2QFY2016 Result Update | Pharmaceutical

November 16, 2015

IPCA Labs

BUY

CMP

`719

Performance Highlights

Target Price

`900

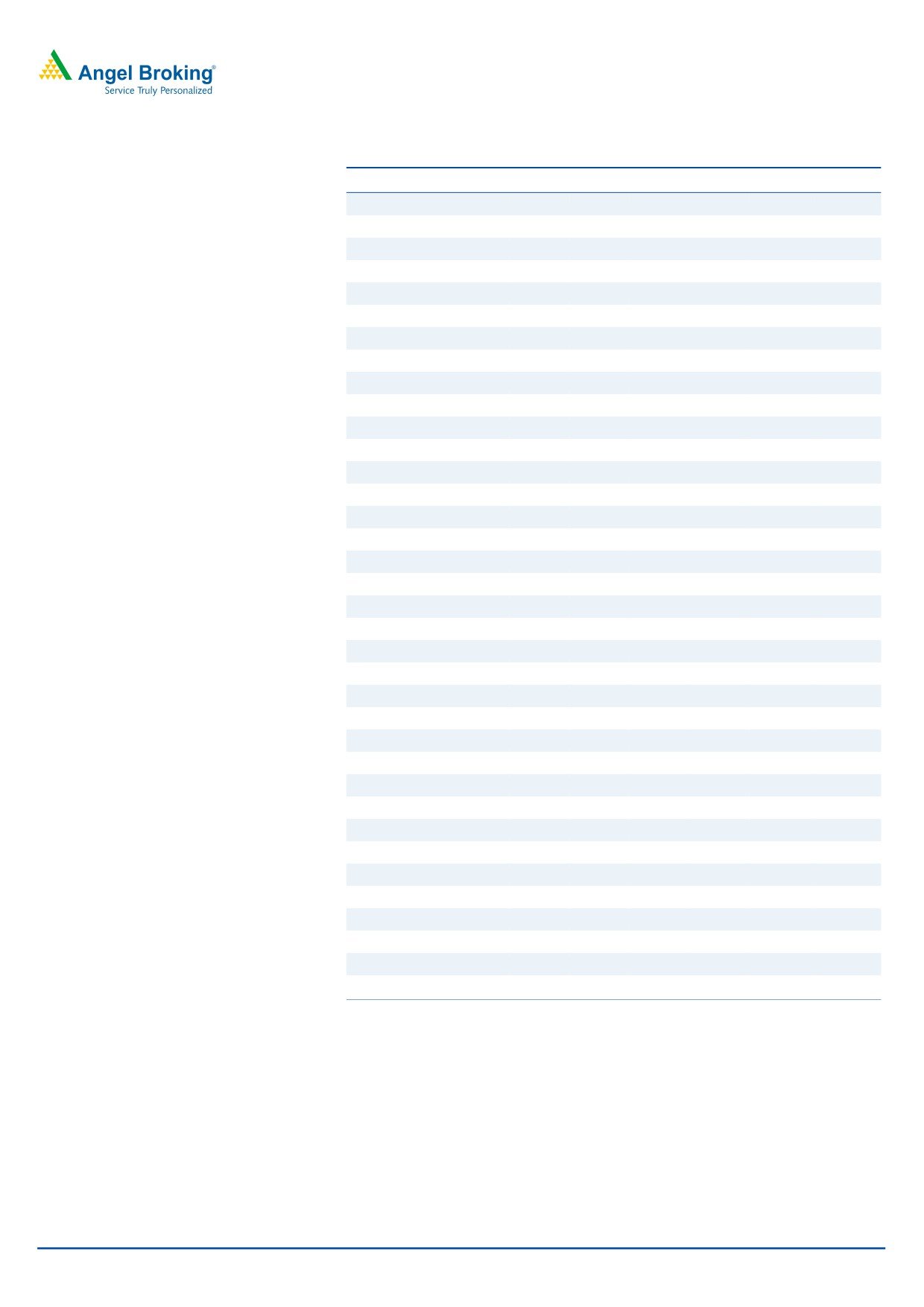

Y/E March (` cr)

2QFY2016 1QFY2016

% chg qoq 2QFY2015

% chg yoy

Investment Period

12 Months

Net sales

739

751

(1.7)

775

(4.7)

Other income

16

11

43.0

14

10.1

Stock Info

Operating profit

79

75

4.6

129

(39.1)

Tax

8

8

-

27

(70.1)

Sector

Pharmaceutical

Adj. net profit/(loss)

31

28

-

68

(54.3)

Market Cap (` cr)

9,076

Source: Company, Angel Research

Net Debt (` cr)

688

Beta

0.5

For 2QFY2016, IPCA Laboratories (IPCA) posted in line sales while the net profit

52 Week High / Low

888/591

came in lower than our estimates. The company posted a 4.7% yoy decline in

Avg. Daily Volume

45,463

sales to `739cr V/s `750cr expected, on back of domestic and exports posting a

dip of 2.3% yoy and 6.9% yoy, respectively. On the operating front, the EBITDA

Face Value (`)

2

margin came in at 10.6% V/s 11.4% expected and V/s 16.7% in 2QFY2015,

BSE Sensex

25,611

owing to lower than expected sales. Thus, the Adj. net profit came in at `31cr V/s

Nifty

7,762

`41cr expected and V/s `68cr in 2QFY2015, a yoy dip of 54.3%. While the

Reuters Code

IPCA.BO

current performance of the company is being impacted due to its key plants being

Bloomberg Code

IPCA@IN

under the USFDA scanner, we believe once out of it, the company can bounce back

to its normalized ROE of 25%. Thus, we maintain our Buy on the stock.

Shareholding Pattern (%)

Results lower than expectations: The company, posted an 4.7% de-growth in sales

Promoters

45.9

to end the period at `739cr V/s `750cr expected and `775cr in 2QFY2015, on

MF / Banks / Indian Fls

18.8

back of domestic and exports posting a dip of 2.3% and 6.9% respectively. In

FII / NRIs / OCBs

22.7

domestic markets (`364cr), posted a dip of 2.3% yoy, mainly on back a tepid

Indian Public / Others

12.6

formulation sales (`331cr), a yoy growth of 0.9%.In exports (`375cr), a yoy dip

of 6.9%, on back of dip in formulation exports (227cr) a dip of 25.7% yoy, while

API exports (`147cr) posted a yoy growth of 52.9%. On operating front, the

Abs. (%)

3m 1yr 3yr

EBITDA margins came in at 10.6% V/s 11.4% expected V/s 10.0% in 2QFY2015,

Sensex

(7.0)

(8.3)

37.6

on back of lower than expected sales during the quarter. Thus, the Adj. net profit

Ipca

(6.8)

7.6

65.1

came in at `31cr V/s `41cr expected and `68cr in 2QFY2015, a yoy dip of 54.3%.

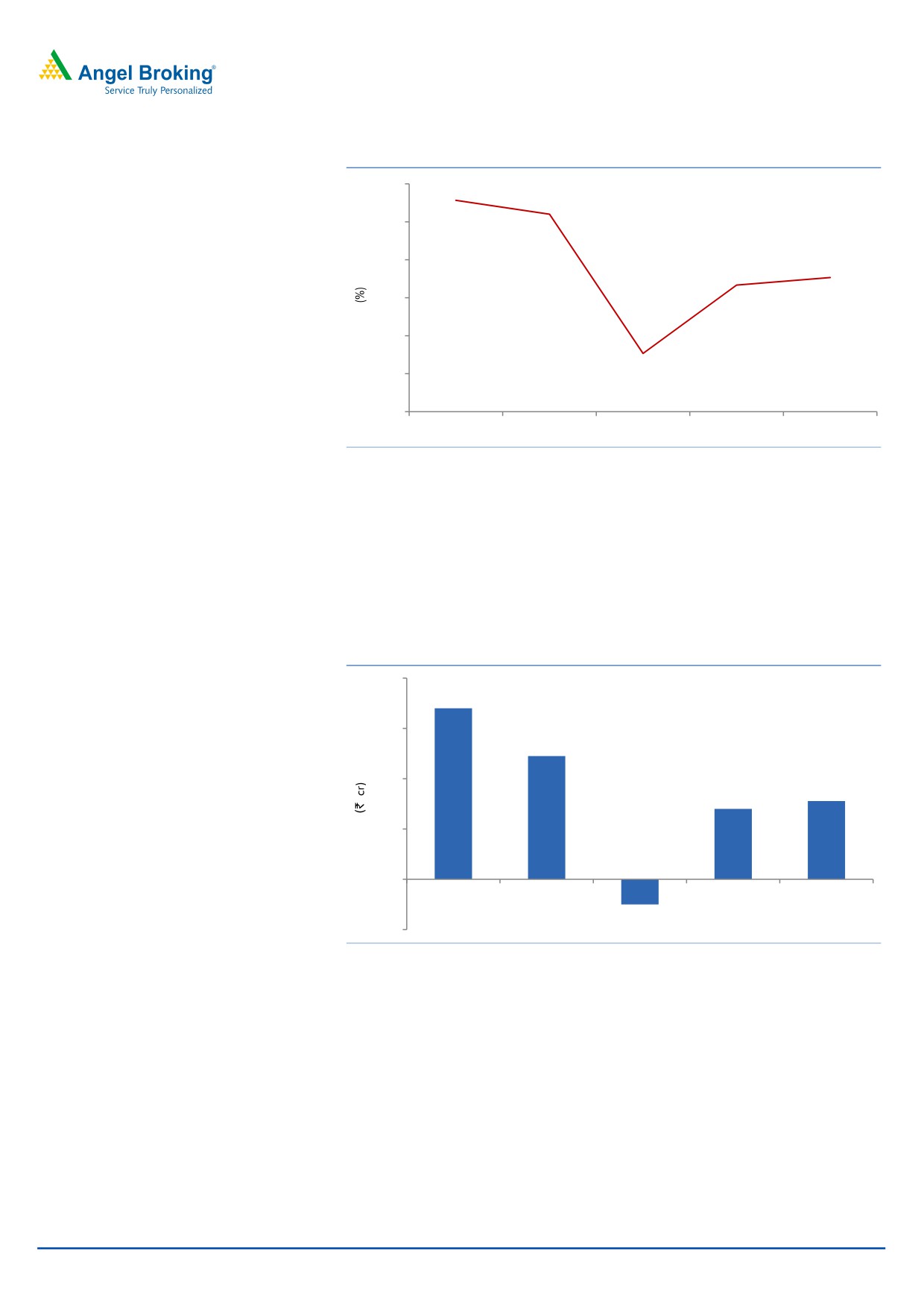

Outlook and Valuation: We expect net sales to post a 12.0% CAGR to `3,909cr,

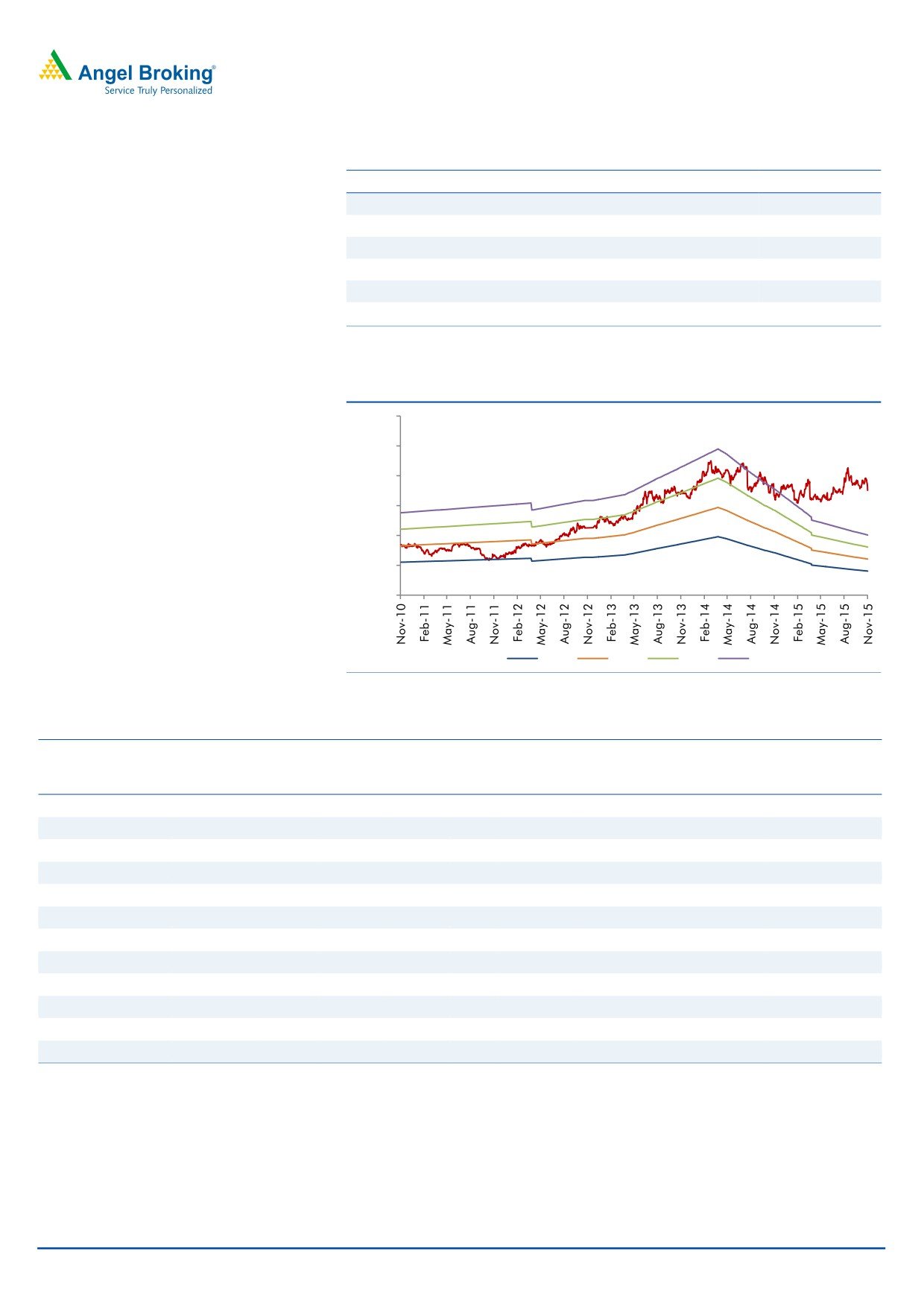

3-Year Daily Price Chart

and EPS to register a 17.9% CAGR to `28.0 over FY2015-17E. The company’s

1,000

financials will be impacted by the USFDA import alert on the Ratlam, Indore and

Silvassa facilities. For 2HFY2016, the Management has given a guidance of 16%

800

yoy growth in sales. We recommend a Buy on the stock, given the valuations.

600

Key financials (Consolidated)

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

400

Net sales

3,199

3,117

3,363

3,909

% chg

16.2

(2.6)

7.9

16.2

200

Adj. Net profit

495

254

169

354

% chg

45.6

(48.6)

(33.5)

109.3

EPS

39.2

20.1

13.4

28.0

Source: Company, Angel Research

EBITDA margin (%)

22.8

16.2

12.9

18.6

P/E (x)

18.3

35.7

53.7

25.7

RoE (%)

28.2

12.2

7.4

14.0

RoCE (%)

25.3

10.9

5.5

11.8

P/BV (x)

4.6

4.1

3.8

3.4

Sarabjit Kour Nangra

EV/Sales (x)

3.0

3.1

3.0

2.6

+91 22 39357800 Ext: 6806

EV/EBITDA (x)

13.1

19.2

23.0

13.7

Source: Company, Angel Research; Note: CMP as of November 13, 2015

Please refer to important disclosures at the end of this report

1

Ipca Laboratories | 2QFY2016 Result Update

Exhibit 1: 2QFY2016 - Standalone performance

Y/E March (` cr)

2QFY2016 1QFY2016

% chg (qoq) 2QFY2015

% chg (yoy) 1HFY2016 1HFY2015

% chg (yoy)

Net sales

739

751

(1.7)

775

(4.7)

1490

1703

(12.5)

Other income

16

11

43.0

14

10.1

27

28

(3.5)

Total income

754

762

(1.0)

789

(4.4)

1517

1731

(12.4)

Gross profit

458

454

0.9

504

(9.1)

912

1090

(16.4)

Gross margins (%)

62.0

60.4

65.0

61.2

64.0

Operating profit

79

75

4.6

129

(39.1)

154

352

(56.4)

Operating margin (%)

10.6

10.0

16.7

10.3

20.7

Interest

7

5

28.9

6

22.0

12

9

38.1

Depreciation

44

42

3.7

40

10.2

86

78

9.9

PBT

44

39

13.2

98

-

82

294

(71.9)

Provision for taxation

8

8

(0.4)

27

(70.1)

16

78

(78.9)

Less: Exceptional Items (gains)/ loss

24

12

9

36

7

407.6

Reported Net profit

12

19

(37.8)

61

(80.9)

31

207

(85.3)

Adj. Net profit/(loss)

31

28

-

68

(54.3)

59

212

(72.2)

EPS (`)

2.5

2.2

5.4

4.7

16.8

Source: Company, Angel Research

Exhibit 2: 2QFY2016 - Actual vs Angel estimates

(` cr)

Actual

Estimates

Variation (%)

Net sales

739

750

(1.5)

Other income

16

14

10.1

Operating profit

79

85

(7.8)

Interest

7

6

22.0

Tax

8

11

(25.6)

Adjusted Net profit/(loss)

31

41

(23.7)

Source: Company, Angel Research

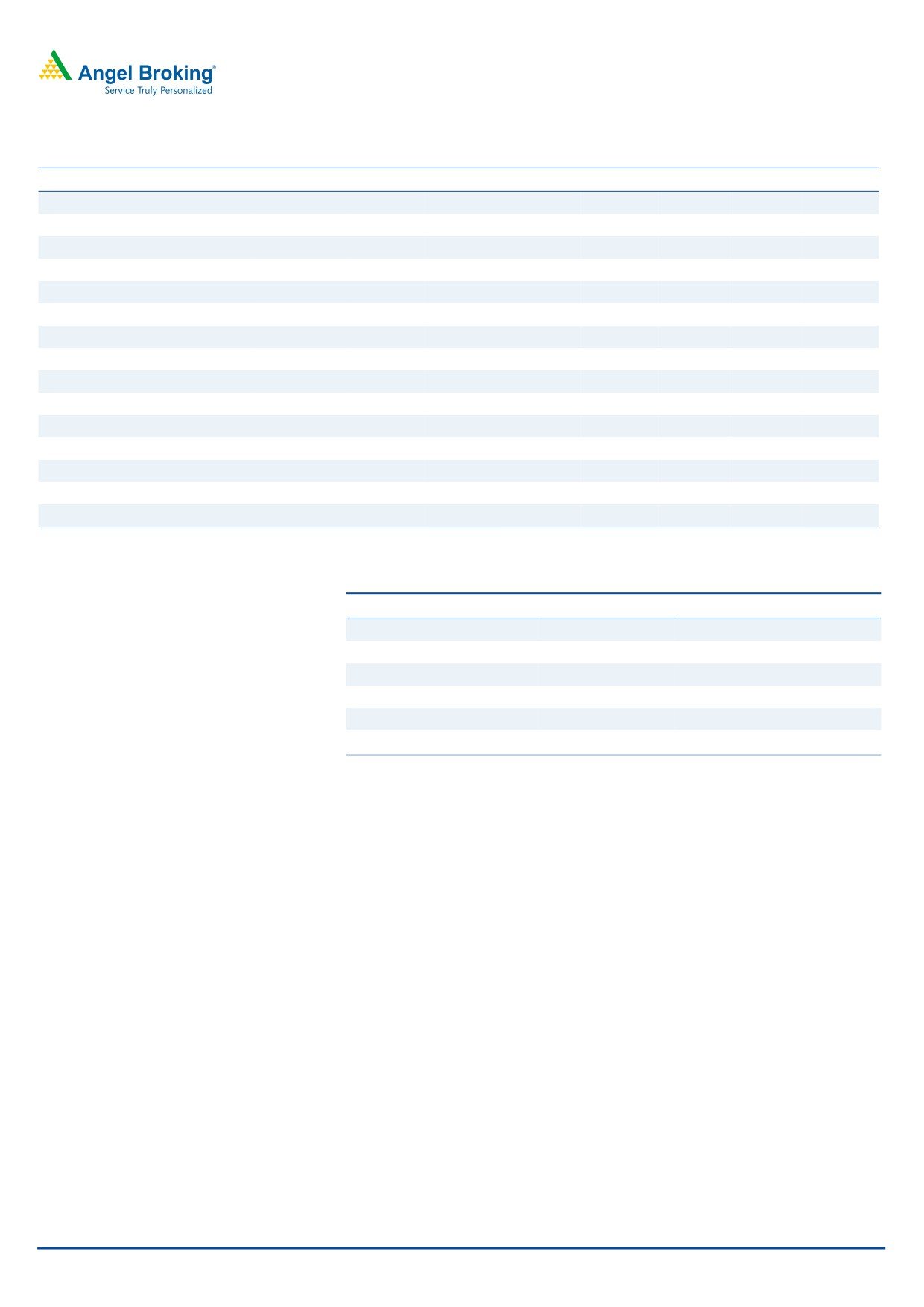

Revenue marginally below our estimate; dips 4.7% yoy: The company posted a

4.7% yoy decline in sales to `739cr V/s `750cr expected and V/s `775cr in

2QFY2015, as domestic and exports posted a dip of 2.3% and 6.9% yoy,

respectively.

Domestic markets (`364cr) posted a dip of 2.3% yoy, mainly on account of tepid

formulation sales (`331cr; a yoy growth of 0.9%), while API sales (`33cr) dipped

by 25.3% yoy. Exports (`375cr) dipped by 6.9% yoy on back of a decline in

formulation exports (`227cr; a dip of 25.7% yoy), while API exports (`147cr)

posted a yoy growth of 52.9%.

Slower pick-up in US supplies for exempted products, absence of institutional

orders from global funds and currency headwinds in Russia/CIS-branded business

impacted exports. The India (45% of sales) business remained flat due to weaker

anti-malaria drug sales in 2QFY2016.

Overall, for 2QFY2016, exports contributed 50.7% to the top-line while the

domestic business contributed by around 49.3%. The overall contribution of

formulation sales is at 75.6% of total sales, for the quarter.

November 16, 2015

2

Ipca Laboratories | 2QFY2016 Result Update

Exhibit 3: Domestic sales trend

360

328

331

318

320

279

280

229

240

200

160

120

80

56

45

37

33

33

40

0

2QFY2015

3QFY2015

4QFY2015

1QFY2016

2QFY2016

Formulation

API

Source: Company, Angel Research

Exhibit 4: Exports sales trend

360

306

305

320

280

240

225

227

240

200

152

147

160

121

113

120

96

80

40

0

2QFY2015

3QFY2015

4QFY2015

1QFY2016

2QFY2016

Formulation

API

Source: Company, Angel Research

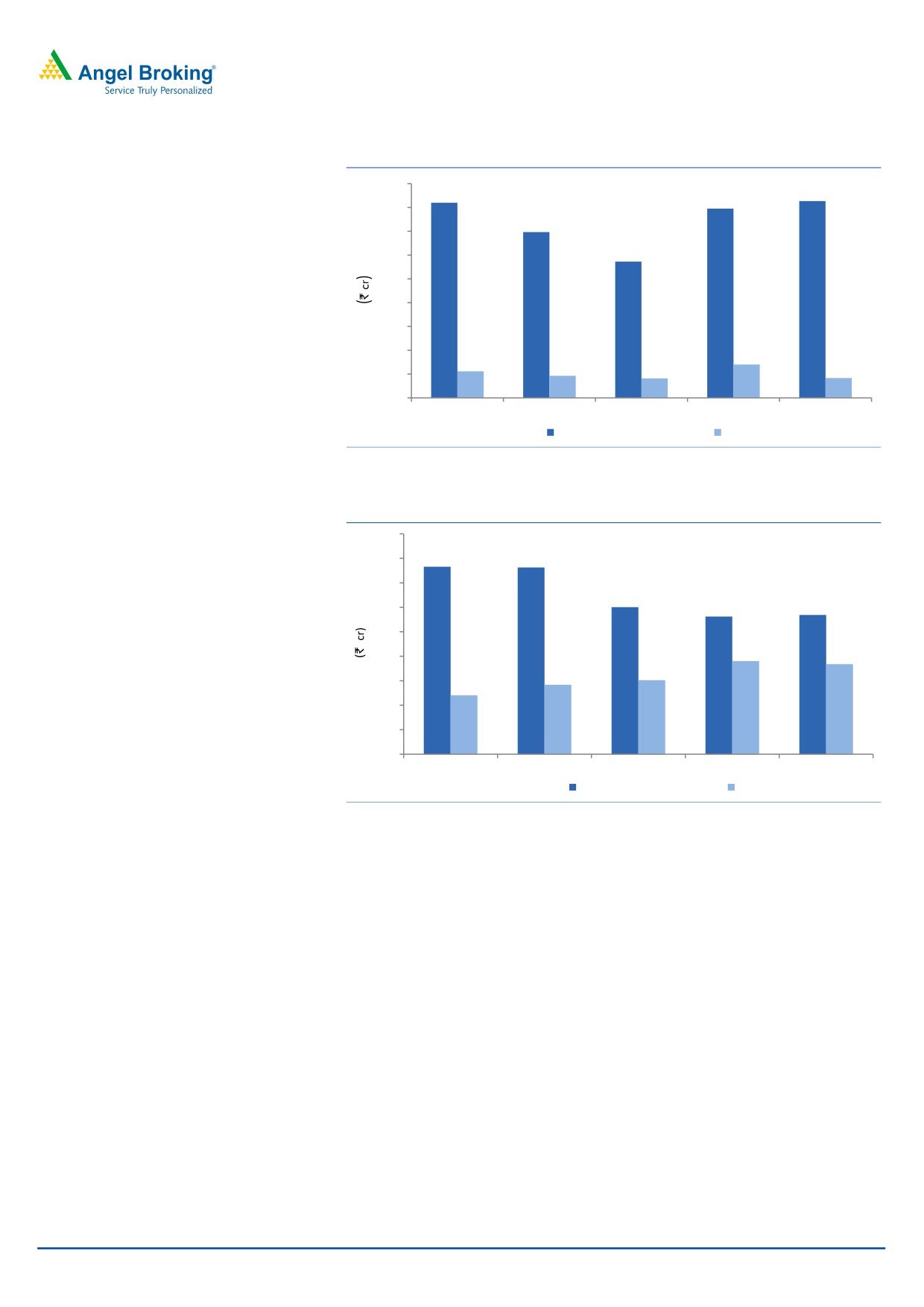

OPM falls sharply: On the operating front, the EBITDA margin came in at 10.6%

V/s 11.4% expected and V/s 16.7% in 2QFY2015, owing to lower than expected

sales during the quarter, while Gross margins came in at 62.0% V/s 65.0% in

2QFY2015.

November 16, 2015

3

Ipca Laboratories | 2QFY2016 Result Update

Exhibit 5: OPM trend

18.0

16.7

15.6

15.0

12.0

10.6

9.0

10

6.0

4.6

3.0

0.0

2QFY2015

3QFY2015

4QFY2015

1QFY2016

2QFY2016

Source: Company, Angel Research

Reported net profit lower than expectation: A lower OPM, along with a rise in

interest expenses and depreciation, which were up by 22.0% and 10.2% yoy

respectively, led the Adj. net profit to come in at `31cr V/s `41cr expected and V/s

`68cr in 2QFY2015, a yoy dip of 54.3%. However, on back of `24cr forex losses,

the company posted a reported net profit of `12cr V/s `61cr in 2QFY2015, a yoy

dip of 80.9% yoy.

Exhibit 6: Adj. Net profit trend

80

68

60

49

40

31

28

20

0

2QFY2015

3QFY2015

4QFY2015

1QFY2016

2QFY2016

(10)

(20)

Source: Company, Angel Research

Concall takeaways

The Management has guided for better 2HFY2016 with 16% yoy sales growth

on the back of scale-up in institutional business, resumption of HCQs supplies

from Nov2015, 16% yoy growth in India business and recovery in the CIS

region.

The Management expects 16% margin in 2HFY2016 with improving operating

leverage.

November 16, 2015

4

Ipca Laboratories | 2QFY2016 Result Update

Investment arguments

Domestic formulations business - the cash cow: IPCA has been successful in

changing its business focus to the high-margin chronic and lifestyle segments

from the low-margin anti-malarial segment. The chronic and lifestyle

segments, comprising CVS, anti-diabetics, pain-management, CNS and

dermatology products, constitute more than 50% of the company’s domestic

formulation sales. The Management has ramped up its field force significantly

with addition of divisions in the domestic formulations segment, taking the

current total strength to nearly 4,000MRs. With a moderate growth in domestic

formulations in 1HFY2016, we expect the domestic formulation business to

grow at a CAGR of 11.3% over FY2015-17E.

Exports to be the next growth driver: On the formulations front, IPCA has been

increasing its penetration in regulated markets, viz Europe and the US, by

expanding the list of generic drugs backed by its own API. In the emerging

and semi-regulated markets, the company plans to focus on building brands

in the CVS, CNS, pain-management and anti-malarial segments along with

tapping new geographies. On the API front, where the company is among the

low-cost producers, it is aggressively pursuing supply tie-ups with

pharmaceutical MNCs.

After the USFDA inspection at the company’s APl manufacturing facility at

Ratlam (Madhya Pradesh), the company has received certain inspection

observations in Form 483, consequent to which the company had voluntarily

decided to temporarily suspend API shipments from this manufacturing facility

to the US markets till this issue was addressed. However, the 483 was

converted into an import alert, except for 4 APIs which constituted around 45%

of US sales in FY2014.

The company’s Silvassa and Indore facilities (formulation facilities) are also

under import alert. These developments impacted FY2015 sales, while

FY2016/FY2017 should see some revival. We expect exports to grow at a

CAGR of 12.5% over FY2015-17E.

Outlook & Valuation:

We expect net sales to post a 12.0% CAGR to `3,909cr, and EPS to register a

17.9% CAGR to `28.0 over FY2015-17E. The company’s financials will be

impacted by the USFDA import alert on the Ratlam, Indore and Silvassa facilities.

For 2HFY2016, the Management has given a guidance of 16% yoy growth on the

sales front, after a dip in 1HFY2016. While the problems are likely to persist in

FY2016, still, given the valuations, we maintain our Buy rating on the stock with a

price target of `900.

November 16, 2015

5

Ipca Laboratories | 2QFY2016 Result Update

Exhibit 7: Key Assumptions

FY2016E

FY2017E

Sales growth (%)

7.8

16.0

Domestic growth (%)

5.0

18.0

Exports growth (%)

10.0

15.0

Operating margins (%)

12.9

18.6

R&D Exp ( % of sales)

4.0

4.0

Capex (` cr)

500

500

Source: Company, Angel Research

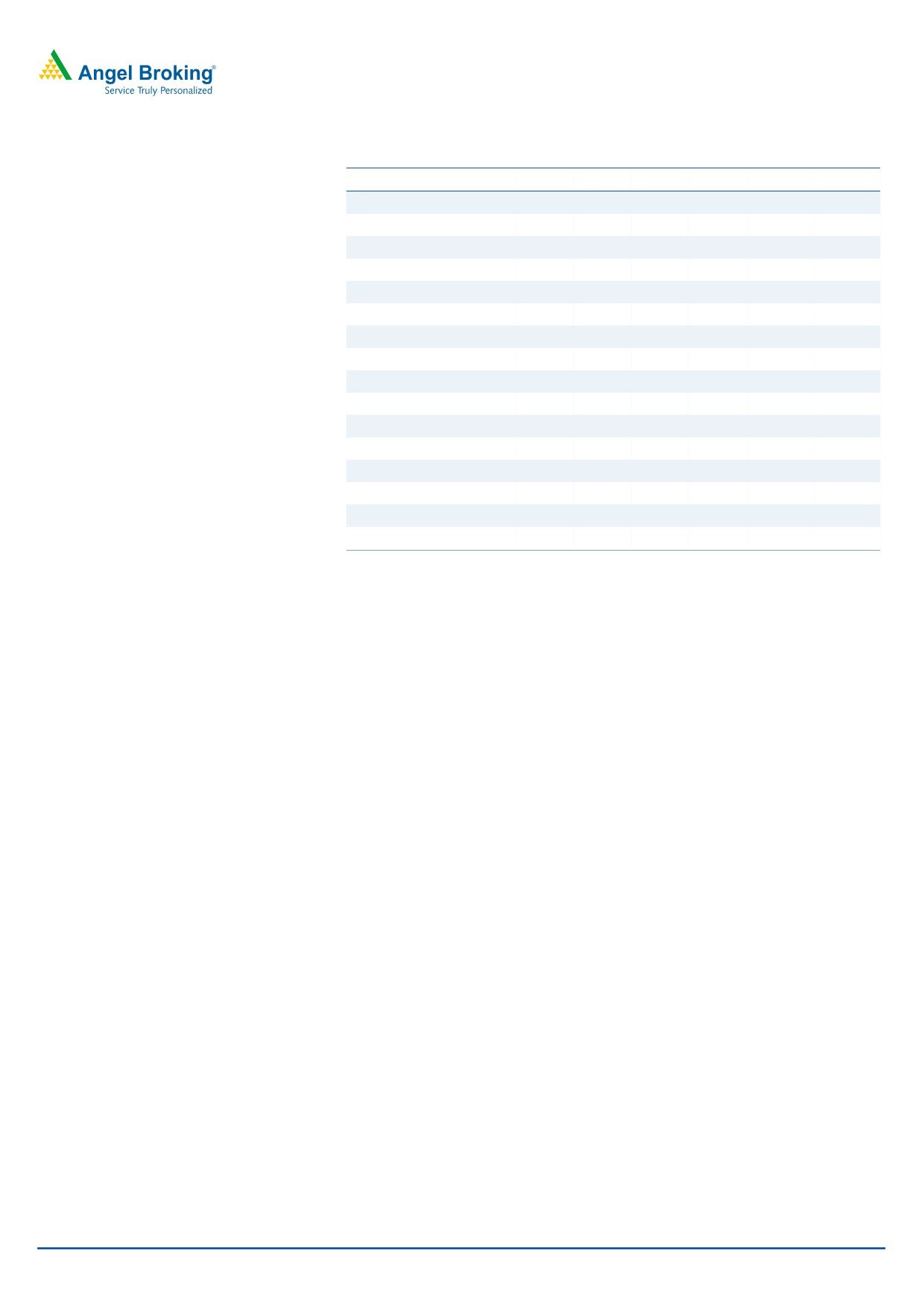

Exhibit 8: One-year forward PE band

1,200

1,000

800

600

400

200

-

10x

15x

20x

25x

Source: Company, Angel Research

Exhibit 9: Recommendation summary

Company

Reco.

CMP Tgt Price

Upside

FY2017E

FY15-17E

FY2017E

PE

EV/Sales

EV/EBITDA

CAGR in EPS

RoCE

RoE

(`)

(`)

(%)

(x)

(x)

(x)

(%)

(%)

(%)

Alembic Pharma

Neutral

662

-

-

27.7

3.9

19.5

26.1

30.3

30.2

Aurobindo Pharma Accumulate

830

872

5.1

19.0

3.1

13.3

16.3

23.4

30.2

Cadila Healthcare

Neutral

413

-

-

23.5

3.5

16.1

24.6

25.2

29.0

Cipla

Neutral

619

-

-

21.4

2.9

15.3

21.4

17.1

16.8

Dr Reddy's

Buy

3,384

3,933

16.2

18.9

2.8

14.7

17.2

19.1

20.6

Dishman Pharma

Neutral

381

-

-

17.6

1.7

8.2

20.4

11.7

11.7

GSK Pharma*

Neutral

3,152

-

-

46.2

8.0

36.4

6.6

33.7

34.3

Indoco Remedies

Neutral

300

-

-

22.1

2.4

13.1

23.0

19.7

19.7

Ipca labs

Buy

719

900

25.1

25.7

2.6

13.7

17.9

11.8

14.0

Lupin

Neutral

1,777

-

-

26.0

4.5

16.6

13.1

29.6

24.7

Sanofi India*

Neutral

4,586

-

-

30.3

4.0

19.0

33.1

27.9

25.5

Sun Pharma

Buy

742

950

28.1

27.6

4.8

15.6

8.4

15.8

16.6

Source: Company, Angel Research; Note: *December year ending

November 16, 2015

6

Ipca Laboratories | 2QFY2016 Result Update

Company background

Formed in 1949, IPCA Labs is a market leader in the anti-malarials and

rheumatoid arthritis segments. The company is a notable name in the domestic

formulations category with 150 formulations across major therapeutic segments

like cardiovascular (CVS), anti-diabetes, anti-malaria, pain-management (NSAID),

anti-bacterial, central nervous system (CNS) and gastro-intestinal. The company

has 7 production units which are approved by most of the discerning regulatory

authorities including USFDA, UKMHRA, Australia-TGA, South Africa-MCC and

Brazil-ANVISA.

November 16, 2015

7

Ipca Laboratories | 2QFY2016 Result Update

Profit & loss statement (Consolidated)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Gross sales

2,333

2,778

3,232

3,157

3,410

3,957

Less: Excise duty

19

25

33

40

47

48

Net Sales

2,314

2,754

3,199

3,117

3,363

3,909

Other operating income

45

59

82

40

40

40

Total operating income

2,359

2,813

3,282

3,157

3,403

3,948

% chg

24.2

19.3

16.7

(3.8)

7.8

16.0

Total expenditure

1,842

2,190

2,471

2,613

2,928

3,182

Net raw materials

913

1,097

1,137

1,155

1,312

1,485

Other mfg costs

208

215

250

277

299

348

Personnel

335

392

498

565

678

645

Other

385

487

587

616

639

704

EBITDA

472

564

728

504

435

727

% chg

16.8

19.5

29.1

(30.8)

(13.7)

67.1

(% of Net Sales)

20.4

20.5

22.8

16.2

12.9

18.6

Depreciation & amortisation

67

87

103

180

250

290

EBIT

405

477

625

324

185

437

% chg

16.2

17.8

31.1

(48.1)

(43.0)

136.3

(% of Net Sales)

17.5

17.3

19.5

10.4

5.5

11.2

Interest & other charges

44

33

27

28

28

28

Other Income

12

14

22

28

28

28

(% of PBT)

2.9

2.8

3.2

7.8

12.6

6.0

Recurring PBT

417

517

703

364

225

477

% chg

22.4

24.0

35.9

(48.2)

(38.3)

112.1

Extraordinary expense/(Inc.)

52.8

63.3

72.2

-

36.0

-

PBT (reported)

364

454

631

364

189

477

Tax

88.1

129.9

152.4

101.9

52.9

119.2

(% of PBT)

24.2

28.6

24.2

28.0

28.0

25.0

PAT (reported)

276

324

478

262

136

358

Add: Share of earnings of asso.

1

-

0

(5)

-

-

PAT after MI (reported)

277

324

478

254

133

354

ADJ. PAT

287

340

495

254

169

354

% chg

8.9

18.4

45.6

(48.6)

(33.5)

109.3

(% of Net Sales)

12.0

11.8

14.9

8.2

4.0

9.0

Basic EPS (`)

22.8

26.9

39.2

20.1

13.4

28.0

Fully Diluted EPS (`)

22.8

26.9

39.2

20.1

13.4

28.0

% chg

8.5

18.4

45.6

(48.6)

(33.5)

109.3

November 16, 2015

8

Ipca Laboratories | 2QFY2016 Result Update

Balance sheet (Consolidated)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

SOURCES OF FUNDS

Equity share capital

25

25

25

25

25

25

Reserves & surplus

1,229

1,529

1,934

2,183

2,337

2,676

Shareholders Funds

1,254

1,554

1,960

2,208

2,363

2,701

Minority interest

-

-

-

-

-

-

Total loans

532

523

603

829

1,000

1,000

Other Long Term Liabilities

1

1

1

-

-

-

Long Term Provisions

9

12

15

22

22

22

Deferred tax liability

93

130

147

174

174

174

Total Liabilities

1,889

2,220

2,726

3,233

3,537

3,876

APPLICATION OF FUNDS

Gross block

1,315

1,537

1,882

2,626

3,126

3,626

Less: Acc. depreciation

394

475

578

758

1,008

1,298

Net Block

920

1,063

1,303

1,868

2,118

2,328

Goodwill

24

42

50

34

34

34

Capital work-in-progress

95

129

165

165

165

165

Investments

34

9

9

16

16

16

Long Term Loans and Adv.

38

57

71

115

54

62

Current assets

1,217

1,397

1,602

1,614

1,787

2,104

Cash

12

58

76

125

36

68

Loans & advances

35

42

67

47

51

59

Other

1,170

1,297

1,459

1,576

1,700

1,976

Current liabilities

439

477

485

579

638

741

Net Current Assets

778

921

1,117

1,035

1,150

1,362

Other Non current Assets

-

-

9

-

-

Total Assets

1,889

2,220

2,725

3,233

3,537

3,876

November 16, 2015

9

Ipca Laboratories | 2QFY2016 Result Update

Cash flow statement (Consolidated)

Y/E March (` cr)

FY2012 FY2013 FY2014 FY2015 FY2016E FY2017E

Profit before tax

364

454

631

364

189

477

Depreciation

67

87

103

180

250

290

(Inc)/Dec in working capital

(52)

(116)

(193)

(46)

(8)

(189)

Direct taxes paid

(88)

(130)

(152)

(102)

(53)

(119)

Cash Flow from Operations

291

295

389

395

378

458

(Inc.)/Dec.in fixed assets

(326)

(257)

(380)

(745)

(500)

(500)

(Inc.)/Dec. in Investments

-

-

-

-

-

-

Cash Flow from Investing

(326)

(257)

(380)

(745)

(500)

(500)

Issue of Equity

0

0

-

-

-

-

Inc./(Dec.) in loans

76

(5)

83

232

171

-

Dividend Paid (Incl. Tax)

(55)

(59)

(74)

(15)

(15)

(15)

Others

14

72

1

181

(123)

88

Cash Flow from Financing

36

8

10

398

34

73

Inc./(Dec.) in Cash

1

46

18

49

(89)

32

Opening Cash balances

11

12

58

76

125

36

Closing Cash balances

12

58

76

125

36

68

November 16, 2015

10

Ipca Laboratories | 2QFY2016 Result Update

Key Ratios

Y/E March

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

31.6

26.7

18.3

35.7

53.7

25.7

P/CEPS

25.6

21.3

15.2

20.9

21.7

14.1

P/BV

7.2

5.8

4.6

4.1

3.8

3.4

Dividend yield (%)

0.4

0.6

0.6

0.6

0.6

0.6

EV/Sales

4.1

3.4

3.0

3.1

3.0

2.6

EV/EBITDA

20.3

16.8

13.1

19.2

23.0

13.7

EV / Total Assets

5.1

4.3

3.5

3.0

2.8

2.6

Per Share Data (`)

EPS (Basic)

22.8

26.9

39.2

20.1

13.4

28.0

EPS (fully diluted)

22.8

26.9

39.2

20.1

13.4

28.0

Cash EPS

28.1

33.8

47.4

34.4

33.2

51.0

DPS

3.2

4.0

4.0

4.0

4.0

4.0

Book Value

99.4

123.1

155.3

175.0

187.2

214.1

Dupont Analysis

EBIT margin

17.5

17.3

19.5

10.4

5.5

11.2

Tax retention ratio

75.8

71.4

75.8

72.0

72.0

75.0

Asset turnover (x)

1.4

1.4

1.4

1.1

1.0

1.1

ROIC (Post-tax)

18.1

17.2

20.2

8.2

4.1

9.1

Cost of Debt (Post Tax)

6.8

4.5

3.6

2.9

2.2

2.1

Leverage (x)

0.4

0.4

0.3

0.3

0.4

0.4

Operating ROE

22.8

21.8

24.9

9.8

4.7

11.7

Returns (%)

RoCE (Pre-tax)

23.2

23.2

25.3

10.9

5.5

11.8

Angel RoIC (Pre-tax)

24.7

25.0

27.7

12.0

5.9

12.5

RoE

24.9

24.2

28.2

12.2

7.4

14.0

Turnover ratios (x)

Asset Turnover (Gross Block)

2.0

2.0

1.9

1.4

1.2

1.2

Inventory / Sales (days)

88

92

88

103

96

97

Receivables (days)

55

49

48

46

52

53

Payables (days)

41

42

45

43

45

46

WC cycle (ex-cash) (days)

115

106

106

113

109

111

Solvency ratios (x)

Net debt to equity

0.4

0.3

0.3

0.3

0.4

0.3

Net debt to EBITDA

1.1

0.8

0.7

1.4

2.2

1.3

Interest Coverage (EBIT / Int.)

9.1

14.3

23.3

11.4

6.5

15.4

November 16, 2015

11

Ipca Laboratories | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Ipca Laboratories

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 16, 2015

12