IPO Note | Insurance

Sept 14, 2017

ICICI Lombard General Insurance Co Ltd

SUBSCRIBE

Issue Open: Sept 15, 2017

Issue Close: Sept 19, 2017

ICICI Lombard is the largest non-life private sector insurer in India. It is a JV

Issue Details

between ICICI Bank and Fairfax Financial Holdings Ltd of Canada. Backed by

Face Value: `10

strong parentage, and under penetration of non-life insurance business in India,

Present Eq. Paid up Capital:

the company has been on a strong growth path with its Gross Direct Premium

`453.95cr

Income growing by 26.7% over FY2015-17.

O ffer for Sale: **8.62cr Shares

Leadership position among private general insurers: ICICI Lombard has retained

Fresh issue: ` 0cr

its leadership position among the private non-life insurance players since 2004

Post Eq. Paid up Capital: `453.95 cr

and has been gaining market share. In FY2017, it had a market share of 8.4%

among all non-life insurance companies and 18% among the private sector non-

Issue size (amount): *`5,615cr -

**5,700cr

life insurance companies. The leadership position of the company can be

attributed to the fact that it is one of the most efficient in terms of claim settlement

Price Band: `651-661

ratios.

Lot Size: 22 shares and in multiple

thereafter

Higher share of business from the low loss ratio segments should improve

Post-issue implied mkt. cap:

*`29,538cr - **`29,992cr

profitability: Motor Insurance forms the largest part of the business (42.3%) for the

company followed by health and personal accident segments (18.8%). However,

Promoters holding Pre-Issue: 84.83%

over the last two years the share of other segments like crop/ weather insurance

Promoters holding Post-Issue: 65.83%

has gone up, which has a relatively lower loss ratio. Increasing share of business

*Calculated on lower price band

from the low loss ratio segments will be a positive trigger for the company.

** Calculated on upper price band

Growth driven by strong parentage & wide distribution network: ICICI Lombard

Book Building

operates through 51 corporate agents, including ICICI Bank (its promoter), which

QIBs

50% of issue

gives the company an access to their 4,850 branches. Moreover, it has a network

Non-Institutional

15% of issue

of 20,775 individual agents. With large distribution network in place, we believe

Retail

35% of issue

the company would continue to gain market share in the years to come.

High solvency ratio leads to better bottom-line with strong RoE: The Company has

Post Issue Shareholding Patter

a strong capital base with a solvency ratio of 2.1x (FY2017) as compared to IRDA

Promoters

66%

prescribed minimum of 1.5x. The company’s net premium income has grown at a

Others

34%

CAGR of 11.3% over FY2013-17, while its PAT has grown by 16.1% over the

same period, which is a testimony to its improving efficiency and as a result its

RoE has also improved to 17.2% by FY17 from 15.6% in FY2015.

Outlook & Valuation: At the upper price band of `661 the issue is offered at 8x its

FY2017 BV. While on the reported numbers it might appear to be fairly valued,

we believe with strong potential to deliver high double digit growth for next

multiple years, the issue looks decently priced, and hence we have a SUBSCRIBE

rating on the issue.

Key Financials

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016

FY2017

Premium Earned

4,012

4,352

4,234

4,826

6,158

% chg

8

(3)

14

28

Net profit

353

520

585

505

642

% chg

47

13

-14

27

EPS

8

11

13

11

14

Book Value

43

53

64

71

82

P/E

86

58

52

60

47

Siddhart Purohit

P/BV (x)

15

13

10

9

8

+022 39357600, Extn: 6872

RoE (%)

18

22

20

16

17

Source: RHP, Angel Research; Note: Valuation ratios based on pre-issue outstanding shares and at upper end of the price band

Please refer to important disclosures at the end of this report

1

ICICI Lombard | IPO Note

Company background

ICICI Lombard General Insurance is the largest private non-life insurer in India

based on gross direct premium income for FY2017. The company has maintained

its leadership stance since 2004. The company offers a comprehensive and well

diversified range of products including motor, health, crop/ weather, fire, personal

accident, marine and engineering insurance, etc.

The company has multiple distribution channels and operates through

51

corporate agents including its promoter ICICI Bank, which gives it an access to

4,850 branches. It caters to 80% of the motor vehicle manufactures in India by

vehicle sales. Further, the company has 20,775 individual agents.

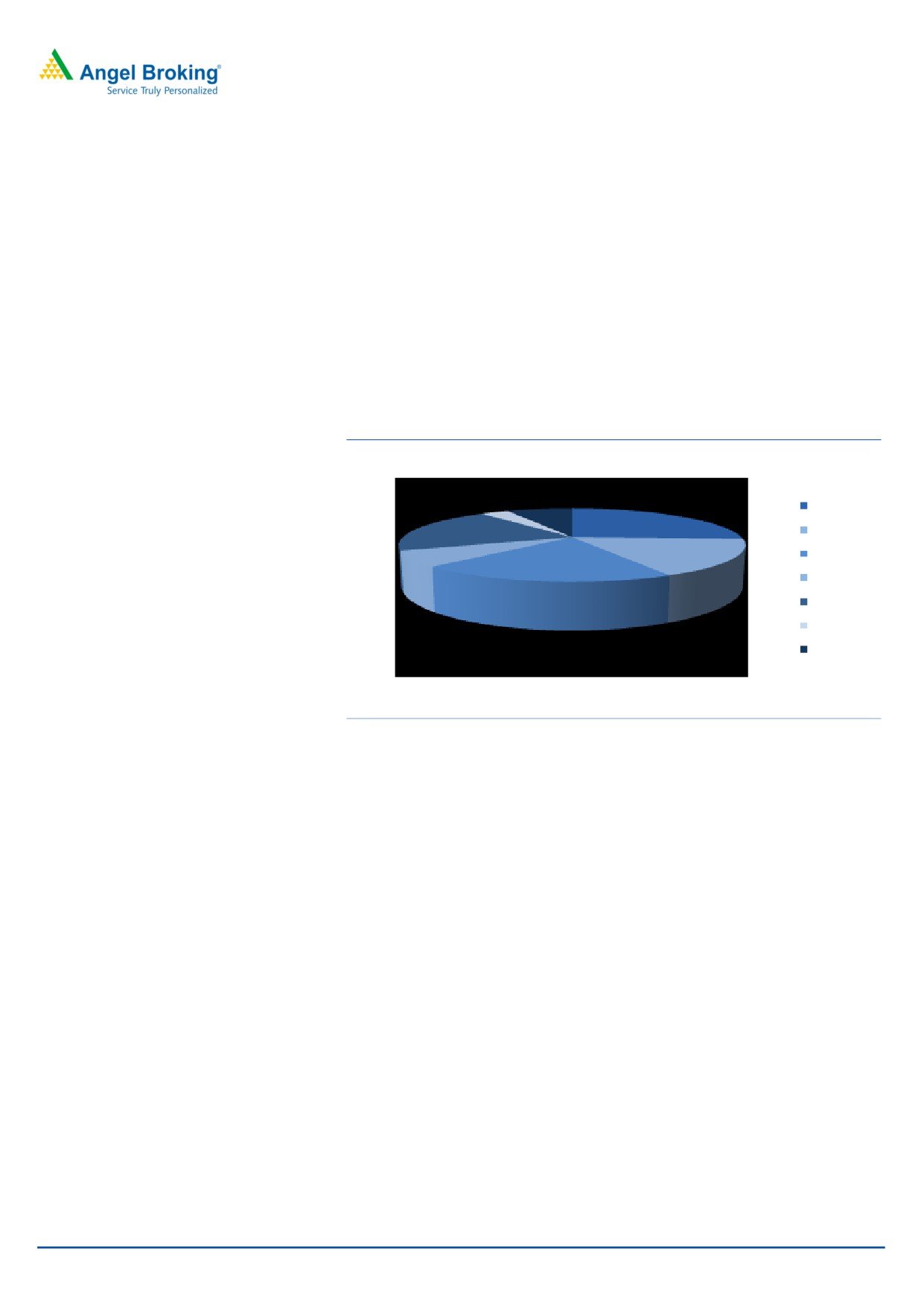

Exhibit 1: Business Contribution Across Segments (FY17)

7.5

3.2

Motor OD

25.7

20.1

Motor TP

Health PA

Fire

Marine

6.9

16.6

Crop

20.0

Others

Source: RHP, Angel Research

Sept 14, 2017

2

ICICI Lombard | IPO Note

Issue details

Issuance of 8.62cr Equity Shares, 3.17 cr shares by ICICI Bank Ltd and 5.44 cr

equity shares by Fairfax Financial Holdings Ltd via an offer for sale.

Objects of the offer

To list the equity share of the company the on the exchanges

Enhance the “ICICI Lombard” brand name and provide liquidity to the existing

shareholders

Being an offer for sale, the company will not receive any proceeds from the

offer

Exhibit 2: Top 10 Share Holders Pre-issues

Shareholders

No Of Equity Shares

%

1 ICICI Bank

28,56,05,284

62.92

2 FAL

9,94,64,479

21.91

3 Red Bloom Investment Ltd

4,08,89,791

9.01

4 Tamarind Capital Pte Ltd

72,11,596

1.59

5 IIFL Special Opportunities Fund

40,76,135

0.90

6 IIFL Special Opportunities Fund-Series 2

27,17,424

0.60

7 IVF Trustee Company Pvt Ltd

14,02,200

0.31

8 IIFL Special Opportunities Fund-Series 3

9,70,509

0.21

9 Sandeep Bakshi

9,41,250

0.21

10 Alok Kumar Agrawal

4,55,000

0.10

Total

44,37,33,668

97.76

Source: RHP, Angel Research

Sept 14, 2017

3

ICICI Lombard | IPO Note

Investment rationale

Leadership position among private General Insurers: ICICI Lombard has retained

its leadership position among the private non-life insurance players since 2004

and has been gaining market share. In FY2017, ICICI Lombard issued ~17.7 mn

policies and had a market share of 8.4% among all non-life insurance companies

and 18% among the private sector non-life insurance companies, while its

competitor, Bajaj Allianz has a market share of 12.8%.

Exhibit 3: Market Share (%)

Exhibit 4: Market Share (%)

14

12.8

12

FY17

18.0

9.8

10

9.2

8

7.0

FY16

18.5

6

4

FY15

17.6

2

0

17

17.5

18

18.5

19

Bajaj Alianz

HDFC Ergo

IIFCO-Tokio

Tata AIG

Source: RHP, Angel Research

Source: RHP, Angel Research

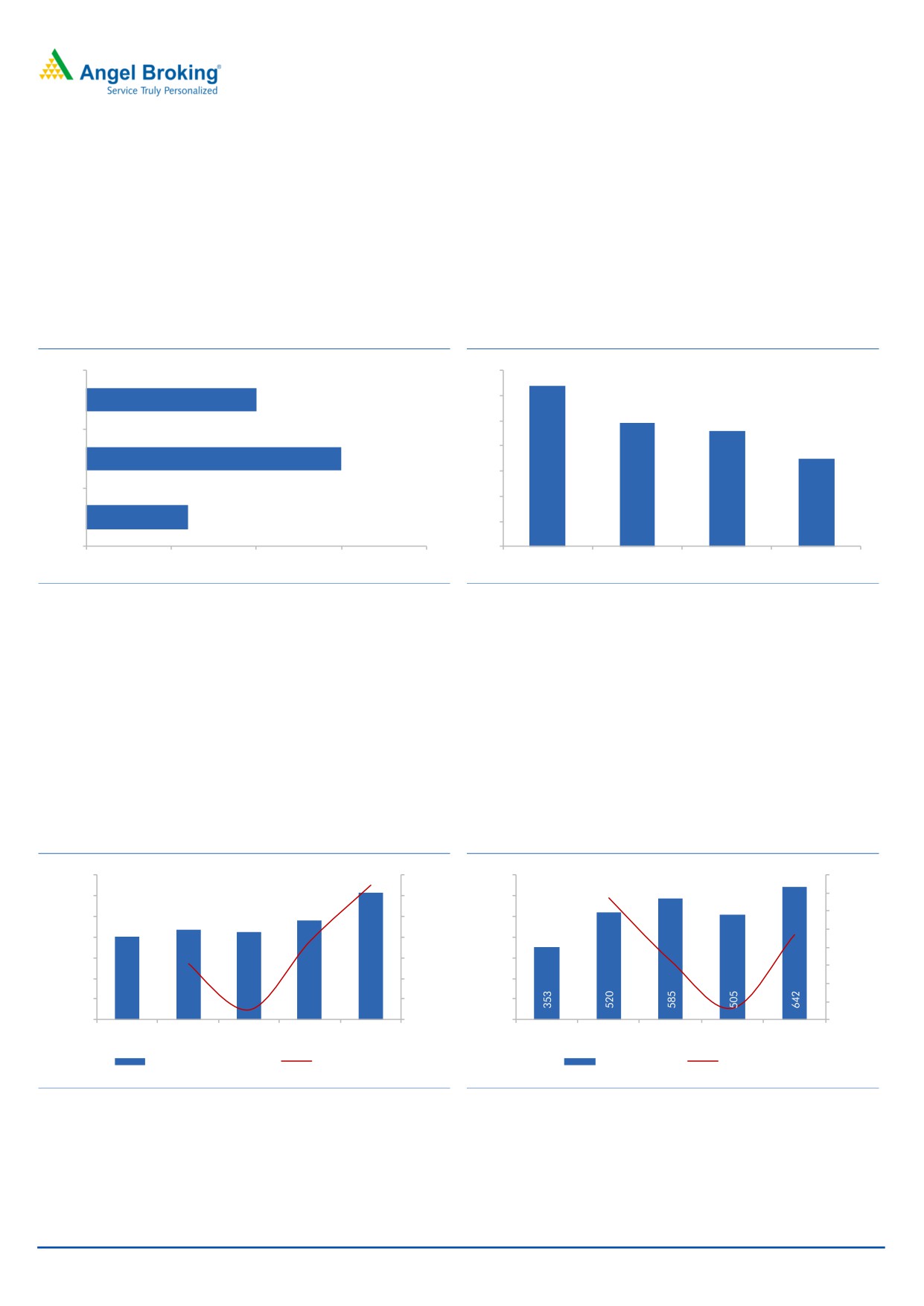

High solvency ratio leading to accelerated bottom-line growth with strong RoE: The

Company has a strong capital base with a solvency ratio of 2.1x (FY2017) as

compared to IRDA prescribed minimum of 1.5x. The company’s net premium

income has grown at a CAGR of 11.3% over FY2013-17, while its PAT has grown

by 16.1% over the same period, which is a testimony to its improving efficiency

and as a result its RoE has also improved to 17.2% from 15.6% in FY2015.

Exhibit 5: Premium Earned Net (` Cr )

Exhibit 6: PAT (` Cr )

7,000

30.0

700

60.0

6,158

47.4

6,000

25.0

600

50.0

27.6

4,826

40.0

5,000

4,352

4,234

20.0

500

27.0

4,012

14.0

30.0

4,000

15.0

400

12.5

20.0

8.5

3,000

10.0

300

10.0

2,000

5.0

200

-13.7

-

-2.7

1,000

-

100

-10.0

-

-5.0

-

-20.0

2,013

2,014

2,015

2,016

2,017

2,013

2,014

2,015

2,016

2,017

Premiums earned (net)

% Growth YoY

Profit after tax

% Growth YoY

Source: Company, Angel Research

Source: Company, Angel Research

Sept 14, 2017

4

ICICI Lombard | IPO Note

Increasing share of business from the low loss ratio segments: As shown in the

table below, Motor Insurance forms the largest part of the business for the

company followed by health and personal accident segments. However, over the

last two years the share of other segments like crop/ weather insurance has gone

up, which has a relatively lower loss ratio.

Exhibit 7: Gross Direct Premium Income (GDPI)

` Cr

FY15

FY16

FY17

` Cr

%

` Cr

%

` Cr

%

Motor

Own Damage

2,132

31.9

2,523

31.2

2,760

25.7

Third Party

1,284

19.2

1,627

20.1

1,782

16.6

Total Motor

3,416

51.1

4,150

51.3

4,542

42.3

Health & Personal Accident

Health

1,318

19.7

1,384

17.1

1,668

15.5

Personal Accident

233

3.5

279

3.4

358

3.3

Total Health & Personal Accident

1,551

23.2

1,663

20.5

2,026

18.8

Crop/ Weather

276

4.1

593

7.3

2,151

20.1

Fire

545

8.2

633

7.8

745

6.9

Marine

246

3.7

300

3.7

341

3.2

Engineering

171

2.6

198

2.5

225

2.1

Other

474

7.1

555

6.9

697

6.5

Total

1,712

25.7

2,279

28

4,159

38.8

Gross Total

6,679

100

8,092

100

10,727

100

Source: RHP, Angel Research

Strong parentage coupled with wide distribution network would continue to drive

the growth: ICICI Lombard operates through 51 corporate agents, including ICICI

Bank (its promoter), which gives it an access to their 4,850 branches. In addition to

this, it has a network of 20,775 individual agents. With large distribution network

in hand, we believe the company would continue to gain market share in the years

to come. Incrementally the company has been focusing a lot on electronic

platform for its sales and approximately 1.6 mn policies were sold via electronic

mode in FY17.

Sept 14, 2017

5

ICICI Lombard | IPO Note

Improving loss ratios across segments: The overall loss ratio of the company has

been improving over the last few years and it has come down to 80.6% during

FY2017 from a level of 83.5% in FY2013. Over FY2016-17 there has been a 100

bps improvement in the loss ratios. Similarly, the expenses ratio has also been

coming down gradually with a 350 bps improvement in the last one year.

Reducing loss and expenses ratios have been one of the primary drivers for

reducing the overall combined ratio, which has seen 80 bps improvement over

FY2016-17.

Exhibit 8: Motor Insurance

Own Damage Motor Insurance

FY15

FY16

FY17

GDPI (` Cr )

2,132

2,523

2,760

Pvt Market Share (%)

18.2

19.4

18.9

Industry Market Share (%)

11.0

11.8

11.6

Loss Ratio (%)

61.8

65.6

64.2

Combined Ratio (%)

84.6

97.3

97.2

Source: Company, Angel Research

Exhibit 9: Motor Insurance

Third Party Motor Insurance

FY15

FY16

FY17

GDPI (` Cr )

1,284

1,627

1,782

Pvt Market Share (%)

15.9

17.0

15.0

Industry Market Share (%)

7.2

7.7

6.7

Loss Ratio (%)

105.8

97.7

97.4

Combined Ratio (%)

138.8

131.2

130.4

Source: Company, Angel Research

Private cars, 2 wheelers and Commercial Vehicles contribute 49.6%, 32.3% and

18.1% respectively of Motor GDPI in FY2017. On an incremental basis, the

company is focusing more on the relatively higher profitable segment, which is

visible from the fact that proportion of 2 wheelers and private cars have increased

to 81.9% in FY2017 from 77% in FY2015. Further, the company is underwriting

select segments of commercial vehicles.

Sept 14, 2017

6

ICICI Lombard | IPO Note

In the health and personal accident segment, the company has been focusing

more on the retail segment and retail, corporate and mass health contributed

54.2%, 32.6% and 13.2% respectively of health GDPI in FY2017. In the crop

insurance sector, it has issued more than 2 mn policies in each of Kharif and Rabi

seasons across 10 states and 83 districts under PMFBY. The company does a

geographic specific risk assessment while selecting regions. In the fire insurance

segment, the company takes underwriting of small risks for diversification of

portfolio and for attractive pricing. In the engineering segment the focus is on long

term policies, including coverage for infrastructure and industrial erection projects.

Exhibit 10: Health & Personal Accident Insurance

Health & Personal Accident Insurance

FY15

FY16

FY17

GDPI (` Cr )

1,640

1,760

2,150

Pvt Market Share (%)

18.0

15.9

15.4

Industry Market Share (%)

7.3

6.4

6.3

Loss Ratio (%)

87.4

82.1

90.2

Combined Ratio (%)

103.1

91.4

99.1

Source: Company, Angel Research

Exhibit 11: Fire Insurance

Fire Insurance

FY15

FY16

FY17

GDPI (` Cr )

545

633

745

Pvt Market Share (%)

16.6

16.4

16.6

Industry Market Share (%)

6.8

7.2

7.8

Loss Ratio (%)

94

63.6

68.4

Combined Ratio (%)

104.8

38.3

58.4

Source: Company, Angel Research

Exhibit 12: Marine Insurance

Marine Insurance

FY15

FY16

FY17

GDPI (` Cr )

246

300

341

Pvt Market Share (%)

21.8

24.0

26.3

Industry Market Share (%)

8.2

10.0

11.8

Loss Ratio (%)

98.7

97.5

83.9

Combined Ratio (%)

134.2

129.6

118.2

Source: Company, Angel Research

Exhibit 13: Crop Insurance

Crop Insurance

FY16

FY17

GDPI (` Cr )

593

1,070

Pvt Market Share (%)

29.9

22.2

Industry Market Share (%)

10.7

10.4

Loss Ratio (%)

140

84.2

Combined Ratio (%)

120.2

72.1

Source: Company, Angel Research

Sept 14, 2017

7

ICICI Lombard | IPO Note

Industry Outlook:

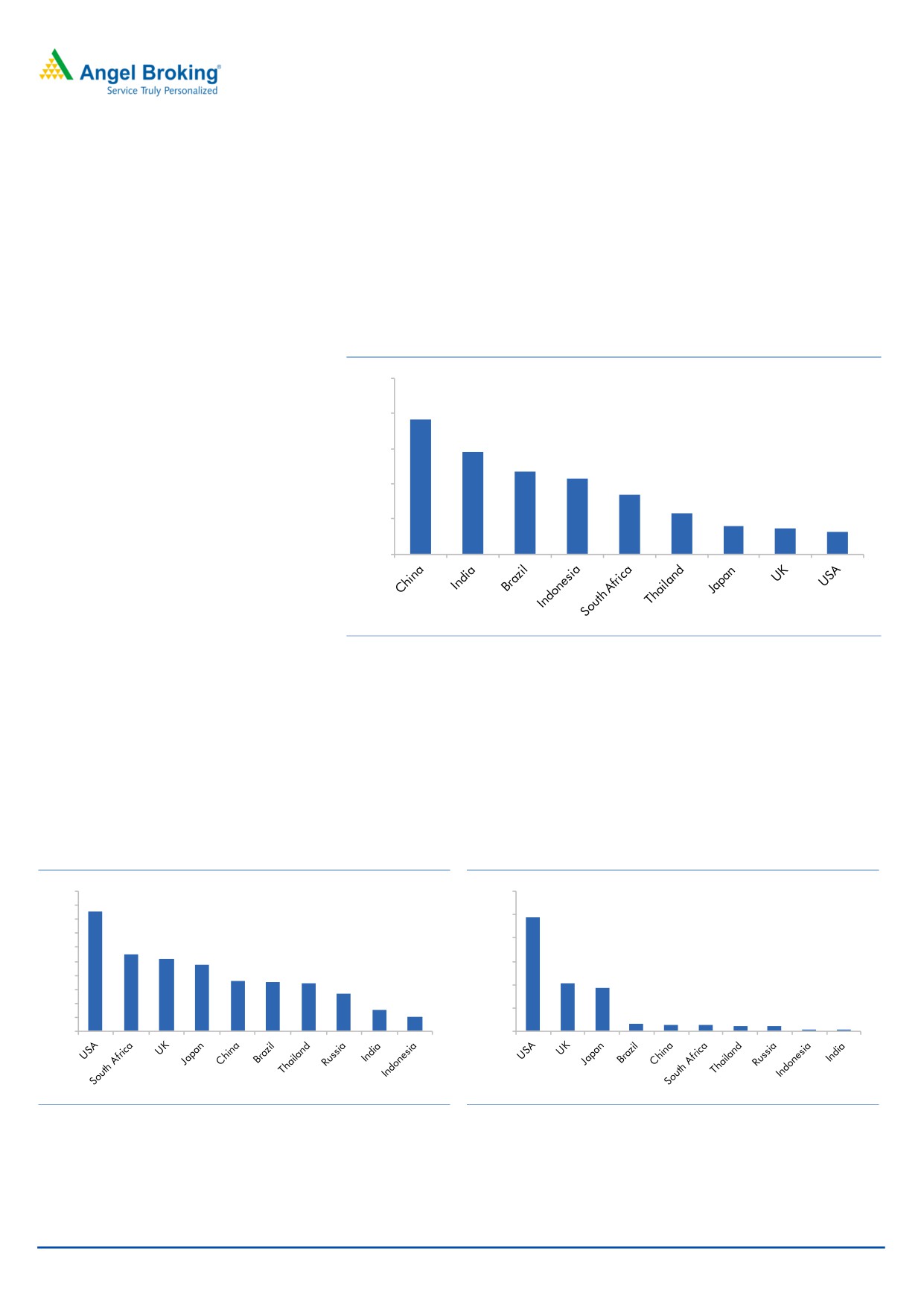

Significant growth opportunity in India: The size of Indian non life insurance

sector was `1.28 trillion on a GDPI basis at end of FY2017. Indian non life

insurance sector grew by 17.4% between FY2001-17. According to Swiss Re, India

was the fifteenth largest market in the world and the fourth largest in Asia in 2016,

behind China, Japan and South Korea. India was also amongst fastest growing

non-life insurance markets over 2011-16, growing at 14.5% ( as per Swiss Re).

Exhibit 14: Non Life Insurance CAGR

25%

19.10%

20%

14.50%

15%

11.70% 10.80%

10%

8.40%

5.80%

4.00%

3.60%

5%

3.20%

0%

Source: RHP, Angel Research

Despite its size and growth profile, India continues to be an underpenetrated

market with a non-life insurance penetration of 0.77% in 2016 as compared to

1.81% in China, 1.70% in Thailand, 1.67% in Singapore and 1.62% in Malaysia

and global average of 2.81% in 2016. At US $ 13.2 in 2016, insurance density

also remains significantly lower as compared to other developed and emerging

market economies.

Exhibit 15: Premium as a % of GDP (CY16)

Exhibit 16: Non Life Insurance Density ( US $)

5.0

3000

4.29

4.5

2449

2500

4.0

3.5

2.74

2000

3.0

2.58

2.37

2.5

1500

1.81

1.76

1.7

1031

2.0

928

1.36

1000

1.5

0.77

1.0

0.51

500

151

147

147

0.5

101

100

18

13

0.0

0

Source: RHP, Angel Research* Data for 2016

Source: RHP, Angel Research

Sept 14, 2017

8

ICICI Lombard | IPO Note

Outlook & Valuation

The Indian Non-Life Insurance Industry has been one of the fastest growing

markets across emerging markets with a 14.5% CAGR over CY2011-16. Despite

the high growth the premium density as % of GDP is still at 0.77% which leaves

scope for much scalability.

At the upper price band of `661 the issue is offered at 8x its FY2017 BV. While on

the reported numbers it might appear to be fairly valued, we believe with strong

potential to deliver high double digit growth for next multiple years, the issue

looks decently priced, and hence we have a SUBSCRIBE rating on the issue.

Sept 14, 2017

9

ICICI Lombard | IPO Note

Statement of Revenue

Y/E March (` cr)

2,013

2,014

2,015

2,016

2,017

Premiums earned (net)

4,012

4,352

4,234

4,826

6,158

% chg

8

-3

14

28

Profit on sale/ redemption of investments

77

175

202

280

329

Less : Loss on sale/ redemption of investments

(20)

(53)

(27)

(9)

(32)

Others

15

22

32

48

27

Interest, Dividend & Rent- Gross

403

533

604

659

699

Total (A)

4,487

5,028

5,045

5,804

7,180

Claims incurred (net)

3,350

3,629

3,446

3,939

4,966

Loss Ratio

83

83

81

82

81

Commission (net)

(183)

(229)

(346)

(328)

(434)

Operating expenses related to insurance business

1,019

1,216

1,387

1,711

1,982

Premium deficiency

(2)

-

-

-

-

Total (B)

4,185

4,616

4,486

5,322

6,513

Statement of P&L

Operating Profit /(Loss) C=(A - B)

303

413

558

482

667

Operating profit/(loss)

303

413

558

482

667

Income from investments

111

136

182

228

315

Other income

2

7

2

14

2

Total (A)

416

556

742

724

984

Provisions (Other than taxation)

56

13

22

1

5

Other expenses

-

-

-

-

-

(a) Expenses other than those business

3

5

13

18

96

(b) Bad debts written off

4

3

0

-

-

(c) Loss on sale/discard of

2

2

2

0

3

(d) Penalty

-

0

1

0

-

Total (B)

65

23

38

19

104

Profit before tax (C) = (A-B)

351

533

705

705

880

Provision for taxation

(1)

13

119

199

238

Profit after tax

353

520

585

505

642

EPS

8

11

13

11

14

% chg

47

13

(14)

27

Sept 14, 2017

10

ICICI Lombard | IPO Note

Balance Sheet

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17

Sources of funds

Share capital

437

445

447

448

451

Reserves and surplus

1,422

1,948

2,439

2,788

3,274

Share application money-pending allotment

100

0

0

-

1

Networth

1,959

2,394

2,885

3,235

3,726

Share Holder Fund

-

18

69

61

175

Policy Holder Fund

-

95

287

249

503

Fair value change account

70

113

356

309

677

Borrowings

485

Total

2,029

2,507

3,241

3,545

4,889

Application of funds

Investments

7,800

9,290

10,200

11,563

15,079

Fixed assets

400

389

390

383

383

Deferred tax asset

48

35

97

124

87

Current assets (A)

4,388

5,029

3,959

5,045

7,802

Cash and bank balances

270

162

142

195

194

Advances and other assets

4,118

4,867

3,818

4,850

7,608

Current liabilities and provisions (B)

10,697 12,237 11,404

13,570

18,462

Net current assets (C) = (A - B)

(6,309)

(7,207)

(7,445)

(8,525)

(10,660)

Debit balance in profit and loss account

89

-

-

-

-

Total

2,029

2,507

3,241

3,545

4,889

Key Ratio

FY13

FY14

FY15

FY16

FY17

ROE

18

22

20

16

17

BV

43

53

64

71

82

EPS

8

11

13

11

14

P/E

85

58

51

59

47

P/BV

15

13

10

9

8

Loss Ratio

83

83

81

82

81

Combined Ratio

104

105

105

107

104

Solvency Ratio

155

172

195

182

210

Investment Leverage Ratio

-

4

4

4

4

Ratio are calculated at Upper Band of IPO

Sept 14, 2017

11

ICICI Lombard | IPO Note

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Sept 14, 2017

12