1QFY2017 Result Update | Pharmaceutical

August 16, 2016

IPCA Laboratories

BUY

CMP

`532

Performance Highlights

Target Price

`613

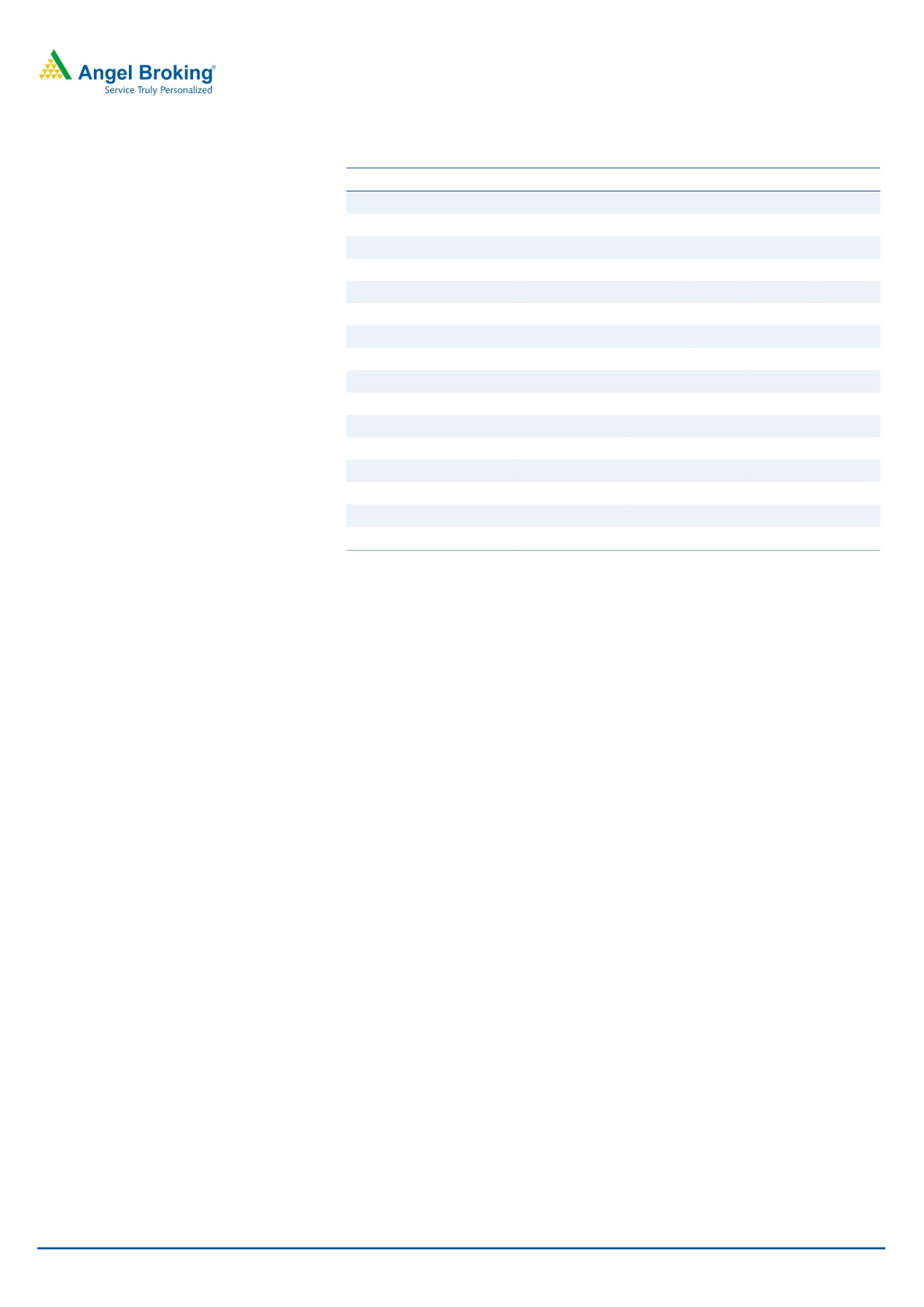

Y/E March (` cr)

1QFY2017 4QFY2016

% chg (QoQ) 1QFY2016

% chg (yoy)

Investment Period

12 Months

Net sales

822

612

34.2

751

9.4

Other income

17

18

(4.5)

11

56.2

Stock Info

Operating profit

108

51

110.9

75

43.6

Sector

Pharmaceutical

Tax

29

(16)

-

8

251.9

Market Cap (` cr)

6,714

Adj. net profit/(loss)

48

38

26.2

28

69.9

Net Debt (` cr)

337

Source: Company, Angel Research

Beta

0.6

For 1QFY2017, the company posted better than expected sales and OPM while

52 Week High / Low

888/402

the net profit missed our estimates. Sales came in at `822cr V/s `680cr expected

Avg. Daily Volume

55,668

and V/s `751cr in 1QFY2016, ie a yoy growth of 9.4%. Formulations (`620cr)

Face Value (`)

2

posted a yoy growth of 15%, while API (`202cr) posted a yoy de-growth of 3%.

BSE Sensex

28,152

On the operating front, the EBITDA margin came in at 13.1% V/s 9.6% expected,

Nifty

8,672

V/s 10.0% in 1QFY2016, and V/s 8.4% in 4QFY2016. Other income (`17.4cr)

Reuters Code

IPCA.BO

posted a yoy growth of 56.2%. Thus, the Adj. net profit came in at `48cr V/s

Bloomberg Code

IPCA@IN

`52cr expected and V/s `28cr in 1QFY2016, a yoy growth of 69.9%. We

maintain our Buy on the stock.

Shareholding Pattern (%)

Results better than expected on sales and operating fronts: Sales came in at

Promoters

45.9

`822cr V/s `680cr expected and V/s `751cr in 1QFY2016, ie a yoy growth of

MF / Banks / Indian Fls

18.1

9.4%. Formulations (`620cr) posted a yoy growth of 15%, while API (`202cr)

FII / NRIs / OCBs

23.5

posted a yoy de-growth of 3%. Domestic formulation sales (`345cr) posted a yoy

Indian Public / Others

12.6

growth of 9%, while exports formulation sales (`275cr) posted a yoy growth of

22%. Domestic API sales (`35cr) posted a de-growth of 37% yoy and exports API

sales (`166cr) posted a growth of 9% yoy. On the operating front, the EBITDA

Abs. (%)

3m 1yr

3yr

margin came in at 13.1% V/s 9.6% expected, V/s 10.0% in 1QFY2016, and V/s

Sensex

8.8

(0.0)

48.3

8.4% in 4QFY2016. Thus, the Adj. net profit came in at `48cr V/s `52cr

Ipca

11.8

(3.0)

162.9

expected and V/s `28cr in 1QFY2016, a yoy growth of 69.9%.

Outlook and Valuation: We expect net sales to post a 15.6% CAGR to `3,799cr,

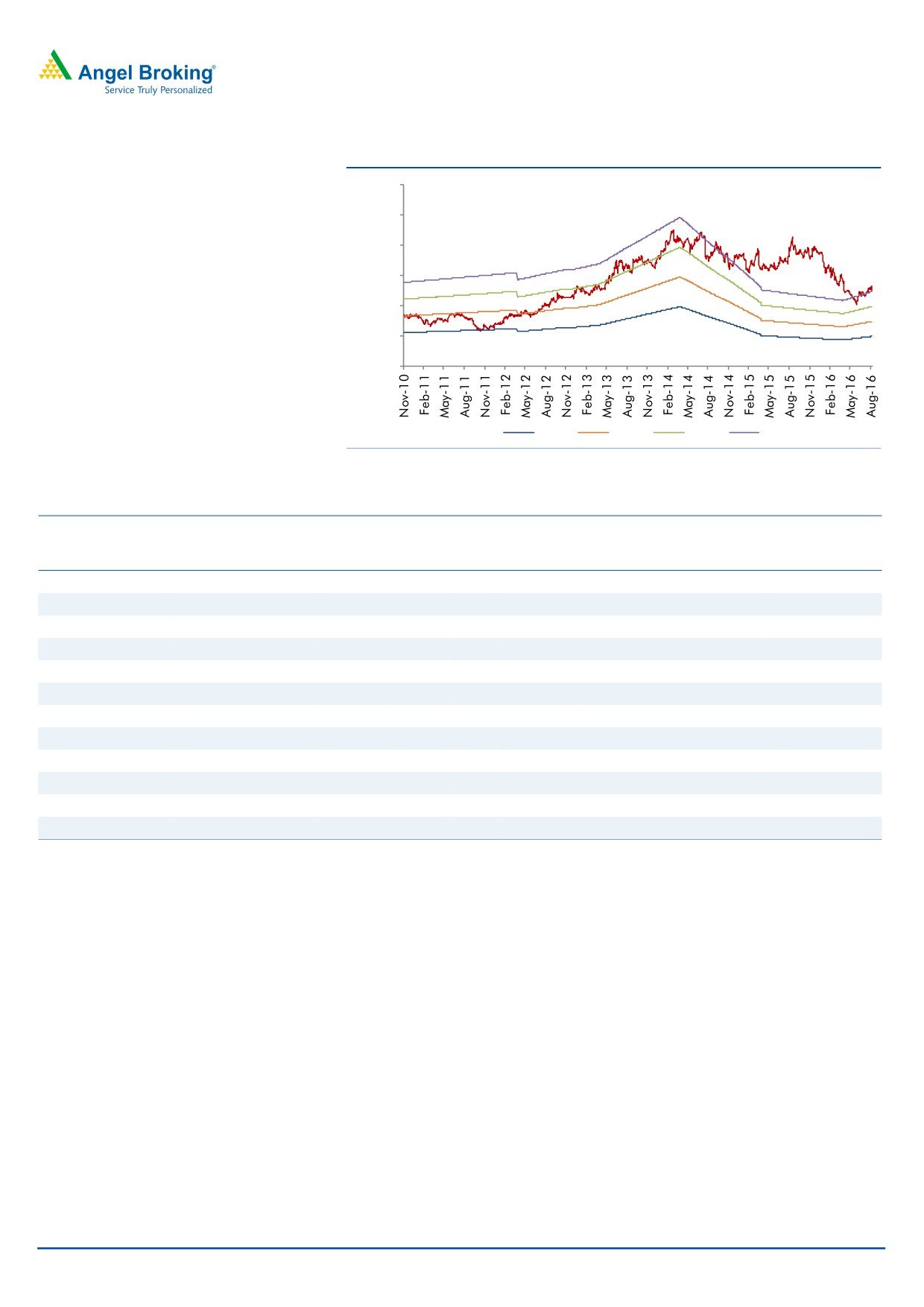

3-Year Daily Price Chart

and EPS to register a 36.5% CAGR to `19.7 over FY2016-18E. The company’s

1,000

financials will be impacted by the USFDA import alert on the Ratlam, Indore and

800

Silvassa facilities. While the problems are likely to persist for a while, we expect the

company’s performance to witness a gradual pick-up going forward. Given the

600

inexpensive valuations, we maintain our Buy rating on the stock.

400

Key financials (Consolidated)

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

200

Net sales

3,117

2,844

3,303

3,799

% chg

(2.6)

(8.7)

16.1

15.0

Adj. Net profit

254

133

219

248

Source: Company, Angel Research

% chg

(48.6)

(47.6)

64.2

13.5

EPS

20.1

10.6

17.3

19.7

EBITDA margin (%)

16.2

10.6

15.3

15.3

P/E (x)

21.2

40.4

24.6

21.7

RoE (%)

12.2

5.9

9.1

9.4

RoCE (%)

10.9

4.1

8.4

8.8

P/BV (x)

2.4

2.3

2.1

2.0

Sarabjit Kour Nangra

EV/Sales (x)

1.9

2.0

1.7

1.5

+91 22 39357800 Ext: 6806

EV/EBITDA (x)

11.9

19.0

11.4

10.1

Source: Company, Angel Research; Note: CMP as of August 12, 2016

Please refer to important disclosures at the end of this report

1

Ipca Laboratories | 1QFY2017 Result Update

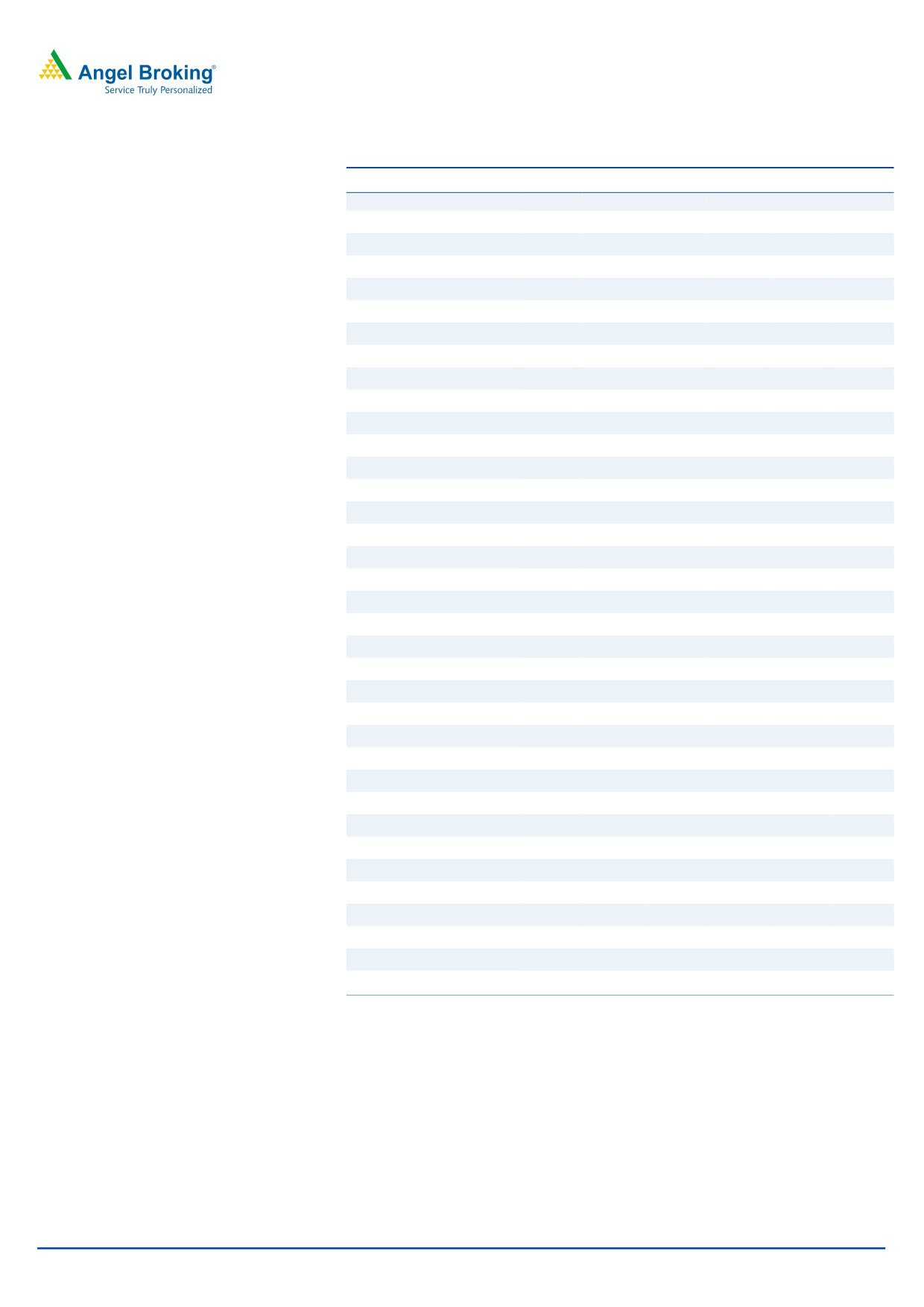

Exhibit 1: 1QFY2017 - Standalone performance

Y/E March (` cr)

1QFY2017 4QFY2016

% chg (QoQ)

1QFY2016

% chg (YoY) FY2016 FY2015

% chg (yoy)

Net sales

822

612

34.2

751

9.4

2844

3060

(7.0)

Other income

17

18

(4.5)

11

56.2

57

65

(11.6)

Total income

839

630

33.1

762

10.1

2902

3125

(7.1)

Gross profit

508

395

28.8

454

12.0

1787

1917

(6.8)

Gross margins (%)

61.9

64.4

60.4

62.8

62.6

Operating profit

108

51

110.9

75

43.6

262

495

(47.1)

Operating margin (%)

13.1

8.4

10.0

9.2

16.2

Interest

7

8

(19.3)

5

20.3

32

26

21.6

Depreciation

42

39

7.6

42

0.1

172

177

(2.7)

PBT

77

22

246.8

39

-

112

352

(68.2)

Provision for taxation

29

(16)

(285.8)

8

19

102

(81.8)

Less: Exceptional Items

0

0

12

0

0

(gains)/ loss

Reported Net profit

48

38

26.2

21

127.4

93

254

(63.3)

Adj. Net profit/(loss)

48

38

26.2

28

69.9

93

254

(63.3)

EPS (`)

3.7

2.9

2.2

7.3

19.8

Source: Company, Angel Research, FY numbers are consolidated

Exhibit 2: 1QFY2017 - Actual vs Angel estimates

(` cr)

Actual

Estimates

Variation (%)

Net sales

822

680

20.8

Other income

17

18

(4.6)

Operating profit

108

66

64.5

Interest

7

8

(19.4)

Tax

29

(16)

-

Adjusted Net profit/(loss)

48

52

(8.7)

Source: Company, Angel Research

Revenue below our estimate; grew at 9.4% yoy: Sales came in at `822cr V/s

`680cr expected and V/s `751cr in 1QFY2016, ie a yoy growth of

9.4%.

Formulations (`620cr) posted a yoy growth of 15%, while API (`202cr) posted a

yoy de-growth of 3%. Domestic formulation sales (`345cr) posted a yoy growth of

9%, while exports formulation sales (`275cr) posted a yoy growth of

22%.

Domestic API sales (`35cr) posted a de-growth of 37% yoy and export API sales

(`166cr) posted a growth of 9% yoy.

Domestic sales growth was impacted to the tune of ~4% by the FDC ban and a

price decline in the NELM portfolio. The Management expects the domestic

business to grow ~12% yoy in FY2017. Such recovery will be led by a ramp-up of

the anti-malaria portfolio. The export formulation segment reported a strong

growth of ~22% yoy, led by USA and the institutional business. Sales in the US

during the quarter were driven by HCQS and Propranolol. For the rest of FY2017,

HCQS will not contribute to sales due to slow ramp-up and channel filling but

would continue contributing to profit share.

Overall, for 1QFY2017, exports contributed 53.7% to the top-line while the

domestic business contributed the rest. The overall contribution of formulations was

at 75.4% of total sales during the quarter. This is against 72.2% in 1QFY2016.

August 16, 2016

2

Ipca Laboratories | 1QFY2017 Result Update

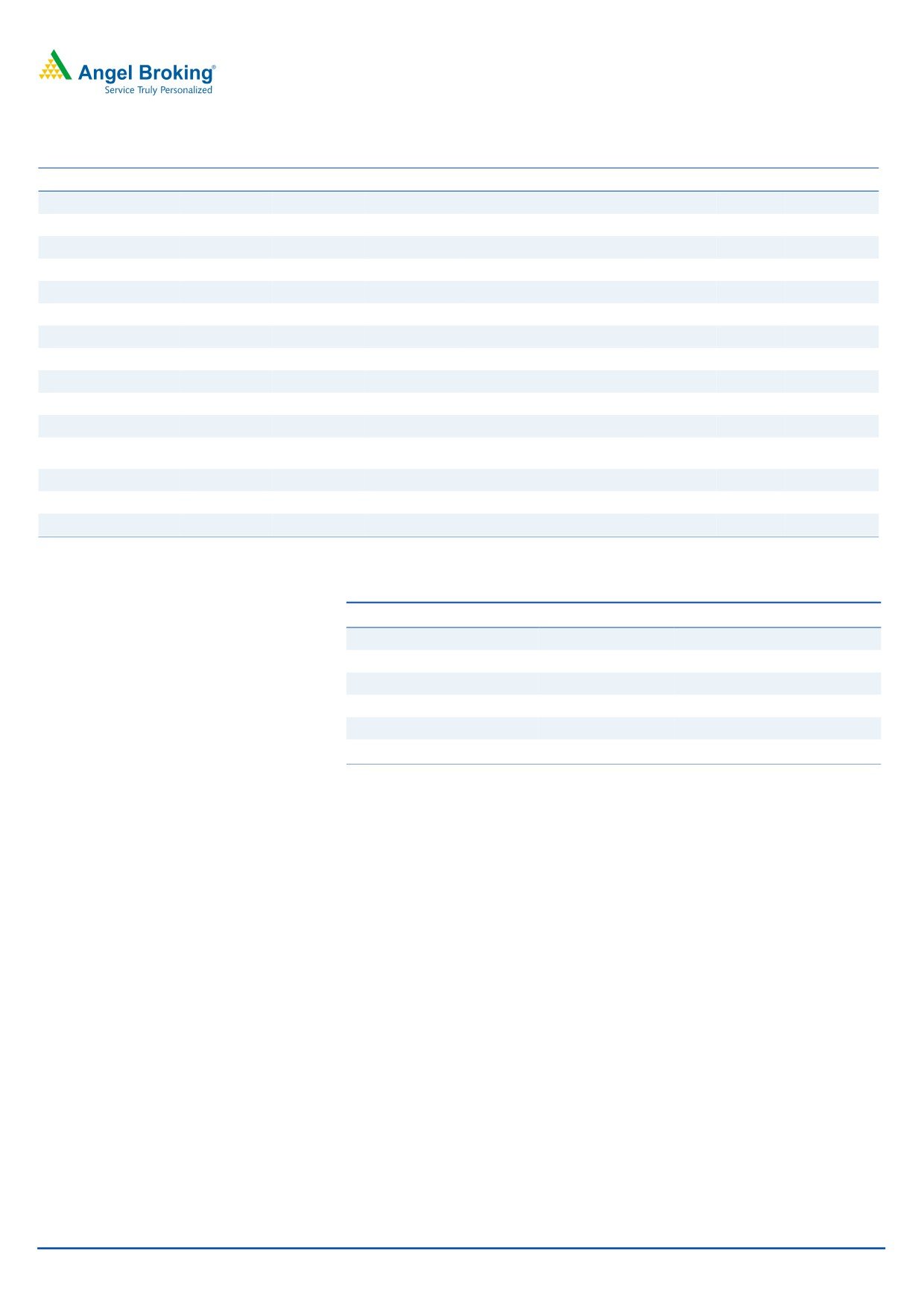

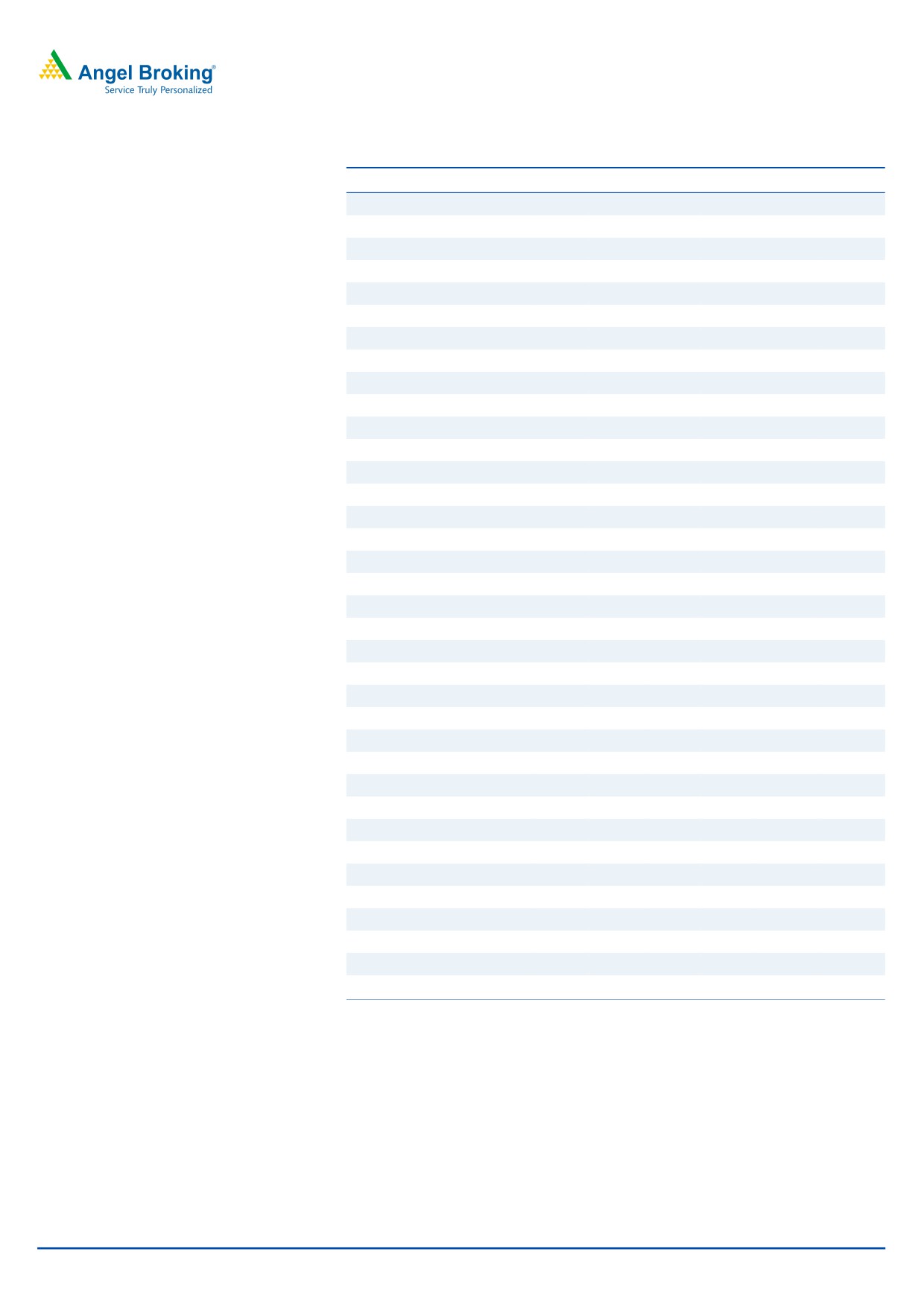

Exhibit 3: Domestic sales trend

400

345

360

331

318

308

320

280

250

240

200

160

120

80

56

33

35

28

24

40

0

1QFY2016

2QFY2016

3QFY2016

4QFY2016

1QFY2017

Formulation

API

Source: Company, Angel Research

Exhibit 4: Exports sales trend

320

275

280

249

225

227

240

221

200

166

152

147

160

117

120

91

80

40

0

1QFY2016

2QFY2016

3QFY2016

4QFY2016

1QFY2017

Formulation

API

Source: Company, Angel Research

OPM expands yoy: On the operating front, the gross margin came in at 61.9% V/s

60.4% in 1QFY2016 on back of an improved sales mix, while the EBDITA margin

came in at 13.1% V/s 10.0% in 1QFY2016. The margins are likely to improve

once the US business picks up, which would hopefully be by FY2018. The

Management expects the EBDITA margin to be around 16.0-16.5%.

August 16, 2016

3

Ipca Laboratories | 1QFY2017 Result Update

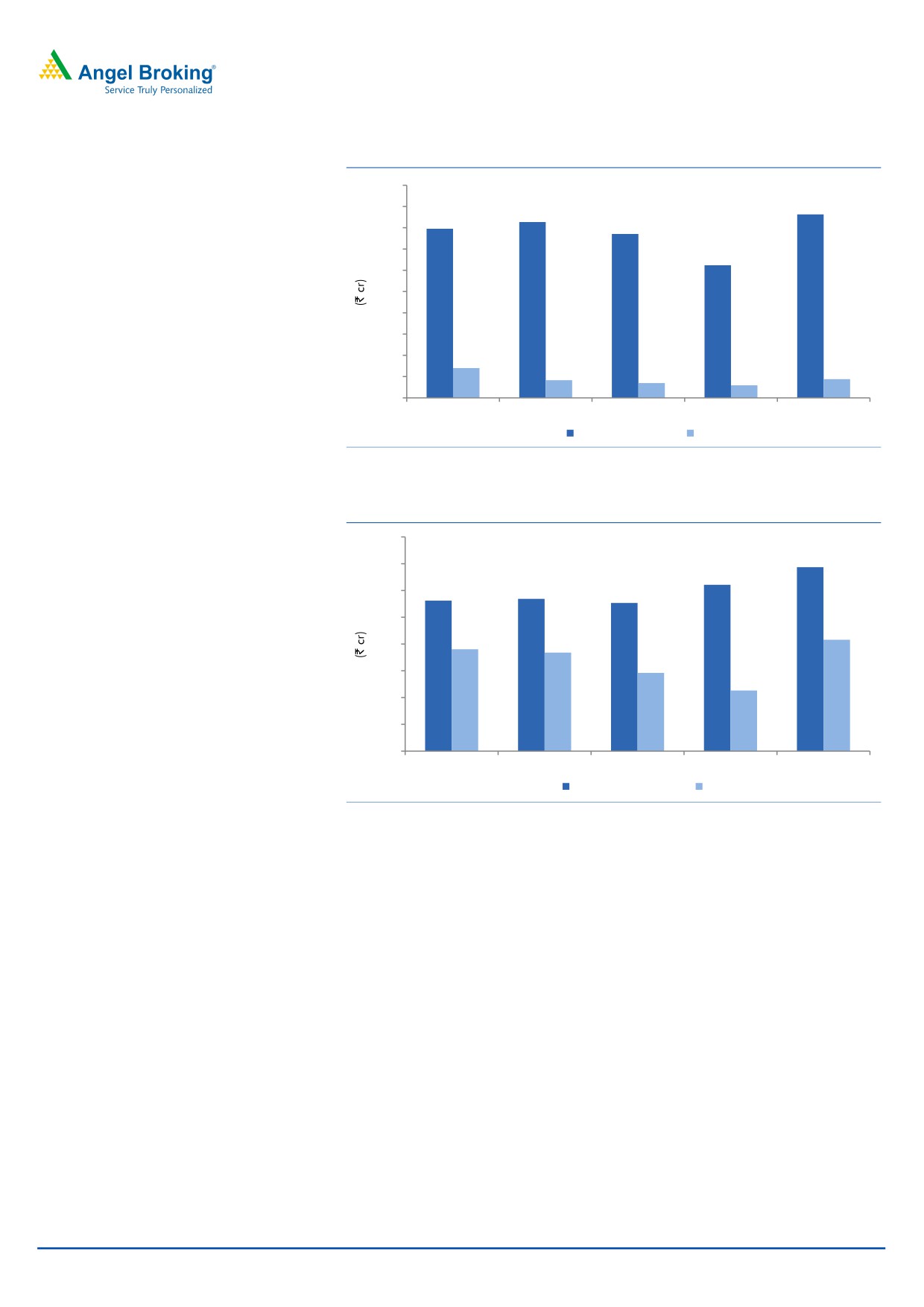

Exhibit 5: OPM trend

15.0

13.0

13.1

11.4

10.6

11.0

10.0

9.0

8.4

7.0

1QFY2016

2QFY2016

3QFY2016

4QFY2016

1QFY2017

Source: Company, Angel Research

Reported net profit lower than estimates: Other income (`17.4cr), posted a yoy

growth of 56.2%. Thus, the Adj. net profit came in at `48cr V/s `52cr expected

and V/s `28cr in 1QFY2016, a yoy growth of 69.9%.

Exhibit 6: Adj. Net profit trend

60

48

50

38

40

28

30

24

20

12

10

0

1QFY2016

2QFY2016

3QFY2016

4QFY2016

1QFY2017

Source: Company, Angel Research

Concall Highlights

Top-line growth for FY2017 estimated by Management at ~11.0-12.0% yoy.

R&D as % of sales stood at 3.7% in 1QFY2017.

Gross margin expected to be ~65.0% in FY2017.

Investment arguments

Domestic formulations business - the cash cow: Ipca has been successful in

changing its business focus to the high-margin chronic and lifestyle segments

from the low-margin anti-malarial segment. The chronic and lifestyle

segments, comprising CVS, anti-diabetics, pain-management, CNS and

dermatology products, constitute more than 50% of the company’s domestic

August 16, 2016

4

Ipca Laboratories | 1QFY2017 Result Update

formulation sales. The Management has ramped up its field force significantly

with addition of divisions in the domestic formulations segment, taking the

current total strength to nearly 4,000MRs. With an expected pick-up in sales in

FY2017, we expect the domestic formulation business to grow at a CAGR of

16.2% over FY2016-18E.

Exports currently under pressure; should pickup only by FY2018: On the

formulations front, Ipca has been increasing its penetration in regulated

markets, viz Europe and the US, by expanding the list of generic drugs backed

by its own API. In the emerging and semi-regulated markets, the company

plans to focus on building brands in the CVS, CNS, pain-management and

anti-malarial segments along with tapping new geographies. On the API front,

where the company is among the low-cost producers, it is aggressively

pursuing supply tie-ups with pharmaceutical MNCs.

After the USFDA inspection at the company’s APl manufacturing facility at

Ratlam (Madhya Pradesh), the company has received certain inspection

observations in Form 483, consequent to which the company had voluntarily

decided to temporarily suspend API shipments from this manufacturing facility

to the US markets until the issue getting resolved. However, the 483 was

converted into an import alert, except for 4 APIs which constituted around 45%

of US sales in FY2014.

The company’s Silvassa and Indore facilities (formulation facilities) are also

under import alert. These developments impacted FY2015 sales, while

FY2017/FY2018 should see some revival. We expect exports to grow at a

CAGR of 15.0% over FY2016-18E.

Outlook & Valuation:

We expect net sales to post a 15.6% CAGR to `3,799cr, and EPS to register a

36.5% CAGR to `19.7 over FY2016-18E. The company’s financials will be

impacted by the USFDA import alert on the Ratlam, Indore and Silvassa facilities.

While the problems are likely to persist for a while, we expect a gradual pick-up in

performance only by FY2018. Still, given the valuations, we maintain our Buy

rating on the stock with a price target of 613.

Exhibit 7: Key Assumptions

FY2017E

FY2018E

Sales growth (%)

16.1

15.0

Domestic growth (%)

17.4

15.0

Exports growth (%)

15.0

15.0

Operating margins (%)

15.3

15.3

R&D Exp ( % of sales)

4.0

4.0

Capex (` cr)

500

500

Source: Company, Angel Research

August 16, 2016

5

Ipca Laboratories | 1QFY2017 Result Update

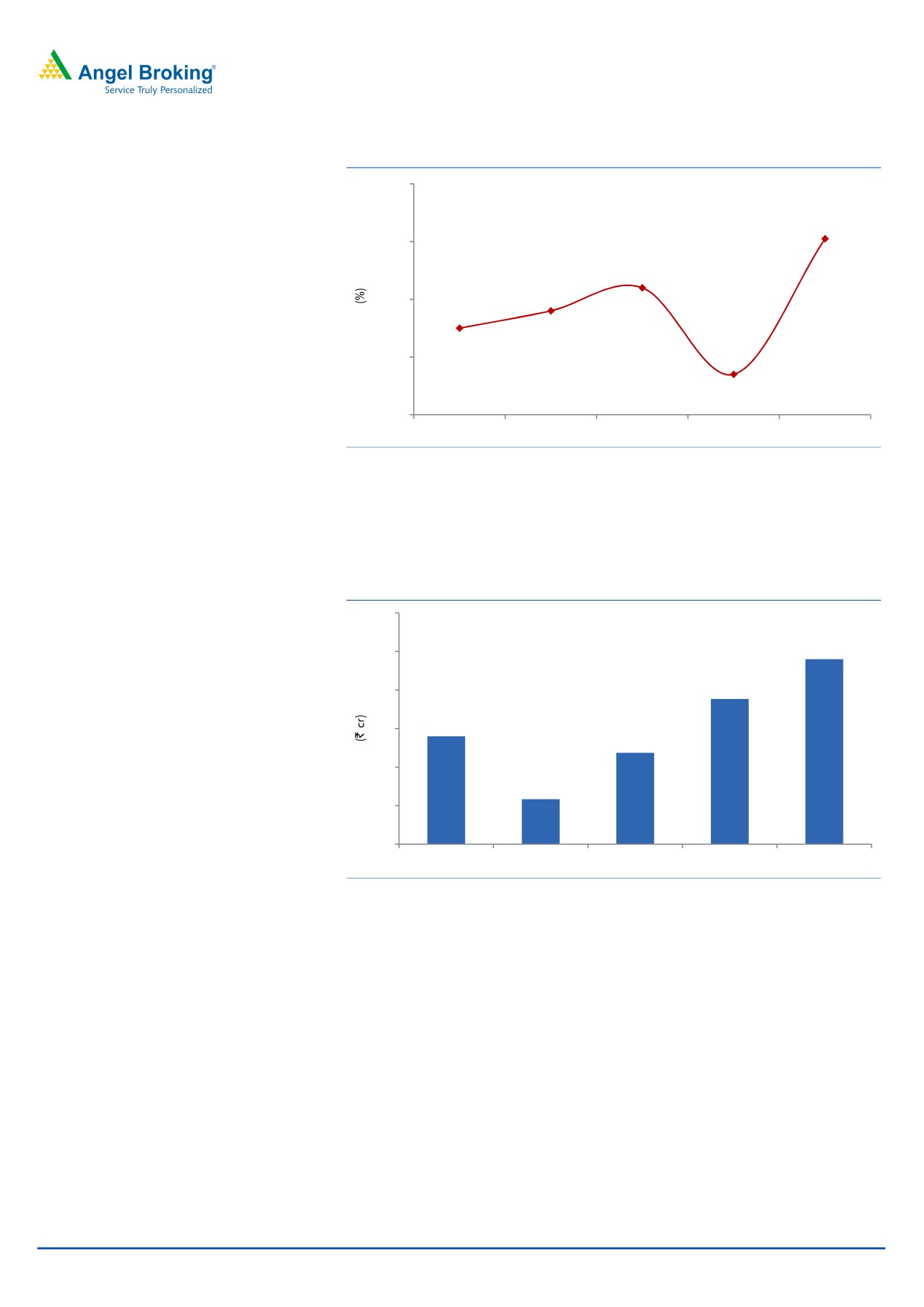

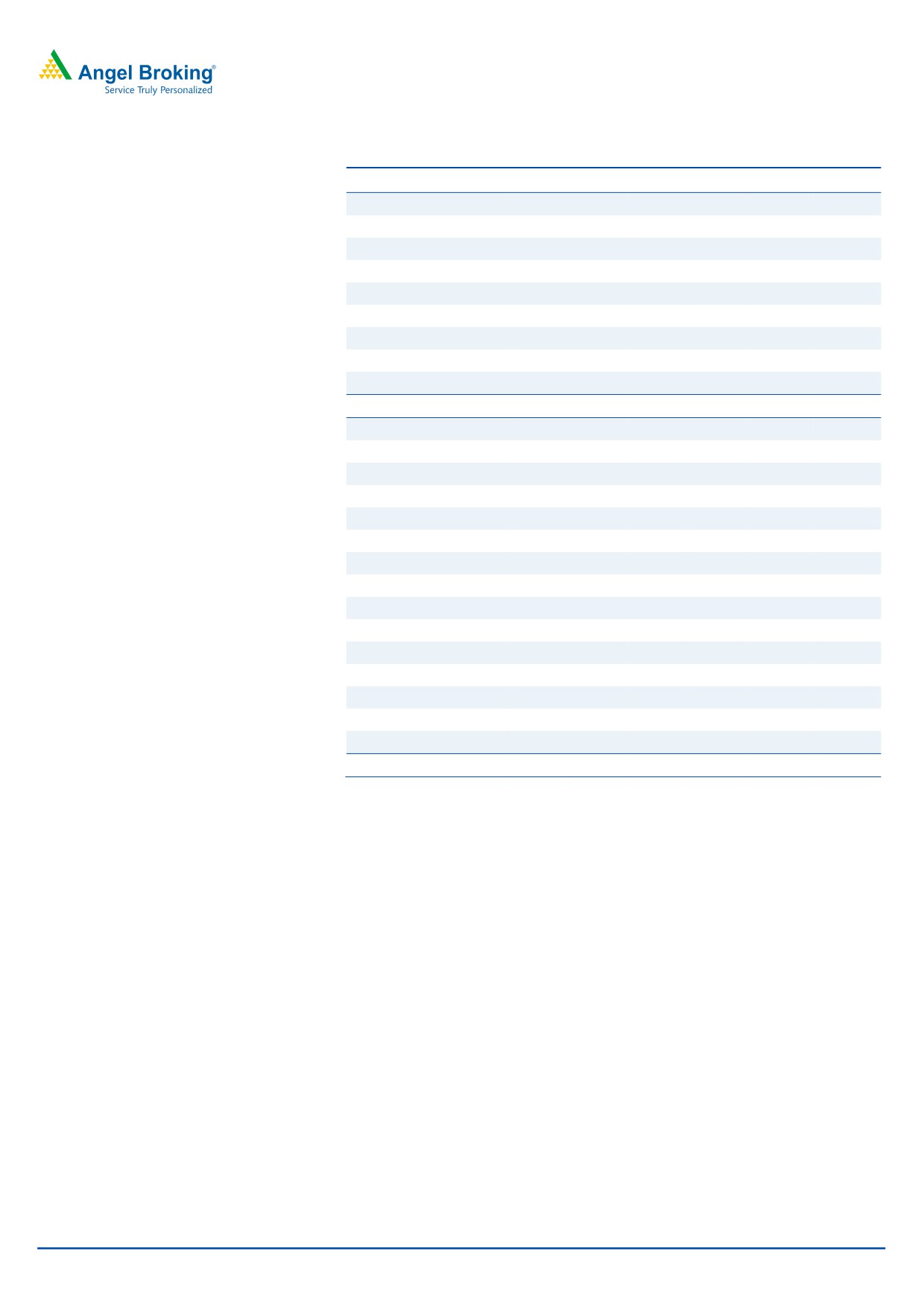

Exhibit 8: One-year forward PE band

1,200

1,000

800

600

400

200

-

10x

15x

20x

25x

Source: Company, Angel Research

Exhibit 9: Recommendation summary

Company

Reco.

CMP Tgt Price

Upside

FY2018E

FY16-18E

FY2018E

PE

EV/Sales

EV/EBITDA

CAGR in EPS

RoCE

RoE

(`)

(`)

(%)

(x)

(x)

(x)

(%)

(%)

(%)

Alembic Pharma

Neutral

647

-

-

21.3

2.8

13.3

(10.8)

27.5

25.3

Aurobindo Pharma Buy

747

877

17.4

15.8

2.6

11.0

18.1

22.5

26.1

Cadila Healthcare

Accumulate

369

400

8.4

18.5

2.8

12.6

15.8

24.3

26.6

Cipla

Neutral

517

-

-

19.0

2.4

13.1

20.4

13.5

15.2

Dr Reddy's

Neutral

3,005

-

-

19.0

2.8

11.2

6.9

18.1

17.1

Dishman Pharma

Neutral

167

-

-

16.0

1.8

8.0

(1.1)

9.6

10.2

GSK Pharma*

Neutral

3,102

-

-

52.2

6.7

35.8

15.9

35.8

31.8

Indoco Remedies

Sell

311

225

(27.7)

19.9

2.3

12.7

31.5

19.1

19.2

Ipca labs

Buy

532

613

15.2

27.0

1.9

12.2

36.5

8.8

9.4

Lupin

Accumulate

1,579

1,809

14.6

22.8

3.7

14.0

17.2

24.4

20.9

Sanofi India

Neutral

4,347

-

-

25.7

3.2

18.5

21.2

24.9

28.4

Sun Pharma

Buy

802

944

17.7

24.4

4.9

15.9

22.0

33.1

18.9

Source: Company, Angel Research; Note: *December year ending

August 16, 2016

6

Ipca Laboratories | 1QFY2017 Result Update

Company background

Formed in 1949, IPCA Labs is a market leader in the anti-malarials and

rheumatoid arthritis segments. The company is a notable name in the domestic

formulations category with 150 formulations across major therapeutic segments

like cardiovascular (CVS), anti-diabetes, anti-malaria, pain-management (NSAID),

anti-bacterial, central nervous system (CNS) and gastro-intestinal. The company

has 7 production units which are approved by most of the discerning regulatory

authorities including USFDA, UKMHRA, Australia-TGA, South Africa-MCC and

Brazil-ANVISA.

August 16, 2016

7

Ipca Laboratories | 1QFY2017 Result Update

Profit & loss statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

Gross sales

2,778

3,232

3,157

2,891

3,356

3,859

Less: Excise duty

25

33

40

47

53

61

Net Sales

2,754

3,199

3,117

2,844

3,303

3,799

Other operating income

59

82

40

41

41

41

Total operating income

2,813

3,282

3,157

2,885

3,344

3,839

% chg

19.3

16.7

(3.8)

(8.6)

15.9

14.8

Total expenditure

2,190

2,471

2,613

2,543

2,799

3,219

Net raw materials

1,097

1,137

1,155

1,058

1,173

1,349

Other mfg costs

245

250

277

253

294

338

Personnel

392

498

565

627

728

837

Other

456

587

616

606

604

695

EBITDA

564

728

504

301

504

580

% chg

19.5

29.1

(30.8)

(40.2)

67.4

15.0

(% of Net Sales)

20.5

22.8

16.2

10.6

15.3

15.3

Depreciation & amortisation

87

103

180

172

233

268

EBIT

477

625

324

129

271

312

% chg

17.8

31.1

(48.1)

(60.2)

110.3

15.0

(% of Net Sales)

17.3

19.5

10.4

4.5

8.2

8.2

Interest & other charges

33

27

28

32

32

32

Other Income

14

22

28

17

17

17

(% of PBT)

2.8

3.2

7.8

10.9

5.7

5.0

Recurring PBT

517

703

364

155

297

338

% chg

24.0

35.9

(48.2)

(57.5)

91.8

13.7

Extraordinary expense/(Inc.)

63.3

72.2

-

39.5

-

-

PBT (reported)

454

631

364

115

297

338

Tax

129.9

152.4

101.9

18.6

74.2

84.4

(% of PBT)

28.6

24.2

28.0

16.1

25.0

25.0

PAT (reported)

324

478

262

97

223

253

Add: Share of earnings of asso.

-

0

(5)

(3)

-

-

PAT after MI (reported)

324

478

254

94

219

248

ADJ. PAT

340

495

254

133

219

248

% chg

18.4

45.6

(48.6)

(47.6)

64.2

13.5

(% of Net Sales)

11.8

14.9

8.2

3.3

6.6

6.5

Basic EPS (`)

26.9

39.2

20.1

10.6

17.3

19.7

Fully Diluted EPS (`)

26.9

39.2

20.1

10.6

17.3

19.7

% chg

18.4

45.6

(48.6)

(47.6)

64.2

13.5

August 16, 2016

8

Ipca Laboratories | 1QFY2017 Result Update

Balance sheet (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

SOURCES OF FUNDS

Equity share capital

25

25

25

25

25

25

Reserves & surplus

1,529

1,934

2,183

2,281

2,485

2,718

Shareholders Funds

1,554

1,960

2,208

2,306

2,510

2,743

Minority interest

-

-

-

-

-

-

Total loans

523

603

829

595

671

809

Other Long Term Liabilities

1

1

-

-

-

-

Long Term Provisions

12

15

22

23

23

23

Deferred tax liability

130

147

174

169

169

169

Total Liabilities

2,220

2,726

3,233

3,094

3,350

3,722

APPLICATION OF FUNDS

Gross block

1,537

1,882

2,626

2,828

3,328

3,828

Less: Acc. depreciation

475

578

758

930

1,163

1,431

Net Block

1,063

1,303

1,868

1,898

2,165

2,397

Goodwill

42

50

34

34

34

34

Capital work-in-progress

129

165

165

165

165

165

Investments

9

9

16

96

96

96

Long Term Loans and Adv.

57

71

115

108

125

144

Current assets

1,397

1,602

1,614

1,522

1,767

2,032

Cash

58

76

125

162

189

223

Loans & advances

42

67

47

43

50

50

Other

1,297

1,459

1,442

1,317

1,529

1,759

Current liabilities

477

485

579

729

847

974

Net Current Assets

921

1,117

1,035

793

920

1,058

Other Non current Assets

-

9

-

-

Total Assets

2,220

2,726

3,233

3,094

3,350

3,722

August 16, 2016

9

Ipca Laboratories | 1QFY2017 Result Update

Cash flow statement (Consolidated)

Y/E March (` cr)

FY2013 FY2014 FY2015 FY2016 FY2017E FY2018E

Profit before tax

454

631

364

115

297

338

Depreciation

87

103

180

172

233

268

(Inc)/Dec in working capital

(116)

(193)

88

286

(411)

1,088

Direct taxes paid

(130)

(152)

(102)

(19)

(74)

(84)

Cash Flow from Operations

295

389

530

555

137

1,722

(Inc.)/Dec.in fixed assets

(257)

(380)

(745)

(202)

(500)

(500)

(Inc.)/Dec. in Investments

-

-

-

-

-

-

Cash Flow from Investing

(257)

(380)

(745)

(202)

(500)

(500)

Issue of Equity

0

-

-

-

-

-

Inc./(Dec.) in loans

(5)

83

232

(232)

76

138

Dividend Paid (Incl. Tax)

(59)

(74)

(15)

(15)

(15)

(15)

Others

72

1

47

(69)

419

(72)

Cash Flow from Financing

8

10

264

(316)

480

51

Inc./(Dec.) in Cash

46

18

49

37

27

38

Opening Cash balances

12

58

76

125

162

189

Closing Cash balances

58

76

125

162

189

223

August 16, 2016

10

Ipca Laboratories | 1QFY2017 Result Update

Key Ratios

Y/E March

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

19.7

13.6

26.4

50.4

30.7

27.1

P/CEPS

15.7

11.2

15.5

22.0

14.9

13.0

P/BV

4.3

3.4

3.0

2.9

2.7

2.4

Dividend yield (%)

0.8

0.8

0.8

0.8

0.8

0.8

EV/Sales

2.6

2.2

2.4

2.5

2.1

1.9

EV/EBITDA

12.7

9.9

14.5

23.5

14.1

12.4

EV / Total Assets

3.2

2.6

2.3

2.3

2.1

1.9

Per Share Data (`)

1.0

2.0

3.0

4.0

5.0

6.0

EPS (Basic)

EPS (fully diluted)

26.9

39.2

20.1

10.6

17.3

19.7

Cash EPS

26.9

39.2

20.1

10.6

17.3

19.7

DPS

33.8

47.4

34.4

24.2

35.8

40.9

Book Value

4.0

5.0

1.0

1.0

1.0

1.0

DuPont Analysis

123.1

155.3

175.0

182.7

198.9

217.4

EBIT margin

Tax retention ratio

17.3

19.5

10.4

4.5

8.2

8.2

Asset turnover (x)

71.4

75.8

72.0

83.9

75.0

75.0

ROIC (Post-tax)

1.4

1.4

1.1

1.0

1.1

1.2

Cost of Debt (Post Tax)

17.2

20.2

8.2

3.6

6.8

7.1

Leverage (x)

4.5

3.6

2.9

3.7

3.7

3.2

Operating ROE

0.4

0.3

0.3

0.3

0.2

0.2

Returns (%)

21.8

24.9

9.8

3.6

7.3

7.9

RoCE (Pre-tax)

Angel RoIC (Pre-tax)

23.2

25.3

10.9

4.1

8.4

8.8

RoE

25.0

27.7

12.0

4.5

9.4

9.9

Turnover ratios (x)

24.2

28.2

12.2

5.9

9.1

9.4

Asset Turnover (Gross Block)

Inventory / Sales (days)

2.0

1.9

1.4

1.1

1.1

1.1

Receivables (days)

92

88

103

111

96

97

Payables (days)

49

48

46

46

52

52

WC cycle (ex-cash) (days)

42

45

43

90

60

60

Solvency ratios (x)

106

106

113

97

74

74

Net debt to equity

Net debt to EBITDA

0.3

0.3

0.3

0.2

0.2

0.2

Interest Coverage (EBIT / Int.)

0.8

0.7

1.4

1.4

1.0

1.0

August 16, 2016

11

Ipca Laboratories | 1QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Ipca Laboratories

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

August 16, 2016

12