1QFY2018 Result Update | Banking

August 4, 2017

Karur Vysya Bank

ACCUMULATE

CMP

`140

Performance Highlights

Target Price

`160

Particulars (` cr)

1QFY18 4QFY17

% chg (qoq) 1QFY17

% chg (yoy)

Investment Period

12 months

NII

539

580

(7)

481

12

Pre-prov. profit

449

508

(12)

283

59

Stock Info

PAT

148

219

(32)

146

1

Source: Company, Angel Research

Sector

Banks

KVB’s 1QFY18 results were in line with expectations. While PAT remained flat YoY

Market Cap (` cr)

8,530

and loan growth remained 7.7%, overall growth should pick in 2HFY18. While

Beta

0.7

slippages were high during the quarter, they were largely from the watch list. Next

52 Week High / Low

153/80

two quarters could be challenging, but FY19 looks much stronger for the bank.

Avg. Daily Volume

1,11,269

Loan continued to be in single digit; however the management commentary

remains positive: For FY17 KVB had a muted loan growth of 4.7% and the

Face Value (`)

2

management had indicated at pick up in credit growth in FY18. Growth for

BSE Sensex

32,325

1QFY18 too remained tepid at 7.7%. Loan to corporate grew by 4%, while retail

Nifty

10,066

loans had a decent growth of 10% However, the management remains confident

of achieving double digit growth in FY18, which we believe is doable. We have

Reuters Code

KARU.BO

factored in 10%/12% growth in advances for FY18/19 respectively.

Bloomberg Code

KVB@IN

Deposit growth has been in sync with loan growth: Overall deposits grew by 7.8%

which is in sync with the growth in loan book. However, the CASA growth

continued to outpace the overall growth, up 29.4% and accordingly the CASA

Shareholding Pattern (%)

ratio has improved further to 29.2% vs 27.7% QoQ. KVB had seen a 590 bps

Promoters

2.1

jump in its CASA base post demonetization; though there were some outflows in

the deposits subsequently, overall CASA ratio remains fairly strong.

MF / Banks / Indian Fls

30.4

Slippages remained elevated, however were largely from the watch list: Slippages

FII / NRIs / OCBs

21.0

during the quarter stood at `389 cr, though it was lower than `560 cr in Q4FY17,

Indian Public / Others

46.5

overall it remained elevated. During the quarter one large account slipped from

the watch list and few more accounts remain under stress. At the end of Q4FY17

the management had indicated at around `650 cr under watch list and with the

Abs.(%)

3m 1yr 3yr

one large account slipping into NPA , the watch list is down to `450 cr. On QoQ

basis GNPAs & NNPAs went up 69 bps and 32 bps to 4.27% and 2.85%.With

Sensex

8.5

16.1

26.3

recovery process gaining steam we expect overall GNPAs to be under control.

KVB

16.0

44.0

49.0

Outlook and valuation: While credit cost will still remain elevated in FY18, we

expect FY19 to be a more meaningful year for the bank with RoE improving to

3- Year Daily Price Chart

14.7% from 12.6% in FY17. Despite the recent run up, the stock is trading at 1.6x

160

it FY19 Adj BV, and we believe this leaves further scope for re-rating. We

150

maintain ACCUMULATE on the stock with a target price of `160.

140

130

Key financials (standalone)

120

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

110

100

NII

1,781

2,074

2,388

2,757

90

% chg

21.5

16.4

15.1

15.4

80

Net profit

568

607

660

858

70

% chg

24.7

6.9

8.8

29.9

60

NIM (%)

3.2

3.5

3.7

3.9

EPS (`)

9.3

10.0

10.8

14.1

P/E (x)

15.0

14.1

12.9

9.9

P/ABV (x)

2.0

2.1

1.9

1.6

Siddharth Purohit

RoA (%)

1.0

1.0

1.0

1.2

RoE (%)

12.9

12.6

12.5

14.7

022 - 3935 7800 Ext: 6872

Source: Company, Angel Research; Note: CMP as of August 04, 2017

Please refer to important disclosures at the end of this report

1

Karur Vysya Bank | 1QFY2018 Result Update

Exhibit 1: Income Statement (Quarterly )

Particulars (` cr)

Q3FY16

Q4FY16

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q1FY18

% YoY

% QoQ

Interest earned

1,352

1,370

1,385

1,393

1,411

1,433

1,384

(0.1)

(3)

Interest expenses

904

898

904

898

894

853

846

(6.5)

(1))

Net interest income

448

473

481

495

518

580

539

11.9

(7)

Non Interest Income

173

166

162

218

170

233

236

45.7

1.3

Operating income

621

639

643

713

688

813

775

20.4

(5)

Operating expenses

295

380

360

393

416

305

325

(9.7)

6.7

Pre-prov. profit

326

259

283

320

272

508

449

58.8

(12)

Provisions & cont.

93

-13

67

119

94

218

233

248.8

7.3

PBT

233

271

216

200

178

291

216

(0.1)

(26)

Prov. for taxes

80

134

70

74

62

72

68

(2.5)

(5.6)

PAT

153

138

146

126

116

219

148

1.1

(32)

EPS (`)

2.5

2.3

2.4

2.1

1.9

3.6

2.4

1.1

(32.4)

Effective tax rate (%)

34.4

49.2

32.3

36.9

34.8

24.8

31.5

(2.4)

27

Source: Company, Angel Research

Exhibit 2: Loan Break Up & Growth (%)

Advances Break Up

Q4FY16 Q1FY17

Q2FY17 Q3FY17 Q4FY17

Q1FY18

Commercial

32%

33%

34%

34%

33%

34%

Agriculture

18%

18%

18%

17%

17%

18%

Retail

15%

15%

16%

16%

15%

16%

Corporate

35%

34%

33%

34%

35%

32%

Advances Growth Break Up

Total Advances

7.6%

5.8%

5.4%

1.6%

5.0%

7.7%

Commercial

8.4%

9.5%

9.4%

7.0%

6.7%

11.7%

Agriculture

12.7%

12.0%

10.2%

3.1%

-0.8%

5.1%

Retail

12.2%

11.5%

11.4%

7.4%

7.1%

9.7%

Corporate

2.7%

-2.6%

-3.0%

-6.4%

5.4%

4.2%

Source: Company, Angel Research

Exhibit 3: Loan Book Break Up (` Cr )

Loan Book Composition

Q1FY17 Q2FY17 Q3FY17 Q4FY17

Q1FY18

Total Advances

39,381

39,537

38,460

41,435

42,401

Commercial

12,905

13,303

13,035

13,612

14,411

Agriculture

7,265

6,950

6,442

6,979

7,635

Retail

6,009

6170

6,093

6340

6592

Corporate

13,202

13,114

12,890

14,504

13,763

Source: Company, Angel Research

August 4, 2017

2

Karur Vysya Bank | 1QFY2018 Result Update

Loan growth continued to be in single digit; however the management

commentary remains positive: For FY17 KVB had a muted loan growth of 4.7%

and the management had indicated at pick up in credit growth in FY18. Growth

for 1QFY18 too remained tepid at 7.7%. Loan to corporate grew by 4%, while

retail loans had a decent growth of 10%. However, the management remains

confident of achieving double digit growth in FY18, which we believe is doable.

We have factored in 10% /12% growth in advances for FY18 /19 respectively. The

management had earlier expected a 15% growth in FY18; however, given the lack

of overall credit demand we believe 10-12% would be more realistic for the bank.

Deposit growth has been in sync with loan growth: Overall deposits grew by 7.8 %

which is in sync with the growth in loan book. However, the CASA growth

continued to outpace the overall growth, up 29.4% and accordingly the CASA ratio

has improved further to 29.2% vs 27.7% QoQ. KVB had seen a 590 bps jump in

its CASA base post demonetization; though there were some outflows in the

deposits subsequently the overall CASA ratio remains fairly strong.

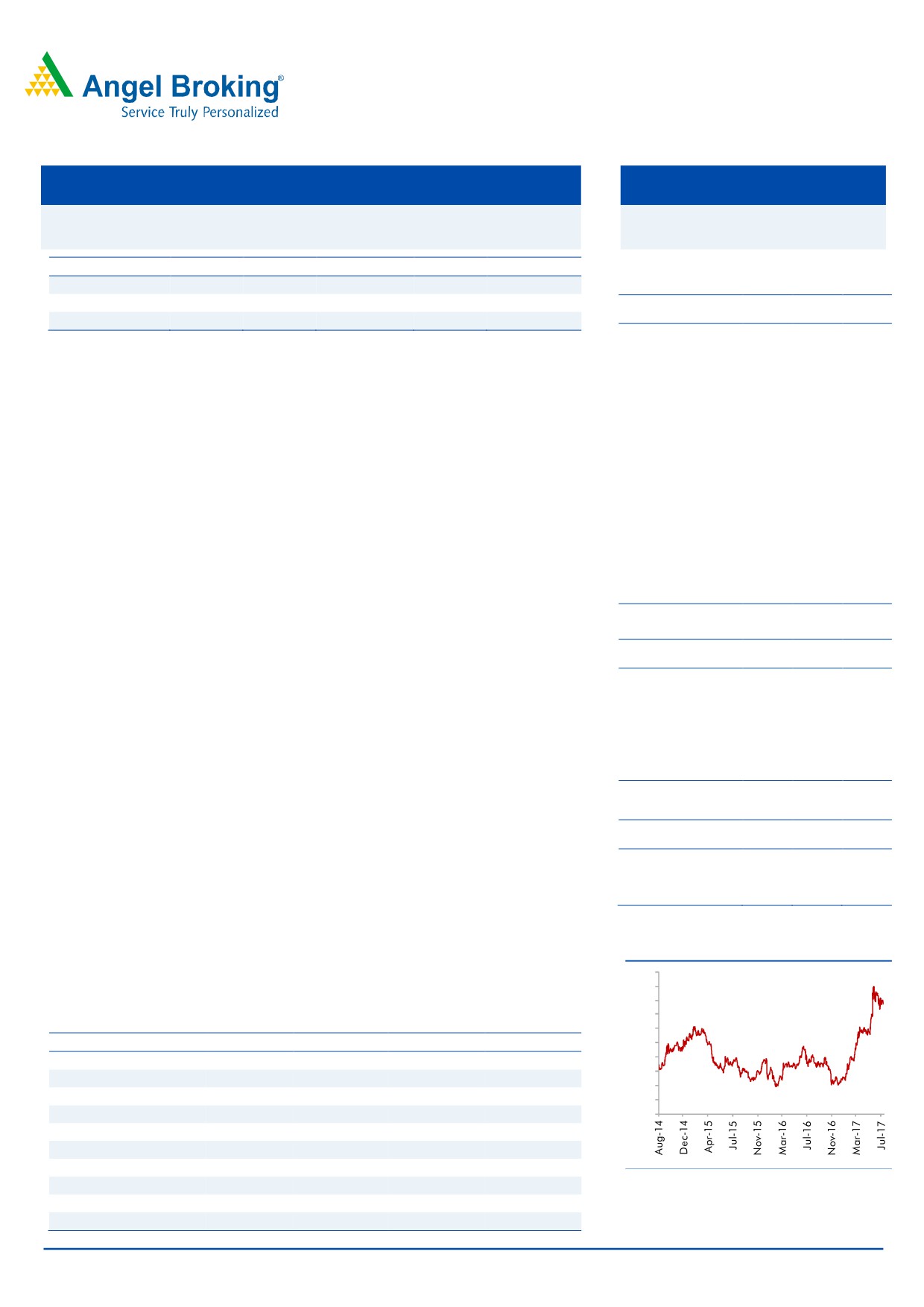

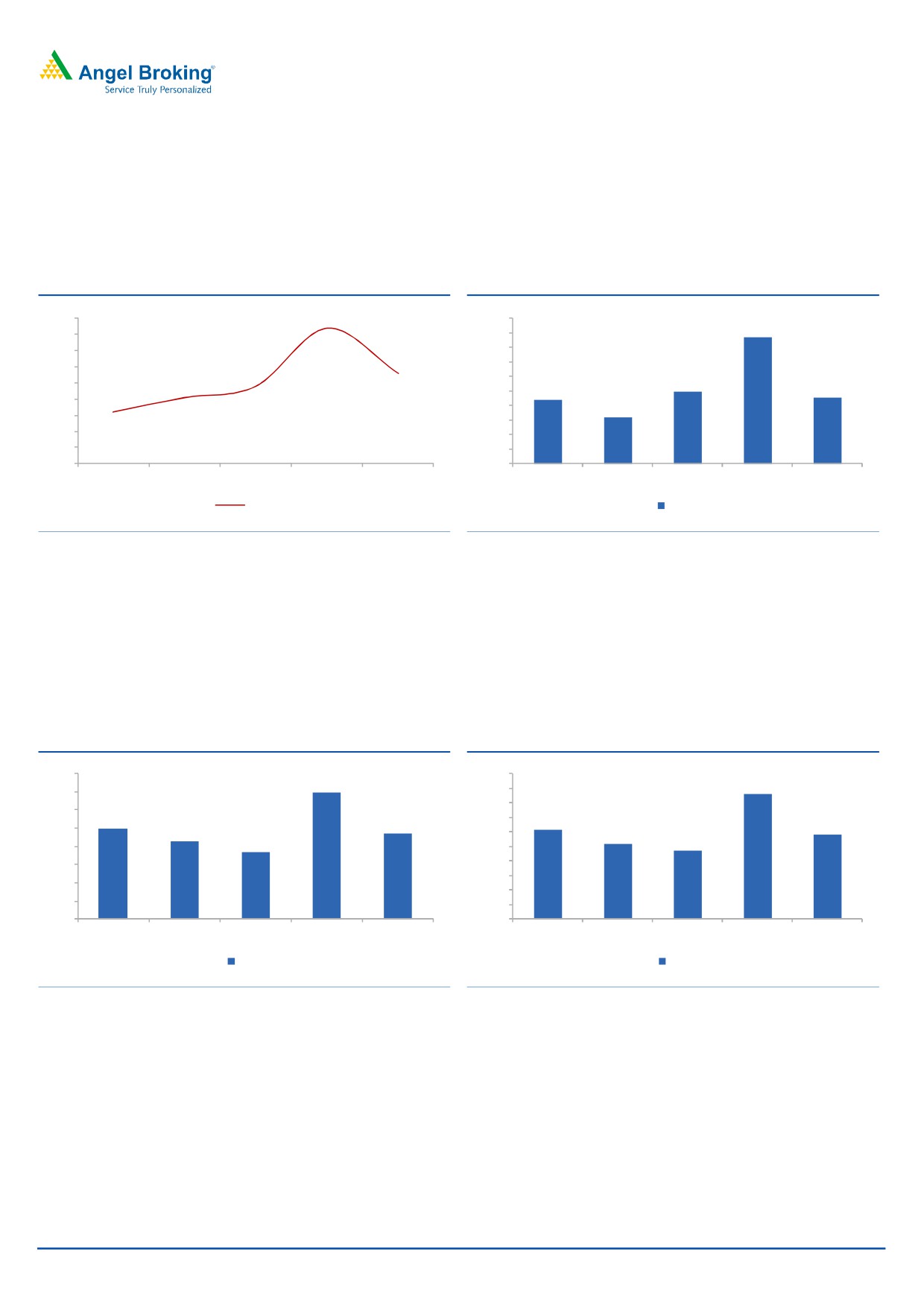

Exhibit 4: Loan growth momentum was strong

Exhibit 5: Deposit growth also remained strong

43,000

9.0

56,000

16.3

18.0

7.7

8.0

55,000

7.8

16.0

42,000

4.7

7.0

7.2

14.0

5.8

5.8

54,000

11.3

41,000

11.1

6.0

12.0

53,000

40,000

5.0

10.0

52,000

39,000

1.5

4.0

8.0

51,000

3.0

6.0

38,000

2.0

50,000

4.0

37,000

49,000

1.0

2.0

36,000

0.0

48,000

0.0

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q1FY18

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q1FY18

Advances

% Growth YoY

Deposits

% Growth YoY

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 6: CASA Growth strong as well

Exhibit 7: CASA Ratio has improved further (%)

18,000

53.3

60.0

35.0

29.4

30.8

27.5

29.2

16,000

27.7

50.0

30.0

14,000

15.7

18.8

24.3

24.9

25.0

12,000

40.0

10,000

20.0

30.0

8,000

15.0

6,000

20.0

10.0

4,000

10.0

5.0

2,000

-

0.0

0.0

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q1FY18

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q1FY18

CASA

Growth % YoY

CASA ( % )

Source: Company, Angel Research

Source: Company, Angel Research

August 4, 2017

3

Karur Vysya Bank | 1QFY2018 Result Update

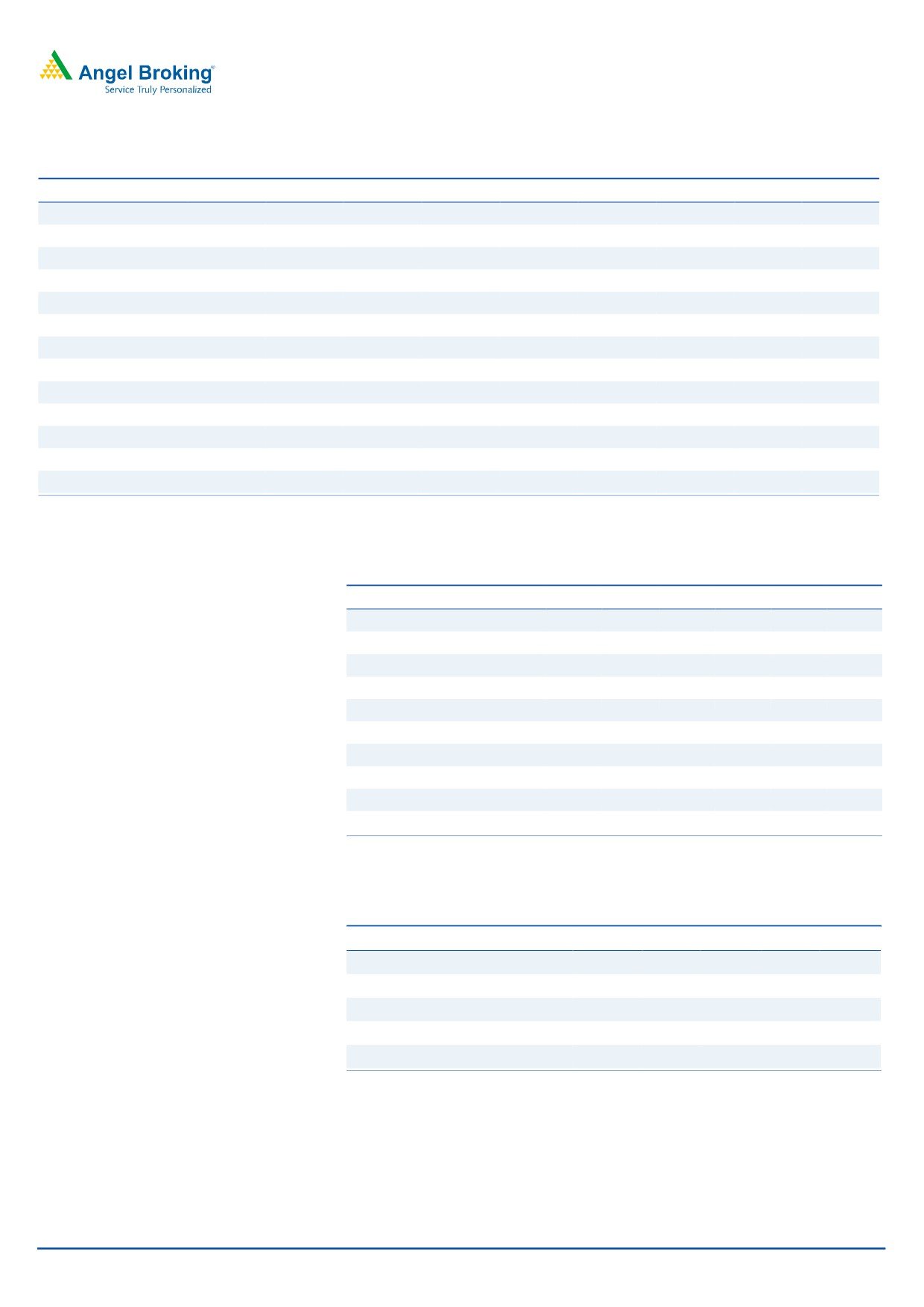

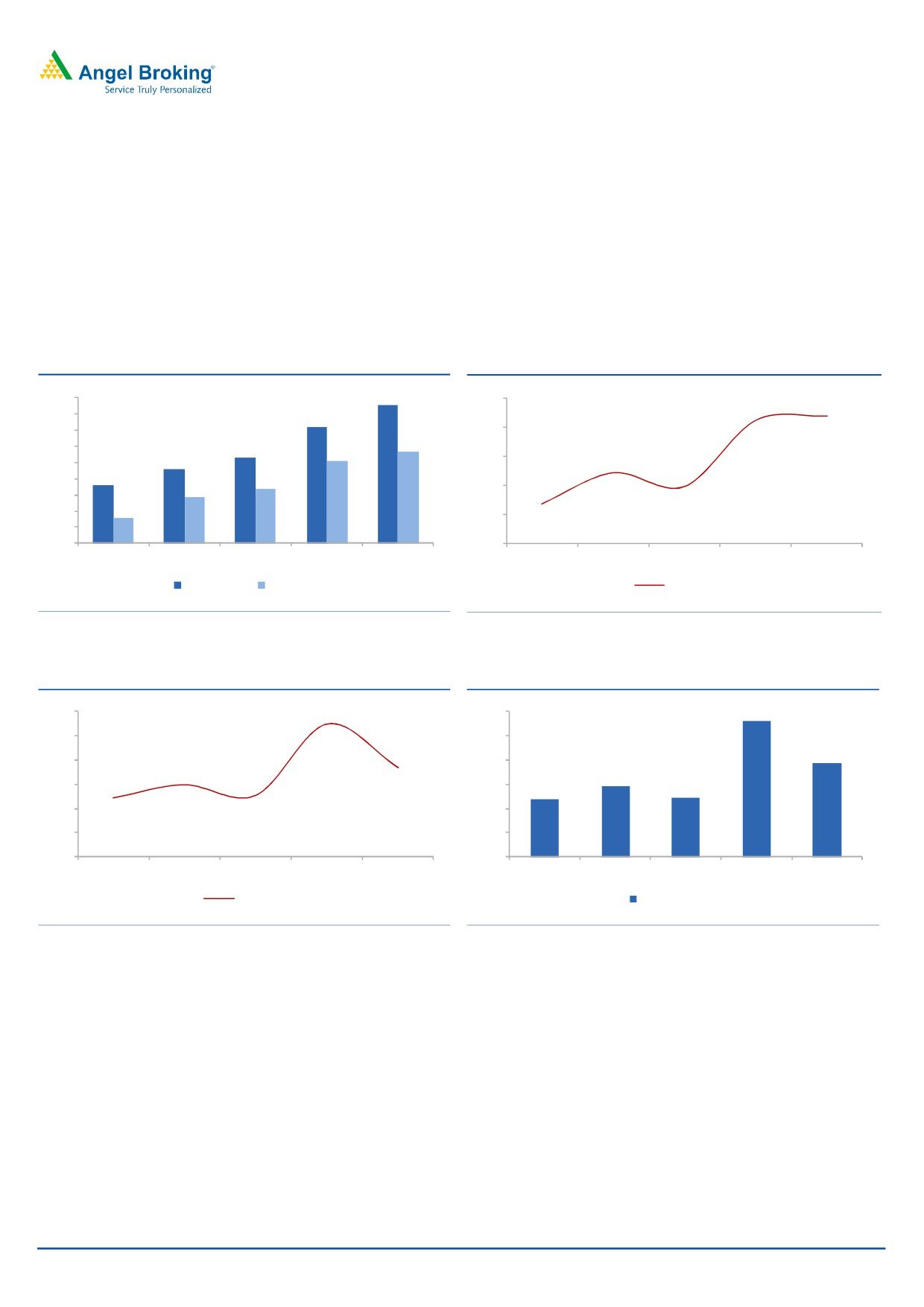

Higher provisions dented profit growth: Higher slippages and consequent interest

reversal impacted the NII growth during the quarter, which stood at 12% YoY. This

was much lower than the 23% YoY growth seen in Q4FY17. As we have

mentioned earlier the slippages could remain higher in the Q2FY18 as well and

could come down in the 2HFY18, hence we expect pick up in NII growth during

the 2nd half of the financial year.

Exhibit 8: NII Growth (%)

Exhibit 9: Other income boosted backed by fees (` Cr)

23%

40.4

45.7

700

25%

250

50.0

5.9

600

12%

40.0

15%

20%

200

13%

14%

-1.6

500

-0.1

30.0

400

15%

150

20.0

300

10%

100

10.0

200

5%

50

0.0

100

0

0%

0

-10.0

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q1FY18

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q1FY18

NII ( Rs Cr )

% Growth YoY

Other Income ( Rs Cr )

% Growth YoY

Source: Company, Angel Research

Source: Company, Angel Research

Other income of the bank has remained strong for the Q4FY17 as well as

Q1FY18, due to higher transactions and ATM related fees. While overall growth in

the fee income could moderate as more and more ATMs of other banks starts

operating, the growth would still be higher than FY17. Provisions during the

quarter higher than expected and hence PAT remained flat YoY.

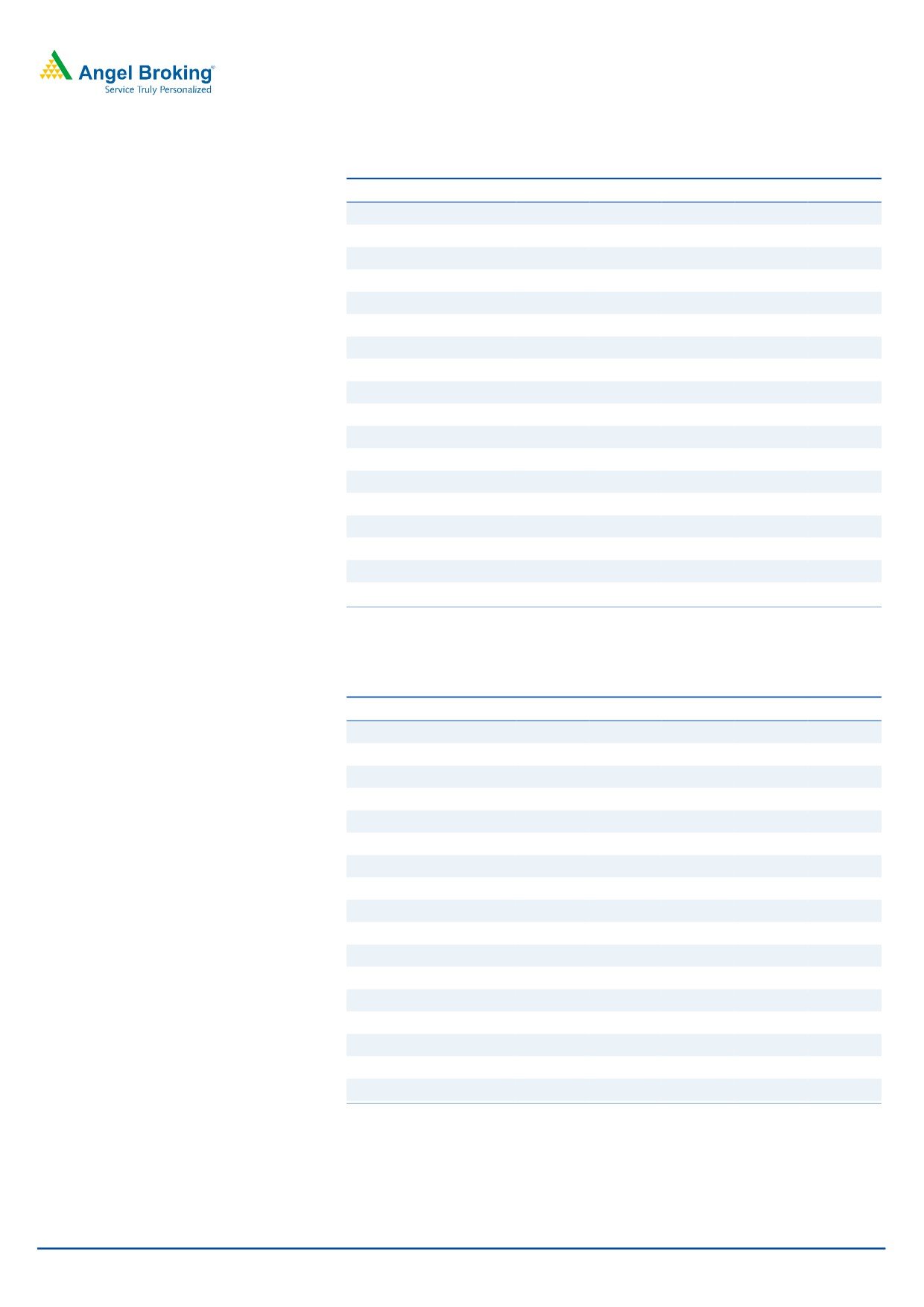

Exhibit 10: Provisions were higher (` Cr )

Exhibit 11: PAT impacted by higher provisions(` Cr )

250

250

58.5

70

60

200

200

50

8.3

40

1.1

30

150

150

-11.2

-24.3

20

10

100

100

0

-10

50

50

-20

-30

0

0

-40

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q1FY18

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q1FY18

Provisions (Rs Cr )

PAT

% Growth YoY

Source: Company, Angel Research

Source: Company, Angel Research

August 4, 2017

4

Karur Vysya Bank | 1QFY2018 Result Update

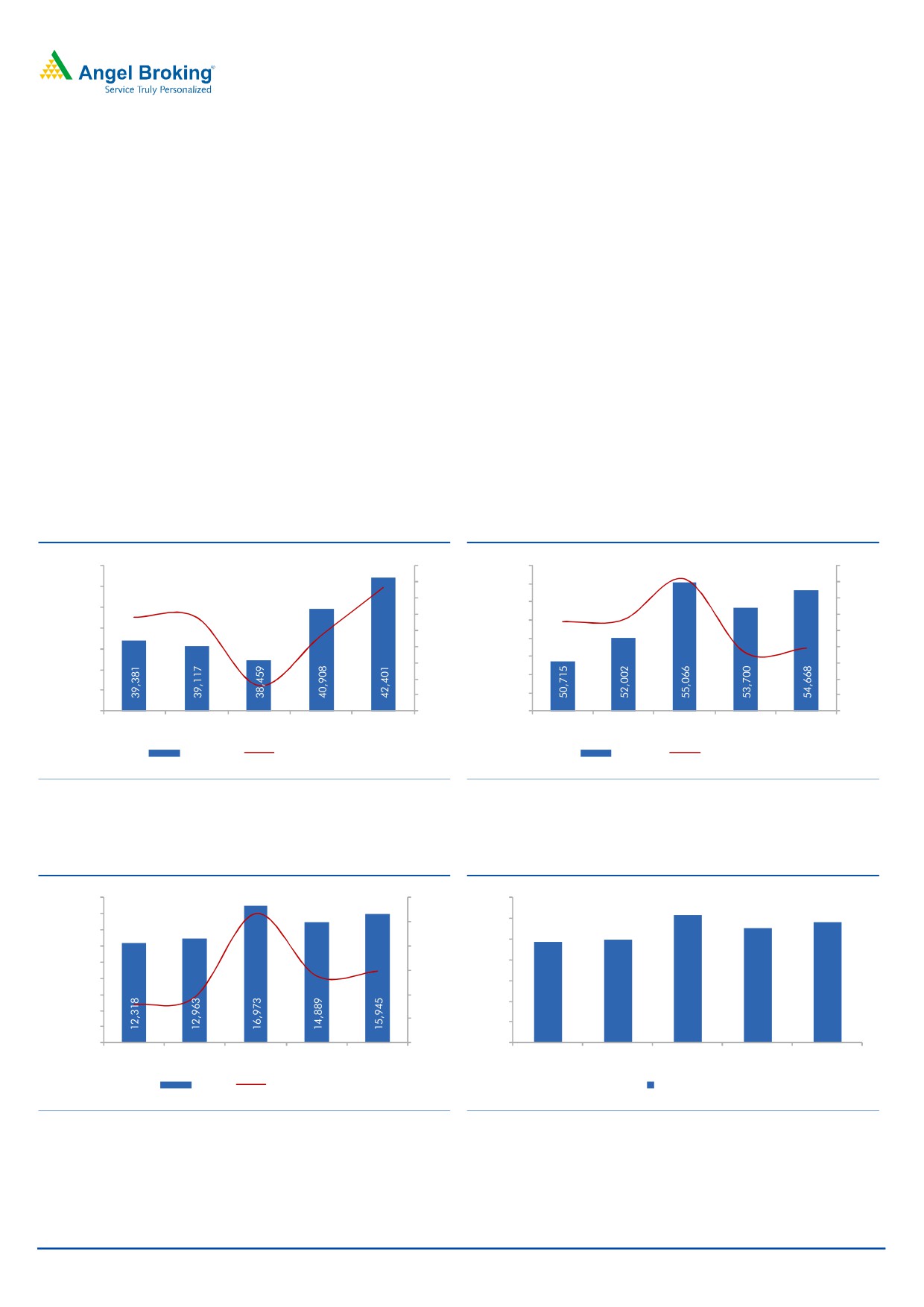

NIM declined due to higher slippages and consequent interest reversal; In the

FY17 the bank had witnessed steady rise in NIM, backed by lower cost of funds.

Increasing share of CASA had been instrumental in helping lower cost of funds

and better NIM. However, during the quarter the bank witnessed one large

slippages and the interest reversal had a negative impact on the NIM.

Exhibit 12: NIM declined due to higher slippages

Exhibit 13: Capital raising planned in near term (%)

4.0

4.1

12.8

12.5

4.0

12.6

3.9

12.4

3.8

12.2

3.8

3.7

3.6

12.0

11.8

3.7

11.7

11.8

11.7

3.6

3.5

11.6

11.4

3.5

11.4

3.4

11.2

3.3

11.0

3.2

10.8

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q1FY18

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q1FY18

NIM %

CAR %

Source: Company, Angel Research

Source: Company, Angel Research

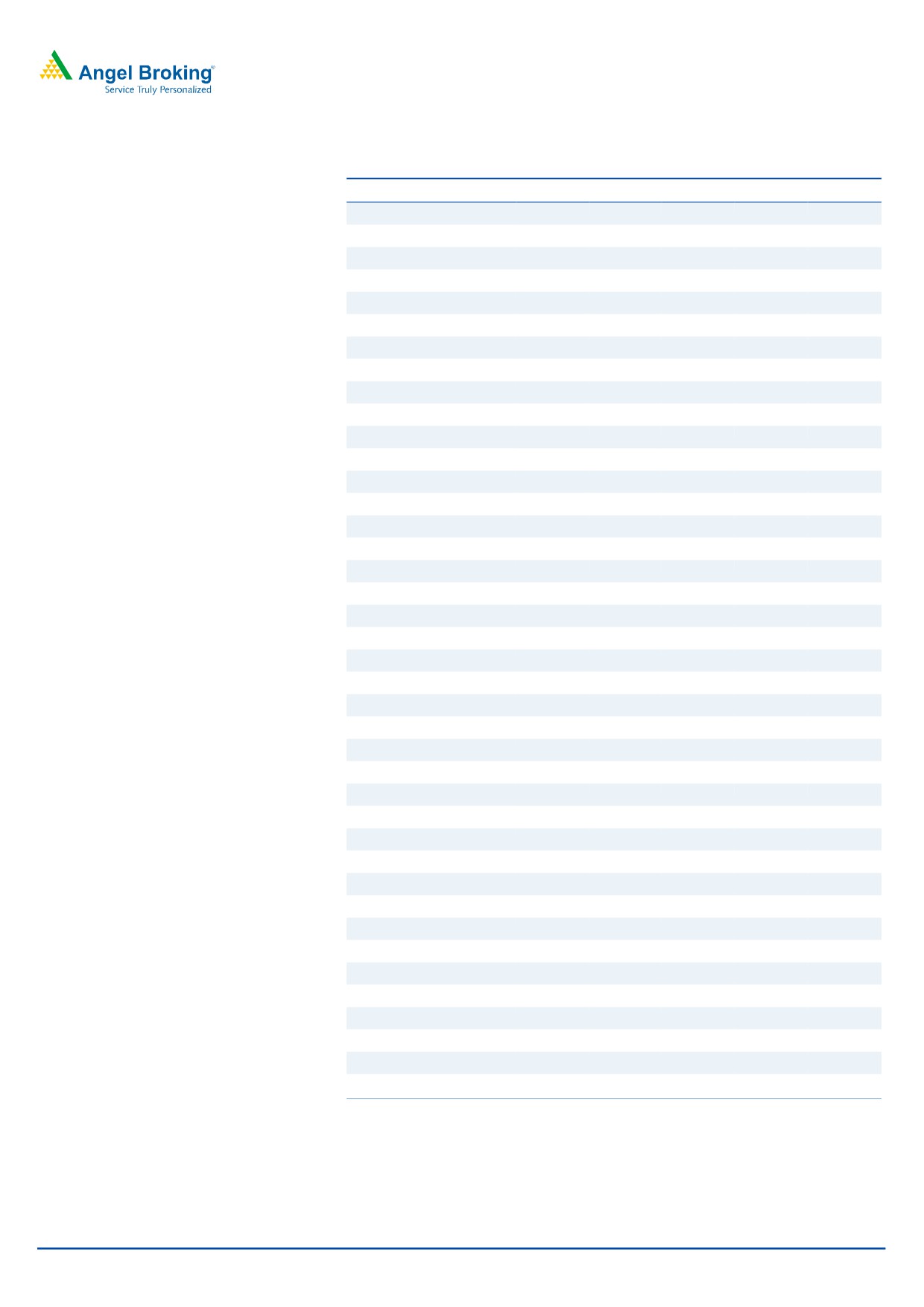

The RoA and RoE of the bank which had started showing positive trend again

under pressure during the quarter, due to higher than expected provisions.

However, the management remains confident that the slippages and consequent

provisions will be lower in the 2HFY18, and this should help in normalizing of

return ratios. Further the bank is in the process of raising capital to meet the

incremental expected growth in FY19 and higher growth coupled with strong

traction in fee income should lift the return ratios in FY19.

Exhibit 14: RoA Trend (%)

Exhibit 15: ROE Trend (%)

1.6

20.0

1.4

17.3

1.4

18.0

16.0

1.2

1.0

12.3

1.0

14.0

11.7

1.0

0.9

12.0

10.3

0.7

9.5

0.8

10.0

0.6

8.0

6.0

0.4

4.0

0.2

2.0

0.0

0.0

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q1FY18

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q1FY18

ROA %

ROE%

Source: Company, Angel Research

Source: Company, Angel Research

August 4, 2017

5

Karur Vysya Bank | 1QFY2018 Result Update

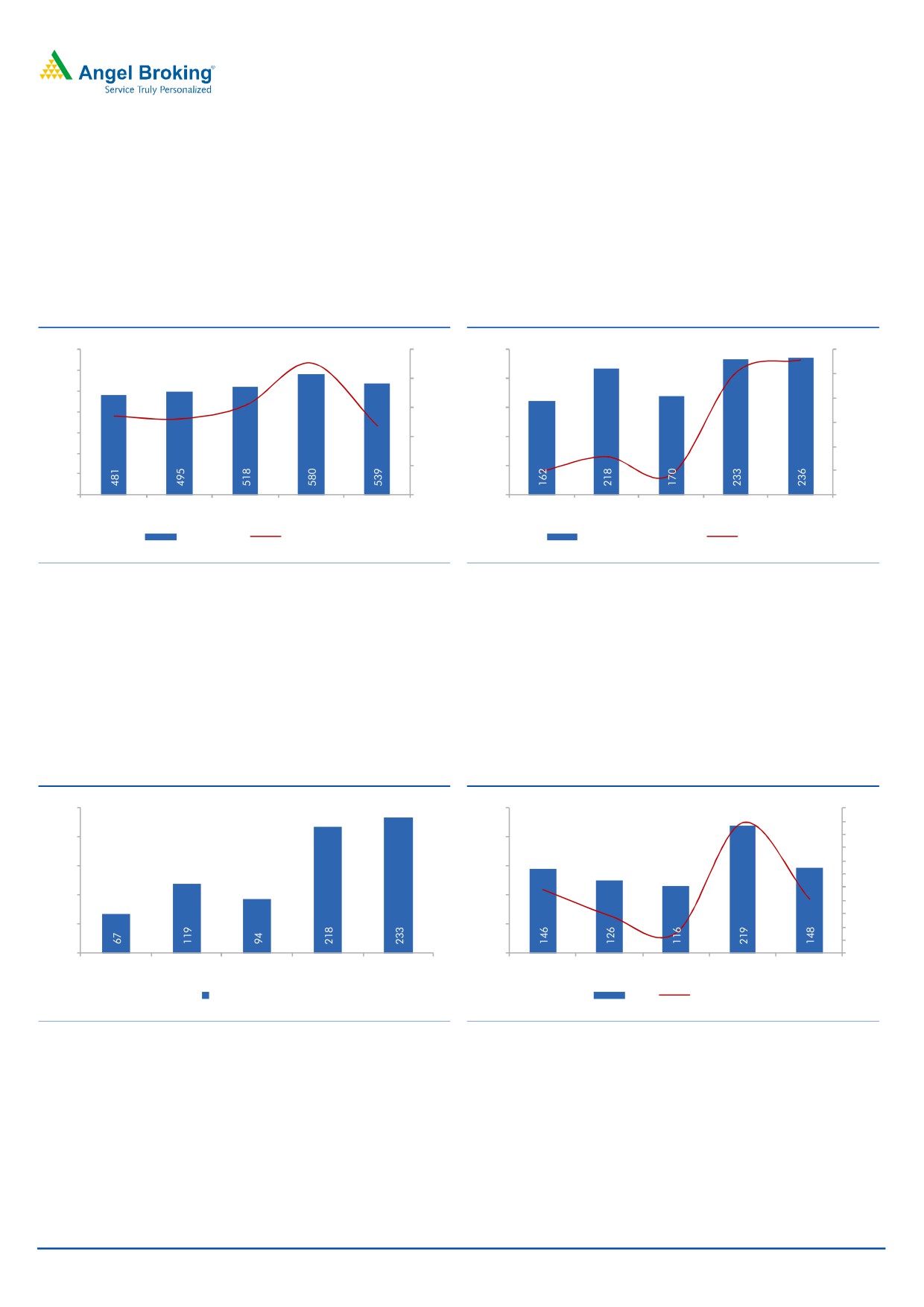

Slippages remained elevated, however were largely from the watch list: Slippages

during the quarter stood at `389 cr, though it was lower than `560 cr in Q4FY17,

overall it remained elevated. During the quarter one large account slipped from

the watch list and few more accounts remain under stress. At the end of Q4FY17

the management had indicated at around `650 cr under watch list and with the

one large account slipping into NPA , the watch list is down to `450 cr. On QoQ

basis GNPAs & NNPAs went up 69 bps and 32 bps to 4.27% and 2.85%.With

recovery process gaining steam we expect overall GNPAs to be under control.

Exhibit 16: Asset quality weakened QoQ (%)

Exhibit 17: Credit Cost (%)

4.3

4.5

2.5

2.2

2.1

4.0

3.6

3.5

2.0

2.9

3.0

2.7

2.5

2.3

1.5

1.2

2.5

1.8

1.0

2.0

1.7

1.4

1.0

0.7

1.5

0.8

1.0

0.5

0.5

0.0

0.0

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q1FY18

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q1FY18

Gross NPA %

Net NPAs %

Credit Cost

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 18: Slippages Ratios (%)

Exhibit 19: Slippages increased (` Cr)

6.0

5.5

600

560

5.0

500

3.7

389

4.0

400

3.0

290

3.0

2.4

2.5

300

239

243

2.0

200

1.0

100

0.0

0

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q1FY18

Q1FY17

Q2FY17

Q3FY17

Q4FY17

Q1FY18

Slippages %

Slippages ( Rs Cr )

Source: Company, Angel Research

Source: Company, Angel Research

August 4, 2017

6

Karur Vysya Bank | 1QFY2018 Result Update

Outlook and valuation

While credit cost will still remain elevated in FY18, we expect FY19 to be a more

meaningful year for the bank. In order to meet higher growth in the years to come

the bank is also in the process of raising capital .The fee income of the bank has

gained momentum and with cost remaining under control we expect RoE to

improve to 14.7% from 12.6% in FY17. Despite the recent run up, the stock is

trading at 1.6x it FY19 Adj BV, which believe leaves further scope for re-rating. We

maintain ACCUMULATE on the stock with a target price of `160.

August 4, 2017

7

Karur Vysya Bank | 1QFY2018 Result Update

Exhibit 20: Income Statement

Y/E March (` cr)

FY15

FY16

FY17

FY18E

FY19E

Net Interest Income

1,466

1,781

2,074

2,388

2,757

- YoY Growth (%)

14.2

21.5

16.4

15.1

15.4

Other Income

581

707

783

902

874

- YoY Growth (%)

2.9

21.7

10.8

15.2

(3.1)

Operating Income

2,046

2,488

2,857

3,289

3,630

- YoY Growth (%)

10.7

21.6

14.8

15.1

10.4

Operating Expenses

1,103

1,253

1,475

1,648

1,827

- YoY Growth (%)

9.2

13.5

17.7

11.8

10.9

Pre - Provision Profit

943

1235

1382

1,641

1,803

- YoY Growth (%)

12.6

31.0

11.9

18.8

9.9

Prov. & Cont.

481

324

498

656

523

- YoY Growth (%)

8.6

(32.6)

53.8

31.8

(20.3)

Profit Before Tax

462

912

884

985

1280

- YoY Growth (%)

17.0

97.1

(3.0)

11.4

29.9

Prov. for Taxation

7

344

278

325

422

- as a % of PBT

1.6

37.7

31.4

33.0

33.0

PAT

455

568

607

660

858

- YoY Growth (%)

6.0

24.7

6.9

8.8

29.9

Source: Company, Angel Research

Exhibit 21: Balance Sheet

Y/E March (` cr)

FY15

FY16

FY17

FY18E

FY19E

Share Capital

122

122

122

122

122

Reserves & Surplus

4,124

4,451

4,914

5,396

6,061

Net worth

4,246

4,573

5,036

5,518

6,183

Deposits

44,690

50,079

53,700

57,996

63,795

- Growth (%)

2.1

12.1

7.2

8.0

10.0

Borrowings

2,901

1,573

1,696

1,740

1,914

- Growth (%)

(11.9)

(45.8)

7.8

2.6

10.0

Other Liab & Prov.

1,315

1,439

1,376

1,450

1,595

Total Liabilities

53,152

57,664

61,808

66,703

73,487

Cash balances

2,693

2,529

2,790

2,900

3,190

Bank balances

56

263

1,555

580

638

Investments

12,773

13,222

14,857

16,239

17,863

Advances

36,109

39,084

40,908

44,998

50,398

- Growth (%)

6.2

8.2

4.7

10.0

12.0

Fixed Assets

411

420

419

470

517

Other Assets

1,110

2,146

1,279

1,516

881

Total Assets

53,152

57,664

61,808

66,703

73,487

Source: Company, Angel Research

August 4, 2017

8

Karur Vysya Bank | 1QFY2018 Result Update

Exhibit 22: Key Ratios

Y/E March

FY15

FY16

FY17

FY18E

FY19E

Profitability Ratios (%)

NIMs

2.8

3.2

3.5

3.7

3.9

Cost to Income Ratio

53.9

50.3

51.6

50.1

50.3

RoA

0.9

1.0

1.0

1.0

1.2

RoE

12.0

12.9

12.6

12.5

14.7

B/S ratios (%)

CASA Ratio

22.0

23.3

32.6

30.0

30.0

Credit/Deposit Ratio

80.8

78.0

76.2

77.6

79.0

CAR

14.6

12.2

12.5

12.8

13.1

- Tier I

13.6

11.3

11.7

12.0

12.3

Asset Quality (%)

Gross NPAs

1.9

1.30

3.6

4.0

3.7

Net NPAs

0.8

0.6

2.5

2.5

1.9

Slippages

1.8

3.1

3.4

2.5

1.5

Loan Loss Prov./Avg. Assets

1.3

0.8

1.2

1.4

1.0

Provision Coverage

59

58

30

50

50

Per Share Data (`)

EPS

7.5

9.3

10.0

10.8

14.1

BVPS

69.8

75.0

82.6

90.6

101.5

ABVPS

65.2

71.5

65.7

75.1

85.7

DPS

1.0

3.0

2.0

3.0

4.0

Valuation Ratios

PER (x)

18.7

15.0

14.1

12.9

9.9

P/BVPS(x)

2.0

1.9

1.7

1.5

1.4

P/ABVPS (x)

2.1

2.0

2.1

1.9

1.6

Dividend Yield

0.7

2.1

1.4

2.1

2.9

DuPont Analysis (%)

Interest Income

10.3

9.8

9.4

9.4

9.6

Interest Expenses

7.5

6.6

5.9

5.7

5.6

NII

2.8

3.2

3.5

3.7

3.9

Non Interest Income

1.1

1.3

1.3

1.4

1.2

Total Revenues

3.9

4.5

4.8

5.1

5.2

Operating Cost

2.1

2.3

2.5

2.6

2.6

PPP

1.8

2.2

2.3

2.6

2.6

Total Provisions

0.9

0.6

0.8

1.0

0.7

PreTax Profit

0.9

1.6

1.5

1.5

1.8

Tax

0.0

0.6

0.5

0.5

0.6

ROA

0.9

1.0

1.0

1.0

1.2

Leverage

13.8

12.6

12.4

12.2

12.0

RoE (%)

12.0

12.9

12.6

12.5

14.7

Source: Company, Angel Research

August 4, 2017

9

Karur Vysya Bank | 1QFY2018 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Karur Vysya Bank

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

August 4, 2017

10