2QFY2016 Result Update | Telecom

October 27, 2015

Idea Cellular

NEUTRAL

CMP

`141

Performance highlights

Target Price

-

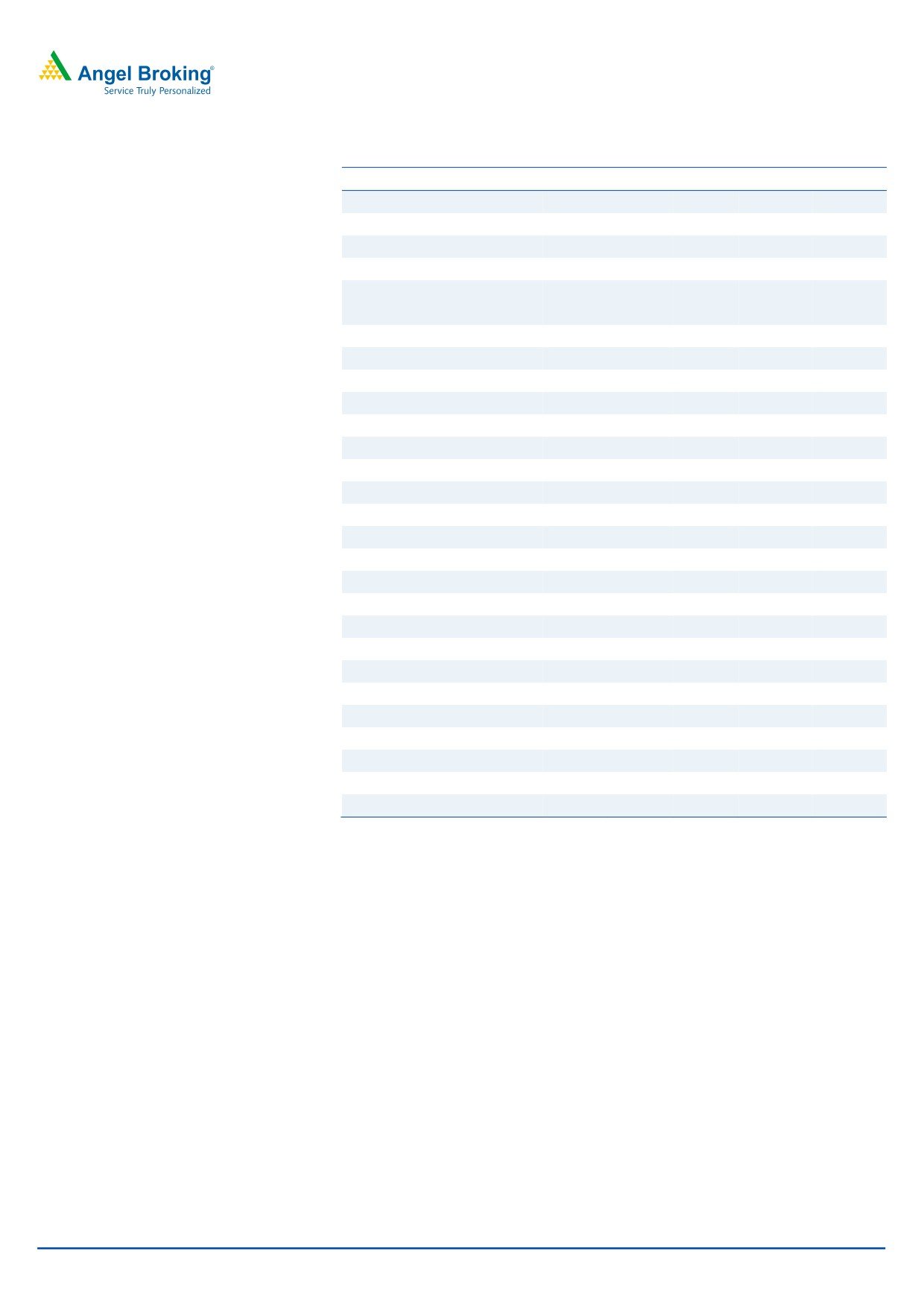

(` cr) - Consl

2QFY16 2QFY15

% chg (qoq) 1QFY16

% chg (yoy)

Investment Period

-

Revenue

8,723

8,921

(2.2)

7,687

13.5

EBITDA

3,057

3,228

(5.3)

2,491

22.7

Stock Info

EBITDA margin (%)

35.2

36.7

(150)bp

32.9

230bp

Sector

Telecom

PAT

809

931

(13.1)

756

7.0

Market Cap (` cr)

50,791

Source: Company, Angel Research

Net debt (` cr)

15,257

Idea Cellular (Idea)’s 2QFY2016 results have come in broadly in line with

Beta

0.7

estimates. The average Minutes of Use (MOU) dipped

5.4% qoq to

52 Week High / Low

204/137

386min/subscriber/month (due to seasonality issues and increasing rural

Avg. Daily Volume

449,731

penetration), the average revenue per min (ARPM) grew 1.8% sequentially to

Face Value (`)

10

`0.45, and thereby the average revenue per user (ARPU) declined by 3.8% on a

BSE Sensex

27,362

qoq basis to `175/month. We maintain our Neutral view on the stock.

Nifty

8,261

Reuters Code

IDEA.BO

Quarterly highlights: Idea’s consolidated revenue for the quarter came in at

Bloomberg Code

IDEA@IN

`8,723cr, down marginally by 2.2% qoq, owing to a decline in the mobility

business. The mobility segment’s revenue dipped by 1.8% qoq to `8,509cr, on

account of a decline in the overall MOU. The EBIDTA margin slipped 150bp qoq

Shareholding Pattern (%)

to 35.2% due to increase in personnel costs and on account of a 5% sequential

Promoters

42.3

increase in advertisement and business promotion expenses. The Net Profit at

MF / Banks / Indian Fls

3.3

`809.3cr, declined by 13.1% on a sequential basis.

FII / NRIs / OCBs

50.6

Indian Public / Others

3.8

Outlook and valuation: Going ahead, the realization would remain under

pressure on account of heightened competition (both in the voice and the data

segment). Further, post the entry of RJio, the pricing pressure would worsen

Abs. (%)

3m 1yr

3yr

further, particularly in the data segment. Also, Idea’s debt/equity ratio has risen

Sensex

(1.1)

1.9

46.3

from 0.7x in FY2015 to about 1x as at the end of 2QFY2016, on account of

Idea

(17.9)

(10.3)

73.8

payments incurred towards spectrum acquisition and network expansion. The

same is expected to worsen further to 1.4x by the end of FY2016, and would

3-year price chart

thereby impact return ratios. We remain cautious on Idea due to its worsening

250

debt/equity ratio coupled with realization pressures. We maintain our Neutral

200

rating on the stock.

150

Key financials (Consolidated, Indian GAAP)

Y/E March (` cr)

FY2013 FY2014

FY2015

FY2016E

FY2017E

100

Net revenue

22,459

26,519

31,571

35,651

38,872

50

% chg

14.9

18.1

19.1

12.9

9.0

0

Net profit

1,012

1,968

3,227

3,196

2,568

% chg

40.1

94.4

64.0

(1.0)

(19.6)

EBITDA margin (%)

26.7

31.4

34.3

35.7

34.1

Source: Company, Angel Research

EPS (`)

3.1

5.9

9.0

8.9

7.1

P/E (x)

46.2

23.8

15.7

15.9

19.8

P/BV (x)

3.5

3.1

2.2

2.0

1.8

RoE (%)

7.1

11.9

14.0

12.3

9.1

RoCE (%)

8.8

9.9

12.7

9.1

8.1

Bharat Gianani

EV/Sales (x)

2.8

2.6

1.7

2.4

2.3

+91 22 3935 7800 Ext: 6817

EV/EBITDA (x)

10.5

8.3

5.0

6.8

6.6

Source: Company, Angel Research;

Please refer to important disclosures at the end of this report

1

Idea Cellular | 2QFY2016 Result Update

Exhibit 1: 2QFY2016 - Financial performance (Consolidated, Indian GAAP)

(` cr)

2QFY16

1QFY16

% chg (qoq)

2QFY15

% chg (yoy)

1HFY16 1HFY15

% chg( yoy)

Net revenue

8,689

8,798

(1.2)

7,570

14.8

17,487

15,132

15.6

Operating expenditure

5,632

5,570

1.1

5,079

10.9

11,202

10,130

10.6

EBITDA

3,057

3,228

(5.3)

2,491

22.7

6,442

5,153

25.0

Dep. and amortization

1,538

1,516

1.5

1,179

30.5

3,054

2,333

30.9

EBIT

1,519

1,712

(11.3)

1,312

15.7

3,388

2,820

20.1

Interest charges

306

402

(23.7)

261

17.3

708

495

42.9

Other income

34

122

(72.5)

117

(71.1)

156

151

3.6

PBT

1,246

1,433

(13.0)

1,168

6.7

2,836

2,475

14.6

Income tax

437

502

(13.0)

412

6.2

940

805

16.7

PAT

809

931

(13.1)

756

7.0

1,896

1,670

13.6

Minority interest

-

-

-

-

-

Adj. PAT

809

931

(13.1)

756

7.0

1,896

1,670

13.6

EPS (`)

2.2

2.6

(13.1)

2.1

6.9

4.8

4.3

13.6

EBITDA margin (%)

35.2

36.7

(150)bp

32.9

230bp

36.5

33.7

280bp

EBIT margin (%)

17.5

19.5

(200)bp

17.3

20bp

19.2

18.5

70bp

PAT margin (%)

9.7

12.0

(230)bp

11.5

(180)bp

11.6

11.9

(30)bp

Source: Company, Angel Research

Soft results

Idea’s consolidated revenue came in at `8,723cr, down 2.2% qoq, as 2Q is a

cyclically soft quarter for telecom companies. The mobility segment’s revenue

dipped by 1.8% qoq to `8,509cr, owing to a decline in the overall MOU. With

increasing proportion of rural subscribers, the seasonal slowdown in 2Q became

more pronounced, resulting in the overall network traffic declining by 3.2% qoq to

189.5bn min. The ARPM inched up sequentially by 1.8% and stood at 45.3

paise/min given the increase in data usage. The MOU for the quarter was

386min/subscriber/month, declining 5.4% qoq; Voice RPM continued to remain

under pressure declining 0.6% sequentially and 9.7% on a yoy basis to 32.7

paise/min. The ARPU dipped 4% qoq and 1% yoy to `175/subscriber/month. The

subscriber base grew by 4.5mn qoq in 2QFY2016 with the end of the period (EoP)

subscriber base standing at 166.6mn.

October 27, 2015

2

Idea Cellular | 2QFY2016 Result Update

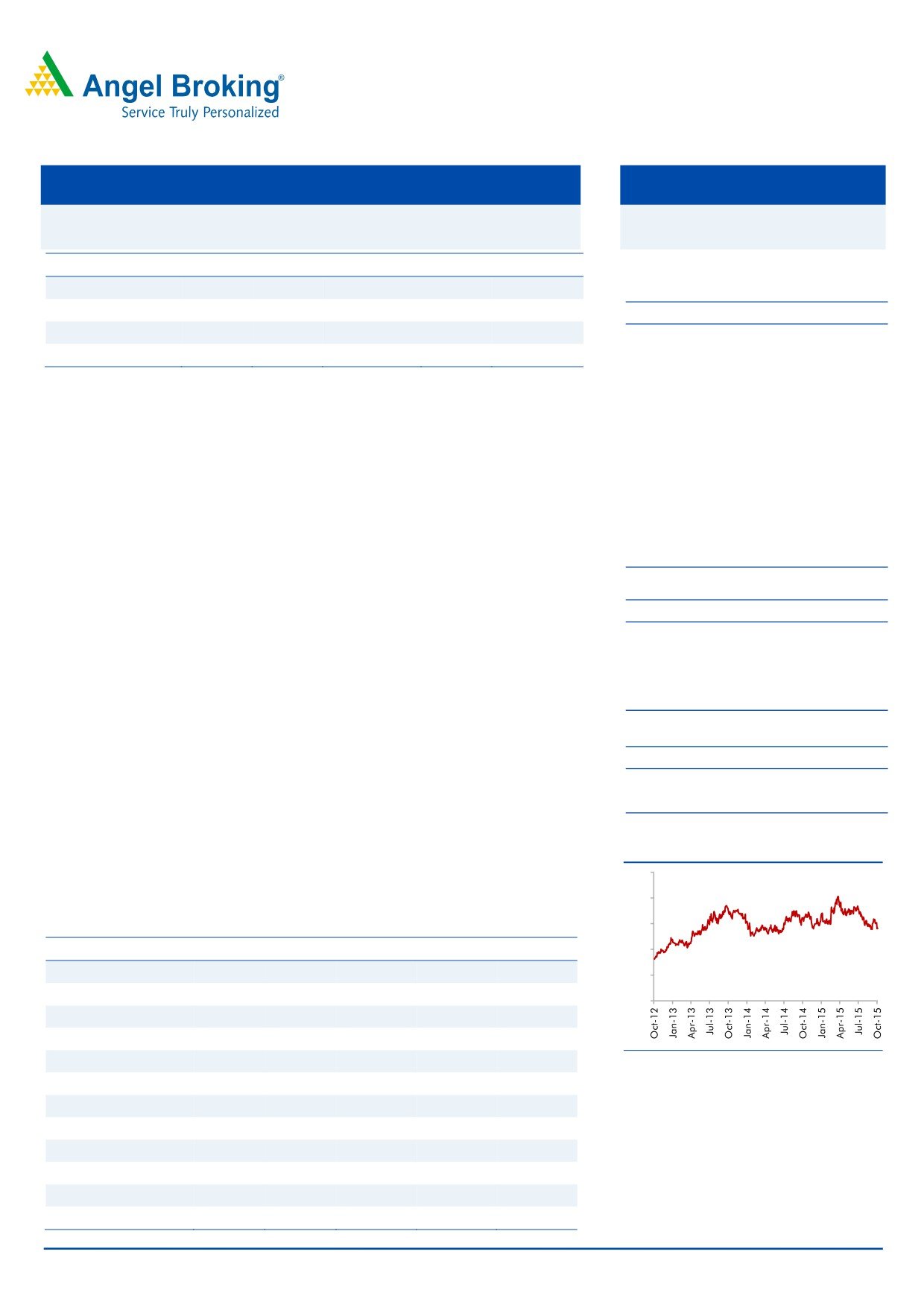

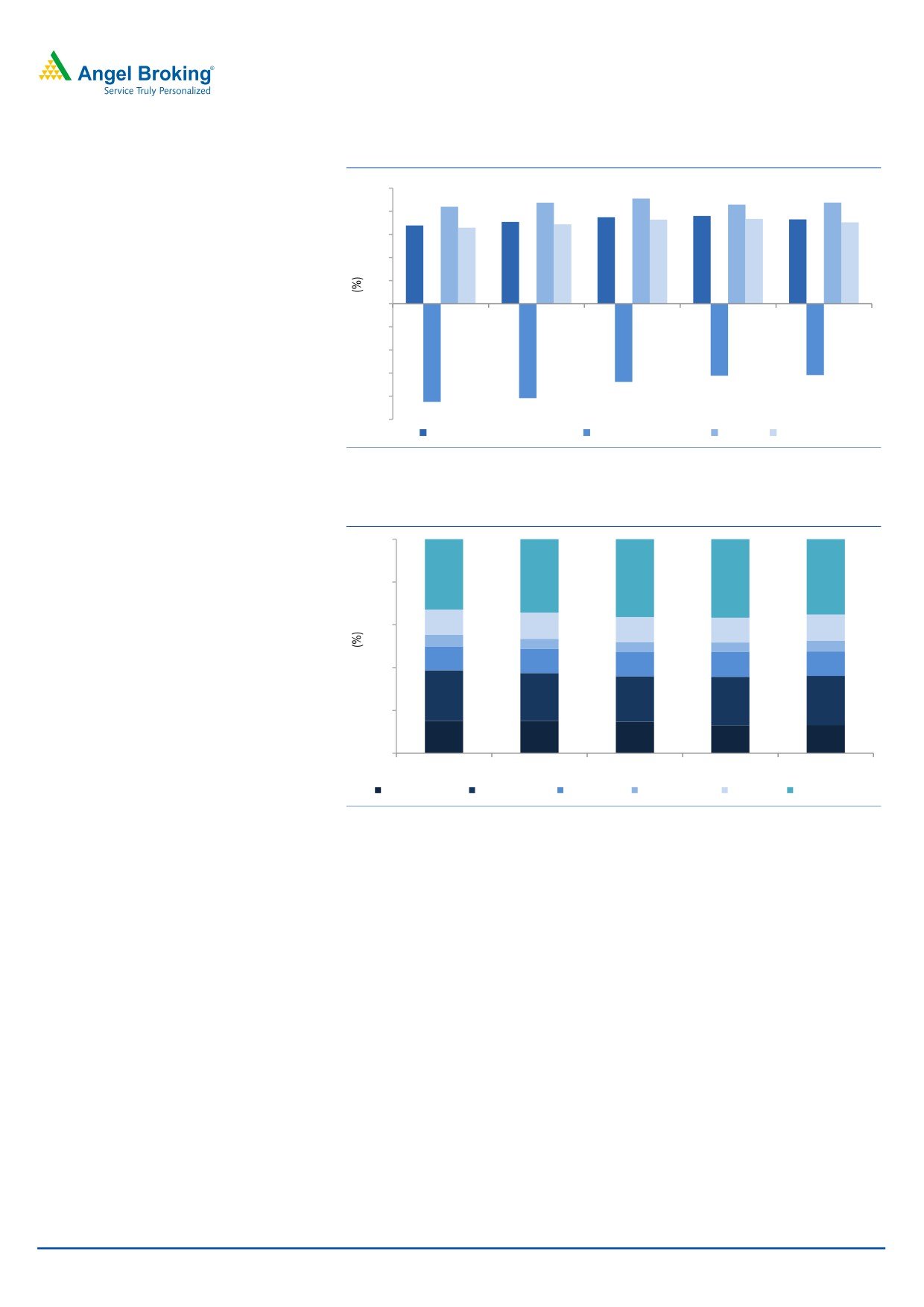

Exhibit 2: Trend in MOU

425

6

3.1

400

3

2.0

375

1.0

1.0

0

350

(3)

325

(4.2)

(5.4)

300

(6)

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

MOU (min)

qoq growth (%)

Source: Company, Angel Research

The share of value added services (VAS) revenues continued to inch up (increased

180bps sequentially to 27.9%) given the higher data adoption. Data revenue as %

of service revenue improved from 14% to 19.6% in the last one year period. Data

revenues grew by 9% qoq and now account for 19.6% of Idea’s wireless revenues,

led by 14.8% qoq and 82.6% yoy growth in data volumes, pointing to strong data

adoption in the Indian wireless market. Data revenue per MB dipped by 4.8% qoq

to 23.4 paise, on account of mix change in favor of 3G data and increased

competitive pressures. Overall mobile data users base (2G+3G) increased 11.2%

sequentially, but the mobile data ARPU at `144 declined 9.8% sequentially. The

company added 5.1mn new 3G users during 1HFY2016 with 3G EoP user base

(Voice and Data) now at 19.6mn. The 3G user mobile data ARPU is steady at `202

per month.

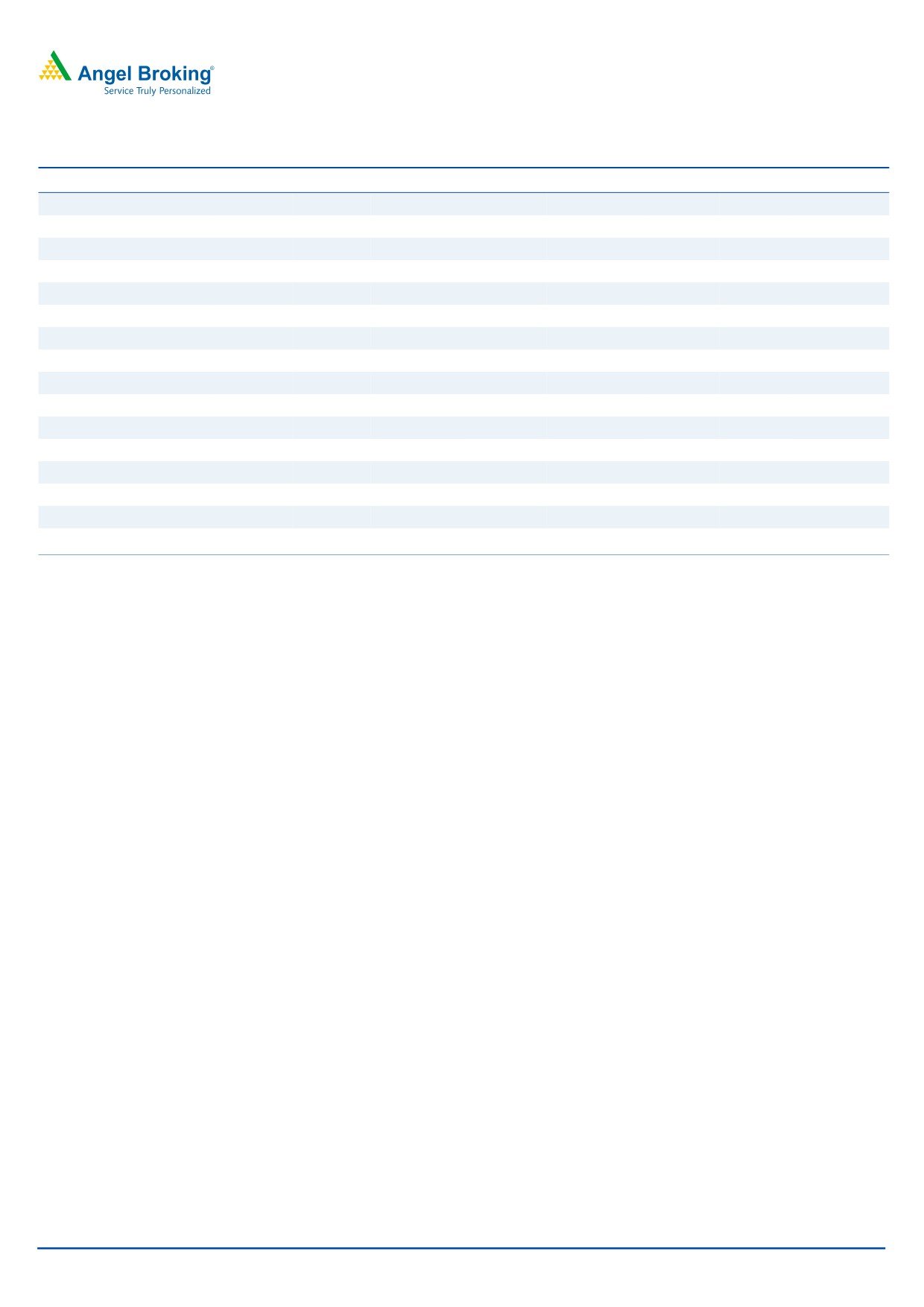

Exhibit 3: Trend in ARPM

0.47

4

3.4

0.45

1.8

2

1.8

0.43

0.9

0.41

0

(0.7)

0.39

(2)

0.37

(3.2)

0.35

(4)

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

ARPM (`/min)

qoq growth (%)

Source: Company, Angel Research

October 27, 2015

3

Idea Cellular | 2QFY2016 Result Update

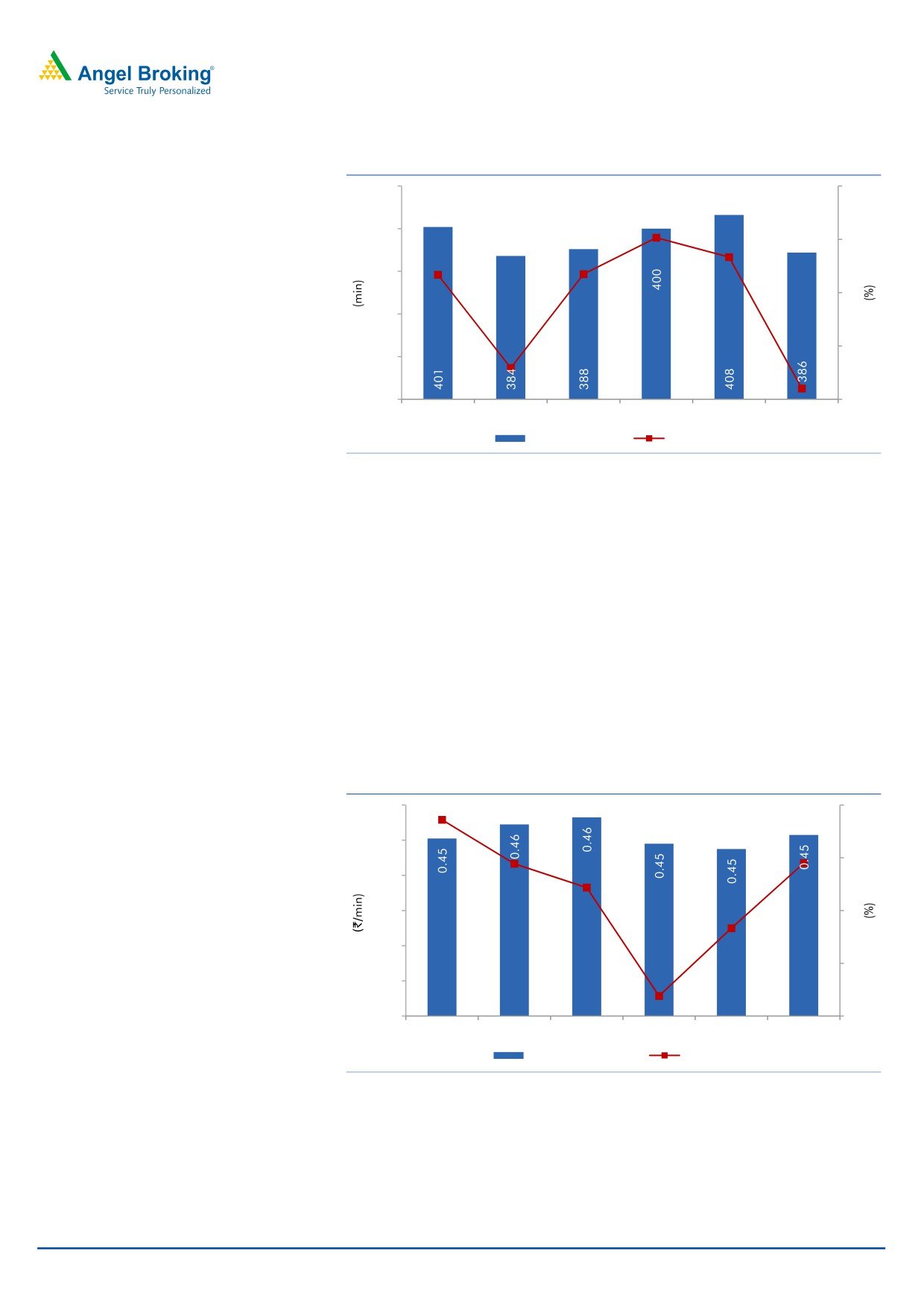

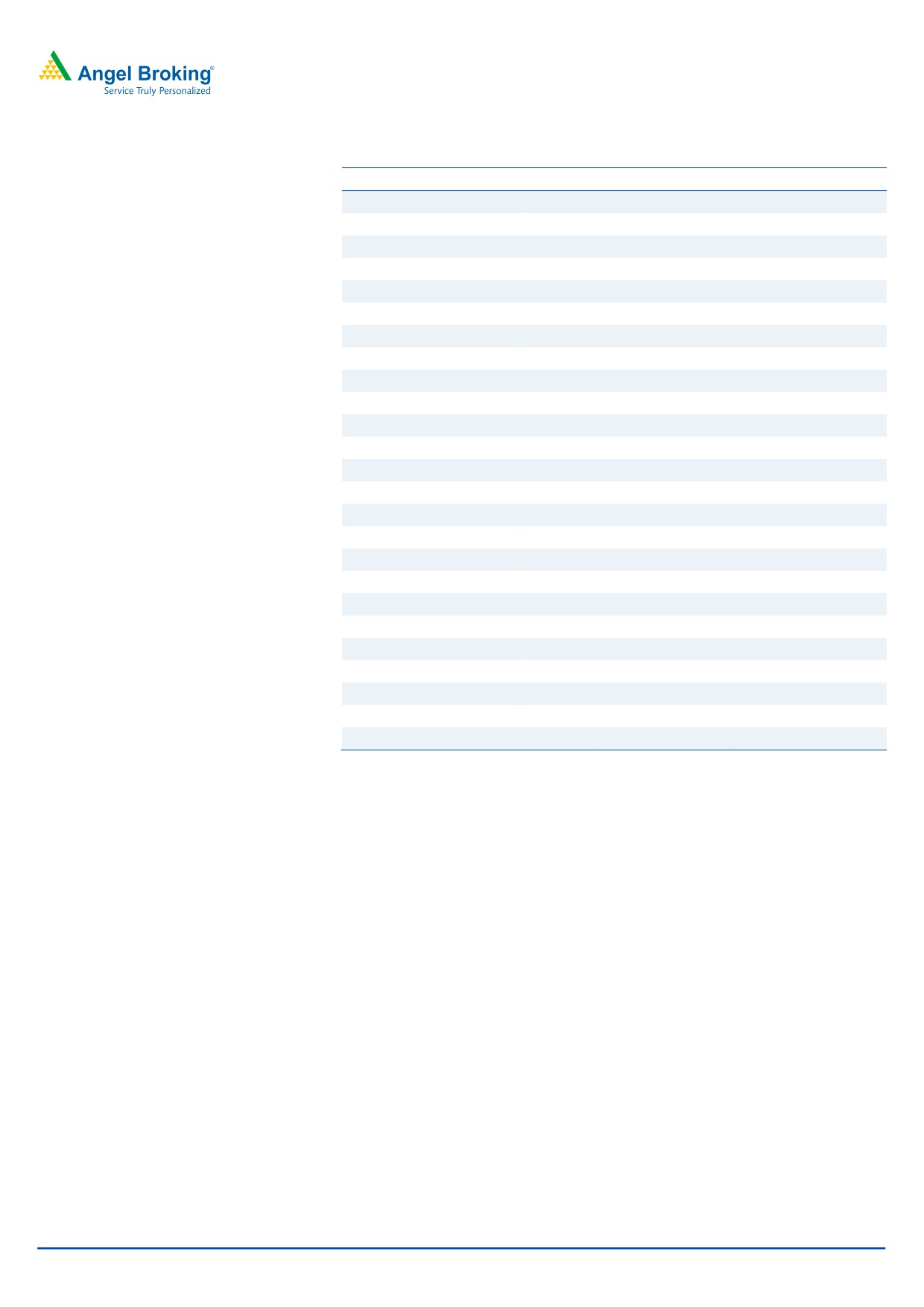

Exhibit 4: Trend in VAS share in mobility revenue

30

27

27.9

26.1

24

24.5

23.1

21

21.1

17.8

18

15

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

VAS share (%)

Source: Company, Angel Research

Thus, a decline in MOU more than offset the marginal increase in the subscriber

base and ARPM, leading to a 3.8% qoq drop in ARPU to `175.

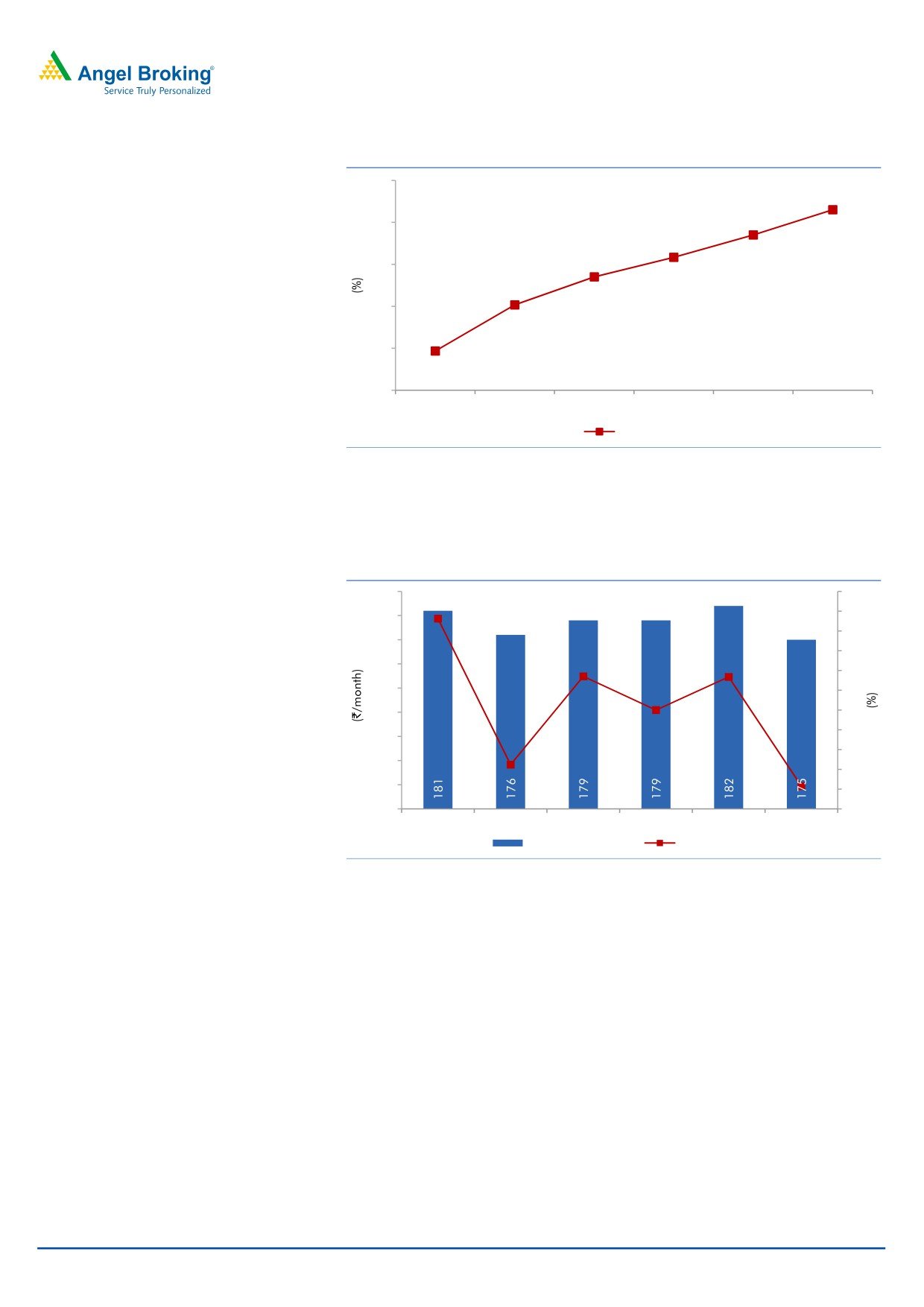

Exhibit 5: Trend in ARPU

185

6

5

180

4.6

4

175

3

170

1.7

2

1.7

165

1

0.0

160

0

(1)

155

(2)

150

(2.8)

(3)

145

(3.8)

(4)

140

(5)

1QFY15

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

ARPU (`/month)

qoq growth (%)

Source: Company, Angel Research

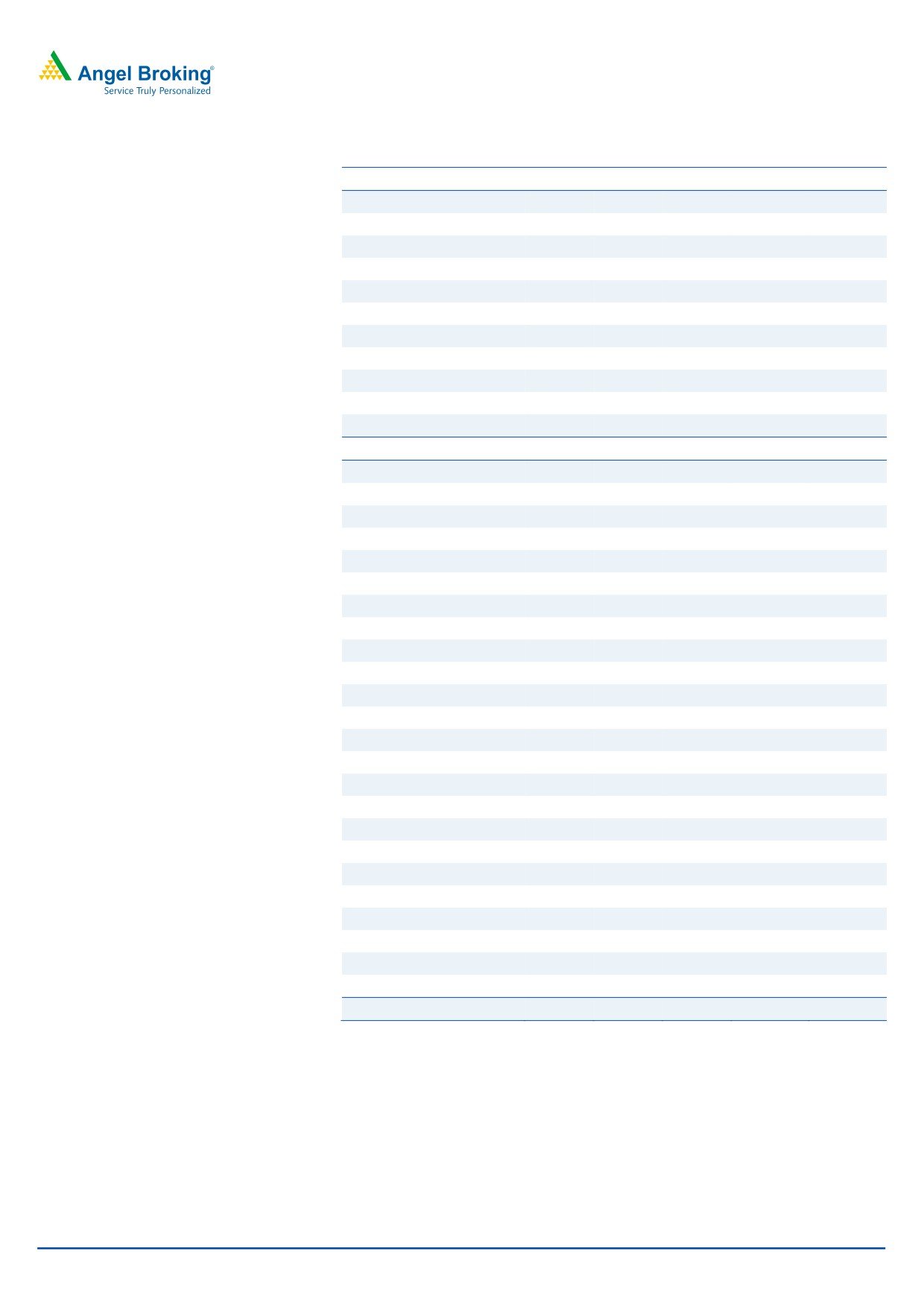

EBITDA margin declines

For 2QFY2016, Idea’s EBITDA margin slipped 150bp qoq to 35.2%, due to

increase in personnel expenses and advertisement and business promotion

expenses. While employee expenses tend to be higher in 2Q, Advertisement

expenses grew 5% sequentially, putting pressure on the margins.

During the quarter, the revenue from established service areas (ESA) stood at

`8,105cr, down 1.8% qoq and revenue from new service areas (NSA) stood at

`575cr, up 5.6% qoq. The EBITDA margin of ESA dipped ~140bp qoq to 36.5%;

EBITDA loss from NSA stood at `178cr (`170cr in 1QFY2016). EBITDA contribution

from Indus Towers (Indus) stood at `280cr (+5% qoq). EBITDA losses from new

circles would continue as the company indicated that it does not expect new circles

to break even at the EBITDA level in the near term.

October 27, 2015

4

Idea Cellular | 2QFY2016 Result Update

Exhibit 6: Trend in EBITDA margin

50

44

46

44

42

43

37

36

38

37

36

40

34

35

34

35

33

30

20

10

0

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

(10)

(20)

(30)

(31)

(31)

(40)

(34)

(41)

(42)

(50)

Established service areas

New service areas

Indus

Consolidated

Source: Company, Angel Research

Exhibit 7: Opex breakup

100

32.9

34.3

80

36.4

36.7

35.2

60

11.8

12.2

11.8

11.6

12.3

5.4

4.7

4.6

4.4

4.9

11.2

11.3

40

11.3

11.6

11.4

23.6

22.4

21.3

22.6

23.0

20

15.1

15.0

14.7

13.1

13.1

0

2QFY15

3QFY15

4QFY15

1QFY16

2QFY16

Access charges

Network costs

License fee

Employee cost

SGA cost

EBITDA margin

Source: Company, Angel Research

Other result highlights

Wireless churn during the quarter increased to 5.1% from 4.7% in the

sequential previous quarter.

Idea added 3,701 2G cell-sites, taking the total count to 119,276. 3G cell

sites increased by 6,246 to 39,867 as at the end of 2QFY2016.

During the quarter, national long distance (NLD) minutes declined marginally

by 0.3% qoq to 16,287mn. NLD currently carries around 98.6% of Idea’s

captive NLD minutes. Idea ILD services now handle around 99% of captive

international long distance (ILD) outgoing minutes, besides bringing large

volume of incoming minutes from top international carriers across the globe.

Idea ISP (Internet Service Provider) currently handles all captive subscriber

traffic requirements.

Capex for the quarter stood at `1,726cr (excluding forex fluctuations) and the

company has maintained its capex guidance of `6,000-6,500cr for FY2016E.

October 27, 2015

5

Idea Cellular | 2QFY2016 Result Update

Outlook and valuation

Going ahead, realization would remain under pressure on account of heightened

competition, both in the voice and the data segment. Further, post the entry of RJio,

the pricing pressure would worsen further, particularly in the data segment. Also

Idea’s debt/equity has risen from 0.7x in FY2015 to about 1x as at the end of

2QFY2016, on account of payments incurred towards spectrum acquisition and

network expansion. The same is expected to worsen further to 1.4x by the end of

FY2016, and would thereby impact return ratios. We remain cautious on Idea due

to its worsening debt/equity ratio coupled with realization pressures. We maintain

our Neutral rating on the stock.

Company background

Idea Cellular (Idea), a part of the Aditya Birla Group, is the third largest

telecommunication service provider in India in terms of revenue. The company

provides mobile services in all the 22 circles of the country and has 167mn

subscribers. Idea had won 3G licenses in 13 out of the 22 circles in India and is

currently providing 3G services in 21 circles (in seven circles by 3G roaming

agreements). The company also holds a 16% stake in Indus Towers, which is a JV

of Bharti Airtel, Vodafone and Idea.

October 27, 2015

6

Idea Cellular | 2QFY2016 Result Update

Profit and loss account (Consolidated, Indian GAAP)

Y/E March (` cr)

FY2013 FY2014 FY2015 FY2016E FY2017E

Net sales

22,459

26,519

31,571

35,651

38,872

Network operating exp.

5,536

6,499

7,196

8,251

9,124

% of net sales

24.6

24.5

22.8

23.1

23.5

License and WPC charges

2,475

2,924

3,535

4,012

4,271

% of net sales

11.0

11.0

11.2

11.3

11.0

Roaming and access charges

4,015

4,162

4,731

4,743

5,358

% of net sales

17.9

15.7

15.0

13.3

13.8

Other expenses

4,427

4,601

5,290

5,934

6,872

Total expenditure

16,453

18,185

20,752

22,941

25,624

% of net sales

73.3

68.6

65.7

64.3

65.9

EBITDA

6,006

8,334

10,819

12,710

13,248

% of net sales

26.7

31.4

34.3

35.7

34.1

Dep. and amortization

3,478

4,519

5,304

6,501

7,377

EBIT

2,528

3,815

5,515

6,209

5,872

% of net sales

11.3

14.4

17.5

17.4

15.1

Interest expense

949

770

1,018

1,447

1,920

Other income, net

-

-

469.7

156.1

-

Profit before tax

1,579

3,045

4,967

4,919

3,951

Provision for tax

566

1,076

1,740

1,723

1,383

% of PBT

35.9

35.4

35.0

35.0

35.0

PAT

1,012

1,968

3,227

3,196

2,568

Share in earnings of asso.

-

-

-

-

-

Minority interest

-

-

-

-

-

Profit after minority interest

1,012

1,968

3,227

3,196

2,568

EPS (`)

3.1

5.9

9.0

8.9

7.1

October 27, 2015

7

Idea Cellular | 2QFY2016 Result Update

Balance sheet (Consolidated, Indian GAAP)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

Liabilities

Share capital

3,314

3,320

3,598

3,598

3,598

Reserves and surplus

10,989

13,205

19,429

22,409

24,762

Additional paid up capital

-

-

-

-

-

Stock option outstanding

-

-

-

-

-

Total shareholders’ funds

14,303

16,525

23,027

26,007

28,359

Convertible preference shares

2

2

2

2

2

Total debt

12,263

18,776

16,810

36,232

37,832

Long term provisions

314

499

574

574

574

Deferred tax liabilities

1,118

1,813

1,902

1,902

1,902

Other liabilities

795

923

963

3,463

3,963

Total liabilities

28,795

38,537

43,278

68,179

72,631

Assets

Gross block - fixed assets

46,605

51,220

61,821

79,321

86,821

Accumulated depreciation

17,451

21,624

26,287

32,788

40,165

Net block

29,154

29,596

35,534

46,532

46,656

Capital WIP

881

11,419

5,141

17,141

17,291

Total fixed assets

30,035

41,015

40,674

63,673

63,946

Long term loans and adv.

3,048

2,897

4,275

9,000

9,000

Investments

-

-

-

-

-

Goodwill on consolidation

6

6

6

6

6

Non compete fees

-

-

-

-

-

Other non current assets

-

145

46

Current assets

Inventories

73

68

71

71

71

Current investments

1,028

216

11,527

327

327

Debtors

960

801

979

1,859

1,597

Cash

143

188

1,554

325

222

Loans and advances

1,085

1,218

1,229

2,387

2,591

Other current assets

1

3

106

106

106

Total current assets

3,289

2,494

15,466

5,074

4,915

Less:- trade payables

2,687

2,788

3,097

2,927

3,332

Less:-current liab.

4,771

5,044

13,789

6,345

1,602

Less:-provisions

125

188

302

302

302

Net current assets

(4,294)

(5,526)

(1,723)

(4,500)

(321)

Profit and loss account

-

-

-

-

-

Total assets

28,795

38,537

43,278

68,179

72,631

October 27, 2015

8

Idea Cellular | 2QFY2016 Result Update

Cash flow statement (Consolidated, Indian GAAP)

Y/E March (` cr)

FY2013 FY2014 FY2015 FY2016E FY2017E

Profit before tax

1,579

3,045

4,967

4,919

3,951

Depreciation

3,347

4,173

4,663

6,501

7,377

Change in working capital

(95)

1,278

(2,437)

1,548

(4,282)

Direct taxes paid

976

863

303

2,546

500

Less: Others

(566)

(1,076)

(1,740)

(1,723)

(1,383)

Cash Flow from Operations

5,241

8,282

5,756

13,791

6,163

(Inc.)/Dec. in fixed assets

(5,715)

(15,153)

(4,322)

(29,500)

(7,650)

(Inc.)/Dec. in investments

-

-

-

-

-

Others

(792)

151

(1,378)

(4,725)

0

Cash Flow from Investing

(6,506)

(15,002)

(5,700)

(34,225)

(7,650)

Issue of equity

6

5

278

0

0

Inc./(Dec.) in loans

1,014

6,512

(1,965)

19,421

1,600

Dividend paid (Incl. Tax)

(108)

(144)

(216)

(216)

(216)

Others

345

392

3,213

(0)

0

Cash Flow from Financing

1,256

6,766

1,310

19,205

1,384

Inc./(Dec.) in cash

(9)

45

1,366

(1,229)

(103)

Opening Cash balances

152

143

188

1,554

325

Closing Cash balances

143

188

1,554

325

222

October 27, 2015

9

Idea Cellular | 2QFY2016 Result Update

Key Ratios

Y/E March

FY2013

FY2014

FY2015

FY2016E

FY2017E

Valuation ratio (x)

P/E (on FDEPS)

46.2

23.8

15.7

15.9

19.8

P/CEPS

11.3

7.8

5.9

5.2

5.1

P/BVPS

3.5

3.1

2.2

2.0

1.8

Dividend yield (%)

0.2

0.3

0.4

0.4

0.4

EV/Sales

2.8

2.6

1.7

2.4

2.3

EV/EBITDA

10.5

8.3

5.0

6.8

6.6

EV/Total assets

2.2

1.8

1.3

1.3

1.2

Per share data (`)

EPS (Fully diluted)

3.1

5.9

9.0

8.9

7.1

Cash EPS

12.5

18.0

23.7

26.9

27.6

Dividend

0.3

0.4

0.6

0.6

0.6

Book value

39.7

45.9

64.0

72.2

78.8

DuPont analysis

Tax retention ratio (PAT/PBT)

0.6

0.6

0.6

0.6

0.7

Cost of debt (PBT/EBIT)

0.6

0.8

0.9

0.8

0.7

EBIT margin (EBIT/Sales)

0.1

0.1

0.2

0.2

0.2

Asset turnover ratio (Sales/Assets)

0.8

0.7

0.7

0.5

0.5

Leverage ratio (Assets/Equity)

2.0

2.3

1.9

2.6

2.6

Operating ROE

7.1

11.9

14.0

12.3

9.1

Return ratios (%)

RoCE (pre-tax)

8.8

9.9

12.7

9.1

8.1

Angel RoIC

9.5

14.3

22.0

12.3

10.7

RoE

7.1

11.9

14.0

12.3

9.1

Turnover ratios (x)

Asset turnover (fixed assets)

0.7

0.6

0.8

0.6

0.6

Receivables days

14

15

15

15

15

Payable days

65

55

60

55

55

October 27, 2015

10

Idea Cellular | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Idea Cellular

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

October 27, 2015

11