3QFY2016 Result Update | FMCG

January 27, 2016

ITC

BUY

CMP

`310

Performance Highlights

Target Price

`359

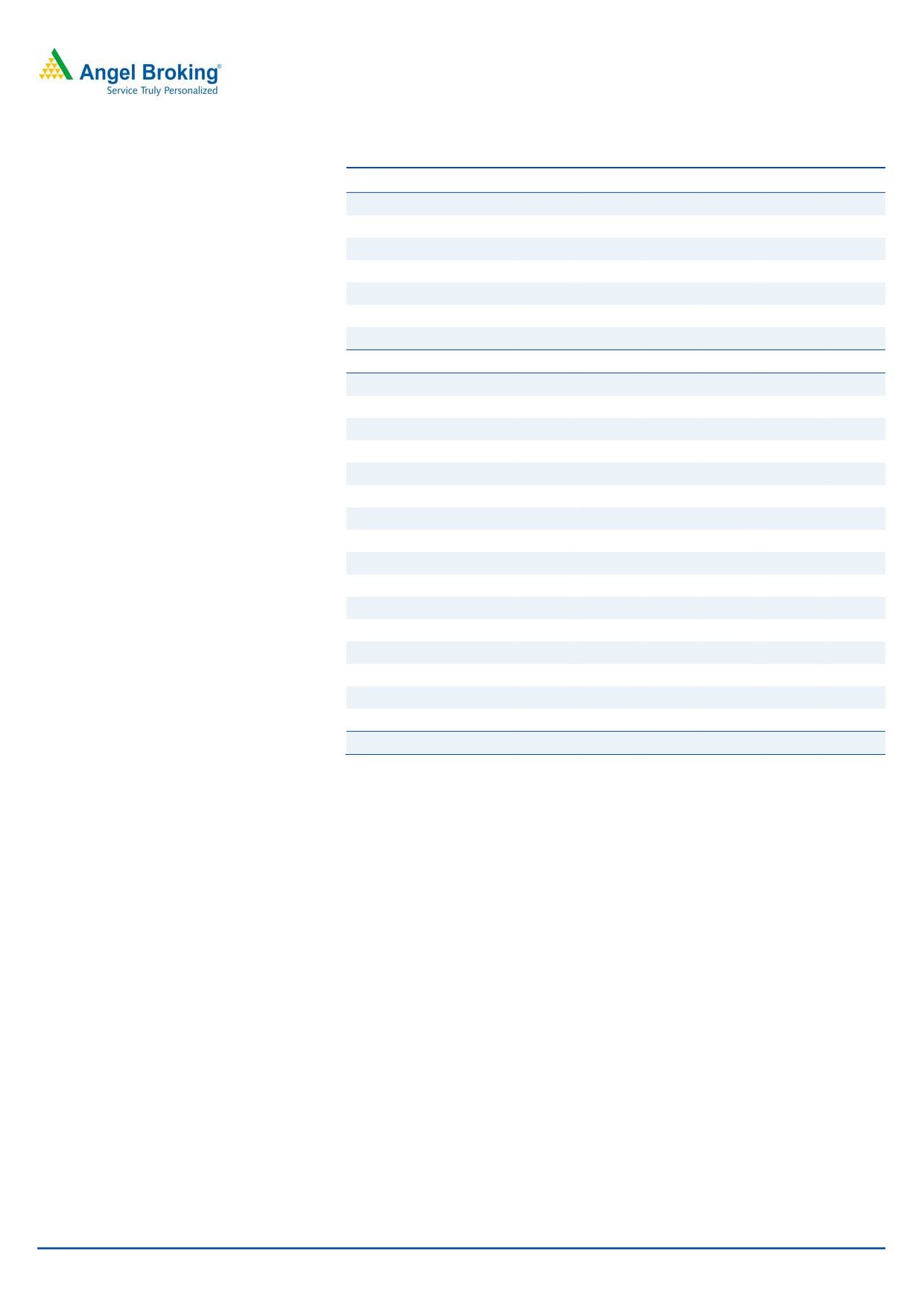

Quarterly result (Standalone)

Investment Period

12 Months

(` cr)

3QFY16

3QFY15

% chg

2QFY16

%qoq

Stock Info

Revenue

9,177

8,943

2.6

8,904

3.1

Sector

FMCG

EBITDA

3,605

3,464

4.1

3,560

1.3

Market Cap (` cr)

248,776

OPM (%)

39.3

38.7

55bp

40.0

(70bp)

Net Debt (` cr)

(15,928)

PAT

2,653

2,635

0.7

2,431

9.1

Beta

0.8

Source: Company, Angel Research

52 Week High / Low

410/295

Avg. Daily Volume

295,887

ITC posted a poor set of numbers for 3QFY2016, both on the top-line and

Face Value (`)

1

bottom-line fronts. The top-line was subdued due to lower growth in Cigarettes &

Hotel businesses and de-growth in Agri business, which in turn resulted in a lower

BSE Sensex

24,486

profitability of the company.

Nifty

7,436

Reuters Code

ITC.BO

Key highlights: ITC’s net sales for the quarter grew by 2.6% yoy to `9,177cr. The

Bloomberg Code

ITC@IN

Cigarettes business posted a 5.7% yoy growth in net sales to `4,380cr, aided by

price hikes. A muted sales growth in the Cigarettes business resulted in the

segment posting a 3.4% yoy growth in its EBIT. The FMCG (others) business,

Shareholding Pattern (%)

which posted a 7.1% yoy growth in net sales to `2,478cr, posted an EBIT level

Promoters

0.0

profit of `19cr. Further, the Paperboards and Packaging division posted a growth

MF / Banks / Indian Fls

20.7

of 5.1% yoy and 12.7% yoy in revenue and segmental EBIT, respectively. The

FII / NRIs / OCBs

35.1

Hotels business posted a 4.5% yoy growth in its top-line, while it reported a

Indian Public / Others

44.2

de-growth at the EBIT level. The Agri business posted a de-growth of 7.3% yoy in

revenue, while its EBIT de-grew by 3.1% on a yoy basis. Overall, the company’s

OPM expanded by 55bp yoy to 39.3%, owing to lower raw material costs (down

Abs. (%)

3m 1yr

3yr

254bp yoy as a % of sales).

Sensex

(10.5)

(17.2)

21.8

ITC

(13.6)

(11.4)

6.9

Outlook and valuation: We expect ITC to report a top-line and bottom-line CAGR

of 4.5% and 5.0% respectively over FY2015-18E. At the current market price, the

stock is trading at 22.2x FY2018E EPS. We recommend buy on the stock with a

3-year price chart

target price of `359.

410

390

Key financials (Standalone)

370

Y/E March (` cr)

FY2015

FY2016E

FY2017E

FY2018E

350

330

Net Sales

36,507

36,804

38,776

41,701

310

290

% chg

9.8

0.8

5.4

7.5

270

Net Profit (Adj)

9,608

9,783

10,357

11,107

250

% chg

9.4

1.8

5.9

7.2

EBITDA (%)

36.9

37.9

37.9

37.9

Source: Company, Angel Research

EPS (`)

12.0

12.2

12.9

13.8

P/E (x)

25.6

25.2

23.8

22.2

P/BV (x)

8.0

7.0

6.2

5.5

RoE (%)

31.3

27.7

25.8

24.6

RoCE (%)

40.6

36.5

33.8

32.1

EV/Sales (x)

6.3

6.3

5.9

5.5

Amarjeet S Maurya

EV/EBITDA (x)

17.1

16.5

15.7

14.5

022 - 3935 7800 Ext: 6831

Source: Company, Angel Research; Note: CMP as of January 25, 2016

Amarjeet maurya@angelbroking com

Please refer to important disclosures at the end of this report

1

ITC | 3QFY2016 Result Update

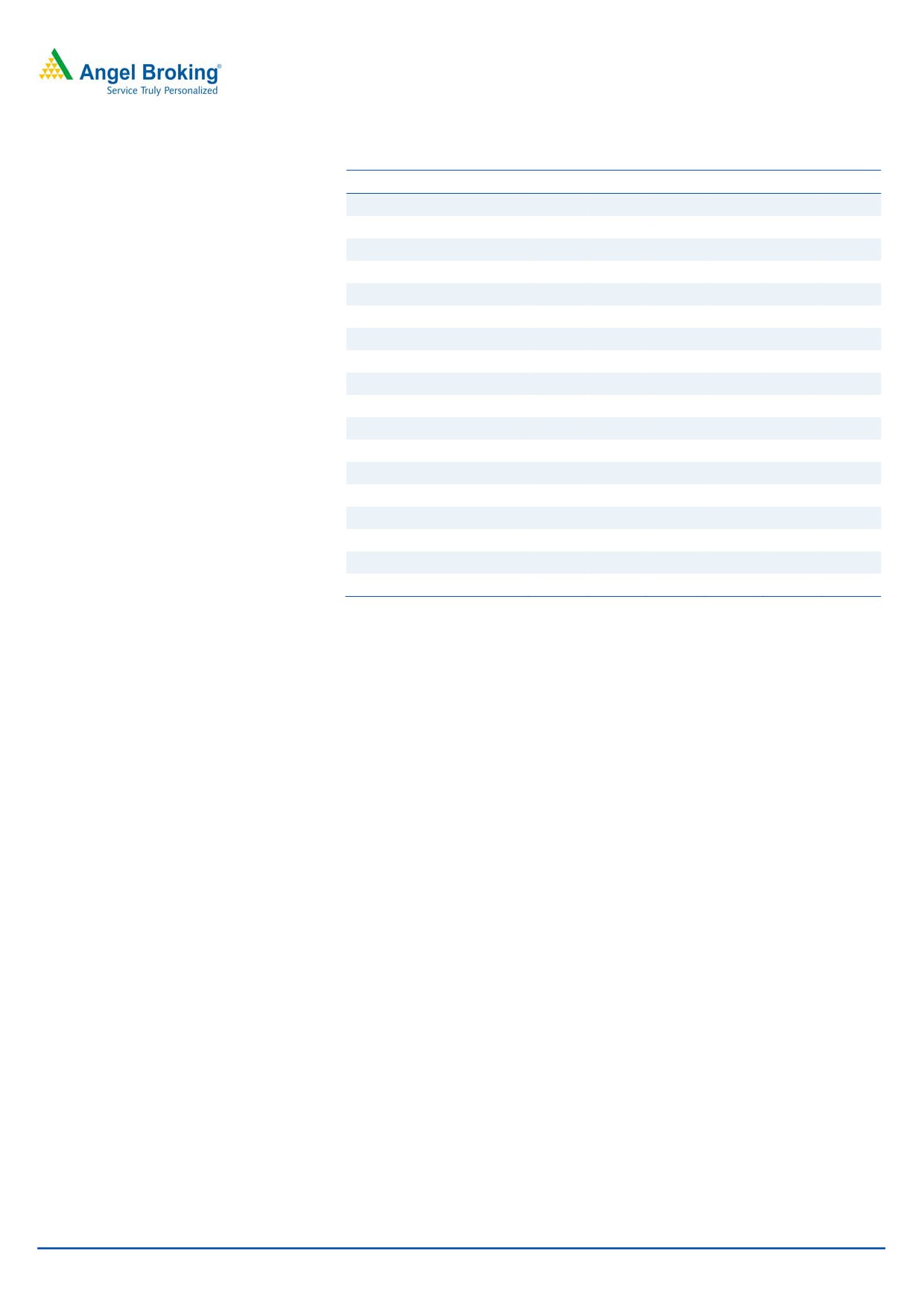

Exhibit 1: Quarterly performance (Standalone)

Y/E March (` cr)

3QFY16

3QFY15

% yoy

2QFY16

%qoq

9MFY16

9MFY15

% chg

Net Sales

9,177

8,943

2.6

8,904

3.1

26,669

27,215

(2.0)

Consumption of RM

3,336

3,478

(4.1)

3,219

3.6

9,723

11,010

(11.7)

(% of Sales)

36.35

38.89

36.15

36.5

40.5

Staff Costs

450

419

7.3

451

(0.2)

1,418

1,326

7.0

(% of Sales)

4.9

4.7

5.1

5.3

4.9

Other Expenses

1,786

1,582

12.9

1,674

6.7

4,976

4,648

7.1

(% of Sales)

19.5

17.7

18.8

18.7

17.1

Total Expenditure

5,572

5,478

1.7

5,344

4.3

16,118

16,984

(5.1)

Operating Profit

3,605

3,464

4.1

3,560

1.3

10,551

10,230

3.1

OPM

39.3

38.7

55

40.0

39.6

37.6

197.2

Interest

16

8

92.2

10

56.1

37

42

(12.0)

Depreciation & Amortization

263

238

10.5

259

1.4

780

712

9.5

Other Income

678

582

16.5

399

69.8

1,392

1,173

18.7

PBT (excl. Extraordinary Items)

4,004

3,800

5.4

3,690

8.5

11,127

10,649

4.5

Extraordinary Income/(Expense)

-

-

-

-

-

PBT (incl. Extraordinary Items)

4,004

3,800

5.4

3,690

8.5

11,127

10,649

4.5

(% of Sales)

43.6

42.5

41.4

41.7

39.1

Provision for Taxation

1,352

1,165

16.0

1,259

7.4

3,777

3,403

11.0

(% of PBT)

33.8

30.7

34.1

33.9

32.0

Reported PAT

2,653

2,635

0.7

2,431

9.1

7,350

7,247

1.4

PATM

29

29

27

28

27

EPS (`)

3.3

3.3

0.7

3.0

9.1

9.2

9.0

1.4

Source: Company, Angel Research

January 27, 6

2

ITC | 3QFY2016 Result Update

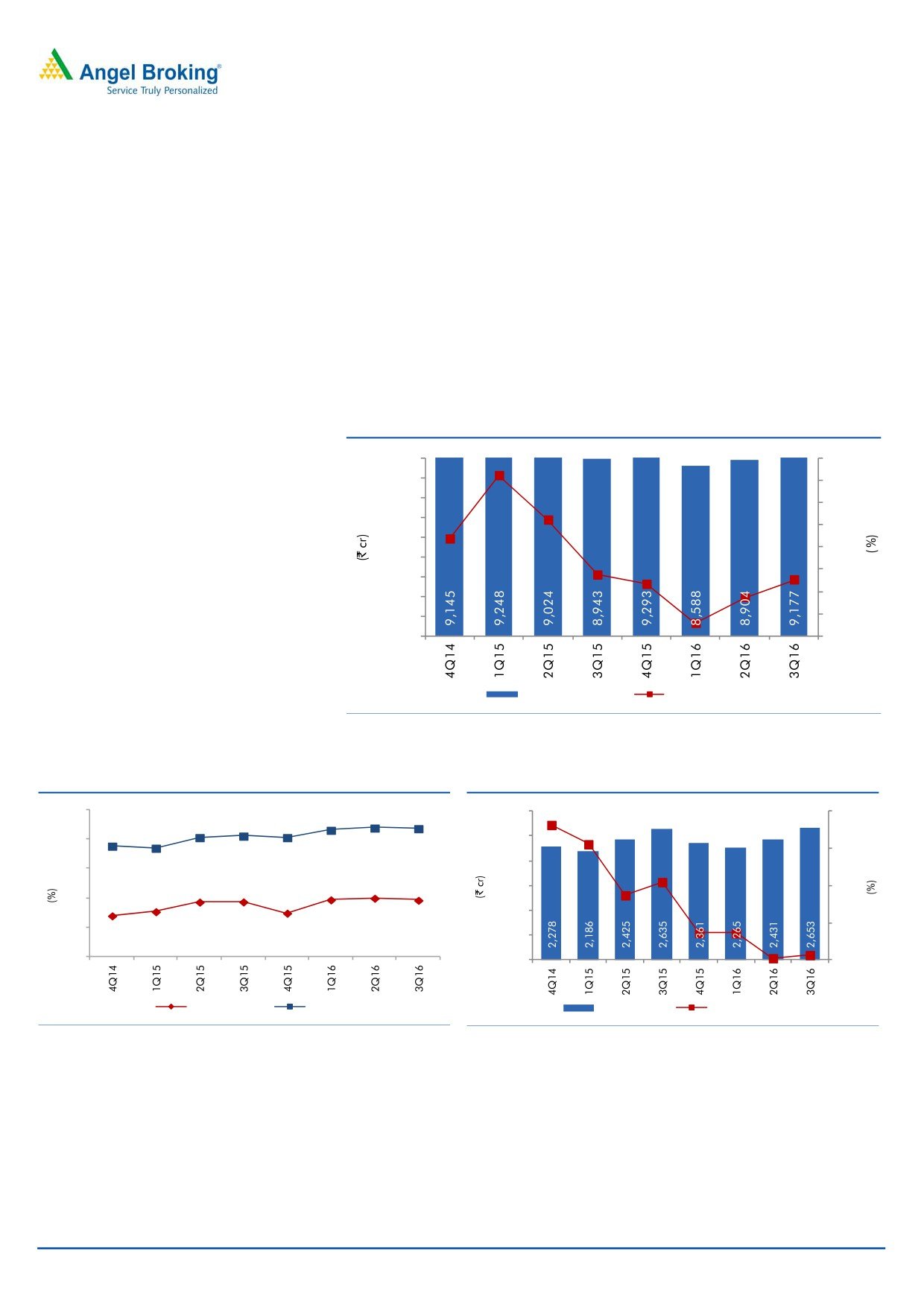

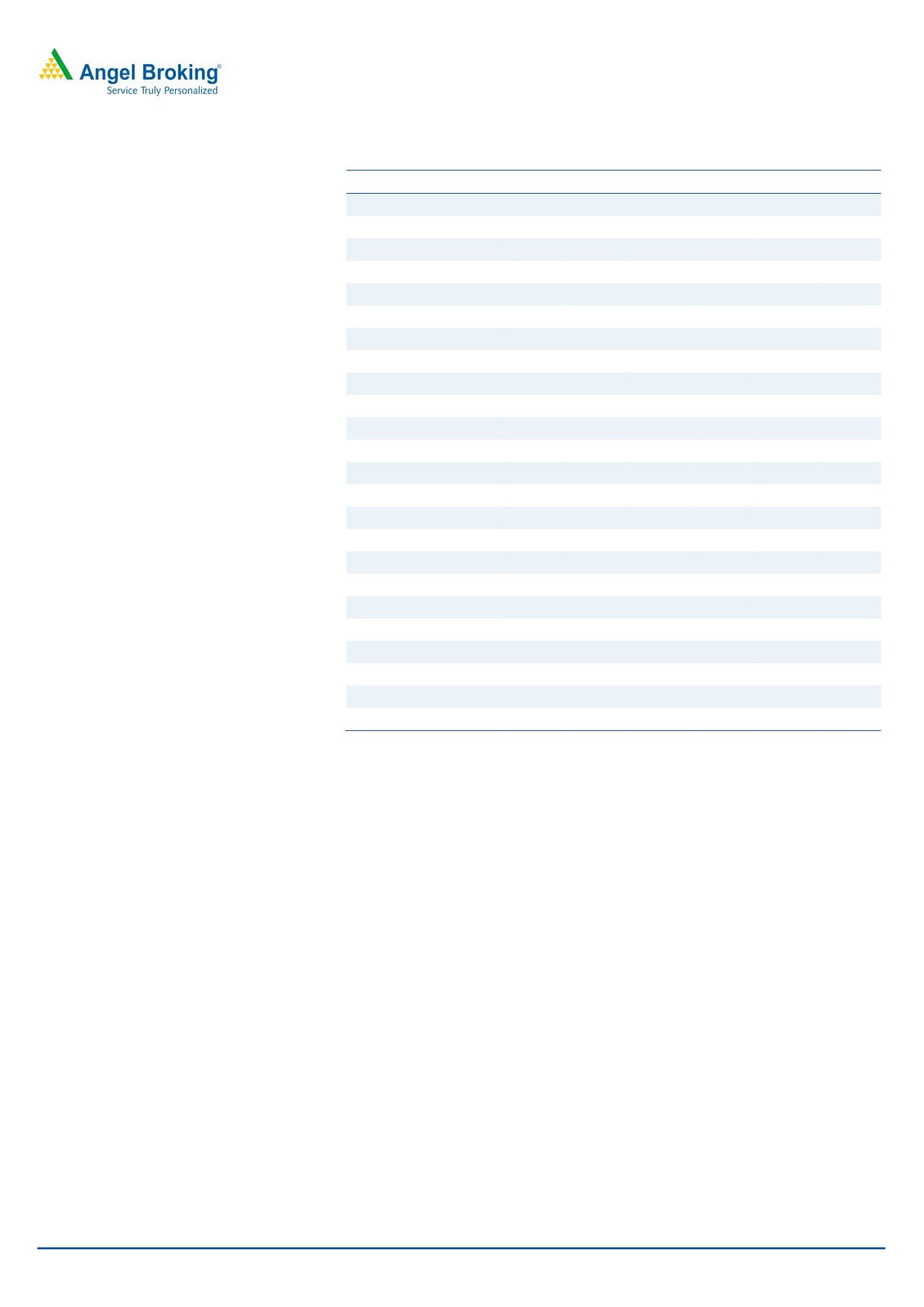

Top-line flat

ITC’s net sales for the quarter grew by 2.6% yoy to `9,177cr. The Cigarettes

business posted a 5.7% yoy growth in net sales to `4,380cr, aided by price hikes.

A muted sales growth in the Cigarettes business resulted in the segment posting a

3.4% yoy growth in its EBIT. The FMCG (others) business, which posted a 7.1% yoy

growth in net sales to `2,478cr, posted an EBIT level profit of `19cr. Further, the

Paperboards and Packaging division posted a growth of 5.1% yoy and 12.7% yoy

in revenue and segmental EBIT, respectively. The Hotels business posted a 4.5%

yoy growth in its top-line, while it reported a de-growth at the EBIT level. The Agri

business posted a de-growth of 7.3% yoy in revenue, while its EBIT de-grew by

3.1% on a yoy basis.

Exhibit 2: Top-line flat

9,000

30.0

8,000

25.0

7,000

20.0

6,000

15.0

5,000

10.0

4,000

5.0

3,000

-

2,000

1,000

(5.0)

-

(10.0)

Top-line (LHS)

yoy growth (RHS)

Source: Company, Angel Research

Exhibit 3: OPM increases by 55bp yoy to 39.3%

Exhibit 4: Earnings growth at 0.7% yoy

70

63.1

63.9

63.7

3,000

18.2

20.0

60.6

61.1

60.6

57.7

57

15.6

60

2,500

15.0

2,000

10.5

50

39.4

40.0

39.3

8.7

38.7

38.7

1,500

10.0

35.4

34.9

40

34

3.6

0.7

1,000

3.7

30

5.0

0.3

500

20

-

-

OPM

Gross margin

PAT (LHS)

yoy growth (RHS)

Source: Company, Angel Research

Source: Company, Angel Research

Operating profit up 4.1% yoy

The company reported an operating profit of `3,605cr for 3QFY2016, up

4.1% yoy. However, the company’s OPM expanded by 55bp yoy to 39.3%, owing

to lower raw material costs (down 254bp yoy as a % of sales).

January 27, 6

3

ITC | 3QFY2016 Result Update

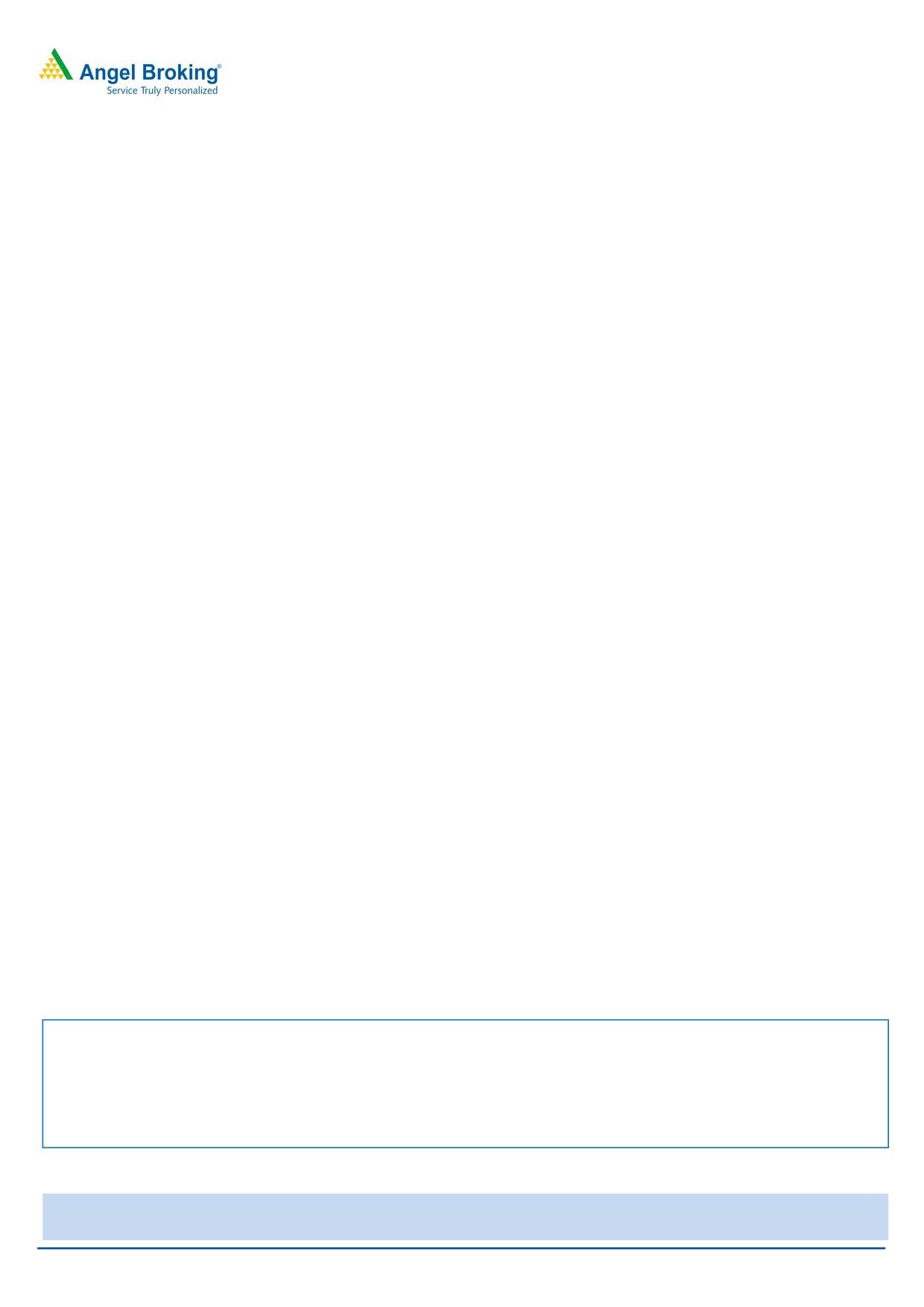

Exhibit 5: Segment-wise performance (Standalone)

Y/E Mar (` cr)

3QFY16

3QFY15

% yoy 2QFY16

% qoq 9MFY16 9MFY15

% chg

Net Income

Cigarettes

4,380

4,142

5.7

4,317

1.5

12,847

12,594

2.0

Others

2,478

2,314

7.1

2,352

5.4

7,000

6,445

8.6

Hotels

345

330

4.5

290

19.0

923

841

9.8

Agri Business

1,481

1,598

(7.3)

1,844

(19.7)

5,650

6,953

(18.7)

Paperboards & Packaging

1,260

1,199

5.1

1,254

0.5

3,779

3,771

0.2

PBIT

Cigarettes

2,984

2,886

3.4

2,969

0.5

8,734

8,490

2.9

Others

19

11

63.6

(11)

(0)

(14)

Hotels

26

29

(10.0)

(6)

13

7

85.2

Agri Business

231

239

(3.1)

294

(21.3)

759

740

2.7

Paperboards & Packaging

241

214

12.7

209

15.2

705

731

(3.6)

PBIT Margin (%)

Cigarettes

68.1

69.7

68.8

68.0

67.4

Others

0.8

0.5

(0.5)

(0.0)

(0.2)

Hotels

7.5

8.7

(1.9)

1.4

0.8

Agri Business

15.6

14.9

15.9

13.4

10.6

Paperboards & Packaging

19.1

17.8

16.7

18.6

19.4

Source: Company, Angel Research

January 27, 6

4

ITC | 3QFY2016 Result Update

Investment rationale

Cigarettes business to enjoy strong pricing power: We believe ITC’s cigarette

business is well poised to continue to post a healthy profit growth over

FY2015-17E due to its strong pricing power and improvement in volume

growth.

Non-cigarette businesses to register healthy growth in FY2015-17E: While

cigarettes remain the main profit center for the company, investments in

the non-cigarettes businesses such as FMCG, Hotels and Paperboards have

given the company a foothold in the respective businesses. We expect these

businesses to play a major role in driving the company’s long-term growth.

Outlook and valuation

We expect ITC to report a top-line and bottom-line CAGR of 4.5% and 5.0%

respectively over FY2015-18E. At the current market price, the stock is trading at

22.2x FY2018E EPS. We recommend a Buy on the stock with a target price of

`360.

Company Background

ITC is a diversified conglomerate, present across various categories - Cigarettes

(41% of revenue); Hotels (3% of revenue); Paperboards and Packaging (13% of

revenue); Agri-business (22% of revenue); and other FMCG (branded apparel,

personal care, stationery, safety matches and specialty papers [21% of revenue]).

Although ITC is a market leader in the cigarettes category, it is rapidly gaining

market share even in its evolving businesses of packaged foods and confectionery,

branded apparel, personal care and stationery.

January 27, 6

5

ITC | 3QFY2016 Result Update

Profit and loss statement (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16E

FY17E

FY18E

Total operating income

29,901

33,239

36,507

36,804

38,776

41,701

% chg

18.9

11.2

9.8

0.8

5.4

7.5

Total Expenditure

19,274

20,784

23,034

22,855

24,080

25,896

Cost of Materials

12,066

13,156

14,672

14,685

15,627

16,847

Personnel

1,387

1,608

1,780

1,840

1,978

2,127

Others

5,821

6,019

6,582

6,330

6,476

6,922

EBITDA

10,628

12,455

13,474

13,949

14,696

15,805

% chg

20.1

17.2

8.2

3.5

5.4

7.5

(% of Net Sales)

35.5

37.5

36.9

37.9

37.9

37.9

Depreciation& Amortisation

796

900

962

1,038

1,123

1,256

EBIT

9,832

11,555

12,512

12,911

13,573

14,548

% chg

20.6

17.5

8.3

3.2

5.1

7.2

(% of Net Sales)

32.9

34.8

34.3

35.1

35.0

34.9

Interest & other Charges

86

3

57

60

65

70

Other Income

939

1,107

1,543

1,750

1,950

2,100

(% of PBT)

8.8

8.7

11.0

12.0

12.6

12.7

Share in profit of Associates

-

-

-

-

-

-

Recurring PBT

10,684

12,659

13,998

14,601

15,458

16,578

% chg

20.1

18.5

10.6

4.3

5.9

7.2

Extraordinary Expense/(Inc.)

-

-

-

-

-

-

PBT (reported)

10,684

12,659

13,998

14,601

15,458

16,578

Tax

3,266

3,874

4,390

4,818

5,101

5,471

(% of PBT)

30.6

30.6

31.4

33.0

33.0

33.0

PAT (reported)

7,418

8,785

9,608

9,783

10,357

11,107

Add: Share of associates

-

-

-

-

-

-

ADJ. PAT

7,418

8,785

9,608

9,783

10,357

11,107

% chg

20.4

18.4

9.4

1.8

5.9

7.2

(% of Net Sales)

24.8

26.4

26.3

26.6

26.7

26.6

Basic EPS (`)

9.2

10.9

12.0

12.2

12.9

13.8

Fully Diluted EPS (`)

9.2

10.9

12.0

12.2

12.9

13.8

% chg

20.4

18.4

9.4

1.8

5.9

7.2

January 27, 6

6

ITC | 3QFY2016 Result Update

Balance Sheet (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16E FY17E FY18E

SOURCES OF FUNDS

Equity Share Capital

790

795

802

802

802

802

Reserves& Surplus

21,498

25,467

29,934

34,532

39,296

44,405

Shareholders Funds

22,288

26,262

30,736

35,333

40,098

45,207

Minority Interest

-

-

-

-

-

-

Total Loans

78

67

53

66

67

67

Deferred Tax Liability

1,706

1,741

2,099

2,099

2,099

2,099

Total Liabilities

24,072

28,070

32,888

37,499

42,264

47,373

APPLICATION OF FUNDS

Gross Block

16,944

18,545

21,727

25,144

28,645

32,147

Less: Acc. Depreciation

5,735

6,532

7,548

8,587

9,710

10,966

Net Block

11,209

12,013

14,178

16,557

18,935

21,181

Capital Work-in-Progress

1,488

2,296

2,114

2,114

2,114

2,114

Investments

7,060

8,823

8,405

8,405

8,405

8,405

Current Assets

14,260

16,097

19,498

21,172

23,120

26,556

Inventories

6,600

7,360

7,837

7,865

8,499

9,368

Sundry Debtors

1,163

2,165

1,722

2,017

2,656

3,085

Cash

3,615

3,289

7,589

7,610

7,700

8,265

Loans & Advances

1,154

1,803

843

1,840

2,327

2,919

Other

1,728

1,480

1,506

1,840

1,939

2,919

Current liabilities

10,448

11,604

11,775

11,218

10,778

11,351

Net Current Assets

3,812

4,494

7,722

9,954

12,342

15,205

Deferred Tax Asset

503

445

468

468

468

468

Mis. Exp. not written off

-

-

-

-

-

-

Total Assets

24,072

28,070

32,888

37,499

42,264

47,373

January 27, 6

7

ITC | 3QFY2016 Result Update

Cash flow statement (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16E FY17E FY18E

Profit before tax

10,684

12,659

13,998

14,601

15,458

16,578

Depreciation

796

900

962

1,038

1,123

1,256

Change in Working Capital

(1,049)

(1,732)

30

(2,128)

(2,297)

(2,299)

Interest / Dividend (Net)

(580)

(767)

(1,131)

60

65

70

Direct taxes paid

(2,886)

(3,797)

(4,226)

(4,818)

(5,101)

(5,471)

Others

(255)

(300)

(324)

-

-

-

Cash Flow from Operations

6,710

6,962

9,309

8,753

9,248

10,135

(Inc.)/ Dec. in Fixed Assets

(4,324)

(4,586)

(4,402)

(3,500)

(3,501)

(3,502)

(Inc.)/ Dec. in Investments

(744)

(1,763)

418

-

-

-

Cash Flow from Investing

(3,581)

(2,823)

(4,820)

(3,500)

(3,501)

(3,502)

Issue of Equity

922

691

979

-

-

-

Inc./(Dec.) in loans

(10)

(11)

(15)

13

1

-

Dividend Paid (Incl. Tax)

(3,518)

(4,148)

(4,772)

(5,185)

(5,593)

(5,998)

Interest / Dividend (Net)

273

(996)

3,619

(60)

(65)

(70)

Cash Flow from Financing

(2,333)

(4,465)

(190)

(5,232)

(5,657)

(6,068)

Inc./(Dec.) in Cash

796

(326)

4,299

21

90

565

Opening Cash balances

2,819

3,615

3,289

7,589

7,610

7,700

Closing Cash balances

3,615

3,289

7,589

7,610

7,700

8,265

January 27, 6

8

ITC | 3QFY2016 Result Update

Key ratios

Y/E March

FY13

FY14

FY15

FY16E

FY17E

FY18E

Valuation Ratio (x)

P/E (on FDEPS)

33.2

28.0

25.6

25.2

23.8

22.2

P/CEPS

30.0

25.4

23.3

22.8

21.5

19.9

P/BV

11.1

9.4

8.0

7.0

6.2

5.5

Dividend yield (%)

1.7

2.0

2.0

2.1

2.3

2.4

EV/Sales

7.9

7.1

6.3

6.3

5.9

5.5

EV/EBITDA

22.2

18.8

17.1

16.5

15.7

14.5

EV / Total Assets

6.8

5.9

5.2

4.7

4.3

3.9

Per Share Data (`)

EPS (Basic)

9.2

10.9

12.0

12.2

12.9

13.8

EPS (fully diluted)

9.2

10.9

12.0

12.2

12.9

13.8

Cash EPS

10.2

12.1

13.2

13.5

14.3

15.4

DPS

5.3

6.0

6.2

6.5

7.0

7.5

Book Value

27.7

32.7

38.2

44.0

49.9

56.3

Returns (%)

RoCE

44.0

43.9

40.6

36.5

33.8

32.1

Angel RoIC (Pre-tax)

84.1

81.3

84.6

66.6

56.4

50.9

RoE

33.3

33.5

31.3

27.7

25.8

24.6

Turnover ratios (x)

Asset Turnover

1.8

1.8

1.7

1.5

1.4

1.3

Inventory / Sales (days)

81

81

78

78

80

82

Receivables (days)

14

24

17

20

25

27

Payables (days)

24

25

22

24

26

26

Net Working capital (days)

71

79

74

74

79

83

January 27, 6

9

ITC | 3QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

ITC

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

January 27, 6

10