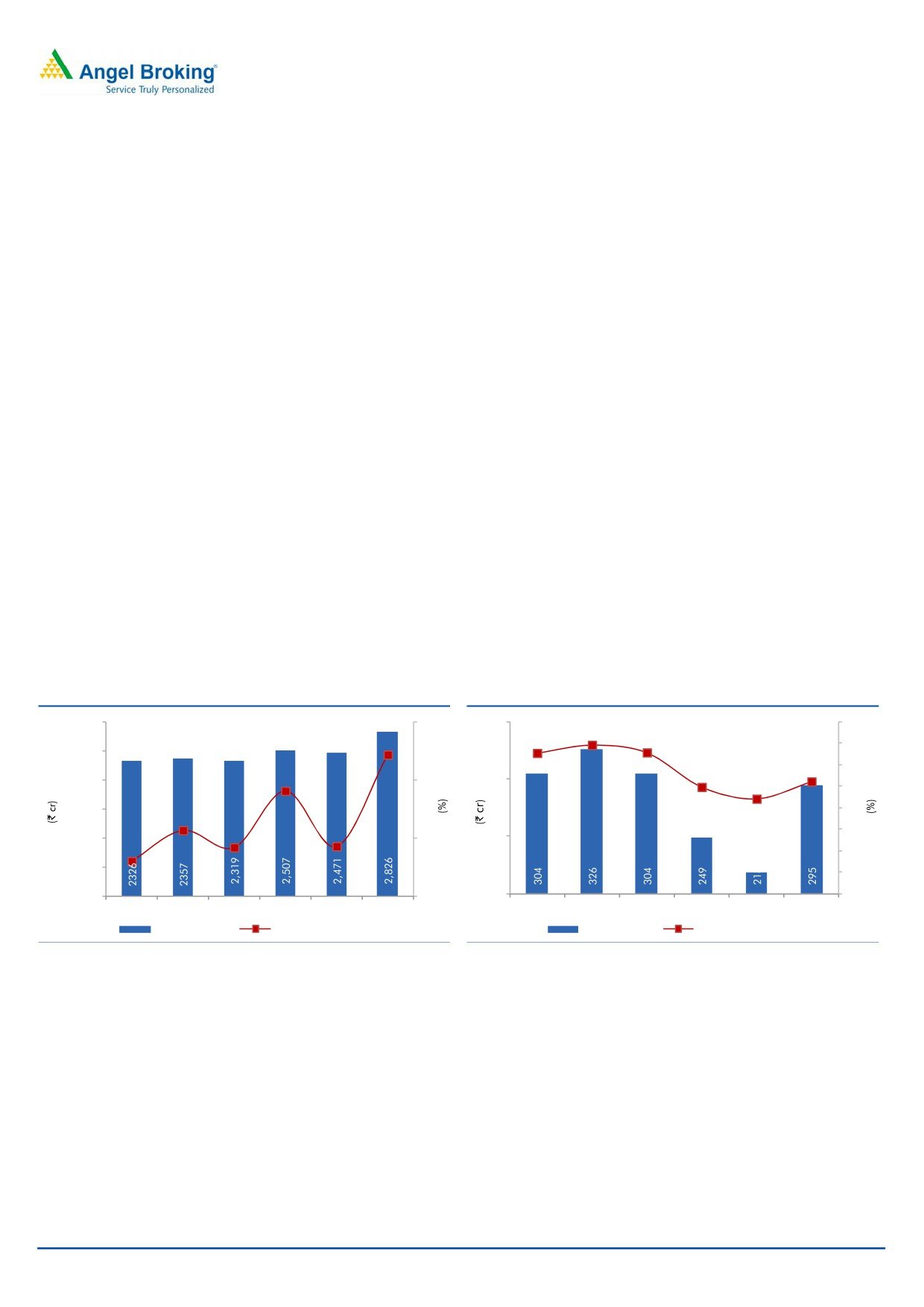

Exhibit 7: Revenue growth to improve going forward

Exhibit 8: EBITDA margin to recover

3,000

20

350

16

13.8

13.1

13.1

14

2,500

14.3

10.4

12

9.9

2,000

10

300

8.8

10

8.1

1,500

8

1.3

6

1,000

0

250

(1.6)

(1.4)

4

(4.0)

500

2

-

(10)

200

0

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E

Revenue (LHS)

Revenue growth (RHS)

EBITDA (LHS)

EBITDA Margin (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

The depreciation expense is expected to be flat as the company has undertaken

capacity expansion in the past to position itself to best cater to the future uptick in

demand. With no significant capex in sight, the flat depreciation is expected to add

directly to the bottom-line. The cash position is expected to remain strong and as

per our estimates, the cash and cash equivalents are expected to be at `982cr in

FY2017E. On account of operating leverage, the PAT for FY2017E is expected to

improve to `193cr.

November 17, 2015

5

Kirloskar Oil Engines | 2QFY2016 Result Update

Exhibit 9: Relative valuation (Trailing twelve months)

Mcap

Sales

OPM

PAT

EPS

RoIC

P/E

P/BV EV/EBITDA

EV/ Sales

Company

(` cr)

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

KOEL

3,796

2,480

8.5

132

9.1

17.6

28.7

2.6

14.1

1.2

Cummins India

27,886

28,491

2.7

781

28.2

23.2

35.7

8.5

35.3

1.0

Greaves Cotton

3,410

1,893

9.4

134

5.5

17.7

25.4

4.1

18.7

1.8

Source: Company, Angel Research

Outlook and valuation: We expect KOEL’s revenue to recover post FY2016E to

`2,826cr in FY2017E. With recovery in top-line, we expect the EBITDA margin to

recover to 10.4% in FY2017E. Consequently the profit is expected to grow to

`193cr in FY2017E. At the moment, the PowerGen and Industrial segments are

facing pressure on account of slower-than-expected recovery in the

macroeconomic environment. We have scaled down our numbers for FY2016E

and have accounted for improvement in the top-line for FY2017E. At the current

market price, the stock trades at 19.7x its FY2017E earnings (vs its 3-year median

of 21.7x). At the current juncture, we have a Neutral rating on the stock as the

infrastructure scenario in the country remains dampened in the near term.

Exhibit 10: One-year forward P/E band

450

400

350

300

250

200

150

100

50

Price (`)

12x

17x

22x

27x

Source: Company, Angel Research

Concerns

Continued slowdown in the economy: Any continued slowdown will adversely

affect the company’s performance.

Surplus electricity scenario: Contracting demand supply gap will be an adverse

situation for the company to some extent.

Fluctuations in Steel price: Any substantial fluctuation in the steel price can lead to

margin compression of the company.

Increasing imports from China: Low cost Chinese imports will continue to pose a

threat to the company.

November 17, 2015

6

Kirloskar Oil Engines | 2QFY2016 Result Update

Company background

KOEL is the flagship company of the Kirloskar group, one of India’s largest

engineering conglomerates. It is one of the world’s largest generating set

manufacturers, specializing in manufacturing of both air-cooled and water-cooled

engines (2.5HP to 740HP) and diesel generating sets across a wide range of

power output from 5kVA to 3,000kVA. It has four manufacturing plants - at Kagal,

Pune, Nashik and Rajkot. It has a sizable presence in international markets, with

offices in Dubai, South Africa, and Kenya, and representatives in Indonesia and

Nigeria. KOEL also has a strong distribution network throughout the Middle East

and Africa. It caters to Power Generation, Agriculture and Industrial and machinery

sectors.

November 17, 2015

7

Kirloskar Oil Engines | 2QFY2016 Result Update

Profit and loss statement

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Total operating income

2,357

2,319

2,507

2,471

2,826

% chg

1.3

(1.6)

8.1

(1.4)

14.3

Net Raw Materials

1446

1444

1626

1567

1779

% chg

4.0

(0.2)

12.6

(3.6)

13.5

Power and Fuel

23

21

21

20

20

% chg

(17.7)

(9.0)

0.6

(1.4)

(2.8)

Personnel

173

163

188

202

222

% chg

(1.1)

(6.3)

15.9

7.0

10.0

Other

390

388

424

464

510

% chg

(9.1)

(0.3)

9.1

9.5

10.0

Total Expenditure

2,032

2,015

2,259

2,253

2,531

EBITDA

326

304

249

218

295

% chg

7.1

(6.6)

(18.3)

(12.3)

35.1

(% of Net Sales)

13.8

13.1

9.9

8.8

10.4

Depreciation& Amortisation

93

98

102

105

111

EBIT

233

206

147

113

184

% chg

9.6

(11.7)

(28.8)

(23.2)

62.9

(% of Net Sales)

9.9

8.9

5.9

4.6

6.5

Interest & other Charges

2

0

0

0

0

Other Income

40

38

59

71

85

(% of Net Sales)

1.7

1.6

2.4

2.9

3.0

Recurring PBT

231

206

147

112

183

% chg

17.5

(11.1)

(28.8)

(23.2)

63.0

PBT (reported)

271

243

205

183

268

Tax

72

65

62

51

75

(% of PBT)

26.6

26.7

30.3

28.0

28.0

PAT (reported)

199

178

143

132

193

Extraordinary Expense/(Inc.)

13.4

0.0

0.0

0.0

0.0

ADJ. PAT

212

178

143

132

193

% chg

35.2

(15.9)

(19.8)

(7.8)

46.1

(% of Net Sales)

9.0

7.7

5.7

5.3

6.8

Basic EPS (`)

14.7

12.3

9.9

9.1

13.3

Fully Diluted EPS (`)

14.7

12.3

9.9

9.1

13.3

% chg

35.2

(15.9)

(19.8)

(7.8)

46.1

November 17, 2015

8

Kirloskar Oil Engines | 2QFY2016 Result Update

Balance sheet

Y/E Mar. (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

SOURCES OF FUNDS

Equity Share Capital

29

29

29

29

29

Reserves& Surplus

1,125

1,238

1,313

1,357

1,463

Shareholders’ Funds

1,154

1,267

1,341

1,386

1,492

Total Loans

-

-

-

-

-

Other Long Term Liabilities

30

13

17

17

17

Long Term Provisions

22

25

24

24

24

Deferred Tax (Net)

34

30

29

29

29

Total liabilities

1,240

1,335

1,412

1,457

1,562

APPLICATION OF FUNDS

Gross Block

1,133

1,179

1,249

1,338

1,440

Less: Acc. Depreciation

542

636

736

841

952

Net Block

591

543

514

497

488

Capital Work-in-Progress

27

42

21

22

14

Goodwill

-

-

-

-

-

Investments

418

608

876

824

824

Long Term Loans and adv.

66

96

108

108

108

Other Non-current asset

26

29

32

32

32

Current Assets

615

534

381

485

672

Cash

25

52

25

52

159

Loans & Advances

93

102

100

104

119

Inventory

189

167

172

176

224

Debtors

289

177

53

122

139

Other current assets

21

35

31

31

31

Current liabilities

504

516

521

512

576

Net Current Assets

112

18

(140)

(27)

96

Misc. Exp. not written off

-

-

-

-

-

Total Assets

1,240

1,335

1,412

1,457

1,562

November 17, 2015

9

Kirloskar Oil Engines | 2QFY2016 Result Update

Cash flow statement

Y/E Mar. (` cr)

FY2013 FY2014

FY2015 FY2016E FY2017E

Profit before tax

271

243

205

183

268

Depreciation

93

98

102

105

111

Change in Working Capital

(81)

122

131

(86)

(17)

Direct taxes paid

(72)

(65)

(64)

(51)

(75)

Others

6

(60)

(35)

(71)

(85)

Cash Flow from Operations

216

338

339

81

202

(Inc.)/Dec. in Fixed Assets

(97)

(61)

(49)

(90)

(94)

(Inc.)/Dec. in Investments

110

(190)

(269)

53

-

(Incr)/Decr In LT loans & adv.

(9)

(33)

(16)

-

-

Others

28

59

52

71

85

Cash Flow from Investing

31

(224)

(282)

33

(9)

Issue of Equity

(0)

-

-

-

-

Inc./(Dec.) in loans

(87)

-

4

-

-

Dividend Paid (Incl. Tax)

(85)

(85)

(87)

(87)

(87)

Others

(78)

(1)

(1)

-

-

Cash Flow from Financing

(250)

(86)

(84)

(87)

(87)

Inc./(Dec.) in Cash

(3)

28

(27)

27

106

Opening Cash balances

27

25

52

25

52

Closing Cash balances

25

52

25

52

159

November 17, 2015

10

Kirloskar Oil Engines | 2QFY2016 Result Update

Key ratios

Y/E Mar.

FY2013

FY2014

FY2015

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

17.9

21.2

26.5

28.7

19.7

P/CEPS

12.4

13.7

15.5

16.0

12.5

P/BV

3.3

3.0

2.8

2.7

2.5

EV/Net sales

1.4

1.4

1.2

1.2

1.0

EV/EBITDA

10.3

10.3

11.6

13.4

9.5

EV / Total Assets

2.8

2.4

2.1

2.0

1.8

Per Share Data (`)

EPS (Basic)

14.7

12.3

9.9

9.1

13.3

EPS (fully diluted)

14.7

12.3

9.9

9.1

13.3

Cash EPS

21.1

19.1

16.9

16.4

21.0

DPS

5.0

5.0

5.0

5.0

5.0

Book Value

79.8

87.6

92.8

95.9

103.2

DuPont Analysis

EBIT margin

9.9

8.9

5.9

4.6

6.5

Tax retention ratio

0.7

0.7

0.7

0.7

0.7

Asset turnover (x)

3.5

3.5

4.7

5.0

5.3

ROIC (Post-tax)

25.1

22.5

19.2

16.4

24.8

Cost of Debt (Post Tax)

3.2

-

-

-

-

Leverage (x)

(0.4)

(0.5)

(0.7)

(0.6)

(0.7)

Operating ROE

16.7

-

-

-

-

Returns (%)

ROCE (Pre-tax)

19.4

16.4

10.9

8.0

12.4

Angel ROIC (Pre-tax)

34.2

30.8

27.6

22.8

34.4

ROE

19.4

14.7

11.0

9.7

13.4

Turnover ratios (x)

Asset TO (Gross Block)

2

2

2

2

2

Inventory / Net sales (days)

25

28

25

26

26

Receivables (days)

45

37

17

18

18

Payables (days)

93

92

84

83

83

WC cycle (ex-cash) (days)

7

4

(15)

(18)

(9)

Solvency ratios (x)

Net debt to equity

(0.4)

(0.5)

(0.7)

(0.6)

(0.7)

Net debt to EBITDA

(1.4)

(2.2)

(3.6)

(4.0)

(3.3)

Int. Coverage (EBIT/ Int.)

124.7

686.5

733.5

563.4

917.6

November 17, 2015

11

Kirloskar Oil Engines | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Kirloskar Oil Engines

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 17, 2015

12