2QFY2016 Result Update | Capital Goods

October 27, 2015

Inox Wind

BUY

CMP

`390

Performance Highlights

Target Price

`505

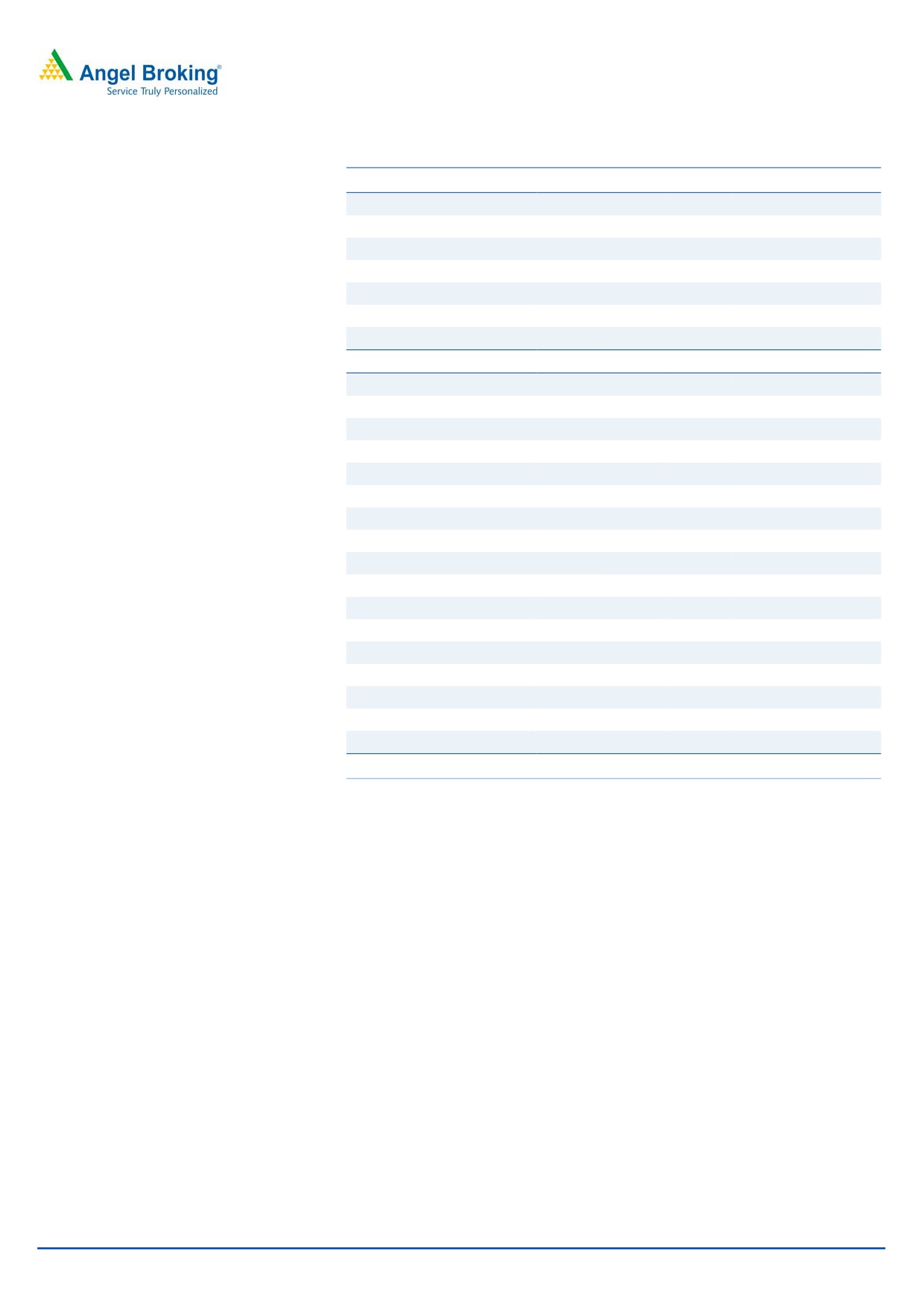

Quarterly Data (Consolidated)

Investment Period

12 months

( ` cr)

2QFY16

2QFY15

% chg (yoy) 1QFY16

% chg (qoq)

Revenues

1,008

543

85.6

636

58.6

Stock Info

EBITDA

137

87

57.6

86

58.6

Sector

Capital Goods

EBITDA margin (%)

13.6

16.0

(242bp)

13.6

-

Market Cap (` cr)

8,651

Reported PAT

89

55

63.5

51

76.5

Source: Company, Angel Research

Net debt (` cr)

135

Beta

1.2

Inox Wind (IWL) reported a strong set of numbers for 2QFY2016. Its top-line grew by

85.6% yoy to `1,008.2cr, led by 212MW of wind turbine generator (WTG) sales (increase

52 Week High / Low

495 / 315

of 86% yoy) during the quarter as against 114MW of WTGs supplied during 2QFY2015.

Avg. Daily Volume

1,463,396

The commissioning of the 140MW of WTG (increase of 367% yoy) during the quarter (as

Face Value (`)

10

against 30MW in 2QFY2015) also contributed to the revenue. The EBITDA during the

quarter came in at `137cr, an increase of 57.6% yoy; however, the same is lower than our

BSE Sensex

27,362

estimate of `152.4cr. Its EBITDA margin fell by 242bp yoy to 13.6% and the same is below our

Nifty

8,261

estimate of 15.3%. The decline in the EBIDTA margin was largely due to increase in the share of

Reuters Code

NA

commissioning revenue. The Net profit improved by 63.5% yoy to `89.1cr, during the quarter.

Bloomberg Code

INXW IN

Strong order book to boost performance: IWL received new orders worth 194MW during

the quarter, and as of September 2015 the order book stands at 1,202MW, down by 1.5%

against 1,220MW during June 2015. The strong order book provides revenue visibility over

Shareholding Pattern (%)

the next 12-15 months. The company also has project sites worth in excess of 5,000MW,

Promoters

85.6

which have been acquired or are under various stages of acquisition. Thus, IWL has a

healthy revenue visibility in the medium term.

MF / Banks / Indian Fls

4.8

EBIDTA rises by 57.6% yoy: IWL reported an EBIDTA of `137cr for the quarter as against `87cr during

FII / NRIs / OCBs

3.4

2QFY2015, thus registering a growth of 57.6% yoy. However, the EBIDTA margin for the quarter

Indian Public / Others

6.2

came in at 13.6% (our estimate was of 15.3%) as against 16% during 2QFY2015, a dip of 242bp

yoy. The margin decline was mainly due to rupee deprecation impacting raw material cost and

increase in the share of the relatively lower margin commissioning segment to the overall revenue.

Abs.(%)

3 Months

Going forward, margin is expected to improve on account of higher supply of 100 meter

blades as against 93 meters being currently supplied. Further it will introduce larger 113

Sensex

(2.7)

meter blades later during FY2016. We expect this higher blade segment to account for 50% of its

Inox Wind

(7.9)

business, going forward. The larger blades would get higher realizations and would improve the overall

margin further. We expect IWL’s margin to improve from 16.9% in FY2015 to 17.5% by FY2017.

3 year price chart

600

Outlook and Valuation: We forecast IWL’s top-line to grow at a CAGR of 48.1% during

FY2015-17 on the back of aggressive capacity expansion, strong order book, and large

550

project sites. We expect EBITDA margin to improve to 17.5% by FY2017 on the basis of higher

500

realization from larger rotor blades and no royalty payment burden from FY2016 onwards.

450

The stock is currently trading at 12.4x its FY2017E EPS. Given the attractive valuation, we

400

maintain our Buy rating on the stock. We have assigned a multiple of 16x to its FY2017 EPS

350

of `31.6 to arrive at a target price of `505.

300

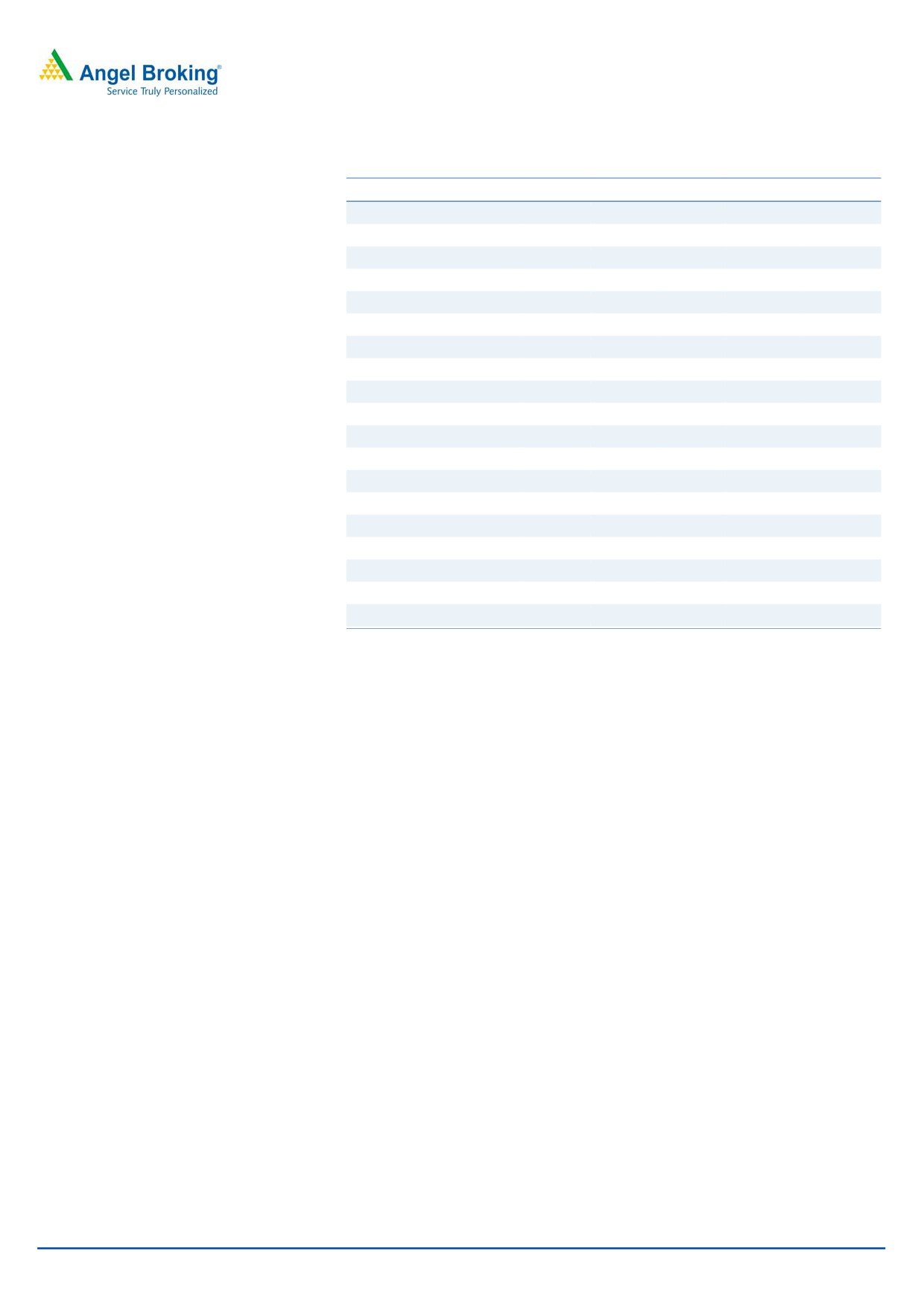

Key Financials (Consolidated)

250

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

Operating income

1,567

2,710

4,980

5,943

% chg

48.0

73.0

83.8

19.3

Adj PAT

132

296

590

701

Source: Company, Angel Research

% chg

(12.0)

124.1

99.2

18.7

EBITDA (%)

11.3

16.9

17.0

17.5

EPS (`)

6.6

13.4

26.6

31.6

P/E (x)

59.0

29.2

14.7

12.4

P/BV (x)

18.2

6.2

4.4

3.2

RoE (%)

36.6

32.6

35.0

30.0

RoCE (%)

20.8

27.6

32.0

31.5

Shrenik C. Gujrathi

EV/Sales (x)

5.3

3.2

1.9

1.5

022 39357800 Ext: 6872

EV/EBITDA (x)

46.7

19.2

11.1

8.7

Source: Company, Angel Research; Note: CMP as of October 26, 2015

Please refer to important disclosures at the end of this report

1

Inox Wind | 2QFY2016 Result Update

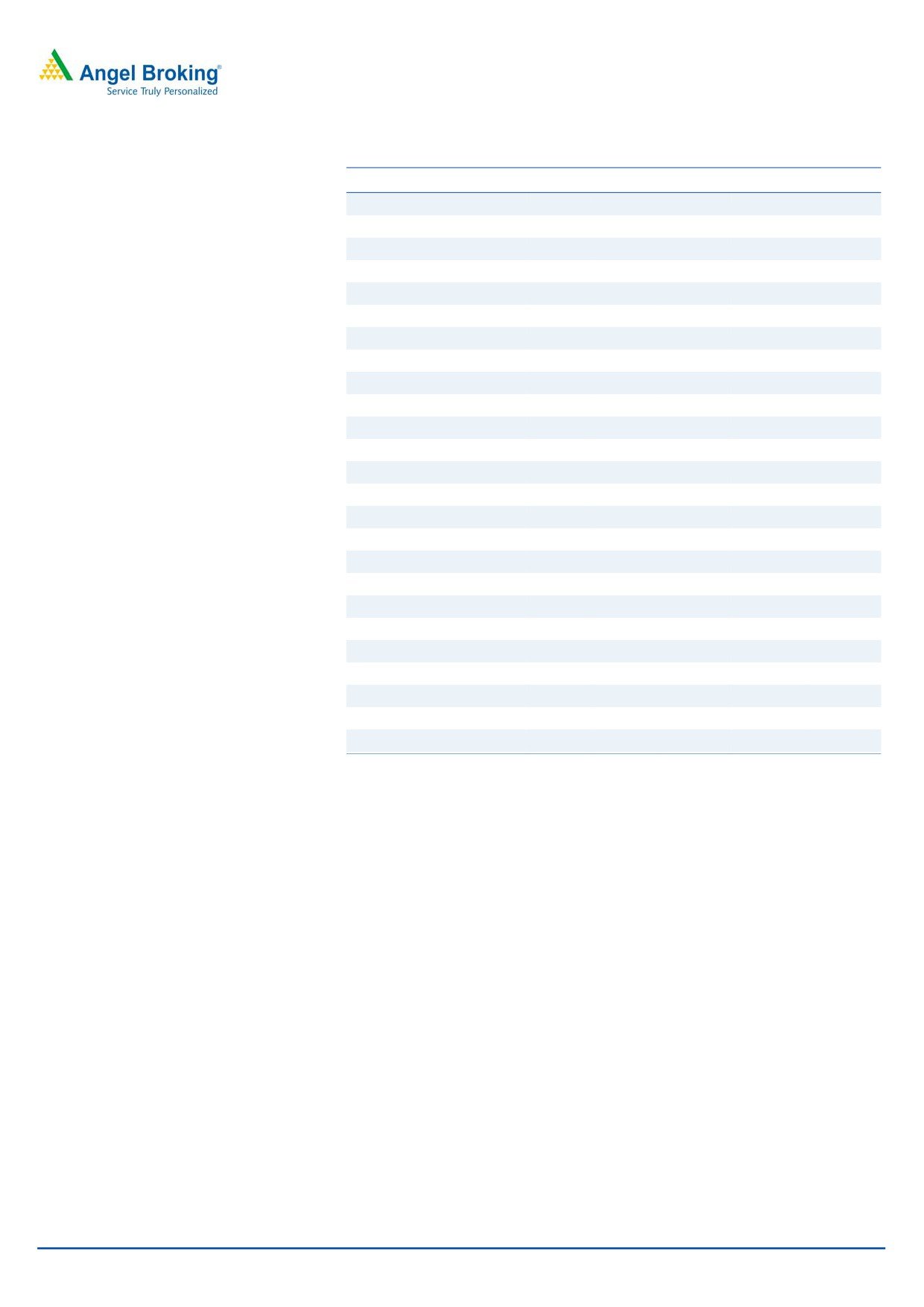

Exhibit 1: Quarterly Performance

(` Cr)

2QFY2016

2QFY2015

% chg (yoy)

1QFY2016

% chg (qoq)

1HFY2016

1HFY2015

% chg (yoy)

Net Sales

1,006

541

86.0

634

58.7

1,640

844

94.3

Other operating income

2

2

2

4

3

Total income

1,008

543

85.6

636

58.6

1,644

848

94.0

Stock adjustments

3

(35)

(17)

(14)

(36)

Raw Material

680

373

82.2

408

66.5

1,088

585

85.9

(% of total income)

67.8

62.3

61.6

65.4

64.8

Employee Cost

20

13

55.3

19

6.3

39

25

58.2

(% of total income)

2.0

2.4

3.0

2.4

2.9

EPC cost

78

54

44.1

73

6.5

151

65

131.6

(% of total income)

7.7

10.0

11.5

9.2

7.7

Other Expenses

90

51

77.9

66

36.8

156

75

108.7

(% of total income)

8.9

9.3

10.3

9.5

8.8

Total Expenditure

871

456

91.0

549

58.6

1,421

714

99.1

EBITDA

137

87

57.6

86

58.6

223

134

66.7

(EBITDA %)

13.6

16.0

13.6

13.6

15.8

Interest

28

15

94.6

22

28.2

50

30

67.0

Depreciation

8

5

62.8

6

25.5

14

9

54.4

Other Income

21

6

237.9

11

91.7

31

8

307.8

PBT

121

74

64.8

69

76.7

190

102

85.9

PBT (%)

12.0

13.6

10.8

11.6

12.1

Total Tax

32

19

(68.7)

18

77.1

50

24

(107.9)

(% of PBT)

26.6

26.0

26.5

26.6

23.7

Reported PAT (After Min. Int.)

89

55

63.5

51

76.5

140

78

79.0

PAT Margins(%)

8.8

10.0

7.9

8.5

9.2

Extra ordinary exp/(inc)

0

0

0

0

0

Adj PAT

89

55

63.5

51

76.5

140

78

79.0

EPS (`)

4.0

2.7

47.3

2.3

76.5

6.3

3.9

61.4

Source: Company, Angel Research

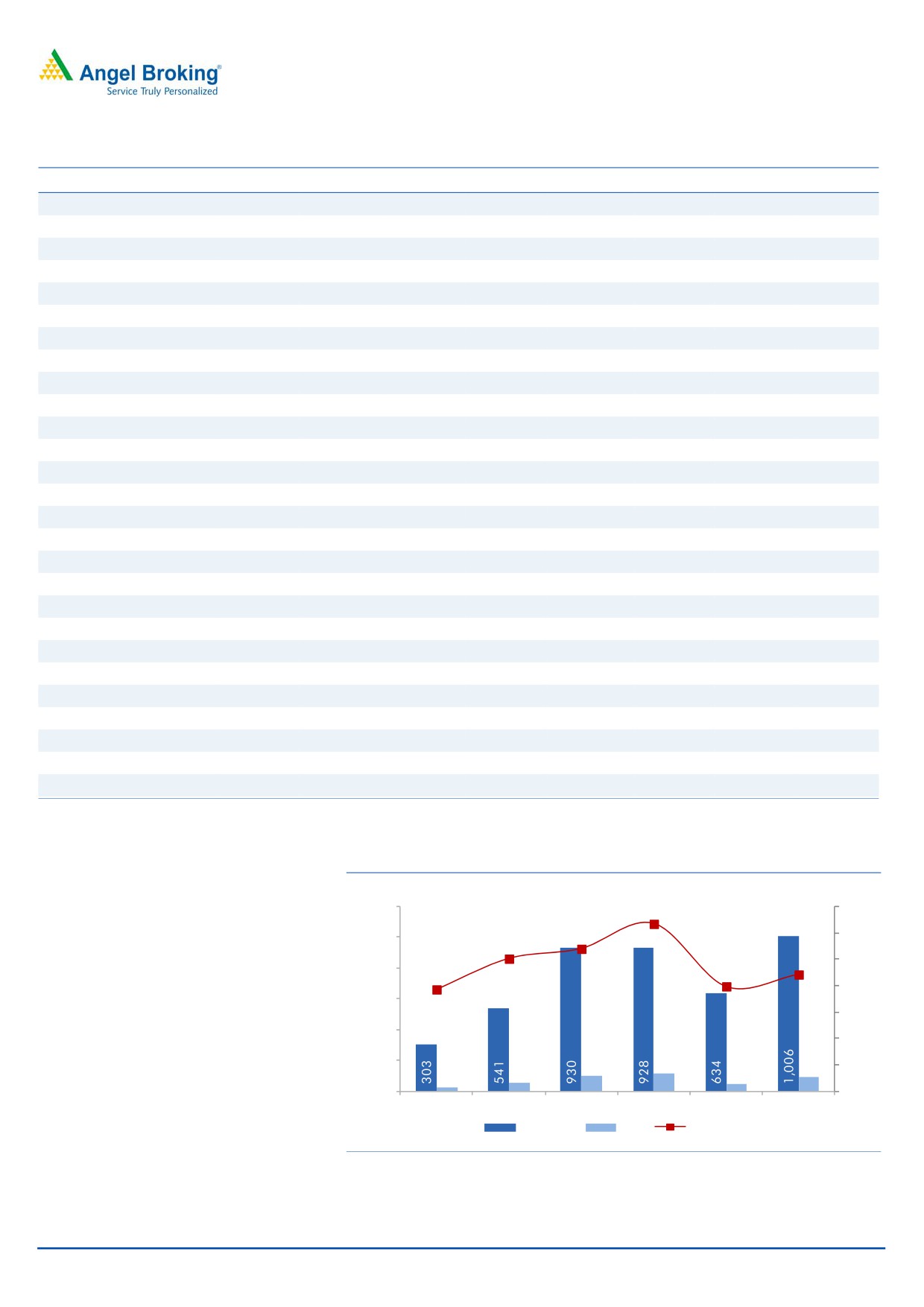

Exhibit 2: Financial Performance

(`cr)

(%)

1,200

14.0

12.7

1,000

10.8

12.0

10.0

10.0

800

7.7

7.9

8.8

8.0

600

6.0

400

4.0

200

101

118

89

2.0

55

51

23

0

0.0

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

Net Sales

PAT

PAT Margin

Source: Company, Angel Research

October 27, 2015

2

Inox Wind | 2QFY2016 Result Update

Strong order book and ready pipeline of project sites

IWL has delivered a strong volume growth of 84% during 1HFY2016, wherein it

has sold 332MW of WTGs as against 180MW sold during 1HFY2015. During

2QFY2016 the company sold 212MW of WTGs as against 114MW of WTGs sold

during 2QFY2015 (growth of 85.6% yoy). The order book as of June 2015 stands

at 1,202MW (down by 1.5% qoq) as against 1,220MW during June 2015, having

an execution period of 12-15 months. Out of this order book, 71% are turnkey

orders, while the remaining 29% orders are for supply of WTGs. The Management

is optimistic about the future order inflow, mainly driven by government focus on

renewable sector and larger capex from independent power producers (IPPs).

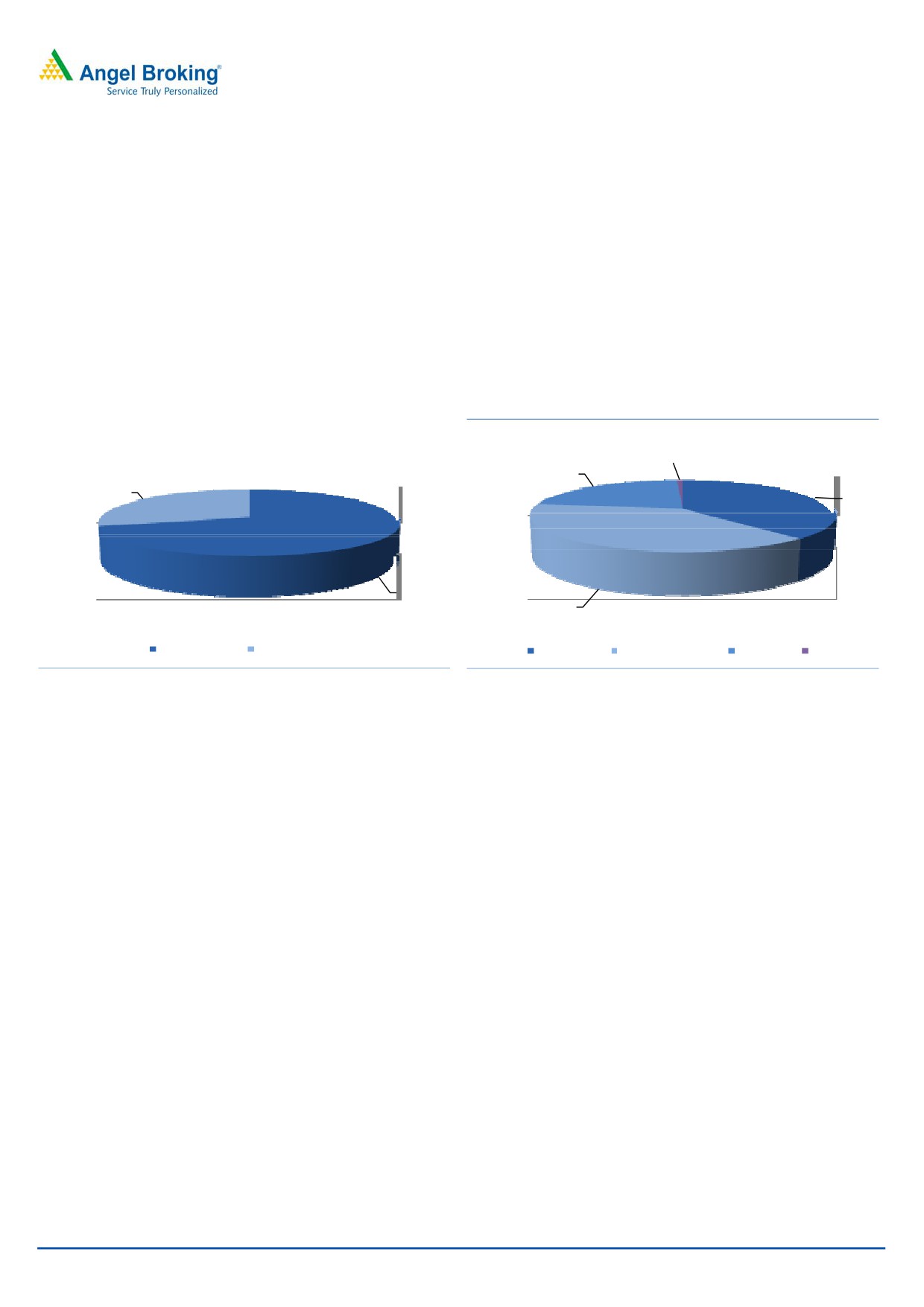

Exhibit 3: Turnkey vs Equipment supply Order Book breakup

Exhibit 4: Geography wise Order Book

1%

22%

29%

38%

71%

39%

Turnkey

Equipment supply

Rajasthan

Madhya Pradesh

Gujarat

AP

Source: Company, Angel Research

Source: Company, Angel Research

The company also has project sites worth in excess of 5,000MW, which have been

acquired or are under various stages of acquisition. These sites are located across

Rajasthan, Gujarat, Madhya Pradesh, Andhra Pradesh and Maharashtra. Thus, it

provides healthy revenue visibility for IWL over the next few years.

Improvement in working capital cycle

IWL improved its working capital (WC) cycle from 169 days in 1QFY2016 to 148

days in 2QFY2016. It was mainly due to reduced capacity mismatch, efficient

execution and increased project commissioning. The Management is confident of

further reducing the WC cycle and expects it to stabilize in the range of 120-

150days.

Margin expected to improve

On the EBITDA front, the company's consolidated margin for 2QFY2016 declined

by 242bp yoy to 13.6% and was below our estimate of 15.3%. It was led by rupee

depreciation (as 64% of raw material is imported) and increase in contribution of

the relatively low margin commissioning segment to the overall revenue. Going

forward, as IWL’s blade plant in Madhya Pradesh commences production of larger

diameter blades (of 100meters vs 93 meters earlier), we expect 50% of its business

to come from this segment. The larger blades would get higher realizations and

would improve the overall margin. We expect IWL’s margin to improve from

16.9% in FY2015 to 17.5% by FY2017.

October 27, 2015

3

Inox Wind | 2QFY2016 Result Update

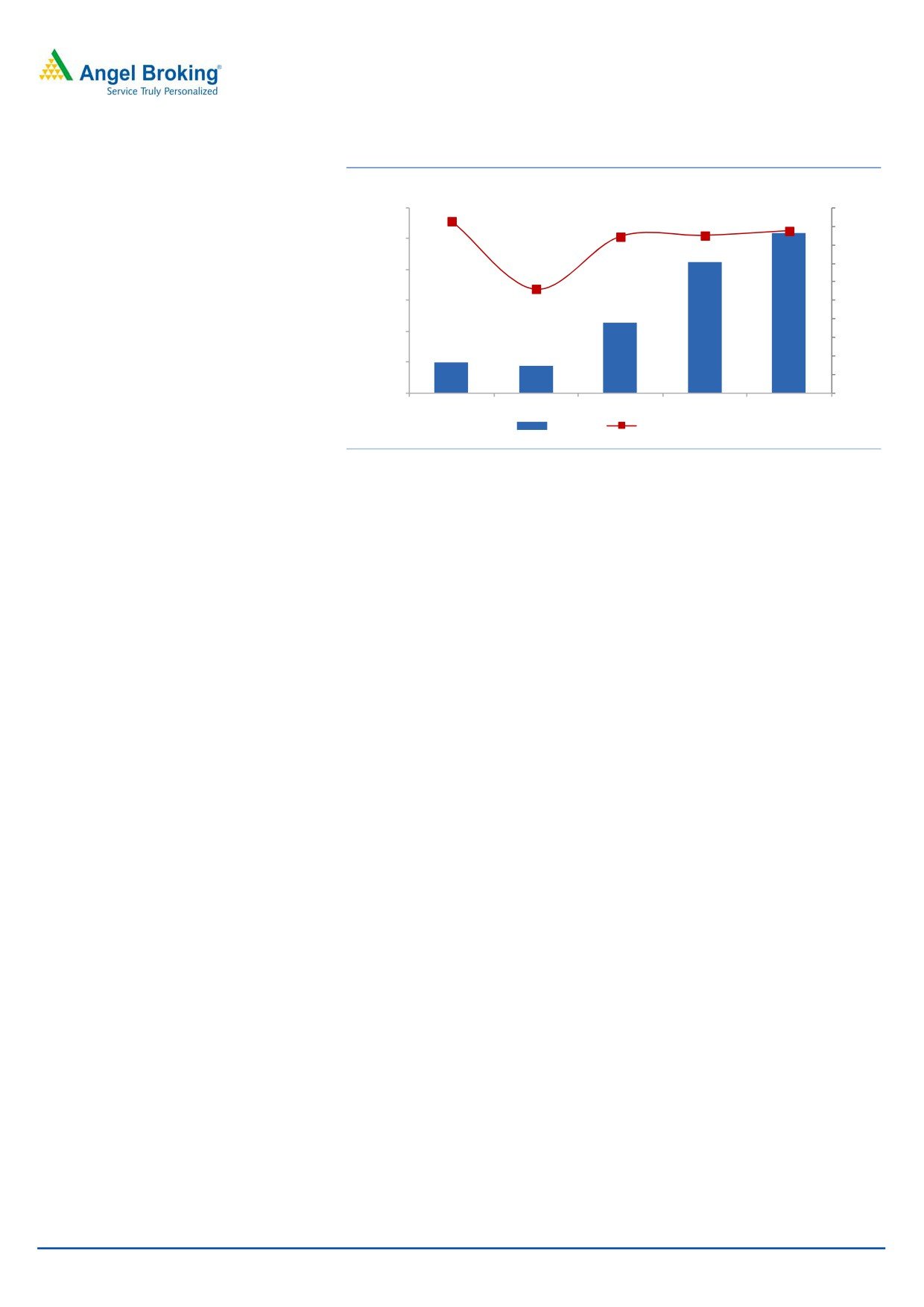

Exhibit 5: Expected margin improvement

(`cr)

(%)

1,200

20.0

18.6

1,040

17.0

18.0

1,000

17.5

16.9

16.0

847

14.0

800

12.0

600

11.3

10.0

457

8.0

400

6.0

196

176

4.0

200

2.0

0

0.0

FY2013

FY2014

FY2015

FY2016E

FY2017E

EBITDA

EBITDA margin

Source: Company, Angel Research

Outlook and Valuation: We forecast IWL’s top-line to grow at a CAGR of 48.1%

during FY2015-17, on the back of aggressive capacity expansion, strong order

book and larger project sites. We expect the EBITDA margin to improve to 17.5%

by FY2017 on the basis of higher realization of larger rotor blades (expect 50% of

revenue to come from this segment). Further, there would be no royalty payment

from FY2016. The stock is trading at 13.7x its FY2017E EPS. Given the attractive

valuation, we recommend a Buy rating on the stock. We have assigned a multiple

of 16x to its FY2017 EPS of `31.6 to arrive at a target price of `505.

October 27, 2015

4

Inox Wind | 2QFY2016 Result Update

Company Background

Inox Wind Ltd (IWL), incorporated in 2009 and a part of the Inox Group, is one of

the leading manufacturers of wind turbine generators in India. The company also

provides turnkey solutions, and operation and maintenance services for wind

power projects. Currently, IWL has an installed capacity of 550 nacelles and hubs

at Una, Himachal Pradesh, 400 rotor blade sets, and a capacity of 300 towers at

Rohika, Ahmedabad, Gujarat. The company is setting up a new integrated

capacity of 400 nacelles and hubs, 400 rotor blade sets, and 300 towers at

Barwani, Madhya Pradesh. This would take the total nacelles and hubs capacity to

950 units, rotor blades capacity to 800 sets, and tower capacity to 600 units.

October 27, 2015

5

Inox Wind | 2QFY2016 Result Update

Profit & Loss Statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Net Sales

1,059

1,567

2,710

4,980

5,943

% Chg

70.3

48.0

73.0

83.8

19.3

Total expenditure

862

1,391

2,252

4,133

4,903

Net Raw Materials

679

940

1,671

3,087

3,685

EPC and O&M expenses

94

273

364

672

802

Employee expenses

25

38

55

100

119

Other expenses

64

139

163

274

297

EBITDA

196

176

457

847

1,040

% Chg

38.5

(10.3)

159.5

85.1

22.9

EBIDTA %

18.6

11.3

16.9

17.0

17.5

Depreciation

9

12

20

36

40

EBIT

188

165

437

811

1,001

% Chg

39.7

(12.2)

165.4

85.5

23.4

Interest Charges

39

46

62

80

76

Other Income

5

9

14

57

10

(% of Net Sales)

0.5

0.6

0.5

1.1

0.2

PBT

154

128

389

787

934

Tax

3

(4)

93

197

234

% of PBT

2.1

(3.5)

23.8

25.0

25.0

PAT

150

132

296

590

701

% Chg

50.6

(12.0)

124.1

99.2

18.7

PAT %

14.2

8.4

10.9

11.9

11.8

Diluted EPS (`)

7.5

6.6

13.4

26.6

31.6

October 27, 2015

6

Inox Wind | 2QFY2016 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Sources of Funds

Equity Capital

40

200

222

222

222

Reserves Total

256

228

1,170

1,760

2,461

Networth

296

428

1,392

1,982

2,683

Total Debt

337

480

845

845

845

Other long term Liabilities

2

2

2

2

2

Deferred Tax Liability

20

15

0

0

0

Total Liabilities

654

926

2,239

2,830

3,530

Application of Funds

Gross Block

177

204

277

477

527

Accumulated Depreciation

21

32

52

88

127

Net Block

157

172

225

389

400

Capital WIP

4

25

25

25

25

Goodwill

0

2

2

2

2

Investments

0

45

0

0

0

Deferred Tax Assets

0

0

1

1

1

Current Assets

Inventories

79

271

424

752

897

Sundry Debtors

500

710

1,432

2,427

2,652

Cash and Bank Balance

2

4

710

131

419

Loans, Advances and Deposits

196

203

344

631

754

Other Current Asset

12

48

34

62

74

Current Liabilities

296

554

957

1,591

1,693

Net Current Assets

494

681

1,986

2,412

3,102

Miscellaneous Expenditure

0

0

0

0

0

Total Assets

654

926

2,239

2,830

3,530

October 27, 2015

7

Inox Wind | 2QFY2016 Result Update

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E

Profit before tax

154

128

389

787

934

Depreciation

9

12

20

36

40

Change in Working Capital

(286)

(185)

(599)

(1,004)

(403)

Interest / Dividend (Net)

34

46

62

80

76

Direct taxes paid

(29)

(4)

93

197

234

Other income

(3)

9

14

57

10

Cash Flow from Operations

(121)

(5)

(234)

(355)

404

(Inc.)/ Dec. in Fixed Assets

(351)

(48)

(73)

(200)

(50)

(Inc.)/ Dec. in Investments

216

(45)

45

0

0

Other income

(3)

9

14

57

10

Cash Flow from Investing

(135)

(84)

(14)

(143)

(40)

Issue of Equity

0

160

22

0

0

Inc./(Dec.) in loans

256

144

365

0

0

Dividend Paid (Incl. Tax)

0

0

0

0

0

Others

(38)

(213)

567

(80)

(76)

Cash Flow from Financing

219

91

953

(80)

(76)

Inc./(Dec.) in Cash

(38)

2

706

(578)

287

Opening Cash balances

39

1

4

709

131

Closing Cash balances

1

4

709

131

419

October 27, 2015

8

Inox Wind | 2QFY2016 Result Update

Key Ratios (Consolidated)

Y/E March

FY2013

FY2014

FY2015E FY2016E FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

57.6

65.5

32.4

16.3

13.7

P/CEPS

54.4

60.2

30.3

15.3

13.0

P/BV

5.9

20.2

6.9

4.8

3.6

EV/Sales

8.5

5.8

3.6

2.1

1.7

EV/EBITDA

45.8

51.6

21.3

12.2

9.6

EV / Total Assets

13.8

9.8

4.4

3.6

2.8

Per Share Data (`)

EPS (fully diluted)

7.5

6.6

13.4

26.6

31.6

Cash EPS

8.0

7.2

14.3

28.2

33.4

Book Value

73.9

21.4

62.7

89.3

120.9

Returns (%)

RoCE (Pre-tax)

28.7

20.8

27.6

32.0

31.5

Angel RoIC (Pre-tax)

28.9

22.0

37.1

38.8

34.7

RoE

50.9

36.6

32.6

35.0

30.0

Turnover ratios (x)

Asset Turnover (Gross Block)

6.0

8.2

11.3

13.2

11.8

Inventory / Sales (days)

27

41

47

43

51

Receivables (days)

172

141

144

141

156

Payables (days)

125

112

122

113

122

WC cycle (ex-cash) (days)

170

136

132

130

152

Solvency ratios (x)

Net debt to equity

1.1

1.0

0.1

0.4

0.2

Net debt to EBITDA

1.7

2.4

0.3

0.8

0.4

Interest Coverage (EBIT / Int.)

4.8

3.6

7.0

10.1

13.2

October 27, 2015

9

Inox Wind | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Inox Wind

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

October 27, 2015

10