2QFY2017 Result Update | Banking

November 11, 2016

ICICI Bank

ACCUMULATE

CMP

`277

Performance Highlights

Target Price

`315

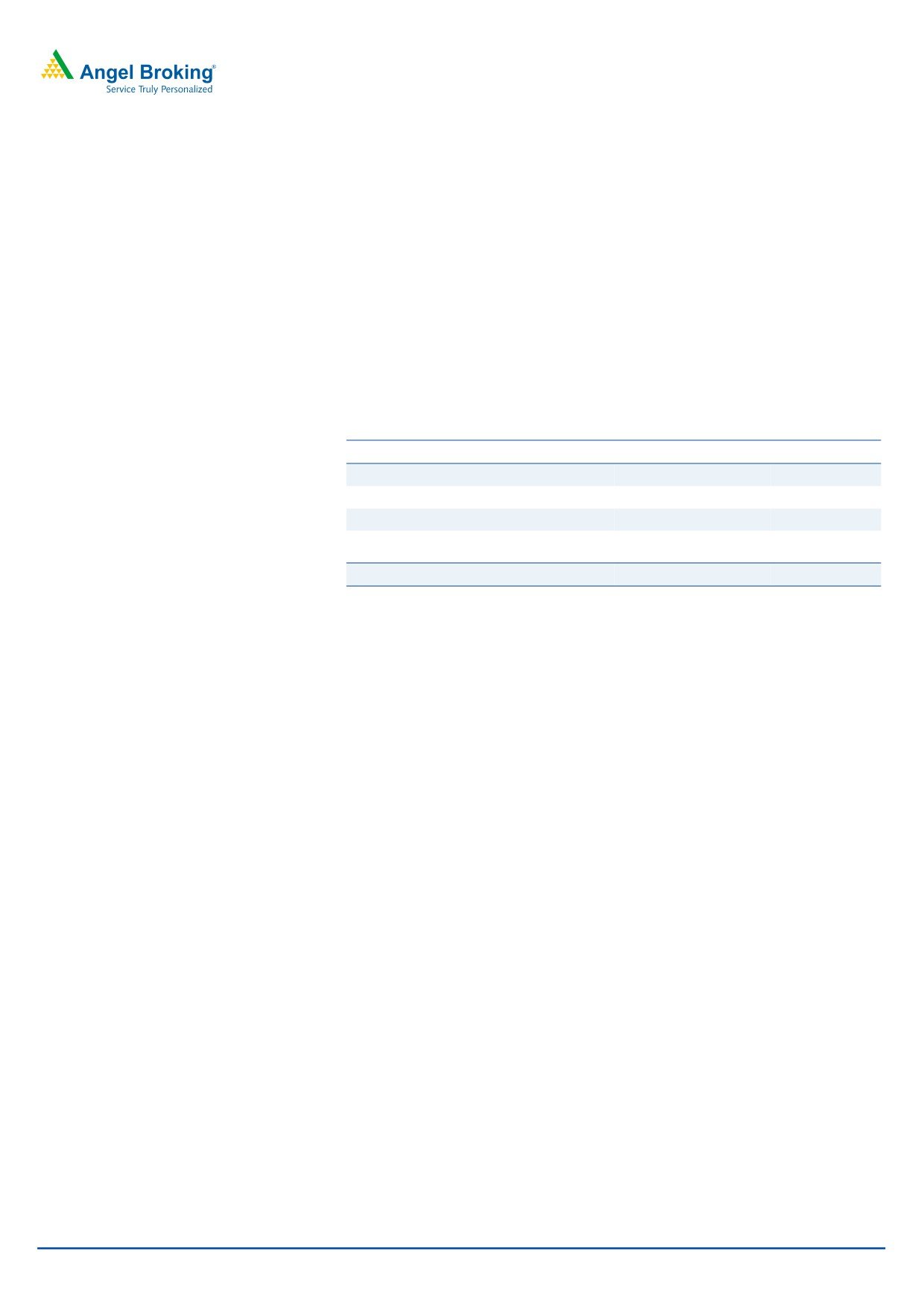

Particulars (` cr)

2QFY17 1QFY17

% chg (qoq)

2QFY16

% chg (yoy)

Investment Period

12 Months

NII

5,253

5,159

1.8

5,251

0.0

Pre-prov. profit

10,636

5,215

104

5,158

106

Stock Info

PAT

3,103

2,254

37.7

3,030

2.4

Source: Company, Angel Research

Sector

Banking

ICICI Bank’s 2QFY17 results have been encouraging. While slippages remained

Market Cap (` cr)

161,198

high, large part of that came from the watch list. The bank has utilized part of the

Beta

1.7

proceeds from stake sale in insurance business towards provisions. Management

52 Week High / Low

298 / 181

commentary also remained optimistic, as no addition is expected to the watch list;

Avg. Daily Volume

1,496,033

sharp deterioration of the accounts within the watch list is also unlikely.

Face Value (`)

2

Overall loan growth remained subdued due to run down in overseas operations:

Domestic loan growth remained decent, growing by

15.9%. However, the

BSE Sensex

26,819

overseas loan book came down by 4%, as a result the overall loan book remained

Nifty

8,296

muted, growing by only 10.9% YoY. Retail loans continued to grow at a healthy

Reuters Code

ICBK.NS

pace, up by 21.1% YoY and now accounted for 47.9 % (46.4% QoQ, 44% YoY) of

the total loan book. Within the domestic corporate side, the bank has been

Bloomberg Code

ICICIBC@IN

selectively lending to high rated corporate only; hence, the growth in that segment

was only 8%. Deposit growth remained strong, up by 16.8%. CASA ratio stood at

Shareholding Pattern (%)

45.7%. The curb on cash transaction by Govt is likely to have a positive impact on

banks, as they will be receiving substantially high deposits from account holders.

Promoters

0.0

MF / Banks / Indian Fls

29.9

Large part of the slippages from the watch list only: During the quarter, the bank

reported slippages worth `8,029cr vs. `8,249cr QoQ. Slippages from watch list

FII / NRIs / OCBs

63.7

was `4,555cr flat QoQ and from that of restructured loan book was `1,231cr vs.

Indian Public / Others

6.4

`1,321cr QoQ. While in absolute term, the slippages remained high, the only

comforting point is that 72% (83% including sales to ARC) of the slippages came

from the list of accounts, which has already been under watch by the bank. The

Abs. (%)

3 m

1 yr

3 yr

drill down list of accounts, which is prone to falling into NPA, has come down by

Sensex

(3.7)

3.7

30.9

`6,242cr during the quarter to `32,490cr vs. `38,732cr in 1QFY17.

ICICI Bank

14.3

4.9

33.5

Outlook and valuation: Earnings growth for ICICI Bank is likely to remain under

pressure for the next few quarters, due to elevated slippages and resultant credit

cost. However, the good part is that large part of the slippages has been coming

3-year price chart

from the known accounts and hence asset quality after few quarters should

450

stabilize, which will pave the ways for secular growth FY18 onwards. The stock has

400

seen quite a run up in the last few months, however we believe as more clarity

350

emerges on its book the valuation gap of ICICI vs other Pvt Sector banks should

300

250

narrow down. At the CMP the stock is trading at 1.4x its FY18E ABV (Excluding

200

`80 for all the subsidiaries).We recommend an Accumulate rating on the stock,

150

with a revised target price of `315.

100

50

Key financials (Standalone)

0

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

NII

19,040

21,224

22,252

28,711

% chg

15.6

11.5

4.8

29.0

Source: Company, Angel Research

Net profit

11,176

9,726

10,498

12,734

% chg

13.9

(13.0)

7.9

21.3

NIM (%)

3.2

3.3

3.1

3.3

EPS (`)

19.3

16.7

18.0

21.9

P/E (x)

14.2

16.3

15.1

12.5

P/ABV (x)

2.1

2.1

2.1

1.9

Siddharth Purohit

RoA (%)

1.8

1.4

1.3

1.4

022 - 3935 7800 Ext: 6872

RoE (%)

14.5

11.4

11.1

12.3

Source: Company, Angel Research; Note: CMP as of November 11, 2016

Please refer to important disclosures at the end of this report

1

ICICI Bank | 2QFY2017 Result Update

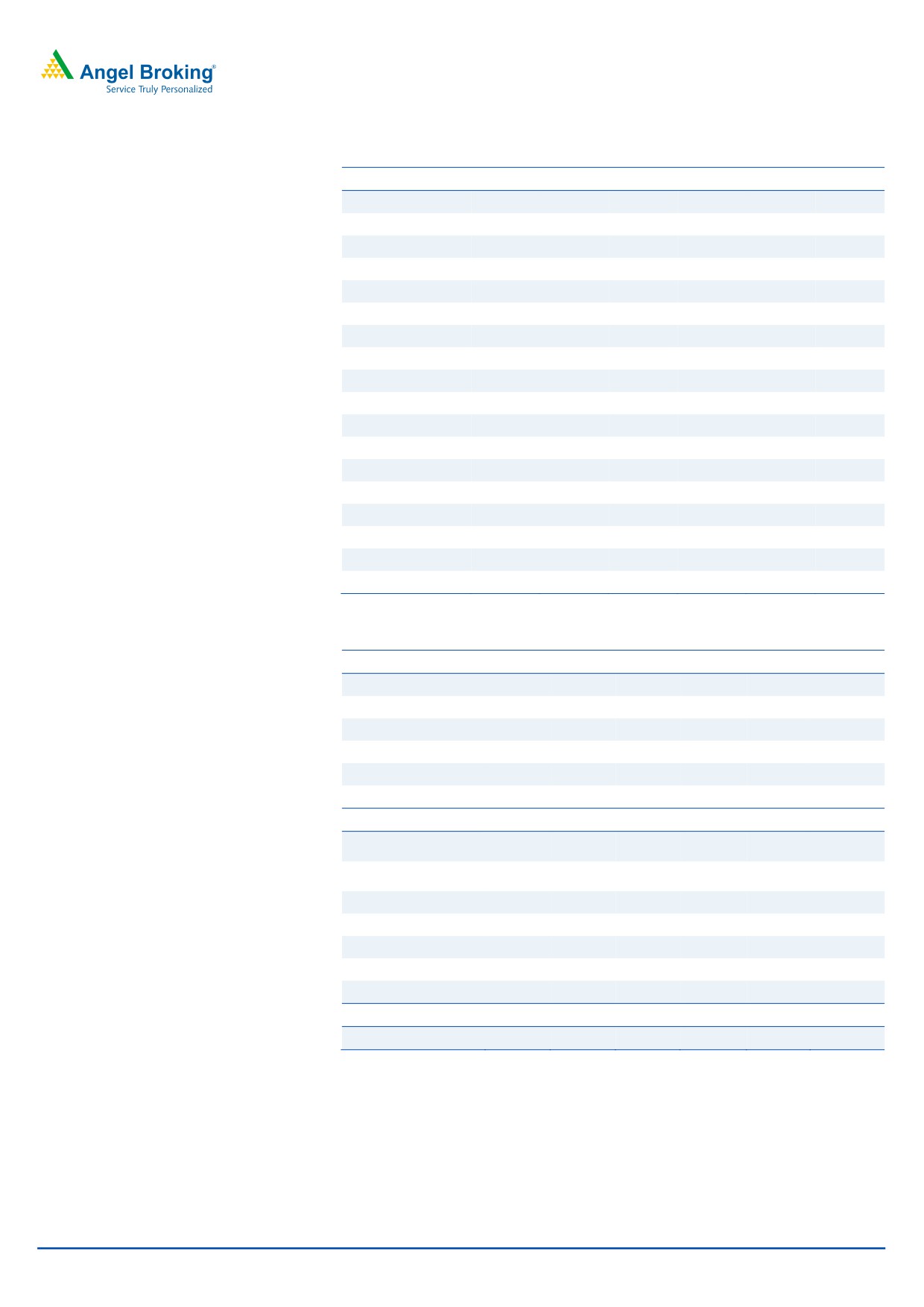

Exhibit 1: 2QFY2017 performance (Standalone)

Particulars (` cr)

Q1FY16

Q2FY16

Q3FY16

Q4FY16

Q1FY17

Q2FY17

% YoY

% QoQ

Interest earned

12,813

13,099

13,346

13,482

13,330

13,639

4.1

2.3

- on Advances / Bills

9,375

9,665

9,863

10,041

9,837

9,905

2

0.7

- on investments

2,659

2,661

2,652

2,652

2,811

2,997

13

6.6

- on balance with RBI & others

32

31

36

59

50

38

21

(24.2)

- on others

747

741

795

730

632

699

(6)

10.6

Interest Expended

7,697

7,847

7,893

8,077

8,172

8,386

7

2.6

Net Interest Income

5,115

5,251

5,453

5,405

5,159

5,253

0.0

1.8

Other income

2,990

3,007

4,217

5,109

3,429

9,119

203

165.9

- Fee income

2,110

2,235

2,262

2,212

2,156

2,356

5

9.3

- Treasury income

673

550

513

707

505

5,682

933

1025.1

- Others

207

222

1,442

2,190

768

729

(228)

(5.1)

Operating income

8,105

8,259

9,670

10,513

8,588

14,372

74.0

67.4

Operating expenses

3,067

3,100

3,110

3,406

3,373

3,736

21

10.8

- Employee expenses

1,267

1,213

1,140

1,382

1,291

1,556

28

20.6

- Other Opex

1,800

1,888

1,970

2,024

2,082

2,180

15

4.7

Pre-provision Profit

5,038

5,158

6,560

7,108

5,215

10,636

106.2

104.0

Provisions & Contingencies

955

942

2,844

6,926

2,515

7,082

652

181.6

PBT

4,082

4,216

3,716

181

2,700

3,554

(15.7)

31.6

Provision for Tax

1,106

1,186

698

(521)

446

451

(62)

(1.1)

PAT

2,976

3,030

3,018

(2,898)

2,254

3,103

2.4

37.7

Effective Tax Rate (%)

27

28

19

(287)

28

28

-

-

Source: Company, Angel Research

Exhibit 2: 2QFY2017 Loan Book Composition (Standalone)

Particulars (` cr)

Q1FY16

Q2FY16

Q3FY16

Q4FY16

Q1FY17

Q2FY17

% YoY

% QoQ

Domestic Corporate

114,725

116,353

125,222

119,698

127,637

125,829

8.1

(1.4)

Overseas branches

96,737

95,458

99,134

94,017

95,278

91,305

(4)

(4.2

SME

17,189

17,617

20,001

18,716

17,977

19,533

10.9

8.7

Retail Total

171,088

180,265

190,442

202,833

208,534

217,588

21

4.3

-Home

93,927

99,326

104,553

109,530

113,234

118,150

19

4.3

-Vehicle loans

30,625

32,267

33,708

35,293

36,285

37,208

15

2.5

Rural

25,663

25,778

27,805

31,845

31,697

31,333

22

(1.1)

-Banking business

9,239

10,095

10,093

10,750

10,635

8,486

(16)

(20.2)

-Credit cards

4,106

4,507

5,142

5,476

5,839

6,092

35

(4.3)

-Personal loans

7,528

8,292

9,141

10,142

10,844

11,750

42

8.4

Others

-

-

-

-

-

4,569

-

-

Total advances

171,088

180,265

190,442

203,036

208,534

217,588

21

4.3

Source: Company, Angel Research

November 11, 2016

2

ICICI Bank | 2QFY2017 Result Update

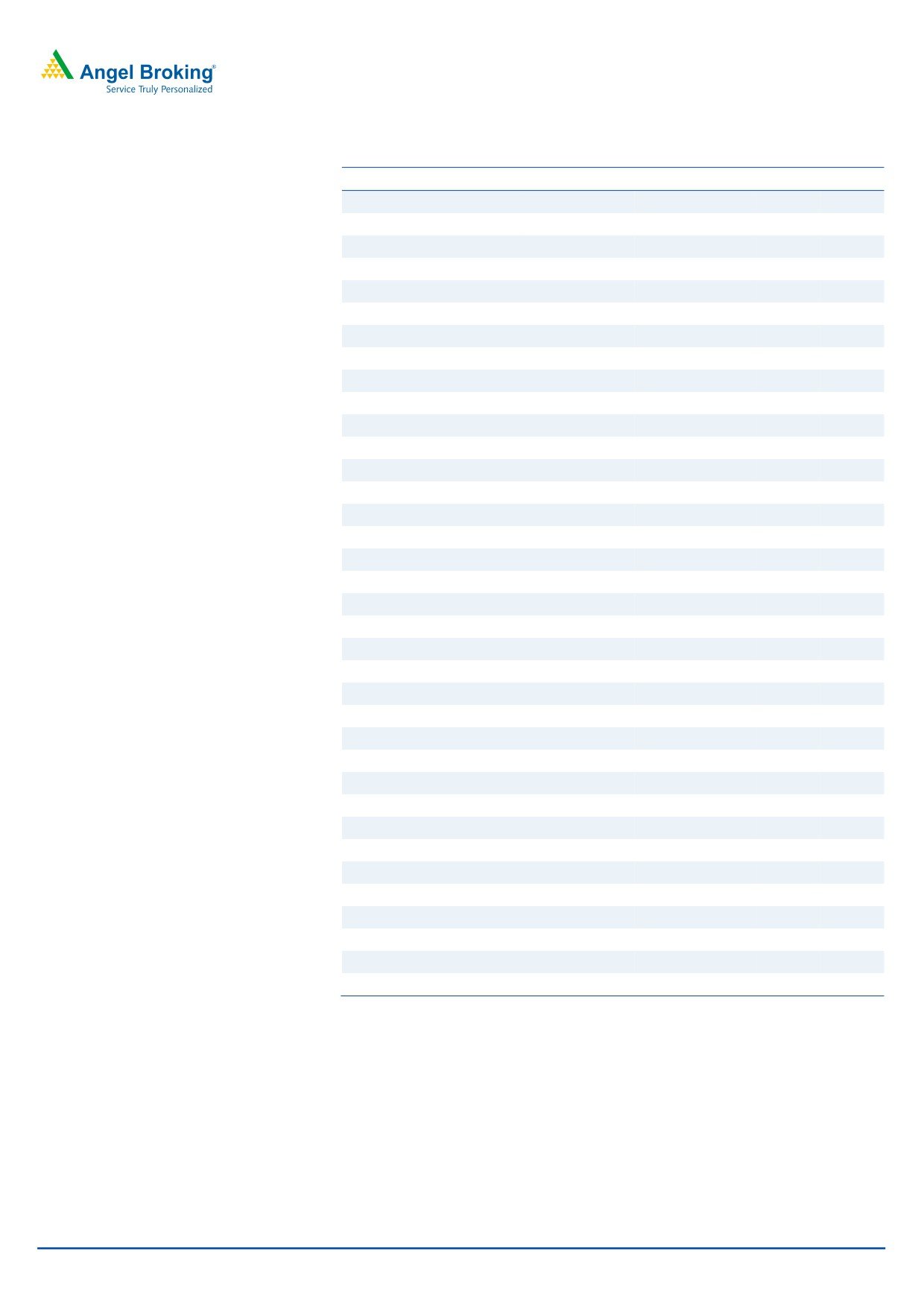

Overall loan growth remained subdued due to run down in

overseas operations: Domestic loan growth remained decent, growing by

15.9%. However, the overseas loan book came down by 4%, as a result the overall

loan book remained muted, growing by only 10.9% YoY. Retail loans continued to

grow at a healthy pace, up by 21.1% YoY and now accounted for 47.9% (46.4%

QoQ, 44% YoY) of the total loan book. Within the retail loan portfolio, mortgages

grew by 19% and auto by 14%. Growth in business banking and rural segment

was even healthier, growing by 26% and 30% YoY, respectively.

Within the domestic corporate side, the bank has been selectively lending to high

rated corporate only; hence, the growth in that segment was only 8%. Share of

overseas loan book has come down to 20.1% compared to 23.3% YoY, which

seems a conscious call by the management.

Deposits growth outpaced loan growth:

Deposit growth remained strong and outpaced loan growth, up by 16.8%. CASA

growth was also strong in line with deposit growth, up by 18% yoy and CASA ratio

stood at 45.7%. Within CASA, saving accounts deposit grew by 22%, while current

deposits grew by 11%. Despite subdued deposit growth in the industry, ICICI Bank

has been able to garner strong CASA deposit, which speaks for the strong

franchise it has developed over the years.

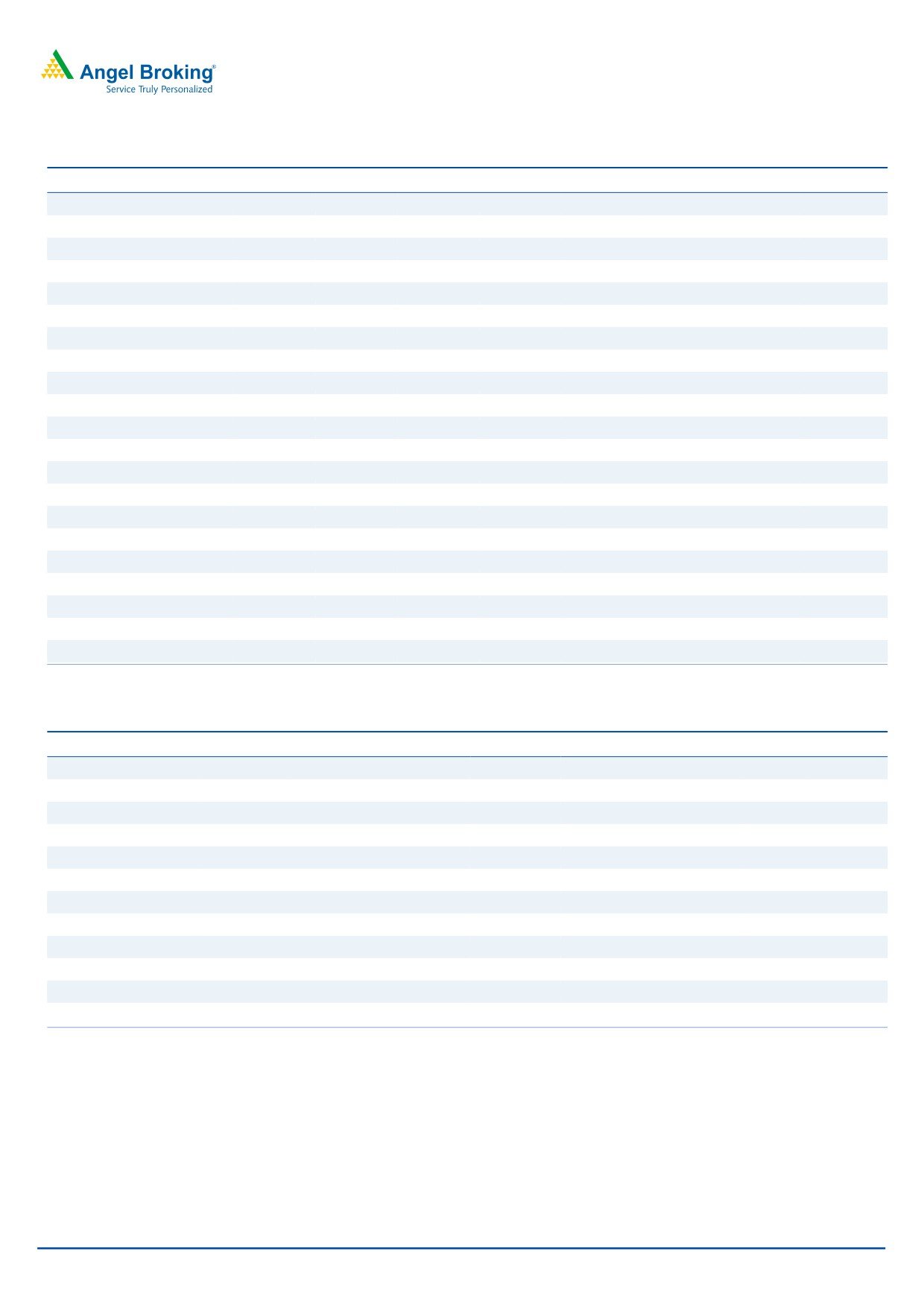

Exhibit 3: Loan & Deposit Growth

Exhibit 4: CASA growth & CASA ratio

18.0

16.6

16.8

46.0

19.0

15.8

15.2

15.3

16.0

14.6

18.0

45.5

13.3

14.0

17.0

12.3

12.4

12.0

10.9

45.0

16.0

9.6

9.2

10.0

15.0

44.5

8.0

14.0

6.0

44.0

13.0

4.0

12.0

43.5

2.0

11.0

44.1

45.1

45.2

45.8

45.1

45.7

0.0

43.0

10.0

Q1FY16

Q2FY16

Q3FY16

Q4FY16

Q1FY17

Q2FY17

Q1FY16

Q2FY16

Q3FY16

Q4FY16

Q1FY17

Q2FY17

Loan Growth YoY (%) Deposit Growth YoY (%)

CASA Ratio (%)

YoY Growth (%)

Source: Company, Angel Research

Source: Company, Angel Research

November 11, 2016

3

ICICI Bank | 2QFY2017 Result Update

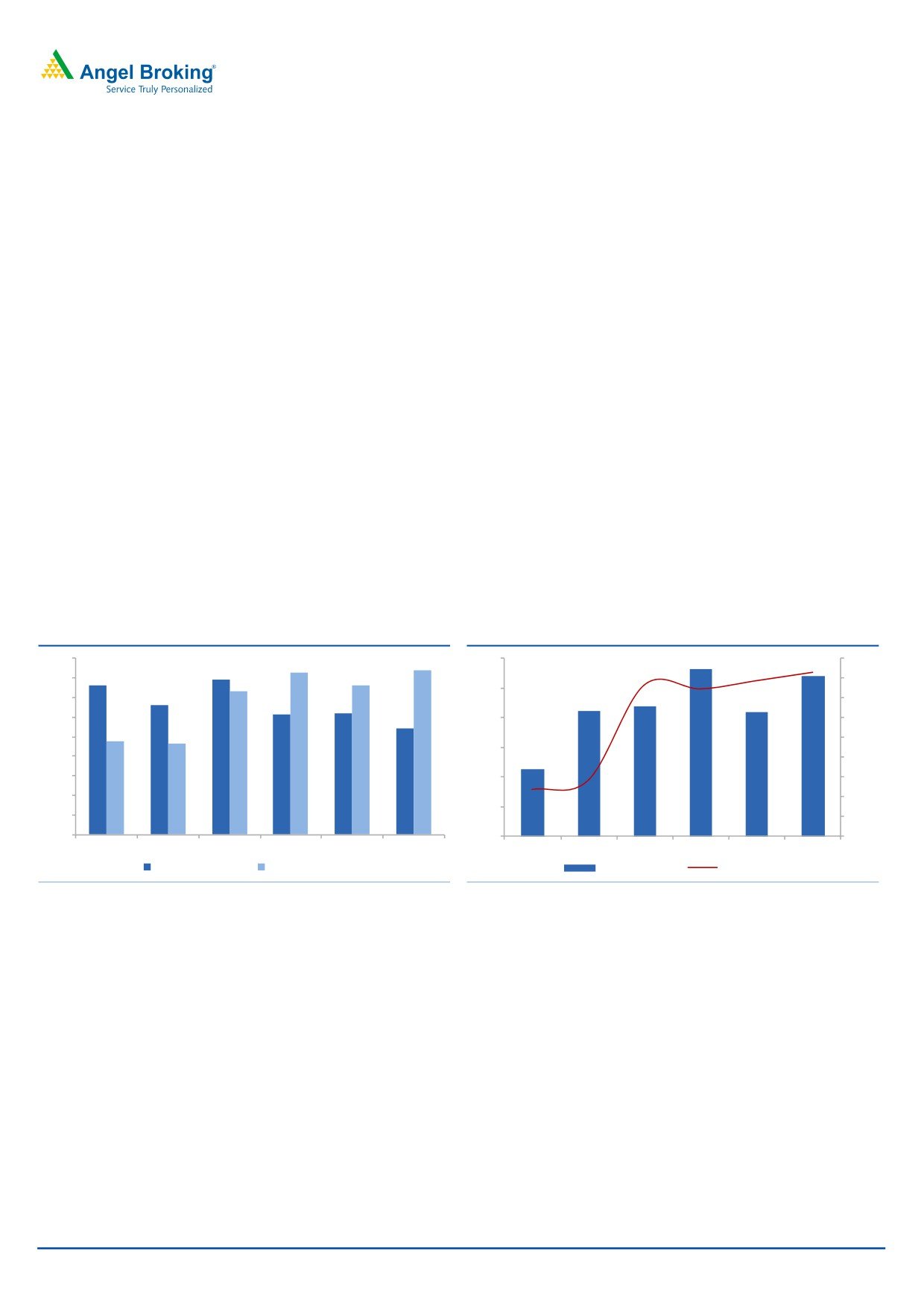

One time gain on stake sale in ICICI-Prudential helped in

taking higher provisions:

Core fee income remained subdued during the quarter growing by only 5.4% YoY.

However, during the queerer the bank booked ` 5,682 cr on account of its stake

sale in the Life Insurance business. The management has judiciously utilized the

onetime gain in taking higher provisions, which has further strengthened its

balance sheet. The bank utilized `680cr from the earlier contingency provisions

created.

Exhibit 5: NII remained flat amid slippages

Exhibit 6: Fee Income also remained subdued

5,500

16.0

2,400

10.0

2,350

9.0

9.0

13.9

14.0

5,400

13.3

12.8

8.0

12.0

2,300

6.3

7.2

7.0

5,300

2,250

10.0

6.0

2,200

5.4

5,200

8.0

5.0

2,150

6.4

6.0

4.0

5,100

2,100

3.5

3.0

4.0

2,050

2.2

5,000

2.0

2.0

2,000

1.0

0.8

4,900

0.0

0.0

1,950

0.0

Q1FY16

Q2FY16

Q3FY16

Q4FY16

Q1FY17

Q2FY17

Q1FY16

Q2FY16

Q3FY16

Q4FY16

Q1FY17

Q2FY17

NII (` Cr)

% YoY Growth

Fee Income (` Cr)

YoY Growth (%)

Source: Company, Angel Research

Source: Company, Angel Research

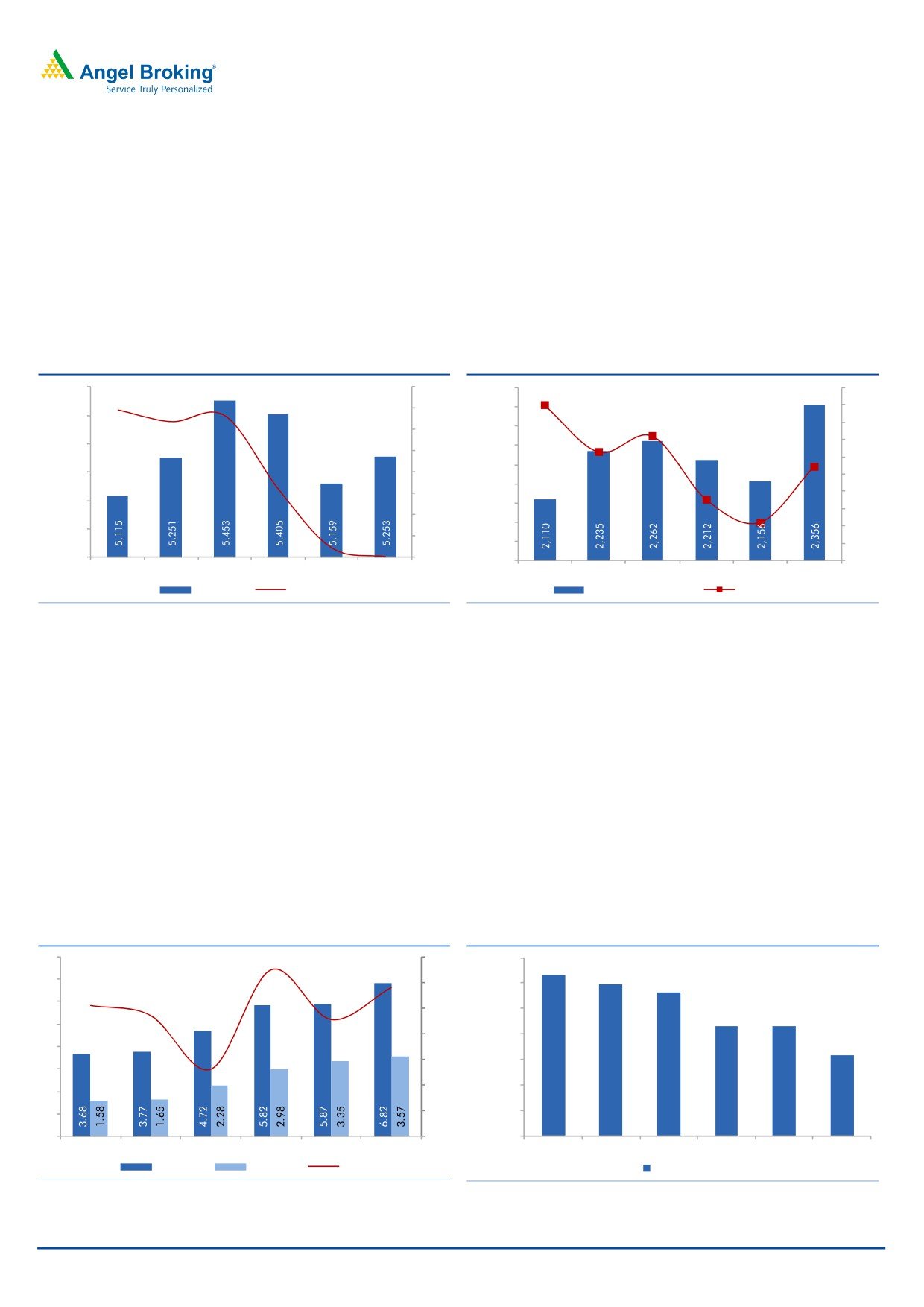

Large part of the slippages from the watch list only; during the

quarter, the bank reported slippages worth `8,029cr vs. `8,249cr QoQ. Slippages

from watch list was `4,555cr flat QoQ and from that of restructured loan book

was `1,231cr vs. `1,321cr QoQ. While in absolute term, the slippages numbers

remained high, the only comforting point is that 72 % (83% including sales to ARC)

of the slippages came from the list accounts, which has already been under watch

by the bank. The drill down list of accounts, which is prone to falling into NPA, has

come down by `6,242cr during the quarter.

In 2QFY17, the bank sold NPAs worth `1,787cr. Loans outstanding on which SDR

has been implemented stood at `2,900cr. Outstanding 5:25 loans were at

`2,700cr.

Exhibit 7: GNPA% remained high, PCR improved

Exhibit 8: Restructured Loan Book has been declining.

8

62

14,000

12,604

61.0

11,868

7

60

12,000

11,294

59.

6

58.2

6

58

10,000

57.4

8,573

8,573

5

57.1

56

8,000

4

6,336

54

6,000

3

53.2

52

4,000

2

50

2,000

1

0

48

-

Q1FY16

Q2FY16

Q3FY16

Q4FY16

Q1FY17

Q2FY17

Q1FY16

Q2FY16

Q3FY16

Q4FY16

Q1FY17

Q2FY17

GNPAs %

NNPAs %

PCR %

O/S Restrctured Book

Source: Company, Angel Research

Source: Company, Angel Research

November 11, 2016

4

ICICI Bank | 2QFY2017 Result Update

Outlook and Valuation

Earnings growth for ICICI Bank is likely to remain under pressure for the next few

quarters, due to elevated slippages and resultant credit cost. However, the good

part is that large part of the slippages has been coming from the known accounts

and hence asset quality after few quarters should stabilize, which will pave the

ways for secular growth FY18 onwards. The stock has seen quite a run up in the

last few months, however we believe as more clarity emerges on its book the

valuation gap of ICICI vs other Pvt Sector banks should narrow down. At the CMP

the stock is trading at

1.4x its FY18E ABV (Excluding

`80 for all the

subsidiaries).We recommend an Accumulate rating on the stock, with a revised

target price of `315.

Exhibit 9: SOTP valuation summary

Particulars

Target multiple

Value/share (`)

ICICI Bank

1.4x FY2018E ABV

229

Life Insurance

Based on Market Price

40

General Insurance

Based On Deal Value

21

Others (Home Fin, AMC, VC, Securities

25

PD and Overseas subsidiaries)

SOTP value

315

Source: Angel Research

Company Background

ICICI Bank is India's largest private sector bank, with more than 5% market share

in credit. The bank has a pan-India extensive network of 4,450 branches and

around 13,776 ATMs. The bank has a large overseas presence (overseas loans

comprise ~20% of total loans). The bank also has market-leading subsidiaries in

life insurance, general insurance and asset management segments.

November 11, 2016

5

ICICI Bank | 2QFY2017 Result Update

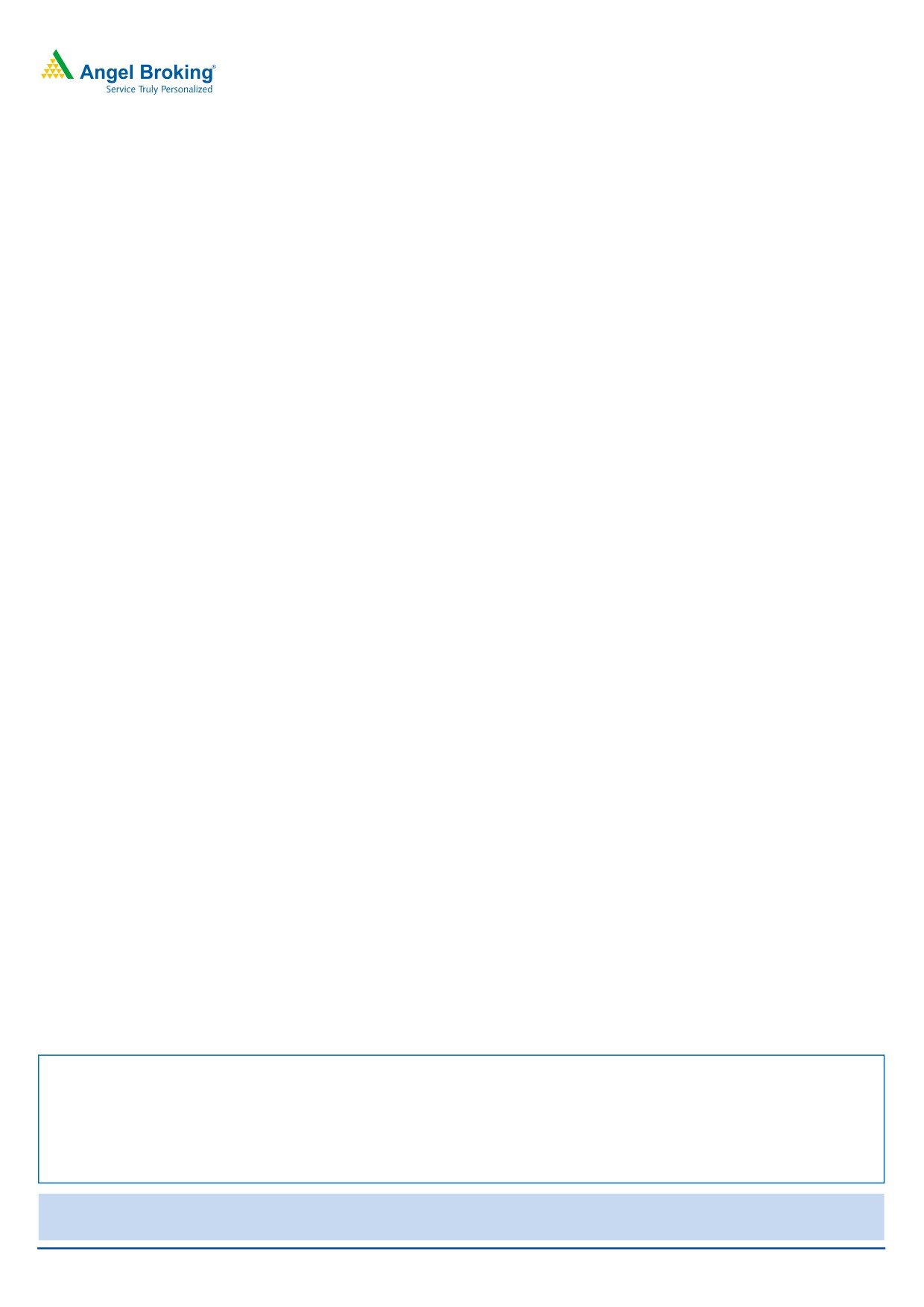

Income statement (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17E

FY18E

Net Interest Income

13,866

16,476

19,040

21,224

22,252

28,711

- YoY Growth (%)

29.2

18.8

15.6

11.5

4.8

29.0

Other Income

8,346

10,428

12,176

15,323

20,548

15,975

- YoY Growth (%)

11.2

24.9

16.8

25.8

34.1

-22.3

Operating Income

22,212

26,903

31,216

36,547

42,800

44,686

- YoY Growth (%)

21.8

21.1

16.0

17.1

17.1

4.4

Operating Expenses

9,013

10,309

11,496

12,684

14,784

17,510

- YoY Growth (%)

14.8

14.4

11.5

10.3

16.6

18.4

Pre - Provision Profit

13,199

16,595

19,720

23,863

28,016

27,176

- YoY Growth (%)

27.1

25.7

18.8

21.0

17.4

-3.0

Prov. & Cont.

1,810

2,626

3,900

11,668

14,622

8,311

- YoY Growth (%)

13.9

45.7

48.5

199.2

25.3

-43.2

Profit Before Tax

11,390

13,968

15,820

12,196

13,394

18,865

- YoY Growth (%)

29.5

22.6

13.3

(22.9)

9.8

40.8

Prov. for Taxation

3,064

4,158

4,644

2,469

2,896

6,131

- as a % of PBT

26.9

29.8%

29.4%

20.2%

21.6

32.5

PAT

8,325

9,810

11,176

9,726

10,498

12,734

- YoY Growth (%)

28.8

17.8

13.9

(130.)

7.9

21.3

Balance sheet (Standalone)

Y/E March (` cr)

FY13

FY14

FY15

FY16

FY17E

FY18E

Share Capital

1,154

1,161

1,167

1,163

1,165

1,165

Reserve & Surplus

65,552

72,052

79,262

88,566

98,128

1,07,042

Deposits

2,92,614

3,31,914

3,61,563

4,21,426

4,85,715

5,60,049

- Growth (%)

14.5

13.4

8.9

16.6

15.3

15.3

Borrowings

1,45,341

1,54,759

1,72,417

1,74,807

2,04,000

2,74,424

Other Liab. & Prov.

32,134

34,757

31,720

34,726

53,429

61,605

Total Liabilities

5,36,795

5,94,642

6,46,129

7,20,688

8,42,437

10,04,285

Cash in Hand & with

19,053

21,822

25,653

27,106

29,143

33,603

RBI

Bal.with banks & money

22,365

19,708

16,652

32,763

20,643

23,802

at call

Investments

1,71,394

1,77,022

1,86,580

1,60,412

2,58,643

3,12,927

Advances

2,90,249

3,38,703

3,87,522

4,35,264

4,91,311

5,69,238

- Growth (%)

16.7

14.4

12.3

12.9

15.9

Fixed Assets

4,647

4,678

4,726

7,577

7,043

8,121

Other Assets

29,087

32,709

24,997

57,567

35,654

56,594

Total Assets

5,36,795

5,94,642

6,46,129

7,20,688

8,42,437

10,04,285

- Growth (%)

11.4

10.8

8.7

11.5

16.9

19.2

November 11, 2016

6

ICICI Bank | 2QFY2017 Result Update

Ratio analysis (Standalone)

Y/E March

FY13

FY14

FY15

FY16

FY17E

FY18E

Profitability ratios (%)

NIMs

2.9

3.1

3.2

3.3

3.1

3.3

Cost to Income Ratio

40.6

38.3

36.8

34.7

34.5

39.2

RoA

1.6

1.7

1.8

1.4

1.3

1.4

RoE

13.1

14.0

14.5

11.4

11.1

12.3

B/S ratios (%)

CASA Ratio

41.9

42.9

45.5

45.8

46.0

46.1

Credit/Deposit Ratio

99.2

102.0

107.2

103.3

101.2

101.6

CAR

18.7%

17.7%

17.0%

16.6%

15.7%

14.5%

- Tier I

5.9%

4.9%

4.2%

3.5%

3.2%

2.8%

Asset Quality (%)

Gross NPAs

3.2

3.0

3.8

5.8

7.1

6.5

Net NPAs

0.6

1.0

1.6

3.0

4.5

4.4

Slippages

1.4

1.7

2.4

4.4

3.7

2.6

Loan Loss Prov. /Avg. Assets

0.6

0.8

1.0

2.7

3.0

1.5

Provision Coverage

76.8

70.4

59.1

50.3

52.0

52.1

Per Share Data (`)

EPS

14.4

17.0

19.3

16.7

18.0

21.9

ABVPS

111.8

121.1

127.9

129.5

132.9

143.1

DPS

4.0

4.4

4.8

5.0

5.0

6.0

Valuation Ratios

PER (x)

18.9

16.1

14.2

16.3

15.1

12.5

P/ABVPS (x)

2.4

2.3

2.1

2.1

2.1

1.9

Dividend Yield

1.4

1.5

1.6

1.7

1.7

2.1

DuPont Analysis

NII

2.7

2.9

3.1

3.1

2.8

3.1

Non Interest Income

1.6

1.8

2.0

2.2

2.6

1.7

Total Revenues

4.3

4.8

5.0

5.3

5.5

4.8

Operating Cost

1.8

1.8

1.9

1.9

1.9

1.9

PPP

2.6

2.9

3.2

3.5

3.6

2.9

Total Provisions

0.4

0.5

0.6

1.7

1.9

0.9

PreTax Profit

2.2

2.5

2.6

1.8

1.7

2.0

Tax

0.6

0.7

0.7

0.4

0.4

0.7

ROA

1.6

1.7

1.8

1.4

1.3

1.4

Leverage

8.1

8.1

8.1

8.0

8.3

8.9

RoE (%)

13.1

14.0

14.5

11.4

11.1

12.3

November 11, 2016

7

ICICI Bank | 2QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

ICICI Bank

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

November 11, 2016

8