2QFY2016 Result Update | Media

October 27, 2015

Hindustan Media Ventures

NEUTRAL

CMP

`275

Performance Highlights

Target Price

-

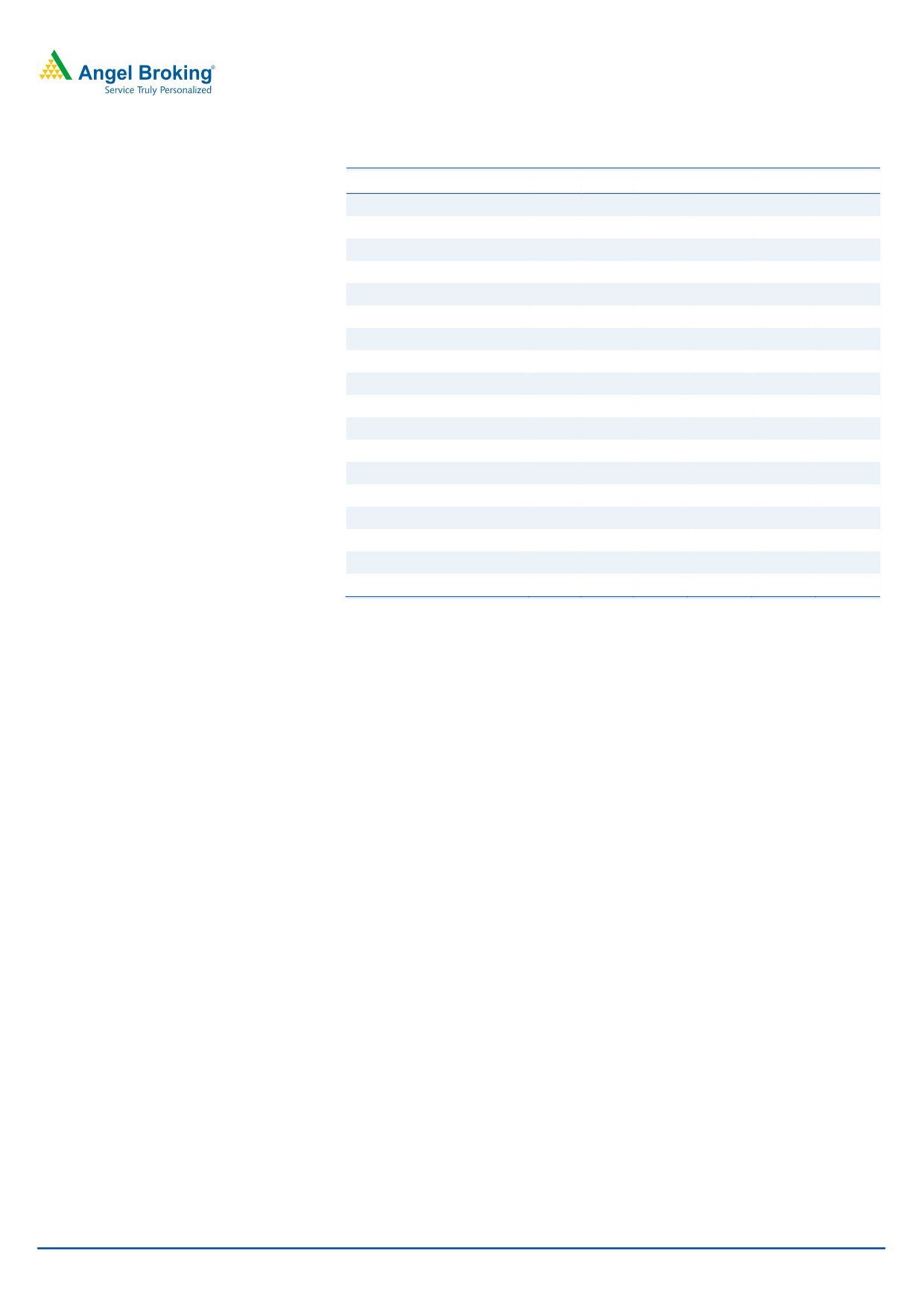

Quarterly Data

Investment Period

-

(` cr)

2QFY16

2QFY15

% yoy

1QFY15

% qoq

Revenue

227

200

13.7

224

1.4

Stock Info

EBITDA

52

39

33.1

55

(4.5)

Sector

Media

Margin (%)

22.9

19.6

334bp

24.4

(142bp)

Market Cap (` cr)

2,048

Reported PAT

45

31

43.1

42

8.0

Net Debt (` cr)

576

Source: Company, Angel Research

Beta

0.8

52 Week High / Low

289 / 168

For 2QFY2016, Hindustan Media Ventures Ltd (HMVL) reported earnings above

Avg. Daily Volume

20,623

our estimates. The top-line growth was healthy with strong growth in advertising

Face Value (`)

10

and circulation revenue. Advertising revenue growth for the quarter was strong due to

BSE Sensex

27,253

pick-up in ad spends by industries. On the operating front, the company’s performance

Nifty

8,233

was strong, which led to a higher PAT growth.

Reuters Code

HINS.BO

Strong growth in ad and circulation revenue: HMVL registered a growth of ~18%

Bloomberg Code

HMVL@IN

yoy in advertising revenue to ~`168cr, on back of increase in advertising yields

and volumes. Further, the company reported a ~8% yoy growth in circulation revenue

Shareholding Pattern (%)

to `53cr on back of higher circulation as well as realization per copy.

Promoters

74.9

Higher PAT on back of strong operating performance: The company reported a

MF / Banks / Indian Fls

13.1

strong PAT growth of ~43% yoy due to strong operating performance. The

FII / NRIs / OCBs

5.4

operating performance was strong on account of lower cost of news print which is

Indian Public / Others

6.6

a key raw material for HMVL.

Outlook and valuation: Going forward, we believe that the company would

Abs. (%)

3m 1yr

3yr

perform well, both on the top-line and bottom-line fronts, on back of strong

Sensex

0.6

1.9

46.3

recovery in the Indian economy. Further, we expect strong growth in both

HMVL

13.1

13.1

127.3

advertising and circulation revenue due to the company’s strong presence in the

states of Uttar Pradesh, Uttarakhand, Bihar and Jharkhand. Further, HT Media is

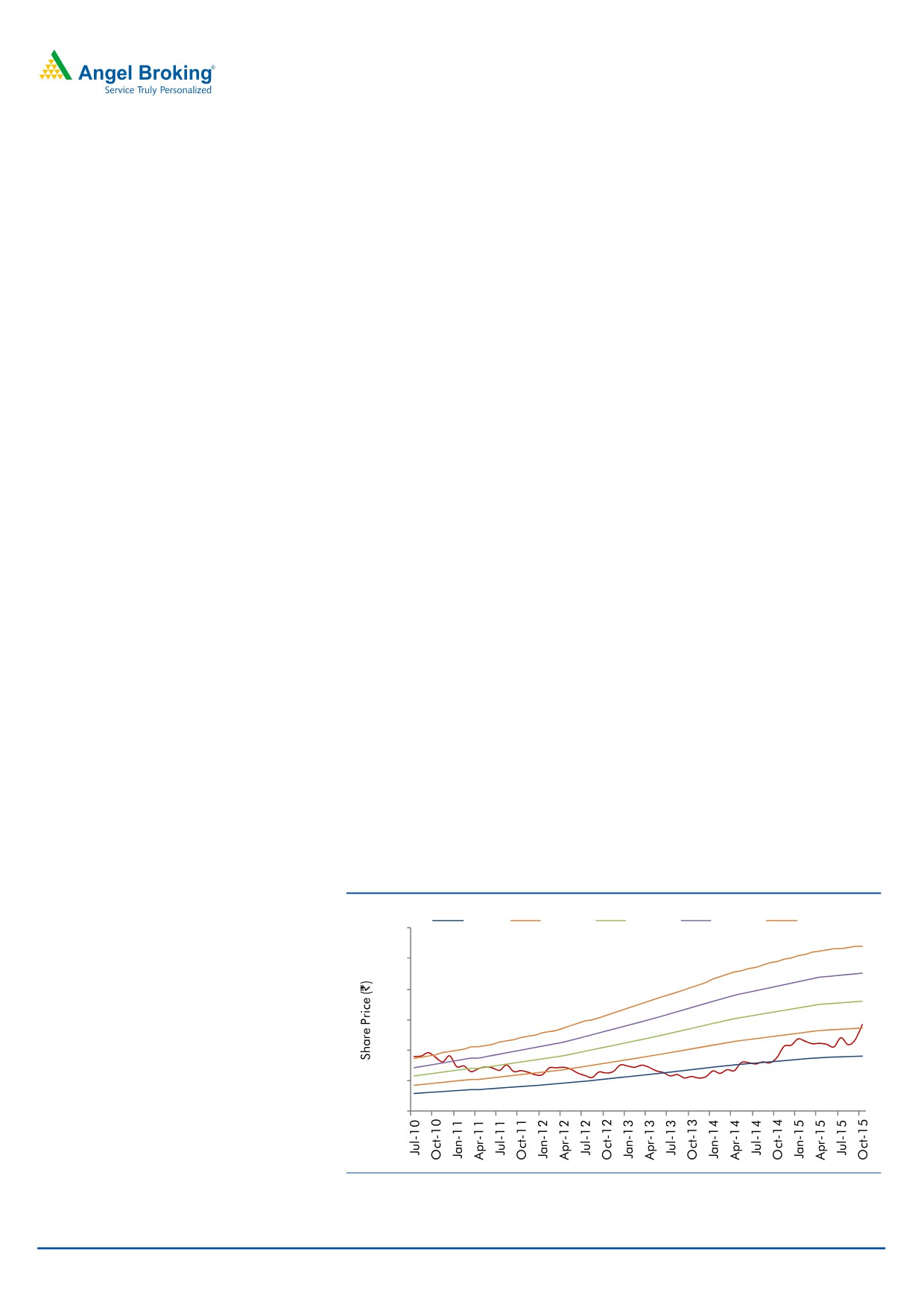

3-year price chart

hiving off its online content business to Hindustan Media Ventures. We are awaiting

300

further clarifications on the deal from the Management in order to assess its financial

250

implications. Until then, we retain our Neutral rating on the stock.

200

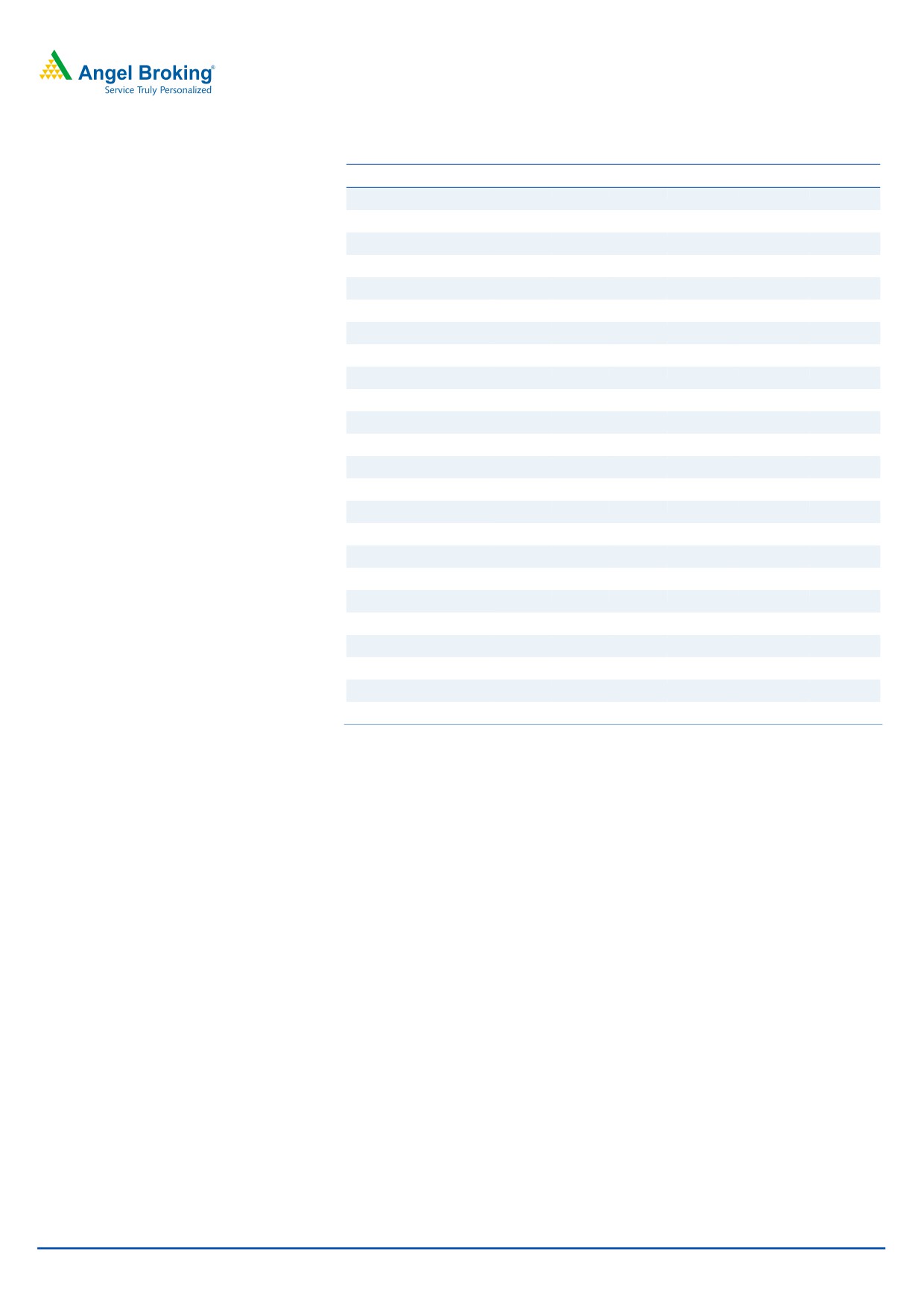

Key financials (Consolidated)

150

Y/E March (` cr)

FY2014

FY2015

FY2016E

FY2017E

100

Net Sales

730

819

907

1,008

50

% chg

14.7

12.2

10.8

11.2

0

Net Profit (Adj.)

111

141

145

155

% chg

31.6

26.7

3.2

6.3

Source: Company, Angel Research

EBITDA margin (%)

20.7

20.3

20.2

20.2

EPS (`)

15.2

19.2

19.8

21.1

P/E (x)

16.7

13.2

12.8

12.0

P/BV (x)

3.0

2.5

2.1

1.8

RoE (%)

18.3

19.0

16.6

15.1

RoCE (%)

20.6

16.9

15.9

15.3

Amarjeet S Maurya

EV/Sales (x)

2.0

1.7

1.5

1.2

022-39357800 Ext: 6831

EV/EBITDA (x)

9.8

8.2

7.3

6.2

Source: Company, Angel Research; Note: CMP as of October 27, 2015

Please refer to important disclosures at the end of this report

1

Hindustan Media Ventures | 2QFY2016 Result Update

Exhibit 1: Quarterly performance

Y/E March (` cr)

2QFY16

2QFY15

% yoy

1QFY16

% qoq

FY2015

FY2014

% chg

Net Sales

226.92

199.54

13.7

223.72

1.4

819

730

12.2

Consumption of RM

86

85

1.6

84

2.3

338

301

12.3

(% of Sales)

38.0

42.5

37.6

41.2

41.2

Staff Costs

30

26

15.9

29

4.0

107

87

23.4

(% of Sales)

13.2

12.9

12.8

13.0

11.9

Other Expense

59

50

17.9

56

4.5

208

191

8.5

(% of Sales)

25.9

25.0

25.2

25.4

26.2

Total Expenditure

175

160

9.0

169

3.3

652

578

12.7

Operating Profit

52

39

33.1

55

(4.5)

166

151

10.1

OPM (%)

22.9

19.6

24.4

20.3

20.7

Interest

3

3

5.2

3

5.9

11

6

Depreciation

5

6

(17.4)

6

(3.1)

24

22

12.8

Other Income

19

12

57.7

12

63.0

56

31

84.6

PBT

63

42

49.9

58

8.5

188

155

21.7

(% of Sales)

27.6

21.0

25.8

23.0

21.2

Provision for Taxation

18

10

70.5

16

9.9

47

43

8.9

(% of PBT)

28.2

24.8

27.8

25.1

28.0

Minority Interest

0

0

Recurring PAT

45

31

43.1

42

8.0

141

111

26.7

PATM

19.8

15.8

18.6

17.2

15.2

Exceptional items

0

0

Reported PAT

45

31

43.1

42

8.0

141

111

26.7

Equity shares (cr)

7.3

7.3

7.3

7.3

7.3

FDEPS (`)

6.1

4.3

43.1

5.7

8.0

19.2

15.2

26.7

Source: Company, Angel Research

October 27, 2015

2

Hindustan Media Ventures | 2QFY2016 Result Update

Strong top-line growth

For 2QFY2016, HMVL reported a healthy top-line growth of ~14% yoy to

~`227cr (excluding other income), owing to growth in advertising and circulation

revenue. Overall, the company registered a ~18% yoy growth in advertising

revenue to ~`168cr, primarily due to increase in advertising yields and volumes.

Further, the company reported a ~8% yoy growth in circulation revenue to ~`53cr

on back of higher circulation and realization per copy. During the quarter, there

was an increase in ad spend by companies in several sectors (barring education

and real estate sectors). Moreover, the company expects an improvement in

circulation revenue owing to its strong presence in the states of Uttar Pradesh and

Uttarakhand, and continuing dominance in Bihar and Jharkhand.

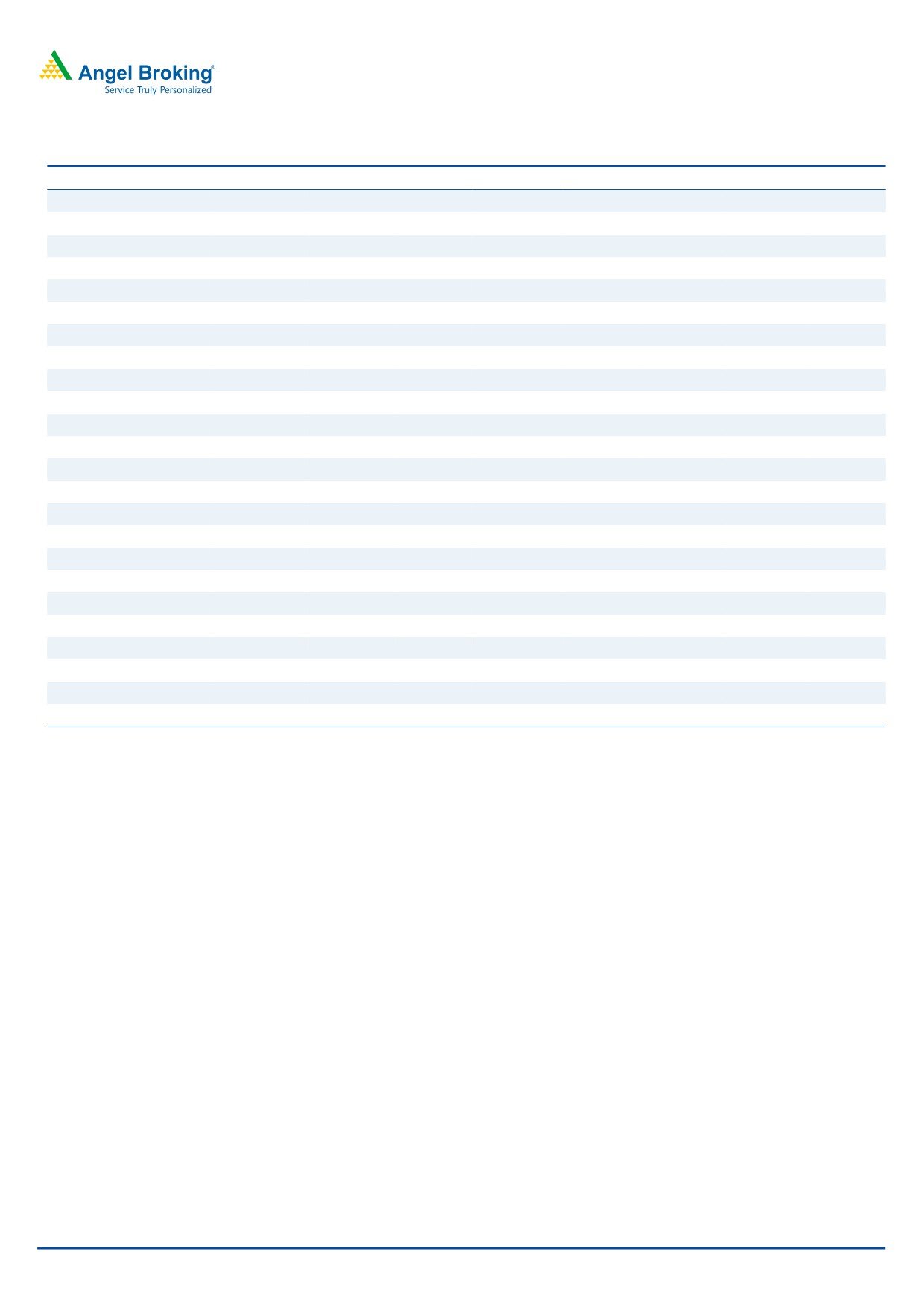

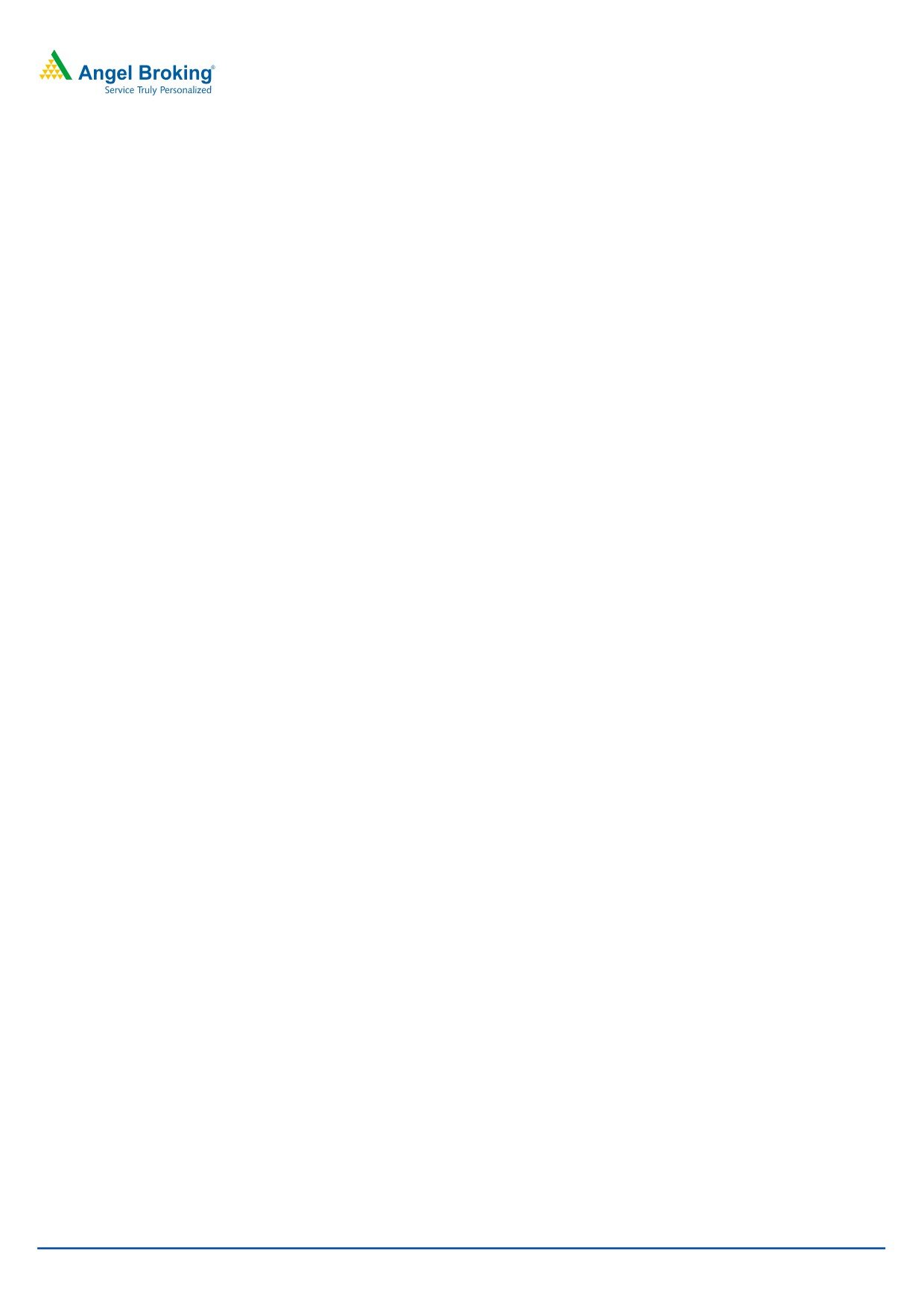

Exhibit 2: Top-line growth trend

250

20

15

200

10

150

5

100

0

50

(5)

0

(10)

Net Sales

QoQ growth (%)

Source: Company, Angel Research

Strong operating performance due to lower material costs

For the quarter, the company reported an operating profit of

~`52cr, up

~33% yoy. The operating margin expanded by a significant 334bp yoy on account of

lower raw material costs as a percentage of sales which were down 452bp yoy due to

decline in cost of news print which is a key raw material for HMVL. Going forward, the

Management expects margins to be better due to lower news print costs and with it

following an effective cost management strategy.

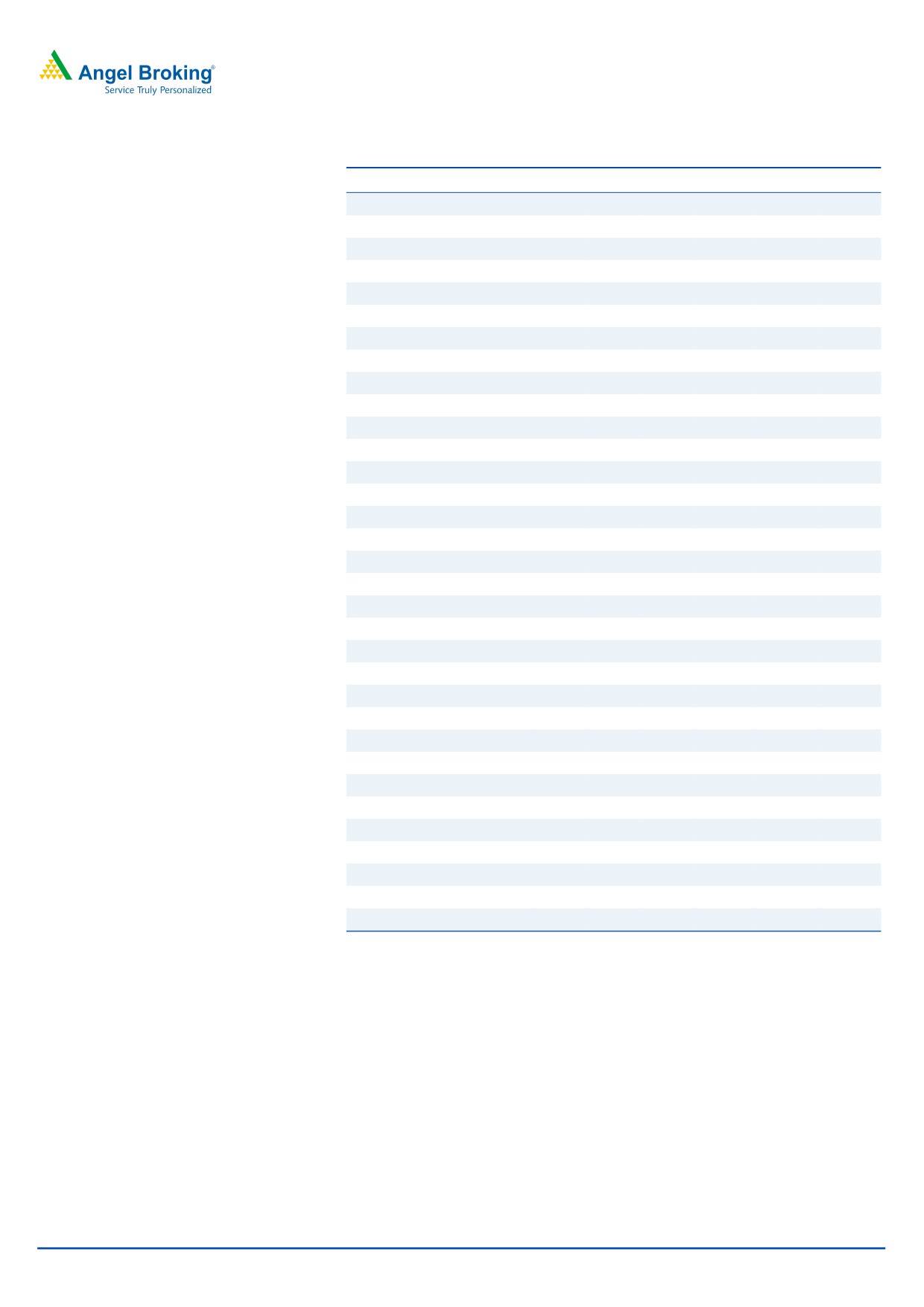

Exhibit 3: Operating profit and margin trend

60

30

50

25

40

20

30

15

20

10

10

5

0

0

Operating Profit

Margin (%)

Source: Company, Angel Research

October 27, 2015

3

Hindustan Media Ventures | 2QFY2016 Result Update

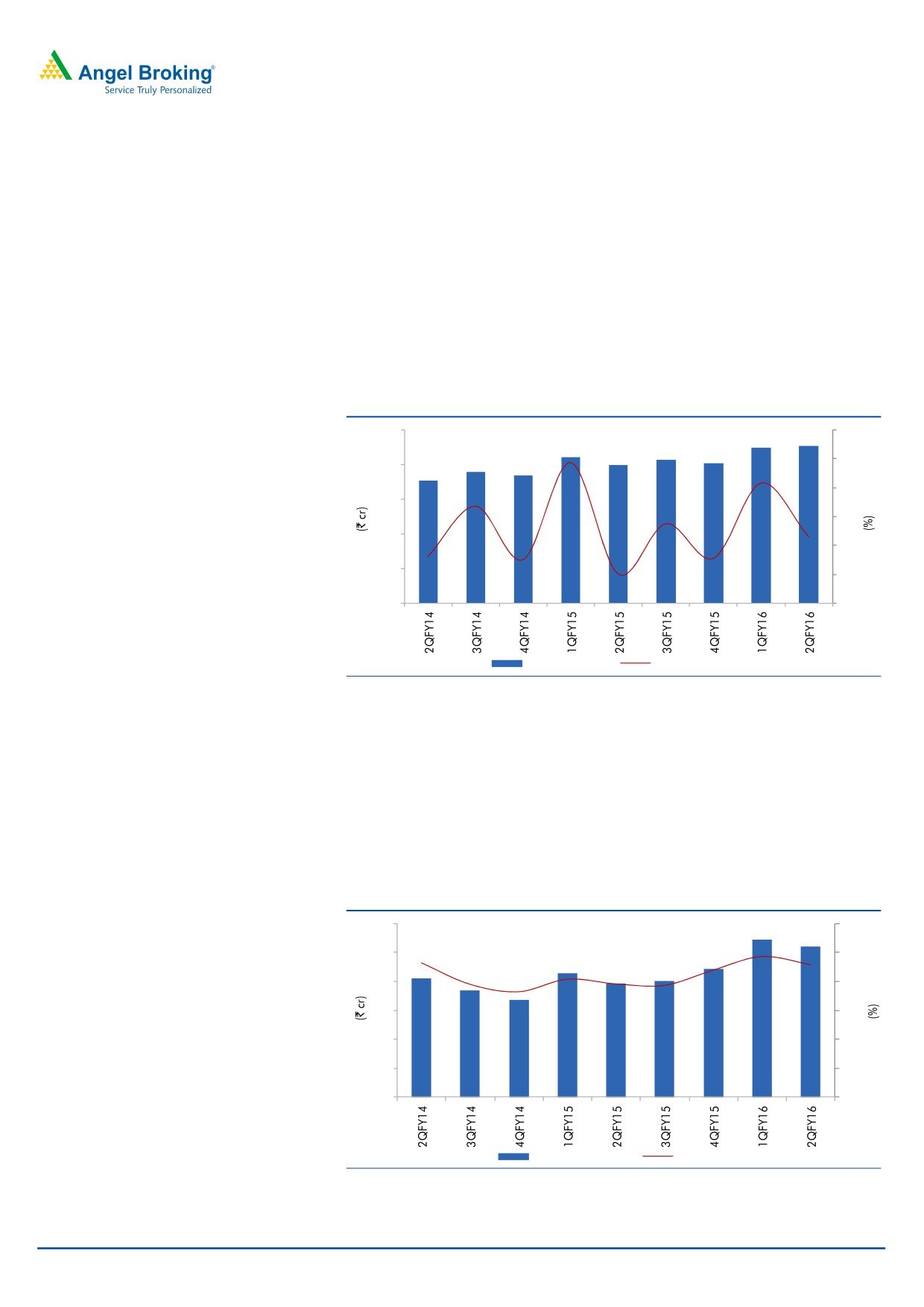

Higher PAT growth on back of strong operating performance

The company has reported strong PAT growth for the quarter of ~43% yoy to

`45cr due to strong operating performance and higher other income.

Exhibit 4: Net Profit and growth trend

50

30

45

25

40

20

35

15

30

10

25

5

20

0

15

(5)

10

(10)

5

(15)

0

(20)

Net Profit

QOQ growth (%)

Source: Company, Angel Research

October 27, 2015

4

Hindustan Media Ventures | 2QFY2016 Result Update

Investment rationale

Robust advertising revenue growth expected to continue

The combination of increase in advertising volume as well as yield has resulted in

a healthy double-digit advertising revenue growth for the company in the last few

quarters. The company reported a double-digit advertising revenue growth in Bihar

and Jharkhand and strong growth in advertising revenue in Uttar Pradesh, which

resulted in a healthy top-line growth for FY2015.

According to the Management, double-digit advertising revenue growth is likely to

continue, considering good gains in readership share, especially in Uttar Pradesh

and on expectations of an improvement in the Indian economy.

Consistent double-digit growth in circulation revenue

The company continues to consistently report double-digit growth in circulation

revenue aided by increase in circulation volume and higher realization per copy.

For FY2015, HMVL reported a growth of 12.4% yoy in circulation revenue. During

the year, HMVL has retained its market leadership in Uttarakhand, Bihar and

Jharkhand by a wide margin and also retained its number two position in Uttar

Pradesh and Delhi. Going forward, the Management expects growth momentum

in circulation revenue to continue owing to the company’s strong brand and

leadership position.

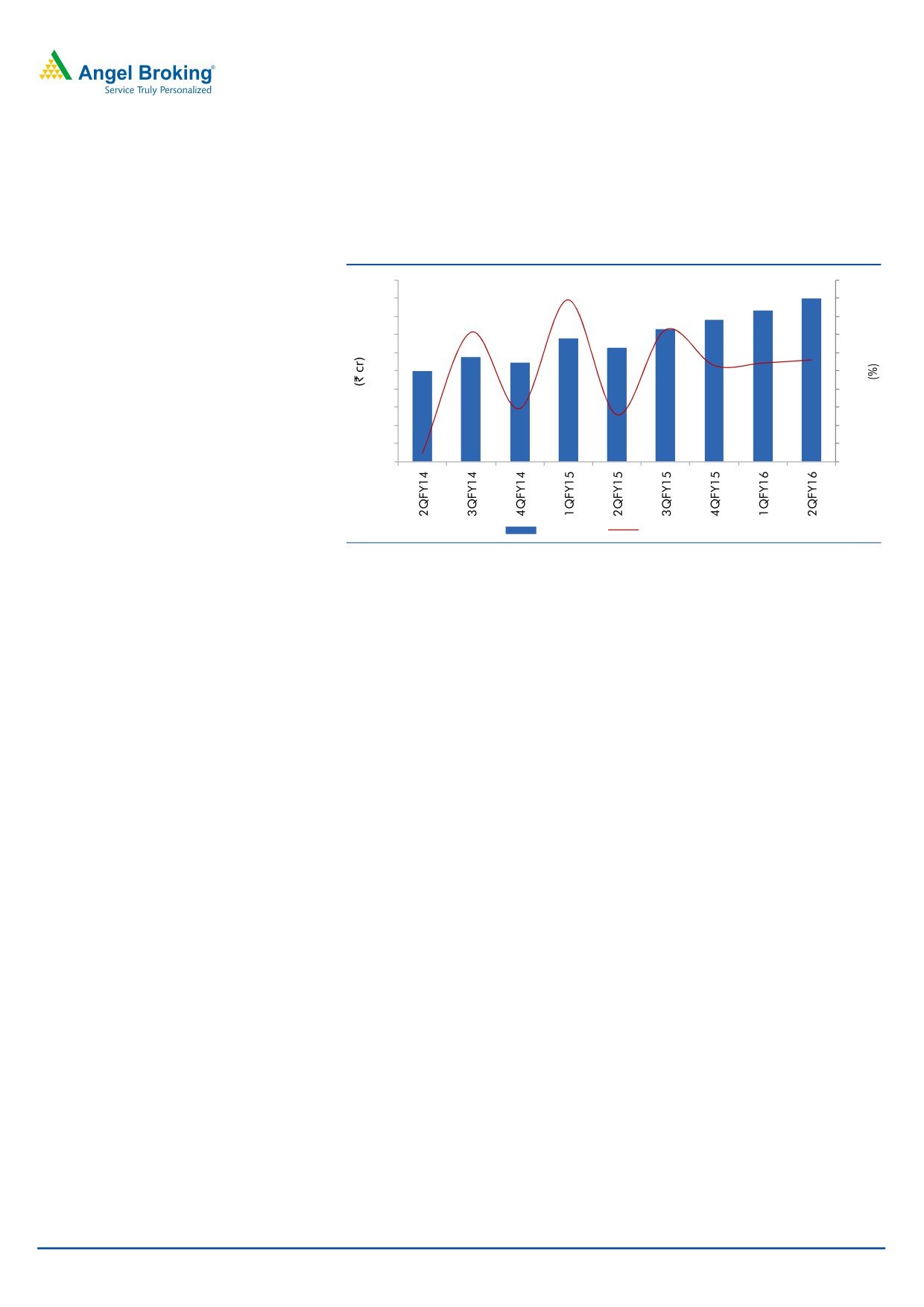

Outlook and valuation

Going forward, we believe that the company would perform well, both on the

top-line and bottom-line fronts, on back of strong recovery in the Indian economy.

Further, we expect strong growth in both advertising and circulation revenue due to

the company’s strong presence in the states of Uttar Pradesh, Uttarakhand, Bihar

and Jharkhand. Further, HT Media is hiving off its online content business to

Hindustan Media Ventures. We are awaiting further clarifications on the deal from the

Management in order to assess its financial implications. Until then, we retain our

Neutral rating on the stock.

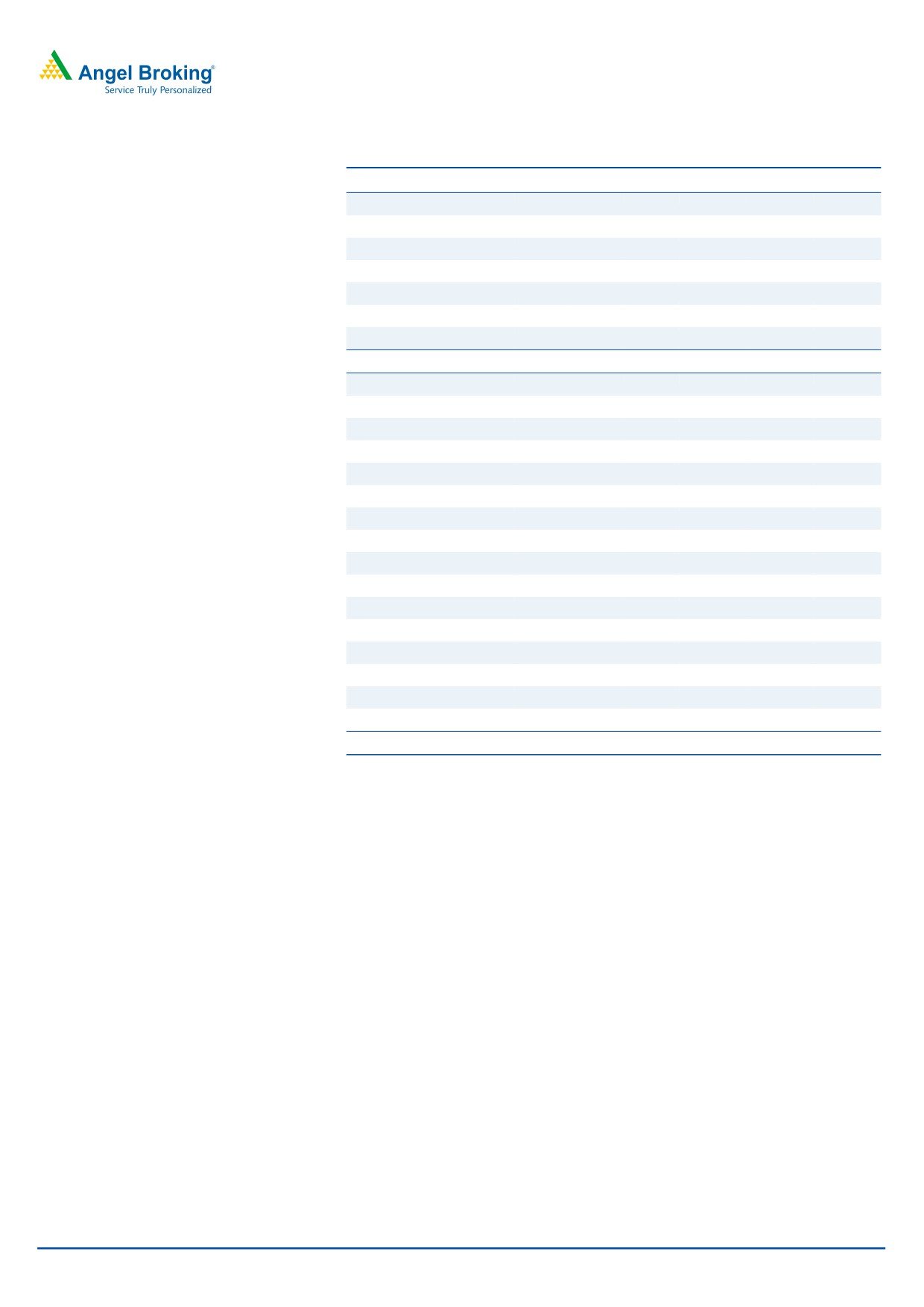

Exhibit 5: One-year forward P/E band

8.0 X

12.0 X

16.0 X

20.0 X

24.0 X

600

500

400

300

200

100

0

Source: Company, Angel Research

October 27, 2015

5

Hindustan Media Ventures | 2QFY2016 Result Update

Company Background

Hindustan Media Ventures Ltd is one of the leading print media companies in

India in terms of readership. The company publishes and prints 'Hindustan', the

third largest daily newspaper in India in terms of readership (9.9mn readers).

'Hindustan' has the largest readership in key Hindi-speaking markets of Bihar and

Jharkhand, with a strong and growing presence in Delhi NCR and the states of

Uttar Pradesh and Uttarakhand. 'Hindustan' is one of the fastest growing Hindi

daily newspapers in India.

October 27, 2015

6

Hindustan Media Ventures | 2QFY2016 Result Update

Profit and Loss Statement

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY17E

Total operating income

597

636

730

819

914

1,016

% chg

15.6

6.6

14.7

12.2

11.7

11.1

Total Expenditure

501

524

578

652

716

797

Cost of Materials

257

265

300

338

370

411

Personnel

73

80

87

107

126

144

Others

171

179

191

208

219

242

EBITDA

95

113

151

166

198

218

% chg

9.1

18.1

34.4

10.1

19.2

10.1

(% of Net Sales)

16.0

17.7

20.7

20.3

21.7

21.5

Depreciation& Amortisation

19

22

22

24

27

32

EBIT

76

91

130

142

171

187

% chg

7.0

19.7

42.7

9.6

20.3

9.2

(% of Net Sales)

12.7

14.3

17.8

17.4

18.7

18.4

Interest & other Charges

3

5

6

11

13

14

Other Income

19

28

31

56

62

64

(% of PBT)

20.8

25.0

19.8

30.0

28.2

27.0

Share in profit of Associates

-

-

-

-

-

-

Recurring PBT

92

114

155

188

220

237

% chg

20.4

24.3

35.5

21.7

17.1

7.6

Prior Period & Extra. Exp./(Inc.)

-

-

-

-

-

-

PBT (reported)

92

114

155

188

220

237

Tax

26

30

43

47

59

66

(% of PBT)

28.8

25.9

28.0

25.1

27.0

28.0

PAT (reported)

65

85

111

141

161

171

Add: Share of earnings of asso.

-

-

-

-

-

-

Less: Minority interest (MI)

-

-

-

-

-

-

PAT after MI (reported)

65

85

111

141

161

171

ADJ. PAT

65

85

111

141

161

171

% chg

21.9

29.3

31.6

26.7

14.1

6.1

(% of Net Sales)

11.0

13.3

15.2

17.2

17.6

16.8

Basic EPS (`)

8.9

11.5

15.2

19.2

21.9

23.2

Fully Diluted EPS (`)

8.9

11.5

15.2

19.2

21.9

23.2

% chg

21.9

29.3

31.6

26.7

14.1

6.1

October 27, 2015

7

Hindustan Media Ventures | 2QFY2016 Result Update

Balance sheet

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY17E

SOURCES OF FUNDS

Equity Share Capital

73

73

73

73

73

73

Reserves& Surplus

361

435

536

668

820

982

Shareholders Funds

434

508

609

741

893

1,055

Minority Interest

-

-

-

-

-

-

Total Loans

26

3

20

99

99

99

Deferred Tax Liability

12

13

13

13

13

13

Total Liabilities

472

525

643

853

1,005

1,167

APPLICATION OF FUNDS

Gross Block

229

242

254

292

322

372

Less: Acc. Depreciation

43

64

85

109

137

168

Net Block

186

178

169

183

186

204

Capital Work-in-Progress

7

1

11

11

11

11

Investments

213

278

369

547

577

597

Current Assets

175

172

225

282

366

492

Inventories

32

32

33

45

58

72

Sundry Debtors

78

79

93

107

128

148

Cash

44

28

26

40

62

109

Loans & Advances

22

27

65

74

91

132

Other Assets

0

5

8

16

27

30

Current liabilities

116

110

138

177

141

144

Net Current Assets

59

61

87

105

224

348

Deferred Tax Asset

7

7

7

7

7

7

Mis. Exp. not written off

-

-

-

-

-

-

Total Assets

472

525

643

853

1,005

1,167

October 27, 2015

8

Hindustan Media Ventures | 2QFY2016 Result Update

Cashflow

Y/E March (` cr)

FY12

FY13

FY14

FY15

FY16E

FY17E

Profit before tax

92

114

155

188

220

237

Depreciation

19

22

22

24

27

32

Change in Working Capital

(13)

(12)

1

(4)

(97)

(76)

Interest / Dividend (Net)

(14)

5

(23)

11

13

14

Direct taxes paid

(24)

(28)

(43)

(47)

(59)

(66)

Others

13

(20)

1

-

-

-

Cash Flow from Operations

72

81

113

171

104

140

(Inc.)/ Dec. in Fixed Assets

(35)

8

(27)

(38)

(30)

(50)

(Inc.)/ Dec. in Investments

(24)

(65)

(91)

(179)

(30)

(20)

Cash Flow from Investing

(59)

(58)

(117)

(217)

(60)

(70)

Issue of Equity

-

-

-

-

-

-

Inc./(Dec.) in loans

6

(23)

17

78

-

-

Dividend Paid (Incl. Tax)

(7)

(9)

(9)

(9)

(9)

(9)

Interest / Dividend (Net)

(4)

(6)

(7)

(11)

(13)

(14)

Cash Flow from Financing

(5)

(38)

2

59

(22)

(23)

Inc./(Dec.) in Cash

8

(15)

(2)

14

22

48

Opening Cash balances

36

44

28

26

40

62

Closing Cash balances

44

28

26

40

62

109

October 27, 2015

9

Hindustan Media Ventures | 2QFY2016 Result Update

Key ratios

Y/E March

FY12

FY13

FY14

FY15

FY16E

FY17E

Valuation Ratio (x)

P/E (on FDEPS)

31.3

24.2

18.4

14.5

12.7

12.0

P/CEPS

24.2

19.3

15.4

12.4

10.9

10.1

P/BV

4.7

4.0

3.4

2.8

2.3

1.9

Dividend yield (%)

0.4

0.4

0.4

0.4

0.4

0.4

EV/Sales

3.0

2.7

2.3

1.9

1.6

1.4

EV/EBITDA

19.1

15.5

11.1

9.4

7.6

6.6

EV / Total Assets

3.1

2.7

2.1

1.5

1.3

1.1

Per Share Data (`)

EPS (Basic)

8.9

11.5

15.2

19.2

21.9

23.2

EPS (fully diluted)

8.9

11.5

15.2

19.2

21.9

23.2

Cash EPS

11.6

14.5

18.1

22.5

25.6

27.6

DPS

1.2

1.2

1.2

1.2

1.2

1.2

Book Value

59.1

69.3

83.0

101.0

121.7

143.8

Returns (%)

RoCE

16.5

17.8

20.6

16.9

17.2

16.2

Angel RoIC (Pre-tax)

37.2

44.3

55.2

56.2

48.5

41.8

RoE

15.1

16.6

18.3

19.0

18.0

16.2

Turnover ratios (x)

Asset Turnover

3.2

3.6

4.3

4.5

4.9

5.0

Inventory / Sales (days)

19

19

16

20

23

26

Receivables (days)

48

45

47

48

51

53

Payables (days)

40

35

38

38

33

30

Net WC (days)

27

29

25

30

41

49

October 27, 2015

10

Hindustan Media Ventures | 2QFY2016 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange of India Limited. It is also registered as a Depository Participant with

CDSL and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is

a registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates including its relatives/analyst do not hold any financial interest/beneficial

ownership of more than 1% in the company covered by Analyst. Angel or its associates/analyst has not received any compensation /

managed or co-managed public offering of securities of the company covered by Analyst during the past twelve months. Angel/analyst

has not served as an officer, director or employee of company covered by Analyst and has not been engaged in market making activity

of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

HMVL

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

October 27, 2015

11