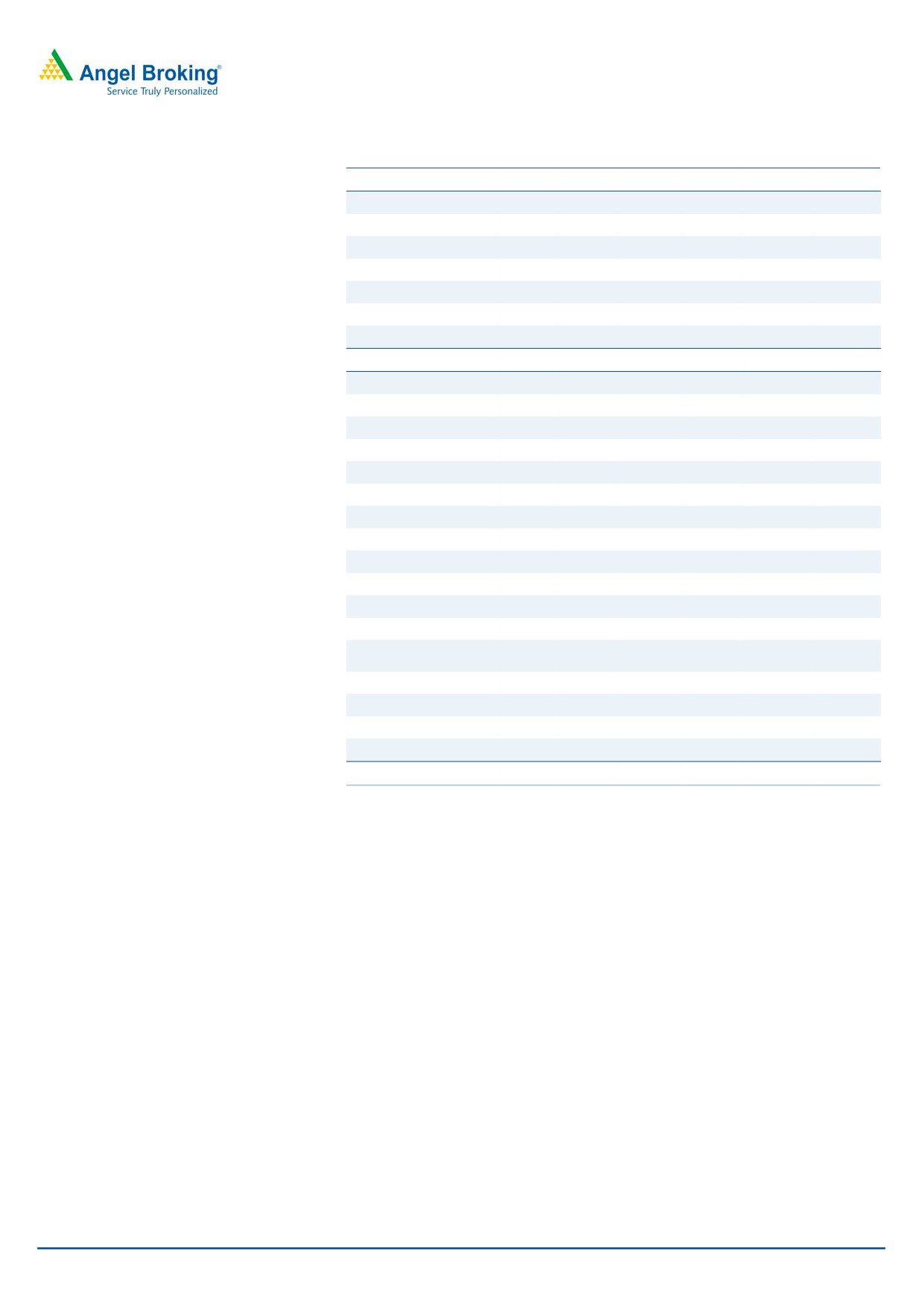

4QFY2016 Result Update | Capital Goods

May 11, 2016

Inox Wind

BUY

CMP

`242

Performance Highlights

Target Price

`286

Quarterly Data (Consolidated)

Investment Period

12 months

( ` cr)

4QFY16

4QFY15

% chg (yoy) 3QFY16

% chg (qoq)

Total Income

1,829

930

96.6

941

94.2

Stock Info

EBITDA

312

170

83.3

155

102.1

Sector

Capital Goods

EBITDA margin (%)

17.1

18.3

(124bp)

16.4

67bp

Market Cap (` cr)

5,426

Reported PAT

209

118

77.5

103

103.1

Net debt (` cr)

971

Source: Company, Angel Research

Beta

1.3

Inox Wind Ltd. (IWL) reported below than expected set of revenue and bottom-line

52 Week High / Low

495/217

numbers. IWL reported top-line of

`1,828cr, below our expectations. Inox

Avg. Daily Volume

621,492

reported 96.9% yoy top-line increase, reflecting 328MW of Turnkey sale volume.

Face Value (`)

10

On the back of strong execution IWL reported 83.3% yoy increase in EBITDA to

`312cr. Reported EBITDA is below our expectations. Led by operating leverage,

BSE Sensex

25,773

IWL reported EBITDA margins of 17.1%. On excluding impact of non-recurring

Nifty

7,888

line-items, Inox reported adj. EBITDA margins of 16.4%. IWL reported 17bps yoy

Reuters Code

INWN NS

decline in Adj. PAT margins to 10.8%, which is below our expectations. Adj. PAT

Bloomberg Code

INXW IN

of the company grew 67.4% yoy to `197cr. High tax rate of 29.4% in 4QFY2016

restricted Adj. PAT growth.

Strong Order Book, gives better revenue visibility: Order book of IWL at

Shareholding Pattern (%)

4QFY2016-end stands at 1,104MW (down 6.3% yoy), having an execution of

Promoters

85.6

12-15 months. Company Management has maintained optimism about future

MF / Banks / Indian Fls

4.7

order inflows, on the back of government’s focus on Renewable sector, IWLs strong

FII / NRIs / OCBs

2.0

market positioning and capex pipeline of Independent Power Producers (IPPs).

Indian Public / Others

7.6

Outlook and Valuation: We forecast IWL’s top-line to grow at CAGR of 19.3%

during FY2016-18, on the back of recent capacity expansion, strong order book

of 1,104MW (gives revenue visibility for next 12-15 months), larger project sites.

Abs.(%)

3 Months

With addition of more efficient products to portfolio, we expect Adj. EBITDA

Sensex

3.9

margins to improve from 15.4% in FY2016 to 16.4% in FY2018E. Increase in

depreciation expenses, and conservative other income estimates, restrict Adj. PAT

Inox Wind

(11.7)

margin expansion during FY2016-18E to 10.6%. Post 17% correction in IWL stock

after 4QFY2016 results were announced, the stock is now trading at FY2017E

3 year price chart

and FY2018E, P/E multiple of 9.8x and 8.1x, respectively. Considering the

600

4QFY2016 Order Book, expected strong order inflow trends and profitability

500

growth, IWL stock is trading at attractive valuations. On assigning, 9.5x P/E

multiple to our FY2018E, EPS estimate of `30.0, we arrive at price target of `286,

400

which gives 18% upside from the current levels. Given the upside, we maintain

300

our BUY rating on the stock.

200

Key Financials (Consolidated)

100

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

0

Operating income

1,567

2,710

4,406

5,605

6,267

% chg

48.0

73.0

62.6

27.2

11.8

Adj PAT

132

296

452

549

666

Source: Company, Angel Research

% chg

(12.0)

124.1

52.4

21.6

21.3

EBITDA (%)

11.3

16.9

15.5

15.7

16.4

EPS (`)

6.6

13.4

20.4

24.8

30.0

P/E (x)

36.6

18.1

11.9

9.8

8.1

P/BV (x)

11.3

3.9

2.9

2.2

1.8

RoE (%)

36.6

32.6

27.9

25.9

24.4

RoCE (%)

20.8

27.4

23.1

23.9

25.5

Yellapu Santosh

EV/Sales (x)

3.4

2.0

1.4

1.1

0.9

022 - 3935 7800 Ext: 6811

EV/EBITDA (x)

29.9

12.0

9.2

6.9

5.6

Source: Company, Angel Research; Note: CMP as of May 10, 2016

Please refer to important disclosures at the end of this report

1

Inox Wind | 4QFY2016 Result Update

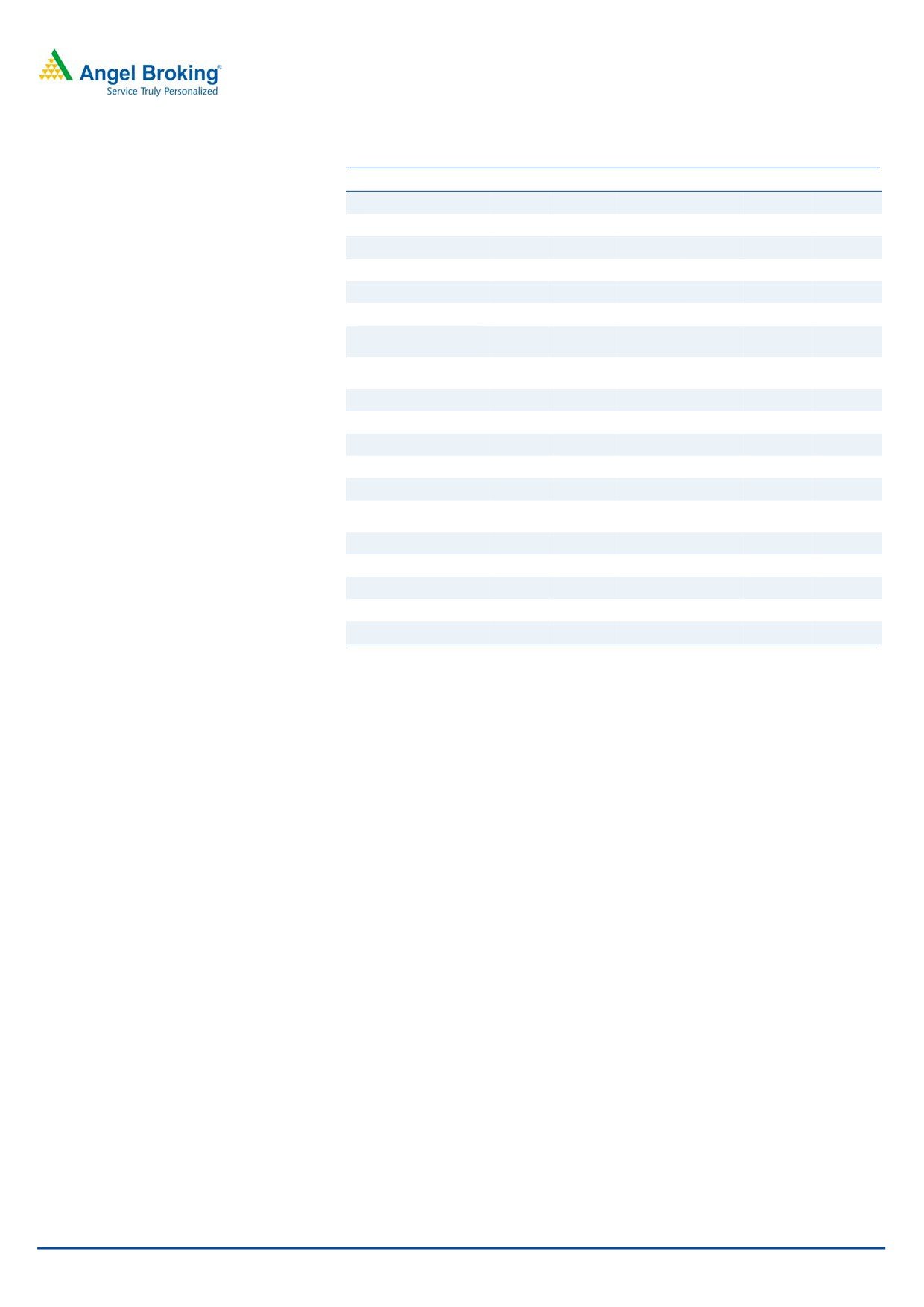

Exhibit 1: Quarterly Performance (Consolidated)

(` Cr)

4QFY16

4QFY15

% chg (yoy)

3QFY16

% chg (qoq)

FY2016

FY2015

% chg (yoy)

Net Sales

1,828

928

96.9

939

94.6

4,407

2,703

63.0

Other Operating Income

1

2

(41.8)

2

(59.5)

8

6

21.5

Total Income

1,829

930

96.6

941

94.2

4,414

2,709

62.9

Stock Adjustments

60

(134)

(18)

29

(144)

Raw Material

1,077

650

65.7

550

96.0

2,715

1,815

49.6

(% of total income)

62.2

55.4

56.5

62.1

61.7

Employee Cost

28

16

76.6

25

10.4

92

55

67.5

(% of total income)

1.5

1.7

2.7

2.1

2.0

EPC cost

237

194

22.1

146

61.7

535

364

47.0

(% of total income)

12.9

20.8

15.6

12.1

13.4

Other Expenses

127

34

267.8

84

51.5

366

163

124.6

(% of total income)

6.9

3.7

8.9

8.3

6.0

Total Expenditure

1,528

760

101.2

787

94.2

3,736

2,253

65.9

Exp. Capitalized & Goodwill written-off

12

0

0

12

0

EBITDA

312

170

83.3

155

102.1

690

456

51.2

(EBITDA %)

17.1

18.3

16.4

15.6

16.9

Interest

25

16

60.6

20

26.7

96

62

54.2

Depreciation

11

6

88.3

9

23.3

33

20

63.9

Other Income

20

4

422.9

15

34.3

66

15

335.6

PBT

296

153

77.3

141

92.3

627

389

61.2

PBT (%)

16.2

16.4

15.0

14.2

14.4

Total Tax

87

35

(149.9)

38

130.4

176

93

(89.3)

(% of PBT)

29.4

22.8

26.9

28.0

23.8

Rep. PAT

209

118

55.8

103

78.3

452

296

52.4

PAT Margins (%)

11.4

12.7

10.9

10.2

10.9

Adj. PAT

197

118

67.4

103

91.5

440

296

48.4

Adj. PAT Margins (%)

10.8

12.7

11.0

10.0

11.0

Rep. EPS (`)

9.4

5.3

77.5

4.6

103.1

20.4

13.4

52.4

Source: Company, Angel Research

Strong quarterly execution, but below our expectation…

IWL reported a top-line of `1,828cr, below our expectations. Lower than expected

revenues for the quarter is on account of delays in decision making by some of the

clients. Inox reported 94.6% yoy increase in revenues, reflecting (1) strong Turnkey

sale volume of 328MW (vs 198MW of volume in 4QFY2015), and (2) deliveries

taken for earlier deferment by some of the clients in 3QFY2016.

May 11, 2016

2

Inox Wind | 4QFY2016 Result Update

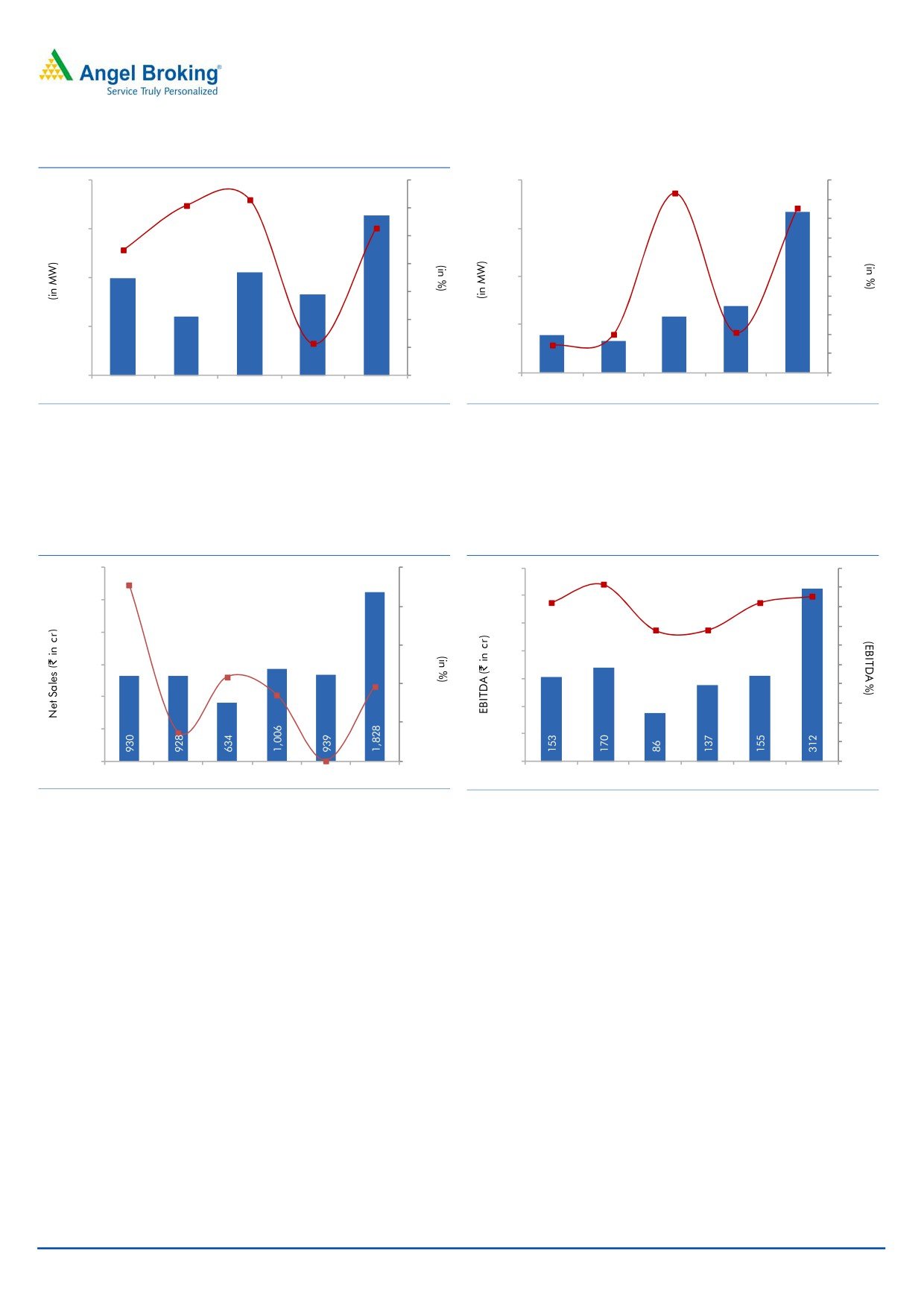

Exhibit 2: Sale Volumes (Turnkey+Equipment Supply)

Exhibit 3: Commissioning (Turnkey+Equipment Supply)

400

100

480

367

400

328

328

350

80

86

300

82

300

360

50

60

250

212

200

40

198

66

200

240

150

166

20

5

100

120

(28)

50

0

0

100

120

0

(20)

(50)

(17)

94

78

140

166

402

0

(40)

0

(100)

4QFY15

1QFY16

2QFY16

3QFY16

4QFY16

4QFY15

1QFY16

2QFY16

3QFY16

4QFY16

Source: Company, Angel Research

Source: Company, Angel Research

For the full year, IWL reported 63.0% yoy increase in revenues to `4,407cr,

reflecting 43% increase in sale volumes to 826MW. Notably, commissioning for

FY2016 witnessed sharp 195% yoy increase to 786MW.

Exhibit 4: Strong Revenue Growth

Exhibit 5: EBITDA Margins continue to expand

2,100

250

350

18

20

17

228

16

16

18

1,750

300

200

16

14

14

250

14

1,400

150

12

200

1,050

10

109

150

97

100

8

700

86

100

6

50

4

350

37

50

2

0

1

0

0

0

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

4QFY16

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

4QFY16

Source: Company, Angel Research

Source: Company, Angel Research

EBITDA numbers disappoint…

On the back of strong execution IWL reported 83.3% yoy increase in EBITDA to

`312cr. Reported EBITDA is below our expectations. Operating leverage helped

IWL report

17.1% EBITDA margins for the quarter. On adjusting for

(1)

capitalization of expenses and (2) goodwill on consolidation written-off, the Adj.

EBITDA margins of IWL were at 16.4%, which were flat on yoy basis.

For FY2016 EBITDA margins declined 121bps yoy to 15.6%, mainly owing to

124.6% increase in other expenses.

PAT also disappoints us…

IWL reported 17bps yoy decline in Adj. PAT (adjusted for exp. Capitalization and

goodwill write-off) margins to 10.8%, which is below our expectations. Adj. PAT of

the company grew 67.4% yoy to `197cr. High tax rate of 29.4% in 4QFY2016

restricted Adj. PAT growth.

In-line with EBITDA margin movement, Adj. PAT margins of the company declined

from 11.0% in FY2015 to 10.0% in FY2016.

May 11, 2016

3

Inox Wind | 4QFY2016 Result Update

Strong Order Book & ready pipeline of Project sites

Order book of IWL at 4QFY2016-end stands at 1,104MW (down 6.3% yoy),

having an execution of 12-15 months. Company Management has maintained

optimism about future order inflows, on the back of government’s strong focus on

Renewable sector, IWLs strong market positioning and strong capex pipeline of

Independent Power Producers (IPPs).

IWL has project sites in excess of 5,000MW, which have been acquired in various

stages. These sites are located across Rajasthan, Gujarat, Madhya Pradesh,

Andhra Pradesh and Maharashtra. Thus, it provides healthy revenue visibility for

IWL in the next few years.

Capex completed…

IWL has completed its capacity expansion exercise, resulting in increase in WTGs

capacity to 1,600MW. Blade plant integrated at their Madhya Pradesh facility has

commenced production. Also, IWL has built capabilities to manufacture 100m and

113m rotor diameter variants, now.

Actual capex for FY2016 stood at `160cr. IWL capitalized its Power Evacuation

Infrastructure facilities, resulting in over `350cr increase in Balance Sheet capex

(shown under the Goss Block).

Working Capital cycle further gets stretched…

IWL surprised the street by reporting further stretch in its working capital cycle (WC

as % of sales increased from 47.2% in FY2015 to 49.0% in FY2016). Key reason

for such expansion in Working capital cycle has been stretch in the AR days, which

increased from 144 days in FY2015 to 159 days in FY2016. Stretch in the AR days

is attributed to the back-ended sales (4QFY2016 revenues contributed 41.4% of

the yearly revenues). Management in the 4QFY2016 concall commented that the

risk of bad debts for IWL is minimal, as 90% of the receivables outstanding is less

than 6 months old.

Given that the company’s business is expected to grow its top-line by 19.3% CAGR

during FY2016-18E, we expect further stretch in working capital cycle from 142

days in FY2016 to 151 days in FY2018E.

May 11, 2016

4

Inox Wind | 4QFY2016 Result Update

Outlook and Valuation

We forecast IWL’s top-line to grow at CAGR of 19.3% (lowering our earlier

estimates considering the overhang on feed-in tariffs for wind) during FY2016-18,

on the back of recent capacity expansion, strong order book of 1,104MW (gives

revenue visibility for next 12-15 months), larger project sites.

Recently, IWL expanded its Turbine capacity to 113m (from the earlier 100m). As a

result, management expects 5% increase in the costs, but efficiency is expected to

increase by 20%. Further, realization of large rotor blades would increase.

Considering shift in business mix (where high capacity Turbines would contribute

more to the financials), we expect efficiency improvement. As a result, we expect

the Adj. EBITDA margins to improve from 15.4% in FY2016 to 16.4% in FY2018E.

Increase in depreciation expenses, and our conservative other income estimates,

restrict the Adj. PAT margin expansion during FY2016-18E to 10.6%.

Post the 17% correction in the IWL stock after 4QFY2016 results were announced,

the stock is now trading at FY2017E and FY2018E, P/E multiple of 9.8x and 8.1x,

respectively. Considering the 4QFY2016 Order Book, and expected strong order

inflow trends, IWL stock is trading at attractive valuations. On assigning, 9.5x P/E

multiple to our FY2018E, EPS estimate of `30.0, we arrive at price target of `286,

which gives 18% upside from the current levels. Given the upside, we maintain our

BUY rating on the stock.

Company Background

Inox Wind Ltd (IWL), incorporated in 2009 and a part of the Inox Group, is one of

the leading manufacturers of wind turbine generators in India. The company also

provides turnkey solutions, and operation and maintenance services for wind

power projects. Currently, IWL has an installed capacity of 950 Nacelles & Hubs at

Una, Himachal Pradesh and Barwani, Himachal Pradesh, 400 Rotor Blade sets,

and capacity of 600 towers at Rohika, Gujarat and Barwani, Himachal Pradesh.

May 11, 2016

5

Inox Wind | 4QFY2016 Result Update

Profit & Loss Statement (Consolidated)

Y/E March (` cr)

FY2013 FY2014 FY2015 FY2016 FY2017E FY2018E

Net Sales

1,059

1,567

2,710

4,406

5,605

6,267

% Chg

70.3

48.0

73.0

62.6

27.2

11.8

Total expenditure

862

1,391

2,252

3,736

4,725

5,239

Net Raw Materials

679

940

1,671

2,743

3,464

3,811

EPC and O&M exp.

94

273

364

535

706

771

Employee expenses

25

38

55

92

112

132

Other expenses

64

139

163

366

443

526

EBITDA

196

176

457

671

880

1,028

% Chg

38.5

(10.3)

159.5

49.2

28.9

16.8

EBIDTA %

18.6

11.3

16.9

15.2

15.7

16.4

Exp. Cap. &

0

0

0

12

0

0

Goodwill written-off

Depreciation

9

12

20

33

43

49

EBIT

188

165

437

649

837

978

% Chg

39.7

(12.2)

165.4

48.5

28.9

17.0

Interest Charges

39

46

62

96

110

87

Other Income

5

9

14

74

36

34

(% of Net Sales)

0.5

0.6

0.5

1.7

0.6

0.5

PBT

154

128

389

627

763

925

Tax

3

(4)

93

176

214

259

% of PBT

2.1

(3.5)

23.8

28.0

28.0

28.0

PAT

150

132

296

452

549

666

% Chg

50.6

(12.0)

124.1

52.4

21.6

21.3

PAT %

14.2

8.4

10.9

10.3

9.8

10.6

Diluted EPS

7.5

6.6

13.4

20.4

24.8

30.0

May 11, 2016

6

Inox Wind | 4QFY2016 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017E

FY2018E

Sources of Funds

Equity Capital

40

200

222

222

222

222

Reserves Total

256

228

1,170

1,622

2,171

2,837

Networth

296

428

1,392

1,844

2,393

3,059

Total Debt

337

480

846

1,450

1,207

909

Other long term Liab.

2

2

5

7

7

7

Deferred Tax Liability

20

15

21

45

45

45

Total Liabilities

654

926

2,264

3,346

3,652

4,020

Application of Funds

Gross Block

177

204

253

624

724

824

Accumulated Dep.

21

32

52

85

129

129

Net Block

157

172

201

539

595

695

Capital WIP

4

25

49

55

65

25

Goodwill

0

2

2

17

17

17

Investments

0

45

0

62

12

12

Deferred Tax Assets

0

0

22

35

35

35

Current Assets

Inventories

79

271

424

542

845

944

Sundry Debtors

500

710

1,432

2,414

2,416

2,615

Cash and Bank Balance

2

4

710

479

490

487

Loans, Advances and

196

203

344

553

779

877

Deposits

Other Current Asset

12

48

34

68

78

81

Current Liabilities

296

554

954

1,419

1,681

1,770

Net Current Assets

494

681

1,989

2,637

2,927

3,235

Misc. Expenditure

0

0

0

0

0

0

Total Assets

654

926

2,264

3,346

3,652

4,020

May 11, 2016

7

Inox Wind | 4QFY2016 Result Update

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY2013 FY2014 FY2015 FY2016 FY2017E FY2018E

Profit before tax

154

128

389

627

763

925

Depreciation

9

12

20

33

43

49

Change in WC

(286)

(185)

(602)

(879)

(278)

(312)

Int. / Dividend (Net)

34

46

62

96

110

87

Direct taxes paid

(29)

(4)

93

176

214

259

Other income

(3)

9

14

74

36

34

Cash Flow from

(121)

(5)

(238)

(372)

388

457

Oper.

(Inc.)/ Dec. in Fixed

(351)

(48)

(73)

(377)

(110)

(60)

Assets

(Inc.)/ Dec. in Inv.

216

(45)

45

(62)

50

0

Other income

(3)

9

14

74

36

34

Cash Flow from Inv.

(135)

(84)

(14)

(365)

(24)

(26)

Issue of Equity

0

160

22

0

0

0

Inc./(Dec.) in loans

256

144

368

606

(243)

(298)

Dividend Paid (Incl.

0

0

0

0

0

0

Tax)

Others

(38)

(213)

567

(100)

(110)

(136)

Cash Flow from Fin.

219

91

957

506

(353)

(434)

Inc./(Dec.) in Cash

(38)

2

706

(230)

11

(3)

Opening Cash bal.

39

1

4

709

479

490

Closing Cash bal.

1

4

709

479

490

487

May 11, 2016

8

Inox Wind | 4QFY2016 Result Update

Key Ratios (Consolidated)

Y/E March

FY2014

FY2015E FY2016E FY2017E FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

36.6

18.1

11.9

9.8

8.1

P/CEPS

33.6

16.9

11.1

9.1

7.5

P/BV

11.3

3.9

2.9

2.2

1.8

EV/Sales

3.4

2.0

1.4

1.1

0.9

EV/EBITDA

29.9

12.0

9.2

6.9

5.6

EV / Total Assets

5.7

2.4

1.9

1.7

1.4

Per Share Data (`)

EPS (fully diluted)

6.6

13.4

20.4

24.8

30.0

Cash EPS

7.2

14.3

21.9

26.7

32.3

Book Value

21.4

62.7

83.1

107.8

137.9

Returns (%)

RoCE (Pre-tax)

20.8

27.4

23.1

23.9

25.5

Angel RoIC (Pre-tax)

22.0

37.1

30.5

28.7

29.7

RoE

36.6

32.6

27.9

25.9

24.4

Turnover ratios (x)

Asset Turnover (Gross Block)

8.2

11.9

10.0

8.3

8.1

Inventory / Sales (days)

41

47

40

45

52

Receivables (days)

141

144

159

157

146

Payables (days)

112

122

116

120

120

WC cycle (ex-cash) (days)

136

132

142

150

151

Solvency ratios (x)

Net debt to equity

1.0

0.1

0.5

0.3

0.1

Net debt to EBITDA

2.4

0.3

1.3

0.8

0.4

Interest Coverage (EBIT / Int.)

3.6

7.0

6.8

7.6

11.2

May 11, 2016

9

Inox Wind | 4QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Inox Wind

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

May 11, 2016

10