3QFY2016 Result Update | Metals

January 27, 2016

Hindustan Zinc

ACCUMULATE

CMP

`151

Volume growth drives outperformance

Target Price

`170

Investment Period

12 Months

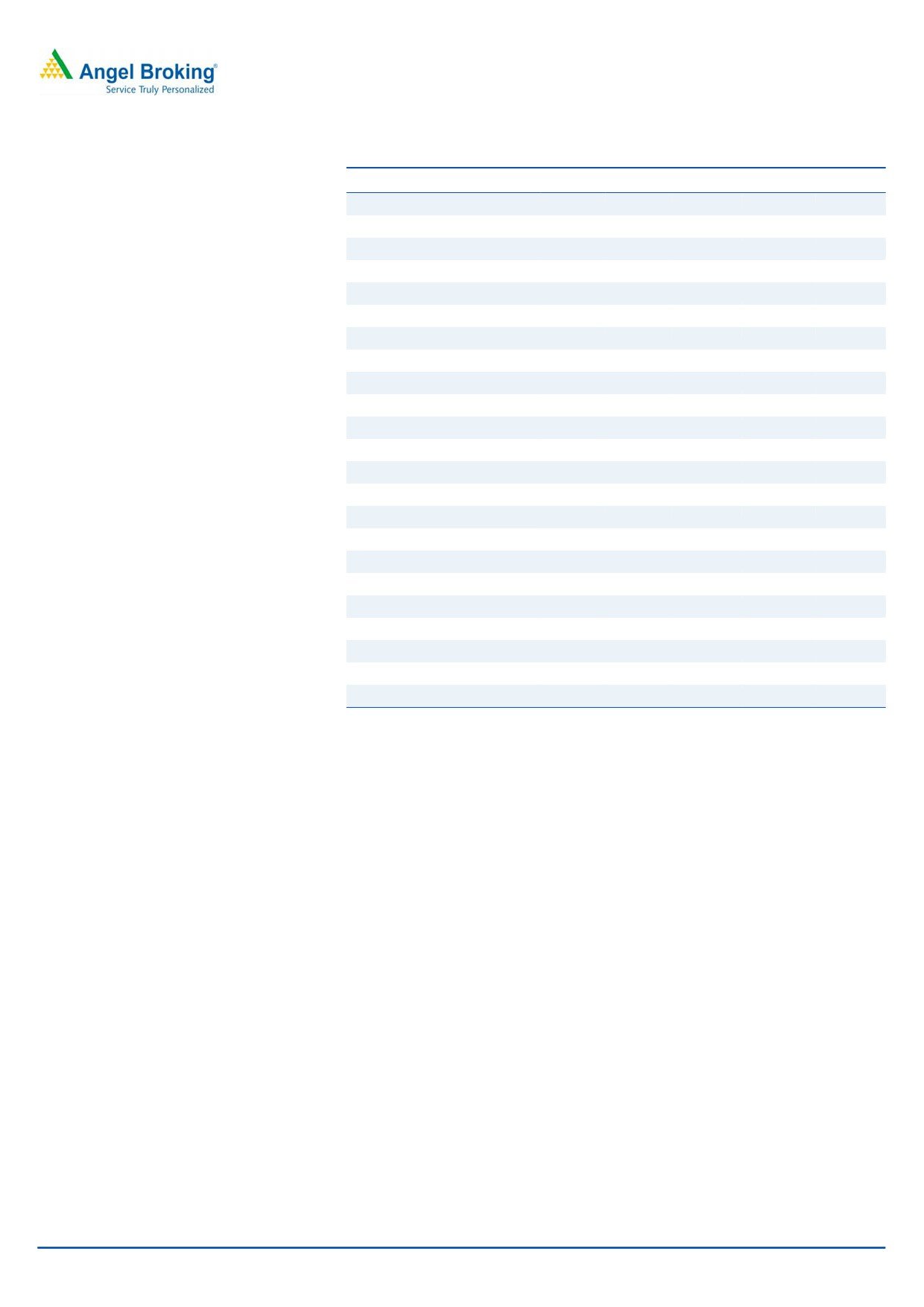

Standalone (` cr)

3QFY16

3QFY15

yoy (%)

2QFY16

qoq%

Revenue

3,431

3,853

(11.0)

4,033

(14.9)

Stock Info

EBITDA

1,478

2,089

(29.2)

2,164

(31.7)

Sector

Metals/Mining

Margin (%)

43.1

54.2

(11pp)

53.7

(11pp)

Market Cap (` cr)

63,844

Reported PAT

1,811

2,379

(23.9)

2,285

(20.7)

Net Cash (` cr)

32,639

Source: Company, Angel Research

Beta

1.0

52 Week High / Low

190/117

For 3QFY2016, Hindustan Zinc (HZL) reported a 11% yoy decline in revenue to

Avg. Daily Volume

4,26,554

`3,385cr, in line with estimates, led by a 17% decline in zinc revenues as higher

Face Value (`)

2

volumes and rupee depreciation benefits were offset by lower realizations on

BSE Sensex

24,486

account of a decline in LME prices and zinc premiums. Mined metal production

Nifty

7,436

declined 13% yoy to 2,40,000MT. EBITDA for the quarter was also in line with

Reuters Code

HZNC.BO

expectation at `1,478cr, declining 29% yoy, led by lower LME prices and `84cr

Bloomberg Code

HZ IN

contribution towards the District Mineral Foundation (DMF). While depreciation

and finance expenses came in line with our expectations, lower tax rate resulted in

Shareholding Pattern (%)

the net profit coming in 9% ahead of expectations at `1,811cr.

Promoters

64.9

Management has maintained its guidance of a ~16% increase in refined metal

MF / Banks / Indian Fls

1.8

production volume for FY2016, despite a weaker mine plan in 4QFY2016.

FII / NRIs / OCBs

1.7

Management also indicated that the expansion projects remain on track, which

Indian Public / Govt / Others

31.6

should help drive volumes.

Outlook and valuation: We expect zinc prices to continue to decline going

Abs. (%)

3m 1yr

3yr

forward led by global headwinds. We have however retained our volume

Sensex

(10.5)

(15.8)

22.3

estimates, led by the healthy growth during the quarter. We reduce our FY2016

HZL

(10.4)

(12.0)

10.6

and FY2017 estimates in view of the higher than expected fall in realizations and

fall in zinc premiums. The stock is currently trading at 4.2x FY2017E EV/EBITDA.

3-year price chart

We value the stock at 6x FY2017E EV/EBITDA and arrive at a target price of

200

`170. We retain our Accumulate rating on the stock.

150

Key financials (Standalone)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E

100

Revenue

12,700

13,636

14,788

14,105

12,977

50

% chg

11.4

7.4

8.5

(4.6)

(8.0)

0

Adj. net profit

6,064

6,059

6,448

7,512

6,015

% chg

19.8

(0.1)

6.4

16.5

(19.9)

Source: Company, Angel Research

Adj. EPS (`)

14.4

14.3

15.3

17.8

14.2

OPM (%)

51.1

50.6

50.2

46.6

44.3

P/E (x)

9.2

9.2

7.8

8.5

10.6

P/BV (x)

2.0

1.7

1.5

1.3

1.2

RoE (%)

23.3

19.8

20.2

16.3

11.8

RoCE (%)

19.8

17.5

16.8

12.7

9.8

Rahul Dholam

EV/Sales (x)

3.3

2.8

2.2

2.1

2.1

Tel: 022- 3935 7800 Ext: 6847

EV/EBIDTA

6.5

5.5

4.5

4.5

4.6

Source: Company, Angel Research: Note CMP as of January 25, 2016

Please refer to important disclosures at the end of this report

1

Hindustan Zinc | 3QFY2016 Result Update

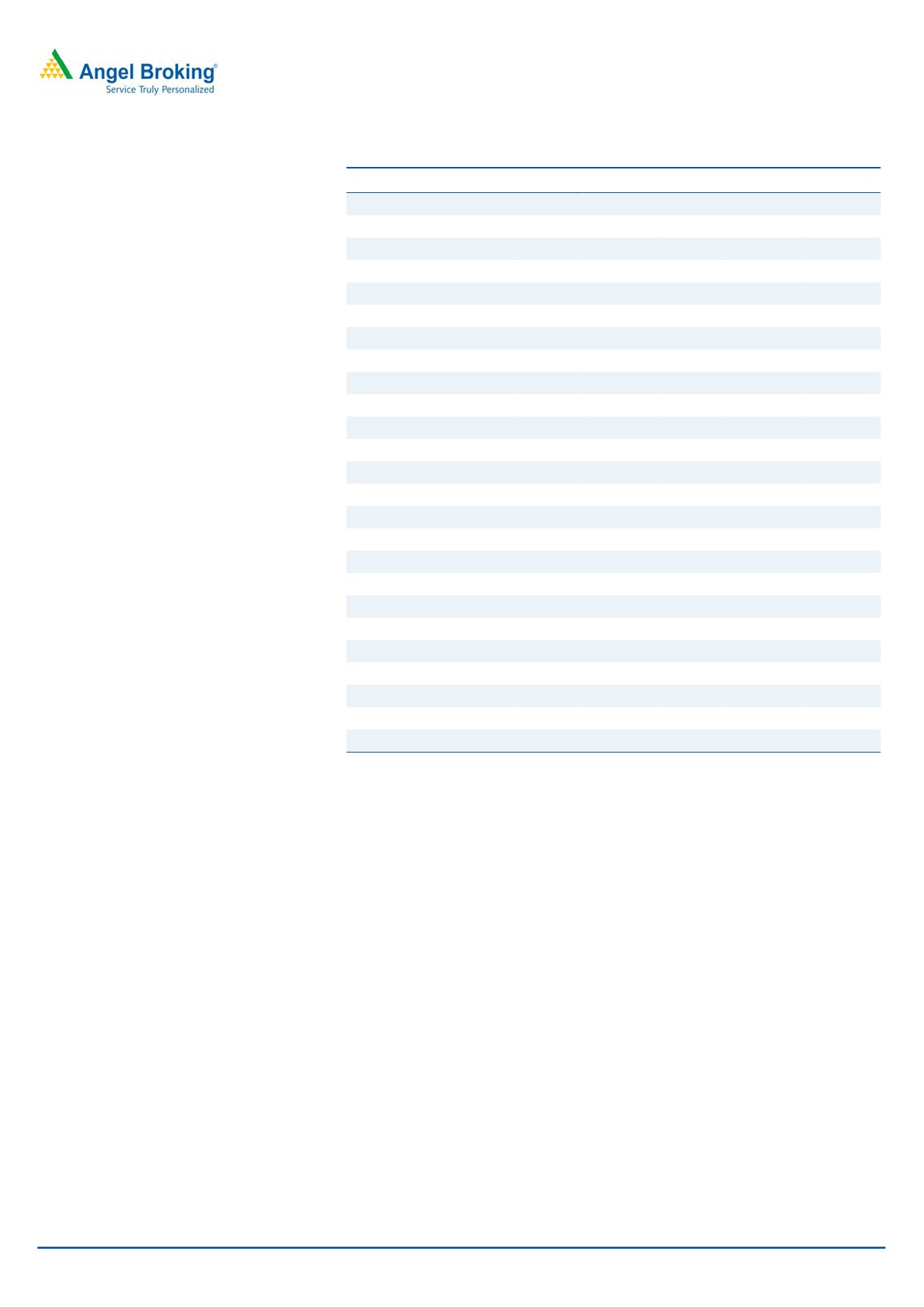

Exhibit 1: 3QFY2016 performance (Standalone)

(` cr)

3QFY16

3QFY15

yoy%

2QFY16

qoq%

9MFY16

9MFY15

yoy%

Net sales

3,385

3,804

(11.0)

3,908

(13.4)

10,889

10,516

3.6

Other operating income

45

49

(8.1)

125

(63.7)

205

147

39.2

Revenue

3,431

3,853

(11.0)

4,033

(14.9)

11,094

10,663

4.0

Manufacturing exp.

715

478

49.6

675

5.9

1,888

1,744

8.2

% of net sales

21.1

12.6

17.3

17.3

16.6

Selling & admin exp.

363

370

(1.7)

306

18.6

1,299

871

49.1

% of net sales

10.7

9.7

7.8

11.9

8.3

Other expenditure

874

917

(4.6)

888

(1.5)

2,604

2,609

(0.2)

% of net sales

25.8

24.1

22.7

23.9

24.8

Total expenditure

1,952

1,764

10.7

1,869

4.4

5,791

5,224

10.9

% of net sales

57.7

46.4

47.8

53.2

49.7

EBITDA

1,478

2,089

(29.2)

2,164

(31.7)

5,303

5,438

(2.5)

Margin (%)

43.1

54.2

(11pp)

53.7

(11pp)

47.8

51.0

(791bp)

Interest

5

1

546.8

1

322.3

8

10

(18.2)

Depreciation

172

209

(17.9)

175

(1.9)

520

617

(15.8)

Other income

555

812

(31.7)

869

(36.2)

1,987

2,226

(10.7)

Profit before tax

1,856

2,692

(31.0)

2,857

(35.0)

6,763

7,037

(3.9)

% of net sales

54.8

70.8

73.1

62.1

66.9

Tax

45

312

572

745

857

(13.0)

% of PBT

2.4

11.6

20.0

11.0

12.2

Reported net profit

1,811

2,379

(23.9)

2,285

(20.7)

6,017

6,181

(2.6)

Adjusted Net Profit

1,811

2,379

(23.9)

2,285

(20.7)

6,017

6,183

(2.7)

Source: Company, Angel Research

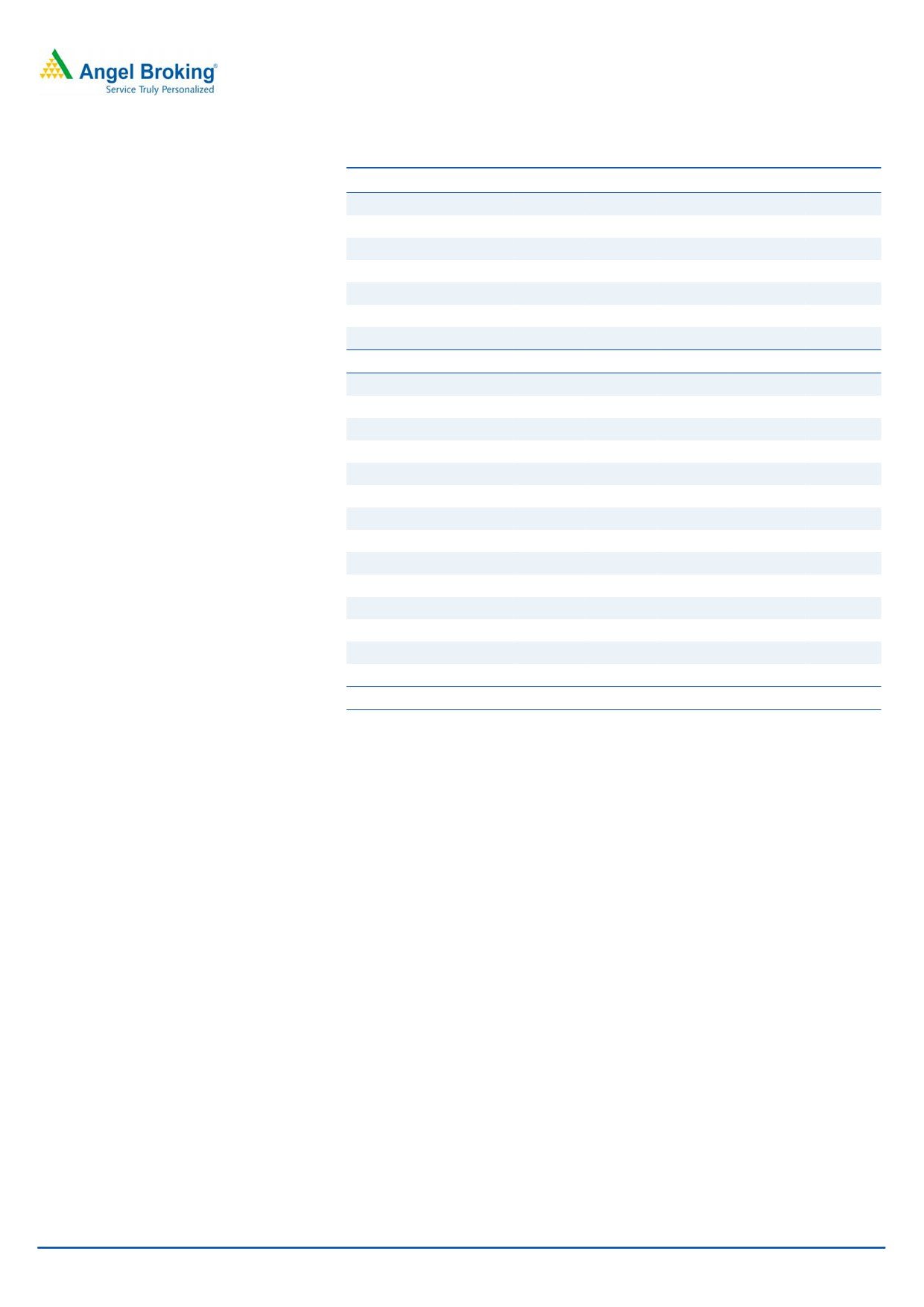

Exhibit 2: 3QFY2016 Actual vs. estimates

(` cr)

Actual

Estimates

Variation (%)

Net sales

3,385

3,384

-

EBITDA

1,478

1,471

0.5

EBITDA margin (%)

43.7

43.5

20bp

Net Profit

1,811

1,656

9.4

Source: Company, Angel Research

Result highlights

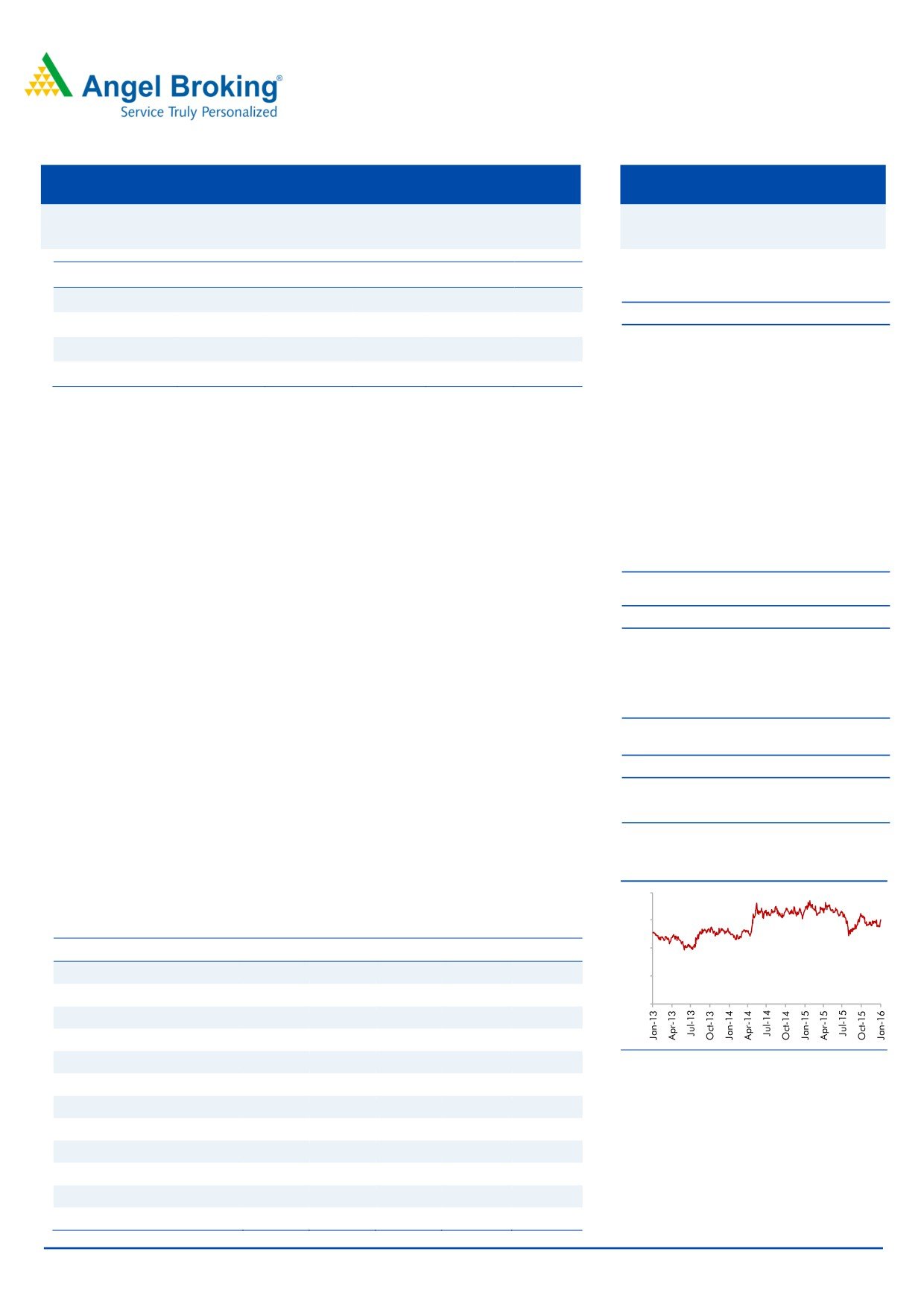

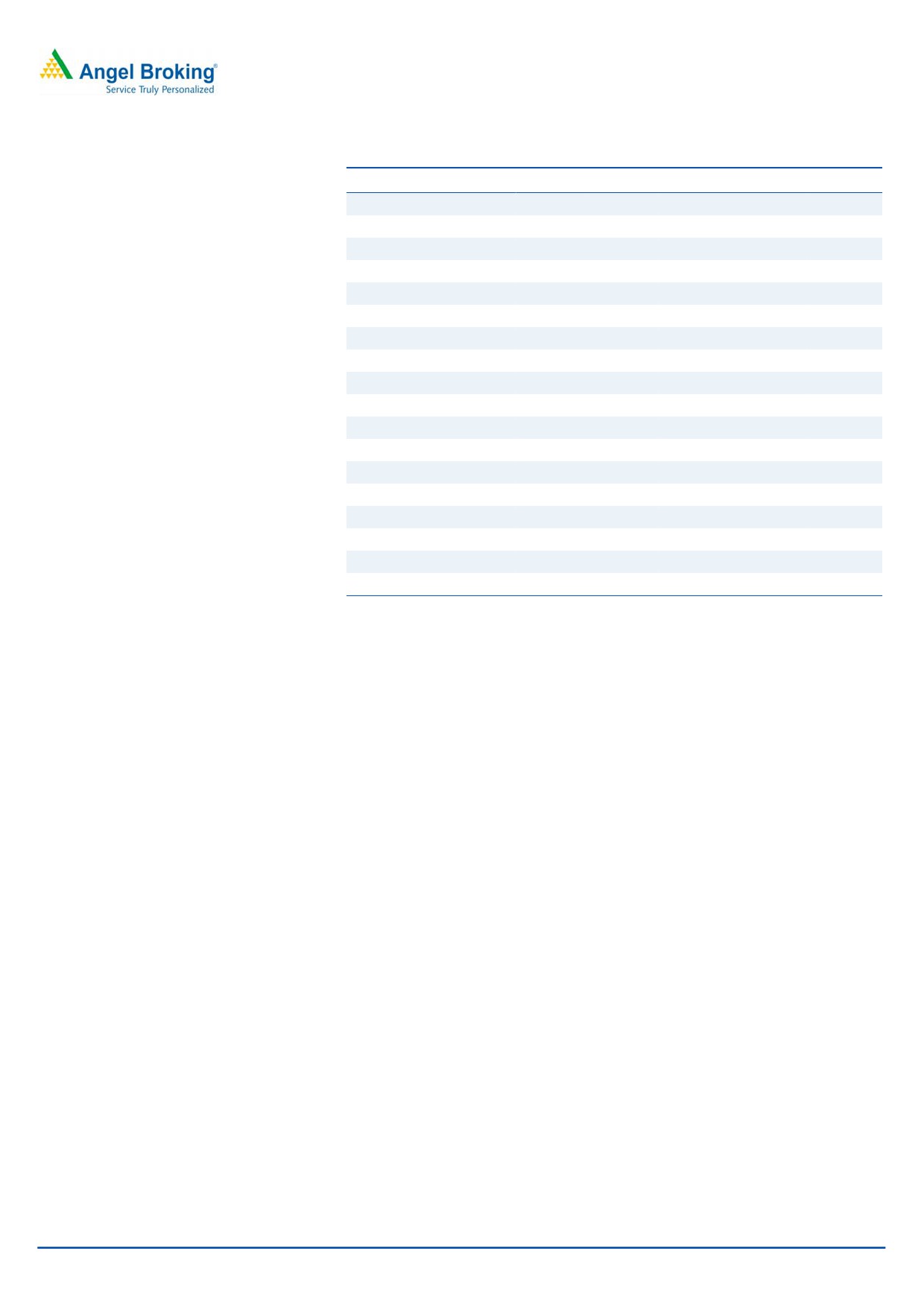

Better than expected volumes drive revenue

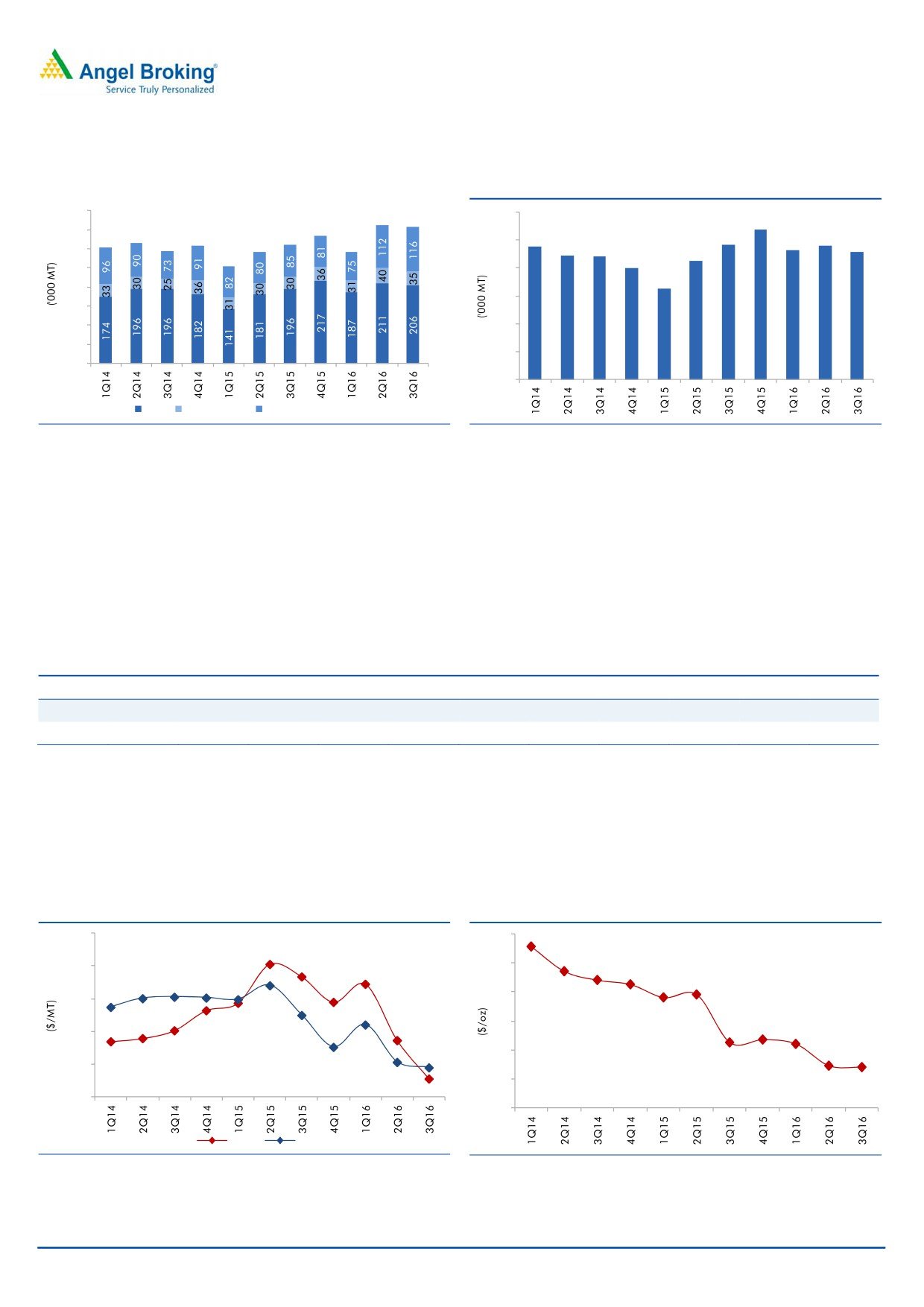

HZL reported a 11% yoy decline in revenue for the quarter at `3,385cr, in line with

estimates, led by a 17% decline in zinc revenues as higher volumes and rupee

depreciation benefits were offset by lower realizations on account of a decline in

LME prices and zinc premiums. Mined metal production declined 13% yoy to

2,40,000MT led by increased contributions from Sindesar Khurd and Kayad

mines, resulting in lower average grades. Volume growth however continued to

remain strong with refined zinc production increasing 5% yoy at 2,06,000MT while

refined lead and silver production came in ahead of estimates. Refined lead

production increased 17% yoy to 35,000MT, while refined silver production

jumped 37% yoy to 116,000MT.

January 27, 2016

2

Hindustan Zinc | 3QFY2016 Result Update

Exhibit 3: Strong volume growth drives revenue growth

Exhibit 4: Mined metal production

300

400

269

350

242

240

250

238

232

228

222

220

300

213

200

250

200

163

200

150

150

100

100

50

50

0

0

Zinc

Refined Lead

Refined Saleable Silver

Source: Company, Angel Research

Source: Company, Angel Research

The EBITDA for the quarter was also in line with our expectation at `1,478cr,

declining 29% yoy, led by lower LME prices and `84cr contribution towards the

District Mineral Foundation (DMF). Depreciation and finance expenses came in line

with our expectation. Tax rate for 9MFY2016 stands at 11% on account of higher

proportion of tax efficient investment income and change in methodology of

accounting for long-term capital gain, with significant investments now becoming

long-term. The lower tax rate resulted in net profit coming in 9% ahead of our

expectation at `1,811cr.

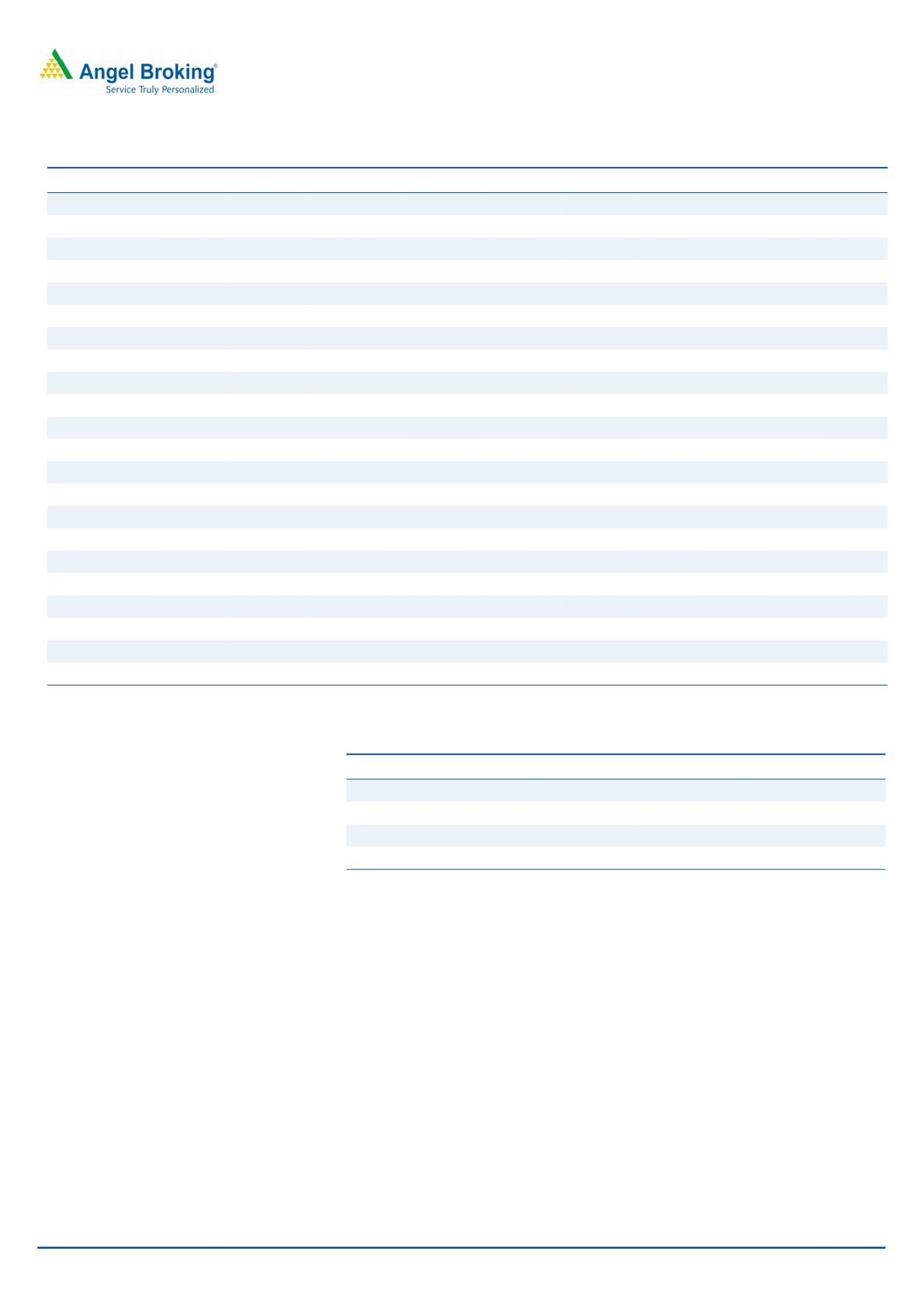

Exhibit 5: EBITDA Margin jumps 212bp yoy

(` cr)

1Q14

2Q14

3Q14

4Q14

1Q15

2Q15

3Q15

4Q15

1Q16

2Q16

3Q16

EBITDA

1,498

1,822

1,824

1,755

1,352

1,997

2,089

1,978

1,660

2,164

1,478

Margin (%)

50.2

51.2

52.9

48.2

45.0

52.5

54.2

48.0

45.7

53.7

43.1

Source: Company, Angel Research

The Management has maintained its guidance for FY2016, despite a weaker mine

plan in 4QFY2016. The ongoing expansion projects also remain on track with

16km of mine development during the quarter, 55% higher than the 3QFY2015

and an all time record for the company.

Exhibit 6: Zinc & Lead Prices continue to decline

Exhibit 7: Silver prices down 10% yoy

2500

24

2300

22

20

2100

18

1900

16

1700

14

1500

12

Zinc

Lead

Source: Company, Angel Research

Source: Company, Angel Research

January 27, 2016

3

Hindustan Zinc | 3QFY2016 Result Update

Exhibit 8: Zinc revenue declines 17% yoy

Exhibit 9: Lead revenue remains flat yoy

3,500

50%

600

40%

3,000

40%

500

30%

30%

2,500

400

20%

20%

2,000

10%

300

10%

1,500

0%

200

0%

1,000

-10%

500

100

-10%

-20%

0

-30%

0

-20%

Zinc Revenue (` Cr)

yoy (%)

Lead (` Cr)

yoy (%)

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 10: Silver volumes jump 37% yoy

Exhibit 11: Lower zinc premiums drag revenue

450

40%

4,500

30%

400

30%

4,000

20%

20%

350

3,500

10%

300

3,000

0%

10%

250

2,500

-10%

200

2,000

-20%

0%

150

1,500

-30%

100

1,000

-40%

-10%

50

-50%

500

0

-60%

0

-20%

Silver (` Cr)

yoy (%)

Total Sales (` Cr)

yoy (%)

Source: Company, Angel Research

Source: Company, Angel Research

Production growth at Sindesar Khurd mine crossed the 3MTPA run rate during the

quarter, well ahead of schedule. The mill debottlenecking project has also been

completed in-line with the mine production and the company has commenced a

new mill project with a capacity of 1.5 MTPA during the quarter and is expected to

be commissioned in 4QFY2017. The shaft sinking project continues to be ahead of

plan. Despite a slowdown due to much higher rock support and safety precautions

at Rampura Agucha, the main shaft sinking project crossed 860 meters during the

quarter of the ultimate depth of 950 meters. The ramp-up of Kayad mine also

remains on track and is expected to achieve 1 MTPA production capacity run rate

by this year-end, making it one of the fastest underground mine ramp-ups. In light

of the challenging environment for metals, the company is reviewing the Zawar

and Rajpura Dariba Mine expansion projects.

The Management expects zinc demand to grow at a compounded average annual

run rate of 2% per annum with the fundamentals of zinc continuing to remain

strong on the back of planned mine closures and medium-term supply shortages.

However, the weak sentiment and nervousness related to the slowdown in China

are dragging prices down contrary to the emerging demand supply imbalances in

zinc.

January 27, 2016

4

Hindustan Zinc | 3QFY2016 Result Update

Investment arguments

Volume growth to remain strong

HZL’s Management has guided for a ~16% increase in refined metal production

volumes in FY2016, led by the strong performance in 2QFY2016. The

Management expects total integrated silver production to be 375,000MT in

FY2016. The Management also indicated that the expansion projects remain on

track, which should help the company drive volumes. The Management had kept

the capex guidance unchanged at ~$200-$225mn, including sustenance capex.

We expect these capacity expansions to help the company offset the pressure from

falling realizations.

Zinc prices may continue to remain under pressure

We believe with the slowdown in China and in overall steel demand, it will be

difficult for zinc prices to firm up over the coming years. Our outlook for zinc prices

continues to remain negative and we are not factoring any improvement in prices

over FY2015-17, leading to a 5%/8% decline in revenue in FY2016 and FY2017,

respectively. Led by the decline in revenue, we expect the EBITDA to decline by

~11-12% in FY2016 and FY2017, respectively.

January 27, 2016

5

Hindustan Zinc | 3QFY2016 Result Update

Outlook and valuation

We expect zinc prices to continue to decline going forward led by global

headwinds. We have however retained our volume estimates, led by the healthy

growth during the quarter. We reduce our FY2016 and FY2017 estimates in view

of the higher than expected fall in realizations and fall in zinc premiums. The stock

is currently trading at 4.2x FY2017E EV/EBITDA. We value the stock at 6x FY2017E

EV/EBITDA and arrive at a target price of `170. We retain our Accumulate rating

on the stock.

Exhibit 12: Valuation (FY2017E)

(` cr)

Adj. EBITDA

5,750

Multiple (x)

6

Total EV

34,492

Net Cash

37,112

Equity Value

71,604

Target price (`)

170

Source: Angel Research

Company background

Hindustan Zinc is one of the world's largest integrated producers of zinc and is

among the leading global lead and silver producers. With reserves and resources

of 375.1mn tonne, the company is one of the lowest cost producers in the world

and is well placed to serve the growing demand in Asia. Hindustan Zinc is a

subsidiary of the London listed diversified metals and mining major, Vedanta

Resources plc.

January 27, 2016

6

Hindustan Zinc | 3QFY2016 Result Update

Profit & Loss Statement (Standalone)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E

Net Sales

12,700

13,636

14,788

14,105

12,977

Other operating income

0

0

0

0

0

Total operating income

12,700

13,636

14,788

14,105

12,977

% chg

11.4

7.4

8.5

(4.6)

(8.0)

Total Expenditure

6,209

6,736

7,372

7,538

7,228

Manufacturing Expenses

4,753

5,134

5,375

5,866

5,658

Selling & General Expenses

1,338

1,557

1,919

1,672

1,570

Other Expenses

118

45

78

0

0

EBITDA

6,491

6,900

7,417

6,567

5,749

% chg

7.7

6.3

7.5

(11.5)

(12.5)

(% of Net Sales)

51.1

50.6

50.2

46.6

44.3

Depreciation& Amortisation

647

785

644

691

766

EBIT

5,844

6,115

6,773

5,875

4,982

% chg

7.9

4.6

10.7

(13.2)

(15.2)

(% of Net Sales)

46.0

44.8

45.8

41.7

38.4

Interest & other Charges

27

45

24

13

16

Other Income

2,003

1,899

2,821

2,633

2,370

Profit before tax

7,820

7,970

9,570

8,495

7,336

% chg

12.6

1.9

20.1

(11.2)

(13.6)

Tax Expense

921

1,065

1,392

983

1,320

(% of PBT)

11.8

13.4

14.5

11.6

18.0

Recurring PAT

6,899

6,905

8,178

7,512

6,015

Adjusted PAT

6,064

6,059

6,448

7,512

6,015

% chg

19.8

(0.1)

6.4

16.5

(19.9)

(% of Net Sales)

47.7

44.4

43.6

53.3

46.4

January 27, 2016

7

Hindustan Zinc | 3QFY2016 Result Update

Balance Sheet (Standalone)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E

SOURCES OF FUNDS

Equity Share Capital

845

845

845

845

845

Reserves & Surplus

31,431

36,573

42,508

48,034

51,937

Shareholders Funds

32,276

37,418

43,353

48,879

52,782

Total Loans

0

0

0

0

0

Deferred Tax Liability

1,280

1,658

2,519

2,997

3,314

Other Long term liabilities

28

56

132

152

182

Total Liabilities

33,584

39,132

46,004

52,027

56,278

APPLICATION OF FUNDS

Gross Block

12,281

13,600

14,551

16,051

17,551

Less: Acc. Depreciation

3,797

4,453

5,104

5,796

6,562

Net Block

8,484

9,147

9,446

10,255

10,989

Capital Work-in-Progress

1,082

1,541

2,005

2,105

2,210

Investments

14,540

22,506

27,254

31,342

35,103

Current Assets

9,222

5,543

5,950

5,948

4,631

Cash

6,942

3,031

3,532

3,197

2,009

Inventories

1,111

1,198

1,212

1,411

1,298

Debtor

403

400

659

705

649

Other

766

914

548

635

675

Current liabilities

1,882

2,545

2,988

2,609

2,141

Net Current Assets

7,341

2,998

2,962

3,338

2,490

Other Assets

2,137.5

2,939.4

4,337.3

4,987.9

5,486.7

Total Assets

33,584

39,132

46,004

52,027

56,278

January 27, 2016

8

Hindustan Zinc | 3QFY2016 Result Update

Cash flow statement (Standalone)

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E FY2017E

Profit before tax

7,820

7,970

9,570

8,495

7,336

Depreciation

647

785

645

691

766

Change in Working Capital

(984)

(505)

(187)

(711)

(339)

Others

(1,087)

(1,133)

(2,463)

(631)

(468)

Direct taxes paid

(1,611)

(1,645)

(2,033)

(505)

(1,003)

Cash Flow from Operations

4,785

5,471

5,531

7,340

6,291

(Inc.)/ Dec. in Fixed Assets

(1,753)

(1,709)

(1,611)

(1,600)

(1,605)

(Inc.)/ Dec. in Investments

(629)

(6,825)

(2,285)

(4,088)

(3,761)

Others

(888)

4,578

89

-

-

Cash Flow from Investing

(3,269)

(3,955)

(3,807)

(5,688)

(5,366)

Issue of Equity

-

-

-

-

-

Inc./(Dec.) in loans

-

-

-

-

-

Dividend Paid (Incl. Tax)

(1,228)

(1,532)

(1,879)

(1,986)

(2,113)

Others

(27)

(45)

(24)

-

-

Cash Flow from Financing

(1,255)

(1,577)

(1,902)

(1,986)

(2,113)

Inc./(Dec.) in Cash

261

(62)

(178)

(334)

(1,188)

Opening Cash balances

29

290

228

3,532

3,197

Closing Cash balances

290

228

50

3,197

2,009

January 27, 2016

9

Hindustan Zinc | 3QFY2016 Result Update

Key ratios

Y/E March

FY2013

FY2014

FY2015

FY2016E FY2017E

Per Share Data (`)

Reported EPS

16.3

16.3

19.4

17.8

14.2

Adjusted EPS

14.4

14.3

15.3

17.8

14.2

Cash EPS

17.9

18.2

20.9

19.4

16.1

DPS

3.1

3.5

4.4

4.7

5.0

Book Value

76.4

88.6

102.6

115.7

124.9

Valuation Ratio (x)

P/E (on FDEPS)

9.2

9.2

7.8

8.5

10.6

P/CEPS

8.5

8.3

7.2

7.8

9.4

P/BV

2.0

1.7

1.5

1.3

1.2

Dividend yield (%)

2.1

2.3

2.9

3.1

3.3

EV/Sales

3.3

2.8

2.2

2.1

2.1

EV/EBITDA

6.5

5.5

4.5

4.5

4.6

EV/Total Assets

1.3

1.0

0.7

0.6

0.5

Returns (%)

ROCE

19.8

17.5

16.8

12.7

9.8

ROE

23.3

19.8

20.2

16.3

11.8

Turnover ratios (x)

Asset Turnover (Gross Block)

1.1

1.1

1.1

0.9

0.8

Inventory (days)

27.4

30.9

29.7

33.9

38.1

Receivables (days)

10.6

10.7

13.1

17.6

19.0

Payables (days)

48.3

59.2

68.3

72.4

66.8

WC cycle (ex-cash) (days)

8.7

4.9

(7.4)

(5.5)

8.7

January 27, 2016

10

Hindustan Zinc | 3QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Hindustan Zinc

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

January 27, 2016

11