2QFY2017 Result Update | Automobile

October 28, 2016

Hero MotoCorp

ACCUMULATE

CMP

`3,314

Performance Highlights

Target Price

`3,541

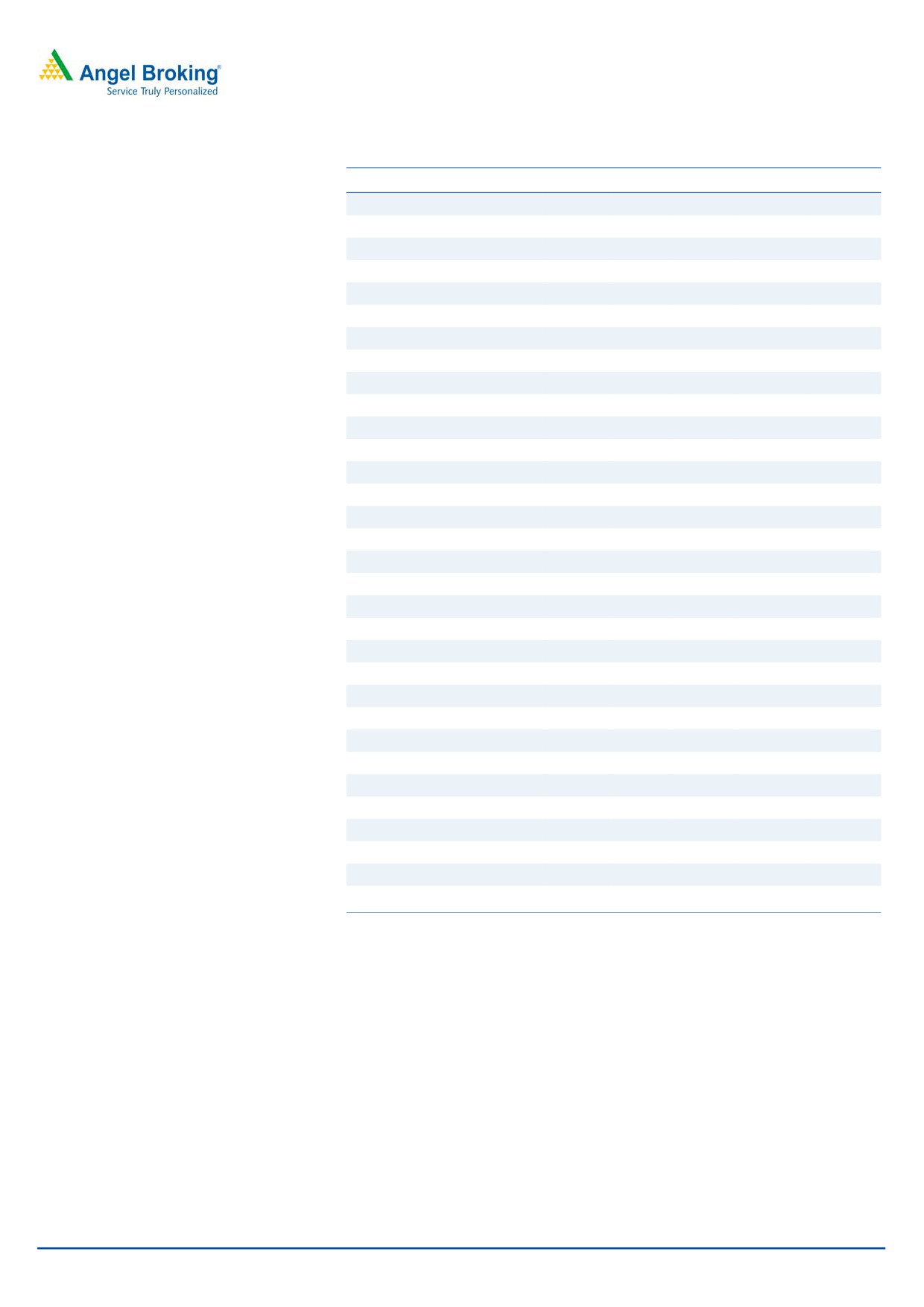

Y/E March (` cr)

2QFY17 2QFY16

% chg (yoy) 1QFY17

% chg (qoq)

Investment Period

12 Months

Net Sales

7,796

6,809

14.5

7,399

5.4

EBITDA

1,369

1,096

24.9

1,230

11.3

Stock Info

EBITDA margin (%)

17.56

16.09

146bp

16.63

93bp

Sector

Automobile

Adj PAT

1,004

786

27.7

883

13.7

Market Cap (` cr)

66,193

Source: Company, Angel Research

Net Debt (` cr)

(103)

Hero Motocorp (HMCL) reported strong 2QFY2017 numbers with 14.7% yoy

Beta

0.9

growth in its gross revenues to `8,322cr and 27.7% yoy growth in its net profit to

52 Week High / Low

3,739/2,375

`1,004cr in Q2FY17. Net sales increased by 14.5% yoy to `7,796cr in this

Avg. Daily Volume

17,212

quarter. With the strong recovery in consumer sentiment and revival in the auto

Face Value (`)

2

industry, HMCL reported 15.8% growth in its total 2W units sold in this quarter.

BSE Sensex

27,916

EBITDA came in at `1,369cr vs. `1,096cr a year ago. EBITDA margins improved

Nifty

8,615

to 17.6% vs. 16.1% in Q2FY16 and 16.7% in Q1FY17. Overall improvement in

Reuters Code

HROM.BO

its margins came due to the 1) lower input costs (4.1% yoy decline in RM cost per

Bloomberg Code

HMCL@IN

unit)

2)

1% QoQ increase in net realizations per unit (`42,059 per unit in

Q2FY17 vs. 41,765 per unit in Q2FY17)

Shareholding Pattern (%)

Outlook and valuation: We believe that HMCL volumes are expected to see

Promoters

34.6

further growth this year owing to the improved consumer sentiment. HMCL is

MF / Banks / Indian Fls

12.6

expected to emerge as a strong beneficiary of the recovery in the rural economy

FII / NRIs / OCBs

43.8

as it has a strong presence in the rural region. Company holds more than 50%

Indian Public / Others

9.0

market share in the overall 2W industry which will also benefit the company

further. Company indicated some cost pressure going ahead as commodity prices

have started to move up. However, overall profitability is expected to increase

Abs. (%)

3m 1yr 3yr

over higher sales volumes. We have estimated double digit volume growth

Sensex

(0.5)

1.7

13.9

(~10%) in remainder of FY2017E and in FY2018E. We also forecast slightly

Hero MotoCorp

6.8

30.6

71.3

higher RM costs in our model to accommodate higher input costs. The stock is

currently valued at15.9x of FY2018E EPS. We value stock at 17.0x of its FY2018E

EPS considering current momentum of growth and earnings. We rate HMCL as

3-year price chart

“Accumulate” with a price target of `3,541 implying 7% upside.

4000

Key financials (Standalone)

3000

Y/E March (` cr)

FY2015

FY2016

FY2017E

FY2018E

2000

Net Sales

27,351

28,001

31,021

34,133

% chg

8.9

2.4

10.8

10.0

1000

Net Profit

2,386

3,162

3,824

4,010

0

% chg

13.1

32.5

20.9

4.9

OPM (%)

12.4

15.9

17.1

16.8

EPS (`)

119.5

158.3

191.5

200.8

Source: Company, Angel Research

P/E (x)

27.7

20.9

17.1

15.9

P/BV (x)

10.1

8.3

6.6

5.4

RoE (%)

32.9

34.2

33.5

30.0

RoCE (%)

39.9

45.0

43.5

39.8

Amarjeet S Maurya

EV/Sales (x)

2.4

2.4

2.1

1.9

022-3935 7800 Ext: 6846

EV/EBITDA (x)

20.9

16.4

13.5

12.2

Source: Company, Angel Research; Note: CMP as of Oct 27, 2015

Please refer to important disclosures at the end of this report

1

Hero MotoCorp | 2QFY2017 Result Update

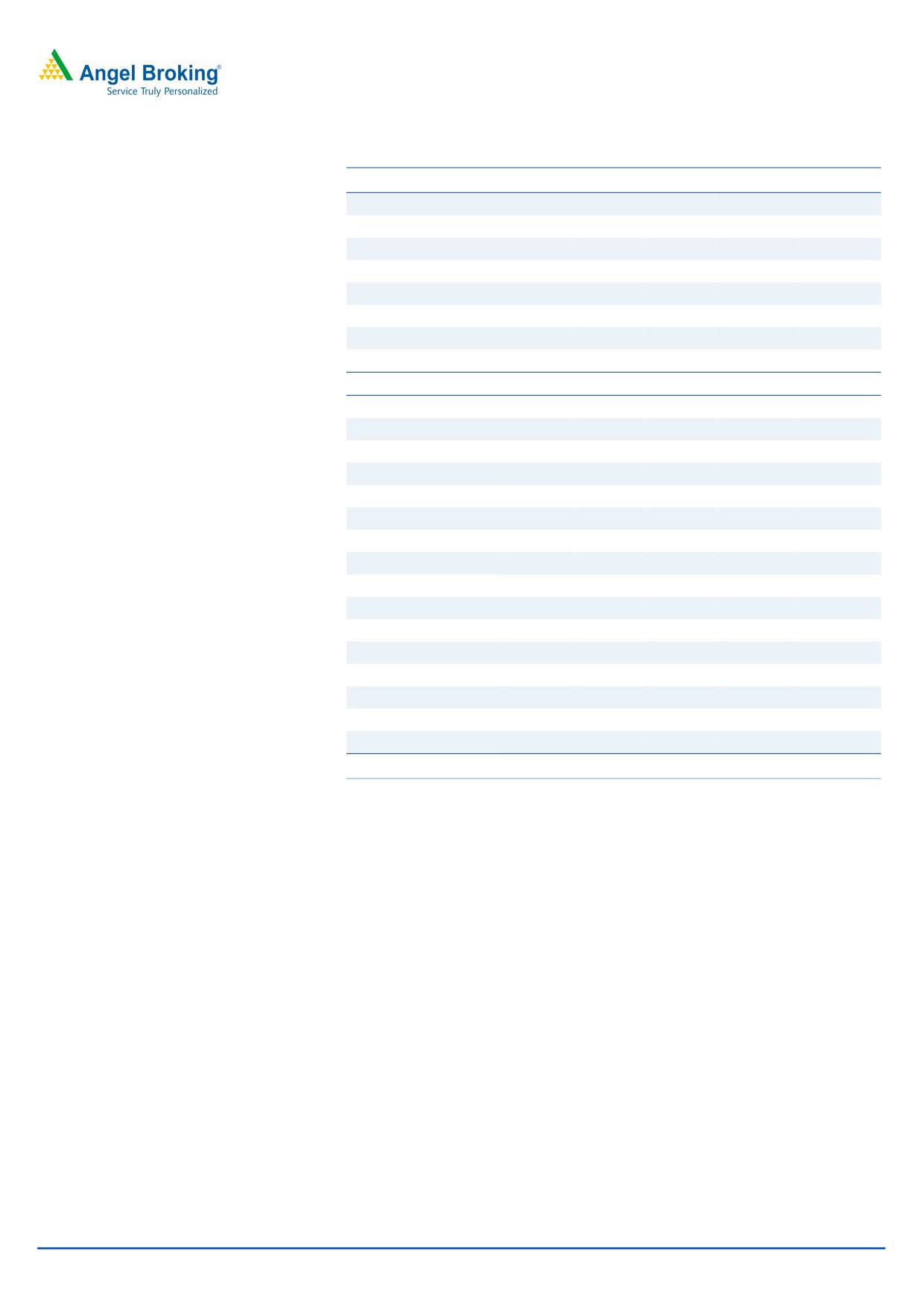

Exhibit 1: Quarterly financial performance (Standalone)

Y/E March (` cr)

Q2FY17

Q2FY16

% chg (yoy)

Q1FY17

% chg (qoq)

1HFY17

1HFY16

% chg (yoy)

Total units sold

1,823,498

1,574,861

15.8

1,745,389

4.5

3,568,887

3,220,728

10.8

Net sales

7,796

6,809

14.5

7,399

5.4

15,195

13,714

10.8

Consumption of RM

5,183

4,666

11.1

4,965

4.4

10,149

9,477

7.1

(% of Sales)

66.5

68.5

67.1

66.8

69.1

Staff costs

357

308

15.9

336

6.3

694

621

11.6

(% of Sales)

4.6

4.5

4.5

4.6

4.5

Other expenses

887

739

20.0

867

2.2

1,754

1,478

18.6

(% of Sales)

11.4

10.9

11.7

11.5

10.8

Total Expenditure

6,427

5,714

12.5

6,169

4.2

12,596

11,576

8.8

Operating Profit

1,369

1,096

24.9

1,230

11.3

2,599

2,138

21.6

OPM

17.6

16.1

146.8

16.6

93.3

17.1

15.6

Depreciation

119

109

9.4

115

3.5

234

212

10.6

Other income

152

112

36.6

120

26.6

273

216

26.3

Finance cost

2

1

26.0

2

3.3

3

2

25.0

PBT (excl. Extr. Items)

1,400

1,097

27.7

1,234

13.5

2,634

2,139

23.1

Extr. Income/(Expense)

-

-

-

-

-

-

-

-

PBT (incl. Extr. Items)

1,400

1,097

27.7

1,234

13.5

2,634

2,139

23.1

(% of Sales)

18.0

16.1

16.7

17.3

15.6

Tax

396

311

27.5

351

13.0

747

605

23.4

(% of PBT)

28.3

28.3

28.4

28.4

28.3

Reported PAT

1,004

786

27.7

883

13.7

1,887

1,534

23.1

Adj PAT

1,004

786

27.7

883

13.7

1,887

1,534

23.1

Adj. PATM

12.9

11.5

11.9

12.4

11.2

Equity capital (cr)

40

40

40

40

40

Adjusted EPS (`)

50.3

39.4

27.7

44.2

13.7

94.5

76.8

23.1

Source: Company, Angel Research

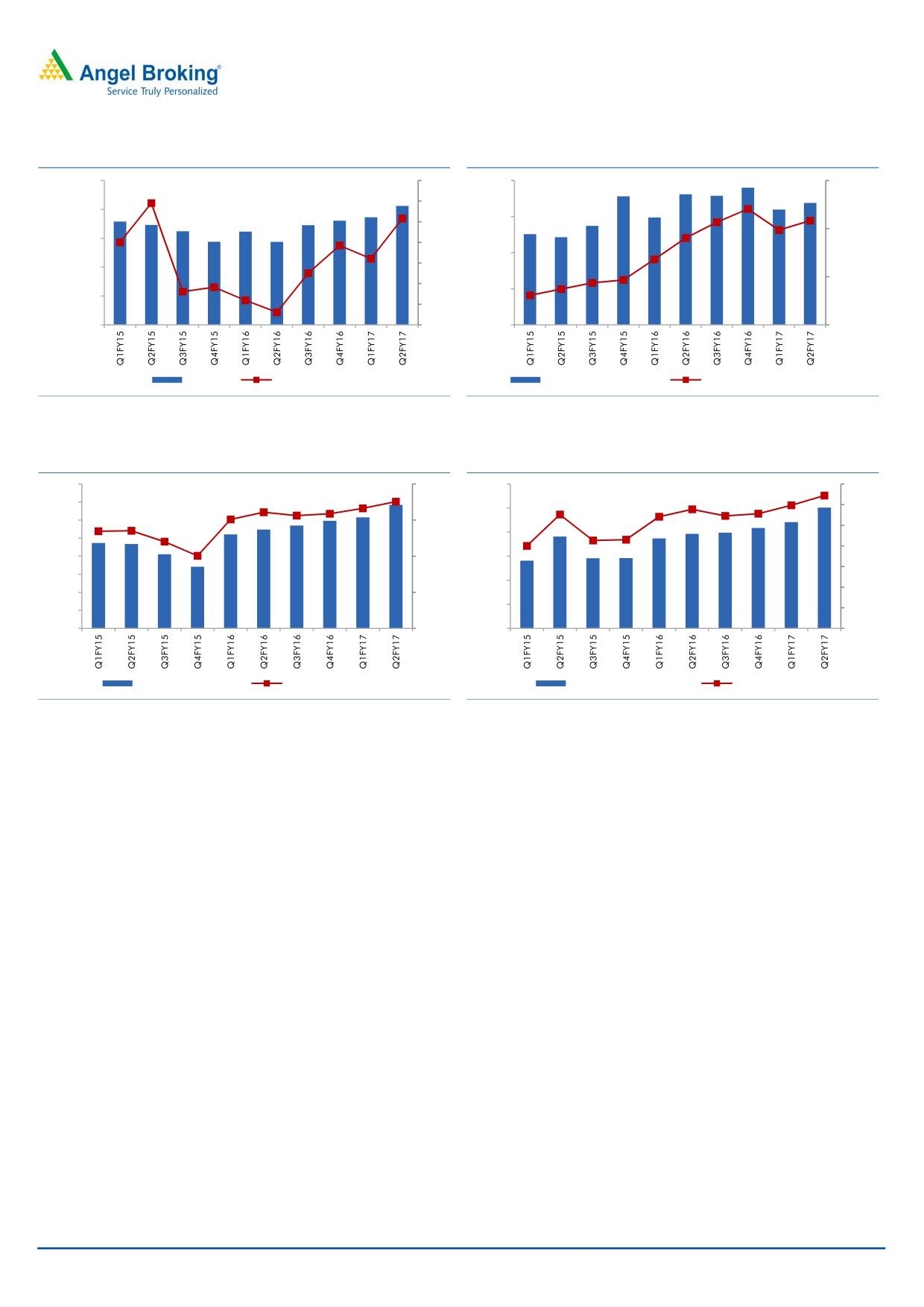

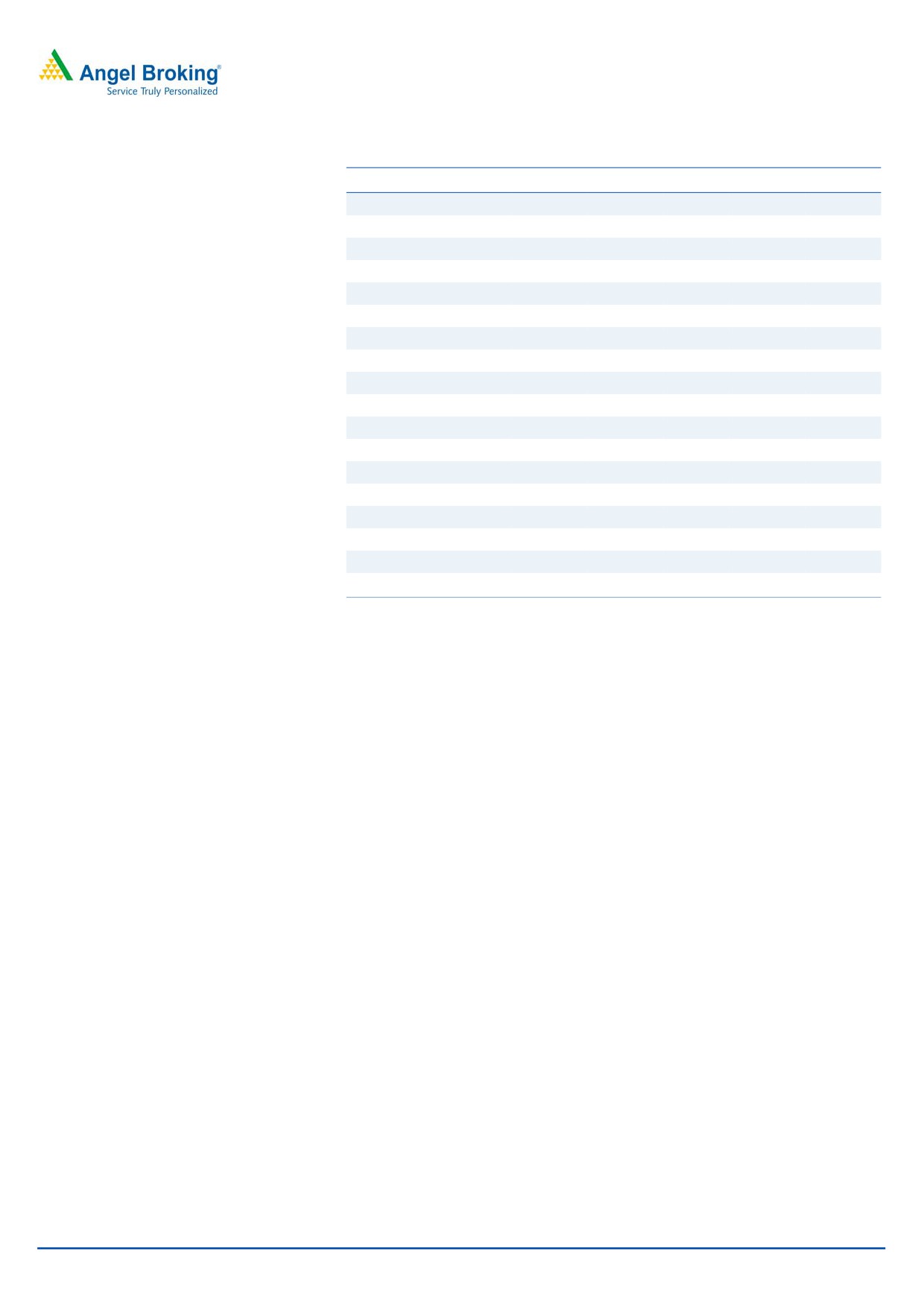

The 15.8% growth in its quarterly volumes is the highest growth seen in the

last 8 quarters.

Contribution per vehicle after decline in Q1FY17 has shown improvement in

this quarter indicating lower discounts in Q2FY17 vs. Q1FY17.

HMCL continues to maintain leading position in the domestic 2W market and

expects better performance of its 150cc segment going ahead due to more

launches in this category. In the 100cc market, company has achieved 68%

market share.

Gross margins improved to 33.5% in Q2FY17 vs. 32.9% in Q1FY17. This is

mainly due to the subdued commodity prices seen during this quarter.

This is first time in last 25 quarters HMCL has reported EBITDA margins in

excess of 17% and these are the highest margins in the last 27 quarters.

At `1,004cr, its highest ever net profit.

The company has grown faster than the industry in its scooters segment.

During the quarter its other income rose by 36.7% to `152cr. Company has

said that most of its investments are in debt instruments which did well during

the quarter.

October 28, 2016

2

Hero MotoCorp | 2QFY2017 Result Update

Exhibit 2: Volume growth at 8 quarter high

Exhibit 3: Realisations & contribution/vehicle improve

2,000,000

25

44,000

16,000

20

1,800,000

42,000

15

14,000

1,600,000

10

40,000

5

1,400,000

12,000

0

38,000

1,200,000

-5

1,000,000

-10

36,000

10,000

Volumes

yoy growth (%)

Net realization (`)

Contribution / Vehicle (`)

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 4: Consistent rise in EBITDA margins beat

Exhibit 5: PAT at record high

1,600

20.0

1,200

14.0

1,400

12.0

1,000

1,200

15.0

10.0

800

1,000

8.0

800

10.0

600

6.0

600

400

4.0

400

5.0

200

2.0

200

0

0.0

0

0.0

EBITDA (`cr)

EBITDA margins (%)

Net profit (`cr)

Net margin (%)

Source: Company, Angel Research

Source: Company, Angel Research

Conference call - Key highlights

During the quarter, HMCL has benefitted due to the lower commodity prices

and has indicated that steel, rubber and plastic prices have started to move up

indicating that raw material costs in Q3 will be higher.

The company said that urban demand remained strong in Q2FY17 while rural

demand has just started to pick-up. It expects strong demand once farmers

start to get harvests money.

HMCL also said that a strong traction is seen in scooters segment and H2FY17

will sees higher sales from scooters segment.

Haridwar plant has a maximum production capacity of ~9,000-9,500 units

per day but at the moment it is producing ~6,000 units a day, indicating

utilization of ~67%. The new capacity will be commissioned in 3QFY17.

HMCL will launch emission compliant models from Q4FY17 onwards which

will increase costs by ~`250-300 and it will pass on the additional costs to

customers.

HMCL also holds highest market share than its peers in the 100cc category

and Glamour remains the best selling product in the entry level motorcycle

segment.

October 28, 2016

3

Hero MotoCorp | 2QFY2017 Result Update

Company was under represented in 150cc category but with launch of new

products in this category sales traction is expected to improve in this category.

It acquired 25-30% shareholding of Bangalore based technology start-up

Ather Energy Private Limited for `205cr. The company is in the business of

designing and manufacturing of smart electric vehicles and is already working

on two models. This investment is expected to boost HMCL’s electric vehicle

aspirations.

Investment arguments

Strong recovery in the domestic vehicle demand: The automobile demand in

India is seeing a strong traction due improvement in the consumer sentiment

as well as recovery in the rural economy. The lowering the interest rate is

expected to further increase the demand. Overall the demand scenario is

expected to remain strong over next few quarters which will result in growth in

volumes for the Automobile companies.

Hero Motocorp well positioned to gain from improving demand: Hero

Motocorp (HMCL) is a well established brand and commands more than 50%

market share in the domestic 2W industry. It has a wide range of brands from

entry level to high end motorbikes. It also has strong presence in scooters

segment and it is a well recognized in brand in rural area. This is expected to

benefit HMCL gong ahead.

Capacity expansion to meet higher demand: HMCL has total installed capacity

of ~8.2 million units. This capacity would further increase by ~0.750mn units

after commissioning of new capacity at Neemrana plant which is currently

under trial product run. Company is also developing a new capacity at Halol

in Gujarat (~1.8mn units), which is expected to be operational in FY2017. As

a result of its capacity expansion, HMCL remains well positioned to meet

future demand. Its Haridwar plant contributes ~35% of the total volumes and

is currently running at the capacity utilization of ~67% which gives enough

room for volume growth in short term.

Outlook and valuation

We believe that HMCL volumes are expected to see further growth this year owing

to the improved consumer sentiment. HMCL is expected to emerge as a strong

beneficiary of the recovery in the rural economy as it has a strong presence in the

rural region. Company holds more than 50% market share in the overall 2W

industry which will also benefit the company further. Company indicated some cost

pressure going ahead as commodity prices have started to move up. However,

overall profitability is expected to increase over higher sales volumes. We have

estimated double digit volume growth (~10%) in remainder of FY2017E and in

FY2018E. We also forecast slightly higher RM costs in our model to accommodate

higher input costs. The stock is currently valued at15.9x of FY2018E EPS. We value

stock at 17.0x of its FY2018E EPS considering current momentum of growth and

earnings. We rate HMCL as “Accumulate” with a price target of `3,541 implying

7% upside.

October 28, 2016

4

Hero MotoCorp | 2QFY2017 Result Update

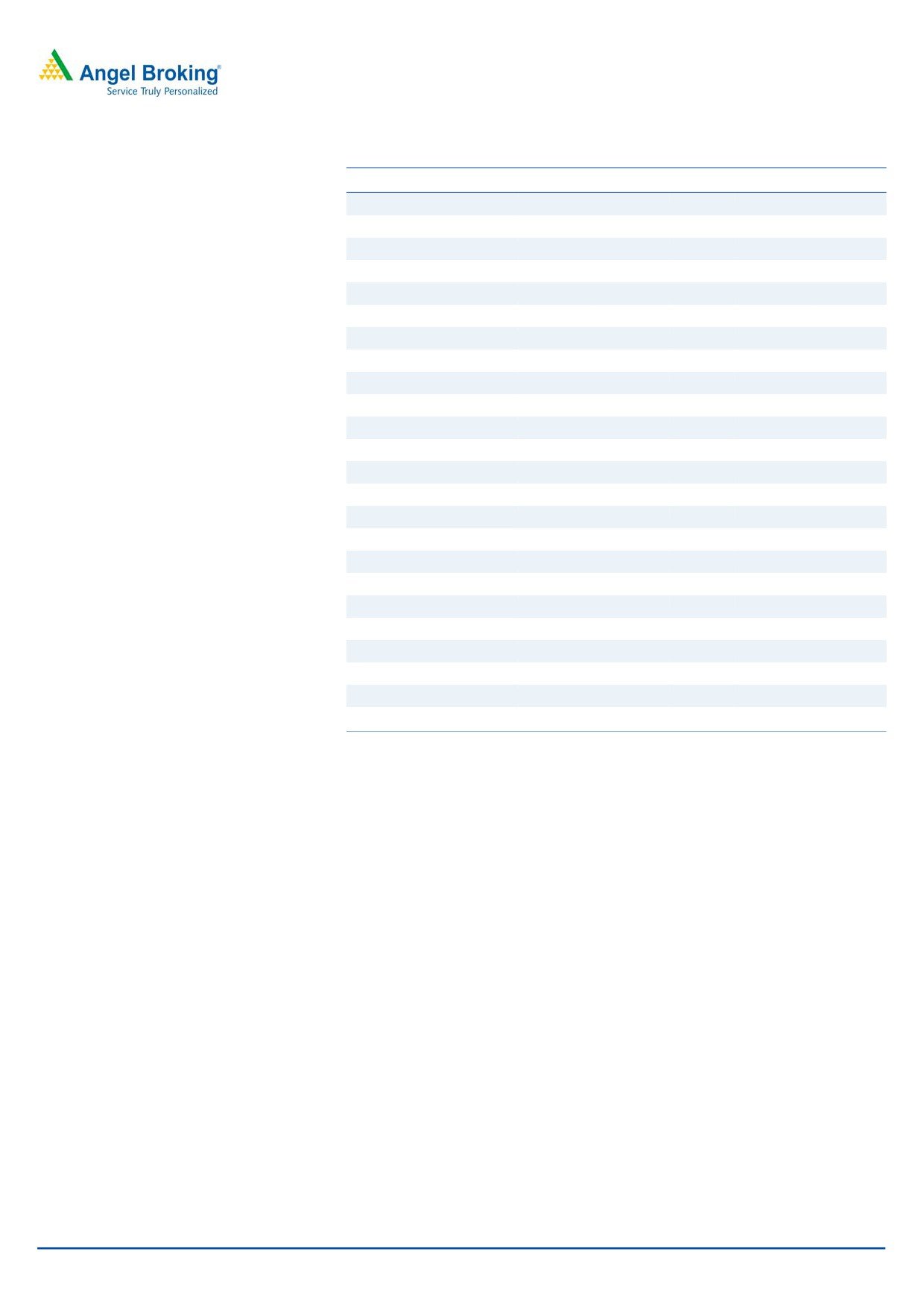

Exhibit 6: Key assumptions - Volumes

Y/E March (` cr)

FY2013

FY2014

FY2015

FY2016E

FY2017E

FY2018E

Total two-wheelers

6,075,583

6,245,960

6,631,826

6,632,322

7,372,660

8,071,888

Source: Company, Angel Research

Company background

Hero MotoCorp (HMCL) is a leading 2W manufacturer globally and the market

leader in the domestic motorcycle segment with more than 50% market share.

HMCL has four manufacturing facilities in India, located at Gurgaon, Dharuhera,

Haridwar and Neemrana. It has also a production facility in Colombia. Together it

has a capacity of ~8.2mn units/year as of September 2016. Over 2010-16,

HMCL recorded a strong volume CAGR of ~12%, backed by its strong brands

(Passion and Splendor) and a well-entrenched dealership network (~19,000),

which has a good presence across rural areas as well.

October 28, 2016

5

Hero MotoCorp | 2QFY2017 Result Update

Profit and loss statement (Standalone)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

Total operating income

25,125

27,351

28,001

30,958

34,139

% chg

6.5

8.9

2.4

10.6

10.3

Total Expenditure

21,735

24,198

23,982

26,094

28,771

Cost of Materials

18,230

19,754

19,315

21,047

23,209

Personnel

930

1,173

1,314

1,441

1,611

Others Expenses

2,576

3,271

3,354

3,606

3,950

EBITDA

3,389

3,152

4,018

4,863

5,368

% chg

7.8

(4.3)

31.7

20.0

9.9

(% of Net Sales)

13.5

11.5

14.4

15.7

15.7

Depreciation& Amortisation

1,107

540

441

481

529

EBIT

2,282

2,612

3,577

4,382

4,838

% chg

16.6

14.5

36.9

22.5

10.4

(% of Net Sales)

9.1

9.6

12.8

14.2

14.2

Interest & other Charges

12

11

5

6

6

Other Income

446

493

423

557

515

(% of PBT)

16.4

15.9

10.6

11.3

9.6

Recurring PBT

2,717

3,094

3,995

4,933

5,347

% chg

15.9

13.9

29.1

23.5

8.4

Prior Period & Extraord. Exp./(Inc.)

-

-

-

-

-

PBT (reported)

2,717

3,094

3,995

4,933

5,347

Tax

758

943

1,275

1,555

1,699

(% of PBT)

27.9

30.5

31.9

31.5

31.8

PAT (reported)

1,958

2,151

2,720

3,378

3,648

Add: Share of earnings of asso.

-

-

-

-

-

Less: Minority interest (MI)

-

-

-

-

-

PAT after MI (reported)

1,958

2,151

2,720

3,378

3,648

ADJ. PAT

1,958

2,151

2,720

3,378

3,648

% chg

(0.4)

13.1

32.5

22.3

7.6

(% of Net Sales)

7.8

7.9

9.7

10.9

10.7

Basic EPS (`)

105.6

119.5

158.3

193.6

208.3

Fully Diluted EPS (`)

105.6

119.5

158.3

193.6

208.3

% chg

(0.4)

13.1

32.5

22.3

7.6

October 28, 2016

6

Hero MotoCorp | 2QFY2017 Result Update

Balance sheet statement (Standalone)

Y/E March (` cr)

FY2014

FY2015

FY2016

FY2017E

FY2018E

SOURCES OF FUNDS

Equity Share Capital

40

40

40

40

40

Reserves& Surplus

5,560

6,501

7,905

10,031

12,111

Shareholders Funds

5,600

6,541

7,945

10,071

12,151

Minority Interest

-

-

-

-

-

Total Loans

284

-

-

-

-

Deferred Tax Liability

5

6

239

239

239

Other Liabilities

74

97

119

119

119

Total Liabilities

5,963

6,645

8,303

10,430

12,510

APPLICATION OF FUNDS

Gross Block

6,909

8,114

9,397

10,697

11,597

Less: Acc. Depreciation

4,666

5,201

5,560

6,041

6,571

Net Block

2,243

2,913

3,837

4,656

5,026

Capital Work-in-Progress

854

713

605

680

780

Investments

4,089

3,154

4,266

4,266

4,266

Current Assets

2,805

3,669

3,632

4,736

5,961

Inventories

670

815

673

1,018

1,309

Sundry Debtors

921

1,390

1,283

1,527

1,871

Cash

118

159

131

365

630

Loans & Advances

572

627

601

712

853

Other Assets

525

677

944

1,114

1,297

Current liabilities

4,139

3,883

4,049

3,920

3,535

Net Current Assets

(1,334)

(215)

(417)

816

2,425

Deferred Tax Asset

111

80

11

11

11

Mis. Exp. not written off

-

-

-

-

-

Total Assets

5,963

6,645

8,303

10,430

12,510

October 28, 2016

7

Hero MotoCorp | 2QFY2017 Result Update

Cash flow statement (Standalone)

Y/E March (` cr)

FY2014E FY2015E FY2016 FY2017E FY2018E

Profit before tax

2,867

3,329

4,395

5,421

5,859

Depreciation

1,107

540

441

481

529

Change in Working Capital

55

(337)

446

(999)

(1,345)

Interest / Dividend (Net)

(134)

(142)

(173)

6

6

Direct taxes paid

(649)

(1,000)

(1,103)

(1,555)

(1,699)

Others

(282)

(141)

(92)

-

-

Cash Flow from Operations

2,963

2,250

3,914

3,354

3,351

(Inc.)/ Dec. in Fixed Assets

(937)

0

0

(1,375)

(1,000)

(Inc.)/ Dec. in Investments

(680)

12

(2,271)

-

-

Cash Flow from Investing

(1,617)

12

(2,271)

(1,375)

(1,000)

Issue of Equity

-

-

1

-

-

Inc./(Dec.) in loans

0

0

0

0

0

Dividend Paid (Incl. Tax)

(1,199)

(1,897)

(1,398)

(1,740)

(2,080)

Interest / Dividend (Net)

(216)

(333)

(287)

(6)

(6)

Cash Flow from Financing

(1,415)

(2,231)

(1,684)

(1,746)

(2,086)

Inc./(Dec.) in Cash

(69)

32

(42)

234

265

Opening Cash balances

135

66

98

131

365

Closing Cash balances

66

98

56

365

630

October 28, 2016

8

Hero MotoCorp | 2QFY2017 Result Update

Key ratios

Y/E March

FY2014E FY2015E FY2016 FY2017E FY2018E

Valuation Ratio (x)

P/E (on FDEPS)

31.4

27.7

20.9

17.1

15.9

P/CEPS

20.6

22.6

18.4

15.2

14.1

P/BV

11.8

10.1

8.3

6.6

5.4

Dividend yield (%)

2.0

1.8

2.2

2.6

3.1

EV/Sales

2.6

2.4

2.4

2.1

1.9

EV/EBITDA

19.6

20.9

16.4

13.5

12.2

EV / Total Assets

6.6

6.3

5.3

4.6

4.1

Per Share Data (`)

EPS (Basic)

105.6

119.5

158.3

193.6

208.3

EPS (fully diluted)

105.6

119.5

158.3

193.6

208.3

Cash EPS

161.1

146.5

180.4

217.7

234.8

DPS

65.1

60.0

72.0

87.1

104.2

Book Value

280.4

327.6

397.8

504.3

608.5

Returns (%)

ROCE

38.8

39.9

45.0

43.5

39.8

Angel ROIC (Pre-tax)

136.0

80.9

100.8

80.6

66.7

ROE

35.0

32.9

34.2

33.5

30.0

Turnover ratios (x)

Asset Turnover (Gross Block)

3.6

3.4

3.0

2.9

2.9

Inventory / Sales (days)

10

11

9

12

14

Receivables (days)

13

19

18

20

-

Payables (days)

33

38

38

32

26

WC cycle (ex-cash) (days)

(10)

(8)

(11)

-

(12)

October 28, 2016

9

Hero MotoCorp | 2QFY2017 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and Metropolitan Stock Exchange Limited. It is also registered as a Depository Participant with CDSL

and Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Private Limited is a

registered entity with SEBI for Research Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number

INH000000164. Angel or its associates has not been debarred/ suspended by SEBI or any other regulatory authority for accessing

/dealing in securities Market. Angel or its associates/analyst has not received any compensation / managed or co-managed public

offering of securities of the company covered by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Disclosure of Interest Statement

Hero MotoCorp

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or relatives

No

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15)

October 28, 2016

10