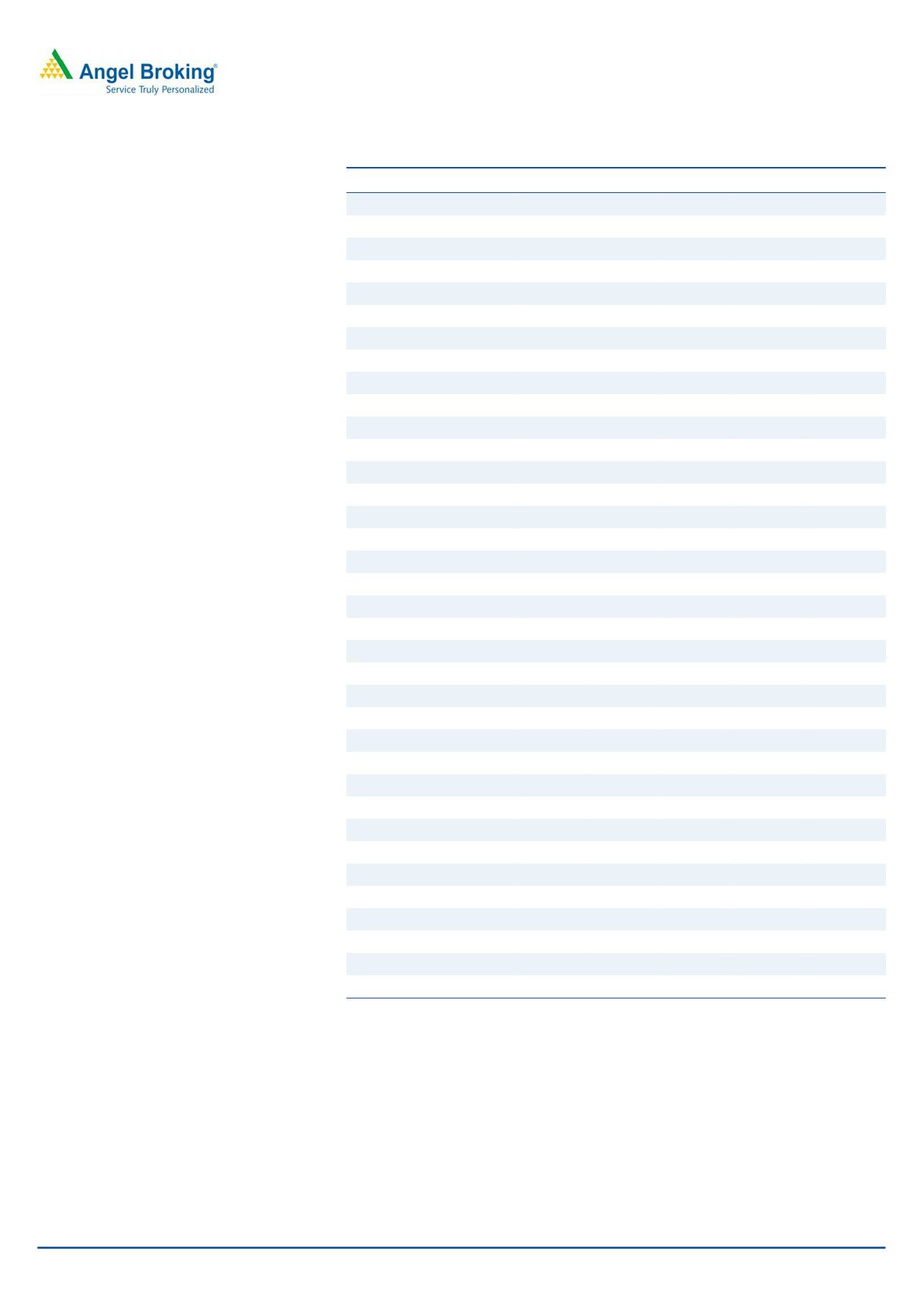

2QFY2016 Result Update | Steel

October 23, 2015

JSW Steel

NEUTRAL

CMP

`906

Weakness persists

Target Price

-

Investment Period

-

(` cr)

2QFY16

2QFY15

yoy (%)

1QFY16

qoq%

Net Sales

9,653

11,886

(18.8)

9,982

(3.3)

S tock Info

EBITDA

1,566

2,620

(40.2)

1,505

4.1

Sector

S teel

EBITDA margin (%)

16.2

22.0

(582)bp

15.1

115bp

Market Cap (` cr)

21,895

Adj. PAT

349

943

(63.0)

168

107.8

Source: Company, Angel Research

Net Debt (` cr)

39,008

Beta

1.2

Steel price declines hurt margins: JSW Steel’s standalone revenues for 2QFY2016

52 Week High / L ow

1.274/801

come in at `9,653cr, in line with our estimate of `9,345cr. Raw Material expenses

Avg. Daily Volume

10,03,011

for the quarter, at ~`5,458cr, are 2.5% below our expectation, led by decline in

Face Value (`)

10

iron ore and coking coal prices. The EBITDA however declined by 40% yoy, owing

BSE Sensex

27,288

to a sharp decline in steel prices.

Nifty

8,252

Consolidated (` cr)

2QFY16

2QFY15

yoy%

1QFY16

qoq%

R euters Code

JSTL.BO

Net Sales

10,743

13,692

(21.5)

11,382

(5.6)

Bloomberg Code

JSTL IN

EBITDA

1,729

2,791

(38.0)

1,627

6.3

Margin (%)

16.1

20.4

(429)bp

14.3

180bp

Shareholding Pattern (% )

Adj. PAT

118

749

(84.2)

(106)

(211.6)

P romoters

41.5

Source: Company, Angel Research

MF / Banks / Indian Fls

5.2

Strong performance of subsidiaries: During the quarter, Coated Products’

FII / NR Is / OCBs

17.2

revenues came in ahead of our expectations at `1,927cr on account of higher

Indian P ublic / Others

36.2

realizations, while the segment’s EBITDA rose by 5.3% yoy to `102cr as against

our expectations of `60cr. The company’s Chilean operations posted an EBITDA

loss of $0.48mn as against a loss of $1.76mn in 2QFY2015, which is in line with

Abs . (% )

3m

1yr

3yr

the guidance. The company’s plate and pipe mill business in the US reported an

Sensex

(3.2)

2.7

46.1

EBITDA loss of $3.1mn, lower than our expectation of a EBITDA loss of $8.5mn.

JSW Steel

8.3

(23.0)

23.4

Outlook: The company’s results for the quarter are marginally better than our

expectations, but the outlook on steel prices continues to remain weak. Pressure

3-year price chart

from imports and slowdown in China remain key concerns for the domestic steel

1,600

1,400

industry. At the current price of `906, the stock trades at 7x FY2017 EV/EBITDA;

1,200

we retain our Neutral rating on the stock.

1,000

800

Key financials (Consolidated)

600

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

400

200

Net sales

38,095

50,409

52,051

42,308

45,147

0

% chg

11.6

32.3

3.3

(18.7)

6.7

Adj. net profit

1,361

2,141

1,822

(217)

1,229

% chg

3.6

4.2

3.5

(0.5)

2.7

Adj. EPS (`)

59.5

87.2

74.0

(10.3)

49.5

Source: Company, Angel Research

OPM (%)

17.1

18.2

18.0

16.4

20.7

P/E (x)

15.2

10.4

12.2

NMF

18.3

P/BV (x)

1.2

1.0

1.0

1.0

1.0

RoE (%)

8.1

11.2

8.4

(1.0)

5.6

RoCE (%)

9.7

10.9

8.9

4.4

7.3

Rahul Dholam

EV/Sales (x)

1.1

1.2

1.3

1.6

1.5

Tel: 022- 3935 7800 Ext: 6847

EV/EBIDTA

6.7

6.6

6.9

9.6

7.0

Source: Company, Angel Research: Note CMP as of October 21, 2015

Please refer to important disclosures at the end of this report

1

JSW Steel | 2QFY2016 Result Update

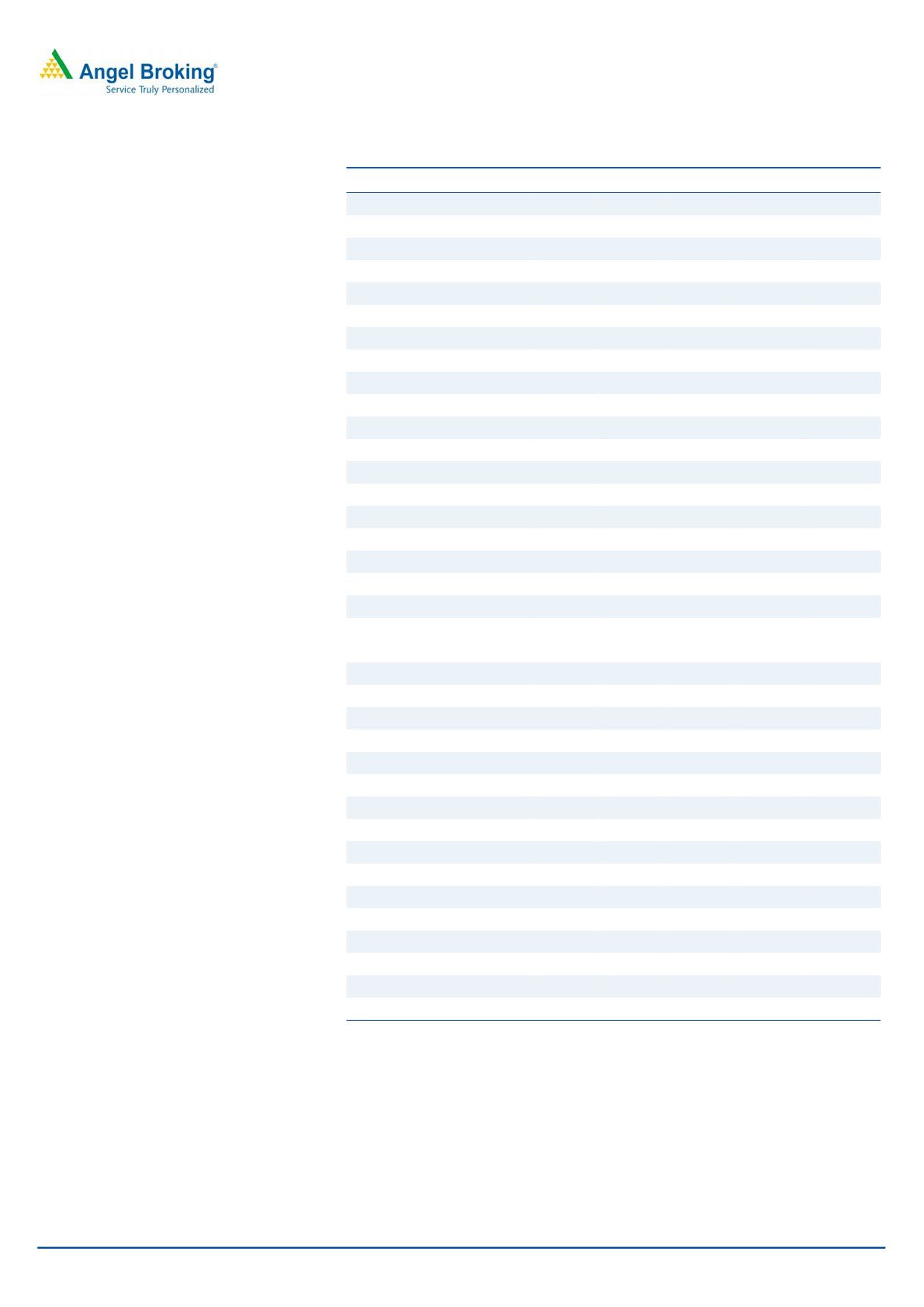

Exhibit 1: 2QFY2016 performance (Standalone)

(` cr)

2QFY16

2QFY15

yoy%

1QFY16

qoq%

FY2015

FY2014

yoy%

Net sales

9,653

11,886

(18.8)

9,982

(3.3)

45,352

44,529

1.8

Raw material

5,458

6,651

(17.9)

5,890

(7.3)

26,064

26,946

(3.3)

% of net sales

56.5

56.0

59.0

57.5

60.5

Power & fuel

834

953

(12.5)

843

(1.1)

3,476

3,354

3.6

% of net sales

8.6

8.0

8.4

7.7

7.5

Staff cost

257

237

8.5

261

(1.6)

947

800

18.4

% of net sales

2.7

2.0

2.6

2.1

1.8

Other expenditure

1,651

1,593

3.7

1,630

1.3

6,729

5,416

24.2

% of net sales

17.1

13.4

16.3

14.8

12.2

Total expenditure

8,199

9,434

(13.1)

8,623

(4.9)

37,216

36,515

1.9

% of net sales

84.9

79.4

86.4

82.1

82.0

Operating profit

1,453

2,452

(40.7)

1,358

7.0

8,136

8,014

1.5

Other operating income

113

168

(32.8)

146

(23.0)

736

768

(4.2)

EBIDTA

1,566

2,620

(40.2)

1,505

4.1

8,872

8,783

1.0

EBITDA margins (%)

16.2

22.0

15.1

19.6

19.7

0.16

Interest

675

720

(6.2)

653

3.3

2,909

2,495

16.6

Depreciation

510

699

(27.1)

752

(32.2)

2,785

2,726

2.2

Other income

106

119

(11.1)

92

14.6

209

86

143.7

Exceptional items

116

(190)

(146)

(396)

(1,692)

Profit before tax

371

1,131

(67.2)

46

704.9

2,992

1,955

42.4

% of net sales

3.8

9.5

0.5

6.6

4.4

Tax

130

369

(64.8)

15

747.4

1,082

621

74.4

% of PBT

35.0

32.6

33.2

36.2

31.8

Reported PAT

241

762

(68.4)

31

683.7

1,909

1,335

43.1

Adj. PAT

349

943

(63.0)

168

107.8

2,305

3,003

(23.2)

Source: Company, Angel Research

Result highlights

Lower realizations continue to dent margins

The company’s standalone revenues for the quarter, at `9,653cr, are in line with

our estimate of

`9,345cr. Raw Material expenses were

2.5% below our

expectations at ~`5,458cr, owing to decline in iron ore and coking coal prices.

We expect the company to further benefit from raw material cost declines in

3QFY2016. Led by better-than-expected revenue, the standalone EBITDA was

2.5% ahead of our estimate at `1,566cr. The EBITDA margin however declined by

582bp yoy.

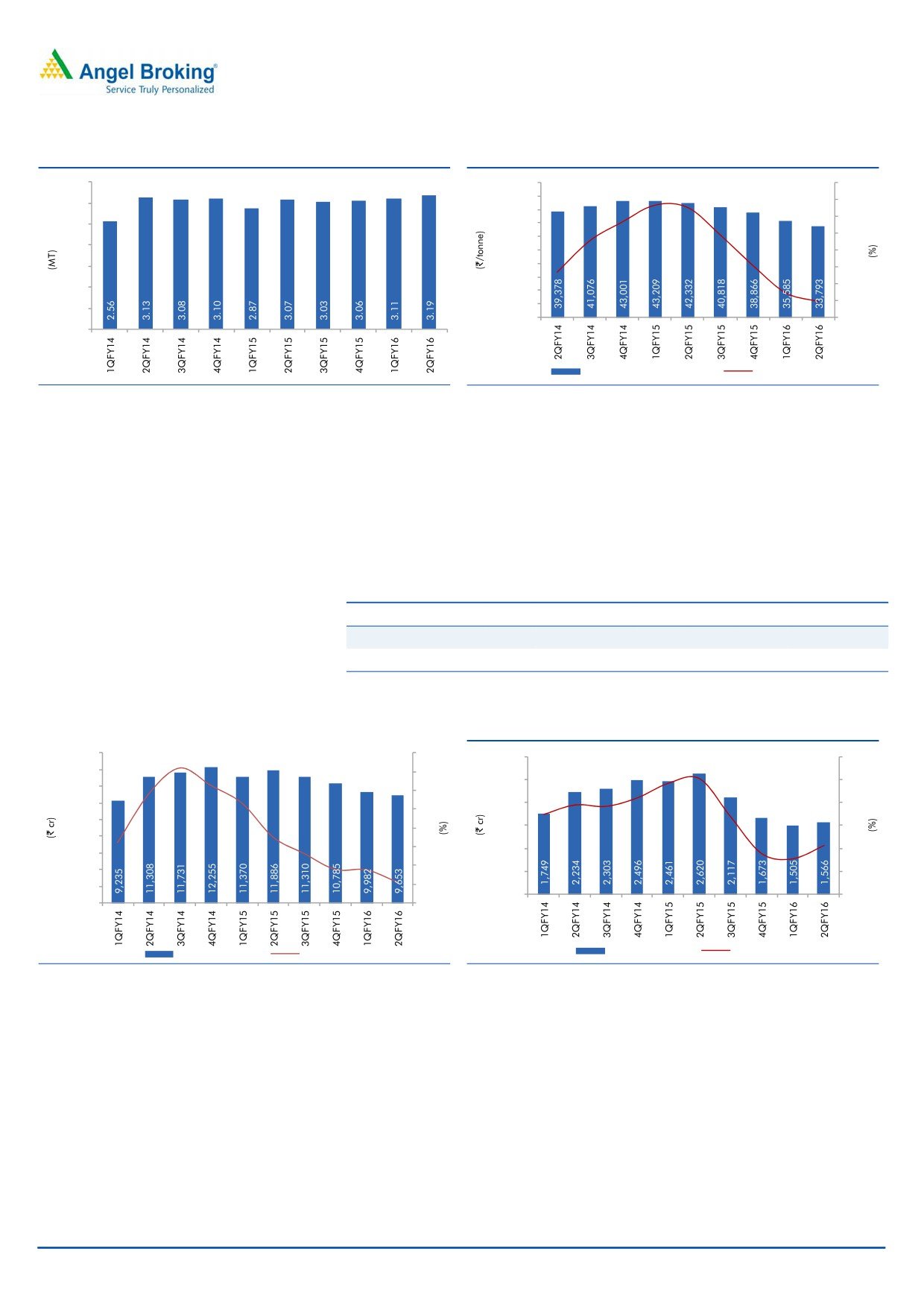

Gross realization/tonne for the quarter declined by 20% yoy to `33,793 from

`42,332 in 2QFY2016, but came in ahead of our expectation of `31,670.

Volumes grew to 3.19MT in 2QFY2016 as against 3.07MT in 2QFY2015, but

were marginally below our expectations of 3.24MT.

October 23, 2015

2

JSW Steel | 2QFY2016 Result Update

Exhibit 2: Volume growth remains steady

Exhibit 3: Realisation dips sharply

3.5

50,000

15

45,000

10

3.0

40,000

5

2.5

35,000

30,000

0

2.0

25,000

(5)

1.5

20,000

(10)

15,000

1.0

(15)

10,000

(20)

0.5

5,000

0

(25)

0.0

Gross Realisation per tonne

yoy change (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

Depreciation expenses declined by 27% yoy, led by a change in the accounting

policy. Revisions in the Companies Act, 2013 allow companies to depreciate assets

over their useful life. Interest costs also declined by 6.2% yoy, led by a reduction in

finance costs. On the back of better-than-expected realisation and lower

depreciation expenses, the company managed to report a net profit of `241cr for

the quarter as against our expectation of a net loss of `44cr.

Exhibit 4: Quarterly performance trend

3Q14

4Q14

1Q15

2Q15

3Q15

4Q15

1Q16

2Q16

Realisation (`/tonne)

41,076 43,001 43,209 42,332 40,818 38,866 35,585 33,793

EBITDA (`/tonne)

7,478

8,052

8,575

8,534

6,988

5,469

4,838

4,908

Source: Company, Angel Research

Exhibit 5: Revenue declines, owing to lower realisation

Exhibit 6: EBITDA margin declines 582bp yoy

13,500

50

3,000

24

12,000

40

2,500

22

10,500

30

9,000

2,000

20

20

7,500

10

1,500

18

6,000

0

1,000

16

4,500

(10)

3,000

500

14

1,500

(20)

0

12

0

(30)

Revenue (LHS)

yoy change (RHS)

EBITDA (LHS)

Margin (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

October 23, 2015

3

JSW Steel | 2QFY2016 Result Update

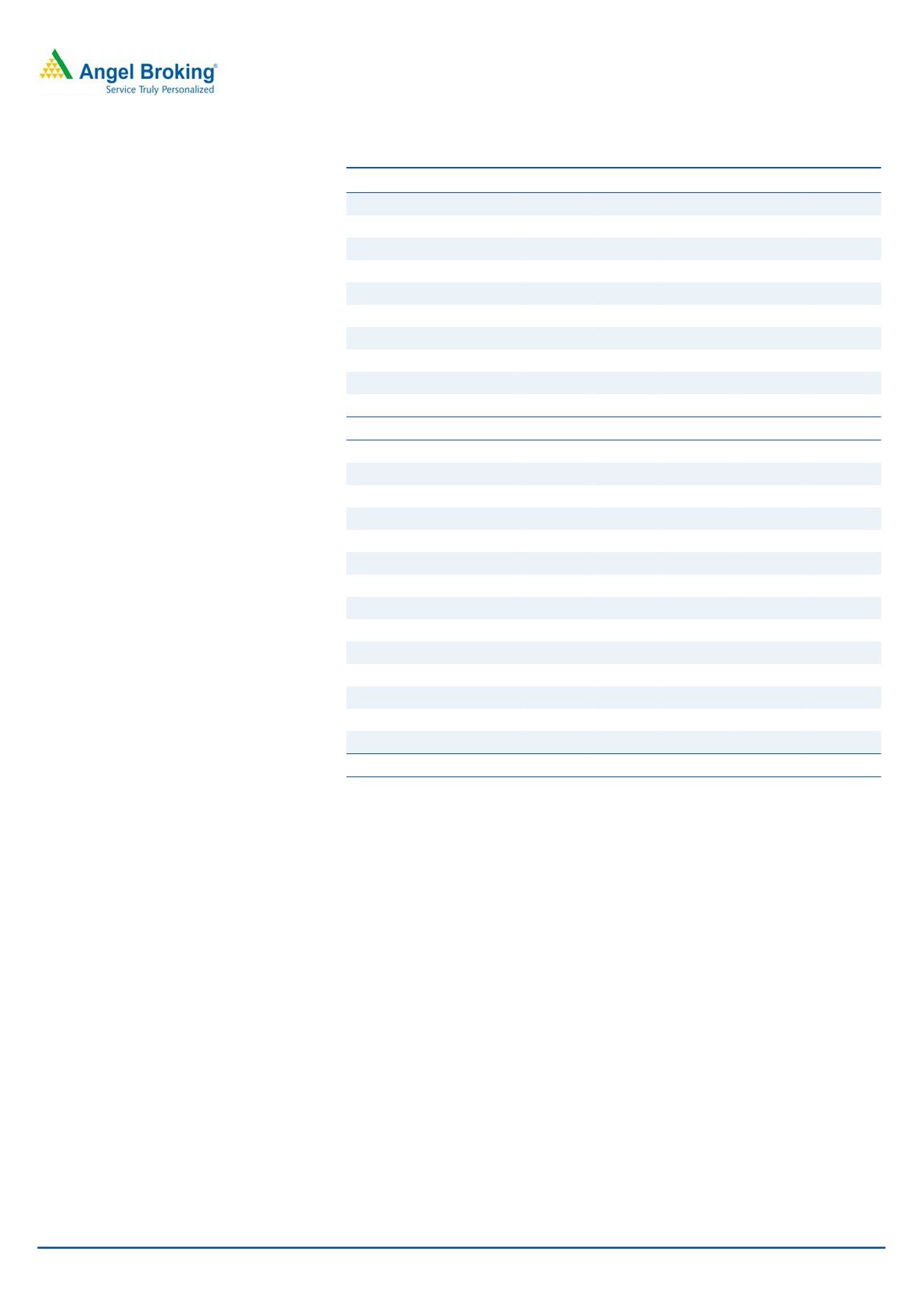

Exhibit 7: 2QFY2016 performance (Consolidated)

(` cr)

2QFY16

2QFY15

yoy%

1QFY16

qoq%

FY2015

FY2014

yoy%

Net sales

10,743

13,692

(21.5)

11,382

(5.6)

52,051

50,409

3.3

Raw material

5,840

7,649

(23.7)

6,527

(10.5)

29,686

30,334

(2.1)

% of net sales

54.4

55.9

57.3

57.0

60.2

Power & fuel

981

1,095

(10.4)

1,034

(5.1)

4,123

3,813

8.1

% of net sales

9.1

8.0

9.1

7.9

7.6

Staff cost

323

387

(16.6)

422

(23.5)

1,533

1,298

18.1

% of net sales

3.0

2.8

3.7

2.9

2.6

Other expenditure

1,943

1,973

(1.5)

1,966

(1.2)

8,249

6,609

24.8

% of net sales

18.1

14.4

17.3

15.8

13.1

Total expenditure

9,178

11,104

(17.3)

9,949

(7.8)

43,590

42,054

3.7

% of net sales

85.4

81.1

87.4

83.7

83.4

Operating profit

1,565

2,588

(39.5)

1,433

9.2

8,460

8,355

1.3

Other operating income

164

203

(19.1)

194

(15.5)

921

811

EBIDTA

1,729

2,791

(38.0)

1,627

6.3

9,381

9,165

2.4

EBITDA margin (%)

16.1

20.4

14.3

18.0

18.2

Interest

836

855

(2.2)

822

1.7

3,493

3,048

14.6

Depreciation

682

851

(19.8)

939

(27.3)

3,434

3,183

7.9

Other income

39

26

47.4

26

51.3

111

86

29.9

Exceptional items

(1)

0

(1)

(26)

(1,713)

Profit before tax

248

1,112

(77.7)

(108)

(329.1)

2,539

1,308

94.1

% of net sales

2.3

8.1

(1.0)

4.9

2.6

Tax

142

374

(61.9)

17

757.0

819

920

(10.9)

% of PBT

57.3

33.6

(15.3)

32.3

70.3

Reported PAT

117

749

(84.4)

(107)

(209.5)

1,720

388

343.3

Adj. PAT

118

749

(84.2)

(106)

(211.6)

1,822

2,141

(14.9)

Source: Company, Angel Research

Exhibit 8: Consolidated - 2QFY2016 Actual vs Angel estimates

(` cr)

Actual

Estimates

Variation (%)

Net sales

10,743

10,190

5.4

EBITDA

1,729

1,313

31.8

EBITDA margin (%)

16.1

12.9

322bp

Source: Company, Angel Research

Result highlights - Consolidated

Better than expected performance from subsidiaries

On a consolidated basis, the company’s net sales declined ~21.5% yoy to

`10,743cr, still ~5.4% ahead of our estimate. Coated Products’ revenues came in

ahead of our expectations at `1,927cr on account of higher realizations. Coated

Products’ realisations have not declined as sharply as HRC prices, which explain

the outperformance. Coated Products’ EBITDA increased 5.3% yoy to `102cr

during the quarter as against our expectations of `60cr. The company’s Chilean

operations posted an EBITDA loss of $0.48mn as against a loss of $1.76mn in

2QFY2015, in line with the guidance given by the company.

October 23, 2015

4

JSW Steel | 2QFY2016 Result Update

Exhibit 9: Quarterly performance trend (Coated Products)

3Q14

4Q14

1Q15

2Q15

3Q15

4Q15

1Q16

2Q16

Deliveries (MT)

0.42

0.44

0.40

0.41

0.37

0.39

0.40

0.37

EBITDA Margin

3.2

3.4

3.8

4.3

2.9

2.8

5.2

5.3

Source: Company, Angel Research

Strong realizations at US Plate and Pipe mill

The company’s plate and pipe mill business in the US reported an EBITDA loss of

$3.1mn as against our expectations of an EBITDA loss of $8.5mn. The lower than

expected loss was on account of better than expected realizations, leading to a

revenue of $53.4mn for the quarter as against our estimate of a revenue of

$42.5mn. Realisation/tonne dipped 2% yoy but increased 12% on a sequential

basis to $989, well ahead of our expectations of $735. Pipe volumes, at

15,964MT, also came in ahead of our expectations of 12,461MT. Plate volumes

however disappointed at 38,054MT as against our estimate of 42,250MT.

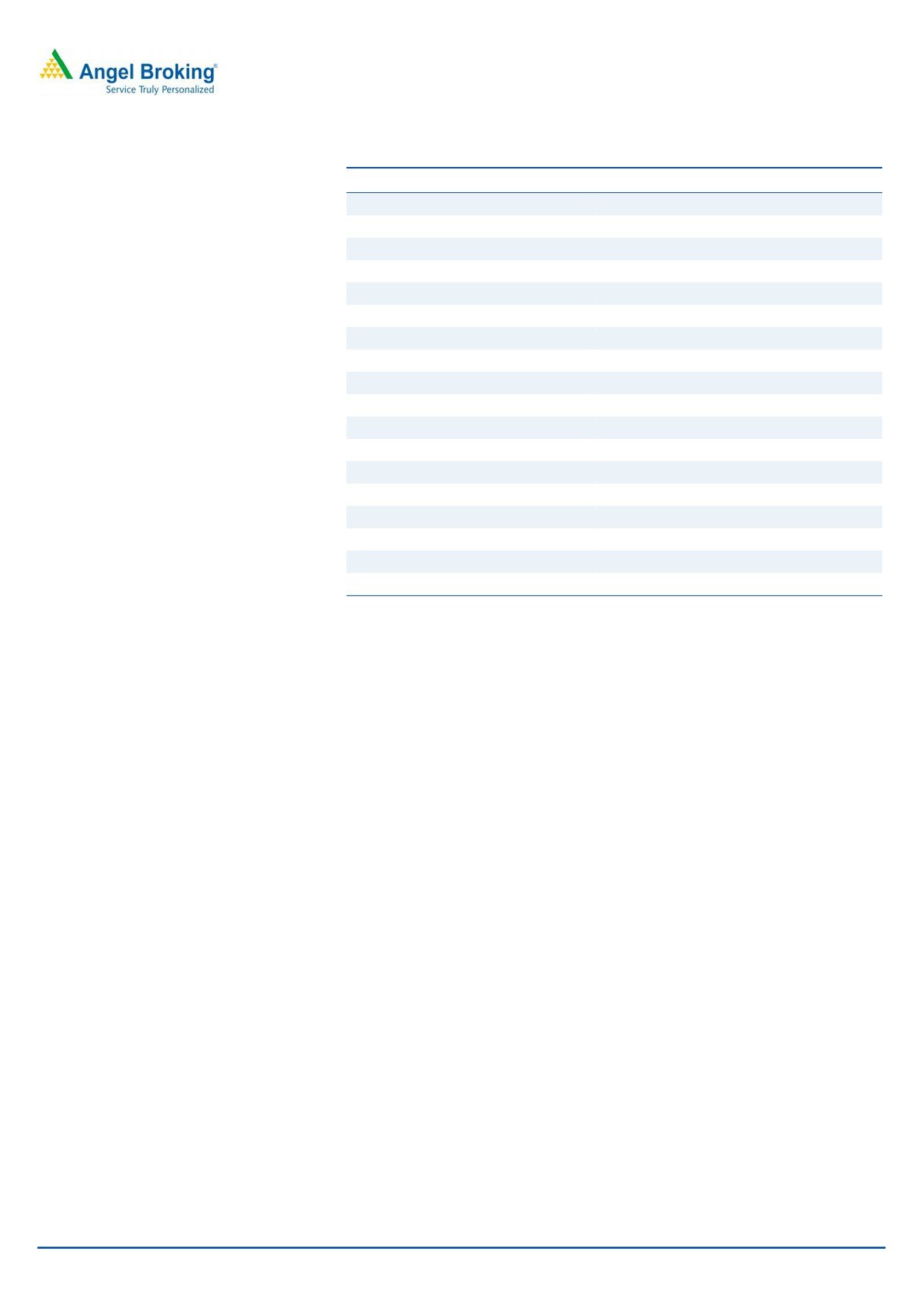

Exhibit 10: US Plate and Pipe Mill Volumes

MT

3Q14

4Q14

1Q15

2Q15

3Q15

4Q15

1Q16

2Q16

Plate Volumes

77813

85892

86642

78094

57898

58024

43614

38054

Pipe Volumes

17608

14217

8373

15096

16421

12138

15565

15964

Source: Company

October 23, 2015

5

JSW Steel | 2QFY2016 Result Update

Investment arguments

Capacity expansion remains on track

JSW Steel is in the process of increasing its capacity to 17.8MT by end-FY2016

from 14.3MT currently. The Management reiterated in the conference call that the

expansion is progressing as per schedule. The expansion at Dolvi, which includes

blast furnace modification, a new sinter plant, billet caster and a bar mill are

scheduled to be commissioned in 2HFY2016. Capacity at Dolvi is expected to

increase to 5MT post expansion from 3.3MT currently. The Vijaynagar expansion is

also expected to be completed by 4QFY2016. We expect volumes to continue to

grow, led by higher capacity. We estimate deliveries of 12.6MT and 13.7MT in

FY2016 and FY2017, respectively.

Margins to sustain going forward

While steel realizations have declined sharply, the company still has some levers to

sustain margins. These include, 1) Lower iron ore and coking coal prices are yet to

pass through. Domestic iron ore prices are expected to decline as supply in

Karnataka increases. The Management expects coking coal cost to decline by a

further $4-$5/tonne over the coming months. 2) The Management also indicated

certain cost saving measures and initiatives which will help reduce costs.

3) Improving mix toward higher margin value added products will help the

company drive its margins going forward.

October 23, 2015

6

JSW Steel | 2QFY2016 Result Update

Outlook and valuation

The results have been marginally better than our expectations, but the outlook on

steel prices continues to remain weak. Pressure from imports and slowdown in

China remain key concerns for the domestic steel industry. We believe that things

may not have bottomed out yet and expect further pain for the industry. In line with

our expectations, we have not materially changed our FY2016 and FY2017

EBITDA estimates. At the current price of `906, the stock trades at 7x FY2017

EV/EBITDA; we retain our Neutral rating on the stock.

Company background:

JSW Steel Ltd is India’s largest integrated steel producer with a manufacturing

capacity of 14.3MT with facilities in Karnataka, Tamil Nadu and Maharashtra. The

company’s products include hot rolled coils, cold rolled coils, wire rods, galvanized

coils and sheets (~35% share of value added and special products). ~20% of its

products are exported, making the company India’s largest exporter of coated

products with a presence in over 100 countries.

October 23, 2015

7

JSW Steel | 2QFY2016 Result Update

Profit & Loss Statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Gross sales

41,463

54,621

56,577

45,987

49,072

Less: Excise duty

3,368

4,212

4,164

3,385

3,612

Net Sales

38,095

50,409

52,051

42,308

45,147

Other operating income

115

811

921

715

762

Total operating income

38,210

51,220

52,972

43,022

45,909

% chg

11.2

34.0

3.4

(18.8)

6.7

Total Expenditure

31,706

42,054

43,590

36,104

36,581

Net Raw Materials

24,168

30,334

29,686

26,439

26,448

Other Mfg costs

6,557

10,422

12,372

8,419

8,804

Personnel

980

1,298

1,533

1,246

1,330

EBITDA

6,504

9,165

9,381

6,918

9,328

% chg

6.6

40.9

2.4

(26.3)

34.8

(% of Net Sales)

17.1

18.2

18.0

16.4

20.7

Depreciation& Amortisation

2,237

3,183

3,434

3,805

4,071

EBIT

4,266

5,983

5,947

3,114

5,258

% chg

2.3

40.2

(0.6)

(47.6)

68.9

(% of Net Sales)

11.2

11.9

11.4

7.4

11.6

Interest & other Charges

1,967

3,048

3,493

3,780

3,821

Other Income

70

86

111

220

253

(% of PBT)

2.9

2.8

4.3

(49.3)

15.0

Recurring PBT

2,369

3,021

2,565

(446)

1,690

% chg

(16.0)

27.5

(15.1)

(117.4)

(478.7)

Exchange gain/(loss)

(369)

(1,713)

(25.9)

(25.9)

(25.9)

PBT (reported)

1,999

1,308

2,539

(472)

1,664

Tax

845

920

819

(152)

537

(% of PBT)

42.3

70.3

32.3

32.3

32.3

PAT (reported)

1,154

388

1,720

(320)

1,127

Add: Share of earnings of asso.

(165)

14

2

2

2

Less: Minority interest (MI)

34

50

75

75

75

Extraordinary Expense/(Inc.)

61

-

-

-

-

PAT after MI (reported)

1,085

452

1,797

(243)

1,203

ADJ. PAT

1,361

2,141

1,822

(217)

1,229

% chg

(33.4)

57.3

(14.9)

(111.9)

(666.0)

(% of Net Sales)

3.6

4.2

3.5

(0.5)

2.7

Basic EPS (`)

59.5

87.2

74.0

(10.3)

49.5

Adj. fully Diluted EPS (`)

59.5

87.2

74.0

(10.3)

49.5

% chg

(33.9)

46.5

(15.2)

(114.0)

(578.8)

October 23, 2015

8

JSW Steel | 2QFY2016 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E

SOURCES OF FUNDS

Equity Share Capital

284

303

303

303

303

Reserves & Surplus

17,060

21,150

22,266

21,649

22,479

Shareholders Funds

17,344

21,453

22,569

21,952

22,781

Share Warrants

-

-

-

-

-

Minority Interest

197

167

98

23

(52)

Total Loans

26,812

39,749

45,772

46,772

46,772

Deferred Tax Liability

3,272

2,123

2,889

2,757

3,223

Other Long term liabilities

600

910

591

592

593

Long term provisions

41

60

90

100

110

Total Liabilities

48,482

64,947

72,760

72,947

74,179

APPLICATION OF FUNDS

Gross Block

44,553

59,736

68,604

73,563

78,546

Less: Acc. Depreciation

11,151

14,252

18,013

21,817

25,888

Net Block

33,402

45,484

50,591

51,746

52,659

Capital Work-in-Progress

5,898

9,400

8,265

8,306

5,822

Goodwill

1,314

1,562

1,585

1,685

1,725

Investments

1,750

663

599

598

599

Current Assets

11,790

15,382

18,817

17,675

18,433

Cash

1,653

663

1,913

1,954

2,336

Loans & Advances

2,535

4,272

3,395

2,971

3,396

Other

7,602

10,448

13,509

12,750

12,701

Current liabilities

9,246

12,693

13,159

13,124

11,122

Net Current Assets

2,544

2,690

5,658

4,551

7,312

Misc. Exp. not written off

-

-

-

-

-

Total Assets

48,482

64,947

72,760

72,947

74,179

October 23, 2015

9

JSW Steel | 2QFY2016 Result Update

Cash flow statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E

Profit before tax

1,999

1,308

2,539

(472)

1,664

Depreciation

2,237

3,183

3,434

3,805

4,071

Change in Working Capital

589

(3,520)

(1,175)

1,148

(2,379)

Others

-

-

-

-

-

Direct taxes paid

511

404

773

(20)

71

Cash Flow from Operations

4,315

567

4,026

4,500

3,284

(Inc.)/ Dec. in Fixed Assets

(5,630)

(5,670)

(6,650)

(5,000)

(2,500)

(Inc.)/ Dec. in Investments

12.0

(56.8)

207.0

1.5

(1.5)

Share of profit from associates

185

56

86

0

0

Cash Flow from Investing

(5,433)

(5,671)

(6,357)

(4,999)

(2,502)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

955

6,029

2,737

1,000

0

Dividend Paid (Incl. Tax)

227

315

344

372

372

Others

1,519

2,413.1

2,562.6

-

-

Cash Flow from Financing

(791)

3,300

(169)

628

(372)

Inc./(Dec.) in Cash

(1,909)

(1,803)

(2,500)

130

410

Opening Cash balances

683

302

579

913

954

Closing Cash balances

302

579

913

954

1,335

October 23, 2015

10

JSW Steel | 2QFY2016 Result Update

Key ratios

Y/E March

FY2013

FY2014

FY2015

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

15.2

10.4

12.2

NMF

18.3

P/CEPS

6.3

6.0

4.2

6.1

4.2

P/BV

1.2

1.0

1.0

1.0

1.0

Dividend yield (%)

1.1

1.2

1.3

1.3

1.3

EV/Sales

1.1

1.2

1.3

1.6

1.5

EV/EBITDA

6.7

6.6

6.9

9.6

7.0

EV/Total Assets

0.9

0.9

0.9

0.9

0.9

Per Share Data (`)

EPS (Basic)

59.5

87.2

74.0

(10.3)

49.5

EPS (fully diluted)

59.5

87.2

74.0

(10.3)

49.5

Cash EPS

143.4

150.3

216.4

147.3

218.2

DPS

10.0

11.0

12.0

12.0

12.0

Book Value

764.8

875.9

922.1

896.5

930.8

Dupont Analysis

EBIT margin

11.2

11.9

11.4

7.4

11.6

Tax retention ratio (%)

57.7

29.7

67.7

67.7

67.7

Asset turnover (x)

0.9

0.8

0.8

0.6

0.7

ROIC (Post-tax)

5.6

2.9

6.0

3.1

5.2

Cost of Debt (Post Tax)

4.7

2.7

5.5

5.5

5.5

Leverage (x)

1.4

1.8

1.9

2.0

1.9

Operating RoE

7.0

3.3

6.9

(1.8)

4.6

Returns (%)

RoCE (Pre-tax)

9.7

10.9

8.9

4.4

7.3

Angel RoIC (Pre-tax)

12.5

13.7

10.9

5.3

8.7

RoE

8.1

11.2

8.4

(1.0)

5.6

Turnover ratios (x)

Asset Turnover (Gross Block)

0.9

1.0

0.8

0.6

0.6

Inventory (days)

50

46

62

80

75

Receivables (days)

17

16

17

22

21

Payables (days)

27

26

29

33

29

WC cycle (ex-cash) (days)

13

44

60

75

72

Solvency ratios (x)

Net debt to equity

1.4

1.8

1.9

2.0

1.9

Net debt to EBITDA

3.6

4.2

4.6

6.4

4.7

Interest Coverage

2.2

2.0

1.7

0.8

1.4

October 23, 2015

11

JSW Steel | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited.. It is also registered as a Depository Participant

with CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private

Limited is a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration

number INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for

accessing /dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial

interest/beneficial ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any

compensation / managed or co-managed public offering of securities of the company covered by Analyst during the past twelve

months. Angel/analyst has not served as an officer, director or employee of company covered by Analyst and has not been engaged in

market making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

JSW Steel

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

October 23, 2015

12