1QFY2018 Result Update | Automobile

July 27, 2017

Hero MotoCorp

ACCUMULATE

CMP

`3,718

Performance Highlights

Target Price

`4,130

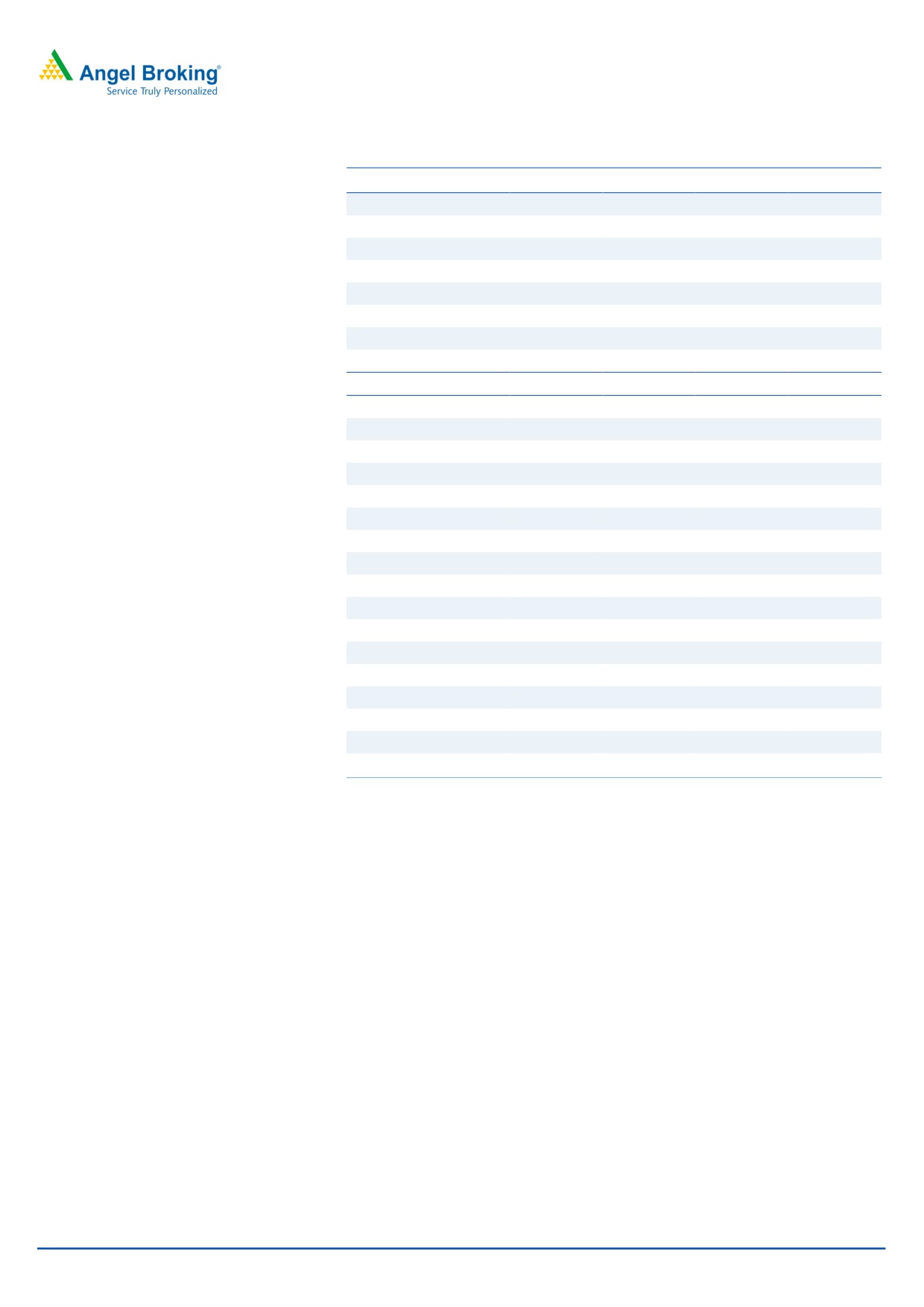

Y/E March (` cr)

1QFY18

1QFY17

% chg (yoy) 4QFY17

% chg (qoq)

Investment Period

12 Months

Net Sales

7,972

7,399

7.7

6,915

15.3

Stock Info

EBITDA

1,296

1,230

5.4

958

35.3

Sector

Automobile

EBITDA margin (%)

16.3

16.6

-37 bps

13.8

241 bps

Market Cap (` cr)

74,242

Adj PAT

914

883

3.5

718

27.3

Net Debt (` cr)

(136)

Source: Company, Angel Research

Beta

1.0

Result meeting consensus estimates: Hero Motocorp’s (HMCL) Q1FY18 number to

52 Week High / Low

3,880/2,844

a great extent, meet the consensus estimates. Net sales were at `7,972cr, up

Avg. Daily Volume

54,516

7.7% yoy. EBITDA was at `1,296cr up 5.4% yoy and PAT was at `914cr, up 3.5%

Face Value (`)

2

yoy. Consensus estimates of revenue, EBITDA and PAT were `8,053cr, `1,280cr and

BSE Sensex

32,382

`912cr. HMCL’s performance looks better than quarterly performance of Bajaj

Nifty

10,021

Auto’s with margins maintained and growth in revenue and PAT.

Reuters Code

HROM.BO

Margins decline: Though Gross margins were maintained above 32%, on yoy

Bloomberg Code

HMCL@IN

basis there was a decline of 56bps. Sequentially gross margins increased by

82bps. The price hike taken by the company in May-2017, helped it to maintain

Shareholding Pattern (%)

the gross margins above 32%. EBITDA margins were at 16.3% in 1QFY18 vs.

Promoters

34.6

16.6% in 1QFY17 and 13.8% in 4QFY17. The margin declined due to 11% yoy

MF / Banks / Indian Fls

11.5

increase in the staff costs.

FII / NRIs / OCBs

42.9

Realization improves slightly, contribution declines: Net realizations improved

Indian Public / Others

10.9

1.4% to `43,005 per vehicle form `42,391 in 1QFY17. Contribution per vehicle

however has declined by 0.3% yoy to `13,905 in 1QFY18 vs. `13,942 in

4QFY17 due to the higher RM and Employee costs.

Abs. (%)

3m 1yr 3yr

Sensex

7.0

15.2

24.0

Outlook and valuation: Company expects to aggressively gain market share to

Hero MotoCorp

12.0

15.5

46.3

consolidate its position. We expect CAGR of ~14%/11% in the sales/PAT over

next two years. The company expects ~100bps decline in margins due to the

expiry of excise benefits at Haridwar plant. The stock, at CMP, trades at 18x of

FY19E earnings. We value the stock at 20x of FY19E earrings due to slightly

3-year price chart

better growth outlook. We derive price target of `4,130 with accumulate rating.

5000

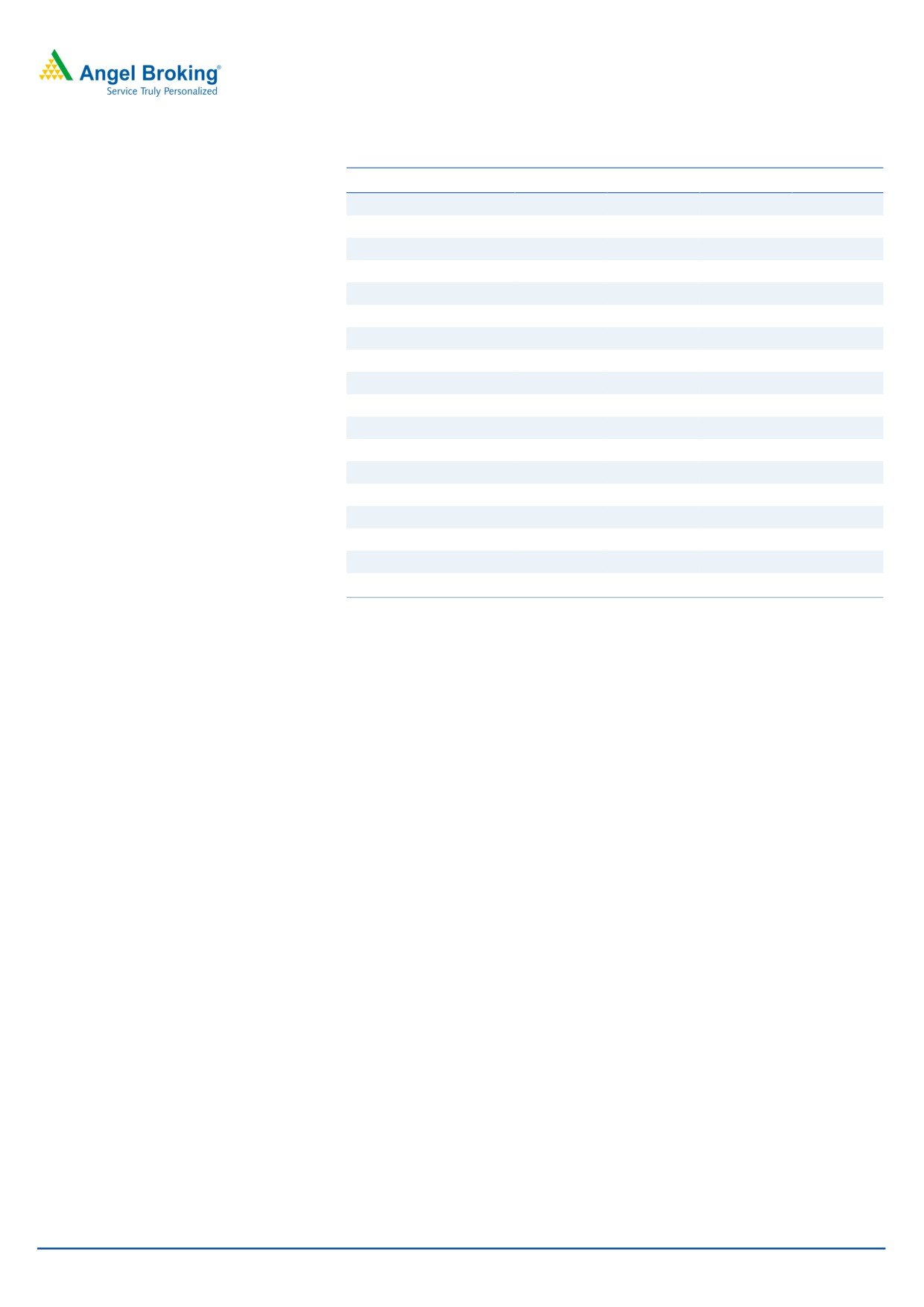

Key financials (Standalone)

4000

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

3000

Net Sales

28,203

28,170

32,239

36,878

2000

% chg

3.1

(0.1)

14.4

14.4

1000

Net Profit

3,160

3,377

3,682

4,123

% chg

32.5

6.9

9.0

12.0

0

OPM (%)

15.7

16.3

16.0

15.6

EPS (Rs)

158.2

169.1

184.4

206.5

P/E (x)

23.5

22.0

20.2

18.0

Source: Company, Angel Research

P/BV (x)

8.4

7.4

6.3

5.5

RoE (%)

33.1

30.4

31.3

30.7

RoCE (%)

42.8

37.9

39.4

38.4

EV/Sales (x)

2.5

2.4

2.1

1.8

Shrikant Akolkar

EV/EBITDA (x)

16.5

15.8

13.0

11.4

022-3935 7800 Ext: 6846

Source: Company, Angel Research; Note: CMP as of July 26, 2017

Please refer to important disclosures at the end of this report

1

Hero MotoCorp | 1QFY2018 Result Update

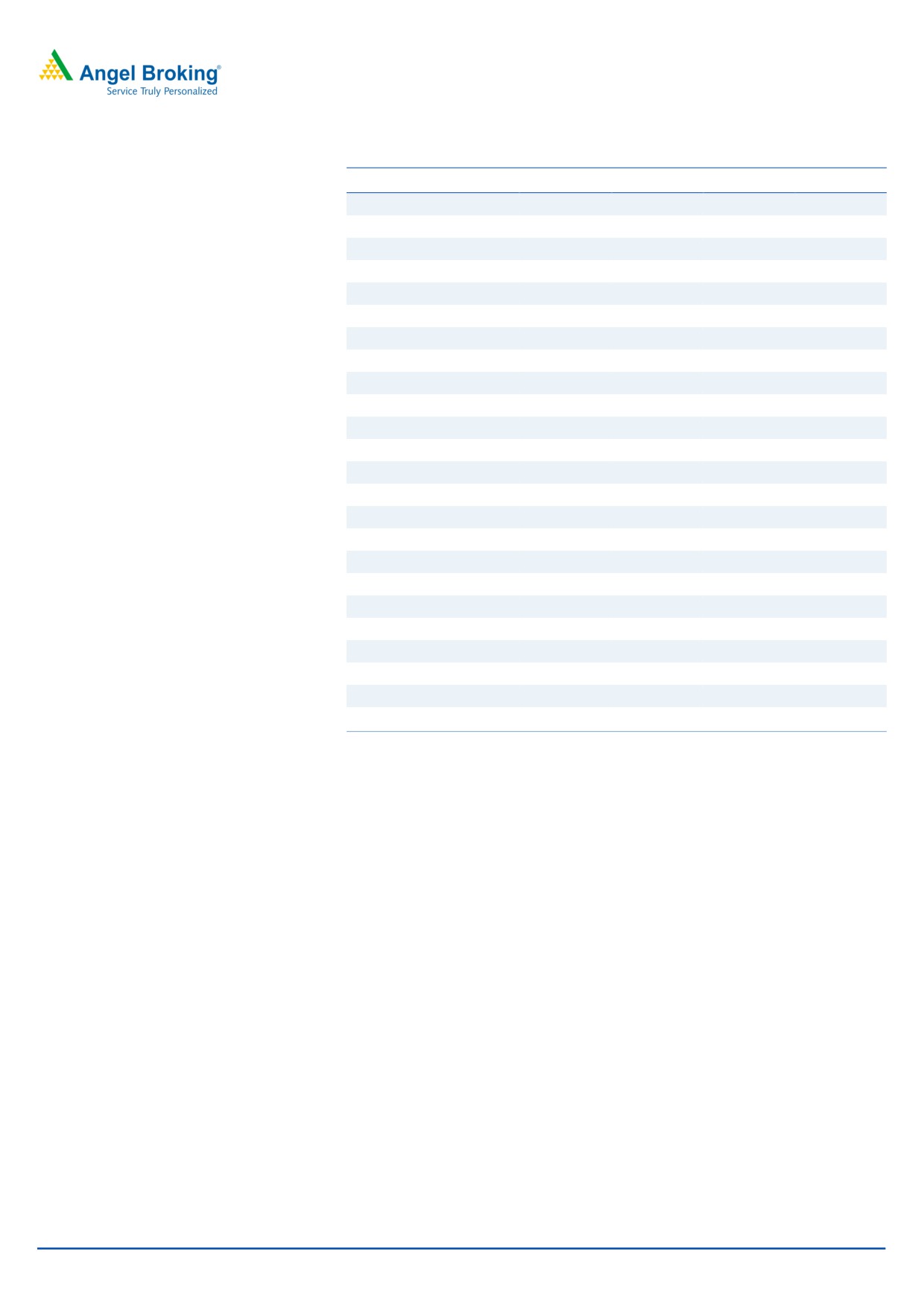

Exhibit 1: Quarterly financial performance (Standalone)

Y/E March (` cr)

1QFY18

1QFY17

% chg (yoy)

4QFY17

% chg (qoq)

Total units sold

1,853,647

1,745,389

6.2

1,621,805

14.3

Net sales

7,972

7,399

7.7

6,915

15.3

Consumption of RM

5,394

4,965

8.6

4,736

13.9

(% of Sales)

67.7

67.1

68.5

Staff costs

374

336

11.1

328

13.9

(% of Sales)

4.7

4.5

4.7

Other expenses

908

867

4.7

893

1.6

(% of Sales)

11.4

11.7

12.9

Total Expenditure

6,676

6,169

8.2

5,958

12.1

Operating Profit

1,296

1,230

5.4

958

35.3

OPM

16.3

16.6

13.8

Depreciation

133

115

15.4

135

(1.7)

Other income

132

120

9.4

118

11.4

Finance cost

2

2

5.3

1

6.8

PBT (excl. Extr. Items)

1,293

1,234

4.8

939

37.7

Extr. Income/(Expense)

0.00

0.00

0.00

PBT (incl. Extr. Items)

1,293

1,234

4.8

939

37.7

(% of Sales)

16.2

16.7

13.6

Tax

379

351

8.1

221

71.3

(% of PBT)

29.3

28.4

23.6

Reported PAT

914

883

3.5

718

27.3

Adj PAT

914

883

3.5

718

27.3

Adj. PATM

11.5

11.9

10.4

Equity capital (cr)

40

40

40

Adjusted EPS (`)

45.8

44.2

3.5

35.9

27.3

Source: Company, Angel Research

Total volumes were at 18.54 lakh vehicles, up 6.20 % yoy. On sequential

basis, volumes grew by 14.3%.

Net realization stood at `43,005 per vehicle vs. `42,391 in 1QFY17 and

`42,639 in 4QFY17.

This is second consecutive quarter that company has seen yoy decline in the

contribution per vehicle which stood at `13,905 per vehicle against `13,942

in 1QFY17.

EBITDA came in at `1,296cr vs. 1,230cr in 1QFY17.

EBITDA margins declined by 37bps on yoy basis and improved by ~241bps

on qoq basis. Gross margins declined to 32.3% vs. 32.9% in 1QFY17. This is

mainly due to the increase in the raw material prices.

Net profit increased by 3.5% yoy from `883cr to `914cr.

July 27, 2017

2

Hero MotoCorp | 1QFY2018 Result Update

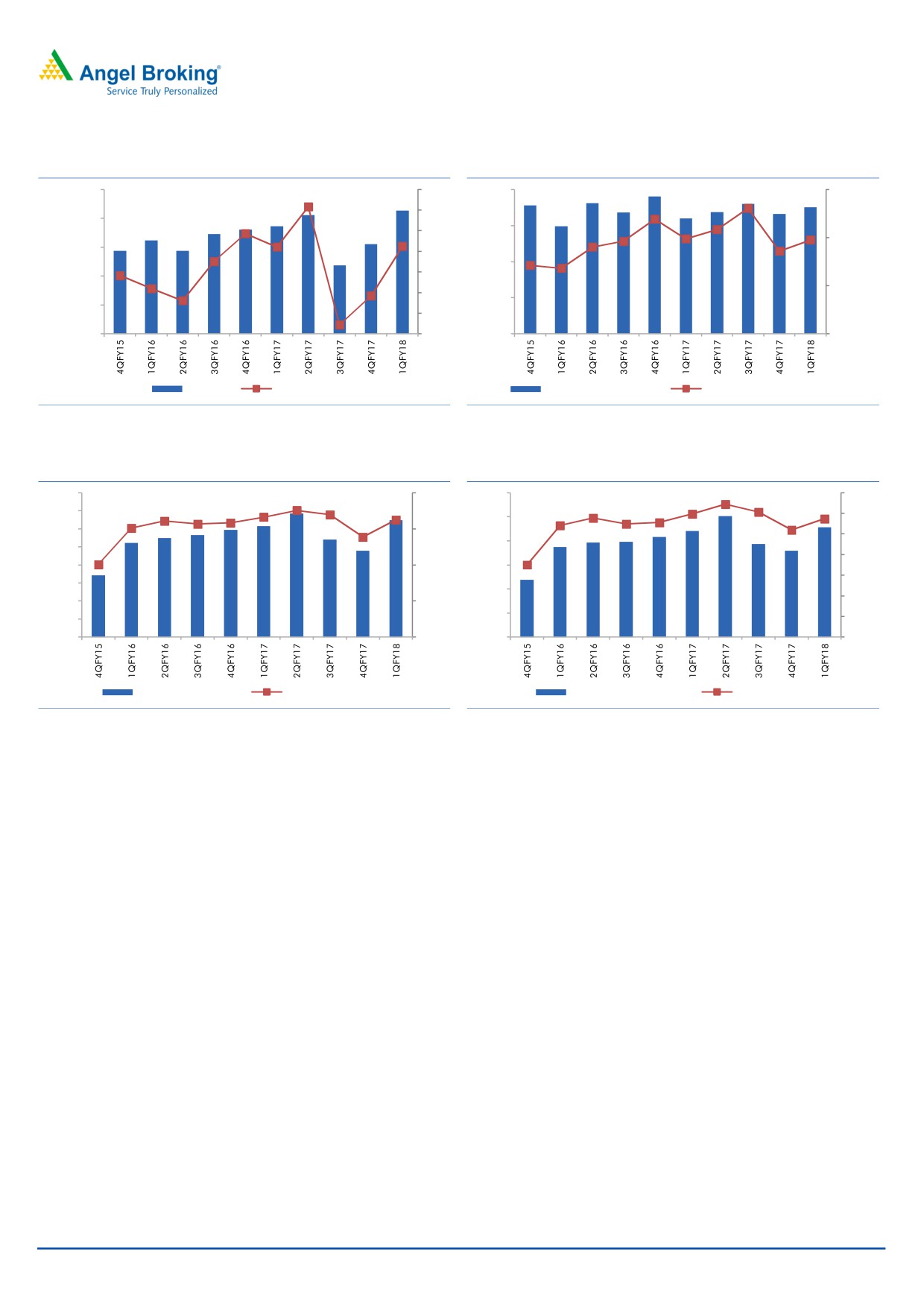

Exhibit 2: Volume growth at 6% yoy and 14% qoq

Exhibit 3: Realisations & contribution/vehicle trend

2,000,000

20

44,000

16,000

15

1,800,000

42,000

10

14,000

1,600,000

5

40,000

0

1,400,000

12,000

-5

38,000

1,200,000

-10

1,000,000

-15

36,000

10,000

Volumes

yoy growth (%)

Net realization (`)

Contribution / Vehicle (`)

Source: Company, Angel Research

Source: Company, Angel Research

Exhibit 4: EBITDA margins decline yoy

Exhibit 5: PAT up 3.5% yoy

1,600

20.0

1,200

14.0

1,400

12.0

1,000

1,200

15.0

10.0

800

1,000

8.0

800

10.0

600

6.0

600

400

4.0

400

5.0

200

2.0

200

0

0.0

0

0.0

EBITDA (`cr)

EBITDA margins (%)

Net profit (`cr)

Net margin (%)

Source: Company, Angel Research

Source: Company, Angel Research

Conference call - Key highlights

Company expects to outperform the industry growth in FY18. Management

expects the industry to grow at higher single digit growth rate in this fiscal.

Long term margin guidance is at 14-15%. Capex for FY18 and FY19E

expected to be `2500cr. This will be spend on expansion of existing facility at

Gujarat and new facility in Andhra Pradesh. The capex also includes provision

for up-gradation of its existing plants.

Company has indicated that the expiry Excise benefits at Haridwar plant in

March-2018 can impact margins by ~100bps; this however would partially

get offset by the tax incentives and higher volumes at newly commissioned

Halol plant. More clarity on the Haridwar plant is awaited from the govt.

While urban demand was strong, company expects rural demand to catch up

with good monsoon.

Spare part revenue grew by 5% yoy in the quarter and near term pick up is

expected.

July 27, 2017

3

Hero MotoCorp | 1QFY2018 Result Update

Company took a price hike in May-17 of about 800-1000per unit to pass on

the increase in the RM prices however with GST implementation, it also offered

discounts on the mass selling models.

Investment arguments

Strong recovery in the domestic vehicle demand: While the industry saw three

back to back disruptions in FY17 and early FY18 due to demonetisation, BSIV

and GST, the demand for 2W domestic automobile demand is expected to

remain strong in FY18E with growth rate in the high single digits. The lower

interest rates, government’s focus on rural economy and normal monsoon this

year is expected to improve the demand for 2Ws.

Hero Motocorp well positioned to gain from improving demand: Hero

Motocorp (HMCL) is a well established brand and commands more than

36.9% market share in the domestic 2W market. It has a wide range of brands

from entry level to high end motorbikes. It also has strong presence in scooters

segment and it is a well recognized in brand in rural area. This is expected to

benefit HMCL gong ahead.

Several growth drives in place: After company has commissioned the

Vadodara and Bangladesh facilities, its total installed capacity has reached

~9.4 million units. It also has a global spare parts facility at Neemrana. As a

result of its capacity expansion, we believe that HMCL remains well positioned

to meet future demand and we believe that going ahead company also will

derive good degree of operating leverage. While in the domestic market,

company remains in top gear to improve its performance. HMCL is expecting

to aggressively gain the market share and consolidate its position in the

domestic market. Company has lined up about half a dozen new product

launches in FY18 and expects them to do well. In the exports too, company is

looking to ramp up its business and has entered two large two wheeler

markets, Nigeria and Argentina. This takes its exposure to 35 countries.

Outlook and valuation

Company expects to aggressively gain market share to consolidate its position. We

expect CAGR of ~14%/11% in the sales/PAT over next two years. The company

expects ~100bps decline in margins due to the expiry of excise benefits at

Haridwar plant. The stock, at CMP, trades at 18x of FY19E earnings. We value the

stock at 20x of FY19E earrings due to slightly better growth outlook. We derive

price target of `4,130 with accumulate rating.

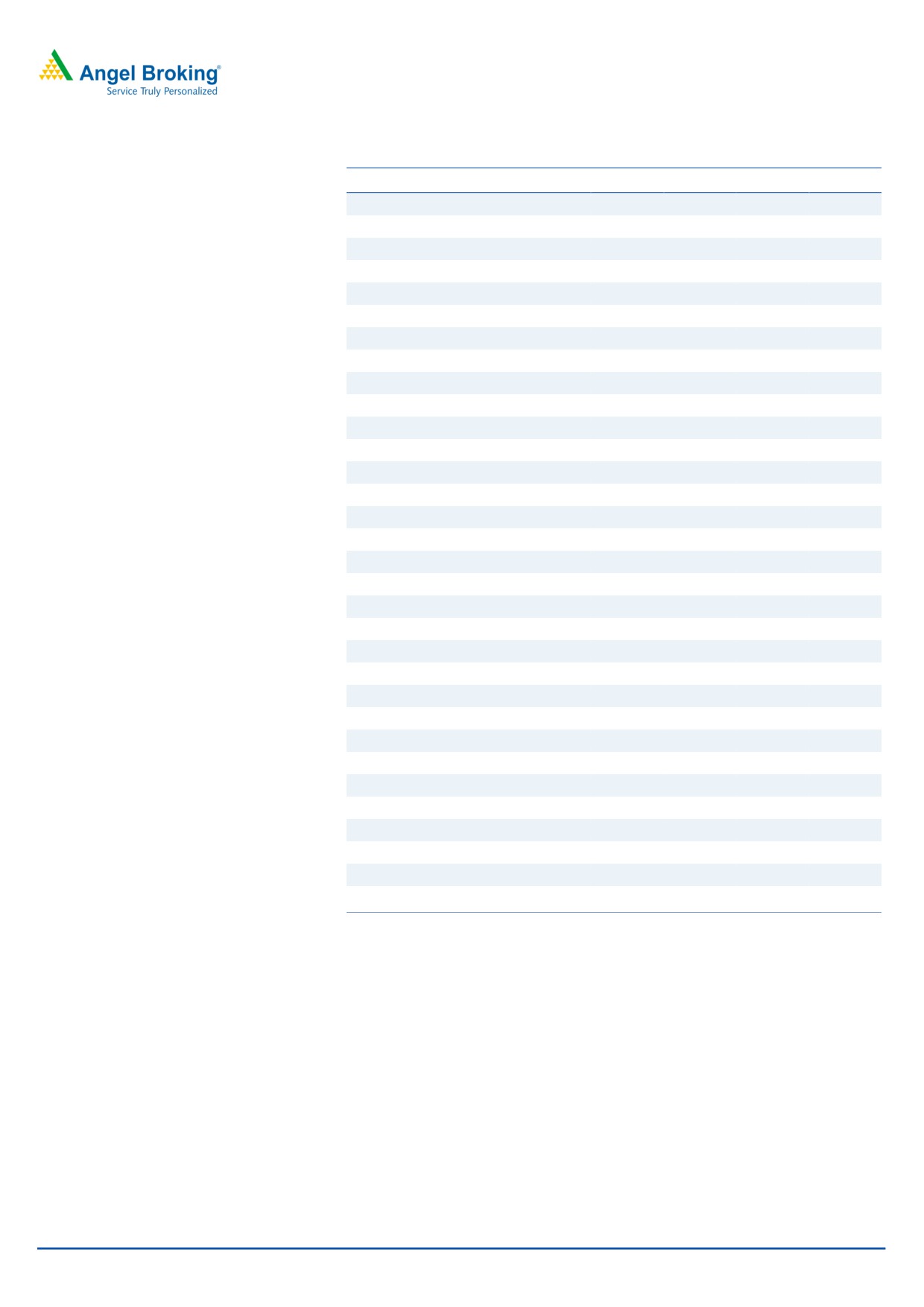

Exhibit 6: Key assumptions - Volumes

Y/E March

FY2014

FY2015

FY2016E

FY2017E

FY2018E

FY2019E

Total two-wheelers

6,245,960

6,631,826

6,632,322

6,664,240

7,438,824

8,407,975

Source: Company, Angel Research

July 27, 2017

4

Hero MotoCorp | 1QFY2018 Result Update

Company background

Hero MotoCorp (HMCL) is a leading 2W manufacturer globally and the market

leader in the domestic motorcycle segment. HMCL has five manufacturing facilities

located in India, and one each in Columbia and Bangladesh. Together it has a

capacity of ~9.4mn units/year as of June-2017. Over 2010-17, HMCL recorded a

volume CAGR of ~5%, backed by its strong brands (Passion and Splendor) and

over 6,000 customer touch points including dealership network across rural as well

urban areas.

July 27, 2017

5

Hero MotoCorp | 1QFY2018 Result Update

Profit and loss statement (Standalone)

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

Total operating income

28,203

28,170

32,239

36,878

% chg

3.1

(0.1)

14.4

14.4

Total Expenditure

23,988

23,840

27,068

31,119

Cost of Materials

19,310

19,012

21,574

24,796

Personnel

1,316

1,396

1,607

1,836

Others Expenses

3,362

3,432

3,887

4,487

EBITDA

4,216

4,329

5,171

5,759

% chg

25.8

4.0

11.6

11.4

(% of Net Sales)

14.9

15.4

16.0

15.6

Depreciation& Amortisation

438

493

540

602

EBIT

3,778

3,837

4,631

5,157

% chg

36.5

1.6

20.7

11.4

(% of Net Sales)

13.4

13.6

14.4

14.0

Interest & other Charges

5

6

6

6

Other Income

422

522

544

627

(% of PBT)

10.1

12.0

10.5

10.8

Recurring PBT

4,195

4,353

5,169

5,778

% chg

29.1

3.8

18.8

11.8

Prior Period & Extraordinary Expense/(Inc.)

-

-

-

-

PBT (reported)

4,195

4,353

5,169

5,778

Tax

1,275

1,281

1,488

1,655

(% of PBT)

30.4

29.4

28.8

28.6

PAT (reported)

2,921

3,072

3,682

4,123

Add: Share of earnings of associate

-

-

-

-

Less: Minority interest (MI)

-

-

-

-

PAT after MI (reported)

2,921

3,072

3,682

4,123

ADJ. PAT

2,921

3,072

3,682

4,123

% chg

32.5

6.9

9.0

12.0

(% of Net Sales)

10.4

10.9

11.4

11.2

Basic EPS (`)

158.2

169.1

184.4

206.5

Fully Diluted EPS (`)

158.2

169.1

184.4

206.5

% chg

32.5

6.9

9.0

12.0

July 27, 2017

6

Hero MotoCorp | 1QFY2018 Result Update

Balance sheet statement (Standalone)

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

SOURCES OF FUNDS

Equity Share Capital

40

40

40

40

Reserves& Surplus

8,794

10,071

11,728

13,377

Shareholders’ Funds

8,834

10,111

11,768

13,417

Minority Interest

-

-

-

-

Total Loans

-

-

-

-

Deferred Tax Liability

280

477

477

477

Other Liabilities

68

75

75

75

Total Liabilities

9,182

10,663

12,320

13,969

APPLICATION OF FUNDS

Gross Block

9,126

10,377

11,677

12,877

Less: Acc. Depreciation

5,542

5,982

6,522

7,124

Net Block

3,584

4,396

5,155

5,754

Capital Work-in-Progress

605

465

365

265

Investments

4,581

5,890

5,890

5,890

Current Assets

3,802

3,944

5,654

7,567

Inventories

673

656

883

909

Sundry Debtors

1,283

1,562

1,502

1,718

Cash

131

137

1,238

2,617

Loans & Advances

595

557

806

922

Other Assets

1,120

1,031

1,225

1,401

Current liabilities

3,448

4,093

4,806

5,569

Net Current Assets

354

(150)

848

1,998

Deferred Tax Asset

58

62

62

62

Mis. Exp. not written off

-

-

-

-

Total Assets

9,182

10,663

12,320

13,969

July 27, 2017

7

Hero MotoCorp | 1QFY2018 Result Update

Cash flow statement (Standalone)

Y/E March (` cr)

FY2016

FY2017

FY2018E

FY2019E

Profit before tax

3,160

3,377

5,169

5,778

Depreciation

438

493

540

602

Change in Working Capital

377

421

104

228

Interest / Dividend (Net)

(170)

(193)

6

6

Direct taxes paid

(1,103)

(1,186)

(1,488)

(1,655)

Others

1,148

1,116

-

-

Cash Flow from Operations

3,849

4,028

4,332

4,959

(Inc.)/ Dec. in Fixed Assets

0

0

(1,200)

(1,100)

(Inc.)/ Dec. in Investments

(2,206)

(1,944)

-

-

Cash Flow from Investing

(2,206)

(1,944)

(1,200)

(1,100)

Issue of Equity

1

1

-

-

Inc./(Dec.) in loans

0

0

0

0

Dividend Paid (Incl. Tax)

(1,398)

(1,737)

(2,025)

(2,474)

Interest / Dividend (Net)

(274)

(343)

(6)

(6)

Cash Flow from Financing

(1,671)

(2,079)

(2,031)

(2,480)

Inc./(Dec.) in Cash

(28)

5

1,101

1,379

Opening Cash balances

159

131

137

1,238

Closing Cash balances

131

137

1,238

2,617

July 27, 2017

8

Hero MotoCorp | 1QFY2018 Result Update

Key ratios

Y/E March

FY2016

FY2017

FY2018E

FY2019E

Valuation Ratio (x)

P/E (on FDEPS)

23.5

22.0

20.2

18.0

P/CEPS

20.6

19.2

17.6

15.7

P/BV

8.4

7.4

6.3

5.5

Dividend yield (%)

1.9

2.3

2.7

3.3

EV/Sales

2.5

2.4

2.1

1.8

EV/EBITDA

16.5

15.8

13.0

11.4

EV / Total Assets

5.5

4.6

3.9

3.4

Per Share Data (`)

EPS (Basic)

158.2

169.1

184.4

206.5

EPS (fully diluted)

158.2

169.1

184.4

206.5

Cash EPS

180.2

193.8

211.4

236.6

DPS

72.0

85.0

101.4

123.9

Book Value

440.4

504.3

587.3

669.9

Returns (%)

ROCE

42.8

37.9

39.4

38.4

Angel ROIC (Pre-tax)

107.4

106.0

108.3

111.0

ROE

33.1

30.4

31.3

30.7

Turnover ratios (x)

Asset Turnover (Gross Block)

3.1

2.7

2.8

2.9

Inventory / Sales (days)

9

9

10

9

Receivables (days)

17

20

17

17

Payables (days)

36

45

40

41

WC cycle (ex-cash) (days)

(11)

(16)

(13)

(15)

July 27, 2017

9

Hero MotoCorp | 1QFY2018 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER

Angel Broking Private Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited,

Bombay Stock Exchange Limited and MCX Stock Exchange Limited. It is also registered as a Depository Participant with CDSL and

Portfolio Manager with SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel has received in-principal approval

from SEBI for registering as a Research Entity in terms of SEBI (Research Analyst) Regulations, 2014. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its associates

including its relatives/analyst do not hold any financial interest/beneficial ownership of more than 1% in the company covered by

Analyst. Angel or its associates/analyst has not received any compensation / managed or co-managed public offering of securities of

the company covered by Analyst during the past twelve months. Angel/analyst has not served as an officer, director or employee of

company covered by Analyst and has not been engaged in market making activity of the company covered by Analyst.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should

make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the

companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine

the merits and risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals.

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot

testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document.

While Angel Broking Pvt. Limited endeavors to update on a reasonable basis the information discussed in this material, there may be

regulatory, compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from

or in connection with the use of this information.

Note: Please refer to the important ‘Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the

latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may

have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement

Hero MotoCorp

1. Analyst ownership of the stock

No

2. Angel and its Group companies ownership of the stock

No

3. Angel and its Group companies' Directors ownership of the stock

No

4. Broking relationship with company covered

No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Based on expected returns

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period):

Reduce (-5% to -15%)

Sell (< -15%)

July 27, 2017

10