2QFY2016 Result Update | Pharmaceutical

November 9, 2015

Indoco Remedies

NEUTRAL

CMP

`305

Performance Highlights

Target Price

-

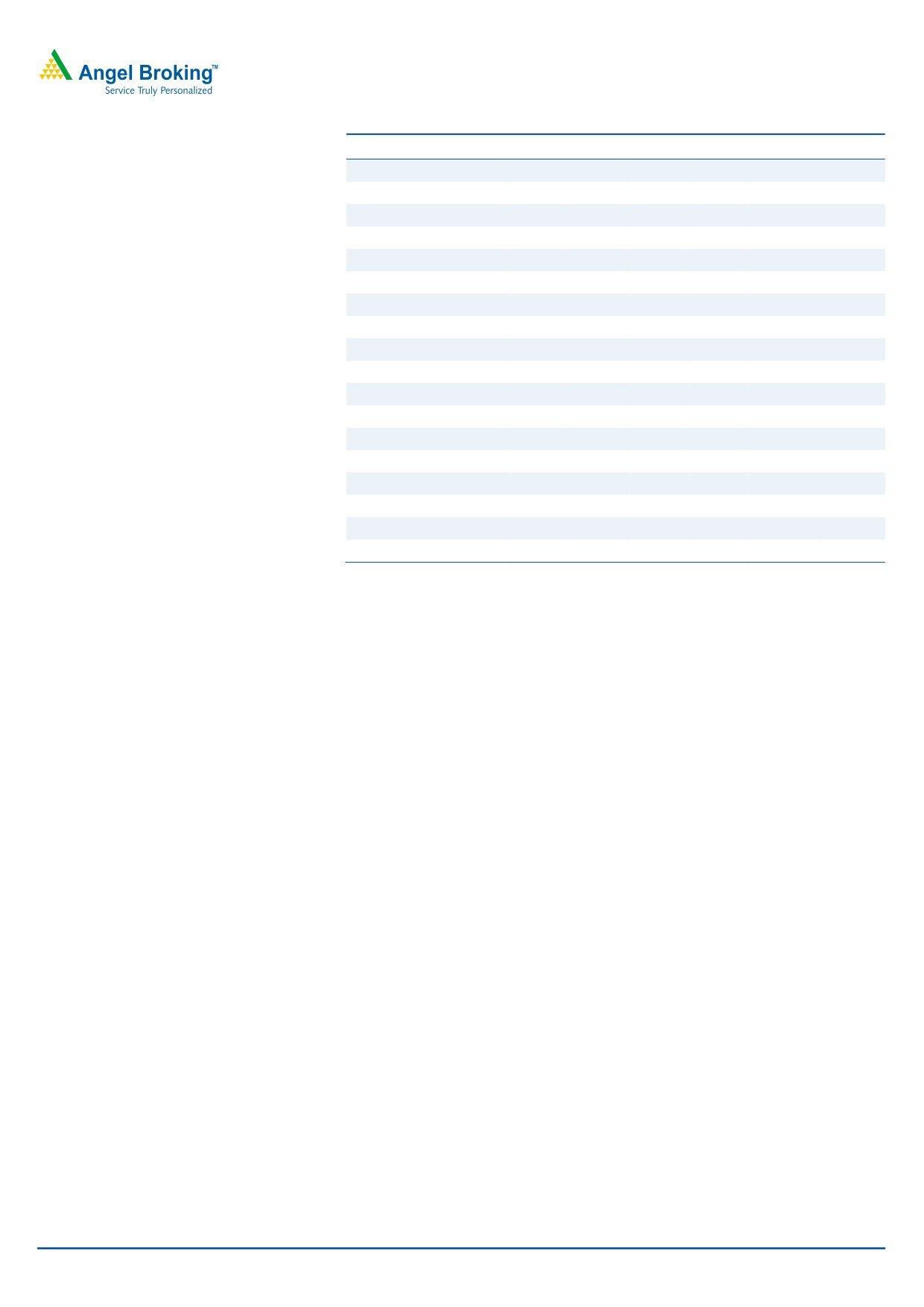

Y/E March (` cr)

2QFY16

1QFY16

% chg (qoq) 2QFY15

% chg (yoy)

Investment Period

-

Net sales

248

216

14.7

226

9.4

Other operating income

8

8

(0.8)

3

194.2

Stock Info

Gross profit

160

140

14.3

147

8.7

Operating profit

38

35

9.4

47

(17.4)

Sector

Pharmaceutical

Net profit

23

20

11.6

22

0.9

Market Cap (` cr)

2,810

Source: Company, Angel Research

Net Debt (` cr)

73

Indoco Remedies posted lower than expected numbers for 2QFY2016. The

Beta

0.9

company posted a 9.4% yoy growth in sales to `248cr V/s `272cr expected and

52 Week High / Low

413/262

V/s `226cr in 2QFY2015, on back of domestic and exports posting a growth of

Avg. Daily Volume

17,447

1.2% and 23.6% respectively. On the operating front, the EBITDA margin came in

Face Value (`)

2

at 15.5% V/s 20.9% expected and V/s 20.6% in 2QFY2015, on back of lower

BSE Sensex

26,265

than expected sales and 28.3% yoy and 82.6% yoy rise in staff expenditure and

Nifty

7,954

R&D expenditure, respectively. The R&D expenditure during the quarter was 3.6%

Reuters Code

INRM.BO

of sales V/s 2.2% of sales in 2QFY2015. Thus, the Adj. net profit came in at

Bloomberg Code

INDR@IN

`22.6cr V/s `33.4cr expected and V/s `22.4cr in 2QFY2015, a yoy growth of

0.9%. The lower than expected net profit is on back of lower than expected sales

and OPM. On back of valuations, we maintain our Neutral stance on the stock.

Shareholding Pattern (%)

Results lower than expected: The company posted lower than expected numbers

Promoters

59.3

for 2QFY2016. The company posted a 9.4% yoy growth in sales to `248cr V/s

MF / Banks / Indian Fls

13.5

`272cr expected and V/s `226cr in 2QFY2015, on back of domestic and exports

FII / NRIs / OCBs

9.4

posting a growth of 1.2% and 23.6% respectively. On the operating front, the

Indian Public / Others

17.8

EBITDA margin came in at 15.5% V/s 20.9% expected and V/s 20.6% in

2QFY2015, on back of lower than expected sales and 28.3% yoy and 82.6% yoy

rise in staff expenditure and R&D expenditure, respectively. The R&D expenditure

Abs. (%)

3m 1yr 3yr

during the quarter was 3.6% of sales V/s 2.2% of sales in 2QFY2015. Thus, the

Sensex

(7.2)

(5.9)

39.6

Adj. net profit came in at `22.6cr V/s `33.4cr expected and V/s `22.4cr in

Indoco

(11.4)

(1.6)

370.2

2QFY2015, a yoy growth of 0.9%. The lower than expected net profit is on back

of lower than expected sales and OPM

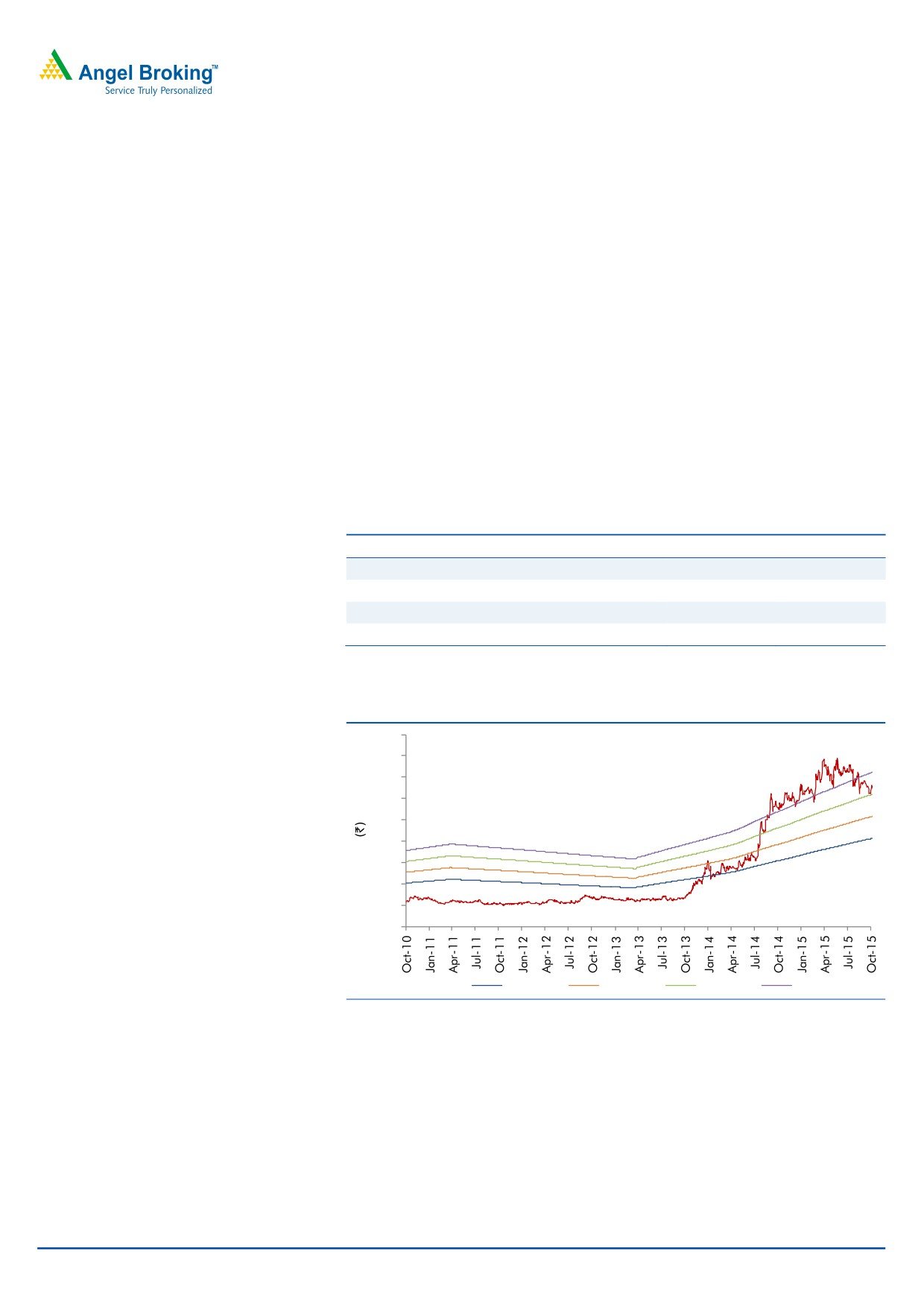

3-Year Daily Price Chart

Outlook and valuation: We expect net sales to post a 19.6% CAGR to `1,199cr

450

400

and EPS to post a 23.0% CAGR to `13.6 over FY2015-17E. At the current market

350

price, the stock is trading at 32.4x and 22.4x its FY2016E and FY2017E earnings,

300

250

respectively. We recommend a Neutral rating on the stock, given the valuations.

200

150

Key financials (Consolidated)

100

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

50

0

Net sales

722.3

852.2

1,032.6

1,198.6

2

3

3

4

4

5

5

1

1

1

1

1

1

1

ŧ

r

ŧ

r

ŧ

r

ŧ

% chg

15.3

18.0

21.2

16.1

c

p

c

p

c

p

c

O

A

O

A

O

A

O

Net profit

58.2

82.8

86.8

125.3

Source: Company, Angel Research

% chg

36.5

42.3

4.9

44.4

EPS (`)

6.3

9.0

9.4

13.6

EBITDA margin (%)

15.2

18.9

15.9

18.2

P/E (x)

48.3

33.9

32.4

22.4

RoE (%)

13.4

17.0

15.7

19.7

RoCE (%)

13.9

18.3

15.3

19.2

P/BV (x)

6.1

5.4

4.8

4.1

Sarabjit Kour Nangra

EV/Sales (x)

4.0

3.4

2.9

2.4

+91 22 39357600 - Ext: 6806

EV/EBITDA (x)

26.1

17.9

17.9

13.3

Source: Company, Angel Research; Note: CMP as of November 6, 2015

Please refer to important disclosures at the end of this report

1

Indoco Remedies | 2QFY2016 Result Update

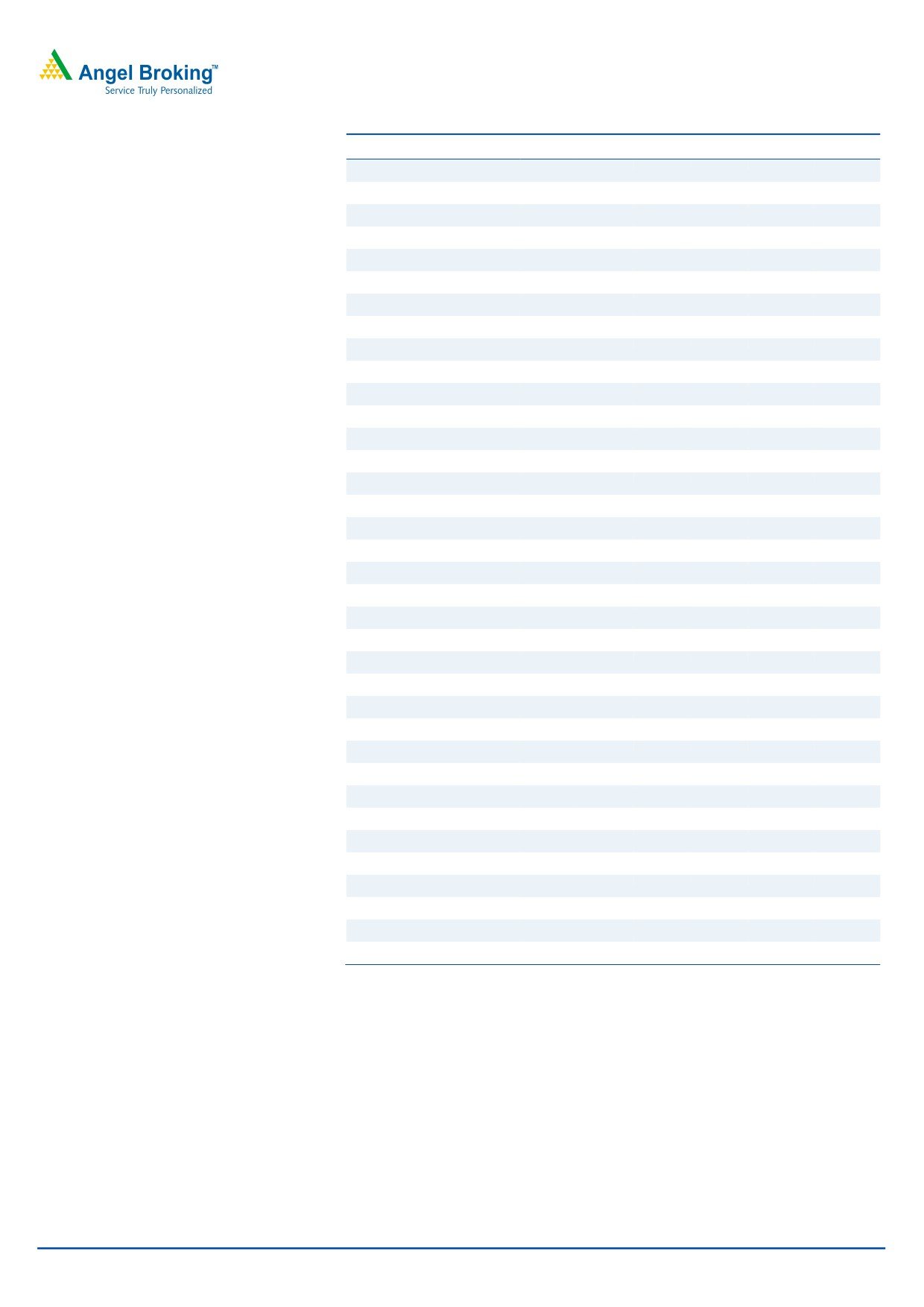

Exhibit 1: 2QFY2016 (Consolidated) performance

Y/E March (` cr)

2QFY2016

1QFY2016

% chg (qoq) 2QFY2015

% chg (yoy) 1HFY2016 1HFY2015

% chg (yoy)

Net sales

248

216

14.7

226

9.4

464

424

9.3

Other income

7.6

7.6

(0.8)

3

194.2

15

4

292.2

Total income

255

224

14.2

229

11.5

479

428

11.8

Gross profit

160

140

14.3

147

8.7

299

272

9.9

Gross margins (%)

64.4

64.6

64.8

64.5

64.1

Operating profit

38.5

35.2

9.4

46.6

(17.4)

73.7

82.5

(10.7)

OPM (%)

15.5

16.3

20.6

15.9

19.4

Interest

3

2

21.3

3

(2.2)

5

5

(11.6)

Dep & amortisation

15

15

(0.5)

13

13.2

30

23

32.0

PBT

29

26

11.2

33

(14.4)

54

58

(7.1)

Provision for taxation

5.9

5.4

9.8

11

(45.9)

11

16

(28.9)

Reported Net profit

23

20

11.6

22

0.9

43

42

1.0

Less : Exceptional items

0

0

-

0

0

0

PAT after exceptional items

23

20

11.6

22

0.9

43

42

1.0

EPS (`)

2.5

2.2

2.4

4.7

4.6

Source: Company, Angel Research

Exhibit 2: 2QFY2016 - Actual vs. Angel estimates

(` cr)

Actual

Estimate

Variation (%)

Net sales

248

272

(8.9)

Other operating income

8

3

194.2

Operating profit

38

57

(32.4)

Tax

6

9

(33.4)

Net profit

23

33

(32.4)

Source: Company, Angel Research

Revenues below expectations: The company posted a 9.4% yoy growth in sales to

`248cr V/s `272cr expected and V/s `226cr in 2QFY2015, on back of domestic

and exports posting a growth of 1.2% and 23.6% respectively.

Domestic markets (`146cr) posted a growth of 1.2% yoy, mainly on back a

tepid formulation sales (`138cr; up 0.5% yoy), while API sales (`7.6cr) posted

an 11.7% yoy growth. Top 10 therapies of the company contributed by 88.1%

to the IPM market. Indoco’s rank has improved from 28th to 27th in Sept’15

over the same month last year and on MAT basis, the rank improved from

29th to 28th (as on Sept’15; Source : AWACs)

Exports (`101cr) grew 23.6% yoy on back of formulation exports (`92.8cr; up

23.7% yoy), while API exports (`6.9cr) grew 3.6% yoy. The regulated markets

during the quarter grew by 25.6% yoy to `82.3cr as against `65.5cr during the

same quarter last year.

During the quarter, the company’s US business grew by 84% with revenues at

`26.4cr. Latanoprost ophthalmic solution sales picked up well during the quarter.

Launch of ophthalmic solution, viz Olopatadine 0.1% and Brimonidine 0.2% (own

ANDA), have been planned in quarter III and quarter IV respectively. In terms of

filings, the company (through partners or by itself), filed 19 ANDAs which are

pending approvals with 6 ANDAs approved till date. There are 33 under the

pipeline for the company.

November 9, 2015

2

Indoco Remedies | 2QFY2016 Result Update

The emerging markets for the quarter grew by 10.8% at `10.5cr as against `9.5cr

during the same quarter last year. Kenya, French West Africa, Uganda, Tanzania

and Myanmar drove sales during the quarter.

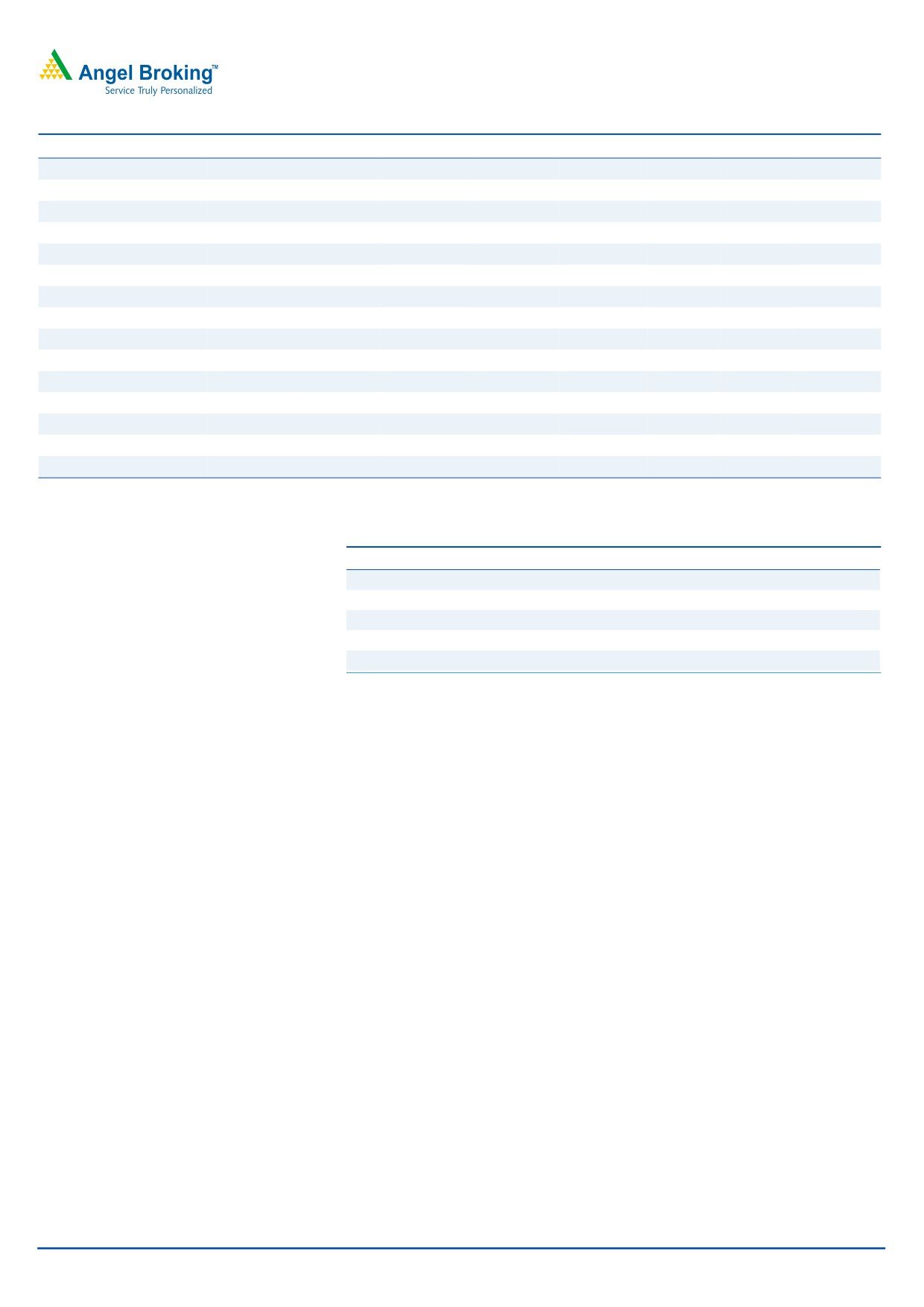

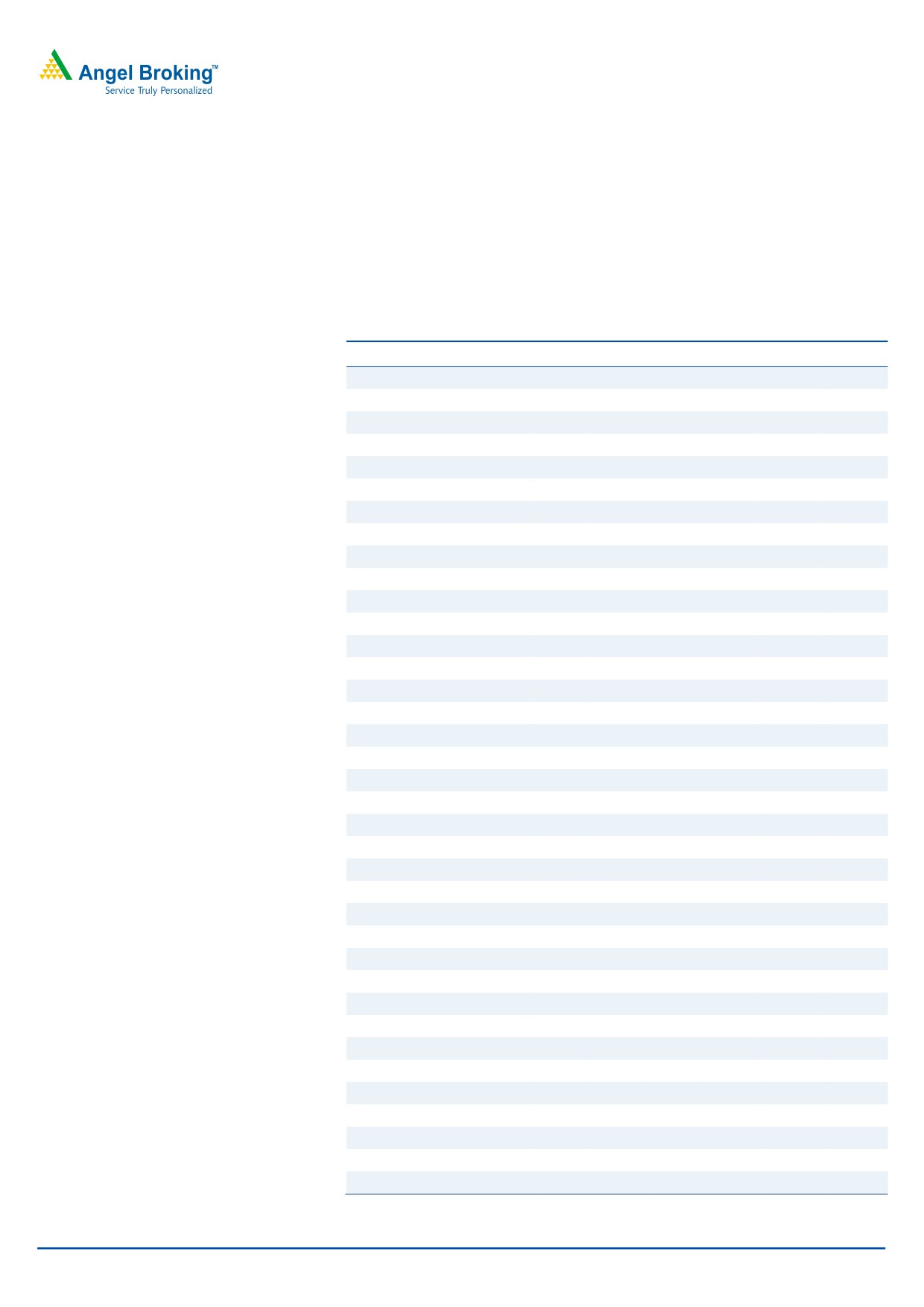

Exhibit 3: Domestic Formulation sales trend

150

137

138

140

130

123

123

124

120

110

100

90

80

70

60

50

2QFY2015

3QFY2015

4QFY2015

1QFY2016

2QFY2016

Source: Company, Angel research

Exhibit 4: Export sales trend

120.0

101

100.0

82

83

82

84

80.0

60.0

40.0

20.0

0.0

2QFY2015

3QFY2015

4QFY2015

1QFY2016

2QFY2016

Source: Company, Angel research

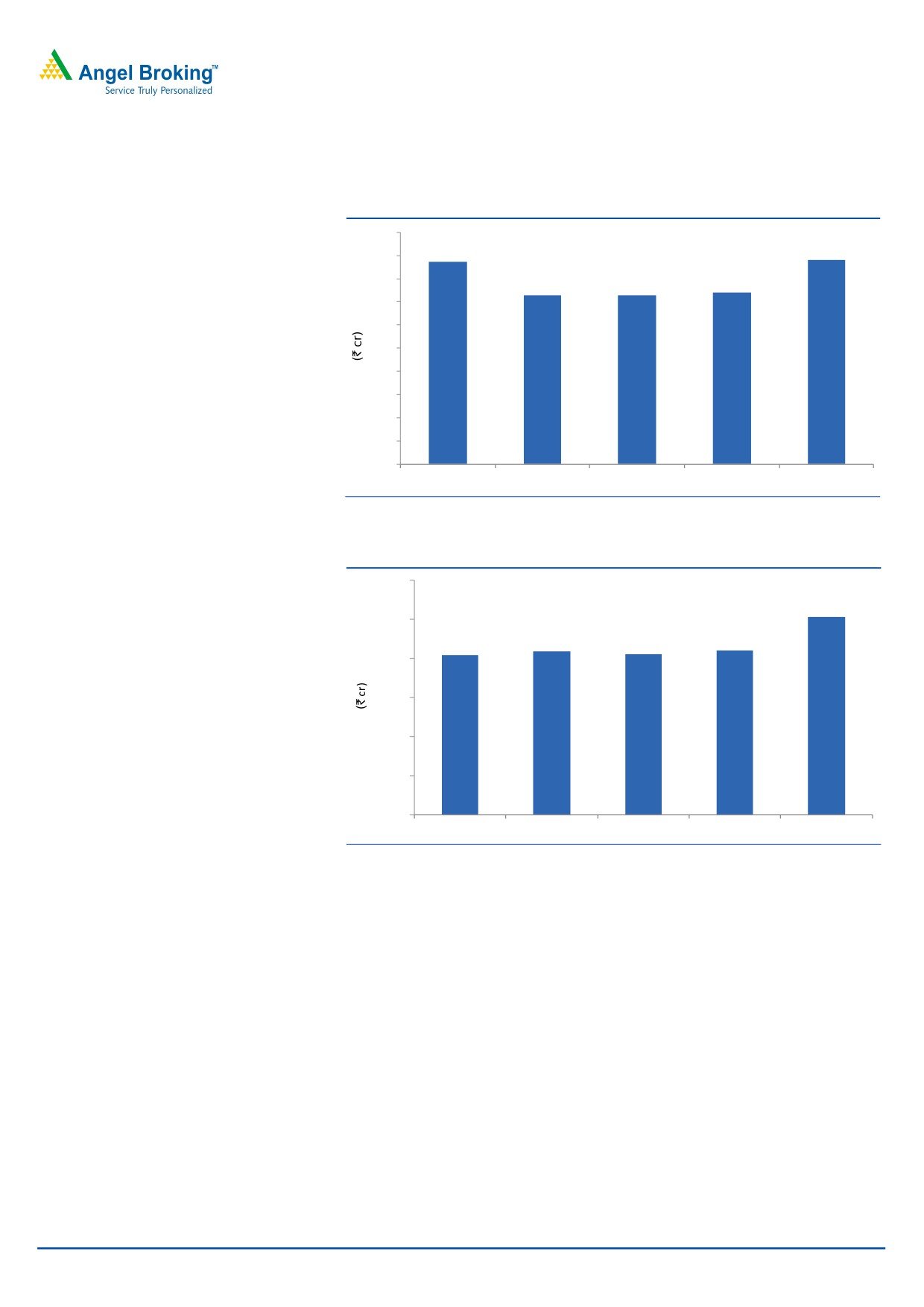

OPM lower than estimated: On the operating front, the EBITDA margin came in at

15.5% V/s 20.9% expected and V/s 20.6% in 2QFY2015, on back of lower than

expected sales and 28.3% yoy and 82.6% yoy rise in staff expenditure and R&D

expenditure respectively. The R&D expenditure during the quarter was 3.6% of

sales V/s 2.2% of sales in 2QFY2015.

November 9, 2015

3

Indoco Remedies | 2QFY2016 Result Update

Exhibit 5: OPM trend

25.0

20.6

18.3

18.4

20.0

16.3

15.5

15.0

10.0

5.0

0.0

2QFY2015

3QFY2015

4QFY2015

1QFY2016

2QFY2016

Source: Company, Angel Research

Net profit lower than expectation: Thus, the Adj. net profit came in at `22.6cr V/s

`33.4cr expected and V/s `22.4cr in 2QFY2015, a yoy growth of 0.9%. The lower

than expected net profit is on back of lower than expected sales and OPM.

Exhibit 6: Net profit trend

25

23

23

22

20

20

19

15

10

5

0

2QFY2015

3QFY2015

4QFY2015

1QFY2016

2QFY2016

Source: Company, Angel Research

November 9, 2015

4

Indoco Remedies | 2QFY2016 Result Update

Concall takeaways

During the quarter, the company successfully completed USFDA audit of its

Sterile Plant and Finished dosage Plant at Goa.

The company has re-structured some of its marketing divisions in domestic

markets with addition to the field force to accelerate growth and build on its

core strengths in the mass specialty segments.

Going forward, the company’s business from US and EU territory is expected

to grow speedily as ANDAs and Dossiers will be commercialized at regular

intervals.

While surging ahead in the regulated markets, Indoco is also consolidating its

position in the emerging markets through active brand promotion. Part of the

emerging market is exploited through distributors appointed by Indoco and

part through alliances.

Investment arguments

Focus on domestic formulations- Aiming for a higher-than-industry growth: Indoco

has a strong brand portfolio of 135 products and a base of ~2,300 MRs. It

operates in various

therapeutic

segments, including anti-infective,

anti-diabetic, CVS, ophthalmic, dental care, pain management and respiratory.

Prominent Indoco brands include Cyclopam, Vepan, Febrex Plus, ATM,

Sensodent-K and Sensoform. The company has seen strong growth across the

respiratory, anti-infective, ophthalmic and alimentary therapeutic segments.

Further, the company is investing to enhance the share of the chronic segment,

which constitutes 10% of overall sales.

Post the restructuring of the domestic business in FY2009, which has resulted in an

improvement in the working capital cycle, Indoco is back on the growth trajectory

with its domestic formulation business growing at 15.1% in FY2015. We expect the

domestic formulation segment to grow at a 9.3% CAGR over FY2015-17E, on

back of a muted FY2016, restructuring, and low monsoon.

Scaling-up on the exports front: Indoco has also started focusing on regulated

markets by entering into long-term supply contracts. The company is currently

executing several contract-manufacturing projects, and covering a number of

products for its clients in the UK, Germany and Slovenia. Indoco has received a

nod from the USFDA for two of its facilities in Goa.

Recently, the US health regulator has approved the sterile facility (plant-II) and

solid dosage facility (plant -III) located at Verna. The nod will facilitate the generic

approvals in the US market and subsequent product launches there will boost

revenues from the highly remunerative US market. With this, the number of Indoco

facilities having approval from the US regulator has gone up to 63 for finished

dosages, and 2 for APIs. The company derived ~39% of its revenues from exports

in 2014-15.

The development is positive for Indoco’s ophthalmic business, as it has filed

products from these facilities, and hence the approval opens up avenues for

high-margin, low-competition product sales in the US. In the last four years, the

company has filed ~15 ANDAs in the ophthalmic space and expects to secure

approval for ~5 products over FY2015-16E, addressing opportunities of US$1bn

brand sales. Thus, we estimate the company to garner around

`120cr of

November 9, 2015

5

Indoco Remedies | 2QFY2016 Result Update

sales in FY2016. We expect the exports segment to grow at a 35.6% CAGR over

FY2015-17E.

Partnering with pharmaceutical majors: The company has a large customer base

of small and medium sized generic companies across the globe and has major

tie-ups with generic companies for certain territories and products. The company

has a deal with Watson Pharmaceuticals to develop and manufacture a number of

sterile (ophthalmic) products for marketing in the USA. The agreement with South

Africa's largest pharmaceutical company, Aspen Pharmacare, encompasses a

number of solid dosages and ophthalmic products, extending to 30 emerging

market countries, while the contract signed with DSM, Austria, is for marketing 8 of

Indoco's APIs in various geographies. These deals have further strengthened

Indoco's image in the international arena.

Valuation: We expect the company to post a net sales CAGR of 19.6% to `1,199cr

and EPS to post a 23.0% CAGR to `13.6 over FY2015-17E. At the current market

price, the stock is trading at 32.4x and 22.4x its FY2016E and FY2017E earnings,

respectively. We recommend a Neutral rating on the stock, given the valuations.

Exhibit 7: Key assumptions

FY2016E

FY2017E

Domestic sales growth (%)

4.0

15.0

Exports growth

55.6

18.0

Operating margins (%)

15.9

18.2

Capex (` cr)

60.0

60.0

Source: Company, Angel Research

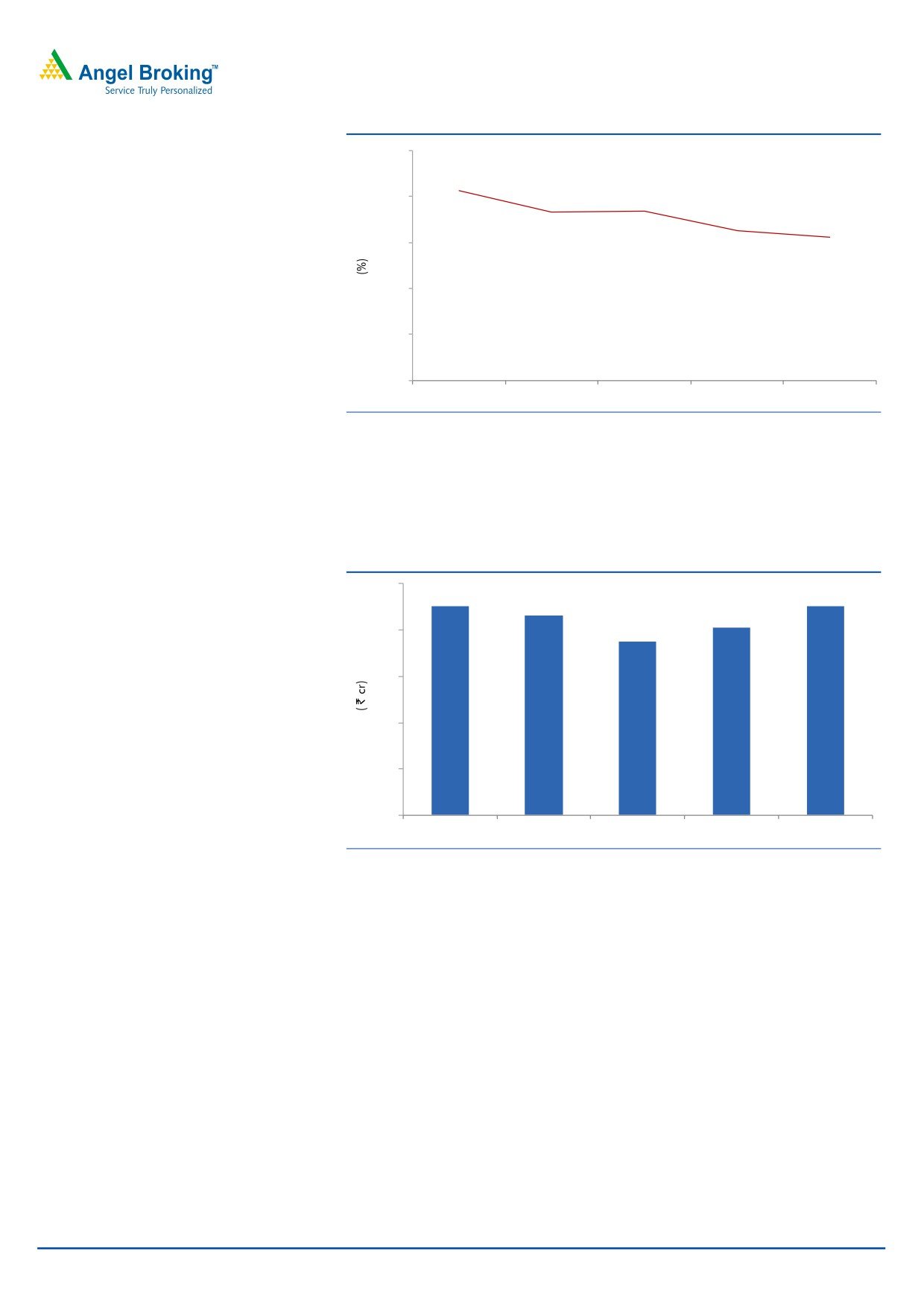

Exhibit 8: One-year forward PE band

450

400

350

300

250

200

150

100

50

0

20x

25x

30x

35x

Source: Company, Angel Research

November 9, 2015

6

Indoco Remedies | 2QFY2016 Result Update

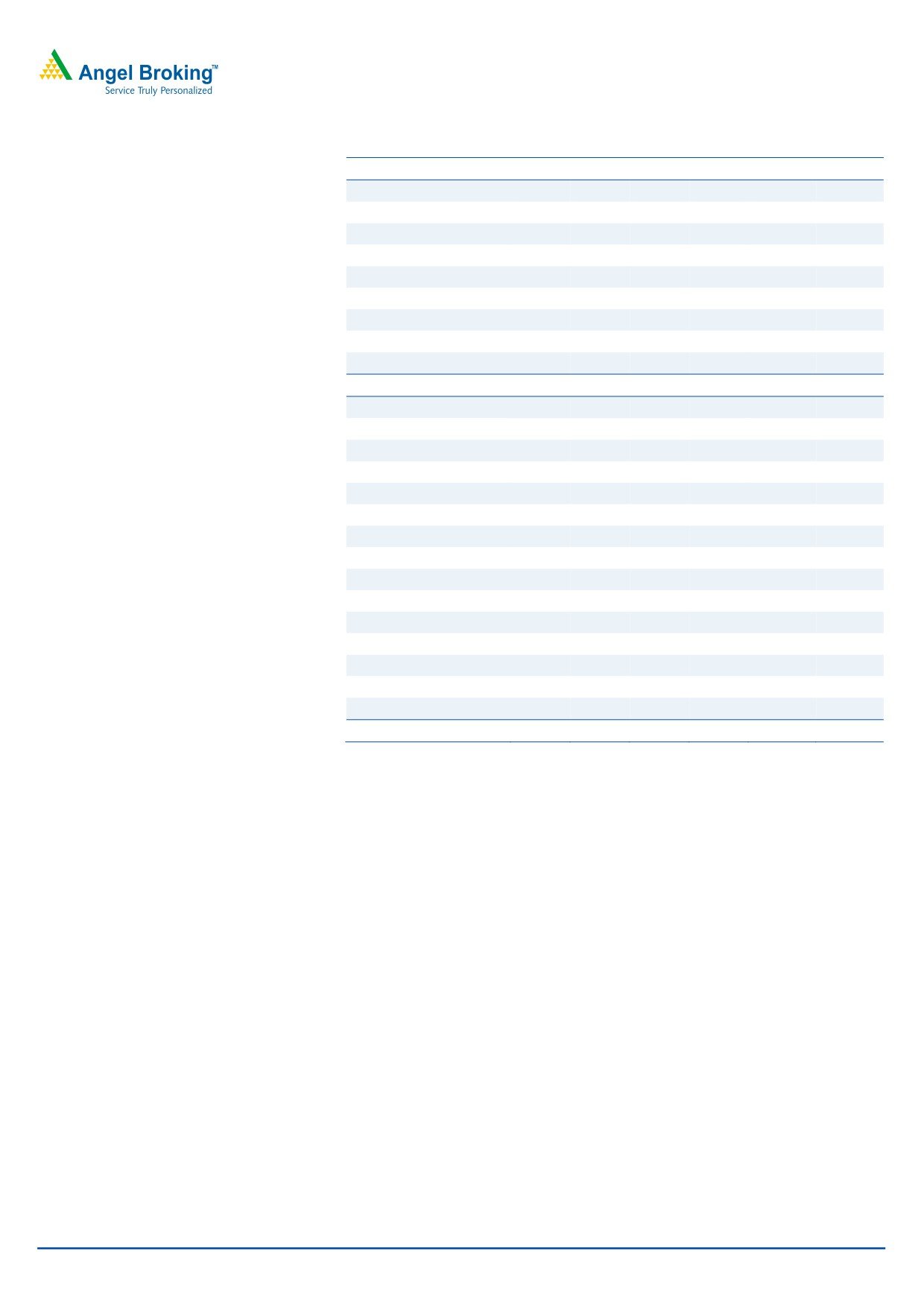

Exhibit 9: Recommendation summary

Company

Reco

CMP Tgt. price Upside

FY2017E

FY15-17E

FY2017E

(`)

(`)

(%) PE (x) EV/Sales (x) EV/EBITDA (x) CAGR in EPS (%) RoCE (%) RoE (%)

Alembic Pharma

Neutral

675

-

-

28.3

4.0

20.0

26.2

31.5

31.8

Aurobindo Pharma Accumulate

820

872

6.3

18.8

3.0

13.2

16.3

23.4

30.2

Cadila Healthcare

Neutral

429

-

-

24.4

3.7

16.7

24.6

25.2

29.0

Cipla

Neutral

659

-

-

22.8

3.1

16.4

21.4

17.1

16.8

Dr Reddy's

Neutral

4,253

-

-

22.1

3.3

14.7

21.6

20.6

22.0

Dishman Pharma

Neutral

402

-

-

18.6

1.7

8.6

20.4

11.7

11.7

GSK Pharma*

Neutral

3,191

-

-

46.7

8.1

36.9

6.6

33.7

34.3

Indoco Remedies

Neutral

310

-

-

22.4

2.4

13.4

23.0

19.7

19.7

Ipca labs

Buy

733

900

22.7

26.2

2.6

14.0

26.1

13.0

14.9

Lupin

Neutral

1,838

-

-

25.8

4.4

16.5

9.7

27.9

23.4

Sanofi India*

Neutral

4,276

-

-

28.2

3.7

17.6

33.1

27.9

25.5

Sun Pharma

Buy

816

950

16.4

30.3

5.3

17.4

8.4

15.8

16.6

Source: Company, Angel Research; Note: *December year ending, Price as of November 6, 2015

November 9, 2015

7

Indoco Remedies | 2QFY2016 Result Update

Company Background

Indoco has a strong brand portfolio of 135 products and a base of 2,300 MRs.

The company operates in various therapeutic segments including anti-infective,

anti-diabetic, CVS, ophthalmic, dental care, pain management and respiratory

areas. Prominent Indoco brands include Cyclopam, Vepan, Febrex Plus, ATM,

Sensodent-K and Sensoform. The company’s top-10 brands contribute over 50%

of its domestic sales. Indoco now proposes to scale up its exports through higher

exposure to the regulated markets.

Profit & loss statement (Consolidated)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Gross sales

576

638

735

863

1,043

1,211

Less: Excise duty

7

11

13

11

10

12

Net sales

569

626

722

852

1,033

1,199

Other operating income

2

4

10

5

5

5

Total operating income

571

630

733

857

1,038

1,204

% chg

17.4

10.4

16.2

17.0

21.0

16.0

Total expenditure

484

537

612

691

868

981

Net raw materials

245

262

272

300

382

443

Other mfg costs

39

37

42

50

60

70

Personnel

82

100

130

140

185

215

Other

119

138

168

201

241

253

EBITDA

85

89

110

161

164

218

% chg

31.2

5.4

23.5

46.1

2.3

32.3

(% of Net Sales)

14.9

14.2

15.2

18.9

15.9

18.2

Depreciation& amortisation

19

24

31

47

52

57

EBIT

65

65

79

114

112

160

% chg

28.1

0.1

21.0

43.7

(1.2)

42.9

(% of Net Sales)

11.5

10.4

11.0

13.3

10.9

13.4

Interest & other charges

16

22

19

11

11

11

Other income

-

1

2

2

2

2

(% of PBT)

0.0

1.8

2.4

1.6

1.6

1.1

Share in profit of Associates

-

-

-

-

1.0

2.0

Recurring PBT

51

48

72

110

109

157

PBT (reported)

51

48

72

110

109

157

Tax

5

6

14

27

22

31

(% of PBT)

9.6

11.8

19.6

24.3

20.0

20.0

PAT (reported)

46

43

58

83

87

125

Add: Share of earnings of asso.

-

-

-

-

-

-

Less: Minority interest (MI)

-

-

-

-

-

-

Prior period items

-

-

-

-

-

-

PAT after MI (reported)

46

43

58

83

87

125

ADJ. PAT

46

43

58

83

87

125

% chg

(9.2)

(7.9)

36.5

42.3

4.9

44.4

(% of Net Sales)

8.1

6.8

8.1

9.7

8.4

10.5

Basic EPS (`)

5.0

4.6

6.3

9.0

9.4

13.6

Fully Diluted EPS (`)

5.0

4.6

6.3

9.0

9.4

13.6

% chg

(9.2)

(7.9)

36.5

42.3

4.9

44.4

November 9, 2015

8

Indoco Remedies | 2QFY2016 Result Update

Balance Sheet (Consolidated)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

SOURCES OF FUNDS

Equity share capital

12

18

18

18

18

18

Reserves & surplus

372

396

439

500

566

669

Shareholders funds

385

414

457

519

584

688

Minority Interest

-

0

-

-

-

-

Total loans

114

90

72

88

181

120

Other Long Term Liab.

9

9

9

9

9

9

Long Term Provisions

5

7

16

16

16

16

Deferred tax liability

29

35

31

27

27

27

Total liabilities

542

555

585

659

792

835

APPLICATION OF FUNDS

Gross block

404

447

481

561

621

681

Less: acc. depreciation

102

126

156

203

255

312

Net block

302

321

325

358

366

369

Capital work-in-progress

33

38

44

44

44

44

Goodwill

-

0

-

0

0

0

Investments

0

0

0

0

0

0

Long Term Loans And Adv.

55

57

55

58

101

117

Current assets

267

273

305

385

535

600

Cash

10

12

13

15

32

16

Loans & advances

38

41

42

85

103

120

Other

219

220

249

285

400

464

Current liabilities

114

134

144

187

255

296

Net current assets

152

139

160

199

280

304

Mis. Exp. not written off

0

0

-

-

-

-

Total assets

542

555

585

659

792

835

November 9, 2015

9

Indoco Remedies | 2QFY2016 Result Update

Cash Flow Statement (Consolidated)

Y/E March (` cr)

FY2012

FY2013

FY2014

FY2015

FY2016E FY2017E

Profit before tax

51

48

72

110

109

157

Depreciation

19

24

31

47

52

57

(Inc)/Dec in working capital

(28)

13

(18)

(39)

(109)

(56)

Less: Other income

-

1

2

2

2

2

Direct taxes paid

1

6

14

27

22

31

Cash Flow from Operations

41

79

69

90

29

125

(Inc.)/Dec.in fixed assets

(84)

(49)

(41)

(80)

(60)

(60)

(Inc.)/Dec. in investments

0

-

-

-

-

-

Other income

-

1

2

2

2

2

Cash Flow from Investing

(84)

(48)

(39)

(78)

(58)

(58)

Issue of equity

-

-

-

-

-

-

Inc./(Dec.) in loans

39

(22)

(9)

16

93

(61)

Dividend Paid (Incl. Tax)

(12)

(12)

(12)

(22)

(22)

(22)

Others

14

3

(16)

(3)

(15)

9

Cash Flow from Financing

41

(30)

(37)

(9)

56

(74)

Inc./(Dec.) in Cash

(2)

1

(7)

3

26

(7)

Opening Cash balances

27

10

12

13

15

32

Closing Cash balances

10

12

13

15

32

16

November 9, 2015

10

Indoco Remedies | 2QFY2016 Result Update

Key Ratios

Y/E March

FY2012

FY2013

FY2014

FY2015

FY2016E

FY2017E

Valuation Ratio (x)

P/E (on FDEPS)

60.6

65.9

48.3

33.9

32.4

22.4

P/CEPS

42.8

42.3

31.5

21.6

20.2

15.4

P/BV

7.3

6.8

6.1

5.4

4.8

4.1

Dividend yield (%)

0.2

0.4

0.4

0.4

0.4

0.4

EV/Sales

5.1

4.6

4.0

3.4

2.9

2.4

EV/EBITDA

34.5

32.4

26.1

17.9

18.0

13.4

EV / Total Assets

5.4

5.2

4.9

4.4

3.7

3.5

Per Share Data (`)

EPS (Basic)

5.0

4.6

6.3

9.0

9.4

13.6

EPS (fully diluted)

5.0

4.6

6.3

9.0

9.4

13.6

Cash EPS

7.1

7.2

9.7

14.1

15.1

19.8

DPS

0.7

1.1

1.1

1.1

1.1

1.1

Book Value

41.8

44.9

49.6

56.3

63.4

74.6

Dupont Analysis

EBIT margin

11.5

10.4

11.0

13.3

10.9

13.4

Tax retention ratio

90.4

88.2

80.4

75.7

80.0

80.0

Asset turnover (x)

1.2

1.2

1.3

1.4

1.5

1.5

ROIC (Post-tax)

12.2

10.8

11.6

14.2

12.9

16.3

Cost of Debt (Post Tax)

15.5

18.9

18.7

10.0

6.3

5.6

Leverage (x)

0.2

0.2

0.2

0.1

0.2

0.2

Operating ROE

11.6

8.9

10.4

14.8

14.2

18.5

Returns (%)

ROCE (Pre-tax)

13.0

11.9

13.9

18.3

15.5

19.7

Angel ROIC (Pre-tax)

14.8

13.0

15.3

20.2

17.1

21.5

ROE

12.6

10.7

13.4

17.0

15.7

19.7

Turnover ratios (x)

Asset Turnover (Gross Block)

1.6

1.5

1.6

1.6

1.8

1.8

Inventory / Sales (days)

56

52

50

55

62

60

Receivables (days)

71

66

64

62

79

76

Payables (days)

47

43

40

46

50

52

WC cycle (ex-cash) (days)

78

78

68

70

76

81

Solvency ratios (x)

Net debt to equity

0.3

0.2

0.1

0.1

0.3

0.2

Net debt to EBITDA

1.2

0.9

0.5

0.5

0.9

0.5

Interest Coverage (EBIT / Int.)

4.0

3.0

4.2

10.7

10.6

15.2

November 9, 2015

11

Indoco Remedies | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Indoco Remedies

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 9, 2015

12