4QFY2016 Result Update | FMCG

May 27, 2016

Jyothy Laboratories

NEUTRAL

CMP

`290

Result Update

Target Price

-

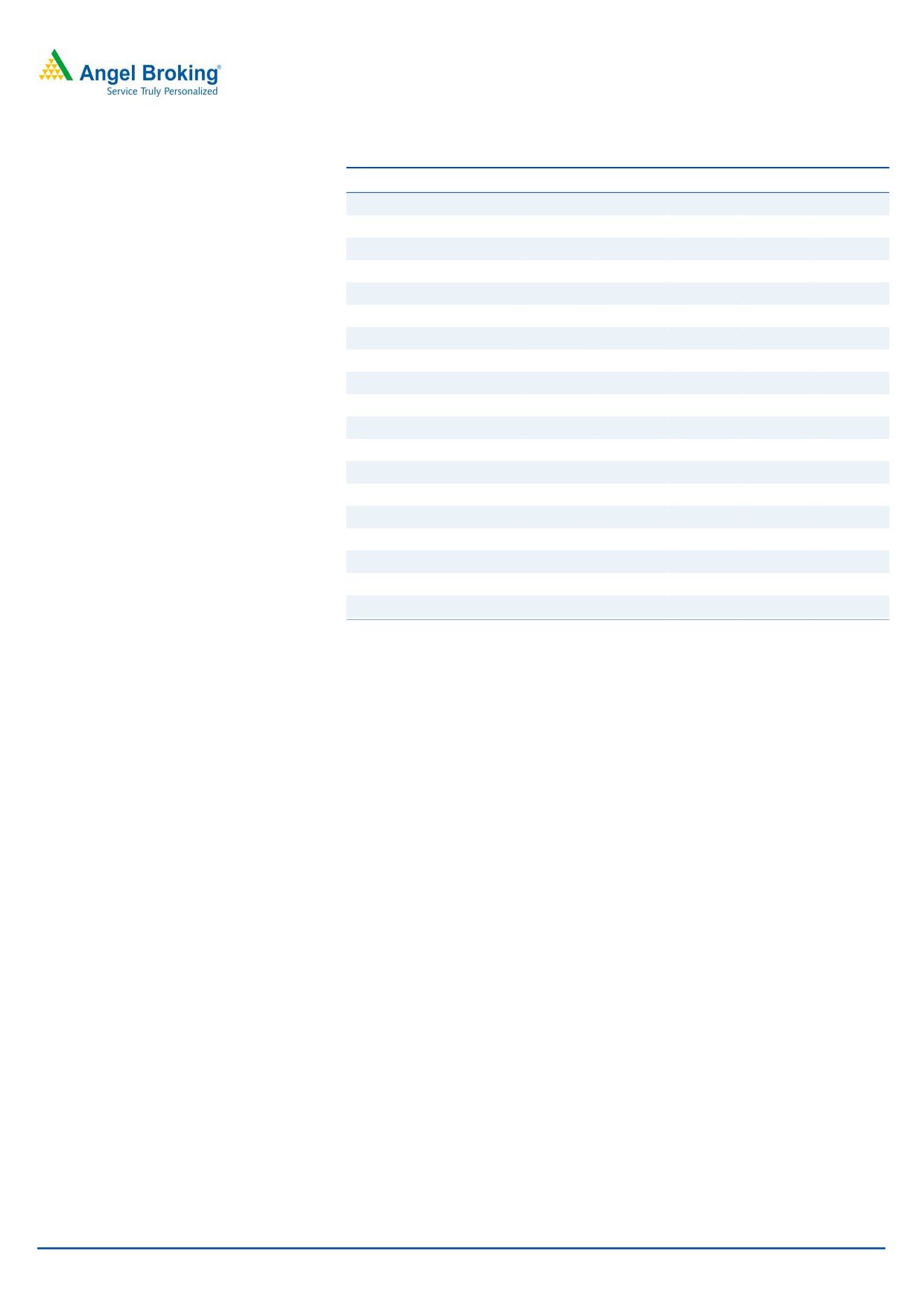

JLL’s 4QFY2015 highlights (Consolidated)

Investment Period

-

Y/E March (` cr)

4QFY16

4QFY15

% chg. (yoy) 3QFY16

% chg. (qoq)

Net Sales

445

401

11.1

385

15.6

Stock Info

Operating profit

63

39

60.1

51

23.1

Sector

FMCG

OPM (%)

14.1

9.8

431bp

13.2

86bp

Market Cap (` cr)

5,278

Adj. PAT

36

27

32.0

39

(8.7)

Net debt (` cr)

465

Source: Company, Angel Research

Beta

0.9

52 Week High / Low

342 / 240

For 4QY2016, Jyothy Laboratories (JLL) reported a top-line growth of 11.1% yoy

Avg. Daily Volume

21,000

to `445cr. On account of lower raw material and employee expenses as a

Face Value (`)

1

percentage of sales, the EBITDA margin expanded by 431bp yoy to 14.1%.

BSE Sensex

26,654

Interest expenses declined by 83.7% yoy to `1cr while the tax rate was higher at

Nifty

8,157

35% vs 11.4% in 4QFY2015. On account of good top-line growth and higher

operating profitability, the net profit grew by 32.0% yoy to `36cr.

Reuters Code

JYOI.BO

Bloomberg Code

JLY IN

Continued focus on power brands and potential acquisitions to drive growth: JLL

has a strong product portfolio post the Henkel acquisition with key brands like

Henko, Margo and Pril coming under its portfolio in addition to its own successful

Shareholding Pattern (%)

brands like Ujala, Exo and Maxo. These power brands have been the driving

Promoters

66.7

factor for the company’s growth. The company has relaunched some products

MF / Banks / Indian Fls

9.3

and introduced newer products within these brands which has yielded positive

results. Going forward, the company has guided for revenue target of `5,000cr

FII / NRIs / OCBs

14.5

by FY2020 and it is open to acquisitions in order to meet the target.

Indian Public / Others

9.5

Henkel may potentially re-rate the stock: Effective April 2016, Henkel has an

option to purchase 26% stake in JLL (the option is valid to be exercised before 31st

March 2017). The promoters of JLL prefer the stake sale to materialize at a

Abs.(%)

3m 1yr

3yr

mutually agreeable valuation. We believe Henkel will likely choose to exercise the

Sensex

15.1

(3.1)

32.2

option, given the prospects of the Indian growth story. Our belief draws its basis

JLL

11.4

9.0

57.8

from the fact that Henkel’s agreement with Asian Paints for tapping the latter’s

distribution channel for promoting its consumer adhesives business (“Loctite”) in India is

some indication of Henkel’s faith in the India growth story. We believe that JLL would

3 year price chart

then be able to fall back on Henkel to launch new products in the Indian market.

400

Outlook and valuation: We have switched over from valuing the company on

350

300

standalone numbers to consolidated numbers. The CEO, Mr Raghunandan is

250

stepping down from the leadership post but will make himself available for the

200

company to figure out big-ticket acquisitions and actively participate in strategic

150

planning. He will be replaced by Mr Rajnikant Sabnavis who was previously in

100

charge of sales & marketing in the company and has valuable industry experience

50

with HUL. The company has laid out an aggressive revenue target of `5,000cr by

-

FY2020 which would be a monitorable as the company has indicated at scouting

for suitable acquisitions. We expect the company’s revenue to grow at a CAGR of

11.6% over FY2016-18E to `2,052cr while net profit is expected to grow at a

Source: Company, Angel Research

CAGR of 7.0% over the same period to `181cr. At the current market price, the

stock trades at 29.2x its FY2018E earnings. We have a Neutral view on the stock.

Key financials (Consolidated)

Y/E

Sales OPM PAT EPS RoE P/E P/BV EV/EBITDA EV/Sales

March

(` cr)

(%)

(` cr)

(`)

(%)

(x)

(x)

(x)

(x)

FY2016

1,647

13.4

158

8.7

19.4

33.4

6.2

26.1

3.5

Milan Desai

FY2017E

1,845

13.0

162

8.9

18.6

32.6

5.9

23.7

3.1

022-4000 3600 Ext: 6846

FY2018E

2,052

12.9

181

10.0

19.3

29.2

5.4

21.3

2.7

Source: Company, Angel Research, Note: CMP as on May 26, 2016

Please refer to important disclosures at the end of this report

1

Jyothy Laboratories | 4QFY2016 Result Update

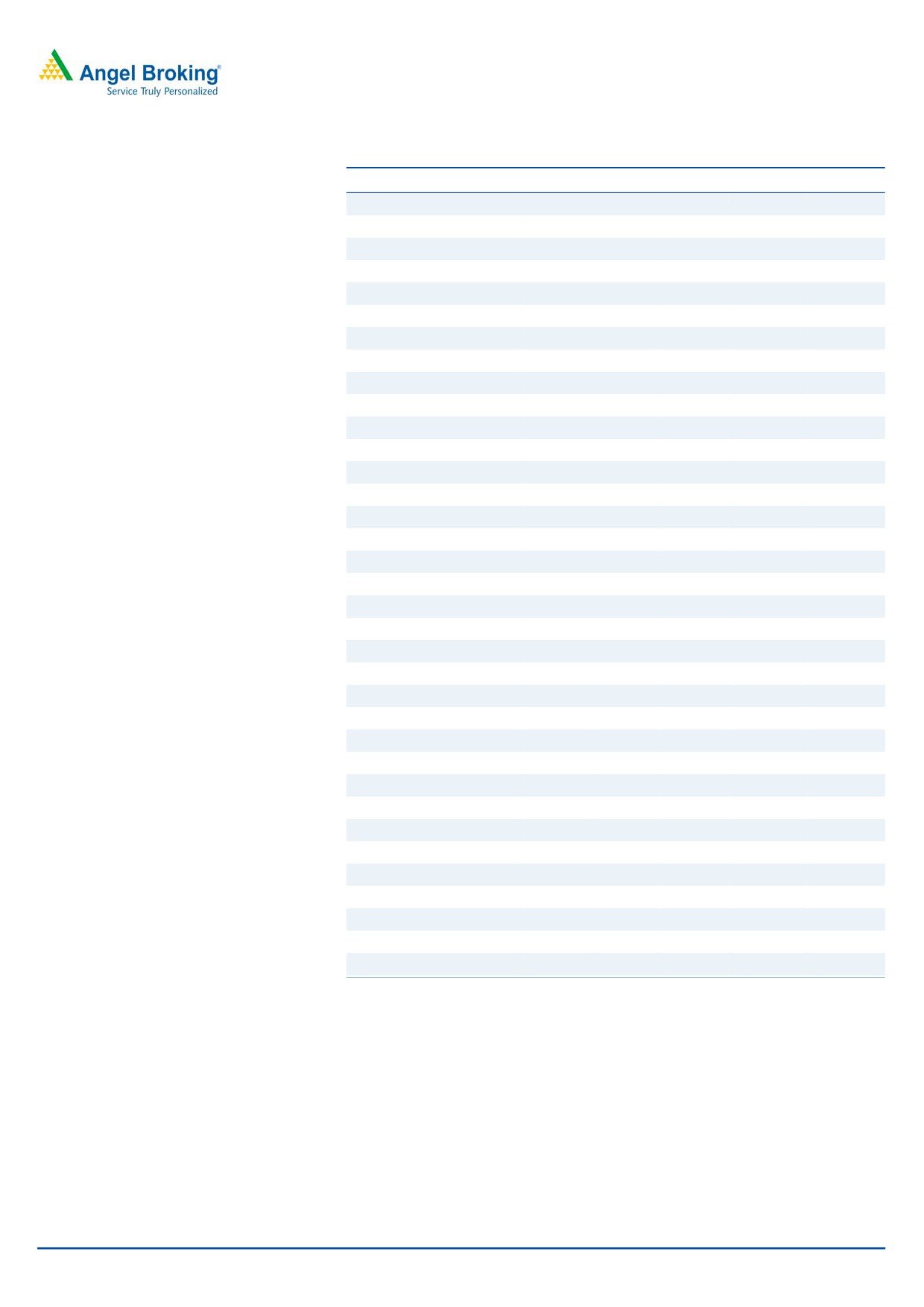

Exhibit 1: 4QFY2014 - JLL’s Performance highlights (Consolidated)

Y/E March (` cr)

4QFY16

4QFY15

% chg. (yoy)

3QFY16

% chg. (qoq)

FY2016

FY2015

% chg

Net Sales

445

401

11.1

385

15.6

1,647

1,515

8.7

Net raw material

223

206

8.2

183

21.6

799

777

2.8

(% of Sales)

50.0

51.3

(135)bp

47.5

248bp

48.5

51.3

(279)bp

Employee Cost

40

48

(17.7)

44

(10.1)

184

179

2.6

(% of Sales)

8.9

12.1

(312)bp

11.5

(254)bp

11.2

11.8

(66)bp

Other Expenses

120

108

11.7

107

12.3

444

395

12.2

(% of Sales)

27.0

26.8

16bp

27.8

(79)bp

26.9

26.1

85bp

Total Expenditure

383

362

5.8

334

14.4

1,426

1,352

5.5

Operating Profit

63

39

60.1

51

23.1

220

163

35.0

OPM (%)

14.1

9.8

431bp

13.2

86bp

13.4

10.8

261bp

Interest

1

3.2

(83.7)

1

(34.2)

6

14

(56.2)

Depreciation

10

8

23.4

7

35.0

31

33

(3.5)

Other Income

3

3

-

2

2.4

15

10

47.2

Extraordinary item

-

-

-

2

PBT

55

30

79.9

45

21.0

197

125

58.4

(% of Sales)

12.3

7.6

11.7

12.0

8.2

Tax

19

3

6

39.3

3.5

(% of PBT)

35.0

11.4

13.8

19.9

2.8

Reported PAT

36

27

32.0

39

(8.7)

158

121

30.6

Minority Interest

(0)

(0)

-

(0)

Exceptional Item

-

(2)

-

-

2

Adjusted PAT

36

29

23.8

39

(8.8)

158

119

32.6

PATM (%)

8.0

7.2

10.1

9.6

7.9

Source: Company, Angel Research

Exhibit 2: Actual vs. Angel Estimates

Y/E March (` cr)

4QFY16

Angel est.

% diff

Net sales

445

446

(0.2)

EBITDA

63

58

9.0

EBITDA margin (%)

14.1

12.9

119bp

Reported PAT

36

38

(6.3)

Source: Company, Angel Research

Mixed set of numbers

JLL reported a mixed set of numbers for 4QFY2016,. Its consolidated top-line for

the quarter increased by 11.1% yoy to `445cr, which is in-line with our estimate of

`446cr. The Home Care segment grew by 18.7% yoy to `142cr while the Soaps &

Detergent segment grew by 10.1% yoy to `289cr. Power brands grew by 10.3%

yoy with volume growth of 9.5%.

May 27, 2016

2

Jyothy Laboratories | 4QFY2016 Result Update

Exhibit 3: Category break-up

4QFY16

4QFY15

% chg FY2016 FY2015

% chg

Fabric Care

171

152

12.6

688

647

6.4

Dishwashing

115

103

11.6

466

417

11.8

Mosquito repellant

114

97

17.9

273

236

15.5

Personal care

28

29

(3.3)

148

141

5.1

Others

6

5

17.0

26

23

15.9

Total

434

386

12.5

1,602

1,463

9.5

Laundry Services

11

11

7.2

43

42

2.4

Grand Total

445

396

19.7

1,645

1,505

11.8

Source: Company, Angel Research

On the operating front, the company benefitted from lower input costs which

declined by 135bp yoy to 50.0% of sales, thus resulting in gross margin

expansion. Gross margins also expanded on account of change in sales mix.

However, on a qoq basis, gross margins dipped by 248bp yoy. Employee

expense declined by 312bp yoy to 8.9% of sales owing to ESOP cost write

backs while other expenses were flat. The Home Care segment reported a

profit of `10cr (vs a loss of `0.8cr in 4QFY2015) while the EBIT for the Soaps

& Detergent segment came in at `53cr as against `42cr in 4QFY2015.

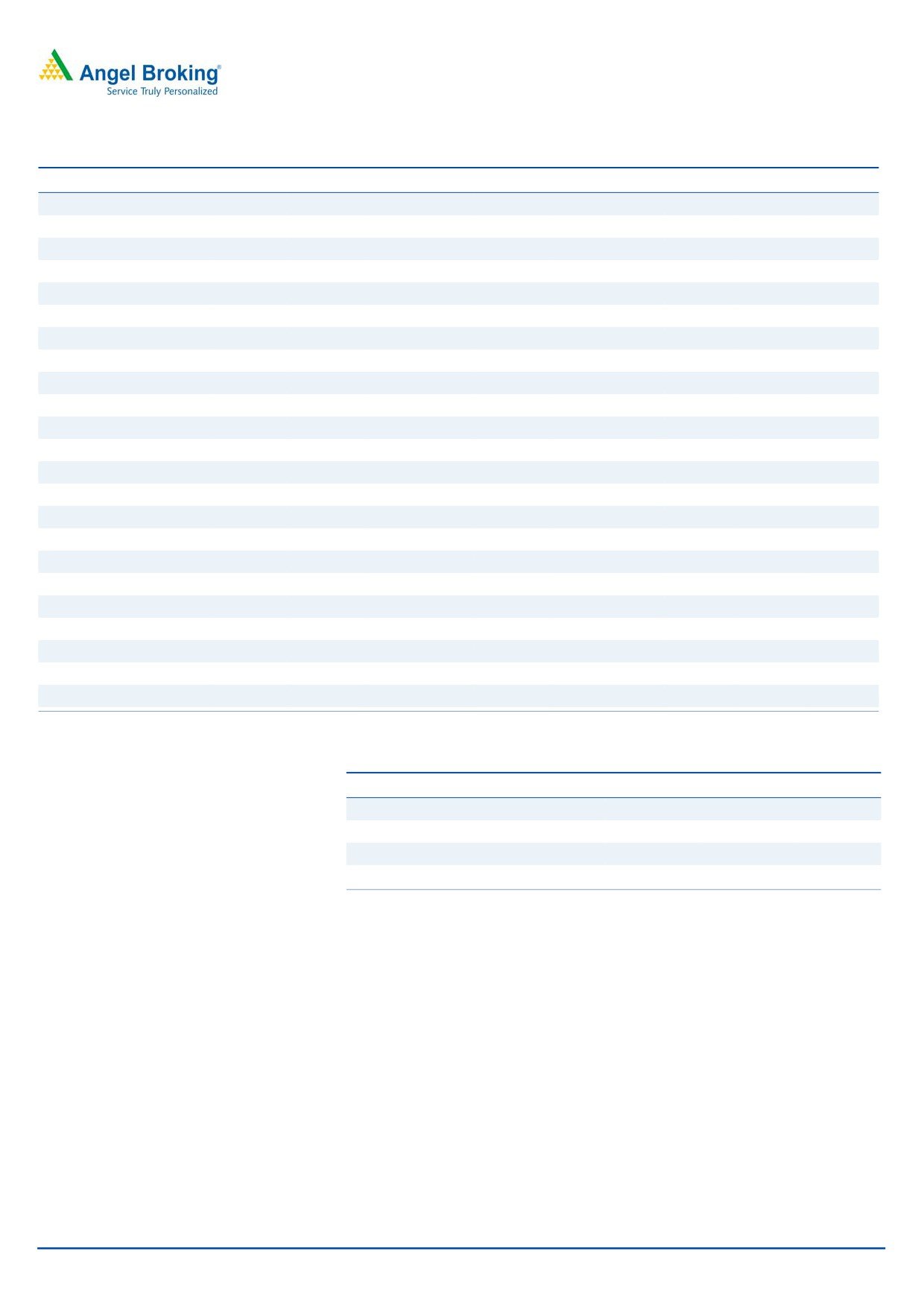

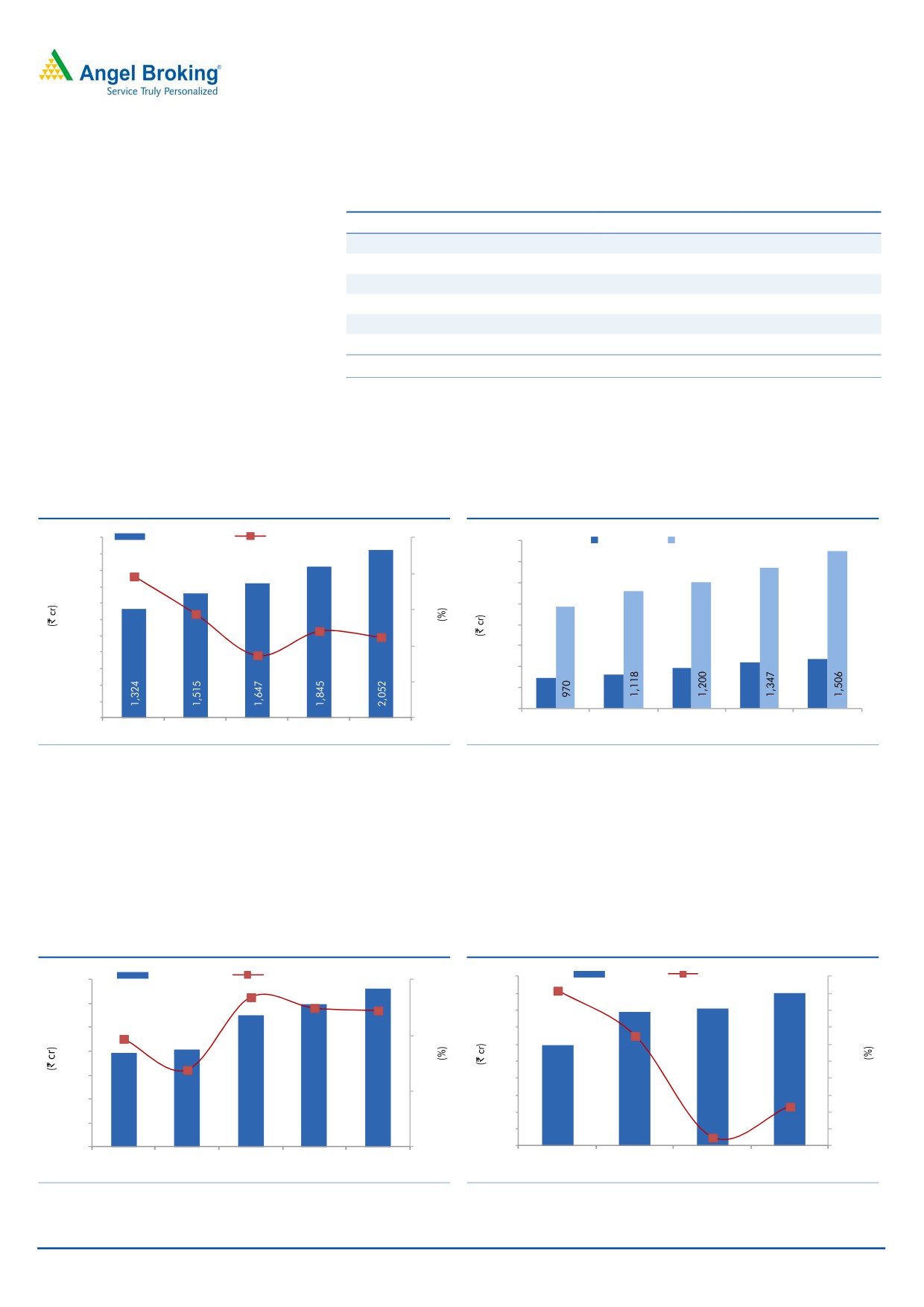

Exhibit 4: Revenue Growth

Exhibit 5: EBIDTA margin expands on lower RM cost

Revenue (LHS)

yoy growth (RHS)

EBITDA (LHS)

EBITDA Margin (RHS)

500

20

70

16

450

1

4.1

60

13.8

400

16.2

16

13.2

14.9

12.3

12

350

50

300

12

10.1

9.8

11.4

11

.1

40

9.1

250

8

9.1

30

200

8

7.5

6.9

150

20

4

100

4

10

50

0

0

0

0

Source: Company, Angel Research

Source: Company, Angel Research

On account of a better operational performance, the EBIDTA margin

expanded by 431bp yoy to 14.1% of sales which is higher than our estimate of

12.9%. The company’s tax rate was higher at 35% in comparison to the past

where it was availing benefits from the Henkel merger. As a result, the net

profit after minority interest grew by 23.8% yoy to `36cr which is lower than

our estimate of `38cr.

May 27, 2016

3

Jyothy Laboratories | 4QFY2016 Result Update

Investment arguments

Continued focus on power brands and potential acquisition to

drive growth

JLL has a strong product portfolio post Henkel’s acquisition with key brands added

to its portfolio like Henko, Margo and Pril in addition to its own successful brands

like Ujala, Exo and Maxo. These power brands have been the driving factor for the

company’s growth post the acquisition. The company has relaunched some

products and introduced newer products within these brands which has yielded

positive results. Going forward, the company has guided for a revenue target of

`5,000cr by FY2020 and is open to acquisitions in order to meet the target. Since

the Henkel acquisition, the acquired power brands have helped the company

expand its geographical presence. The non-south contribution for the company

has increased to 60% from ~50% in FY2013.

Exhibit 6: Power Brands Performance

Brand

4QFY16

4QFY15

% chg FY2016 FY2015

% chg

Ujala

93

87

6.3

392

372

5.3

Exo

86

79

9.4

348

315

10.7

Maxo

114

97

17.9

273

236

15.5

Henko

46

34

37.2

169

152

11.3

Margo

25

25

(1.1)

131

121

8.3

Pril

29

24

19.0

118

102

15.5

Total Power Brand

393

346

13.6

1,430

1,297

10.3

Others

41

40

3.1

171

166

3.3

Total

434

386

12.5

1,602

1,463

9.5

Source: Company, Angel Research

Henkel may potentially re-rate the stock

Effective April 2016, Henkel has an option to purchase 26% stake in JLL (the

option is valid to be exercised before 31st March 2017). The promoters of JLL

prefer the stake sale to materialize at a mutually agreeable valuation. We believe

Henkel will likely choose to exercise the option, given the prospects of the Indian

growth story. Our belief draws its basis from the fact that Henkel’s agreement with

Asian Paints for tapping the latter’s distribution channel for promoting its consumer

adhesives business (“Loctite”) in India is some indication of Henkel’s faith in the

India growth story. We believe that JLL would then be able to fall back on Henkel

to launch new products in the Indian market.

May 27, 2016

4

Jyothy Laboratories | 4QFY2016 Result Update

Financials

Exhibit 7: Sales growth assumption for JLL

Y/E March

FY2017E

FY2018E

Home care

437

476

(% Growth)

13.3

8.8

Soaps and Detergents

1,347

1,506

(% Growth)

12.2

11.8

Others

16

17

Laundry Services

43

45

Total Sales

1,843

2,044

Source: Company, Angel Research

We expect the top-line to post a revenue CAGR of 11.6% over FY2016-18E to

`2,052cr. This will be on the back of strong focus on power brands as well as

greater distribution reach.

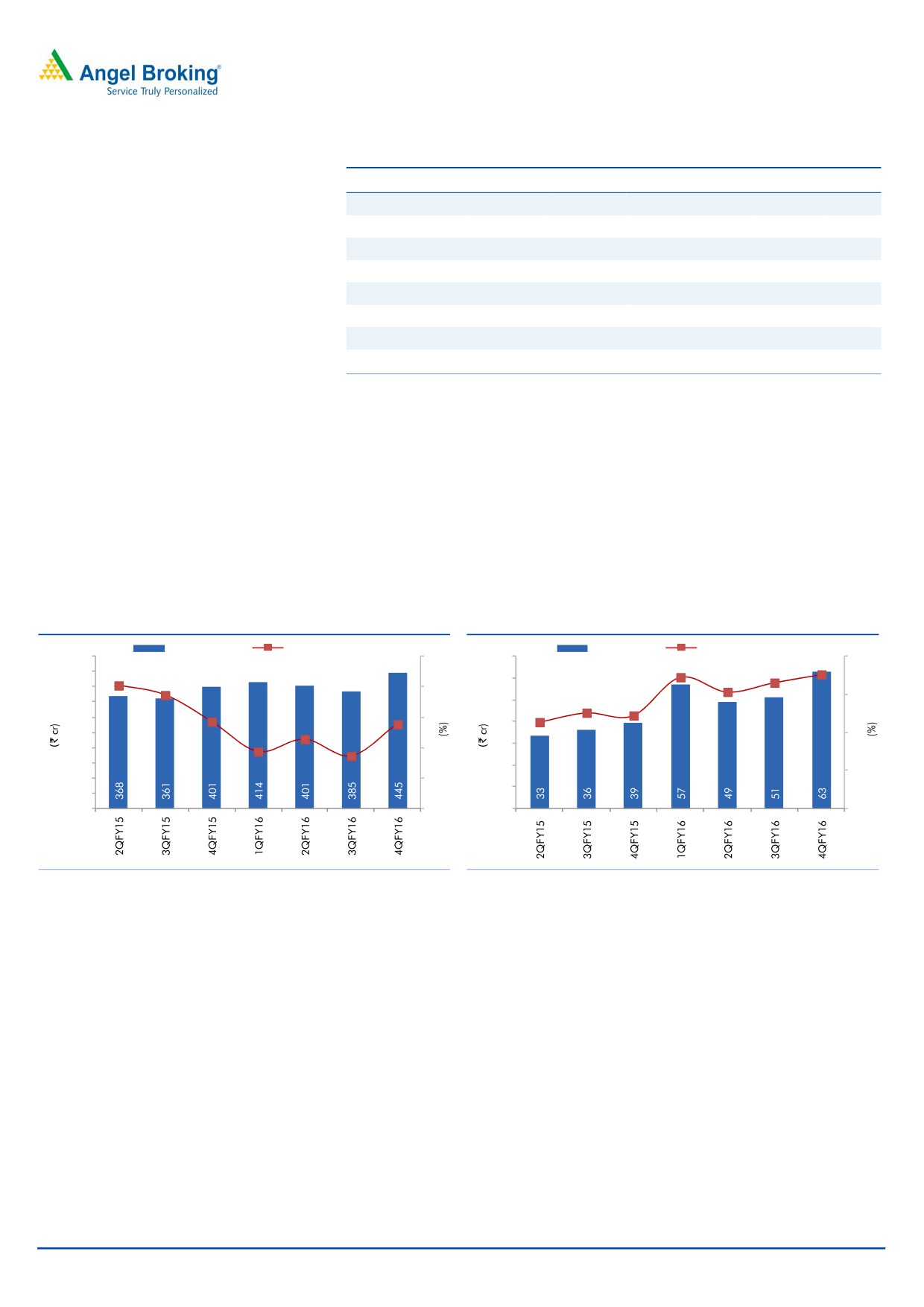

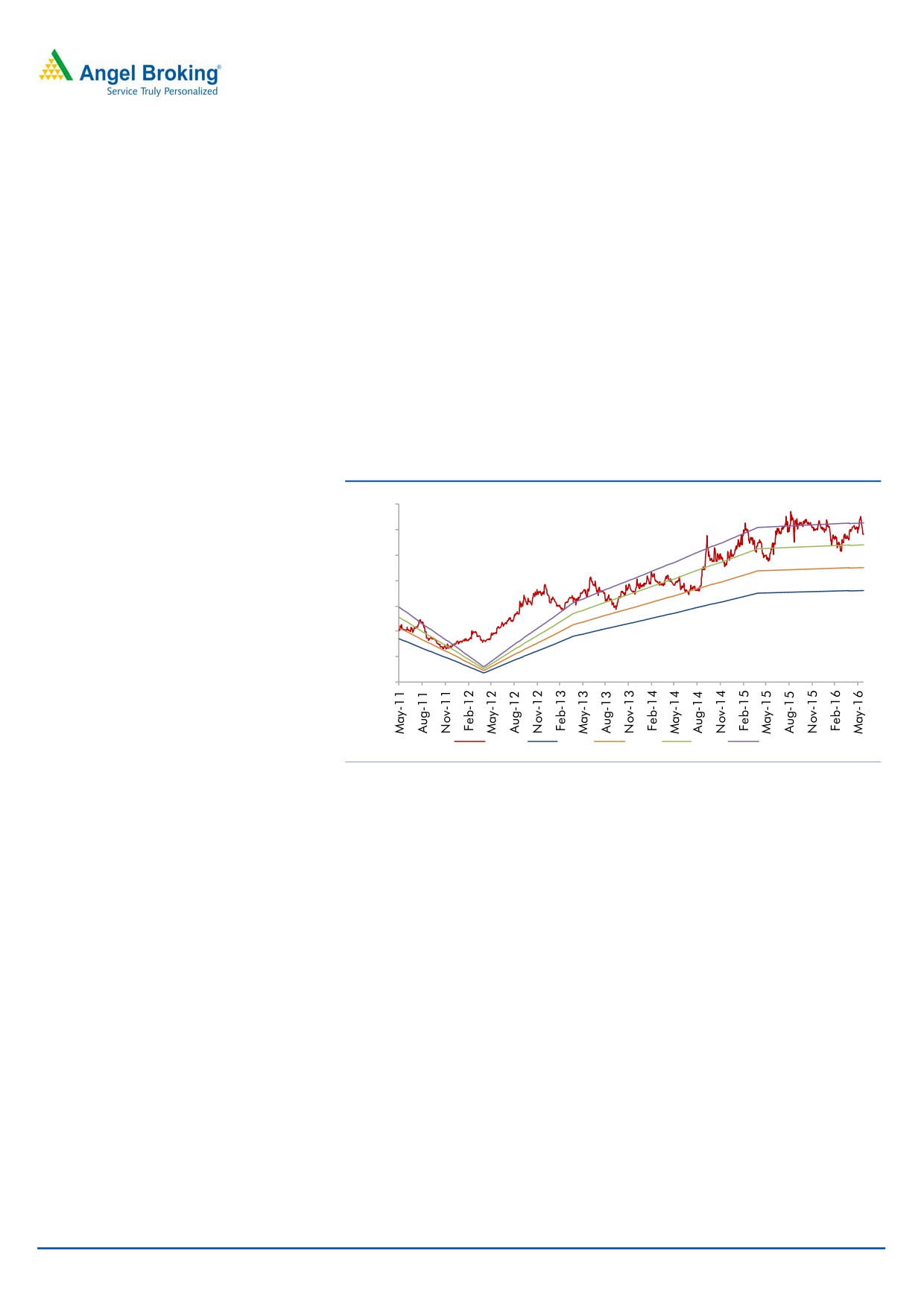

Exhibit 8: Brand building to result in healthy sales

Exhibit 9: Segmental sales contribution

2,200

Revenue (LHS)

Revenue growth (RHS)

25

1,600

Home care

Soaps and Detergents

2,000

1,400

1,800

19.6

20

1,200

1,600

1,400

1,000

15

14.4

1,200

800

1,000

11.2

12.0

10

600

476

800

437

8.7

386

327

600

400

288

400

5

200

200

0

-

0

FY2014

FY2015

FY2016

FY2017E

FY2018E

FY2014

FY2015

FY2016

FY2017E

FY2018E

Source: Company, Angel Research; Note: * Merged numbers of JLL and JCPL

Source: Company, Angel Research, Note: * Merged numbers of JLL and JCPL

With raw material prices expected to have bottomed out, we expect gross margins

to witness slight contraction. Also, the company has targeted the advertisement

spend to remain at current levels of ~12%. We expect EBITDA margin to be at

12.9% in FY2018E. The company will be amalgamating with its subsidiary JCML

which will lead to JLL paying minimum alternate tax over the next two years. We

expect the net profit to post a CAGR of 7.0% over FY2016-18E to `181cr.

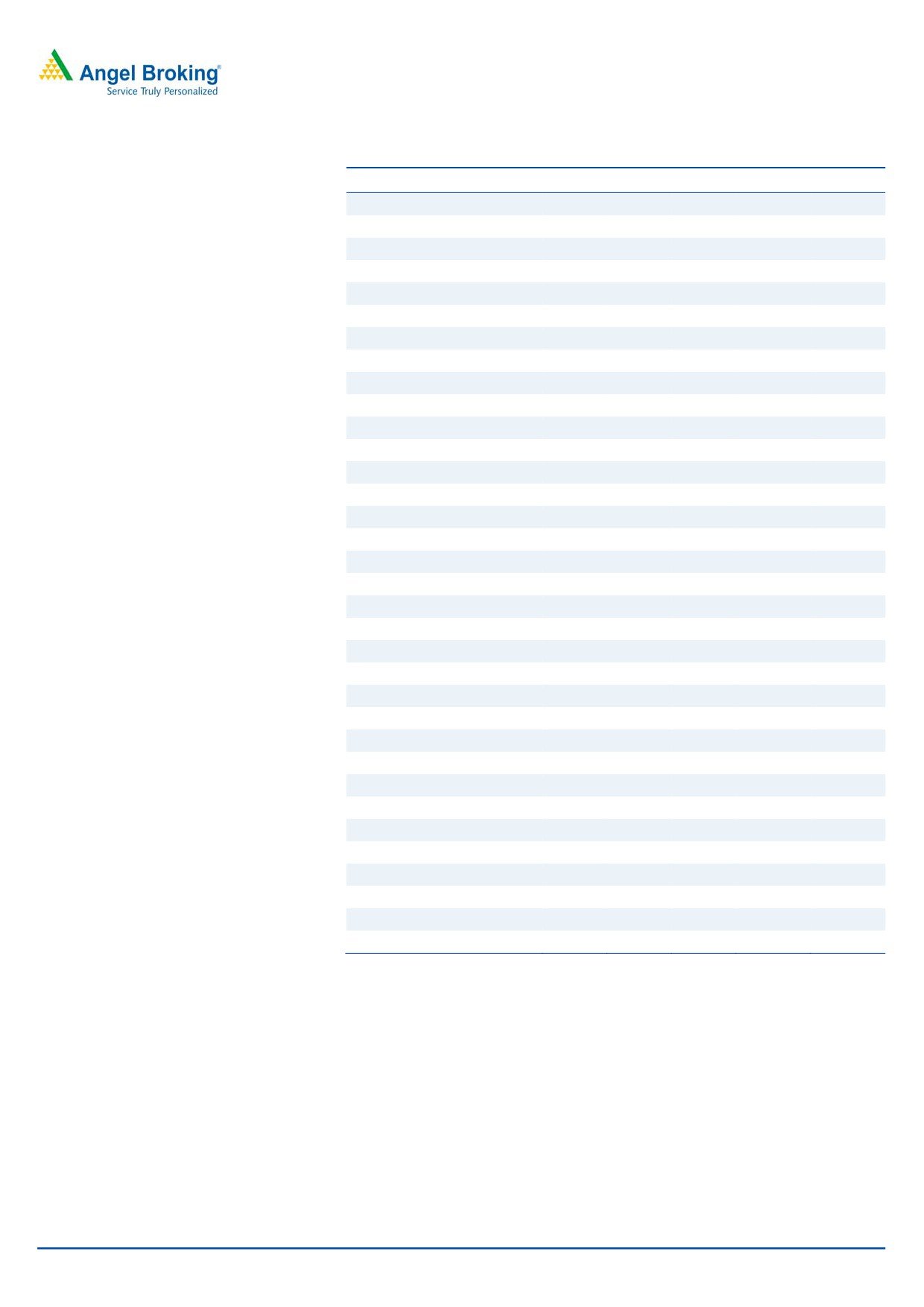

Exhibit 10: Margin expansion to correct

Exhibit 11: Profit growth subdued

EBITDA (LHS)

EBITDA Margin (RHS)

200

PAT (LHS)

PAT growth (RHS)

50

280

14

180

45.8

45

13.4

240

160

40

13.0

12.9

200

140

35

11.9

12

32.5

120

30

160

100

25

10.8

120

80

20

10

60

15

80

11.6

40

10

40

20

5

157

163

220

239

265

119

158

162

181

2.5

0

8

0

0

FY2014

FY2015

FY2016

FY2017E

FY2018E

FY2015

FY2016

FY2017E

FY2018E

Source: Company, Angel Research; Note: * Merged numbers of JLL and JCPL

Source: Company, Angel Research; Note: * Merged numbers of JLL and JCPL

May 27, 2016

5

Jyothy Laboratories | 4QFY2016 Result Update

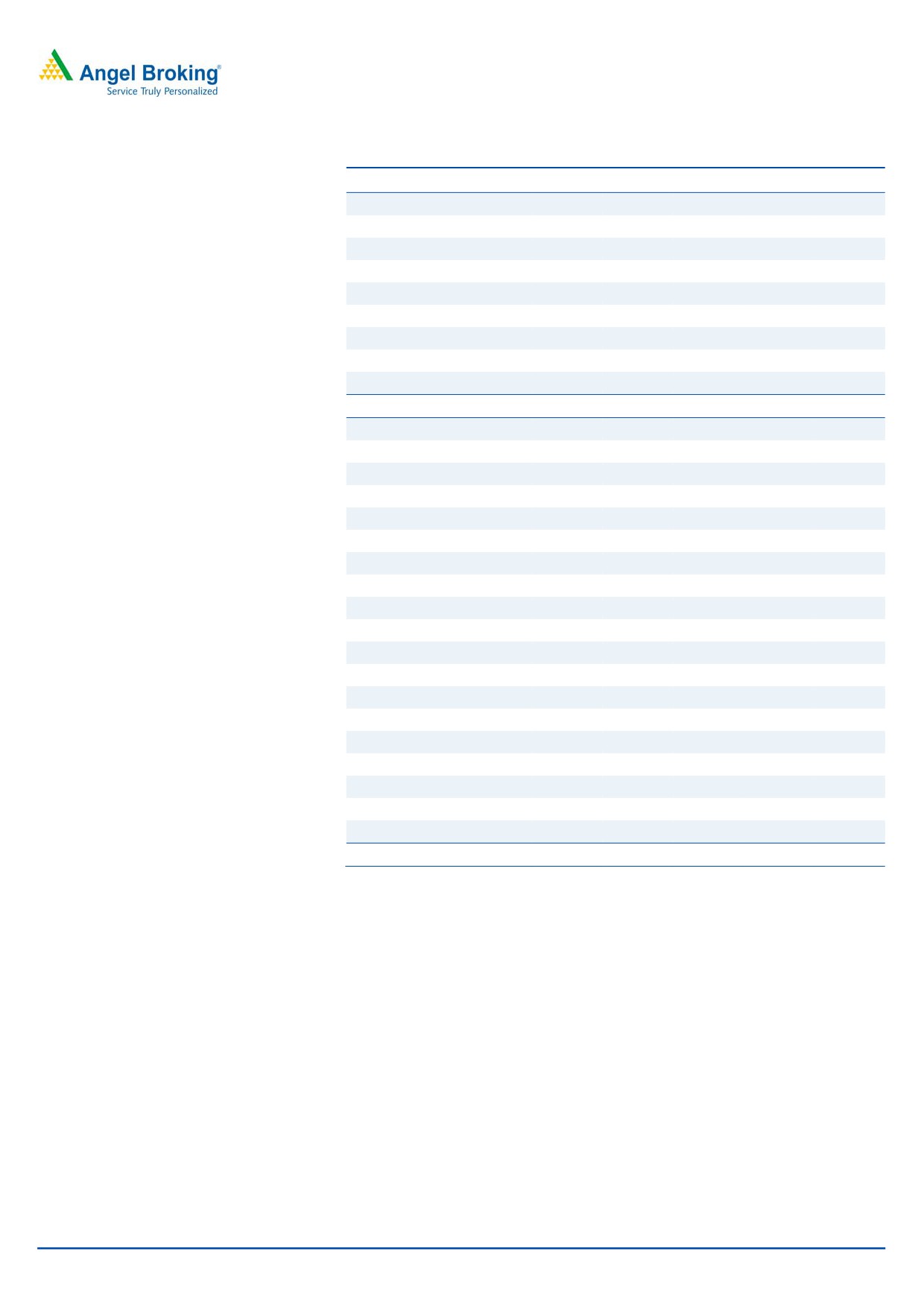

Outlook and valuation

We have switched over from valuing the company on standalone numbers to

consolidated numbers. The CEO, Mr Raghunandan is stepping down from the

leadership post but will make himself available for the company to figure out big-

ticket acquisitions and actively participate in strategic planning. He will be replaced

by Mr Rajnikant Sabnavis as the CEO who was previously in charge of sales &

marketing in the company and has valuable industry experience with HUL. The

company has laid out an aggressive revenue target of `5,000cr by FY2020 which

would be a monitorable as the company has indicated at scouting for suitable

acquisitions. We expect the company’s revenue to grow at a CAGR of 11.6% over

FY2016-18E to `2,052cr while net profit is expected to grow at a CAGR of 7.0%

over the same period to `181cr. At the current market price, the stock trades at

29.2x its FY2018E earnings. We have a Neutral view on the stock.

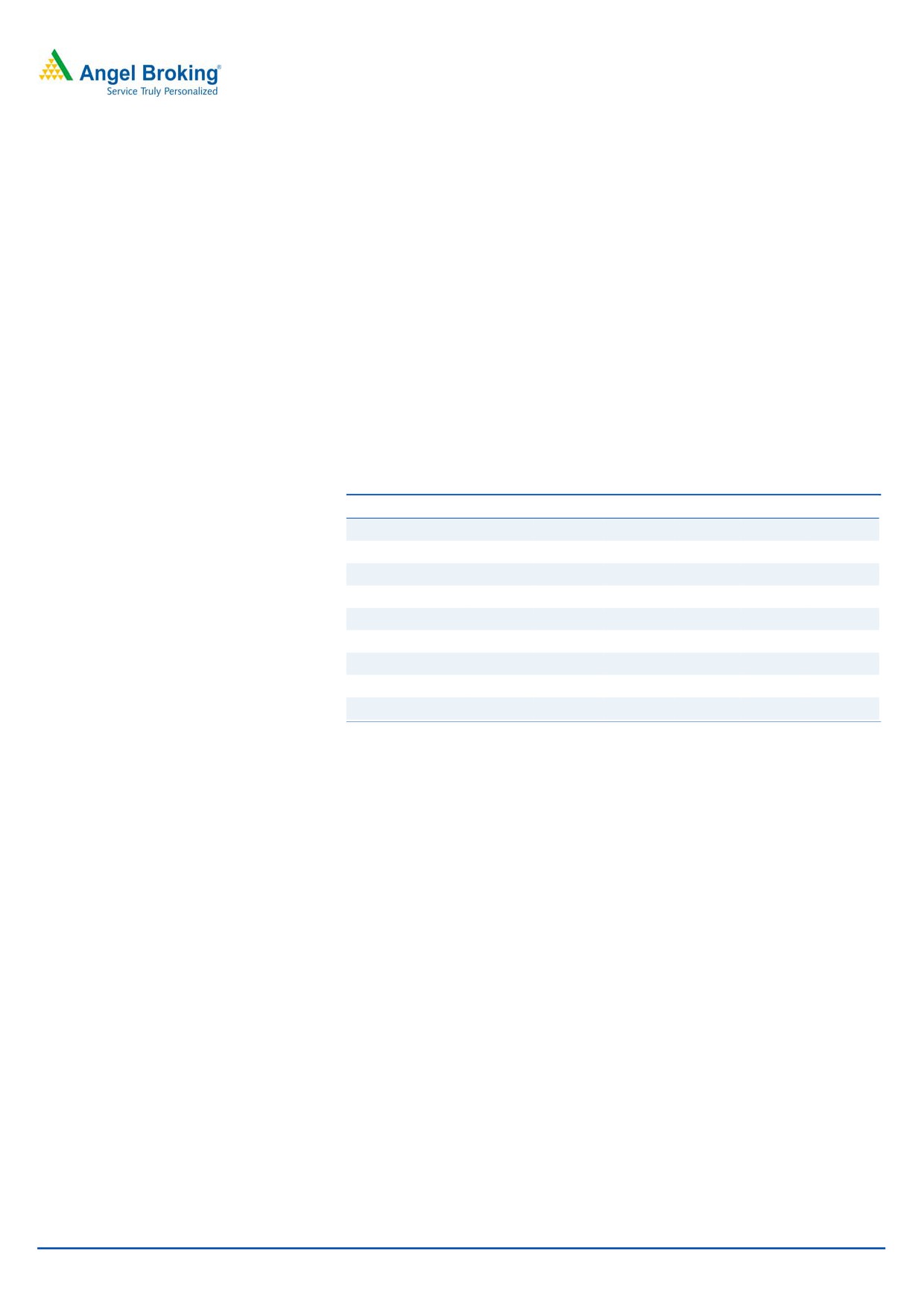

Exhibit 12: One-year forward PE band

350

300

250

200

150

100

50

-

Price

20x

25x

30x

35x

Source: Company, Angel Research

Risk factors

Raw-material cost & economic slowdown: The company’s raw material costs are

exposed to fluctuations in the price of crude and rupee exchange rate, and

inflationary pressure. Any substantial depreciation in the rupee, rise in the price of

crude oil, inflation and slow down in overall economy may pose risk to the

company’s business.

May 27, 2016

6

Jyothy Laboratories | 4QFY2016 Result Update

Profit and Loss (Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

Total operating income

1,324

1,515

1,647

1,845

2,052

% chg

19.6

14.4

8.7

12.0

11.2

Net Raw Materials

694

777

799

904

1008

% chg

18.8

12.0

2.8

13.2

11.4

Personnel

138

179

184

212

236

% chg

5.9

29.5

2.6

15.6

11.2

Other

334

395

444

489

544

% chg

27.9

18.3

12.2

10.2

11.2

Total Expenditure

1167

1352

1426

1606

1788

EBITDA

157

163

220

239

265

% chg

20.4

3.7

35.0

8.8

10.5

(% of Net Sales)

11.9

10.8

13.4

13.0

12.9

Depreciation& Amortisation

24

33

31

33

35

EBIT

133

130

189

206

230

% chg

22.9

(1.8)

44.6

9.4

11.3

(% of Net Sales)

10.6

9.1

12.2

11.7

11.7

Interest & other Charges

55

14

6

9

9

Other Income

8

10

15

5

6

(% of Net Sales)

0.7

0.7

0.9

0.3

0.3

Recurring PBT

78

117

183

198

221

% chg

94.7

50.3

56.5

8.2

11.7

Extra ordi. item/Prior period items

4.0

2.1

0.0

0.0

0.0

PBT (reported)

82

125

197

203

226

Tax

1

4

39

41

46

(% of PBT)

0.8

2.8

19.9

20.2

20.2

PAT (reported)

81

121

158

162

181

Minority Interest

0

0

0

0

0

Extraordinary Expense/(Inc.)

(1)

2

0

0

0

ADJ. PAT

82

119

158

162

181

% chg

472.6

45.8

32.5

2.5

11.6

(% of Net Sales)

6.5

8.3

10.2

9.2

9.2

Basic EPS (`)

4.5

6.6

8.7

8.9

10.0

Fully Diluted EPS (`)

4.5

6.6

8.7

8.9

10.0

% chg

409.8

45.8

32.5

2.5

11.6

May 27, 2016

7

Jyothy Laboratories | 4QFY2016 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

SOURCES OF FUNDS

Equity Share Capital

18

18

18

18

18

Reserves& Surplus

716

762

828

881

953

Shareholders’ Funds

734

780

846

899

971

Minority Interest

2

1

2

2

2

Total Loans

681

730

609

562

561

Other Long Term Liabilities

0

1

5

5

5

Long Term Provisions

11

14

18

18

18

Deferred Tax (Net)

1

1

25

25

25

Total Liabilities

1,428

1,526

1,505

1,510

1,581

APPLICATION OF FUNDS

Gross Block

505

507

532

559

587

Less: Acc. Depreciation

173

198

229

262

297

Less: Impairment

25

22

22

22

22

Net Block

307

287

281

275

268

Capital Work-in-Progress

4

16

8

8

8

Goodwill

787

787

787

787

787

Investments

61

194

83

83

83

Long Term Loans and adv.

135

176

237

266

295

Other Non-current asset

1

3

1

1

1

Current Assets

358

354

370

402

485

Cash

70

77

61

83

126

Loans & Advances

38

32

26

29

32

Inventory

174

185

183

203

230

Debtors

67

57

94

81

90

Other current assets

10

3

7

7

7

Current liabilities

225

290

262

311

346

Net Current Assets

133

64

108

91

139

Misc. Exp. not written off

-

-

-

-

-

Total Assets

1,428

1,526

1,505

1,510

1,581

May 27, 2016

8

Jyothy Laboratories | 4QFY2016 Result Update

Cash Flow (Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E FY2018E

Profit before tax

82

125

197

203

226

Depreciation

24

33

31

33

35

Change in Working Capital

5

77

(60)

39

(4)

Direct taxes paid

(1)

(4)

(15)

(41)

(46)

Others

(8)

(10)

(15)

(5)

(6)

Cash Flow from Operations

103

220

139

228

206

(Inc.)/Dec. in Fixed Assets

(52)

(14)

(17)

(27)

(28)

(Inc.)/Dec. in Investments

(59)

(133)

110

-

-

(Incr)/Decr In LT loans & adv.

(38)

(43)

(59)

(29)

(30)

Others

8

10

15

5

6

Cash Flow from Investing

(142)

(179)

49

(50)

(52)

Issue of Equity

2

-

0

-

-

Inc./(Dec.) in loans

51

49

(112)

(48)

(1)

Dividend Paid (Incl. Tax)

(64)

(87)

(109)

(109)

(109)

Others

73

4

18

-

-

Cash Flow from Financing

62

(34)

(204)

(157)

(110)

Inc./(Dec.) in Cash

24

7

(16)

22

44

Opening Cash balances

46

70

77

61

83

Closing Cash balances

70

77

61

83

126

May 27, 2016

9

Jyothy Laboratories | 4QFY2016 Result Update

Key Ratios (Consolidated)

Y/E March

FY2014

FY2015

FY2016

FY2017E

FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

64.5

44.3

33.4

32.6

29.2

P/CEPS

49.7

34.8

27.9

27.1

24.5

P/BV

7.2

6.8

6.2

5.9

5.4

EV/Net sales

4.4

3.8

3.5

3.1

2.7

EV/EBITDA

37.1

35.2

26.1

23.7

21.3

EV / Total Assets

4.1

3.8

3.9

3.8

3.6

Per Share Data (`)

EPS (Basic)

4.5

6.6

8.7

8.9

10.0

EPS (fully diluted)

4.5

6.6

8.7

8.9

10.0

Cash EPS

5.9

8.4

10.5

10.8

11.9

DPS

3.0

4.0

5.0

5.0

5.0

Book Value

40.5

43.0

46.7

49.6

53.6

DuPont Analysis

EBIT margin

10.0

8.6

11.5

11.2

11.2

Tax retention ratio

1.0

1.0

0.8

0.8

0.8

Asset turnover (x)

0.9

1.0

1.1

1.2

1.3

ROIC (Post-tax)

9.2

8.3

10.2

11.1

11.8

Cost of Debt (Post Tax)

8.4

1.9

0.7

1.2

1.3

Leverage (x)

0.7

0.6

0.5

0.4

0.4

Operating ROE

9.9

12.1

15.4

15.5

15.6

Returns (%)

ROCE (Pre-tax)

0.1

0.1

0.1

0.1

0.2

Angel ROIC (Pre-tax)

27.2

27.2

38.0

38.8

42.7

ROE

11.9

15.8

19.4

18.6

19.3

Turnover ratios (x)

Asset TO (Gross Block)

2.7

3.0

3.2

3.4

3.6

Inventory / Net sales (days)

48

43

41

38

38

Receivables (days)

20

15

17

16

16

Payables (days)

72

70

71

71

71

WC cycle (ex-cash) (days)

18

(3)

10

2

2

Solvency ratios (x)

Net debt to equity

0.7

0.6

0.5

0.4

0.4

Net debt to EBITDA

3.5

2.8

2.1

1.7

1.3

Int. Coverage (EBIT/ Int.)

2.4

9.5

31.3

23.3

24.9

May 27, 2016

10

Jyothy Laboratories | 4QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Jyothy Laboratories

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

May 27, 2016

11