2QFY2016 Result Update | Media

November 5, 2015

Jagran Prakashan

BUY

CMP

`146

Performance highlights

Target Price

`169

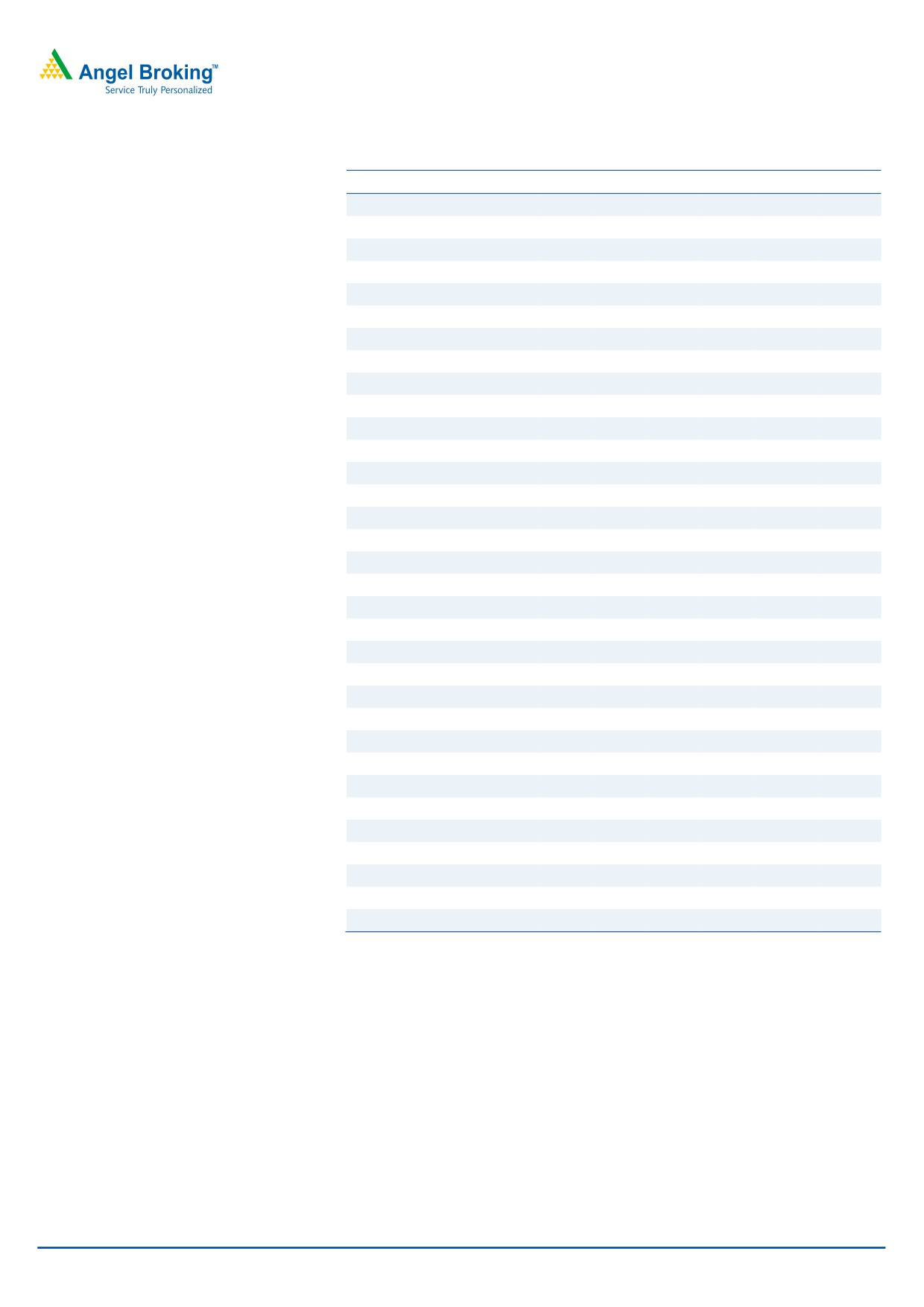

Quarterly data (Consolidated)

Investment Period

12 Months

(` cr)

2QFY16

2QFY15

% yoy

1QFY16

% qoq

Revenue

520

436

19.1

481

8.0

Stock Info

EBITDA

147

106

38.3

135

8.9

Sector

Media

OPM (%)

28.3

24.3

393

28.0

24

Market Cap (` cr)

4,849

PAT

91

57

61.4

180

(49.3)

Source: Company, Angel Research

Net Debt (` cr)

(202)

Beta

0.5

For 2QFY2016, Jagran Prakashan (JPL)’s consolidated top-line grew by 19% yoy,

52 Week High / Low

154 / 107

mainly due to strong growth in the advertisement segment. The acquisition of the

Radio City business in 1QFY2016 added to the advertising revenue. However,

Avg. Daily Volume

28,669

circulation revenue showed lower growth during the quarter. The company

Face Value (`)

2

reported strong profitability on a consolidated basis due to falling news print costs

BSE Sensex

26,553

and with contribution from Radio City.

Nifty

8,040

Reuters Code

JAGP.BO

Ad revenue up ~27% yoy, Circulation revenue up ~4% yoy: The company’s

Bloomberg Code

JAGP@IN

advertising revenue growth for the quarter was healthy at ~27% yoy to ~`520cr,

primarily driven by increase in print revenue and radio advertisement revenue.

Circulation revenue was up 4% yoy to `100cr due to increase in cover prices.

Shareholding Pattern (%)

However, income from other businesses declined by

~7% yoy to ~`31cr.

Promoters

60.8

Consequently, the consolidated top-line grew by ~19% yoy to~ `520cr.

MF / Banks / Indian Fls

12.7

OPM improves: The consolidated operating profit grew by ~38% yoy to `147cr

FII / NRIs / OCBs

15.0

and the OPM expanded by 393bp yoy to 28.2% owing to lower raw material

Indian Public / Others

11.6

cost. This led to a strong reported net profit growth of ~61% yoy to `91cr (including

profits from the radio business).

Abs. (%)

3m 1yr

3yr

Outlook and valuation: Considering Dainik Jagran’s status as the most read

Sensex

(4.7)

4.7

41.5

Hindi newspaper in the country and its strong presence in the rapidly growing

JAGP

6.4

11.8

45.1

Hindi markets of Bihar, Haryana, Jharkhand, Punjab, Madhya Pradesh and Uttar

Pradesh, we expect JPL to benefit the most from an eventual recovery in the Indian

3-year price chart

economy. Further, the acquisition of Radio City is also expected to boost the

160

150

company’s profitability, going ahead. Hence, we maintain our Buy rating on the stock

140

with a target price of `169.

130

120

110

Key financials (Consolidated)

100

90

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

80

70

Net Sales

1,522

1,703

1,770

2,170

2,355

60

% chg

12.3

11.9

3.9

22.6

8.5

Adj. Net Profit

258

234

225

290

325

Source: Company, Angel Research

% chg

44.6

(9.4)

(3.6)

28.9

11.9

OPM (%)

19.2

22.5

25.5

27.2

26.2

EPS (`)

7.9

7.1

6.9

8.9

9.9

P/E (x)

18.5

20.4

21.2

16.5

14.7

P/BV (x)

5.1

5.0

4.2

3.4

3.0

RoE (%)

27.4

23.5

27.2

29.3

20.4

RoCE (%)

11.8

20.9

19.5

23.1

21.3

Amarjeet S Maurya

EV/Sales (x)

3.3

2.9

2.6

2.1

1.9

022-39357800 Ext: 6831

EV/EBITDA (x)

17.0

12.8

10.1

7.7

7.3

Source: Company, Angel Research; Note: CMP as of November 4, 2015

Please refer to important disclosures at the end of this report

1

Jagran Prakashan | 2QFY2016 Result Update

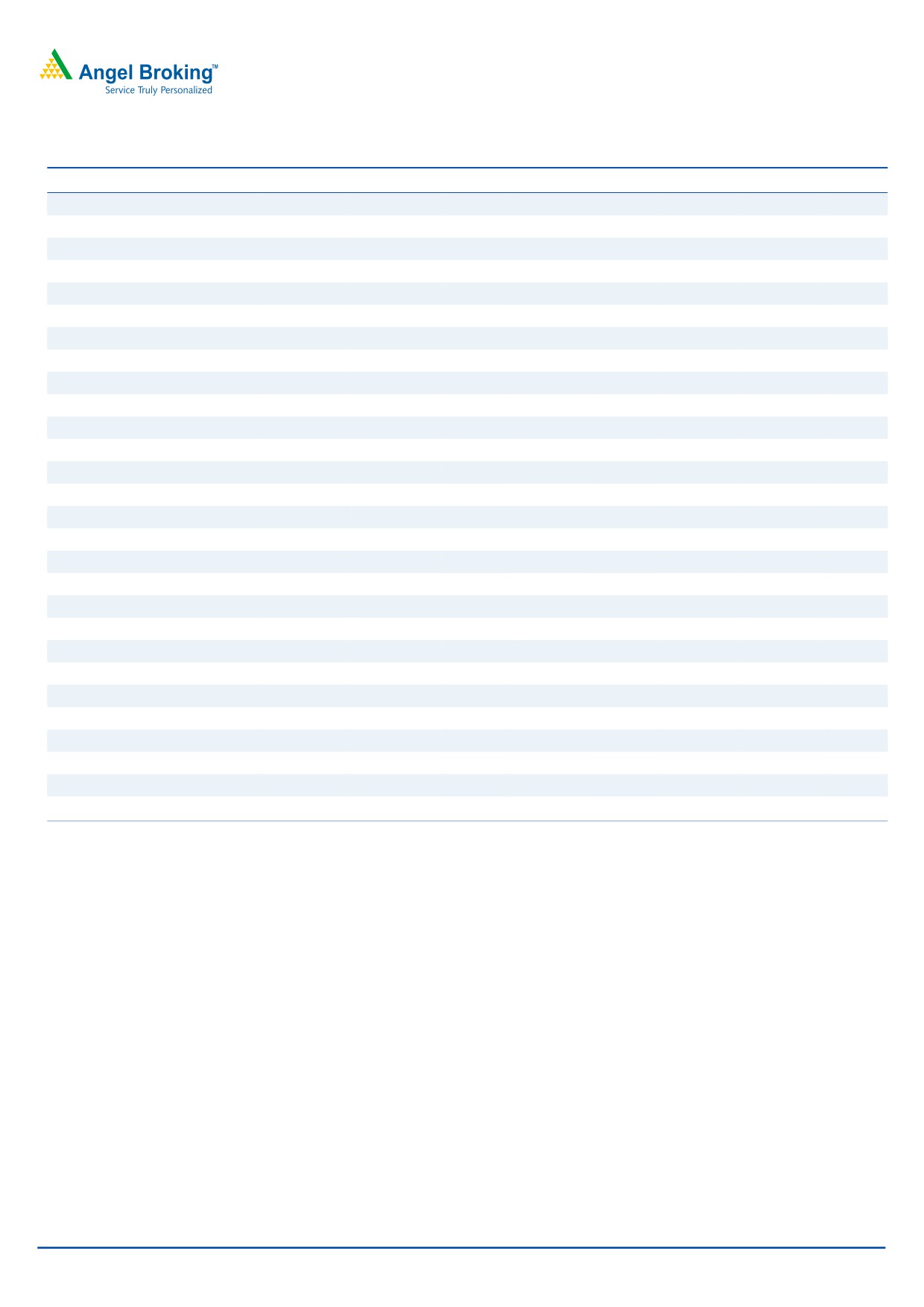

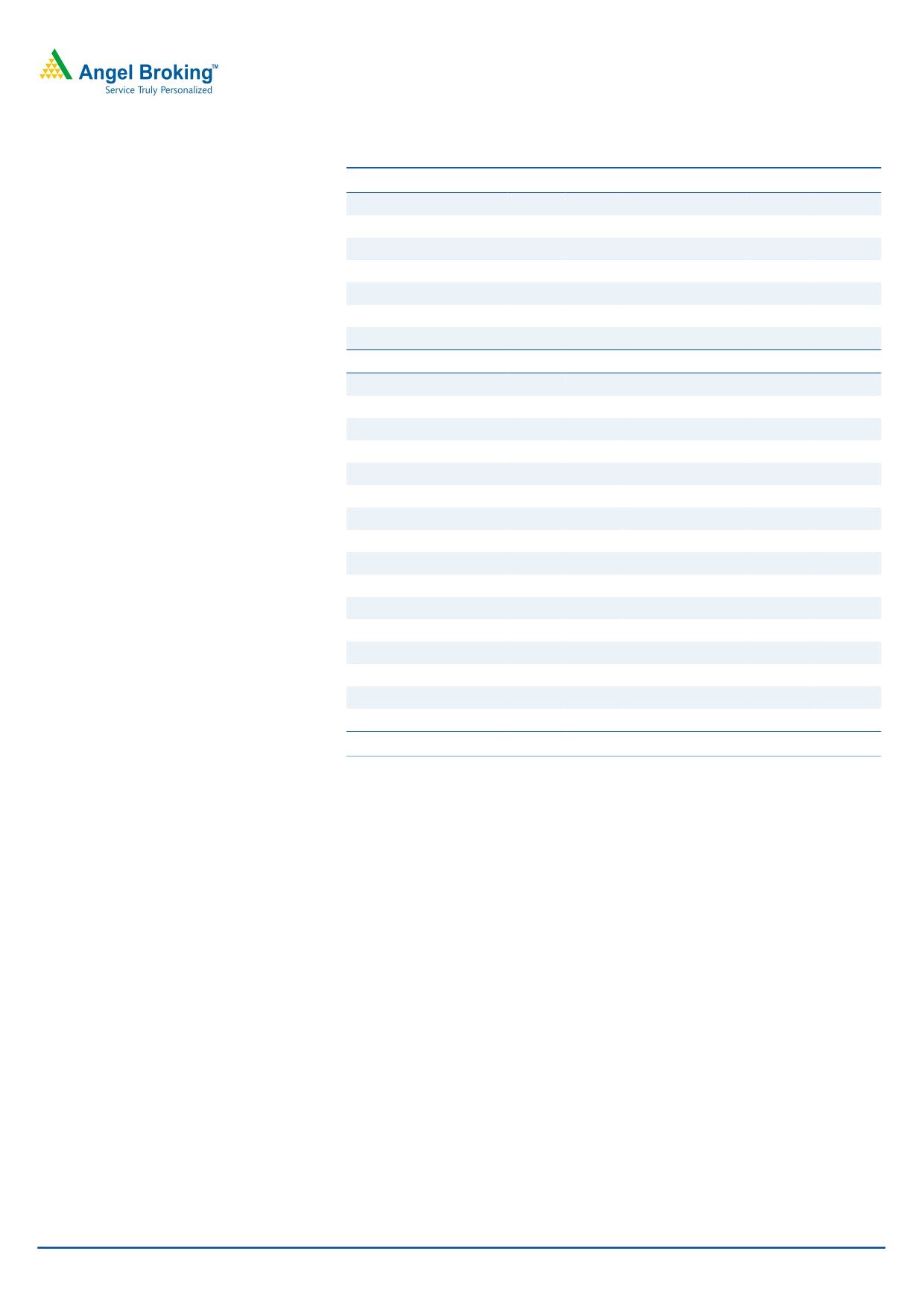

Exhibit 1: Quarterly performance (Consolidated)

Y/E March (` cr)

2QFY16

2QFY15

% yoy

1QFY16

% qoq

FY2015

FY2014

% chg

Net Sales

520

436

19.1

481

8.0

1,770

1,703

3.9

Consumption of RM

155

160

(3.6)

156

(0.8)

626

609

2.7

(% of Sales)

29.7

36.7

32.4

35.3

35.8

Staff Costs

82

65

26.3

72

13.3

263

240

10.0

(% of Sales)

15.7

14.8

15.0

14.9

14.1

Other Expenses

136

105

29.8

118

15.2

430

482

(10.7)

(% of Sales)

26.3

24.1

24.6

24.3

28.3

Total Expenditure

373

330

12.9

346

7.6

1,319

1,330

(0.8)

Operating Profit

147

106

38.3

135

8.9

451

373

20.9

OPM

28.3

24.3

28.0

25.5

21.9

Interest

8

7

10.5

13

(35.9)

37

35

7.0

Depreciation

29

25

17.0

23

24.1

104

79

31.3

Other Income

14

7

116

108

47

132.3

PBT (excl. Ext Items)

124

82

52.1

215

(42.3)

418

306

36.8

Ext Income/(Expense)

0

0

PBT (incl. Ext Items)

124

82

52.1

215

(42.3)

418

306

36.8

(% of Sales)

23.9

18.7

44.7

23.6

18.0

Provision for Taxation

33

25

35

110

79

38.7

(% of PBT)

26.4

30.6

16.2

26.3

26.0

Recurring PAT

91

57

61.3

180

(49.3)

308

226

36.2

PATM

17.6

13.0

37.4

17.4

13.3

Minority Interest After NP

0.0

0.0

0.2

(0.3)

Profit/Loss of Associate Company

(0.0)

(0.0)

(0.0)

0.0

0.0

(0.4)

Reported PAT

91

57

61.4

180

(49.3)

308

226

36.2

Extra-ordinary Items

15

2

106

83

(7)

Adj. PAT

77

54

41.7

73.7

4.2

225

234

(3.6)

Equity shares (cr)

33

33

33

33

32.69

FDEPS (`)

2.8

1.7

61.4

5.5

(49.3)

9.4

6.9

36.2

Source: Company, Angel Research

Acquisition of Radio City boosts Ad revenue

The company reported a ~27% yoy growth in advertising revenue to ~`520cr on

the back of increase in yields and optimum utilization of advertisement inventory. In

the print business, the company reported a 6% yoy growth to ~`464cr and the

balance of the revenue came from radio advertising. However, the company’s

other businesses witnessed a decline in operating income owing to its policy of not

aggressively pursuing unprofitable non-print businesses, which led to a fall in the

overall top-line.

Circulation revenue up 4% yoy

The company’s circulation revenue for the quarter was up ~4% yoy to `100cr due

to increase in cover prices. Further, the Management expects 8-10% growth in

circulation revenue, going ahead.

November 5, 2015

2

Jagran Prakashan | 2QFY2016 Result Update

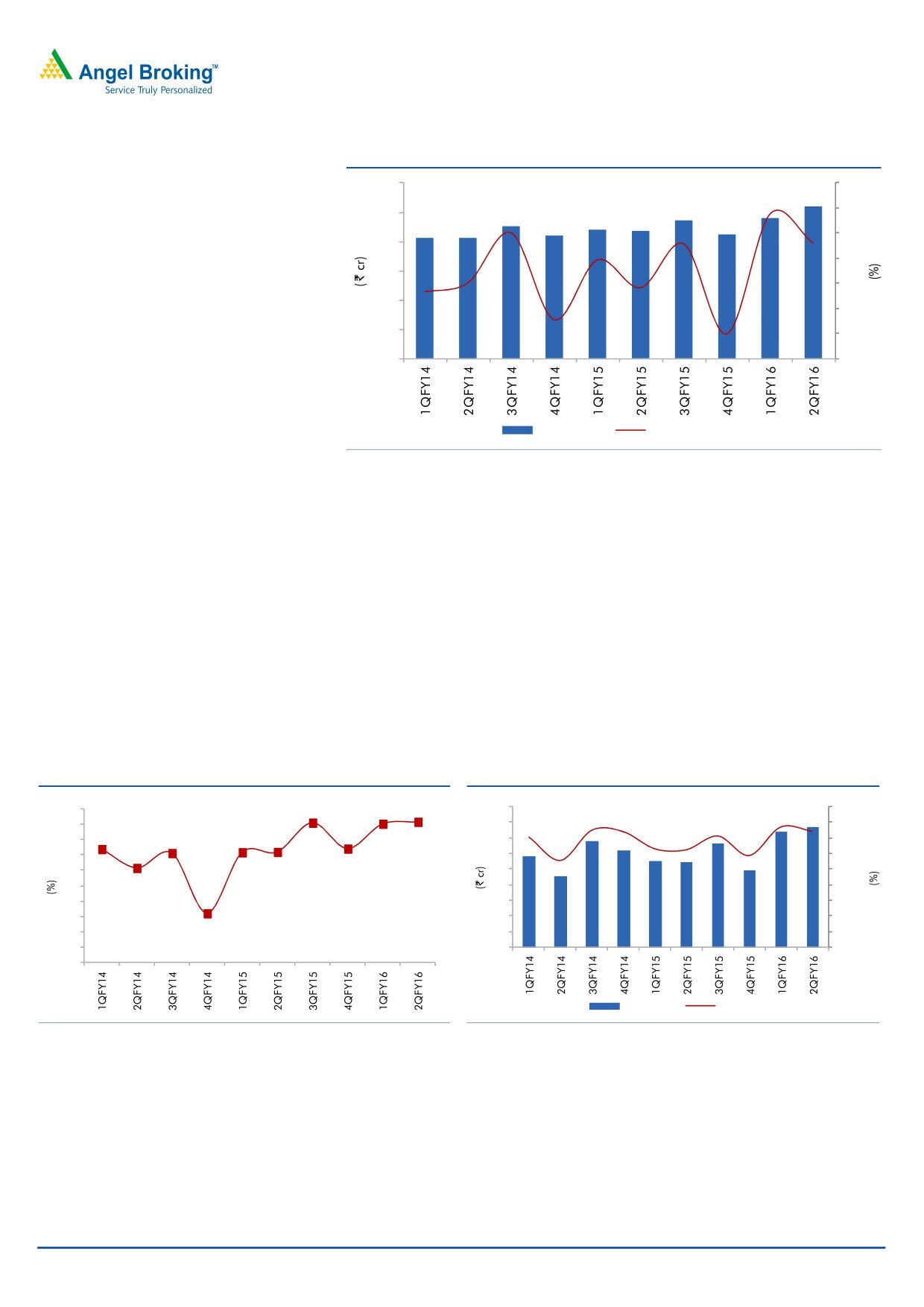

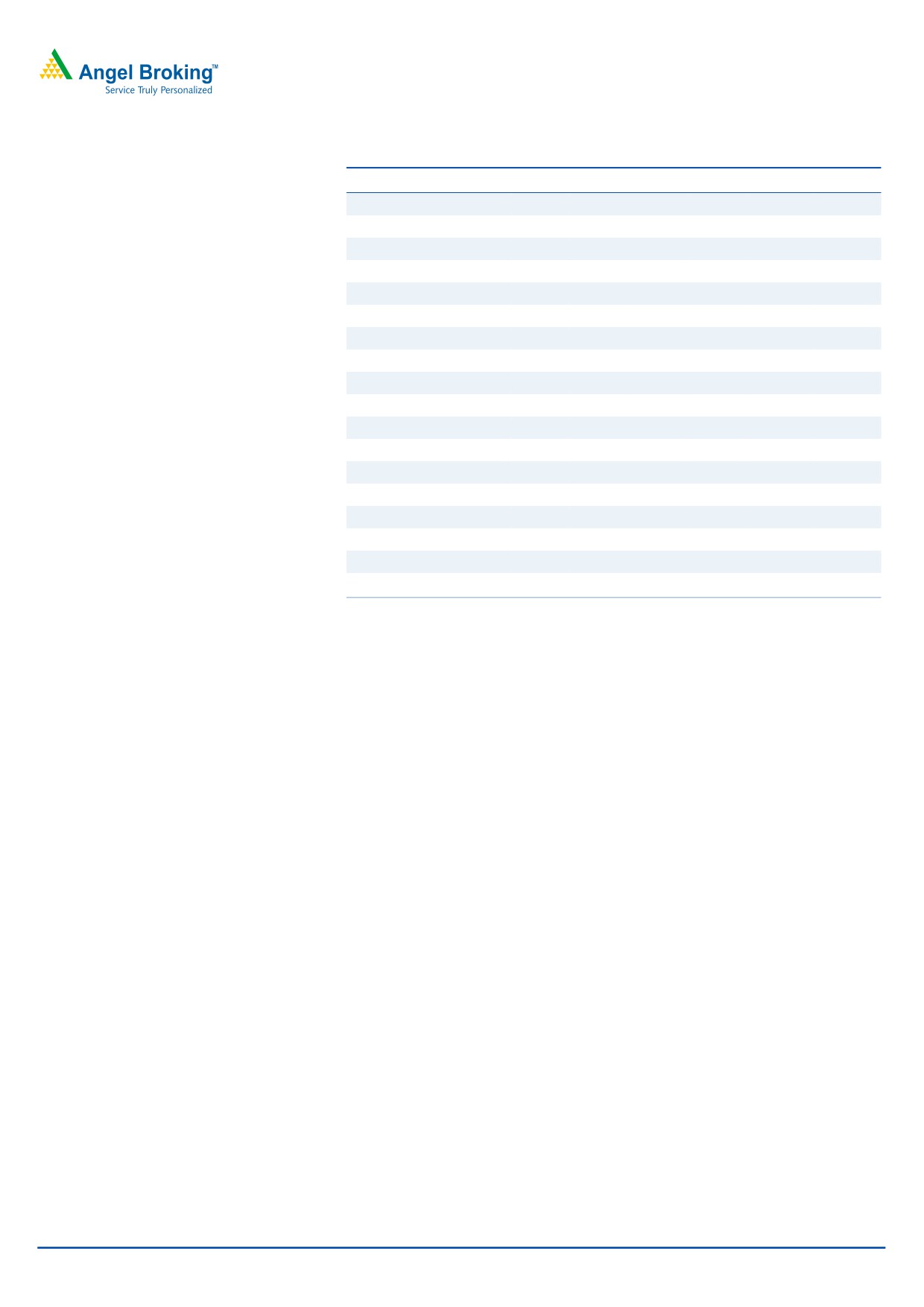

Exhibit 2: Consolidated Net sales growth trend

600

20

15

500

10

400

5

300

0

200

(5)

100

(10)

0

(15)

Net Sale

QoQ growth (%)

Source: Company, Angel Research

Improved operating performance

For the quarter, JPL’s flagship daily - Dainik Jagran’s margin expanded yoy to

34.8%. Other publications reported a cumulative operating profit of `7cr in

2QFY2016 as against a loss of `2cr for the same quarter last year. Overall, the

consolidated EBITDA grew by ~38% yoy to `147cr and the OPM expanded by

393bp yoy to 28.2% owing to lower raw material costs (down 700bp as a % of

sales, mainly due to lower news print costs). Further, the company is not

aggressively pursuing other unprofitable businesses which led to a fall in the top-line

for the quarter, although these businesses contributed towards improvement in the

overall operating margins. Overall, at the consolidated level, the reported net profit

grew to ~61% yoy to `91cr (including profit of the radio business).

Exhibit 3: Consolidated operating margin trend

Exhibit 4: Consolidated Net profit and margin trend

30

90

18.0

28

80

16.0

26

70

14.0

24

60

12.0

22

50

10.0

20

40

8.0

18

30

6.0

16

20

4.0

14

10

2.0

12

0

0.0

10

Net Profit

Margin (%)

Source: Company, Angel research

Source: Company, Angel research

November 5, 2015

3

Jagran Prakashan | 2QFY2016 Result Update

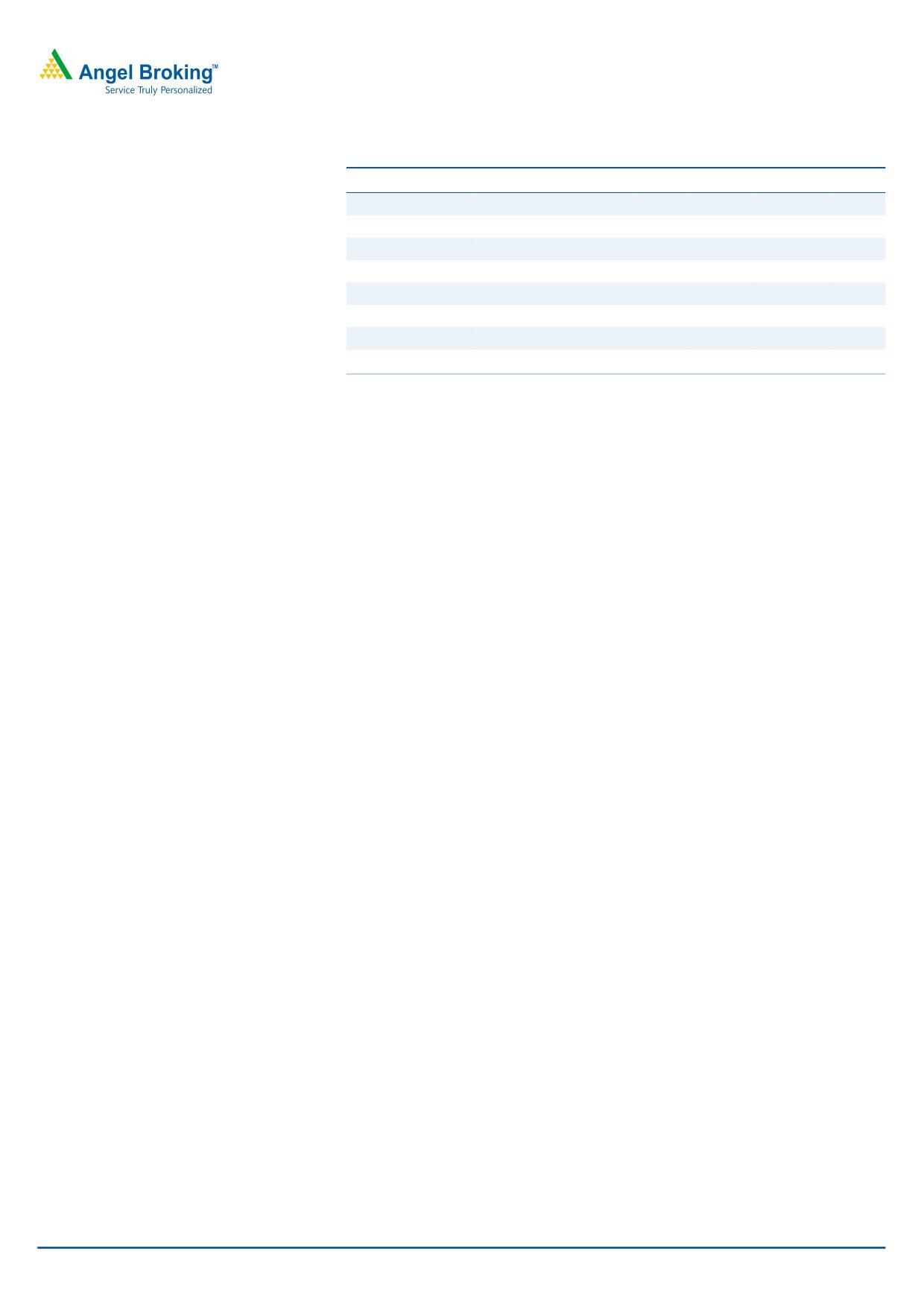

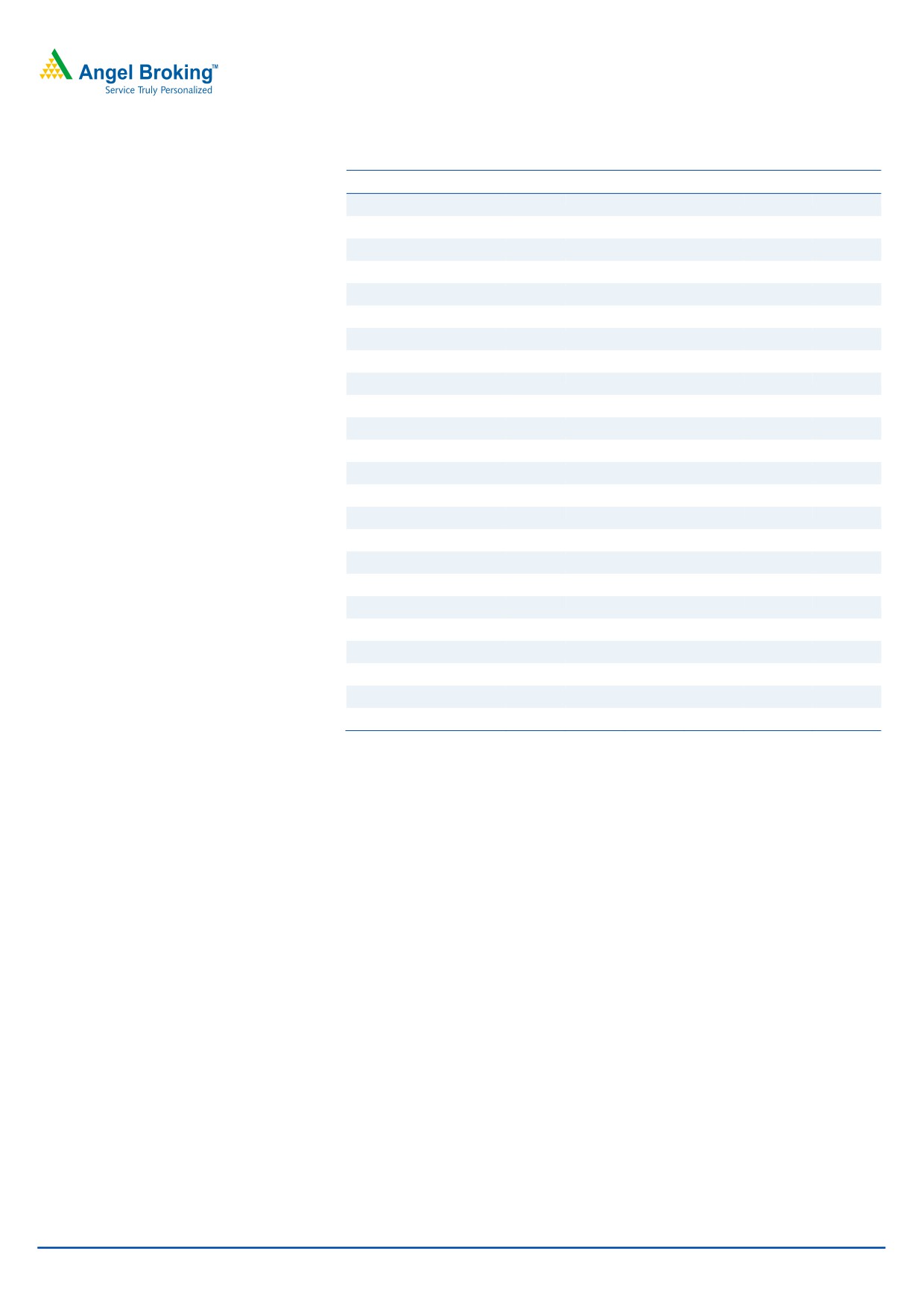

Exhibit 5: Operating performance

2QFY2016

2QFY2016

% yoy 1FY2016 1HFY2015

% chg

Dainik Jagran

Operating Revenue

362.5

336.0

7.9

723.9

671.9

7.7

Operating Profit

126.3

110.3

14.5

248.3

224.5

10.6

Operating Margin (%)

34.8

32.8

-

34.3

33.4

-

Other Publications

Operating Revenue

79.2

76.7

3.3

158.2

152.8

3.5

Operating Profit

7.0

-2.4

-

13.9

-10.0

-

Operating Margin (%)

8.8

-3.1

-

8.8

-6.5

-

Source: Company, Angel Research

Investment rationale

Advertising revenue expected to bounce on back of improvement in economy:

After cutting advertising rates in FY2013, JPL has again been hiking rates since

the beginning of FY2014. The Management expects yield driven advertising

revenue growth to continue in FY2015, enabling the company to post decent

growth in top-line. Further, considering Dainik Jagran’s status as the most

read Hindi newspaper and its strong presence in the rapidly growing Hindi

markets of Bihar, Haryana, Jharkhand, Punjab, Madhya Pradesh and Uttar

Pradesh, we believe JPL will benefit the most from an eventual recovery in the

Indian economy.

Recent acquisitions to fuel growth: The acquisition of the radio business (Radio

City) would also boost the company's revenue going ahead. Radio City has

~20 stations across 7 states in the country and is second only to ENIL in all its

operating circles, ie Delhi, Mumbai, Bengaluru, Chennai, Ahmedabad,

Hyderabad, Pune and Lucknow. The company covers ~51% (~66mn people)

of the total radio population.

Falling raw material prices to boost profitability: Raw material prices

(newsprint costs) have been declining over the past 5 quarters and are

expected to remain stable, going forward. Thus, considering lower news print

costs, healthy sales, and higher margins in the radio business, we expect the

company to post higher profitability, going ahead.

Outlook and valuation

Considering Dainik Jagran’s status as the most read Hindi newspaper in the

country and its strong presence in the rapidly growing Hindi markets of Bihar,

Haryana, Jharkhand, Punjab, Madhya Pradesh and Uttar Pradesh, we expect JPL to

benefit the most from an eventual recovery in the Indian economy. Further, the

acquisition of Radio City will also boost the company’s profitability, going ahead.

Hence, we maintain our Buy rating on the stock with a target price of `169.

November 5, 2015

4

Jagran Prakashan | 2QFY2016 Result Update

Company Background

Dainik Jagran, with an AIR of ~16.4mn, is the most read newspaper in India

published by Jagran Prakashan (JPL). The company enjoys a leadership position in

Uttar Pradesh, the largest Hindi market for almost a decade now. The company is

present in the rapidly growing Hindi print media markets of Bihar, Delhi, Haryana,

Jharkhand, Punjab and Uttar Pradesh. Apart from its commanding position in print

media, JPL is also present in the internet, OOH, and event management

businesses.

November 5, 2015

5

Jagran Prakashan | 2QFY2016 Result Update

Profit & Loss Statement (Consolidated)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY16E

Total operating income

1,356

1,522

1,703

1,770

2,170

2,355

% chg

11.0

12.3

11.9

3.9

22.6

8.5

Total Expenditure

1,039

1,229

1,320

1,319

1,580

1,738

Cost of Materials

461

544

609

626

720

803

Personnel

194

227

240

263

326

356

Others

383

458

472

430

534

579

EBITDA

317

292

383

451

590

617

% chg

(11.1)

(7.7)

30.9

17.8

31.0

4.5

(% of Net Sales)

23.4

19.2

22.5

25.5

27.2

26.2

Depreciation& Amortisation

71

126

79

104

120

141

EBIT

246

167

304

347

470

476

% chg

(15.5)

(32.1)

82.0

14.3

35.5

1.3

(% of Net Sales)

18.1

11.0

17.8

19.6

21.7

20.2

Interest & other Charges

16

31

35

37

45

45

Other Income

25

119

47

108

140

20

(% of PBT)

10.0

46.6

14.8

25.9

24.7

4.4

Share in profit of Associates

-

-

-

-

-

-

Recurring PBT

256

255

316

418

565

451

% chg

(17.0)

(0.2)

23.8

32.5

35.0

(20.1)

Prior Period & Ex-ord. Exp./(Inc.)

-

-

10

-

-

-

PBT (reported)

256

255

306

418

565

451

Tax

77

0

79

110

158

126

(% of PBT)

30.2

0.2

26.0

26.3

28.0

28.0

PAT (reported)

178

255

226

308

407

325

Add: Share of earnings of asso.

(0)

(1)

(0)

0

0

0

Less: Minority interest (MI)

(0)

(0)

(0)

0

0

0

PAT after MI (reported)

178

255

226

308

406

325

Extra-ordinary Items

-

(3)

(7)

83

116

-

ADJ. PAT

178

258

234

225

290

325

% chg

(15.1)

44.6

(9.4)

(3.6)

28.9

11.9

(% of Net Sales)

13.2

16.9

13.7

12.7

13.4

13.8

Adj.Basic EPS (`)

5.5

7.9

7.1

6.9

8.9

9.9

% chg

(14.8)

44.6

(9.4)

(3.6)

28.9

11.9

November 5, 2015

6

Jagran Prakashan | 2QFY2016 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY17E

SOURCES OF FUNDS

Equity Share Capital

63

63

62

63

63

63

Reserves& Surplus

689

869

899

1,071

1,323

1,524

Shareholders’ Funds

752

932

962

1,134

1,386

1,587

Minority Interest

8

1

1

1

1

1

Total Loans

668

484

490

648

648

648

Deferred Tax Liability

76

89

91

78

78

78

Total Liabilities

1,503

1,506

1,543

1,861

2,113

2,314

APPLICATION OF FUNDS

Gross Block

1,216

1,241

1,336

1,418

1,483

1,603

Less: Acc. Depreciation

351

466

545

644

765

906

Net Block

865

776

791

773

718

697

Capital Work-in-Progress

66

131

114

72

72

72

Investments

252

222

332

357

357

357

Current Assets

672

672

688

1,051

1,393

1,569

Inventories

78

83

100

93

119

142

Sundry Debtors

289

319

343

364

464

516

Cash

100

52

33

493

528

534

Loans & Advances

196

155

151

36

174

212

Other

11

62

62

65

109

165

Current liabilities

358

313

388

399

435

389

Net Current Assets

314

358

300

651

958

1,181

Deferred Tax Asset

6

19

6

7

7

7

Mis. Exp. not written off

-

-

-

-

-

-

Total Assets

1,503

1,506

1,543

1,861

2,113

2,314

November 5, 2015

7

Jagran Prakashan | 2QFY2016 Result Update

Cashflow Statement (Consolidated)

Y/E March (` cr)

FY12

FY13

FY14

FY15E

FY16E

FY17E

Profit before tax

256

255

306

418

565

451

Depreciation

71

125

89

104

120

141

Change in Working Capital

(14)

(69)

(13)

(51)

(271)

(216)

Interest / Dividend (Net)

0

24

29

22

45

45

Direct taxes paid

(75)

(50)

(62)

(70)

(158)

(126)

Others

(10)

(83)

(19)

14

-

-

Cash Flow from Operations

228

202

331

437

300

294

(Inc.)/ Dec. in Fixed Assets

(160)

(194)

(60)

(415)

(100)

(121)

(Inc.)/ Dec. in Investments

(53)

30

(110)

(25)

-

-

Cash Flow from Investing

(213)

(164)

(170)

(441)

(100)

(121)

Issue of Equity

-

-

-

-

-

-

Inc./(Dec.) in loans

148

87

(26)

139

35

1

Dividend Paid (Incl. Tax)

(111)

(111)

(95)

(93)

(154)

(123)

Interest / Dividend (Net)

13

(63)

(59)

417

(45)

(45)

Cash Flow from Financing

50

(86)

(180)

463

(165)

(167)

Inc./(Dec.) in Cash

65

(48)

(20)

459

35

6

Opening Cash balances

35

100

52

33

493

528

Closing Cash balances

100

52

33

493

528

534

November 5, 2015

8

Jagran Prakashan | 2QFY2016 Result Update

Key Ratios

Y/E March

FY12

FY13

FY14

FY15

FY16E

FY17E

Valuation Ratio (x)

P/E (on FDEPS)

26.8

18.5

20.4

21.2

16.5

14.7

P/CEPS

19.1

12.5

15.6

11.6

9.1

10.3

P/BV

6.3

5.1

5.0

4.2

3.4

3.0

Dividend yield (%)

2.4

1.4

0.7

1.4

1.7

2.1

EV/Sales

3.8

3.3

2.9

2.6

2.1

1.9

EV/EBITDA

16.1

17.0

12.8

10.1

7.7

7.3

EV / Total Assets

2.7

2.7

2.5

2.0

1.8

1.7

Per Share Data (`)

EPS (Basic)

5.5

7.9

7.1

6.9

8.9

9.9

EPS (fully diluted)

5.5

7.9

7.1

6.9

8.9

9.9

Cash EPS

7.6

11.6

9.3

12.6

16.1

14.2

DPS

3.5

2.0

1.0

2.0

2.5

3.0

Book Value

23.0

28.5

29.4

34.7

42.4

48.6

Returns (%)

RoCE

17.3

11.8

20.9

19.5

23.1

21.3

Angel RoIC (Pre-tax)

23.0

14.6

27.9

37.2

40.9

35.4

RoE

23.7

27.4

23.5

27.2

29.3

20.4

Turnover ratios (x)

Asset Turnover

1.1

1.2

1.3

1.2

1.5

1.5

Inventory / Sales (days)

21

20

21

19

20

22

Receivables (days)

78

77

73

75

78

80

Payables (days)

27

27

28

24

23

23

Net Working capital (days)

72

69

67

71

75

79

November 5, 2015

9

Jagran Prakashan | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Jagran Prakashan

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 5, 2015

10