3QFY2016 Result Update | IT

January 20, 2016

Infosys

BUY

CMP

`1,139

Performance highlights

Target Price

`1,347

(` cr)

3QFY16

2QFY16

% chg (qoq)

3QFY15

% chg (yoy)

Investment Period

12 Months

Net revenue

15,902

15,635

1.7

13,796

15.3

EBITDA

4,328

4,352

(0.5)

3,980

8.7

EBITDA margin (%)

27.2

27.8

(62)bp

28.8

(163)bp

Stock Info

PAT

3,465

3,398

2.0

3,250

6.6

Sector

IT

Source: Company, Angel Research

Market Cap (` cr)

261,645

For 3QFY2016, Infosys posted a 0.6% sequential growth in USD revenues to

Net Debt (` cr)

(30,250)

US$2,407mn (V/s an expected US$2,368mn). In constant currency (CC) terms,

Beta

0.7

the company posted a 1.1% qoq growth. Volume growth during the quarter was

52 Week High / Low

1,219/933

of 3.1% qoq. On the operating front, the EBITDA margin came in at 27.2% (V/s

Avg. Daily Volume

178,359

an expected 27.0%) dipping by 62bp qoq. This was owing to pricing decline by

2.5% qoq and lower utilization. Consequently, the PAT came in at `3,465cr (V/s

Face Value (`)

5

an expected `3,251cr), a growth of 2.0% qoq. Overall, the Management is

BSE Sensex

24,480

upbeat about the company’s future prospects, given the strong order book

Nifty

7,435

position which is guided towards US$3bn. Also, the Management has guided

Reuters Code

INFY.BO

towards a higher revenue growth for FY2016, ie of 12.8-13.2% in CC terms and

Bloomberg Code

INFY@IN

16.2-16.6% in INR terms, on an exchange rate of `66.16/US$ (as on December

31, 2015). The earlier guidance was of 10-12% revenue growth in CC terms for

FY2016. We maintain our Buy rating on the stock with a target price of `1,347.

Shareholding Pattern (%)

Quarterly highlights: For 3QFY2016, Infosys posted a 0.6% sequential growth in

Promoters

13.1

USD revenues to US$2,407mn (V/s an expected US$2,368mn). In constant

MF / Banks / Indian Fls

18.0

currency (CC) terms, the company posted a 1.1% qoq growth. Volume growth

FII / NRIs / OCBs

58.2

during the quarter was of 3.1% qoq. On the operating front, the EBITDA margin

Indian Public / Others

10.7

came in at 27.2% (V/s an expected 27.0%) dipping by 62bp qoq. This was owing

to pricing decline by 2.5% qoq and lower utilization. Consequently, the PAT came

in at `3,465cr (V/s an expected `3,251cr), a growth of 2.0% qoq

Abs.(%)

3m 1yr

3yr

In terms of client additions, the company added 4 clients in the US$25mn+

Sensex

(10.5)

(13.4)

22.2

bracket and one in the US$50mn+ bracket. Overall, 1045 clients were active

Infosys

2.4

8.4

63.3

during the quarter. The Management is upbeat about the future prospects of the

company given the strong order book position, which is guided towards US$3bn.

3-year price chart

Outlook and valuation: The company has revised its future CC revenue growth

1,400

guidance for FY2016 to 12.8-13.2%. By FY2017, the company expects to lead

1,200

industry growth and reach a milestone of achieving sales of US$20bn by

1,000

FY2020. We maintain our Buy rating on the stock.

800

Key financials (Consolidated, IFRS)

600

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

400

Net sales

50,133

53,319

61,850

69,891

200

% chg

24.2

6.4

16.0

13.0

0

2

3

3

3

3

4

4

4

4

5

5

5

5

6

Adj. net profit

10,867

12,330

13,631

15,087

1

1

1

1

1

1

1

ŧ

1

1r

-

ŧ

1

r

1

-

ŧ

1

1r

-

ŧ

1

c

n

u

c

n

u

c

n

u

c

n

a

p

J

a

p

J

a

p

J

a

% chg

15.4

13.5

10.6

10.7

O

J

A

O

J

A

O

J

A

O

J

EBITDA margin (%)

27.2

27.9

27.5

27.5

Source: Company, Angel Research

EPS (`)

47.3

53.7

59.4

65.7

P/E (x)

24.1

21.2

19.2

17.3

P/BV (x)

5.5

4.8

4.1

3.5

RoE (%)

22.9

22.5

21.2

20.1

RoCE (%)

21.5

20.8

20.7

20.5

Sarabjit kour Nangra

EV/Sales (x)

4.6

4.3

3.5

3.0

+91 22-39357800 Ext: 6806

EV/EBITDA (x)

16.9

15.3

12.8

10.8

Source: Company, Angel Research; Note: CMP as of January 19, 2016

Please refer to important disclosures at the end of this report

1

Infosys | 3QFY2016 Result Update

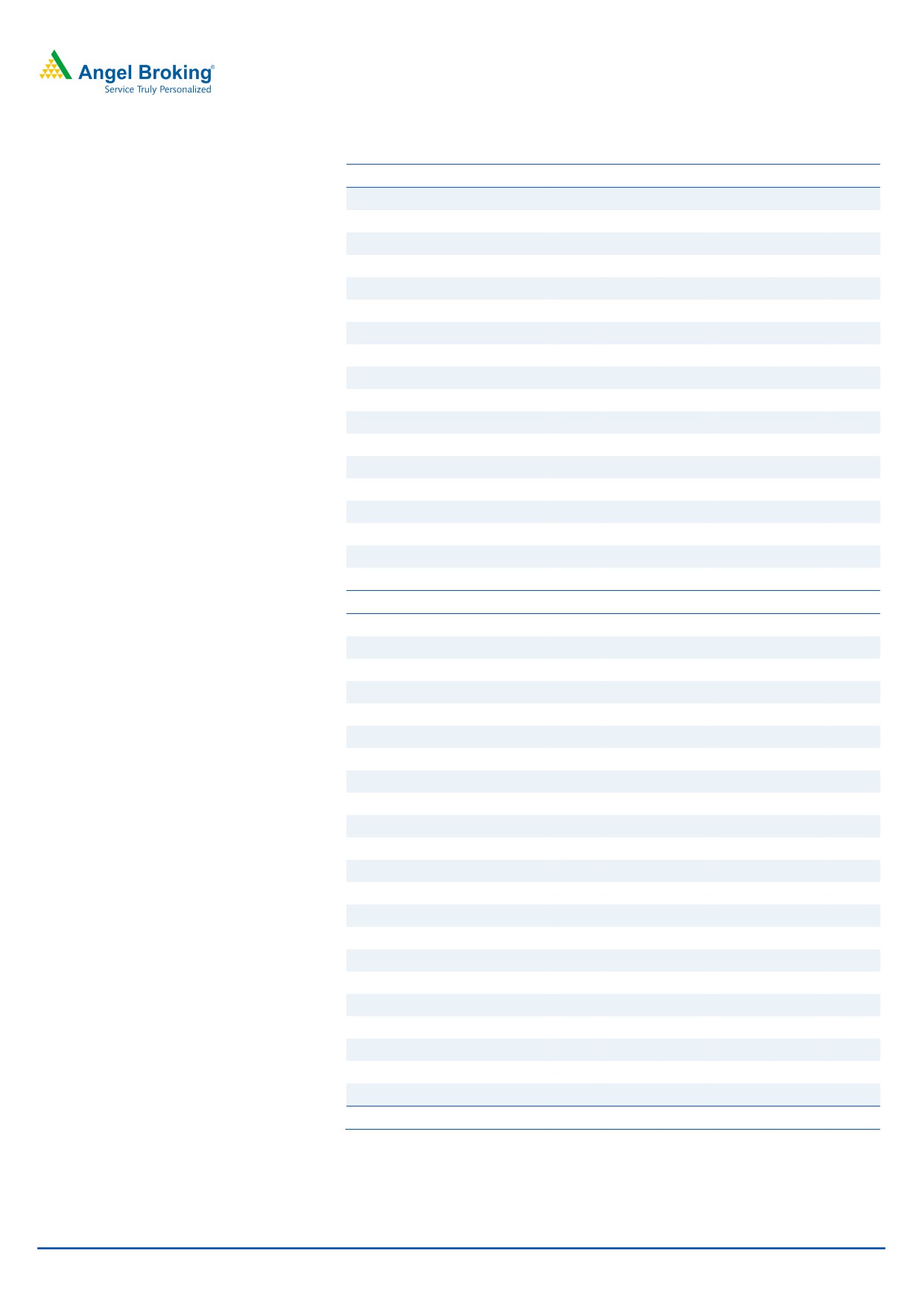

Exhibit 1: 3QFY2016 performance (IFRS, consolidated)

(` cr)

3QFY16

2QFY16

% chg (qoq)

3QFY15

% chg (yoy)

9MFY2016

9MFY2015

% chg (yoy)

Net revenue

15,902

15,635

1.7

13,796

15.3

45,891

39,908

15.0

Cost of revenue

9,621

9,365

2.7

8,171

17.7

27,797

23,924

16.2

Gross profit

6,281

6,270

0.2

5,625

11.7

18,094

15,984

13.2

SG&A expenses

1,953

1,918

1.8

1,645

18.7

5,654

4,816

17.4

EBITDA

4,328

4,352

(0.5)

3,980

8.7

12,440

11,168

11.4

Depreciation

369

359

2.9

291

26.8

1,040

785

32.5

EBIT

3,959

3,993

(0.9)

3,689

7.3

11,400

10,383

9.8

Other income

802

793

1.1

840

(4.5)

2,353

2,546

PBT

4,761

4,786

(0.5)

4,529

5.1

13,751

12,929

6.4

Income tax

1,296

1,387

(6.6)

1,279

1.3

3,857

3,697

4.3

Exceptional item

-

-

-

-

-

Reported PAT

3,465

3,399

1.9

3,250

6.6

9,894

9,232

7.2

Adjusted PAT

3,465

3,398

2.0

3,250

6.6

9,894

9,232

7.2

EPS

15.2

14.9

2.0

14.2

6.6

43.3

40.4

7.2

Gross margin (%)

39.5

40.1

(60)bp

40.8

(127)bp

39.4

40.1

(62)bp

EBITDA margin (%)

27.2

27.8

(62)bp

28.8

(163)bp

27.1

28.0

(88)bp

EBIT margin (%)

24.9

25.5

(64)bp

26.7

(184)bp

24.8

26.0

(118)bp

PAT margin (%)

21.8

21.7

5bp

23.6

(177)bp

21.6

23.1

(157)bp

Source: Company, Angel Research

Exhibit 2: 3QFY2016 - Actual vs Angel estimates

(` cr)

Actual

Estimate

% Var.

Net revenue

15,902

15,610

1.9

EBITDA margin (%)

27.2

27.0

22

PAT

3,465

3,251

6.6

Source: Company, Angel Research

Revenues ahead of expectation

For 3QFY2016, Infosys posted a 0.6% sequential growth in USD

revenues to

US$2,407mn (V/s an expected US$2,368mn). In constant currency (CC) terms, the

company posted a 1.1% qoq growth. In rupee terms, revenue came in at

`15,902cr (V/s an expected `15,610cr), a growth of 1.7% qoq. Volume growth

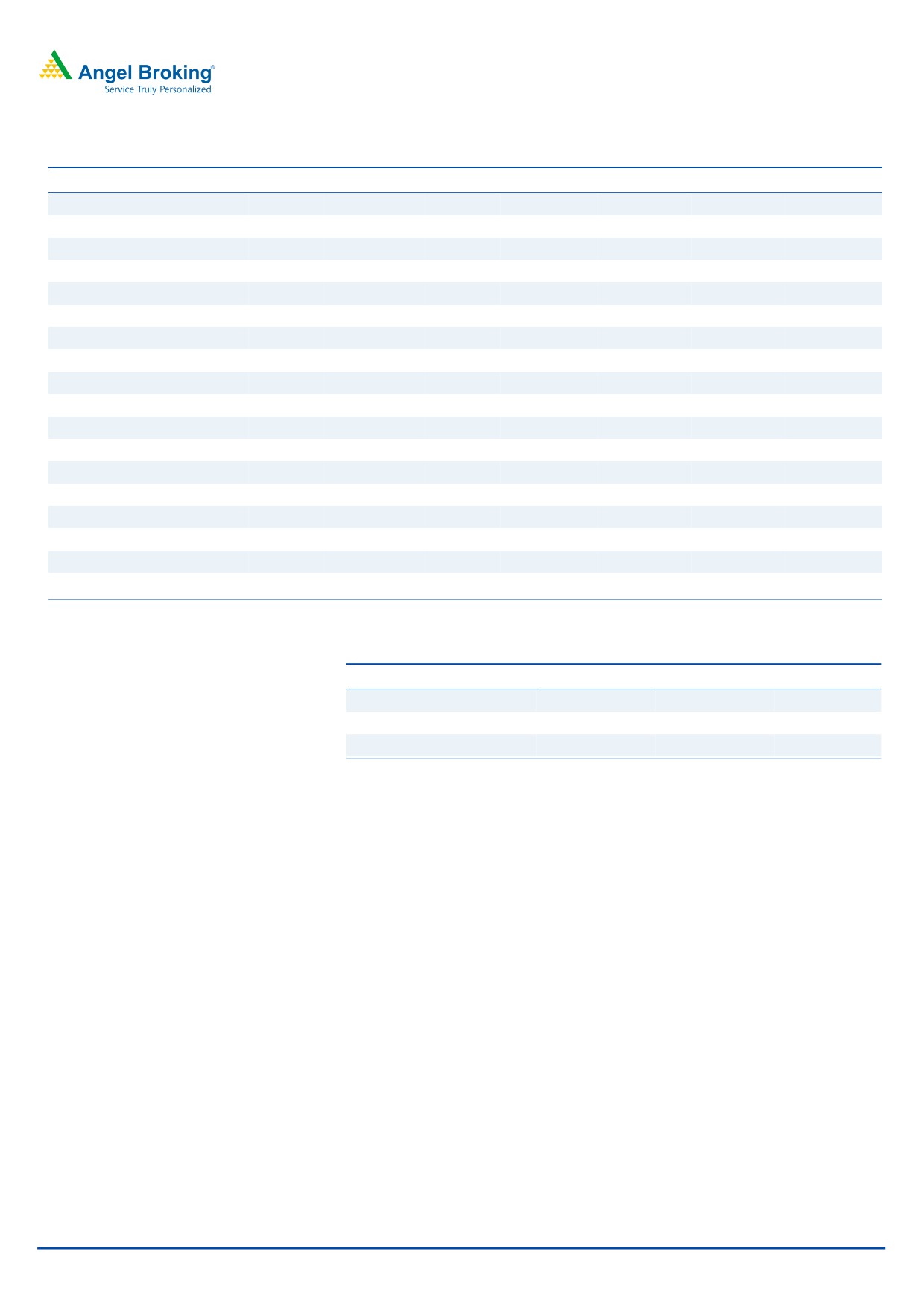

during the quarter was of 3.1% qoq. Growth was driven more by onsite volume

which grew by 4.4% qoq, while the offshore volume growth was of 2.5% qoq.

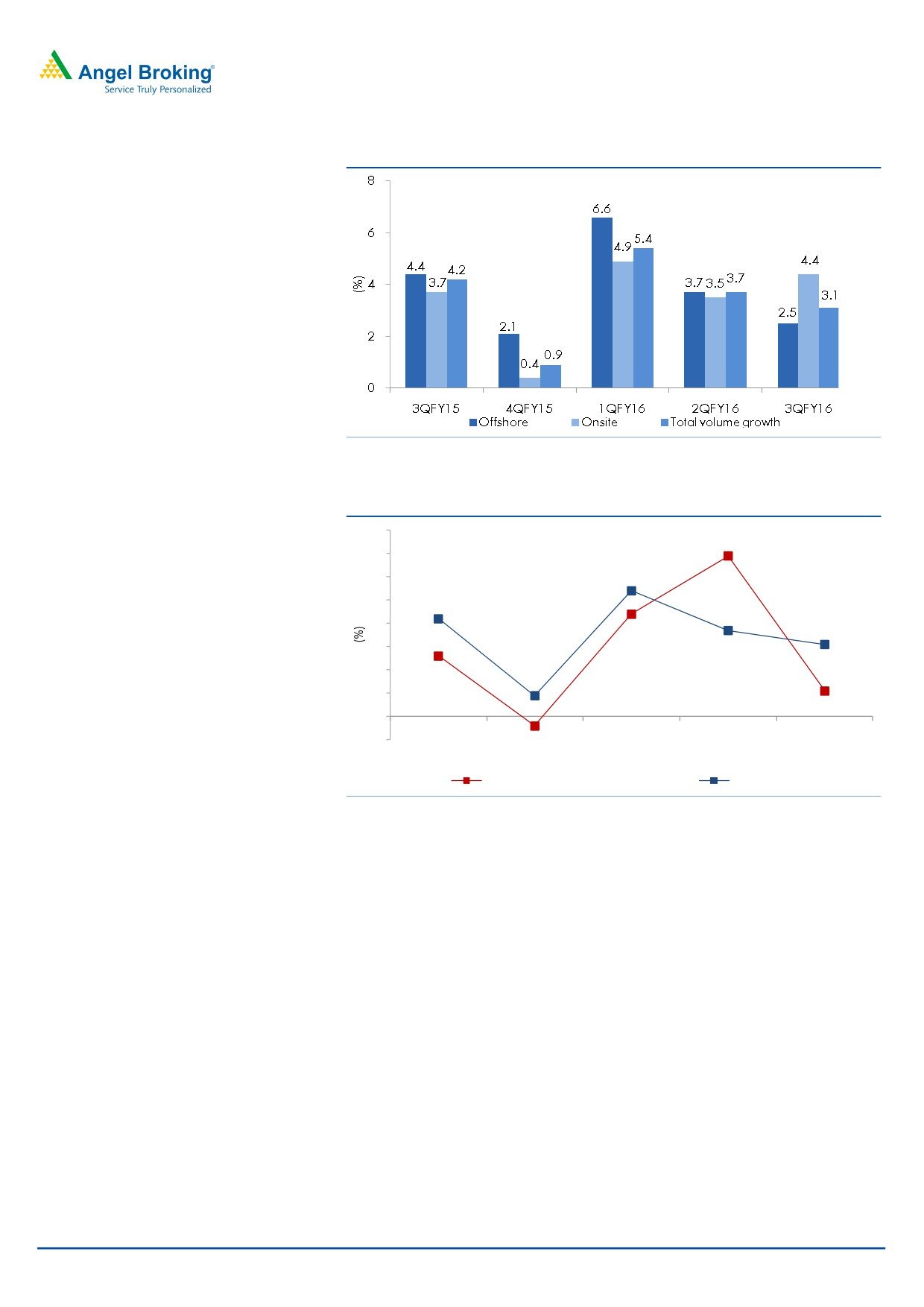

In terms of geographies, USA grew by 0.5% qoq CC, Europe grew by 3.9% qoq

CC, India grew by 24.3% qoq CC and ROW grew by 0.3% qoq CC. In terms of

domains, FSI (Banking & Financial Services) grew by 3.1% qoq CC, Manufacturing

grew by 3.2% qoq CC, RCL (Retail and Life Sciences) grew by 0.1% qoq CC and

ECS (Energy, Utilities, Communication and Services) grew by 4.6% qoq CC.

January 20, 2016

2

Infosys | 3QFY2016 Result Update

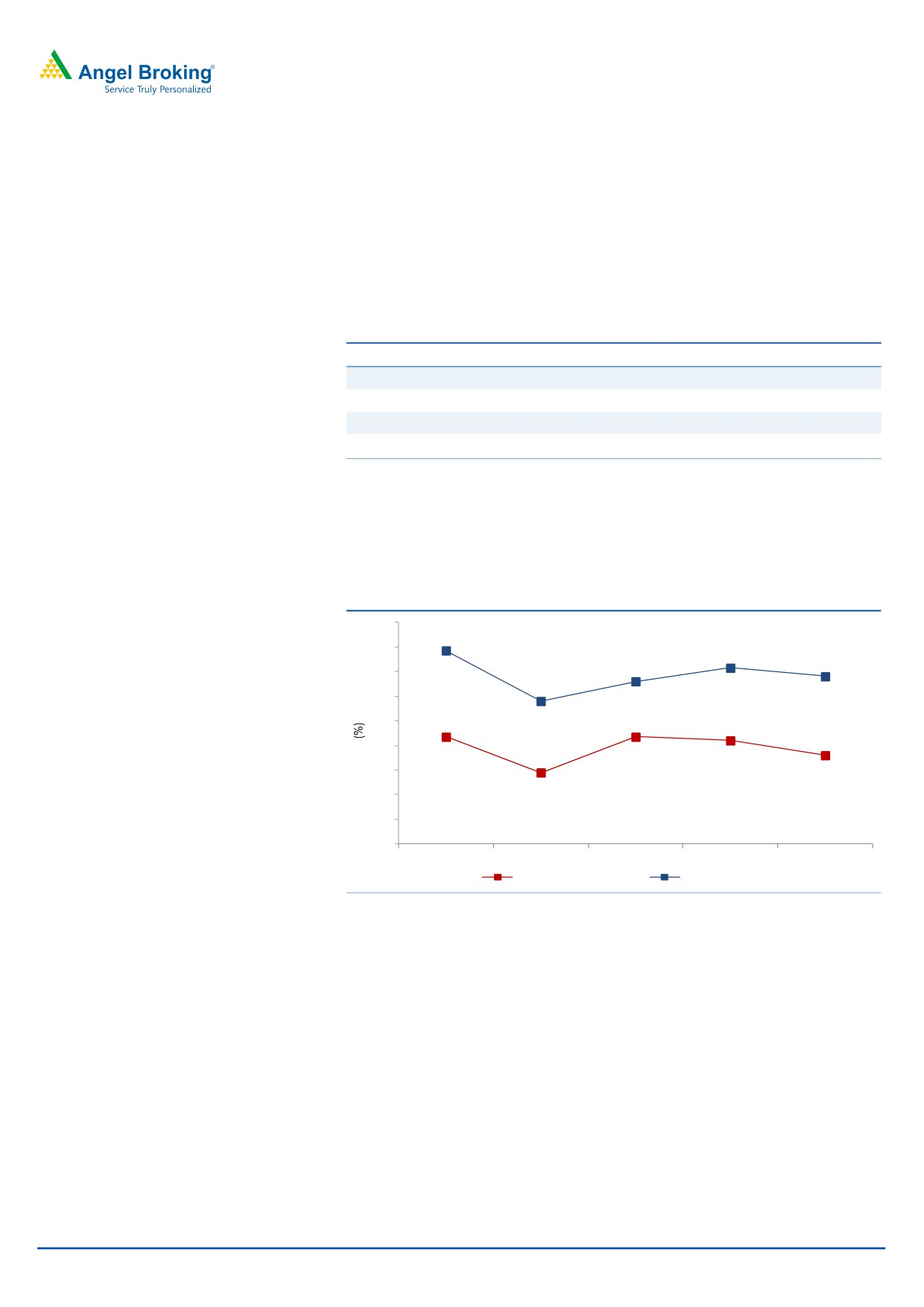

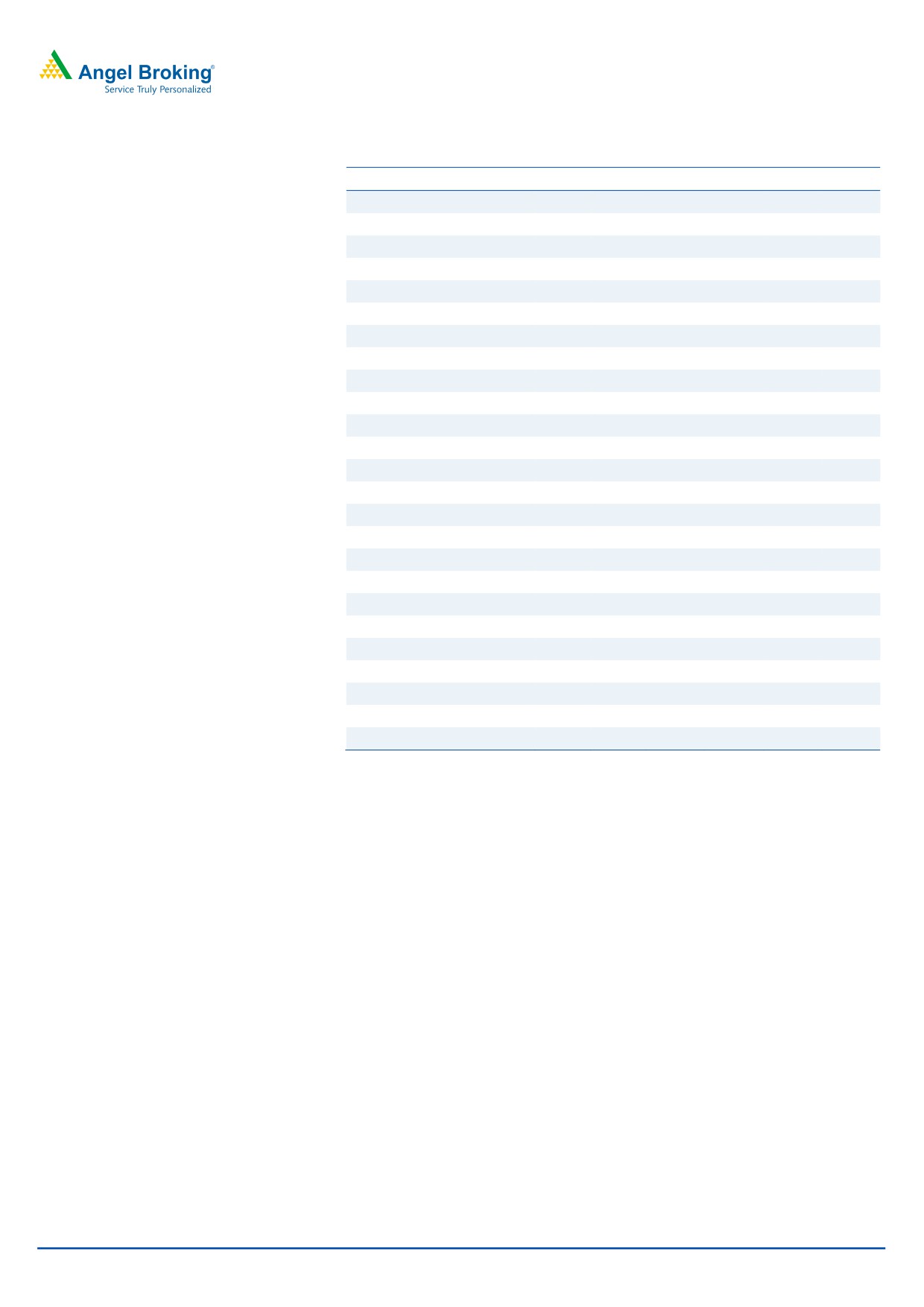

Exhibit 3: Trend in volume growth qoq (Effort wise)

Source: Company, Angel Research

Exhibit 4: Trend in volume and USD revenue growth (qoq)

8

7

4.4

6.9

6

5

3.7

4

5.4

3.1

4.2

3

2

2.6

1

1.1

0.90.4)

0

(1)

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Revenue growth (constant currency)

Volume growth

Source: Company, Angel Research

Industry-wise, the revenue from Financial Services and Insurance, the company’s

anchor vertical which contributed by 33.5% to revenues, grew by 2.7% qoq; in CC

terms, revenue from FSI grew by 3.1% qoq. The Manufacturing industry vertical,

which contributed by 22.8% to revenues, de-grew by 3.7% qoq. In CC terms, the

revenue from this vertical grew by 3.2% sequentially.

The Retail, CPG and Logistics segment (RCL; contributed by 24.3% to revenues)

reported a 0.5% qoq growth. In CC terms, the revenue from RCL grew by 0.1%

qoq. The Energy Utilities and Communications & Services segment (contributed by

13.1% to revenue) reported a growth of 4.2% qoq in revenue, with Energy and

Utilities posting the biggest fall among verticals of 4.6% qoq.

January 20, 2016

3

Infosys | 3QFY2016 Result Update

Exhibit 5: Growth trend in industry segments (Reported basis)

Particulars

% to revenue

% growth qoq

% growth yoy

FSI

33.5

2.8

9.8

Banking and financial services

27.6

2.1

11.8

Insurance

5.9

6.0

1.6

Manufacturing

22.8

(3.6)

5.7

RCL

24.3

(0.6)

12.2

Retail and CPG

14.7

(0.7)

7.1

Transport and logistics

1.9

0.6

37.5

Life Sciences

5.8

(1.1)

23.4

Healthcare

1.9

0.6

3.1

ECS

19.4

3.8

5.3

Energy and utilities

5.1

9.2

13.0

Communication and services

8.0

1.9

(0.2)

Others

6.3

2.3

6.8

Source: Company, Angel Research

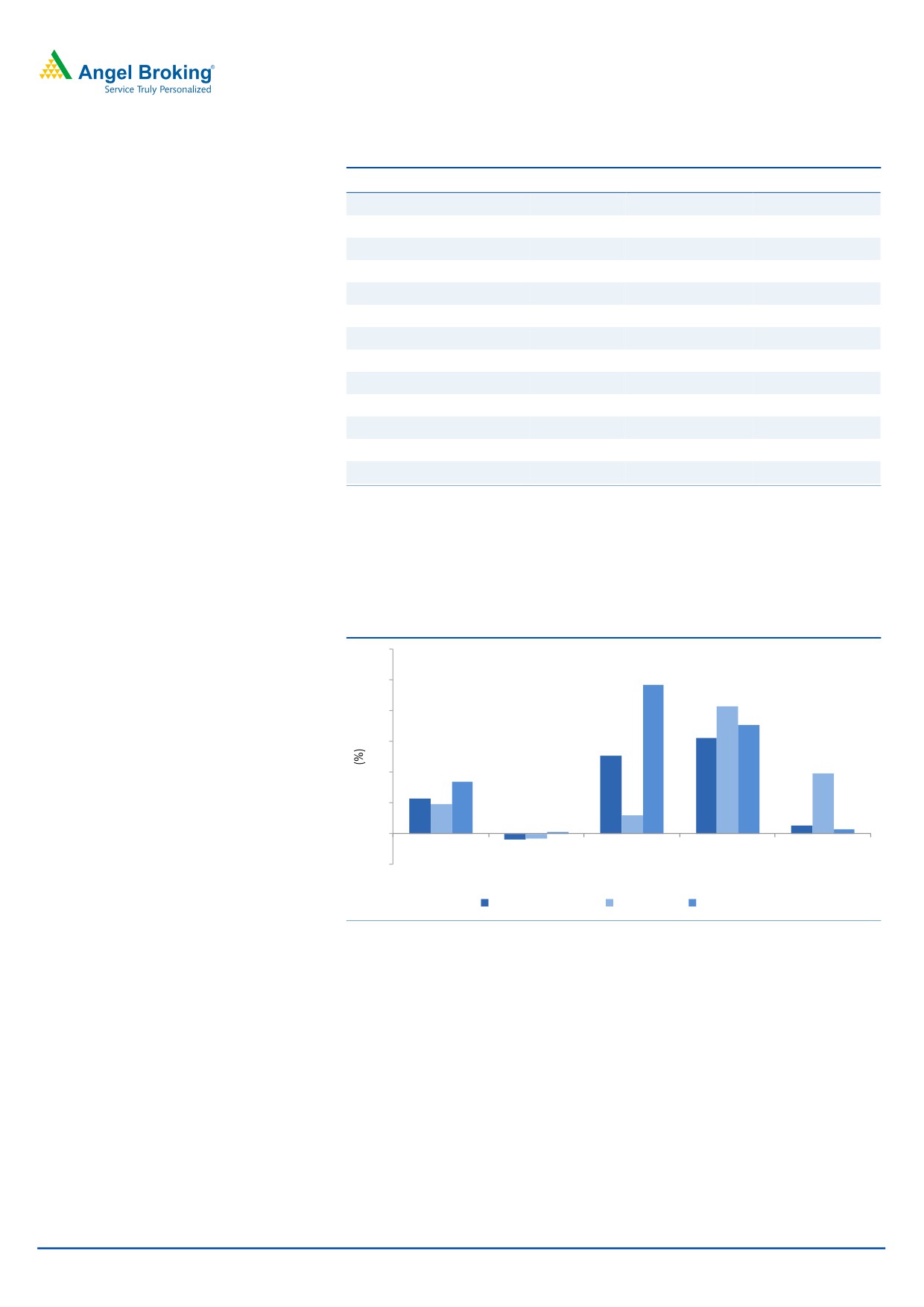

In terms of geographies, revenues from North America grew by 0.5% qoq in CC

terms, while other geographies such as Europe grew by 3.9% qoq and RoW grew

by 0.3% qoq (both in CC terms). India posted a 24.3% qoq growth in CC terms.

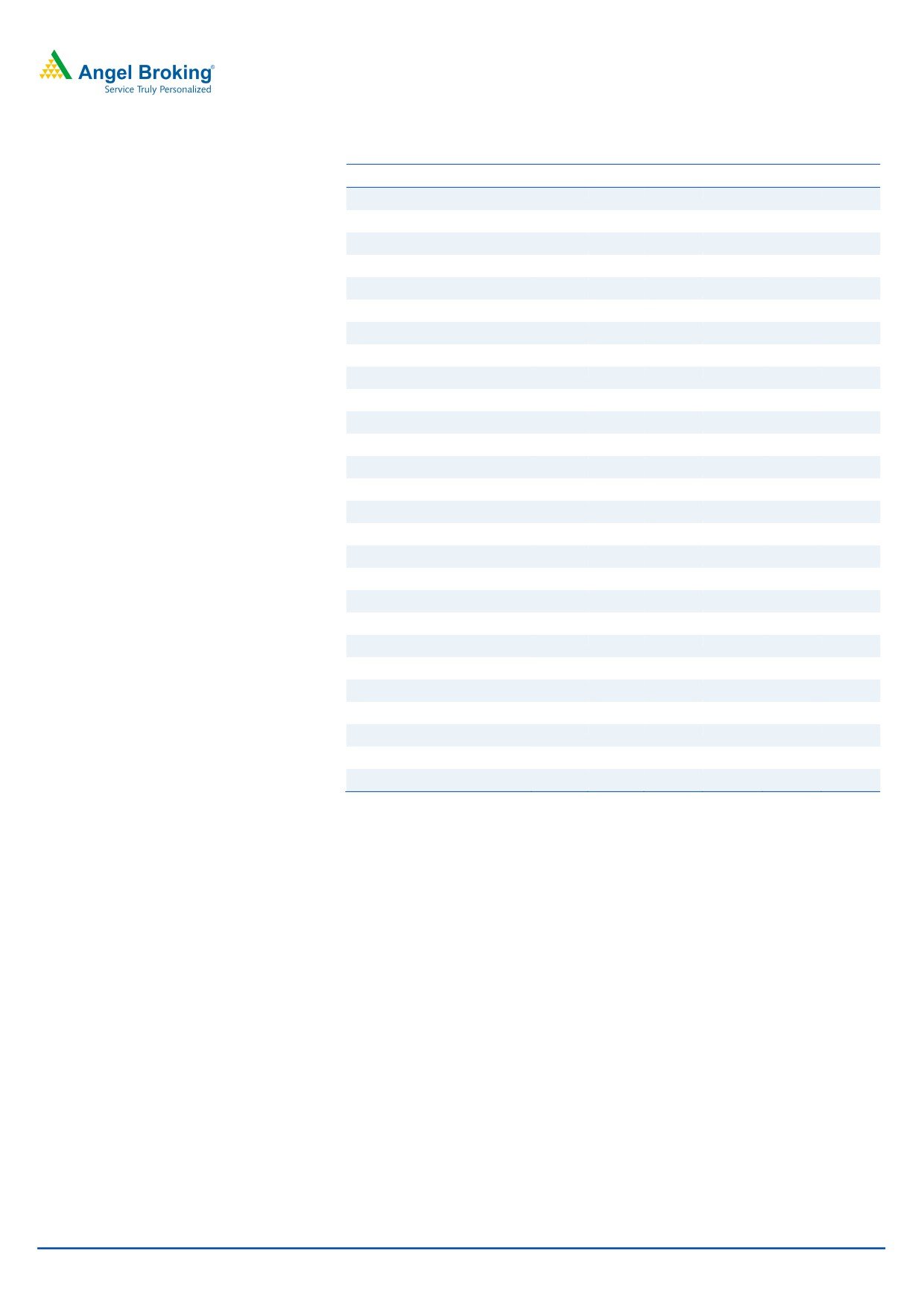

Exhibit 6: USD growth trend in geographies qoq (CC basis)

12

9.7

10

8.3

8

7.1

6.2

6

5.1

3.9

4

3.4

2.31.9

2

1.2

0.1

0.5

0.3

0

(0.3)

(0.4)

(2)

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

North America

Europe

Rest of the world

Source: Company, Angel Research

January 20, 2016

4

Infosys | 3QFY2016 Result Update

Hiring and utilization

Infosys added 14,027 gross employees in 3QFY2016, of which 6,115 were lateral

additions. The net addition number for the quarter stood at 8,620. Attrition (for

standalone entity) remained persistently high in 3QFY2016; it increased to 18.1%

(LTM), up from 19.9% in 2QFY2016. The levels of attrition in the company which

had been on continues rise, came down during the quarter. The company is trying

to inch up its utilization level, which could act as one of the margin levers.

Exhibit 7: Employee metrics

3QFY15 4QFY15 1QFY16 2QFY16 3QFY16

Gross addition

13,154

14,471

11,889

17,595

14,027

Net addition

4,227

6,549

3,336

8,453

8,620

Gross lateral emp. addition

6,094

8,334

5,886

7,452

6,115

Attrition - LTM basis (%)*

20.4

18.4

19.2

19.9

18.1

Source: Company, Angel Research, Note-* excluding subsidiaries

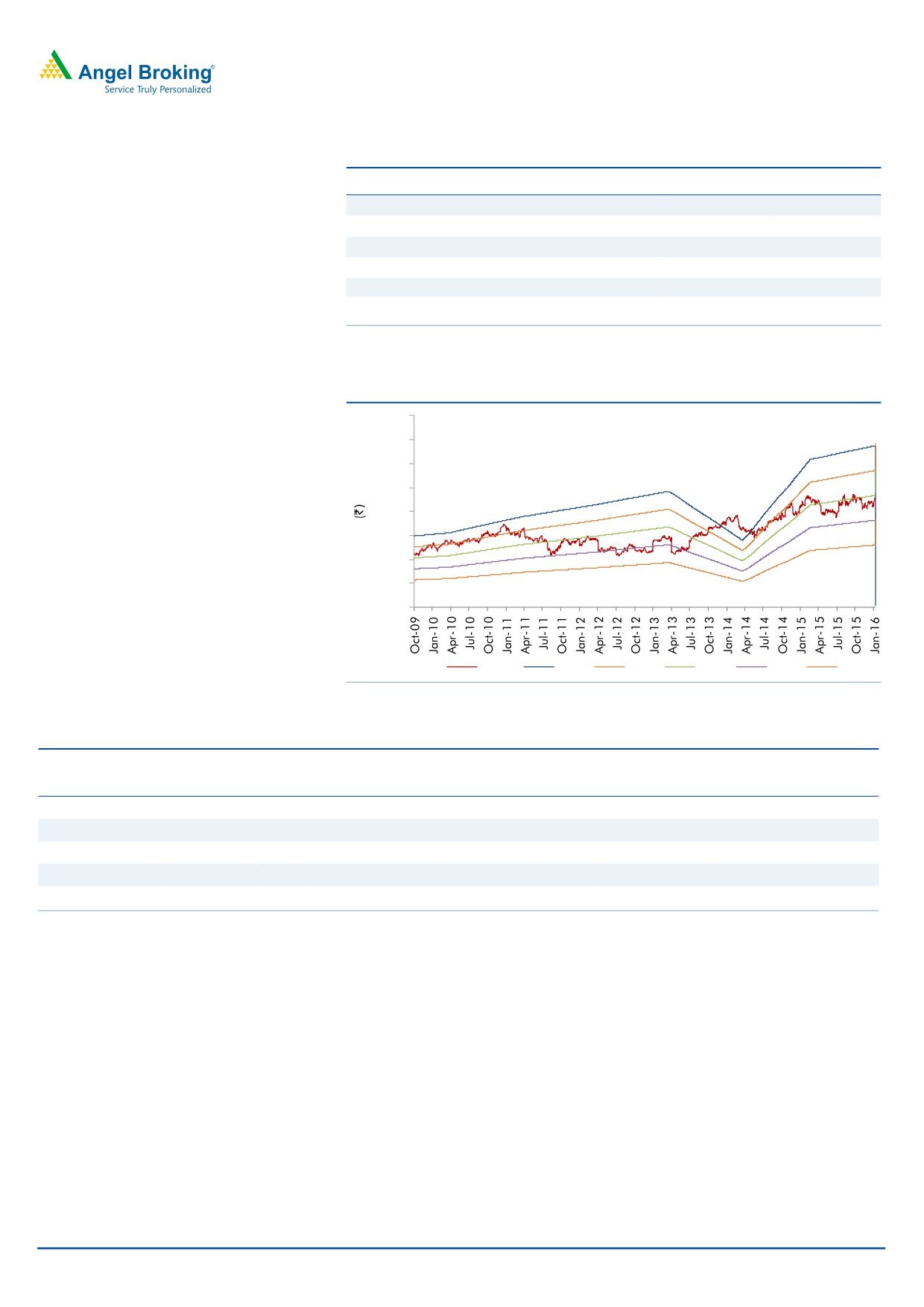

With the company focusing on improving its utilization level, the utilization rate

including trainees de-grew by 120bp qoq to 74.2% (higher than 75.4% as in

2QFY2016); while excluding trainees, it de-grew by 70bp qoq to 80.6%.

Exhibit 8: Trend in utilization (Services and consulting + Projects)

85

82.7

83

81.3

80.6

80.2

81

78.6

79

77

75

75.7

75.7

75.4

73

74.2

71

72.8

69

67

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Including trainees

Excluding trainees

Source: Company, Angel Research

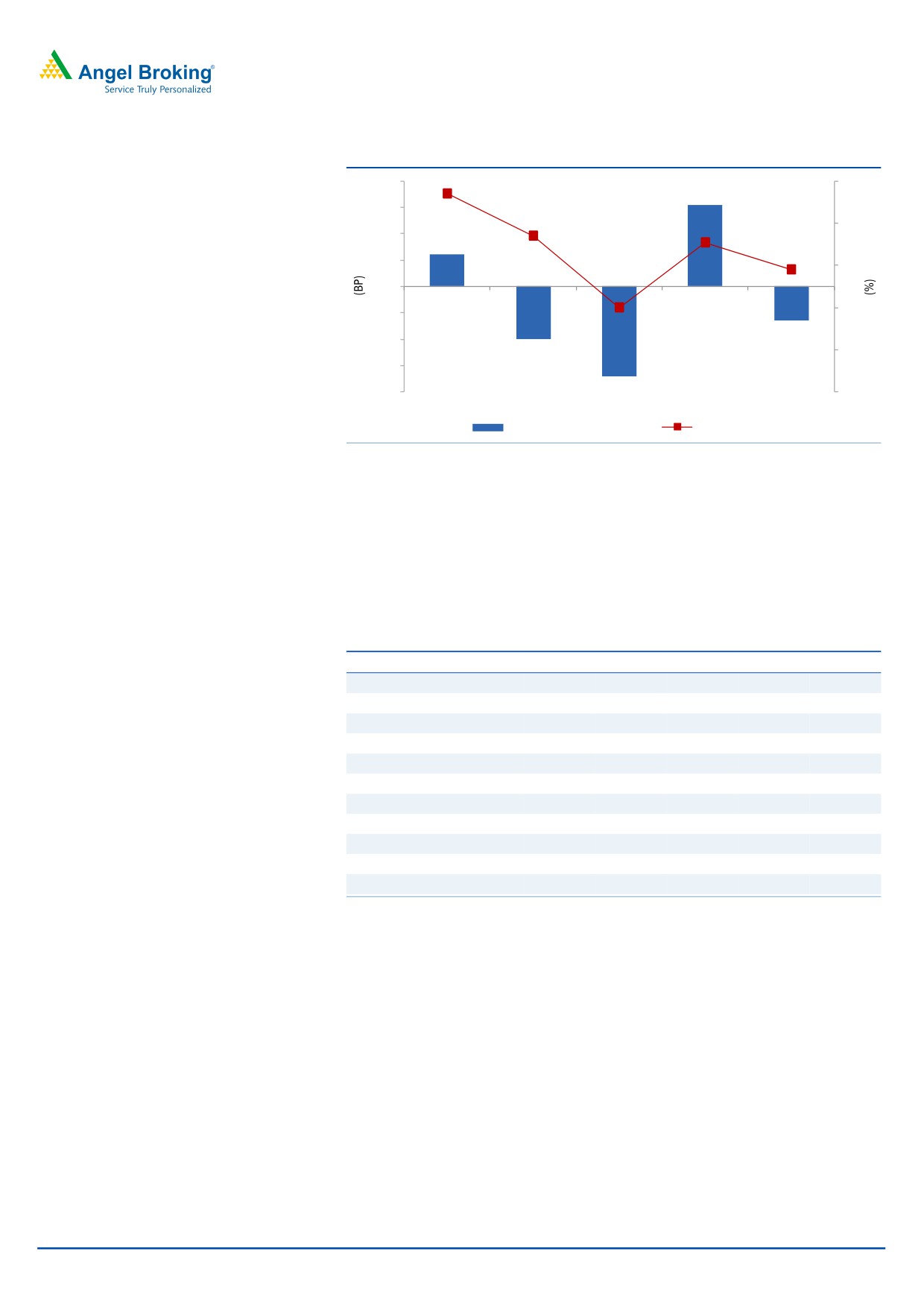

Margins dip

On the operating front, the EBITDA margin came in at 27.2% (V/s

27.0%

expected), declining by 62bp qoq, owing to pricing decline by 2.5% qoq and lower

utilization. The EBIT margin at 24.9%, declining by 64bp sequentially, impacted

adversely by lower realization

(110bp impact), lower utilization and Noah

Consulting consolidation (~60bp impact) while rupee depreciation and lower

variable pay aided to mitigate margin headwinds partially.

The Management indicated that the EBIT margin for FY2016 is expected to be in

the range of 24-26%.

January 20, 2016

5

Infosys | 3QFY2016 Result Update

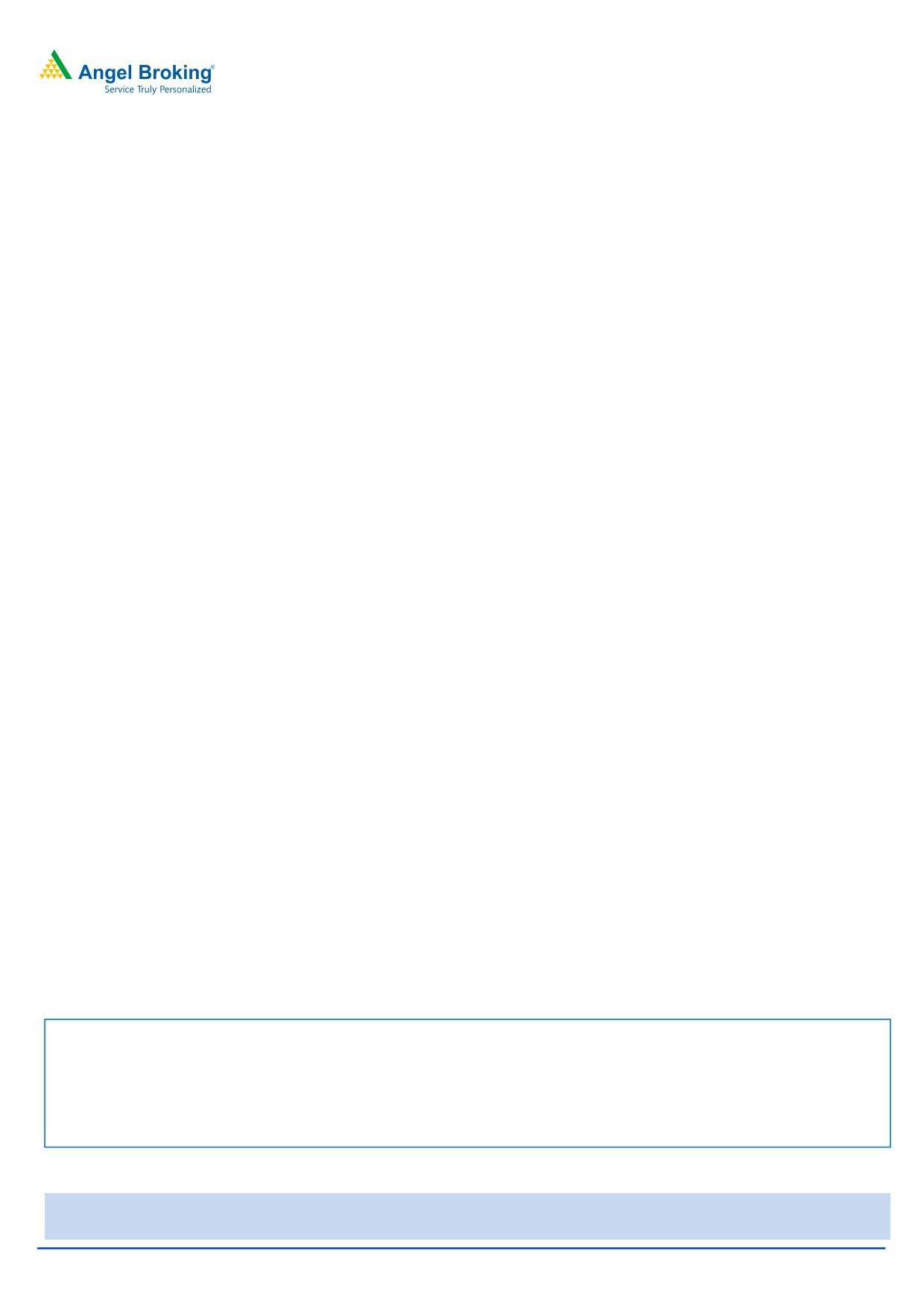

Exhibit 9: Trend in EBIT margin

200

26.7

27

150

25.7

154

26

100

25.5

50

60

25

24.9

24.0

0

24

(50)

(100)

(64)

(100)

23

(170)

(150)

(200)

22

3QFY15

4QFY15

1QFY16

2QFY16

3QFY16

Margin movement (qoq)

EBIT margin (%)

Source: Company, Angel Research

Client pyramid

Infosys added 75 new clients (gross additions) during the quarter, taking its

total active client base to 1045. The client addition was across the board. The

company added 7 clients in the US$100-200mn bracket. Also, the company

bagged new deals with TCV of US$360mn, during the quarter.

Exhibit 10: Client metrics

Particulars

3QFY15 4QFY15 1QFY16 2QFY16 3QFY16

Top client (% of revenue)

3.2

3.5

3.7

3.7

3.5

Gross Client addition

59

52

79

82

75

Active client

932

950

987

1011

1045

US$1mn-5mn

292

285

287

284

294

US$5mn-10mn

86

85

87

89

90

US$10mn-20mn

71

76

78

84

82

US$20mn-50mn

37

36

34

35

23

US$50mn-100mn

17

18

21

19

15

US$100mn-200mn

15

14

14

17

7

US$200mn-300mn

10

11

8

8

5

US$300mn plus

0

0

1

1

1

Source: Company, Angel Research

Concall Highlights

Infosys won deals worth TCV of US$360mn during the quarter.

Overall, the Management is upbeat about the future prospects of the

company, given the strong order book position which is guided towards

US$3bn.

On back of strong performance in 1HFY2016, the Management has

maintained CC revenue growth guidance of 12.8-13.2% V/s 10.0-12.0%

guided earlier for FY2016.

The company reiterated its target EBIT margins band of 24-26% for the

medium term while citing continued need for calibrated investments in the

business.

January 20, 2016

6

Infosys | 3QFY2016 Result Update

Investment arguments

Revenue growth guidance upgraded to 12.8-13.2% from 10-12% CC guided

earlier for FY2016: The Management has guided towards higher revenue growth

for FY2016, ie of 12.8-13.2% in CC terms and 16.2-16.6% in INR terms on

exchange rate of (as on December 31, 2015). The earlier revenue growth

guidance was of 10-12% in CC terms for FY2016. We expect the company to post

~9.6% USD revenue growth in FY2016. The company expects to lead industry

growth and reach a milestone of achieving sales of US$20bn by FY2020.

Currently we have factored in a moderate growth for FY2017 (INR and USD

growth of 13.0%).

Aims to be US$20bn company by FY2020: The Management believes the

traditional IT services model is dying and a structural change is taking place in the

industry. Pricing pressure is being witnessed in commoditized services, thus

necessitating the company to pursue newer growth avenues including acquisitions

in areas like automation. The outsourcing services provider is therefore looking to

ramp up its productivity through automation and is looking for acquisitions to

boost growth. Infosys' cash and cash equivalents were at US$5.2bn as at the end

of March 2015.

The company expects its revenue to rise to US$20bn by FY2020, from US$8.7bn

now, as it focuses on acquisitions and win more new technology services, implying

a 14% CAGR over the period. Over the near term, we expect Infosys to post a

9.6% USD revenue growth in FY2016. Over FY2015-17E, we expect USD and INR

revenue to grow at a CAGR of 11.3% and 14.5%, respectively. The Management

expects to lead industry growth from FY2017 onwards.

Operating margin likely to be range bound in near term: The Management

maintained its stance that the company is right now focused on growth (at least for

the next couple of quarters) and this may lead to sacrifice in margins in the near

term. The operating margin is subject to tailwinds on a stable rupee, further

improvement in utilization rates and cost optimization drive running in the

company, though it has headroom to increase its utilization level by ~300bp to be

comparable with peers. This, in turn, will assist in increasing operating margins

further. Going ahead, given a stable rupee, higher S&M spends, and wage hikes

in FY2016, we expect the EBIT margin to remain at 25.5% in FY2016 and FY2017

(V/s 25.9% in FY2015). Over FY2015-17E, we expect an EBIT CAGR of 13.5%.

However, as part of its `Vision 2020’ (target to have US$20bn revenues at 30%

operating margins and US$80,000 per employee revenue productivity by

CY2020), the Management expects acceleration in revenue growth and margin

improvement to reflect ahead of the increase in revenue productivity.

Outlook and valuation

The company has upgraded its USD revenue growth guidance for FY2016 to 12.8-

13.2% from 10-12% on CC basis earlier. We expect the company to post ~9.6%

USD revenue growth in FY2016. By FY2017, the company expects to lead industry

growth. It aims to reach a milestone of achieving sales of US$20bn by FY2020.

Also, the company plans to utilize cash properly through increased dividends and

acquisitions, so that it can increase its capital efficiency. Currently we have built in

a conservative growth for FY2017. The stock trades at current valuations of 17.3x

FY2017E earnings. We recommend a Buy on the stock with a price target of

`1,347.

January 20, 2016

7

Infosys | 3QFY2016 Result Update

Exhibit 11: Key assumptions

Parameters

FY2016E

FY2017E

Revenue growth - USD terms (%)

9.6

13.0

USD-INR rate

65.0

65.0

Revenue growth - INR terms (%)

16.0

13.0

EBITDA margin (%)

27.5

27.5

Tax rate (%)

29.0

29.0

EPS growth (%)

10.6

10.7

Source: Company, Angel Research

Exhibit 12: One-year forward PE (x)

2,000

1,750

1,500

1,250

1,000

750

500

250

0

Price

26x

22x

18x

14x

10x

Source: Company, Angel Research

Exhibit 13: Recommendation summary

Company

Reco

CMP Tgt. price Upside

FY2017E FY2017E

FY2015-17E

FY2017E

FY2017E

(`)

(`)

(%)

EBITDA (%)

P/E (x)

EPS CAGR (%)

EV/Sales (x)

RoE (%)

HCL Tech

Buy

839

1,132

34.9

23.5

13.3

10.6

1.9

19.8

Infosys

Buy

1,139

1,347

18.3

27.5

17.3

10.6

3.1

20.1

TCS

Buy

2,279

2,854

25.2

28.5

16.5

11.8

3.2

38.9

Tech Mahindra

Buy

512

646

25.9

17.0

16.1

8.0

1.4

18.6

Wipro

Buy

542

719

32.6

23.8

12.8

9.7

1.7

17.9

Source: Company, Angel Research

Company Background

Infosys is the second largest IT company in India, employing over

1,76,187

professionals (as of FY2015). The company services more than 900 clients across

various verticals, such as financial services, manufacturing, telecom, retail and

healthcare. Infosys has the widest portfolio of service offerings amongst Indian IT

companies, spanning across the entire IT service value chain - from traditional

Application Development and Maintenance to Consulting and Package

Implementation to Products and Platforms.

January 20, 2016

8

Infosys | 3QFY2016 Result Update

Profit and loss statement (IFRS, consolidated)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E

Net sales

33,733

40,352

50,133

53,319

61,850

69,891

Cost of revenue

18,877

24,158

30,767

31,817

42,034

35,994

Gross profit

14,856

16,194

19,366

21,502

24,431

27,607

% of net sales

44.0

40.1

38.6

40.3

39.5

39.5

Selling and mktg exp.

1,757

2,034

2,625

2,941

3,402

3,844

% of net sales

5.2

5.0

5.2

5.5

5.5

5.5

General and admin exp.

2,390

2,609

3,107

3,663

4,020

4,543

% of net sales

7.1

6.5

6.2

6.9

6.5

6.5

EBITDA

10,709

11,551

13,634

14,898

17,009

19,220

% of net sales

31.7

28.6

27.2

27.9

27.5

27.5

Dep and amortization

931

1,122

1,374

1,066

1,237

1,398

% of net sales

2.8

2.8

2.7

2.0

2.0

2.0

EBIT

9,778

10,429

12,260

13,832

15,772

17,822

% of net sales

29.0

25.8

24.5

25.9

25.5

25.5

Other income

1,904

2,359

2,669

3,427

3,427

3,427

Profit before tax

11,683

12,788

14,929

17,259

19,199

21,249

Provision for tax

3,368

3,367

4,062

4,929

5,568

6,162

% of PBT

28.8

26.3

27.2

28.6

29.0

29.0

PAT

8,315

9,421

10,648

12,330

13,631

15,087

Exceptional item

-

-

219

-

-

-

Adj. PAT

8,315

9,421

10,867

12,330

13,631

15,087

EPS (`)

36.2

41.0

47.3

53.7

59.4

65.7

January 20, 2016

9

Infosys | 3QFY2016 Result Update

Balance sheet (IFRS, consolidated)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E

Current assets

Cash and cash equivalents

20,591

21,832

25,950

30,367

38,702

48,978

Available for sale financial assets

32

1,739

2,197

874

2,197

2,197

Investment in certificates of deposit

345

-

859

93

859

859

Trade receivables

5,882

7,083

8,351

9,713

10,122

11,742

Unbilled revenue

1,873

2,435

2,811

2,845

3,434

3,434

Derivative financial instruments

-

101

215

101

215

215

Prepayments and other current assets

1,523

2,123

2,636

3,296

3,497

4,054

Total current assets

30,246

35,313

43,019

47,289

59,026

71,479

Non-current assets

Property, plant and equipment

5,409

6,468

7,887

9,125

9,325

9,525

Goodwill

993

1,976

2,157

3,091

2,157

2,157

Intangible assets

173

368

342

638

342

342

Available for sale financial assets

12

394

1,252

1,345

1,252

1,252

Deferred income tax assets

316

503

656

537

656

656

Income tax assets

1,037

1,092

1,522

4,089

1,722

1,722

Other non-current assets

162

237

220

238

1,632

1,632

Total non-current assets

8,102

11,038

14,036

19,063

17,086

15,507

Total assets

38,348

46,351

57,055

66,352

76,112

86,986

Current liabilities

Trade payables

23

189

173

140

173

173

Derivative financial instruments

42

-

-

3

-

-

Current income tax liabilities

1,054

1,329

2,187

2,818

3,787

3,787

Client deposits

15

36

40

27

40

40

Unearned revenue

545

823

660

1,052

660

660

Employee benefit obligations

498

614

954

1,069

954

954

Provisions

133

213

379

478

379

379

Other liabilties

2,456

3,082

4,745

5,796

5,545

5,545

Total current liabilities

4,766

6,286

9,138

11,383

11,538

11,538

Non-current liabilities

Deferred income tax liabilties

12

119

64

160

64

64

Employee benefit obligations

109

149

323

46

323

323

Other liabilities

-

-

-

-

-

-

Total non-current liabilties

121

268

387

206

387

387

Total liabilities

4,887

6,554

9,525

11,589

11,925

11,925

Equity

Share capital

286

286

286

572

1,148

1,148

Share premium

3,089

3,090

3,090

3,090

3,090

3,090

Retained earnings

29,816

36,114

43,584

50,531

59,378

70,253

Other components of equity

270

307

570

570

570

570

Total equity

33,461

39,797

47,530

54,763

64,187

75,061

Total liabilties and equity

38,348

46,351

57,055

66,352

76,112

86,986

January 20, 2016

10

Infosys | 3QFY2016 Result Update

Cash flow statement (IFRS, consolidated)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015 FY2016E FY2017E

Pre tax profit from operations

9,778

10,429

12,260

13,832

15,772

17,822

Depreciation

931

1,122

1,374

1,066

1,237

1,398

Pre tax cash from operations

10,709

11,551

13,634

14,898

17,009

19,220

Other income/prior period ad

1,904

2,359

2,669

3,427

3,427

3,427

Net cash from operations

12,614

13,910

16,303

18,325

20,436

22,647

Tax

3,368

3,367

4,062

4,929

5,568

6,162

Cash profits

9,246

10,543

12,241

13,396

14,868

16,485

(Inc)/dec in current assets

(2,399)

(2,464)

(2,271)

(1,942)

(1,313)

(2,176)

Inc/(dec) in current liabilties

1,125

1,520

2,852

2,245

155

-

(Inc)/dec in net trade WC

(1,274)

(944)

581

303

(1,158)

(2,176)

Cashflow from operating actv.

7,972

9,599

12,822

13,699

13,710

14,308

(Inc)/dec in fixed assets

(1,496)

(2,181)

(2,793)

(2,304)

(1,437)

(1,598)

(Inc)/dec in investments

(233)

(1,362)

(1,317)

2,089

(2,089)

-

(inc)/dec in sale of financial assets

11

(382)

(858)

(93)

93

-

(Inc)/dec in deferred tax assets

18

(242)

(583)

(2,448)

2,248

-

Inc/(dec) in other non current liab.

(198)

147

119

(181)

181

-

(Inc)/dec in other non current ass.

8

(1,253)

(138)

(1,248)

(164)

-

Cashflow from investing actv.

(1,890)

(5,273)

(5,570)

(4,185)

(1,168)

(1,598)

Inc/(dec) in debt

-

-

-

-

-

-

Inc/(dec) in equity/premium

(1,155)

(280)

1,077

(885)

4

748

Dividends

1,002

2,805

4,211

4,212

4,212

3,182

Cashflow from financing actv.

(2,157)

(3,085)

(3,134)

(5,097)

(4,208)

(2,434)

Cash generated/(utilised)

3,925

1,241

4,118

4,417

8,335

10,277

Cash at start of the year

16,666

20,591

21,832

25,950

30,367

38,702

Cash at end of the year

20,591

21,832

25,950

30,367

38,702

48,978

January 20, 2016

11

Infosys | 3QFY2016 Result Update

Key ratios

Y/E March

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Valuation ratio (x)

P/E

31.5

27.8

24.1

21.2

19.2

17.3

P/CEPS

28.3

24.8

21.4

19.5

17.6

15.9

P/BVPS

7.8

6.6

5.5

4.8

4.1

3.5

Dividend yield (%)

1.3

3.7

5.5

5.5

5.5

5.5

EV/Sales

7.1

5.9

4.6

4.3

3.5

3.0

EV/EBITDA

22.3

20.4

16.9

15.3

12.8

10.8

EV/Total assets

6.2

5.1

4.0

3.4

2.9

2.4

Per share data (`)

EPS

36

41

47

54

59

66

Cash EPS

40

46

53

58

65

72

Dividend

15

42

63

63

63

63

Book value

146

173

207

239

280

327

Dupont analysis

Tax retention ratio (PAT/PBT)

0.7

0.7

0.7

0.7

0.7

0.7

Cost of debt (PBT/EBIT)

1.2

1.2

1.2

1.2

1.2

1.2

EBIT margin (EBIT/Sales)

0.3

0.3

0.2

0.3

0.3

0.3

Asset turnover ratio (Sales/Assets)

0.9

0.9

0.9

0.8

0.8

0.8

Leverage ratio (Assets/equity)

1.1

1.2

1.2

1.2

1.2

1.2

Operating ROE

24.9

23.7

22.4

22.5

21.2

20.1

Return ratios (%)

RoCE (pre-tax)

25.5

22.5

21.5

20.8

20.7

20.5

Angel RoIC

56.3

45.8

43.7

39.5

45.9

51.0

RoE

24.9

23.7

22.9

22.5

21.2

20.1

Turnover ratios(x)

Asset turnover (fixed assets)

4.2

3.7

3.6

2.8

3.6

4.5

Receivables days

84

86

81

86

80

79

January 20, 2016

12

Infosys | 3QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Infosys

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

January 20, 2016

13